1 はじめに 30

1.1 調査目的 30

1.2 市場の定義 30

1.3 調査範囲 31

1.3.1 対象市場 31

1.3.2 調査対象および除外項目 32

1.3.3 考慮した年数 33

1.4 考慮した通貨 33

1.5 単位の考慮 33

1.6 制限事項 33

1.7 利害関係者 34

1.8 変更点のまとめ 34

2 調査方法 37

2.1 調査データ 37

2.1.1 二次調査および一次調査 39

2.1.2 二次データ 39

2.1.2.1 主要な二次情報源のリスト 40

2.1.2.2 二次資料からの主要データ 40

2.1.3 一次データ 40

2.1.3.1 一次インタビュー参加者リスト 41

2.1.3.2 プライマリーの内訳 41

2.1.3.3 一次資料からの主要データ 42

2.1.3.4 主要な業界インサイト 43

2.2 市場規模の推定方法 44

2.2.1 ボトムアップアプローチ 46

2.2.1.1 ボトムアップ分析による市場規模算出のアプローチ

(需要側) 46

2.2.2 トップダウンアプローチ 47

2.2.2.1 トップダウン分析による市場規模推計手法(供給側

(供給側) 47

2.3 市場の内訳とデータの三角測量 48

2.4 リサーチの前提 49

2.5 リスク分析 49

2.6 調査の限界 50

3 エグゼクティブ・サマリー 51

4 プレミアムインサイト 56

4.1 AIインフラ市場におけるプレーヤーにとっての魅力的な機会 56

4.2 AIインフラ市場、機能別 56

4.3 AIインフラ市場:デプロイメント別 57

4.4 AIインフラ市場:用途別 57

4.5 AIインフラ市場:エンドユーザー別 58

4.6 AIインフラ市場:地域別 58

4.7 AIインフラ市場:国別 59

5 市場の概要 60

5.1 はじめに 60

5.2 市場ダイナミクス 60

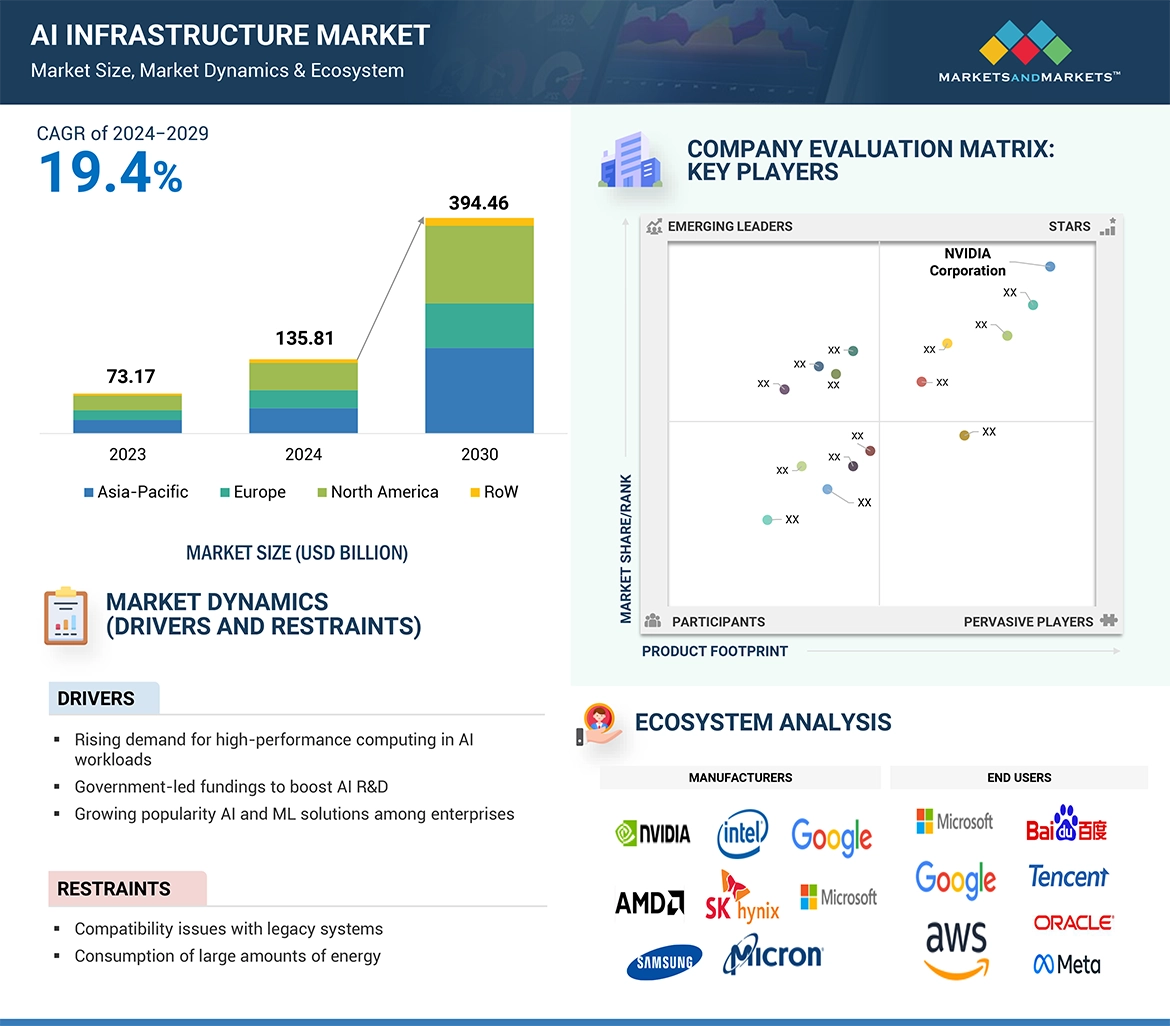

5.2.1 推進要因 61

5.2.1.1 AIワークロードにおけるハイパフォーマンスコンピューティング需要の高まり 61

5.2.1.2 AI 研究開発を後押しする政府主導の資金調達 61

5.2.1.3 企業におけるAIおよびMLソリューションの人気の高まり 62

5.2.1.4 急速なデジタルトランスフォーメーションによる大量のデータ生成 63

5.2.2 阻害要因 64

5.2.2.1 レガシーシステムとの互換性の問題 64

5.2.2.2 大量のエネルギー消費 65

5.2.3 機会 67

5.2.3.1 AI-as-a-Serviceプラットフォームの台頭 67

5.2.3.2 クラウドベースのAIインフラに対する需要の急増 67

5.2.3.3 AI主導の意思決定システムの採用拡大 68

5.2.3.4 AI向けニューロモルフィックコンピューティングと量子コンピューティングの進歩 69

5.2.3.5 クラウドサービスプロバイダーによるデータセンターへの投資の増加 70

5.2.4 課題 71

5.2.4.1 高い初期投資 71

5.2.4.2 分散AIシステムにおけるデータセキュリティと完全性の維持 72

5.2.4.3 既存のITエコシステムへのAI技術の統合に伴う複雑性 73

5.3 顧客ビジネスに影響を与えるトレンド/破壊 74

5.4 価格分析 74

5.4.1 主要プレイヤーのコンピュート別インディケータ価格 75

5.4.2 平均販売価格の動向(地域別) 76

5.5 バリューチェーン分析

5.6 エコシステム分析 80

5.7 投資と資金調達のシナリオ 81

5.8 技術分析 82

5.8.1 主要技術 82

5.8.1.1 ジェネレーティブAI 82

5.8.1.2 会話型AI 83

5.8.1.3 AIに最適化されたクラウドプラットフォーム 83

5.8.2 補完技術 84

5.8.2.1 ブロックチェーン 84

5.8.2.2 エッジコンピューティング 84

5.8.2.3 サイバーセキュリティ 84

5.8.3 隣接技術 85

5.8.3.1 ビッグデータ 85

5.8.3.2 予測分析 85

5.9 クラウドサービスプロバイダーによるデータセンターの今後の展開 86

5.10 クラウドサービスプロバイダーの設備投資 86

5.11 プロセッサーのベンチマーク 88

5.11.1 NVIDIAによるGPUベンチマーク 88

5.11.2 NVIDIAによるCPUベンチマーク 88

5.12 特許分析 89

5.13 貿易分析 92

5.13.1 輸入シナリオ(HSコード854231) 92

5.13.2 輸出シナリオ(HSコード 854231) 94

5.14 主要な会議とイベント(2024-2025年) 95

5.15 ケーススタディ分析 97

5.16 規制の状況 101

5.16.1 規制機関、政府機関、

その他の組織 101

5.16.2 規格 105

5.17 ポーターの5つの力分析 108

5.17.1 新規参入の脅威 109

5.17.2 代替品の脅威 110

5.17.3 供給者の交渉力 110

5.17.4 買い手の交渉力 110

5.17.5 競争の激しさ 111

5.18 主要ステークホルダーと購買基準 111

5.18.1 購入プロセスにおける主要ステークホルダー 111

5.18.2 購入基準 112

6 AIサーバー業界の展望 113

6.1 導入 114

6.2 AIサーバーの普及率と成長予測 114

6.3 AIサーバー産業:プロセッサタイプ別 114

6.3.1 Gpuベースのサーバー 115

6.3.1.1 膨大なデータセットを処理し、複雑なアルゴリズムを効率的に実行する能力が市場を牽引 115

6.3.2 FPGAベースのサーバー 116

6.3.2.1 AIワークロード向けの柔軟性とカスタマイズのニーズの高まりが需要を後押し 116

6.3.3 ASICベースのサーバー 118

6.3.3.1 高性能コンピューティングと機械学習への需要の高まりが市場成長を促進 118

市場成長を促進 118

6.4 AIサーバー産業(機能別) 119

6.4.1 トレーニング 120

6.4.1.1 ディープラーニング技術の採用急増が市場成長を促進 120

6.4.2 推論 121

6.4.2.1 エッジコンピューティングへの急速なシフトが需要を加速 121

6.5 AIサーバー業界シェア分析(2023年) 122

7 AIインフラ市場、サービス別 126

7.1 導入 127

7.2 コンピュート 128

7.2.1 GPU 131

7.2.1.1 ハイパースケールクラウドサービスプロバイダーからの需要拡大が市場成長を促進 131

市場成長を促進 131

7.2.2 CPU 132

7.2.2.1 費用対効果が高く高性能なAIインフラへのニーズが高まり

AIインフラへのニーズの高まりが成長機会をもたらす 132

7.2.3 FPGA 133

7.2.3.1 増加するAIワークロードに対応するためにハードウェアを再構成する必要性の高まりが

需要を押し上げる 133

7.2.4 TPU 134

7.2.4.1 深層学習とニューラルネットワーク処理を加速するニーズの高まりが市場成長を促進 134

7.2.5 道場とFSD 135

7.2.5.1 ディープラーニングとニューラルネットワークのトレーニングにおける計算需要の急増が需要を加速 135

7.2.6 Trainium & Inferentia 135

7.2.6.1 費用対効果の高いトレーニングと推論に対する需要の高まりが有利な成長機会を提供 135

7.2.7 アテナ 136

7.2.7.1 AIモデルの訓練と推論機能の加速に重点が置かれ、需要が拡大 136

7.2.8 Tヘッド 136

7.2.8.1 データセンター全体でAIを活用したアプリケーションの需要拡大が成長機会をもたらす 136

7.2.9 MTIA 137

7.2.9.1 MLモデルの学習と推論を最適化する需要の高まりが市場成長を促進 137

7.2.10 LPU 137

7.2.10.1 NLPの厳しい計算要件を処理する必要性の高まりが市場成長を促進 137

7.2.11 その他のASIC 138

7.3 メモリ 138

7.3.1 DDR 140

7.3.1.1 半導体メーカーの需要増加が市場成長を促進 140

7.3.2 HBM 141

7.3.2.1 リアルタイム画像認識用途の増加が需要を押し上げる 141

7.4 ネットワーク 142

7.4.1 NIC/ネットワークアダプター 144

7.4.1.1 ネットワークの高速化重視の高まりが有利な成長機会を提供 144

7.4.1.2 インフィニバンド 146

7.4.1.2.1 大規模AIモデル学習時のレイテンシ低減重視の高まりが市場成長を促進 146

7.4.1.3 イーサネット 147

7.4.1.3.1 次世代AIモデルの需要に対応する高速ソリューションへのニーズの高まりが市場成長を促進 147

7.4.1.4 相互接続 147

7.4.1.4.1 大規模AIモデルへの需要増加が市場成長を促進 147

7.5 ストレージ 148

7.5.1 持続可能で費用対効果の高いストレージ・ソリューションへのニーズの高まりが有利な成長機会をもたらす 148

7.6 サーバーソフトウェア 149

7.6.1 AIデータセンターにおける安全で安定したコンピューティング環境に対するニーズの高まりが

AIデータセンターにおける安全で安定したコンピューティング環境に対するニーズの高まりが市場成長を促進 149

8 AIインフラ市場(機能別) 151

8.1 導入 152

8.2 トレーニング 154

8.2.1 AIモデル開発の複雑化と規模拡大が市場を牽引 154

8.3 推論 155

8.3.1 エッジコンピューティングの普及が市場成長を促進 155

9 AIインフラ市場(展開別) 156

9.1 導入 157

9.2 オンプレミス 159

9.2.1 データプライバシーへの懸念の高まりが市場を牽引 159

9.3 クラウド 159

9.3.1 オンデマンドでリソースを拡張できる能力が市場成長を促進 159

9.4 ハイブリッド 160

9.4.1 性能とセキュリティを両立させるスケーラブルなソリューションへの需要の高まりが市場成長を促進 160

10 AIインフラ市場:用途別 161

10.1 導入 162

10.2 ジェネレーティブAI 163

10.2.1 ルールベースのモデル 165

10.2.1.1 MLやディープラーニングとの統合が有利な成長機会を提供 165

10.2.2 統計モデル 165

10.2.2.1 傾向や結果を予測する金融、経済、医療分野での応用拡大が市場成長を促進 165

10.2.3 ディープラーニング 166

10.2.3.1 AIが生成するコンテンツと自動化に対する需要の急増が有利な成長機会を提供 166

10.2.4 生成敵対ネットワーク(GANS) 167

10.2.4.1 エンターテインメントやゲーム分野での3Dモデル作成用途の増加が市場成長を促進 167

10.2.5 オートエンコーダ 167

10.2.5.1 データの次元数を減らし、複雑なデータセットを扱う必要性の高まりが需要を加速 167

10.2.6 畳み込みニューラルネットワーク(CNN) 168

10.2.6.1 自律走行車とスマートシティの増加が市場を牽引 168

市場を牽引 168

10.2.7 トランスフォーマーモデル 169

10.2.7.1 GPTモデルとBERTの人気の高まりが有利な成長機会を提供 169

10.3 機械学習 170

10.3.1 リアルタイムの意思決定とデータ分析への応用が増加し

市場成長を促進するデータ分析 170

10.4 自然言語処理 171

10.4.1 センチメント分析、言語翻訳、音声認識への機械利用の増加が需要を加速 171

10.5 コンピュータビジョン 172

10.5.1 自動視覚認識システムの需要増加が市場成長を促進 172

11 AIインフラ市場:エンドユーザー別 173

11.1 導入 174

11.2 クラウドサービスプロバイダー 177

177 11.2.1 事前に構築されたAIモデルの提供が重視されるようになり、成長機会が拡大 178

11.3 企業 179

11.3.1 ヘルスケア 184

11.3.1.1 個別化治療への需要の高まりが市場成長を促進 184

11.3.2 BFSI 185

11.3.2.1 セキュリティ強化と顧客サービス向上への注目の高まりが市場成長を促進 185

11.3.3 自動車 186

11.3.3.1 コネクテッドカーの普及が成長機会をもたらす 186

11.3.4 小売・電子商取引 188

11.3.4.1 顧客エンゲージメントを強化するデータ中心モデルへの急速なシフトが需要を加速 188

11.3.5 メディア&エンターテインメント 189

11.3.5.1 コンテンツ推薦エンジンと双方向メディア体験への需要の高まりが

市場成長を促進するインタラクティブなメディア体験 189

11.3.6 その他の企業 190

11.4 政府機関 191

191 11.4.1 公共の安全とセキュリティ強化のニーズの高まりが有望な成長機会を提供 191

12 AIインフラ市場(地域別) 193

12.1 はじめに 194

12.2 北米 196

12.2.1 北米のマクロ経済見通し 196

12.2.2 米国 201

12.2.2.1 既存のAIインフラメーカーの存在が市場を牽引 201

12.2.3 カナダ 201

12.2.3.1 AIの商業化重視の高まりが有利な成長機会をもたらす 201

12.2.4 メキシコ 202

12.2.4.1 急速なデジタルトランスフォーメーションとクラウドコンピューティングの採用が市場成長を促進 202

12.3 欧州 203

12.3.1 欧州のマクロ経済見通し 203

12.3.2 英国 208

12.3.2.1 データセンターインフラへの投資拡大が需要を押し上げる 208

12.3.3 ドイツ 209

12.3.3.1 製造業を促進するスマート技術の採用が市場を牽引 209

12.3.4 フランス 209

12.3.4.1 AIインフラ強化に向けた政府の積極的な取り組みが市場成長を促進 209

12.3.5 イタリア 210

209 12.3.5.1 デジタルインフラ整備への重点の高まりが有利な成長機会を提供 210

12.3.6 スペイン 211

12.3.6.1 クラウドコンピューティングの急速な普及が需要を加速 211

12.3.7 その他の欧州 211

12.4 アジア太平洋地域 212

12.4.1 アジア太平洋地域のマクロ経済見通し 213

12.4.2 中国 218

12.4.2.1 IoTデバイスの普及が市場を牽引 218

12.4.3 日本 219

12.4.3.1 クラウドインフラを強化する投資の増加が市場成長を促進 219

12.4.4 インド 219

12.4.4.1 AIインフラ強化に向けた政府主導の取り組みが有利な成長機会を提供 219

12.4.5 韓国 220

12.4.5.1 半導体産業の繁栄が需要を加速 220

12.4.6 その他のアジア太平洋地域 221

12.5 ROW 221

12.5.1 行のマクロ経済見通し 225

12.5.2 中東 226

12.5.2.1 デジタルトランスフォーメーションと技術革新を重視する傾向が強まり

技術革新が市場を牽引 226

12.5.2.2 中国・朝鮮半島 227

12.5.2.3 その他の中東地域 227

12.5.3 アフリカ 228

12.5.3.1 高度なデータ処理要件の管理ニーズの高まりが市場成長を促進 228

12.5.4 南米 228

12.5.4.1 柔軟で安全なクラウドストレージソリューションへの需要の高まりが市場成長を促進 228

13 競争環境 229

13.1 概要 229

13.2 主要プレーヤーの戦略/勝利への権利(2019~2024年) 229

13.3 収益分析、2021-2023年 231

13.4 市場シェア分析、2023年 232

13.4.1 コンピュート市場シェア分析、2023年 232

13.4.2 メモリ市場シェア分析、2023年 235

13.5 企業評価と財務指標(2023年) 237

13.6 ブランド/製品の比較 238

13.7 企業評価マトリックス:主要企業、2023年 239

13.7.1 スター企業 239

13.7.2 新興リーダー 239

13.7.3 浸透型プレーヤー 239

13.7.4 参加企業 239

13.7.5 企業フットプリント:主要プレーヤー、2023年 241

13.7.5.1 企業フットプリント 241

13.7.5.2 地域別フットプリント 242

13.7.5.3 オファリングのフットプリント 242

13.7.5.4 機能別フットプリント 243

13.7.5.5 展開フットプリント 244

13.7.5.6 アプリケーションフットプリント 244

13.7.5.7 エンドユーザーフットプリント 245

13.8 企業評価マトリクス:新興企業/SM(2023年) 246

13.8.1 進歩的企業 246

13.8.2 対応力のある企業 246

13.8.3 ダイナミックな企業 246

13.8.4 スターティングブロック 246

13.8.5 競争ベンチマーキング:新興企業/SM(2023年) 248

13.8.5.1 主要新興企業/中小企業の競合ベンチマーキング 248

13.8.5.2 主要新興企業/中小企業の詳細リスト 249

13.9 競争シナリオ 249

13.9.1 製品上市 250

13.9.2 取引 251

13.9.3 その他の開発 254

14 企業プロフィール 255

14.1 主要企業 255

NVIDIA Corporation(米国)

Advanced Micro Devices Inc.(米国)

SK HYNIX INC.(韓国)

SAMSUNG(韓国)

Micron Technology Inc.(米国)

Intel Corporation(米国)

Google(米国)

Amazon Web Services Inc.(米国)

Tesla(米国)

Microsoft(米国)

Meta(米国)

Graphcore(英国)

Cerebras(米国)

15 付録 330

15.1 ディスカッションガイド 330

15.2 Knowledgestore: Marketsandmarketsの購読ポータル 334

15.3 カスタマイズオプション 336

15.4 関連レポート 336

15.5 著者の詳細 337

The AI infrastructure market is being driven by the rapid growth in data generation due to digital transformation, IoT, social media, and e-commerce, which requires advanced computing and storage to manage vast datasets for AI and machine learning models. Additionally, the increasing need for cloud-based AI infrastructure in data centers is reshaping how companies manage complex AI workloads, with major cloud providers investing heavily in AI-ready infrastructure to meet growing global and industry-specific demands. These factors collectively serve as key drivers propelling the growth of the AI infrastructure market.

“Generative AI segment will hold highest CAGR in the forecast period.”

Generative AI is expected to exhibit high growth rate due to a rise in demand for advanced AI applications across industries. Generative AI powers capabilities like content creation, language models, and image synthesis, all of which depends heavily on substantial computational power to train and run large neural networks. This demand requires high infrastructure investments, with an emphasis on high-performance GPU and DPU capabilities able to support intensive processing requirements. As more enterprises seek to capitalize on generative AI's potential, the market for AI infrastructure will rise. In November 2024, GMO Internet Group, Inc. (Japan) launched the GMO GPU Cloud, powered by NVIDIA Corporation's (US) H200 Tensor Core GPUs, Spectrum-X Ethernet, BlueField-3 DPUs, and NVIDIA AI Enterprise software, exemplifies the kind of specialized infrastructure needed to support generative AI at scale. This infrastructure, developed on Dell PowerEdge servers, is aligned to support the needs of production-grade generative AI applications, with reduced latency and high-bandwidth capability. Such innovations underline industry momentum in wide-scale deployment of infrastructure optimized for generative AI workloads. Further, this makes the local high-performance cloud solutions to be drivers for growth of this segment.

"Enterprises is projected to grow at a high CAGR of AI Infrastructure market during the forecasted timeline"

The enterprise segment is expected to record high growth in AI Infrastructure Market. Enterprises are increasingly adopting AI infrastructure as they use AI to facilitate digital transformation, enhance operational efficiency, and enhance customer experience. Manufacturing, finance, and retail enterprises are increasing their investments in AI powered predictive analysis, process automation, and customer insight tools that require robust and scalable AI infrastructure. Enterprises are also expanding their AI capabilities by investing in private cloud infrastructure and hybrid cloud models, especially as they seek to protect sensitive data while benefiting from cloud-based AI's flexibility and innovation. Companies are providing cloud and on-premises flexibility along with comprehensive support that aligns with enterprise needs for adaptable, high-performance AI resources that can integrate with existing IT environments. In February 2024, Cisco and NVIDIA announced a partnership to bring AI infrastructure solutions tailored for data centers, designed to streamline deployment and management while offering high computing power necessary for enterprise AI. Its joint offering includes flexible AI infrastructure options for cloud-based and on-premises enterprises, as well as robust networking, security, and end-to-end observability features. Such collaborations support the growth of enterprise AI infrastructure market because companies demand scalable, secure, and manageable infrastructure for the deployment of AI solutions.

“Asia Pacific is expected to hold high CAGR in during the forecast period.”

AI infrastructure market in Asia Pacific will grow at a high CAGR during the forecast period. Countries like China, Japan, South Korea, and India are at the forefront of AI innovation and governments and private sectors in the region are making high investments in AI research, infrastructure, and talent development. In September 2024 Lenovo (Hong Kong) announced its mass manufacturing operations for high-performance AI servers in India, and it also unveiled a cutting-edge research & development (R&D) lab, adding to the advancement of Lenovo's Infrastructure Solutions. These are the significant efforts that Lenovo has taken towards the significant positioning of India as a hub in innovation and manufacturing, while supporting 'Make in India' and 'AI for All' vision by the Indian government. Initiatives like these will speed up region's leadership in AI technology and will lead to significant growth in AI infrastructure deployment across Asia Pacific industries. Moreover, as enterprises and governments are driving digital transformation and cloud adoption, the requirement for high-performance AI offerings is increasing, making Asia Pacific one of the fastest-growing markets for AI Infrastructure globally.

Extensive primary interviews were conducted with key industry experts in the AI Infrastructure market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The break-up of primary participants for the report has been shown below: The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs.

The break-up of the primaries is as follows:

• By Company Type: Tier 1 – 50%, Tier 2 – 20%, and Tier 3 – 30%

• By Designation: C-level Executives – 20%, Directors – 30%, and Others – 50%

• By Region: North America – 30%, Europe – 20%, Asia Pacific – 40%, and RoW – 10%

The report profiles key players in the AI Infrastructure market with their respective market ranking analysis. Prominent players profiled in this report are NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), SK HYNIX INC. (South Korea), SAMSUNG (South Korea), Micron Technology, Inc. (US), Intel Corporation (US), Google (US), Amazon Web Services, Inc. (US), Tesla (US), Microsoft (US), Meta (US), Graphcore (UK), and Cerebras (US), among others.

Apart from this, KIOXIA Holdings Corporation (Japan), Western Digital Corporation (US), Mythic (US), Blaize (US), Groq, Inc. (US), HAILO TECHNOLOGIES LTD (Israel), SiMa Technologies, Inc. (US), Kneron, Inc. (US), Rain Neuromorphics Inc. (US), Tenstorrent (Canada), SambaNova Systems, Inc. (US), Taalas (Canada), SAPEON Inc. (US), Rebellions Inc. (South Korea), Rivos Inc. (US), and Shanghai BiRen Technology Co., Ltd. (China) are among a few emerging companies in the AI Infrastructure market.

Research Coverage: This research report categorizes the AI infrastructure market based on offerings, function, deployment, application, end user, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the AI infrastructure market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the AI infrastructure ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI infrastructure market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (Rising demand for high-performance computing in AI workloads, government initiatives and investments in AI research and development, and growing implementation of AI and ML solutions across enterprises) influencing the growth of the AI infrastructure market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI infrastructure market.

• Market Development: Comprehensive information about lucrative markets – the report analysis the AI infrastructure market across varied regions

• Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI infrastructure market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), SK HYNIX INC. (South Korea), SAMSUNG (South Korea), Micron Technology, Inc. (US) among others in the AI infrastructure market.

1 INTRODUCTION 30

1.1 STUDY OBJECTIVES 30

1.2 MARKET DEFINITION 30

1.3 STUDY SCOPE 31

1.3.1 MARKETS COVERED 31

1.3.2 INCLUSIONS AND EXCLUSIONS 32

1.3.3 YEARS CONSIDERED 33

1.4 CURRENCY CONSIDERED 33

1.5 UNIT CONSIDERED 33

1.6 LIMITATIONS 33

1.7 STAKEHOLDERS 34

1.8 SUMMARY OF CHANGES 34

2 RESEARCH METHODOLOGY 37

2.1 RESEARCH DATA 37

2.1.1 SECONDARY AND PRIMARY RESEARCH 39

2.1.2 SECONDARY DATA 39

2.1.2.1 List of key secondary sources 40

2.1.2.2 Key data from secondary sources 40

2.1.3 PRIMARY DATA 40

2.1.3.1 List of primary interview participants 41

2.1.3.2 Breakdown of primaries 41

2.1.3.3 Key data from primary sources 42

2.1.3.4 Key industry insights 43

2.2 MARKET SIZE ESTIMATION METHODOLOGY 44

2.2.1 BOTTOM-UP APPROACH 46

2.2.1.1 Approach to arrive at market size using bottom-up analysis

(demand side) 46

2.2.2 TOP-DOWN APPROACH 47

2.2.2.1 Approach to arrive at market size using top-down analysis

(supply side) 47

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 48

2.4 RESEARCH ASSUMPTIONS 49

2.5 RISK ANALYSIS 49

2.6 RESEARCH LIMITATIONS 50

3 EXECUTIVE SUMMARY 51

4 PREMIUM INSIGHTS 56

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI INFRASTRUCTURE MARKET 56

4.2 AI INFRASTRUCTURE MARKET, BY FUNCTION 56

4.3 AI INFRASTRUCTURE MARKET, BY DEPLOYMENT 57

4.4 AI INFRASTRUCTURE MARKET, BY APPLICATION 57

4.5 AI INFRASTRUCTURE MARKET, BY END USER 58

4.6 AI INFRASTRUCTURE MARKET, BY REGION 58

4.7 AI INFRASTRUCTURE MARKET, BY COUNTRY 59

5 MARKET OVERVIEW 60

5.1 INTRODUCTION 60

5.2 MARKET DYNAMICS 60

5.2.1 DRIVERS 61

5.2.1.1 Rising demand for high-performance computing in AI workloads 61

5.2.1.2 Government-led fundings to boost AI R&D 61

5.2.1.3 Growing popularity AI and ML solutions among enterprises 62

5.2.1.4 Massive data generation due to rapid digital transformation 63

5.2.2 RESTRAINTS 64

5.2.2.1 Compatibility issues with legacy systems 64

5.2.2.2 Consumption of large amount of energy 65

5.2.3 OPPORTUNITIES 67

5.2.3.1 Rise of AI-as-a-Service platforms 67

5.2.3.2 Surging demand for cloud-based AI infrastructure 67

5.2.3.3 Growing adoption of AI-driven decision making systems 68

5.2.3.4 Advancements in neuromorphic and quantum computing for AI 69

5.2.3.5 Increasing investments in data centers by cloud service providers 70

5.2.4 CHALLENGES 71

5.2.4.1 High initial investments 71

5.2.4.2 Maintaining data security and integrity in distributed AI systems 72

5.2.4.3 Complexities associated with integrating AI technologies into existing IT ecosystems 73

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 74

5.4 PRICING ANALYSIS 74

5.4.1 INDICATIVE PRICING OF KEY PLAYERS, BY COMPUTE 75

5.4.2 AVERAGE SELLING PRICE TREND, BY REGION 76

5.5 VALUE CHAIN ANALYSIS 77

5.6 ECOSYSTEM ANALYSIS 80

5.7 INVESTMENT AND FUNDING SCENARIO 81

5.8 TECHNOLOGY ANALYSIS 82

5.8.1 KEY TECHNOLOGIES 82

5.8.1.1 Generative AI 82

5.8.1.2 Conversational AI 83

5.8.1.3 AI-optimized cloud platforms 83

5.8.2 COMPLEMENTARY TECHNOLOGIES 84

5.8.2.1 Blockchain 84

5.8.2.2 Edge computing 84

5.8.2.3 Cybersecurity 84

5.8.3 ADJACENT TECHNOLOGIES 85

5.8.3.1 Big data 85

5.8.3.2 Predictive analysis 85

5.9 UPCOMING DEPLOYMENT OF DATA CENTERS BY CLOUD SERVICE PROVIDERS 86

5.10 CAPEX OF CLOUD SERVICE PROVIDERS 86

5.11 PROCESSOR BENCHMARKING 88

5.11.1 GPU BENCHMARKING BY NVIDIA 88

5.11.2 CPU BENCHMARKING BY NVIDIA 88

5.12 PATENT ANALYSIS 89

5.13 TRADE ANALYSIS 92

5.13.1 IMPORT SCENARIO (HS CODE 854231) 92

5.13.2 EXPORT SCENARIO (HS CODE 854231) 94

5.14 KEY CONFERENCES AND EVENTS, 2024–2025 95

5.15 CASE STUDY ANALYSIS 97

5.16 REGULATORY LANDSCAPE 101

5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 101

5.16.2 STANDARDS 105

5.17 PORTER’S FIVE FORCES ANALYSIS 108

5.17.1 THREAT OF NEW ENTRANTS 109

5.17.2 THREAT OF SUBSTITUTES 110

5.17.3 BARGAINING POWER OF SUPPLIERS 110

5.17.4 BARGAINING POWER OF BUYERS 110

5.17.5 INTENSITY OF COMPETITION RIVALRY 111

5.18 KEY STAKEHOLDERS AND BUYING CRITERIA 111

5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS 111

5.18.2 BUYING CRITERIA 112

6 AI SERVER INDUSTRY LANDSCAPE 113

6.1 INTRODUCTION 114

6.2 AI SERVER PENETRATION AND GROWTH FORECAST 114

6.3 AI SERVER INDUSTRY, BY PROCESSOR TYPE 114

6.3.1 GPU-BASED SERVERS 115

6.3.1.1 Ability to process massive datasets and run intricate algorithms efficiently to drive market 115

6.3.2 FPGA-BASED SERVERS 116

6.3.2.1 Growing need for flexibility and customization for AI workloads to boost demand 116

6.3.3 ASIC-BASED SERVERS 118

6.3.3.1 Increasing demand for high-performance computing and

machine learning to foster market growth 118

6.4 AI SERVER INDUSTRY, BY FUNCTION 119

6.4.1 TRAINING 120

6.4.1.1 Surging adoption of deep learning technologies to fuel market growth 120

6.4.2 INFERENCE 121

6.4.2.1 Rapid shift toward edge computing to accelerate demand 121

6.5 AI SERVER INDUSTRY SHARE ANALYSIS, 2023 122

7 AI INFRASTRUCTURE MARKET, BY OFFERING 126

7.1 INTRODUCTION 127

7.2 COMPUTE 128

7.2.1 GPU 131

7.2.1.1 Growing demand from hyperscale cloud service providers to

fuel market growth 131

7.2.2 CPU 132

7.2.2.1 Increasing need for cost-effective and high-performance

AI infrastructure to offer lucrative growth opportunities 132

7.2.3 FPGA 133

7.2.3.1 Growing need to reconfigure hardware to address growing

AI workloads to boost demand 133

7.2.4 TPU 134

7.2.4.1 Rising need to accelerate deep learning and neural network processing to foster market growth 134

7.2.5 DOJO & FSD 135

7.2.5.1 Surging computational demands of deep learning and neural network training to accelerate demand 135

7.2.6 TRAINIUM & INFERENTIA 135

7.2.6.1 Growing demand for cost-effective training and inference to offer lucrative growth opportunities 135

7.2.7 ATHENA 136

7.2.7.1 Increasing emphasis on accelerating AI model training and inference capabilities to fuel demand 136

7.2.8 T-HEAD 136

7.2.8.1 Growing demand for AI-powered applications across data centers to offer lucrative growth opportunities 136

7.2.9 MTIA 137

7.2.9.1 Rising demand to optimize training and inference of ML models to foster market growth 137

7.2.10 LPU 137

7.2.10.1 Increasing need to handle demanding computational requirements of NLP to fuel market growth 137

7.2.11 OTHER ASIC 138

7.3 MEMORY 138

7.3.1 DDR 140

7.3.1.1 Increasing demand among semiconductor manufacturers to fuel market growth 140

7.3.2 HBM 141

7.3.2.1 Rising application for real-time image recognition to boost demand 141

7.4 NETWORK 142

7.4.1 NIC/NETWORK ADAPTERS 144

7.4.1.1 Increasing emphasis on advancing network speeds to offer lucrative growth opportunities 144

7.4.1.2 InfiniBand 146

7.4.1.2.1 Growing emphasis on reducing latency during large-scale AI model training to foster market growth 146

7.4.1.3 Ethernet 147

7.4.1.3.1 Rising need for high-speed solutions to meet next-gen AI model demands to foster market growth 147

7.4.1.4 Interconnects 147

7.4.1.4.1 Increasing demand for larger-scale AI models to fuel market growth 147

7.5 STORAGE 148

7.5.1 GROWING NEED FOR SUSTAINABLE AND COST-EFFECTIVE STORAGE SOLUTIONS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES 148

7.6 SERVER SOFTWARE 149

7.6.1 RISING NEED FOR SECURE AND STABLE COMPUTING ENVIRONMENTS IN

AI DATA CENTERS TO FUEL MARKET GROWTH 149

8 AI INFRASTRUCTURE MARKET, BY FUNCTION 151

8.1 INTRODUCTION 152

8.2 TRAINING 154

8.2.1 INCREASING COMPLEXITIES AND SCALE OF AI MODEL DEVELOPMENT TO DRIVE MARKET 154

8.3 INFERENCE 155

8.3.1 RISING POPULARITY OF EDGE COMPUTING TO FUEL MARKET GROWTH 155

9 AI INFRASTRUCTURE MARKET, BY DEPLOYMENT 156

9.1 INTRODUCTION 157

9.2 ON-PREMISES 159

9.2.1 GROWING CONCERNS OF DATA PRIVACY TO DRIVE MARKET 159

9.3 CLOUD 159

9.3.1 ABILITY TO SCALE RESOURCES ON-DEMAND TO FUEL MARKET GROWTH 159

9.4 HYBRID 160

9.4.1 INCREASING DEMAND FOR SCALABLE SOLUTIONS TO BALANCE PERFORMANCE AND SECURITY TO FOSTER MARKET GROWTH 160

10 AI INFRASTRUCTURE MARKET, BY APPLICATION 161

10.1 INTRODUCTION 162

10.2 GENERATIVE AI 163

10.2.1 RULE-BASED MODELS 165

10.2.1.1 Integration with ML and deep learning to offer lucrative growth opportunities 165

10.2.2 STATISTICAL MODELS 165

10.2.2.1 Growing application in finance, economics, and healthcare sectors to predict trends and outcomes to fuel market growth 165

10.2.3 DEEP LEARNING 166

10.2.3.1 Surging demand for AI-generated content and automation to offer lucrative growth opportunities 166

10.2.4 GENERATIVE ADVERSARIAL NETWORKS (GANS) 167

10.2.4.1 Increasing application to create 3D models in entertainment and gaming sectors to foster market growth 167

10.2.5 AUTOENCODERS 167

10.2.5.1 Growing need to reduce dimensionality of data and handle complex datasets to accelerate demand 167

10.2.6 CONVOLUTIONAL NEURAL NETWORKS (CNNS) 168

10.2.6.1 Rising number of autonomous vehicles and smart cities to

drive market 168

10.2.7 TRANSFORMER MODELS 169

10.2.7.1 Growing popularity of GPT models and BERT to offer lucrative growth opportunities 169

10.3 MACHINE LEARNING 170

10.3.1 RISING APPLICATION FOR REAL-TIME DECISION-MAKING AND

DATA ANALYSIS TO FOSTER MARKET GROWTH 170

10.4 NATURAL LANGUAGE PROCESSING 171

10.4.1 GROWING USAGE OF MACHINES FOR SENTIMENT ANALYSIS, LANGUAGE TRANSLATION, AND SPEECH RECOGNITION TO ACCELERATE DEMAND 171

10.5 COMPUTER VISION 172

10.5.1 INCREASING DEMAND FOR AUTOMATED VISUAL RECOGNITION SYSTEMS TO FUEL MARKET GROWTH 172

11 AI INFRASTRUCTURE MARKET, BY END USER 173

11.1 INTRODUCTION 174

11.2 CLOUD SERVICE PROVIDERS 177

11.2.1 RISING EMPHASIS ON OFFERING PRE-BUILT AI MODELS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES 177

11.3 ENTERPRISES 179

11.3.1 HEALTHCARE 184

11.3.1.1 Growing demand for personalized treatment to fuel market growth 184

11.3.2 BFSI 185

11.3.2.1 Rising focus on enhancing security and improving customer services to foster market growth 185

11.3.3 AUTOMOTIVE 186

11.3.3.1 Increasing popularity of connected vehicles to offer lucrative growth opportunities 186

11.3.4 RETAIL & E-COMMERCE 188

11.3.4.1 Rapid shift toward data-centric models to enhance customer engagement to accelerate demand 188

11.3.5 MEDIA & ENTERTAINMENT 189

11.3.5.1 Rising demand for content recommendation engines and

interactive media experiences to foster market growth 189

11.3.6 OTHER ENTERPRISES 190

11.4 GOVERNMENT ORGANIZATIONS 191

11.4.1 GROWING NEED TO ENHANCE PUBLIC SAFETY AND SECURITY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES 191

12 AI INFRASTRUCTURE MARKET, BY REGION 193

12.1 INTRODUCTION 194

12.2 NORTH AMERICA 196

12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 196

12.2.2 US 201

12.2.2.1 Presence of established AI infrastructure manufacturers to drive market 201

12.2.3 CANADA 201

12.2.3.1 Growing emphasis on commercializing AI to offer lucrative growth opportunities 201

12.2.4 MEXICO 202

12.2.4.1 Rapid digital transformation and surging adoption of cloud computing to fuel market growth 202

12.3 EUROPE 203

12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 203

12.3.2 UK 208

12.3.2.1 Growing investments in data center infrastructure to boost demand 208

12.3.3 GERMANY 209

12.3.3.1 Rising adoption smart technologies to boost manufacturing to drive market 209

12.3.4 FRANCE 209

12.3.4.1 Favorable government initiatives to strengthen AI infrastructure to fuel market growth 209

12.3.5 ITALY 210

12.3.5.1 Increasing emphasis on developing digital infrastructure to offer lucrative growth opportunities 210

12.3.6 SPAIN 211

12.3.6.1 Rapid adoption of cloud computing to accelerate demand 211

12.3.7 REST OF EUROPE 211

12.4 ASIA PACIFIC 212

12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 213

12.4.2 CHINA 218

12.4.2.1 Proliferation of IoT devices to drive market 218

12.4.3 JAPAN 219

12.4.3.1 Rising investments to boost cloud infrastructure to foster market growth 219

12.4.4 INDIA 219

12.4.4.1 Government-led initiatives to strengthen AI infrastructure to offer lucrative growth opportunities 219

12.4.5 SOUTH KOREA 220

12.4.5.1 Thriving semiconductor industry to accelerate demand 220

12.4.6 REST OF ASIA PACIFIC 221

12.5 ROW 221

12.5.1 MACROECONOMIC OUTLOOK FOR ROW 225

12.5.2 MIDDLE EAST 226

12.5.2.1 Growing emphasis on digital transformation and

technological innovation to drive market 226

12.5.2.2 GCC 227

12.5.2.3 Rest of Middle East 227

12.5.3 AFRICA 228

12.5.3.1 Rising need for managing advanced data processing requirements to fuel market growth 228

12.5.4 SOUTH AMERICA 228

12.5.4.1 Growing demand for flexible and secure cloud storage solutions to foster market growth 228

13 COMPETITIVE LANDSCAPE 229

13.1 OVERVIEW 229

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024 229

13.3 REVENUE ANALYSIS, 2021–2023 231

13.4 MARKET SHARE ANALYSIS, 2023 232

13.4.1 COMPUTE MARKET SHARE ANALYSIS, 2023 232

13.4.2 MEMORY MARKET SHARE ANALYSIS, 2023 235

13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2023 237

13.6 BRAND/PRODUCT COMPARISON 238

13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 239

13.7.1 STARS 239

13.7.2 EMERGING LEADERS 239

13.7.3 PERVASIVE PLAYERS 239

13.7.4 PARTICIPANTS 239

13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 241

13.7.5.1 Company footprint 241

13.7.5.2 Region footprint 242

13.7.5.3 Offering footprint 242

13.7.5.4 Function footprint 243

13.7.5.5 Deployment footprint 244

13.7.5.6 Application footprint 244

13.7.5.7 End user footprint 245

13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 246

13.8.1 PROGRESSIVE COMPANIES 246

13.8.2 RESPONSIVE COMPANIES 246

13.8.3 DYNAMIC COMPANIES 246

13.8.4 STARTING BLOCKS 246

13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 248

13.8.5.1 Competitive benchmarking of key startups/SMEs 248

13.8.5.2 Detailed list of key startups/SMEs 249

13.9 COMPETITIVE SCENARIO 249

13.9.1 PRODUCT LAUNCHES 250

13.9.2 DEALS 251

13.9.3 OTHER DEVELOPMENTS 254

14 COMPANY PROFILES 255

14.1 KEY PLAYERS 255

14.1.1 NVIDIA CORPORATION 255

14.1.1.1 Business overview 255

14.1.1.2 Products/Solutions/Services offered 256

14.1.1.3 Recent developments 259

14.1.1.3.1 Product launches 259

14.1.1.3.2 Deals 261

14.1.1.4 MnM view 262

14.1.1.4.1 Key strengths/Right to win 262

14.1.1.4.2 Strategic choices 263

14.1.1.4.3 Weaknesses/Competitive threats 263

14.1.2 ADVANCED MICRO DEVICES, INC. 264

14.1.2.1 Business overview 264

14.1.2.2 Products/Solutions/Services offered 265

14.1.2.3 Recent developments 267

14.1.2.3.1 Product launches 267

14.1.2.3.2 Deals 268

14.1.2.4 MnM view 269

14.1.2.4.1 Key strengths/Right to win 269

14.1.2.4.2 Strategic choices 270

14.1.2.4.3 Weaknesses/Competitive threats 270

14.1.3 SK HYNIX INC. 271

14.1.3.1 Business overview 271

14.1.3.2 Products/Solutions/Services offered 273

14.1.3.3 Recent developments 274

14.1.3.3.1 Product launches 274

14.1.3.3.2 Deals 274

14.1.3.3.3 Other developments 275

14.1.3.4 MnM view 275

14.1.3.4.1 Key strengths/Right to win 275

14.1.3.4.2 Strategic choices 275

14.1.3.4.3 Weaknesses/Competitive threats 275

14.1.4 SAMSUNG 276

14.1.4.1 Business overview 276

14.1.4.2 Products/Solutions/Services offered 277

14.1.4.3 Recent developments 279

14.1.4.3.1 Product launches 279

14.1.4.3.2 Deals 281

14.1.4.4 MnM view 282

14.1.4.4.1 Key strengths/Right to win 282

14.1.4.4.2 Strategic choices 282

14.1.4.4.3 Weaknesses/Competitive threats 282

14.1.5 MICRON TECHNOLOGY, INC. 283

14.1.5.1 Business overview 283

14.1.5.2 Products/Solutions/Services offered 284

14.1.5.3 Recent developments 286

14.1.5.3.1 Product launches 286

14.1.5.3.2 Deals 288

14.1.5.4 MnM view 289

14.1.5.4.1 Key strengths/Right to win 289

14.1.5.4.2 Strategic choices 289

14.1.5.4.3 Weaknesses/Competitive threats 289

14.1.6 INTEL CORPORATION 290

14.1.6.1 Business overview 290

14.1.6.2 Products/Solutions/Services offered 291

14.1.6.3 Recent developments 294

14.1.6.3.1 Product launches 294

14.1.6.3.2 Deals 296

14.1.6.3.3 Other developments 298

14.1.7 GOOGLE 299

14.1.7.1 Business overview 299

14.1.7.2 Products/Solutions/Services offered 300

14.1.7.3 Recent developments 301

14.1.7.3.1 Product launches 301

14.1.7.3.2 Deals 302

14.1.8 AMAZON WEB SERVICES, INC. 304

14.1.8.1 Business overview 304

14.1.8.2 Products/Solutions/Services offered 305

14.1.8.3 Recent developments 305

14.1.8.3.1 Product launches 305

14.1.8.3.2 Deals 306

14.1.9 TESLA 307

14.1.9.1 Business overview 307

14.1.9.2 Products/Solutions/Services offered 308

14.1.10 MICROSOFT 309

14.1.10.1 Business overview 309

14.1.10.2 Products/Solutions/Services offered 310

14.1.10.3 Recent developments 311

14.1.10.3.1 Product launches 311

14.1.10.3.2 Deals 311

14.1.11 META 312

14.1.11.1 Business overview 312

14.1.11.2 Products/Solutions/Services offered 313

14.1.11.3 Recent developments 314

14.1.11.3.1 Product launches 314

14.1.11.3.2 Deals 314

14.1.12 GRAPHCORE 315

14.1.12.1 Business overview 315

14.1.12.2 Products/Solutions/Services offered 315

14.1.12.3 Recent developments 316

14.1.12.3.1 Product launches 316

14.1.12.3.2 Deals 316

14.1.13 CEREBRAS 317

14.1.13.1 Business overview 317

14.1.13.2 Products/Solutions/Services offered 317

14.1.13.3 Recent developments 318

14.1.13.3.1 Product launches 318

14.1.13.3.2 Deals 318

14.2 OTHER PLAYERS 319

14.2.1 KIOXIA HOLDINGS CORPORATION 319

14.2.2 WESTERN DIGITAL CORPORATION 320

14.2.3 MYTHIC 321

14.2.4 BLAIZE 322

14.2.5 GROQ, INC. 323

14.2.6 HAILO TECHNOLOGIES LTD 324

14.2.7 SIMA TECHNOLOGIES, INC. 325

14.2.8 KNERON, INC. 325

14.2.9 RAIN NEUROMORPHICS INC. 326

14.2.10 TENSTORRENT 326

14.2.11 SAMBANOVA SYSTEMS, INC. 327

14.2.12 TAALAS 327

14.2.13 SAPEON INC. 328

14.2.14 REBELLIONS INC. 328

14.2.15 RIVOS INC. 329

14.2.16 SHANGHAI BIREN TECHNOLOGY CO., LTD. 329

15 APPENDIX 330

15.1 DISCUSSION GUIDE 330

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 334

15.3 CUSTOMIZATION OPTIONS 336

15.4 RELATED REPORTS 336

15.5 AUTHOR DETAILS 337

❖ 世界のAIインフラストラクチャ市場に関するよくある質問(FAQ) ❖

・AIインフラストラクチャの世界市場規模は?

→MarketsandMarkets社は2024年のAIインフラストラクチャの世界市場規模を1,358億1,000万米ドルと推定しています。

・AIインフラストラクチャの世界市場予測は?

→MarketsandMarkets社は2030年のAIインフラストラクチャの世界市場規模を3,944億6,000万米ドルと予測しています。

・AIインフラストラクチャ市場の成長率は?

→MarketsandMarkets社はAIインフラストラクチャの世界市場が2024年~2030年に年平均19.4%成長すると予測しています。

・世界のAIインフラストラクチャ市場における主要企業は?

→MarketsandMarkets社は「NVIDIA Corporation(米国)、Advanced Micro Devices, Inc.(米国)、SK HYNIX INC.(韓国)、SAMSUNG(韓国)、Micron Technology, Inc.(米国)、Intel Corporation(米国)、Google(米国)、Amazon Web Services, Inc.(米国)、Tesla(米国)、Microsoft(米国)、Meta(米国)、Graphcore(英国)、Cerebras(米国)など ...」をグローバルAIインフラストラクチャ市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。