1 はじめに

1.1 調査目的 28

1.2 市場の定義 28

1.3 調査範囲 29

1.3.1 対象市場と地域範囲 29

1.3.2 対象範囲と除外範囲 30

1.3.3 考慮した年数 31

1.4 考慮した通貨 31

1.5 単位の検討 31

1.6 制限事項 31

1.7 利害関係者 32

1.8 変更点のまとめ 32

2 調査方法 33

2.1 調査データ 33

2.1.1 二次データ 34

2.1.1.1 主要な二次情報源のリスト 34

2.1.1.2 二次資料からの主要データ 35

2.1.2 一次データ 35

2.1.2.1 一次インタビュー参加者リスト 36

2.1.2.2 プライマリーの内訳 36

2.1.2.3 一次資料からの主要データ 37

2.1.2.4 主要な業界インサイト 38

2.1.3 二次調査および一次調査 38

2.2 市場規模の推定方法 39

2.2.1 ボトムアップアプローチ 40

2.2.1.1 ボトムアップ分析による市場規模算出のアプローチ

(需要側) 40

2.2.2 トップダウンアプローチ 41

2.2.2.1 トップダウン分析(供給側)による市場規模算出手法

(供給側) 41

2.3 市場の内訳とデータの三角測量 43

2.4 リサーチの前提 44

2.5 調査の限界 44

2.6 リスク分析 45

3 エグゼクティブ・サマリー 46

4 プレミアムインサイト 51

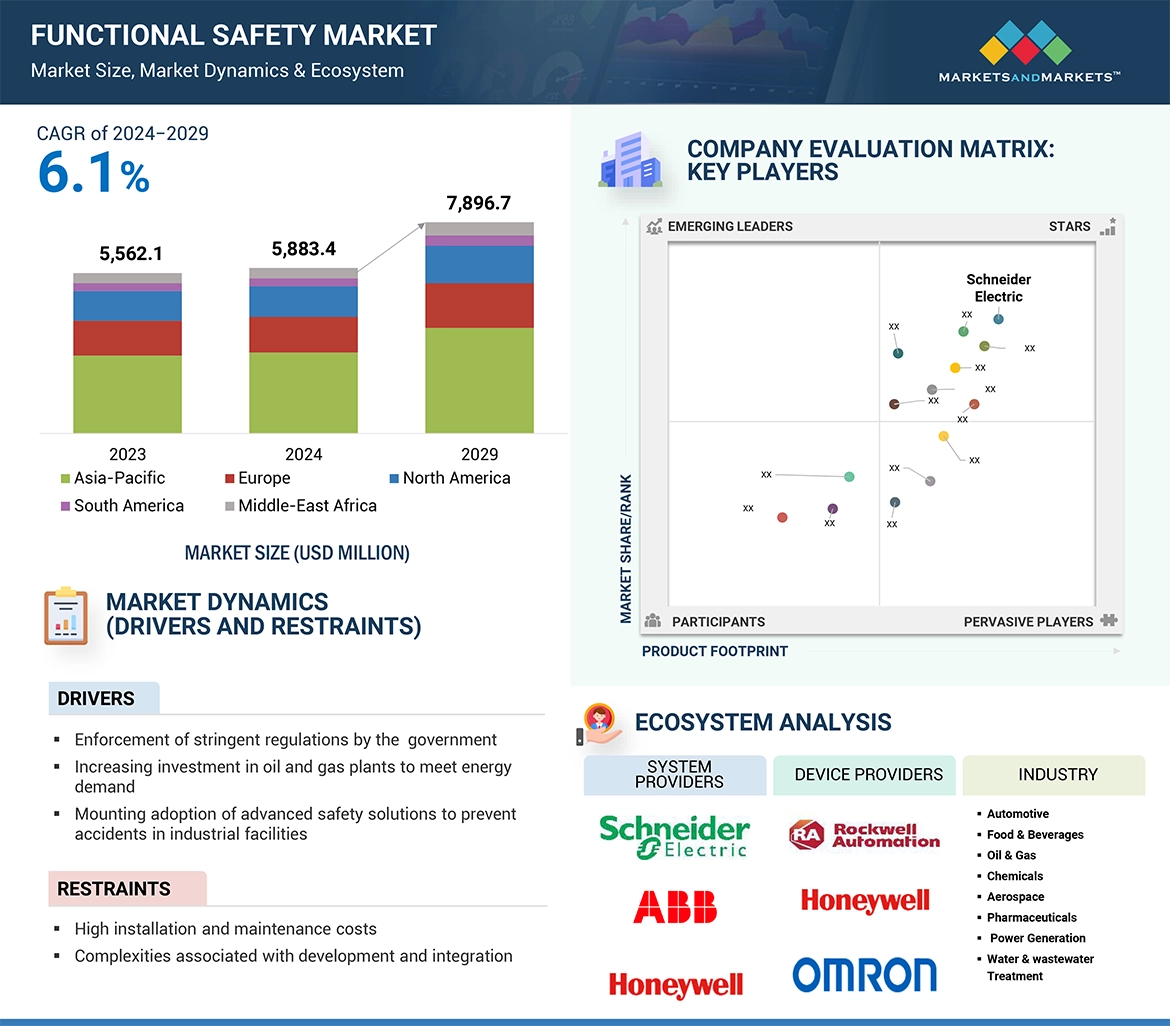

4.1 機能安全市場におけるプレーヤーにとっての魅力的な機会 51

4.2 機能安全市場:デバイス別 51

4.3 機能安全市場:システム別 52

4.4 機能安全市場:産業別 52

4.5 機能安全市場:地域別 53

4.6 機能安全市場:国別 53

5 市場の概要

5.1 はじめに

5.2 市場ダイナミクス

5.2.1 推進要因

5.2.1.1 政府当局による厳しい安全規制の施行 55

5.2.1.2 エネルギー需要を満たすための石油・ガスプラントへの投資の増加 55

5.2.1.3 産業施設における事故防止のための先進安全ソリューションの採用増加 56

5.2.1.4 伝統的製造業を変革する急速なデジタル変革 56

5.2.2 阻害要因 57

5.2.2.1 高い設置コストとメンテナンスコスト 57

5.2.2.2 安全装置に対する認識不足 57

5.2.3 機会 58

5.2.3.1 先進国における労働安全重視の高まり 58

5.2.3.2 産業におけるIIoT技術の展開の増加 59

5.2.4 課題 59

5.2.4.1 複雑な安全規格に準拠したシステム設計に関する複雑さ 59

5.2.4.2 熟練労働者の不足 60

5.3 顧客ビジネスに影響を与えるトレンド/混乱 60

5.4 プロセスフロー分析 61

5.5 価格分析 62

5.5.1 主要企業の平均販売価格動向(デバイス別、2023年) 63

5.5.2 平均販売価格動向(デバイス別)、2020~2023年 64

5.5.3 平均販売価格動向(地域別)、2020-2023年 65

5.6 サプライチェーン分析 65

5.7 エコシステム分析 67

5.8 技術分析 68

5.8.1 主要技術 68

5.8.1.1 コンピュータビジョン 68

5.8.1.2 サイバーセキュリティ・ソリューション 69

5.8.1.3 5G 69

5.8.1.4 自動機械学習 69

5.8.2 補完技術 70

5.8.2.1 IIoT 70

5.8.2.2 予知保全ツール 70

5.8.3 隣接技術 70

5.8.3.1 バーチャルリアリティ 70

5.8.3.2 遠隔監視システム 70

5.9 特許分析 71

5.10 貿易分析 74

5.10.1 輸入シナリオ(HSコード8481) 74

5.10.2 輸出シナリオ(HSコード8481) 75

5.11 主要会議・イベント(2025~2026年) 76

5.12 ケーススタディ分析 77

5.12.1 MP機器、安全性実装のための構造化アプローチを提供するアレン・ブラドリーのガードマスターセーフティリレーを採用 77

5.12.2 MP機器はロックウェル・オートメーションと提携し、プロテインポーションマシーンの設計を再評価 78

5.12.3 BP 社が油の流出防止にエマソン社の安全システムを採用 78

5.12.4 アジア太平洋地域の肥料メーカーがエマソン社のincus 超音波システムを採用し、ガス漏れ検知を改善 79

5.12.5 エクシダ、機能安全ライフサイクルの保守・運用フェーズでアイオワ肥料会社を 支援する手順を確立 79

5.13 投資と資金調達のシナリオ 80

5.14 規制の状況 81

5.14.1 規制機関、政府機関、その他の組織 81

5.14.2 規格 83

5.15 ポーターの5つの力分析 85

5.15.1 新規参入の脅威 86

5.15.2 代替品の脅威 86

5.15.3 供給者の交渉力 86

5.15.4 買い手の交渉力 86

5.15.5 競合の激しさ 87

5.16 主要ステークホルダーと購買基準 87

5.16.1 購入プロセスにおける主要ステークホルダー 87

5.16.2 購買基準 88

5.17 機能安全市場におけるAI/GEN AIの影響 88

5.17.1 導入 88

5.17.2 AI の使用例 89

6 機能安全システムのためのサイレント・タイプ 90

6.1 導入 90

6.2 SIL 2 91

6.3 SIL 3 91

6.4 SIL 4 92

7 機能安全システムの販売チャネル 93

7.1 はじめに

7.2 直接チャネル 93

7.3 代理店/再販業者 94

7.4 システムインテグレーター 94

8 機能安全市場:アプリケーション別 95

8.1 導入 96

8.2 ロボット 97

8.2.1 従来のロボット 97

8.2.1.1 高速、高荷重の産業環境での採用が増加し、セグメントの成長を促進 97

8.2.2 協働ロボット 98

8.2.2.1 人とロボットの安全でダイナミックな協働を確保する需要の高まりが分野成長を後押し 98

8.3 非ロボット分野 98

8.3.1 作業員の安全と環境保護への関心の高まりがセグメント成長を加速 98

9 機能安全市場、デバイス別 99

9.1 導入 100

9.2 セーフティセンサー 102

9.2.1 自動化システムと追跡ツールを統合するための採用が増加し、セグメント成長を促進 102

9.2.1.1 非常停止センサー 102

9.2.1.2 温度センサー 103

9.2.1.3 圧力センサー 103

9.2.1.4 ガスセンサー 103

9.3 セーフティコントローラ/モジュール/リレー 104

9.3.1 既存の安全基準を満たし、リスクを許容レベルまで低減するための用途が増加し、セグメント成長を促進 104

9.4 プログラマブル・セーフティ・システム 105

9.4.1 信号分析、機器の状態監視、その他の診断を提供するために採用が増加し、市 場を牽引 105

9.5 セーフティスイッチ 107

9.5.1 機器を保護し、怪我を防止する能力による需要の増加がセグメントの成長を促進 107

9.6 バルブ 108

9.6.1 産業分野での用途拡大がセグメント成長に寄与 108

9.7 アクチュエーター 109

9.7.1 石油・ガスやその他の産業での使用の増加が市場を牽引 109

9.8 非常停止装置 111

9.8.1 産業事故の多発による安全対策ニーズの高まりがセグメント成長を促進 111

9.9 その他の機器 112

10 機能安全市場:サービス別 114

10.1 導入 115

10.2 試験、検査、認証 116

10.2.1 プロセス産業における安全認証システムの需要増加がセグメント成長を促進 116

10.2.2 故障モード、影響、診断範囲分析(Fmeda) 117

10.2.3 フォルトツリー解析(FTA) 117

10.2.4 イベントツリー解析(ETA) 117

10.2.5 ハザード&操作性調査(Hazop) 117

10.3 設計、エンジニアリング、メンテナンス 117

10.3.1 安全基準への準拠重視の高まりがセグメント成長を促進 117

10.4 トレーニング&コンサルティングサービス 118

10.4.1 機能安全を維持するために高度なスキルと訓練を受けた人材へのニーズが高 まり、この分野の成長を促進 118

11 機能安全市場:システム別 119

11.1 導入 120

11.2 緊急シャットダウンシステム 122

11.2.1 産業安全性と操業リスク軽減への重点の高まりがセグメント成長を促進 122

11.3 火災・ガス監視制御システム 125

11.3.1 様々な産業で資産保護ニーズの高まりがセグメント成長を促進 125

11.4 ターボ機械制御システム 129

11.4.1 先進発電技術の採用拡大がセグメント成長に寄与 129

11.5 バーナー管理システム 132

11.5.1 産業プロセスの複雑化と危険な事象を防止するための信頼性の高いシステ ムへのニーズが市場を牽引 132

11.6 高信頼性圧力保護システム 135

11.6.1 高圧環境における人員と資産保護のための信頼性の高い安全ソリューションに対する需要の高まりがセグメント成長を促進 135

11.7 分散型制御システム 138

11.7.1 様々な産業でプロセスの最適化、自動化、安全性へのニーズの高まりがセグメント成長を促進 138

11.8 監視制御&データ収集システム 141

11.8.1 重要インフラの運用効率向上とリアルタイム監視のニーズの高まりが市場を牽引 141

12 機能安全市場(産業別) 145

12.1 導入 146

12.2 石油・ガス 148

12.2.1 上流 149

12.2.1.1 探査、掘削、採掘プロセスの最適化重視の高まりがセグメント成長を後押し 149

12.2.2 ミッドストリーム 150

12.2.2.1 亀裂や破裂を回避するためのパイプラインのメンテナンス重視の高まりがセグメント成長を促進 150

12.2.3 下流 150

12.2.3.1 最終製品の精製、マーケティング、流通に関連する課題に対処する必要性の高まりが市場を牽引 150

12.3 発電 152

12.3.1 エネルギー効率と生産最適化への関心の高まりがセグメント成長に寄与 152

12.4 化学 154

12.4.1 コスト削減と輸送改善への関心の高まりがセグメント成長を促進 154

12.5 食品・飲料 156

12.5.1 安全基準不遵守の罰則に対する意識の高まりがセグメント成長を促進 156

12.6 水処理・廃水処理 158

12.6.1 システム障害から人員とプラント環境を守る安全ソリューションの採用増が市場を牽引 158

12.7 医薬品 160

12.7.1 潜在的な危険の防止と機械の安全性確保への関心の高まりがセグメント成長を促進 160

12.8 金属・鉱業 162

12.8.1 厳格な安全規制の実施が増加し、セグメント成長に寄与 162

12.9 自動車 164

12.9.1 自律走行車志向の高まりがセグメント成長を加速 164

12.10 航空宇宙 165

12.10.1 高度化、自律化、相互接続システムへの需要の高まりがセグメント成長を促進 165

12.11 鉄道 167

12.11.1 センサーを監視・制御する安全装置の導入が増加し、セグメント成長を促進 167

12.12 医療 169

12.12.1 製造工程を制御する安全ソリューションの採用が増加し、セグメント成長を促進 169

12.13 その他の産業 170

13 機能安全市場:地域別 173

13.1 はじめに 174

13.2 欧州 175

13.2.1 欧州のマクロ経済見通し 175

13.2.2 ドイツ 180

13.2.2.1 製造業務の自動化を目的としたインダストリー4.0 の導入拡大が市場を牽引 180

13.2.3 イギリス 180

13.2.3.1 石油・ガスセクターにおける安全操業の維持に向けた取り組みの増加が市場成長を促進 180

13.2.4 フランス 181

13.2.4.1 化学プラントの安全性に対する関心の高まりが市場成長を促進 181

13.2.5 その他のヨーロッパ 181

13.3 北米 182

13.3.1 北米のマクロ経済見通し 182

13.3.2 米国 186

13.3.2.1 産業安全基準やガイドラインの導入増加による市場成長促進 186

13.3.3 カナダ 187

13.3.3.1 石油・ガスセクターにおける安全性の維持と排出ガスの最小化重視の高まりが市場成長を促進 187

13.3.4 メキシコ 187

13.3.4.1 石油及びその他の液体生産量の増加が市場成長に寄与 187

13.4 アジア太平洋地域 188

13.4.1 アジア太平洋地域のマクロ経済見通し 188

13.4.2 中国 193

13.4.2.1 製造業の繁栄と電気自動車の普及が市場成長を後押し 193

13.4.3 日本 193

13.4.3.1 スマート工場システムの導入重視の高まりが市場成長を促進 193

13.4.4 インド 194

13.4.4.1 電力事業への注目の高まりが市場成長に寄与 194

13.4.5 韓国 194

194 13.4.5.1 労働災害防止のための職場での厳格な安全対策の実施が増加し、市場を牽引 194

13.4.6 その他のアジア太平洋地域 195

13.5 ROW 195

13.5.1 行のマクロ経済見通し 195

13.5.2 中東 199

13.5.2.1 石油・ガス探査活動の増加が市場成長に寄与 199

13.5.2.2 GCC諸国 199

13.5.2.3 その他の中東地域 199

13.5.3 アフリカ 200

13.5.3.1 盛んな電力、化学、鉱業が市場成長を後押し 200

13.5.4 南米 200

13.5.4.1 産業界における自動化ソリューション導入の増加が市場成長を促進 200

14 競争環境 201

14.1 概要 201

14.2 主要プレーヤーの戦略/勝利への権利(2022~2024年) 201

14.3 収益分析(2019-2023年) 203

14.4 市場シェア分析、2023年 203

14.5 企業評価と財務指標(2024年

14.6 製品比較 207

14.7 企業評価マトリックス:主要企業(2023年) 207

14.7.1 スター企業 207

14.7.2 新興リーダー 207

14.7.3 浸透型プレーヤー 208

14.7.4 参加企業 208

14.7.5 企業フットプリント:主要プレイヤー(2023年

14.7.5.1 企業フットプリント 209

14.7.5.2 地域別フットプリント 210

14.7.5.3 産業別フットプリント 211

14.7.5.4 デバイスフットプリント 212

14.7.5.5 システムフットプリント 213

14.8 企業評価マトリクス:新興企業/SM(2023年) 215

14.8.1 進歩的企業 215

14.8.2 対応力のある企業 215

14.8.3 ダイナミックな企業 215

14.8.4 スターティングブロック 215

14.8.5 競争ベンチマーキング:新興企業/SM(2023年) 217

14.8.5.1 主要新興企業/中小企業の詳細リスト 217

14.8.5.2 主要新興企業/中小企業の競合ベンチマーキング 218

14.9 競争シナリオ 219

14.9.1 製品上市 219

14.9.2 取引 221

14.9.3 事業拡大 222

14.9.4 その他の開発 223

15 企業プロフィール 224

15.1 主要プレーヤー 224

Schneider Electric (France)

ABB (Switzerland)

Honeywell International Inc. (US)

Emerson Electric Co. (US)

Rockwell Automation (US)

General Electric (US)

Siemens (Germany)

Siemens (Germany)

Stratasys (US)

Omron Corporation (Japan)

Yokogawa Electric Corporation (Japan)

Endress+Hauser Group Services AG (Switzerland)

16 付録 284

16.1 業界の専門家による洞察 284

16.2 ディスカッションガイド 285

16.3 Knowledgestore: Marketsandmarketsの購読ポータル 288

16.4 カスタマイズオプション 290

16.5 関連レポート 290

16.6 著者の詳細 291

Mounting adoption of advanced safety solutions to prevent accidents in industrial facilities is driving the functional safety market. Whereas high installation and maintenance costs is restraining the growth of the functional safety market.

“Emergency Shutdown System (ESD) segment is expected to hold the largest market share throughout the forecast period.”

An ESD system is used to manage emergencies, especially those that can lead to the release of hydrocarbons, uncontrolled flood, or fire outbreaks in areas where the materials stored are hazardous. Such emergencies can lead to the stoppage of a plant, unit or equipment. Concha, sensors relating to ESD capture specific states and logic solvers act on these sensors to put final items like valves and pumps to a safe state. In the event of a problem, the ESD system removes power from the process, but at the same time in a controlled manner.

Furthermore, ESD systems are essential in multiple sectors, such as oil & gas, chemicals, power generation, manufacturing, and water treatment. They act promptly on their own in situations like leakage, fire, or system failure where they shut down the equipment, safeguard the workers, and observe various measures and codes of safety.

“Non-robotic application of functional safety is expected to hold the largest market share during the forecast period.”

The functional safety market for non-robotic application is expected to have the largest market share during the forecast period as functional safety is more of an imperative and has a lot to offer high-risk industries such as manufacturing, oil and gas industry and power generation industries. These are regulatory requirements such as IEC 61508/ 61511 or other regulations that govern use of many safety critical systems, need for protection of assets and machinery.

"Oil & Gas segment is likely to hold the largest market in 2024.”

The global functional safety market is expected to register the largest portion of oil and a gas segment in 2024. The oil & gas industry experience several risks and hazards which causes serious mishap to people, assets and/or the environment. In the industry, different types of safety instrumented systems (SIS) are deployed towards achieving functional safety. A control and protection scheme for example is the Emergency Shutdown (ESD) systems that enable inhibition of a couple of systems and apparatus in an endeavor to reduce the impact of the emergent situation. They also segregate hydrocarbon stock, electrical equipment and emergency blowers and ventilation systems to give right response in the event of fire.

Additionally, High Integrity Pressure Protection System (HIPPS) safeguards the pipelines, vessels and process packages against over pressure. Some of the industries’ players that deliver functional safety systems and safety devices include ABB Ltd, Siemens, and Schneider Electric.

“The Germany is to contribute the highest market share of European region during the forecast period.”

Germany is predicted to be the highest market share of European region during the forecast period. In Germany, machine and functional safety measures are strictly followed under various regulatory standards. The IEC 61508 standard has been adopted and published as DIN EN 61508 by the German Institute for Standardization (DIN). The machinery supplied and in operation in Europe is required to comply with this functional safety standard. The national-level regulatory standards and EU directives present in this country are increasing the demand for safety-related systems, which, in turn, is driving the growth of the functional safety market.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

• By Company Type - Tier 1 – 51%, Tier 2 – 32%, Tier 3 – 17%

• By Designation— C-level Executives - 47%, Directors - 32%, Others - 21%

• By Region—North America - 36%, Europe - 29%, Asia Pacific - 27%, RoW - 8%

The functional safety market is dominated by a few globally established players such as Schneider Electric (France), ABB (Switzerland), Honeywell International Inc. (US), Emerson Electric Co. (US), Rockwell Automation (US), General Electric (US), Siemens (Germany), Siemens (Germany), Stratasys (US), Omron Corporation (Japan), Yokogawa Electric Corporation (Japan), Endress+Hauser Group Services AG (Switzerland). The study includes an in-depth competitive analysis of these key players in the functional safety market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the functional safety market and forecasts its size by system, device, service, application, industry, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions—North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the functional safety ecosystem.

Key Benefits to Buy the Report:

• Analysis of key drivers (Enforcement of stringent safety regulations by the government, Increasing investment in oil and gas plants to meet energy demand, Mounting adoption of advanced safety solutions to prevent accidents in industrial facilities, Rapid digital transformation to revolutionize traditional manufacturing), Restraint (High installation and maintenance costs, Complexities associated with development and integration), Opportunity (Rising emphasis on workplace safety in developed countries, Increasing deployment of IIoT technology in industries), Challenges (Complexities related to designing systems that comply with complex safety standards

• Requirement of functional safety systems specialized expertise for Implementation and maintenance)

• Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the functional safety market.

• Market Development: Comprehensive information about lucrative markets – the report analyses the functional safety market across varied regions

• Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the functional safety market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Schneider Electric (France), ABB (Switzerland), Honeywell International Inc. (US), Emerson Electric Co. (US), Rockwell Automation (US), General Electric (US), Siemens (Germany), Siemens (Germany), Stratasys (US), Omron Corporation (Japan), Yokogawa Electric Corporation (Japan), among others in the functional safety market.

1 INTRODUCTION 28

1.1 STUDY OBJECTIVES 28

1.2 MARKET DEFINITION 28

1.3 STUDY SCOPE 29

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 29

1.3.2 INCLUSIONS AND EXCLUSIONS 30

1.3.3 YEARS CONSIDERED 31

1.4 CURRENCY CONSIDERED 31

1.5 UNIT CONSIDERED 31

1.6 LIMITATIONS 31

1.7 STAKEHOLDERS 32

1.8 SUMMARY OF CHANGES 32

2 RESEARCH METHODOLOGY 33

2.1 RESEARCH DATA 33

2.1.1 SECONDARY DATA 34

2.1.1.1 List of key secondary sources 34

2.1.1.2 Key data from secondary sources 35

2.1.2 PRIMARY DATA 35

2.1.2.1 List of primary interview participants 36

2.1.2.2 Breakdown of primaries 36

2.1.2.3 Key data from primary sources 37

2.1.2.4 Key industry insights 38

2.1.3 SECONDARY AND PRIMARY RESEARCH 38

2.2 MARKET SIZE ESTIMATION METHODOLOGY 39

2.2.1 BOTTOM-UP APPROACH 40

2.2.1.1 Approach to arrive at market size using bottom-up analysis

(demand side) 40

2.2.2 TOP-DOWN APPROACH 41

2.2.2.1 Approach to arrive at market size using top-down analysis

(supply side) 41

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 43

2.4 RESEARCH ASSUMPTIONS 44

2.5 RESEARCH LIMITATIONS 44

2.6 RISK ANALYSIS 45

3 EXECUTIVE SUMMARY 46

4 PREMIUM INSIGHTS 51

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FUNCTIONAL SAFETY MARKET 51

4.2 FUNCTIONAL SAFETY MARKET, BY DEVICE 51

4.3 FUNCTIONAL SAFETY MARKET, BY SYSTEM 52

4.4 FUNCTIONAL SAFETY MARKET, BY INDUSTRY 52

4.5 FUNCTIONAL SAFETY MARKET, BY REGION 53

4.6 FUNCTIONAL SAFETY MARKET, BY COUNTRY 53

5 MARKET OVERVIEW 54

5.1 INTRODUCTION 54

5.2 MARKET DYNAMICS 54

5.2.1 DRIVERS 55

5.2.1.1 Enforcement of stringent safety regulations by government authorities 55

5.2.1.2 Increasing investment in oil and gas plants to meet energy demand 55

5.2.1.3 Mounting adoption of advanced safety solutions to prevent accidents in industrial facilities 56

5.2.1.4 Rapid digital transformation to revolutionize traditional manufacturing 56

5.2.2 RESTRAINTS 57

5.2.2.1 High installation and maintenance costs 57

5.2.2.2 Lack of awareness about safety devices 57

5.2.3 OPPORTUNITIES 58

5.2.3.1 Rising emphasis on occupational safety in developed countries 58

5.2.3.2 Increasing deployment of IIoT technology in industries 59

5.2.4 CHALLENGES 59

5.2.4.1 Complexities related to designing systems that comply with complex safety standards 59

5.2.4.2 Shortage of skilled workforce 60

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 60

5.4 PROCESS FLOW ANALYSIS 61

5.5 PRICING ANALYSIS 62

5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY DEVICE, 2023 63

5.5.2 AVERAGE SELLING PRICE TREND, BY DEVICE, 2020–2023 64

5.5.3 AVERAGE SELLING PRICE TREND, BY REGION, 2020–2023 65

5.6 SUPPLY CHAIN ANALYSIS 65

5.7 ECOSYSTEM ANALYSIS 67

5.8 TECHNOLOGY ANALYSIS 68

5.8.1 KEY TECHNOLOGIES 68

5.8.1.1 Computer vision 68

5.8.1.2 Cybersecurity solutions 69

5.8.1.3 5G 69

5.8.1.4 Automated machine learning 69

5.8.2 COMPLEMENTARY TECHNOLOGIES 70

5.8.2.1 IIoT 70

5.8.2.2 Predictive maintenance tools 70

5.8.3 ADJACENT TECHNOLOGIES 70

5.8.3.1 Virtual reality 70

5.8.3.2 Remote monitoring systems 70

5.9 PATENT ANALYSIS 71

5.10 TRADE ANALYSIS 74

5.10.1 IMPORT SCENARIO (HS CODE 8481) 74

5.10.2 EXPORT SCENARIO (HS CODE 8481) 75

5.11 KEY CONFERENCES AND EVENTS, 2025–2026 76

5.12 CASE STUDY ANALYSIS 77

5.12.1 MP EQUIPMENT USES ALLEN BRADLEY GUARDMASTER SAFETY RELAYS TO PROVIDE STRUCTURED APPROACH TO SAFETY IMPLEMENTATION 77

5.12.2 MP EQUIPMENT PARTNERS WITH ROCKWELL AUTOMATION TO REEVALUATE PROTEIN PORTIONING MACHINE DESIGN 78

5.12.3 BP CHOSES EMERSON ELECTRIC CO.’S SAFETY SYSTEMS FOR OIL OVERSPILL PROTECTION 78

5.12.4 FERTILIZER MANUFACTURER IN ASIA PACIFIC ADOPTS EMERSON ELECTRIC CO.’S INCUS ULTRASONIC SYSTEM TO IMPROVE GAS LEAK DETECTION 79

5.12.5 EXIDA ESTABLISHES PROCEDURES TO SUPPORT IOWA FERTILIZER COMPANY IN MAINTENANCE AND OPERATION PHASE OF FUNCTIONAL SAFETY LIFECYCLE 79

5.13 INVESTMENT AND FUNDING SCENARIO 80

5.14 REGULATORY LANDSCAPE 81

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 81

5.14.2 STANDARDS 83

5.15 PORTER’S FIVE FORCES ANALYSIS 85

5.15.1 THREAT OF NEW ENTRANTS 86

5.15.2 THREAT OF SUBSTITUTES 86

5.15.3 BARGAINING POWER OF SUPPLIERS 86

5.15.4 BARGAINING POWER OF BUYERS 86

5.15.5 INTENSITY OF COMPETITIVE RIVALRY 87

5.16 KEY STAKEHOLDERS AND BUYING CRITERIA 87

5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS 87

5.16.2 BUYING CRITERIA 88

5.17 IMPACT OF AI/GEN AI ON FUNCTIONAL SAFETY MARKET 88

5.17.1 INTRODUCTION 88

5.17.2 AI USE CASES 89

6 SIL TYPES FOR FUNCTIONAL SAFETY SYSTEMS 90

6.1 INTRODUCTION 90

6.2 SIL 2 91

6.3 SIL 3 91

6.4 SIL 4 92

7 SALES CHANNELS OF FUNCTIONAL SAFETY SYSTEMS 93

7.1 INTRODUCTION 93

7.2 DIRECT CHANNELS 93

7.3 DISTRIBUTORS/RESELLERS 94

7.4 SYSTEM INTEGRATORS 94

8 FUNCTIONAL SAFETY MARKET, BY APPLICATION 95

8.1 INTRODUCTION 96

8.2 ROBOTIC 97

8.2.1 TRADITIONAL ROBOTS 97

8.2.1.1 Escalating adoption in high-speed, high-force industrial environments to expedite segmental growth 97

8.2.2 COLLABORATIVE ROBOTS 98

8.2.2.1 Growing demand to ensure safe and dynamic human-robot collaborations to bolster segmental growth 98

8.3 NON-ROBOTIC 98

8.3.1 RISING FOCUS ON WORKER SAFETY AND ENVIRONMENTAL PROTECTION TO ACCELERATE SEGMENTAL GROWTH 98

9 FUNCTIONAL SAFETY MARKET, BY DEVICE 99

9.1 INTRODUCTION 100

9.2 SAFETY SENSORS 102

9.2.1 RISING ADOPTION TO INTEGRATE AUTOMATED SYSTEMS AND TRACK TOOLS TO BOOST SEGMENTAL GROWTH 102

9.2.1.1 Emergency stop sensors 102

9.2.1.2 Temperature sensors 103

9.2.1.3 Pressure sensors 103

9.2.1.4 Gas sensors 103

9.3 SAFETY CONTROLLERS/MODULES/RELAYS 104

9.3.1 INCREASING USE TO MEET EXISTING SAFETY STANDARDS AND REDUCE RISKS TO ACCEPTABLE LEVEL TO FUEL SEGMENTAL GROWTH 104

9.4 PROGRAMMABLE SAFETY SYSTEMS 105

9.4.1 ESCALATING ADOPTION TO OFFER SIGNAL ANALYSIS, EQUIPMENT STATUS MONITORING, AND OTHER DIAGNOSTICS TO DRIVE MARKET 105

9.5 SAFETY SWITCHES 107

9.5.1 GROWING DEMAND DUE TO ABILITY TO SAFEGUARD EQUIPMENT AND PREVENT INJURIES TO AUGMENT SEGMENTAL GROWTH 107

9.6 VALVES 108

9.6.1 RISING APPLICATION IN INDUSTRIAL SECTORS TO CONTRIBUTE TO SEGMENTAL GROWTH 108

9.7 ACTUATORS 109

9.7.1 INCREASING USE IN OIL & GAS AND OTHER INDUSTRIES TO DRIVE MARKET 109

9.8 EMERGENCY STOP DEVICES 111

9.8.1 MOUNTING NEED FOR SAFETY MEASURES DUE TO HIGH INCIDENCE OF INDUSTRIAL ACCIDENTS TO FOSTER SEGMENTAL GROWTH 111

9.9 OTHER DEVICES 112

10 FUNCTIONAL SAFETY MARKET, BY SERVICE 114

10.1 INTRODUCTION 115

10.2 TESTING, INSPECTION & CERTIFICATION 116

10.2.1 INCREASING DEMAND FOR SAFETY-CERTIFIED SYSTEMS IN PROCESS INDUSTRIES TO BOOST SEGMENTAL GROWTH 116

10.2.2 FAILURE MODES, EFFECTS, AND DIAGNOSTIC COVERAGE ANALYSIS (FMEDA) 117

10.2.3 FAULT TREE ANALYSIS (FTA) 117

10.2.4 EVENT TREE ANALYSIS (ETA) 117

10.2.5 HAZARD & OPERABILITY STUDY (HAZOP) 117

10.3 DESIGN, ENGINEERING & MAINTENANCE 117

10.3.1 RISING EMPHASIS ON COMPLIANCE WITH SAFETY STANDARDS TO FUEL SEGMENTAL GROWTH 117

10.4 TRAINING & CONSULTING SERVICES 118

10.4.1 INCREASING NEED FOR HIGH-SKILLED AND TRAINED PERSONNEL TO MAINTAIN FUNCTIONAL SAFETY TO AUGMENT SEGMENTAL GROWTH 118

11 FUNCTIONAL SAFETY MARKET, BY SYSTEM 119

11.1 INTRODUCTION 120

11.2 EMERGENCY SHUTDOWN SYSTEMS 122

11.2.1 RISING EMPHASIS ON INDUSTRIAL SAFETY AND OPERATIONAL RISK MITIGATION TO FUEL SEGMENTAL GROWTH 122

11.3 FIRE & GAS MONITORING CONTROL SYSTEMS 125

11.3.1 INCREASING NEED FOR ASSET PROTECTION ACROSS VARIOUS INDUSTRIES TO BOOST SEGMENTAL GROWTH 125

11.4 TURBOMACHINERY CONTROL SYSTEMS 129

11.4.1 GROWING ADOPTION OF ADVANCED POWER GENERATION TECHNOLOGIES TO CONTRIBUTE TO SEGMENTAL GROWTH 129

11.5 BURNER MANAGEMENT SYSTEMS 132

11.5.1 INCREASING COMPLEXITY OF INDUSTRIAL PROCESSES AND NEED FOR RELIABLE SYSTEMS TO PREVENT HAZARDOUS EVENTS TO DRIVE MARKET 132

11.6 HIGH INTEGRITY PRESSURE PROTECTION SYSTEMS 135

11.6.1 RISING DEMAND FOR RELIABLE SAFETY SOLUTIONS FOR PERSONNEL AND ASSET PROTECTION IN HIGH-PRESSURE ENVIRONMENTS TO SPUR SEGMENTAL GROWTH 135

11.7 DISTRIBUTED CONTROL SYSTEMS 138

11.7.1 RISING NEED FOR PROCESS OPTIMIZATION, AUTOMATION, AND SAFETY ACROSS VARIOUS INDUSTRIES TO FUEL SEGMENTAL GROWTH 138

11.8 SUPERVISORY CONTROL & DATA ACQUISITION SYSTEMS 141

11.8.1 INCREASING NEED TO IMPROVE OPERATIONAL EFFICIENCY AND REAL-TIME MONITORING OF CRITICAL INFRASTRUCTURE TO DRIVE MARKET 141

12 FUNCTIONAL SAFETY MARKET, BY INDUSTRY 145

12.1 INTRODUCTION 146

12.2 OIL & GAS 148

12.2.1 UPSTREAM 149

12.2.1.1 Growing emphasis on optimizing exploration, drilling, and extraction processes to bolster segmental growth 149

12.2.2 MIDSTREAM 150

12.2.2.1 Increasing focus on pipeline maintenance to avoid cracking and bursting to fuel segmental growth 150

12.2.3 DOWNSTREAM 150

12.2.3.1 Rising need to address challenges associated with refining, marketing, and distributing end products to drive market 150

12.3 POWER GENERATION 152

12.3.1 GROWING FOCUS ON ENERGY EFFICIENCY AND PRODUCTION OPTIMIZATION TO CONTRIBUTE TO SEGMENTAL GROWTH 152

12.4 CHEMICALS 154

12.4.1 RISING EMPHASIS ON COST REDUCTION AND TRANSPORTATION IMPROVEMENT TO FOSTER SEGMENTAL GROWTH 154

12.5 FOOD & BEVERAGES 156

12.5.1 GROWING AWARENESS ABOUT PENALTIES FOR NON-ADHERENCE TO SAFETY STANDARDS TO AUGMENT SEGMENTAL GROWTH 156

12.6 WATER & WASTEWATER TREATMENT 158

12.6.1 INCREASING ADOPTION OF SAFETY SOLUTIONS TO SAFEGUARD PERSONNEL AND PLANT ENVIRONMENTS FROM SYSTEM FAILURES TO DRIVE MARKET 158

12.7 PHARMACEUTICALS 160

12.7.1 GROWING FOCUS ON PREVENTING POTENTIAL HAZARDS AND ENSURING MACHINE SAFETY TO BOOST SEGMENTAL GROWTH 160

12.8 METALS & MINING 162

12.8.1 RISING IMPLEMENTATION OF STRINGENT SAFETY REGULATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH 162

12.9 AUTOMOTIVE 164

12.9.1 INCREASING PREFERENCE FOR AUTONOMOUS VEHICLES TO ACCELERATE SEGMENTAL GROWTH 164

12.10 AEROSPACE 165

12.10.1 MOUNTING DEMAND FOR INCREASINGLY ADVANCED, AUTONOMOUS, AND INTERCONNECTED SYSTEMS TO FUEL SEGMENTAL GROWTH 165

12.11 RAILWAYS 167

12.11.1 INCREASING DEPLOYMENT OF SAFETY DEVICES TO MONITOR AND CONTROL SENSORS TO AUGMENT SEGMENTAL GROWTH 167

12.12 MEDICAL 169

12.12.1 RISING ADOPTION OF SAFETY SOLUTIONS TO CONTROL MANUFACTURING PROCESSES TO CONTRIBUTE TO SEGMENTAL GROWTH 169

12.13 OTHER INDUSTRIES 170

13 FUNCTIONAL SAFETY MARKET, BY REGION 173

13.1 INTRODUCTION 174

13.2 EUROPE 175

13.2.1 MACROECONOMIC OUTLOOK FOR EUROPE 175

13.2.2 GERMANY 180

13.2.2.1 Increasing deployment of Industry 4.0 to automate manufacturing operations to drive market 180

13.2.3 UK 180

13.2.3.1 Increasing commitment to maintaining safe operations in oil & gas sector to spur market growth 180

13.2.4 FRANCE 181

13.2.4.1 Rising concern about safety of chemical plants to augment market growth 181

13.2.5 REST OF EUROPE 181

13.3 NORTH AMERICA 182

13.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 182

13.3.2 US 186

13.3.2.1 Rising implementation of industrial safety standards and guidelines to foster market growth 186

13.3.3 CANADA 187

13.3.3.1 Growing emphasis on maintaining safety and minimizing emissions in oil & gas sector to boost market growth 187

13.3.4 MEXICO 187

13.3.4.1 Increasing production of petroleum and other liquids to contribute to market growth 187

13.4 ASIA PACIFIC 188

13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 188

13.4.2 CHINA 193

13.4.2.1 Flourishing manufacturing sector and electric vehicle adoption to boost market growth 193

13.4.3 JAPAN 193

13.4.3.1 Rising emphasis on implementing smart factory systems to augment market growth 193

13.4.4 INDIA 194

13.4.4.1 Increasing focus on electricity projects to contribute to market growth 194

13.4.5 SOUTH KOREA 194

13.4.5.1 Rising implementation of stringent safety measures at workplace to prevent industrial accidents to drive market 194

13.4.6 REST OF ASIA PACIFIC 195

13.5 ROW 195

13.5.1 MACROECONOMIC OUTLOOK FOR ROW 195

13.5.2 MIDDLE EAST 199

13.5.2.1 Rising oil and gas exploration activities to contribute to market growth 199

13.5.2.2 GCC countries 199

13.5.2.3 Rest of Middle East 199

13.5.3 AFRICA 200

13.5.3.1 Thriving power, chemicals, and mining industries to bolster market growth 200

13.5.4 SOUTH AMERICA 200

13.5.4.1 Increased adoption of automation solutions in industries to fuel market growth 200

14 COMPETITIVE LANDSCAPE 201

14.1 OVERVIEW 201

14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2024 201

14.3 REVENUE ANALYSIS, 2019–2023 203

14.4 MARKET SHARE ANALYSIS, 2023 203

14.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024 206

14.6 PRODUCT COMPARISON 207

14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 207

14.7.1 STARS 207

14.7.2 EMERGING LEADERS 207

14.7.3 PERVASIVE PLAYERS 208

14.7.4 PARTICIPANTS 208

14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 209

14.7.5.1 Company footprint 209

14.7.5.2 Region footprint 210

14.7.5.3 Industry footprint 211

14.7.5.4 Device footprint 212

14.7.5.5 System footprint 213

14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 215

14.8.1 PROGRESSIVE COMPANIES 215

14.8.2 RESPONSIVE COMPANIES 215

14.8.3 DYNAMIC COMPANIES 215

14.8.4 STARTING BLOCKS 215

14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 217

14.8.5.1 Detailed list of key startups/SMEs 217

14.8.5.2 Competitive benchmarking of key startups/SMEs 218

14.9 COMPETITIVE SCENARIO 219

14.9.1 PRODUCT LAUNCHES 219

14.9.2 DEALS 221

14.9.3 EXPANSIONS 222

14.9.4 OTHER DEVELOPMENTS 223

15 COMPANY PROFILES 224

15.1 KEY PLAYERS 224

15.1.1 SCHNEIDER ELECTRIC 224

15.1.1.1 Business overview 224

15.1.1.2 Products/Solutions/Services offered 226

15.1.1.3 Recent developments 227

15.1.1.3.1 Product launches 227

15.1.1.4 MnM view 227

15.1.1.4.1 Key strengths/Right to win 227

15.1.1.4.2 Strategic choices 227

15.1.1.4.3 Weaknesses/Competitive threats 227

15.1.2 ABB 228

15.1.2.1 Business overview 228

15.1.2.2 Products/Solutions/Services offered 229

15.1.2.3 Recent developments 231

15.1.2.3.1 Product launches 231

15.1.2.3.2 Deals 231

15.1.2.4 MnM view 232

15.1.2.4.1 Key strengths/Right to win 232

15.1.2.4.2 Strategic choices 232

15.1.2.4.3 Weaknesses/Competitive threats 232

15.1.3 HONEYWELL INTERNATIONAL INC. 233

15.1.3.1 Business overview 233

15.1.3.2 Products/Solutions/Services offered 235

15.1.3.3 Recent developments 236

15.1.3.3.1 Product launches 236

15.1.3.3.2 Expansions 236

15.1.3.4 MnM view 236

15.1.3.4.1 Key strengths/Right to win 236

15.1.3.4.2 Strategic choices 236

15.1.3.4.3 Weaknesses/Competitive threats 237

15.1.4 EMERSON ELECTRIC CO. 238

15.1.4.1 Business overview 238

15.1.4.2 Products/Solutions/Services offered 239

15.1.4.3 Recent developments 240

15.1.4.3.1 Product launches 240

15.1.4.4 MnM view 241

15.1.4.4.1 Key strengths/Right to win 241

15.1.4.4.2 Strategic choices 241

15.1.4.4.3 Weaknesses/Competitive threats 241

15.1.5 ROCKWELL AUTOMATION 242

15.1.5.1 Business overview 242

15.1.5.2 Products/Solutions/Services offered 243

15.1.5.3 Recent developments 245

15.1.5.3.1 Product launches 245

15.1.5.4 MnM view 245

15.1.5.4.1 Key strengths/Right to win 245

15.1.5.4.2 Strategic choices 245

15.1.5.4.3 Weaknesses/Competitive threats 245

15.1.6 YOKOGAWA ELECTRIC CORPORATION 246

15.1.6.1 Business overview 246

15.1.6.2 Products/Solutions/Services offered 247

15.1.6.3 Recent developments 248

15.1.6.3.1 Product launches 248

15.1.6.3.2 Other developments 249

15.1.7 HIMA 250

15.1.7.1 Business overview 250

15.1.7.2 Products/Solutions/Services offered 250

15.1.7.3 Recent developments 251

15.1.7.3.1 Product launches 251

15.1.8 GENERAL ELECTRIC COMPANY 252

15.1.8.1 Business overview 252

15.1.8.2 Products/Solutions/Services offered 253

15.1.9 OMRON CORPORATION 254

15.1.9.1 Business overview 254

15.1.9.2 Products/Solutions/Services offered 256

15.1.10 SIEMENS 257

15.1.10.1 Business overview 257

15.1.10.2 Products/Solutions/Services offered 258

15.1.11 JOHNSON CONTROLS INC. 260

15.1.11.1 Business overview 260

15.1.11.2 Products/Solutions/Services offered 261

15.1.11.3 Recent developments 262

15.1.11.3.1 Product launches 262

15.1.11.3.2 Expansions 262

15.1.12 DEKRA 263

15.1.12.1 Business overview 263

15.1.12.2 Products/Solutions/Services offered 264

15.1.12.3 Recent developments 265

15.1.12.3.1 Other developments 265

15.1.13 TÜV RHEINLAND 266

15.1.13.1 Business overview 266

15.1.13.2 Products/Solutions/Services offered 267

15.1.13.3 Recent developments 268

15.1.13.3.1 Deals 268

15.1.14 BALLUFF GMBH 269

15.1.14.1 Business overview 269

15.1.14.2 Products/Solutions/Services offered 270

15.1.15 ENDRESS+HAUSER GROUP SERVICES AG 271

15.1.15.1 Business overview 271

15.1.15.2 Products/Solutions/Services offered 272

15.1.15.3 Recent developments 273

15.1.15.3.1 Deals 273

15.2 OTHER KEY PLAYERS 274

15.2.1 SLB 274

15.2.2 VELAN INC. 275

15.2.3 PALADON SYSTEMS S.R.L. 276

15.2.4 INTERTEK GROUP PLC 277

15.2.5 SGS GENERAL SURVEILLANCE COMPANY SA. 278

15.2.6 WEIDMÜLLER INTERFACE GMBH & CO. KG 279

15.2.7 SMC CORPORATION 280

15.2.8 TEXAS INSTRUMENTS INCORPORATED 281

15.2.9 WITTENSTEIN HIGH INTEGRITY SYSTEMS LTD 282

15.2.10 IMAGINATION TECHNOLOGIES 283

16 APPENDIX 284

16.1 INSIGHTS FROM INDUSTRY EXPERTS 284

16.2 DISCUSSION GUIDE 285

16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 288

16.4 CUSTOMIZATION OPTIONS 290

16.5 RELATED REPORTS 290

16.6 AUTHOR DETAILS 291

❖ 世界の機能安全市場に関するよくある質問(FAQ) ❖

・機能安全の世界市場規模は?

→MarketsandMarkets社は2024年の機能安全の世界市場規模を58億8340万米ドルと推定しています。

・機能安全の世界市場予測は?

→MarketsandMarkets社は2029年の機能安全の世界市場規模を78億9670万米ドルと予測しています。

・機能安全市場の成長率は?

→MarketsandMarkets社は機能安全の世界市場が2024年~2029年に年平均6.1%成長すると予測しています。

・世界の機能安全市場における主要企業は?

→MarketsandMarkets社は「Schneider Electric (France), ABB (Switzerland), Honeywell International Inc. (US), Emerson Electric Co. (US), Rockwell Automation (US), General Electric (US), Siemens (Germany), Siemens (Germany), Stratasys (US), Omron Corporation (Japan), Yokogawa Electric Corporation (Japan), Endress+Hauser Group Services AG (Switzerland)など ...」をグローバル機能安全市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。