1 はじめに 27

1.1 調査目的 27

1.2 市場の定義 27

1.3 調査範囲 28

1.3.1 対象市場と地域範囲 28

1.3.2 対象範囲と除外項目 29

1.3.3 考慮した年数 29

1.4 考慮した通貨 30

1.5 単位の考慮 30

1.6 制限事項 30

1.7 利害関係者 31

2 調査方法 32

2.1 調査データ 32

2.1.1 二次データ 33

2.1.1.1 主な二次資料のリスト 34

2.1.1.2 二次資料からの主要データ 34

2.1.2 一次データ 34

2.1.2.1 一次インタビュー参加者リスト 35

2.1.2.2 プライマリーの内訳 35

2.1.2.3 一次資料からの主要データ 36

2.1.2.4 主要な業界インサイト 37

2.1.3 二次調査および一次調査 38

2.2 市場規模の推定 39

2.2.1 ボトムアップアプローチ 41

2.2.1.1 ボトムアップ分析を用いた市場規模推定のアプローチ

(需要側) 41

2.2.2 トップダウンアプローチ 42

2.2.2.1 トップダウン分析による市場規模推計のアプローチ(供給側

(供給側

2.3 市場の内訳とデータの三角測量 43

2.4 リサーチの前提 44

2.5 リスク評価 45

2.6 調査の限界 45

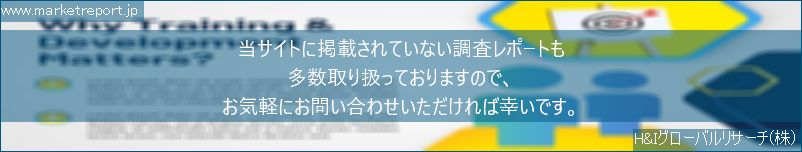

3 エグゼクティブ・サマリー 46

4 プレミアムインサイト 51

4.1 AIサーバー市場におけるプレーヤーにとっての魅力的な機会 51

4.2 AIサーバー市場、プロセッサタイプ別 51

4.3 AIサーバー市場、機能別 52

4.4 AIサーバー市場:冷却技術別 52

4.5 AIサーバー市場:フォームファクター別 53

4.6 AIサーバー市場:デプロイメント別 53

4.7 AIサーバー市場:用途別 54

4.8 AIサーバー市場:エンドユーザー別 54

4.9 AIサーバー市場:国別 55

4.10 AIサーバー市場:地域別 55

5 市場の概要 56

5.1 はじめに 56

5.2 市場ダイナミクス 56

5.2.1 推進要因 57

5.2.1.1 データトラフィックの増加と高コンピューティングパワーの必要性 57

5.2.1.2 機械学習と深層学習アルゴリズムの採用増加 57

5.2.1.3 業界全体におけるクラウドベースのAIソリューションの採用増加 58

5.2.1.4 AI高速化のためのGPUとASIC技術の進歩 59

5.2.2 阻害要因 60

5.2.2.1 AIサーバーのハードウェアとインフラの初期コストの高さ 60

5.2.2.2 AIハードウェアの専門家と熟練労働者の不足 60

5.2.2.3 高密度AIサーバーの消費電力と冷却の課題 61

5.2.3 ビジネスチャンス 63

5.2.3.1 ヘルスケア分野におけるAIの可能性の高まり 63

5.2.3.2 クラウドサービスプロバイダーによるデータセンターへの投資の増加 65

5.2.3.3 AI-as-a-Service(AIaaS)プラットフォームへの需要の高まり 66

5.2.3.4 中小企業におけるAI導入の増加 66

5.2.4 課題 67

5.2.4.1 データセキュリティとプライバシーに関する懸念 67

5.2.4.2 サプライチェーンの混乱 68

5.3 顧客ビジネスに影響を与えるトレンド/破壊 69

5.4 価格分析 69

5.4.1 主要企業の平均販売価格(プロセッサータイプ別) 70

5.4.2 平均販売価格の動向(地域別) 71

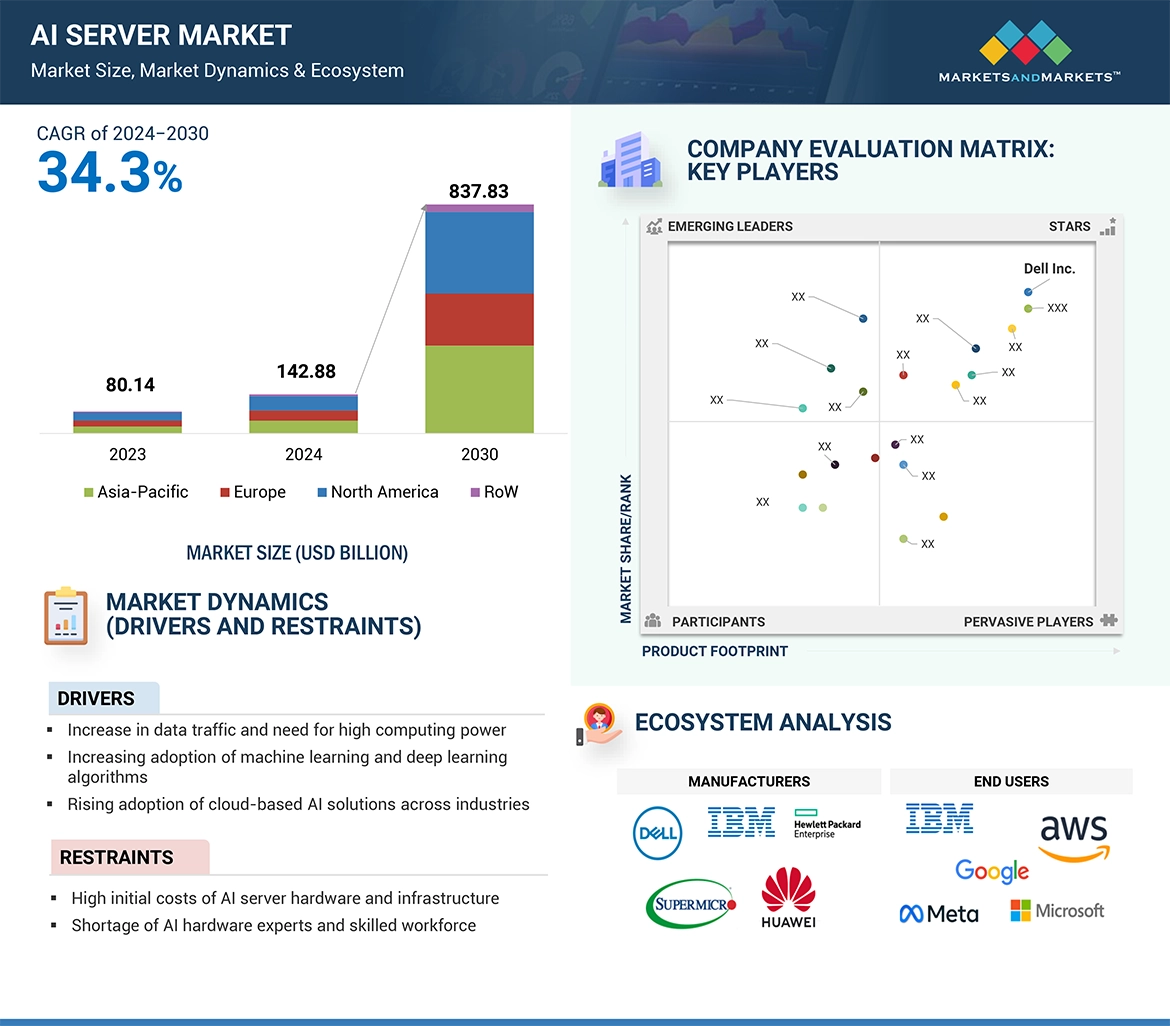

5.5 バリューチェーン分析 72

5.6 エコシステム分析 75

5.7 投資と資金調達のシナリオ 76

5.8 技術分析 76

5.8.1 主要技術 76

5.8.1.1 ハイパフォーマンス・コンピューティング(HPC) 76

5.8.1.2 高帯域幅メモリ(HBM) 77

5.8.1.3 GenAI ワークロード 78

5.8.2 補完技術 78

5.8.2.1 データセンターの電力管理と冷却システム 78

5.8.2.2 高速相互接続 79

5.8.3 隣接技術 79

5.8.3.1 AI開発フレームワーク 79

5.8.3.2 量子AI 80

5.9 サーバーのコスト構造/部品表(BOM) 80

5.9.1 Gpuサーバー 80

5.10 AIサーバーの現在の普及率と成長予測 83

5.11 クラウドサービスプロバイダーによるデータセンターの今後の展開 83

5.12 クラウドサービスプロバイダーの設備投資 84

5.13 プロセッサーのベンチマーク 85

5.13.1 Gpuベンチマーク 85

5.13.2 CPUベンチマーク 86

5.14 特許分析 86

5.15 貿易分析 92

5.15.1 輸入シナリオ(HSコード847150) 92

5.15.2 輸出シナリオ(HSコード847150) 93

5.16 主要な会議とイベント(2024-2025年) 94

5.17 ケーススタディ分析 97

5.17.1 AIソリューション開発を加速するアイブレスの高性能コンピューティングサーバー 97

5.17.2 シーウェブはレノボ、エヌビディアと協業し、AIアクセシビリティを拡大するGPUコンピューティング・アズ・ア・サービス・モデルを立ち上げ 97

5.17.3 シャロナイ、Lenovo Truscale で AI インフラを拡張、数百台の Gpu 高密度サーバーを導入 98

5.17.4 llmsのための推論: Nvidia Triton推論サーバーとEleuther AIのケーススタディ 98

5.17.5 アプライド・デジタル・コーポレーション、スーパーマイクロ・サーバーでAI機能を拡張 99

5.18 規制の状況 100

5.18.1 規制機関、政府機関、その他の組織 100

5.18.2 標準規格 104

5.19 ポーターの5つの力分析 106

5.19.1 新規参入の脅威 107

5.19.2 代替品の脅威 107

5.19.3 供給者の交渉力 108

5.19.4 買い手の交渉力 108

5.19.5 競合の激しさ 108

5.20 主要ステークホルダーと購買基準 109

5.20.1 購入プロセスにおける主要ステークホルダー 109

5.20.2 購入基準

6 AIサーバー市場:プロセッサタイプ別 111

6.1 はじめに 112

6.2 Gpuベースのサーバー 114

6.2.1 クラウドプロバイダーによるGPUベースのAIサーバー統合の増加が市場を押し上げる 114

6.3 FPGAベースのサーバー 116

6.3.1 AIワークロードの柔軟性とカスタマイズへのニーズの高まりがFPGAベースの需要を促進 116

6.4 ASICベースのサーバー 118

6.4.1 カスタマイズされた高性能AI処理への需要の高まりがasicベースサーバーの採用を促進 118

7 AIサーバー市場(機能別) 121

7.1 導入 122

7.2 トレーニング 124

7.2.1 ディープラーニング技術の急増がAIサーバー市場の成長を促進 124

7.3 推論 126

7.3.1 エッジコンピューティングへのシフトがAI推論サーバーの需要を押し上げる 126

8 AIサーバー市場:冷却技術別 128

8.1 導入 129

8.2 空冷 131

8.2.1 コスト効率が高く、設置が簡単な空冷技術が需要を牽引 131

8.3 液冷 132

8.3.1 PC と AI ワークロードの冷却需要の増加が市場を活性化 132

8.4 ハイブリッド冷却 133

8.4.1 AI主導の機械学習、自然言語処理、コンピュータビジョンの台頭が需要を押し上げる 133

9 AI サーバー市場:フォームファクター別 134

9.1 導入 135

9.2 ラックマウントサーバー 136

9.2.1 冷却技術とエネルギー効率の向上がラックマウント型AIサーバーの需要を促進 136

9.3 ブレードサーバー 137

9.3.1 医療、金融、自動車産業におけるAIワークロード処理需要の増加が市場を牽引 137

9.4 タワーサーバー 137

9.4.1 機械学習、データ分析、小規模なAI推論タスクでの利用の増加が需要を押し上げる 137

10 AI サーバー市場(デプロイメント別) 138

10.1 導入 139

10.2 オンプレミス 140

10.2.1 医療・金融分野での導入拡大が市場を牽引 140

10.3 クラウド 141

10.3.1 多額の先行投資を行うことなく、変動するワークロードに迅速に対応できる能力が成長を促進 141

11 AIサーバー市場:用途別 143

11.1 導入 144

11.2 ジェネレーティブAI 145

11.2.1 ルールベースのモデル 146

11.2.1.1 金融、医療、法務システムでの利用拡大が市場を牽引 146

11.2.2 統計モデル 147

11.2.2.1 IoTデバイス、ソーシャルメディア、公衆衛生データからの膨大なデータセットの利用可能性の増加が需要を牽引 147

11.2.3 ディープラーニング 148

11.2.3.1 ヘルスケア、自動車、家電におけるAIの普及が需要を押し上げる 148

11.2.4 生成的敵対ネットワーク(GANS) 149

11.2.4.1 高品質でスケーラブルなデータ生成へのニーズの高まりが市場成長を支える 149

11.2.5 オートエンコーダ 149

11.2.5.1 サーバー性能向上のためのクラウドやエッジコンピューティングでの使用増加 が需要を牽引 149

11.2.6 畳み込みニューラルネットワーク(CNN) 150

11.2.6.1 スマートデバイス、防犯カメラ、自動運転車による視覚データの普及が市場を牽引 150

11.2.7 トランスフォーマーモデル 150

11.2.7.1 大規模データセットの入手可能性とデータストレージ技術の進歩が市場を活性化 150

11.3 機械学習 151

11.3.1 mlモデルの急速な進歩と展開が需要を押し上げる 151

11.4 自然言語処理 152

11.4.1 自然言語処理アプリケーションのリアルタイム性ニーズの高まりが市場成長を支える 152

11.5 コンピュータビジョン 152

11.5.1 セキュリティ、ヘルスケア、自動車、小売におけるコンピュータビジョンアプリケーションの急増がAIサーバーの需要を促進 152

12 AIサーバー市場:エンドユーザー別 154

12.1 導入 155

12.2 クラウドサービスプロバイダー 156

12.2.1 AIワークロードの急増とクラウド導入が市場成長を促進 156

12.3 企業 157

12.3.1 ヘルスケア 159

12.3.1.1 コンピュータ支援創薬へのAIの統合が市場成長を促進 159

12.3.2 BFSI 160

12.3.2.1 金融機関における不正検知ニーズの高まりが需要を後押し 160

12.3.3 自動車 161

12.3.3.1 安全性、効率性、運転体験の向上への注目の高まりが成長を促進 161

12.3.4 小売・電子商取引 163

12.3.4.1 パーソナライズされたショッピング体験と顧客サービスの向上が有利な成長機会を提供 163

12.3.5 メディア・娯楽 164

12.3.5.1 視聴者の嗜好、エンゲージメントパターン、人口統計情報のリアルタイム分析が市場成長を促進 164

12.3.6 その他 165

12.3.6.1 スマートデバイス、防犯カメラ、自動運転車によるビジュアルデータの普及が需要を促進 165

12.4 政府機関 166

12.4.1 国家安全保障と防衛におけるAI利用の増加が市場成長を促進 166

13 AIサーバー市場(地域別) 168

13.1 はじめに 169

13.2 北米 171

13.2.1 北米のマクロ経済見通し 171

13.2.2 米国 177

13.2.2.1 政府主導の半導体製造促進策が市場を牽引 177

13.2.3 カナダ 178

13.2.3.1 AIの商業化重視の高まりが需要を促進 178

13.2.4 メキシコ 179

179 13.2.4.1 デジタルプラットフォームとクラウドベースのソリューションへのシフトが 需要を加速 179

13.3 欧州 181

13.3.1 欧州のマクロ経済見通し 181

13.3.2 英国 188

13.3.2.1 データセンター・インフラへの投資拡大が需要を押し上げる 188

13.3.3 ドイツ 189

13.3.3.1 堅牢な産業基盤が有利な成長機会をもたらす 189

13.3.4 フランス 190

13.3.4.1 AI新興企業の増加でAIサーバーの需要が加速 190

13.3.5 イタリア 191

13.3.5.1 自動車・医療分野でのデジタル化の採用拡大が市場を牽引 191

13.3.6 スペイン 192

13.3.6.1 AIメーカー間の連携やパートナーシップの拡大が市場成長を後押し 192

13.3.7 その他の欧州 193

13.4 アジア太平洋地域 195

13.4.1 アジア太平洋地域のマクロ経済見通し 195

13.4.2 中国 202

13.4.2.1 研究費の急増と支援的な規制政策の実施が市場成長を促進 202

13.4.3 日本 203

13.4.3.1 ロボットシステムを進化させるAIサーバーの採用が増加し、有利な成長機会を提供 203

13.4.4 韓国 204

13.4.4.1 韓国では半導体産業がAIサーバー市場を牽引 204

13.4.5 インド 205

13.4.5.1 政府主導のAIインフラ強化策が市場成長を促進 205

13.4.6 その他のアジア太平洋地域 206

13.5 ROW 207

13.5.1 ROWのマクロ経済見通し 208

13.5.2 中東 213

13.5.2.1 デジタルトランスフォーメーションと技術革新を重視する動きが市場成長を牽引 213

13.5.2.2 GCC諸国 216

13.5.2.3 その他の中東地域 217

13.5.3 アフリカ 218

13.5.3.1 インターネット普及率とモバイル契約数の増加が有利な成長機会をもたらす 218

13.5.4 南米 219

13.5.4.1 膨大なデータの保存ニーズの高まりが需要を押し上げる 219

14 競争環境 221

14.1 概要 221

14.2 主要プレイヤーの戦略/勝利への権利(2020~2024年) 221

14.3 収益分析 224

14.4 市場シェア分析、2023年 224

14.5 企業評価と財務指標 228

14.6 ブランド/製品の比較 229

14.7 企業評価マトリックス:主要プレーヤー、2023年 230

14.7.1 スター企業 230

14.7.2 新興リーダー 230

14.7.3 浸透型プレーヤー 230

14.7.4 参加企業 230

14.7.5 企業フットプリント:主要プレーヤー、2023年 232

14.7.5.1 企業フットプリント 232

14.7.5.2 地域別フットプリント 233

14.7.5.3 プロセッサータイプのフットプリント 234

14.7.5.4 機能別フットプリント 235

14.7.5.5 冷却技術のフットプリント 235

14.7.5.6 フォームファクターフットプリント 236

14.7.5.7 展開フットプリント 237

14.7.5.8 アプリケーションフットプリント 238

14.7.5.9 エンドユーザーフットプリント 239

14.8 企業評価マトリクス:新興企業/SM(2023年) 239

14.8.1 進歩的企業 239

14.8.2 対応力のある企業 240

14.8.3 ダイナミックな企業 240

14.8.4 スターティングブロック 240

14.8.5 競争ベンチマーキング:新興企業/SM、2023年 241

14.8.5.1 主要新興企業/中小企業の詳細リスト 241

14.8.5.2 主要新興企業/SMEの競合ベンチマーキング 242

14.9 競争シナリオと動向 243

14.9.1 製品上市 243

14.9.2 取引 245

14.9.3 拡張 248

15 企業プロファイル 249

15.1 主要プレーヤー 249

Dell Inc.(米国)

Hewlett Packard Enterprise Development LP(米国)

Lenovo(香港)

Huawei Technologies Co. (中国)

IBM(米国)

H3C Technologies Co. (Ltd.(中国)

Cisco Systems Inc.(米国)

Super Micro Computer Inc.(米国)

富士通(日本)

INSPUR Co. Ltd.(中国)

16 付録 308

16.1 ディスカッションガイド 308

16.2 Knowledgestore: Marketsandmarketsの購読ポータル 312

16.3 カスタマイズオプション 314

16.4 関連レポート 314

16.5 著者の詳細 315

The increasing adoption of machine learning (ML) and deep learning algorithms is a key driver for the AI server market, as businesses and industries rely more heavily on AI technologies for data analysis, automation, and decision-making. The rising adoption of cloud-based AI solutions is a another driver for the AI server market, as more industries leverage the scalability, flexibility, and cost-efficiency of cloud platforms to implement AI technologies. With cloud-based AI services, organizations no longer need to invest in expensive on-premise infrastructure, making AI accessible to businesses of all sizes. Cloud AI platforms like AWS, Microsoft Azure, and Google Cloud, enable businesses to deploy sophisticated AI models without the need for specialized in-house hardware, driving demand for cloud-based AI servers that can handle large-scale AI computations.

“Liquid cooling segment to hold the largest share in 2030.”

Liquid cooling holds largest market share in the AI server market. The rapidly increasing demand of cooling for HPC and AI workloads are reshaping the server cooling landscape by adopting liquid cooling technology. Air cooling can't cope up with high heat loads generated by powerful GPUs and CPUs, while liquid cooling, especially direct-to-chip liquid cooling, provides superior thermal management. Liquid cooling is the most important solution in managing higher compute densities while maintaining energy efficiency. As AI adoption continues to grow, liquid cooling is expected to become standard in data centers with new deployment strategies and innovations in the whole supply chain. Servers Original Design Manufacturers (ODMs) are increasingly investing in liquid cooling where they now even accept the leakage risk, as they position themselves as leaders in this evolving ecosystem. Chilldyne, Inc. (US) launched their Liquid Cooling Starter Kit in July 2024 to enable data centers to transition rapidly to liquid cooling-supporting the shift toward next-generation AI and HPC workloads. These cooling technologies ensured stable and sustainable cooling for the cutting-edge AI systems, therefore supporting the trend to shift from air-cooling towards much more efficient liquid cooling solutions.

"Rack mounted servers by form factor is projected to grow at a high CAGR of AI server market during the forecasted timeline”

Rack-mounted AI servers are poised to grow rapidly in the AI server market. Applications for artificial intelligence have increasingly high complexity and data intensity, including handling large quantities of data and real-time decision-making. That is precisely where rackmounted servers are used to provide the required performance to handle the massive volumes of data in an efficient process. In addition, rapid advancements in cooling technologies and energy efficiency enable easy deployment of rack-mounted servers for even high-performance AI workloads. Rack mounted servers also simplify maintenance/upgrades procedure with stream-lined cabling and management tools, which reduce operation overheads. As the rising need for AI-driven solutions sweeps through industries in such a broad scale, from healthcare and finance to manufacturing and retail, rack mounted AI servers seem to be on an upward growth trend that is especially fueled by the adaptability, performance, and space-efficient utilization of data centers.

“Cloud segment is expected to have the highest share during the forecast period.”

Cloud-based deployment dominates the AI server market through flexibility, cost efficiency, access to advanced capabilities of AI, and is critical for businesses adopting AI at scale. Companies can scale their AI operations very quickly without highly investing in physical servers via a cloud infrastructure. For example, AWS provides Elastic Compute Cloud (EC2) instances that are specifically optimized for machine learning that allow businesses to ramp up and down based on the demand. Microsoft Azure contains AI tools such as Azure Machine Learning and Cognitive Services that have been widely designed to support complex model training and deployment with minimum time. CSPs also provide pre-built models and tools that reduce the development time for businesses and reduce technical barriers in various enterprises. In retail, for example, there is demand forecasting and personalized marketing. Healthcare organizations use cloud AI services for predictive analytics and diagnostics. These advantages make cloud-based AI deployments highly attractive and enable companies from all industries to utilize powerful, scalable, and flexible AI resources, making it the largest market share in the AI server market.

“North America is expected to hold high CAGR in during the forecast period.”

North America will occupy high CAGR during the forecast period due to the presence of various AI server manufacturers, such NVIDIA Corporation (US), Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), IBM (US), and Cisco Systems, Inc. (US), which contributes to the market's growth in this region. These firms are researching and developing AI servers and solutions, leading the region into the innovation front in technology. The growing trend of cloud computing has radically increased the economic impact of data center investments made by leading service providers such as Amazon Web Services, Inc. (AWS) (US), Meta (US), Google (US), and Microsoft (US). The competition for data center projects has increased in North America. The growth of emerging startups in the region further contribute to the developments in AI servers in the region. With a focus on harnessing the potential of artificial intelligence to drive economic growth, improve customer experiences, and address complex challenges, North America continues to be a hub for artificial intelligence innovation and entrepreneurship.

Extensive primary interviews were conducted with key industry experts in the AI server market space to determine and verify the market size for various segments and subsegments gathered through secondary research.

The break-up of primary participants for the report has been shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

• By Company Type: Tier 1 – 50%, Tier 2 – 20%, and Tier 3 – 30%

• By Designation: C-level Executives – 20%, Directors – 30%, and Others – 50%

• By Region: North America – 40%, Europe – 20%, Asia Pacific – 30%, and RoW – 10%

The report profiles key players in the AI server market with their respective market ranking analysis. Prominent players profiled in this report are Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Super Micro Computer, Inc. (US), Fujitsu (Japan), INSPUR Co., Ltd. (China) among others.

Apart from this, ADLINK Technology Inc. (Taiwan), Advanced Micro Devices, Inc. (US), Quanta Computer lnc. (Taiwan), WISTRON CORPORATION (Taiwan), GIGABIT Technologies Pvt. Ltd. (Taiwan), ASUSTeK Computer Inc. (Taiwan), Aivres (US), AIME (Germany), Wiwynn Corporation (Taiwan), MiTAC Computing Technology Corporation (Taiwan), NEC Corporation India Private Limited (India), XENON Systems Pty Ltd (Australia), Graphcore (UK), and 2CRSi Group (France) are among a few emerging companies in the AI server market.

Research Coverage: This research report categorizes the AI server market based on processor type, function, cooling technology, form factor, deployment, application, end user, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the AI server market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the AI server ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI server market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (Increase in data traffic and need for high computing power; Increasing adoption of machine learning and deep learning algorithms, and Rising adoption of cloud-based AI solutions across industries) influencing the growth of the AI server market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI server market.

• Market Development: Comprehensive information about lucrative markets – the report analysis the AI server market across varied regions

• Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI server market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US) among others in the AI server market.

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 27

1.3 STUDY SCOPE 28

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 28

1.3.2 INCLUSIONS AND EXCLUSIONS 29

1.3.3 YEARS CONSIDERED 29

1.4 CURRENCY CONSIDERED 30

1.5 UNITS CONSIDERED 30

1.6 LIMITATIONS 30

1.7 STAKEHOLDERS 31

2 RESEARCH METHODOLOGY 32

2.1 RESEARCH DATA 32

2.1.1 SECONDARY DATA 33

2.1.1.1 List of major secondary sources 34

2.1.1.2 Key data from secondary sources 34

2.1.2 PRIMARY DATA 34

2.1.2.1 List of primary interview participants 35

2.1.2.2 Breakdown of primaries 35

2.1.2.3 Key data from primary sources 36

2.1.2.4 Key industry insights 37

2.1.3 SECONDARY AND PRIMARY RESEARCH 38

2.2 MARKET SIZE ESTIMATION 39

2.2.1 BOTTOM-UP APPROACH 41

2.2.1.1 Approach to estimate market size using bottom-up analysis

(demand side) 41

2.2.2 TOP-DOWN APPROACH 42

2.2.2.1 Approach to estimate market size using top-down analysis

(supply side) 42

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 43

2.4 RESEARCH ASSUMPTIONS 44

2.5 RISK ASSESSMENT 45

2.6 RESEARCH LIMITATIONS 45

3 EXECUTIVE SUMMARY 46

4 PREMIUM INSIGHTS 51

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI SERVER MARKET 51

4.2 AI SERVER MARKET, BY PROCESSOR TYPE 51

4.3 AI SERVER MARKET, BY FUNCTION 52

4.4 AI SERVER MARKET, BY COOLING TECHNOLOGY 52

4.5 AI SERVER MARKET, BY FORM FACTOR 53

4.6 AI SERVER MARKET, BY DEPLOYMENT 53

4.7 AI SERVER MARKET, BY APPLICATION 54

4.8 AI SERVER MARKET, BY END USER 54

4.9 AI SERVER MARKET, BY COUNTRY 55

4.10 AI SERVER MARKET, BY REGION 55

5 MARKET OVERVIEW 56

5.1 INTRODUCTION 56

5.2 MARKET DYNAMICS 56

5.2.1 DRIVERS 57

5.2.1.1 Increase in data traffic and need for high computing power 57

5.2.1.2 Increasing adoption of machine learning and deep learning algorithms 57

5.2.1.3 Rising adoption of cloud-based AI solutions across industries 58

5.2.1.4 Advancements in GPU and ASIC technologies for AI acceleration 59

5.2.2 RESTRAINTS 60

5.2.2.1 High initial costs of AI server hardware and infrastructure 60

5.2.2.2 Shortage of AI hardware experts and skilled workforce 60

5.2.2.3 Power consumption and cooling challenges for high-density AI servers 61

5.2.3 OPPORTUNITIES 63

5.2.3.1 Growing potential of AI in healthcare sector 63

5.2.3.2 Increasing investments in data centers by cloud service providers 65

5.2.3.3 Growing demand for AI-as-a-Service (AIaaS) platforms 66

5.2.3.4 Increasing adoption of AI in small and medium-sized enterprises (SMEs) 66

5.2.4 CHALLENGES 67

5.2.4.1 Data security and privacy concerns 67

5.2.4.2 Supply chain disruptions 68

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 69

5.4 PRICING ANALYSIS 69

5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PROCESSOR TYPE 70

5.4.2 AVERAGE SELLING PRICE TREND, BY REGION 71

5.5 VALUE CHAIN ANALYSIS 72

5.6 ECOSYSTEM ANALYSIS 75

5.7 INVESTMENT AND FUNDING SCENARIO 76

5.8 TECHNOLOGY ANALYSIS 76

5.8.1 KEY TECHNOLOGIES 76

5.8.1.1 High-performance computing (HPC) 76

5.8.1.2 High bandwidth memory (HBM) 77

5.8.1.3 GenAI workload 78

5.8.2 COMPLEMENTARY TECHNOLOGIES 78

5.8.2.1 Data center power management and cooling system 78

5.8.2.2 High-speed interconnects 79

5.8.3 ADJACENT TECHNOLOGIES 79

5.8.3.1 AI development frameworks 79

5.8.3.2 Quantum AI 80

5.9 SERVER COST STRUCTURE/BILL OF MATERIAL (BOM) 80

5.9.1 GPU SERVER 80

5.10 AI SERVER’S CURRENT PENETRATION AND GROWTH FORECAST 83

5.11 UPCOMING DEPLOYMENTS OF DATA CENTER BY CLOUD SERVICE PROVIDERS 83

5.12 CLOUD SERVICE PROVIDERS’ CAPEX 84

5.13 PROCESSOR BENCHMARKING 85

5.13.1 GPU BENCHMARKING 85

5.13.2 CPU BENCHMARKING 86

5.14 PATENT ANALYSIS 86

5.15 TRADE ANALYSIS 92

5.15.1 IMPORT SCENARIO (HS CODE 847150) 92

5.15.2 EXPORT SCENARIO (HS CODE 847150) 93

5.16 KEY CONFERENCES AND EVENTS, 2024–2025 94

5.17 CASE STUDY ANALYSIS 97

5.17.1 AIVRES’ HIGH-PERFORMANCE COMPUTING SERVER ACCELERATES AI SOLUTION DEVELOPMENT 97

5.17.2 SEEWEB COLLABORATED WITH LENOVO AND NVIDIA TO LAUNCH GPU-COMPUTING-AS-A-SERVICE MODEL FOR EXPANDING AI ACCESSIBILITY 97

5.17.3 SHARONAI EXPANDS AI INFRASTRUCTURE WITH LENOVO TRUSCALE, DEPLOYING HUNDREDS OF GPU-DENSE SERVERS 98

5.17.4 SERVING INFERENCE FOR LLMS: A CASE STUDY WITH NVIDIA TRITON INFERENCE SERVER AND ELEUTHER AI 98

5.17.5 APPLIED DIGITAL CORPORATION EXPANDED AI CAPABILITIES WITH SUPERMICRO SERVERS 99

5.18 REGULATORY LANDSCAPE 100

5.18.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 100

5.18.2 STANDARDS 104

5.19 PORTER’S FIVE FORCES ANALYSIS 106

5.19.1 THREAT OF NEW ENTRANTS 107

5.19.2 THREAT OF SUBSTITUTES 107

5.19.3 BARGAINING POWER OF SUPPLIERS 108

5.19.4 BARGAINING POWER OF BUYERS 108

5.19.5 INTENSITY OF COMPETITIVE RIVALRY 108

5.20 KEY STAKEHOLDERS AND BUYING CRITERIA 109

5.20.1 KEY STAKEHOLDERS IN BUYING PROCESS 109

5.20.2 BUYING CRITERIA 110

6 AI SERVER MARKET, BY PROCESSOR TYPE 111

6.1 INTRODUCTION 112

6.2 GPU-BASED SERVERS 114

6.2.1 INCREASING INTEGRATION OF GPU-BASED AI SERVER BY CLOUD PROVIDERS TO BOOST MARKET 114

6.3 FPGA-BASED SERVERS 116

6.3.1 GROWING NEED FOR FLEXIBILITY AND CUSTOMIZATION FOR AI WORKLOADS TO DRIVE DEMAND FOR FPGA-BASED SERVERS 116

6.4 ASIC-BASED SERVERS 118

6.4.1 RISING DEMAND FOR CUSTOMIZED, HIGH-PERFORMANCE AI PROCESSING TO FUEL ADOPTION OF ASIC-BASED SERVERS 118

7 AI SERVER MARKET, BY FUNCTION 121

7.1 INTRODUCTION 122

7.2 TRAINING 124

7.2.1 SURGE IN DEEP LEARNING TECHNOLOGIES TO DRIVE AI SERVER MARKET GROWTH 124

7.3 INFERENCE 126

7.3.1 SHIFT TOWARDS EDGE COMPUTING TO BOOST DEMAND FOR AI INFERENCE SERVERS 126

8 AI SERVER MARKET, BY COOLING TECHNOLOGY 128

8.1 INTRODUCTION 129

8.2 AIR COOLING 131

8.2.1 COST-EFFECTIVE AND SIMPLE INSTALLATION OF AIR COOLING TECHNOLOGY TO DRIVE DEMAND 131

8.3 LIQUID COOLING 132

8.3.1 INCREASING COOLING DEMANDS OF HPC AND AI WORKLOADS TO FUEL MARKET 132

8.4 HYBRID COOLING 133

8.4.1 RISE OF AI-DRIVEN MACHINE LEARNING, NATURAL LANGUAGE PROCESSING, AND COMPUTER VISION TO BOOST DEMAND 133

9 AI SERVER MARKET, BY FORM FACTOR 134

9.1 INTRODUCTION 135

9.2 RACK-MOUNTED SERVERS 136

9.2.1 ADVANCEMENTS IN COOLING TECHNOLOGIES AND ENERGY EFFICIENCY TO DRIVE DEMAND FOR RACK-MOUNTED AI SERVERS 136

9.3 BLADE SERVERS 137

9.3.1 INCREASING DEMAND FOR HANDLING AI WORKLOADS IN HEALTHCARE, FINANCE, AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET 137

9.4 TOWER SERVERS 137

9.4.1 INCREASED USE IN MACHINE LEARNING, DATA ANALYTICS, AND SMALLER-SCALE AI INFERENCING TASKS TO BOOST DEMAND 137

10 AI SERVER MARKET, BY DEPLOYMENT 138

10.1 INTRODUCTION 139

10.2 ON-PREMISES 140

10.2.1 INCREASING IMPLEMENTATION IN HEALTHCARE AND FINANCE SECTORS TO DRIVE MARKET 140

10.3 CLOUD 141

10.3.1 ABILITY TO RAPIDLY ADAPT TO FLUCTUATING WORKLOADS WITHOUT HEAVY UPFRONT INVESTMENTS TO DRIVE GROWTH 141

11 AI SERVER MARKET, BY APPLICATION 143

11.1 INTRODUCTION 144

11.2 GENERATIVE AI 145

11.2.1 RULE-BASED MODELS 146

11.2.1.1 Growing use in finance, healthcare, or legal systems to drive market 146

11.2.2 STATISTICAL MODELS 147

11.2.2.1 Increasing availability of vast datasets from IoT devices, social media, and public health data to drive demand 147

11.2.3 DEEP LEARNING 148

11.2.3.1 Proliferation of AI in healthcare, automotive, and consumer electronics to boost demand 148

11.2.4 GENERATIVE ADVERSARIAL NETWORKS (GANS) 149

11.2.4.1 Increasing need for high-quality, scalable data generation to support market growth 149

11.2.5 AUTOENCODERS 149

11.2.5.1 Increasing use in cloud and edge computing to enhance server performance to drive demand 149

11.2.6 CONVOLUTIONAL NEURAL NETWORKS (CNNS) 150

11.2.6.1 Proliferation of visual data through smart devices, security cameras, and self-driving cars to drive market 150

11.2.7 TRANSFORMER MODELS 150

11.2.7.1 Availability of large-scale datasets and advancements in data storage technologies to fuel market 150

11.3 MACHINE LEARNING 151

11.3.1 RAPID ADVANCEMENT AND DEPLOYMENT OF ML MODELS TO BOOST DEMAND 151

11.4 NATURAL LANGUAGE PROCESSING 152

11.4.1 INCREASING NEED FOR REAL-TIME REQUIREMENTS OF NLP APPLICATIONS TO SUPPORT MARKET GROWTH 152

11.5 COMPUTER VISION 152

11.5.1 SURGE IN COMPUTER VISION APPLICATIONS IN SECURITY, HEALTHCARE, AUTOMOTIVE, AND RETAIL FUELING DEMAND FOR AI SERVERS 152

12 AI SERVER MARKET, BY END USER 154

12.1 INTRODUCTION 155

12.2 CLOUD SERVICE PROVIDERS 156

12.2.1 SURGING AI WORKLOADS AND CLOUD ADOPTION TO STIMULATE MARKET GROWTH 156

12.3 ENTERPRISES 157

12.3.1 HEALTHCARE 159

12.3.1.1 Integration of AI for computer-aided drug discovery to foster market growth 159

12.3.2 BFSI 160

12.3.2.1 Growing need for fraud detection in financial institutions to boost demand 160

12.3.3 AUTOMOTIVE 161

12.3.3.1 Growing focus on safety, efficiency, and enhanced driving experiences to drive growth 161

12.3.4 RETAIL & E-COMMERCE 163

12.3.4.1 Personalized shopping experiences and improved customer service to offer lucrative growth opportunities 163

12.3.5 MEDIA & ENTERTAINMENT 164

12.3.5.1 Real-time analysis of viewer preferences, engagement patterns, and demographic information to augment market growth 164

12.3.6 OTHERS 165

12.3.6.1 Proliferation of visual data through smart devices, security cameras, and self-driving cars to drive demand 165

12.4 GOVERNMENT ORGANIZATIONS 166

12.4.1 INCREASING USE OF AI IN NATIONAL SECURITY AND DEFENSE TO DRIVE MARKET GROWTH 166

13 AI SERVER MARKET, BY REGION 168

13.1 INTRODUCTION 169

13.2 NORTH AMERICA 171

13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 171

13.2.2 US 177

13.2.2.1 Government-led initiatives to boost semiconductor manufacturing to drive market 177

13.2.3 CANADA 178

13.2.3.1 Growing emphasis on commercializing AI to fuel demand 178

13.2.4 MEXICO 179

13.2.4.1 Increasing shift toward digital platforms and cloud-based solutions to accelerate demand 179

13.3 EUROPE 181

13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 181

13.3.2 UK 188

13.3.2.1 Growing investments in data center infrastructure to boost demand 188

13.3.3 GERMANY 189

13.3.3.1 Presence of robust industrial base to offer lucrative growth opportunities 189

13.3.4 FRANCE 190

13.3.4.1 Increasing number of AI startups to accelerate demand for AI servers 190

13.3.5 ITALY 191

13.3.5.1 Growing adoption of digitalization in automotive and healthcare sectors to drive market 191

13.3.6 SPAIN 192

13.3.6.1 Growing collaborations and partnerships among AI manufacturers to support market growth 192

13.3.7 REST OF EUROPE 193

13.4 ASIA PACIFIC 195

13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 195

13.4.2 CHINA 202

13.4.2.1 Surge in research funding and implementation of supportive regulatory policy to augment market growth 202

13.4.3 JAPAN 203

13.4.3.1 Rising adoption of AI servers to advance robotics systems to offer lucrative growth opportunities 203

13.4.4 SOUTH KOREA 204

13.4.4.1 Thriving semiconductor industry in South Korea to drive market for AI servers 204

13.4.5 INDIA 205

13.4.5.1 Government-led initiatives to boost AI infrastructure to foster market growth 205

13.4.6 REST OF ASIA PACIFIC 206

13.5 ROW 207

13.5.1 MACROECONOMIC OUTLOOK FOR ROW 208

13.5.2 MIDDLE EAST 213

13.5.2.1 Growing emphasis on digital transformation and technological innovation to drive market growth 213

13.5.2.2 GCC countries 216

13.5.2.3 Rest of Middle East 217

13.5.3 AFRICA 218

13.5.3.1 Rising internet penetration and mobile subscriptions to offer lucrative growth opportunities 218

13.5.4 SOUTH AMERICA 219

13.5.4.1 Growing need to store vast amounts of data to boost demand 219

14 COMPETITIVE LANDSCAPE 221

14.1 OVERVIEW 221

14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 221

14.3 REVENUE ANALYSIS 224

14.4 MARKET SHARE ANALYSIS, 2023 224

14.5 COMPANY VALUATION AND FINANCIAL METRICS 228

14.6 BRAND/PRODUCT COMPARISON 229

14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 230

14.7.1 STARS 230

14.7.2 EMERGING LEADERS 230

14.7.3 PERVASIVE PLAYERS 230

14.7.4 PARTICIPANTS 230

14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 232

14.7.5.1 Company footprint 232

14.7.5.2 Region footprint 233

14.7.5.3 Processor type footprint 234

14.7.5.4 Function footprint 235

14.7.5.5 Cooling technology footprint 235

14.7.5.6 Form factor footprint 236

14.7.5.7 Deployment footprint 237

14.7.5.8 Application footprint 238

14.7.5.9 End user footprint 239

14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 239

14.8.1 PROGRESSIVE COMPANIES 239

14.8.2 RESPONSIVE COMPANIES 240

14.8.3 DYNAMIC COMPANIES 240

14.8.4 STARTING BLOCKS 240

14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 241

14.8.5.1 Detailed list of key startups/SMEs 241

14.8.5.2 Competitive benchmarking of key startups/SMEs 242

14.9 COMPETITIVE SCENARIO AND TRENDS 243

14.9.1 PRODUCT LAUNCHES 243

14.9.2 DEALS 245

14.9.3 EXPANSIONS 248

15 COMPANY PROFILES 249

15.1 KEY PLAYERS 249

15.1.1 DELL INC. 249

15.1.1.1 Business overview 249

15.1.1.2 Products offered 250

15.1.1.3 Recent developments 251

15.1.1.3.1 Deals 251

15.1.1.4 MnM view 252

15.1.1.4.1 Key strengths 252

15.1.1.4.2 Strategic choices 252

15.1.1.4.3 Weaknesses and competitive threats 252

15.1.2 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP 253

15.1.2.1 Business overview 253

15.1.2.2 Products offered 254

15.1.2.3 Recent developments 255

15.1.2.3.1 Product launches 255

15.1.2.3.2 Deals 256

15.1.2.4 MnM view 257

15.1.2.4.1 Key strengths 257

15.1.2.4.2 Strategic choices 257

15.1.2.4.3 Weaknesses and competitive threats 257

15.1.3 LENOVO 258

15.1.3.1 Business overview 258

15.1.3.2 Products offered 259

15.1.3.3 Recent developments 260

15.1.3.3.1 Product launches 260

15.1.3.3.2 Deals 261

15.1.3.3.3 Expansions 263

15.1.3.4 MnM view 263

15.1.3.4.1 Key strengths 263

15.1.3.4.2 Strategic choices 263

15.1.3.4.3 Weaknesses and competitive threats 263

15.1.4 HUAWEI TECHNOLOGIES CO., LTD. 264

15.1.4.1 Business overview 264

15.1.4.2 Products offered 265

15.1.4.3 Recent developments 266

15.1.4.3.1 Deals 266

15.1.4.4 MnM view 267

15.1.4.4.1 Key strengths 267

15.1.4.4.2 Strategic choices 267

15.1.4.4.3 Weaknesses and competitive threats 267

15.1.5 IBM 268

15.1.5.1 Business overview 268

15.1.5.2 Products offered 269

15.1.5.3 Recent developments 271

15.1.5.3.1 Product launches 271

15.1.5.3.2 Deals 271

15.1.5.4 MnM view 272

15.1.5.4.1 Key strengths 272

15.1.5.4.2 Strategic choices 272

15.1.5.4.3 Weaknesses and competitive threats 272

15.1.6 H3C TECHNOLOGIES CO., LTD. 273

15.1.6.1 Business overview 273

15.1.6.2 Products offered 273

15.1.6.3 Recent developments 275

15.1.6.3.1 Product launches 275

15.1.6.3.2 Deals 275

15.1.7 CISCO SYSTEMS, INC. 277

15.1.7.1 Business overview 277

15.1.7.2 Products offered 278

15.1.7.3 Recent developments 279

15.1.7.3.1 Product launches 279

15.1.7.3.2 Deals 280

15.1.8 SUPER MICRO COMPUTER, INC. 282

15.1.8.1 Business overview 282

15.1.8.2 Products offered 283

15.1.8.3 Recent developments 285

15.1.8.3.1 Product launches 285

15.1.8.3.2 Deals 286

15.1.9 FUJITSU 287

15.1.9.1 Business overview 287

15.1.9.2 Products offered 288

15.1.9.3 Recent developments 289

15.1.9.3.1 Deals 289

15.1.10 INSPUR CO., LTD. 290

15.1.10.1 Business overview 290

15.1.10.2 Products offered 291

15.1.10.3 Recent developments 291

15.1.10.3.1 Product launches 291

15.1.10.3.2 Deals 292

15.2 OTHER PLAYERS 293

15.2.1 NVIDIA CORPORATION 293

15.2.2 ADLINK TECHNOLOGY INC. 294

15.2.3 ADVANCED MICRO DEVICES, INC. 295

15.2.4 QUANTA COMPUTERS 296

15.2.5 WISTRON CORPORATION 297

15.2.6 GIGABIT TECHNOLOGIES PVT LTD. 298

15.2.7 ASUSTEK COMPUTER INC. 299

15.2.8 AIVRES 300

15.2.9 AIME 301

15.2.10 WIWYNN CORPORATION 302

15.2.11 MITAC COMPUTING TECHNOLOGY CORPORATION 303

15.2.12 NEC CORPORATION INDIA PRIVATE LIMITED 304

15.2.13 XENON SYSTEMS PTY LTD. 305

15.2.14 GRAPHCORE 306

15.2.15 2CRSI GROUP 307

16 APPENDIX 308

16.1 DISCUSSION GUIDE 308

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 312

16.3 CUSTOMIZATION OPTIONS 314

16.4 RELATED REPORTS 314

16.5 AUTHOR DETAILS 315

❖ 世界のAIサーバー市場に関するよくある質問(FAQ) ❖

・AIサーバーの世界市場規模は?

→MarketsandMarkets社は2024年のAIサーバーの世界市場規模を1428.8億米ドルと推定しています。

・AIサーバーの世界市場予測は?

→MarketsandMarkets社は2030年のAIサーバーの世界市場規模を8,378.3億米ドルと予測しています。

・AIサーバー市場の成長率は?

→MarketsandMarkets社はAIサーバーの世界市場が2024年~2030年に年平均34.3%成長すると予測しています。

・世界のAIサーバー市場における主要企業は?

→MarketsandMarkets社は「Dell Inc.(米国)、Hewlett Packard Enterprise Development LP(米国)、Lenovo(香港)、Huawei Technologies Co. (中国)、IBM(米国)、H3C Technologies Co. (Ltd.(中国)、Cisco Systems, Inc.(米国)、Super Micro Computer, Inc.(米国)、富士通(日本)、INSPUR Co. (Ltd.(中国)など ...」をグローバルAIサーバー市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。