1 はじめに 30

1.1 調査目的 30

1.2 市場の定義 30

1.2.1 包含と除外 31

1.3 調査範囲 32

1.3.1 対象市場 32

1.3.2 考慮した年数 33

1.4 考慮した通貨 33

1.5 考慮した単位 34

1.6 利害関係者 34

2 調査方法 35

2.1 調査データ 35

2.1.1 二次データ 36

2.1.1.1 二次資料からの主要データ 37

2.1.2 一次データ 37

2.1.2.1 一次資料 37

2.1.2.2 一次資料からの主要データ 38

2.1.2.3 一次インタビューの内訳 38

2.2 因子分析 39

2.2.1 導入 39

2.2.2 需要側指標 39

2.2.3 供給側指標 39

2.3 市場規模の推定 40

2.3.1 ボトムアップアプローチ 40

2.3.2 トップダウンアプローチ 40

2.4 データの三角測量 41

2.5 調査の前提 42

2.6 調査の限界 43

2.7 リスク評価 43

3 エグゼクティブ・サマリー 44

4 プレミアムインサイト 49

4.1 無人システム市場におけるプレーヤーの魅力的な機会 49

4.2 無人システム市場、タイプ別 49

4.3 無人航空機市場:タイプ別 50

4.4 無人地上車両市場、タイプ別 50

4.5 無人海上車両市場:タイプ別 51

5 市場の概要 52

5.1 はじめに 52

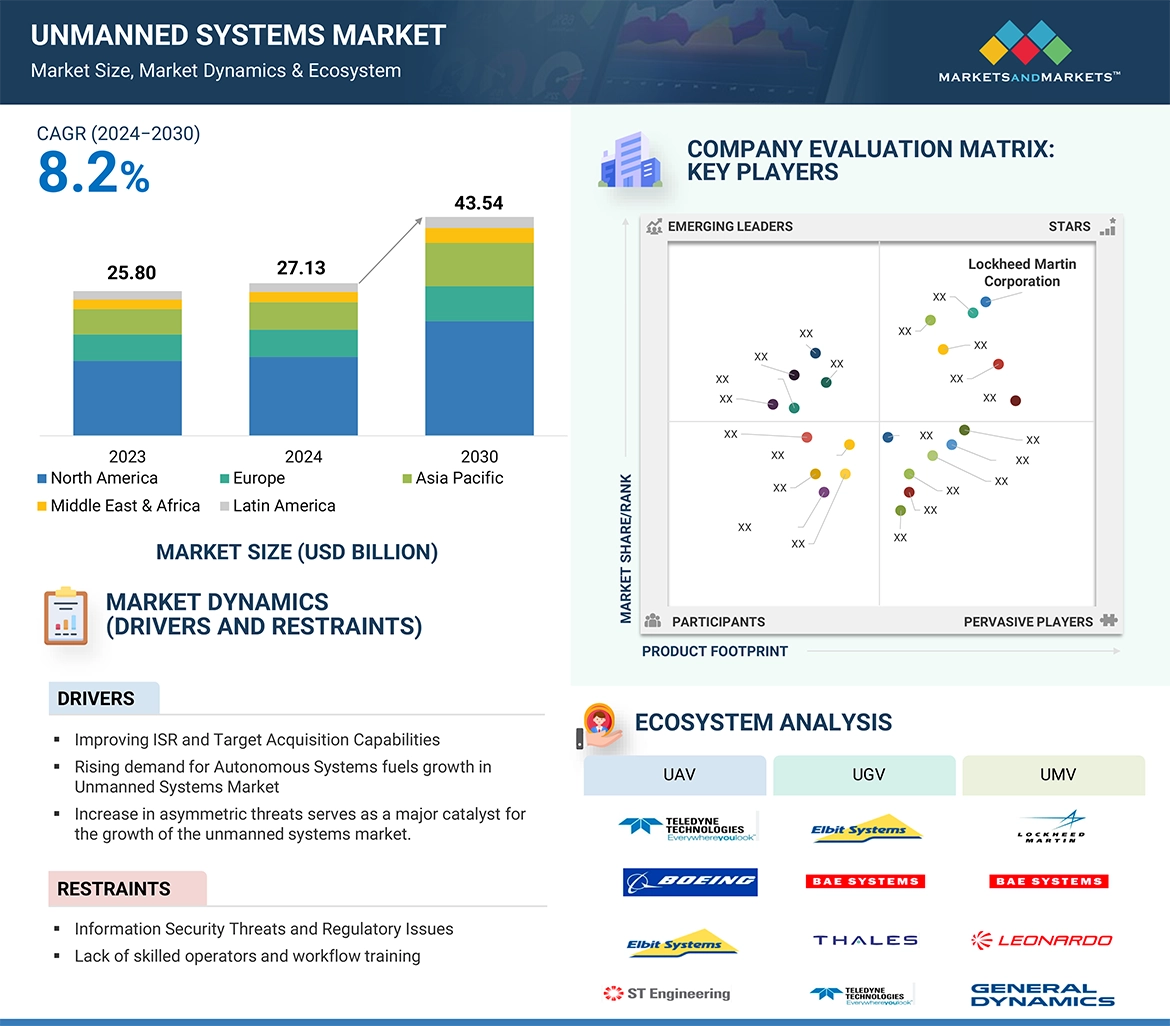

5.2 市場ダイナミクス

5.2.1 推進要因 53

5.2.1.1 自律システムに対する需要の急増 53

5.2.1.2 ISRと目標捕捉能力の向上へのニーズ 53

5.2.1.3 非対称な脅威の増加 53

5.2.1.4 運用効率とコスト削減による商業的採用の増加 54

5.2.2 阻害要因 54

5.2.2.1 情報セキュリティリスクと規制上の制約 54

5.2.2.2 熟練オペレーターの不足と人材育成 55

5.2.3 機会 55

5.2.3.1 世界的な防衛予算の増加 55

5.2.3.2 急速なイノベーションと技術の進歩 56

5.2.4 課題 56

5.2.4.1 電源問題と耐久性の限界 56

5.2.4.2 高い運用コスト 57

5.2.4.3 サプライチェーンの混乱 58

5.3 顧客のビジネスに影響を与えるトレンドと混乱 58

5.4 バリューチェーン分析 59

5.5 エコシステム分析 60

5.5.1 著名企業 60

5.5.2 民間企業及び中小企業 60

5.5.3 エンドユーザー 60

5.6 価格分析 62

5.6.1 無人航空機の指標価格分析 63

5.6.2 無人地上走行車の指標価格分析 63

5.6.3 無人海上移動体の指標価格分析 64

5.7 規制情勢 65

5.8 貿易データ 69

5.9 技術分析 75

5.9.1 主要技術 75

5.9.1.1 LiDAR 75

5.9.1.2 高度ナビゲーションシステム 76

5.9.2 補完技術 76

5.9.2.1 電気光学センサーとレーダーセンサーペイロード 76

5.10 主要ステークホルダーと購買基準 76

5.10.1 購入プロセスにおける主要ステークホルダー 76

5.10.2 購入基準 78

5.11 主要な会議とイベント(2025 年) 79

5.12 部品表 80

5.12.1 無人航空機の部品表 80

5.12.2 無人地上車両の部品表 82

5.12.3 無人海上車両の部品表 84

5.13 ビジネスモデル 86

5.13.1 無人航空機市場のビジネスモデル 86

5.13.1.1 直接販売モデル 86

5.13.1.2 サブスクリプション型サービスモデル 87

5.13.1.3 オペレーティングリースモデル 89

5.13.2 無人地上車両市場のビジネスモデル 91

5.13.2.1 機器販売・リースモデル 91

5.13.2.2 UGVアズ・ア・サービス(UGVAAS)モデル 91

5.13.2.3 カスタマイズソリューションモデル 91

5.13.3 無人海上車両市場のビジネスモデル 93

5.13.3.1 製品ベースの販売モデル 93

5.13.3.2 サービス提供型モデル 93

5.13.3.3 リース・レンタルモデル 94

5.14 総所有コスト 95

5.14.1 無人航空機の総所有コスト 95

5.14.2 無人地上車両の総所有コスト 99

5.14.3 無人海上車両の総所有コスト 101

5.15 技術ロードマップ 104

5.15.1 無人航空機市場の技術ロードマップ 104

5.15.2 無人地上車両市場の技術ロードマップ 106

5.15.3 無人海上車両市場の技術ロードマップ 107

5.16 AIのインパクト 109

5.16.1 導入 109

5.16.2 AIが防衛産業に与える影響 109

5.16.3 上位国の軍事分野におけるAIの採用 110

5.16.4 AIが無人航空機市場に与える影響 111

5.16.5 無人地上車両市場におけるAIの影響 113

5.16.6 無人海上車両市場におけるAIの影響 116

5.17 マクロ経済見通し 119

5.17.1 はじめに 119

5.17.2 北米 120

5.17.3 欧州 120

5.17.4 アジア太平洋地域 120

5.17.5 中東 121

5.17.6 ラテンアメリカ 121

5.17.7 アフリカ 121

5.18 コントロールステーション 122

5.18.1 導入 122

5.18.2 無人航空機用制御ステーション 122

5.18.3 無人地上車両用制御ステーション 123

5.18.4 無人海上移動体用制御ステーション 123

5.19 投資と資金調達のシナリオ 124

6 業界動向 125

6.1 はじめに 125

6.2 技術動向 125

6.2.1 群運航技術 126

6.2.2 自律給油 126

6.2.3 モジュール式で交換可能なペイロードシステム 127

6.2.4 先進的センサー技術 127

6.2.5 高度通信システム 128

6.3 メガトレンドの影響 129

6.3.1 人工知能と機械学習 129

6.3.2 先端材料と製造 129

6.3.3 ビッグデータ分析 129

6.4 サプライチェーン分析 130

6.5 特許分析 131

7 無人システム市場:タイプ別 134

7.1 はじめに 135

7.2 無人航空機 136

7.2.1 医薬品送達における広範な利用が市場を牽引 136

7.2.2 小型 138

7.2.3 中型・大型 139

7.2.4 戦術的 140

7.2.5 戦略的 141

7.3 無人海上車両 141

7.3.1 無人サーフェスビークル 142

7.3.1.1 より安全な海上オペレーションへの需要の高まりが市場を牽引 142

7.3.1.2 小型 143

7.3.1.3 中型 144

7.3.1.4 大型 144

7.3.1.5 超大型 144

7.3.2 無人水中航走体 144

7.3.2.1 探査・モニタリングニーズの高まりが市場を牽引 144

7.3.2.2 遠隔操作ビークル 146

7.3.2.3 自律型水中ビークル 146

7.4 無人地上走行車 147

7.4.1 厳しい地形での操縦能力が市場を牽引 147

7.4.2 車輪式 149

7.4.3 追跡型 149

7.4.4 ハイブリッド 149

7.4.5 脚式 150

8 無人システム市場、動作モード別 151

8.1 はじめに 152

8.2 無人航空機 152

8.2.1 遠隔操縦 153

8.2.1.1 費用対効果の高い製造が市場を牽引 153

8.2.2 オプション操縦 154

8.2.2.1 多様な軍事・商業用途が市場を牽引 154

8.2.3 完全自律型 154

8.2.3.1 軍事用途での高い需要が市場を牽引 154

8.3 無人地上車両 155

8.3.1 テザー式 155

8.3.1.1 安全なデータ伝送を必要とするミッションにおける優位性が市場を牽引 155

8.3.2 遠隔操作 155

8.3.2.1 地雷探知・除去作業への展開が市場を牽引 155

8.3.3 自律型 156

8.3.3.1 目標追跡、監視、偵察任務での優位性が市場を牽引 156

8.4 無人海上車両 156

8.4.1 遠隔操作型 157

8.4.1.1 商業・科学用途への広範な展開が市場を牽引 157

8.4.2 自律型 157

8.4.2.1 データ精度の重視とペイロード容量の向上が市場を牽引 157

9 無人システム市場(用途別) 158

9.1 はじめに 159

9.2 無人航空機 159

9.2.1 防衛 160

9.2.1.1 国防戦闘任務における無人システムのニーズが市場を牽引 160

9.2.2 民間 161

9.2.2.1 無人機への高度な機能の統合が市場を牽引 161

9.2.3 政府・法執行機関 161

9.2.3.1 国土安全保障へのUAVの急速な導入が市場を牽引 161

9.2.4 一般消費者 162

9.2.4.1 レクリエーション志向が市場を牽引 162

9.3 無人地上車両 162

9.3.1 防衛分野 163

9.3.1.1 爆発物処理ロボットの進歩が市場を牽引 163

9.3.2 政府・法執行機関 163

9.3.2.1 テロ活動の緩和に注力することが市場を牽引 163

9.3.3 民間 164

9.3.3.1 農業分野からの需要の高まりが市場を牽引 164

9.4 無人海上車両 164

9.4.1 防衛分野 165

9.4.1.1 地雷対策や対潜水艦戦における遠隔操作ビークルの普及が市場を牽引 165

9.4.2 商用 166

9.4.2.1 石油・ガス探査活動の拡大が市場を牽引 166

9.4.3 その他 166

10 無人システム市場(地域別) 167

10.1 はじめに 168

10.2 北米 170

10.2.1 ペストル分析 171

10.2.2 米国 175

10.2.2.1 研究開発投資の増加が市場を牽引 175

10.2.3 カナダ 178

10.2.3.1 継続的な無人化機能の開発が市場を牽引 178

10.3 欧州 181

10.3.1 ペストル分析 181

10.3.2 イギリス 186

10.3.2.1 防衛分野からの無人システムに対する高い需要が市場を牽引 186

10.3.3 フランス 189

10.3.3.1 民生・商業用途での無人システム導入を促す政府の取り組みが市場を牽引 189

10.3.4 ドイツ 192

10.3.4.1 民間企業や研究機関による技術革新が市場を牽引 192

10.4 アジア太平洋地域 195

10.4.1 乳棒の分析 195

10.4.2 インド 200

10.4.2.1 国境を越えた脅威の軽減に注力することが市場を牽引 200

10.4.3 日本 203

10.4.3.1 防衛予算の急増が市場を牽引 203

10.4.4 韓国 206

10.4.4.1 ロボット技術への多額の資金が市場を牽引 206

10.4.5 オーストラリア 209

10.4.5.1 海上監視強化のニーズが市場を牽引 209

10.5 中東・アフリカ 212

10.5.1 ペストル分析 212

10.5.2 GCC 217

10.5.2.1 UAE 217

10.5.2.1.1 無人システムの調達増が市場を牽引 217

10.5.2.2 サウジアラビア 220

10.5.2.2.1 防衛用途での無人システムの普及が市場を牽引 220

10.5.3 イスラエル 223

10.5.3.1 複雑な地政学的環境が市場を牽引 223

10.5.4 トルコ 226

10.5.4.1 軍事力強化に注力することが市場を牽引 226

10.5.5 南アフリカ 228

10.5.5.1 国境警備と対密猟作戦の重視が市場を牽引 228

10.6 ラテンアメリカ 231

10.6.1 乳棒分析 231

10.6.1.1 ブラジル 235

10.6.1.1.1 技術リーダーとの戦略的パートナーシップが市場を牽引 235

10.6.1.2 メキシコ 238

10.6.1.2.1 業務用無人システムの需要増加が市場を牽引 238

11 競争環境 242

11.1 はじめに 242

11.2 主要プレーヤーの戦略/勝利への権利(2020~2024年) 242

11.3 収益分析、2020-2023年 246

11.4 市場シェア分析、2023年 247

11.5 企業評価マトリックス:主要プレーヤー、2023年 251

11.5.1 スター企業 251

11.5.2 新興リーダー 251

11.5.3 浸透型プレーヤー 251

11.5.4 参加企業 251

11.5.5 企業フットプリント 255

11.5.5.1 企業フットプリント 255

11.5.5.2 タイプ別フットプリント 256

11.5.5.3 アプリケーションフットプリント 256

11.5.5.4 地域別フットプリント 257

11.6 企業評価マトリクス:新興企業/SM(2023年) 258

11.6.1 進歩的企業 258

11.6.2 対応力のある企業 258

11.6.3 ダイナミックな企業 258

11.6.4 スタートアップ・ブロック 258

11.6.5 競争ベンチマーキング 262

11.6.5.1 新興企業/中小企業のリスト 262

11.6.5.2 新興企業/中小企業の競合ベンチマーキング 263

11.7 企業評価と財務指標 264

11.8 ブランド/製品の比較 265

11.9 競争シナリオ 268

11.9.1 製品上市 268

11.9.2 取引 270

11.9.3 その他 278

12 企業プロファイル 286

Teledyne Technologies Inc. (US)

BAE Systems (UK)

DJI (China)

Lockheed Martin Corporation (US)

RTX (US)

BAE Systems (UK)

Northrop Grumman (US)

Boeing (US) Israel Aerospace Industries (Israel)

Thales (France)

General Dynamics Corporation (US)

Textron Inc. (US)

L3Harris Technologies Inc. (US)

Leonardo S.p.A. (Italy)

EDGE PJSC Group (UAE)

ST Engineering (Singapore)

and Elbit Systems Ltd. (Israel)

13 付録 363

13.1 ディスカッション・ガイド 363

13.2 地図に掲載された企業のリスト 364

13.3 Knowledgestore: Marketsandmarketsの購読ポータル 367

13.4 カスタマイズオプション 369

13.5 関連レポート 369

13.6 作者の詳細 370

The market is driven by key factors, including improving ISR capabilities, a surge in demand for autonomous systems, and increasing asymmetric threats in the military. However, the market faces challenges from power supply issues for extended coverage and limited endurance, and supply chain Disruptions in the industry, which can hinder expansion.

Regulatory frameworks and cybersecurity concerns also play a role in shaping market dynamics. As these systems often operate in sensitive environments, ensuring data security and regulatory compliance is critical, especially when deployed for national security and intelligence purposes. Overcoming these hurdles will be essential for sustained growth in the unmanned systems sector, as companies and governments continue to invest in next-generation capabilities.

“Based on Unmanned Surface Vehicle type, the Large USVs segment is estimated to capture the largest share in the market during the forecast period”

Large Unmanned Surface Vessels (USVs) are projected to dominate the USV market during the forecast period due to their advanced capabilities such as extended operational range. Large USVs are particularly valuable for long-duration missions such as maritime surveillance, anti-submarine warfare, and naval escort operations, where extended range, heavy payload capacity, and endurance are critical. For example, the Seagull USV by Elbit Systems is a large USV used for multi-mission naval tasks including mine countermeasures and anti-submarine warfare. In the commercial domain, large USVs are crucial for offshore oil and gas inspections, long-range environmental monitoring, and deep-sea exploration. The growing global emphasis on enhancing maritime security, driven by geopolitical tensions and the need for protecting vast exclusive economic zones (EEZs), is a key factor driving demand for large USVs. Furthermore, their ability to carry advanced sensors, weapons, and communication systems makes them indispensable for high-stakes defense missions. As maritime industries and navies increasingly seek automated solutions for cost efficiency and safety, large USVs are positioned to dominate the market due to their robust capabilities and wide range of applications.

“Based on Unmanned Aerial Vehicle type, the strategic UAVs segment is estimated to dominate the market during the forecast period”

During the projection period, strategic unmanned aerial vehicles (UAVs) are anticipated to dominate the UAV by type market because of their vital role in long-distance, high-altitude missions, mostly for military and defense applications. These UAVs are crucial for military operations since they are made for intelligence, surveillance, and reconnaissance (ISR) missions and can gather real-time data over longer distances and for longer periods. To improve their defense capabilities, nations are investing more and more in strategic UAVs, particularly in light of growing geopolitical tensions and the requirement for continuous border and high-threat zone monitoring. These drones are also multipurpose tools in warfare and reconnaissance missions due to their capacity to carry sophisticated payloads including sensors, communication relays, and precision-guided bombs. MQ-9 Reaper, a popular tool for intelligence collection and counterterrorism. Strategic UAV supremacy is further supported by the necessity for air superiority in complex battle scenarios, the increased emphasis on autonomous warfare, and the fact that these drones are more cost-effective than manned aircraft. Strategic UAVs are expected to play a key role in the expansion of defense infrastructure as militaries throughout the world prioritize modernization.

“The North America region is estimated to be the largest market during the forecast period”

The market for unmanned systems will be led by North America. The US-led region is a global leader in technical innovation, especially in the aerospace and defense industries, which heavily rely on unmanned systems like drones, unmanned ground vehicles (UGVs), and unmanned marine vehicles (UMVs). Growth is further fueled by government backing through large investments in R&D and supportive regulations for the integration of autonomous systems into commercial and military applications. Unmanned systems are crucial to the U.S. Department of Defense's efforts to modernize its military capabilities and improve combat effectiveness, surveillance, and reconnaissance.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the unmanned systems marketplace.

• By Company Type: Tier 1 – 35%, Tier 2 – 45%, and Tier 3 – 20%

• By Designation: C-level – 35%, Director Level – 25%, and Others – 40%

• By Region: North America– 25%, Europe – 25%, Asia Pacific– 35%, Middle East & Africa– 10% and Latin America- 5%

include Teledyne Technologies Inc. (US), BAE Systems (UK), DJI (China), Lockheed Martin Corporation (US), RTX (US), BAE Systems (UK), Northrop Grumman (US), Boeing (US) Israel Aerospace Industries (Israel), Thales (France), General Dynamics Corporation (US), Textron Inc. (US), L3Harris Technologies, Inc. (US), Leonardo S.p.A. (Italy), EDGE PJSC Group (UAE), ST Engineering (Singapore), and Elbit Systems Ltd. (Israel) are some of the leading players operating in the unmanned systems market.

Research Coverage

This research report categorizes the unmanned systems market by type (Unmanned Aerial Vehicles, Unmanned Marine Vehicles, and Unmanned Surface Vehicles), by Applications (Defense, Government & Law Enforcement, Commercial, consumer, and Other), by Mode of Operation (Remotely Piloted, Optionally Piloted, Autonomous, Tethered, Teleoperated, and Remotely Operated) and by Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the unmanned systems market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; Contracts, partnerships, agreements, new product launches, and recent developments associated with the unmanned systems market. Competitive analysis of upcoming startups in the unmanned systems market ecosystem is covered in this report.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall unmanned systems market and its subsegments. The report covers the entire ecosystem of the unmanned systems market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key Drivers (Rising demand for Autonomous Systems, Improving ISR and Target Acquisition Capabilities, and Increasing asymmetric threats in the military), restrains (Information Security Threats and Regulatory Issues), opportunities (Growing global defense budgets, and Rapid Innovations and Increasing Technological Advancements) and challenges (Power supply issues for extended coverage and limited endurance, and High Operational Costs associated with Unmanned Systems) influencing the growth of the market.

• Product Development/Innovation: Detailed Insights on upcoming technologies, R&D activities, and new products/solutions launched in the market.

• Market Development: Comprehensive information about lucrative markets – the report analyses the unmanned systems market across varied regions

• Market Diversification: Exhaustive information about new solutions, recent developments, and investments in the unmanned systems market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including Northrop Grumman (US), Lockheed Martin Corporation (US), Teledyne Technologies Inc. (US), BAE Systems (UK), and DJI (China) among others in the unmanned systems market.

1 INTRODUCTION 30

1.1 STUDY OBJECTIVES 30

1.2 MARKET DEFINITION 30

1.2.1 INCLUSIONS AND EXCLUSIONS 31

1.3 STUDY SCOPE 32

1.3.1 MARKETS COVERED 32

1.3.2 YEARS CONSIDERED 33

1.4 CURRENCY CONSIDERED 33

1.5 UNIT CONSIDERED 34

1.6 STAKEHOLDERS 34

2 RESEARCH METHODOLOGY 35

2.1 RESEARCH DATA 35

2.1.1 SECONDARY DATA 36

2.1.1.1 Key data from secondary sources 37

2.1.2 PRIMARY DATA 37

2.1.2.1 Primary sources 37

2.1.2.2 Key data from primary sources 38

2.1.2.3 Breakdown of primary interviews 38

2.2 FACTOR ANALYSIS 39

2.2.1 INTRODUCTION 39

2.2.2 DEMAND-SIDE INDICATORS 39

2.2.3 SUPPLY-SIDE INDICATORS 39

2.3 MARKET SIZE ESTIMATION 40

2.3.1 BOTTOM-UP APPROACH 40

2.3.2 TOP-DOWN APPROACH 40

2.4 DATA TRIANGULATION 41

2.5 RESEARCH ASSUMPTIONS 42

2.6 RESEARCH LIMITATIONS 43

2.7 RISK ASSESSMENT 43

3 EXECUTIVE SUMMARY 44

4 PREMIUM INSIGHTS 49

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UNMANNED SYSTEMS MARKET 49

4.2 UNMANNED SYSTEMS MARKET, BY TYPE 49

4.3 UNMANNED AERIAL VEHICLES MARKET, BY TYPE 50

4.4 UNMANNED GROUND VEHICLES MARKET, BY TYPE 50

4.5 UNMANNED MARINE VEHICLES MARKET, BY TYPE 51

5 MARKET OVERVIEW 52

5.1 INTRODUCTION 52

5.2 MARKET DYNAMICS 52

5.2.1 DRIVERS 53

5.2.1.1 Surge in demand for autonomous systems 53

5.2.1.2 Need for improved ISR and target acquisition capabilities 53

5.2.1.3 Rise in asymmetric threats 53

5.2.1.4 Increased commercial adoption due to operational efficiency and cost savings 54

5.2.2 RESTRAINTS 54

5.2.2.1 Information security risks and regulatory constraints 54

5.2.2.2 Lack of skilled operators and workforce training 55

5.2.3 OPPORTUNITIES 55

5.2.3.1 Growing global defense budgets 55

5.2.3.2 Rapid innovations and technological advancements 56

5.2.4 CHALLENGES 56

5.2.4.1 Power supply issues and limited endurance 56

5.2.4.2 High operational costs 57

5.2.4.3 Supply chain disruptions 58

5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 58

5.4 VALUE CHAIN ANALYSIS 59

5.5 ECOSYSTEM ANALYSIS 60

5.5.1 PROMINENT COMPANIES 60

5.5.2 PRIVATE AND SMALL ENTERPRISES 60

5.5.3 END USERS 60

5.6 PRICING ANALYSIS 62

5.6.1 INDICATIVE PRICING ANALYSIS OF UNMANNED AERIAL VEHICLES 63

5.6.2 INDICATIVE PRICING ANALYSIS OF UNMANNED GROUND VEHICLES 63

5.6.3 INDICATIVE PRICING ANALYSIS OF UNMANNED MARINE VEHICLES 64

5.7 REGULATORY LANDSCAPE 65

5.8 TRADE DATA 69

5.9 TECHNOLOGY ANALYSIS 75

5.9.1 KEY TECHNOLOGIES 75

5.9.1.1 LiDAR 75

5.9.1.2 Advanced navigation systems 76

5.9.2 COMPLEMENTARY TECHNOLOGIES 76

5.9.2.1 Electro-optical and radar sensor payloads 76

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA 76

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS 76

5.10.2 BUYING CRITERIA 78

5.11 KEY CONFERENCES AND EVENTS, 2025 79

5.12 BILL OF MATERIALS 80

5.12.1 BILL OF MATERIALS FOR UNMANNED AERIAL VEHICLES 80

5.12.2 BILL OF MATERIALS FOR UNMANNED GROUND VEHICLES 82

5.12.3 BILL OF MATERIALS FOR UNMANNED MARINE VEHICLES 84

5.13 BUSINESS MODELS 86

5.13.1 BUSINESS MODELS OF UNMANNED AERIAL VEHICLES MARKET 86

5.13.1.1 Direct sale model 86

5.13.1.2 Subscription-based service model 87

5.13.1.3 Operating lease model 89

5.13.2 BUSINESS MODELS OF UNMANNED GROUND VEHICLES MARKET 91

5.13.2.1 Equipment sale and leasing model 91

5.13.2.2 UGV-as-a-service (UGVAAS) model 91

5.13.2.3 Customized solution model 91

5.13.3 BUSINESS MODELS OF UNMANNED MARINE VEHICLES MARKET 93

5.13.3.1 Product-based sale model 93

5.13.3.2 Service-based model 93

5.13.3.3 Leasing and rental model 94

5.14 TOTAL COST OF OWNERSHIP 95

5.14.1 TOTAL COST OF OWNERSHIP OF UNMANNED AERIAL VEHICLES 95

5.14.2 TOTAL COST OF OWNERSHIP OF UNMANNED GROUND VEHICLES 99

5.14.3 TOTAL COST OF OWNERSHIP OF UNMANNED MARINE VEHICLES 101

5.15 TECHNOLOGY ROADMAP 104

5.15.1 TECHNOLOGY ROADMAP OF UNMANNED AERIAL VEHICLES MARKET 104

5.15.2 TECHNOLOGY ROADMAP OF UNMANNED GROUND VEHICLES MARKET 106

5.15.3 TECHNOLOGY ROADMAP OF UNMANNED MARINE VEHICLES MARKET 107

5.16 IMPACT OF AI 109

5.16.1 INTRODUCTION 109

5.16.2 IMPACT OF AI ON DEFENSE INDUSTRY 109

5.16.3 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES 110

5.16.4 IMPACT OF AI ON UNMANNED AERIAL VEHICLES MARKET 111

5.16.5 IMPACT OF AI ON UNMANNED GROUND VEHICLES MARKET 113

5.16.6 IMPACT OF AI ON UNMANNED MARINE VEHICLES MARKET 116

5.17 MACROECONOMIC OUTLOOK 119

5.17.1 INTRODUCTION 119

5.17.2 NORTH AMERICA 120

5.17.3 EUROPE 120

5.17.4 ASIA PACIFIC 120

5.17.5 MIDDLE EAST 121

5.17.6 LATIN AMERICA 121

5.17.7 AFRICA 121

5.18 CONTROL STATIONS 122

5.18.1 INTRODUCTION 122

5.18.2 CONTROL STATIONS FOR UNMANNED AERIAL VEHICLES 122

5.18.3 CONTROL STATIONS FOR UNMANNED GROUND VEHICLES 123

5.18.4 CONTROL STATIONS FOR UNMANNED MARINE VEHICLES 123

5.19 INVESTMENT AND FUNDING SCENARIO 124

6 INDUSTRY TRENDS 125

6.1 INTRODUCTION 125

6.2 TECHNOLOGY TRENDS 125

6.2.1 SWARM OPERATION TECHNOLOGY 126

6.2.2 AUTONOMOUS REFUELING 126

6.2.3 MODULAR AND INTERCHANGEABLE PAYLOAD SYSTEM 127

6.2.4 ADVANCED SENSOR TECHNOLOGY 127

6.2.5 ADVANCED COMMUNICATION SYSTEM 128

6.3 IMPACT OF MEGATRENDS 129

6.3.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING 129

6.3.2 ADVANCED MATERIALS AND MANUFACTURING 129

6.3.3 BIG DATA ANALYTICS 129

6.4 SUPPLY CHAIN ANALYSIS 130

6.5 PATENT ANALYSIS 131

7 UNMANNED SYSTEMS MARKET, BY TYPE 134

7.1 INTRODUCTION 135

7.2 UNMANNED AERIAL VEHICLES 136

7.2.1 EXTENSIVE USE IN MEDICINE DELIVERY TO DRIVE MARKET 136

7.2.2 SMALL 138

7.2.3 MEDIUM & LARGE 139

7.2.4 TACTICAL 140

7.2.5 STRATEGIC 141

7.3 UNMANNED MARINE VEHICLES 141

7.3.1 UNMANNED SURFACE VEHICLES 142

7.3.1.1 Surge in demand for safer maritime operations to drive market 142

7.3.1.2 Small 143

7.3.1.3 Medium 144

7.3.1.4 Large 144

7.3.1.5 Extra Large 144

7.3.2 UNMANNED UNDERWATER VEHICLES 144

7.3.2.1 Growing exploration and monitoring needs to drive market 144

7.3.2.2 Remotely operated vehicles 146

7.3.2.3 Autonomous underwater vehicles 146

7.4 UNMANNED GROUND VEHICLES 147

7.4.1 ABILITY TO MANEUVER THROUGH TOUGH TERRAINS TO DRIVE MARKET 147

7.4.2 WHEELED 149

7.4.3 TRACKED 149

7.4.4 HYBRID 149

7.4.5 LEGGED 150

8 UNMANNED SYSTEMS MARKET, BY MODE OF OPERATION 151

8.1 INTRODUCTION 152

8.2 UNMANNED AERIAL VEHICLES 152

8.2.1 REMOTELY PILOTED 153

8.2.1.1 Cost-effective manufacturing to drive market 153

8.2.2 OPTIONALLY PILOTED 154

8.2.2.1 Diverse military and commercial applications to drive market 154

8.2.3 FULLY AUTONOMOUS 154

8.2.3.1 High demand in military applications to drive market 154

8.3 UNMANNED GROUND VEHICLES 155

8.3.1 TETHERED 155

8.3.1.1 Advantages in missions requiring secure data transmission to drive market 155

8.3.2 TELEOPERATED 155

8.3.2.1 Deployment in mine detection and clearing operations to drive market 155

8.3.3 AUTONOMOUS 156

8.3.3.1 Predominance in target tracking, surveillance, and reconnaissance missions to drive market 156

8.4 UNMANNED MARINE VEHICLES 156

8.4.1 REMOTELY OPERATED 157

8.4.1.1 Wide-scale deployment in commercial and scientific applications to drive market 157

8.4.2 AUTONOMOUS 157

8.4.2.1 Emphasis on data accuracy and improved payload capacity to drive market 157

9 UNMANNED SYSTEMS MARKET, BY APPLICATION 158

9.1 INTRODUCTION 159

9.2 UNMANNED AERIAL VEHICLES 159

9.2.1 DEFENSE 160

9.2.1.1 Need for unmanned systems in defense combat missions to drive market 160

9.2.2 COMMERCIAL 161

9.2.2.1 Integration of advanced features in drones to drive market 161

9.2.3 GOVERNMENT & LAW ENFORCEMENT 161

9.2.3.1 Rapid adoption of UAVs for homeland security to drive market 161

9.2.4 CONSUMER 162

9.2.4.1 Inclination toward recreational activities to drive market 162

9.3 UNMANNED GROUND VEHICLES 162

9.3.1 DEFENSE 163

9.3.1.1 Advancements in explosive ordnance disposal robots to drive market 163

9.3.2 GOVERNMENT AND LAW ENFORCEMENT 163

9.3.2.1 Focus on mitigating terrorist activities to drive market 163

9.3.3 COMMERCIAL 164

9.3.3.1 Elevated demand from agricultural sector to drive market 164

9.4 UNMANNED MARINE VEHICLES 164

9.4.1 DEFENSE 165

9.4.1.1 Prevalence of remotely operated vehicles in mine countermeasures and anti-submarine warfare to drive market 165

9.4.2 COMMERCIAL 166

9.4.2.1 Expanding oil & gas exploration activities to drive market 166

9.4.3 OTHERS 166

10 UNMANNED SYSTEMS MARKET, BY REGION 167

10.1 INTRODUCTION 168

10.2 NORTH AMERICA 170

10.2.1 PESTLE ANALYSIS 171

10.2.2 US 175

10.2.2.1 Increasing investments in R&D to drive market 175

10.2.3 CANADA 178

10.2.3.1 Ongoing development of unmanned capabilities to drive market 178

10.3 EUROPE 181

10.3.1 PESTLE ANALYSIS 181

10.3.2 UK 186

10.3.2.1 High demand for unmanned systems from defense sector to drive market 186

10.3.3 FRANCE 189

10.3.3.1 Government initiatives prompting unmanned system adoption in civil and commercial applications to drive market 189

10.3.4 GERMANY 192

10.3.4.1 Technological innovations by private companies and research institutions to drive market 192

10.4 ASIA PACIFIC 195

10.4.1 PESTLE ANALYSIS 195

10.4.2 INDIA 200

10.4.2.1 Focus on mitigating cross-border threats to drive market 200

10.4.3 JAPAN 203

10.4.3.1 Surge in defense budget to drive market 203

10.4.4 SOUTH KOREA 206

10.4.4.1 Substantial funding in robotics technologies to drive market 206

10.4.5 AUSTRALIA 209

10.4.5.1 Need for enhanced maritime surveillance to drive market 209

10.5 MIDDLE EAST & AFRICA 212

10.5.1 PESTLE ANALYSIS 212

10.5.2 GCC 217

10.5.2.1 UAE 217

10.5.2.1.1 Rising procurement of unmanned systems to drive market 217

10.5.2.2 SAUDI ARABIA 220

10.5.2.2.1 Extensive use of unmanned systems in defense applications to drive market 220

10.5.3 ISRAEL 223

10.5.3.1 Complex geopolitical environment to drive market 223

10.5.4 TURKEY 226

10.5.4.1 Focus on strengthening military capabilities to drive market 226

10.5.5 SOUTH AFRICA 228

10.5.5.1 Emphasis on border security and anti-poaching operations to drive market 228

10.6 LATIN AMERICA 231

10.6.1 PESTLE ANALYSIS 231

10.6.1.1 BRAZIL 235

10.6.1.1.1 Strategic partnerships with technology leaders to drive market 235

10.6.1.2 MEXICO 238

10.6.1.2.1 Increasing demand for unmanned systems for commercial applications to drive market 238

11 COMPETITIVE LANDSCAPE 242

11.1 INTRODUCTION 242

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 242

11.3 REVENUE ANALYSIS, 2020–2023 246

11.4 MARKET SHARE ANALYSIS, 2023 247

11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 251

11.5.1 STARS 251

11.5.2 EMERGING LEADERS 251

11.5.3 PERVASIVE PLAYERS 251

11.5.4 PARTICIPANTS 251

11.5.5 COMPANY FOOTPRINT 255

11.5.5.1 Company footprint 255

11.5.5.2 Type footprint 256

11.5.5.3 Application footprint 256

11.5.5.4 Region footprint 257

11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023 258

11.6.1 PROGRESSIVE COMPANIES 258

11.6.2 RESPONSIVE COMPANIES 258

11.6.3 DYNAMIC COMPANIES 258

11.6.4 STARTING BLOCKS 258

11.6.5 COMPETITIVE BENCHMARKING 262

11.6.5.1 List of start-ups/SMEs 262

11.6.5.2 Competitive benchmarking of start-ups/SMEs 263

11.7 COMPANY VALUATION AND FINANCIAL METRICS 264

11.8 BRAND/PRODUCT COMPARISON 265

11.9 COMPETITIVE SCENARIO 268

11.9.1 PRODUCT LAUNCHES 268

11.9.2 DEALS 270

11.9.3 OTHERS 278

12 COMPANY PROFILES 286

12.1 KEY PLAYERS 286

12.1.1 NORTHROP GRUMMAN 286

12.1.1.1 Business overview 286

12.1.1.2 Products offered 287

12.1.1.3 Recent developments 289

12.1.1.3.1 Deals 289

12.1.1.3.2 Others 289

12.1.1.4 MnM view 290

12.1.1.4.1 Key strengths 290

12.1.1.4.2 Strategic choices 290

12.1.1.4.3 Weaknesses and competitive threats 291

12.1.2 TELEDYNE TECHNOLOGIES INCORPORATED 292

12.1.2.1 Business overview 292

12.1.2.2 Products offered 293

12.1.2.3 Recent developments 295

12.1.2.3.1 Product launches 295

12.1.2.3.2 Deals 295

12.1.2.3.3 Others 296

12.1.2.4 MnM view 297

12.1.2.4.1 Key strengths 297

12.1.2.4.2 Strategic choices 297

12.1.2.4.3 Weaknesses and competitive threats 297

12.1.3 LOCKHEED MARTIN CORPORATION 298

12.1.3.1 Business overview 298

12.1.3.2 Products offered 299

12.1.3.3 Recent developments 301

12.1.3.3.1 Deals 301

12.1.3.3.2 Others 301

12.1.3.4 MnM view 302

12.1.3.4.1 Key strengths 302

12.1.3.4.2 Strategic choices 302

12.1.3.4.3 Weaknesses and Competitive threats 302

12.1.4 BAE SYSTEMS 303

12.1.4.1 Business overview 303

12.1.4.2 Products offered 304

12.1.4.3 Recent developments 306

12.1.4.3.1 Product launches 306

12.1.4.3.2 Deals 306

12.1.4.3.3 Others 307

12.1.4.4 MnM view 307

12.1.4.4.1 Key strengths 307

12.1.4.4.2 Strategic choices 308

12.1.4.4.3 Weaknesses and competitive threats 308

12.1.5 DJI 309

12.1.5.1 Business overview 309

12.1.5.2 Products offered 309

12.1.5.3 Recent developments 310

12.1.5.3.1 Product launches 310

12.1.5.3.2 Deals 312

12.1.5.4 MnM view 313

12.1.5.4.1 Key strengths 313

12.1.5.4.2 Strategic choices 313

12.1.5.4.3 Weaknesses and competitive threats 313

12.1.6 THALES 314

12.1.6.1 Business overview 314

12.1.6.2 Products offered 315

12.1.6.3 Recent developments 317

12.1.6.3.1 Deals 317

12.1.7 ISRAEL AEROSPACE INDUSTRIES 318

12.1.7.1 Business overview 318

12.1.7.2 Products offered 319

12.1.7.3 Recent developments 321

12.1.7.3.1 Deals 321

12.1.7.3.2 Others 323

12.1.8 BOEING 324

12.1.8.1 Business overview 324

12.1.8.2 Products offered 325

12.1.8.3 Recent developments 327

12.1.8.3.1 Deals 327

12.1.8.3.2 Others 328

12.1.9 GENERAL DYNAMICS CORPORATION 329

12.1.9.1 Business overview 329

12.1.9.2 Products offered 330

12.1.9.3 Recent developments 330

12.1.9.3.1 Others 330

12.1.10 TEXTRON INC. 331

12.1.10.1 Business overview 331

12.1.10.2 Products offered 332

12.1.10.3 Recent developments 333

12.1.10.3.1 Deals 333

12.1.10.3.2 Others 333

12.1.11 L3HARRIS TECHNOLOGIES, INC. 335

12.1.11.1 Business overview 335

12.1.11.2 Products offered 336

12.1.11.3 Recent developments 338

12.1.11.3.1 Deals 338

12.1.11.3.2 Others 338

12.1.12 ELBIT SYSTEMS LTD. 339

12.1.12.1 Business overview 339

12.1.12.2 Products offered 340

12.1.12.3 Recent developments 341

12.1.12.3.1 Product launches 341

12.1.12.3.2 Deals 342

12.1.12.3.3 Others 342

12.1.13 LEONARDO S.P.A. 344

12.1.13.1 Business overview 344

12.1.13.2 Products offered 345

12.1.13.3 Recent developments 346

12.1.13.3.1 Deals 346

12.1.13.3.2 Others 347

12.1.14 EDGE PJSC GROUP 348

12.1.14.1 Business overview 348

12.1.14.2 Products offered 348

12.1.14.3 Recent developments 351

12.1.14.3.1 Product launches 351

12.1.14.3.2 Deals 351

12.1.14.3.3 Others 352

12.1.15 ST ENGINEERING 353

12.1.15.1 Business overview 353

12.1.15.2 Products offered 354

12.1.15.3 Recent developments 355

12.1.15.3.1 Deals 355

12.2 OTHER PLAYERS 357

12.2.1 SHIELD AI 357

12.2.2 AUTEL ROBOTICS 357

12.2.3 DELAIR 358

12.2.4 MICRODRONES 358

12.2.5 MSUBS 359

12.2.6 ANDURIL 360

12.2.7 INTERNATIONAL SUBMARINE ENGINEERING LTD. 361

12.2.8 OCIUS TECHNOLOGIES 361

12.2.9 CLEARPATH ROBOTICS INC. 362

12.2.10 MARITIME ROBOTICS 362

13 APPENDIX 363

13.1 DISCUSSION GUIDE 363

13.2 LAUNDRY LIST OF MAPPED COMPANIES 364

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 367

13.4 CUSTOMIZATION OPTIONS 369

13.5 RELATED REPORTS 369

13.6 AUTHOR DETAILS 370

❖ 世界の無人システム市場に関するよくある質問(FAQ) ❖

・無人システムの世界市場規模は?

→MarketsandMarkets社は2024年の無人システムの世界市場規模を271.3億米ドルと推定しています。

・無人システムの世界市場予測は?

→MarketsandMarkets社は2029年の無人システムの世界市場規模を435.4億米ドルと予測しています。

・無人システム市場の成長率は?

→MarketsandMarkets社は無人システムの世界市場が2024年~2029年に年平均8.2%成長すると予測しています。

・世界の無人システム市場における主要企業は?

→MarketsandMarkets社は「Teledyne Technologies Inc. (US)、BAE Systems (UK)、DJI (China)、Lockheed Martin Corporation (US)、RTX (US)、BAE Systems (UK)、Northrop Grumman (US)、Boeing (US) Israel Aerospace Industries (Israel)、Thales (France)、General Dynamics Corporation (US)、Textron Inc. (US)、L3Harris Technologies、Inc. (US)、Leonardo S.p.A. (Italy)、EDGE PJSC Group (UAE)、ST Engineering (Singapore)、and Elbit Systems Ltd. (Israel)など ...」をグローバル無人システム市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。