1 はじめに 26

1.1 調査目的 26

1.2 市場の定義 26

1.3 市場範囲 27

1.3.1 対象市場 27

1.3.2 対象範囲と対象外 28

1.3.3 考慮した年数 28

1.3.4 通貨

1.4 市場関係者 29

1.5 変更点のまとめ 30

2 調査方法 31

2.1 調査データ 31

2.1.1 二次データ 32

2.1.1.1 二次ソースからの主要データ 33

2.1.2 一次データ 33

2.1.2.1 主要な業界インサイト 35

2.2 市場規模の推定 36

2.3 市場の内訳とデータの三角測量 41

2.4 調査の前提 42

2.5 調査の限界 42

2.5.1 方法論に関連する限界 42

2.5.2 範囲に関する限界 43

2.6 リスク評価 43

3 エグゼクティブ・サマリー 44

4 プレミアムインサイト 48

4.1 病理検査におけるAI市場の概要 48

4.2 病理検査におけるAI市場:地域構成 49

4.3 アジア太平洋地域:病理検査におけるAI市場:エンドユーザー・国別 50

4.4 地理的成長機会 51

5 市場概要 52

5.1 はじめに 52

5.2 市場ダイナミクス

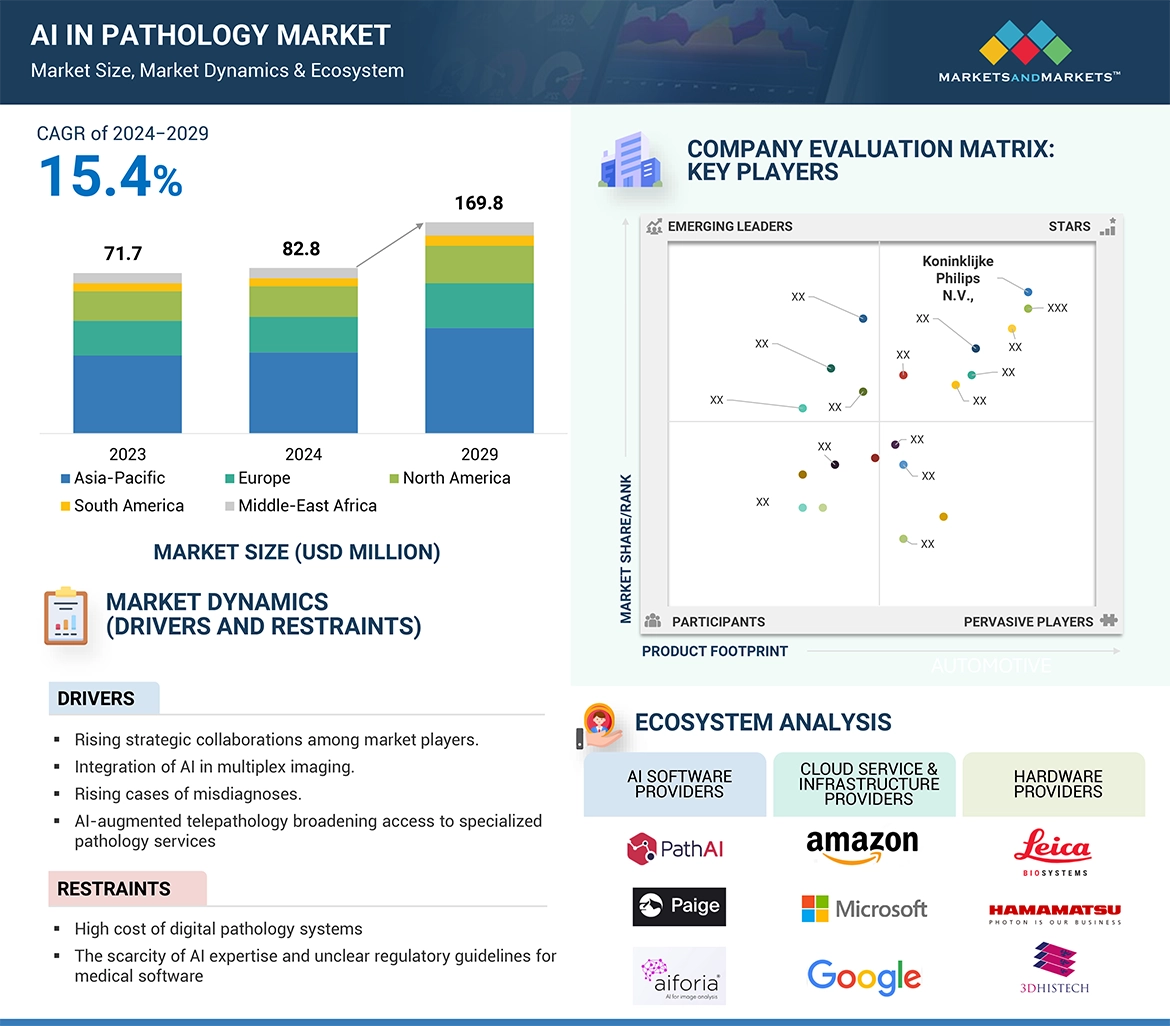

5.2.1 推進要因 53

5.2.1.1 CNNと高度AIモデルの開発 53

5.2.1.2 マルチプレックスイメージングへのAIの統合 53

5.2.1.3 患者の誤診事例の増加 54

5.2.1.4 AIを活用したテレパソロジーの利点 54

5.2.1.5 ディープラーニングと画像処理の進歩 55

5.2.2 阻害要因 55

5.2.2.1 デジタル病理システムの高コスト 55

5.2.2.2 AIの専門知識が限られており、医療用ソフトウェアの規制ガイドラインが多様 56

5.2.2.3 レガシーシステムとの不十分な相互運用性の問題 56

5.2.3 機会 57

5.2.3.1 個別化医療への需要の高まり 57

5.2.3.2 マルチオミクスデータの統合 57

5.2.3.3 疾患進行の予測分析 58

5.2.4 課題 58

5.2.4.1 AIアルゴリズムのためのデータ不足 58

5.2.4.2 データのプライバシーと倫理的懸念 58

5.2.4.3 AIモデルの解釈可能性に関する課題 59

5.3 顧客のビジネスに影響を与えるトレンド/混乱 60

5.4 業界動向 60

5.4.1 病理学におけるAIの進化 60

5.5 エコシステム分析 61

5.6 バリューチェーン分析 62

5.7 技術分析 64

5.7.1 主要技術 64

5.7.1.1 機械学習と人工知能 64

5.7.1.2 コンピュータビジョン 64

5.7.2 補完技術 64

5.7.2.1 クラウドコンピューティング 64

5.7.3 隣接技術 65

5.7.3.1 テレパソロジー 65

5.8 規制分析 65

5.8.1 規制機関、政府機関、

その他の組織 65

5.8.2 規制の状況 66

5.8.2.1 北米 66

5.8.2.1.1 米国 66

5.8.2.1.2 カナダ 67

5.8.2.2 欧州 67

5.8.2.3 アジア太平洋地域 69

5.8.2.3.1 日本 69

5.8.2.3.2 中国 69

5.9 価格分析 70

5.9.1 指標価格分析(製品別) 70

5.9.2 平均販売価格動向(地域別) 71

5.10 ポーターの5つの力分析 71

5.10.1 新規参入の脅威 72

5.10.2 代替品の脅威 72

5.10.3 供給者の交渉力 72

5.10.4 買い手の交渉力 72

5.10.5 競合の激しさ 73

5.11 特許分析 73

5.11.1 AI病理ソリューションの特許公開動向 73

5.11.2 管轄地域と上位出願人の分析 74

5.12 主要ステークホルダーと購買基準 75

5.12.1 購入プロセスにおける主要ステークホルダー 75

5.12.2 購入基準 76

5.13 エンドユーザー分析 77

5.13.1 エンドユーザーの満たされていないニーズ 77

5.13.2 エンドユーザーの期待 77

5.14 主要な会議とイベント(2024~2025年) 78

5.15 ケーススタディ分析 79

5.15.1 ケーススタディ1:AIを活用した病理検査で患者の予後を改善したパサイ社 79

5.15.2 ケーススタディ 2: AIによる子宮頸がん対策 79

5.16 投資と資金調達のシナリオ 79

5.17 病理学におけるAI市場:ビジネスモデル 80

5.18 AI/遺伝子AIが病理検査AI市場に与える影響 81

5.18.1 主な使用事例 82

5.18.2 AI/ジェネレーティブAIの導入事例 82

5.18.2.1 ケーススタディ: バイオマーカー探索と臨床試験の最適化の加速 82

5.18.3 AI/ジェネレーティブAIの相互接続された隣接エコシステムへの影響 83

5.18.3.1 創薬・医薬品開発市場 83

5.18.3.2 医療画像&診断市場 83

5.18.4 ユーザーの準備と影響評価 84

5.18.4.1 ユーザー準備状況 84

5.18.4.1.1 製薬企業 84

5.18.4.1.2 バイオ医薬品企業 84

5.18.4.2 影響評価 84

5.18.4.2.1 ユーザーA:製薬会社 84

5.18.4.2.1.1 実施 84

5.18.4.2.1.2 影響 85

5.18.4.2.2 ユーザーB:バイオ製薬会社 85

5.18.4.2.2.1 実施 85

5.18.4.2.2 影響 85

5.19 貿易分析 86

5.19.1 輸入データ 86

5.19.2 輸出データ 87

6 病理学におけるAI市場:提供製品別 88

6.1 導入 89

6.2 エンドツーエンドソリューション 91

6.2.1 医療モデルにおける統合ワークフローへの需要の高まりが市場を牽引 91

6.3 ニッチポイントソリューション 92

6.3.1 精密医療と標的治療研究への関心の高まりが市場を促進 92

6.4 テクノロジー 93

6.4.1 高度なデータ管理ソリューションに対するニーズの高まりが

が高まる 93

6.5 ハードウェア 94

6.6 顕微鏡 95

6.6.1 効果的な結論を得るための組織サンプルの自動分析が普及を後押し 95

6.7 スキャナー 96

6.7.1 画質の向上と精密診断が需要を押し上げる 96

6.8 ストレージシステム 98

6.8.1 高解像度画像の構造化モデルを提供する能力が市場成長を後押し 98

7 病理学におけるAI市場:ニューラルネットワーク別 100

7.1 はじめに 101

7.2 畳み込みニューラルネットワーク(CNN) 101

7.2.1 高品質の画像認識と異同検出が可能なことが市場を牽引 101

7.3 生成的敵対ネットワーク(Gans) 103

7.3.1 正確な合成病理画像の生成用に設計されたものが市場を牽引 103

7.4 リカレントニューラルネットワーク(Rnns) 104

7.4.1 逐次データと時間依存パターンの分析が普及を促進 104

7.5 その他のニューラルネットワーク 106

8 病理学におけるAI市場(機能別) 107

8.1 導入 108

8.2 画像解析 109

8.2.1 細胞の異常と疾患マーカーの検出が普及を促進 109

8.3 診断 110

8.3.1 自動化されたサンプルの迅速な処理が市場を牽引 110

8.4 ワークフロー管理 111

8.4.1 ハイスループット結果を得るためのラボリソースの最適化が普及を促進 111

8.5 データ管理 112

8.5.1 データ統合と処理の進歩が需要を押し上げる 112

8.6 予測分析 113

8.6.1 早期疾病診断への関心の高まりが市場を牽引 113

8.7 CDSS 114

8.7.1 リアルタイムインサイトの提供が市場を活性化 114

8.8 自動レポート作成 115

8.8.1 品質管理に対する需要の高まりが市場を牽引 115

8.9 品質保証ツール 116

8.9.1 規制上の要求の高まりが品質保証ツールの需要を加速 116

9 病理学におけるAI市場(ユースケース別) 117

9.1 導入 118

9.2 創薬 118

9.2.1 ターゲット同定と選択 121

9.2.1.1 バイオマーカー探索のための分子・組織学的データの分析が市場を活性化 121

9.2.2 ターゲットバリデーション 122

9.2.2.1 精密医療への需要の高まりが市場を牽引 122

9.2.3 ヒットの同定と優先順位付け 123

9.2.3.1 迅速な解析とコスト効率への要求の高まりが市場拡大に寄与 123

9.2.4 ヒットからリードへの同定 124

9.2.4.1 ML技術の進歩が市場成長を後押し 124

9.2.5 リード最適化 125

9.2.5.1 治療効果への関心の高まりが市場を後押し 125

9.2.6 候補化合物の選定とバリデーション 126

9.2.6.1 規制当局の承認要件が市場を牽引 126

9.3 病気の診断と予後 127

9.3.1 慢性疾患の罹患率の増加が市場を後押し 127

9.4 臨床ワークフロー 128

9.4.1 膨大なデータの構造化された自動化が市場を牽引 128

9.5 トレーニングと教育 129

9.5.1 学術機関におけるデジタル病理システムの活用が市場成長を後押し 129

10 病理学におけるAI市場(エンドユーザー別) 131

10.1 導入 132

10.2 製薬・バイオ医薬品企業 132

10.2.1 毒物学的検査への関心の高まりが市場を促進 132

10.3 病院・標準検査機関 133

10.3.1 感染症診断の増加が市場を牽引 133

10.4 学術・研究機関 135

10.4.1 ライフサイエンス研究への投資の増加が市場成長を後押し 135

11 病理学におけるAI市場(地域別) 136

11.1 はじめに 137

11.2 北米 137

11.2.1 北米のマクロ経済見通し 137

11.2.2 米国 141

11.2.2.1 高い医療費とクラウドコンピューティングプラットフォームの改善が市場を促進 141

11.2.3 カナダ 145

11.2.3.1 先端医療診断へのディープラーニング採用の増加が市場を牽引 145

11.3 欧州 147

11.3.1 欧州のマクロ経済見通し 148

11.3.2 英国 151

11.3.2.1 創薬・開発への注力の高まりが需要を押し上げる 151

11.3.3 ドイツ 153

11.3.3.1 AIイニシアチブのための資金調達が可能で普及が加速 153

11.3.4 フランス 156

11.3.4.1 ヘルスケアコンピューティングにおけるビッグデータ導入の増加が普及を促進 156

11.3.5 イタリア 159

11.3.5.1 ヘルスケアのデジタルトランスフォーメーションとイノベーションが市場成長を支える 159

11.3.6 スペイン 161

11.3.6.1 労働力不足が市場を活性化 161

11.3.7 その他のヨーロッパ 164

11.4 アジア太平洋地域 167

11.4.1 アジア太平洋地域のマクロ経済見通し 167

11.4.2 中国 171

11.4.2.1 感染症・慢性疾患の罹患率が上昇し、普及が加速 171

11.4.3 日本 174

11.4.3.1 高度な医療インフラが市場を促進 174

11.4.4 インド 177

11.4.4.1 医療のデジタル化に対する注目の高まりが需要を後押し 177

11.4.5 その他のアジア太平洋地域 180

11.5 ラテンアメリカ 183

11.5.1 ラテンアメリカのマクロ経済見通し 183

11.5.2 ブラジル 186

11.5.2.1 市場成長を支えるAI導入のための戦略的投資 186

11.5.3 メキシコ 189

11.5.3.1 医薬品研究開発の成長が市場を牽引 189

11.5.4 その他のラテンアメリカ 191

11.6 中東・アフリカ 194

11.6.1 中東・アフリカのマクロ経済見通し 194

11.6.2 GCC諸国 197

11.6.2.1 市場成長を支える技術的専門知識の拡大への投資の増加 197

11.6.3 その他の中東・アフリカ地域 200

12 競争環境 204

12.1 はじめに 204

12.2 主要プレーヤーの戦略/勝利への権利 204

12.2.1 病理学におけるAI市場でプレーヤーが採用した戦略の概要 205

12.3 収益分析、2019年~2023年 207

12.4 市場シェア分析、2023年 207

12.5 企業評価マトリックス:主要プレイヤー、2023年 210

12.5.1 スター企業 210

12.5.2 新興リーダー 210

12.5.3 浸透型プレーヤー 210

12.5.4 参加企業 210

12.5.5 企業フットプリント:主要プレーヤー、2023年 212

12.5.5.1 企業フットプリント 212

12.5.5.2 オファリングのフットプリント 213

12.5.5.3 ユースケース・フットプリント 214

12.5.5.4 エンドユーザーフットプリント 215

12.5.5.5 地域別フットプリント 216

12.6 企業評価マトリクス:新興企業/中小企業(2023年) 217

12.6.1 進歩的企業 217

12.6.2 対応力のある企業 217

12.6.3 ダイナミックな企業 217

12.6.4 スタートアップ・ブロック 217

12.6.5 競争ベンチマーキング:新興企業/SM(2023年) 219

12.7 企業評価と財務指標 220

12.7.1 企業評価 220

12.7.2 財務指標 220

12.7.3 ブランド/ソフトウェア比較分析 221

12.8 競争シナリオ 222

12.8.1 製品/サービスの上市と承認 222

12.8.2 取引 223

12.8.3 その他の開発 224

13 企業プロフィール 225

Koninklijke Philips N.V. (Netherlands)

F. Hoffmann-La Roche Ltd (Switzerland)

Hologic Inc. (US).

14 付録 281

14.1 ディスカッションガイド 281

14.2 Knowledgestore: Marketsandmarketsの購読ポータル 288

14.3 カスタマイズオプション 290

14.4 関連レポート 290

14.5 著者の詳細 291

AI in pathology refers to the healthcare industry’s sector which comprises of development, deployment, and utilization of Artificial Intelligence (AI) designed for pathology applications specifically. Clinical data, genomic information, and disease progression can be analysed by using these AI models. These AI models assist in personalized treatment planning, identifying high-risk patients, and optimizing healthcare resource allocation. The AI helps and assists pathologists in extracting relevant information and analyzing images with the use of advanced AI algorithms, computer vision, and machine learning.

“The drug discovery segment accounted for the largest share in 2023, by use case.”

In 2023, the drug discovery segment held the largest share of the AI in pathology market. The major factor behind this is the high demand for efficient and cost-effective drugs, as AI in pathology helps in accelerating the drug discovery process by automating the data analytics and identifying potential drug faster. In addition, the advancements in high throughput screenings imaging technologies and utilization of AI in toxicology testing for illicit drugs also act as a driving force for this market. Furthermore, the reduced time and costs play a very vital role as traditional methods are very time consuming and expensive as well, the introduction of AI in pathology helps in streamlining the process by enabling faster insights and decision making. Which in tun makes the process more efficient and cost effective, these all factors combined act as a catalyst for the growth of this market.

“Pharmaceutical and biopharmaceutical companies is the fastest growing end-user segment in the AI in pathology market.”

The pharmaceutical and biopharmaceutical companies segment is projected to witness the highest growth rate during the forecast period. The growing collaboration between pharmaceutical companies and AI providers fuels rapid adoption of AI, also the companies are heavily investing in AI tools to stay competitive in drug development and innovation. As AI helps in fast tracking and streamlining the processes for drug discovery by analysing large datasets, identifying patterns in tissue samples, and predicting treatment responses, which reduces the time consumption and makes it cost effective, leading to faster innovations. The biopharmaceutical companies rely on AI-based digital pathology for majorly development of individualized medicine, as AI powered pathology aids the development of personalised medicine by providing detailed insights into individual portfolio.

“North America accounted for the largest share in 2023, in AI in pathology market.”

In 2023, the North American region held the largest market share in the AI in pathology market due to several factors. The first and foremost being the high adoption of AI technology and strong investment in research and development driving the market growth. For instance, companies like Koninklijke Philips N.V. in 2023, invested nearly USD 895 million in R&D for diagnosis and treatment. On the other hand, the advanced healthcare infrastructre plays a very vital role in this market as there’s a need of high tech machinery such as advanced microscopes and scanners. Morover, the large patient pool and data availability contributes in creating a large database, which can be further used to train the AI for greater accuracy and efficiency. This increasing focus on technoology, patient safety, and quality improvement, combined with technological advancements in medical devices, continues to drive the adoption of AI in pathology market in North America.

The break-down of primary participants is as mentioned below:

• By Company Type - Tier 1: 55%, Tier 2: 25%, and Tier 3: 20%

• By Designation - C-level: 50%, Director-level: 30%, and Others: 20%

• By Region - North America: 40%, Europe: 35%, Asia Pacific: 20%, RoW: 5%

Key Players in the AI in pathology Market

The key players functioning in the AI in pathology market include Koninklijke Philips N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Hologic, Inc. (US), Akoya Biosciences, Inc. (US), Aiforia Technologies Plc (Finland), Indica Labs Inc. (US), OptraScan (US), Ibex Medical Analytics Ltd. (Israel), Mindpeak GmbH (Germany), Tribun Health (France), Techcyte, Inc. (US), Deep Bio Inc. (Korea), Lumea Inc. (US), Visiopharm (Denmark), aetherAI (Taiwan), Aiosyn (Netherlands), Paige AI, Inc. (US), Proscia Inc. (US), PathAI, Inc. (US), Tempus Labs, Inc. (US), Konfoong Biotech International Co., Ltd. (China), DoMore Diagnostics AS (Norway), Verily Life Sciences, LLC (US), deepPath (US), and 4D Path Inc (US).

Research Coverage:

The report analyses the AI in pathology market. It aims to estimate the market size and future growth potential of various market segments based on by offerings, neural networks, use-case, end-user, by functions and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms and new entrants/smaller firms to gauge the market's pulse, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

•Analysis of key drivers (Rising strategic collaborations among market players, integration of AI in multiplex imaging, Rising cases of misdiagnoses, AI-augmented telepathology broadening access to specialized pathology services, and technological advancements in deep learning), restraints (High cost of digital pathology systems, the scarcity of AI expertise and unclear regulatory guidelines for medical software, and lack of interoperability with legacy systems), opportunities (Growing demand for personalized medicine, integration of multi-omics data, and predictive analytics for disease Progression) challenges (Lack of sufficient data to train AI algorithms, data privacy, and ethical concerns, interpretability of AI models) influencing the growth of the AI in pathology market.

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI in pathology market.

Market Development: Comprehensive information on the lucrative emerging markets, offering, neural networks, functions, use-case, end-user, and region.

Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the AI in pathology market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the AI in pathology market like Koninklijke Philips N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Hologic, Inc. (US).

1 INTRODUCTION 26

1.1 STUDY OBJECTIVES 26

1.2 MARKET DEFINITION 26

1.3 MARKET SCOPE 27

1.3.1 MARKETS COVERED 27

1.3.2 INCLUSIONS & EXCLUSIONS 28

1.3.3 YEARS CONSIDERED 28

1.3.4 CURRENCY CONSIDERED 29

1.4 MARKET STAKEHOLDERS 29

1.5 SUMMARY OF CHANGES 30

2 RESEARCH METHODOLOGY 31

2.1 RESEARCH DATA 31

2.1.1 SECONDARY DATA 32

2.1.1.1 Key data from secondary sources 33

2.1.2 PRIMARY DATA 33

2.1.2.1 Key industry insights 35

2.2 MARKET SIZE ESTIMATION 36

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 41

2.4 STUDY ASSUMPTIONS 42

2.5 RESEARCH LIMITATIONS 42

2.5.1 METHODOLOGY-RELATED LIMITATIONS 42

2.5.2 SCOPE-RELATED LIMITATIONS 43

2.6 RISK ASSESSMENT 43

3 EXECUTIVE SUMMARY 44

4 PREMIUM INSIGHTS 48

4.1 AI IN PATHOLOGY MARKET OVERVIEW 48

4.2 AI IN PATHOLOGY MARKET: REGIONAL MIX 49

4.3 ASIA PACIFIC: AI IN PATHOLOGY MARKET, BY END USER & COUNTRY 50

4.4 GEOGRAPHIC GROWTH OPPORTUNITIES 51

5 MARKET OVERVIEW 52

5.1 INTRODUCTION 52

5.2 MARKET DYNAMICS 52

5.2.1 DRIVERS 53

5.2.1.1 Development of CNNs and advanced AI models 53

5.2.1.2 Integration of AI into multiplex imaging 53

5.2.1.3 Increasing cases of misdiagnoses in patients 54

5.2.1.4 Benefits of AI-augmented telepathology 54

5.2.1.5 Advancements in deep learning & image processing 55

5.2.2 RESTRAINTS 55

5.2.2.1 High cost of digital pathology systems 55

5.2.2.2 Limited AI expertise and varied regulatory guidelines for medical software 56

5.2.2.3 Inadequate interoperability issues with legacy systems 56

5.2.3 OPPORTUNITIES 57

5.2.3.1 Increasing demand for personalized medicine 57

5.2.3.2 Integration of multi-omics data 57

5.2.3.3 Predictive analytics for disease progression 58

5.2.4 CHALLENGES 58

5.2.4.1 Insufficient data for AI algorithms 58

5.2.4.2 Data privacy & ethical concerns 58

5.2.4.3 Challenges associated with interpretability of AI models 59

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 60

5.4 INDUSTRY TRENDS 60

5.4.1 EVOLUTION OF AI IN PATHOLOGY 60

5.5 ECOSYSTEM ANALYSIS 61

5.6 VALUE CHAIN ANALYSIS 62

5.7 TECHNOLOGY ANALYSIS 64

5.7.1 KEY TECHNOLOGIES 64

5.7.1.1 Machine learning and artificial intelligence 64

5.7.1.2 Computer vision 64

5.7.2 COMPLEMENTARY TECHNOLOGIES 64

5.7.2.1 Cloud computing 64

5.7.3 ADJACENT TECHNOLOGIES 65

5.7.3.1 Telepathology 65

5.8 REGULATORY ANALYSIS 65

5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 65

5.8.2 REGULATORY LANDSCAPE 66

5.8.2.1 North America 66

5.8.2.1.1 US 66

5.8.2.1.2 Canada 67

5.8.2.2 Europe 67

5.8.2.3 Asia Pacific 69

5.8.2.3.1 Japan 69

5.8.2.3.2 China 69

5.9 PRICING ANALYSIS 70

5.9.1 INDICATIVE PRICING ANALYSIS, BY OFFERING 70

5.9.2 AVERAGE SELLING PRICE TREND, BY REGION 71

5.10 PORTER’S FIVE FORCES ANALYSIS 71

5.10.1 THREAT OF NEW ENTRANTS 72

5.10.2 THREAT OF SUBSTITUTES 72

5.10.3 BARGAINING POWER OF SUPPLIERS 72

5.10.4 BARGAINING POWER OF BUYERS 72

5.10.5 INTENSITY OF COMPETITIVE RIVALRY 73

5.11 PATENT ANALYSIS 73

5.11.1 PATENT PUBLICATION TRENDS FOR AI IN PATHOLOGY SOLUTIONS 73

5.11.2 JURISDICTION & TOP APPLICANT ANALYSIS 74

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA 75

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS 75

5.12.2 BUYING CRITERIA 76

5.13 END-USER ANALYSIS 77

5.13.1 UNMET NEEDS OF END USERS 77

5.13.2 END-USER EXPECTATIONS 77

5.14 KEY CONFERENCES AND EVENTS, 2024–2025 78

5.15 CASE STUDY ANALYSIS 79

5.15.1 CASE STUDY 1: PATHAI USES PYTORCH TO IMPROVE PATIENT OUTCOMES WITH AI-POWERED PATHOLOGY 79

5.15.2 CASE STUDY 2: COMBATING CERVICAL CANCER WITH AI 79

5.16 INVESTMENT & FUNDING SCENARIO 79

5.17 AI IN PATHOLOGY MARKET: BUSINESS MODELS 80

5.18 IMPACT OF AI/GEN AI ON AI IN PATHOLOGY MARKET 81

5.18.1 KEY USE CASES 82

5.18.2 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION 82

5.18.2.1 Case Study: Accelerated biomarker discovery and clinical trial optimization 82

5.18.3 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS 83

5.18.3.1 Drug discovery & development market 83

5.18.3.2 Medical imaging & diagnostics market 83

5.18.4 USERS READINESS AND IMPACT ASSESSMENT 84

5.18.4.1 User readiness 84

5.18.4.1.1 Pharmaceutical companies 84

5.18.4.1.2 Biopharmaceutical companies 84

5.18.4.2 Impact assessment 84

5.18.4.2.1 User A: Pharmaceutical companies 84

5.18.4.2.1.1 Implementation 84

5.18.4.2.1.2 Impact 85

5.18.4.2.2 User B: Biopharmaceutical companies 85

5.18.4.2.2.1 Implementation 85

5.18.4.2.2.2 Impact 85

5.19 TRADE ANALYSIS 86

5.19.1 IMPORT DATA 86

5.19.2 EXPORT DATA 87

6 AI IN PATHOLOGY MARKET, BY OFFERING 88

6.1 INTRODUCTION 89

6.2 END-TO-END SOLUTIONS 91

6.2.1 INCREASING DEMAND FOR INTEGRATED WORKFLOWS IN HEALTHCARE MODELS TO DRIVE MARKET 91

6.3 NICHE POINT SOLUTIONS 92

6.3.1 GROWING FOCUS ON PRECISION MEDICINE AND TARGETED THERAPY RESEARCH TO PROPEL MARKET 92

6.4 TECHNOLOGY 93

6.4.1 RISING NEED FOR ADVANCED DATA MANAGEMENT SOLUTIONS

TO FUEL UPTAKE 93

6.5 HARDWARE 94

6.6 MICROSCOPES 95

6.6.1 AUTOMATED ANALYSIS OF TISSUE SAMPLES FOR EFFECTIVE CONCLUSIONS TO FUEL UPTAKE 95

6.7 SCANNERS 96

6.7.1 IMPROVEMENTS IN IMAGE QUALITY AND PRECISION DIAGNOSTICS TO BOOST DEMAND 96

6.8 STORAGE SYSTEMS 98

6.8.1 ABILITY TO PROVIDE STRUCTURED MODELS OF HIGH-RESOLUTION IMAGES TO SUPPORT MARKET GROWTH 98

7 AI IN PATHOLOGY MARKET, BY NEURAL NETWORK 100

7.1 INTRODUCTION 101

7.2 CONVOLUTIONAL NEURAL NETWORKS (CNNS) 101

7.2.1 ABILITY TO PROVIDE HIGH-QUALITY IMAGE RECOGNITION AND OBJECTION DETECTION TO PROPEL MARKET 101

7.3 GENERATIVE ADVERSARIAL NETWORKS (GANS) 103

7.3.1 DESIGNED FOR GENERATION OF ACCURATE SYNTHETIC PATHOLOGY IMAGES TO DRIVE MARKET 103

7.4 RECURRENT NEURAL NETWORKS (RNNS) 104

7.4.1 ANALYSIS OF SEQUENTIAL DATA AND TIME-DEPENDENT PATTERNS TO FUEL UPTAKE 104

7.5 OTHER NEURAL NETWORKS 106

8 AI IN PATHOLOGY MARKET, BY FUNCTION 107

8.1 INTRODUCTION 108

8.2 IMAGE ANALYSIS 109

8.2.1 DETECTION OF CELLULAR ANOMALIES AND DISEASE MARKERS TO FUEL UPTAKE 109

8.3 DIAGNOSTICS 110

8.3.1 RAPID PROCESSION OF AUTOMATED SAMPLES TO DRIVE MARKET 110

8.4 WORKFLOW MANAGEMENT 111

8.4.1 OPTIMIZATION OF LAB RESOURCES FOR HIGH-THROUGHPUT RESULTS TO FUEL UPTAKE 111

8.5 DATA MANAGEMENT 112

8.5.1 ADVANCEMENTS IN DATA INTEGRATION & PROCESSING TO BOOST DEMAND 112

8.6 PREDICTIVE ANALYTICS 113

8.6.1 GROWING FOCUS ON EARLY DISEASE DIAGNOSIS TO DRIVE MARKET 113

8.7 CDSS 114

8.7.1 PROVISION OF REAL-TIME INSIGHTS TO FUEL MARKET 114

8.8 AUTOMATED REPORT GENERATION 115

8.8.1 INCREASING DEMAND FOR QUALITY CONTROL TO DRIVE MARKET 115

8.9 QUALITY ASSURANCE TOOLS 116

8.9.1 RISING REGULATORY DEMANDS TO ACCELERATE DEMAND FOR QUALITY ASSURANCE TOOLS 116

9 AI IN PATHOLOGY MARKET, BY USE CASE 117

9.1 INTRODUCTION 118

9.2 DRUG DISCOVERY 118

9.2.1 TARGET IDENTIFICATION & SELECTION 121

9.2.1.1 Analysis of molecular & histological data for biomarker discovery to fuel market 121

9.2.2 TARGET VALIDATION 122

9.2.2.1 Increasing demand for precision medicine to drive market 122

9.2.3 HIT IDENTIFICATION & PRIORITIZATION 123

9.2.3.1 Growing requirement for rapid analysis and cost efficiency to fuel uptake 123

9.2.4 HIT-TO-LEAD IDENTIFICATION 124

9.2.4.1 Advancements in ML to support market growth 124

9.2.5 LEAD OPTIMIZATION 125

9.2.5.1 Growing focus on therapeutic efficacy to propel market 125

9.2.6 CANDIDATE SELECTION & VALIDATION 126

9.2.6.1 Critical requirement for regulatory approvals to drive market 126

9.3 DISEASE DIAGNOSIS & PROGNOSIS 127

9.3.1 INCREASING INCIDENCE OF CHRONIC DISEASES TO FUEL MARKET 127

9.4 CLINICAL WORKFLOW 128

9.4.1 STRUCTURED AUTOMATION OF EXTENSIVE VOLUME DATA TO DRIVE MARKET 128

9.5 TRAINING & EDUCATION 129

9.5.1 UTILIZATION OF DIGITAL PATHOLOGY SYSTEMS IN ACADEMIC INSTITUTES TO SUPPORT MARKET GROWTH 129

10 AI IN PATHOLOGY MARKET, BY END USER 131

10.1 INTRODUCTION 132

10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES 132

10.2.1 GROWING FOCUS ON TOXICOLOGY TESTING TO PROPEL MARKET 132

10.3 HOSPITALS & REFERENCE LABORATORIES 133

10.3.1 INCREASING UPTAKE OF INFECTIOUS DISEASE DIAGNOSIS TO DRIVE MARKET 133

10.4 ACADEMIC & RESEARCH INSTITUTES 135

10.4.1 INCREASING INVESTMENTS IN LIFE SCIENCES RESEARCH TO SUPPORT MARKET GROWTH 135

11 AI IN PATHOLOGY MARKET, BY REGION 136

11.1 INTRODUCTION 137

11.2 NORTH AMERICA 137

11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 137

11.2.2 US 141

11.2.2.1 High healthcare expenditure and improvements in cloud computing platforms to propel market 141

11.2.3 CANADA 145

11.2.3.1 Increasing adoption of deep learning for advanced healthcare diagnostics to drive market 145

11.3 EUROPE 147

11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 148

11.3.2 UK 151

11.3.2.1 Increasing focus on drug discovery & development to boost demand 151

11.3.3 GERMANY 153

11.3.3.1 Availability of funding for AI initiatives to fuel uptake 153

11.3.4 FRANCE 156

11.3.4.1 Increasing adoption of big data in healthcare computing to fuel uptake 156

11.3.5 ITALY 159

11.3.5.1 Digital transformation and innovation in healthcare to support market growth 159

11.3.6 SPAIN 161

11.3.6.1 Workforce shortages to fuel market 161

11.3.7 REST OF EUROPE 164

11.4 ASIA PACIFIC 167

11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 167

11.4.2 CHINA 171

11.4.2.1 Increasing incidence of infectious & chronic diseases to fuel uptake 171

11.4.3 JAPAN 174

11.4.3.1 Advanced healthcare infrastructure to propel market 174

11.4.4 INDIA 177

11.4.4.1 Growing focus on healthcare digitization to boost demand 177

11.4.5 REST OF ASIA PACIFIC 180

11.5 LATIN AMERICA 183

11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 183

11.5.2 BRAZIL 186

11.5.2.1 Strategic investments for AI adoption to support market growth 186

11.5.3 MEXICO 189

11.5.3.1 Growth in pharmaceutical R&D to drive market 189

11.5.4 REST OF LATIN AMERICA 191

11.6 MIDDLE EAST & AFRICA 194

11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 194

11.6.2 GCC COUNTRIES 197

11.6.2.1 Increasing investments in expansion of technological expertise to support market growth 197

11.6.3 REST OF MIDDLE EAST & AFRICA 200

12 COMPETITIVE LANDSCAPE 204

12.1 INTRODUCTION 204

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 204

12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN AI IN PATHOLOGY MARKET 205

12.3 REVENUE ANALYSIS, 2019−2023 207

12.4 MARKET SHARE ANALYSIS, 2023 207

12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 210

12.5.1 STARS 210

12.5.2 EMERGING LEADERS 210

12.5.3 PERVASIVE PLAYERS 210

12.5.4 PARTICIPANTS 210

12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 212

12.5.5.1 Company footprint 212

12.5.5.2 Offering footprint 213

12.5.5.3 Use-case footprint 214

12.5.5.4 End-user footprint 215

12.5.5.5 Region footprint 216

12.6 COMPANY EVALUATION MATRIX: STARTUPS /SMES, 2023 217

12.6.1 PROGRESSIVE COMPANIES 217

12.6.2 RESPONSIVE COMPANIES 217

12.6.3 DYNAMIC COMPANIES 217

12.6.4 STARTING BLOCKS 217

12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 219

12.7 COMPANY VALUATION & FINANCIAL METRICS 220

12.7.1 COMPANY VALUATION 220

12.7.2 FINANCIAL METRICS 220

12.7.3 BRAND/SOFTWARE COMPARISON ANALYSIS 221

12.8 COMPETITIVE SCENARIO 222

12.8.1 PRODUCT/SERVICE LAUNCHES & APPROVALS 222

12.8.2 DEALS 223

12.8.3 OTHER DEVELOPMENTS 224

13 COMPANY PROFILES 225

13.1 KEY PLAYERS 225

13.1.1 KONINKLIJKE PHILIPS N.V. 225

13.1.1.1 Business overview 225

13.1.1.2 Products/Services offered 226

13.1.1.3 MnM view 227

13.1.1.3.1 Key strengths 227

13.1.1.3.2 Strategic choices 227

13.1.1.3.3 Weaknesses & competitive threats 227

13.1.2 F. HOFFMANN-LA ROCHE LTD. 228

13.1.2.1 Business overview 228

13.1.2.2 Products/Services offered 229

13.1.2.3 Recent developments 230

13.1.2.3.1 Product/Service launches 230

13.1.2.3.2 Deals 231

13.1.2.4 MnM view 231

13.1.2.4.1 Key strengths 231

13.1.2.4.2 Strategic choices 231

13.1.2.4.3 Weaknesses & competitive threats 231

13.1.3 HOLOGIC, INC. 232

13.1.3.1 Business overview 232

13.1.3.2 Products/Services offered 233

13.1.3.3 Recent developments 234

13.1.3.3.1 Product/Service approvals 234

13.1.3.4 MnM view 234

13.1.3.4.1 Key strengths 234

13.1.3.4.2 Strategic choices 234

13.1.3.4.3 Weaknesses & competitive threats 234

13.1.4 AKOYA BIOSCIENCES, INC. 235

13.1.4.1 Business overview 235

13.1.4.2 Products/Services offered 237

13.1.4.3 Recent developments 237

13.1.4.3.1 Deals 237

13.1.4.4 MnM view 238

13.1.4.4.1 Key strengths 238

13.1.4.4.2 Strategic choices 238

13.1.4.4.3 Weaknesses & competitive threats 238

13.1.5 AIFORIA TECHNOLOGIES PLC 239

13.1.5.1 Business overview 239

13.1.5.2 Products/Services offered 240

13.1.5.3 Recent developments 241

13.1.5.3.1 Deals 241

13.1.5.4 MnM view 241

13.1.5.4.1 Key strengths 241

13.1.5.4.2 Strategic choices 241

13.1.5.4.3 Weaknesses & competitive threats 241

13.1.6 INDICA LABS INC. 242

13.1.6.1 Business overview 242

13.1.6.2 Products/Services offered 242

13.1.6.3 Recent developments 243

13.1.6.3.1 Product/Service launches & approvals 243

13.1.6.3.2 Deals 244

13.1.6.3.3 Expansions 245

13.1.7 OPTRASCAN 246

13.1.7.1 Business overview 246

13.1.7.2 Products/Services offered 246

13.1.7.3 Recent developments 247

13.1.7.3.1 Other developments 247

13.1.8 IBEX MEDICAL ANALYTICS LTD. 248

13.1.8.1 Business overview 248

13.1.8.2 Products/Services offered 248

13.1.8.3 Recent developments 249

13.1.8.3.1 Product/Service launches & approvals 249

13.1.8.3.2 Deals 250

13.1.9 MINDPEAK GMBH 252

13.1.9.1 Business overview 252

13.1.9.2 Products/Services offered 252

13.1.9.3 Recent developments 253

13.1.9.3.1 Product/Service approvals 253

13.1.9.3.2 Deals 253

13.1.9.3.3 Other developments 253

13.1.10 TRIBUN HEALTH 254

13.1.10.1 Business overview 254

13.1.10.2 Products/Services offered 254

13.1.10.3 Recent developments 255

13.1.10.3.1 Deals 255

13.1.11 TECHCYTE, INC. 256

13.1.11.1 Business overview 256

13.1.11.2 Products/services offered 256

13.1.11.3 Recent developments 257

13.1.11.3.1 Product/Service launches 257

13.1.11.3.2 Deals 257

13.1.11.3.3 Other developments 257

13.1.12 DEEP BIO INC. 258

13.1.12.1 Business overview 258

13.1.12.2 Products/Services offered 258

13.1.12.3 Recent developments 259

13.1.12.3.1 Deals 259

13.1.13 LUMEA INC. 260

13.1.13.1 Business overview 260

13.1.13.2 Products/Services offered 260

13.1.13.3 Recent developments 261

13.1.13.3.1 Deals 261

13.1.14 VISIOPHARM 262

13.1.14.1 Business overview 262

13.1.14.2 Products/Services offered 262

13.1.14.2.1 Recent developments 263

13.1.14.2.2 Product/Service launches 263

13.1.14.2.3 Expansions 263

13.1.15 AETHERAI 265

13.1.15.1 Business overview 265

13.1.15.2 Products/Services offered 265

13.1.15.3 Recent developments 265

13.1.15.3.1 Deals 265

13.1.16 AIOSYN 266

13.1.16.1 Business overview 266

13.1.16.2 Product/Services offered 266

13.1.16.2.1 Product/Service launches 267

13.1.16.3 Recent developments 267

13.1.16.3.1 Deals 267

13.1.16.4 Recent developments 267

13.1.16.4.1 Other developments 267

13.1.17 PAIGE AI, INC. 268

13.1.17.1 Business overview 268

13.1.17.2 Products/Services offered 268

13.1.17.3 Recent developments 269

13.1.17.3.1 Product/Service launches & approvals 269

13.1.17.3.2 Deals 270

13.1.17.3.3 Other developments 270

13.1.18 PROSCIA, INC. 271

13.1.18.1 Business overview 271

13.1.18.2 Products/Services offered 271

13.1.18.3 Recent developments 272

13.1.18.3.1 Product/Service launches & enhancements 272

13.1.18.3.2 Deals 273

13.1.18.3.3 Other developments 273

13.1.19 PATHAI, INC. 274

13.1.19.1 Business overview 274

13.1.19.2 Products/Services offered 274

13.1.19.3 Recent developments 275

13.1.19.3.1 Product/Service launches & approvals 275

13.1.19.3.2 Deals 276

13.1.20 TEMPUS LABS, INC. 277

13.1.20.1 Business overview 277

13.1.20.2 Products/Services offered 277

13.1.20.3 Recent developments 277

13.1.20.3.1 Product/Service launches 277

13.2 OTHER PLAYERS 278

13.2.1 KONFOONG BIOINFORMATION TECH CO., LTD. 278

13.2.2 DOMORE DIAGNOSTICS AS 278

13.2.3 VERILY LIFE SCIENCES, LLC 279

13.2.4 DEEPPATH 279

13.2.5 4D PATH INC. 280

14 APPENDIX 281

14.1 DISCUSSION GUIDE 281

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 288

14.3 CUSTOMIZATION OPTIONS 290

14.4 RELATED REPORTS 290

14.5 AUTHOR DETAILS 291

❖ 世界の病理学におけるAI市場に関するよくある質問(FAQ) ❖

・病理学におけるAIの世界市場規模は?

→MarketsandMarkets社は2024年の病理学におけるAIの世界市場規模を8,280万米ドルと推定しています。

・病理学におけるAIの世界市場予測は?

→MarketsandMarkets社は2029年の病理学におけるAIの世界市場規模を1億6,980万米ドルと予測しています。

・病理学におけるAI市場の成長率は?

→MarketsandMarkets社は病理学におけるAIの世界市場が2024年~2029年に年平均15.4%成長すると予測しています。

・世界の病理学におけるAI市場における主要企業は?

→MarketsandMarkets社は「Koninklijke Philips N.V. (Netherlands)、F. Hoffmann-La Roche Ltd (Switzerland)、Hologic、Inc. (US).など ...」をグローバル病理学におけるAI市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。