1 はじめに 31

1.1 調査目的 31

1.2 市場の定義 31

1.3 市場範囲 32

1.3.1 市場セグメンテーション 32

1.3.2 包含と除外 33

1.4 考慮した年数 34

1.5 考慮した単位 34

1.5.1 通貨/価値単位 34

1.6 利害関係者 35

1.7 変更点のまとめ 35

2 調査方法 36

2.1 調査データ 36

2.1.1 二次データ 37

2.1.1.1 二次資料からの主要データ 37

2.1.2 一次データ 37

2.1.2.1 一次情報源からの主要データ 38

2.1.2.2 主要な業界インサイト 39

2.1.2.3 一次インタビューの内訳 40

2.2 市場規模の推定 40

2.2.1 ボトムアップアプローチ 41

2.2.2 トップダウンアプローチ 42

2.2.2.1 トップダウン分析による市場規模推定のアプローチ 42

2.3 データの三角測量 44

2.4 リサーチの前提 45

2.5 調査の限界 45

3 エグゼクティブサマリー 46

4 プレミアムインサイト 52

4.1 精密栄養市場におけるプレーヤーの魅力的な機会 52

4.2 北米:精密栄養市場:用途別、国別 53

4.3 精密栄養市場:主要地域サブマーケットのシェア 53

4.4 精密栄養市場:技術別、地域別 54

4.5 精密栄養市場:サービスタイプ別・地域別 55

4.6 精密栄養市場:サプリメント別・地域別 56

4.7 精密栄養市場:用途・地域別 57

4.8 精密栄養市場:最終用途・地域別 58

5 市場の概要 59

5.1 はじめに 59

5.2 マクロ経済指標 59

5.2.1 医療費の増加 59

5.2.2 世界GDPの増加 60

5.3 市場ダイナミクス

5.3.1 推進要因 61

5.3.1.1 個別化医療に対する意識の高まり 61

5.3.1.2 世界的なウェルネス経済のブーム 62

5.3.1.3 非感染性疾患の増加 63

5.3.2 阻害要因 63

5.3.2.1 精密栄養ソリューションの高コスト 63

5.3.2.2 標準化と包括的な科学的検証の欠如 64

5.3.3 機会 64

5.3.3.1 AIとビッグデータ分析の統合 64

5.3.3.2 デジタルヘルスツールの採用増加 64

5.3.4 課題 65

5.3.4.1 プライバシーとデータセキュリティへの懸念 65

5.3.4.2 消費者の懐疑心への対応 65

5.4 精密栄養市場へのAI/GEN AIの影響 66

5.4.1 導入 66

5.4.2 精密栄養における遺伝子AIの利用 67

5.4.3 ケーススタディ分析 68

5.4.3.1 Nutrigenomixによる個別化栄養の変革 68

5.4.3.2 IBMワトソンとPathAIの専門医療への影響 68

6 業界動向 69

6.1 はじめに 69

6.2 バリューチェーン分析 69

6.2.1 データ収集 69

6.2.2 データ分析と推奨 70

6.2.3 栄養ソリューションのカスタマイズ 70

6.2.4 製品デリバリー 70

6.3 貿易分析 70

6.3.1 HSコード3822の輸出シナリオ 70

6.3.2 HSコード3822の輸入シナリオ 72

6.4 技術分析 73

6.4.1 主要技術 73

6.4.1.1 人工知能と機械学習 73

6.4.2 補足技術 74

6.4.2.1 先進イメージングとバイオセンサー 74

6.4.3 隣接技術 74

6.4.3.1 バーチャルヘルスプラットフォームと遠隔医療 74

6.5 価格分析 75

6.5.1 主要企業の平均販売価格動向、

ゲノミクス・マルチオミクス解析サービス別 75

6.6 エコシステム分析 80

6.6.1 需要サイド 80

6.6.2 供給サイド 80

6.7 顧客ビジネスに影響を与えるトレンド/破壊 82

6.8 特許分析 83

6.9 主要な会議とイベント(2024-2025年) 87

6.10 規制の状況 87

6.10.1 規制機関、政府機関、

その他の組織 88

6.10.2 北米 90

6.10.2.1 米国 90

6.10.2.2 カナダ

6.10.2.3 メキシコ 90

6.10.3 欧州 90

6.10.3.1 欧州連合規制 90

6.10.3.1.1 個人データの処理 90

6.10.3.1.2 ボーダーライン製品 91

6.10.3.1.3 栄養・健康強調表示 91

6.10.4 アジア太平洋地域 92

6.10.4.1 中国 92

6.10.4.2 インド 92

6.10.4.3 オーストラリア・ニュージーランド 92

6.10.5 南米 92

6.10.5.1 ブラジル 92

6.10.5.2 アルゼンチン 93

6.11 ポーターの5つの力分析 93

6.11.1 競争相手の激しさ 94

6.11.2 サプライヤーの交渉力 95

6.11.3 買い手の交渉力 95

6.11.4 代替品の脅威 95

6.11.5 新規参入の脅威 96

6.12 主要ステークホルダーと購買基準 96

6.12.1 購入プロセスにおける主要ステークホルダー 96

6.12.2 購入基準 97

6.13 ケーススタディ分析 98

6.13.1 23andme+トータルヘルスメンバーシップの立ち上げ 98

6.13.2 Genesis Healthcare Co. が全ゲノムシーケンス機能を拡張 98

6.13.3 ビオーム・ライフサイエンス社が全身の知能検査を開始 99

6.14 投資と資金調達のシナリオ 99

7 精密栄養市場、技術別 100

7.1 導入 101

7.2 メタボロミクス 102

7.2.1 慢性疾患管理における代謝健康ソリューションへのニーズの高まりが市場を牽引 102

7.3 ゲノミクス 103

7.3.1 遺伝子検査コストの低下とニュートリゲノミクスへの関心の高まりが需要を牽引 103

7.4 トランスクリプトミクス 104

7.4.1 シークエンシングの進歩がRNA研究を促進し、精密栄養学におけるトランスクリプトミクスを後押し 104

7.5 プロテオミクス 105

7.5.1 質量分析計とバイオインフォマティクスの進歩が需要を促進 105

需要に拍車をかける 105

7.6 その他の技術 106

8 精密栄養市場、用途別 108

8.1 導入 109

8.2 体重管理 110

8.2.1 過体重・肥満率の増加が市場を牽引 110

8.3 疾病管理 111

8.3.1 慢性疾患率の急増とゲノム・バイオテクノロジーの躍進が市場を牽引 111

8.4 スポーツ栄養 113

8.4.1 個別化された健康評価と調整への注目の高まりが需要を牽引 113

8.5 一般的な健康とウェルネス 114

8.5.1 長期的な健康のために個別化された食事指導の重要性の高まりが需要を牽引 114

が需要を牽引 114

9 精密栄養市場(サービスタイプ別) 116

9.1 はじめに 117

9.2 ゲノミクス&マルチオミクス分析サービス 118

9.2.1 ゲノムベースの食事サービスに対する需要の増加が市場を牽引 118

市場を牽引 118

9.3 個別化プラン&サブスクリプションサービス 120

9.3.1 利便性とカスタマイズされたウェルネスプログラムへのニーズが需要を牽引 120

9.4 コンサルティングサービス 121

9.4.1 特定の健康状態に関する専門家の指導に対する需要の増加が市場を牽引 121

9.5 デジタルプラットフォームとソリューション 122

9.5.1 AI技術の革新とウェアラブルデバイスの普及が市場を牽引 122

9.6 施設&ウェルネス・プログラム 123

9.6.1 医療費の急増とエビデンスに基づく信頼性の高いウェルネスプログラムへの需要が市場を牽引 123

10 精密栄養市場(最終用途別) 125

10.1 導入 126

10.2 医療機関 127

10.2.1 医療提供者は精密医療の推進に重要な役割を果たす 127

10.3 研究機関 128

10.3.1 安全で効果的、かつエビデンスに基づく個別化栄養ソリューションへの需要が市場を牽引 128

10.4 栄養補助食品メーカー 129

10.4.1 透明性が高く、エビデンスに裏付けられた処方による精密栄養のトレンドが市場を押し上げる 129

10.5 フィットネス&ウェルネス企業 130

10.5.1 フィットネスと栄養における高度な個別化志向の高まりが市場を牽引 130

10.6 消費者への直接販売 132

10.6.1 遺伝子検査キット、在宅健康診断、栄養追跡アプリの人気の高まりが市場を牽引 132

11 精密栄養市場(サプリメント別) 133

11.1 はじめに 134

11.2 ビタミン 136

11.2.1 高齢化人口の増加が需要を牽引 136

11.3 ミネラル 137

11.3.1 骨粗鬆症と鉄欠乏症の増加が市場を牽引 137

11.4 プロバイオティクス 138

11.4.1 消化器系健康サプリメントの人気の高まりが需要を高める 138

11.5 ハーブサプリメント 139

11.5.1 一般的な健康とウェルネスのための個別化ハーブ・ソリューションへの注目の高まりが市場を拡大 139

11.6 タンパク質サプリメント 140

11.6.1 植物ベースの食事に対する需要の高まりが需要を牽引 140

11.7 アミノ酸 141

11.7.1 スポーツ栄養における使用の増加が需要を高める 141

11.8 酵素 142

11.8.1 栄養吸収の利点が需要を牽引 142

11.9 その他のサプリメント 143

12 精密栄養市場(地域別) 144

12.1 はじめに 145

12.2 北米 146

12.2.1 米国 152

12.2.1.1 AIの進歩、豊富なデータセットの利用可能性、個別化栄養への関心の高まりが市場を牽引 152

12.2.2 カナダ 154

12.2.2.1 支援的な医療政策と長期的な健康への関心の高まりが市場を牽引 154

12.2.3 メキシコ 156

12.2.3.1 公衆衛生への関心の高まり、ウェルネス志向の高まり、

革新的な技術統合が市場を牽引 156

12.3 欧州 158

12.3.1 ドイツ 163

12.3.1.1 AIとデジタルヘルスへの強いコミットメントが市場を拡大 163

12.3.2 フランス 164

12.3.2.1 新たな栄養補助食品と機能性食品の上市の増加が市場を牽引 164

市場を牽引 164

12.3.3 イギリス 166

12.3.3.1 主要業界プレイヤーの存在と個別化された食事ソリューションへの注目の高まりが市場を牽引 166

12.3.4 イタリア 168

12.3.4.1 個別化された健康ソリューションへの投資の増加

市場の成長を促進 168

12.3.5 スペイン 169

12.3.5.1 健康意識の高まりと技術の進歩が市場を牽引 169

が市場を牽引 169

12.3.6 その他のヨーロッパ 171

12.4 アジア太平洋地域 173

12.4.1 中国 179

12.4.1.1 個別化された栄養戦略と国家保健政策目標への注目の高まりが市場を牽引 179

中国 179

12.4.2 インド 181

12.4.2.1 心血管疾患による死亡者数の増加が市場を牽引 181

12.4.3 日本 183

12.4.3.1 高齢化の進展と健康リスクの増加が市場を牽引 183

12.4.4 シンガポール 185

12.4.4.1 国家精密医療計画が市場を牽引 185

12.4.5 オーストラリア・ニュージーランド 187

12.4.5.1 研究革新と個別化医療ソリューションの需要増加が市場を後押し 187

12.4.6 インドネシア 189

12.4.6.1 ゲノム技術拡大への政府の取り組みが市場を牽引 189

12.4.7 マレーシア 191

12.4.7.1 若者の精密栄養に対する意識の高まりが市場を後押し 191

12.4.8 タイ 193

12.4.8.1 ゲノミクスエコシステムの進歩が市場を牽引 193

12.4.9 ベトナム 195

12.4.9.1 ゲノミクス技術開発における共同研究が市場を牽引 195

12.4.10 その他のアジア太平洋地域 196

12.5 南米 198

12.5.1 ブラジル 203

12.5.1.1 栄養改善による栄養不良と肥満への取り組みに政府が注力することが市場を牽引 203

12.5.2 アルゼンチン 204

12.5.2.1 非感染性疾患の管理に注力し、市場成長を加速 204

12.5.3 その他の南米地域 206

12.6 その他の地域 208

12.6.1 アフリカ 212

12.6.1.1 医療インフラの充実とグローバル企業との連携が市場を牽引 212

12.6.2 中東 214

12.6.2.1 ゲノミクス、個別化医療、デジタルヘルス技術の進歩が市場を加速、

デジタルヘルス技術の進歩が市場成長を加速 214

13 競争環境 216

13.1 概要 216

13.2 主要プレーヤーの戦略/勝利への権利(2020~2024年) 217

13.3 収益分析、2021-2023年 219

13.4 市場シェア分析、2023年 219

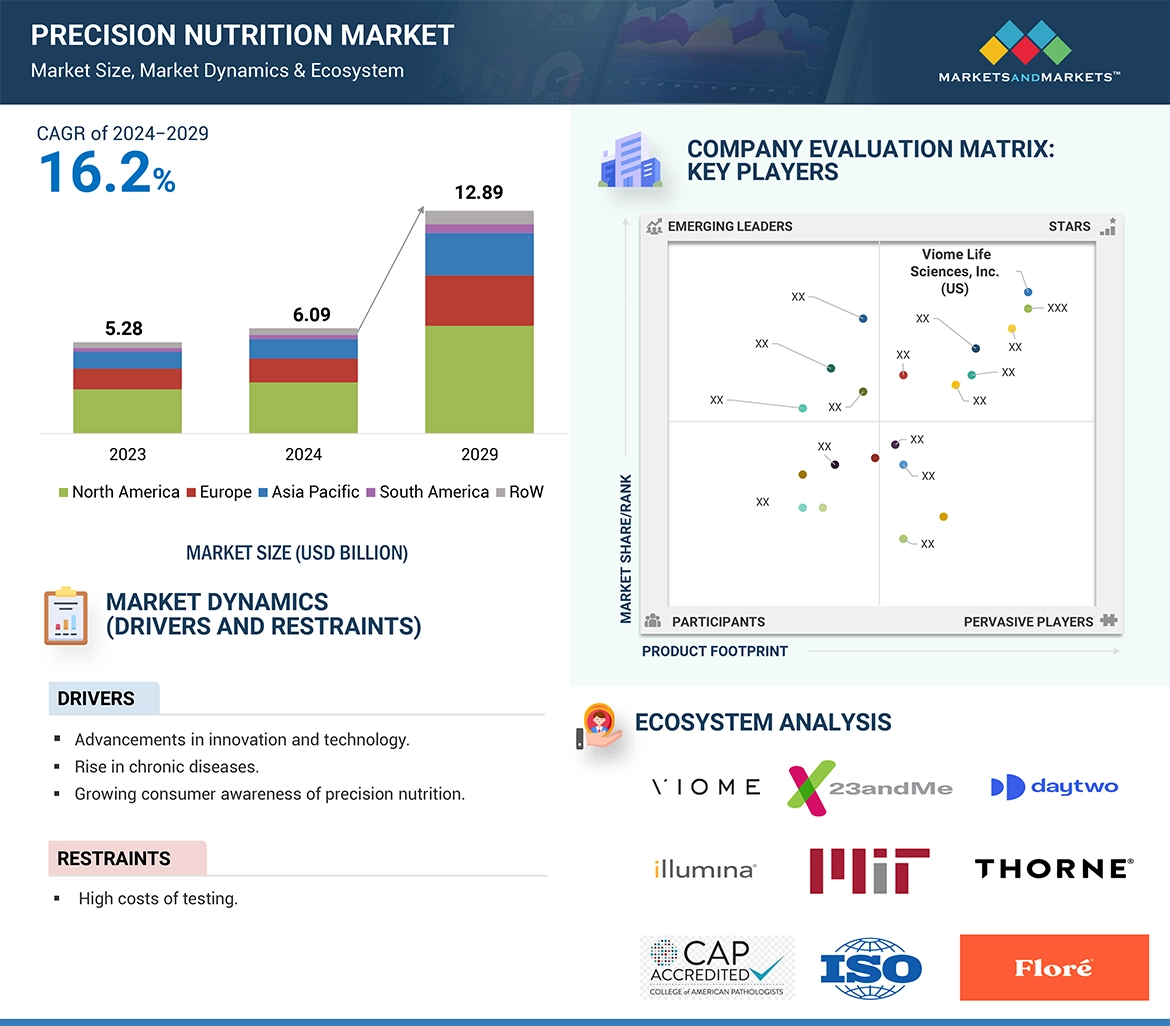

13.5 企業評価マトリックス:主要プレイヤー(2023年) 221

13.5.1 スター企業 221

13.5.2 新興リーダー 221

13.5.3 浸透型プレーヤー 221

13.5.4 参加企業 221

13.5.5 企業フットプリント:主要プレーヤー、2023年 223

13.5.5.1 企業フットプリント 223

13.5.5.2 地域別フットプリント 224

13.5.5.3 サービスタイプのフットプリント 225

13.5.5.4 技術のフットプリント 226

13.5.5.5 アプリケーションのフットプリント 227

13.6 企業評価マトリクス:新興企業/SM(2023年) 227

13.6.1 進歩的企業 227

13.6.2 対応力のある企業 227

13.6.3 ダイナミックな企業 228

13.6.4 スタートアップ・ブロック 228

13.6.5 競争ベンチマーキング:新興企業/SM(2023年) 229

13.6.5.1 主要新興企業/中小企業の詳細リスト 229

13.6.5.2 主要新興企業/SMEの競合ベンチマーキング 230

13.7 企業の評価と財務指標 231

13.8 製品比較 232

13.9 競争シナリオ 233

13.9.1 製品上市 233

13.9.2 取引 235

13.9.3 拡張 237

13.9.4 その他 238

13.10 主要企業の強み分析 239

14 企業プロフィール 242

14.1 主要プレーヤー 242

Viome Life Sciences Inc. (US)

Prenetics Global Limited (China)

ZOE Limited (UK)

myDNA Life Australia Pty Ltd. (Australia)

23andMe Inc. (US)

DayTwo Inc (US)

Nutrigenomix (Canada)

Genesis Healthcare Co. (Japan)

AMILI (Singapore)

SelfDecode (US)

Genequest Inc. (Japan)

Ajinomoto Co.Inc. (Japan)

Thorne (US)

DNAlysis (South Africa)

and Xcode Life (US)

15 隣接・関連市場 297

15.1 導入 297

15.2 制限 297

15.3 個別化栄養市場 297

15.3.1 市場の定義 297

15.3.2 市場概要 298

15.4 栄養分析市場 299

15.4.1 市場の定義 299

15.4.2 市場概要 299

15.5 栄養補助食品市場 300

15.5.1 市場の定義 300

15.5.2 市場概要 301

16 付録 302

16.1 ディスカッションガイド 302

16.2 Knowledgestore: Marketsandmarketsの購読ポータル 307

16.3 カスタマイズオプション 309

16.4 関連レポート 309

16.5 著者の詳細 310

Precision nutrition is shaping the industry by incorporating AI, bringing with it the possibility of very individualized and data-driven health solutions. AI-powered platforms can analyze complex datasets, which incorporate genetic, microbiome, and lifestyle information, allowing for the provision of tailored dietary recommendations and health plans. Technological innovations in nutrition are improving the accuracy of nutrient insights, cutting the intricacy of data interpretation, and making product innovation easier. As a consequence, AI is driving efficiency, scalability, and accessibility in precision nutrition to make personalized health solutions more precise and broadly available.

ZOE Limited (UK) offers a personal food quality score that is determined using advanced AI-driven insights, powered by ongoing PREDICT studies. The food quality scores predict the effect of a particular food on an individual's dietary inflammation and gut health, making personalized recommendations for diet. Similarly, Viome Life Sciences, Inc (US) utilizes AI in combination with mRNA sequencing to decipher vast mountains of microbiome data. Such a method turns complex biological information into sharp health scores, providing personalized recommendations to foods, vitamins, supplements, as well as other nutrients that enhance one's health.

Disruption in the precision nutrition market: The precision nutrition market is experiencing significant disruptions driven by advancements in technology, increasing consumer awareness, and evolving healthcare approaches. Companies are leveraging AI, genetic testing, and microbiome analysis to deliver personalized nutrition solutions, transforming traditional dietary practices. This shift is reshaping how individuals manage health and wellness. Technological advancements, greater consumer awareness, and health care changing approaches are bringing about unprecedented disruptions to the precision nutrition market.

Some of the key disruptions in the precision nutrition market include:

• Advances in Genomics and Microbiome Research: Technologies like mRNA sequencing are enabling deeper insights into gut health and genetic predispositions, driving innovation in tailored health solutions.

• Real-Time Analytics and Feedback: Innovations in data analytics allow consumers to receive instant feedback on dietary choices, empowering them to make informed health decisions.

• Integration with Lifestyle Apps: Precision nutrition platforms are being integrated with fitness and mental health apps, offering a comprehensive approach to health management.

“The direct-to-consumer segment holds the highest share in the end-use segment of precision nutrition market.”

The DTC segment currently rules the roost in the precision nutrition market as demand increases for tailored, preventive healthcare solutions, with this segment very actively leveraging technological advancements in AI, genomics, and microbiome research, providing such tailor-made dietary and supplement recommendations through easy-to-use platforms. At-home DNA, microbiome, and metabolic health test kits have become popular because most of them are offered by brands such as ZOE, Viome, and 23andMe, and bring instant convenience to access health insights through such platforms without having to visit clinics or laboratories.

Subscription-based models and digital platforms drive engagement even further by delivering live health monitoring, changing meal plans, and nutrition consultation. The DTC approach resonates especially with the more health-conscious consumers who seek actionable, data-driven insights that enable them to optimize their well-being. Additionally, seamless integration with wearable devices and apps allows users to follow real-time health metrics, making the appeal of personalized nutrition even more significant. Conclusively, the upscaling of testing kits in terms of affordability, as well as deepening internet penetration, has reached the emerging markets. Therefore, DTC continues to gain precedence over traditional healthcare channels: this segment is the biggest and also growing faster than any other segment, with precision nutrition.

“The general health & wellness segment is projected to hold a significant market share in the application segment during the forecast period.”

The General Health & Wellness segment is important in the precision nutrition market and is anticipated to continue to grow, driven by increasing focus on holistic well-being and preventive health. This segment caters to consumers seeking an improvement in the overall quality of life through personalized dietary solutions, supplements, and functional foods. With more chronic cases, such as obesity and diabetes, the need to raise the bar for precision nutrition for that specific population segment is also on the rise. Finally, with more focus on immunity and healthy living in the long term, the wellness programs naturally find greater interest in personalization. Exercise apps and wearables have added numerous solutions in this space, making it possible for consumers to track in real-time their progress and adjust their regimen. As the average consumer becomes more proactive about maintaining a healthy lifestyle, it is indeed growth within the General Health & Wellness segment that drives the precise nutrition industry forward-that catalyst for the sector.

"North America is expected to hold highest share in the precision nutrition market."

North America dominates the precision nutrition market, supported by the great health care infrastructure and awareness among consumers as well as the widespread adoption of personalized health solutions in the region. The key players have intensified their presence in the region with innovation in at-home test kits and AI-driven recommendations through companies such as Viome, ZOE, and 23andMe. Improving health awareness and associated chronic conditions, such as obesity and diabetes, have increased demand for individualized nutritional plans. Investment in genomics and microbiome research has also been significant along with wearable devices and digital platforms that create ease of accessibility and deepen customer engagement. North America continues to be the early adopter of technological innovations and thus has a supporting regulatory environment that remains in its favor to remain the market leader for precision nutrition.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the precision nutrition market:

• By Company Type: Tier 1 – 25%, Tier 2 – 45%, and Tier 3 – 30%

• By Designation: Directors – 20%, Managers – 50%, Others- 30%

• By Region: North America – 25%, Europe – 30%, Asia Pacific – 20%, South America – 15% and Rest of the World –10%

Prominent companies in the market include Viome Life Sciences, Inc. (US), Prenetics Global Limited (China), ZOE Limited (UK), myDNA Life Australia Pty Ltd. (Australia) , 23andMe, Inc. (US), DayTwo Inc (US), Nutrigenomix (Canada), Genesis Healthcare Co. (Japan), AMILI (Singapore), SelfDecode (US), Genequest Inc. (Japan), Ajinomoto Co., Inc. (Japan), Thorne (US), DNAlysis (South Africa), and Xcode Life (US).

Other players include GenoPalate Inc (US), LifeNome Inc. (US), Century Genomics Limited (UK), Sun Genomics (US), Metagen, Inc. (Japan), Segterra, Inc. (US), GeneusDNA (Thailand), Holifya S.r.l. (Italy), GX Sciences, LLC (US), and Nutrisense (US).

Research Coverage:

This research report categorizes the precision nutrition market by technology (metabolomics, genomics, transcriptomics, proteomics and others), service type (genomics and multi-omics analysis services, personalized plans & subscription services, consultation services, digital platforms & solutions, and institutional and wellness programs), end use (healthcare providers, direct-to-consumer, fitness & wellness companies, research institutes, and dietary supplement manufacturers), application (disease management, weight management, general health & wellness, and sports nutrition), supplements (vitamins, minerals, probiotics, herbal supplements, protein supplements, amino acids, enzymes, and other supplements) and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of precision nutrition market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the precision nutrition market. Competitive analysis of upcoming startups in the precision nutrition market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, patent, regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall precision nutrition and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (rising non communicable diseases), restraints (high costs of testing), opportunities (integration of AI and big data analytics) and challenges (privacy and security concerns) influencing the growth of the precision nutrition market.

• New product launch/Innovation: Detailed insights on research & development activities and new product launches in the precision nutrition market.

• Market Development: Comprehensive information about lucrative markets – the report analyzes the precision nutrition market across varied regions.

• Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the precision nutrition market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product foot prints of leading players such as Viome Life Sciences, Inc. (US), Prenetics Global Limited (China), ZOE Limited (UK), myDNA Life Australia Pty Ltd. (Australia), 23andMe, Inc. (US), DayTwo Inc (US), and other players in the precision nutrition market.

1 INTRODUCTION 31

1.1 STUDY OBJECTIVES 31

1.2 MARKET DEFINITION 31

1.3 MARKET SCOPE 32

1.3.1 MARKET SEGMENTATION 32

1.3.2 INCLUSIONS AND EXCLUSIONS 33

1.4 YEARS CONSIDERED 34

1.5 UNIT CONSIDERED 34

1.5.1 CURRENCY/VALUE UNIT 34

1.6 STAKEHOLDERS 35

1.7 SUMMARY OF CHANGES 35

2 RESEARCH METHODOLOGY 36

2.1 RESEARCH DATA 36

2.1.1 SECONDARY DATA 37

2.1.1.1 Key data from secondary sources 37

2.1.2 PRIMARY DATA 37

2.1.2.1 Key data from primary sources 38

2.1.2.2 Key industry insights 39

2.1.2.3 Breakdown of primary interviews 40

2.2 MARKET SIZE ESTIMATION 40

2.2.1 BOTTOM-UP APPROACH 41

2.2.2 TOP-DOWN APPROACH 42

2.2.2.1 Approach to estimate market size using top-down analysis 42

2.3 DATA TRIANGULATION 44

2.4 RESEARCH ASSUMPTIONS 45

2.5 RESEARCH LIMITATIONS 45

3 EXECUTIVE SUMMARY 46

4 PREMIUM INSIGHTS 52

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION NUTRITION MARKET 52

4.2 NORTH AMERICA: PRECISION NUTRITION MARKET, BY APPLICATION AND COUNTRY 53

4.3 PRECISION NUTRITION MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS 53

4.4 PRECISION NUTRITION MARKET, BY TECHNOLOGY AND REGION 54

4.5 PRECISION NUTRITION MARKET, BY SERVICE TYPE AND REGION 55

4.6 PRECISION NUTRITION MARKET, BY SUPPLEMENT AND REGION 56

4.7 PRECISION NUTRITION MARKET, BY APPLICATION AND REGION 57

4.8 PRECISION NUTRITION MARKET, BY END USE AND REGION 58

5 MARKET OVERVIEW 59

5.1 INTRODUCTION 59

5.2 MACROECONOMIC INDICATORS 59

5.2.1 INCREASE IN HEALTHCARE EXPENDITURES 59

5.2.2 INCREASE IN GLOBAL GDP 60

5.3 MARKET DYNAMICS 61

5.3.1 DRIVERS 61

5.3.1.1 Growing awareness of personalized health 61

5.3.1.2 Boom in global wellness economy 62

5.3.1.3 Rise in non-communicable diseases 63

5.3.2 RESTRAINTS 63

5.3.2.1 High cost of precision nutrition solutions 63

5.3.2.2 Lack of standardization and comprehensive scientific validation 64

5.3.3 OPPORTUNITIES 64

5.3.3.1 Integration of AI and big data analytics 64

5.3.3.2 Rising adoption of digital health tools 64

5.3.4 CHALLENGES 65

5.3.4.1 Privacy and data security concerns 65

5.3.4.2 Addressing consumer skepticism 65

5.4 IMPACT OF AI/GEN AI ON PRECISION NUTRITION MARKET 66

5.4.1 INTRODUCTION 66

5.4.2 USE OF GEN AI IN PRECISION NUTRITION 67

5.4.3 CASE STUDY ANALYSIS 68

5.4.3.1 Transforming personalized nutrition with Nutrigenomix 68

5.4.3.2 IBM Watson and PathAI’s impact on specialized healthcare 68

6 INDUSTRY TRENDS 69

6.1 INTRODUCTION 69

6.2 VALUE CHAIN ANALYSIS 69

6.2.1 DATA COLLECTION 69

6.2.2 DATA ANALYSIS AND RECOMMENDATION 70

6.2.3 CUSTOMIZED NUTRITION SOLUTIONS 70

6.2.4 PRODUCT DELIVERY 70

6.3 TRADE ANALYSIS 70

6.3.1 EXPORT SCENARIO OF HS CODE 3822 70

6.3.2 IMPORT SCENARIO OF HS CODE 3822 72

6.4 TECHNOLOGY ANALYSIS 73

6.4.1 KEY TECHNOLOGIES 73

6.4.1.1 Artificial intelligence and machine learning 73

6.4.2 COMPLEMENTARY TECHNOLOGIES 74

6.4.2.1 Advanced imaging and biosensors 74

6.4.3 ADJACENT TECHNOLOGIES 74

6.4.3.1 Virtual health platforms and telemedicine 74

6.5 PRICING ANALYSIS 75

6.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS,

BY GENOMICS AND MULTI-OMICS ANALYSIS SERVICES 75

6.6 ECOSYSTEM ANALYSIS 80

6.6.1 DEMAND-SIDE 80

6.6.2 SUPPLY-SIDE 80

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 82

6.8 PATENT ANALYSIS 83

6.9 KEY CONFERENCES AND EVENTS, 2024–2025 87

6.10 REGULATORY LANDSCAPE 87

6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 88

6.10.2 NORTH AMERICA 90

6.10.2.1 US 90

6.10.2.2 Canada 90

6.10.2.3 Mexico 90

6.10.3 EUROPE 90

6.10.3.1 European Union Regulations 90

6.10.3.1.1 Processing of personal data 90

6.10.3.1.2 Borderline products 91

6.10.3.1.3 Nutrition & health claims 91

6.10.4 ASIA PACIFIC 92

6.10.4.1 China 92

6.10.4.2 India 92

6.10.4.3 Australia & New Zealand 92

6.10.5 SOUTH AMERICA 92

6.10.5.1 Brazil 92

6.10.5.2 Argentina 93

6.11 PORTER’S FIVE FORCES ANALYSIS 93

6.11.1 INTENSITY OF COMPETITIVE RIVALRY 94

6.11.2 BARGAINING POWER OF SUPPLIERS 95

6.11.3 BARGAINING POWER OF BUYERS 95

6.11.4 THREAT OF SUBSTITUTES 95

6.11.5 THREAT OF NEW ENTRANTS 96

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA 96

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS 96

6.12.2 BUYING CRITERIA 97

6.13 CASE STUDY ANALYSIS 98

6.13.1 LAUNCH OF 23ANDME+ TOTAL HEALTH MEMBERSHIP 98

6.13.2 GENESIS HEALTHCARE CO. EXPANDS WHOLE GENOME SEQUENCING CAPABILITIES 98

6.13.3 VIOME LIFE SCIENCES LAUNCHES FULL BODY INTELLIGENCE TEST 99

6.14 INVESTMENT AND FUNDING SCENARIO 99

7 PRECISION NUTRITION MARKET, BY TECHNOLOGY 100

7.1 INTRODUCTION 101

7.2 METABOLOMICS 102

7.2.1 RISING NEED FOR METABOLIC HEALTH SOLUTIONS IN CHRONIC DISEASE CONTROL TO DRIVE MARKET 102

7.3 GENOMICS 103

7.3.1 FALLING GENETIC TESTING COSTS AND RISING PUBLIC INTEREST IN NUTRIGENOMICS TO DRIVE DEMAND 103

7.4 TRANSCRIPTOMICS 104

7.4.1 SEQUENCING ADVANCES PROPEL RNA RESEARCH AND BOOST TRANSCRIPTOMICS IN PRECISION NUTRITION 104

7.5 PROTEOMICS 105

7.5.1 ADVANCEMENTS IN MASS SPECTROMETRY AND BIOINFORMATICS

TO FUEL DEMAND 105

7.6 OTHER TECHNOLOGIES 106

8 PRECISION NUTRITION MARKET, BY APPLICATION 108

8.1 INTRODUCTION 109

8.2 WEIGHT MANAGEMENT 110

8.2.1 RISING RATES OF OVERWEIGHT AND OBESITY TO DRIVE MARKET 110

8.3 DISEASE MANAGEMENT 111

8.3.1 SURGE IN CHRONIC DISEASE RATES AND BREAKTHROUGHS IN GENOMICS AND BIOTECH TO DRIVE MARKET 111

8.4 SPORTS NUTRITION 113

8.4.1 GROWING FOCUS ON PERSONALIZED HEALTH ASSESSMENTS AND ADJUSTMENTS TO DRIVE DEMAND 113

8.5 GENERAL HEALTH & WELLNESS 114

8.5.1 GROWING EMPHASIS ON PERSONALIZED DIETARY GUIDANCE

FOR LONG-TERM HEALTH TO DRIVE DEMAND 114

9 PRECISION NUTRITION MARKET, BY SERVICE TYPE 116

9.1 INTRODUCTION 117

9.2 GENOMICS & MULTI-OMICS ANALYSIS SERVICES 118

9.2.1 INCREASING DEMAND FOR GENOMIC-BASED DIETARY SERVICES

TO DRIVE MARKET 118

9.3 PERSONALIZED PLANS & SUBSCRIPTION SERVICES 120

9.3.1 NEED FOR CONVENIENCE AND CUSTOMIZED WELLNESS PROGRAMS TO DRIVE DEMAND 120

9.4 CONSULTATION SERVICES 121

9.4.1 INCREASING DEMAND FOR EXPERT GUIDANCE ON SPECIFIC HEALTH CONDITIONS TO DRIVE MARKET 121

9.5 DIGITAL PLATFORMS & SOLUTIONS 122

9.5.1 INNOVATIONS IN AI TECHNOLOGY AND WIDESPREAD ADOPTION OF WEARABLE DEVICES TO DRIVE MARKET 122

9.6 INSTITUTIONAL & WELLNESS PROGRAMS 123

9.6.1 SURGE IN HEALTHCARE EXPENDITURES AND DEMAND FOR CREDIBLE, EVIDENCE-BASED WELLNESS PROGRAMS TO DRIVE MARKET 123

10 PRECISION NUTRITION MARKET, BY END USE 125

10.1 INTRODUCTION 126

10.2 HEALTHCARE PROVIDERS 127

10.2.1 HEALTHCARE PROVIDERS PLAY SIGNIFICANT ROLE IN ADVANCING PRECISION MEDICINE 127

10.3 RESEARCH INSTITUTES 128

10.3.1 DEMAND FOR SAFE, EFFECTIVE, AND EVIDENCE-BASED PERSONALIZED NUTRITION SOLUTIONS TO DRIVE MARKET 128

10.4 DIETARY SUPPLEMENT MANUFACTURERS 129

10.4.1 PRECISION NUTRITION TREND WITH TRANSPARENT, EVIDENCE-BACKED FORMULATIONS TO BOOST MARKET 129

10.5 FITNESS & WELLNESS COMPANIES 130

10.5.1 GROWING PREFERENCE FOR HIGH-LEVEL PERSONALIZATION IN FITNESS AND NUTRITION TO DRIVE MARKET 130

10.6 DIRECT-TO-CONSUMERS 132

10.6.1 RISING POPULARITY OF GENETIC TESTING KITS, HOME HEALTH ASSESSMENTS, AND NUTRITION-TRACKING APPS TO DRIVE MARKET 132

11 PRECISION NUTRITION MARKET, BY SUPPLEMENT 133

11.1 INTRODUCTION 134

11.2 VITAMINS 136

11.2.1 RISING AGING POPULATION TO DRIVE DEMAND 136

11.3 MINERALS 137

11.3.1 RISING CASES OF OSTEOPOROSIS AND IRON DEFICIENCY TO DRIVE MARKET 137

11.4 PROBIOTICS 138

11.4.1 INCREASING POPULARITY OF DIGESTIVE HEALTH SUPPLEMENTS TO INCREASE DEMAND 138

11.5 HERBAL SUPPLEMENTS 139

11.5.1 INCREASING FOCUS ON PERSONALIZED HERBAL SOLUTIONS FOR GENERAL HEALTH & WELLNESS TO EXPAND MARKET 139

11.6 PROTEIN SUPPLEMENTS 140

11.6.1 RISING DEMAND FOR PLANT-BASED DIETS TO DRIVE DEMAND 140

11.7 AMINO ACIDS 141

11.7.1 GROWING USE IN SPORTS NUTRITION TO INCREASE DEMAND 141

11.8 ENZYMES 142

11.8.1 NUTRIENT ABSORPTION BENEFITS TO DRIVE DEMAND 142

11.9 OTHER SUPPLEMENTS 143

12 PRECISION NUTRITION MARKET, BY REGION 144

12.1 INTRODUCTION 145

12.2 NORTH AMERICA 146

12.2.1 US 152

12.2.1.1 Advancements in AI, availability of rich datasets, and growing public interest in personalized nutrition to drive market 152

12.2.2 CANADA 154

12.2.2.1 Supportive healthcare policies and growing focus on long-term health to drive market 154

12.2.3 MEXICO 156

12.2.3.1 Increasing public health concerns, rising wellness priorities,

and innovative tech integration to drive market 156

12.3 EUROPE 158

12.3.1 GERMANY 163

12.3.1.1 Strong commitment to AI and digital health to expand market 163

12.3.2 FRANCE 164

12.3.2.1 Increasing launch of new nutraceuticals and functional foods

to drive market 164

12.3.3 UK 166

12.3.3.1 Presence of key industry players and rising focus on personalized dietary solutions to drive market 166

12.3.4 ITALY 168

12.3.4.1 Increased investment in personalized health solutions

to fuel market growth 168

12.3.5 SPAIN 169

12.3.5.1 Rising health awareness and technological advancements

to drive market 169

12.3.6 REST OF EUROPE 171

12.4 ASIA PACIFIC 173

12.4.1 CHINA 179

12.4.1.1 Growing focus on personalized nutritional strategies and

national health policy goals to drive market 179

12.4.2 INDIA 181

12.4.2.1 Surge in cardiovascular disease deaths to drive market 181

12.4.3 JAPAN 183

12.4.3.1 Rising aging population and increased health risks to drive market 183

12.4.4 SINGAPORE 185

12.4.4.1 National Precision Medicine Programme to drive market 185

12.4.5 AUSTRALIA & NEW ZEALAND 187

12.4.5.1 Research innovations and increasing demand for personalized health solutions to fuel market 187

12.4.6 INDONESIA 189

12.4.6.1 Government initiatives to expand genomic technology to drive market 189

12.4.7 MALAYSIA 191

12.4.7.1 Increasing awareness of precision nutrition among youth to fuel market 191

12.4.8 THAILAND 193

12.4.8.1 Advancements in genomics ecosystem to drive market 193

12.4.9 VIETNAM 195

12.4.9.1 Collaborations in genomics technology development to drive market 195

12.4.10 REST OF ASIA PACIFIC 196

12.5 SOUTH AMERICA 198

12.5.1 BRAZIL 203

12.5.1.1 Government focus on tackling malnutrition and obesity through better nutrition to drive market 203

12.5.2 ARGENTINA 204

12.5.2.1 Focus on managing non-communicable diseases to accelerate market growth 204

12.5.3 REST OF SOUTH AMERICA 206

12.6 REST OF THE WORLD 208

12.6.1 AFRICA 212

12.6.1.1 Enhanced healthcare infrastructure and cooperation with global entities to drive market 212

12.6.2 MIDDLE EAST 214

12.6.2.1 Advancements in genomics, personalized healthcare,

and digital health technologies to accelerate market growth 214

13 COMPETITIVE LANDSCAPE 216

13.1 OVERVIEW 216

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 217

13.3 REVENUE ANALYSIS, 2021–2023 219

13.4 MARKET SHARE ANALYSIS, 2023 219

13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 221

13.5.1 STARS 221

13.5.2 EMERGING LEADERS 221

13.5.3 PERVASIVE PLAYERS 221

13.5.4 PARTICIPANTS 221

13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 223

13.5.5.1 Company footprint 223

13.5.5.2 Region footprint 224

13.5.5.3 Service type footprint 225

13.5.5.4 Technology footprint 226

13.5.5.5 Application footprint 227

13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 227

13.6.1 PROGRESSIVE COMPANIES 227

13.6.2 RESPONSIVE COMPANIES 227

13.6.3 DYNAMIC COMPANIES 228

13.6.4 STARTING BLOCKS 228

13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 229

13.6.5.1 Detailed list of key startups/SMEs 229

13.6.5.2 Competitive benchmarking of key startups/SMEs 230

13.7 COMPANY VALUATION AND FINANCIAL METRICS 231

13.8 PRODUCT COMPARISON 232

13.9 COMPETITIVE SCENARIO 233

13.9.1 PRODUCT LAUNCHES 233

13.9.2 DEALS 235

13.9.3 EXPANSIONS 237

13.9.4 OTHERS 238

13.10 KEY PLAYER STRENGTH ANALYSIS 239

14 COMPANY PROFILES 242

14.1 KEY PLAYERS 242

14.1.1 PRENETICS GLOBAL LIMITED 242

14.1.1.1 Business overview 242

14.1.1.2 Products/Solutions/Services offered 243

14.1.1.3 MnM view 243

14.1.1.3.1 Key strengths 243

14.1.1.3.2 Strategic choices 243

14.1.1.3.3 Weaknesses and competitive threats 243

14.1.2 VIOME LIFE SCIENCES, INC. 244

14.1.2.1 Business overview 244

14.1.2.2 Products/Solutions/Services offered 244

14.1.2.3 Recent developments 245

14.1.2.3.1 Product launches 245

14.1.2.3.2 Deals 246

14.1.2.3.3 Others 246

14.1.2.4 MnM view 246

14.1.2.4.1 Key strengths 246

14.1.2.4.2 Strategic choices 247

14.1.2.4.3 Weaknesses and competitive threats 247

14.1.3 ZOE LIMITED 248

14.1.3.1 Business overview 248

14.1.3.2 Products/Solutions/Services offered 248

14.1.3.3 Recent developments 249

14.1.3.3.1 Product launches 249

14.1.3.4 MnM view 249

14.1.3.4.1 Key strengths 249

14.1.3.4.2 Strategic choices 249

14.1.3.4.3 Weaknesses and competitive threats 249

14.1.4 DAYTWO INC. 250

14.1.4.1 Business overview 250

14.1.4.2 Products/Solutions/Services offered 250

14.1.4.3 Recent developments 250

14.1.4.3.1 Others 250

14.1.4.4 MnM view 251

14.1.4.4.1 Key strengths 251

14.1.4.4.2 Strategic choices 251

14.1.4.4.3 Weaknesses and competitive threats 251

14.1.5 23ANDME, INC. 252

14.1.5.1 Business overview 252

14.1.5.2 Products/Solutions/Services offered 253

14.1.5.3 Recent developments 253

14.1.5.3.1 Product launches 253

14.1.5.3.2 Deals 254

14.1.5.4 MnM view 254

14.1.5.4.1 Key strengths 254

14.1.5.4.2 Strategic choices 255

14.1.5.4.3 Weaknesses and competitive threats 255

14.1.6 THORNE 256

14.1.6.1 Business overview 256

14.1.6.2 Product/Solutions/Services offered 256

14.1.6.3 MnM view 257

14.1.7 GENESIS HEALTHCARE CO. 258

14.1.7.1 Business overview 258

14.1.7.2 Products/Solutions/Services offered 258

14.1.7.3 Recent developments 259

14.1.7.3.1 Product launches 259

14.1.7.3.2 Deals 259

14.1.7.4 MnM view 260

14.1.8 AJINOMOTO CO., INC. 261

14.1.8.1 Business overview 261

14.1.8.2 Products/Solutions/Services offered 262

14.1.8.3 MnM view 262

14.1.9 AMILI 263

14.1.9.1 Business overview 263

14.1.9.2 Products/Solutions/Services offered 263

14.1.9.3 Recent developments 264

14.1.9.3.1 Others 264

14.1.9.4 MnM view 264

14.1.10 DNALYSIS 265

14.1.10.1 Business overview 265

14.1.10.2 Products/Solutions/Services offered 265

14.1.10.3 MnM view 266

14.1.11 MYDNA LIFE AUSTRALIA PTY LTD. 267

14.1.11.1 Business overview 267

14.1.11.2 Products/Solutions/Services offered 267

14.1.11.3 Recent developments 268

14.1.11.3.1 Deals 268

14.1.11.4 MnM view 268

14.1.12 NUTRIGENOMIX 269

14.1.12.1 Business overview 269

14.1.12.2 Products/Solutions/Services offered 269

14.1.12.3 MnM view 269

14.1.13 SELFDECODE 270

14.1.13.1 Business overview 270

14.1.13.2 Products/Solutions/Services offered 270

14.1.13.3 Recent developments 271

14.1.13.3.1 Deals 271

14.1.13.4 MnM view 271

14.1.14 XCODE LIFE 272

14.1.14.1 Business overview 272

14.1.14.2 Products/Solutions/Services offered 272

14.1.14.3 Recent developments 273

14.1.14.3.1 Product launches 273

14.1.14.4 MnM view 273

14.1.15 GENEQUEST INC. 274

14.1.15.1 Business overview 274

14.1.15.2 Products/Solutions/Services offered 274

14.1.15.3 Recent developments 275

14.1.15.3.1 Product launches 275

14.1.15.3.2 Deals 275

14.1.15.4 MnM view 275

14.2 OTHER PLAYERS 276

14.2.1 METAGEN, INC. 276

14.2.1.1 Business overview 276

14.2.1.2 Products/Solutions/Services offered 277

14.2.1.3 MnM view 277

14.2.2 HOLIFYA S.R.L. 278

14.2.2.1 Business overview 278

14.2.2.2 Products/Solutions/Services offered 278

14.2.2.3 Recent developments 279

14.2.2.3.1 Others 279

14.2.2.4 MnM view 279

14.2.3 LIFENOME INC. 280

14.2.3.1 Business overview 280

14.2.3.2 Products/Solutions/Services offered 280

14.2.3.3 Recent developments 281

14.2.3.3.1 Product launches 281

14.2.3.4 MnM view 281

14.2.4 GENOPALATE INC. 282

14.2.4.1 Business overview 282

14.2.4.2 Product/Solutions/Services offered 282

14.2.4.3 Recent developments 283

14.2.4.3.1 Product launches 283

14.2.4.3.2 Others 283

14.2.4.4 MnM view 283

14.2.5 SUN GENOMICS 284

14.2.5.1 Business overview 284

14.2.5.2 Products/Solutions/Services offered 284

14.2.5.3 Recent developments 285

14.2.5.3.1 Product launches 285

14.2.5.3.2 Deals 286

14.2.5.3.3 Expansions 286

14.2.5.4 MnM view 286

14.2.6 GX SCIENCES, LLC 287

14.2.6.1 Business overview 287

14.2.6.2 Products/Solutions/Services offered 288

14.2.6.3 MnM view 288

14.2.7 SEGTERRA, INC. 289

14.2.7.1 Business overview 289

14.2.7.2 Products/Solutions/Services offered 289

14.2.7.3 Recent developments 290

14.2.7.3.1 Product launches 290

14.2.7.3.2 Others 290

14.2.7.4 MnM view 291

14.2.8 NUTRISENSE 292

14.2.8.1 Business overview 292

14.2.8.2 Products/Solutions/Services offered 292

14.2.8.3 MnM view 293

14.2.9 CENTURY GENOMICS LIMITED 294

14.2.9.1 Business overview 294

14.2.9.2 Products/Solutions/Services offered 294

14.2.9.3 MnM view 294

14.2.10 GENEUSDNA 295

14.2.10.1 Business overview 295

14.2.10.2 Products/Solutions/Services offered 296

14.2.10.3 MnM view 296

15 ADJACENT AND RELATED MARKETS 297

15.1 INTRODUCTION 297

15.2 LIMITATIONS 297

15.3 PERSONALIZED NUTRITION MARKET 297

15.3.1 MARKET DEFINITION 297

15.3.2 MARKET OVERVIEW 298

15.4 NUTRITIONAL ANALYSIS MARKET 299

15.4.1 MARKET DEFINITION 299

15.4.2 MARKET OVERVIEW 299

15.5 DIETARY SUPPLEMENTS MARKET 300

15.5.1 MARKET DEFINITION 300

15.5.2 MARKET OVERVIEW 301

16 APPENDIX 302

16.1 DISCUSSION GUIDE 302

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 307

16.3 CUSTOMIZATION OPTIONS 309

16.4 RELATED REPORTS 309

16.5 AUTHOR DETAILS 310

❖ 世界の精密栄養市場に関するよくある質問(FAQ) ❖

・精密栄養の世界市場規模は?

→MarketsandMarkets社は2024年の精密栄養の世界市場規模を60.9億米ドルと推定しています。

・精密栄養の世界市場予測は?

→MarketsandMarkets社は2029年の精密栄養の世界市場規模を128.9億米ドルと予測しています。

・精密栄養市場の成長率は?

→MarketsandMarkets社は精密栄養の世界市場が2024年~2029年に年平均16.2%成長すると予測しています。

・世界の精密栄養市場における主要企業は?

→MarketsandMarkets社は「Viome Life Sciences, Inc. (US), Prenetics Global Limited (China), ZOE Limited (UK), myDNA Life Australia Pty Ltd. (Australia) , 23andMe, Inc. (US), DayTwo Inc (US), Nutrigenomix (Canada), Genesis Healthcare Co. (Japan), AMILI (Singapore), SelfDecode (US), Genequest Inc. (Japan), Ajinomoto Co., Inc. (Japan), Thorne (US), DNAlysis (South Africa), and Xcode Life (US)など ...」をグローバル精密栄養市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。