1 はじめに 24

1.1 調査目的 24

1.2 市場の定義 24

1.3 調査範囲 25

1.3.1 対象と除外 26

1.4 考慮した通貨 27

1.5 考慮した単位 27

1.6 制限事項 27

1.7 利害関係者 27

1.8 変更点のまとめ 27

2 調査方法 28

2.1 調査データ 28

2.1.1 二次データ 29

2.1.1.1 二次資料からの主要データ 30

2.1.1.2 主な二次資料 30

2.1.2 一次データ 30

2.1.2.1 一次資料からの主要データ 31

2.1.2.2 一次インタビューにおける主な参加者 32

2.1.2.3 一次インタビューの内訳 32

2.1.2.4 主要な業界インサイト 33

2.1.3 二次調査および一次調査 33

2.2 市場規模の推定 34

2.2.1 ボトムアップアプローチ 36

2.2.1.1 ボトムアップ分析による市場規模算出のアプローチ

(需要側) 36

2.2.2 トップダウンアプローチ 37

2.2.2.1 トップダウン分析による市場規模算出アプローチ

(供給サイド

2.3 市場シェアの推定 38

2.4 データの三角測量 39

2.5 リスク評価 40

2.5.1 リスク要因分析 40

2.6 リサーチの前提 41

2.7 調査の限界 41

3 エグゼクティブサマリー

4 プレミアムインサイト 48

4.1 超音波探傷市場におけるプレーヤーの魅力的な機会 48

4.2 超音波探傷試験市場:サービス別 49

4.3 超音波探傷市場:業種別 49

4.4 超音波探傷市場:地域別 50

5 市場の概要 51

5.1 はじめに 51

5.2 市場ダイナミクス

5.2.1 推進要因

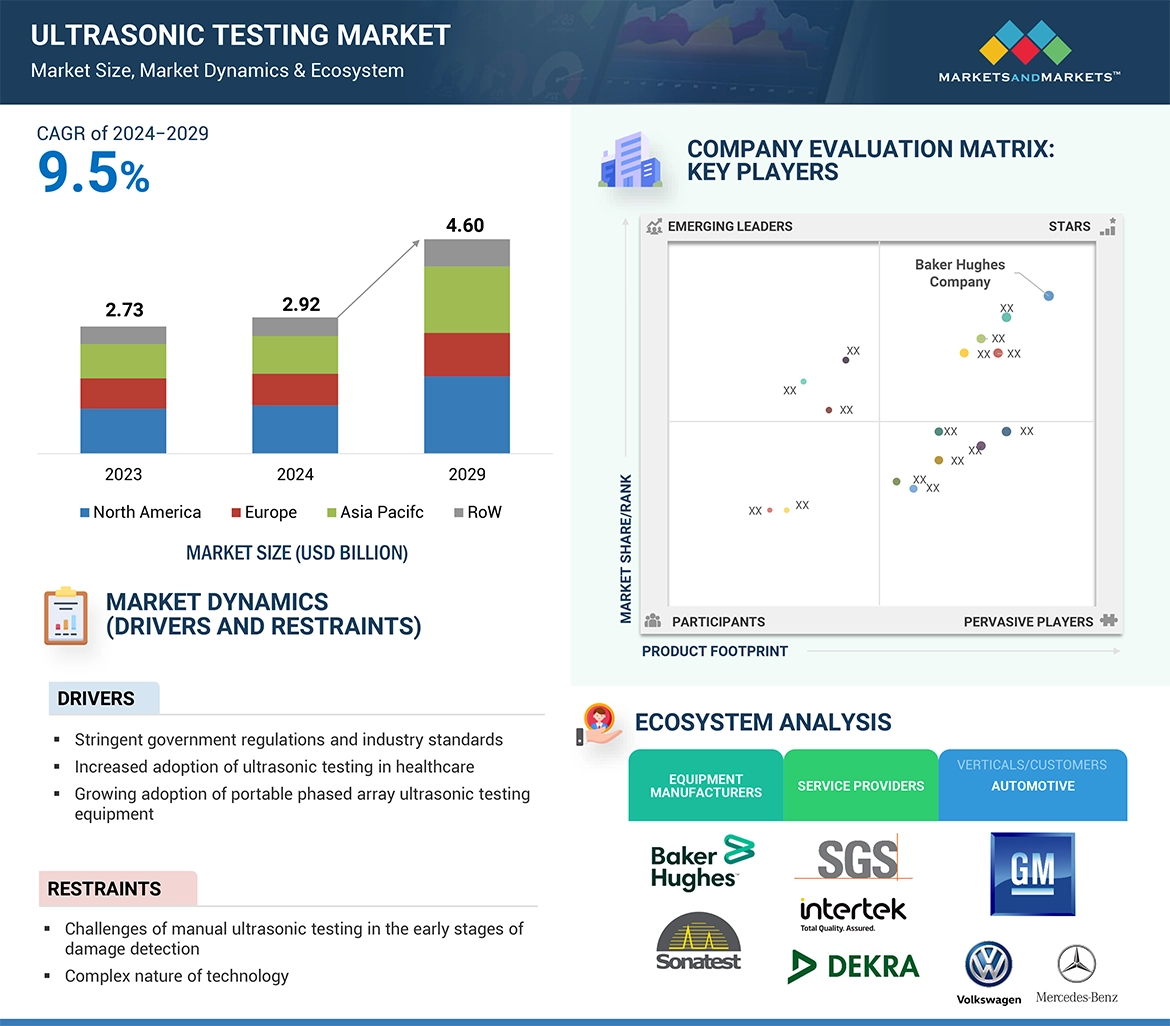

5.2.1.1 厳しい政府規制と業界標準 52

5.2.1.2 ヘルスケア分野での超音波検査の採用増加 52

5.2.1.3 ポータブルフェーズドアレイ超音波探傷器の採用増加 53

5.2.1.4 オフショア石油・ガス探査の増加 53

5.2.1.5 インフラ整備への投資の増加 53

5.2.2 阻害要因 55

5.2.2.1 損傷検出の初期段階における手動超音波試験の限界 55

5.2.2.2 超音波探傷技術の複雑な性質 55

5.2.3 機会 56

5.2.3.1 予知保全重視の高まり 56

5.2.3.2 再生可能エネルギープロジェクトの増加 56

5.2.4 課題 57

5.2.4.1 熟練技術者の不足 57

5.2.4.2 高いメンテナンスコストと設備のダウンタイム 57

5.3 ポーターの5つの力分析 58

5.3.1 競争相手の激しさ 60

5.3.2 新規参入の脅威 60

5.3.3 代替品の脅威 60

5.3.4 買い手の交渉力 60

5.3.5 供給者の交渉力 61

5.4 バリューチェーン分析 61

5.4.1 原材料供給業者 62

5.4.2 部品供給業者 62

5.4.3 装置設計者及び製造者 62

5.4.4 販売幹部及び販売業者 63

5.4.5 サービスプロバイダー 63

5.4.6 バーティカル部門 63

5.5 顧客ビジネスに影響を与えるトレンド/破壊 63

5.6 エコシステム分析 64

5.7 技術分析 67

5.7.1 主要技術 67

5.7.1.1 フルマトリックス捕捉法(FMC)と全集束法(TFM) 67

5.7.1.2 電磁超音波トランスデューサ(EMAT) 67

5.7.2 補完技術 68

5.7.2.1 誘導波超音波探傷法(GWUT) 68

5.7.3 隣接技術 68

5.7.3.1 動的干渉計 68

5.8 投資と資金調達のシナリオ 69

5.9 価格分析 70

5.9.1 主要企業の平均販売価格動向(装置別) 70

5.9.2 平均販売価格動向(地域別) 71

5.10 ケーススタディ分析 71

5.10.1 Guided Ultrasonics Ltd. 石油・ガス産業におけるパイプサポート下の腐食に対応 71

5.10.2 ストログループのロープアクセスエンジニアリングによるフレアスタックの超音波検査 72

5.10.3 コブラのフェーズドアレイ超音波検査(Paut)ソリューションによる熱交換器溶接部検査の最適化 72

5.11 特許分析 73

5.12 貿易分析 75

5.12.1 輸入シナリオ(HSコード9031) 75

5.12.2 輸出シナリオ(HSコード9031) 76

5.13 主要ステークホルダーと購買基準 77

5.13.1 購入プロセスにおける主要ステークホルダー 77

5.13.2 購入基準 78

5.14 関税と規制の状況 79

5.14.1 関税分析 79

5.14.2 規制機関、政府機関、その他の組織 79

5.15 主要な会議とイベント(2024~2025年) 84

5.16 ジェネレーティブAI/AIが超音波探傷市場に与える影響 84

5.16.1 導入 84

6 超音波探傷市場:装置別 86

6.1 導入 87

6.2探傷器 97

6.2.1 不連続面を識別する探傷器の能力が採用を促進 97

6.3 厚みゲージ 98

6.3.1 超音波厚さ計の高精度が石油・ガス産業での使用を促進 98

6.4 トランスデューサーとプローブ 100

6.4.1 トランスデューサーとプローブの強力な検査能力が普及を促進 100

6.5 産業用スキャナー 101

6.5.1 検査結果の品質と精度の向上が産業用スキャナーの採用を後押し 101

6.6 チューブ検査システム 103

6.6.1 腐食や亀裂の高精度検出ニーズが電力セクターでの管内検査システムの採用を促進 103

6.7 ボンドテスター 104

6.7.1 接着接合部の完全性検証におけるボンドテスターの有効性が石油・ガス、 航空宇宙産業での採用を促進 104

6.8 画像処理システム 106

6.8.1 画像処理システムは損傷を与えることなく内部欠陥を特定できる 106

6.9 その他 107

7 超音波探傷市場:サービス別 109

7.1 導入 110

7.2 検査サービス 118

7.2.1 精度の向上、効率化、検査時間の短縮、コスト削減のニーズが市場を牽引 118

7.3 機器レンタルサービス 120

7.3.1 特殊な検査機器にアクセスする費用対効果への需要が市場を牽引 120

7.4 校正サービス 121

7.4.1 測定精度の向上と試験機器の不確実性の低減が市場の成長を促進 121

7.5 トレーニングサービス 123

7.5.1 超音波探傷試験の幅広い産業への普及が需要を促進 123

8 超音波探傷試験市場:タイプ別 125

8.1 導入 126

8.2 フェーズドアレイ

8.2.1 精度の向上と迅速かつ効率的な検査のニーズが市場を牽引 127

8.3 飛行時間型回折法 128

8.3.1 亀裂や融着欠陥の正確な検出が可能 128

8.4 浸漬試験 128

128 8.4.1 内部欠陥や表面欠陥の検出強化 128

8.5 ガイド波検査 128

8.5.1 誘導波探傷試験の長距離検査とモニタリング機能が市場を牽引 128

8.6 音響検査 129

129 8.6.1 浸漬タンクを必要としない単一面検査への音響検査の適合性が市場を牽引 129

8.7 その他のタイプ 129

9 超音波探傷検査市場:垂直分野別 130

9.1 導入 131

9.2 製造業 133

9.2.1 製品の信頼性と安全性を確保するための厳格な品質基準が市場を押し上げる 133

9.3 石油・ガス 136

9.3.1 漏洩や流出防止のための厳しい規制が超音波探傷サービスの採用を後押し 136

9.4 航空宇宙 139

9.4.1 複合材料の広範な使用が超音波探傷サービスの必要性を高める 139

9.5 政府・インフラストラクチャー 142

9.5.1 インフラの完全性維持の重視が超音波探傷試験サービスの需要を促進 142

9.6 自動車 145

9.6.1 安全性と品質保証に対する需要の高まりが成長を後押し 145

9.7 発電 148

9.7.1 厳しい安全要件と規制要件が

超音波探傷サービスの利用を促進 148

9.8 海洋 151

9.8.1 船隊の老朽化とメンテナンスニーズの増加が

市場を牽引する 151

9.9 その他の業種 154

10 超音波探傷試験市場:地域別 158

10.1 はじめに 159

10.2 北米 161

10.2.1 北米:マクロ経済見通し 161

10.2.2 米国 166

10.2.2.1 自動車・航空宇宙産業における超音波探傷サービスの採用増加が成長を後押し 166

10.2.3 カナダ 167

10.2.3.1 検査と保守を必要とする老朽化インフラの著しい増加が市場を押し上げる 167

10.2.4 メキシコ 167

10.2.4.1 国内外の安全基準遵守の必要性が市場を促進 167

10.3 欧州 168

10.3.1 欧州 マクロ経済見通し 168

10.3.2 ドイツ 173

10.3.2.1 成長する自動車・航空宇宙産業が超音波探傷サービスの需要を促進 173

10.3.3 イギリス 174

10.3.3.1 インフラ老朽化の著しい増加が超音波探傷試験の需要を促進 174

10.3.4 フランス 174

10.3.4.1 インフラの安全性と耐久性を重視する動きが市場を後押し 174

10.3.5 イタリア 175

10.3.5.1 航空宇宙・防衛セクターの活況が高度な超音波探傷サービスのニーズを促進 175

10.3.6 その他の欧州 175

10.4 アジア太平洋地域 176

10.4.1 アジア太平洋地域:マクロ経済見通し 176

10.4.2 中国 181

10.4.2.1 中国のエネルギー部門は安全性と操業基準を維持するために超音波探傷サービスを利用 181

10.4.3 日本 182

10.4.3.1 安全性と長寿命化のために橋、トンネル、ダムを頻繁に検査する必要性が成長を後押し 182

10.4.4 インド 183

10.4.4.1 産業界における安全規制と品質管理対策の強化が需要を押し上げる 183

10.4.5 その他のアジア太平洋地域 183

10.5 その他の地域(列) 184

10.5.1 ROW: マクロ経済見通し 184

10.5.2 南米 188

10.5.2.1 ブラジル 189

10.5.2.1.1 製造業や建設業などにおける予防保守・点検戦略の重視が市場を牽引 189

10.5.2.2 その他の南米地域 189

10.5.3 中東・アフリカ 190

10.5.3.1 GCC 191

10.5.3.1.1 パイプライン、リグ、製油所の厳密な検査と保守の必要性に重 点が置かれ、需要が増加 191

10.5.3.2 その他の中東・アフリカ 191

11 競争環境 192

11.1 概要 192

11.2 主要企業の戦略/勝利への権利(2021年5月~2024年10月) 192

11.3 収益分析(2021~2023年) 193

11.4 市場シェア分析、2023年 194

11.5 企業評価と財務指標 197

11.6 製品・ブランド比較 198

11.7 企業評価マトリックス:主要企業(2023年) 198

11.7.1 スター企業 198

11.7.2 新興リーダー企業 199

11.7.3 浸透型プレーヤー 199

11.7.4 参加企業 199

11.7.5 企業フットプリント:主要プレイヤー(2023年) 201

11.7.5.1 企業フットプリント 201

11.7.5.2 企業フットプリント: 主要プレーヤー、2023年

11.7.5.3 地域別フットプリント 203

11.7.5.4 タイプ別フットプリント 204

11.7.5.5 機器のフットプリント 205

11.7.5.6 サービスのフットプリント 205

11.7.5.7 垂直フットプリント 206

11.8 企業評価マトリクス:新興企業/SM(2023年) 207

11.8.1 進歩的企業 207

11.8.2 対応力のある企業 207

11.8.3 ダイナミックな企業 207

11.8.4 スタートアップ・ブロック 207

11.8.5 競争ベンチマーキング:新興企業/SM(2023年

11.8.5.1 新興企業/中小企業のリスト 209

11.8.5.2 新興企業/中小企業の競争ベンチマーク 210

11.9 競争シナリオ 211

11.9.1 製品上市 211

11.9.2 取引 213

12 企業プロファイル 214

12.1 主要機器メーカー 214

Baker Hughes Company (US)

EVIDENT (Japan)

Eddyfi (Canada)

Sonatest (US)

NDT Systems Inc (US)

SGS SOCIETE GENERALE DE SURVEILLANCE SA. (Switzerland)

Intertek Group plc (UK)

MISTRAS Group (US)

DEKRA (Germany)

Applus+ (Spain)

TÜV Rheinland (Germany)

Element Materials Technology (UK)

Acoustic Control Systems (Germany)

Amerapex Corporation (US)

Ashtead Technology (Scotland)

Acuren (US)

Modsonic Instruments Mfg. Co. (P) Ltd. (India)

SONOTEC GmbH (Germany)

Applied Technical Services (US)

Nexxis (Australia)

Vertech Group (Australia)

Guided Ultrasonics Ltd. (US)

IRISNDT (Canada)

Nanjing BKN Automation System Co.Ltd. (China)

and OKOndt GROUP (US)

13 付録 261

13.1 業界専門家による洞察 261

13.2 ディスカッションガイド 262

13.3 Knowledgestore: Marketsandmarketsの購読ポータル 265

13.4 カスタマイズオプション 267

13.5 関連レポート 267

13.6 著者の詳細 268

These investments require rigorous quality assurance and safety inspections on multiple structural components. Global enhancement of infrastructures, including bridges, highways, railways, and energy facilities, requires reliable non-destructive testing methods for detecting flaws. This inspection technique is also known because ultrasonic testing allows for determining the integrity of materials by finding internal flaws without destroying them, thereby being fundamental in the building and subsequent maintenance of any critical structure.

Large investments are made for infrastructure projects in emerging economies like India and China for instance to build new transportation structures, power plants, and urban development. This raises the demand for strict safety standards combined with quality materials and work that would ensure durability and safety. Ultrasonic testing is used to inspect welds, check the material thickness, and analyze the structural integrity of the components in these structures.

“Oil & gas vertical of the ultrasonic testing market is expected to hold the 2nd largest market share during the forecast period from 2024-2029”

Strict regulatory and environmental standards drive ultrasonic testing adoption in the oil and gas industry. This is due to stringent safety and environmental protection guidelines enforced by regulatory bodies. To protect air, water, and soil from hazardous pollutants, the US Environmental Protection Agency (EPA) has mandated some strict leak- and spill-proofing measures, particularly within the oil and gas infrastructure. The Pipeline and Hazardous Materials Safety Administration (PHMSA), through the Pipeline Safety Act and other regulations, requires regular inspections of pipelines to detect corrosion cracking and other structural weaknesses. Some amendments, such as the Pipeline Safety Act in 2021, also emphasize the use of more modern, non-destructive testing methods, including ultrasonic testing, such that pipelines meet higher standards for safety where they pose high risks and pass by close to population centers or highly sensitive ecological areas.

“India is projected to grow at the highest CAGR during the forecast period from 2024-2029”

The stringent quality and safety standards set by the government of India in all the key industries have raised the demand for non-destructive testing (NDT) to a considerable level. In this regard, ultrasonic testing has emerged as a crucial tool to meet compliance requirements. With growing aerospace, oil and gas, and infrastructure industries, higher safety and reliability standards are required to avoid failures and ensure efficiency in operations.

Ultrasonic testing in the aerospace industry is a requirement to check the welds and materials while manufacturing aircraft parts. It is regulated by the standards of Indian national specifications of the Directorate General of Civil Aviation, or DGCA. In 2023, the Ministry of Defence made a declaration to enhance the defense manufacturing in India through indigenization, leading to new DRDO guidelines on ultrasonic testing of aircraft and other defense-related equipment. Infrastructure safety standards have also been enhanced.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the Ultrasonic testing market.

The break-up of the profile of primary participants in the Ultrasonic testing market-

• By Company Type: Tier 1 – 26%, Tier 2 – 32%, Tier 3 – 42%

• By Designation Type: C Level Excecutives – 52%, Directors – 23%, Others – 25%

• By Region Type: North America – 44%, Europe –29 %, Asia Pacific– 23%, RoW – 4%,

The major players in the ultrasonic testing market are Baker Hughes Company (US), EVIDENT (Japan), Eddyfi (Canada), Sonatest (US), NDT Systems Inc (US), SGS SOCIETE GENERALE DE SURVEILLANCE SA. (Switzerland), Intertek Group plc (UK), MISTRAS Group (US), DEKRA (Germany), Applus+ (Spain), TÜV Rheinland (Germany), Element Materials Technology (UK), Acoustic Control Systems (Germany), Amerapex Corporation (US), Ashtead Technology (Scotland), Acuren (US), Modsonic Instruments Mfg. Co. (P) Ltd. (India), SONOTEC GmbH (Germany), Applied Technical Services (US), Nexxis (Australia), Vertech Group (Australia), Guided Ultrasonics Ltd. (US), IRISNDT (Canada), Nanjing BKN Automation System Co., Ltd. (China), and OKOndt GROUP (US).

Research Coverage

The report segments the ultrasonic testing market and forecasts its size by region. It also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

This report has categorized the ultrasonic testing market by type (phased array, time-of-flight diffraction, immersion testing, guided wave testing, acoustography), equipment (flaw detectors, thickness gauges, transducers & probes, industrial scanners, tube inspection systems, bond testers, imaging systems), service type (inspection services, equipment rental services, calibration services, training services), vertical (manufacturing, oil & gas, aerospace, government & infrastructure, power generation, automotive, marine), and region (North America, Europe, Asia Pacific, RoW).

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall ultrasonic testing market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the objectives of the market and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

• Analysis of key drivers (growing adoption of portable phased array ultrasonic testing equipment), restraint (complex nature of the technology), opportunities (growing emphasis on predictive maintenance), and challenges (high maintenance cost and downtime of equipment)

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the ultrasonic testing market

• Market Development: Comprehensive information about lucrative markets – the report analyses the ultrasonic testing market across varied regions.

• Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the ultrasonic testing market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Baker Hughes Company (US), SGS SOCIETE GENERALE DE SURVEILLANCE SA. (Switzerland), Intertek Group plc (UK), DEKRA (Germany), and MISTRAS Group (US).

1 INTRODUCTION 24

1.1 STUDY OBJECTIVES 24

1.2 MARKET DEFINITION 24

1.3 STUDY SCOPE 25

1.3.1 INCLUSIONS AND EXCLUSIONS 26

1.4 CURRENCY CONSIDERED 27

1.5 UNIT CONSIDERED 27

1.6 LIMITATIONS 27

1.7 STAKEHOLDERS 27

1.8 SUMMARY OF CHANGES 27

2 RESEARCH METHODOLOGY 28

2.1 RESEARCH DATA 28

2.1.1 SECONDARY DATA 29

2.1.1.1 Key data from secondary sources 30

2.1.1.2 Key secondary sources 30

2.1.2 PRIMARY DATA 30

2.1.2.1 Key data from primary sources 31

2.1.2.2 Key participants in primary interviews 32

2.1.2.3 Breakdown of primary Interviews 32

2.1.2.4 Key industry insights 33

2.1.3 SECONDARY AND PRIMARY RESEARCH 33

2.2 MARKET SIZE ESTIMATION 34

2.2.1 BOTTOM-UP APPROACH 36

2.2.1.1 Approach to arrive at market size using bottom-up analysis

(Demand side) 36

2.2.2 TOP-DOWN APPROACH 37

2.2.2.1 Approach to arrive at market size using top-down analysis

(Supply Side) 37

2.3 MARKET SHARE ESTIMATION 38

2.4 DATA TRIANGULATION 39

2.5 RISK ASSESSMENT 40

2.5.1 RISK FACTOR ANALYSIS 40

2.6 RESEARCH ASSUMPTIONS 41

2.7 RESEARCH LIMITATIONS 41

3 EXECUTIVE SUMMARY 42

4 PREMIUM INSIGHTS 48

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ULTRASONIC TESTING MARKET 48

4.2 ULTRASONIC TESTING MARKET, BY SERVICE 49

4.3 ULTRASONIC TESTING MARKET, BY VERTICAL 49

4.4 ULTRASONIC TESTING MARKET, BY REGION 50

5 MARKET OVERVIEW 51

5.1 INTRODUCTION 51

5.2 MARKET DYNAMICS 51

5.2.1 DRIVERS 52

5.2.1.1 Stringent government regulations and industry standards 52

5.2.1.2 Increasing adoption of ultrasonic testing in healthcare 52

5.2.1.3 Growing adoption of portable phased array ultrasonic testing equipment 53

5.2.1.4 Growing offshore oil and gas exploration 53

5.2.1.5 Rising investments in infrastructure development 53

5.2.2 RESTRAINTS 55

5.2.2.1 Manual ultrasonic testing limitations in early stages of damage detection 55

5.2.2.2 Complex nature of ultrasonic testing technology 55

5.2.3 OPPORTUNITIES 56

5.2.3.1 Growing emphasis on predictive maintenance 56

5.2.3.2 Rising number of renewable energy projects 56

5.2.4 CHALLENGES 57

5.2.4.1 Limited availability of skilled technicians 57

5.2.4.2 High maintenance cost and downtime of equipment 57

5.3 PORTER'S FIVE FORCES ANALYSIS 58

5.3.1 INTENSITY OF COMPETITIVE RIVALRY 60

5.3.2 THREAT OF NEW ENTRANTS 60

5.3.3 THREAT OF SUBSTITUTES 60

5.3.4 BARGAINING POWER OF BUYERS 60

5.3.5 BARGAINING POWER OF SUPPLIERS 61

5.4 VALUE CHAIN ANALYSIS 61

5.4.1 RAW MATERIAL PROVIDERS 62

5.4.2 COMPONENT SUPPLIERS 62

5.4.3 EQUIPMENT DESIGNERS AND MANUFACTURERS 62

5.4.4 SALES EXECUTIVES AND DISTRIBUTORS 63

5.4.5 SERVICE PROVIDERS 63

5.4.6 VERTICALS 63

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 63

5.6 ECOSYSTEM ANALYSIS 64

5.7 TECHNOLOGY ANALYSIS 67

5.7.1 KEY TECHNOLOGIES 67

5.7.1.1 Full matrix capture (FMC) and total focusing method (TFM) 67

5.7.1.2 Electromagnetic acoustic transducer (EMAT) 67

5.7.2 COMPLEMENTARY TECHNOLOGIES 68

5.7.2.1 Guided wave ultrasonic testing (GWUT) 68

5.7.3 ADJACENT TECHNOLOGIES 68

5.7.3.1 Dynamic interferometer 68

5.8 INVESTMENT AND FUNDING SCENARIO 69

5.9 PRICING ANALYSIS 70

5.9.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY EQUIPMENT 70

5.9.2 AVERAGE SELLING PRICE TREND, BY REGION 71

5.10 CASE STUDY ANALYSIS 71

5.10.1 GUIDED ULTRASONICS LTD. ADDRESSES CORROSION UNDER PIPE SUPPORT IN OIL & GAS INDUSTRY 71

5.10.2 ULTRASONIC INSPECTION OF FLARE STACK USING ROPE ACCESS ENGINEERING BY SUTRO GROUP 72

5.10.3 OPTIMIZING HEAT EXCHANGER WELD INSPECTIONS WITH COBRA PHASED ARRAY ULTRASONIC TESTING (PAUT) SOLUTION BY EVIDENT 72

5.11 PATENT ANALYSIS 73

5.12 TRADE ANALYSIS 75

5.12.1 IMPORT SCENARIO (HS CODE 9031) 75

5.12.2 EXPORT SCENARIO (HS CODE 9031) 76

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA 77

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS 77

5.13.2 BUYING CRITERIA 78

5.14 TARIFF AND REGULATORY LANDSCAPE 79

5.14.1 TARIFF ANALYSIS 79

5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 79

5.15 KEY CONFERENCES AND EVENTS, 2024–2025 84

5.16 IMPACT OF GENERATIVE AI/AI ON ULTRASONIC TESTING MARKET 84

5.16.1 INTRODUCTION 84

6 ULTRASONIC TESTING MARKET, BY EQUIPMENT 86

6.1 INTRODUCTION 87

6.2 FLAW DETECTORS 97

6.2.1 ABILITY OF FLAW DETECTORS TO IDENTIFY DISCONTINUITIES TO DRIVE THEIR ADOPTION 97

6.3 THICKNESS GAUGES 98

6.3.1 HIGH PRECISION OF ULTRASONIC THICKNESS GAUGES TO DRIVE THEIR USE IN OIL & GAS INDUSTRY 98

6.4 TRANSDUCERS & PROBES 100

6.4.1 ROBUST INSPECTION CAPABILITIES OF TRANSDUCERS AND PROBES TO PROPEL THEIR ADOPTION 100

6.5 INDUSTRIAL SCANNERS 101

6.5.1 FOCUS ON ENHANCED QUALITY AND PRECISION IN TESTING RESULTS TO BOOST ADOPTION OF INDUSTRIAL SCANNERS 101

6.6 TUBE INSPECTION SYSTEMS 103

6.6.1 NEED FOR HIGH-PRECISION DETECTION OF CORROSION AND CRACKS TO FUEL ADOPTION OF TUBE INSPECTION SYSTEMS IN POWER SECTOR 103

6.7 BOND TESTERS 104

6.7.1 EFFECTIVENESS OF BOND TESTERS IN VERIFYING INTEGRITY OF ADHESIVELY BONDED JOINTS TO FUEL THEIR ADOPTION IN OIL & GAS AND AEROSPACE INDUSTRIES 104

6.8 IMAGING SYSTEMS 106

6.8.1 IMAGING SYSTEMS ENABLE IDENTIFICATION OF INTERNAL FLAWS WITHOUT CAUSING DAMAGE 106

6.9 OTHERS 107

7 ULTRASONIC TESTING MARKET, BY SERVICE 109

7.1 INTRODUCTION 110

7.2 INSPECTION SERVICES 118

7.2.1 NEED FOR IMPROVED ACCURACY, EFFICIENCY, QUICK INSPECTION TIMES, AND REDUCED COSTS TO DRIVE MARKET 118

7.3 EQUIPMENT RENTAL SERVICES 120

7.3.1 DEMAND FOR COST-EFFECTIVE WAY TO ACCESS SPECIALIZED TESTING TOOLS TO DRIVE MARKET 120

7.4 CALIBRATION SERVICES 121

7.4.1 EMPHASIS ON ENHANCED MEASUREMENT ACCURACY AND REDUCED TESTING EQUIPMENT UNCERTAINTIES TO DRIVE SEGMENTAL GROWTH 121

7.5 TRAINING SERVICES 123

7.5.1 WIDE COVERAGE OF ULTRASONIC TESTING ACROSS INDUSTRIES TO FUEL DEMAND 123

8 ULTRASONIC TESTING MARKET, BY TYPE 125

8.1 INTRODUCTION 126

8.2 PHASED ARRAY 127

8.2.1 NEED FOR ENHANCED ACCURACY AND QUICK AND EFFICIENT INSPECTION TO DRIVE MARKET 127

8.3 TIME-OF-FLIGHT DIFFRACTION 128

8.3.1 OFFERS ACCURATE DETECTION OF CRACKS AND FUSION DEFICIENCIES 128

8.4 IMMERSION TESTING 128

8.4.1 OFFERS ENHANCED DETECTION OF INTERNAL AND SURFACE FLAWS 128

8.5 GUIDED WAVE TESTING 128

8.5.1 LONG-RANGE INSPECTION AND MONITORING CAPABILITIES OF GUIDED WAVE TESTING TO DRIVE MARKET 128

8.6 ACOUSTOGRAPHY 129

8.6.1 SUITABILITY OF ACOUSTOGRAPHY FOR SINGLE-SIDE INSPECTION WITHOUT REQUIRING IMMERSION TANK TO DRIVE MARKET 129

8.7 OTHER TYPES 129

9 ULTRASONIC TESTING MARKET, BY VERTICAL 130

9.1 INTRODUCTION 131

9.2 MANUFACTURING 133

9.2.1 NEED FOR RIGOROUS QUALITY STANDARDS TO ENSURE PRODUCT RELIABILITY AND SAFETY TO BOOST MARKET 133

9.3 OIL & GAS 136

9.3.1 STRINGENT REGULATIONS TO PREVENT LEAKS AND SPILLS TO BOOST ADOPTION OF ULTRASONIC TESTING SERVICES 136

9.4 AEROSPACE 139

9.4.1 EXTENSIVE USE OF COMPOSITE MATERIALS TO FUEL NEED FOR ULTRASONIC TESTING SERVICES 139

9.5 GOVERNMENT & INFRASTRUCTURE 142

9.5.1 EMPHASIS ON MAINTAINING INFRASTRUCTURAL INTEGRITY TO PROPEL DEMAND FOR ULTRASONIC TESTING SERVICES 142

9.6 AUTOMOTIVE 145

9.6.1 RISING DEMAND FOR SAFETY AND QUALITY ASSURANCE TO BOOST GROWTH 145

9.7 POWER GENERATION 148

9.7.1 STRINGENT SAFETY AND REGULATORY REQUIREMENTS

TO ENCOURAGE USE OF ULTRASONIC TESTING SERVICES 148

9.8 MARINE 151

9.8.1 AGING GLOBAL FLEET AND INCREASED MAINTENANCE NEEDS

TO DRIVE MARKET 151

9.9 OTHER VERTICALS 154

10 ULTRASONIC TESTING MARKET, BY REGION 158

10.1 INTRODUCTION 159

10.2 NORTH AMERICA 161

10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK 161

10.2.2 US 166

10.2.2.1 Increasing adoption of ultrasonic testing services in automotive and aerospace industries to boost growth 166

10.2.3 CANADA 167

10.2.3.1 Significant growth in aging infrastructure needing inspection and maintenance to boost market 167

10.2.4 MEXICO 167

10.2.4.1 Need for adherence to domestic and international safety standards to propel market 167

10.3 EUROPE 168

10.3.1 EUROPE: MACROECONOMIC OUTLOOK 168

10.3.2 GERMANY 173

10.3.2.1 Growing automotive and aerospace industries to fuel demand for ultrasonic testing services 173

10.3.3 UK 174

10.3.3.1 Significant growth in aging infrastructure to drive demand for ultrasonic testing services 174

10.3.4 FRANCE 174

10.3.4.1 Growing emphasis on safety and durability of infrastructure to boost market 174

10.3.5 ITALY 175

10.3.5.1 Booming aerospace & defense sector to propel need for advanced ultrasonic testing services 175

10.3.6 REST OF EUROPE 175

10.4 ASIA PACIFIC 176

10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK 176

10.4.2 CHINA 181

10.4.2.1 China’s energy sector uses ultrasonic testing services to maintain safety and operational standards 181

10.4.3 JAPAN 182

10.4.3.1 Need for frequent inspection of bridges, tunnels, and dams for safety and longevity to boost growth 182

10.4.4 INDIA 183

10.4.4.1 Increasing safety regulations and quality control measures across industries to boost demand 183

10.4.5 REST OF ASIA PACIFIC 183

10.5 REST OF THE WORLD (ROW) 184

10.5.1 ROW: MACROECONOMIC OUTLOOK 184

10.5.2 SOUTH AMERICA 188

10.5.2.1 Brazil 189

10.5.2.1.1 Emphasis on preventive maintenance and inspection strategies in industries like manufacturing and construction to drive market 189

10.5.2.2 Rest of South America 189

10.5.3 MIDDLE EAST & AFRICA 190

10.5.3.1 GCC 191

10.5.3.1.1 Focus on necessitating rigorous inspection and maintenance of pipelines, rigs, and refineries to boost demand 191

10.5.3.2 Rest of Middle East & Africa 191

11 COMPETITIVE LANDSCAPE 192

11.1 OVERVIEW 192

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, MAY 2021–OCTOBER 2024 192

11.3 REVENUE ANALYSIS, 2021–2023 193

11.4 MARKET SHARE ANALYSIS, 2023 194

11.5 COMPANY VALUATION AND FINANCIAL METRICS 197

11.6 PRODUCT/BRAND COMPARISON 198

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 198

11.7.1 STARS 198

11.7.2 EMERGING LEADERS 199

11.7.3 PERVASIVE PLAYERS 199

11.7.4 PARTICIPANTS 199

11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 201

11.7.5.1 Company footprint 201

11.7.5.2 Company footprint: Key players, 2023 202

11.7.5.3 Region footprint 203

11.7.5.4 Type footprint 204

11.7.5.5 Equipment footprint 205

11.7.5.6 Service footprint 205

11.7.5.7 Vertical footprint 206

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 207

11.8.1 PROGRESSIVE COMPANIES 207

11.8.2 RESPONSIVE COMPANIES 207

11.8.3 DYNAMIC COMPANIES 207

11.8.4 STARTING BLOCKS 207

11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 209

11.8.5.1 List of startups/SMEs 209

11.8.5.2 Competitive benchmarking of startups/SMEs 210

11.9 COMPETITIVE SCENARIO 211

11.9.1 PRODUCT LAUNCHES 211

11.9.2 DEALS 213

12 COMPANY PROFILES 214

12.1 KEY EQUIPMENT MANUFACTURERS 214

12.1.1 BAKER HUGHES COMPANY (WAYGATE TECHNOLOGIES) 214

12.1.1.1 Business overview 214

12.1.1.2 Products/Solutions/Services offered 215

12.1.1.3 Recent developments 217

12.1.1.3.1 Product launches 217

12.1.1.4 MnM view 218

12.1.1.4.1 Key strengths/Right to win 218

12.1.1.4.2 Strategic choices 218

12.1.1.4.3 Weaknesses/Competitive threats 218

12.1.2 EVIDENT 219

12.1.2.1 Business overview 219

12.1.2.2 Products/Solutions/Services offered 219

12.1.2.3 Recent developments 220

12.1.2.3.1 Product launches 220

12.1.2.4 MnM view 221

12.1.2.4.1 Key strengths/Right to win 221

12.1.2.4.2 Strategic choices 221

12.1.2.4.3 Weaknesses/Competitive threats 221

12.1.3 EDDYFI 222

12.1.3.1 Business overview 222

12.1.3.2 Products/Solutions/Services offered 222

12.1.3.3 Recent developments 223

12.1.3.3.1 Product launches 223

12.1.3.3.2 Deals 223

12.1.4 SONATEST 224

12.1.4.1 Business overview 224

12.1.4.2 Products/Solutions/Services offered 224

12.1.5 NDT SYSTEMS INC 226

12.1.5.1 Business overview 226

12.1.5.2 Products/Solutions/Services offered 226

12.2 KEY SERVICE PROVIDERS 229

12.2.1 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA. 229

12.2.1.1 Business overview 229

12.2.1.2 Products/Solutions/Services offered 230

12.2.1.3 MnM view 232

12.2.1.3.1 Key strengths 232

12.2.1.3.2 Strategic choices 232

12.2.1.3.3 Weaknesses/Competitive threats 232

12.2.2 INTERTEK GROUP PLC 233

12.2.2.1 Business overview 233

12.2.2.2 Products/Solutions/Services offered 234

12.2.2.3 MnM view 235

12.2.2.3.1 Key strengths/Right to win 235

12.2.2.3.2 Strategic choices 235

12.2.2.3.3 Weaknesses/Competitive threats 235

12.2.3 MISTRAS GROUP 236

12.2.3.1 Business overview 236

12.2.3.2 Products/Solutions/Services offered 237

12.2.3.3 MnM view 238

12.2.3.3.1 Key strengths/Right to win 238

12.2.3.3.2 Strategic choices 238

12.2.3.3.3 Weaknesses/Competitive threats 239

12.2.4 DEKRA 240

12.2.4.1 Business overview 240

12.2.4.2 Products/Solutions/Services offered 240

12.2.4.3 MnM view 241

12.2.4.3.1 Key strengths/Right to win 241

12.2.4.3.2 Strategic choices 241

12.2.4.3.3 Weaknesses/Competitive threats 241

12.2.5 APPLUS+ 242

12.2.5.1 Business overview 242

12.2.5.2 Products/Solutions/Services offered 244

12.2.6 TÜV RHEINLAND 245

12.2.6.1 Business overview 245

12.2.6.2 Products/Solutions/Services offered 246

12.2.7 ELEMENT MATERIALS TECHNOLOGY 248

12.2.7.1 Business overview 248

12.2.7.2 Products/Solutions/Services offered 248

12.2.7.3 Recent developments 249

12.2.7.3.1 Deals 249

12.3 OTHER PLAYERS 250

12.3.1 ACOUSTIC CONTROL SYSTEMS 250

12.3.2 AMERAPEX CORPORATION 251

12.3.3 ASHTEAD TECHNOLOGY 252

12.3.4 ACUREN 253

12.3.5 MODSONIC INSTRUMENTS MFG. CO. (P) LTD. 254

12.3.6 SONOTEC GMBH 255

12.3.7 APPLIED TECHNICAL SERVICES 256

12.3.8 NEXXIS 257

12.3.9 VERTECH GROUP 257

12.3.10 GUIDED ULTRASONICS LTD. 258

12.3.11 IRISNDT 259

12.3.12 NANJING BKN AUTOMATION SYSTEM CO., LTD. 259

12.3.13 OKONDT GROUP 260

13 APPENDIX 261

13.1 INSIGHTS FROM INDUSTRY EXPERTS 261

13.2 DISCUSSION GUIDE 262

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 265

13.4 CUSTOMIZATION OPTIONS 267

13.5 RELATED REPORTS 267

13.6 AUTHOR DETAILS 268

❖ 世界の超音波探傷検査市場に関するよくある質問(FAQ) ❖

・超音波探傷検査の世界市場規模は?

→MarketsandMarkets社は2024年の超音波探傷検査の世界市場規模を29.2億米ドルと推定しています。

・超音波探傷検査の世界市場予測は?

→MarketsandMarkets社は2029年の超音波探傷検査の世界市場規模を46.0億米ドルと予測しています。

・超音波探傷検査市場の成長率は?

→MarketsandMarkets社は超音波探傷検査の世界市場が2024年~2029年に年平均9.5%成長すると予測しています。

・世界の超音波探傷検査市場における主要企業は?

→MarketsandMarkets社は「Baker Hughes Company (US), EVIDENT (Japan), Eddyfi (Canada), Sonatest (US), NDT Systems Inc (US), SGS SOCIETE GENERALE DE SURVEILLANCE SA. (Switzerland), Intertek Group plc (UK), MISTRAS Group (US), DEKRA (Germany), Applus+ (Spain), TÜV Rheinland (Germany), Element Materials Technology (UK), Acoustic Control Systems (Germany), Amerapex Corporation (US), Ashtead Technology (Scotland), Acuren (US), Modsonic Instruments Mfg. Co. (P) Ltd. (India), SONOTEC GmbH (Germany), Applied Technical Services (US), Nexxis (Australia), Vertech Group (Australia), Guided Ultrasonics Ltd. (US), IRISNDT (Canada), Nanjing BKN Automation System Co., Ltd. (China), and OKOndt GROUP (US)など ...」をグローバル超音波探傷検査市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。