1 はじめに 36

1.1 調査目的 36

1.2 市場の定義 36

1.3 調査範囲 37

1.3.1 食用油市場のセグメンテーション 37

1.4 考慮した年 40

1.5 通貨を考慮 40

1.6 数量単位の考慮 41

1.7 利害関係者 41

1.8 変化のまとめ 42

2 調査方法 43

2.1 調査データ 43

2.1.1 二次データ 44

2.1.1.1 二次資料からの主要データ 44

2.1.2 一次データ 45

2.1.2.1 専門家への一次インタビュー 45

2.1.2.2 主要な業界インサイト 45

2.1.2.3 一次インタビューの内訳 46

2.1.2.4 一次情報源 47

2.2 市場規模の推定 47

2.2.1 食用油市場規模の推定:供給側 48

2.2.2 食用油の市場規模予測:需要サイド 48

2.2.3 市場規模推定:ボトムアップアプローチ 49

2.2.4 市場規模の推定:トップダウンアプローチ 50

2.3 データ三角測量 51

2.4 リサーチの前提 52

2.5 調査の限界 52

3 エグゼクティブサマリー

4 プレミアムインサイト 57

4.1 食用油市場におけるプレーヤーの魅力的な機会 57

4.2 食用油市場:主要地域のサブマーケット 58

4.3 アジア太平洋地域:食用油市場:最終用途別、国別 58

4.4 食用油市場:タイプ別 59

4.5 食用油市場:最終用途別 60

5 市場の概要

5.1 はじめに

5.2 マクロ経済指標 61

5.2.1 健康志向の高まりと消費者の嗜好 61

5.2.2 人口増加、GDP成長、都市化 62

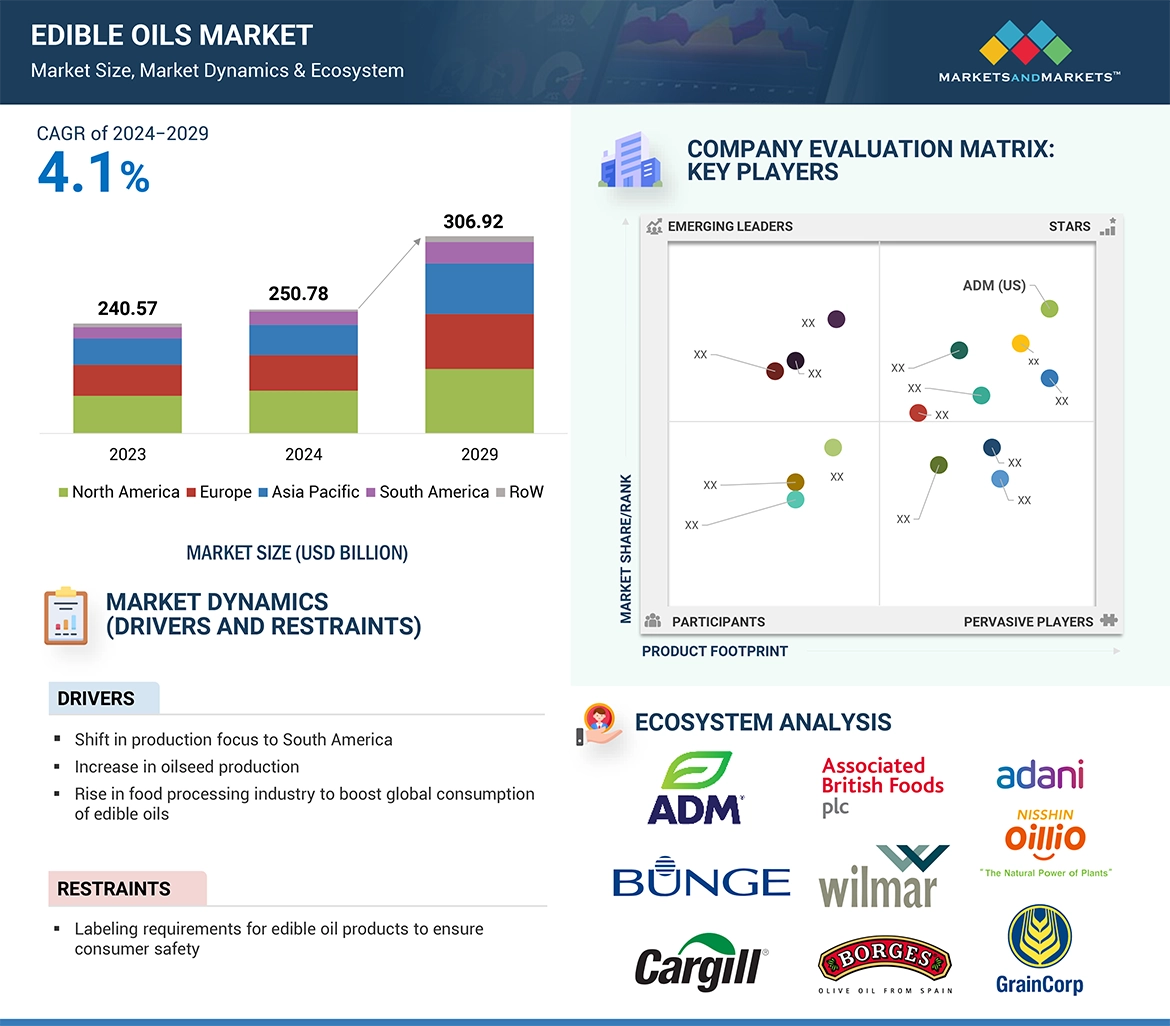

5.3 市場ダイナミクス 64

5.3.1 推進要因 64

5.3.1.1 生産拠点の南米へのシフト 64

5.3.1.2 油糧種子生産の増加 65

5.3.1.3 食品需要の増加 66

5.3.1.4 製菓・製パン、食品加工分野からの高い需要 67

5.3.1.5 食用油の研究開発と製品上市の増加 68

5.3.2 阻害要因 68

5.3.2.1 消費者の安全性確保のためのラベル表示要件 68

5.3.2.2 食用油の価格変動が激しい 68

5.3.3 機会 69

5.3.3.1 オリーブ油価格高騰によるヒマワリ油需要の増加 69

5.3.3.2 大豆油に関連する数多くの利点 69

5.3.3.3 消費者の健康志向の高まり 69

5.3.4 課題 70

5.3.4.1 供給不足と価格高騰による詐欺行為の急増 70

5.3.4.2 欧州における菜種生産の減少 70

5.3.4.3 パーム油と菜種の収量低迷 72

5.4 食用油セクターへのGEN AIの影響 72

5.4.1 導入 72

5.4.2 食用油市場における遺伝子AIの採用 73

5.4.3 ケーススタディ分析 73

5.4.3.1 パーム油管理におけるAIを活用したスマート農業 73

5.4.3.2 AIを活用したパーム油の精密農業 74

5.4.4 食用油市場への影響 75

5.4.5 AIに取り組む隣接エコシステム 75

6 業界動向 76

6.1 はじめに 76

6.2 サプライチェーン分析 77

6.3 バリューチェーン分析 79

6.3.1 研究開発 80

6.3.2 原料調達・調達 80

6.3.3 破砕、精製、生産 80

6.3.4 安全性と品質 80

6.3.5 マーケティング&流通 80

6.4 貿易分析 81

6.4.1 ひまわり油 81

6.4.1.1 ヒマワリ油の輸出シナリオ(HSコード151219) 81

6.4.1.2 ヒマワリ油の輸入シナリオ(HSコード151219) 82

6.4.2 パーム油 85

6.4.2.1 パーム油(HSコード1511)の輸出シナリオ 85

6.4.2.2 パーム油(HSコード1511)の輸入シナリオ 85

6.4.3 大豆油 88

6.4.3.1 大豆油(HSコード1507)の輸出シナリオ 88

6.4.3.2 大豆油(HSコード1507)の輸入シナリオ 89

6.4.4 菜種油 92

6.4.4.1 菜種油(HSコード151491)の輸出シナリオ 92

6.4.4.2 菜種油(HSコード151491)の輸入シナリオ 93

6.4.5 オリーブ油 96

6.4.5.1 オリーブ油(HSコード1509)の輸出シナリオ 96

6.4.5.2 オリーブ油(HSコード1509)の輸入シナリオ 97

6.5 技術分析 100

6.5.1 主要技術 100

6.5.1.1 強化・濃縮技術 100

6.5.1.2 超音波技術 101

6.5.2 補完的技術 101

6.5.2.1 トランス脂肪低減技術 101

6.5.3 隣接技術 101

6.5.3.1 ナノテクノロジー 101

6.5.3.2 DNA配列決定と遺伝子型分類 102

6.6 価格分析 102

6.6.1 主要企業の食用油の平均販売価格動向 102

6.6.2 タイプ別の平均販売価格動向 103

6.6.3 平均販売価格動向(地域別) 104

6.7 エコシステム分析 105

6.7.1 需要サイド 106

6.7.2 供給サイド 106

6.8 顧客ビジネスに影響を与えるトレンド/混乱 108

6.9 特許分析 110

6.9.1 主要特許リスト 111

6.10 主要な会議とイベント(2024~2025年) 117

6.11 関税と規制の状況 118

6.11.1 食用油に関する関税 118

6.12 規制の枠組み 118

6.12.1 規制機関、政府機関、その他の組織 120

6.12.2 北米 122

6.12.2.1 米国 122

6.12.2.2 カナダ 122

6.12.3 欧州 123

6.12.4 アジア太平洋地域 124

6.12.4.1 インド 124

6.12.4.2 中国 125

6.12.4.3 その他のアジア太平洋地域 125

6.12.5 南米 125

6.12.5.1 ブラジル 125

6.12.6 その他の地域 125

6.13 ポーターの5つの力分析 126

6.13.1 競争相手の強さ 127

6.13.2 サプライヤーの交渉力 128

6.13.3 買い手の交渉力 128

6.13.4 代替品の脅威 128

6.13.5 新規参入企業の脅威 128

6.14 主要ステークホルダーと購買基準 129

6.14.1 購入プロセスにおける主要ステークホルダー 129

6.14.2 購入基準 130

6.15 ケーススタディ分析 132

6.15.1 欧州の森林破壊規制(Eudr)と食用油産業 132

6.15.2 食用油に関する国家ミッション-パーム油: インドの自給率向上と持続可能性 133

6.16 投資と資金調達のシナリオ 133

7 食用油市場:タイプ別 134

7.1 はじめに 135

7.2 パーム油 137

7.2.1 高い耐酸化性による食品産業での需要促進 137

7.3 大豆油 139

7.3.1 費用対効果と健康上の利点が市場を牽引 139

7.4 ひまわり油 141

7.4.1 生産量の増加がヒマワリ油市場の成長を牽引 141

7.5 菜種油 143

7.5.1 多様な料理用途と高濃度の栄養素が市場を牽引 143

7.6 オリーブ油 146

7.6.1 健康増進作用が市場の成長を促進 146

7.7 その他の食用油 148

7.7.1 ココナッツオイル 148

7.7.1.1 健康上の利点に対する需要の高まりが市場成長を促進 148

7.7.2 ピーナッツ油 148

7.7.2.1 アジア諸国における需要と生産の増加が市場を牽引 148

8 食用油市場(用途別) 151

8.1 導入 151

8.2 調理とフライ 151

8.3 製パン 151

8.4 ドレッシング及びマリネ 152

8.5 香味増強及び仕上げ 152

8.6 ソースと調味料 152

8.7 食品保存 153

8.8 乳製品及び乳製品代替製品 153

8.9 粉ミルク及び栄養強化 153

9 食用油市場:最終用途別 154

9.1 導入 155

9.2 家庭用 157

9.2.1 健康的な油の利点に対する意識の高まりが市場を牽引 157

9.3 外食 159

9.3.1 外食店舗の増加が食用油のようなバルク原料の需要を促進 159

9.4 工業用 161

9.4.1 加工食品需要の増加が市場を牽引 161

10 食用油市場:抽出技術別 164

10.1 導入 164

10.2 機械的抽出 164

10.3 溶媒抽出 165

10.4 酵素抽出 165

10.5 超音波抽出 166

10.6 水抽出 166

11 食用油市場、グレード別 168

11.1 はじめに 168

11.2 バージン 168

11.3 エクストラバージン 168

11.4 コールドプレス 169

11.5 オーガニック 169

11.6 精製されたもの 170

11.7 その他 170

12 食用油市場:流通チャネル別 171

12.1 導入 171

12.2 オフライン 171

12.2.1 卸売 171

12.2.2 小売 171

12.2.3 工業用 172

12.3 オンライン 172

13 食用油市場:包装タイプ別 173

13.1 はじめに 173

13.2 小容量包装 173

13.2.1 パウチ 173

13.2.2 ボトル(プラスチック、ガラス、スプレーボトル) 173

13.2.3 瓶 174

13.2.4 テトラパックカートン 174

13.3 ばら包装と工業用包装 174

13.3.1 金属缶(アルミニウムまたはブリキ) 174

13.3.2 バッグインボックス 174

13.3.3 バルク容器 175

14 食用油市場:包装技術別 176

14.1 はじめに 176

14.2 素材ベース 176

14.2.1 プラスチックボトル(ペットボトル、hdpe) 176

14.2.2 ガラス瓶 176

14.2.3 金属缶 177

14.2.4 フレキシブルパウチ 177

14.3 特殊包装 177

14.3.1 テトラパックカートン 177

14.3.2 バッグオンバルブ(Bov)技術 178

14.3.3 バルク容器 178

14.3.4 スマート包装技術(コネクテッド包装またはセンサー対応包装) 178

15 食用油市場(地域別) 179

15.1 はじめに 180

15.2 北米 182

15.2.1 米国 186

15.2.1.1 食用油の大規模市場、焼き菓子の生産と輸出の増加 186

15.2.2 カナダ 189

15.2.2.1 菜種油の増産と確立された貿易システム 189

菜種油 189

15.2.3 メキシコ 192

15.2.3.1 増え続ける加工食品需要と強固な貿易関係 192

15.3 欧州 196

15.3.1 ドイツ 204

15.3.1.1 ベーカリー製品の増産が促進する菜種油の成長 204

15.3.2 イギリス 207

15.3.2.1 菜種油と大豆油の輸入は、持続可能な便利食品のトレンドと製パン産業の成長に支えられて大幅増 207

15.3.3 フランス 210

15.3.3.1 小規模な油製造業者と輸出業者の存在に伴う有機食品原料の需要 210

15.3.4 スペイン 214

15.3.4.1 著名なオリーブ油の消費者、生産者、輸出国 214

15.3.5 チェコ共和国 217

15.3.5.1 特にロシアとウクライナの紛争時には、ヒマワリ油を菜種油で代用して市場を支援 217

15.3.6 イタリア 220

15.3.6.1 健康志向の高まりとヒマワリ油の供給不足によりイタリア産オリーブ油の需要が増加 220

15.3.7 オランダ 223

15.3.7.1 国際市場におけるヒマワリ油の供給不足がもたらす機会により輸出ビジネスが支援される 223

15.3.8 ポーランド 226

15.3.8.1 菜種生産量の漸進的な年次改善による油の増産と継続的生産 226

15.3.9 スロバキア 229

15.3.9.1 菜種油メーカーとの政府協力と大豆作付面積の拡大による植物油生産の改善 229

15.3.10 オーストリア 232

15.3.10.1 持続可能な農業と安定生産に焦点を当てた大豆生産の増加 232

15.3.11 ハンガリー 235

15.3.11.1 政府の規制にもかかわらず、輸出の増加でヒマワリ油市場が活性化 235

15.3.12 ルーマニア 238

15.3.12.1 ヒマワリの生産・輸出拡大に注力 238

15.3.13 ブルガリア 241

15.3.13.1 高い圧搾能力による実質的かつ継続的なヒマワリ油生産と菜種の輸入 241

15.3.14 その他のヨーロッパ 244

15.4 アジア太平洋地域 247

15.4.1 中国 253

15.4.1.1 高品質の特殊油の開発に支えられた加工食品の増産と油糧種子の大幅な輸入 253

15.4.2 インド 256

15.4.2.1 油糧種子生産のリーダー、植物油生産の急成長、食用油の高い消費 256

15.4.3 日本 259

15.4.3.1 外食産業の回復による菜種油と大豆油の需要、オリーブ油の自由な輸入国と消費国 259

15.4.4 オーストラリア 263

15.4.4.1 国内の豊富な菜種生産量と外食産業における安定した油需要 263

15.4.5 韓国 266

15.4.5.1 堅調な食品加工産業と地元産バイオディーゼルの需要増加 266

15.4.6 インドネシア 269

15.4.6.1 ヒマワリ油の代替としてのパーム油需要の増加 269

15.4.7 マレーシア 272

15.4.7.1 世界的な食用油不足を背景にマレーシアは世界のパーム油市場で重要な地位を強化 272

15.4.8 その他のアジア太平洋地域 276

15.5 南米 279

15.5.1 ブラジル 283

15.5.1.1 国内の油糧種子の豊富さ、特に大豆 283

15.5.2 アルゼンチン 286

15.5.2.1 食用油の国内消費を奨励する政府の政策 286

15.5.3 南アメリカのその他の地域 289

15.6 その他の地域(列記) 292

15.6.1 中東 296

15.6.1.1 ヘルシーな加工食品への需要の高まり、パーム油の高い輸入量、ひまわり油の堅調な小売市場 296

15.6.2 アフリカ 299

15.6.2.1 現地需要の伸びを伴う各種油糧種子の生産と輸入の増加 299

16 競争環境 303

16.1 概要 303

16.2 主要プレーヤーの戦略/勝利への権利 303

16.3 収益分析、2021~2023年 305

16.4 市場シェア分析、2023年 307

16.5 企業評価と財務指標 309

16.5.1 企業評価 309

16.5.2 EV/EBITDA 309

16.6 ブランド比較分析 310

16.6.1 カーギル(ネイチャーフレッシュ、ジェミニ、スイカーなど) 311

16.6.2 アダニ・ウィルマー(フォーチュン) 311

16.6.3 アソシエイテッド・ブリティッシュ・フーズ(ABF) 311

16.6.4 ボルゲス・アグリカルチュラル・アンド・インダストリアル・エディブルオイルズ, S.A.U. 311

16.7 企業評価マトリックス:主要企業(2023年) 312

16.7.1 スター 312

16.7.2 新興リーダー 312

16.7.3 浸透型プレーヤー 312

16.7.4 参加企業 313

16.7.5 企業フットプリント:主要プレーヤー、2023年 314

16.7.5.1 企業フットプリント 314

16.7.5.2 地域別フットプリント 315

16.7.5.3 タイプ別フットプリント 316

16.7.5.4 最終用途フットプリント 317

16.7.5.5 パッケージングタイプのフットプリント 318

16.8 企業評価マトリクス:新興企業/SM(2023年) 319

16.8.1 進歩的企業 319

16.8.2 対応力のある企業 319

16.8.3 ダイナミックな企業 319

16.8.4 スターティングブロック 319

16.8.5 競争ベンチマーキング 321

16.8.5.1 主要新興企業/中小企業の詳細リスト 321

16.8.5.2 主要新興企業/中小企業の競合ベンチマーキング 322

16.9 競争シナリオと動向 324

16.9.1 製品上市 324

16.9.2 取引 326

16.9.3 拡張 329

16.9.4 その他 330

17 会社プロファイル 331

17.1 主要企業 331

ADM (US)

Bunge (US)

Associated British Foods plc (UK)

Wilmar International Ltd (Singapore)

United Plantations Berhad (Malaysia)

Sime Darby Berhad (Malaysia)

BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS

S.A.U. (Spain)

Cargill Incorporated (US)

GrainCorp (Australia)

Adani Group (India)

The Nisshin OilliO Group Ltd. (Japan)

Beidahuang Group (China)

AJANTA SOYA LIMITED (India)

Patanjali Foods Ltd. (India)

and Louis Dreyfus Company (Netherlands)

18 隣接・関連市場 423

18.1 導入 423

18.2 制限事項 423

18.3 油脂市場 423

18.3.1 市場の定義 423

18.3.2 市場の概要 424

18.4 特殊油脂市場 425

18.4.1 市場の定義 425

18.4.1.1 特殊油脂 425

18.4.1.2 特殊油 425

18.4.2 市場の概要 425

19 付録 427

19.1 ディスカッション・ガイド 427

19.2 Knowledgestore: マーケットサ ンドマーケッツの購読ポータル 432

19.3 カスタマイズオプション 434

19.4 関連レポート 434

19.5 著者の詳細 435

Technological advancements play a pivotal role in the growth of the edible oils market. Innovations in extraction methods, such as improved solvent recovery systems and mechanical pressing technologies, have significantly enhanced efficiency and yield. Furthermore, the development of enzymatic and ultrasound-assisted extraction methods allows for higher quality oils with preserved nutritional value. Automation and digitalization in oil processing plants also improve production capacity, reduce waste, and ensure consistent product quality. These technological improvements contribute to the cost-effectiveness of oil production, meeting the increasing global demand for edible oils while supporting sustainability initiatives in the industry.

Disruption in the edible oils market: The edible oils market is experiencing disruption due to various factors, including changing consumer preferences, environmental concerns, and technological advancements. These disruptions are reshaping the industry, influencing production processes, market dynamics, and the types of oils consumers prefer.

Some of the key disruptions in the edible oils market include:

• Increased trend towards healthy plant-based diet: : Consumers are increasingly prioritizing healthier oils, such as olive, avocado, and canola oils, in place of traditional vegetable oils. This trend is driven by growing health consciousness, particularly concerns over heart disease, obesity, and cholesterol levels, influencing production and consumption patterns.

• Sustainable and Ethical Sourcing: The demand for sustainably sourced oils, such as certified palm oil and organic oils, is rising. Environmental concerns, particularly related to deforestation and biodiversity loss in palm oil production, are pushing manufacturers to adopt ethical sourcing practices, aligning with consumer preferences for eco-friendly products.

• Technological Innovations: Advancements in processing technologies, such as cold-press and enzymatic extraction, are enhancing the quality and nutritional value of edible oils. These innovations not only improve flavor and health benefits but also offer greater efficiency and sustainability in oil production, further disrupting traditional methods.

• Supply chain challenges: The edible oils market has faced significant supply chain disruptions due to geopolitical tensions and escalating raw material costs. Conflicts such as the Russia-Ukraine war, which disrupted sunflower oil exports from two leading producers, have created supply shortages and volatility. Additionally, trade restrictions, tariffs, and sanctions further complicate global logistics. Rising costs of raw materials, driven by climate change impacts on crop yields and increased input costs, have amplified the challenges. These factors not only elevate prices but also create uncertainty in the supply chain. Consequently, manufacturers and suppliers are focusing on diversifying sourcing strategies and investing in alternative oils to mitigate risks and maintain market stability amidst these challenges.

“The Palm oil segment holds a significant market share among the type segment in the edible oils market.”

Edible palm oil has seen significant growth in recent years, driven by its versatile uses and economic benefits. Commonly used in cooking, frying, and as an ingredient in processed foods like snacks, margarine, and baked goods, palm oil is valued for its high stability at high cooking temperatures. It also has a longer shelf life compared to other vegetable oils, which is beneficial for food manufacturers. The growth of edible palm oil is attributed to its cost-effectiveness, high yield per hectare, and growing demand in emerging markets, particularly in Asia and Africa.

“The solvent extraction technology holds significant use among the technology in the edible oils market.”

Solvent extraction methods are widely used in the edible oil extraction industry due to their efficiency and ability to process a wide range of raw materials, including seeds, grains, and other oil-rich crops. This method primarily involves using solvents, such as hexane, to dissolve the oil from the raw material, followed by separating and evaporating the solvent to obtain the oil. It is widely adopted for its ability to extract a higher yield compared to mechanical methods, making it ideal for large-scale commercial production.

Solvent extraction's benefits include its high efficiency, cost-effectiveness, and ability to extract oil from a diverse range of crops with minimal waste. It is particularly beneficial for extracting oils from oilseeds with low oil content, such as soybeans, sunflowers, and canola.

The growth of solvent extraction is driven by the increasing demand for edible oils in food processing, rising production capacities, and innovations in solvent recovery systems that enhance environmental sustainability and reduce costs, further fueling its market dominance.

"North America region holds a significant market share in the edible oils market."

North America holds a significant market share in the global edible oils market due to its well-established food processing industry, high disposable incomes, and the increasing popularity of health-conscious and premium oils. The presence of key players such as Cargill, Incorporated (US), ADM (US), and Bunge (US) further strengthens the market, as these companies offer a wide range of products, including vegetable oils, olive oils, and specialty oils. These players benefit from advanced production technologies, strong distribution networks, and a diverse consumer base.

Growth opportunities in North America are driven by several factors. The rising demand for healthier cooking oils, such as avocado oil and olive oil, aligns with shifting consumer preferences toward plant-based, organic, and low-cholesterol products. Additionally, innovation in packaging and the expansion of plant-based food products provide further growth prospects. Strategic partnerships, mergers, and acquisitions in the region are expected to enhance market expansion.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the edible oils market:

• By Company Type: Tier 1 – 45%, Tier 2 – 33%, and Tier 3 – 22%

• By Designation: Directors – 45%, Managers – 33%, Others- 22%

• By Region: North America – 15%, Europe – 30%, Asia Pacific – 13%, South America – 30% and Rest of the World –12%

Prominent companies in the market include ADM (US), Bunge (US), Associated British Foods plc (UK), Wilmar International Ltd (Singapore), United Plantations Berhad (Malaysia), Sime Darby Berhad (Malaysia), BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U. (Spain), Cargill Incorporated (US), GrainCorp (Australia), Adani Group (India), The Nisshin OilliO Group, Ltd. (Japan), Beidahuang Group (China), AJANTA SOYA LIMITED (India), Patanjali Foods Ltd. (India), and Louis Dreyfus Company (Netherlands).

Other players include Golden Agri-Resources Ltd. (Singapore), Richardson International Limited (Canada), Hebany (UAE), Aceitera General Deheza (Argentina), Vicentin S.A.I.C. (Argentina), Tradizione Italiana (Italy), EFKO Group (Russia), Nutiva Inc. (US), American Vegetable Oils, Inc. (US),and Sunora Foods (Canada).

Research Coverage:

This research report categorizes the edible oils market edible oils market by type (soybean oil, palm oil, sunflower oil, rapeseed oil, olive oil, and other edible oils), end use (Domestic, Industrial, and food service), packaging technology, packaging type, application, extraction technology, grade, distribution channel, and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of edible oils. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the edible oils market. Competitive analysis of upcoming startups in the edible oils market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent, and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall edible oils and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (Increase in oilseed production), restraints (High price volatility for edible oils), opportunities (Rising sunflower oil demand offers growth potential due to high olive oil prices), and challenges (Surge in fraud due to tight supplies and soaring prices) influencing the growth of the edible oils market.

• New product launch/Innovation: Detailed insights on research & development activities and new product launches in the edible oils market.

• Market Development: Comprehensive information about lucrative markets – the report analyzes edible oils across varied regions.

• Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the edible oils market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as ADM (US), Bunge (US), Associated British Foods plc (UK), Wilmar International Ltd (Singapore), United Plantations Berhad (Malaysia), and other players in the edible oils market.

1 INTRODUCTION 36

1.1 STUDY OBJECTIVES 36

1.2 MARKET DEFINITION 36

1.3 STUDY SCOPE 37

1.3.1 EDIBLE OILS MARKET SEGMENTATION 37

1.4 YEARS CONSIDERED 40

1.5 CURRENCY CONSIDERED 40

1.6 VOLUME UNIT CONSIDERED 41

1.7 STAKEHOLDERS 41

1.8 SUMMARY OF CHANGES 42

2 RESEARCH METHODOLOGY 43

2.1 RESEARCH DATA 43

2.1.1 SECONDARY DATA 44

2.1.1.1 Key data from secondary sources 44

2.1.2 PRIMARY DATA 45

2.1.2.1 Primary interviews with experts 45

2.1.2.2 Key industry insights 45

2.1.2.3 Breakdown of primary interviews 46

2.1.2.4 Primary sources 47

2.2 MARKET SIZE ESTIMATION 47

2.2.1 EDIBLE OILS MARKET SIZE ESTIMATION: SUPPLY SIDE 48

2.2.2 EDIBLE OILS MARKET SIZE ESTIMATION: DEMAND SIDE 48

2.2.3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 49

2.2.4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 50

2.3 DATA TRIANGULATION 51

2.4 RESEARCH ASSUMPTIONS 52

2.5 RESEARCH LIMITATIONS 52

3 EXECUTIVE SUMMARY 53

4 PREMIUM INSIGHTS 57

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EDIBLE OILS MARKET 57

4.2 EDIBLE OILS MARKET: MAJOR REGIONAL SUBMARKETS 58

4.3 ASIA PACIFIC: EDIBLE OILS MARKET, BY END USE AND COUNTRY 58

4.4 EDIBLE OILS MARKET, BY TYPE 59

4.5 EDIBLE OILS MARKET, BY END USE 60

5 MARKET OVERVIEW 61

5.1 INTRODUCTION 61

5.2 MACROECONOMIC INDICATORS 61

5.2.1 GROWING HEALTH TRENDS AND CONSUMER PREFERENCES 61

5.2.2 POPULATION INCREASE, GDP GROWTH, AND URBANIZATION 62

5.3 MARKET DYNAMICS 64

5.3.1 DRIVERS 64

5.3.1.1 Shift in production focus to South America 64

5.3.1.2 Rise in oilseed production 65

5.3.1.3 Increasing demand for food 66

5.3.1.4 High demand from confectionery & bakery and food processing sectors 67

5.3.1.5 Growth in R&D and product launches of edible oils 68

5.3.2 RESTRAINTS 68

5.3.2.1 Labeling requirements to ensure consumer safety 68

5.3.2.2 High price volatility for edible oils 68

5.3.3 OPPORTUNITIES 69

5.3.3.1 Rising sunflower oil demand due to high olive oil prices 69

5.3.3.2 Numerous benefits associated with soybean oil 69

5.3.3.3 Increase in consumer shift toward healthier oils 69

5.3.4 CHALLENGES 70

5.3.4.1 Surge in fraudulent activities due to tight supplies and soaring prices 70

5.3.4.2 Reduced rapeseed production in Europe 70

5.3.4.3 Yield stagnation in palm oil and rapeseed 72

5.4 IMPACT OF GEN AI ON EDIBLE OILS SECTOR 72

5.4.1 INTRODUCTION 72

5.4.2 ADOPTION OF GEN AI IN EDIBLE OILS MARKET 73

5.4.3 CASE STUDY ANALYSIS 73

5.4.3.1 AI-powered smart agriculture in palm oil management 73

5.4.3.2 AI-powered precision agriculture for palm oil 74

5.4.4 IMPACT ON EDIBLE OILS MARKET 75

5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI 75

6 INDUSTRY TRENDS 76

6.1 INTRODUCTION 76

6.2 SUPPLY CHAIN ANALYSIS 77

6.3 VALUE CHAIN ANALYSIS 79

6.3.1 RESEARCH & DEVELOPMENT 80

6.3.2 RAW MATERIAL SOURCING & PROCUREMENT 80

6.3.3 CRUSHING, REFINING, & PRODUCTION 80

6.3.4 SAFETY & QUALITY 80

6.3.5 MARKETING & DISTRIBUTION 80

6.4 TRADE ANALYSIS 81

6.4.1 SUNFLOWER OIL 81

6.4.1.1 Export scenario of sunflower oil (HS code 151219) 81

6.4.1.2 Import scenario of sunflower oil (HS code 151219) 82

6.4.2 PALM OIL 85

6.4.2.1 Export scenario of palm oil (HS code 1511) 85

6.4.2.2 Import scenario of palm oil (HS code 1511) 85

6.4.3 SOYBEAN OIL 88

6.4.3.1 Export scenario of soybean oil (HS code 1507) 88

6.4.3.2 Import scenario of soybean oil (HS code 1507) 89

6.4.4 RAPESEED OIL 92

6.4.4.1 Export scenario of rapeseed oil (HS code 151491) 92

6.4.4.2 Import scenario of rapeseed oil (HS code 151491) 93

6.4.5 OLIVE OIL 96

6.4.5.1 Export scenario of olive oil (HS code 1509) 96

6.4.5.2 Import scenario of olive oil (HS code 1509) 97

6.5 TECHNOLOGY ANALYSIS 100

6.5.1 KEY TECHNOLOGIES 100

6.5.1.1 Fortification and enrichment technologies 100

6.5.1.2 Ultrasound technology 101

6.5.2 COMPLEMENTARY TECHNOLOGIES 101

6.5.2.1 Trans-fat reduction technology 101

6.5.3 ADJACENT TECHNOLOGIES 101

6.5.3.1 Nanotechnology 101

6.5.3.2 DNA sequencing and genotyping 102

6.6 PRICING ANALYSIS 102

6.6.1 AVERAGE SELLING PRICE TREND OF EDIBLE OILS AMONG KEY PLAYERS 102

6.6.2 AVERAGE SELLING PRICE TREND, BY TYPE 103

6.6.3 AVERAGE SELLING PRICE TREND, BY REGION 104

6.7 ECOSYSTEM ANALYSIS 105

6.7.1 DEMAND SIDE 106

6.7.2 SUPPLY SIDE 106

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 108

6.9 PATENT ANALYSIS 110

6.9.1 LIST OF MAJOR PATENTS 111

6.10 KEY CONFERENCES AND EVENTS, 2024–2025 117

6.11 TARIFF AND REGULATORY LANDSCAPE 118

6.11.1 TARIFF RELATED TO EDIBLE OIL 118

6.12 REGULATORY FRAMEWORK 118

6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 120

6.12.2 NORTH AMERICA 122

6.12.2.1 US 122

6.12.2.2 Canada 122

6.12.3 EUROPE 123

6.12.4 ASIA PACIFIC 124

6.12.4.1 India 124

6.12.4.2 China 125

6.12.4.3 Rest of Asia Pacific 125

6.12.5 SOUTH AMERICA 125

6.12.5.1 Brazil 125

6.12.6 REST OF THE WORLD 125

6.13 PORTER’S FIVE FORCES ANALYSIS 126

6.13.1 INTENSITY OF COMPETITIVE RIVALRY 127

6.13.2 BARGAINING POWER OF SUPPLIERS 128

6.13.3 BARGAINING POWER OF BUYERS 128

6.13.4 THREAT OF SUBSTITUTES 128

6.13.5 THREAT OF NEW ENTRANTS 128

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA 129

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS 129

6.14.2 BUYING CRITERIA 130

6.15 CASE STUDY ANALYSIS 132

6.15.1 EUROPEAN DEFORESTATION REGULATION (EUDR) AND EDIBLE OIL INDUSTRY IN EUROPE 132

6.15.2 NATIONAL MISSION ON EDIBLE OILS – PALM OIL: BOOSTING INDIA’S SELF-SUFFICIENCY AND SUSTAINABILITY 133

6.16 INVESTMENT AND FUNDING SCENARIO 133

7 EDIBLE OILS MARKET, BY TYPE 134

7.1 INTRODUCTION 135

7.2 PALM OIL 137

7.2.1 HIGH OXIDATION RESISTANCE TO FUEL DEMAND IN FOOD INDUSTRIES 137

7.3 SOYBEAN OIL 139

7.3.1 COST-EFFECTIVENESS AND HEALTH BENEFITS TO DRIVE MARKET 139

7.4 SUNFLOWER OIL 141

7.4.1 INCREASED PRODUCTION TO DRIVE GROWTH OF SUNFLOWER OIL MARKET 141

7.5 RAPESEED OIL 143

7.5.1 VARIED CULINARY APPLICATIONS AND HIGH CONCENTRATION OF NUTRIENTS TO DRIVE MARKET 143

7.6 OLIVE OIL 146

7.6.1 HEALTH-PROMOTING PROPERTIES TO AUGMENT SEGMENT GROWTH 146

7.7 OTHER EDIBLE OILS 148

7.7.1 COCONUT OIL 148

7.7.1.1 Rising demand for health benefits to drive market growth 148

7.7.2 PEANUT OIL 148

7.7.2.1 Growing demand and production in Asian countries to drive market 148

8 EDIBLE OILS MARKET, BY APPLICATION 151

8.1 INTRODUCTION 151

8.2 COOKING AND FRYING 151

8.3 BAKING 151

8.4 SALAD DRESSING AND MARINADES 152

8.5 FLAVOR ENHANCEMENT AND FINISHING TOUCHES 152

8.6 SAUCES AND CONDIMENTS 152

8.7 FOOD PRESERVATION 153

8.8 DAIRY AND DAIRY ALTERNATIVE PRODUCTS 153

8.9 INFANT FORMULA AND NUTRITIONAL FORTIFICATION 153

9 EDIBLE OILS MARKET, BY END USE 154

9.1 INTRODUCTION 155

9.2 HOUSEHOLD 157

9.2.1 INCREASED AWARENESS ABOUT BENEFITS OF HEALTHY OILS TO DRIVE MARKET 157

9.3 FOOD SERVICE 159

9.3.1 INCREASING FOOD SERVICE OUTLETS TO DRIVE DEMAND FOR BULK INGREDIENTS LIKE EDIBLE OILS 159

9.4 INDUSTRIAL 161

9.4.1 INCREASED DEMAND FOR PROCESSED FOOD TO DRIVE MARKET 161

10 EDIBLE OILS MARKET, BY EXTRACTION TECHNOLOGY 164

10.1 INTRODUCTION 164

10.2 MECHANICAL EXTRACTION 164

10.3 SOLVENT EXTRACTION 165

10.4 ENZYMATIC EXTRACTION 165

10.5 ULTRASOUND EXTRACTION 166

10.6 AQUEOUS EXTRACTION 166

11 EDIBLE OILS MARKET, BY GRADE 168

11.1 INTRODUCTION 168

11.2 VIRGIN 168

11.3 EXTRA VIRGIN 168

11.4 COLD PRESSED 169

11.5 ORGANIC 169

11.6 REFINED 170

11.7 OTHERS 170

12 EDIBLE OILS MARKET, BY DISTRIBUTION CHANNEL 171

12.1 INTRODUCTION 171

12.2 OFFLINE 171

12.2.1 WHOLESALE 171

12.2.2 RETAIL 171

12.2.3 INDUSTRIAL 172

12.3 ONLINE 172

13 EDIBLE OILS MARKET, BY PACKAGING TYPE 173

13.1 INTRODUCTION 173

13.2 SMALL VOLUME PACKAGING 173

13.2.1 POUCHES 173

13.2.2 BOTTLES (PLASTIC, GLASS, SPRAY BOTTLES) 173

13.2.3 JARS 174

13.2.4 TETRA PAK CARTONS 174

13.3 BULK AND INDUSTRIAL PACKAGING 174

13.3.1 METAL CANS (ALUMINUM OR TINPLATE) 174

13.3.2 BAG-IN-BOX 174

13.3.3 BULK CONTAINERS 175

14 EDIBLE OILS MARKET, BY PACKAGING TECHNOLOGY 176

14.1 INTRODUCTION 176

14.2 MATERIAL-BASED 176

14.2.1 PLASTIC BOTTLES (PET, HDPE) 176

14.2.2 GLASS BOTTLES 176

14.2.3 METAL CANS 177

14.2.4 FLEXIBLE POUCHES 177

14.3 SPECIALIZED PACKAGING 177

14.3.1 TETRA PAK CARTONS 177

14.3.2 BAG-ON-VALVE (BOV) TECHNOLOGY 178

14.3.3 BULK CONTAINERS 178

14.3.4 SMART PACKAGING TECHNOLOGIES (CONNECTED OR SENSOR-ENABLED PACKAGING 178

15 EDIBLE OILS MARKET, BY REGION 179

15.1 INTRODUCTION 180

15.2 NORTH AMERICA 182

15.2.1 US 186

15.2.1.1 Large market for cooking oils and rise in production and export of baked goods 186

15.2.2 CANADA 189

15.2.2.1 Increased production and well-established trade system for

rapeseed oil 189

15.2.3 MEXICO 192

15.2.3.1 Ever-growing processed food demand and strong trade ties 192

15.3 EUROPE 196

15.3.1 GERMANY 204

15.3.1.1 Rapeseed oil growth fostered by increased production of bakery items 204

15.3.2 UK 207

15.3.2.1 Sizeable import of rapeseed and soybean oils, supported by trend of sustainable convenient foods and growing baking industry 207

15.3.3 FRANCE 210

15.3.3.1 Demand for organic food ingredients, along with presence of both small oil producers and exporters 210

15.3.4 SPAIN 214

15.3.4.1 Prominent consumer, producer, and exporter of olive oil 214

15.3.5 CZECH REPUBLIC 217

15.3.5.1 Substituting sunflower oil with rapeseed oil to help market, especially during Russia-Ukraine conflict 217

15.3.6 ITALY 220

15.3.6.1 Demand for Italian olive oil to increase with greater health awareness and short supply of sunflower oil 220

15.3.7 NETHERLANDS 223

15.3.7.1 Export businesses to be supported by opportunities created by short supply of sunflower oil in international market 223

15.3.8 POLAND 226

15.3.8.1 Gradual, annual improvement in rapeseed production to ensure increased and continuous production of oils 226

15.3.9 SLOVAKIA 229

15.3.9.1 Government collaboration with rapeseed oil manufacturers and expanding soybean acreage to aid in improved plant oil production 229

15.3.10 AUSTRIA 232

15.3.10.1 Increased soybean production with focus on sustainable agriculture and stable output 232

15.3.11 HUNGARY 235

15.3.11.1 Sunflower oil market fueled by increased export, despite government-imposed restrictions 235

15.3.12 ROMANIA 238

15.3.12.1 Focus on expanding sunflower production and exports 238

15.3.13 BULGARIA 241

15.3.13.1 High crushing capacity to ensure substantial and continuous sunflower oil production and rapeseed imports 241

15.3.14 REST OF EUROPE 244

15.4 ASIA PACIFIC 247

15.4.1 CHINA 253

15.4.1.1 Increased production of processed foods and significant imports of oilseeds, supported by development of high-quality specialty oils 253

15.4.2 INDIA 256

15.4.2.1 Leader in oilseed production, rapid growth in vegetable oil production, and high consumption of edible oils 256

15.4.3 JAPAN 259

15.4.3.1 Demand for rapeseed and soybean oils due to rebound of food service industry; liberal importer and consumer of olive oil 259

15.4.4 AUSTRALIA 263

15.4.4.1 Abundant domestic rapeseed crop production and consistent demand for oil in food service 263

15.4.5 SOUTH KOREA 266

15.4.5.1 Robust food processing industry and increased demand for local biodiesel 266

15.4.6 INDONESIA 269

15.4.6.1 Increased demand for palm oil as alternative to sunflower oil 269

15.4.7 MALAYSIA 272

15.4.7.1 Global shortage of edible oils to help Malaysia enhance its position as key player in global palm oil market 272

15.4.8 REST OF ASIA PACIFIC 276

15.5 SOUTH AMERICA 279

15.5.1 BRAZIL 283

15.5.1.1 Abundance of oilseed in country, especially soybean 283

15.5.2 ARGENTINA 286

15.5.2.1 Government policies to encourage domestic consumption of edible oils 286

15.5.3 REST OF SOUTH AMERICA 289

15.6 REST OF THE WORLD (ROW) 292

15.6.1 MIDDLE-EAST 296

15.6.1.1 Rising demand for healthy processed foods, high imports of palm oil, and strong retail market for sunflower oil 296

15.6.2 AFRICA 299

15.6.2.1 Increased production and import of various oilseeds with growth in local demand 299

16 COMPETITIVE LANDSCAPE 303

16.1 OVERVIEW 303

16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 303

16.3 REVENUE ANALYSIS, 2021–2023 305

16.4 MARKET SHARE ANALYSIS, 2023 307

16.5 COMPANY VALUATION AND FINANCIAL METRICS 309

16.5.1 COMPANY VALUATION 309

16.5.2 EV/EBITDA 309

16.6 BRAND COMPARISON ANALYSIS 310

16.6.1 CARGILL (NATUREFRESH, GEMINI, SWEEKAR, ETC.) 311

16.6.2 ADANI WILMAR (FORTUNE) 311

16.6.3 ASSOCIATED BRITISH FOODS (ABF) 311

16.6.4 BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U. 311

16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 312

16.7.1 STARS 312

16.7.2 EMERGING LEADERS 312

16.7.3 PERVASIVE PLAYERS 312

16.7.4 PARTICIPANTS 313

16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 314

16.7.5.1 Company footprint 314

16.7.5.2 Region footprint 315

16.7.5.3 Type footprint 316

16.7.5.4 End use footprint 317

16.7.5.5 Packaging type footprint 318

16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 319

16.8.1 PROGRESSIVE COMPANIES 319

16.8.2 RESPONSIVE COMPANIES 319

16.8.3 DYNAMIC COMPANIES 319

16.8.4 STARTING BLOCKS 319

16.8.5 COMPETITIVE BENCHMARKING 321

16.8.5.1 Detailed list of key startups/SMEs 321

16.8.5.2 Competitive benchmarking of key startups/SMEs 322

16.9 COMPETITIVE SCENARIO AND TRENDS 324

16.9.1 PRODUCT LAUNCHES 324

16.9.2 DEALS 326

16.9.3 EXPANSIONS 329

16.9.4 OTHERS 330

17 COMPANY PROFILES 331

17.1 KEY PLAYERS 331

17.1.1 ADM 331

17.1.1.1 Business overview 331

17.1.1.2 Products/Solutions/Services offered 332

17.1.1.3 Recent developments 334

17.1.1.3.1 Deals 334

17.1.1.3.2 Expansions 335

17.1.1.4 MnM view 335

17.1.1.4.1 Key strengths 335

17.1.1.4.2 Strategic choices 335

17.1.1.4.3 Weaknesses and competitive threats 335

17.1.2 BUNGE 336

17.1.2.1 Business overview 336

17.1.2.2 Products/Solutions/Services offered 337

17.1.2.3 Recent developments 340

17.1.2.3.1 Product launches 340

17.1.2.3.2 Deals 341

17.1.2.4 MnM view 342

17.1.2.4.1 Right to win 342

17.1.2.4.2 Strategic choices 342

17.1.2.4.3 Weaknesses and competitive threats 342

17.1.3 ASSOCIATED BRITISH FOODS PLC 343

17.1.3.1 Business overview 343

17.1.3.2 Products/Solutions/Services offered 344

17.1.3.3 Recent developments 345

17.1.3.4 MnM view 345

17.1.3.4.1 Key strengths 345

17.1.3.4.2 Strategic choices 345

17.1.3.4.3 Weaknesses and competitive threats 345

17.1.4 WILMAR INTERNATIONAL LTD 346

17.1.4.1 Business overview 346

17.1.4.2 Products/Solutions/Services offered 347

17.1.4.3 Recent developments 349

17.1.4.3.1 Deals 349

17.1.4.4 MnM view 349

17.1.4.4.1 Key strengths 349

17.1.4.4.2 Strategic choices 349

17.1.4.4.3 Weaknesses and competitive threats 349

17.1.5 UNITED PLANTATIONS BERHAD 350

17.1.5.1 Business overview 350

17.1.5.2 Products/Solutions/Services offered 351

17.1.5.3 Recent developments 354

17.1.5.3.1 Product launches 354

17.1.5.3.2 Expansions 355

17.1.5.4 MnM view 355

17.1.5.4.1 Key strengths 355

17.1.5.4.2 Strategic choices 355

17.1.5.4.3 Weaknesses and competitive threats 355

17.1.6 CARGILL, INCORPORATED 356

17.1.6.1 Business overview 356

17.1.6.2 Products/Solutions/Services offered 357

17.1.6.3 Recent developments 358

17.1.6.3.1 Deals 358

17.1.6.3.2 Expansions 359

17.1.6.4 MnM view 360

17.1.7 SIME DARBY BERHAD 361

17.1.7.1 Business overview 361

17.1.7.2 Products/Solutions/Services offered 362

17.1.7.3 Recent developments 363

17.1.7.3.1 Product launches 363

17.1.7.4 MnM view 364

17.1.8 BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U. 365

17.1.8.1 Business overview 365

17.1.8.2 Products/Solutions/Services offered 366

17.1.8.3 Recent developments 367

17.1.8.3.1 Expansions 367

17.1.8.3.2 Other deals/developments 368

17.1.8.4 MnM view 368

17.1.9 GRAINCORP 369

17.1.9.1 Business overview 369

17.1.9.2 Products/Solutions/Services offered 370

17.1.9.3 Recent developments 371

17.1.9.3.1 Product launches 371

17.1.9.3.2 Deals 372

17.1.9.4 MnM view 372

17.1.10 ADANI GROUP 373

17.1.10.1 Business overview 373

17.1.10.2 Products/Solutions/Services offered 374

17.1.10.3 Recent developments 376

17.1.10.3.1 Expansions 376

17.1.10.4 MnM view 377

17.1.10.4.1 Key strengths 377

17.1.11 THE NISSHIN OILLIO GROUP, LTD. 378

17.1.11.1 Business overview 378

17.1.11.2 Products/Solutions/Services offered 379

17.1.11.3 Recent developments 380

17.1.11.3.1 Deals 380

17.1.11.4 MnM view 381

17.1.12 BEIDAHUANG GROUP 381

17.1.12.1 Business overview 381

17.1.12.2 Products/Solutions/Services offered 383

17.1.12.3 Recent developments 387

17.1.12.3.1 Deals 387

17.1.12.4 MnM view 387

17.1.12.4.1 Key strengths 387

17.1.13 AJANTA SOYA LIMITED 388

17.1.13.1 Business overview 388

17.1.13.2 Products/Solutions/Services offered 389

17.1.13.3 Recent developments 391

17.1.13.4 MnM view 391

17.1.14 PATANJALI FOODS LTD. 392

17.1.14.1 Business overview 392

17.1.14.2 Products/Solutions/Services offered 393

17.1.14.3 Recent developments 395

17.1.14.4 MnM view 396

17.1.15 LOUIS DREYFUS COMPANY 397

17.1.15.1 Business overview 397

17.1.15.2 Products/Solutions/Services offered 398

17.1.15.3 Recent developments 399

17.1.15.3.1 Deals 399

17.1.15.4 MnM view 400

17.2 OTHER PLAYERS 401

17.2.1 GOLDEN AGRI-RESOURCES LTD. 401

17.2.1.1 Business overview 401

17.2.1.2 Products/Solutions/Services offered 402

17.2.1.3 Recent developments 403

17.2.1.4 MnM view 403

17.2.2 RICHARDSON INTERNATIONAL LIMITED 404

17.2.2.1 Business overview 404

17.2.2.2 Products/Solutions/Services offered 405

17.2.2.3 Recent developments 406

17.2.2.3.1 Expansions 406

17.2.2.4 MnM view 407

17.2.3 HEBANY 408

17.2.3.1 Business overview 408

17.2.3.2 Products/Solutions/Services offered 408

17.2.3.3 Recent developments 410

17.2.3.4 MnM view 410

17.2.4 ACEITERA GENERAL DEHEZA 411

17.2.4.1 Business overview 411

17.2.4.2 Products/Solutions/Services offered 411

17.2.4.3 Recent developments 413

17.2.4.4 MnM view 413

17.2.5 VICENTIN S.A.I.C. 414

17.2.5.1 Business overview 414

17.2.5.2 Products/Solutions/Services offered 415

17.2.5.3 Recent developments 416

17.2.5.4 MnM view 416

17.2.6 TRADIZIONE ITALIANA 417

17.2.7 ALAMI COMMODITIES SDN BHD 418

17.2.8 NUTIVA INC. 419

17.2.9 AMERICAN VEGETABLE OILS, INC. 420

17.2.10 SUNORA FOODS 421

18 ADJACENT & RELATED MARKETS 423

18.1 INTRODUCTION 423

18.2 LIMITATIONS 423

18.3 FATS & OILS MARKET 423

18.3.1 MARKET DEFINITION 423

18.3.2 MARKET OVERVIEW 424

18.4 SPECIALTY FATS & SPECIALTY OILS MARKET 425

18.4.1 MARKET DEFINITION 425

18.4.1.1 Specialty fats 425

18.4.1.2 Specialty oils 425

18.4.2 MARKET OVERVIEW 425

19 APPENDIX 427

19.1 DISCUSSION GUIDE 427

19.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 432

19.3 CUSTOMIZATION OPTIONS 434

19.4 RELATED REPORTS 434

19.5 AUTHOR DETAILS 435

❖ 世界の食用油市場に関するよくある質問(FAQ) ❖

・食用油の世界市場規模は?

→MarketsandMarkets社は2024年の食用油の世界市場規模を2,507億8,000万米ドルと推定しています。

・食用油の世界市場予測は?

→MarketsandMarkets社は2029年の食用油の世界市場規模を3,069億2,000万米ドルと予測しています。

・食用油市場の成長率は?

→MarketsandMarkets社は食用油の世界市場が2024年~2029年に年平均4.1%成長すると予測しています。

・世界の食用油市場における主要企業は?

→MarketsandMarkets社は「ADM (US), Bunge (US), Associated British Foods plc (UK), Wilmar International Ltd (Singapore), United Plantations Berhad (Malaysia), Sime Darby Berhad (Malaysia), BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U. (Spain), Cargill Incorporated (US), GrainCorp (Australia), Adani Group (India), The Nisshin OilliO Group, Ltd. (Japan), Beidahuang Group (China), AJANTA SOYA LIMITED (India), Patanjali Foods Ltd. (India), and Louis Dreyfus Company (Netherlands)など ...」をグローバル食用油市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。