1 はじめに 38

1.1 調査目的 38

1.2 市場の定義 38

1.3 調査範囲 39

1.3.1 対象市場と地域範囲 39

1.3.2 対象範囲と除外範囲 40

1.3.3 考慮した年数 41

1.4 考慮した通貨 41

1.5 利害関係者 41

1.6 市場との調整 41

2 調査方法 42

2.1 調査データ 42

2.1.1 二次データ 43

2.1.1.1 二次ソースからの主要データ 44

2.1.2 一次データ 44

2.1.2.1 一次情報源 45

2.1.2.2 主要な業界インサイト 46

2.1.2.3 一次情報源からの主要データ 46

2.1.2.4 一次インタビューの内訳 47

2.2 市場規模の推定 48

2.2.1 ボトムアップアプローチ 48

2.2.1.1 アプローチ1:企業収益推定アプローチ 48

2.2.1.2 アプローチ2:企業プレゼンテーションと一次ヒアリング 49

2.2.1.3 アプローチ3:プライマリーインタビュー 49

2.2.1.4 成長予測 49

2.2.1.5 CAGR予測 49

2.2.2 トップダウンアプローチ 50

2.3 市場の内訳とデータの三角測量 51

2.4 調査の前提 52

2.4.1 調査に関する前提条件 52

2.4.2 パラメトリックな前提 52

2.5 調査の限界

2.6 リスク評価

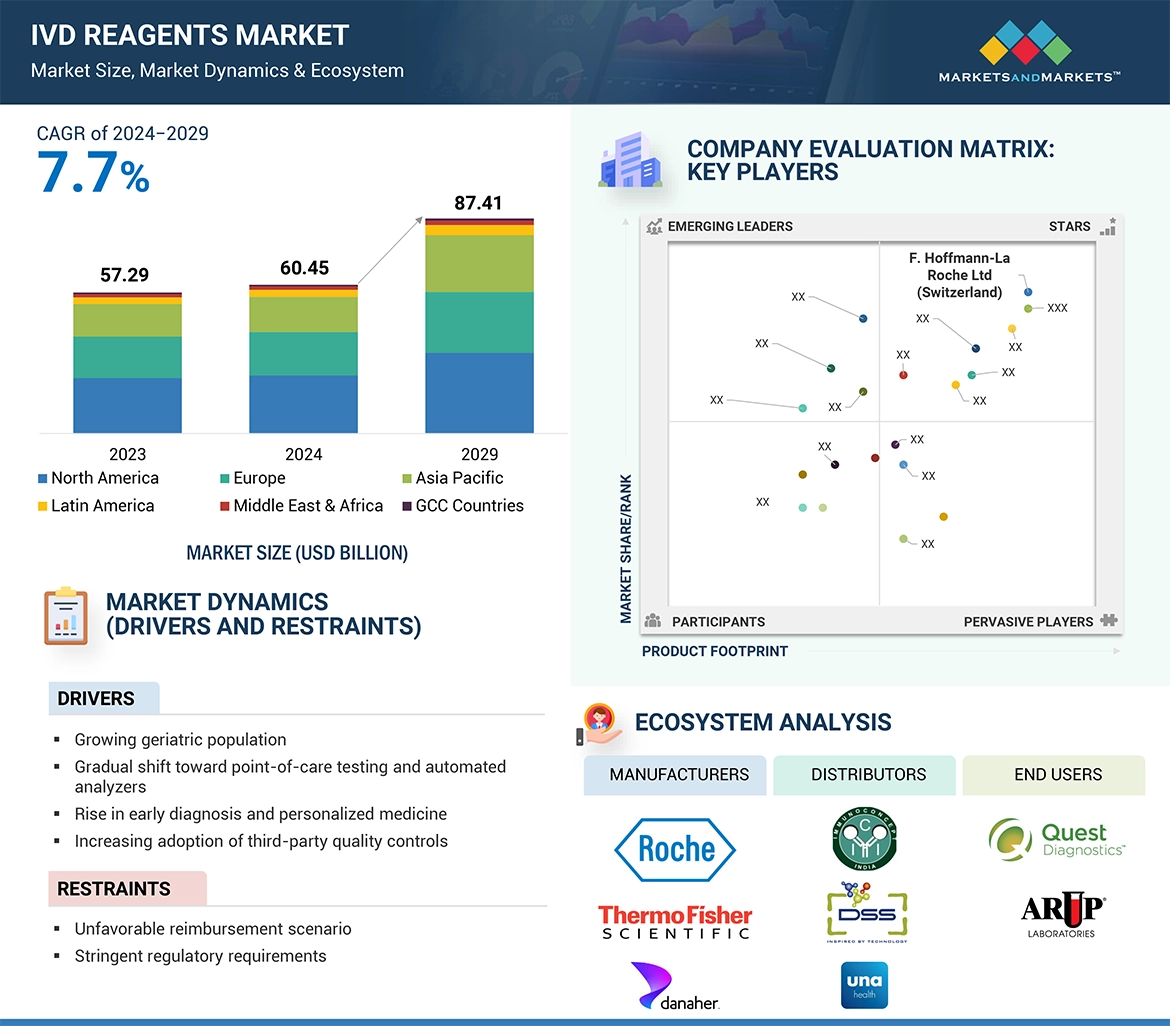

3 エグゼクティブ・サマリー 54

4 プレミアムインサイト 59

4.1 IVD試薬市場の概要 59

4.2 アジア太平洋地域:IVD試薬市場:国別 60

4.3 北米:IVD試薬市場:検査タイプ別、国別 60

4.4 IVD試薬市場:国別 61

5 市場の概要 62

5.1 はじめに 62

5.2 市場ダイナミクス 62

5.2.1 推進要因 63

5.2.1.1 高齢者人口の増加 63

5.2.1.2 ポイントオブケア検査と自動分析装置への漸進的シフト 64

5.2.1.3 早期診断と個別化医療の増加 65

5.2.1.4 第三者機関による品質管理の採用増加 66

5.2.1.5 バイオテクノロジーとバイオ医薬品産業の成長 67

5.2.1.6 研究開発活動のための資金調達の増加 67

5.2.2 阻害要因 68

5.2.2.1 不利な償還シナリオ 68

5.2.2.2 厳しい規制要件 68

5.2.3 機会 69

5.2.3.1 バイオマーカー開発の増加 69

5.2.3.2 コンパニオン診断薬の重要性の高まり 70

5.2.3.3 新興国における市場成長機会 71

5.2.3.4 デジタル化の進展 72

5.2.4 課題 73

5.2.4.1 臨床プロセスにおける運用上の課題 73

5.3 顧客のビジネスに影響を与えるトレンド/混乱 74

5.4 価格分析 75

5.4.1 主要企業の平均販売価格動向(用途別) 75

5.4.2 主要企業の平均販売価格動向(地域別) 76

5.4.3 技術別の平均販売価格動向 77

5.5 バリューチェーン分析 77

5.6 サプライチェーン分析 79

5.7 エコシステム分析 80

5.8 投資と資金調達のシナリオ 81

5.9 技術分析 81

5.9.1 主要技術 82

5.9.2 隣接技術 83

5.9.2.1 多重化ポイントオブケア検査 83

5.9.2.2 核酸ラテラルフロー免疫測定法 83

5.9.2.3 DNAベースの検出 83

5.9.2.4 免疫診断法 83

5.9.2.5 デュアルパス技術 83

5.10 特許分析 84

5.11 貿易分析 85

5.11.1 輸入データ 85

5.11.2 輸出データ 85

5.12 主要会議・イベント(2024-2025年) 86

5.13 ポーターのファイブフォース分析 86

5.13.1 新規参入の脅威 87

5.13.2 代替品の脅威 87

5.13.3 供給者の交渉力 88

5.13.4 買い手の交渉力 88

5.13.5 競合の激しさ 88

5.14 規制分析 88

5.14.1 規制の状況 88

5.14.1.1 北米 89

5.14.1.1.1 米国 89

5.14.1.1.2 カナダ 90

5.14.1.2 欧州 90

5.14.1.3 アジア太平洋 92

5.14.1.3.1 中国 92

5.14.1.3.2 日本 92

5.14.1.3.3 インド 93

5.14.1.4 中南米 93

5.14.1.4.1 ブラジル 93

5.14.1.5 中東 94

5.14.2 規制機関、政府機関、その他の組織 94

5.14.2.1 北米 94

5.14.2.2 欧州 95

5.14.2.3 アジア太平洋 95

5.14.2.4 ラテンアメリカ 96

5.14.2.5 中東・アフリカ 96

5.14.2.6 GCC諸国 96

5.15 主要ステークホルダーと購買基準 97

5.15.1 購入プロセスにおける主要ステークホルダー 97

5.15.2 購入基準 98

5.16 AI/ジェネレーティブAIがIVD試薬市場に与える影響 98

5.16.1 導入 98

5.16.2 IVD試薬の市場ポテンシャル 98

5.16.3 AIの使用事例 99

5.16.4 AIを導入する主要企業 100

5.16.5 IVD試薬におけるジェネレーティブAIの将来性 100

6 IVD試薬市場、タイプ別 101

6.1 導入 102

6.2 抗体 102

6.2.1 モノクローナル抗体 105

6.2.1.1 癌罹患率の増加が成長を刺激 105

6.2.2 ポリクローナル抗体 107

6.2.2.1 感染症や自己免疫疾患の有病率の増加が成長を後押し 107

成長を支える 107

6.3 抗原、精製タンパク質、ペプチド 110

6.3.1 高度な精密医療への注目の高まりが成長を促進 110

成長を促す 110

6.4 オリゴヌクレオチド 113

6.4.1 分子診断への志向の高まりが市場を牽引 113

6.5 核酸プローブ 116

6.5.1 病気の早期発見と低存在バイオマーカーのモニタリングの必要性が成長を後押し 116

6.6 その他のIVD試薬 119

7 IVD試薬市場:技術別 123

7.1 導入 124

7.2 イムノアッセイ 124

7.2.1 自動化傾向の高まりが成長を促進 124

7.3 臨床化学 128

7.3.1 糖尿病有病率の上昇がセグメントを押し上げる 128

7.4 分子診断薬 131

7.4.1 血液スクリーニングとポイントオブケア検査の需要拡大が

市場が活性化 131

7.5 血液学 133

7.5.1 幹細胞研究への注目の高まりが成長を加速 133

7.6 微生物学 136

7.6.1 微生物感染症の流行増加が市場を刺激 136

7.7 凝固・止血 138

7.7.1 抗凝固療法の普及が市場を牽引 138

7.8 尿検査 141

7.8.1 腎臓疾患の有病率の上昇が市場成長を支える 141

7.9 クロマトグラフィー&質量分析 144

7.9.1 疾患スクリーニング、法医学分析、薬物治療における用途の増加、

薬物療法が市場を押し上げる 144

7.10 免疫組織化学 146

7.10.1 がん診断のための臨床検査数の増加が市場を牽引 146

市場を牽引 146

8 IVD試薬市場(用途別) 150

8.1 導入 151

8.2 感染症 151

8.2.1 製品の上市と承認の増加が市場を押し上げる 151

8.3 がん領域への応用 154

8.3.1 早期診断と質の高い治療が重視されるようになり

市場が活性化 154

8.4 内分泌アプリケーション 157

8.4.1 増加する糖尿病と甲状腺関連疾患

が成長を維持する 157

8.5 心臓病アプリケーション 160

8.5.1 先進国および発展途上国におけるライフスタイルの変化が

が市場を牽引 160

8.6 血液スクリーニング 163

8.6.1 自動診断機器の採用が増加。

成長を促進 163

8.7 遺伝子検査 166

8.7.1 希少疾患や致死的疾患の診断に遺伝子検査が採用されるケースが増加し

成長が持続 166

8.8 自己免疫疾患 169

8.8.1 臨床検査技術、試薬、代替アッセイ手法の進歩が成長、

および代替アッセイ手法の進歩が市場を牽引 169

8.9 アレルギー診断 172

8.9.1 アレルギー治療と予防への注目の高まり

成長を加速 172

8.10 薬物モニタリング・検査 175

8.10.1 乱用薬物検査の実施拡大が市場を牽引 175

8.11 その他の用途 178

9 IVD試薬市場:検査タイプ別 182

9.1 導入 183

9.2 ラボ検査 183

9.2.1 自動化ニーズの高まりが成長を促進 183

9.3 ポイントオブケア検査 186

9.3.1 患者の状態を詳細にモニタリングする必要性が成長を促進 186

10 IVD試薬市場:エンドユーザー別 190

10.1 導入 191

10.2 病院・診療所 191

10.2.1 専門的な診断検査の増加が成長を加速 191

10.3 臨床検査室 194

10.3.1 大規模基準検査室 198

10.3.1.1 専門的な検査能力と最小のターンアラウンドタイムに対するニーズが

市場を押し上げる 198

10.3.2 中小規模の検査室 201

10.3.2.1 自動化・半自動化機器の採用拡大が成長を支える 201

成長を支える 201

10.4 血液銀行 203

10.4.1 外傷症例の増加と高度な外科手術の可能性が市場を後押し 203

10.5 在宅介護環境 206

10.5.1 在宅検査キットへの嗜好の高まりが市場を牽引 206

10.6 製薬・バイオテクノロジー企業 209

10.6.1 研究開発努力の増加が市場の成長に寄与

成長への寄与 209

10.7 学術機関 212

10.7.1 産学連携の増加が成長を促進 212

10.8 その他のエンドユーザー 216

11 IVD試薬市場:地域別 219

11.1 はじめに 220

11.2 北米 220

11.2.1 北米のマクロ経済見通し 221

11.2.2 米国 226

11.2.2.1 確立された償還の枠組みが市場を牽引 226

11.2.3 カナダ 230

11.2.3.1 慢性疾患および感染性生活習慣病の罹患率の増加が市場を牽引 230

が市場を牽引 230

11.3 欧州 235

11.3.1 欧州のマクロ経済見通し 236

11.3.2 ドイツ 240

11.3.2.1 臨床診断研究への投資の増加が市場を牽引 240

11.3.3 英国 244

11.3.3.1 ゲノムベースの検査導入の増加が成長を促進 244

11.3.4 フランス 248

11.3.4.1 高い医療費とゲノム医療への投資の増加が市場を押し上げる 248

市場を押し上げる 248

11.3.5 イタリア 251

11.3.5.1 老年人口の増加とそれに伴う慢性疾患の増加が市場成長を支える 251

市場成長を支える 251

11.3.6 スペイン 255

11.3.6.1 免疫測定試薬の採用増加が市場を牽引 255

11.3.7 その他の欧州 258

11.4 アジア太平洋地域 263

11.4.1 アジア太平洋地域のマクロ経済見通し 263

11.4.2 日本 268

11.4.2.1 社会医療保険制度の増加が成長を促進 268

11.4.3 中国 272

11.4.3.1 予防医療への関心の高まりが需要を後押し 272

11.4.4 インド 276

11.4.4.1 慢性疾患の蔓延が市場を刺激 276

11.4.5 その他のアジア太平洋地域 280

11.5 ラテンアメリカ 284

11.5.1 ラテンアメリカのマクロ経済見通し 284

11.5.2 ブラジル 288

11.5.2.1 成長を刺激する糖尿病有病率の上昇 288

11.5.3 メキシコ 291

11.5.3.1 臨床検査施設設立の増加が市場を押し上げる 291

11.5.4 その他のラテンアメリカ 295

11.6 中東・アフリカ 298

11.6.1 免疫学、出生前検査、がん検査への関心の高まりが市場を牽引 298

市場を牽引 298

11.6.2 中東・アフリカのマクロ経済見通し 299

11.7 GCC諸国 303

11.7.1 GCC諸国のマクロ経済見通し 303

11.7.2 サウジアラビア 307

11.7.2.1 成長促進に向けた医療支出の増加 307

11.7.3 アラブ首長国連邦 310

11.7.3.1 成長を促進する高度医療インフラ整備の増加

成長を促進 310

11.7.4 その他のGCC諸国 314

12 競争環境 318

12.1 概要 318

12.2 主要プレーヤーの戦略/勝利への権利(2023年) 318

12.2.1 IVD試薬市場で主要企業が採用した戦略の概要(2021~2023年) 318

市場(2021-2023年) 318

12.3 収益分析、2021-2023年 319

12.4 市場シェア分析、2023年 320

12.5 企業評価と財務指標 322

12.6 ブランド/製品の比較 324

12.7 企業評価マトリックス:主要企業、2023年 325

12.7.1 スター企業 325

12.7.2 新興リーダー 325

12.7.3 浸透型プレーヤー 325

12.7.4 参加企業 325

12.7.5 企業フットプリント:主要プレーヤー、2023年 327

12.7.5.1 企業フットプリント 327

12.7.5.2 技術のフットプリント 328

12.7.5.3 アプリケーションフットプリント 329

12.7.5.4 検査タイプのフットプリント 330

12.7.5.5 地域別フットプリント 331

12.8 企業評価マトリクス:新興企業/SM(2023年) 332

12.8.1 進歩的企業 332

12.8.2 対応力のある企業 332

12.8.3 ダイナミックな企業 332

12.8.4 スタートアップ・ブロック 332

12.8.5 競争ベンチマーキング:新興企業/中小企業(2023年) 334

12.8.5.1 主要新興企業/中小企業の詳細リスト 334

334 12.8.5.2 主要新興企業/中小企業の競争ベンチマーク 334

12.9 競争シナリオ 335

12.9.1 製品の上市と承認 335

12.9.2 取引 336

12.9.3 事業拡大 337

337 12.9.4 その他の開発 337

13 会社プロファイル 338

13.1 主要企業 338

Danaher Corporation (US)

F. Hoffmann-La Roche Ltd (Switzerland)

Abbott (US)

Siemens Healthineers AG (Germany)

Thermo Fisher Scientific Inc. (US)

Illumina Inc. (US)

BioMerieux (France)

BD (US)

Hologic Inc. (US)

Bio-Rad Laboratories Inc. (US)

Sysmex Corporation (Japan)

QIAGEN N.V. (Netherlands)

Agilent Technologies Inc. (US)

Revvity (US)

DiaSorin S.p.A (Italy)

Grifols S.A. (Spain)

Werfen S.A. (Spain)

QuidelOrtho Corporation (US)

Chembio Diagnostics Inc. (US)

Surmodics Inc. (US)

Merck KGaA (Germany)

MEDICAL & BIOLOGICAL LABORATORIES CO.LTD. (Tokyo)

Canvax (Spain)

Prestige Diagnostics (US)

Adaltis S.r.l. (Italy)

and Randox Laboratories Ltd. (UK)

14 付録 415

14.1 ディスカッションガイド 415

14.2 Knowledgestore: マーケットサ ンドマーケッツの購読ポータル 420

14.3 カスタマイズオプション 422

14.4 関連レポート 422

14.5 著者の詳細 423

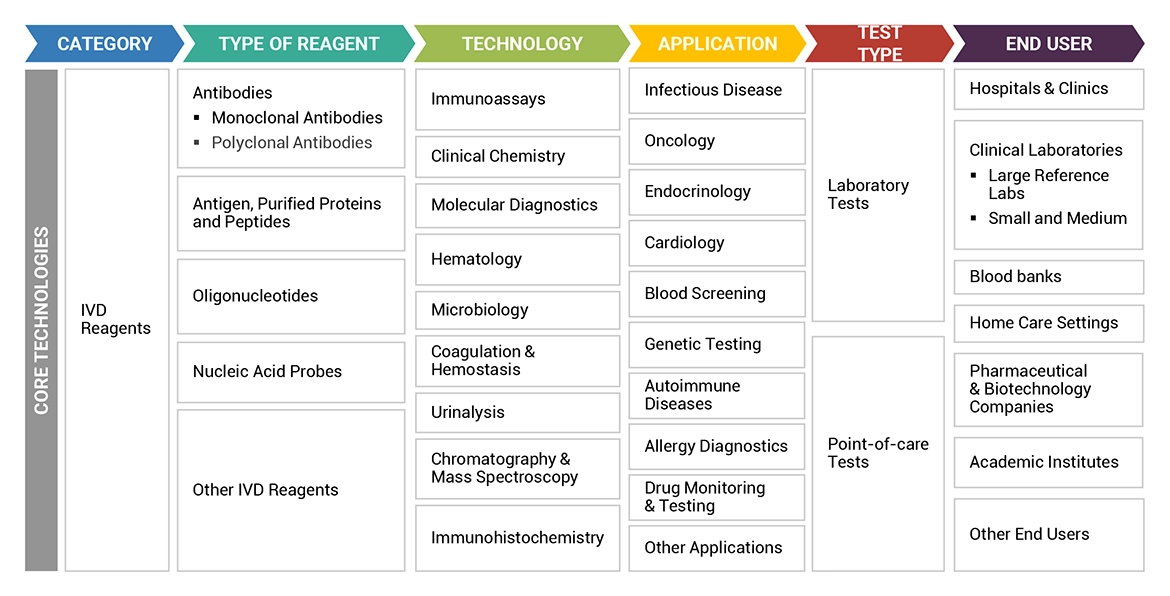

The increasing adoption of IVD technologies has led to a growing need of IVD reagents. The demand for IVD reagents is therefore expected to increase as new diagnostic technologies are getting FDA, EMA approvals from regulatory bodies.

“The oligonucleotide segment is projected to witness the highest growth rate in the IVD reagents market, by type, during the forecast period.”

Based on type, the IVD reagents market is segmented into antibodies, antigen, purified proteins, and peptides, oligonucleotides, nucleic acid probes, and other IVD reagents. The growing adoption of PCR-based tests in diagnostics has boosted the demand for oligonucleotide in the IVD reagents market. Oligonucleotides have wide range of applications in infectious diseases and genetic testing.

“The infectious disease segment to witness the highest share in the IVD reagents market, in 2023, by application”

Based on application, the IVD reagents market is segmented into infectious diseases, oncological applications, endocrinological applications, cardiological applications, blood screening, genetic testing, autoimmune diseases, allergy diagnostics, drug monitoring & testing and other applications. The infectious diseases segment experience highest market share of IVD reagents market due to rising number of R&D activities and product approvals for infectious disease applications.

“The Asia Pacific region is projected to witness highest growth rate in the IVD reagents market during the forecast period”

The global IVD reagents market is segmented into six regions - North America, Europe, Asia Pacific, the Middle East & Africa, Latin America, and the GCC Countries. Over the span of the forecast period, the IVD reagents market is expected to grow at the fastest rate in the Asia Pacific region. Over the projected period, the Asia Pacific market is expected to develop at the greatest rate due to factors such increasing healthcare spending and an extensive population base.

The primary interviews conducted for this report can be categorized as follows:

• By Company Type: Tier 1 - 42%, Tier 2 - 30%, and Tier 3 - 28%

• By Designation: C-level - 46%, Director-level - 23%, and Others - 31%

• By Region: North America – 23%, Europe – 44%, Asia Pacific – 28%, Latin America – 3%, Middle East & Africa – 1%, and the GCC Countries – 1%

Lists of Companies Profiled in the Report:

Danaher Corporation (US), F. Hoffmann-La Roche Ltd (Switzerland), Abbott (US), Siemens Healthineers AG (Germany), Thermo Fisher Scientific Inc. (US), Illumina, Inc. (US), BioMerieux (France), BD (US), Hologic, Inc. (US), Bio-Rad Laboratories, Inc. (US), Sysmex Corporation (Japan), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (US), Revvity (US), DiaSorin S.p.A (Italy), Grifols, S.A. (Spain), Werfen, S.A. (Spain), QuidelOrtho Corporation (US), Chembio Diagnostics, Inc. (US), Surmodics, Inc. (US), Merck KGaA (Germany), MEDICAL & BIOLOGICAL LABORATORIES CO., LTD. (Tokyo), Canvax (Spain), Prestige Diagnostics (US), Adaltis S.r.l. (Italy), and Randox Laboratories Ltd. (UK)

Study Coverage:

In this report, the IVD reagents market has been categorized based on type (antibodies, antigen, purified proteins, and peptides, oligonucleotides, nucleic acid probes, and other IVD reagents), technology (immunoassays, clinical chemistry, molecular diagnostics, hematology, microbiology, coagulation & hemostasis, urinalysis, chromatography & mass spectrometry, immunohistochemistry), application (infectious diseases, oncological applications, endocrinological application, cardiology application, blood screening, genetic testing, autoimmune diseases, allergy diagnostics, drug monitoring & testing, and other applications), test type (laboratory test, and point-of-care tests), end user (hospitals & clinics, clinical laboratories, blood banks, home care settings, pharmaceutical & biotechnology companies, academic institutes, and other end users), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and the GCC Countries).

Information regarding the main drivers, restraints, opportunities, and challenges influencing the IVD reagents market's expansion is includes detail in this study. An intensive study of the key players in the IVD reagents market has been done to provide insights into their business profile, service offered, note worthy strategies, acquisitions and expansions, and other deals made pertaining to the market. This study examines the fragmented landscape of emerging IVD reagents startups.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall IVD reagents marketand the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, challenges, opportunities, and restaints.

The report provides insights on the following pointers:

• Analysis of key drivers: (growing geriatric population, gradual shift towards point-of-care testing and automated analyzers, rise in early diagnosis and personalized medicine, increasing adoption of third-party quality controls, growing biotechnology and biopharmaceutical industries, increasing funding for R&D activities), restraints (unfavorable reimbursement scenario, stringent regulatory requirements), opportunities (increasing development of biomarkers, rising significance of companion diagnostics, market growth opportunities in emerging economies, and growing trend of digitalization), and challenges (operational challenges in clinical process) influencing the growth of the in IVD reagents market.

• Market Development: Comprehensive information about lucrative markets – the report analyses the IVD reagents market across varied regions.

• Market Diversification: Exhaustive information about untapped geographies, and investments in the IVD reagents market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like include F. Hoffmann-La Roche Ltd (Switzerland), Abbott (US), Danaher Corporation (US), Siemens Healthineers AG (Germany), and Thermo Fisher Scientific Inc. (US) are among others, in the IVD reagents market strategies.

1 INTRODUCTION 38

1.1 STUDY OBJECTIVES 38

1.2 MARKET DEFINITION 38

1.3 STUDY SCOPE 39

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 39

1.3.2 INCLUSIONS AND EXCLUSIONS 40

1.3.3 YEARS CONSIDERED 41

1.4 CURRENCY CONSIDERED 41

1.5 STAKEHOLDERS 41

1.6 MARKET RECONCILIATION 41

2 RESEARCH METHODOLOGY 42

2.1 RESEARCH DATA 42

2.1.1 SECONDARY DATA 43

2.1.1.1 Key data from secondary sources 44

2.1.2 PRIMARY DATA 44

2.1.2.1 Primary sources 45

2.1.2.2 Key industry insights 46

2.1.2.3 Key data from primary sources 46

2.1.2.4 Breakdown of primary interviews 47

2.2 MARKET SIZE ESTIMATION 48

2.2.1 BOTTOM-UP APPROACH 48

2.2.1.1 Approach 1: Company revenue estimation approach 48

2.2.1.2 Approach 2: Presentations of companies and primary interviews 49

2.2.1.3 Approach 3: Primary interviews 49

2.2.1.4 Growth forecast 49

2.2.1.5 CAGR projections 49

2.2.2 TOP-DOWN APPROACH 50

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 51

2.4 RESEARCH ASSUMPTIONS 52

2.4.1 STUDY-RELATED ASSUMPTIONS 52

2.4.2 PARAMETRIC ASSUMPTIONS 52

2.5 RESEARCH LIMITATIONS 53

2.6 RISK ASSESSMENT 53

3 EXECUTIVE SUMMARY 54

4 PREMIUM INSIGHTS 59

4.1 IVD REAGENTS MARKET OVERVIEW 59

4.2 ASIA PACIFIC: IVD REAGENTS MARKET, BY COUNTRY 60

4.3 NORTH AMERICA: IVD REAGENTS MARKET, BY TEST TYPE AND COUNTRY 60

4.4 IVD REAGENTS MARKET, BY COUNTRY 61

5 MARKET OVERVIEW 62

5.1 INTRODUCTION 62

5.2 MARKET DYNAMICS 62

5.2.1 DRIVERS 63

5.2.1.1 Growing geriatric population 63

5.2.1.2 Gradual shift toward point-of-care testing and automated analyzers 64

5.2.1.3 Rise in early diagnosis and personalized medicine 65

5.2.1.4 Increasing adoption of third-party quality controls 66

5.2.1.5 Growing biotechnology and biopharmaceutical industries 67

5.2.1.6 Increasing funding for R&D activities 67

5.2.2 RESTRAINTS 68

5.2.2.1 Unfavorable reimbursement scenario 68

5.2.2.2 Stringent regulatory requirements 68

5.2.3 OPPORTUNITIES 69

5.2.3.1 Increasing development of biomarkers 69

5.2.3.2 Rising significance of companion diagnostics 70

5.2.3.3 Market growth opportunities in emerging economies 71

5.2.3.4 Growing trend of digitalization 72

5.2.4 CHALLENGES 73

5.2.4.1 Operational challenges in clinical process 73

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 74

5.4 PRICING ANALYSIS 75

5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION 75

5.4.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY REGION 76

5.4.3 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY 77

5.5 VALUE CHAIN ANALYSIS 77

5.6 SUPPLY CHAIN ANALYSIS 79

5.7 ECOSYSTEM ANALYSIS 80

5.8 INVESTMENT AND FUNDING SCENARIO 81

5.9 TECHNOLOGY ANALYSIS 81

5.9.1 KEY TECHNOLOGIES 82

5.9.2 ADJACENT TECHNOLOGIES 83

5.9.2.1 Multiplexed point-of-care testing 83

5.9.2.2 Nucleic acid lateral flow immunoassay 83

5.9.2.3 DNA-based detection 83

5.9.2.4 Immunodiagnostics 83

5.9.2.5 Dual path technology 83

5.10 PATENT ANALYSIS 84

5.11 TRADE ANALYSIS 85

5.11.1 IMPORT DATA 85

5.11.2 EXPORT DATA 85

5.12 KEY CONFERENCES AND EVENTS, 2024−2025 86

5.13 PORTER’S FIVE FORCES ANALYSIS 86

5.13.1 THREAT OF NEW ENTRANTS 87

5.13.2 THREAT OF SUBSTITUTES 87

5.13.3 BARGAINING POWER OF SUPPLIERS 88

5.13.4 BARGAINING POWER OF BUYERS 88

5.13.5 INTENSITY OF COMPETITIVE RIVALRY 88

5.14 REGULATORY ANALYSIS 88

5.14.1 REGULATORY LANDSCAPE 88

5.14.1.1 North America 89

5.14.1.1.1 US 89

5.14.1.1.2 Canada 90

5.14.1.2 Europe 90

5.14.1.3 Asia Pacific 92

5.14.1.3.1 China 92

5.14.1.3.2 Japan 92

5.14.1.3.3 India 93

5.14.1.4 Latin America 93

5.14.1.4.1 Brazil 93

5.14.1.5 Middle East 94

5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 94

5.14.2.1 North America 94

5.14.2.2 Europe 95

5.14.2.3 Asia Pacific 95

5.14.2.4 Latin America 96

5.14.2.5 Middle East & Africa 96

5.14.2.6 GCC Countries 96

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA 97

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS 97

5.15.2 BUYING CRITERIA 98

5.16 IMPACT OF AI/GENERATIVE AI ON IVD REAGENTS MARKET 98

5.16.1 INTRODUCTION 98

5.16.2 MARKET POTENTIAL FOR IVD REAGENTS 98

5.16.3 AI USE CASES 99

5.16.4 KEY COMPANIES IMPLEMENTING AI 100

5.16.5 FUTURE OF GENERATIVE AI ON IVD REAGENTS 100

6 IVD REAGENTS MARKET, BY TYPE 101

6.1 INTRODUCTION 102

6.2 ANTIBODIES 102

6.2.1 MONOCLONAL ANTIBODIES 105

6.2.1.1 Increasing incidence of cancer to stimulate growth 105

6.2.2 POLYCLONAL ANTIBODIES 107

6.2.2.1 Rising prevalence of infectious diseases and autoimmune disorders

to support growth 107

6.3 ANTIGENS, PURIFIED PROTEINS, AND PEPTIDES 110

6.3.1 INCREASING FOCUS ON ADVANCED PRECISION MEDICINE

TO ENCOURAGE GROWTH 110

6.4 OLIGONUCLEOTIDES 113

6.4.1 GROWING INCLINATION TOWARD MOLECULAR DIAGNOSTICS TO DRIVE MARKET 113

6.5 NUCLEIC ACID PROBES 116

6.5.1 NEED FOR EARLY DISEASE DETECTION AND MONITORING LOW-ABUNDANCE BIOMARKERS TO AID GROWTH 116

6.6 OTHER IVD REAGENTS 119

7 IVD REAGENTS MARKET, BY TECHNOLOGY 123

7.1 INTRODUCTION 124

7.2 IMMUNOASSAYS 124

7.2.1 RISING TREND OF AUTOMATION TO PROMOTE GROWTH 124

7.3 CLINICAL CHEMISTRY 128

7.3.1 RISING PREVALENCE OF DIABETES TO BOOST SEGMENT 128

7.4 MOLECULAR DIAGNOSTICS 131

7.4.1 GROWING DEMAND FOR BLOOD SCREENING AND POINT-OF-CARE TESTING

TO FUEL MARKET 131

7.5 HEMATOLOGY 133

7.5.1 INCREASING FOCUS ON STEM CELL RESEARCH TO SPEED UP GROWTH 133

7.6 MICROBIOLOGY 136

7.6.1 RISING PREVALENCE OF MICROBIAL INFECTIONS TO FUEL MARKET 136

7.7 COAGULATION & HEMOSTASIS 138

7.7.1 GROWING USE OF ANTICOAGULATION THERAPY TO PROPEL MARKET 138

7.8 URINALYSIS 141

7.8.1 RISING PREVALENCE OF KIDNEY DISEASES TO SUPPORT MARKET GROWTH 141

7.9 CHROMATOGRAPHY & MASS SPECTROMETRY 144

7.9.1 INCREASING APPLICATIONS IN DISEASE SCREENING, FORENSIC ANALYSIS,

AND DRUG THERAPY TO BOOST MARKET 144

7.10 IMMUNOHISTOCHEMISTRY 146

7.10.1 GROWING NUMBER OF LABORATORY TESTS FOR CANCER DIAGNOSIS

TO DRIVE MARKET 146

8 IVD REAGENTS MARKET, BY APPLICATION 150

8.1 INTRODUCTION 151

8.2 INFECTIOUS DISEASES 151

8.2.1 INCREASING PRODUCT LAUNCHES AND APPROVALS TO BOOST MARKET 151

8.3 ONCOLOGICAL APPLICATIONS 154

8.3.1 GROWING EMPHASIS ON EARLY DIAGNOSIS AND QUALITY TREATMENT

TO FUEL MARKET 154

8.4 ENDOCRINOLOGICAL APPLICATIONS 157

8.4.1 RISING PREVALENCE OF DIABETES AND THYROID-RELATED DISORDERS

TO SUSTAIN GROWTH 157

8.5 CARDIOLOGICAL APPLICATIONS 160

8.5.1 CHANGING LIFESTYLES IN DEVELOPED AND DEVELOPING COUNTRIES

TO PROPEL MARKET 160

8.6 BLOOD SCREENING 163

8.6.1 RISING ADOPTION OF AUTOMATED DIAGNOSTIC INSTRUMENTS

TO FACILITATE GROWTH 163

8.7 GENETIC TESTING 166

8.7.1 INCREASING ADOPTION OF GENETIC TESTING TO DIAGNOSE RARE

AND FATAL DISEASES TO SUSTAIN GROWTH 166

8.8 AUTOIMMUNE DISEASES 169

8.8.1 GROWING ADVANCEMENTS IN LABORATORY TECHNOLOGY, REAGENTS,

AND ALTERNATIVE ASSAY METHODOLOGIES TO DRIVE MARKET 169

8.9 ALLERGY DIAGNOSTICS 172

8.9.1 GROWING FOCUS ON ALLERGY THERAPY AND PREVENTION

TO ACCELERATE GROWTH 172

8.10 DRUG MONITORING & TESTING 175

8.10.1 GROWING IMPLEMENTATION OF DRUGS-OF-ABUSE TESTING TO DRIVE MARKET 175

8.11 OTHER APPLICATIONS 178

9 IVD REAGENTS MARKET, BY TEST TYPE 182

9.1 INTRODUCTION 183

9.2 LABORATORY TESTS 183

9.2.1 INCREASING NEED FOR AUTOMATION TO EXPEDITE GROWTH 183

9.3 POINT-OF-CARE TESTS 186

9.3.1 NEED TO CLOSELY MONITOR PATIENT CONDITIONS TO AUGMENT GROWTH 186

10 IVD REAGENTS MARKET, BY END USER 190

10.1 INTRODUCTION 191

10.2 HOSPITALS & CLINICS 191

10.2.1 INCREASING SPECIALTY DIAGNOSTIC TESTS TO ACCELERATE GROWTH 191

10.3 CLINICAL LABORATORIES 194

10.3.1 LARGE REFERENCE LABORATORIES 198

10.3.1.1 Need for specialized testing capabilities and minimal turnaround

time to boost market 198

10.3.2 SMALL & MEDIUM-SIZED LABORATORIES 201

10.3.2.1 Growing adoption of automated and semi-automated instruments

to support growth 201

10.4 BLOOD BANKS 203

10.4.1 GROWING NUMBER OF TRAUMA CASES AND AVAILABILITY OF SOPHISTICATED SURGICAL PROCEDURES TO FUEL MARKET 203

10.5 HOME CARE SETTINGS 206

10.5.1 GROWING PREFERENCE FOR AT-HOME TESTING KITS TO DRIVE MARKET 206

10.6 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES 209

10.6.1 INCREASING RESEARCH & DEVELOPMENT EFFORTS TO CONTRIBUTE

TO GROWTH 209

10.7 ACADEMIC INSTITUTES 212

10.7.1 INCREASING INDUSTRY-ACADEMIA COLLABORATIONS TO FAVOR GROWTH 212

10.8 OTHER END USERS 216

11 IVD REAGENTS MARKET, BY REGION 219

11.1 INTRODUCTION 220

11.2 NORTH AMERICA 220

11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 221

11.2.2 US 226

11.2.2.1 Established reimbursement framework to drive market 226

11.2.3 CANADA 230

11.2.3.1 Rising incidence of chronic and infectious lifestyle diseases

to propel market 230

11.3 EUROPE 235

11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 236

11.3.2 GERMANY 240

11.3.2.1 Increasing investments in clinical diagnostics research to drive market 240

11.3.3 UK 244

11.3.3.1 Rising adoption of genome-based testing to promote growth 244

11.3.4 FRANCE 248

11.3.4.1 High healthcare expenditure and rising investments in genomic

medicine to boost market 248

11.3.5 ITALY 251

11.3.5.1 Growing geriatric population and subsequent rise in chronic

conditions to support market growth 251

11.3.6 SPAIN 255

11.3.6.1 Rising adoption of immunoassay reagents to drive market 255

11.3.7 REST OF EUROPE 258

11.4 ASIA PACIFIC 263

11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 263

11.4.2 JAPAN 268

11.4.2.1 Rise in social health insurance programs to encourage growth 268

11.4.3 CHINA 272

11.4.3.1 Growing focus on preventive care to boost demand 272

11.4.4 INDIA 276

11.4.4.1 Rising prevalence of chronic diseases to fuel market 276

11.4.5 REST OF ASIA PACIFIC 280

11.5 LATIN AMERICA 284

11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 284

11.5.2 BRAZIL 288

11.5.2.1 Rising prevalence of diabetes to stimulate growth 288

11.5.3 MEXICO 291

11.5.3.1 Growing establishment of clinical laboratories to boost market 291

11.5.4 REST OF LATIN AMERICA 295

11.6 MIDDLE EAST & AFRICA 298

11.6.1 GROWING FOCUS ON IMMUNOLOGY AND PRENATAL & CANCER TESTING

TO DRIVE MARKET 298

11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 299

11.7 GCC COUNTRIES 303

11.7.1 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES 303

11.7.2 KINGDOM OF SAUDI ARABIA 307

11.7.2.1 Rising healthcare expenditure to promote growth 307

11.7.3 UNITED ARAB EMIRATES 310

11.7.3.1 Increasing development of advanced healthcare infrastructure

to expedite growth 310

11.7.4 OTHER GCC COUNTRIES 314

12 COMPETITIVE LANDSCAPE 318

12.1 OVERVIEW 318

12.2 KEY PLAYER STRATEGY/RIGHT TO WIN, 2023 318

12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IVD REAGENTS

MARKET, 2021–2023 318

12.3 REVENUE ANALYSIS, 2021−2023 319

12.4 MARKET SHARE ANALYSIS, 2023 320

12.5 COMPANY VALUATION AND FINANCIAL METRICS 322

12.6 BRAND/PRODUCT COMPARISON 324

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 325

12.7.1 STARS 325

12.7.2 EMERGING LEADERS 325

12.7.3 PERVASIVE PLAYERS 325

12.7.4 PARTICIPANTS 325

12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 327

12.7.5.1 Company footprint 327

12.7.5.2 Technology footprint 328

12.7.5.3 Application footprint 329

12.7.5.4 Test type footprint 330

12.7.5.5 Region footprint 331

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 332

12.8.1 PROGRESSIVE COMPANIES 332

12.8.2 RESPONSIVE COMPANIES 332

12.8.3 DYNAMIC COMPANIES 332

12.8.4 STARTING BLOCKS 332

12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 334

12.8.5.1 Detailed list of key startups/SMEs 334

12.8.5.2 Competitive benchmarking of key startups/SMEs 334

12.9 COMPETITIVE SCENARIO 335

12.9.1 PRODUCT LAUNCHES AND APPROVALS 335

12.9.2 DEALS 336

12.9.3 EXPANSIONS 337

12.9.4 OTHER DEVELOPMENTS 337

13 COMPANY PROFILES 338

13.1 KEY PLAYERS 338

13.1.1 DANAHER CORPORATION 338

13.1.1.1 Business overview 338

13.1.1.2 Products offered 339

13.1.1.3 Recent developments 340

13.1.1.3.1 Deals 340

13.1.1.3.2 Expansions 340

13.1.1.3.3 Other developments 340

13.1.1.4 MnM view 341

13.1.1.4.1 Right to win 341

13.1.1.4.2 Strategic choices 341

13.1.1.4.3 Weaknesses and competitive threats 341

13.1.2 F. HOFFMANN-LA ROCHE LTD. 342

13.1.2.1 Business overview 342

13.1.2.2 Products offered 343

13.1.2.3 Recent developments 344

13.1.2.3.1 Deals 344

13.1.2.4 MnM view 345

13.1.2.4.1 Right to win 345

13.1.2.4.2 Strategic choices 345

13.1.2.4.3 Weaknesses and competitive threats 345

13.1.3 ABBOTT 346

13.1.3.1 Business overview 346

13.1.3.2 Products offered 347

13.1.3.3 Recent developments 348

13.1.3.3.1 Deals 348

13.1.3.4 MnM view 349

13.1.3.4.1 Right to win 349

13.1.3.4.2 Strategic choices 349

13.1.3.4.3 Weaknesses and competitive threats 349

13.1.4 SIEMENS HEALTHINEERS AG 350

13.1.4.1 Business overview 350

13.1.4.2 Products offered 351

13.1.4.3 Recent developments 352

13.1.4.3.1 Deals 352

13.1.4.4 MnM view 353

13.1.4.4.1 Right to win 353

13.1.4.4.2 Strategic choices 353

13.1.4.4.3 Weaknesses and competitive threats 353

13.1.5 THERMO FISHER SCIENTIFIC INC. 354

13.1.5.1 Business overview 354

13.1.5.2 Products offered 355

13.1.5.3 Recent developments 356

13.1.5.3.1 Deals 356

13.1.5.3.2 Expansions 357

13.1.5.4 MnM view 358

13.1.5.4.1 Right to win 358

13.1.5.4.2 Strategic choices 358

13.1.5.4.3 Weaknesses and competitive threats 358

13.1.6 ILLUMINA, INC. 359

13.1.6.1 Business overview 359

13.1.6.2 Products offered 360

13.1.6.3 Recent developments 361

13.1.6.3.1 Deals 361

13.1.7 BIOMÉRIEUX 362

13.1.7.1 Business overview 362

13.1.7.2 Products offered 363

13.1.7.3 Recent developments 364

13.1.7.3.1 Deals 364

13.1.8 BD 365

13.1.8.1 Business overview 365

13.1.8.2 Products offered 367

13.1.8.3 Recent developments 367

13.1.8.3.1 Deals 367

13.1.9 HOLOGIC, INC. 368

13.1.9.1 Business overview 368

13.1.9.2 Products offered 370

13.1.9.3 Recent developments 371

13.1.9.3.1 Product launches and approvals 371

13.1.9.3.2 Deals 371

13.1.10 BIO-RAD LABORATORIES, INC. 372

13.1.10.1 Business overview 372

13.1.10.2 Products offered 374

13.1.10.3 Recent developments 374

13.1.10.3.1 Deals 374

13.1.11 SYSMEX CORPORATION 375

13.1.11.1 Business overview 375

13.1.11.2 Products offered 376

13.1.11.3 Recent developments 377

13.1.11.3.1 Product launches and approvals 377

13.1.11.3.2 Deals 377

13.1.11.3.3 Expansions 377

13.1.12 QIAGEN N.V. 378

13.1.12.1 Business overview 378

13.1.12.2 Products offered 379

13.1.12.3 Recent developments 380

13.1.12.3.1 Deals 380

13.1.13 AGILENT TECHNOLOGIES, INC. 381

13.1.13.1 Business overview 381

13.1.13.2 Products offered 383

13.1.13.3 Recent developments 384

13.1.13.3.1 Deals 384

13.1.13.3.2 Expansions 384

13.1.14 REVVITY 385

13.1.14.1 Business overview 385

13.1.14.2 Products offered 386

13.1.14.3 Recent developments 387

13.1.14.3.1 Deals 387

13.1.14.3.2 Other developments 387

13.1.15 DIASORIN S.P.A. 388

13.1.15.1 Business overview 388

13.1.15.2 Products offered 389

13.1.15.3 Recent developments 391

13.1.15.3.1 Deals 391

13.1.16 GRIFOLS, S.A. 392

13.1.16.1 Business overview 392

13.1.16.2 Products offered 393

13.1.16.3 Recent developments 394

13.1.16.3.1 Deals 394

13.1.17 WERFEN, S.A. 395

13.1.17.1 Business overview 395

13.1.17.2 Products offered 396

13.1.17.3 Recent developments 397

13.1.17.3.1 Deals 397

13.1.18 QUIDELORTHO CORPORATION 398

13.1.18.1 Business overview 398

13.1.18.2 Products offered 400

13.1.18.3 Recent developments 401

13.1.18.3.1 Deals 401

13.1.18.3.2 Expansions 401

13.1.19 CHEMBIO DIAGNOSTICS, INC. 402

13.1.19.1 Business overview 402

13.1.19.2 Products offered 403

13.1.20 SURMODICS, INC. 404

13.1.20.1 Business overview 404

13.1.20.2 Products offered 406

13.1.21 MERCK KGAA 407

13.1.21.1 Business overview 407

13.1.21.2 Products offered 408

13.2 OTHER PLAYERS 410

13.2.1 MEDICAL & BIOLOGICAL LABORATORIES CO., LTD. 410

13.2.2 CANVAX 411

13.2.3 PRESTIGE DIAGNOSTICS 412

13.2.4 ADALTIS S.R.L. 413

13.2.5 RANDOX LABORATORIES LTD. 414

14 APPENDIX 415

14.1 DISCUSSION GUIDE 415

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 420

14.3 CUSTOMIZATION OPTIONS 422

14.4 RELATED REPORTS 422

14.5 AUTHOR DETAILS 423

❖ 世界のIVD試薬市場に関するよくある質問(FAQ) ❖

・IVD試薬の世界市場規模は?

→MarketsandMarkets社は2024年のIVD試薬の世界市場規模を604.5億ドルと推定しています。

・IVD試薬の世界市場予測は?

→MarketsandMarkets社は2029年のIVD試薬の世界市場規模を874.1億ドルと予測しています。

・IVD試薬市場の成長率は?

→MarketsandMarkets社はIVD試薬の世界市場が2024年~2029年に年平均7.7%成長すると予測しています。

・世界のIVD試薬市場における主要企業は?

→MarketsandMarkets社は「Danaher Corporation (US), F. Hoffmann-La Roche Ltd (Switzerland), Abbott (US), Siemens Healthineers AG (Germany), Thermo Fisher Scientific Inc. (US), Illumina, Inc. (US), BioMerieux (France), BD (US), Hologic, Inc. (US), Bio-Rad Laboratories, Inc. (US), Sysmex Corporation (Japan), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (US), Revvity (US), DiaSorin S.p.A (Italy), Grifols, S.A. (Spain), Werfen, S.A. (Spain), QuidelOrtho Corporation (US), Chembio Diagnostics, Inc. (US), Surmodics, Inc. (US), Merck KGaA (Germany), MEDICAL & BIOLOGICAL LABORATORIES CO., LTD. (Tokyo), Canvax (Spain), Prestige Diagnostics (US), Adaltis S.r.l. (Italy), and Randox Laboratories Ltd. (UK)など ...」をグローバルIVD試薬市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。