1 はじめに 22

1.1 調査目的 22

1.2 市場の定義 22

1.3 調査範囲 23

1.3.1 対象市場と対象地域 23

1.3.2 対象範囲と除外項目 23

1.3.3 考慮した年数 24

1.3.4 考慮した通貨 24

1.4 利害関係者 24

1.5 AI/ジェネAIのインパクト 24

2 調査方法 25

2.1 調査データ 25

2.1.1 二次データ 26

2.1.1.1 二次調査の主な情報源 26

2.1.2 一次データ 26

2.1.2.1 主要な一次情報源 27

2.1.2.2 主要な業界インサイト 28

2.1.2.3 一次インタビューの内訳 28

2.2 市場規模の推定 29

2.2.1 ボトムアップアプローチ 31

2.2.1.1 企業収益推計アプローチ 31

2.2.1.2 顧客ベースの市場推定 32

2.2.1.3 成長予測アプローチ 32

2.2.1.4 CAGR予測 33

2.3 データ三角測量 33

2.4 市場シェア分析 34

2.5 リサーチの前提 35

2.5.1 パラメトリックな仮定 35

2.5.2 成長率の仮定 35

2.6 調査の限界 35

2.7 リスク評価 36

3 エグゼクティブ・サマリー 37

4 プレミアムインサイト 40

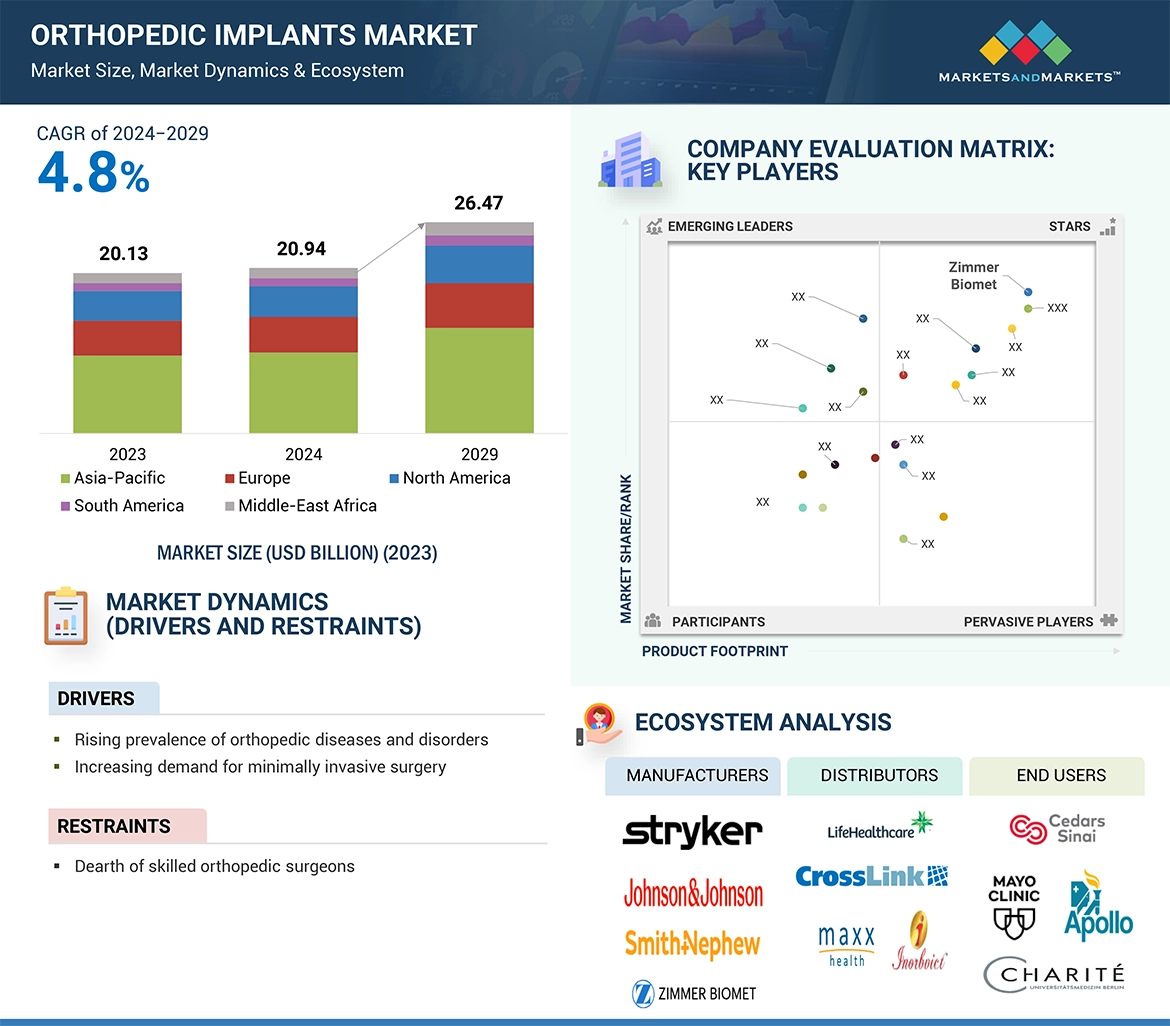

4.1 整形外科用インプラント市場の概要 40

4.2 北米:整形外科用インプラント市場:タイプ別 41

4.3 欧州: 整形外科用インプラント市場、材料別 41

4.4 アジア太平洋地域:整形外科用インプラント市場:エンドユーザー別(百万米ドル) 42

4.5 整形外科用インプラント市場における地理的成長機会 43

5 市場の概要 44

5.1 はじめに 44

5.2 市場ダイナミクス 44

5.2.1 推進要因 45

5.2.1.1 整形外科疾患および障害の有病率の上昇 45

5.2.1.2 低侵襲手術に対する需要の増加 45

5.2.1.3 スポーツ傷害の増加 46

5.2.1.4 研究資金と認知度向上のためのイニシアチブの増加 46

5.2.2 阻害要因 47

5.2.2.1 整形外科手術に伴うリスクと合併症

外科的処置に伴うリスクと合併症 47

5.2.2.2 整形外科手術の高額費用 47

5.2.3 機会 47

5.2.3.1 ロボット手術と3Dプリンティングの進歩 47

5.2.3.2 新興市場における成長機会 48

5.2.4 課題 49

5.2.4.1 熟練した整形外科医の不足 49

5.3 バリューチェーン分析 50

5.3.1 研究・製品開発 50

5.3.2 原材料の調達と製造 51

5.3.3 流通、マーケティング&販売、ポストセールス・サービス 51

5.4 サプライチェーン分析 52

5.4.1 メーカー 52

5.4.1.1 著名企業 52

5.4.1.2 中小企業 52

5.4.2 エンドユーザー 53

5.5 エコシステム分析 53

5.6 規制の状況 54

5.6.1 規制機関、政府機関、

その他の組織 54

5.6.2 規制分析 57

5.6.2.1 北米 57

5.6.2.1.1 米国 57

5.6.2.1.2 カナダ 59

5.6.2.2 欧州 61

5.6.2.3 アジア太平洋 63

5.6.2.3.1 日本 63

5.6.2.3.2 中国 64

5.6.2.3.3 インド 65

5.6.2.4 ラテンアメリカ 66

5.6.2.4.1 ブラジル 66

5.6.3 薬事承認 66

5.7償還シナリオ 66

5.8 投資と資金調達のシナリオ 68

5.9 価格分析 70

5.9.1 平均販売価格(地域別) 70

5.9.2 平均販売価格、主要プレーヤー別 72

5.10 貿易分析 72

5.10.1 HSコード9021の輸入データ 72

5.10.2 HSコード9021の輸出データ 73

5.11 特許分析 74

5.12 ポーターの5つの力分析 76

5.12.1 新規参入の脅威 77

5.12.2 代替品の脅威 77

5.12.3 供給者の交渉力 77

5.12.4 買い手の交渉力 77

5.12.5 競合の激しさ 77

5.13 主要ステークホルダーと購買基準 78

5.13.1 購入プロセスにおける主要ステークホルダー 78

5.13.2 主要な購買基準 79

5.14 主要な会議とイベント(2024~2025年) 80

5.15 ケーススタディ分析 81

5.15.1 患者の治療経路を改善するために設計されたデジタルプラットフォーム 81

5.15.2 ロサ・パーシャル・ニー・システムを用いた部分膝関節置換術 82

パーシャル・ニー・システム 82

5.15.3 Shapegrabber 3Dによる正確なデータ生成 82

5.16 技術分析 82

5.16.1 主要技術 82

5.16.1.1 3Dプリンティング/付加製造 82

5.16.2 補足技術 83

5.16.2.1 ロボット整形外科 83

5.16.3 隣接技術 83

5.16.3.1 画像診断 83

5.17 顧客のビジネスに影響を与えるトレンド/混乱 84

5.18 アンメット・ニーズ 84

5.19 整形外科用インプラント市場におけるAI/GEN AIの影響 85

5.19.1 主な使用例 86

6 整形外科用インプラント市場、タイプ別 88

6.1 はじめに

6.2 膝インプラント 89

6.2.1 成長を支える膝インプラントの継続的な技術革新 89

6.3 股関節インプラント 90

6.3.1 股関節骨折の増加と人工股関節置換術の成功率の上昇が市場成長を支える 90

6.4 肩関節インプラント 91

6.4.1 新しい人工肩関節インプラントの発売と肩関節逆置換術の人気の高まりが市場成長を支

市場成長を支える 91

6.5 肘インプラント 92

6.5.1 肘関節骨折の頻度増加と高齢者人口の増加が市場を牽引 92

6.6 足関節インプラント 93

6.6.1 足関節置換術件数の増加が市場成長を促進

市場の成長を促進 93

6.7 手首インプラント 94

6.7.1 手首の人工関節置換術件数の増加が市場を牽引

が市場を牽引 94

6.8 その他のインプラント 95

7 整形外科用インプラント市場、材料別 96

7.1 導入 97

7.2 ハイブリッドインプラント 97

7.2.1 生体適合性の改善、機械的性能の向上、

再手術のリスク軽減が市場を牽引 97

7.3 金属・金属合金 98

7.3.1 ステンレス鋼 99

7.3.1.1 手頃な価格で入手可能なステンレス鋼の増加が市場を牽引 99

市場を牽引

7.3.2 チタン合金 100

7.3.2.1 生体適合性と高応力に耐える能力が採用を促進 100

採用の推進力 100

7.3.3 その他の金属及び金属合金 100

7.4 ポリマー 101

7.4.1 ポリマーの設計の柔軟性と調整可能な特性

が成長を促進する 101

7.5 セラミックス 102

7.5.1 低摩擦特性と耐摩耗性。

市場が活性化 102

8 整形外科用インプラント市場、エンドユーザー別 103

8.1 導入 104

8.2 病院および手術センター 104

8.2.1 整形外科手術件数の増加が市場を牽引 104

8.3 外来・外傷治療センター 105

8.3.1 外来医療センターが提供する費用対効果の高い治療が市場成長を促進 105

9 整形外科インプラント市場:地域別 107

9.1 はじめに 108

9.2 北米 108

9.2.1 北米のマクロ経済見通し 111

9.2.2 米国 112

9.2.2.1 予測期間中、北米の整形外科インプラント市場は米国が支配的 112

予測期間中 112

9.2.3 カナダ 113

9.2.3.1 変性骨疾患の発生率の増加が市場成長を支える 113

市場成長を支える 113

9.3 欧州 114

9.3.1 欧州のマクロ経済見通し 114

9.3.2 ドイツ 117

9.3.2.1 欧州で最大の市場シェアを占めるドイツ 117

9.3.3 フランス 118

9.3.3.1 肥満の増加と整形外科用インプラントの大幅な普及が市場成長を支える 118

9.3.4 イギリス 119

9.3.4.1 整形外科疾患に対する意識の高まりが革新的治療の採用を促進 119

9.3.5 イタリア 120

9.3.5.1 筋骨格系損傷の予防医療に対する意識の高まりが市場を牽引 120

9.3.6 スペイン 121

9.3.6.1 低侵襲手術への嗜好の高まりが市場を牽引 121

9.3.7 その他のヨーロッパ 122

9.4 アジア太平洋地域 123

9.4.1 アジア太平洋地域のマクロ経済見通し 123

9.4.2 日本 128

9.4.2.1 急増する老年人口が市場を牽引 128

9.4.3 中国 128

9.4.3.1 ターゲット患者層の拡大が市場を牽引 128

9.4.4 インド 129

9.4.4.1 ロボット支援人工関節置換術を導入する病院数の増加が市場成長を支える 129

9.4.5 オーストラリア 130

9.4.5.1 政府の好意的な取り組みが市場成長を促進 130

9.4.6 韓国 131

9.4.6.1 研究開発と資金調達の増加が市場を牽引 131

9.4.7 その他のアジア太平洋地域 132

9.5 ラテンアメリカ 132

9.5.1 ラテンアメリカのマクロ経済見通し 133

9.5.2 ブラジル 136

9.5.2.1 グローバル企業の強いプレゼンスが市場を牽引 136

9.5.3 メキシコ 137

9.5.3.1 医療機器メーカーに有利な投資シナリオが市場成長を促進 137

9.5.4 その他のラテンアメリカ 138

9.6 中東・アフリカ 139

9.6.1 高品質な治療法の普及が市場を牽引 139

9.6.2 中東・アフリカのマクロ経済見通し 139

10 競争環境 143

10.1 概要 143

10.2 主要プレーヤーの戦略/勝利への権利(2021~2024年) 143

10.2.1 整形外科インプラント市場で各社が採用した戦略の概要

整形外科インプラント市場 144

10.3 収益分析(2019-2023年) 147

10.4 市場シェア分析 148

10.5 企業評価マトリックス:主要企業、2023年 149

10.5.1 スター企業 149

10.5.2 新興リーダー 149

10.5.3 浸透型プレイヤー 150

10.5.4 参加企業 150

10.5.5 企業フットプリント:主要プレーヤー、2023年 151

10.5.5.1 企業フットプリント 151

10.5.5.2 地域別フットプリント 152

10.5.5.3 タイプ別フットプリント 153

10.5.5.4 素材別フットプリント 154

10.5.5.5 エンドユーザー・フットプリント 155

10.6 企業評価マトリクス:新興企業/SM(2023年) 155

10.6.1 進歩的企業 155

10.6.2 対応力のある企業 155

10.6.3 ダイナミックな企業 156

10.6.4 スターティング・ブロック 156

10.6.5 競争ベンチマーク:新興企業/SM(2023年) 157

10.7 評価と財務指標 159

10.7.1 財務指標 159

10.7.2 企業評価 160

10.8 ブランド/製品の比較 161

10.9 競争シナリオ 161

10.9.1 製品の上市と承認 161

10.9.2 取引 162

10.9.3 事業拡大 162

11 会社プロファイル 163

11.1 主要企業 163

Stryker Corporation(米国)

Zimmer Biomet Holdings,Inc.(米国)

Johnson & Johnson MedTech(米国)

Smith+Nephew(英国)

B. Braun(ドイツ)

Globus Medical Inc. (米国)

Enovis(米国)

Acumed LLC(米国)

Orthofix Medical Inc(米国)

MicroPort Scientiifc Corporation(中国)

CONMED Corporation(米国)

Medacta International(スイス)

Paragon 28 Inc. (インド)

12 付録 252

12.1 ディスカッションガイド 252

12.2 Knowledgestore: Marketsandmarketsの購読ポータル 256

12.3 カスタマイズオプション 258

12.4 関連レポート 258

12.5 著者の詳細 259

Increased access to various type of orthopedic implants and technological advancements such as use of 3D printing with the manufacturing process has increased demand for the orthopedic implants. Further, increased incidence of accidents and sport injuries that may result in fractures and damage to the joints has enhanced the demand for the orthopedic implants.

“The knee implants segment of type segment held the largest share of the market in 2023”

The orthopedic implants market is segmented based on type into knee implants, hip implants, shoulder implants, elbow implants, foot & ankle implants, wrist implants and other implants. The knee implants accounted for a the highest share in 2023. Increase in technological innovations, rise in number of obesity cases and the favorable reimbursement scenario for knee replacement procedures is anticipated to fuel the growth of the segment. Developments in robotic assisted knee replacement procedures that improves patient outcomes is another factor propelling the segment expansion. For example, compared to traditional surgery, the Mako Total Knee Replacement from Stryker Corporation can result in less discomfort and a shorter recovery period.

“The metals and metal alloys segment of material segment held the largest share of the market in 2023”

The orthopedic implants market can be segmented based on material into metals and metal alloys, ceramics, polymers and hybrid implants. Growing number for joint replacement surgeries such as reverse shoulder arthroplasty and unique properties such as longevity and resistance to corrosion drive the segment growth. Metal alloys are less expensive and more readily available than other materials. This makes them an appropriate choice for patients and other healthcare professionals especially in areas of price-sensitive markets, and is expected to fuel the segment growth.

“The ambulatory and trauma care centers segment for the end user segment is projected to register a significant CAGR during the forecast period.”

The orthopedic implants market is segmented by end-users into hospitals & surgical centers and ambulatory & trauma care centers. The ambulatory and trauma care centers is projected to register significant growthduring the forecast period. According to Definitive Healthcare there is 304% increase in knee replacement procedures performed in ambulatory surgery centers during the period of 2018-2022. The cost-effectiveness and accessibility anticipated to propel the segment growth. Furthermore, reduced recovery time using minimally invasive surgical techniques is expected to support the growth of this segment.

“The market in the Asia Pacific region is expected to witness the highest growth during the forecast period.”

The north america region accounted for major share in 2023. Asia pacific region to grow at the highest CAGR in orthopedic implants market. Healthcare infrastructure and service investments, in the emerging economies, are fostering the demand for orthopedic implants. Furthermore, market leaders have increased their efforts to strengthen their presence in the Asia Pacific market to meet the ever-growing requirement for orthopedic surgeries and joint replacements. According to International Osteoporosis Foundation more than 50% of osteoporotic hip fractures are expected to occur by 2050.

A breakdown of the primary participants referred to for this report is provided below:

• By Company Type: Tier 1–30%, Tier 2–42%, and Tier 3– 28%

• By Designation: Director-level–10%, C-level–14%, and Others–76%

• By Region: North America–40%, Europe–30%, Asia Pacific–22%, Latin America–6%, and Middle East & Africa - 2%

The prominent players in the orthopedic implants market are as Stryker Corporation (US), Zimmer Biomet Holdings,Inc. (US), Johnson & Johnson MedTech (US), Smith+Nephew (UK), B. Braun (Germany), Globus Medical, Inc. (US), Arthrex, Inc.(US), Enovis (US), Acumed LLC (US), Orthofix Medical Inc.(US) , MicroPort Scientiifc Corporation (China), CONMED Corporation (US), Medacta International (Switzerland), Paragon 28, Inc. (US) and, Meril Life Sciences Pvt. Ltd. (India)

The study includes as in-depth competitive analysis of these key players in the authentication and brand protection market, with their company profiles recent developments, and key market stratergies

Research Coverage

This report studies the orthopedic implants market based on type, material, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall orthopedic implants market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

• Analysis of key drivers (increasing demand for minimally invasive orthopedic surgical procedures and rising number of sports injuries, increasing prevalence of orthopedic diseases and disorders, and increasing research funding and awareness initiatives), restraints (risk and complications associated with orthopedic surgical procedures, high costs of orthopedic surgery), opportunities (growth opportunities in merging markets, advancements in robotic surgery and 3D printing), and challenges (dearth of skilled orthopedic surgeons) influencing the growth of the orthopedic implants market

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the orthopedic implants market

• Market Development: Comprehensive information about lucrative markets–the report analyses the orthopedic implants market across varied regions.

• Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the orthopedic implants market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Stryker Corporation (US), Zimmer Biomet Holdings, Inc. (US), Johnson & Johnson MedTech (US), Smith+Nephew (UK), B. Braun (Germany).

1 INTRODUCTION 22

1.1 STUDY OBJECTIVES 22

1.2 MARKET DEFINITION 22

1.3 STUDY SCOPE 23

1.3.1 MARKETS COVERED AND REGIONS CONSIDERED 23

1.3.2 INCLUSIONS AND EXCLUSIONS 23

1.3.3 YEARS CONSIDERED 24

1.3.4 CURRENCY CONSIDERED 24

1.4 STAKEHOLDERS 24

1.5 IMPACT OF AI/GEN AI 24

2 RESEARCH METHODOLOGY 25

2.1 RESEARCH DATA 25

2.1.1 SECONDARY DATA 26

2.1.1.1 Key sources for secondary research 26

2.1.2 PRIMARY DATA 26

2.1.2.1 Key primary sources 27

2.1.2.2 Key industry insights 28

2.1.2.3 Breakdown of primary interviews 28

2.2 MARKET SIZE ESTIMATION 29

2.2.1 BOTTOM-UP APPROACH 31

2.2.1.1 Company revenue estimation approach 31

2.2.1.2 Customer-based market estimation 32

2.2.1.3 Growth forecast approach 32

2.2.1.4 CAGR projections 33

2.3 DATA TRIANGULATION 33

2.4 MARKET SHARE ANALYSIS 34

2.5 RESEARCH ASSUMPTIONS 35

2.5.1 PARAMETRIC ASSUMPTIONS 35

2.5.2 GROWTH RATE ASSUMPTIONS 35

2.6 RESEARCH LIMITATIONS 35

2.7 RISK ASSESSMENT 36

3 EXECUTIVE SUMMARY 37

4 PREMIUM INSIGHTS 40

4.1 ORTHOPEDIC IMPLANTS MARKET OVERVIEW 40

4.2 NORTH AMERICA: ORTHOPEDIC IMPLANTS MARKET, BY TYPE 41

4.3 EUROPE: ORTHOPEDIC IMPLANTS MARKET, BY MATERIAL 41

4.4 ASIA PACIFIC: ORTHOPEDIC IMPLANTS MARKET, BY END USER (USD MILLION) 42

4.5 GEOGRAPHIC GROWTH OPPORTUNITIES IN ORTHOPEDIC IMPLANTS MARKET 43

5 MARKET OVERVIEW 44

5.1 INTRODUCTION 44

5.2 MARKET DYNAMICS 44

5.2.1 DRIVERS 45

5.2.1.1 Rising prevalence of orthopedic diseases and disorders 45

5.2.1.2 Increasing demand for minimally invasive surgery 45

5.2.1.3 Rising number of sports injuries 46

5.2.1.4 Increasing research funding and awareness initiatives 46

5.2.2 RESTRAINTS 47

5.2.2.1 Risks and complications associated with orthopedic

surgical procedures 47

5.2.2.2 High cost of orthopedic surgery 47

5.2.3 OPPORTUNITIES 47

5.2.3.1 Advancements in robotic surgery and 3D printing 47

5.2.3.2 Growth opportunities in emerging markets 48

5.2.4 CHALLENGES 49

5.2.4.1 Dearth of skilled orthopedic surgeons 49

5.3 VALUE CHAIN ANALYSIS 50

5.3.1 RESEARCH & PRODUCT DEVELOPMENT 50

5.3.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING 51

5.3.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES 51

5.4 SUPPLY CHAIN ANALYSIS 52

5.4.1 MANUFACTURERS 52

5.4.1.1 Prominent companies 52

5.4.1.2 Small and medium-sized enterprises 52

5.4.2 END USERS 53

5.5 ECOSYSTEM ANALYSIS 53

5.6 REGULATORY LANDSCAPE 54

5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 54

5.6.2 REGULATORY ANALYSIS 57

5.6.2.1 North America 57

5.6.2.1.1 US 57

5.6.2.1.2 Canada 59

5.6.2.2 Europe 61

5.6.2.3 Asia Pacific 63

5.6.2.3.1 Japan 63

5.6.2.3.2 China 64

5.6.2.3.3 India 65

5.6.2.4 Latin America 66

5.6.2.4.1 Brazil 66

5.6.3 REGULATORY APPROVALS 66

5.7 REIMBURSEMENT SCENARIO 66

5.8 INVESTMENT AND FUNDING SCENARIO 68

5.9 PRICING ANALYSIS 70

5.9.1 AVERAGE SELLING PRICE, BY REGION 70

5.9.2 AVERAGE SELLING PRICE, BY KEY PLAYER 72

5.10 TRADE ANALYSIS 72

5.10.1 IMPORT DATA FOR HS CODE 9021 72

5.10.2 EXPORT DATA FOR HS CODE 9021 73

5.11 PATENT ANALYSIS 74

5.12 PORTER’S FIVE FORCES ANALYSIS 76

5.12.1 THREAT OF NEW ENTRANTS 77

5.12.2 THREAT OF SUBSTITUTES 77

5.12.3 BARGAINING POWER OF SUPPLIERS 77

5.12.4 BARGAINING POWER OF BUYERS 77

5.12.5 INTENSITY OF COMPETITIVE RIVALRY 77

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA 78

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS 78

5.13.2 KEY BUYING CRITERIA 79

5.14 KEY CONFERENCES AND EVENTS, 2024–2025 80

5.15 CASE STUDY ANALYSIS 81

5.15.1 DIGITAL PLATFORM DESIGNED TO IMPROVE PATIENT CARE PATHWAYS 81

5.15.2 PARTIAL KNEE ARTHROPLASTY PERFORMED WITH ROSA

PARTIAL KNEE SYSTEM 82

5.15.3 ACCURATE DATA GENERATION WITH SHAPEGRABBER 3D 82

5.16 TECHNOLOGY ANALYSIS 82

5.16.1 KEY TECHNOLOGIES 82

5.16.1.1 3D printing/additive manufacturing 82

5.16.2 COMPLEMENTARY TECHNOLOGIES 83

5.16.2.1 Robotic orthopedic surgery 83

5.16.3 ADJACENT TECHNOLOGIES 83

5.16.3.1 Diagnostic imaging 83

5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS 84

5.18 UNMET NEEDS 84

5.19 IMPACT OF AI/GEN AI ON ORTHOPEDIC IMPLANTS MARKET 85

5.19.1 KEY USE CASES 86

6 ORTHOPEDIC IMPLANTS MARKET, BY TYPE 88

6.1 INTRODUCTION 89

6.2 KNEE IMPLANTS 89

6.2.1 ONGOING INNOVATION IN KNEE IMPLANTS TO SUPPORT GROWTH 89

6.3 HIP IMPLANTS 90

6.3.1 RISING NUMBER OF HIP FRACTURES AND INCREASING SUCCESS RATE OF HIP ARTHROPLASTY TO SUPPORT MARKET GROWTH 90

6.4 SHOULDER IMPLANTS 91

6.4.1 LAUNCH OF NEW SHOULDER REPLACEMENT IMPLANTS AND RISING POPULARITY OF REVERSE SHOULDER ARTHROPLASTY TO

SUPPORT MARKET GROWTH 91

6.5 ELBOW IMPLANTS 92

6.5.1 INCREASING FREQUENCY OF ELBOW JOINT FRACTURES AND GROWTH IN ELDERLY POPULATION TO DRIVE MARKET 92

6.6 FOOT & ANKLE IMPLANTS 93

6.6.1 RISING NUMBER OF ANKLE REPLACEMENT PROCEDURES TO

FUEL MARKET GROWTH 93

6.7 WRIST IMPLANTS 94

6.7.1 GROWING NUMBER OF WRIST REPLACEMENT PROCEDURES

TO DRIVE MARKET 94

6.8 OTHER IMPLANTS 95

7 ORTHOPEDIC IMPLANTS MARKET, BY MATERIAL 96

7.1 INTRODUCTION 97

7.2 HYBRID IMPLANTS 97

7.2.1 IMPROVED BIOCOMPATIBILITY, BETTER MECHANICAL PERFORMANCE,

AND REDUCED RISKS OF REVISION SURGERIES TO DRIVE MARKET 97

7.3 METALS & METAL ALLOYS 98

7.3.1 STAINLESS STEEL 99

7.3.1.1 Growing affordability and availability of stainless steel to

drive market 99

7.3.2 TITANIUM ALLOYS 100

7.3.2.1 Biocompatibility and ability to withstand high stress to

propel adoption 100

7.3.3 OTHER METALS & METAL ALLOYS 100

7.4 POLYMERS 101

7.4.1 DESIGN FLEXIBILITY AND TUNABLE PROPERTIES OF POLYMERS

TO PROPEL GROWTH 101

7.5 CERAMICS 102

7.5.1 LOW FRICTIONAL PROPERTIES AND RESISTANCE AGAINST WEAR

TO FUEL MARKET 102

8 ORTHOPEDIC IMPLANTS MARKET, BY END USER 103

8.1 INTRODUCTION 104

8.2 HOSPITALS & SURGICAL CENTERS 104

8.2.1 RISING NUMBER OF ORTHOPEDIC SURGERIES TO DRIVE MARKET 104

8.3 AMBULATORY & TRAUMA CARE CENTERS 105

8.3.1 COST-EFFECTIVE TREATMENT OFFERED BY AMBULATORY CARE CENTERS TO PROPEL MARKET GROWTH 105

9 ORTHOPEDIC IMPLANTS MARKET, BY REGION 107

9.1 INTRODUCTION 108

9.2 NORTH AMERICA 108

9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 111

9.2.2 US 112

9.2.2.1 US to dominate North American orthopedic implants market

during forecast period 112

9.2.3 CANADA 113

9.2.3.1 Rising incidence of degenerative bone diseases to

support market growth 113

9.3 EUROPE 114

9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 114

9.3.2 GERMANY 117

9.3.2.1 Germany to account for largest market share in Europe 117

9.3.3 FRANCE 118

9.3.3.1 Increasing obesity and significant adoption of orthopedic implants to support market growth 118

9.3.4 UK 119

9.3.4.1 Increasing awareness of orthopedic conditions to drive adoption of innovative treatments 119

9.3.5 ITALY 120

9.3.5.1 Increasing awareness of preventive care for musculoskeletal injuries to drive market 120

9.3.6 SPAIN 121

9.3.6.1 Growing preference for minimally invasive surgical procedures to drive market 121

9.3.7 REST OF EUROPE 122

9.4 ASIA PACIFIC 123

9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 123

9.4.2 JAPAN 128

9.4.2.1 Rapidly growing geriatric population to propel market 128

9.4.3 CHINA 128

9.4.3.1 Expanding target patient population to drive market 128

9.4.4 INDIA 129

9.4.4.1 Increasing number of hospitals adopting robotic-assisted joint replacement surgery to support market growth 129

9.4.5 AUSTRALIA 130

9.4.5.1 Favorable government initiatives to promote market growth 130

9.4.6 SOUTH KOREA 131

9.4.6.1 Rising R&D and funding to drive market 131

9.4.7 REST OF ASIA PACIFIC 132

9.5 LATIN AMERICA 132

9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 133

9.5.2 BRAZIL 136

9.5.2.1 Strong presence of global players to drive market 136

9.5.3 MEXICO 137

9.5.3.1 Favorable investment scenario for medical device manufacturers to favor market growth 137

9.5.4 REST OF LATIN AMERICA 138

9.6 MIDDLE EAST & AFRICA 139

9.6.1 GROWING AVAILABILITY OF HIGH-QUALITY TREATMENTS TO DRIVE MARKET 139

9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 139

10 COMPETITIVE LANDSCAPE 143

10.1 OVERVIEW 143

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024 143

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN

ORTHOPEDIC IMPLANTS MARKET 144

10.3 REVENUE ANALYSIS, 2019−2023 147

10.4 MARKET SHARE ANALYSIS 148

10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 149

10.5.1 STARS 149

10.5.2 EMERGING LEADERS 149

10.5.3 PERVASIVE PLAYERS 150

10.5.4 PARTICIPANTS 150

10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 151

10.5.5.1 Company footprint 151

10.5.5.2 Region footprint 152

10.5.5.3 Type footprint 153

10.5.5.4 Material footprint 154

10.5.5.5 End-user footprint 155

10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 155

10.6.1 PROGRESSIVE COMPANIES 155

10.6.2 RESPONSIVE COMPANIES 155

10.6.3 DYNAMIC COMPANIES 156

10.6.4 STARTING BLOCKS 156

10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 157

10.7 VALUATION & FINANCIAL METRICS 159

10.7.1 FINANCIAL METRICS 159

10.7.2 COMPANY VALUATION 160

10.8 BRAND/PRODUCT COMPARISON 161

10.9 COMPETITIVE SCENARIO 161

10.9.1 PRODUCT LAUNCHES & APPROVALS 161

10.9.2 DEALS 162

10.9.3 EXPANSIONS 162

11 COMPANY PROFILES 163

11.1 KEY PLAYERS 163

11.1.1 ZIMMER BIOMET HOLDINGS, INC. 163

11.1.1.1 Business overview 163

11.1.1.2 Products offered 164

11.1.1.3 Recent developments 167

11.1.1.3.1 Product approvals 167

11.1.1.3.2 Deals 167

11.1.1.4 MnM view 167

11.1.1.4.1 Key strengths 167

11.1.1.4.2 Strategic choices 168

11.1.1.4.3 Weaknesses and competitive threats 168

11.1.2 STRYKER CORPORATION 169

11.1.2.1 Business overview 169

11.1.2.2 Products offered 170

11.1.2.3 Recent developments 174

11.1.2.3.1 Deals 174

11.1.2.3.2 Expansions 174

11.1.2.4 MnM view 174

11.1.2.4.1 Right to win 174

11.1.2.4.2 Strategic choices 174

11.1.2.4.3 Weaknesses and competitive threats 175

11.1.3 JOHNSON & JOHNSON MEDTECH 176

11.1.3.1 Business overview 176

11.1.3.2 Products offered 177

11.1.3.3 Recent developments 179

11.1.3.3.1 Product launches & approvals 179

11.1.3.3.2 Deals 180

11.1.3.4 MnM view 180

11.1.3.4.1 Right to win 180

11.1.3.4.2 Strategic choices 180

11.1.3.4.3 Weaknesses and competitive threats 180

11.1.4 SMITH+NEPHEW 181

11.1.4.1 Business overview 181

11.1.4.2 Products offered 182

11.1.4.3 Recent developments 184

11.1.4.3.1 Product launches & approvals 184

11.1.4.3.2 Deals 185

11.1.4.3.3 Expansions 185

11.1.5 B. BRAUN 186

11.1.5.1 Business overview 186

11.1.5.2 Products offered 187

11.1.6 GLOBUS MEDICAL, INC. 190

11.1.6.1 Business overview 190

11.1.6.2 Products offered 191

11.1.6.3 Recent developments 192

11.1.6.3.1 Product launches & approvals 192

11.1.6.3.2 Deals 193

11.1.7 ARTHREX, INC. 194

11.1.7.1 Business overview 194

11.1.7.2 Products offered 194

11.1.8 ENOVIS 200

11.1.8.1 Business overview 200

11.1.8.2 Products offered 201

11.1.8.3 Recent developments 203

11.1.8.3.1 Product launches 203

11.1.8.3.2 Deals 203

11.1.8.3.3 Expansions 204

11.1.9 ACUMED LLC 205

11.1.9.1 Business overview 205

11.1.9.2 Products offered 205

11.1.9.3 Recent developments 207

11.1.9.3.1 Product launches 207

11.1.9.3.2 Deals 208

11.1.9.3.3 Expansions 208

11.1.10 ORTHOFIX MEDICAL INC. 209

11.1.10.1 Business overview 209

11.1.10.2 Products offered 210

11.1.10.3 Recent developments 212

11.1.10.3.1 Product launches & approvals 212

11.1.10.3.2 Deals 212

11.1.11 MICROPORT SCIENTIFIC CORPORATION 213

11.1.11.1 Business overview 213

11.1.11.2 Products offered 214

11.1.11.3 Recent developments 215

11.1.11.3.1 Product launches 215

11.1.11.3.2 Deals 216

11.1.12 CONMED CORPORATION 217

11.1.12.1 Business overview 217

11.1.12.2 Products offered 218

11.1.12.3 Recent developments 219

11.1.12.3.1 Deals 219

11.1.13 MEDACTA INTERNATIONAL 220

11.1.13.1 Business overview 220

11.1.13.2 Products offered 221

11.1.13.3 Recent developments 222

11.1.13.3.1 Product approvals 222

11.1.13.3.2 Deals 222

11.1.13.3.3 Expansions 223

11.1.14 PARAGON 28, INC. 224

11.1.14.1 Business overview 224

11.1.14.2 Products offered 225

11.1.14.3 Recent developments 227

11.1.14.3.1 Product launches & approvals 227

11.1.14.3.2 Deals 228

11.1.15 MERIL LIFE SCIENCES PVT. LTD. 229

11.1.15.1 Business overview 229

11.1.15.2 Products offered 229

11.1.15.3 Recent developments 231

11.1.15.3.1 Expansions 231

11.2 OTHER PLAYERS 232

11.2.1 FH ORTHO SAS 232

11.2.2 SYMBIOS ORTHOPÉDIE S.A. 233

11.2.3 MADISON ORTHO 234

11.2.4 GREEN SURGICALS PVT. LTD. 236

11.2.5 SIORA SURGICALS PRIVATE LIMITED 241

11.2.6 ORTHOPEDIATRICS CORP. 244

11.2.7 RESTOR3D 245

11.2.8 DOUBLE MEDICAL TECHNOLOGY INC. 246

11.2.9 TREACE MEDICAL CONCEPTS, INC. 249

11.2.10 AK MEDICAL HOLDINGS LIMITED 250

12 APPENDIX 252

12.1 DISCUSSION GUIDE 252

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 256

12.3 CUSTOMIZATION OPTIONS 258

12.4 RELATED REPORTS 258

12.5 AUTHOR DETAILS 259

❖ 世界の整形外科用インプラント市場に関するよくある質問(FAQ) ❖

・整形外科用インプラントの世界市場規模は?

→MarketsandMarkets社は2024年の整形外科用インプラントの世界市場規模を209.4億米ドルと推定しています。

・整形外科用インプラントの世界市場予測は?

→MarketsandMarkets社は2029年の整形外科用インプラントの世界市場規模を264.7億米ドルと予測しています。

・整形外科用インプラント市場の成長率は?

→MarketsandMarkets社は整形外科用インプラントの世界市場が2024年~2029年に年平均4.8%成長すると予測しています。

・世界の整形外科用インプラント市場における主要企業は?

→MarketsandMarkets社は「Stryker Corporation(米国)、Zimmer Biomet Holdings,Inc.(米国)、Johnson & Johnson MedTech(米国)、Smith+Nephew(英国)、B. Braun(ドイツ)、Globus Medical, Inc. (米国)、Enovis(米国)、Acumed LLC(米国)、Orthofix Medical Inc(米国)、MicroPort Scientiifc Corporation(中国)、CONMED Corporation(米国)、Medacta International(スイス)、Paragon 28, Inc. (インド)など ...」をグローバル整形外科用インプラント市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。