1 はじめに

1.1 調査目的 25

1.2 市場の定義 25

1.3 調査範囲 26

1.3.1 対象市場 26

1.3.2 考慮した年数 27

1.3.3 含むものと含まないもの 27

1.3.4 考慮した通貨 28

1.3.5 単位

1.4 制限事項 28

1.5 利害関係者 28

2 調査方法 29

2.1 調査データ 29

2.1.1 二次データ 30

2.1.1.1 二次資料からの主要データ 30

2.1.2 一次データ 31

2.1.2.1 一次資料からの主なデータ 31

2.1.2.2 主要な一次情報源 32

2.1.2.3 一次インタビューの主な参加者 32

2.1.2.4 プライマリーの内訳 33

2.1.2.5 主要な業界インサイト 33

2.2 ベースナンバーの算出 34

2.2.1 供給側分析 34

2.2.2 需要サイド分析 34

2.3 予想 34

2.3.1 供給サイド 34

2.3.2 需要サイド 35

2.4 市場規模の推定 35

2.4.1 ボトムアップアプローチ 36

2.4.2 トップダウンアプローチ 36

2.5 データの三角測量 37

2.6 リサーチの前提 38

2.7 成長予測 38

2.8 リスク評価 39

2.9 要因分析 39

3 エグゼクティブ・サマリー 40

4 プレミアムインサイト 43

4.1 高機能エラストマー市場におけるプレーヤーの魅力的な機会 43

4.2 高機能エラストマー市場:タイプ別 43

4.3 高機能エラストマー市場:国別 44

5 市場の概要

5.1 導入 45

5.2 市場ダイナミクス

5.2.1 推進要因 46

5.2.1.1 医療機器の進歩による生体適合性と滅菌性に優れた高機能エラストマーへの需要増 46

5.2.1.2 リサイクル技術の進歩による高機能エラストマー需要の増加 46

5.2.2 阻害要因 47

5.2.2.1 高機能エラストマーに関する標準化されたグレードと仕様の欠如 47

5.2.3 機会 47

5.2.3.1 3Dプリンティングに適した高機能エラストマーの開発 47

5.2.3.2 ポリマー化学の革新 – ナノコンポジットとハイブリッド材料の開発 48

5.2.4 課題 48

5.2.4.1 高い製造コスト、複雑な製造工程、特殊な設備と専門知識の必要性 48

5.2.4.2 合成品と同等の性能特性を有するバイオベース・エラストマーの開発 49

5.3 先進エラストマー市場におけるAI/ジェネレーティブAIの影響 49

5.3.1 導入 49

6 業界動向 52

6.1 導入 52

6.2 顧客ビジネスに影響を与えるトレンド/破壊 52

6.3 サプライチェーン分析 53

6.4 投資と資金調達のシナリオ 55

6.5 価格分析 56

6.5.1 平均販売価格動向(地域別) 56

6.5.2 平均販売価格動向:タイプ別 57

6.5.3 主要企業の平均販売価格動向(タイプ別) 57

6.6 エコシステム分析 58

6.7 技術分析 60

6.7.1 主要技術 60

6.7.2 補完的技術 60

6.7.3 隣接技術 61

6.8 特許分析 61

6.8.1 方法論 62

6.8.2 付与特許 62

6.8.3 特許公開動向 62

6.8.4 洞察 63

6.8.5 法的地位 63

6.8.6 管轄区域分析 64

6.8.7 出願人のトップ 65

6.9 貿易分析 69

6.9.1 輸入シナリオ(HSコード390469と39100090) 69

6.9.2 輸出シナリオ(HSコード390469と39100090) 71

6.10 主要会議とイベント(2024~2025年) 72

6.11 関税、規格、規制の状況 72

6.11.1 関税分析 72

6.11.2 規制機関、政府機関、その他の組織 74

6.11.3 標準規格 77

6.12 ポーターの5つの力分析 78

6.12.1 新規参入の脅威 79

6.12.2 代替品の脅威 80

6.12.3 供給者の交渉力 80

6.12.4 買い手の交渉力 80

6.12.5 競合の激しさ 80

6.13 主要ステークホルダーと購買基準 81

6.13.1 購入プロセスにおける主要ステークホルダー 81

6.13.2 購入基準 82

6.14 マクロ経済見通し 83

6.14.1 国別GDPトレンドと予測 83

6.15 ケーススタディ分析 84

6.15.1 先進エラストマーにおける革新的なデュアルダイナミックネットワーク設計: 高性能と自己修復能力の達成 84

6.15.2 現代の製造業における熱可塑性エラストマーの変革的役割: 効率性、持続可能性、イノベーション 85

6.15.3 過酷な環境における信頼性の確保: 深海油田探査用先端エラストマー 86

7 高機能エラストマー市場、タイプ別 87

7.1 はじめに 88

7.2 熱可塑性エラストマー(Tpes) 90

7.2.1 様々な産業における柔軟でリサイクル可能な材料への需要の高まりが市場を牽引 90

7.3 シリコンエラストマー 90

7.3.1 過酷な条件下での高性能と優れた熱安定性が需要を牽引 90

7.4 フッ素系エラストマー 91

7.4.1 性能を損なうことなく過酷な環境に長時間さらされることに耐える能力が 需要の原動力に 91

7.5 エチレン・プロピレン・ジエンモノマー(EPDM) 91

7.5.1 耐クラック性、耐収縮性、過酷な環境条件下での長寿命が需要を牽引 91

7.6 その他のタイプ 92

7.6.1 ポリウレタンエラストマー 92

7.6.2 エピクロルヒドリン系エラストマー(エコ) 92

8 高機能エラストマー市場、用途別 93

8.1 導入 94

8.2 断熱材 95

8.2.1 絶縁用途における熱効率と電気効率を高める能力が需要を牽引 95

8.3 インプラント 96

8.3.1 医療用インプラントの長寿命化と機能性向上が市場を牽引 96

8.4 フレキシブル回路 96

8.4.1 フレキシブル回路の設計と運用における高い採用率が市場を牽引 96

8.5 コネクター 97

8.5.1 重要システムにおける信頼性と弾力性のある接続を確保する能力が需要を促進 97

8.6 その他の用途 98

8.6.1 シール及びガスケット 98

8.6.2 コンベアシステム 98

9 高機能エラストマー市場、最終用途別 99

9.1 導入 100

9.2 工業用 101

9.2.1 大型製造業を変革するための採用拡大が市場を牽引 101

9.3 航空宇宙・防衛 102

9.3.1 ミッションクリティカルな機器の高性能、安全性、信頼性を確保するための用途拡大が市 場成長を促進 102

9.4 医療 102

9.4.1 機能性と安全性に優れた先端エラストマーを使用した医療機器の最適化が 需要を牽引 102

9.5 電子・電気 103

9.5.1 優れた電気絶縁性、柔軟性、熱安定性、耐湿性、耐薬品性、耐紫外線性が 需要を牽引 103

9.6 その他の最終用途 104

9.6.1 繊維製品 104

9.6.2 移動・輸送 104

10 高機能エラストマー市場:地域別 105

10.1 はじめに 106

10.2 アジア太平洋 111

10.2.1 中国 117

10.2.1.1 世界的な製造拠点への転換が需要を牽引 117

10.2.2 日本 118

10.2.2.1 技術進歩と電子・航空宇宙産業における先端エラストマー使用の増加が市場を牽引 118

10.2.3 インド 119

10.2.3.1 急速な工業化と製造業の拡大が需要を牽引 119

10.2.4 韓国 120

10.2.4.1 先端材料の研究開発投資の増加が市場を牽引 120

10.2.5 その他のアジア太平洋地域 121

10.3 北米 122

10.3.1 米国 128

10.3.1.1 医療・製薬産業の拡大が需要を促進 128

10.3.2 カナダ 129

10.3.2.1 先端製造技術とエラストマー応用研究への注目の高まりが市場を牽引 129

10.3.3 メキシコ 130

10.3.3.1 製造拠点としての台頭が需要を牽引 130

10.4 欧州 131

10.4.1 ドイツ 137

10.4.1.1 自動車産業における技術革新と性能重視の高まりが需要を促進 137

10.4.2 イタリア 138

10.4.2.1 高級品製造における高品質で耐久性のある素材への需要の高まり 138

10.4.3 フランス 139

10.4.3.1 航空宇宙産業における先端エラストマー需要の増加が市場を牽引 139

10.4.4 イギリス 140

10.4.4.1 ヘルスケアと自動車用途で高品質規格とコンプライアンスが重視され、 需要を牽引 140

10.4.5 スペイン 141

10.4.5.1 持続可能性と環境保護への高い関心が需要を後押し 141

10.4.6 ロシア 142

10.4.6.1 工業分野と航空宇宙産業における先端エラストマーの用途拡大が市場を牽引 142

10.4.7 その他のヨーロッパ 143

10.5 中東・アフリカ 144

10.5.1 GCC諸国 145

10.5.1.1 サウジアラビア 150

10.5.1.1.1 新産業技術とスマートインフラの開発が市場を牽引 150

10.5.1.2 ウアイ 151

10.5.1.2.1 経済の多様化と原材料への容易なアクセスが市場成長を促進 151

10.5.1.3 その他のGCC諸国 152

10.5.2 南アフリカ 153

10.5.2.1 医療セクターの拡大と国内製造・輸出への注目の高まりが市場を牽引 153

10.5.3 その他の中東・アフリカ 154

10.6 南米 155

10.6.1 アルゼンチン 159

10.6.1.1 先端エレクトロニクス技術の開発が需要を牽引 159

10.6.2 ブラジル 160

10.6.2.1 高い原料供給力と医療機器需要の増加が市場を牽引 160

10.6.3 その他の南米地域 161

11 競争環境 163

11.1 概要 163

11.2 主要プレーヤーの戦略/勝利への権利 163

11.3 市場シェア分析、2023年 166

11.3.1 セラニーズコーポレーション 167

11.3.2 BASF 167

11.3.3 AGC Inc. 168

168 11.3.4 三井化学株式会社 168

11.3.5 ワッカーケミー 168

11.4 収益分析、2020年~2024年 169

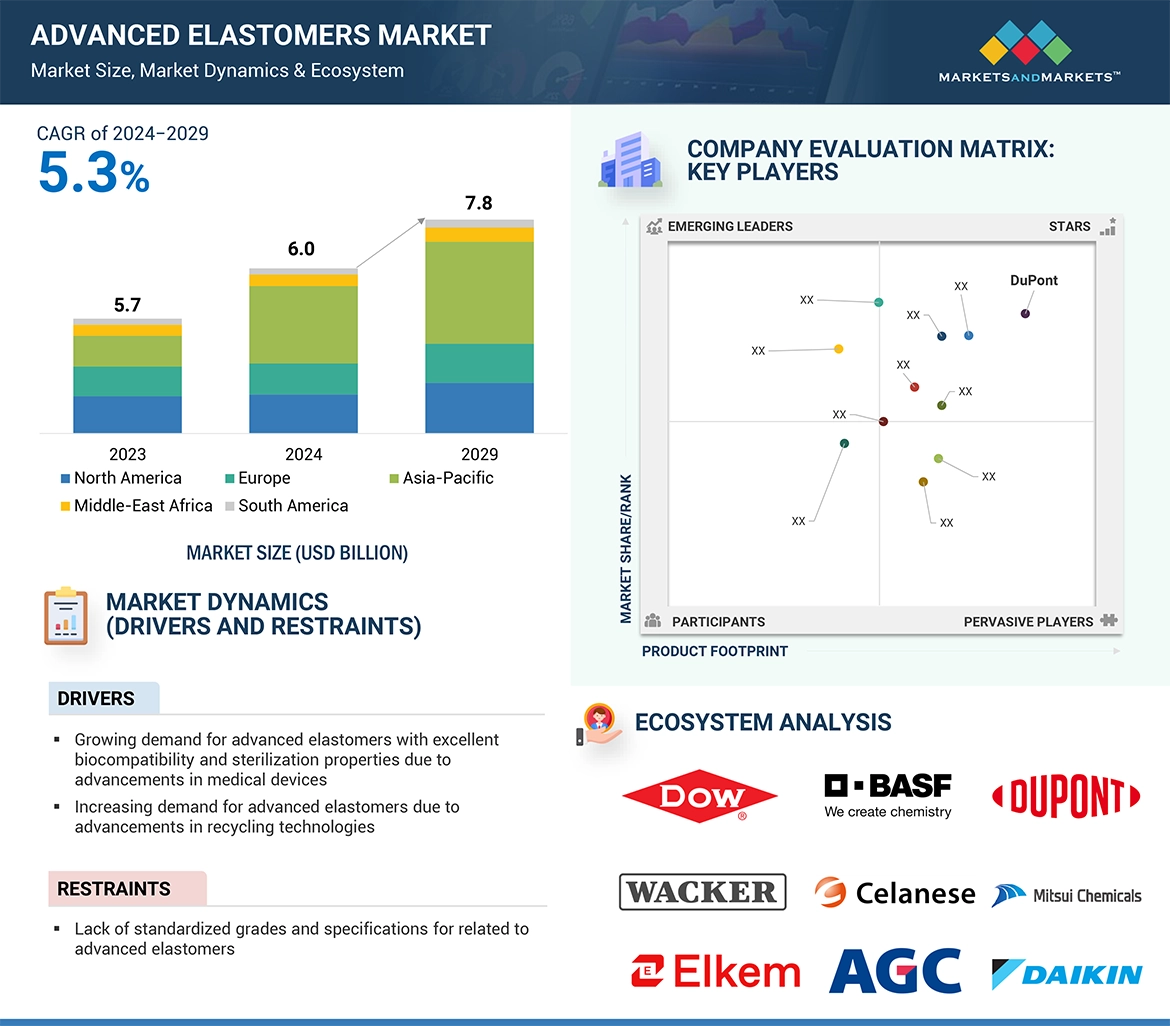

11.5 企業評価マトリックス:主要企業(2023年) 169

11.5.1 スター企業 170

11.5.2 新興リーダー 170

11.5.3 浸透型プレーヤー 170

11.5.4 参加企業 170

11.5.5 企業フットプリント:主要プレーヤー、2023年 172

11.5.5.1 企業フットプリント 172

11.5.5.2 タイプ別フットプリント 173

11.5.5.3 アプリケーション別フットプリント 173

11.5.5.4 エンドユーズフットプリント 174

11.5.5.5 地域別フットプリント 174

11.6 企業評価マトリクス:新興企業/SM(2023年) 175

11.6.1 進歩的企業 175

11.6.2 対応力のある企業 175

11.6.3 ダイナミックな企業 175

175 11.6.4 スタートアップ・ブロック 175

11.6.5 競争ベンチマーキング:新興企業/SM(2023年) 177

11.6.5.1 主要新興企業/中小企業の詳細リスト 177

11.6.5.2 主要新興企業/SMEの競合ベンチマーキング 178

11.7 ブランド/製品の比較 179

11.7.1 エラストシル® 179

179 11.7.2 ミラストマー

179 11.7.3 サントプレン

179 11.7.4 エラストラン® 180

180 11.7.5 アフラス

11.8 企業評価と財務指標 180

11.9 競争シナリオ 181

11.9.1 製品上市 181

11.9.2 拡張 183

11.9.3 取引 184

12 企業プロファイル 186

12.1 主要企業 186

BASF SE (Germany)

Celanese Corporation (Switzerland)

Elkem ASA (Waltham)

DuPont (US)

Wacker Chemie AG (Germany)

AGC Inc. (Japan)

Mitsui Chemicals Inc. (Japan)

DAIKIN INDUSTRIES,Ltd. (Japan)

Avient Corporation (US)

Arkema (France)

and Dow (US)

13 付録 240

13.1 ディスカッション・ガイド 240

13.2 Knowledgestore: Marketsandmarketsの購読ポータル 243

13.3 カスタマイズオプション 245

13.4 関連レポート 245

13.5 著者の詳細 246

The growth in the market for advanced elastomers is attributed to a number of factors. Technological innovations that improve the quality and functionality of a material make advanced elastomers more attractive for different kinds of applications. Rising demand for light yet solid materials in the industrial manufacturing, medical, and aerospace & defense sectors is a key driver. This will give a stable rise to the advanced elastomers market since industries strive to be increasingly sustainable and effective.

“Implants accounted for the second largest share in application segment of Advanced elastomers market in terms of value.”

The second-largest application segment of advanced elastomers is that of implants, mainly due to the critical role these materials play in medical devices and healthcare. Advanced elastomers are used in the manufacture of implants, with silicone and TPEs primarily considered for use in implants due to their excellent biocompatibility, flexibility, and durability. It is readily tolerable by these materials under adverse conditions of the human body, such as high temperature ranges, mechanical stress, and various body fluids, without degradation or adverse reaction. One major factor for the impressive market share of implants is the growing demand for medical procedures and devices that use long-lasting and reliable materials. Medical implants, like orthopedic implants, pacemakers, and stents, are much in demand owing to the rise in the aging population of the world and a resulting increase in chronic diseases.

“Medical accounted for the second largest share in end-use industry segment of Advanced elastomers market in terms of value.”

The medical sector is the second-largest end-use industry segment in the advanced elastomers market because it includes materials able to withstand strict requirements regarding their use in healthcare applications. Advanced elastomers have been widely used in medical applications since they are biocompatible, flexible in nature, and resistant to multiple types of sterilization methods, which are perfect for a great many devices and other applications connected with medicine. These are used to fabricate surgery instruments and tubing, catheters, implants, and prosthetic devices in which smooth operations. One of the primary reasons that the medical field is such a large marketplace for engineered elastomers is that there is a real need from medical equipment for durable, high-quality materials. Particularly, the development of medical devices that are both safe and effective becomes almost an imperative, especially since global tendencies show an increase in aging populations and the prevalence of chronic diseases.

“ Silicon elastomers accounted for the second largest share in type segment of Advanced elastomers market in terms of value.”

This is the second-largest type segment of the advanced elastomers market, as it is this unique combination of properties that has made silicone-based elastomers greatly indispensable in a wide range of industries. Silicone elastomers are highly valued for their high level of thermal stability, outstanding flexibility, and excellent resistance to extreme temperatures, chemicals, and UV radiation. These characteristics make them especially applicable for use in very demanding applications where other materials would fail. In that respect, they are vastly applied in industries such as healthcare, automotive, and electronics. In the healthcare industry. silicone elastomers find wide application due to their biocompatibility-they do not cause an adverse reaction with human tissue. This bestows them with the quality needed for medical devices such as implants, prosthetics, and tubing. The features of sterilization, without loss of properties, back up the safety and efficiency of medical devices.

“Asia pacific is the largest market for Advanced elastomers.”

strong manufacturing bases for many industries such as electronics, industry, and medical act as drivers of Asia Pacific's leadership in the market of advanced elastomers. This region is a leading producer of consumer electronics, whereby advanced elastomers find an application in insulation, sealing, and vibration damping. rapid growth in the construction sector, driven by rapid urbanization and infrastructure development in developing economies such as India and China, will probably boost demand for the market. Besides, low production costs, easy availability of raw materials, and skilled labor force have made it a favorite destination for multinational companies to set up bases for the manufacture of advanced elastomers. The region hosts some of the global and regional key players, and heavy investments in research and development have ensured constant innovation in elastomer technologies, further broadening their scope of applications.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Advanced elastomers market, and information was gathered from secondary research to determine and verify the market size of several segments.

• By Company Type: Tier 1 – 40%, Tier 2 – 30%, and Tier 3 – 30%

• By Designation: C Level Executives– 20%, Directors – 10%, and Others – 70%

• By Region: North America – 30%, Europe – 20%, APAC – 30%, the Middle East & Africa –10%, and South America- 10%

The Advanced elastomers market comprises major players BASF SE (Germany), Celanese Corporation (Switzerland), Elkem ASA (Waltham), DuPont (US), Wacker Chemie AG (Germany), AGC Inc. (Japan), Mitsui Chemicals, Inc. (Japan), DAIKIN INDUSTRIES,Ltd. (Japan), Avient Corporation (US), Arkema (France), and Dow (US). The study includes in-depth competitive analysis of these key players in the Advanced elastomers market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for Advanced elastomers market on the basis of types, applications, end-use industries, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for Advanced elastomers market.

Key benefits of buying this report

This research report is focused on various levels of analysis industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Advanced elastomers market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

• Analysis of drivers: (Increased automation in manufacturing drives demand for advanced elastomers in high-performance seals, gaskets, and hoses in robotics and machinery), restraints (The dependence on petroleum-based feedstocks exposes the market to fluctuations in crude oil prices, affecting cost stability), opportunities (Advancements in Recycling Technologies), and challenges (Developing bio-based elastomers with performance characteristics equivalent to synthetic counterparts remains a significant technical hurdle) influencing the growth of Advanced elastomers market.

• Market Penetration: Comprehensive information on the Advanced elastomers market offered by top players in the global Advanced elastomers market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, in the Advanced elastomers market.

• Market Development: Comprehensive information about lucrative emerging markets the report analyzes the markets for Advanced elastomers market across regions.

• Market Capacity: Production capacities of companies producing Advanced elastomers are provided wherever available with upcoming capacities for the Advanced elastomers market.

• Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Advanced elastomers market.

1 INTRODUCTION 25

1.1 STUDY OBJECTIVES 25

1.2 MARKET DEFINITION 25

1.3 STUDY SCOPE 26

1.3.1 MARKETS COVERED 26

1.3.2 YEARS CONSIDERED 27

1.3.3 INCLUSIONS AND EXCLUSIONS 27

1.3.4 CURRENCY CONSIDERED 28

1.3.5 UNITS CONSIDERED 28

1.4 LIMITATIONS 28

1.5 STAKEHOLDERS 28

2 RESEARCH METHODOLOGY 29

2.1 RESEARCH DATA 29

2.1.1 SECONDARY DATA 30

2.1.1.1 Key data from secondary sources 30

2.1.2 PRIMARY DATA 31

2.1.2.1 Key data from primary sources 31

2.1.2.2 Key primary sources 32

2.1.2.3 Key participants for primary interviews 32

2.1.2.4 Breakdown of primaries 33

2.1.2.5 Key industry insights 33

2.2 BASE NUMBER CALCULATION 34

2.2.1 SUPPLY-SIDE ANALYSIS 34

2.2.2 DEMAND-SIDE ANALYSIS 34

2.3 FORECAST 34

2.3.1 SUPPLY SIDE 34

2.3.2 DEMAND SIDE 35

2.4 MARKET SIZE ESTIMATION 35

2.4.1 BOTTOM-UP APPROACH 36

2.4.2 TOP-DOWN APPROACH 36

2.5 DATA TRIANGULATION 37

2.6 RESEARCH ASSUMPTIONS 38

2.7 GROWTH FORECAST 38

2.8 RISK ASSESSMENT 39

2.9 FACTOR ANALYSIS 39

3 EXECUTIVE SUMMARY 40

4 PREMIUM INSIGHTS 43

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ADVANCED ELASTOMERS MARKET 43

4.2 ADVANCED ELASTOMERS MARKET, BY TYPE 43

4.3 ADVANCED ELASTOMERS MARKET, BY COUNTRY 44

5 MARKET OVERVIEW 45

5.1 INTRODUCTION 45

5.2 MARKET DYNAMICS 45

5.2.1 DRIVERS 46

5.2.1.1 Growing demand for advanced elastomers with excellent biocompatibility and sterilization properties due to advancements in medical devices 46

5.2.1.2 Increasing demand for advanced elastomers due to advancements in recycling technologies 46

5.2.2 RESTRAINTS 47

5.2.2.1 Lack of standardized grades and specifications related to advanced elastomers 47

5.2.3 OPPORTUNITIES 47

5.2.3.1 Development of advanced elastomers suitable for 3D printing 47

5.2.3.2 Innovations in polymer chemistry – development of nanocomposites and hybrid materials 48

5.2.4 CHALLENGES 48

5.2.4.1 High production cost, complex manufacturing processes, and need for specialized equipment and expertise 48

5.2.4.2 Development of bio-based elastomers with performance characteristics equivalent to synthetic counterparts 49

5.3 IMPACT OF AI/GENERATIVE AI ON ADVANCED ELASTOMERS MARKET 49

5.3.1 INTRODUCTION 49

6 INDUSTRY TRENDS 52

6.1 INTRODUCTION 52

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 52

6.3 SUPPLY CHAIN ANALYSIS 53

6.4 INVESTMENT AND FUNDING SCENARIO 55

6.5 PRICING ANALYSIS 56

6.5.1 AVERAGE SELLING PRICE TREND, BY REGION 56

6.5.2 AVERAGE SELLING PRICE TREND, BY TYPE 57

6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE 57

6.6 ECOSYSTEM ANALYSIS 58

6.7 TECHNOLOGY ANALYSIS 60

6.7.1 KEY TECHNOLOGIES 60

6.7.2 COMPLEMENTARY TECHNOLOGIES 60

6.7.3 ADJACENT TECHNOLOGIES 61

6.8 PATENT ANALYSIS 61

6.8.1 METHODOLOGY 62

6.8.2 GRANTED PATENTS 62

6.8.3 PATENT PUBLICATION TRENDS 62

6.8.4 INSIGHTS 63

6.8.5 LEGAL STATUS 63

6.8.6 JURISDICTION ANALYSIS 64

6.8.7 TOP APPLICANTS 65

6.9 TRADE ANALYSIS 69

6.9.1 IMPORT SCENARIO (HS CODES 390469 AND 39100090) 69

6.9.2 EXPORT SCENARIO (HS CODES 390469 AND 39100090) 71

6.10 KEY CONFERENCES AND EVENTS, 2024–2025 72

6.11 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPE 72

6.11.1 TARIFF ANALYSIS 72

6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 74

6.11.3 STANDARDS 77

6.12 PORTER’S FIVE FORCES ANALYSIS 78

6.12.1 THREAT OF NEW ENTRANTS 79

6.12.2 THREAT OF SUBSTITUTES 80

6.12.3 BARGAINING POWER OF SUPPLIERS 80

6.12.4 BARGAINING POWER OF BUYERS 80

6.12.5 INTENSITY OF COMPETITIVE RIVALRY 80

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA 81

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS 81

6.13.2 BUYING CRITERIA 82

6.14 MACROECONOMIC OUTLOOK 83

6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY 83

6.15 CASE STUDY ANALYSIS 84

6.15.1 INNOVATIVE DUAL-DYNAMIC NETWORK DESIGN IN ADVANCED ELASTOMERS: ACHIEVING HIGH PERFORMANCE AND SELF-HEALING CAPABILITIES 84

6.15.2 TRANSFORMATIVE ROLE OF THERMOPLASTIC ELASTOMERS IN MODERN MANUFACTURING: EFFICIENCY, SUSTAINABILITY, AND INNOVATION 85

6.15.3 ENSURING RELIABILITY IN EXTREME ENVIRONMENTS: ADVANCED ELASTOMERS FOR DEEPWATER OIL EXPLORATION 86

7 ADVANCED ELASTOMERS MARKET, BY TYPE 87

7.1 INTRODUCTION 88

7.2 THERMOPLASTIC ELASTOMERS (TPES) 90

7.2.1 RISING DEMAND FOR FLEXIBLE AND RECYCLABLE MATERIALS IN VARIOUS INDUSTRIES TO DRIVE MARKET 90

7.3 SILICON ELASTOMERS 90

7.3.1 HIGH PERFORMANCE IN EXTREME CONDITIONS AND EXCEPTIONAL THERMAL STABILITY TO DRIVE DEMAND 90

7.4 FLUORINATED ELASTOMERS 91

7.4.1 ABILITY TO WITHSTAND EXTENDED EXPOSURE TO HARSH ENVIRONMENTS WITHOUT COMPROMISING PERFORMANCE TO FUEL DEMAND 91

7.5 ETHYLENE PROPYLENE DIENE MONOMERS (EPDM) 91

7.5.1 ABILITY TO RESIST CRACKING, SHRINKING, AND SECURING LONGEVITY IN HARSH ENVIRONMENTAL CONDITIONS TO DRIVE DEMAND 91

7.6 OTHER TYPES 92

7.6.1 POLYURETHANE ELASTOMERS 92

7.6.2 EPICHLOROHYDRIN ELASTOMERS (ECO) 92

8 ADVANCED ELASTOMERS MARKET, BY APPLICATION 93

8.1 INTRODUCTION 94

8.2 INSULATION 95

8.2.1 ABILITY TO BOOST THERMAL AND ELECTRICAL EFFICIENCY IN INSULATION APPLICATIONS TO DRIVE DEMAND 95

8.3 IMPLANTS 96

8.3.1 USE TO EXTEND OPERATIONAL LIFE AND ENHANCE FUNCTIONALITY OF MEDICAL IMPLANTS TO DRIVE MARKET 96

8.4 FLEXIBLE CIRCUITS 96

8.4.1 HIGH ADOPTION IN DESIGNING AND OPERATION OF FLEXIBLE CIRCUITS TO PROPEL MARKET 96

8.5 CONNECTORS 97

8.5.1 ABILITY TO ENSURE RELIABLE AND RESILIENT CONNECTIONS IN CRITICAL SYSTEMS TO FUEL DEMAND 97

8.6 OTHER APPLICATIONS 98

8.6.1 SEALS AND GASKETS 98

8.6.2 CONVEYOR SYSTEMS 98

9 ADVANCED ELASTOMERS MARKET, BY END USE 99

9.1 INTRODUCTION 100

9.2 INDUSTRIAL 101

9.2.1 GROWING ADOPTION TO REVOLUTIONIZE HEAVY-DUTY MANUFACTURING TO DRIVE MARKET 101

9.3 AEROSPACE & DEFENSE 102

9.3.1 RISING USE TO ENSURE HIGH PERFORMANCE, SAFETY, AND DEPENDABILITY OF MISSION-CRITICAL EQUIPMENT TO FUEL MARKET GROWTH 102

9.4 MEDICAL 102

9.4.1 OPTIMIZATION OF MEDICAL DEVICES USING ADVANCED ELASTOMERS FOR SUPERIOR FUNCTIONALITY AND SAFETY TO DRIVE DEMAND 102

9.5 ELECTRONICS & ELECTRICAL 103

9.5.1 EXCELLENT ELECTRICAL INSULATION, FLEXIBILITY, THERMAL STABILITY, AND RESISTANCE TO MOISTURE, CHEMICALS, AND ULTRAVIOLET RADIATION TO DRIVE DEMAND 103

9.6 OTHER END USES 104

9.6.1 TEXTILES 104

9.6.2 MOBILITY & TRANSPORTATION 104

10 ADVANCED ELASTOMERS MARKET, BY REGION 105

10.1 INTRODUCTION 106

10.2 ASIA PACIFIC 111

10.2.1 CHINA 117

10.2.1.1 Transformation into global manufacturing hub to drive demand 117

10.2.2 JAPAN 118

10.2.2.1 Technological advancements and rising use of advanced elastomers in electronics and aerospace industries to drive market 118

10.2.3 INDIA 119

10.2.3.1 Rapid industrialization and expansion of manufacturing sector to drive demand 119

10.2.4 SOUTH KOREA 120

10.2.4.1 Increased investments in R&D for advanced materials to drive market 120

10.2.5 REST OF ASIA PACIFIC 121

10.3 NORTH AMERICA 122

10.3.1 US 128

10.3.1.1 Expanding medical and pharmaceutical industries to fuel demand 128

10.3.2 CANADA 129

10.3.2.1 Rising focus on advanced manufacturing technologies and research in elastomer applications to drive market 129

10.3.3 MEXICO 130

10.3.3.1 Emergence as manufacturing hub to drive demand 130

10.4 EUROPE 131

10.4.1 GERMANY 137

10.4.1.1 Increased emphasis on innovation and performance in automotive sector to fuel demand 137

10.4.2 ITALY 138

10.4.2.1 Rising demand for high-quality, durable materials in manufacturing of luxury products to propel demand 138

10.4.3 FRANCE 139

10.4.3.1 Increasing demand for advanced elastomers in aerospace industry to drive market 139

10.4.4 UK 140

10.4.4.1 High emphasis on high-quality standards and compliance in healthcare and automobile applications to propel demand 140

10.4.5 SPAIN 141

10.4.5.1 High focus on sustainability and environmental protection to fuel demand 141

10.4.6 RUSSIA 142

10.4.6.1 Rising applications of advanced elastomers in industrial sector and aerospace industry to drive market 142

10.4.7 REST OF EUROPE 143

10.5 MIDDLE EAST & AFRICA 144

10.5.1 GCC COUNTRIES 145

10.5.1.1 Saudi Arabia 150

10.5.1.1.1 Development of new industrial technologies and smart infrastructure to drive market 150

10.5.1.2 UAE 151

10.5.1.2.1 Economic diversification and easy access to raw materials to fuel market growth 151

10.5.1.3 Rest of GCC countries 152

10.5.2 SOUTH AFRICA 153

10.5.2.1 Expanding healthcare sector and rising focus on local manufacturing and exports to drive market 153

10.5.3 REST OF MIDDLE EAST & AFRICA 154

10.6 SOUTH AMERICA 155

10.6.1 ARGENTINA 159

10.6.1.1 Development of advanced electronics technologies to drive demand 159

10.6.2 BRAZIL 160

10.6.2.1 High availability of raw materials and rising demand for medical devices to propel market 160

10.6.3 REST OF SOUTH AMERICA 161

11 COMPETITIVE LANDSCAPE 163

11.1 OVERVIEW 163

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 163

11.3 MARKET SHARE ANALYSIS, 2023 166

11.3.1 CELANESE CORPORATION 167

11.3.2 BASF 167

11.3.3 AGC INC. 168

11.3.4 MITSUI CHEMICALS, INC. 168

11.3.5 WACKER CHEMIE AG 168

11.4 REVENUE ANALYSIS, 2020–2024 169

11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 169

11.5.1 STARS 170

11.5.2 EMERGING LEADERS 170

11.5.3 PERVASIVE PLAYERS 170

11.5.4 PARTICIPANTS 170

11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 172

11.5.5.1 Company footprint 172

11.5.5.2 Type footprint 173

11.5.5.3 Application footprint 173

11.5.5.4 End use footprint 174

11.5.5.5 Region footprint 174

11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 175

11.6.1 PROGRESSIVE COMPANIES 175

11.6.2 RESPONSIVE COMPANIES 175

11.6.3 DYNAMIC COMPANIES 175

11.6.4 STARTING BLOCKS 175

11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 177

11.6.5.1 Detailed list of key startups/SMEs 177

11.6.5.2 Competitive benchmarking of key startups/SMEs 178

11.7 BRAND/PRODUCT COMPARISON 179

11.7.1 ELASTOSIL® 179

11.7.2 MILASTOMER™ 179

11.7.3 SANTOPRENE™ 180

11.7.4 ELASTOLLAN® 180

11.7.5 AFLAS® 180

11.8 COMPANY VALUATION AND FINANCIAL METRICS 180

11.9 COMPETITIVE SCENARIOS 181

11.9.1 PRODUCT LAUNCHES 181

11.9.2 EXPANSIONS 183

11.9.3 DEALS 184

12 COMPANY PROFILES 186

12.1 KEY PLAYERS 186

12.1.1 DOW 186

12.1.1.1 Business overview 186

12.1.1.2 Products/Solutions/Services offered 187

12.1.1.3 Recent developments 188

12.1.1.3.1 Product launches 188

12.1.1.3.2 Others 188

12.1.1.4 MnM view 189

12.1.1.4.1 Key strengths/Right to win 189

12.1.1.4.2 Strategic choices 189

12.1.1.4.3 Weaknesses/Competitive threats 189

12.1.2 WACKER CHEMIE AG 190

12.1.2.1 Business overview 190

12.1.2.2 Products/Solutions/Services offered 191

12.1.2.3 Recent developments 192

12.1.2.3.1 Expansions 192

12.1.2.4 MnM view 192

12.1.2.4.1 Key strengths/Right to win 192

12.1.2.4.2 Strategic choices 192

12.1.2.4.3 Weaknesses/Competitive threats 192

12.1.3 MITSUI CHEMICALS, INC. 193

12.1.3.1 Business overview 193

12.1.3.2 Products/Solutions/Services offered 194

12.1.3.3 Recent developments 194

12.1.3.3.1 Product launches 194

12.1.3.3.2 Others 194

12.1.3.4 MnM view 195

12.1.3.4.1 Key strengths/Right to win 195

12.1.3.4.2 Strategic choices 195

12.1.3.4.3 Weaknesses/Competitive threats 195

12.1.4 CELANESE CORPORATION 196

12.1.4.1 Business overview 196

12.1.4.2 Products/Solutions/Services offered 197

12.1.4.3 Recent developments 198

12.1.4.3.1 Deals 198

12.1.4.4 MnM view 199

12.1.4.4.1 Key strengths/Right to win 199

12.1.4.4.2 Strategic choices 199

12.1.4.4.3 Weaknesses/Competitive threats 199

12.1.5 ARKEMA 200

12.1.5.1 Business overview 200

12.1.5.2 Products/Solutions/Services offered 201

12.1.5.3 Recent developments 202

12.1.5.3.1 Expansions 202

12.1.5.3.2 Others 202

12.1.5.4 MnM view 202

12.1.5.4.1 Key strengths/Right to win 202

12.1.5.4.2 Strategic choices 203

12.1.5.4.3 Weaknesses/Competitive threats 203

12.1.6 DUPONT 204

12.1.6.1 Business overview 204

12.1.6.2 Products/Solutions/Services offered 205

12.1.6.3 Recent developments 206

12.1.6.3.1 Deals 206

12.1.6.3.2 Expansions 206

12.1.6.3.3 Others 207

12.1.6.4 MnM view 207

12.1.6.4.1 Key strengths/Right to win 207

12.1.6.4.2 Strategic choices 207

12.1.6.4.3 Weaknesses/Competitive threats 207

12.1.7 BASF 208

12.1.7.1 Business overview 208

12.1.7.2 Products/Solutions/Services offered 209

12.1.7.3 Recent developments 210

12.1.7.3.1 Deals 210

12.1.7.3.2 Expansions 210

12.1.7.3.3 Others 210

12.1.7.4 MnM view 210

12.1.7.4.1 Key strengths/Right to win 210

12.1.7.4.2 Strategic choices 211

12.1.7.4.3 Weaknesses/Competitive threats 211

12.1.8 AGC INC. 212

12.1.8.1 Business overview 212

12.1.8.2 Products/Solutions/Services offered 213

12.1.8.3 Recent developments 214

12.1.8.3.1 Expansions 214

12.1.8.4 MnM view 214

12.1.8.4.1 Key strengths/Right to win 214

12.1.8.4.2 Strategic choices 214

12.1.8.4.3 Weaknesses/Competitive threats 215

12.1.9 AVIENT CORPORATION 216

12.1.9.1 Business overview 216

12.1.9.2 Products/Solutions/Services offered 217

12.1.9.3 Recent developments 218

12.1.9.3.1 Product launches 218

12.1.9.3.2 Others 219

12.1.9.4 MnM view 219

12.1.9.4.1 Key strengths/Right to win 219

12.1.9.4.2 Strategic choices 219

12.1.9.4.3 Weaknesses/Competitive threats 219

12.1.10 DAIKIN INDUSTRIES, LTD. 220

12.1.10.1 Business overview 220

12.1.10.2 Products/Solutions/Services offered 221

12.1.10.3 MnM view 221

12.1.10.3.1 Key strengths/Right to win 221

12.1.10.3.2 Strategic choices 221

12.1.10.3.3 Weaknesses/Competitive threats 221

12.1.11 ELKEM ASA 222

12.1.11.1 Business overview 222

12.1.11.2 Products/Solutions/Services offered 223

12.1.11.3 Recent developments 223

12.1.11.3.1 Deals 223

12.1.11.3.2 Expansions 223

12.1.11.4 MnM view 224

12.1.11.4.1 Key strengths/Right to win 224

12.1.11.4.2 Strategic choices 224

12.1.11.4.3 Weaknesses/Competitive threats 224

12.2 OTHER PLAYERS 225

12.2.1 MOMENTIVE PERFORMANCE MATERIALS 225

12.2.2 RADO GUMMI GMBH 226

12.2.3 AURORA MATERIAL SOLUTIONS 227

12.2.4 BRP MANUFACTURING 228

12.2.5 STAR THERMOPLASTIC ALLOYS & RUBBERS, LLC 229

12.2.6 ELASTRON TPE 230

12.2.7 RTP COMPANY 231

12.2.8 AMERICHEM 232

12.2.9 STOCKWELL ELASTOMERICS 233

12.2.10 NANJING SISIB SILICONES CO., LTD. 234

12.2.11 LOPIGOM S.P.A. 235

12.2.12 CABOT CORPORATION 236

12.2.13 FUSION-POLYMER 237

12.2.14 KRAIBURG TPE 238

12.2.15 ARLANXEO 239

13 APPENDIX 240

13.1 DISCUSSION GUIDE 240

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 243

13.3 CUSTOMIZATION OPTIONS 245

13.4 RELATED REPORTS 245

13.5 AUTHOR DETAILS 246

❖ 世界の高機能エラストマー市場に関するよくある質問(FAQ) ❖

・高機能エラストマーの世界市場規模は?

→MarketsandMarkets社は2024年の高機能エラストマーの世界市場規模を60億米ドルと推定しています。

・高機能エラストマーの世界市場予測は?

→MarketsandMarkets社は2029年の高機能エラストマーの世界市場規模を78億米ドルと予測しています。

・高機能エラストマー市場の成長率は?

→MarketsandMarkets社は高機能エラストマーの世界市場が2024年~2029年に年平均5.3%成長すると予測しています。

・世界の高機能エラストマー市場における主要企業は?

→MarketsandMarkets社は「BASF SE (Germany), Celanese Corporation (Switzerland), Elkem ASA (Waltham), DuPont (US), Wacker Chemie AG (Germany), AGC Inc. (Japan), Mitsui Chemicals, Inc. (Japan), DAIKIN INDUSTRIES,Ltd. (Japan), Avient Corporation (US), Arkema (France), and Dow (US)など ...」をグローバル高機能エラストマー市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。