1 はじめに

1.1 調査目的 28

1.2 市場の定義 28

1.3 調査範囲 29

1.3.1 対象市場 29

1.3.2 考慮した年数 30

1.3.3 含むものと含まないもの 30

1.3.4 通貨 31

1.3.5 考慮した単位 31

1.4 制限事項 31

1.5 利害関係者 31

2 調査方法 32

2.1 調査データ 32

2.1.1 二次データ 33

2.1.1.1 二次資料からの主要データ 33

2.1.2 一次データ

2.1.2.1 一次資料からの主なデータ 34

2.1.2.2 主要な一次情報源 34

2.1.2.3 一次インタビューの主な参加者 34

2.1.2.4 一次インタビューの内訳 35

2.1.2.5 主要な業界インサイト 35

2.2 ベースナンバーの算出 36

2.2.1 供給側分析 36

2.2.2 需要サイド分析 36

2.3 予測 37

2.3.1 供給サイド 37

2.3.2 需要サイド 37

2.4 市場規模の推定 37

2.4.1 ボトムアップアプローチ 38

2.4.2 トップダウンアプローチ 39

2.5 データの三角測量 40

2.6 リサーチの前提 41

2.7 成長予測 41

2.8 リスク評価 42

2.9 要因分析 43

3 エグゼクティブ・サマリー 44

4 プレミアム・インサイト 50

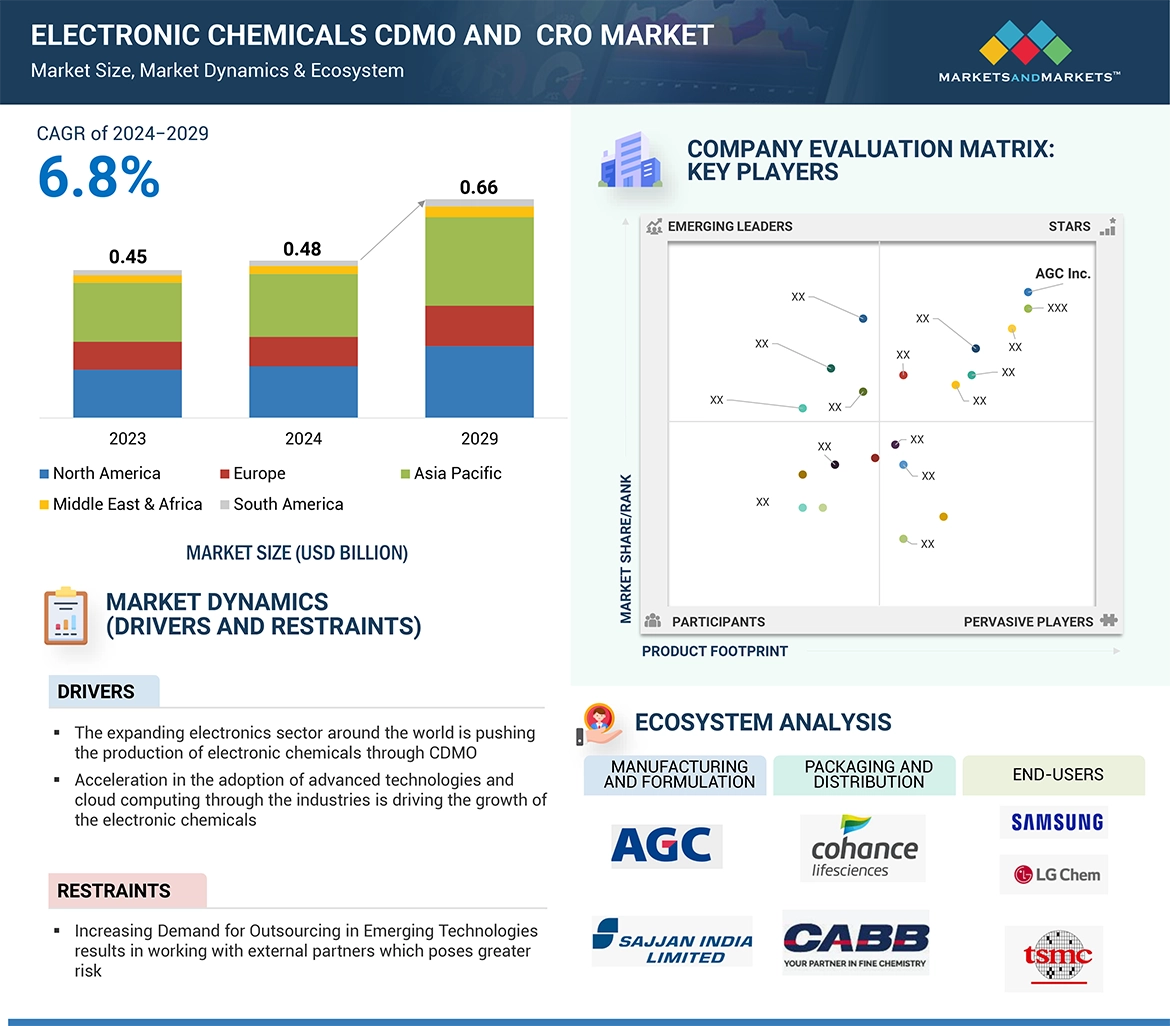

4.1 電子化学分野のプレーヤーにとっての魅力的な機会

cdmo & cro 市場 50

4.2 電子化学品Cdmo&Cro市場、タイプ別 51

4.3 電子化学Cdmo&Cro市場:用途別 51

4.4 電子化学品Cdmo&Cro市場:規模別 52

4.5 電子化学Cdmo&Cro市場:最終用途産業別 52

4.6 電子化学Cdmo&Cro市場:国別 53

5 市場の概要

5.1 はじめに 54

5.2 市場ダイナミクス

5.2.1 推進要因 55

5.2.1.1 半導体産業の拡大がCDMOを通じた電子化学品の生産を促進 55

5.2.1.2 先端技術とクラウドコンピューティングの採用加速 55

5.2.1.3 小型化傾向の高まりによる電子産業への投資の増加 56

5.2.2 阻害要因 56

5.2.2.1 エレクトロニクスのアウトソーシングによる外部パートナーとの協業 56

5.2.3 機会 57

5.2.3.1 AIに最適化されたハードウェアの開発により、高い処理能力と効率を備えた特化型チップとセンサーが必要になる 57

5.2.3.2 高周波技術の急成長 57

5.2.4 課題 58

5.2.4.1 先端技術を組み込んだ製品に関する厳しい規制 58

5.3 ジェネレーティブAIが電子化学Cdmo&Cro市場に与える影響 59

5.3.1 導入 59

5.4 電子化学品CDMO&CRO市場への影響 60

6 業界動向 61

6.1 はじめに

6.2 顧客ビジネスに影響を与えるトレンド/混乱 61

6.3 サプライチェーン分析 62

6.3.1 原材料調達 63

6.3.2 製造と処方 63

6.3.3 顧客サービスとカスタマイズ 64

6.3.4 エンドユーザー 64

6.4 投資と資金調達のシナリオ 65

6.5 価格分析 65

6.5.1 平均販売価格動向(地域別) 65

6.5.2 CDM&CRO市場における電子化学製品のタイプ別平均販売価格動向 66

6.5.3 CDMO&CRO市場における電子化学製品のタイプ別平均販売価格動向と上位5社 66

6.6 エコシステム分析 67

6.7 技術分析 68

6.8 特許分析 70

6.8.1 方法論 70

6.8.2 世界で取得された特許、2014年~2023年 70

6.8.3 特許公開動向、2014年~2023年 71

6.8.4 洞察 71

6.8.5 特許の法的地位 71

6.8.6 裁判管轄分析 72

6.8.7 上位企業/出願人 73

6.8.8 主要特許のリスト 74

6.9 貿易分析 75

6.9.1 輸入シナリオ 75

6.9.2 輸出シナリオ 76

6.10 主要会議・イベント 77

6.11 関税と規制の状況 78

6.11.1 電子化学cdmo&cro市場に関連する関税データ 78

6.11.2 規制機関、政府機関、その他の団体 79

6.11.3 電子化学品Cdmo&Cro市場に関連する規制 82

6.12 ポーターの5つの力分析 84

6.12.1 電子化学品Cdmo&Cro市場へのポーターの5つの力の影響 84

6.12.2 供給者の交渉力 85

6.12.3 新規参入者の脅威 85

6.12.4 代替品の脅威 85

6.12.5 買い手の交渉力 85

6.12.6 競合の激しさ 86

6.13 主要ステークホルダーと購買基準 86

6.13.1 購入プロセスにおける主要ステークホルダー 86

6.13.2 購入基準 87

6.14 マクロ経済指標 88

6.14.1 主要国のGDP動向と予測 88

6.15 ケーススタディ分析 89

6.15.1 電子化学CDMO&CROサービスにおける革新とアウトソーシング 89

6.15.2 インテルのプリント基板製造における水性洗浄への移行 89

6.15.3 電子化学における精度の向上: スマートエレクトロニクスの需要に対応するためのCdmoとCroの役割 90

7 電子化学製品のCDMOとCRO市場、タイプ別 91

7.1 はじめに 92

7.2 高機能ポリマー 94

7.2.1 高温や化学薬品曝露下での耐久性と安定性 94

7.3 酸・塩基性化学品 94

7.3.1 電子部品の小型化が需要を牽引 94

7.4 ガス 94

7.4.1 精密な薄膜蒸着、表面処理、汚染のない環境の実現に不可欠 94

7.5 パウダー 95

7.5.1 最新デバイスの高速接続と効率的な熱放散の促進 95

7.6 金属とペースト

7.6.1 半導体デバイスや電子アセンブリの導電性、相互接続、 接合に使用されるもの 95

7.7 その他のタイプ 96

8 電子化学品cdmo&cro市場(規模別) 97

8.1 導入 98

8.2 大規模 99

8.2.1 大衆市場向けアプリケーションを強化する大規模cdmoサービス 99

8.3 中規模 100

8.3.1 中規模のCdmo サービスはニッチ及び新興アプリケーションのイノベーションを最適化 100

8.4 小規模

8.4.1 小規模CDMO サービスは特殊市場のイノベーションを促進する 101

9 電子化学品のCdmoとCRO市場、用途別 102

9.1 導入 103

9.2 フォトレジスト 105

9.2.1 先端エレクトロニクスへの需要拡大と小型化傾向が成長を牽引 105

9.3 エッチャント 105

9.3.1 フレキシブル・ウェアラブル電子機器の発展が成長を牽引 105

9.4 ドーパント 106

9.4.1 正確な電気特性のための半導体材料改良の鍵 106

9.5 洗浄剤 106

9.5.1 汚染物質を確実に除去して電子機器の完全性を維持 106

9.6 蒸着材料 107

9.6.1 先端電子デバイスの製造に不可欠な物質の精密な積層を可能にする 107

9.7 その他の用途 107

9.7.1 熱界面材料 107

9.7.2 化学的機械的平坦化 108

10 電子化学Cdmo&Cro市場:最終用途産業別 109

10.1 導入 110

10.2 集積回路 112

10.2.1 エネルギー需要の増加と再生可能な取り組みが成長を牽引 112

10.3 ディスクリート半導体 112

10.3.1 精度、カスタマイズ性、拡張性の提供 112

10.4 センサー 113

10.4.1 リアルタイムのデータ監視と相互接続デバイスが重要な産業に不可欠 113

10.5 オプトエレクトロニクス 113

10.5.1 エネルギー効率の高い高性能技術の採用増加が成長を牽引 113

10.6 電池 114

10.6.1 リチウムイオンより高いエネルギー密度と安全性を提供する固体電池 114

10.7 その他の最終用途産業 114

11 電子化学品Cdmo&Cro市場(地域別) 115

11.1 はじめに 116

11.2 アジア太平洋地域 118

11.2.1 中国 126

11.2.1.1 広範な電子機器製造能力が成長を牽引 126

11.2.2 インド 128

11.2.2.1 半導体生産の現地化が市場を牽引 128

11.2.3 日本 130

11.2.3.1 半導体製造の活性化に注力することが成長を牽引 130

11.2.4 韓国 132

11.2.4.1 電子産業における旺盛な研究開発投資と先端材料への旺盛な需要が成長を牽引 132

11.2.5 その他のアジア太平洋地域 134

11.3 北米 136

11.3.1 米国 144

11.3.1.1 半導体産業の成長が市場を牽引 144

11.3.2 カナダ 146

11.3.2.1 先端半導体技術の需要拡大が市場を牽引 146

11.3.3 メキシコ 148

11.3.3.1 様々な電子機器用途からの旺盛な需要が市場を牽引 148

11.4 欧州 150

11.4.1 ドイツ 158

11.4.1.1 欧州半導体生産のリーダーシップが市場を牽引 158

11.4.2 英国 160

11.4.2.1 半導体製造の革新と自動車・通信業界の需要拡大が市場を牽引 160

11.4.3 フランス 162

11.4.3.1 電子・半導体産業のダイナミックな成長が市場を牽引 162

11.4.4 イタリア 164

11.4.4.1 エレクトロニクス・半導体生産への多額の投資と関連する戦略的パートナーシップ、政府のイニシアチブが市場を牽引 164

11.4.5 スペイン 166

11.4.5.1 PERTE Chipプログラムと半導体産業に対するその他の政府イニシアティブが市場を牽引 166

11.4.6 その他のヨーロッパ 168

11.5 南米 171

11.5.1 ブラジル 178

11.5.1.1 政府の奨励策と電気自動車の普及が市場を牽引 178

11.5.2 アルゼンチン 180

11.5.2.1 産業発展と先端エレクトロニクス・半導体需要の拡大が市場を牽引 180

11.5.3 その他の南米地域 182

11.6 中東・アフリカ 184

11.6.1 GCC諸国 190

11.6.1.1 サウジアラビア 190

11.6.1.1.1 半導体製造の重視と経済の多様化が市場を牽引 190

11.6.1.2 ウアイ 192

11.6.1.2.1 エレクトロニクス産業の振興と研究開発の促進が市場を牽引 192

11.6.1.3 その他のGCC諸国 194

11.6.2 南アフリカ 196

11.6.2.1 成長するエレクトロニクス産業と政府の産業政策が市場を牽引 196

11.6.3 その他の中東・アフリカ 198

12 競争環境 201

12.1 はじめに 201

12.2 主要プレーヤーの戦略/勝利への権利 201

12.3 市場シェア分析、2023年 203

12.4 収益分析 205

12.5 ブランド/製品比較分析 206

12.6 企業評価マトリックス、主要プレイヤー(2023年) 207

12.6.1 スター企業 207

12.6.2 新興リーダー 207

12.6.3 浸透型プレーヤー 207

12.6.4 参加企業 207

12.6.5 企業フットプリント 209

12.6.5.1 企業フットプリント 209

12.6.5.2 アプリケーションのフットプリント 210

12.6.5.3 最終用途産業のフットプリント 210

12.6.5.4 地域別フットプリント 211

12.7 企業評価マトリクス, 新興企業/SM, 2023 212

12.7.1 進歩的企業 212

12.7.2 対応力のある企業 212

12.7.3 ダイナミックな企業 212

12.7.4 スタートアップ・ブロック 212

12.7.5 競争ベンチマーキング 214

12.7.5.1 主要新興企業/中小企業のリスト 214

12.8 電子化学cdmoとcroベンダーの評価と財務指標 217

12.9 競争シナリオ 218

12.9.1 製品上市 218

12.9.2 取引 218

12.9.3 拡張 219

12.9.4 その他 221

13 企業プロファイル 224

13.1 主要プレーヤー 224

Sajjan India Ltd. (India)

Cohance Lifesciences (India)

noctiluca (Poland)

Actylis (US)

AGC Inc. (Japan)

Navin Fluorine International limited (India)

CABB Group GmbH (Germany)

Adesis Inc. (US)

Inventys Research Company (India)

LinkChem Technology Co.,Ltd.(China)

14 付録 267

14.1 ディスカッションガイド 267

14.2 Knowledgestore: Marketsandmarketsの購読ポータル 270

14.3 カスタマイズオプション 272

14.4 関連レポート 272

14.5 著者の詳細 273

“Growing trend of miniaturization has resulted into increased investment in electronics industry “

Electronics miniaturization has dramatically altered the face of electronic chemicals, particularly for companies that are interested in CDMOs and CROs. Such a trend demands not only advanced chemical formulations but also ultra-high purity standards for the tiny, intricate components that make up today's electronics. Because semiconductors and other electronic components are being scaled down in size, minor impurities can cause failure in performance, affecting the quality and functionality of the final product. CDMOs and CROs invest heavily in research and development to create materials that are up to these challenging standards, keeping pace with industry trends of reducing component size while improving functionality.

This sector also has important R&D investment requirements since developing high-performance ultra-pure materials involves intricate processes with heavy cost inputs. It has been estimated, for example, that according to industry reports, electronic chemical market worldwide will exhibit healthy growth, given increased demands on miniaturization for electronics and semiconductors. This demand calls for improvement among CDMOs and CROs on how they offer high-purity chemicals necessary for stages in the electronic manufacturing processes such as etching, cleaning, and deposition that require lithography. The smallest nodes involve extreme precision and stability that demands to operate at their targeted levels of consumer electronics applications, automotive electronics applications, and much more.

This miniaturization trend has motivated CDMOs and CROs to invest in special facilities and equipment that would help them achieve the desired levels of purity and consistency expected by their clients.

“Gases, by type, accounts for the largest market share in terms of volume in 2023.”

The fastest-growing type is the gases segment in terms of volume of the electronics chemicals CDMO and CRO market because these are considered essential in the semiconductor manufacturing and advanced electronics production processes. Gases such as nitrogen, hydrogen, argon, and specialty gases, such as silane, ammonia, and fluorinated compounds, are absolutely needed in each stage of semiconductor fabrication, namely deposition, etching, doping, and cleaning processes. The demand for semiconductors is increasing in applications, such as artificial intelligence, 5G technologies, electric vehicles, and renewable energy systems. This led to a need for higher purity electronic gases, especially for high-precision efficiency in the fabrication of the wafer, which ensures smaller, more efficient, and complex chips. Overall, expansion within the global semiconductor industry coupled with a continued pace in electronic device technologies represents vital factors responsible for the exponential increase of gases in this market.

“Large have the largest market share in terms of volume in 2023.”

Large-scale production is going to be the major market segment for electronics chemicals CDMO and CRO because of high demand for cost efficiency, quality output, and scaling in meeting the increasing requirements of the electronics and semiconductor industry. The rapid growth in adoption of advanced technologies, including 5G, artificial intelligence, electric vehicles, and renewable energy systems, has increased the demand for the mass production of microelectronic components such as semiconductors, chips, and display panels. Large-scale facilities enable the manufacturers to face this increasing demand effectively.

Large-scale operations are of prime importance to achieve economy of scale, which reduces the cost of production while maintaining consistency and quality. These facilities cater to large-scale production for etchants, photoresists, and deposition material for high-volume electronics. This ensures that supply chains on a global level do not experience any disruption and will meet the needs of most industries that rely on the just-in-time production system.

“Cleaning Agents have the largest market share in terms of volume in 2023.”

Cleaning agents should be the largest segment within the electronics chemicals CDMO and CRO market owing to their indispensable role in preserving the stringent purity and quality standards required in the microelectronics and semiconductor manufacturing sectors. These agents are therefore critical for removing contaminants, particulate matter, and residues from wafers, components, and surfaces at various steps in semiconductor manufacturing. As semiconductor technology advances toward smaller node sizes, cleaning agents are essential to achieving defect-free surfaces and ensuring the optimal performance of microelectronics. Applications such as wafer cleaning, photomask cleaning, and tool maintenance rely on these specialized chemicals, which must meet ultra-high purity standards to prevent adverse impacts on device performance.

“Optoelectronics have the largest market share in terms of volume in 2023.”

Optoelectronics will be the biggest application segment for the electronics chemicals CDMO and CRO market, in view of its high pace of adoption across diverse applications and due to its role at the very heart of modern technology. It encompasses light-emitting diodes, laser diodes, photovoltaic cells, and optical sensors; these products are an essential part of industries ranging from telecommunication and consumer electronics to automobile. Global demand for advanced display technologies, including OLEDs and micro-LEDs in smartphones, TVs, and wearable devices, has significantly increased the consumption of optoelectronic materials. Furthermore, increasing the use of optical sensors in autonomous vehicles and smart devices increases the demand even further. These devices need very specialized electronic chemicals, including deposition materials and photoresists, to provide precision and performance in optoelectronic components. With its ability to support diverse, high-growth industries combined with technological advancements, optoelectronics is a leading segment in the electronics chemicals CDMO and CRO market. Its growth mirrors the increased dependence on advanced technologies in daily life and industrial processes.

“Based on region, North America was the second largest market in 2023.”

North America, in particular, is expected to be the second largest of the CDMO and CRO markets for electronics chemicals by virtue of its robust high-technology industry base, leading edge semiconductor manufacturing, and highly strong R&D ecosystems. North America is also home to among the world's largest electronics and semiconductor manufacturers. Among Silicon Valley and other major technology complexes, this region provides important demand for specialty electronic chemicals. Growing adoption of cutting-edge technologies such as 5G, artificial intelligence, autonomous vehicles, and renewable energy would drive the consumption of chemicals like photoresists, etchants, and high-purity cleaning agents. Moreover, North America's leadership in optoelectronics, especially applications in telecommunications and automotive, reinforces the demand for electronic chemicals in the region. Further, the presence of leading CDMO and CRO players and advanced chemical manufacturing facilities adds to the growth of this market.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

• By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

• By Designation: Manger-Level - 30%, Director Level - 20%, and Others - 50%

• By Region: North America - 20%, Europe -30%, Asia Pacific - 30%, Middle East & Africa - 10%, and South America-10%

The key players in this market are Sajjan India Ltd. (India), Cohance Lifesciences (India), noctiluca (Poland), Actylis (US), AGC Inc. (Japan), Navin Fluorine International limited (India), CABB Group GmbH (Germany), Adesis Inc. (US), Inventys Research Company (India), LinkChem Technology Co.,Ltd.(China), among others.

Research Coverage

This report segments the market for the electronic chemicals CDMO and CRO market on the basis of type, scale, end-use, application and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and partnerships associated with the market for the electronic chemicals CDMO and CRO market.

Key benefits of buying this report

This research report is focused on various levels of analysis — industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the electronic chemicals CDMO and CRO market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

• Analysis of key drivers: Expanding electronic sectors, along with growing trend of miniaturization are some of the key driving forces of electronics chemicals CDMO and CRO market

• Market Penetration: Comprehensive information on the electronic chemicals CDMO and CRO market offered by top players in the global electronic chemicals CDMO and CRO market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the electronic chemicals CDMO and CRO market.

• Market Development: Comprehensive information about lucrative emerging markets — the report analyzes the markets for the electronic chemicals CDMO and CRO across regions.

• Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global electronic chemicals CDMO and CRO market.

• Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the electronic chemicals CDMO and CRO market.

1 INTRODUCTION 28

1.1 STUDY OBJECTIVES 28

1.2 MARKET DEFINITION 28

1.3 STUDY SCOPE 29

1.3.1 MARKETS COVERED 29

1.3.2 YEARS CONSIDERED 30

1.3.3 INCLUSIONS AND EXCLUSIONS 30

1.3.4 CURRENCY CONSIDERED 31

1.3.5 UNITS CONSIDERED 31

1.4 LIMITATIONS 31

1.5 STAKEHOLDERS 31

2 RESEARCH METHODOLOGY 32

2.1 RESEARCH DATA 32

2.1.1 SECONDARY DATA 33

2.1.1.1 Key data from secondary sources 33

2.1.2 PRIMARY DATA 33

2.1.2.1 Key data from primary sources 34

2.1.2.2 Key primary sources 34

2.1.2.3 Key participants for primary interviews 34

2.1.2.4 Breakdown of primary interviews 35

2.1.2.5 Key industry insights 35

2.2 BASE NUMBER CALCULATION 36

2.2.1 SUPPLY-SIDE ANALYSIS 36

2.2.2 DEMAND-SIDE ANALYSIS 36

2.3 FORECASTS 37

2.3.1 SUPPLY SIDE 37

2.3.2 DEMAND SIDE 37

2.4 MARKET SIZE ESTIMATION 37

2.4.1 BOTTOM-UP APPROACH 38

2.4.2 TOP-DOWN APPROACH 39

2.5 DATA TRIANGULATION 40

2.6 RESEARCH ASSUMPTIONS 41

2.7 GROWTH FORECAST 41

2.8 RISK ASSESSMENT 42

2.9 FACTOR ANALYSIS 43

3 EXECUTIVE SUMMARY 44

4 PREMIUM INSIGHTS 50

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRONIC CHEMICALS

CDMO & CRO MARKET 50

4.2 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY TYPE 51

4.3 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY APPLICATION 51

4.4 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY SCALE 52

4.5 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY END-USE INDUSTRY 52

4.6 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY COUNTRY 53

5 MARKET OVERVIEW 54

5.1 INTRODUCTION 54

5.2 MARKET DYNAMICS 54

5.2.1 DRIVERS 55

5.2.1.1 Expanding semiconductors industry pushing production of electronic chemicals through CDMOs 55

5.2.1.2 Acceleration in adoption of advanced technologies and cloud computing 55

5.2.1.3 Growing trend of miniaturization resulting in increased investments in electronics industry 56

5.2.2 RESTRAINTS 56

5.2.2.1 Electronics outsourcing resulting in working with external partners 56

5.2.3 OPPORTUNITIES 57

5.2.3.1 Development of AI-optimized hardware leading to need for specialized chips and sensors with high processing power and efficiency 57

5.2.3.2 Rapid growth of high-frequency technologies 57

5.2.4 CHALLENGES 58

5.2.4.1 Strict regulations pertaining to products incorporating advanced technologies 58

5.3 IMPACT OF GENERATIVE AI ON ELECTRONIC CHEMICALS CDMO & CRO MARKET 59

5.3.1 INTRODUCTION 59

5.4 IMPACT ON ELECTRONIC CHEMICALS CDMO & CRO MARKET 60

6 INDUSTRY TRENDS 61

6.1 INTRODUCTION 61

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 61

6.3 SUPPLY CHAIN ANALYSIS 62

6.3.1 RAW MATERIAL SOURCING 63

6.3.2 MANUFACTURING AND FORMULATION 63

6.3.3 CLIENT SERVICES AND CUSTOMIZATION 64

6.3.4 END USER 64

6.4 INVESTMENT AND FUNDING SCENARIO 65

6.5 PRICING ANALYSIS 65

6.5.1 AVERAGE SELLING PRICE TREND, BY REGION 65

6.5.2 AVERAGE SELLING PRICE TREND OF ELECTRONIC CHEMICALS IN CDMO & CRO MARKET, BY TYPE 66

6.5.3 AVERAGE SELLING PRICE TREND OF ELECTRONIC CHEMICALS IN CDMO & CRO MARKET, BY TYPE AND TOP 5 PLAYERS 66

6.6 ECOSYSTEM ANALYSIS 67

6.7 TECHNOLOGY ANALYSIS 68

6.8 PATENT ANALYSIS 70

6.8.1 METHODOLOGY 70

6.8.2 PATENTS GRANTED WORLDWIDE, 2014–2023 70

6.8.3 PATENT PUBLICATION TRENDS, 2014–2023 71

6.8.4 INSIGHTS 71

6.8.5 LEGAL STATUS OF PATENTS 71

6.8.6 JURISDICTION ANALYSIS 72

6.8.7 TOP COMPANIES/APPLICANTS 73

6.8.8 LIST OF MAJOR PATENTS 74

6.9 TRADE ANALYSIS 75

6.9.1 IMPORT SCENARIO 75

6.9.2 EXPORT SCENARIO 76

6.10 KEY CONFERENCES AND EVENTS 77

6.11 TARIFF AND REGULATORY LANDSCAPE 78

6.11.1 TARIFF DATA RELATED TO ELECTRONIC CHEMICALS CDMO & CRO MARKET 78

6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 79

6.11.3 REGULATIONS RELATED TO ELECTRONIC CHEMICALS CDMO & CRO MARKET 82

6.12 PORTER’S FIVE FORCES ANALYSIS 84

6.12.1 IMPACT OF PORTER’S FIVE FORCES ON ELECTRONIC CHEMICALS CDMO & CRO MARKET 84

6.12.2 BARGAINING POWER OF SUPPLIERS 85

6.12.3 THREAT OF NEW ENTRANTS 85

6.12.4 THREAT OF SUBSTITUTES 85

6.12.5 BARGAINING POWER OF BUYERS 85

6.12.6 INTENSITY OF COMPETITIVE RIVALRY 86

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA 86

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS 86

6.13.2 BUYING CRITERIA 87

6.14 MACROECONOMIC INDICATORS 88

6.14.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES 88

6.15 CASE STUDY ANALYSIS 89

6.15.1 INNOVATIONS AND OUTSOURCING IN ELECTRONIC CHEMICALS CDMO & CRO SERVICES 89

6.15.2 INTEL'S TRANSITION TO AQUEOUS-BASED CLEANING IN PCB MANUFACTURING 89

6.15.3 ADVANCING PRECISION IN ELECTRONIC CHEMICALS: ROLE OF CDMOS AND CROS IN MEETING SMART ELECTRONICS DEMANDS 90

7 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY TYPE 91

7.1 INTRODUCTION 92

7.2 HIGH-PERFORMANCE POLYMERS 94

7.2.1 OFFER DURABILITY AND STABILITY UNDER HIGH TEMPERATURES AND CHEMICAL EXPOSURE 94

7.3 ACID AND BASE CHEMICALS 94

7.3.1 MINIATURIZATION OF ELECTRONIC COMPONENTS TO DRIVE DEMAND 94

7.4 GASES 94

7.4.1 INDISPENSABLE FOR ENABLING PRECISE THIN-FILM DEPOSITION, SURFACE TREATMENTS, AND CONTAMINATION-FREE ENVIRONMENTS 94

7.5 POWDERS 95

7.5.1 FACILITATE HIGH-SPEED CONNECTIVITY AND EFFICIENT HEAT DISSIPATION IN MODERN DEVICES 95

7.6 METALS AND PASTES 95

7.6.1 USED FOR CONDUCTIVITY, INTERCONNECTIONS, AND BONDING IN SEMICONDUCTOR DEVICES AND ELECTRONIC ASSEMBLIES 95

7.7 OTHER TYPES 96

8 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY SCALE 97

8.1 INTRODUCTION 98

8.2 LARGE SCALE 99

8.2.1 LARGE-SCALE CDMO SERVICES EMPOWER MASS-MARKET APPLICATIONS 99

8.3 MEDIUM SCALE 100

8.3.1 MEDIUM-SCALE CDMO SERVICES OPTIMIZE INNOVATION FOR NICHE AND EMERGING APPLICATIONS 100

8.4 SMALL SCALE 101

8.4.1 SMALL-SCALE CDMO SERVICES CATALYZE INNOVATION IN SPECIALIZED MARKETS 101

9 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY APPLICATION 102

9.1 INTRODUCTION 103

9.2 PHOTORESISTS 105

9.2.1 GROWING DEMAND FOR ADVANCED ELECTRONICS AND MINIATURIZATION TREND TO DRIVE GROWTH 105

9.3 ETCHANTS 105

9.3.1 DEVELOPMENTS IN FLEXIBLE AND WEARABLE ELECTRONICS TO DRIVE GROWTH 105

9.4 DOPANTS 106

9.4.1 KEY TO MODIFYING SEMICONDUCTOR MATERIALS FOR PRECISE ELECTRICAL PROPERTIES 106

9.5 CLEANING AGENTS 106

9.5.1 ENSURE REMOVAL OF CONTAMINANTS TO MAINTAIN INTEGRITY OF ELECTRONIC DEVICES 106

9.6 DEPOSITION MATERIALS 107

9.6.1 ENABLE PRECISE LAYERING OF SUBSTANCES ESSENTIAL FOR FABRICATION OF ADVANCED ELECTRONIC DEVICES 107

9.7 OTHER APPLICATIONS 107

9.7.1 THERMAL INTERFACE MATERIALS 107

9.7.2 CHEMICAL MECHANICAL PLANARIZATION 108

10 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY END-USE INDUSTRY 109

10.1 INTRODUCTION 110

10.2 INTEGRATED CIRCUITS 112

10.2.1 RISING ENERGY DEMAND AND RENEWABLE INITIATIVES TO DRIVE GROWTH 112

10.3 DISCRETE SEMICONDUCTORS 112

10.3.1 OFFER PRECISION, CUSTOMIZATION, AND SCALABILITY 112

10.4 SENSORS 113

10.4.1 INTEGRAL TO INDUSTRIES WHERE REAL-TIME DATA MONITORING AND INTERCONNECTED DEVICES ARE CRITICAL 113

10.5 OPTOELECTRONICS 113

10.5.1 INCREASING ADOPTION OF ENERGY-EFFICIENT AND HIGH-PERFORMANCE TECHNOLOGIES TO DRIVE GROWTH 113

10.6 BATTERY 114

10.6.1 SOLID-STATE BATTERIES OFFERING HIGHER ENERGY DENSITY AND IMPROVED SAFETY OVER LITHIUM-ION 114

10.7 OTHER END-USE INDUSTRIES 114

11 ELECTRONIC CHEMICALS CDMO & CRO MARKET, BY REGION 115

11.1 INTRODUCTION 116

11.2 ASIA PACIFIC 118

11.2.1 CHINA 126

11.2.1.1 Extensive electronics manufacturing capacity to drive growth 126

11.2.2 INDIA 128

11.2.2.1 Localization of semiconductor production to drive market 128

11.2.3 JAPAN 130

11.2.3.1 Focus on revitalizing semiconductor manufacturing to drive growth 130

11.2.4 SOUTH KOREA 132

11.2.4.1 Strong R&D investments and robust demand for advanced materials in electronics industry to drive growth 132

11.2.5 REST OF ASIA PACIFIC 134

11.3 NORTH AMERICA 136

11.3.1 US 144

11.3.1.1 Growth of semiconductors industry to drive market 144

11.3.2 CANADA 146

11.3.2.1 Growing demand for advanced semiconductor technology to drive market 146

11.3.3 MEXICO 148

11.3.3.1 Strong demand from various electronics applications to drive market 148

11.4 EUROPE 150

11.4.1 GERMANY 158

11.4.1.1 Leadership in European semiconductor production to drive market 158

11.4.2 UK 160

11.4.2.1 Innovation in semiconductor manufacturing and growing demand across automotive and telecommunications industries to drive market 160

11.4.3 FRANCE 162

11.4.3.1 Dynamic growth in electronics and semiconductors industries to drive market 162

11.4.4 ITALY 164

11.4.4.1 Significant investment in electronics and semiconductor production and related strategic partnerships and government initiatives to drive market 164

11.4.5 SPAIN 166

11.4.5.1 PERTE Chip program and other government initiatives for semiconductors industry to drive market 166

11.4.6 REST OF EUROPE 168

11.5 SOUTH AMERICA 171

11.5.1 BRAZIL 178

11.5.1.1 Government incentives and growing adoption of electric vehicles to drive market 178

11.5.2 ARGENTINA 180

11.5.2.1 Industrial development and expanding demand for advanced electronics and semiconductors to drive market 180

11.5.3 REST OF SOUTH AMERICA 182

11.6 MIDDLE EAST & AFRICA 184

11.6.1 GCC COUNTRIES 190

11.6.1.1 Saudi Arabia 190

11.6.1.1.1 Emphasis on semiconductor manufacturing and economic diversification to drive market 190

11.6.1.2 UAE 192

11.6.1.2.1 Government initiatives promoting electronics industry and fostering advancements in R&D to drive market 192

11.6.1.3 Rest of GCC Countries 194

11.6.2 SOUTH AFRICA 196

11.6.2.1 Growing electrotechnical industry and government-backed industrial policies to drive market 196

11.6.3 REST OF MIDDLE EAST & AFRICA 198

12 COMPETITIVE LANDSCAPE 201

12.1 INTRODUCTION 201

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 201

12.3 MARKET SHARE ANALYSIS, 2023 203

12.4 REVENUE ANALYSIS 205

12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS 206

12.6 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2023 207

12.6.1 STARS 207

12.6.2 EMERGING LEADERS 207

12.6.3 PERVASIVE PLAYERS 207

12.6.4 PARTICIPANTS 207

12.6.5 COMPANY FOOTPRINT 209

12.6.5.1 Company footprint 209

12.6.5.2 Application footprint 210

12.6.5.3 End-use industry footprint 210

12.6.5.4 Region footprint 211

12.7 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2023 212

12.7.1 PROGRESSIVE COMPANIES 212

12.7.2 RESPONSIVE COMPANIES 212

12.7.3 DYNAMIC COMPANIES 212

12.7.4 STARTING BLOCKS 212

12.7.5 COMPETITIVE BENCHMARKING 214

12.7.5.1 List of key startups/SMEs 214

12.8 VALUATION AND FINANCIAL METRICS IN ELECTRONIC CHEMICALS CDMO AND CRO VENDORS 217

12.9 COMPETITIVE SCENARIO 218

12.9.1 PRODUCT LAUNCHES 218

12.9.2 DEALS 218

12.9.3 EXPANSIONS 219

12.9.4 OTHERS 221

13 COMPANY PROFILES 224

13.1 KEY PLAYERS 224

13.1.1 SAJJAN INDIA LTD. 224

13.1.1.1 Business overview 224

13.1.1.2 Products/Solutions/Services offered 224

13.1.1.3 Recent developments 225

13.1.1.3.1 Expansions 225

13.1.1.3.2 Deals 225

13.1.1.4 MnM view 226

13.1.1.4.1 Right to win 226

13.1.1.4.2 Strategic choices 226

13.1.1.4.3 Weaknesses and competitive threats 226

13.1.2 COHANCE LIFESCIENCES 227

13.1.2.1 Business overview 227

13.1.2.2 Products/Solutions/Services offered 227

13.1.2.3 Recent developments 228

13.1.2.3.1 Deals 228

13.1.2.3.2 Others 228

13.1.2.4 MnM view 229

13.1.2.4.1 Right to win 229

13.1.2.4.2 Strategic choices 229

13.1.2.4.3 Weaknesses and competitive threats 229

13.1.3 NOCTILUCA 230

13.1.3.1 Business overview 230

13.1.3.2 Products/Solutions/Services offered 231

13.1.3.3 Recent developments 231

13.1.3.3.1 Product launches 231

13.1.3.3.2 Expansions 232

13.1.3.3.3 Others 232

13.1.3.4 MnM view 232

13.1.3.4.1 Right to win 232

13.1.3.4.2 Strategic choices 233

13.1.3.4.3 Weaknesses and competitive threats 233

13.1.4 ACTYLIS 234

13.1.4.1 Business overview 234

13.1.4.2 Products/Solutions/Services offered 234

13.1.4.3 Recent developments 235

13.1.4.3.1 Deals 235

13.1.4.3.2 Others 235

13.1.4.4 MnM view 236

13.1.4.4.1 Right to win 236

13.1.4.4.2 Strategic choices 236

13.1.4.4.3 Weaknesses and competitive threats 236

13.1.5 AGC INC. 237

13.1.5.1 Business overview 237

13.1.5.2 Products/Solutions/Services offered 238

13.1.5.3 Recent developments 239

13.1.5.3.1 Product Launches 239

13.1.5.3.2 Expansions 239

13.1.5.3.3 Others 240

13.1.5.4 MnM view 240

13.1.5.4.1 Right to win 240

13.1.5.4.2 Strategic choices 240

13.1.5.4.3 Weaknesses and competitive threats 241

13.1.6 NAVIN FLUORINE INTERNATIONAL LIMITED 242

13.1.6.1 Business overview 242

13.1.6.2 Products/Solutions/Services offered 243

13.1.6.3 Recent developments 244

13.1.6.3.1 Deals 244

13.1.6.3.2 Others 244

13.1.6.4 MnM view 244

13.1.6.4.1 Right to win 244

13.1.6.4.2 Strategic choices 245

13.1.6.4.3 Weaknesses and competitive threats 245

13.1.7 CABB GROUP GMBH 246

13.1.7.1 Business overview 246

13.1.7.2 Products/Solutions/Services offered 246

13.1.7.3 Recent developments 247

13.1.7.3.1 Others 247

13.1.7.4 MnM view 247

13.1.7.4.1 Right to win 247

13.1.7.4.2 Strategic choices 248

13.1.7.4.3 Weaknesses and competitive threats 248

13.1.8 ADESIS INC. 249

13.1.8.1 Business overview 249

13.1.8.2 Products/Solutions/Services offered 250

13.1.8.3 Recent developments 251

13.1.8.3.1 Expansions 251

13.1.8.3.2 Others 251

13.1.8.4 MnM view 252

13.1.8.4.1 Right to win 252

13.1.8.4.2 Strategic choices 252

13.1.8.4.3 Weaknesses and competitive threats 252

13.1.9 INVENTYS RESEARCH COMPANY 253

13.1.9.1 Business overview 253

13.1.9.2 Products/Solutions/Services offered 253

13.1.9.3 Recent developments 254

13.1.9.3.1 Expansions 254

13.1.9.3.2 Others 254

13.1.9.4 MnM view 254

13.1.9.4.1 Right to win 254

13.1.9.4.2 Strategic choices 254

13.1.9.4.3 Weaknesses and competitive threats 255

13.1.10 LINKCHEM TECHNOLOGY CO., LTD. 256

13.1.10.1 Business overview 256

13.1.10.2 Products/Solutions/Services offered 256

13.1.10.3 Recent developments 257

13.1.10.3.1 Others 257

13.1.10.4 MnM view 257

13.1.10.4.1 Right to win 257

13.1.10.4.2 Strategic choices 257

13.1.10.4.3 Weaknesses and competitive threats 258

13.2 OTHER PLAYERS 259

13.2.1 SSK BIOSCIENCES PVT. LTD. 259

13.2.2 CHONGQING WERLCHEM NEW MATERIALS TECHNOLOGY CO., LTD 260

13.2.3 VIAKEM 261

13.2.4 INNOVASSYNTH 261

13.2.5 PHT INDUSTRIES 262

13.2.6 SYMPHARMA 262

13.2.7 VIRUJ GROUP 263

13.2.8 REDOX SCIENTIFIC 264

13.2.9 SUNGWUN PHARMACOPIA CO., LTD. 265

13.2.10 KNC LABORATORIES CO., LTD. 266

14 APPENDIX 267

14.1 DISCUSSION GUIDE 267

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 270

14.3 CUSTOMIZATION OPTIONS 272

14.4 RELATED REPORTS 272

14.5 AUTHOR DETAILS 273

❖ 世界の電子化学品CDMO&CRO市場に関するよくある質問(FAQ) ❖

・電子化学品CDMO&CROの世界市場規模は?

→MarketsandMarkets社は2024年の電子化学品CDMO&CROの世界市場規模を4.8億米ドルと推定しています。

・電子化学品CDMO&CROの世界市場予測は?

→MarketsandMarkets社は2029年の電子化学品CDMO&CROの世界市場規模を6.6億米ドルと予測しています。

・電子化学品CDMO&CRO市場の成長率は?

→MarketsandMarkets社は電子化学品CDMO&CROの世界市場が2024年~2029年に年平均6.8%成長すると予測しています。

・世界の電子化学品CDMO&CRO市場における主要企業は?

→MarketsandMarkets社は「Sajjan India Ltd. (India), Cohance Lifesciences (India), noctiluca (Poland), Actylis (US), AGC Inc. (Japan), Navin Fluorine International limited (India), CABB Group GmbH (Germany), Adesis Inc. (US), Inventys Research Company (India), LinkChem Technology Co.,Ltd.(China)など ...」をグローバル電子化学品CDMO&CRO市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。