1 はじめに

1.1 調査目的 42

1.2 市場の定義 42

1.3 調査範囲 43

1.3.1 市場セグメンテーション 43

1.3.2 対象と除外 44

1.4 考慮した年数 44

1.5 考慮した通貨 45

1.6 利害関係者

2 調査方法 46

2.1 調査データ 46

2.1.1 二次データ 47

2.1.1.1 二次資料からの主要データ 48

2.1.2 一次データ 48

2.1.2.1 一次資料からの主要データ 49

2.2 要因分析 50

2.2.1 導入 50

2.2.2 需要側指標 50

2.2.3 供給側指標 51

2.3 市場規模の推定 51

2.3.1 ボトムアップアプローチ 51

2.3.1.1 民間機と軍用機の市場規模推計と方法論 52

2.3.1.2 無人航空機の市場規模推計と方法論 54

2.3.2 トップダウンアプローチ

2.4 データの三角測量 56

2.5 調査の前提 57

2.6 制限事項 58

3 エグゼクティブサマリー 59

4 プレミアムインサイト 62

4.1 航空機プラットフォーム市場におけるプレーヤーの魅力的な機会 62

4.2 航空機プラットフォーム市場、タイプ別 62

4.3 航空機プラットフォーム市場:民間航空機別 63

4.4 航空機プラットフォーム市場:軍用機別 63

4.5 航空機プラットフォーム市場(アクティブフリート):国別 64

5 市場の概要

5.1 はじめに 65

5.2 市場ダイナミクス 65

5.2.1 推進要因

5.2.1.1 航空機の素材、アビオニクス、設計の技術的進歩が近代化航空機の需要を牽引 66

設計における技術進歩が、近代化航空機の需要を牽引している 66

5.2.1.2 世界的な航空需要の増加が航空機能力の大幅な成長を促進

66

5.2.1.3 地政学的不安定性と防衛近代化計画への投資の増加 67

5.2.2 阻害要因 67

5.2.2.1 新規航空機の開発・調達に必要な高額資本が参入・更新の障壁となる 67

5.2.2.2 グローバルサプライチェーンの不安定性が航空機部品の納期に重大な影響 68

5.2.2.3 厳しい航空規制と認証プロセス

ディレイの新型機導入と市場参入 68

5.2.2.4 UAM開発のための高額な初期投資 68

5.2.3 機会 69

5.2.3.1 電気・ハイブリッド推進システムへの需要の増加 69

5.2.3.2 効率的な航空機整備の必要性の高まりが、デジタル技術と予測的 MRO 技術の採用を刺激 69

5.2.4 課題 70

5.2.4.1 不安定な経済状況は航空会社の財務安定性に影響し、航空機の拡張と近代化に影響 70

5.2.4.2 熟練した航空宇宙エンジニアと技術者の不足は、業界の革新と効率的な事業拡大能力を制限 70

5.3 価格分析 71

5.3.1 指標価格分析 71

5.3.1.1 航空機プラットフォームの価格設定に影響を与える要因 71

5.3.2 指標的価格分析(地域別) 72

5.4 運用データ 74

5.5 バリューチェーン分析 74

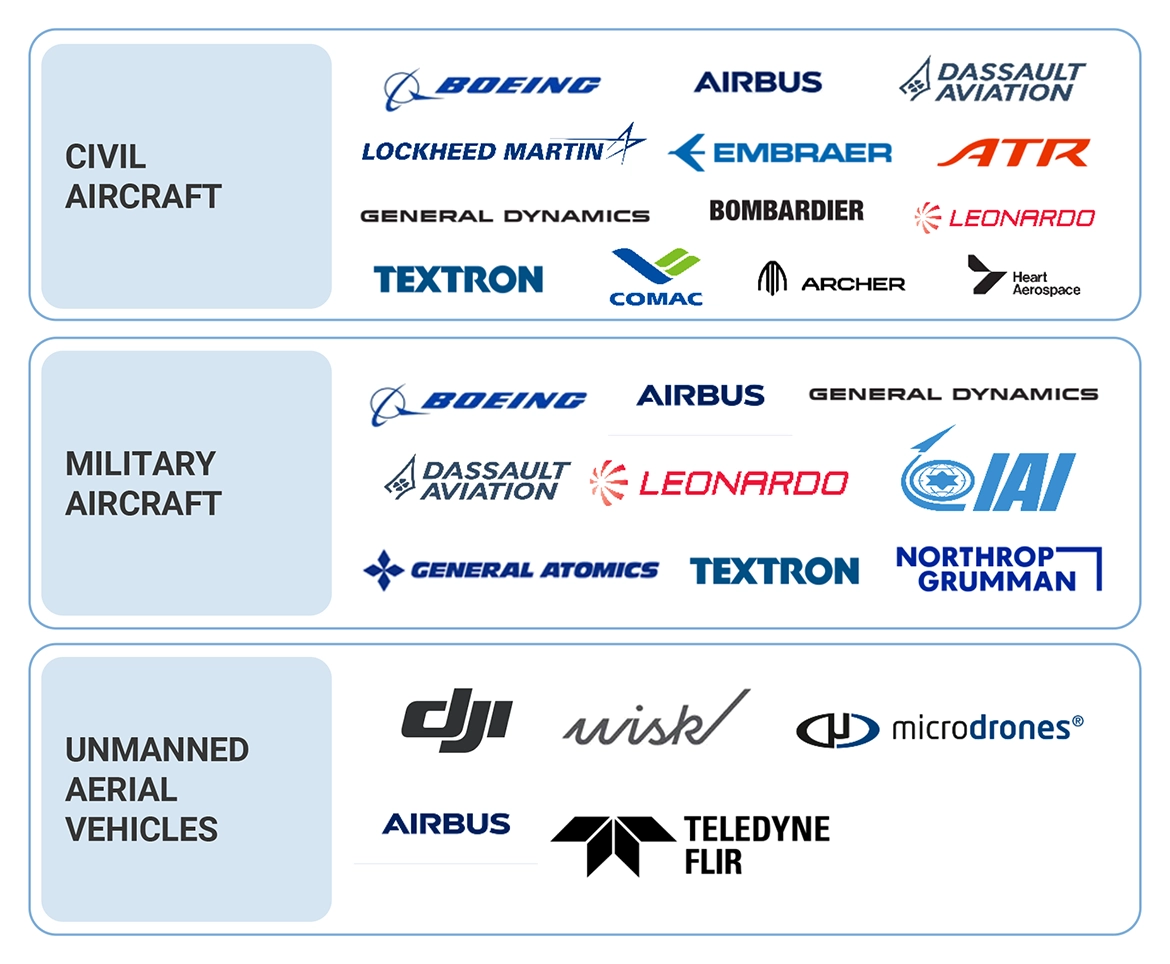

5.6 エコシステム分析 75

5.6.1 著名企業 75

5.6.2 民間・中小企業 76

5.6.3 エンドユーザー 76

5.7 顧客ビジネスに影響を与えるトレンドと破壊 78

5.8 貿易分析 79

5.8.1 航空機:輸入シナリオ(HSコード8802) 79

5.8.2 航空機:輸出シナリオ(HSコード8802) 80

5.8.3 無人航空機: 輸入シナリオ(HSコード8806) 81

5.8.4 無人航空機: 輸出シナリオ(HSコード8806) 82

5.9 規制の状況 83

5.9.1 北米:規制機関、政府機関、その他の団体

その他の組織 83

5.9.2 欧州: 規制機関、政府機関、その他の団体

その他の組織 84

5.9.3 アジア太平洋: 規制機関、政府機関

その他の組織 84

5.9.4 中東: 規制機関、政府機関

その他の組織 85

5.9.5 その他の地域: 規制機関、政府機関

その他の組織 86

5.10 ケーススタディ分析 86

5.10.1 マナ・エアロが商業運航開始計画を発表 86

5.10.2 2024年までに商業運航を開始するボロコプターの計画 87

5.10.3 グリーンジェット社とリカルド社が第一世代の完全稼働可能な電気実証機推進モジュールを開発 87

5.11 主要ステークホルダーと購買基準 88

5.11.1 購入プロセスにおける主要ステークホルダー 88

5.11.2 購入基準 89

5.12 主要会議とイベント(2024~2025年) 90

5.13 投資と資金調達のシナリオ 91

5.14 技術ロードマップ 92

5.14.1 軍用機 92

5.14.2 民間航空機 94

5.14.3 無人航空機 95

5.15 部品表 97

5.15.1 部品表 軍用機 97

5.15.2 部品表 民間航空機 98

5.15.3 部品表 無人航空機 99

5.16 総所有コスト 100

5.16.1 総所有コスト:民間航空機 100

5.16.2 総所有コスト:軍用機 101

5.16.3 総所有コスト:無人航空機 103

5.17 ビジネスモデル 106

5.17.1 ビジネスモデル: 無人航空機 106

5.17.2 ビジネスモデル: 軍用機 106

5.17.3 ビジネスモデル: 民間航空機 107

5.18 遺伝子AIのインパクト 108

5.18.1 導入 108

5.18.2 民間および軍用機における汎用AIの採用 109

5.18.3 無人航空機へのGEN AIの影響 110

5.19 マクロ経済展望 111

5.19.1 北米 112

5.19.2 欧州 112

5.19.3 アジア太平洋 112

5.19.4 中東 112

5.19.5 ラテンアメリカ 113

5.19.6 アフリカ 114

6 業界動向 115

6.1 はじめに 115

6.2 技術動向 115

6.2.1 デジタル・ツイン技術 116

6.2.2 ゼロ・エミッション技術 116

6.2.3 コーティングのナノテクノロジー 116

6.2.4 複合現実感 116

6.2.5 アドバンスト・エアロダイナミクス 117

6.3 技術分析 117

6.3.1 主要技術 117

6.3.1.1 超音速技術 117

6.3.1.2 スマートセンサーとIoT 117

6.3.2 補足技術 117

6.3.2.1 先進アビオニクスと統合飛行管理システム 117

6.3.2.2 ヘルス・モニタリング・システム(HMS) 118

6.4 メガトレンドの影響 118

6.4.1 人工知能と機械学習 118

6.4.2 積層造形 118

6.4.3 ロボット工学と自動化 119

6.5 サプライチェーン分析 119

6.6 特許分析 120

7 航空機プラットフォーム市場、タイプ別 125

7.1 導入 126

7.2 軍用機 128

7.2.1 戦闘機 129

7.2.1.1 制空権への需要と強固な戦闘能力へのニーズが市場を牽引 129

7.2.1.2 F-35 ライトニングⅡ 130

7.2.1.3 ユーロファイター 130

7.2.2 輸送機 131

7.2.2.1 兵員、装備品、物資の効率的な移動が需要を牽引 131

7.2.2.2 C-130 J ハーキュリーズ 131

7.2.2.3 A400 アトラス 131

7.2.3 特殊任務 132

7.2.3.1 需要を牽引する状況認識と情報優位性の強化ニーズ 132

7.2.3.2 エアバス C295 132

7.2.3.3 キングエア 200 132

7.2.4 ヘリコプター 133

7.2.4.1 多様な作戦環境における迅速な機動性と支援ニーズが成長を促進 133

7.2.4.2 ボーイングAH-64アパッチ 133

7.2.4.3 ボーイングCH-47チヌーク 133

7.3 民間航空機 134

7.3.1 ナローボディ 136

7.3.1.1 新興市場における航空旅行の増加がセグメントの成長を牽引 136

7.3.1.2 ボーイング737-800 136

7.3.1.3 エアバス A320 ネオ 137

7.3.2 ワイドボディ 137

7.3.2.1 世界的な観光産業の成長と経済発展が市場を牽引 137

7.3.2.2 ボーイング787 137

7.3.2.3 エアバス A330 138

7.3.3 地域輸送 138

7.3.3.1 広範な航空情勢における地域間接続の重要性が成長を牽引 138

7.3.3.2 E175 138

7.3.3.3 E190 139

7.3.4 ビジネスジェット 139

7.3.4.1 企業旅行のトレンドの進化がこのセグメントの成長を牽引 139

7.3.4.2 ガルフストリーム G500 140

7.3.4.3 シーラス・ビジョン SF50 140

7.3.5 軽飛行機 141

7.3.5.1 国境警備能力強化のニーズが市場を牽引 141

7.3.5.2 シーラスSR22/T 141

7.3.5.3 セスナCE-172Sスカイホーク 141

7.3.6 民間ヘリコプター 142

7.3.6.1 戦略的パートナーシップとフリート拡大が成長を牽引 142

7.3.6.2 ベル 407 142

7.3.6.3 エアバス H145 142

7.4 無人航空機(UAV) 143

7.4.1 民間・商用 144

7.4.1.1 民間・商業用途でのUAV採用の増加が市場を牽引 144

7.4.1.2 DJI MAVIC Pro 144

7.4.1.3 DJI Phantom 4 Pro 144

7.4.2 防衛・官公庁 145

7.4.2.1 著名な防衛企業や政府による継続的な開発が成長を促進 145

7.4.2.2 MQ-9 リーパー 146

7.4.2.3 RQ-11 146

8 推進技術別航空機プラットフォーム市場 147

8.1 導入 148

8.2 ターボプロップ 149

8.2.1 地域間接続のための費用対効果の高いソリューションへのニーズが成長を牽引 149

8.3 ターボファン 149

8.3.1 国際航空旅行の増加が市場を押し上げる 149

8.4 ピストンエンジン 150

8.4.1 エアタクシーサービスとアーバンエアモビリティ(uam)イニシアチブの成長が成長を促進 150

8.5 ターボシャフト 150

8.5.1 垂直離陸のための高出力重量比を実現するターボシャフ トエンジン 150

8.6 ターボジェット 150

8.6.1 高速ターボジェット機の需要が成長を牽引 150

8.7 ハイブリッド電気 151

8.7.1 カーボンフットプリント削減への世界的取り組みが市場を牽引 151

8.8 電気 151

8.8.1 電気推進による環境面での利点が成長を牽引 151

9 航空機プラットフォーム市場、動力源別 152

9.1 導入 153

9.2 従来型燃料 154

9.2.1 従来型燃料航空機の実証された信頼性と高出力が市場を牽引 154

9.3 セーフベース 154

9.3.1 バイオ燃料と合成燃料生産の革新が成長を後押し 154

9.4 燃料電池 154

9.4.1 ゼロエミッション輸送の推進が需要を促進 154

9.5 電池式 155

9.5.1 動力源における技術的進歩の強化の必要性が成長を促進 155

9.6 太陽電池式 155

9.6.1 環境への影響を最小限に抑えることへの注目が太陽電池搭載航空機の採用を促進 155

10 航空機プラットフォーム市場(地域別) 156

10.1 導入 157

10.1.1 活発な保有機体 158

10.1.2 新規納入機数 159

10.2 北米 160

10.2.1 北米:ペストル分析 160

10.2.2 活発な保有台数 162

10.2.3 新規納入台数 164

10.2.4 米国 167

10.2.4.1 柔軟な出張に対する高い需要が成長を後押し 167

10.2.4.2 活発なフリート 167

10.2.4.3 新規納入台数 169

10.2.5 カナダ 171

10.2.5.1 堅牢な航空宇宙エコシステムの必要性が市場を活性化 171

10.2.5.2 活発な航空機 171

10.2.5.3 新規納入機数 173

10.3 欧州 176

10.3.1 欧州: ペストル分析 176

10.3.2 活発な保有台数 177

10.3.3 新規納入台数 180

10.3.4 イギリス 183

10.3.4.1 柔軟な出張に対する高い需要が市場を押し上げる 183

10.3.4.2 アクティブフリート 183

10.3.4.3 新規納入台数 185

10.3.5 ドイツ 187

10.3.5.1 事業の進歩が成長を促進する 187

10.3.5.2 活発な保有台数 187

10.3.5.3 新規納入台数 189

10.3.6 フランス 191

10.3.6.1 主要航空機メーカーの存在が航空機プラットフォームの人気を牽引 191

10.3.6.2 活発な保有機数 192

10.3.6.3 新規納入機数 193

10.3.7 イタリア 195

10.3.7.1 政府の取り組みが同国の航空機産業の成長を促進 195

10.3.7.2 活発な航空機保有数 196

10.3.7.3 新規納入機数 197

10.3.8 アイランド 199

10.3.8.1 成長を牽引する航空サービスへの戦略的重点化 199

10.3.8.2 活発な航空機 200

10.3.8.3 新規納入機数 201

10.4 アジア太平洋地域 202

10.4.1 アジア太平洋地域:ペストル分析 202

10.4.2 活発なフリート 204

10.4.3 新規納入 206

10.4.4 中国 209

10.4.4.1 航空機能の強化が市場を押し上げる 209

10.4.4.2 活発な保有機体 210

10.4.4.3 新規納入機数 211

10.4.5 日本 212

10.4.5.1 市場成長を支える政府の取り組み 212

10.4.5.2 活発なフリート 212

10.4.5.3 新規納入台数 214

10.4.6 インド 216

10.4.6.1 政府の支援と技術開発が市場を牽引 216

10.4.6.2 活発なフリート 217

10.4.6.3 新規納入台数 218

10.4.7 オーストラリア 220

10.4.7.1 民間航空機能の強化への関心の高まりが需要を促進 220

10.4.7.2 活発な航空機 221

10.4.7.3 新規納入機数 223

10.4.8 韓国 225

10.4.8.1 市場の燃料となる政府投資の大幅増加 225

10.4.8.2 活発な車両 225

10.4.8.3 新規納入台数 227

10.4.9 シンガポール 229

10.4.9.1 主要業界企業間のパートナーシップが市場成長を牽引 229

10.4.9.2 活発なフリート 230

10.4.9.3 新規納入台数 231

10.5 ラテンアメリカ 233

10.5.1 ラテンアメリカ:ペストル分析 233

10.5.2 活発なフリート 235

10.5.3 新規納入台数 237

10.5.4 ブラジル 239

10.5.4.1 出張需要の増加が市場を押し上げる 239

10.5.4.2 アクティブフリート 240

10.5.4.3 新規デリバリー 241

10.5.5 メキシコ 243

10.5.5.1 航空機のエンジニアリングと製造能力の向上が市場を押し上げる 243

10.5.5.2 活発な航空機 244

10.5.5.3 新規納入 245

10.6 アフリカ 247

10.6.1 アフリカ:ペッスル分析 247

10.6.2 活発な車両 249

10.6.3 新規納入台数 251

10.6.4 南アフリカ 254

10.6.4.1 フレキシブルな出張需要の増加が市場を牽引 254

10.6.4.2 アクティブフリート 254

10.6.4.3 新規納入台数 256

10.6.5 ナイジェリア 258

10.6.5.1 フリート拡大への注力の高まりが成長を後押し 258

10.6.5.2 活発なフリート 258

10.6.5.3 新規デリバリー 259

10.7 中東 261

10.7.1 中東 ペストル分析 261

10.7.2 活発な保有台数 263

10.7.3 新規引き渡し件数 265

10.7.4 湾岸協力会議(GCC) 267

10.7.4.1 アラブ首長国連邦 268

10.7.4.1.1 軍用船隊の近代化が市場を牽引 268

10.7.4.1.2 活発な艦隊 268

10.7.4.1.3 新規納入台数 270

10.7.4.2 サウジアラビア 272

10.7.4.2.1 国防支出の増加と近代化への取り組みが市場を牽引 272

10.7.4.2.2 活発な航空機群 272

10.7.4.2.3 新規納入量 274

10.7.5 カタール 277

10.7.5.1 投資と技術革新の増加が市場を牽引 277

10.7.5.2 活発な保有台数 277

10.7.5.3 新規納入台数 278

10.7.6 トルコ 279

10.7.6.1 堅牢な防衛生産能力が市場を牽引 279

10.7.6.2 活発な防衛車両 279

10.7.6.3 新規納入数 281

11 競争環境 284

11.1 はじめに 284

11.2 主要プレイヤーの戦略/勝利への権利(2020~2024年) 284

11.3 収益分析 287

11.4 市場シェア分析 289

11.5 ブランド/製品の比較 294

11.6 企業評価と財務指標 295

11.7 企業評価マトリックス:主要企業、2023年 296

11.8 軍用機市場 296

11.8.1 スター企業 296

11.8.2 新興リーダー 296

296 11.8.3 浸透型プレーヤー 296

11.8.4 参入企業 296

11.9 民間航空機市場 297

11.9.1 スター 297

11.9.2 新興リーダー 297

11.9.3 浸透型プレーヤー 298

11.9.4 参入企業 298

11.10 無人航空機市場 299

11.10.1 スター 299

11.10.2 新興リーダー 299

11.10.3 広範なプレーヤー 299

11.10.4 参加企業 299

11.10.5 企業フットプリント:主要企業 301

11.11 企業評価マトリックス:新興企業/SM(2023年) 306

11.11.1 先進的な企業 306

11.11.2 対応力のある企業 306

11.11.3 ダイナミックな企業 306

11.11.4 スタートアップ企業 306

11.11.5 競争ベンチマーキング 309

11.12 競争シナリオとトレンド 310

11.12.1 製品上市 310

11.12.2 取引 313

316 11.12.3 その他の開発 316

12 企業プロファイル 321

12.1 主要企業 321

Airbus (France)

Boeing (US)

Embraer (Brazil)

Textron Inc. (US)

Lockheed Martin Corporation (US))

13 付録 389

13.1 ディスカッションガイド 389

13.2 付属資料 391

13.3 Knowledgestore: Marketsandmarketsの購読ポータル 392

13.4 カスタマイズオプション 394

13.5 関連レポート 394

13.6 著者詳細 395

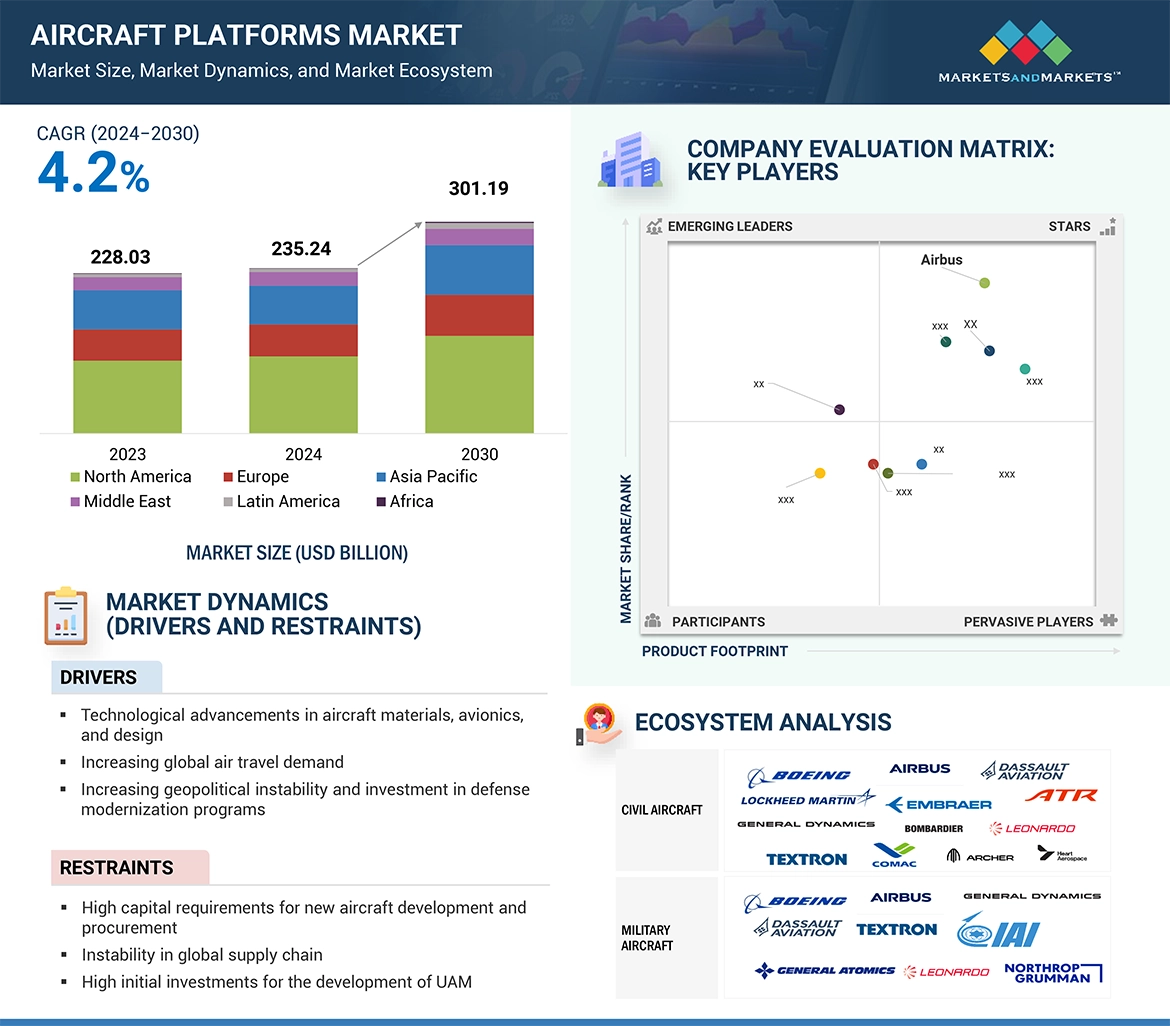

The market primarily driven by the modernization of aging fleets, increasing demand for advanced fighter jets, UAVs, and the adoption of next-generation technologies like stealth and artificial intelligence in military aircraft. Increasing defense budgets globally to enhance air defense capabilities to address emerging security threats further fuels the market growth. Factors such as ongoing research & development in UAM solutions tailored for easing urban congestion and offering novel transportation options with progress in electric propulsion and autonomous piloting technologies drives the market growth.

As global security dynamics evolve, there's a marked shift toward more advanced aircraft platforms across military, civil, UAV, and UAM sectors. This transition is fueled by the integration of advanced technologies such as enhanced stealth capabilities, precision-guided systems, and robust command and control frameworks. Major industry players are increasing theirs R&D investments to develop cutting-edge solutions that meet the strategic defense requirements of leading nations in North America, Europe, Asia-Pacific, and the Middle East. This strategic focus aims to modernize and strengthen the capabilities of the aircraft platforms market, ensuring these platforms are equipped to handle the diverse challenges of modern air defense and civil aviation needs effectively.

“Based on type, unmanned aerial vehicles segment estimated to grow at highest CAGR during the forecast period”

The UAV segment is expected to grow at highest CAGR during the forecast period due to its increasing adoption for diverse applications including surveillance, logistics, and agriculture. Enhanced investment in R&D for autonomous and longer-range UAVs, combined with their cost-effectiveness and versatility, supports their widespread use in both civilian and military sectors. Additionally, regulatory advancements are further facilitating UAV integration into national airspace, amplifying their market presence. Technological advancements in artificial intelligence and machine learning, improving operational efficiency and autonomy and deployment of drones in remote sensing and disaster management, alongside increasing military reconnaissance and surveillance activities, further fuels the market growth.

“Based on propulsion technology, turbofan aircraft segment estimated to have the largest share during forecast period ”

Turbofan aircraft by propulsion technology is expected to dominate the aircraft platform market, due to their high efficiency and reliability in a variety of operational environments. It is further enhanced by their widespread adoption in commercial airliners due to fuel consumption and emissions that are more favorable than older propulsion technologies. Turbofan technology is also steadily improving, thereby enhancing the performance and reducing noise levels, making them suitable for already-existing and new aircraft platforms such as UAVs and Urban Air Mobility (UAM), where performance and environment are of utmost importance.

“The Asia Pacific region is estimated to be hold the second largest market share during the forecast period”

The second highest market share in the aircraft platforms market is expected during the forecast period to be hold by Asia Pacific region. This is due to robust economic growth, rising regional security concerns, and increasing air traffic. Governments are heavily investing in modernizing and expanding their military and civil aviation fleets to enhance air defense capabilities and meet growing commercial aviation demands. The rise in disposable incomes is boosting travel frequency, driving demand for new civil aircraft. Additionally, the region is seeing significant advancements in UAV and UAM technologies, supported by favorable government policies aimed at integrating these systems into the broader transportation infrastructure. This comprehensive development across different aircraft platforms is setting Asia Pacific apart as a rapidly evolving market leader.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the aircraft platforms marketplace.

• By Company Type: Tier 1 – 32%, Tier 2 – 50%, and Tier 3 – 18%

• By Designation: C-Level Executives – 35%, Directors – 25%, and Others – 40%

• By Region: North America – 40%, Europe – 20%, Asia Pacific – 30%, Latin America- 5%, Middle East- 3%, Africa- 2%

Airbus (France), Boeing (US), Embraer (Brazil), Textron Inc. (US), Lockheed Martin Corporation (US) are some of the leading players operating in the aircraft platforms market.

Research Coverage

This research report categorizes the aircraft platforms market by type, propulsion technology, power source and by Region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the aircraft platforms market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; Contracts, partnerships, agreements, new product launches, and recent developments associated with the aircraft platforms market. Competitive analysis of upcoming startups in aircraft platforms market ecosystem is covered in this report.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aircraft platforms market and its subsegments. The report covers the entire ecosystem of the aircraft platforms market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key Drivers (Technological advancements in aircraft materials, avionics, and design, Increasing global air travel demand, Increasing geopolitical instability, and investment in defense modernization programs), restrains (High capital cost of military platforms, Instability in the global supply chain, Stringent aviation regulations and certification processes, High Initial Investment for development of UAM), opportunities (Increasing demand for electric and hybrid propulsion systems, Increasing need for efficient aircraft maintenance stimulate the adoption of digital and predictive MRO technologies) and challenges (Volatile economic conditions, Shortage of skilled aerospace engineers and technicians) influencing the growth of the market.

• Product Development/Innovation: Detailed Insights on upcoming technologies, R&D activities, and new products/solutions launched in the market.

• Market Development: Comprehensive information about lucrative markets – the report analyses the aircraft platforms market across varied regions

• Market Diversification: Exhaustive information about new solutions, recent developments, and investments in the aircraft platforms market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players including Airbus (France), Boeing (US), Embraer (Brazil), Textron Inc. (US), Lockheed Martin Corporation (US), and among others in the aircraft platforms market

1 INTRODUCTION 42

1.1 STUDY OBJECTIVES 42

1.2 MARKET DEFINITION 42

1.3 STUDY SCOPE 43

1.3.1 MARKET SEGMENTATION 43

1.3.2 INCLUSIONS AND EXCLUSIONS 44

1.4 YEARS CONSIDERED 44

1.5 CURRENCY CONSIDERED 45

1.6 STAKEHOLDERS 45

2 RESEARCH METHODOLOGY 46

2.1 RESEARCH DATA 46

2.1.1 SECONDARY DATA 47

2.1.1.1 Key data from secondary sources 48

2.1.2 PRIMARY DATA 48

2.1.2.1 Key data from primary sources 49

2.2 FACTOR ANALYSIS 50

2.2.1 INTRODUCTION 50

2.2.2 DEMAND-SIDE INDICATORS 50

2.2.3 SUPPLY-SIDE INDICATORS 51

2.3 MARKET SIZE ESTIMATION 51

2.3.1 BOTTOM-UP APPROACH 51

2.3.1.1 Market size estimation and methodology for civil and military aircraft 52

2.3.1.2 Market size estimation and methodology for unmanned aerial vehicles 54

2.3.2 TOP-DOWN APPROACH 55

2.4 DATA TRIANGULATION 56

2.5 RESEARCH ASSUMPTIONS 57

2.6 LIMITATIONS 58

3 EXECUTIVE SUMMARY 59

4 PREMIUM INSIGHTS 62

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT PLATFORMS MARKET 62

4.2 AIRCRAFT PLATFORMS MARKET, BY TYPE 62

4.3 AIRCRAFT PLATFORMS MARKET, BY CIVIL AIRCRAFT 63

4.4 AIRCRAFT PLATFORMS MARKET, BY MILITARY AIRCRAFT 63

4.5 AIRCRAFT PLATFORMS MARKET (ACTIVE FLEET), BY COUNTRY 64

5 MARKET OVERVIEW 65

5.1 INTRODUCTION 65

5.2 MARKET DYNAMICS 65

5.2.1 DRIVERS 66

5.2.1.1 Technological advancements in aircraft materials, avionics,

and design are driving the demand for modernized aircraft 66

5.2.1.2 Increasing global air travel demand drives substantial growth

in fleet capabilities 66

5.2.1.3 Increasing geopolitical instability and investment in defense modernization programs 67

5.2.2 RESTRAINTS 67

5.2.2.1 High capital requirements for new aircraft development and procurement pose a barrier to entry and fleet renewal 67

5.2.2.2 Instability in global supply chain critically affects the delivery schedules of aircraft components 68

5.2.2.3 Stringent aviation regulations and certification processes

delay’s new aircraft introduction and market entry 68

5.2.2.4 High initial investment for development of UAM 68

5.2.3 OPPORTUNITIES 69

5.2.3.1 Increasing demand for electric and hybrid propulsion systems 69

5.2.3.2 Increasing need for efficient aircraft maintenance stimulates the adoption of digital and predictive MRO technologies 69

5.2.4 CHALLENGES 70

5.2.4.1 Volatile economic conditions affect airlines financial stability, impacting fleet expansion and modernization 70

5.2.4.2 Scarcity of skilled aerospace engineers and technicians limits industry innovation and the ability to scale operations efficiently 70

5.3 PRICING ANALYSIS 71

5.3.1 INDICATIVE PRICING ANALYSIS 71

5.3.1.1 Factors affecting the pricing of aircraft platforms 71

5.3.2 INDICATIVE PRICING ANALYSIS, BY REGION 72

5.4 OPERATIONAL DATA 74

5.5 VALUE CHAIN ANALYSIS 74

5.6 ECOSYSTEM ANALYSIS 75

5.6.1 PROMINENT COMPANIES 75

5.6.2 PRIVATE AND SMALL ENTERPRISES 76

5.6.3 END USERS 76

5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 78

5.8 TRADE ANALYSIS 79

5.8.1 AIRCRAFT: IMPORT SCENARIO (HS CODE 8802) 79

5.8.2 AIRCRAFT: EXPORT SCENARIO (HS CODE 8802) 80

5.8.3 UNMANNED AERIAL VEHICLES: IMPORT SCENARIO (HS CODE 8806) 81

5.8.4 UNMANNED AERIAL VEHICLES: EXPORT SCENARIO (HS CODE 8806) 82

5.9 REGULATORY LANDSCAPE 83

5.9.1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 83

5.9.2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 84

5.9.3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 84

5.9.4 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

5.9.5 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 86

5.10 CASE STUDY ANALYSIS 86

5.10.1 MANNA AERO ANNOUNCED PLANS TO BEGIN COMMERCIAL OPERATIONS 86

5.10.2 VOLOCOPTER’S PLAN T0 COMMERCIALIZE OPERATIONS BY 2024 87

5.10.3 GREENJETS AND RICARDO CREATED FIRST-GENERATION, FULLY OPERATIONAL ELECTRIC DEMONSTRATOR PROPULSION MODULE 87

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA 88

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS 88

5.11.2 BUYING CRITERIA 89

5.12 KEY CONFERENCES AND EVENTS, 2024–2025 90

5.13 INVESTMENT AND FUNDING SCENARIO 91

5.14 TECHNOLOGY ROADMAP 92

5.14.1 MILITARY AIRCRAFT 92

5.14.2 CIVIL AIRCRAFT 94

5.14.3 UNMANNED AERIAL VEHICLES 95

5.15 BILL OF MATERIALS 97

5.15.1 BILL OF MATERIALS: MILITARY AIRCRAFT 97

5.15.2 BILL OF MATERIALS: CIVIL AIRCRAFT 98

5.15.3 BILL OF MATERIALS: UNMANNED AERIAL VEHICLES 99

5.16 TOTAL COST OF OWNERSHIP 100

5.16.1 TOTAL COST OF OWNERSHIP: CIVIL AIRCRAFT 100

5.16.2 TOTAL COST OF OWNERSHIP: MILITARY AIRCRAFT 101

5.16.3 TOTAL COST OF OWNERSHIP: UNMANNED AERIAL VEHICLES 103

5.17 BUSINESS MODELS 106

5.17.1 BUSINESS MODELS: UNMANNED AERIAL VEHICLES 106

5.17.2 BUSINESS MODELS: MILITARY AIRCRAFT 106

5.17.3 BUSINESS MODELS: CIVIL AIRCRAFT 107

5.18 IMPACT OF GEN AI 108

5.18.1 INTRODUCTION 108

5.18.2 ADOPTION OF GEN AI IN COMMERCIAL AND MILITARY AVIATION 109

5.18.3 IMPACT OF GEN AI ON UNMANNED AERIAL VEHICLES 110

5.19 MACROECONOMIC OUTLOOK 111

5.19.1 NORTH AMERICA 112

5.19.2 EUROPE 112

5.19.3 ASIA PACIFIC 112

5.19.4 MIDDLE EAST 112

5.19.5 LATIN AMERICA 113

5.19.6 AFRICA 114

6 INDUSTRY TRENDS 115

6.1 INTRODUCTION 115

6.2 TECHNOLOGY TRENDS 115

6.2.1 DIGITAL TWIN TECHNOLOGY 116

6.2.2 ZERO-EMISSION TECHNOLOGY 116

6.2.3 NANOTECHNOLOGY FOR COATINGS 116

6.2.4 MIXED REALITY 116

6.2.5 ADVANCED AERODYNAMICS 117

6.3 TECHNOLOGY ANALYSIS 117

6.3.1 KEY TECHNOLOGIES 117

6.3.1.1 Supersonic technology 117

6.3.1.2 Smart sensors and IoT 117

6.3.2 COMPLEMENTARY TECHNOLOGIES 117

6.3.2.1 Advanced avionics and integrated flight management systems 117

6.3.2.2 Health Monitoring Systems (HMSs) 118

6.4 IMPACT OF MEGA TRENDS 118

6.4.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING 118

6.4.2 ADDITIVE MANUFACTURING 118

6.4.3 ROBOTICS & AUTOMATION 119

6.5 SUPPLY CHAIN ANALYSIS 119

6.6 PATENT ANALYSIS 120

7 AIRCRAFT PLATFORMS MARKET, BY TYPE 125

7.1 INTRODUCTION 126

7.2 MILITARY AIRCRAFT 128

7.2.1 COMBAT 129

7.2.1.1 Demand for air superiority and need for robust combat capabilities to drive market 129

7.2.1.2 F-35 Lightning II 130

7.2.1.3 Eurofighter 130

7.2.2 TRANSPORT 131

7.2.2.1 Need for efficient movement of troops, equipment, and supplies to drive demand 131

7.2.2.2 C-130 J Hercules 131

7.2.2.3 A400 Atlas 131

7.2.3 SPECIAL MISSIONS 132

7.2.3.1 Need for enhanced situational awareness and information superiority to drive demand 132

7.2.3.2 Airbus C295 132

7.2.3.3 King Air 200 132

7.2.4 HELICOPTERS 133

7.2.4.1 Need for rapid mobility and support in diverse operational environments to propel growth 133

7.2.4.2 Boeing AH-64 Apache 133

7.2.4.3 Boeing CH-47 Chinook 133

7.3 CIVIL AIRCRAFT 134

7.3.1 NARROW-BODY 136

7.3.1.1 Increase in air travel in emerging markets to drive segment’s growth 136

7.3.1.2 Boeing 737-800 136

7.3.1.3 Airbus A320 Neo 137

7.3.2 WIDE-BODY 137

7.3.2.1 Growth in global tourism and economic development to drive market 137

7.3.2.2 Boeing 787 137

7.3.2.3 Airbus A330 138

7.3.3 REGIONAL TRANSPORT 138

7.3.3.1 Importance of regional connectivity in broad aviation landscape to drive growth 138

7.3.3.2 E175 138

7.3.3.3 E190 139

7.3.4 BUSINESS JETS 139

7.3.4.1 Evolving corporate travel trends to drive segment’s growth 139

7.3.4.2 Gulfstream G500 140

7.3.4.3 Cirrus Vision SF50 140

7.3.5 LIGHT AIRCRAFT 141

7.3.5.1 Need for enhanced border protection capabilities to drive market 141

7.3.5.2 Cirrus SR22/T 141

7.3.5.3 Cessna CE-172S Skyhawk 141

7.3.6 COMMERCIAL HELICOPTERS 142

7.3.6.1 Strategic partnerships and fleet expansion to drive growth 142

7.3.6.2 Bell 407 142

7.3.6.3 Airbus H145 142

7.4 UNMANNED AERIAL VEHICLES (UAVS) 143

7.4.1 CIVIL & COMMERCIAL 144

7.4.1.1 Increasing adoption of UAVs for civil and commercial applications to drive market 144

7.4.1.2 DJI MAVIC Pro 144

7.4.1.3 DJI Phantom 4 Pro 144

7.4.2 DEFENSE & GOVERNMENT 145

7.4.2.1 Ongoing developments by prominent defense companies and governments to drive growth 145

7.4.2.2 MQ-9 Reaper 146

7.4.2.3 RQ-11 146

8 AIRCRAFT PLATFORMS MARKET, BY PROPULSION TECHNOLOGY 147

8.1 INTRODUCTION 148

8.2 TURBOPROP 149

8.2.1 NEED FOR COST-EFFECTIVE SOLUTIONS FOR REGIONAL CONNECTIVITY TO DRIVE GROWTH 149

8.3 TURBOFAN 149

8.3.1 GROWTH IN INTERNATIONAL AIR TRAVEL TO BOOST MARKET 149

8.4 PISTON ENGINE 150

8.4.1 GROWTH OF AIR TAXI SERVICES AND URBAN AIR MOBILITY (UAM) INITIATIVES TO DRIVE GROWTH 150

8.5 TURBOSHAFT 150

8.5.1 TURBOSHAFT ENGINES DELIVER HIGH POWER-TO-WEIGHT RATIO FOR VERTICAL TAKEOFF 150

8.6 TURBOJET 150

8.6.1 DEMAND FOR HIGH-SPEED TURBOJET AIRCRAFT TO DRIVE GROWTH 150

8.7 HYBRID-ELECTRIC 151

8.7.1 GLOBAL EFFORTS TO REDUCE CARBON FOOTPRINT TO DRIVE MARKET 151

8.8 ELECTRIC 151

8.8.1 ENVIRONMENTAL BENEFITS OF ELECTRIC PROPULSION TO DRIVE GROWTH 151

9 AIRCRAFT PLATFORMS MARKET, BY POWER SOURCE 152

9.1 INTRODUCTION 153

9.2 CONVENTIONAL FUEL 154

9.2.1 PROVEN RELIABILITY AND HIGH POWER OF CONVENTIONAL FUEL AIRCRAFT TO DRIVE MARKET 154

9.3 SAF-BASED 154

9.3.1 INNOVATION IN BIOFUEL AND SYNTHETIC FUEL PRODUCTION TO BOOST GROWTH 154

9.4 FUEL CELL 154

9.4.1 PUSH FOR ZERO-EMISSION TRANSPORTATION TO PROPEL DEMAND 154

9.5 BATTERY-POWERED 155

9.5.1 NEED FOR ENHANCED TECHNOLOGICAL ADVANCEMENTS IN POWER SOURCES TO DRIVE GROWTH 155

9.6 SOLAR-POWERED 155

9.6.1 FOCUS ON CAUSING MINIMAL ENVIRONMENTAL IMPACT TO FUEL ADOPTION OF SOLAR-POWERED AIRCRAFT 155

10 AIRCRAFT PLATFORMS MARKET, BY REGION 156

10.1 INTRODUCTION 157

10.1.1 ACTIVE FLEET 158

10.1.2 NEW DELIVERIES 159

10.2 NORTH AMERICA 160

10.2.1 NORTH AMERICA: PESTLE ANALYSIS 160

10.2.2 ACTIVE FLEET 162

10.2.3 NEW DELIVERIES 164

10.2.4 US 167

10.2.4.1 High demand for flexible business travel to boost growth 167

10.2.4.2 Active fleet 167

10.2.4.3 New deliveries 169

10.2.5 CANADA 171

10.2.5.1 Need for robust aerospace ecosystem to fuel market 171

10.2.5.2 Active fleet 171

10.2.5.3 New deliveries 173

10.3 EUROPE 176

10.3.1 EUROPE: PESTLE ANALYSIS 176

10.3.2 ACTIVE FLEET 177

10.3.3 NEW DELIVERIES 180

10.3.4 UK 183

10.3.4.1 High demand for flexible business travel to boost market 183

10.3.4.2 Active fleet 183

10.3.4.3 New deliveries 185

10.3.5 GERMANY 187

10.3.5.1 Focus on undertaking advancements to propel growth 187

10.3.5.2 Active fleet 187

10.3.5.3 New deliveries 189

10.3.6 FRANCE 191

10.3.6.1 Presence of key aircraft manufacturers to drive popularity of aircraft platforms 191

10.3.6.2 Active fleet 192

10.3.6.3 New deliveries 193

10.3.7 ITALY 195

10.3.7.1 Government initiatives to propel growth in country’s aircraft industry 195

10.3.7.2 Active fleet 196

10.3.7.3 New deliveries 197

10.3.8 IRELAND 199

10.3.8.1 Strategic focus on aviation services to drive growth 199

10.3.8.2 Active fleet 200

10.3.8.3 New deliveries 201

10.4 ASIA PACIFIC 202

10.4.1 ASIA PACIFIC: PESTLE ANALYSIS 202

10.4.2 ACTIVE FLEET 204

10.4.3 NEW DELIVERIES 206

10.4.4 CHINA 209

10.4.4.1 Focus on enhanced aviation capabilities to boost market 209

10.4.4.2 Active fleet 210

10.4.4.3 New deliveries 211

10.4.5 JAPAN 212

10.4.5.1 Government initiatives to support market growth 212

10.4.5.2 Active fleet 212

10.4.5.3 New deliveries 214

10.4.6 INDIA 216

10.4.6.1 Government support and technological developments to drive market 216

10.4.6.2 Active fleet 217

10.4.6.3 New deliveries 218

10.4.7 AUSTRALIA 220

10.4.7.1 Growing interest in enhancing civil aviation capabilities to fuel demand 220

10.4.7.2 Active fleet 221

10.4.7.3 New deliveries 223

10.4.8 SOUTH KOREA 225

10.4.8.1 Significant increase in government investments to fuel market 225

10.4.8.2 Active fleet 225

10.4.8.3 New deliveries 227

10.4.9 SINGAPORE 229

10.4.9.1 Partnerships between major industry players to drive market growth 229

10.4.9.2 Active fleet 230

10.4.9.3 New deliveries 231

10.5 LATIN AMERICA 233

10.5.1 LATIN AMERICA: PESTLE ANALYSIS 233

10.5.2 ACTIVE FLEET 235

10.5.3 NEW DELIVERIES 237

10.5.4 BRAZIL 239

10.5.4.1 Growing demand for business travel to boost market 239

10.5.4.2 Active fleet 240

10.5.4.3 New deliveries 241

10.5.5 MEXICO 243

10.5.5.1 Enhanced capabilities in aircraft engineering and manufacturing to boost market 243

10.5.5.2 Active fleet 244

10.5.5.3 New deliveries 245

10.6 AFRICA 247

10.6.1 AFRICA: PESTLE ANALYSIS 247

10.6.2 ACTIVE FLEET 249

10.6.3 NEW DELIVERIES 251

10.6.4 SOUTH AFRICA 254

10.6.4.1 Increasing demand for flexible business travel to drive market 254

10.6.4.2 Active fleet 254

10.6.4.3 New deliveries 256

10.6.5 NIGERIA 258

10.6.5.1 Increased focus on fleet expansion to boost growth 258

10.6.5.2 Active fleet 258

10.6.5.3 New deliveries 259

10.7 MIDDLE EAST 261

10.7.1 MIDDLE EAST: PESTLE ANALYSIS 261

10.7.2 ACTIVE FLEET 263

10.7.3 NEW DELIVERIES 265

10.7.4 GULF COOPERATION COUNCIL (GCC) 267

10.7.4.1 UAE 268

10.7.4.1.1 Focus on modernizing military fleet to drive market 268

10.7.4.1.2 Active fleet 268

10.7.4.1.3 New deliveries 270

10.7.4.2 Saudi Arabia 272

10.7.4.2.1 Increased defense spending and modernization efforts to drive market 272

10.7.4.2.2 Active fleet 272

10.7.4.2.3 New deliveries 274

10.7.5 QATAR 277

10.7.5.1 Rise in investments and innovation to drive market 277

10.7.5.2 Active fleet 277

10.7.5.3 New deliveries 278

10.7.6 TURKEY 279

10.7.6.1 Country’s robust defense production capabilities to drive market 279

10.7.6.2 Active fleet 279

10.7.6.3 New deliveries 281

11 COMPETITIVE LANDSCAPE 284

11.1 INTRODUCTION 284

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 284

11.3 REVENUE ANALYSIS 287

11.4 MARKET SHARE ANALYSIS 289

11.5 BRAND/PRODUCT COMPARISON 294

11.6 COMPANY VALUATION AND FINANCIAL METRICS 295

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 296

11.8 MILITARY AIRCRAFT MARKET 296

11.8.1 STARS 296

11.8.2 EMERGING LEADERS 296

11.8.3 PERVASIVE PLAYERS 296

11.8.4 PARTICIPANTS 296

11.9 CIVIL AIRCRAFT MARKET 297

11.9.1 STARS 297

11.9.2 EMERGING LEADERS 297

11.9.3 PERVASIVE PLAYERS 298

11.9.4 PARTICIPANTS 298

11.10 UNMANNED AERIAL VEHICLES MARKET 299

11.10.1 STARS 299

11.10.2 EMERGING LEADERS 299

11.10.3 PERVASIVE PLAYERS 299

11.10.4 PARTICIPANTS 299

11.10.5 COMPANY FOOTPRINT: KEY PLAYERS 301

11.11 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 306

11.11.1 PROGRESSIVE COMPANIES 306

11.11.2 RESPONSIVE COMPANIES 306

11.11.3 DYNAMIC COMPANIES 306

11.11.4 STARTING BLOCKS 306

11.11.5 COMPETITIVE BENCHMARKING 309

11.12 COMPETITIVE SCENARIO & TRENDS 310

11.12.1 PRODUCT LAUNCHES 310

11.12.2 DEALS 313

11.12.3 OTHER DEVELOPMENTS 316

12 COMPANY PROFILES 321

12.1 KEY PLAYERS 321

12.1.1 AIRBUS 321

12.1.1.1 Business overview 321

12.1.1.2 Products offered 323

12.1.1.3 Recent developments 324

12.1.1.3.1 Product launches 324

12.1.1.3.2 Deals 324

12.1.1.3.3 Other developments 325

12.1.1.4 MnM view 326

12.1.1.4.1 Right to win 326

12.1.1.4.2 Strategic choices 326

12.1.1.4.3 Weaknesses and competitive threats 326

12.1.2 BOEING 327

12.1.2.1 Business overview 327

12.1.2.2 Products offered 328

12.1.2.3 Recent developments 329

12.1.2.3.1 Other developments 329

12.1.2.4 MnM view 330

12.1.2.4.1 Right to win 330

12.1.2.4.2 Strategic choices 330

12.1.2.4.3 Weaknesses and competitive threats 330

12.1.3 EMBRAER 331

12.1.3.1 Business overview 331

12.1.3.2 Products offered 332

12.1.3.3 Recent developments 333

12.1.3.3.1 Product launches 333

12.1.3.3.2 Deals 333

12.1.3.3.3 Other developments 334

12.1.3.4 MnM view 335

12.1.3.4.1 Right to win 335

12.1.3.4.2 Strategic choices 335

12.1.3.4.3 Weaknesses and competitive threats 335

12.1.4 TEXTRON INC. 336

12.1.4.1 Business overview 336

12.1.4.2 Products offered 337

12.1.4.3 Recent developments 338

12.1.4.3.1 Product launches 338

12.1.4.3.2 Deals 339

12.1.4.3.3 Other developments 339

12.1.4.4 MnM view 340

12.1.4.4.1 Right to win 340

12.1.4.4.2 Strategic choices 340

12.1.4.4.3 Weaknesses and competitive threats 340

12.1.5 LOCKHEED MARTIN CORPORATION 341

12.1.5.1 Business overview 341

12.1.5.2 Products offered 342

12.1.5.3 Recent developments 343

12.1.5.3.1 Other developments 343

12.1.5.4 MnM view 344

12.1.5.4.1 Right to win 344

12.1.5.4.2 Strategic choices 344

12.1.5.4.3 Weaknesses and competitive threats 344

12.1.6 GENERAL DYNAMICS CORPORATION 345

12.1.6.1 Business overview 345

12.1.6.2 Products/Solutions offered 346

12.1.7 LEONARDO S.P.A. 347

12.1.7.1 Business overview 347

12.1.7.2 Products offered 349

12.1.7.3 Recent developments 350

12.1.7.3.1 Deals 350

12.1.7.3.2 Other developments 350

12.1.8 RTX 351

12.1.8.1 Business overview 351

12.1.8.2 Products offered 352

12.1.8.3 Recent developments 352

12.1.8.3.1 Other developments 352

12.1.9 NORTHROP GRUMMAN 353

12.1.9.1 Business overview 353

12.1.9.2 Products offered 354

12.1.9.3 Recent developments 355

12.1.9.3.1 Other developments 355

12.1.10 IAI 356

12.1.10.1 Business overview 356

12.1.10.2 Products offered 357

12.1.10.3 Recent developments 357

12.1.10.3.1 Deals 357

12.1.10.3.2 Other developments 358

12.1.11 DJI 359

12.1.11.1 Business overview 359

12.1.11.2 Products offered 359

12.1.11.3 Recent developments 360

12.1.11.3.1 Product launches 360

12.1.11.3.2 Deals 361

12.1.12 DASSAULT AVIATION 362

12.1.12.1 Business overview 362

12.1.12.2 Products offered 363

12.1.12.3 Recent developments 363

12.1.12.3.1 Other developments 363

12.1.13 VERTICAL AEROSPACE 364

12.1.13.1 Business overview 364

12.1.13.2 Products offered 364

12.1.13.3 Recent developments 365

12.1.13.3.1 Deals 365

12.1.13.3.2 Other developments 365

12.1.14 ARCHER AVIATION INC. 366

12.1.14.1 Business overview 366

12.1.14.2 Products offered 366

12.1.14.3 Recent developments 367

12.1.14.3.1 Deals 367

12.1.14.3.2 Other developments 367

12.1.15 EHANG 368

12.1.15.1 Business overview 368

12.1.15.2 Products offered 368

12.1.15.3 Recent developments 369

12.1.15.3.1 Deals 369

12.1.16 TELEDYNE FLIR LLC 370

12.1.16.1 Business overview 370

12.1.16.2 Products offered 371

12.1.16.3 Recent developments 372

12.1.16.3.1 Product launches 372

12.1.16.3.2 Deals 372

12.1.16.3.3 Other developments 373

12.1.17 BOMBARDIER 374

12.1.17.1 Business overview 374

12.1.17.2 Products offered 375

12.1.17.3 Recent developments 375

12.1.17.3.1 Product launches 375

12.1.17.3.2 Deals 375

12.1.18 GENERAL ATOMICS 376

12.1.18.1 Business overview 376

12.1.18.2 Products offered 376

12.1.18.3 Recent developments 377

12.1.18.3.1 Deals 377

12.1.19 ATR 379

12.1.19.1 Business overview 379

12.1.19.2 Products offered 379

12.1.20 COMAC 380

12.1.20.1 Business overview 380

12.1.20.2 Products offered 380

12.2 OTHER PLAYERS 381

12.2.1 VOLOCOPTER GMBH 381

12.2.2 OVERAIR INC. 382

12.2.3 TATA ADVANCED SYSTEMS LIMITED 383

12.2.4 DELAIR 384

12.2.5 WISK AERO LLC 385

12.2.6 ELECTRA AERO 386

12.2.7 MICRODRONES 386

12.2.8 PIVOTAL 387

12.2.9 HEART AEROSPACE 387

12.2.10 VAERIDION GMBH 388

13 APPENDIX 389

13.1 DISCUSSION GUIDE 389

13.2 ANNEXURE 391

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 392

13.4 CUSTOMIZATION OPTIONS 394

13.5 RELATED REPORTS 394

13.6 AUTHOR DETAILS 395

❖ 世界の航空機プラットフォーム市場に関するよくある質問(FAQ) ❖

・航空機プラットフォームの世界市場規模は?

→MarketsandMarkets社は2024年の航空機プラットフォームの世界市場規模を2,352億4,000万米ドルと推定しています。

・航空機プラットフォームの世界市場予測は?

→MarketsandMarkets社は2030年の航空機プラットフォームの世界市場規模を3,011億9,000万米ドルと予測しています。

・航空機プラットフォーム市場の成長率は?

→MarketsandMarkets社は航空機プラットフォームの世界市場が2024年~2030年に年平均4.2%成長すると予測しています。

・世界の航空機プラットフォーム市場における主要企業は?

→MarketsandMarkets社は「Airbus (France), Boeing (US), Embraer (Brazil), Textron Inc. (US), Lockheed Martin Corporation (US))など ...」をグローバル航空機プラットフォーム市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。