1 はじめに

1.1 調査目的 25

1.2 市場の定義 25

1.3 調査範囲 26

1.3.1 対象市場と地域範囲 26

1.3.2 対象範囲と除外範囲 27

1.3.3 考慮した年数 29

1.3.4 通貨

1.3.5 単位の検討 29

1.4 利害関係者 30

1.5 変更点のまとめ 30

2 調査方法 31

2.1 調査データ 31

2.1.1 二次データ 32

2.1.2 一次データ 32

2.1.2.1 主要な主要参加者 32

2.1.2.2 主要な業界インサイト 33

2.1.2.3 一次インタビューの内訳 33

2.2 市場規模の推定 34

2.2.1 ボトムアップアプローチ 34

2.2.2 トップダウンアプローチ 36

2.3 データの三角測量 37

2.4 成長予測 39

2.4.1 供給サイド分析 39

2.4.2 需要サイド分析 40

2.5 リサーチの前提 40

2.6 調査の限界 41

2.7 リスク評価 41

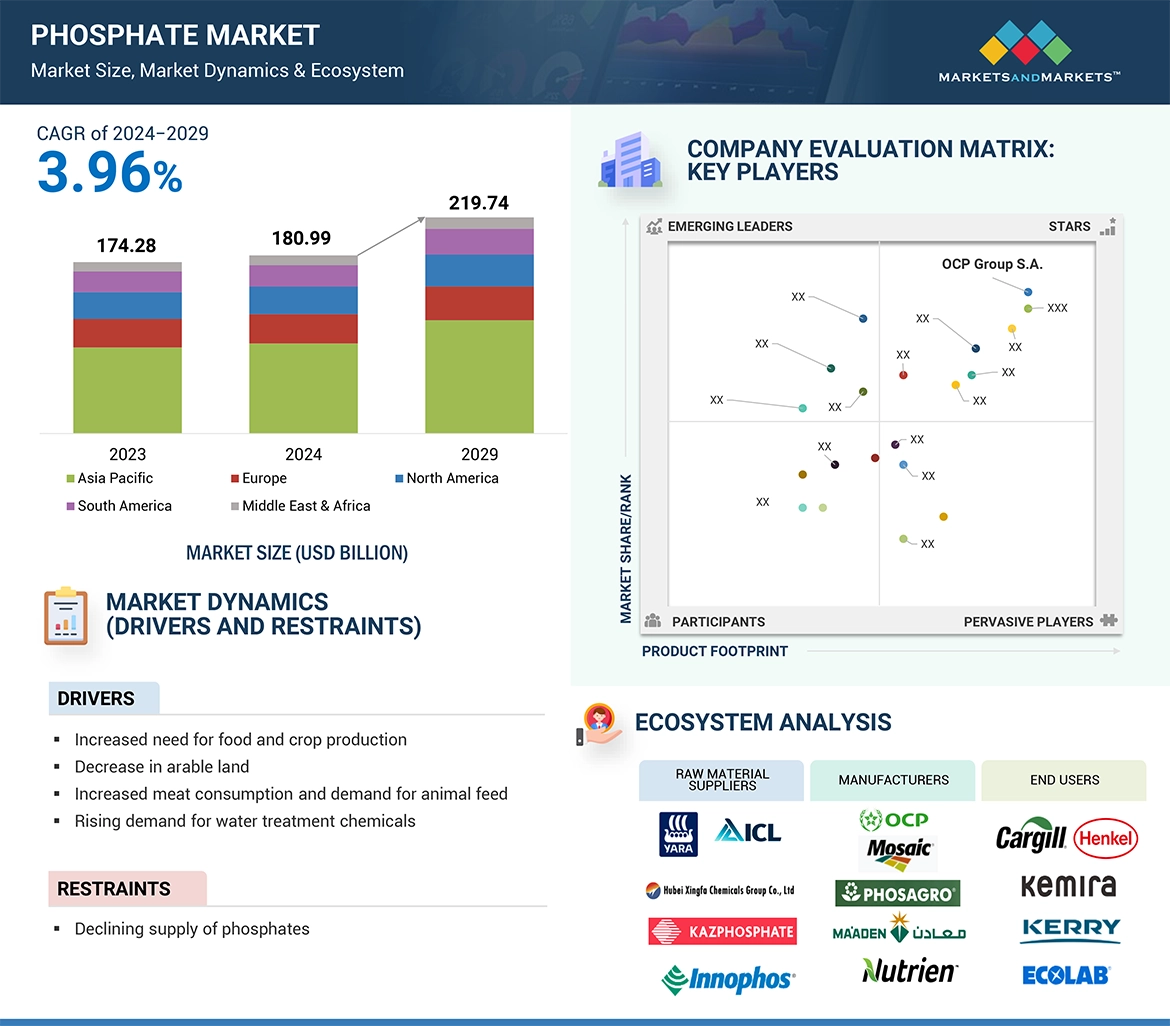

3 エグゼクティブ・サマリー

4 プレミアムインサイト

4.1 リン酸塩市場におけるプレーヤーの魅力的な機会 45

4.2 リン酸塩市場、地域別 45

4.3 アジア太平洋地域のリン酸塩市場:用途別、国別 46

4.4 リン酸塩市場:タイプ別、地域別 46

4.5 リン酸塩市場:国別 47

5 市場の概要 48

5.1 はじめに 48

5.2 市場ダイナミクス 48

5.2.1 推進要因 49

5.2.1.1 食糧および作物生産のニーズの増加 49

5.2.1.2 耕地の減少 49

5.2.1.3 食肉消費量と飼料需要の増加 50

5.2.1.4 水処理薬品需要の増加 50

5.2.2 抑制要因 51

5.2.2.1 リン酸塩供給の減少 51

5.2.3 機会 51

5.2.3.1 革新的生産プロセスの開発 51

5.2.3.2 電気自動車(EV)産業におけるリン酸鉄リチウム(LiFePO4)電池の需要増 51

5.2.4 課題 52

5.2.4.1 リン酸塩埋蔵量の世界的分布の限定 52

5.2.4.2 洗剤中のリン酸塩使用削減に対する世界的な規制圧力 53

5.3 ポーターの5つの力分析 54

5.3.1 新規参入の脅威 55

5.3.2 代替品の脅威 55

5.3.3 供給者の交渉力 55

5.3.4 買い手の交渉力 55

5.3.5 競合の激しさ 56

5.4 主要ステークホルダーと購買基準 56

5.4.1 購入プロセスにおける主要ステークホルダー 56

5.4.2 購買基準 57

5.5 マクロ経済指標 58

5.5.1 主要国のGDP動向と予測 58

6 業界動向 59

6.1 サプライチェーン分析 59

6.2 価格分析 61

6.2.1 主要企業の平均販売価格動向(用途別) 61

6.2.2 平均販売価格動向(地域別) 62

6.3 顧客ビジネスに影響を与えるトレンド/混乱 63

6.4 エコシステム分析 64

6.5 技術分析 66

6.5.1 主要技術 66

6.5.1.1 現場浸出と溶液採掘: リン酸抽出への革新的アプローチ 66

6.5.2 補完的技術 67

6.5.2.1 リン酸生産技術 67

6.6 ケーススタディ分析 67

6.6.1 クリアエッジ社がリン酸塩生産者にクリアエッジ濾過ソリューションを提供し、生産性を向上 67

6.6.2 スロバキアにおけるリン(P)管理の実施によるP サイクルのクローズ化と採掘リン酸塩への 依存度の低減 67

6.6.3 メトコート社がセントラセップ濾過システムを導入し、リン酸亜鉛溶液を清潔に保 ち、タンクからスラッジを除去 67

6.7 貿易分析 67

6.7.1 輸入シナリオ(HSコード280470) 68

6.7.2 輸出シナリオ(HSコード280470) 69

6.8 規制の状況 70

6.8.1 規制機関、政府機関、その他の団体 70

6.9 主要会議・イベント(2024~2025年) 73

6.10 投資と資金調達シナリオ 74

6.11 特許分析 74

6.11.1 アプローチ 74

6.11.2 特許の種類 75

6.11.3 上位出願者 78

6.11.4 管轄地域分析 80

6.12 リン酸塩市場におけるAI/GEN AIの影響 81

7 リン酸塩市場、タイプ別 82

7.1 はじめに 83

7.2 リン酸 85

7.2.1 様々な産業での需要増加が市場を牽引 85

7.3 リン酸アンモニウム 86

7.3.1 肥料消費の増加が需要を牽引 86

7.4 リン酸カルシウム 88

7.4.1 ヘルスケア用途での高い使用が市場を牽引 88

7.5 リン酸ナトリウム 90

7.5.1 洗剤産業における広範な用途が市場成長を促進 90

7.6 リン酸カリウム 91

7.6.1 好況の農業産業が需要を牽引 91

7.7 その他のタイプ 93

8 リン酸塩市場、資源タイプ別 95

8.1 はじめに 96

8.2 海洋堆積物 98

8.2.1 持続可能性への関心の高まりが需要を牽引 98

8.3 火成岩及び風化岩 100

8.3.1 火成岩と風化鉱床のリン酸塩の純度が高く、市場成長を促進 100

8.4 生物起源 101

8.4.1 農業生産性の向上ニーズの高まりが需要を後押し 101

8.5 その他の資源タイプ 103

9 リン酸塩市場、用途別 105

9.1 導入 106

9.2 肥料 108

9.2.1 農業生産性向上のためのリン酸塩の広範な使用が市場を牽引 108

9.3 動物飼料 110

9.3.1 動物の栄養と健康に関する意識の高まりが需要を牽引 110

9.4 食品添加物 112

9.4.1 加工食品と簡便食品の需要増加が市場を牽引 112

9.5 洗剤 113

9.5.1 工業用洗浄分野の成長が需要を牽引 113

9.6 水処理薬品 115

9.6.1 清浄水需要の増加が市場成長を促進 115

9.7 金属仕上げ 117

9.7.1 製造業における軽量材料の使用傾向の高まりが市場を牽引 117

9.8 その他の用途 118

10 リン酸塩市場(地域別) 121

10.1 はじめに 122

10.2 アジア太平洋地域 124

10.2.1 中国 132

10.2.1.1 高い肥料需要が市場を牽引 132

10.2.2 インド 134

10.2.2.1 肥料とリン酸輸入の増加が市場成長を促進 134

10.2.3 オーストラリア 136

10.2.3.1 食肉および食肉製品の需要増加が市場を促進 136

10.2.4 パキスタン 138

10.2.4.1 農業生産高の増加が市場成長を促進 138

10.2.5 バングラデシュ 140

10.2.5.1 加工食品需要の増加が市場を牽引 140

10.2.6 インドネシア 142

10.2.6.1 広大で豊富な肥沃な土地の存在が需要を牽引 142

10.3 北米 144

10.3.1 米国 151

10.3.1.1 持続的な人口増加と生活水準の向上が市場を牽引 151

10.3.2 カナダ 153

10.3.2.1 定着した農業が需要を牽引 153

10.3.3 メキシコ 155

10.3.3.1 成長する食品産業が市場成長を促進 155

10.4 欧州 157

10.4.1 ドイツ 164

10.4.1.1 最大の食品・飲料メーカーの存在が市場を牽引 164

10.4.2 フランス 166

10.4.2.1 広大な肥沃な土地、穏やかな気候、農業に適した十分な降雨量が需要を促進 166

10.4.3 イタリア 168

10.4.3.1 肥料需要の増加が市場成長を後押し 168

10.4.4 ポーランド 170

10.4.4.1 耕地の枯渇が需要を増加させる 170

10.4.5 スペイン 172

10.4.5.1 加工食品消費の増加が需要を牽引 172

10.4.6 ロシア 174

10.4.6.1 農民の購買力の増加とリン酸系肥料の使用を促進する政府主導のイニシ アティブが市場を牽引 174

10.5 南米 177

10.5.1 ブラジル 183

10.5.1.1 経済成長が市場を牽引 183

10.5.2 アルゼンチン 185

10.5.2.1 飼料や食品添加物の生産における使用の増加が市場を牽引 185

10.5.3 チリ 187

10.5.3.1 加工食品、乾燥加工食品、清涼飲料産業の拡大が市場を牽引 187

10.5.4 コロンビア 189

10.5.4.1 農業に適した景観と気候条件が市場を牽引 189

10.6 中東・アフリカ 191

10.6.1 GCC諸国 197

10.6.1.1 サウジアラビア 198

10.6.1.1.1 肥料生産を支える石油依存削減のための政府の取り組みが需要を押し上げる 198

10.6.2 エジプト 200

10.6.2.1 農業開発のための土地回収に国を挙げて注力することが市場を牽引 200

10.6.3 南アフリカ 202

10.6.3.1 成長する製造業が巨大な成長機会を生み出す 202

11 競争環境 204

11.1 導入 204

11.2 主要企業の戦略/勝利への権利 204

11.3 市場シェア分析 206

11.4 収益分析 208

11.5 企業評価マトリックス:主要プレイヤー(2023年) 209

11.5.1 スター企業 209

11.5.2 新興リーダー 209

11.5.3 浸透型プレーヤー 209

11.5.4 参加企業 209

11.5.5 企業フットプリント:主要プレーヤー(2023年) 211

11.5.5.1 企業フットプリント 211

11.5.5.2 タイプ別フットプリント 212

11.5.5.3 資源フットプリントのタイプ 213

11.5.5.4 アプリケーションフットプリント 214

11.5.5.5 地域別フットプリント 216

11.6 企業評価マトリクス:新興企業/SM(2023年) 217

11.6.1 進歩的企業 217

11.6.2 対応力のある企業 217

11.6.3 ダイナミックな企業 217

11.6.4 スタートアップ・ブロック 217

11.6.5 競争ベンチマーキング:新興企業/SM(2023年) 219

11.6.5.1 主要新興企業/中小企業の詳細リスト 219

11.6.5.2 主要新興企業/SMEの競合ベンチマーキング 219

11.7 ブランド/製品の比較 220

11.8 企業評価と財務指標 221

11.9 競争シナリオ 222

11.9.1 製品発表 222

11.9.2 取引 222

11.9.3 拡張 225

12 企業プロファイル 227

OCP Group S.A. (Morocco)

The Mosaic Company (US)

PhosAgro Group of Companies (Russia)

Ma’aden (Saudi Arabia)

Nutrien Ltd. (Canada)

EuroChem Group (Switzerland)

Innophos Holdings Inc. (US)

Jordan Phosphate Mines Company (PLC) (Jordan)

Kazphosphate LLP (Kazakhstan)

ICL Group Ltd. (ICL) (Israel)

Wengfu Group Co.Ltd. (China)

Yara (Norway)

and Yuntianhua Group Co.Ltd. (China).

13 隣接市場と関連市場 283

13.1 導入 283

13.2 制限 283

13.3 飼料用リン酸塩市場 283

13.3.1 市場の定義 283

13.3.2 市場の概要 284

13.4 リン酸塩飼料市場:地域別 284

13.4.1 欧州 284

13.4.2 北米 285

13.4.3 アジア太平洋地域 285

13.4.4 南米 286

13.4.5 中東・アフリカ 287

14 付録 288

14.1 ディスカッション・ガイド 288

14.2 Knowledgestore: Marketsandmarketsの購読ポータル 291

14.3 カスタマイズオプション 293

14.4 関連レポート 293

14.5 著者の詳細 294

The market for phosphate is experiencing a significant increase in demand due to problems in the environment caused by soil erosion and depletion. Continuous years of cultivation on the same land, not replaced with adequate nutrient supply, have caused extensive loss of soil nutrient levels in most farmlands and agricultural lands, especially with the intensified farming practices. Since phosphorus is one of the minerals necessary for root development and transfer of energy within plants, it tends to be among the earliest minerals depleted. Applying phosphate fertilizers will help farmers regain fertility for their lands and prevent degradation through replenishing phosphorus reserves in the soils.

“Ammonium phosphate segment is projected to be the second-fastest growing segment of phosphate market, during the forecast period”

Ammonium phosphate segment is estimated to be the second-fastest growing segment of phosphate market, during the forecast period. Ammonium phosphate's increasing market significance can be attributed to its adaptability in industrial applications. Among its many non-agricultural applications is fire suppression, where it is an essential part of dry chemical fire extinguishers. Ammonium phosphate's fire-retardant qualities make it a perfect chemical for putting out flames, particularly in areas with flammable materials. In areas where wildfires are common or in businesses where fire dangers are a significant issue, this application is extremely crucial.

“Biogenic segment was the third-largest type of resource of phosphate market, in terms of value, in 2023.”

Biogenic segment stands as the third-largest type of resource in the phosphate market. Given that it is constantly generated by biological activity, biogenic phosphate is a renewable resource. When it comes to phosphate extraction, this renewable nature provides a distinct ecological benefit since it provides a more sustainable way to source phosphorus for agriculture without depleting non-renewable resources. Moreover, biogenic phosphates are more appealing to nations and enterprises looking to lessen their ecological footprint because of their comparatively minimal environmental impact when extracted when compared to other mining techniques.

“Food additives segment was the third largest application of phosphate market, in terms of value, in 2023.”

Food additives segment stands as the third-largest application in the phosphate market. The usage of phosphates as food additives is mainly linked to their functional properties. Adding phosphates to meat and poultry products enhances the juiciness and tenderness of the meat while maintaining their water content. They ensure that the moisture in meats is not lost during the stages of processing and cooking, preventing the loss of valuable nutrients, and improving the overall eating experience. Phosphates that improve the quality and shelf life of meat products are therefore in greater demand due to the growing demand for meat products worldwide.

“North America was the third largest region in the phosphate market, in terms of value.”

North America was the third-largest region in the phosphate market, in terms of value, in 2023. The phosphate market in the region is comparatively mature, growing slower than the developing markets in the Asia-Pacific region or even in the Middle East and Africa. Developments in mining techniques have increased efficiency in the extraction of phosphates, which lowered cost and lower negative impacts on the environment. Furthermore, developments in fertilizer formulations, for instance, more efficient fertilizer formulation, promote the growth of the phosphate industry. Such fertilizers resolve both economic and environmental issues since they are specially developed to increase the efficiency of nutrient uptake and allow farmers to produce more yields on fewer applications of fertilizers.

• By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

• By Designation: Directors - 50%, Managers - 30%, and Others - 20%

• By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World – 5%

The key players profiled in the report include OCP Group S.A. (Morocco), The Mosaic Company (US), PhosAgro Group of Companies (Russia), Ma’aden (Saudi Arabia), Nutrien Ltd. (Canada), EuroChem Group (Switzerland), Innophos Holdings, Inc. (US), Jordan Phosphate Mines Company (PLC) (Jordan), Kazphosphate LLP (Kazakhstan), ICL Group Ltd. (ICL) (Israel), Wengfu Group Co., Ltd. (China), Yara (Norway), and Yuntianhua Group Co., Ltd. (China).

Research Coverage

This report segments the market for phosphate based on type, type of resource, application, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for phosphate.

Reasons to Buy this Report

This research report is focused on various levels of analysis — industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the phosphate market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

•Market Penetration: Comprehensive information on phosphate offered by top players in the global market

•Analysis of key drivers: (Increased need for food and crop production, Decrease in arable land, Increased meat consumption and demand for animal feed, and Rising demand for water treatment chemicals), restraints (Declining supply of phosphates), opportunities (Development of innovation production processes, and Rising demand for lithium iron phosphate (LiFePO4) batteries in electric vehicle (EV) industry), and challenges (Limited global distribution of phosphate reserves, and Global regulatory pressure on reducing phosphate use in detergents) influencing the growth of phosphate market.

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the phosphate market

•Market Development: Comprehensive information about lucrative emerging markets — the report analyzes the markets for phosphate across regions.

•Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global phosphate market

•Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the phosphate market

1 INTRODUCTION 25

1.1 STUDY OBJECTIVES 25

1.2 MARKET DEFINITION 25

1.3 STUDY SCOPE 26

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 26

1.3.2 INCLUSIONS AND EXCLUSIONS 27

1.3.3 YEARS CONSIDERED 29

1.3.4 CURRENCY CONSIDERED 29

1.3.5 UNIT CONSIDERED 29

1.4 STAKEHOLDERS 30

1.5 SUMMARY OF CHANGES 30

2 RESEARCH METHODOLOGY 31

2.1 RESEARCH DATA 31

2.1.1 SECONDARY DATA 32

2.1.2 PRIMARY DATA 32

2.1.2.1 Key primary participants 32

2.1.2.2 Key industry insights 33

2.1.2.3 Breakdown of primary interviews 33

2.2 MARKET SIZE ESTIMATION 34

2.2.1 BOTTOM-UP APPROACH 34

2.2.2 TOP-DOWN APPROACH 36

2.3 DATA TRIANGULATION 37

2.4 GROWTH FORECAST 39

2.4.1 SUPPLY-SIDE ANALYSIS 39

2.4.2 DEMAND-SIDE ANALYSIS 40

2.5 RESEARCH ASSUMPTIONS 40

2.6 RESEARCH LIMITATIONS 41

2.7 RISK ASSESSMENT 41

3 EXECUTIVE SUMMARY 42

4 PREMIUM INSIGHTS 45

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHOSPHATE MARKET 45

4.2 PHOSPHATE MARKET, BY REGION 45

4.3 ASIA PACIFIC PHOSPHATE MARKET, BY APPLICATION AND COUNTRY 46

4.4 PHOSPHATE MARKET, TYPE AND REGION 46

4.5 PHOSPHATE MARKET, BY COUNTRY 47

5 MARKET OVERVIEW 48

5.1 INTRODUCTION 48

5.2 MARKET DYNAMICS 48

5.2.1 DRIVERS 49

5.2.1.1 Increased need for food and crop production 49

5.2.1.2 Decrease in arable land 49

5.2.1.3 Increased meat consumption and demand for animal feed 50

5.2.1.4 Rising demand for water treatment chemicals 50

5.2.2 RESTRAINTS 51

5.2.2.1 Declining supply of phosphate 51

5.2.3 OPPORTUNITIES 51

5.2.3.1 Development of innovative production processes 51

5.2.3.2 Rising demand for lithium iron phosphate (LiFePO4) batteries in electric vehicle (EV) industry 51

5.2.4 CHALLENGES 52

5.2.4.1 Limited global distribution of phosphate reserves 52

5.2.4.2 Global regulatory pressure on reducing phosphate use in detergents 53

5.3 PORTER’S FIVE FORCES ANALYSIS 54

5.3.1 THREAT OF NEW ENTRANTS 55

5.3.2 THREAT OF SUBSTITUTES 55

5.3.3 BARGAINING POWER OF SUPPLIERS 55

5.3.4 BARGAINING POWER OF BUYERS 55

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 56

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA 56

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS 56

5.4.2 BUYING CRITERIA 57

5.5 MACROECONOMIC INDICATORS 58

5.5.1 GDP TRENDS AND FORECAST OF MOST PROMINENT ECONOMIES 58

6 INDUSTRY TRENDS 59

6.1 SUPPLY CHAIN ANALYSIS 59

6.2 PRICING ANALYSIS 61

6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION 61

6.2.2 AVERAGE SELLING PRICE TREND, BY REGION 62

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 63

6.4 ECOSYSTEM ANALYSIS 64

6.5 TECHNOLOGY ANALYSIS 66

6.5.1 KEY TECHNOLOGIES 66

6.5.1.1 In-situ leaching and solution mining: An innovative approach to phosphate extraction 66

6.5.2 COMPLIMENTARY TECHNOLOGIES 67

6.5.2.1 Phosphoric acid production technologies 67

6.6 CASE STUDY ANALYSIS 67

6.6.1 CLEAR EDGE OFFERS CLEAR EDGE FILTRATION SOLUTIONS TO PHOSPHATE PRODUCERS TO INCREASE PRODUCTIVITY 67

6.6.2 IMPLEMENTATION OF PHOSPHORUS (P) MANAGEMENT IN SLOVAKIA TO CLOSE P CYCLE AND REDUCE RELIANCE ON MINED PHOSPHATE ROCK 67

6.6.3 METOKOTE INSTALLS CENTRASEP FILTRATION SYSTEM TO REMOVE SLUDGE FROM TANK, KEEPING ZINC PHOSPHATE SOLUTION CLEAN 67

6.7 TRADE ANALYSIS 67

6.7.1 IMPORT SCENARIO (HS CODE 280470) 68

6.7.2 EXPORT SCENARIO (HS CODE 280470) 69

6.8 REGULATORY LANDSCAPE 70

6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 70

6.9 KEY CONFERENCES AND EVENTS, 2024–2025 73

6.10 INVESTMENT AND FUNDING SCENARIO 74

6.11 PATENT ANALYSIS 74

6.11.1 APPROACH 74

6.11.2 PATENT TYPES 75

6.11.3 TOP APPLICANTS 78

6.11.4 JURISDICTION ANALYSIS 80

6.12 IMPACT OF AI/GEN AI ON PHOSPHATE MARKET 81

7 PHOSPHATE MARKET, BY TYPE 82

7.1 INTRODUCTION 83

7.2 PHOSPHORIC ACID 85

7.2.1 GROWING DEMAND IN VARIOUS INDUSTRIES TO DRIVE MARKET 85

7.3 AMMONIUM PHOSPHATE 86

7.3.1 RISING FERTILIZER CONSUMPTION TO DRIVE DEMAND 86

7.4 CALCIUM PHOSPHATE 88

7.4.1 HIGH USE IN HEALTHCARE APPLICATIONS TO PROPEL MARKET 88

7.5 SODIUM PHOSPHATE 90

7.5.1 EXTENSIVE APPLICATIONS IN DETERGENT INDUSTRY TO FUEL MARKET GROWTH 90

7.6 POTASSIUM PHOSPHATE 91

7.6.1 BOOMING AGRICULTURE INDUSTRY TO DRIVE DEMAND 91

7.7 OTHER TYPES 93

8 PHOSPHATE MARKET, BY TYPE OF RESOURCE 95

8.1 INTRODUCTION 96

8.2 SEDIMENTARY MARINE DEPOSITS 98

8.2.1 INCREASING FOCUS ON SUSTAINABILITY TO DRIVE DEMAND 98

8.3 IGNEOUS AND WEATHERED 100

8.3.1 HIGH PURITY OF PHOSPHATE IN IGNEOUS AND WEATHERED RESOURCE TYPES TO BOOST MARKET GROWTH 100

8.4 BIOGENIC 101

8.4.1 GROWING NEED TO INCREASE AGRICULTURAL PRODUCTIVITY TO FUEL DEMAND 101

8.5 OTHER TYPES OF RESOURCES 103

9 PHOSPHATE MARKET, BY APPLICATION 105

9.1 INTRODUCTION 106

9.2 FERTILIZERS 108

9.2.1 EXTENSIVE USE OF PHOSPHATES TO ENHANCE AGRICULTURAL PRODUCTIVITY TO DRIVE MARKET 108

9.3 ANIMAL FEED 110

9.3.1 GROWING AWARENESS REGARDING ANIMAL NUTRITION AND HEALTH TO DRIVE DEMAND 110

9.4 FOOD ADDITIVES 112

9.4.1 RISING DEMAND FOR PROCESSED AND CONVENIENCE FOODS TO DRIVE MARKET 112

9.5 DETERGENTS 113

9.5.1 GROWTH OF INDUSTRIAL CLEANING SECTOR TO DRIVE DEMAND 113

9.6 WATER TREATMENT CHEMICALS 115

9.6.1 INCREASING DEMAND FOR CLEAN WATER TO FUEL MARKET GROWTH 115

9.7 METAL FINISHING 117

9.7.1 RISING TREND OF USING LIGHTWEIGHT MATERIALS IN MANUFACTURING SECTOR TO DRIVE MARKET 117

9.8 OTHER APPLICATIONS 118

10 PHOSPHATE MARKET, BY REGION 121

10.1 INTRODUCTION 122

10.2 ASIA PACIFIC 124

10.2.1 CHINA 132

10.2.1.1 High fertilizer demand to drive market 132

10.2.2 INDIA 134

10.2.2.1 Increasing fertilizer and phosphoric acid import to fuel market growth 134

10.2.3 AUSTRALIA 136

10.2.3.1 Increasing demand for meat and meat products to propel market 136

10.2.4 PAKISTAN 138

10.2.4.1 Rise in agricultural output to boost market growth 138

10.2.5 BANGLADESH 140

10.2.5.1 Rising demand for processed food to drive market 140

10.2.6 INDONESIA 142

10.2.6.1 Presence of vast and abundant fertile land to drive demand 142

10.3 NORTH AMERICA 144

10.3.1 US 151

10.3.1.1 Continuous population growth and improving living standards to drive market 151

10.3.2 CANADA 153

10.3.2.1 Well-established agriculture industry to drive demand 153

10.3.3 MEXICO 155

10.3.3.1 Growing food industry to fuel market growth 155

10.4 EUROPE 157

10.4.1 GERMANY 164

10.4.1.1 Presence of largest food & beverage producers to drive market 164

10.4.2 FRANCE 166

10.4.2.1 Presence of extensive fertile land, moderate climate, and sufficient rainfall suitable for agriculture to fuel demand 166

10.4.3 ITALY 168

10.4.3.1 Rising fertilizer demand to boost market growth 168

10.4.4 POLAND 170

10.4.4.1 Depletion of arable land to increase demand 170

10.4.5 SPAIN 172

10.4.5.1 Growing processed food consumption to drive demand 172

10.4.6 RUSSIA 174

10.4.6.1 Increasing purchasing power of farmers and government-led initiatives to promote use of phosphate-based fertilizers to drive market 174

10.5 SOUTH AMERICA 177

10.5.1 BRAZIL 183

10.5.1.1 Economic growth to drive market 183

10.5.2 ARGENTINA 185

10.5.2.1 Increased use in production of animal feed and food additives to drive market 185

10.5.3 CHILE 187

10.5.3.1 Expanding processed food, dried processed food, and soft drink industries to drive market 187

10.5.4 COLOMBIA 189

10.5.4.1 Suitable landscape and climatic conditions for agriculture to drive market 189

10.6 MIDDLE EAST & AFRICA 191

10.6.1 GCC COUNTRIES 197

10.6.1.1 Saudi Arabia 198

10.6.1.1.1 Government initiatives to reduce dependency on oil to support fertilizer production to boost demand 198

10.6.2 EGYPT 200

10.6.2.1 Nationwide focus on land retrieval for agricultural development to drive market 200

10.6.3 SOUTH AFRICA 202

10.6.3.1 Growing manufacturing sector to create immense growth opportunities 202

11 COMPETITIVE LANDSCAPE 204

11.1 INTRODUCTION 204

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 204

11.3 MARKET SHARE ANALYSIS 206

11.4 REVENUE ANALYSIS 208

11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 209

11.5.1 STARS 209

11.5.2 EMERGING LEADERS 209

11.5.3 PERVASIVE PLAYERS 209

11.5.4 PARTICIPANTS 209

11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 211

11.5.5.1 Company footprint 211

11.5.5.2 Type footprint 212

11.5.5.3 Type of resource footprint 213

11.5.5.4 Application footprint 214

11.5.5.5 Region footprint 216

11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 217

11.6.1 PROGRESSIVE COMPANIES 217

11.6.2 RESPONSIVE COMPANIES 217

11.6.3 DYNAMIC COMPANIES 217

11.6.4 STARTING BLOCKS 217

11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 219

11.6.5.1 Detailed list of key startups/SMEs 219

11.6.5.2 Competitive benchmarking of key startups/SMEs 219

11.7 BRAND/PRODUCT COMPARISON 220

11.8 COMPANY VALUATION AND FINANCIAL METRICS 221

11.9 COMPETITIVE SCENARIO 222

11.9.1 PRODUCT LAUNCHES 222

11.9.2 DEALS 222

11.9.3 EXPANSIONS 225

12 COMPANY PROFILES 227

12.1 KEY PLAYERS 227

12.1.1 THE MOSAIC COMPANY 227

12.1.1.1 Business overview 227

12.1.1.2 Products/Solutions/Services offered 228

12.1.1.3 MnM view 229

12.1.1.3.1 Key strengths/Right to win 229

12.1.1.3.2 Strategic choices 230

12.1.1.3.3 Weaknesses/Competitive threats 230

12.1.2 OCP GROUP S.A. 231

12.1.2.1 Business overview 231

12.1.2.2 Products/Solutions/Services offered 232

12.1.2.3 Recent developments 233

12.1.2.3.1 Product launches 233

12.1.2.3.2 Deals 233

12.1.2.3.3 Expansions 234

12.1.2.4 MnM view 234

12.1.2.4.1 Key strengths/Right to win 234

12.1.2.4.2 Strategic choices 234

12.1.2.4.3 Weaknesses/Competitive threats 234

12.1.3 NUTRIEN LTD. 235

12.1.3.1 Business overview 235

12.1.3.2 Products/Solutions/Services offered 236

12.1.3.3 Recent developments 238

12.1.3.3.1 Deals 238

12.1.3.3.2 Expansions 239

12.1.3.4 MnM view 239

12.1.3.4.1 Key strengths/Right to win 239

12.1.3.4.2 Strategic choices 239

12.1.3.4.3 Weaknesses/Competitive threats 239

12.1.4 PHOSAGRO GROUP OF COMPANIES 240

12.1.4.1 Business overview 240

12.1.4.2 Products/Solutions/Services offered 241

12.1.4.3 MnM view 241

12.1.4.3.1 Key strengths/Right to win 241

12.1.4.3.2 Strategic choices 242

12.1.4.3.3 Weaknesses/Competitive threats 242

12.1.5 MA’ADEN 243

12.1.5.1 Business overview 243

12.1.5.2 Products/Solutions/Services offered 244

12.1.6 EUROCHEM GROUP 246

12.1.6.1 Business overview 246

12.1.6.2 Products/Solutions/Services offered 247

12.1.6.3 Recent developments 248

12.1.6.3.1 Deals 248

12.1.6.3.2 Expansions 249

12.1.6.4 MnM view 249

12.1.6.4.1 Key strengths/Right to win 249

12.1.6.4.2 Strategic choices 250

12.1.6.4.3 Weaknesses/Competitive threats 250

12.1.7 INNOPHOS HOLDINGS, INC. 251

12.1.7.1 Business overview 251

12.1.7.2 Products/Solutions/Services offered 251

12.1.7.3 Recent developments 254

12.1.7.3.1 Deals 254

12.1.7.4 MnM view 254

12.1.7.4.1 Key strengths/Right to win 254

12.1.7.4.2 Strategic choices 255

12.1.7.4.3 Weaknesses/Competitive threats 255

12.1.8 JORDAN PHOSPHATE MINES COMPANY (PLC) 256

12.1.8.1 Business overview 256

12.1.8.2 Products/Solutions/Services offered 257

12.1.9 KAZPHOSPHATE LLP 259

12.1.9.1 Business overview 259

12.1.9.2 Products/Solutions/Services offered 259

12.1.10 ICL GROUP LTD. 260

12.1.10.1 Business overview 260

12.1.10.2 Products/Solutions/Services offered 261

12.1.10.3 Recent developments 263

12.1.10.3.1 Deals 263

12.1.10.4 MnM view 263

12.1.10.4.1 Key strengths/Right to win 263

12.1.10.4.2 Strategic choices 263

12.1.10.4.3 Weaknesses/Competitive threats 263

12.1.11 WENGFU GROUP CO., LTD. 264

12.1.11.1 Business overview 264

12.1.11.2 Products/Solutions/Services offered 264

12.1.11.3 Recent developments 265

12.1.11.3.1 Deals 265

12.1.12 YARA 266

12.1.12.1 Business overview 266

12.1.12.2 Products/Solutions/Services offered 267

12.1.12.3 Recent developments 268

12.1.12.3.1 Deals 268

12.1.13 YUNTIANHUA GROUP CO., LTD. 269

12.1.13.1 Business overview 269

12.1.13.2 Products/Solutions/Services offered 269

12.2 STARTUP/SMES 270

12.2.1 ADITYA BIRLA GROUP 270

12.2.2 FOSFA A.S. 271

12.2.3 REEPHOS CHEMICAL CO., LTD. 272

12.2.4 SUDEEP PHARMA PRIVATE LIMITED 273

12.2.5 DR. PAUL LOHMANN GMBH & CO. KGAA 274

12.2.6 JIANGSU CHENGXING PHOSPH-CHEMICALS CO., LTD 275

12.2.7 BALCHEM CORPORATION 276

12.2.8 ELIXIRGROUP 277

12.2.9 YUNNAN BK GIULINI TIANCHUANG PHOSPHATE CO., LTD. 278

12.2.10 XINGFA GROUP 279

12.2.11 THERMPHOS INTERNATIONAL B.V. 280

12.2.12 WENDA INGREDIENTS, LLC 281

12.2.13 JIANGSU DEBANG CHEMICAL INDUSTRY GROUP CO., LTD 282

13 ADJACENT AND RELATED MARKETS 283

13.1 INTRODUCTION 283

13.2 LIMITATIONS 283

13.3 FEED PHOSPHATES MARKET 283

13.3.1 MARKET DEFINITION 283

13.3.2 MARKET OVERVIEW 284

13.4 FEED PHOSPHATES MARKET, BY REGION 284

13.4.1 EUROPE 284

13.4.2 NORTH AMERICA 285

13.4.3 ASIA PACIFIC 285

13.4.4 SOUTH AMERICA 286

13.4.5 MIDDLE EAST & AFRICA 287

14 APPENDIX 288

14.1 DISCUSSION GUIDE 288

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 291

14.3 CUSTOMIZATION OPTIONS 293

14.4 RELATED REPORTS 293

14.5 AUTHOR DETAILS 294

❖ 世界のリン酸塩市場に関するよくある質問(FAQ) ❖

・リン酸塩の世界市場規模は?

→MarketsandMarkets社は2024年のリン酸塩の世界市場規模を1,809億9,000万米ドルと推定しています。

・リン酸塩の世界市場予測は?

→MarketsandMarkets社は2029年のリン酸塩の世界市場規模を2,197億4,000万米ドルと予測しています。

・リン酸塩市場の成長率は?

→MarketsandMarkets社はリン酸塩の世界市場が2024年~2029年に年平均3.9%成長すると予測しています。

・世界のリン酸塩市場における主要企業は?

→MarketsandMarkets社は「OCP Group S.A. (Morocco)、The Mosaic Company (US)、PhosAgro Group of Companies (Russia)、Ma’aden (Saudi Arabia)、Nutrien Ltd. (Canada)、EuroChem Group (Switzerland)、Innophos Holdings、Inc. (US)、Jordan Phosphate Mines Company (PLC) (Jordan)、Kazphosphate LLP (Kazakhstan)、ICL Group Ltd. (ICL) (Israel)、Wengfu Group Co.、Ltd. (China)、Yara (Norway)、and Yuntianhua Group Co.、Ltd. (China).など ...」をグローバルリン酸塩市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。