1 はじめに 24

1.1 調査目的 24

1.2 市場の定義 24

1.3 調査範囲 25

1.3.1 市場のセグメンテーションと地域的広がり 25

1.3.2 含むものと含まないもの 25

1.3.3 考慮した年数 26

1.3.4 通貨

1.3.5 単位の検討 27

1.4 利害関係者 27

2 調査方法 28

2.1 調査データ 28

2.1.1 二次データ 29

2.1.1.1 主要な二次情報源のリスト 29

2.1.1.2 二次資料からの主要データ 29

2.1.2 一次データ 30

2.1.2.1 一次資料からの主要データ 30

2.1.2.2 主要参加者のリスト 31

2.1.2.3 主要な業界インサイト 31

2.1.2.4 専門家へのインタビューの内訳 31

2.2 市場規模の推定 32

2.2.1 ボトムアップアプローチ 32

2.2.2 トップダウンアプローチ 33

2.3 成長予測 33

2.4 データ三角測量 34

2.5 要因分析 35

2.6 リサーチの前提 35

2.7 制限とリスク 36

3 エグゼクティブサマリー 37

4 プレミアムインサイト 40

4.1 CIP 化学品市場におけるプレーヤーの魅力的な機会 40

4.2 CIP 化学品市場、プロセスタイプ別 40

4.3 CIP 化学品市場、化学物質別 41

4.4 CIP 化学品市場:最終用途産業別 41

4.5 CIP薬品ズ市場:主要国別 42

5 市場の概要 43

5.1 導入 43

5.2 市場ダイナミクス 43

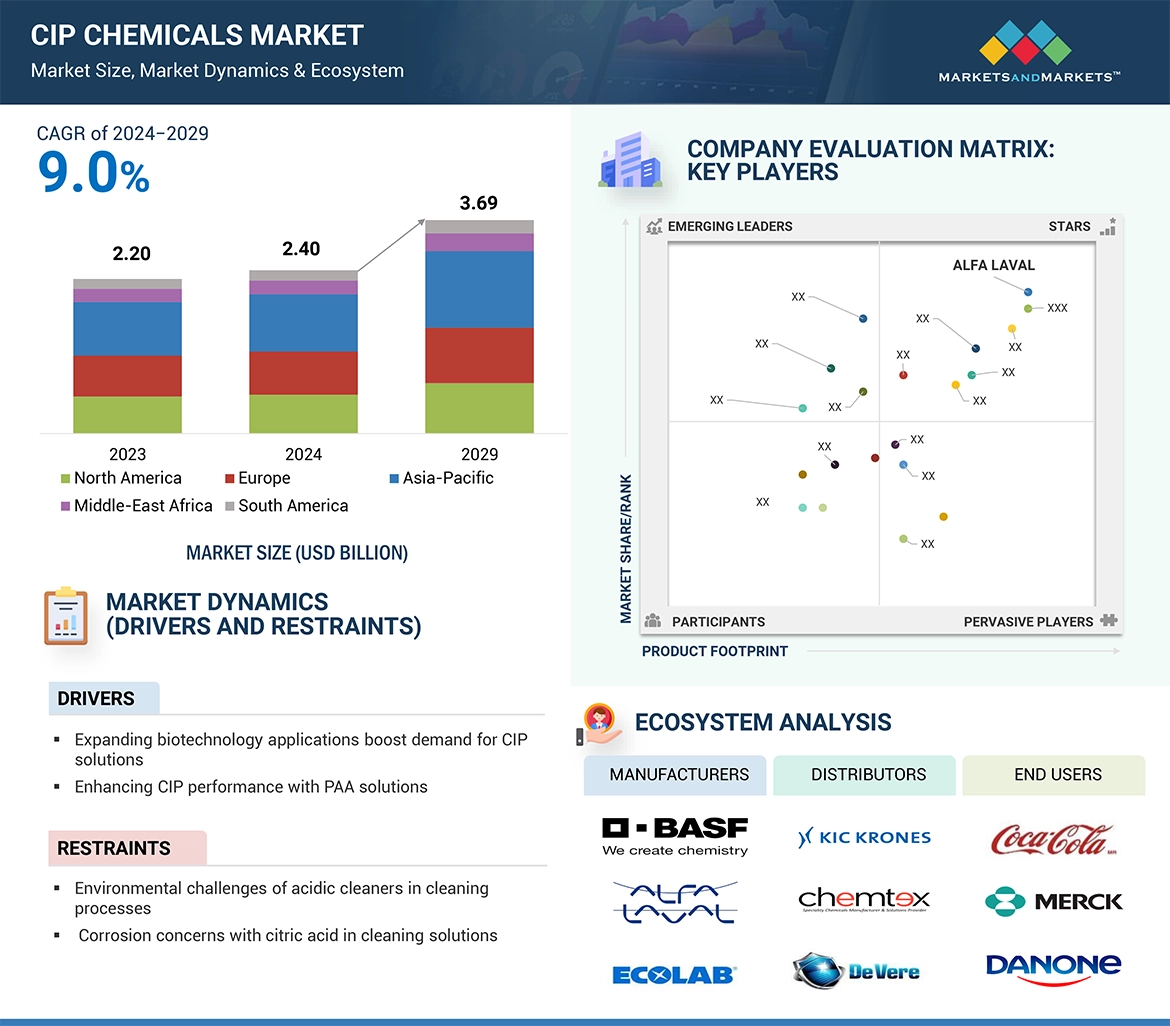

5.2.1 推進要因 44

5.2.1.1 バイオテクノロジー用途の拡大がCIP ソリューションの需要を押し上げる 44

5.2.1.2 PAAソリューションによるCIP性能の向上 44

5.2.2 阻害要因 45

5.2.2.1 水生生態系を脅かす酸性洗浄剤の使用 45

5.2.2.2 クエン酸洗浄液による腐食のリスク 45

5.2.3 機会 46

5.2.3.1 近代的な食品・飲料製造のためのCIPソリューションの拡大 46

5.2.3.2 酵素ベースのCIP ソリューションによる持続可能な洗浄 46

5.2.4 課題 46

5.2.4.1 二次汚染の高いリスクとCIP製品のリサイクルの複雑さ 46

5.3 ポーターの5つの力分析 47

5.3.1 新規参入の脅威 47

5.3.2 代替品の脅威 48

5.3.3 買い手の交渉力 48

5.3.4 供給者の交渉力 48

5.3.5 競合の激しさ 49

5.4 主要ステークホルダーと購買基準 50

5.4.1 購買プロセスにおける主要ステークホルダー 50

5.4.2 購買基準 51

5.5 マクロ経済指標 52

5.5.1 世界のGDP動向 52

5.6 遺伝子AIの影響 53

5.7 バリューチェーン分析

5.7.1 原材料サプライヤー 54

5.7.2 メーカー 54

5.7.3 供給業者/販売業者 54

5.7.4 最終用途産業 55

5.8 エコシステム分析

5.9 ケーススタディ分析 56

5.9.1 オ・サフウォーターは国際的な飲料会社の洗浄プロセスのCIP効率と持続可能性を向上 56

5.9.2 fmc corp. は、効率的な洗浄のためのグリーンオキシダント殺生物剤として高保持サニタイザーを導入 57

5.9.3 再利用可能な洗浄剤の導入によるコスト削減と化学廃棄物の削減によるCIP効率の向上 57

5.10 規制の状況 58

5.10.1 規制 58

5.10.1.1 欧州 58

5.10.1.2 アジア太平洋 58

5.10.1.3 北米 59

5.10.2 規格 59

5.10.2.1 ISO 14001 59

5.10.2.2 ISO 14644-10 59

5.10.2.3 ISO 979:1974 59

5.10.2.4 ISO 14644-13:2017 59

5.10.2.5 ISO 13485 59

5.10.3 規制機関、政府機関、その他の機関 60

5.11 技術分析 60

5.11.1 主要技術 60

5.11.1.1 プロバイオティック洗浄 60

5.11.1.2 リン酸ベースの超音波洗浄 61

5.11.2 補完技術 61

5.11.2.1 水性洗浄 61

5.11.3 隣接技術 61

5.11.3.1 静電技術 61

5.12 顧客ビジネスに影響を与えるトレンド/混乱 62

5.13 貿易分析 62

5.13.1 輸出シナリオ 62

5.13.2 輸入シナリオ 64

5.14 2024-2025年の主要会議・イベント 65

5.15 価格分析 66

5.15.1 平均販売価格動向(地域別、2020-2023年) 66

5.15.2 平均販売価格動向(化学別)、2020-2023年 67

5.15.3 主要企業の平均販売価格動向(最終用途産業別、2023年) 67

5.16 投資と資金調達のシナリオ 68

5.17 特許分析 68

5.17.1 アプローチ 68

5.17.2 文書タイプ 69

5.17.3 過去11年間の公開動向(2013~2023年) 69

5.17.4 洞察 70

5.17.5 特許の法的地位 70

5.17.6 管轄地域の分析 70

5.17.7 上位企業/出願人 71

5.17.8 過去10年間の特許所有者上位10社(米国) 72

6 CIP化学品市場、プロセスタイプ別 73

6.1 導入 74

6.2 シングルユース洗浄 75

6.2.1 シングルユースCIPソリューションによる汚染リスクの最小化 75

6.3 再循環洗浄 76

6.3.1 再循環洗浄プロセスによるコストと無駄の削減 76

7 CIP薬品市場、ケミストリー別 77

7.1 導入 78

7.2 アルカリ洗浄剤 80

7.2.1 生分解性アルカリ性CIP剤による持続可能な洗浄 80

7.3 酸性洗浄剤 80

7.3.1 CIP システムの効果的な洗浄と殺菌のための酸性洗浄剤 80

7.4 消毒剤/消毒剤 80

7.4.1 CIP プロセスにおける高度殺菌剤による微生物負荷の制御 80

7.5 酵素系洗浄剤

7.5.1 環境への影響を緩和し装置を保護する酵素洗浄剤

装置の保護

7.6 その他の化学物質 81

8 CIP 化学品市場:最終用途産業別 82

8.1 導入 83

8.2 化学物質 85

8.2.1 洗浄工程の合理化によるダウンタイムの削減と生産能力の最大化 85

8.2.2 特殊化学品 85

8.2.3 石油化学 86

8.2.4 その他 86

8.3 食品・飲料 86

8.3.1 食品の品質向上と安全性確保のための高度洗浄ソリューション 86

8.3.2 乳製品加工 87

8.3.3 加工食品 87

8.3.4 その他 87

8.4 製薬及びバイオテクノロジー 87

8.4.1 GMP 準拠の CIP 洗浄プロセスによる製品の安全性の確保 87

8.5 化粧品 88

8.5.1 残留物のない化粧品製造のためのCIPソリューション 88

8.6 繊維 88

8.6.1 スケールフリー繊維生産のための革新的な洗浄戦略 88

8.7 その他の最終用途産業 88

9 CIP 化学品市場、地域別 89

9.1 はじめに

9.2 北米 92

9.2.1 米国 99

9.2.1.1 加工食品の需要が市場を牽引 99

9.2.2 カナダ 100

9.2.2.1 産業の拡大と輸出の増加が市場を牽引 100

9.2.3 メキシコ 102

9.2.3.1 ヘルスケア産業の成長が医療機器のCIP薬品需要を押し上げる 102

9.3 欧州 104

9.3.1 ドイツ 110

9.3.1.1 製薬・石油・ガス産業からのCIP薬品需要の増加が市場を牽引 110

9.3.2 フランス 112

9.3.2.1 化学産業の成長が環境に優しい製品開発を後押し 112

9.3.3 スペイン 114

9.3.3.1 医療機器製造需要の増加が市場を牽引 114

9.3.4 イギリス 115

9.3.4.1 新たな改革政策と経済成長が市場を牽引 115

9.3.5 イタリア 117

9.3.5.1 安全衛生への投資が化学製品の需要を押し上げる 117

9.3.6 その他の欧州 119

9.4 アジア太平洋地域 120

9.4.1 中国 127

9.4.1.1 バイオ産業の成長によりCIP化学品の需要が増加 127

9.4.2 日本 128

9.4.2.1 バイオ医薬品の技術進歩が市場を牽引 128

9.4.3 インド 130

9.4.3.1 効率的な洗浄へのニーズの高まりが市場を牽引 130

9.4.4 韓国 132

9.4.4.1 特殊食品への戦略的重点化が成長を牽引 132

9.4.5 その他のアジア太平洋地域 133

9.5 中東・アフリカ 135

9.5.1 GCC諸国 141

9.5.1.1 サウジアラビア 141

9.5.1.1.1 経済の多様化がCIP化学品の需要を牽引 141

9.5.1.2 その他のGCC諸国 143

9.5.2 南アフリカ 145

9.5.2.1 化学産業の優位性がCIPソリューションの需要を押し上げる 145

9.5.3 その他の中東・アフリカ 147

9.6 南アメリカ 148

9.6.1 ブラジル 154

9.6.1.1 電力・鉱業の成長が市場を牽引 154

9.6.2 アルゼンチン 156

9.6.2.1 衛生サービスへの投資が市場成長を促進 156

9.6.3 その他の南米地域 158

10 競争環境 160

10.1 概要 160

10.2 主要企業の戦略 160

10.3 収益分析 162

10.4 市場シェア分析 162

10.4.1 アルファ・ラバル 163

10.4.2 バスフ 164

10.4.3 エコラボ 164

10.4.4 ノボザイムズ 164

10.4.5 ステリス 164

10.5 企業評価と財務指標 165

10.6 ブランド/製品比較分析 166

10.7 企業評価マトリックス:主要企業(2023年) 167

10.7.1 スター企業 167

10.7.2 新興リーダー 167

10.7.3 浸透型プレーヤー 167

10.7.4 参加企業 167

10.7.5 企業フットプリント:主要プレーヤー(2023年) 169

10.7.5.1 企業フットプリント 169

10.7.5.2 地域別フットプリント 170

10.7.5.3 化学フットプリント 171

10.7.5.4 プロセスタイプのフットプリント 172

10.7.5.5 最終用途産業のフットプリント 173

10.8 企業評価マトリクス:新興企業/SM(2023年) 174

10.8.1 進歩的企業 174

10.8.2 対応力のある企業 174

10.8.3 ダイナミックな企業 174

10.8.4 スターティング・ブロック 174

10.8.5 競争ベンチマーキング:主要新興企業/テーマ(2023年) 176

10.8.5.1 主要新興企業/中小企業の詳細リスト 176

10.8.5.2 主要新興企業/中小企業の競合ベンチマーキング 177

10.9 競争シナリオと動向 178

10.9.1 拡張 178

10.9.2 製品上市 178

10.9.3 取引 178

11 企業プロファイル 180

11.1 主要企業 180

ALFA LAVAL (Sweden)

BASF (Germany)

Ecolab (US)

Novozymes (Denmark)

STERIS (US)

Solvay (Belgium)

KIC KRONES Internationale Cooperations-Gesellschaft mbH (Germany)

Diversey Inc (US)

Chemtex Speciality Limited (India)

and Keller & Bohacek GmbH & Co. KG (Germany)

12 付録 221

12.1 ディスカッションガイド 221

12.2 Knowledgestore: Marketsandmarketsの購読ポータル 224

12.3 カスタマイズオプション 226

12.4 関連レポート 226

12.5 著者の詳細 227

The global CIP chemicals market is witnessing growth due to its versatile cleaning formulations, widely used in various industries due to its exceptional cleaning properties. Furthermore, CIP chemicals are required for the application in various end use industries like pharmaceutical & biotechnology, chemicals, textiles, food & beverage and cosmetics which fuels the need for CIP chemicals.

“Disinfectants/ Sanitizers by chemistry, is projected to have the third largest market share in terms of value.”

Disinfectants in CIPs are important for hygienic and safety conditions. Disinfectants are agents of chemical formulations which have been designed to achieve inactivating or destroying microorganisms on inert surfaces to ensure production areas become sterile without contamination. They are also crucial in controlling the microbial load in production, packaging and laboratory areas. Common disinfectants found in these industries include alcohols, chlorine-based compounds, and hydrogen peroxide formulations that are selected according to their effectiveness against the targeted pathogens and surface compatibility. CIP processes ensure in a single operation that both cleaning and disinfection occur. This contributes not only to improved operational efficiency but also facilitates achieving expected or dictated levels of cleanliness and sterility for manufactured products.

“Recirculated cleaning by process to be the fastest growing segment for forecasted period in terms of value.”

This process allows cleaning solutions to circulate continuously around equipment without the need to dismantle those pieces of equipment, significantly reducing downtime and labor. For example, manufacturers can make better use of water and cleaning agents by recirculating the cleaning solution, thereby keeping their operational costs as low as possible and minimizing the environmental impact. The recirculation process also ensures that cleaning agents maintain their effectiveness all the way through the cleaning cycle, because they can be replenished as necessary to varying levels of soil and contamination. In addition to this, this method allows better control over the cleaning parameters of temperature and concentration, which can be adjusted according to specific equipment requirements for cleaning.

“Chemicals by end-use industry to be the third fastest growing segment for forecasted period in terms of value.”

This is further divided into specialty chemicals and petrochemicals. In the manufacture of specialty chemicals, trace contaminants can easily degrade a product, so it needs to make sure that its CIP chemicals like caustic soda, nitric acid, and phosphoric acid will effectively remove organic residues, mineral deposits, and all other contaminants in reactors, storage tanks, and pipelines. In the petrochemical industry, where processes often involve complex mixtures and high temperatures, CIP systems help clean in a much faster manner between different product batches with an eventual reduction in downtime, maximizing production efficiency. The CIP process automation also increases the accuracy of the control of cleaning cycles and chemical concentrations that further increase consistency and compliance with safety regulations.

“North America is estimated to be the third fastest growing region in terms of value for the forecasted period.”

North America is the fourth largest market for CIP chemicals. Region’s growth in the CIP chemicals market is spurred by the growth of food & beverages and pharmaceutical & biotechnology industries as well as high hygiene standards. Increasing demand for convenience foods boosts demand for CIP systems within the food manufacturing sector, not only to maintain equipment cleanliness but also to ensure regulatory compliance. Due to the tighter regulations and standards, the pharmaceutical companies are more and more applying specialized cleaning agents and single-use systems to reduce the risk of contamination. Development in this direction creates a focus that defines the industry for advanced, responsible cleaning solutions. Innovations such as enzyme-based cleaners and green formulations maximize efficiency and match sustainability objectives. The market is growing due to North America's strong industrial base and significant producers of CIP chemicals in developed economies like: US, Canada and Mexico. Business expenditure on R&D is aimed at producing cleaners more efficiently in line with the unique requirements of different sectors.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the CIP chemicals market, and information was gathered from secondary research to determine and verify the market size of several segments.

• By Company Type: Tier 1 – 40%, Tier 2 – 30%, and Tier 3 – 30%

• By Designation: C Level Executives– 20%, Directors – 10%, and Others – 70%

• By Region: North America – 22%, Europe – 22%, APAC – 45%, ROW –11%

The CIP chemicals market comprises major players such as ALFA LAVAL (Sweden), BASF (Germany), Ecolab (US), Novozymes (Denmark), STERIS (US), Solvay (Belgium), KIC KRONES Internationale Cooperations-Gesellschaft mbH (Germany), Diversey, Inc (US), Chemtex Speciality Limited (India), and Keller & Bohacek GmbH & Co. KG (Germany). The study includes in-depth competitive analysis of these key players in the CIP chemicals market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for CIP chemicals market on the basis of chemistry, process type, end use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for CIP chemicals market.

Key benefits of buying this report

This research report is focused on various levels of analysis — industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the CIP chemicals market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

• Market Penetration: Comprehensive information on the CIP chemicals market offered by top players in the global CIP chemicals market.

• Analysis of drivers: (Expanding biotechnology applications boost demand for CIP solutions, Enhancing CIP performance with PAA solutions) restraints (Environmental challenges of acidic cleaners in cleaning processes, Corrosion concerns with citric acid in cleaning solutions), opportunities (Scaling CIP solutions for modern food and beverage manufacturing, Sustainable cleaning with enzyme-based CIP solutions) and challenges (Complexities of recycling cip cleaning solutions)

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the CIP chemicals market.

• Market Development: Comprehensive information about lucrative emerging markets — the report analyzes the markets for CIP chemicals market across regions.

• Market Capacity: Production capacities of companies producing CIP chemicals are provided wherever available with upcoming capacities for the CIP chemicals market.

• Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the CIP chemicals market.

1 INTRODUCTION 24

1.1 STUDY OBJECTIVES 24

1.2 MARKET DEFINITION 24

1.3 STUDY SCOPE 25

1.3.1 MARKET SEGMENTATION AND REGIONAL SPREAD 25

1.3.2 INCLUSIONS & EXCLUSIONS 25

1.3.3 YEARS CONSIDERED 26

1.3.4 CURRENCY CONSIDERED 27

1.3.5 UNITS CONSIDERED 27

1.4 STAKEHOLDERS 27

2 RESEARCH METHODOLOGY 28

2.1 RESEARCH DATA 28

2.1.1 SECONDARY DATA 29

2.1.1.1 List of key secondary sources 29

2.1.1.2 Key data from secondary sources 29

2.1.2 PRIMARY DATA 30

2.1.2.1 Key data from primary sources 30

2.1.2.2 List of primary participants 31

2.1.2.3 Key industry insights 31

2.1.2.4 Breakdown of interviews with experts 31

2.2 MARKET SIZE ESTIMATION 32

2.2.1 BOTTOM-UP APPROACH 32

2.2.2 TOP-DOWN APPROACH 33

2.3 GROWTH FORECAST 33

2.4 DATA TRIANGULATION 34

2.5 FACTOR ANALYSIS 35

2.6 RESEARCH ASSUMPTIONS 35

2.7 LIMITATIONS & RISKS 36

3 EXECUTIVE SUMMARY 37

4 PREMIUM INSIGHTS 40

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CIP CHEMICALS MARKET 40

4.2 CIP CHEMICALS MARKET, BY PROCESS TYPE 40

4.3 CIP CHEMICALS MARKET, BY CHEMISTRY 41

4.4 CIP CHEMICALS MARKET, BY END-USE INDUSTRY 41

4.5 CIP CHEMICALS MARKET, BY KEY COUNTRY 42

5 MARKET OVERVIEW 43

5.1 INTRODUCTION 43

5.2 MARKET DYNAMICS 43

5.2.1 DRIVERS 44

5.2.1.1 Expanding biotechnology applications to boost demand for CIP solutions 44

5.2.1.2 Enhancing CIP performance with PAA solutions 44

5.2.2 RESTRAINTS 45

5.2.2.1 Use of acidic cleaners to threaten aquatic ecosystems 45

5.2.2.2 Risk of corrosion with citric acid cleaning solutions 45

5.2.3 OPPORTUNITIES 46

5.2.3.1 Scaling CIP solutions for modern food and beverage manufacturing 46

5.2.3.2 Sustainable cleaning with enzyme-based CIP solutions 46

5.2.4 CHALLENGES 46

5.2.4.1 High risk of cross-contamination and complexities in recycling CIP products 46

5.3 PORTER’S FIVE FORCES ANALYSIS 47

5.3.1 THREAT OF NEW ENTRANTS 47

5.3.2 THREAT OF SUBSTITUTES 48

5.3.3 BARGAINING POWER OF BUYERS 48

5.3.4 BARGAINING POWER OF SUPPLIERS 48

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 49

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA 50

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS 50

5.4.2 BUYING CRITERIA 51

5.5 MACROECONOMIC INDICATORS 52

5.5.1 GLOBAL GDP TRENDS 52

5.6 IMPACT OF GEN AI 53

5.7 VALUE CHAIN ANALYSIS 53

5.7.1 RAW MATERIAL SUPPLIERS 54

5.7.2 MANUFACTURERS 54

5.7.3 SUPPLIERS/DISTRIBUTORS 54

5.7.4 END-USE INDUSTRIES 55

5.8 ECOSYSTEM ANALYSIS 55

5.9 CASE STUDY ANALYSIS 56

5.9.1 EAU SAFEWATER ENHANCED CIP EFFICIENCY AND SUSTAINABILITY OF CLEANING PROCESSES FOR AN INTERNATIONAL BEVERAGE COMPANY 56

5.9.2 FMC CORP. INTRODUCED HIGH-RETENTION SANITIZER AS A GREEN OXIDANT BIOCIDE FOR EFFICIENT CLEANING 57

5.9.3 ADVANCING CIP EFFICIENCY BY IMPLEMENTING REUSABLE CLEANING AGENTS TO CUT COSTS AND REDUCE CHEMICAL WASTE 57

5.10 REGULATORY LANDSCAPE 58

5.10.1 REGULATIONS 58

5.10.1.1 Europe 58

5.10.1.2 Asia Pacific 58

5.10.1.3 North America 59

5.10.2 STANDARDS 59

5.10.2.1 ISO 14001 59

5.10.2.2 ISO 14644-10 59

5.10.2.3 ISO 979:1974 59

5.10.2.4 ISO 14644-13:2017 59

5.10.2.5 ISO 13485 59

5.10.3 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES 60

5.11 TECHNOLOGY ANALYSIS 60

5.11.1 KEY TECHNOLOGIES 60

5.11.1.1 Probiotic cleaning 60

5.11.1.2 Phosphoric acid-based ultrasonic cleaning 61

5.11.2 COMPLEMENTARY TECHNOLOGIES 61

5.11.2.1 Aqueous cleaning 61

5.11.3 ADJACENT TECHNOLOGIES 61

5.11.3.1 Electrostatic technology 61

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 62

5.13 TRADE ANALYSIS 62

5.13.1 EXPORT SCENARIO 62

5.13.2 IMPORT SCENARIO 64

5.14 KEY CONFERENCES & EVENTS IN 2024–2025 65

5.15 PRICING ANALYSIS 66

5.15.1 AVERAGE SELLING PRICE TREND, BY REGION, 2020–2023 66

5.15.2 AVERAGE SELLING PRICE TREND, BY CHEMISTRY, 2020–2023 67

5.15.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2023 67

5.16 INVESTMENT AND FUNDING SCENARIO 68

5.17 PATENT ANALYSIS 68

5.17.1 APPROACH 68

5.17.2 DOCUMENT TYPES 69

5.17.3 PUBLICATION TRENDS, LAST 11 YEARS (2013–2023) 69

5.17.4 INSIGHTS 70

5.17.5 LEGAL STATUS OF PATENTS 70

5.17.6 JURISDICTION ANALYSIS 70

5.17.7 TOP COMPANIES/APPLICANTS 71

5.17.8 TOP 10 PATENT OWNERS (US) LAST 10 YEARS 72

6 CIP CHEMICALS MARKET, BY PROCESS TYPE 73

6.1 INTRODUCTION 74

6.2 SINGLE-USE CLEANING 75

6.2.1 MINIMIZING CONTAMINATION RISKS WITH SINGLE-USE CIP SOLUTIONS 75

6.3 RECIRCULATED CLEANING 76

6.3.1 LOWERING COSTS AND WASTAGE WITH RECIRCULATED CLEANING PROCESS 76

7 CIP CHEMICALS MARKET, BY CHEMISTRY 77

7.1 INTRODUCTION 78

7.2 ALKALINE CLEANERS 80

7.2.1 SUSTAINABLE CLEANING WITH BIODEGRADABLE ALKALINE CIP AGENTS 80

7.3 ACID CLEANERS 80

7.3.1 ACID CLEANERS FOR EFFECTIVE CLEANING AND DISINFECTING CIP SYSTEMS 80

7.4 DISINFECTANTS/SANITIZERS 80

7.4.1 CONTROLLING MICROBIAL LOADS WITH ADVANCED DISINFECTANTS IN CIP PROCESSES 80

7.5 ENZYME-BASED CLEANERS 81

7.5.1 ENZYME CLEANERS MITIGATING ENVIRONMENTAL IMPACT AND

PROTECTING EQUIPMENT 81

7.6 OTHER CHEMISTRIES 81

8 CIP CHEMICALS MARKET, BY END-USE INDUSTRY 82

8.1 INTRODUCTION 83

8.2 CHEMICALS 85

8.2.1 STREAMLINED CLEANING PROCESSES TO REDUCE DOWNTIME AND MAXIMIZE PRODUCTION CAPACITY 85

8.2.2 SPECIALTY CHEMICALS 85

8.2.3 PETROCHEMICALS 86

8.2.4 OTHERS 86

8.3 FOOD & BEVERAGE 86

8.3.1 ADVANCED CLEANING SOLUTIONS TO ENHANCE FOOD QUALITY AND ENSURE SAFETY 86

8.3.2 DAIRY PROCESSING 87

8.3.3 PROCESSED FOOD 87

8.3.4 OTHERS 87

8.4 PHARMACEUTICAL & BIOTECHNOLOGY 87

8.4.1 ENSURING PRODUCT SAFETY WITH GMP-COMPLIANT CIP CLEANING PROCESSES 87

8.5 COSMETICS 88

8.5.1 CIP SOLUTIONS FOR RESIDUE-FREE COSMETIC MANUFACTURING 88

8.6 TEXTILES 88

8.6.1 INNOVATIVE CLEANING STRATEGIES FOR SCALE-FREE TEXTILE PRODUCTION 88

8.7 OTHER END-USE INDUSTRIES 88

9 CIP CHEMICALS MARKET, BY REGION 89

9.1 INTRODUCTION 90

9.2 NORTH AMERICA 92

9.2.1 US 99

9.2.1.1 Demand for processed foods to drive market 99

9.2.2 CANADA 100

9.2.2.1 Industrial expansion and rise in exports to drive market 100

9.2.3 MEXICO 102

9.2.3.1 Growth of healthcare industry to boost demand for CIP chemicals in medical devices 102

9.3 EUROPE 104

9.3.1 GERMANY 110

9.3.1.1 Increasing demand for CIP chemicals from pharmaceutical and oil & gas industries to drive market 110

9.3.2 FRANCE 112

9.3.2.1 Growth of chemical industry to boost eco-friendly product development 112

9.3.3 SPAIN 114

9.3.3.1 Increasing demand for manufacturing medical devices to drive market 114

9.3.4 UK 115

9.3.4.1 New reformed policies and economic growth to drive market 115

9.3.5 ITALY 117

9.3.5.1 Investments in safety and hygiene to boost chemical demand 117

9.3.6 REST OF EUROPE 119

9.4 ASIA PACIFIC 120

9.4.1 CHINA 127

9.4.1.1 Growth of biotech industries to increase demand for CIP chemicals 127

9.4.2 JAPAN 128

9.4.2.1 Technological advancements in biopharmaceuticals to drive market 128

9.4.3 INDIA 130

9.4.3.1 Increasing need for efficient cleaning to drive market 130

9.4.4 SOUTH KOREA 132

9.4.4.1 Strategic focus on specialty foods to drive growth 132

9.4.5 REST OF ASIA PACIFIC 133

9.5 MIDDLE EAST & AFRICA 135

9.5.1 GCC COUNTRIES 141

9.5.1.1 Saudi Arabia 141

9.5.1.1.1 Economic diversification to drive demand for CIP chemicals 141

9.5.1.2 Other GCC countries 143

9.5.2 SOUTH AFRICA 145

9.5.2.1 Dominance of chemical industry to boost demand for CIP solutions 145

9.5.3 REST OF MIDDLE EAST & AFRICA 147

9.6 SOUTH AMERICA 148

9.6.1 BRAZIL 154

9.6.1.1 Growth of power and mining industries to drive market 154

9.6.2 ARGENTINA 156

9.6.2.1 Investment in sanitation services to boost market growth 156

9.6.3 REST OF SOUTH AMERICA 158

10 COMPETITIVE LANDSCAPE 160

10.1 OVERVIEW 160

10.2 KEY PLAYER STRATEGIES 160

10.3 REVENUE ANALYSIS 162

10.4 MARKET SHARE ANALYSIS 162

10.4.1 ALFA LAVAL 163

10.4.2 BASF 164

10.4.3 ECOLAB 164

10.4.4 NOVOZYMES 164

10.4.5 STERIS 164

10.5 COMPANY VALUATION AND FINANCIAL METRICS 165

10.6 BRAND/PRODUCT COMPARISON ANALYSIS 166

10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 167

10.7.1 STARS 167

10.7.2 EMERGING LEADERS 167

10.7.3 PERVASIVE PLAYERS 167

10.7.4 PARTICIPANTS 167

10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 169

10.7.5.1 Company footprint 169

10.7.5.2 Region footprint 170

10.7.5.3 Chemistry footprint 171

10.7.5.4 Process type footprint 172

10.7.5.5 End-use industry footprint 173

10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 174

10.8.1 PROGRESSIVE COMPANIES 174

10.8.2 RESPONSIVE COMPANIES 174

10.8.3 DYNAMIC COMPANIES 174

10.8.4 STARTING BLOCKS 174

10.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2023 176

10.8.5.1 Detailed list of key startups/SMEs 176

10.8.5.2 Competitive benchmarking of key startups/SMEs 177

10.9 COMPETITIVE SCENARIO AND TRENDS 178

10.9.1 EXPANSIONS 178

10.9.2 PRODUCT LAUNCHES 178

10.9.3 DEALS 178

11 COMPANY PROFILES 180

11.1 KEY PLAYERS 180

11.1.1 ALFA LAVAL 180

11.1.1.1 Business overview 180

11.1.1.2 Products/Solutions/Services offered 181

11.1.1.3 MnM view 182

11.1.1.3.1 Key strengths 182

11.1.1.3.2 Strategic choices 182

11.1.1.3.3 Weaknesses and competitive threats 182

11.1.2 BASF 183

11.1.2.1 Business overview 183

11.1.2.2 Products/Solutions/Services offered 184

11.1.2.3 Recent developments 185

11.1.2.3.1 Expansions 185

11.1.2.3.2 Deals 186

11.1.2.4 MnM view 186

11.1.2.4.1 Key strengths 186

11.1.2.4.2 Strategic choices 186

11.1.2.4.3 Weaknesses and competitive threats 186

11.1.3 ECOLAB 187

11.1.3.1 Business overview 187

11.1.3.2 Products/Solutions/Services offered 188

11.1.3.3 MnM view 189

11.1.3.3.1 Key strengths 189

11.1.3.3.2 Strategic choices 189

11.1.3.3.3 Weaknesses and competitive threats 189

11.1.4 NOVOZYMES 190

11.1.4.1 Business overview 190

11.1.4.2 Products/Solutions/Services offered 191

11.1.4.3 Recent developments 192

11.1.4.3.1 Product launches 192

11.1.4.4 MnM view 192

11.1.4.4.1 Key strengths 192

11.1.4.4.2 Strategic choices 192

11.1.4.4.3 Weaknesses and competitive threats 192

11.1.5 STERIS 193

11.1.5.1 Business overview 193

11.1.5.2 Products/Solutions/Services offered 194

11.1.5.3 MnM view 195

11.1.5.3.1 Key strengths 195

11.1.5.3.2 Strategic choices 195

11.1.5.3.3 Weaknesses and competitive threats 195

11.1.6 SOLVAY 196

11.1.6.1 Business overview 196

11.1.6.2 Products/Solutions/Services offered 197

11.1.6.3 Recent developments 198

11.1.6.3.1 Deals 198

11.1.6.4 MnM view 198

11.1.7 KIC KRONES INTERNATIONALE COOPERATIONS-GESELLSCHAFT MBH 199

11.1.7.1 Business overview 199

11.1.7.2 Products/Solutions/Services offered 199

11.1.7.3 MnM view 200

11.1.8 DIVERSEY, INC. 201

11.1.8.1 Business overview 201

11.1.8.2 Products/Solutions/Services offered 201

11.1.8.3 Recent developments 202

11.1.8.3.1 Deals 202

11.1.8.4 MnM view 202

11.1.9 CHEMTEX SPECIALITY LIMITED 203

11.1.9.1 Business overview 203

11.1.9.2 Products/Solutions/Services offered 203

11.1.9.3 MnM view 204

11.1.10 KELLER & BOHACEK GMBH & CO. KG 205

11.1.10.1 Business overview 205

11.1.10.2 Products/Solutions/Services offered 205

11.1.10.3 MnM view 206

11.2 OTHER PLAYERS 207

11.2.1 VALVOLINE GLOBAL OPERATIONS 207

11.2.2 KONARK CHEMIE 208

11.2.3 HYDRITE CHEMICAL 209

11.2.4 ACURO ORGANICS LIMITED 210

11.2.5 DEVERE 211

11.2.6 BIOSAFE SYSTEMS 212

11.2.7 ALCONOX INC. 213

11.2.8 NYCO PRODUCTS COMPANY 214

11.2.9 SATOL CHEMICALS 215

11.2.10 TRICE CHEMICALS 216

11.2.11 SPARTAN CHEMICAL COMPANY, INC. 217

11.2.12 AFCO 218

11.2.13 MOMAR 219

11.2.14 BETCO 220

11.2.15 NATIONAL CHEMICAL LABORATORIES, INC. 220

12 APPENDIX 221

12.1 DISCUSSION GUIDE 221

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 224

12.3 CUSTOMIZATION OPTIONS 226

12.4 RELATED REPORTS 226

12.5 AUTHOR DETAILS 227

❖ 世界のCIP薬品市場に関するよくある質問(FAQ) ❖

・CIP薬品の世界市場規模は?

→MarketsandMarkets社は2024年のCIP薬品の世界市場規模を24億米ドルと推定しています。

・CIP薬品の世界市場予測は?

→MarketsandMarkets社は2029年のCIP薬品の世界市場規模を36.9億米ドルと予測しています。

・CIP薬品市場の成長率は?

→MarketsandMarkets社はCIP薬品の世界市場が2024年~2029年に年平均9.0%成長すると予測しています。

・世界のCIP薬品市場における主要企業は?

→MarketsandMarkets社は「ALFA LAVAL (Sweden), BASF (Germany), Ecolab (US), Novozymes (Denmark), STERIS (US), Solvay (Belgium), KIC KRONES Internationale Cooperations-Gesellschaft mbH (Germany), Diversey, Inc (US), Chemtex Speciality Limited (India), and Keller & Bohacek GmbH & Co. KG (Germany)など ...」をグローバルCIP薬品市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。