1 はじめに 26

1.1 調査目的 26

1.2 市場の定義 26

1.3 調査範囲 27

1.3.1 対象市場と地域範囲 27

1.3.2 考慮した年数 28

1.3.3 対象範囲と除外項目 28

1.4 考慮した通貨 29

1.5 考慮した単位 29

1.6 制限事項 29

1.7 利害関係者 29

1.8 変更点のまとめ 29

2 調査方法 30

2.1 調査データ 30

2.1.1 二次データ 31

2.1.1.1 主な二次情報源 32

2.1.1.2 二次資料からの主要データ 32

2.1.2 一次データ 32

2.1.2.1 一次面接の対象者 33

2.1.2.2 主要な一次インタビュー参加者 33

2.1.2.3 プライマリーの内訳 33

2.1.2.4 主要な業界インサイト 34

2.1.2.5 一次情報源からの主要データ 34

2.1.3 二次調査および一次調査 35

2.2 市場規模の推定 35

2.2.1 ボトムアップアプローチ 36

2.2.1.1 ボトムアップアプローチによる市場規模の推定 36

2.2.2 トップダウンアプローチ 37

2.2.2.1 市場規模推定のためのトップダウンアプローチ 37

2.3 市場の内訳とデータの三角測量 39

2.4 リサーチの前提 40

2.5 調査の限界 40

2.6 リスク評価 40

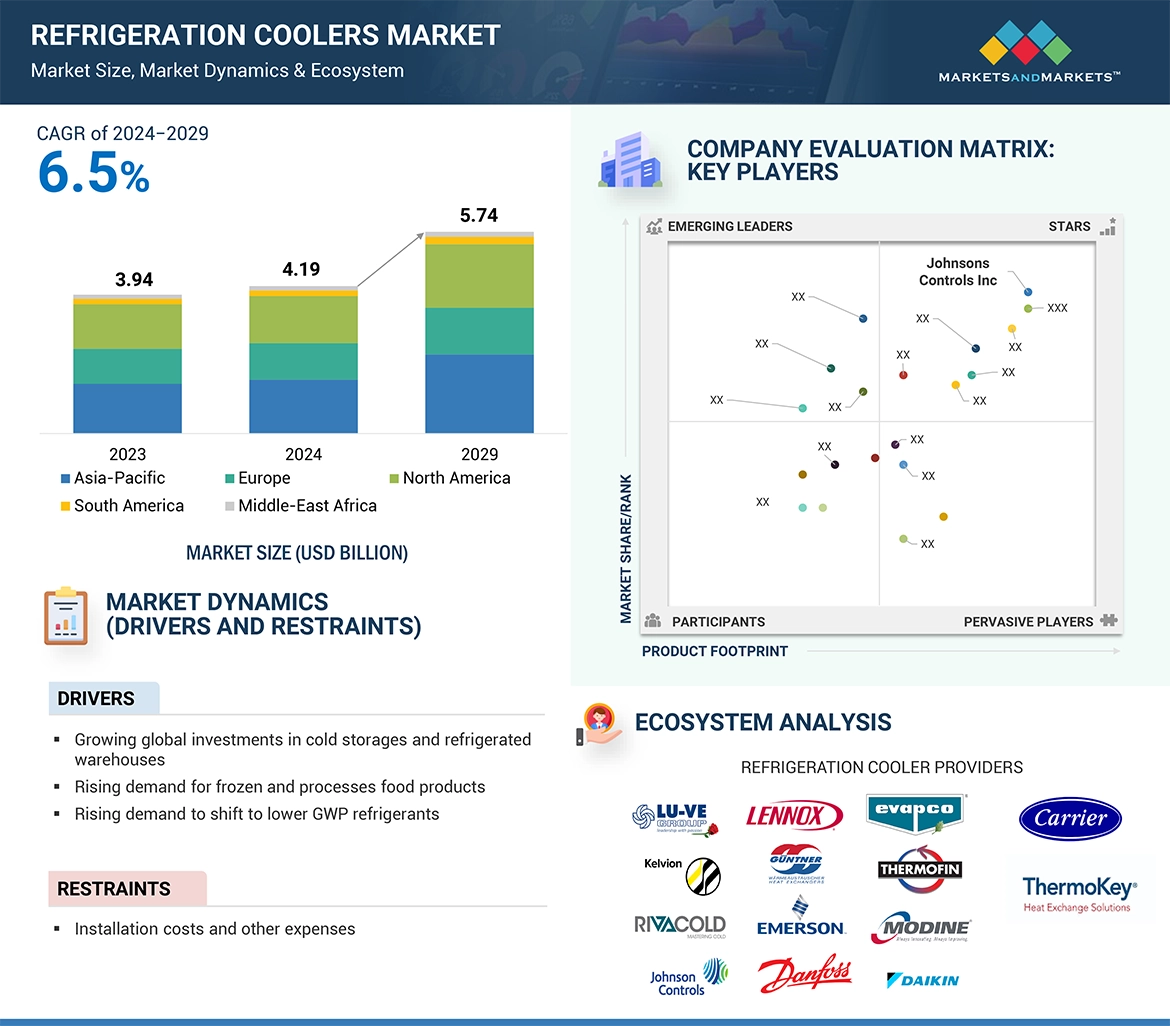

3 エグゼクティブサマリー 41

4 プレミアムインサイト

4.1 冷凍クーラー市場におけるプレーヤーにとっての魅力的な機会 45

4.2 冷凍クーラー市場:提供物別 45

4.3 冷凍クーラー市場:移動性別 46

4.4 冷却クーラー市場:冷媒別 46

5 市場の概要 47

5.1 はじめに 47

5.2 市場ダイナミクス 47

5.2.1 推進要因 48

5.2.1.1 冷蔵倉庫/冷蔵倉庫への投資の増加 48

5.2.1.2 冷凍食品と加工食品の需要の増大 48

5.2.1.3 低GWP 冷媒へのシフト 48

5.2.1.4 世界の気象パターンの変化 49

5.2.2 抑制要因 50

5.2.2.1 高い設置コストと運用コスト 50

5.2.3 機会 50

5.2.3.1 FMCG製品に対する需要の増加 50

5.2.3.2 冷凍技術におけるIoTの採用 50

5.2.3.3 ウォークインクーラーの需要急増 51

5.2.3.4 医療や物流などの新興用途での需要拡大 51

5.2.4 課題 52

5.2.4.1 熟練者の不足と安全性への懸念 52

5.2.4.2 冷凍冷却システムの設置に伴う複雑さ 53

5.3 冷凍クーラー市場へのaiの影響 53

5.4 バリューチェーン分析

5.4.1 研究開発(R&D) 55

5.4.2 コンポーネントメーカー

5.4.3 代理店/再販業者 56

5.4.4 アセンブラー/インストーラー/インテグレーター 56

5.4.5 エンドユーザー 56

5.4.6 アフターサービス 56

5.5 エコシステム分析 56

5.6 投資と資金調達のシナリオ 59

5.7 価格分析 59

5.7.1 主要企業の平均販売価格動向(コンポーネント別) 60

5.8 顧客ビジネスに影響を与えるトレンド/混乱 62

5.9 技術分析 62

5.9.1 主要技術 62

5.9.1.1 人工知能(AI) 62

5.9.1.2 モノのインターネット(IoT) 63

5.9.2 補完技術 63

5.9.2.1 オートメーション 63

5.9.3 隣接技術 64

5.9.3.1 シェル&チューブ式熱交換器 64

5.9.3.2 スパイラル熱交換器 64

5.9.3.3 プレート式熱交換器 64

5.9.3.4 プレートフィン熱交換器 64

5.10 ポーターのファイブフォース分析 64

5.10.1 新規参入の脅威 65

5.10.2 代替品の脅威 66

5.10.3 供給者の交渉力 66

5.10.4 買い手の交渉力 66

5.10.5 競合の激しさ 66

5.11 主要ステークホルダーと購買基準 67

5.11.1 購入プロセスにおける主要ステークホルダー 67

5.11.2 購買基準 68

5.12 ケーススタディ分析 69

5.12.1 ダンフォス、アナンダ・フーズ(インド)にコンプレッサーシステムを設置 69

5.12.2 ルヴェ・グループがイタリアのカルフール・スーパーマーケットに冷蔵ソリューションを提供 69

5.12.3 カルフールのトリノ、リバルタの北西ロジスティクスセンターが

がrivacoldの冷蔵ソリューションを採用 70

5.12.4 インドスペース社とKool-ex社が温度管理倉庫で提携 70

5.12.5 Innovate UK、IMS Evolve、Tesco Store が冷蔵システムの需要側応答を調査 71

サイドレスポンスを調査

5.13 貿易分析 71

5.13.1 輸入シナリオ(HSコード841869) 71

5.13.2 輸出シナリオ(HSコード841869) 72

5.14 特許分析 74

5.14.1 冷凍クーラー市場:主要特許リスト 75

5.15 主要会議とイベント(2024-2025年) 77

5.16 規制情勢 78

5.16.1 規制機関、政府機関、その他の団体 78

5.16.2 規格 80

6 冷凍クーラー市場、製品別 82

6.1 導入 83

6.2 コンデンサー 84

6.2.1 空冷式 85

6.2.1.1 水不足地域での使用に適した空冷式コンデンサー 85

6.2.2 水冷式 85

6.2.2.1 小型コンデンサへの需要が水冷式コンデンサの成長を促進 85

6.2.3 蒸発式 85

6.2.3.1 冷却システムの物理的サイズを制限する規制が蒸発式コンデンサーの使用を制限 85

6.3 圧縮機 86

6.3.1 容積式コンプレッサー 87

6.3.1.1 効率的なガス圧縮に対する需要の高まりが容積式コンプレッサーの原動力 87

6.3.2 動的圧縮機 87

6.3.2.1 大量の冷媒を低圧縮するニーズが動的圧縮機の需要を促進 87

6.4 蒸発器・冷却器 88

6.4.1 大型冷凍プラントと中央空調プラントの需要増加が成長の原動力 88

6.4.2 エアユニット 88

6.4.2.1 設計タイプ別 89

6.4.2.1.1 横型 89

6.4.2.1.1 屋根裏部屋やクロールスペースでの冷蔵需要の増加が横型エアクーラーの成長を促進 89

6.4.2.1.2 縦型 89

6.4.2.1.2.1 エアクーラーのコンパクト設計への傾斜が縦型エアクーラーの採用を増加 89

6.4.2.1.3 V字型および角度付きデザイン 89

6.4.2.1.3.1 平面寸法を縮小したクーラーへの需要が V 型エアクーラーの成長を促進 89

6.4.2.2 実装タイプ別 89

6.4.2.2.1 天井/壁 89

6.4.2.2.1.1 ビルのスペース不足の増大が天井/壁取付け型エアクーラーの採用を促進 89

6.4.2.2.2 床 90

6.4.2.2.2.1 広い部屋での空冷需要が床用エアクーラーの成長を促進 90

6.4.2.2.3 カウンター/キャビネット 90

6.4.2.2.3.1 過酷な環境における空冷クーラーのニーズの高まりがカウンター/キャビネット用クーラーの成長を促進 90

6.4.3 ドライクーラー 90

6.4.3.1 効率的な熱伝達の需要がドライクーラーの成長に寄与 90

6.4.4 ブライン冷却器 90

6.4.4.1 商業用及び工業用冷凍における空気冷却器の設置増加がブライン冷却器の成長を促進 90

6.4.5 ブラスト/トンネル式ユニットクーラー 91

6.4.5.1 ブラストユニットクーラーの採用に拍車をかける保冷需要 91

7 冷凍クーラー市場:冷媒別 93

7.1 導入 94

7.2 HFC/HFO 96

7.2.1 冷凍クーラーに最も広く使用されている冷媒タイプ 96

7.3 CO2 97

7.3.1 熱回収需要の増加がCO2 冷媒の採用を促進 97

7.4 NH3 98

7.4.1 産業用途における効率的な冷却の必要性が NH3 冷媒の成長に寄与 98

7.5 プロパン 99

7.5.1 環境にやさしく手ごろな価格のオプションへの需要がプロパンの採用を促進 99

7.6 その他 100

7.6.1 安全操業のために高まる A2L 冷媒の需要 100

8 冷凍クーラー市場、モビリティ別 102

8.1 導入 103

8.2 定置型 104

8.2.1 信頼性が高く、大規模で長期的な冷却ソリューションに広く利用されている定置型冷凍クーラー 104

8.3 ポータブル 105

8.3.1 食品輸送需要の増加がモバイル/ポータブル冷却システムの採用に拍車 105

9 冷凍クーラー市場、用途別 107

9.1 導入 108

9.2 小売 110

9.2.1 スーパーマーケット 110

9.2.1.1 連続冷蔵の必要性がスーパーマーケットの冷凍ユニット需要を促進 110

9.2.2 ハイパーマーケット 111

9.2.2.1 ハイパーマーケットではラック上の食品を見やすくする需要が冷蔵クーラーの採用を増加 111

9.2.3 コンビニエンスストアとミニマーケット 111

9.2.3.1 コンビニにおけるウォークイン冷凍庫のニーズが冷蔵クーラーの需要を加速 111

9.2.4 ホスピタリティ 111

9.2.4.1 ホテルにおける食品・飲料の冷蔵保存需要が冷凍クーラーの採用を促進 111

9.3 食品・飲料 115

9.3.1 青果物加工 115

9.3.1.1 果物・野菜の長期保存ニーズが成長を促進 115

9.3.2 飲料加工 115

9.3.2.1 生鮮飲料の需要が冷蔵クーラー市場を活性化 115

9.3.3 乳製品・アイスクリーム加工 116

9.3.3.1 乳製品の腐敗を減らす必要性により冷凍冷却機の使用が増加 116

9.3.4 食肉、鶏肉、魚加工 116

9.3.4.1 賞味期限が限られているため食肉、鶏肉、魚の加工で冷凍クーラーの需要が高い 116

9.4 物流・倉庫 120

9.4.1 冷蔵倉庫 120

9.4.1.1 需要を煽る生鮮品の特別な監視とメンテナンスの必要性 120

9.4.2 物流・倉庫 120

9.4.2.1 果物や野菜の適時熟成への需要が小型貯蔵室の採用を加速 120

9.5 医療・医薬品 123

9.5.1 ワクチンの保管 123

9.5.1.1 医薬品やワクチンの安全性、寿命、有効性を確保する必要性が市場を牽引 123

9.5.2 医療機器 123

9.5.2.1 特定の重要な医療機器の材料劣化を最小限に抑えるために使用される冷凍冷却器 123

9.6 その他の用途 126

9.6.1 垂直農業 126

9.6.2 科学研究 126

9.6.3 特殊用途 126

10 冷凍クーラー市場、地域別 129

10.1 はじめに 130

10.2 北米 131

10.2.1 北米のマクロ経済見通し 136

10.2.2 米国 136

10.2.2.1 腐敗や細菌の増殖を防ぐための食品の保管に関する厳格なガイドラインが需要を牽引 136

10.2.3 カナダ 137

10.2.3.1 環境問題への関心の高まりによるCO2 冷媒の需要増加 137

10.2.4 メキシコ 138

10.2.4.1 GWP値の低い冷凍ユニットの使用が市場を牽引 138

10.3 欧州 139

10.3.1 欧州のマクロ経済見通し 145

10.3.2 ドイツ 145

10.3.2.1 自然冷媒へのニーズの高まりがドイツ市場を牽引 145

10.3.3 イギリス 146

10.3.3.1 保冷庫需要の増加が英国市場を牽引 146

10.3.4 フランス 147

10.3.4.1 人工アイススケートリンクでの冷凍クーラー採用の増加が市場を活性化 147

10.3.5 イタリア 148

10.3.5.1 環境に優しい冷媒を用いたより環境に優しい冷凍技術の採用が市場成長を加速 148

10.3.6 その他の欧州 149

10.4 アジア太平洋地域 150

10.4.1 アジア太平洋地域のマクロ経済見通し 156

10.4.2 中国 157

10.4.2.1 食品、医薬品、化粧品、コールドチェーンロジスティクスの大幅な需要増が市場を牽引 157

10.4.3 日本 158

10.4.3.1 自然冷媒ベースのシステム導入へのシフトが市場の特徴 158

10.4.4 インド 159

10.4.4.1 全国にコールドチェーン網を構築する政府の取り組みが市場成長を促進 159

10.4.5 韓国 160

10.4.5.1 大規模冷蔵倉庫の存在が市場成長を促進 160

10.4.6 その他のアジア太平洋地域 161

10.5 その他の地域(列) 162

10.5.1 行のマクロ経済見通し 166

10.5.2 中東 166

10.5.2.1 倉庫・冷蔵施設への投資の増加が需要を促進 166

10.5.3 アフリカ 167

10.5.3.1 食糧安全保障、医療、医薬品、輸出主導型アグリビジネスが市場を牽引 167

10.5.4 南米 168

10.5.4.1 スーパーマーケットを中心とした業務用需要の増加が市場成長を促進 168

11 競争環境 170

11.1 概要 170

11.2 主要プレーヤーの戦略/勝利への権利(2021~2024年) 170

11.3 収益分析、2020-2023年 171

11.4 市場シェア分析、2023年 172

11.5 企業評価と財務指標 174

11.6 ブランド/製品の比較 175

11.7 企業評価マトリックス:主要企業、2023年 176

11.7.1 スター企業 176

11.7.2 新興リーダー 176

11.7.3 浸透型プレーヤー 176

11.7.4 参加企業 176

11.7.5 企業フットプリント:主要プレーヤー(2023年) 178

11.7.5.1 企業フットプリント 178

11.7.5.2 地域別フットプリント 179

11.7.5.3 オファリングのフットプリント 180

11.7.5.4 モビリティ・フットプリント 181

11.7.5.5 アプリケーション・フットプリント 182

11.8 企業評価マトリクス:新興企業/SM(2023年) 183

11.8.1 進歩的企業 183

11.8.2 対応力のある企業 183

11.8.3 ダイナミックな企業 183

183 11.8.4 スタートアップ・ブロック 183

11.8.5 競争ベンチマーキング(新興企業/SM)(2023年) 185

11.8.5.1 主要新興企業/中小企業の詳細リスト 185

11.8.5.2 主要新興企業/SMEの競合ベンチマーキング 185

11.9 競争シナリオ 186

11.9.1 製品上市 186

11.9.2 取引 187

11.9.3 拡張 188

11.9.4 その他の開発 188

12 企業プロファイル 189

Johnson Controls International plc (Ireland)

LU-VE SPA (Italy)

Lennox International (US)

Kelvion Holding GmbH (Germany)

Rivacold srl (Italy)

13 付録 291

13.1 業界の専門家による洞察 291

13.2 ディスカッションガイド 292

13.3 Knowledgestore: Marketsandmarketsの購読ポータル 296

13.4 カスタマイズオプション 298

13.5 関連レポート 298

13.6 著者の詳細 299

Rising urbanization, regulatory requirements for cooling refrigerants, growth in online grocery shopping, efficient cold storage and transportation solutions, growth in refrigeration technology, and transition to more environmentally friendly refrigerants are leading to market growth. These and other strategies foster a reasonable setting for the refrigeration coolers market.

“Ammonia to contribute significant share in refrigeration coolers market.”

Ammonia refrigerant, therefore, is expected to grow strongly in the refrigeration coolers market because of its excellent thermodynamic properties, energy efficiency, and environmental benefits. Industries will have to reduce their carbon footprints because there is an increasing international tendency to oblige with sterner regulations on environmental issues that border on climate change, depleting the ozone layer, and others. High efficiency, lower energy consumption, and high-scale application in industrial refrigeration and cold storage also has promising prospects for large-scale growth. Moreover, the safety and performance improvements of ammonia refrigeration technologies promote more extensive acceptance. Thus, by meeting sustainability requirements, ammonia as a refrigerant is posed for healthy growth in the market.

“Portable mobility to grow significantly in the refrigeration coolers market.”

In 2023, the portable mobility segment accounted for a larger market share, and a similar trend is likely to be observed during the forecast period, as the use of refrigeration coolers systems is on the rise in newly emerging applications such as logistics & warehousing. There is great potential for portable refrigeration coolers, as they can be carried everywhere and used anywhere to satisfy convenience and growing demand in a variety of applications. The growth of more street food vendors and food trucks has increased the demand for efficient and compact refrigeration solutions that are portable and can be easily transported and set up in different locations. Similarly, the technology trends in this area have given birth to energy-efficient, lighter, portable coolers, which further contribute to the growing demands among consumers and firms as well. With changing lifestyle and consumer preferences, the market for portable refrigeration coolers will rise significantly.

“Asia Pacific will contribute significantly to the growth rate in refrigeration coolers market.”

Asia Pacific is poised to contribute a significant share to the refrigeration coolers market for several compelling reasons, by increasing adoption of energy-efficient refrigeration technologies in Asia Pacific countries due to environmental regulations and more awareness towards sustainable practices. First, the government supports refrigerants like ammonia and CO₂ that are not only environmentally friendly but also contribute to the trend that is currently worldwide in helping alleviate the impact of refrigerator systems on the environment. On the other hand, the region's pharmaceutical-based manufacturing facilities have always had a high demand for refrigeration coolers. With growth in e-commerce and online grocery platforms requiring efficient cold chains, these factors are also driving Asia Pacific's growth in the refrigeration coolers market.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the refrigeration coolers market place.

• By Company Type: Tier 1 – 40%, Tier 2 – 35%, and Tier 3 – 25%

• By Designation: C-level Executives – 48%, Directors – 33%, and Others – 19%

• By Region: North America– 35%, Europe – 18%, Asia Pacific– 40% and RoW- 7%

The study includes an in-depth competitive analysis of these key players in the refrigeration coolers market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the refrigeration coolers market by offering, refrigerant, industry, mobility and region (North America, Europe, Asia Pacific). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the refrigeration coolers market. A detailed analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, Contracts, partnerships, and agreements. New product and service launches, acquisitions, and recent developments associated with the refrigeration coolers market. This report covers competitive analysis of upcoming startups in the refrigeration coolers market ecosystem.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the refrigeration coolers market, and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

•Analysis of key drivers (growing investments in refrigerated warehouses/cold storage, rising demand for frozen and processed foods worldwide, rising demand for innovative and compact refrigeration coolers, and growing adoption of natural refrigerant-based systems due to stringent regulatory policies), restraints (High Installation cost ), opportunities (growing popularity of CO2-based cascade refrigeration systems and rising demand for frozen and processed food worldwide), and challenges (the lack of skilled personnel and growing safety concerns pose, setup issues associated with refrigeration coolers systems) influencing the growth of the refrigeration coolers market.

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the refrigeration coolers market

•Market Development: Comprehensive information about lucrative markets – the report analyses the refrigeration coolers market across varied regions.

•Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the refrigeration coolers market

•Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as Johnson Controls International plc (Ireland), LU-VE SPA (Italy), Lennox International (US), Kelvion Holding GmbH (Germany), Rivacold srl (Italy) among others in the refrigeration coolers market.

1 INTRODUCTION 26

1.1 STUDY OBJECTIVES 26

1.2 MARKET DEFINITION 26

1.3 STUDY SCOPE 27

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 27

1.3.2 YEARS CONSIDERED 28

1.3.3 INCLUSIONS AND EXCLUSIONS 28

1.4 CURRENCY CONSIDERED 29

1.5 UNITS CONSIDERED 29

1.6 LIMITATIONS 29

1.7 STAKEHOLDERS 29

1.8 SUMMARY OF CHANGES 29

2 RESEARCH METHODOLOGY 30

2.1 RESEARCH DATA 30

2.1.1 SECONDARY DATA 31

2.1.1.1 Key secondary sources 32

2.1.1.2 Key data from secondary sources 32

2.1.2 PRIMARY DATA 32

2.1.2.1 Intended participants in primary interviews 33

2.1.2.2 Key primary interview participants 33

2.1.2.3 Breakdown of primaries 33

2.1.2.4 Key industry insights 34

2.1.2.5 Key data from primary sources 34

2.1.3 SECONDARY AND PRIMARY RESEARCH 35

2.2 MARKET SIZE ESTIMATION 35

2.2.1 BOTTOM-UP APPROACH 36

2.2.1.1 Bottom-up approach for estimating market size 36

2.2.2 TOP-DOWN APPROACH 37

2.2.2.1 Top-down approach for estimating market size 37

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 39

2.4 RESEARCH ASSUMPTIONS 40

2.5 RESEARCH LIMITATIONS 40

2.6 RISK ASSESSMENT 40

3 EXECUTIVE SUMMARY 41

4 PREMIUM INSIGHTS 45

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REFRIGERATION COOLERS MARKET 45

4.2 REFRIGERATION COOLERS MARKET, BY OFFERING 45

4.3 REFRIGERATION COOLERS MARKET, BY MOBILITY 46

4.4 REFRIGERATION COOLERS MARKET, BY REFRIGERANT 46

5 MARKET OVERVIEW 47

5.1 INTRODUCTION 47

5.2 MARKET DYNAMICS 47

5.2.1 DRIVERS 48

5.2.1.1 Increasing investments in refrigerated warehouses/cold storage facilities 48

5.2.1.2 Growing demand for frozen and processed foods 48

5.2.1.3 Shift towards low GWP refrigerants 48

5.2.1.4 Changes in global weather patterns 49

5.2.2 RESTRAINTS 50

5.2.2.1 High installation and operational costs 50

5.2.3 OPPORTUNITIES 50

5.2.3.1 Increasing demand for FMCG products 50

5.2.3.2 Adoption of IoT in refrigeration technologies 50

5.2.3.3 Surging demand for walk-in coolers 51

5.2.3.4 Growing demand in emerging applications such as healthcare and logistics 51

5.2.4 CHALLENGES 52

5.2.4.1 Lack of skilled personnel and safety concerns 52

5.2.4.2 Complexity associated with installation of refrigeration cooling systems 53

5.3 AI IMPACT ON REFRIGERATION COOLERS MARKET 53

5.4 VALUE CHAIN ANALYSIS 55

5.4.1 RESEARCH AND DEVELOPMENT (R&D) 55

5.4.2 COMPONENT MANUFACTURERS 55

5.4.3 DISTRIBUTORS/RESELLERS 56

5.4.4 ASSEMBLERS/INSTALLERS/INTEGRATORS 56

5.4.5 END USERS 56

5.4.6 AFTER-SALES SERVICES 56

5.5 ECOSYSTEM ANALYSIS 56

5.6 INVESTMENT AND FUNDING SCENARIO 59

5.7 PRICING ANALYSIS 59

5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY COMPONENT 60

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 62

5.9 TECHNOLOGY ANALYSIS 62

5.9.1 KEY TECHNOLOGIES 62

5.9.1.1 Artificial Intelligence (AI) 62

5.9.1.2 Internet of Things (IoT) 63

5.9.2 COMPLEMENTARY TECHNOLOGIES 63

5.9.2.1 Automation 63

5.9.3 ADJACENT TECHNOLOGIES 64

5.9.3.1 Shell and tube heat exchanger 64

5.9.3.2 Spiral heat exchanger 64

5.9.3.3 Plate heat exchanger 64

5.9.3.4 Plate-fin heat exchanger 64

5.10 PORTER’S FIVE FORCES ANALYSIS 64

5.10.1 THREAT OF NEW ENTRANTS 65

5.10.2 THREAT OF SUBSTITUTES 66

5.10.3 BARGAINING POWER OF SUPPLIERS 66

5.10.4 BARGAINING POWER OF BUYERS 66

5.10.5 INTENSITY OF COMPETITIVE RIVALRY 66

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA 67

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS 67

5.11.2 BUYING CRITERIA 68

5.12 CASE STUDY ANALYSIS 69

5.12.1 DANFOSS INSTALLS COMPRESSOR SYSTEM AT ANANDA FOODS (INDIA) 69

5.12.2 LU-VE GROUP OFFERS COLD STORAGE SOLUTIONS FOR CARREFOUR SUPERMARKET IN ITALY 69

5.12.3 CARREFOUR'S NORTH-WEST LOGISTICS CENTER IN RIVALTA, TURIN,

ADOPTS RIVACOLD'S REFRIGERATION SOLUTIONS 70

5.12.4 INDOSPACE AND KOOL-EX PARTNERSHIP FOR TEMPERATURE-CONTROLLED WAREHOUSING 70

5.12.5 INNOVATE UK, IMS EVOLVE, AND TESCO STORES INVESTIGATE DEMAND-

SIDE RESPONSE IN REFRIGERATION SYSTEMS 71

5.13 TRADE ANALYSIS 71

5.13.1 IMPORT SCENARIO (HS CODE 841869) 71

5.13.2 EXPORT SCENARIO (HS CODE 841869) 72

5.14 PATENT ANALYSIS 74

5.14.1 REFRIGERATION COOLERS MARKET: LIST OF MAJOR PATENTS 75

5.15 KEY CONFERENCES AND EVENTS, 2024–2025 77

5.16 REGULATORY LANDSCAPE 78

5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

5.16.2 STANDARDS 80

6 REFRIGERATION COOLERS MARKET, BY OFFERING 82

6.1 INTRODUCTION 83

6.2 CONDENSERS 84

6.2.1 AIR-COOLED 85

6.2.1.1 Air-cooled condensers suitable for use in water-scarce areas 85

6.2.2 WATER-COOLED 85

6.2.2.1 Demand for compact condensers fueling growth of water-cooled condensers 85

6.2.3 EVAPORATIVE 85

6.2.3.1 Regulations limiting physical size of cooling systems restricting use of evaporative condensers 85

6.3 COMPRESSORS 86

6.3.1 POSITIVE DISPLACEMENT COMPRESSORS 87

6.3.1.1 Increasing demand for efficient gas compression driving positive displacement compressors 87

6.3.2 DYNAMIC COMPRESSORS 87

6.3.2.1 Need for low compression with high volume flows refrigerant fueling demand for dynamic compressors 87

6.4 EVAPORATORS & AIR COOLERS 88

6.4.1 RISING DEMAND IN LARGE REFRIGERATION PLANTS AND CENTRAL AIR CONDITIONING PLANTS FUELING GROWTH 88

6.4.2 AIR UNITS 88

6.4.2.1 By design type 89

6.4.2.1.1 Horizontal 89

6.4.2.1.1.1 Rising demand for refrigeration in attics or crawl spaces fueling growth of horizontal air coolers 89

6.4.2.1.2 Vertical 89

6.4.2.1.2.1 Inclination toward compact design of air coolers increasing adoption of vertical air coolers 89

6.4.2.1.3 V-shaped and angled designs 89

6.4.2.1.3.1 Demand for coolers with reduced plan dimensions driving growth of V-shaped air coolers 89

6.4.2.2 By implementation type 89

6.4.2.2.1 Ceiling/Wall 89

6.4.2.2.1.1 Increasing space crunch in buildings propelling adoption of ceiling/wall-mounted air coolers 89

6.4.2.2.2 Floor 90

6.4.2.2.2.1 Demand for air cooling in large rooms driving growth of floor air coolers 90

6.4.2.2.3 Counter/Cabinets 90

6.4.2.2.3.1 Rising need for air coolers in harsh environments fueling growth of counter/cabinet coolers 90

6.4.3 DRY COOLERS 90

6.4.3.1 Demand for efficient heat transfer contributing to growth of dry coolers 90

6.4.4 BRINE COOLERS 90

6.4.4.1 Rising installation of air coolers in commercial and industrial refrigeration fueling growth of brine coolers 90

6.4.5 BLAST/TUNNEL UNIT COOLERS 91

6.4.5.1 Demand for cold storage fueling adoption of blast unit coolers 91

7 REFRIGERATION COOLERS MARKET, BY REFRIGERANT 93

7.1 INTRODUCTION 94

7.2 HFC/HFO 96

7.2.1 MOST WIDELY USED REFRIGERANT TYPE FOR REFRIGERATION COOLERS 96

7.3 CO2 97

7.3.1 INCREASED DEMAND FOR HEAT RECOVERY FUELING ADOPTION OF CO2 REFRIGERANTS 97

7.4 NH3 98

7.4.1 NEED FOR EFFICIENT COOLING IN INDUSTRIAL APPLICATIONS CONTRIBUTING TO GROWTH OF NH3 REFRIGERANTS 98

7.5 PROPANE 99

7.5.1 DEMAND FOR ENVIRONMENTALLY FRIENDLY, AFFORDABLE OPTION PROPELLING ADOPTION OF PROPANE 99

7.6 OTHERS 100

7.6.1 DEMAND FOR A2L REFRIGERANTS INCREASING TO ENSURE SAFE OPERATIONS 100

8 REFRIGERATION COOLERS MARKET, BY MOBILITY 102

8.1 INTRODUCTION 103

8.2 STATIONARY 104

8.2.1 STATIONARY REFRIGERATION COOLERS WIDELY USED FOR RELIABLE, LARGE-SCALE, AND LONG-TERM COOLING SOLUTIONS 104

8.3 PORTABLE 105

8.3.1 INCREASED FOOD TRANSPORTATION DEMAND FUELING ADOPTION OF MOBILE/PORTABLE COOLING SYSTEMS 105

9 REFRIGERATION COOLERS MARKET, BY APPLICATION 107

9.1 INTRODUCTION 108

9.2 RETAIL 110

9.2.1 SUPERMARKETS 110

9.2.1.1 Need for continuous refrigeration propelling demand for refrigeration units in supermarkets 110

9.2.2 HYPERMARKETS 111

9.2.2.1 Demand for better visibility of food on racks increasing adoption of refrigeration coolers in hypermarkets 111

9.2.3 CONVENIENCE STORES & MINI MARKETS 111

9.2.3.1 Need for walk-in freezers in convenience stores accelerating demand for refrigeration coolers 111

9.2.4 HOSPITALITY 111

9.2.4.1 Demand for cold storage of food & beverages in hotels driving adoption of refrigeration coolers 111

9.3 FOOD & BEVERAGE 115

9.3.1 FRUIT & VEGETABLE PROCESSING 115

9.3.1.1 Need for preservation of fruits & vegetables for longer periods fueling growth 115

9.3.2 BEVERAGE PROCESSING 115

9.3.2.1 Demand for fresh beverages fueling market for refrigeration coolers 115

9.3.3 DAIRY & ICE-CREAM PROCESSING 116

9.3.3.1 Need to reduce spoilage of dairy products increasing use of refrigeration coolers 116

9.3.4 MEAT, POULTRY & FISH PROCESSING 116

9.3.4.1 Demand for refrigeration coolers high in meat, poultry, and fish processing due to their limited shelf life 116

9.4 LOGISTICS & WAREHOUSING 120

9.4.1 REFRIGERATED WAREHOUSES 120

9.4.1.1 Need for extra surveillance and maintenance of perishable items fueling demand 120

9.4.2 LOGISTICS & STORAGE ROOMS 120

9.4.2.1 Demand for timely ripening of fruits and vegetables accelerating adoption of small storage rooms 120

9.5 HEALTHCARE & PHARMACEUTICALS 123

9.5.1 VACCINE STORAGE 123

9.5.1.1 Need to ensure safety, longevity, and efficacy of medical products and vaccines to drive market 123

9.5.2 MEDICAL DEVICES 123

9.5.2.1 Refrigeration coolers used to minimize material degradation of certain critical medical devices 123

9.6 OTHER APPLICATIONS 126

9.6.1 VERTICAL FARMING 126

9.6.2 SCIENTIFIC RESEARCH 126

9.6.3 SPECIAL APPLICATIONS 126

10 REFRIGERATION COOLERS MARKET, BY REGION 129

10.1 INTRODUCTION 130

10.2 NORTH AMERICA 131

10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 136

10.2.2 US 136

10.2.2.1 Strict guidelines regarding storage of food to prevent spoilage and bacterial growth driving demand 136

10.2.3 CANADA 137

10.2.3.1 Rising demand for CO2 refrigerant due to increased environmental concerns 137

10.2.4 MEXICO 138

10.2.4.1 Focus on using refrigeration units with low GWP values to drive market 138

10.3 EUROPE 139

10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 145

10.3.2 GERMANY 145

10.3.2.1 Rising need for natural refrigerants to drive market in Germany 145

10.3.3 UK 146

10.3.3.1 Rising demand for cold storage driving market in UK 146

10.3.4 FRANCE 147

10.3.4.1 Increasing adoption of refrigeration coolers in artificial ice-skating rinks to fuel market 147

10.3.5 ITALY 148

10.3.5.1 Adoption of greener refrigeration technologies using eco-friendly refrigerants to accelerate market growth 148

10.3.6 REST OF EUROPE 149

10.4 ASIA PACIFIC 150

10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 156

10.4.2 CHINA 157

10.4.2.1 Significant increase in demand for food, drugs, cosmetics, and cold chain logistics to drive market 157

10.4.3 JAPAN 158

10.4.3.1 Market characterized by shifting focus toward implementation of natural refrigerant-based systems 158

10.4.4 INDIA 159

10.4.4.1 Government initiatives for setting up cold chain networks across country to augment market growth 159

10.4.5 SOUTH KOREA 160

10.4.5.1 Presence of large refrigerated warehousing capacity to propel market growth 160

10.4.6 REST OF ASIA PACIFIC 161

10.5 REST OF THE WORLD (ROW) 162

10.5.1 MACROECONOMIC OUTLOOK FOR ROW 166

10.5.2 MIDDLE EAST 166

10.5.2.1 Increasing investments in warehouses and cold storage facilities to fuel demand 166

10.5.3 AFRICA 167

10.5.3.1 Food security, healthcare, pharmaceuticals, and export-driven agribusiness to drive market 167

10.5.4 SOUTH AMERICA 168

10.5.4.1 Increasing demand in commercial applications, especially supermarkets, to fuel market growth 168

11 COMPETITIVE LANDSCAPE 170

11.1 OVERVIEW 170

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024 170

11.3 REVENUE ANALYSIS, 2020–2023 171

11.4 MARKET SHARE ANALYSIS, 2023 172

11.5 COMPANY VALUATION AND FINANCIAL METRICS 174

11.6 BRAND/PRODUCT COMPARISON 175

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 176

11.7.1 STARS 176

11.7.2 EMERGING LEADERS 176

11.7.3 PERVASIVE PLAYERS 176

11.7.4 PARTICIPANTS 176

11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 178

11.7.5.1 Company footprint 178

11.7.5.2 Region footprint 179

11.7.5.3 Offering footprint 180

11.7.5.4 Mobility footprint 181

11.7.5.5 Application footprint 182

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 183

11.8.1 PROGRESSIVE COMPANIES 183

11.8.2 RESPONSIVE COMPANIES 183

11.8.3 DYNAMIC COMPANIES 183

11.8.4 STARTING BLOCKS 183

11.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023 185

11.8.5.1 Detailed list of key startups/SMEs 185

11.8.5.2 Competitive benchmarking of key startups/SMEs 185

11.9 COMPETITIVE SCENARIO 186

11.9.1 PRODUCT LAUNCHES 186

11.9.2 DEALS 187

11.9.3 EXPANSIONS 188

11.9.4 OTHER DEVELOPMENTS 188

12 COMPANY PROFILES 189

12.1 KEY PLAYERS 189

12.1.1 JOHNSON CONTROLS INC. 189

12.1.1.1 Business overview 189

12.1.1.2 Products/Solutions/Services offered 190

12.1.1.3 Recent developments 194

12.1.1.3.1 Product launches 194

12.1.1.3.2 Deals 195

12.1.1.4 MnM view 195

12.1.1.4.1 Key strengths/Right to win 195

12.1.1.4.2 Strategic choices 196

12.1.1.4.3 Weaknesses and competitive threats 196

12.1.2 LU-VE 197

12.1.2.1 Business overview 197

12.1.2.2 Products/Solutions/Services offered 199

12.1.2.3 Recent developments 218

12.1.2.3.1 Deals 218

12.1.2.3.2 Expansions 219

12.1.2.3.3 Other developments 220

12.1.2.4 MnM view 220

12.1.2.4.1 Key strengths/Right to win 220

12.1.2.4.2 Strategic choices 220

12.1.2.4.3 Weaknesses and competitive threats 220

12.1.3 KELVION HOLDING GMBH 221

12.1.3.1 Business overview 221

12.1.3.2 Products/Solutions/Services offered 221

12.1.3.3 Recent developments 228

12.1.3.3.1 Product launches 228

12.1.3.3.2 Deals 229

12.1.3.3.3 Expansions 229

12.1.3.4 MnM view 230

12.1.3.4.1 Key strengths/Right to win 230

12.1.3.4.2 Strategic choices 230

12.1.3.4.3 Weaknesses and competitive threats 230

12.1.4 RIVACOLD SRL 231

12.1.4.1 Business overview 231

12.1.4.2 Products/Solutions/Services offered 232

12.1.4.3 MnM view 235

12.1.4.3.1 Key strengths/Right to win 235

12.1.4.3.2 Strategic choices 235

12.1.4.3.3 Weaknesses and competitive threats 235

12.1.5 LENNOX INTERNATIONAL INC. 236

12.1.5.1 Business overview 236

12.1.5.2 Products/Solutions/Services offered 238

12.1.5.3 MnM view 244

12.1.5.3.1 Key strengths/Right to win 244

12.1.5.3.2 Strategic choices 244

12.1.5.3.3 Weaknesses and competitive threats 244

12.1.6 GÜNTNER GMBH & CO. KG 245

12.1.6.1 Business overview 245

12.1.6.2 Products/Solutions/Services offered 245

12.1.7 COPELAND LP 250

12.1.7.1 Business overview 250

12.1.7.2 Products/Solutions/Services offered 250

12.1.7.3 Recent developments 251

12.1.7.3.1 Product launches 251

12.1.7.3.2 Deals 252

12.1.7.3.3 Expansions 252

12.1.8 DANFOSS 253

12.1.8.1 Business overview 253

12.1.8.2 Products/Solutions/Services offered 255

12.1.8.3 Recent developments 255

12.1.8.3.1 Product launches 255

12.1.8.3.2 Deals 256

12.1.8.3.3 Other developments 256

12.1.9 MODINE MANUFACTURING COMPANY 258

12.1.9.1 Business overview 258

12.1.9.2 Products/Solutions/Services offered 259

12.1.10 EVAPCO 263

12.1.10.1 Business overview 263

12.1.10.2 Products/Solutions/Services offered 263

12.1.11 THERMOFIN 274

12.1.11.1 Business overview 274

12.1.11.2 Products/Solutions/Services offered 274

12.2 OTHER PLAYERS 276

12.2.1 STEFANI 276

12.2.2 ONDA S.P.A. 277

12.2.3 ROEN EST 278

12.2.4 KFL 279

12.2.5 WALTER ROLLER 279

12.2.6 CABERO 280

12.2.7 THERMOKEY 282

12.2.8 KOXKA 283

12.2.9 CENTAURO INTERNACIONAL 285

12.2.10 BALTIMORE AIRCOIL COMPANY, INC. 285

12.2.11 FRITERM 286

12.2.12 DAIKIN 288

12.2.13 PROFROID 289

12.2.14 ROCKWELL INDUSTRIES LIMITED 290

13 APPENDIX 291

13.1 INSIGHTS FROM INDUSTRY EXPERTS 291

13.2 DISCUSSION GUIDE 292

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 296

13.4 CUSTOMIZATION OPTIONS 298

13.5 RELATED REPORTS 298

13.6 AUTHOR DETAILS 299

❖ 世界の冷凍クーラー市場に関するよくある質問(FAQ) ❖

・冷凍クーラーの世界市場規模は?

→MarketsandMarkets社は2024年の冷凍クーラーの世界市場規模を41.9億米ドルと推定しています。

・冷凍クーラーの世界市場予測は?

→MarketsandMarkets社は2029年の冷凍クーラーの世界市場規模を57.4億米ドルと予測しています。

・冷凍クーラー市場の成長率は?

→MarketsandMarkets社は冷凍クーラーの世界市場が2024年~2029年に年平均6.5%成長すると予測しています。

・世界の冷凍クーラー市場における主要企業は?

→MarketsandMarkets社は「Johnson Controls International plc (Ireland)、LU-VE SPA (Italy)、Lennox International (US)、Kelvion Holding GmbH (Germany)、Rivacold srl (Italy)など ...」をグローバル冷凍クーラー市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。