1 はじめに

1.1 調査目的 25

1.2 市場の定義 25

1.3 調査範囲 26

1.3.1 対象市場と地域範囲 26

1.3.2 対象範囲と除外項目 27

1.3.3 考慮した年数 27

1.3.4 通貨 28

1.3.5 単位の考慮 28

1.4 利害関係者 28

1.5 変更点のまとめ 28

2 調査方法 30

2.1 調査データ 30

2.1.1 二次データ 31

2.1.1.1 主な二次資料 31

2.1.1.2 二次資料からの主要データ 31

2.1.2 一次データ 32

2.1.2.1 一次資料からの主なデータ 32

2.1.2.2 主要な業界インサイト 33

2.1.2.3 専門家へのインタビューの内訳 33

2.2 市場規模の推定 34

2.2.1 ボトムアップアプローチ 35

2.2.2 トップダウンアプローチ 35

2.3 データの三角測量 36

2.4 リサーチの前提 37

2.5 要因分析 37

2.6 成長予測 37

2.6.1 供給サイド 38

2.6.2 需要サイド 38

2.7 研究の限界 38

2.8 リスク評価 38

3 エグゼクティブ・サマリー 39

4 プレミアムインサイト 43

4.1 生分解性プラスチック市場におけるプレーヤーの魅力的な機会 43

4.2 生分解性プラスチック市場、タイプ別 43

4.3 生分解性プラスチック市場:最終用途産業別 44

4.4 生分解性プラスチック市場:最終用途産業別、地域別 44

4.5 生分解性プラスチック市場:主要国別 45

5 市場の概要 46

5.1 導入 46

5.2 AI/ジェネAIの影響 46

5.2.1 導入 46

5.2.2 影響の概要 46

5.2.2.1 ブドウ園の廃棄物からの革新的な生分解性パッケージ 46

5.2.2.2 持続可能な農業のための生成AIと生分解性プラスチックの相乗効果 46

5.2.2.3 包装における持続可能性の向上: AIと生分解性プラスチックの役割 47

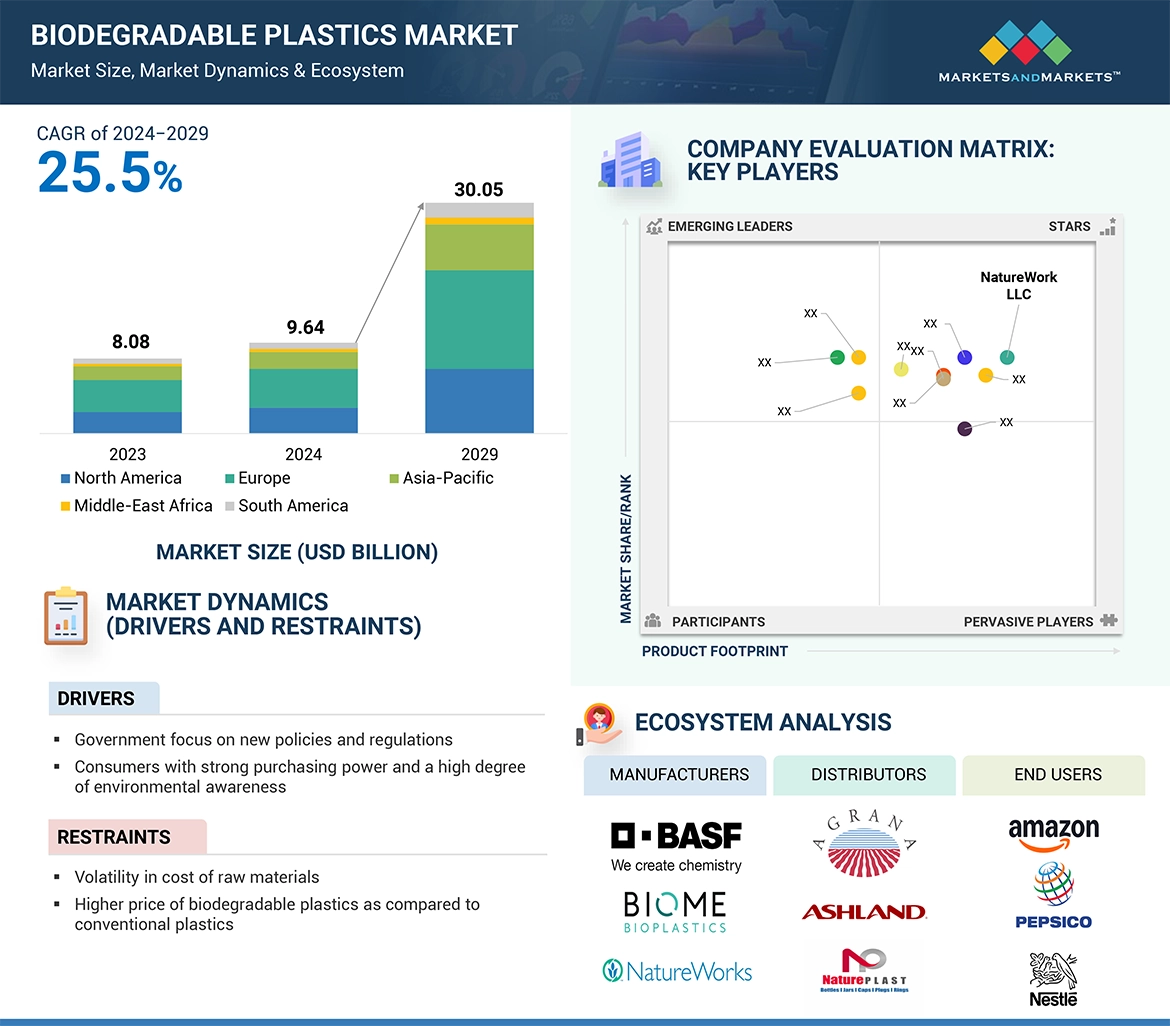

5.3 市場ダイナミクス 47

5.3.1 推進要因 48

5.3.1.1 政府による新たな政策と規制の重視 48

5.3.1.2 強い購買力と環境持続可能性へのコミットメントを持つ消費者 51

5.3.1.3 環境に優しい製品の用途拡大 51

5.3.2 阻害要因 51

5.3.2.1 原材料価格の変動 51

5.3.2.2 生分解性プラスチックの価格が従来型プラスチックより高い 52

5.3.3 機会 52

5.3.3.1 包装最終用途産業における生分解性プラスチックの使用の増加 52

5.3.3.2 アジア太平洋地域の新興経済圏における高い成長 52

5.3.4 課題 53

5.3.4.1 高価格と複雑な製造工程 53

5.3.4.2 生分解性プラスチックは従来のプラスチックより耐久性が劣る 53

5.4 ポーターの5つの力分析 54

5.4.1 代替品の脅威 55

5.4.2 供給者の交渉力 55

5.4.3 新規参入企業の脅威 55

5.4.4 買い手の交渉力 55

5.4.5 競合の激しさ 55

5.5 主要ステークホルダーと購買基準 56

5.5.1 購入プロセスにおける主要ステークホルダー 56

5.5.2 購入基準 56

5.6 バリューチェーン分析 57

5.6.1 原材料供給 58

5.6.2 製造 58

5.6.3 流通 58

5.6.4 最終用途 59

5.7 マクロ経済指標 59

5.7.1 世界のGDP動向 59

5.8 エコシステム分析 61

5.9 ケーススタディ分析 62

5.9.1 ホラー・ポーラー – バイオプラスチック・タイヤの木製玩具 62

5.9.2 天然樹脂誘導体によるバイオベースプラスチックの強化 63

5.9.3 ラマプラストS.P.A.による持続可能な化粧品パッケージ 63

5.10 規制の状況 64

5.10.1 規制 64

5.10.1.1 北米 64

5.10.1.1.1 米国 64

5.10.1.1.2 カナダ 65

5.10.1.2 アジア太平洋地域 65

5.10.1.3 ヨーロッパ 66

5.10.1.4 中東・アフリカ 67

5.10.1.5 南米 67

5.10.2 規制機関、政府機関、その他の団体 68

5.11 技術分析 69

5.11.1 主要技術 69

5.11.1.1 PLAの生産 69

5.11.1.2 ポリヒドロキシアルカノエート(PHA)合成 69

5.11.2 補足技術 70

5.11.2.1 酵素触媒重合 70

5.11.2.2 ナノ複合材料技術 70

5.11.3 隣接技術 70

5.11.3.1 リサイクルとアップサイクル技術 70

5.11.3.2 持続可能な包装ソリューション 71

5.12 顧客ビジネスに影響を与えるトレンド/混乱 71

5.13 貿易分析(輸出/輸入)-貿易量と貿易価格(2020~2023年) 72

5.13.1 貿易分析 72

5.13.2 輸入シナリオ(HSコード390770) 72

5.13.3 輸出シナリオ(HSコード390770) 73

5.14 主要会議・イベント(2024-2025年) 74

5.15 平均販売価格(2021-2029年) 75

5.15.1 価格に影響を与える要因 75

5.15.2 地域別平均販売価格動向 76

5.15.3 平均販売価格(タイプ別) 77

5.15.4 平均販売価格:最終用途産業別 77

5.15.5 主要企業の平均販売価格動向(最終用途産業別) 78

5.16 投資と資金調達のシナリオ 79

5.17 特許分析 79

5.17.1 方法論 79

5.17.2 文書タイプ 80

5.17.3 インサイト 81

5.17.4 会社別の特許 82

5.17.5 過去10年間の特許所有者トップ10 82

6 生分解性プラスチック市場:タイプ別 83

6.1 導入 84

6.2 PLA 86

6.2.1 包装産業におけるプラの広範な利用 86

6.3 デンプン混合物 86

6.3.1 様々な産業における用途の増加 86

6.4 PHA 87

6.4.1 農業・園芸産業での利用の増加 87

6.5 PBAT 87

6.5.1 包装、フレキシブル、マルチフィルムでの用途の増加 87

6.6 PBS 88

6.6.1 PBS の費用対効果で需要が増加 88

6.7 セルロース系 88

6.7.1 包装産業での使用の増加 88

6.8 その他のタイプ 89

7 生分解性プラスチック市場:最終用途産業別 90

7.1 導入 91

7.2 包装 93

7.2.1 軟包装 93

7.2.1.1 長い保存期間、低コスト、環境に優しいことが複数のブランドに影響を与えている 93

7.2.1.2 袋 93

7.2.1.3 パウチ 94

7.2.1.4 フィルムとロールストック 94

7.2.1.5 その他 94

7.2.2 硬質包装 94

7.2.2.1 食品・飲料、パーソナルケア、消費財産業における需要の増加 94

7.2.2.2 ボトル及び瓶 94

7.2.2.3 トレー 95

7.2.2.4 桶 95

7.2.2.5 キャップ・クロージャー 95

7.2.2.6 その他 95

7.3 消費財 95

7.3.1 電化製品 95

7.3.1.1 動きの速い家電製品の需要 95

7.3.2 家庭用電化製品 96

7.3.2.1 生分解性家庭用品の需要 96

7.3.3 その他 96

7.4 繊維 96

7.4.1 医療・ヘルスケア繊維 97

7.4.1.1 医療用繊維製品の需要増加 97

7.4.2 パーソナルケア、衣料、その他の繊維製品 97

7.4.2.1 熱可塑性プラスチック繊維の需要増加 97

7.5 農業・園芸 97

7.5.1 テープ・マルチフィルム 98

7.5.1.1 低い人件費と廃棄コスト 98

7.5.2 その他 98

7.6 その他の最終用途産業 98

8 生分解性プラスチック市場:地域別 99

8.1 はじめに 100

8.2 北米 102

8.2.1 米国 105

8.2.1.1 持続可能な包装製品への注目の高まり 105

8.2.2 カナダ 107

8.2.2.1 持続可能な包装に対する需要の高まり 107

8.2.3 メキシコ 109

8.2.3.1 熟練労働力、地理的優位性、政治的・経済的安定 109

8.3 ヨーロッパ 111

8.3.1 ドイツ 115

8.3.1.1 包装産業の成長 115

8.3.2 イタリア 117

8.3.2.1 様々な最終用途産業における成長 117

8.3.3 フランス 119

8.3.3.1 持続可能な包装に対する需要 119

8.3.4 イギリス 121

8.3.4.1 政策実施と規制への注目の高まり 121

8.3.5 スペイン 123

8.3.5.1 食品・飲料用包装に対する需要の増加 123

8.3.6 その他のヨーロッパ 125

8.4 アジア太平洋地域 127

8.4.1 中国 130

8.4.1.1 使い切りプラスチックの禁止 130

8.4.2 日本 132

8.4.2.1 様々な最終用途産業における生分解性プラスチックの需要増加 132

8.4.3 韓国 134

8.4.3.1 環境の持続可能性 134

8.4.4 インド 136

8.4.4.1 農業分野での生分解性プラスチック用途の増加 136

8.4.5 その他のアジア太平洋地域 138

8.5 中東・アフリカ 140

8.5.1 GCC諸国 143

8.5.2 サウジアラビア 143

8.5.2.1 今後の潜在成長率 143

8.5.3 その他のGCC諸国 145

8.5.4 南アフリカ 146

8.5.4.1 バイオプラスチックの研究とイノベーションの進展 146

8.5.5 その他の中東・アフリカ 148

8.6 南米 150

8.6.1 ブラジル 152

8.6.1.1 農業分野からの持続可能な包装ソリューションの需要増加 152

農業セクターからの需要の高まり 152

8.6.2 アルゼンチン 154

8.6.2.1 環境に優しい包装材料への需要の高まり 154

8.6.3 その他の南米 156

9 競争環境 158

9.1 はじめに 158

9.2 主要プレイヤーの戦略/2019-2024年の勝利への権利 159

9.3 市場シェア分析、2023年 161

9.4 収益分析(2019-2023年) 162

9.4.1 BASF SE 162

9.4.2 Natureworks LLC 162

9.4.3 三菱ケミカルホールディングス 163

9.4.4 トータルエナジー・コルビオン 163

9.4.5 バイオメ・バイオプラスチックス 163

9.5 会社の評価と財務指標 164

9.6 ブランドと生産の比較 165

9.7 企業評価マトリックス:主要企業(2023年) 165

9.7.1 スター企業 165

9.7.2 新興リーダー 165

9.7.3 浸透型プレーヤー 166

9.7.4 参加型プレーヤー 166

9.7.5 企業フットプリント:主要プレイヤー(2023年) 167

9.7.5.1 企業フットプリント 167

9.7.5.2 タイプ別フットプリント 168

9.7.5.3 最終用途産業のフットプリント 169

9.7.5.4 地域別フットプリント 170

9.8 企業評価マトリクス:新興企業/SM(2023年) 171

9.8.1 進歩的企業 171

9.8.2 対応力のある企業 171

9.8.3 ダイナミックな企業 171

9.8.4 スターティングブロック 171

9.8.5 競争ベンチマーキング(新興企業/SM)(2023年) 173

9.8.5.1 主要新興企業/SMESの詳細リスト 173

9.8.5.2 主要新興企業/SMESの競合ベンチマーキング 174

9.9 競争シナリオ 175

9.9.1 製品上市 175

9.9.2 取引 177

9.9.3 拡張 182

10 企業プロファイル 184

NatureWork LLC (US)

BASF SE (Germany)

TotalEnergies Corbion (Netherlands)

Mitsubishi Chemical Group Corporation. (Japan)

Biome Bioplastics (UK)

Plantic (Australia)

FKuR (Germany)

Danimer Scientific (US)

TORAY INDUSTRIES INC. (Japan)

and Novamont (Italy)

11 付録 234

11.1 ディスカッションガイド 234

11.2 Knowledgestore: Marketsandmarketsの購読ポータル 236

11.3 カスタマイズオプション 238

11.4 関連レポート 238

11.5 著者の詳細 239

The global biodegradable plastics market is witnessing growth due to its versatile properties and it is also widely used in various industries due to its exceptional properties. Furthermore, biodegradable plastics are required for the application in various end use industries like packaging, consumer goods, textiles, agriculture & horticulture, which fuels the need for biodegradable plastics.

“PBAT type is projected to be the third fastest growing type in terms of value.”

PBAT type is projected to be the third fastest growing type in the biodegradable plastics market due to several factors. As the two major monomers that the copolymer PBAT is made of are butylene adipate and terephthalate. The stacking together of the monomers yields it certain unique properties, namely biodegradability and flexibility. It is completely biodegradable and degrades readily in the presence of natural microorganisms and bacteria. Entombed in soil, it degrades completely with no toxic residues. PBAT is often used in biodegradable bags that add flexibility, fast biodegradability and acceleration of the rate of compostability in order to comply with regulations on compost. PBAT can also be blended or co-extruded with other polymers for better performances and properties. Blending PBAT with other biodegradable polymers, such as polylactic acid (PLA) or starch, can improve its mechanical strength, biodegradability, and processability. These blends offer customized solutions for specific applications. It is fully biodegradable (compostable) and can be processed on conventional blown film equipment used for polyethylene. PBAT has also been investigated as a toughening agent for PLA.

“Agriculture & Horticulture end use industry is expected to be the third fastest growing end use industry for forecasted period in terms of value.”

Agriculture & Horticulture end use industry is expected to be the third fastest growing end use industry for forecasted period in terms of value. As biodegradable plastics are used in the making of mulches, seeding strips, and tapes in agriculture and horticulture. Its several advantages include better crop productions and environmental resource saving. It makes the soil healthier and more fertile when biodegradable plastics are used in agriculture and horticulture. Organic matters are produced by the breakdown of plastics and so improve the water holding capacity and availability of nutrients in the soil. This promotes healthy growth for these plants while avoiding many synthetic fertilizers and amendments of the soil. High disposal costs of traditional mulch, for example, promote the use of starch-based plastics in this industry. Biodegradable plastics are widely used by countries such as Germany, France, the US, China, and Mediterranean countries such as Spain and Israel, where agriculture is more intensive.

“Europe is estimated to be the second fastest growing region in terms of value for the forecasted period.”

Europe region is expected to be the second fastest growing region in forecasted period in terms of value. As Germany, Italy, France, Spain, and the UK are the major European biodegradable plastics market countries. This region is likely to see an increase in growth in the market for biodegradable plastics as the countries here are heavily investing into new packaging technologies to meet customer demands and requirements. It has a developed industrial base in developed economies such as the United Kingdom, France, Italy, Spain, and Germany. Europe accounts for a significant market share of the biodegradable plastic market, due to increased consumer requirement for ecologically friendly packaging materials. These governments of the European nations encourage the use of biodegradable plastics by establishing the fundamental infrastructure for composting such materials.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the biodegradable plastics market, and information was gathered from secondary research to determine and verify the market size of several segments.

• By Company Type: Tier 1 – 40%, Tier 2 – 30%, and Tier 3 – 30%

• By Designation: C Level Executives– 20%, Directors – 10%, and Others – 70%

• By Region: North America – 22%, Europe – 22%, APAC – 45%, ROW –11%

The Biodegradable plastics market comprises major players such as NatureWork LLC (US), BASF SE (Germany), TotalEnergies Corbion (Netherlands), Mitsubishi Chemical Group Corporation. (Japan), Biome Bioplastics (UK), Plantic (Australia), FKuR (Germany), Danimer Scientific (US), TORAY INDUSTRIES, INC. (Japan), and Novamont (Italy). The study includes in-depth competitive analysis of these key players in the biodegradable plastics market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for biodegradable plastics market on the basis of type, end use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for biodegradable plastics market.

Key benefits of buying this report

This research report is focused on various levels of analysis — industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the biodegradable plastics market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

•Market Penetration: Comprehensive information on the biodegradable plastics market offered by top players in the global biodegradable plastics market.

•Analysis of drivers: (Government focus on new policies and regulations, Consumers with strong purchasing power and a high degree of environmental awareness, High growth in applications in end-use industries) restraints (Volatility in cost of raw materials, Higher price of biodegradable plastics as compared to conventional plastics), opportunities (Increasing use of biodegradable plastics in packaging end use industry, Higher growth in emerging economies of Asia Pacific) and challenges (High price and complex production process, Less durability of biodegradable plastics as compared to traditional plastics)

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the biodegradable plastics market.

•Market Development: Comprehensive information about lucrative emerging markets — the report analyzes the markets for biodegradable plastics market across regions.

•Market Capacity: Production capacities of companies producing biodegradable plastics are provided wherever available with upcoming capacities for the biodegradable plastics market.

•Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the biodegradable plastics market.

1 INTRODUCTION 25

1.1 STUDY OBJECTIVES 25

1.2 MARKET DEFINITION 25

1.3 STUDY SCOPE 26

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 26

1.3.2 INCLUSIONS AND EXCLUSIONS 27

1.3.3 YEARS CONSIDERED 27

1.3.4 CURRENCY CONSIDERED 28

1.3.5 UNITS CONSIDERED 28

1.4 STAKEHOLDERS 28

1.5 SUMMARY OF CHANGES 28

2 RESEARCH METHODOLOGY 30

2.1 RESEARCH DATA 30

2.1.1 SECONDARY DATA 31

2.1.1.1 Key secondary sources 31

2.1.1.2 Key data from secondary sources 31

2.1.2 PRIMARY DATA 32

2.1.2.1 Key data from primary sources 32

2.1.2.2 Key industry insights 33

2.1.2.3 Breakdown of interviews with experts 33

2.2 MARKET SIZE ESTIMATION 34

2.2.1 BOTTOM-UP APPROACH 35

2.2.2 TOP-DOWN APPROACH 35

2.3 DATA TRIANGULATION 36

2.4 RESEARCH ASSUMPTIONS 37

2.5 FACTOR ANALYSIS 37

2.6 GROWTH FORECAST 37

2.6.1 SUPPLY SIDE 38

2.6.2 DEMAND SIDE 38

2.7 RESEARCH LIMITATIONS 38

2.8 RISK ASSESSMENT 38

3 EXECUTIVE SUMMARY 39

4 PREMIUM INSIGHTS 43

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIODEGRADABLE PLASTICS MARKET 43

4.2 BIODEGRADABLE PLASTICS MARKET, BY TYPE 43

4.3 BIODEGRADABLE PLASTICS MARKET, END-USE INDUSTRY 44

4.4 BIODEGRADABLE PLASTICS MARKET, BY END-USE INDUSTRY AND REGION 44

4.5 BIODEGRADABLE PLASTICS MARKET, BY KEY COUNTRY 45

5 MARKET OVERVIEW 46

5.1 INTRODUCTION 46

5.2 IMPACT OF AI/GEN AI 46

5.2.1 INTRODUCTION 46

5.2.2 OVERVIEW OF IMPACT 46

5.2.2.1 Innovative biodegradable packaging from vineyard waste 46

5.2.2.2 Synergizing generative AI and biodegradable plastics for sustainable agriculture 46

5.2.2.3 Enhancing sustainability in packaging: Role of AI and biodegradable plastics 47

5.3 MARKET DYNAMICS 47

5.3.1 DRIVERS 48

5.3.1.1 Government focus on new policies and regulations 48

5.3.1.2 Consumers with strong purchasing power and commitment to environmental sustainability 51

5.3.1.3 Increasing applications of eco-friendly products 51

5.3.2 RESTRAINTS 51

5.3.2.1 Volatility in raw material prices 51

5.3.2.2 Higher price of biodegradable plastics than that of conventional plastics 52

5.3.3 OPPORTUNITIES 52

5.3.3.1 Increasing use of biodegradable plastics in packaging end-use industry 52

5.3.3.2 Higher growth in emerging economies of Asia Pacific 52

5.3.4 CHALLENGES 53

5.3.4.1 High price and complex production process 53

5.3.4.2 Less durability of biodegradable plastics than traditional plastics 53

5.4 PORTER’S FIVE FORCES ANALYSIS 54

5.4.1 THREAT OF SUBSTITUTES 55

5.4.2 BARGAINING POWER OF SUPPLIERS 55

5.4.3 THREAT OF NEW ENTRANTS 55

5.4.4 BARGAINING POWER OF BUYERS 55

5.4.5 INTENSITY OF COMPETITIVE RIVALRY 55

5.5 KEY STAKEHOLDERS AND BUYING CRITERIA 56

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS 56

5.5.2 BUYING CRITERIA 56

5.6 VALUE CHAIN ANALYSIS 57

5.6.1 RAW MATERIAL SUPPLY 58

5.6.2 MANUFACTURING 58

5.6.3 DISTRIBUTION 58

5.6.4 END USE 59

5.7 MACROECONOMIC INDICATORS 59

5.7.1 GLOBAL GDP TRENDS 59

5.8 ECOSYSTEM ANALYSIS 61

5.9 CASE STUDY ANALYSIS 62

5.9.1 HOLLER POLLER – WOODEN TOYS WITH BIO-PLASTIC TIRES 62

5.9.2 ENHANCING BIOBASED PLASTICS WITH NATURAL RESIN DERIVATIVES 63

5.9.3 SUSTAINABLE COSMETIC PACKAGING BY RAMAPLAST S.P.A. 63

5.10 REGULATORY LANDSCAPE 64

5.10.1 REGULATIONS 64

5.10.1.1 North America 64

5.10.1.1.1 US 64

5.10.1.1.2 Canada 65

5.10.1.2 Asia Pacific 65

5.10.1.3 Europe 66

5.10.1.4 Middle East & Africa 67

5.10.1.5 South America 67

5.10.2 REGULATORY BODIES, GOVERNMENT BODIES AND OTHER ORGANIZATIONS 68

5.11 TECHNOLOGY ANALYSIS 69

5.11.1 KEY TECHNOLOGIES 69

5.11.1.1 PLA production 69

5.11.1.2 Polyhydroxyalkanoates (PHA) Synthesis 69

5.11.2 COMPLEMENTARY TECHNOLOGIES 70

5.11.2.1 Enzyme-catalyzed polymerization 70

5.11.2.2 Nano-Composite Technologies 70

5.11.3 ADJACENT TECHNOLOGIES 70

5.11.3.1 Recycling and Upcycling Technologies 70

5.11.3.2 Sustainable Packaging Solutions 71

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 71

5.13 TRADE ANALYSIS (EXPORT/IMPORT)- VOLUME AND TRADE PRICES, 2020-2023 72

5.13.1 TRADE ANALYSIS 72

5.13.2 IMPORT SCENARIO (HS CODE 390770) 72

5.13.3 EXPORT SCENARIO (HS CODE 390770) 73

5.14 KEY CONFERENCES AND EVENTS, 2024–2025 74

5.15 AVERAGE SELLING PRICE, 2021–2029 75

5.15.1 FACTORS AFFECTING PRICES 75

5.15.2 AVERAGE SELLING PRICE TREND BY REGION 76

5.15.3 AVERAGE SELLING PRICE, BY TYPE 77

5.15.4 AVERAGE SELLING PRICE, BY END-USE INDUSTRY 77

5.15.5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY 78

5.16 INVESTMENT AND FUNDING SCENARIO 79

5.17 PATENT ANALYSIS 79

5.17.1 METHODOLOGY 79

5.17.2 DOCUMENT TYPE 80

5.17.3 INSIGHTS 81

5.17.4 PATENTS BY BASF SE 82

5.17.5 TOP 10 PATENT OWNERS IN LAST 10 YEARS 82

6 BIODEGRADABLE PLASTICS MARKET, BY TYPE 83

6.1 INTRODUCTION 84

6.2 PLA 86

6.2.1 EXTENSIVE UTILIZATION OF PLA IN PACKAGING INDUSTRY 86

6.3 STARCH BLENDS 86

6.3.1 RISING APPLICATION IN VARIOUS INDUSTRIES 86

6.4 PHA 87

6.4.1 INCREASING USE IN AGRICULTURE AND HORTICULTURE INDUSTRIES 87

6.5 PBAT 87

6.5.1 GROWING APPLICATIONS IN PACKAGING, FLEXIBLE, AND MULCH FILMS 87

6.6 PBS 88

6.6.1 COST-EFFECTIVENESS OF PBS TO INCREASE DEMAND 88

6.7 CELLULOSE BASED 88

6.7.1 INCREASED USE IN PACKAGING INDUSTRY 88

6.8 OTHER TYPES 89

7 BIODEGRADABLE PLASTICS MARKET, BY END-USE INDUSTRY 90

7.1 INTRODUCTION 91

7.2 PACKAGING 93

7.2.1 FLEXIBLE PACKAGING 93

7.2.1.1 Long shelf-life, low costs, and eco-friendliness influencing several brands 93

7.2.1.2 Bags 93

7.2.1.3 Pouches 94

7.2.1.4 Films and roll stocks 94

7.2.1.5 Others 94

7.2.2 RIGID PACKAGING 94

7.2.2.1 Growing demand in food & beverages, personal care, and consumer goods industries 94

7.2.2.2 Bottle and jars 94

7.2.2.3 Trays 95

7.2.2.4 Tubs 95

7.2.2.5 Caps and closures 95

7.2.2.6 Others 95

7.3 CONSUMER GOODS 95

7.3.1 ELECTRICAL APPLIANCES 95

7.3.1.1 Demand from fast-moving consumer electronics 95

7.3.2 DOMESTIC APPLIANCES 96

7.3.2.1 Demand for biodegradable houseware 96

7.3.3 OTHERS 96

7.4 TEXTILE 96

7.4.1 MEDICAL & HEALTHCARE TEXTILES 97

7.4.1.1 Increasing demand for medical textiles 97

7.4.2 PERSONAL CARE, CLOTHES, AND OTHER TEXTILES 97

7.4.2.1 Increasing demand for thermoplastics fibers 97

7.5 AGRICULTURE AND HORTICULTURE 97

7.5.1 TAPES & MULCH FILMS 98

7.5.1.1 Low labor and disposal costs 98

7.5.2 OTHERS 98

7.6 OTHER END-USE INDUSTRIES 98

8 BIODEGRADABLE PLASTICS MARKET, BY REGION 99

8.1 INTRODUCTION 100

8.2 NORTH AMERICA 102

8.2.1 US 105

8.2.1.1 Increasing focus on sustainable packaging products 105

8.2.2 CANADA 107

8.2.2.1 Growing demand for sustainable packaging 107

8.2.3 MEXICO 109

8.2.3.1 Skilled workforce, geographic advantages, political and economic stability 109

8.3 EUROPE 111

8.3.1 GERMANY 115

8.3.1.1 Growth in packaging industry 115

8.3.2 ITALY 117

8.3.2.1 Growth in various end-use industries 117

8.3.3 FRANCE 119

8.3.3.1 Demand for sustainable packaging 119

8.3.4 UK 121

8.3.4.1 Increasing focus on policy implementation and regulations 121

8.3.5 SPAIN 123

8.3.5.1 Increasing demand for food & beverage packaging 123

8.3.6 REST OF EUROPE 125

8.4 ASIA PACIFIC 127

8.4.1 CHINA 130

8.4.1.1 Ban on single-use plastics 130

8.4.2 JAPAN 132

8.4.2.1 Increasing demand for biodegradable plastic in various end-use industries 132

8.4.3 SOUTH KOREA 134

8.4.3.1 Environmental sustainability 134

8.4.4 INDIA 136

8.4.4.1 Increasing application biodegradable plastics in agricultural industry 136

8.4.5 REST OF ASIA PACIFIC 138

8.5 MIDDLE EAST & AFRICA 140

8.5.1 GCC COUNTRIES 143

8.5.2 SAUDI ARABIA 143

8.5.2.1 Potential growth in upcoming years 143

8.5.3 REST OF GCC COUNTRIES 145

8.5.4 SOUTH AFRICA 146

8.5.4.1 Advancements in bioplastics research and innovation 146

8.5.5 REST OF MIDDLE EAST & AFRICA 148

8.6 SOUTH AMERICA 150

8.6.1 BRAZIL 152

8.6.1.1 Rising demand for sustainable packaging solutions

from agricultural sector 152

8.6.2 ARGENTINA 154

8.6.2.1 Rising demand for environmentally friendly packaging materials 154

8.6.3 REST OF SOUTH AMERICA 156

9 COMPETITIVE LANDSCAPE 158

9.1 INTRODUCTION 158

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 2019–2024 159

9.3 MARKET SHARE ANALYSIS, 2023 161

9.4 REVENUE ANALYSIS, 2019–2023 162

9.4.1 BASF SE 162

9.4.2 NATUREWORKS LLC 162

9.4.3 MITSUBISHI CHEMICAL HOLDING CORPORATION 163

9.4.4 TOTALENERGIES CORBION 163

9.4.5 BIOME BIOPLASTICS 163

9.5 COMPANY VALUATION AND FINANCIAL METRICS 164

9.6 BRAND/PRODUCTION COMPARISON 165

9.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 165

9.7.1 STARS 165

9.7.2 EMERGING LEADERS 165

9.7.3 PERVASIVE PLAYERS 166

9.7.4 PARTICIPANTS PLAYERS 166

9.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 167

9.7.5.1 Company footprint 167

9.7.5.2 Type footprint 168

9.7.5.3 End-use industry footprint 169

9.7.5.4 Region footprint 170

9.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 171

9.8.1 PROGRESSIVE COMPANIES 171

9.8.2 RESPONSIVE COMPANIES 171

9.8.3 DYNAMIC COMPANIES 171

9.8.4 STARTING BLOCKS 171

9.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023 173

9.8.5.1 Detailed list of key startups/SMES 173

9.8.5.2 Competitive benchmarking of key startups/SMES 174

9.9 COMPETITIVE SCENARIO 175

9.9.1 PRODUCT LAUNCHES 175

9.9.2 DEALS 177

9.9.3 EXPANSIONS 182

10 COMPANY PROFILES 184

10.1 KEY PLAYERS 184

10.1.1 NATUREWORKS LLC 184

10.1.1.1 Business overview 184

10.1.1.2 Products/Solutions/Services offered 184

10.1.1.3 Recent developments 186

10.1.1.3.1 Product launches 186

10.1.1.3.2 Expansions 188

10.1.1.4 MnM view 189

10.1.1.4.1 Right to win 189

10.1.1.4.2 Strategic choices 189

10.1.1.4.3 Weaknesses and competitive threats 189

10.1.2 BASF SE 190

10.1.2.1 Business overview 190

10.1.2.2 Products/Solutions/Services offered 191

10.1.2.3 Recent developments 192

10.1.2.3.1 Product launches 192

10.1.2.3.2 Deals 193

10.1.2.4 MnM view 194

10.1.2.4.1 Right to win 194

10.1.2.4.2 Strategic choices 194

10.1.2.4.3 Weaknesses and competitive threats 194

10.1.3 TOTALENERGIES CORBION 195

10.1.3.1 Business overview 195

10.1.3.2 Products/Solutions/Services offered 195

10.1.3.3 Recent developments 196

10.1.3.3.1 Product launches 196

10.1.3.3.2 Deals 196

10.1.3.3.3 Expansions 197

10.1.3.4 MnM view 198

10.1.3.4.1 Right to win 198

10.1.3.4.2 Strategic choices 198

10.1.3.4.3 Weaknesses and competitive threats 198

10.1.4 MITSUBISHI CHEMICAL GROUP CORPORATION 199

10.1.4.1 Business overview 199

10.1.4.2 Products/solutions/services offered 200

10.1.4.3 Recent developments 201

10.1.4.3.1 Others 201

10.1.4.4 MnM view 202

10.1.4.4.1 Right to win 202

10.1.4.4.2 Strategic choices 202

10.1.4.4.3 Weaknesses and competitive threats 202

10.1.5 BIOME BIOPLASTICS 203

10.1.5.1 Business overview 203

10.1.5.2 Products/Solutions/Services offered 203

10.1.5.3 Recent developments 204

10.1.5.3.1 Deals 204

10.1.5.3.2 Others 204

10.1.5.4 MnM view 205

10.1.5.4.1 Right to win 205

10.1.5.4.2 Strategic choices 205

10.1.5.4.3 Weaknesses and competitive threats 205

10.1.6 PLANTIC 206

10.1.6.1 Business overview 206

10.1.6.2 Products/Solutions/Services offered 206

10.1.6.3 MnM view 207

10.1.7 FKUR 208

10.1.7.1 Business overview 208

10.1.7.2 Products/Solutions/Services offered 208

10.1.7.3 Recent developments 210

10.1.7.3.1 Deals 210

10.1.7.3.2 Others 211

10.1.7.4 MnM view 211

10.1.8 DANIMER SCIENTIFIC 212

10.1.8.1 Business overview 212

10.1.8.2 Products/Solutions/Services offered 213

10.1.8.3 Recent developments 214

10.1.8.3.1 Deals 214

10.1.8.3.2 Others 215

10.1.8.4 MnM view 216

10.1.9 TORAY INDUSTRIES, INC. 217

10.1.9.1 Business overview 217

10.1.9.2 Products/Solutions/Services offered 218

10.1.9.3 Recent developments 219

10.1.9.3.1 Deals 219

10.1.9.4 MnM view 219

10.1.10 NOVAMONT 220

10.1.10.1 Business overview 220

10.1.10.2 Products/Solutions/Services offered 220

10.1.10.3 Recent developments 221

10.1.10.3.1 Product launches 221

10.1.10.3.2 Expansions 221

10.1.10.4 MnM view 222

10.2 OTHER PLAYERS 223

10.2.1 BIO ON 223

10.2.2 ZHEJIANG HISUN BIOMATERIALS CO., LTD. 223

10.2.3 BIO-FED 224

10.2.4 GREEN DOT BIOPLASTICS 225

10.2.5 SPHERE 226

10.2.6 TIANAN BIOLOGIC MATERIALS CO., LTD. 226

10.2.7 SUCCINITY 227

10.2.8 CARBIOLICE 227

10.2.9 AGRANA 228

10.2.10 FUTERRO 228

10.2.11 EASTMAN CHEMICAL COMPANY 229

10.2.12 INGEVITY 230

10.2.13 PTT MCC BIOCHEM CO., LTD. 231

10.2.14 YIELD10 BIOSCIENCE, INC. 232

10.2.15 NATUR TEC 233

11 APPENDIX 234

11.1 DISCUSSION GUIDE 234

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 236

11.3 CUSTOMIZATION OPTIONS 238

11.4 RELATED REPORTS 238

11.5 AUTHOR DETAILS 239

❖ 世界の生分解性プラスチック市場に関するよくある質問(FAQ) ❖

・生分解性プラスチックの世界市場規模は?

→MarketsandMarkets社は2024年の生分解性プラスチックの世界市場規模を129.2億米ドルと推定しています。

・生分解性プラスチックの世界市場予測は?

→MarketsandMarkets社は2029年の生分解性プラスチックの世界市場規模を335.2億米ドルと予測しています。

・生分解性プラスチック市場の成長率は?

→MarketsandMarkets社は生分解性プラスチックの世界市場が2024年~2029年に年平均21.3%成長すると予測しています。

・世界の生分解性プラスチック市場における主要企業は?

→MarketsandMarkets社は「NatureWork LLC (US)、BASF SE (Germany)、TotalEnergies Corbion (Netherlands)、Mitsubishi Chemical Group Corporation. (Japan)、Biome Bioplastics (UK)、Plantic (Australia)、FKuR (Germany)、Danimer Scientific (US)、TORAY INDUSTRIES、INC. (Japan)、and Novamont (Italy)など ...」をグローバル生分解性プラスチック市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。