1 はじめに

1.1 調査目的 25

1.2 市場の定義 25

1.3 市場範囲 26

1.3.1 対象市場 26

1.3.2 対象範囲と対象外 27

1.3.3 考慮した年数 27

1.3.4 通貨

1.4 利害関係者 28

1.5 変更点のまとめ 28

2 調査方法 29

2.1 調査データ 29

2.2 調査デザイン 30

2.2.1 二次調査 30

2.2.2 一次調査 32

2.2.2.1 一次情報源 33

2.2.2.2 主要な業界インサイト 34

2.2.2.3 一次調査の内訳 34

2.3 市場規模の推定 35

2.3.1 ボトムアップアプローチ 36

2.3.1.1 アプローチ1:企業収益推定アプローチ 37

2.3.1.2 アプローチ2:顧客ベースの市場推定 38

2.3.1.3 アプローチ3:トップダウンアプローチ 39

2.3.1.4 アプローチ4:プライマリーインタビュー 40

2.3.1.5 CAGR予測 41

2.4 データの三角測量と市場の内訳 42

2.5 市場シェア評価 43

2.6 調査の前提 43

2.7 前提条件/市場予測方法 43

2.8 限界とリスク評価 44

3 エグゼクティブサマリー

4 プレミアムインサイト 49

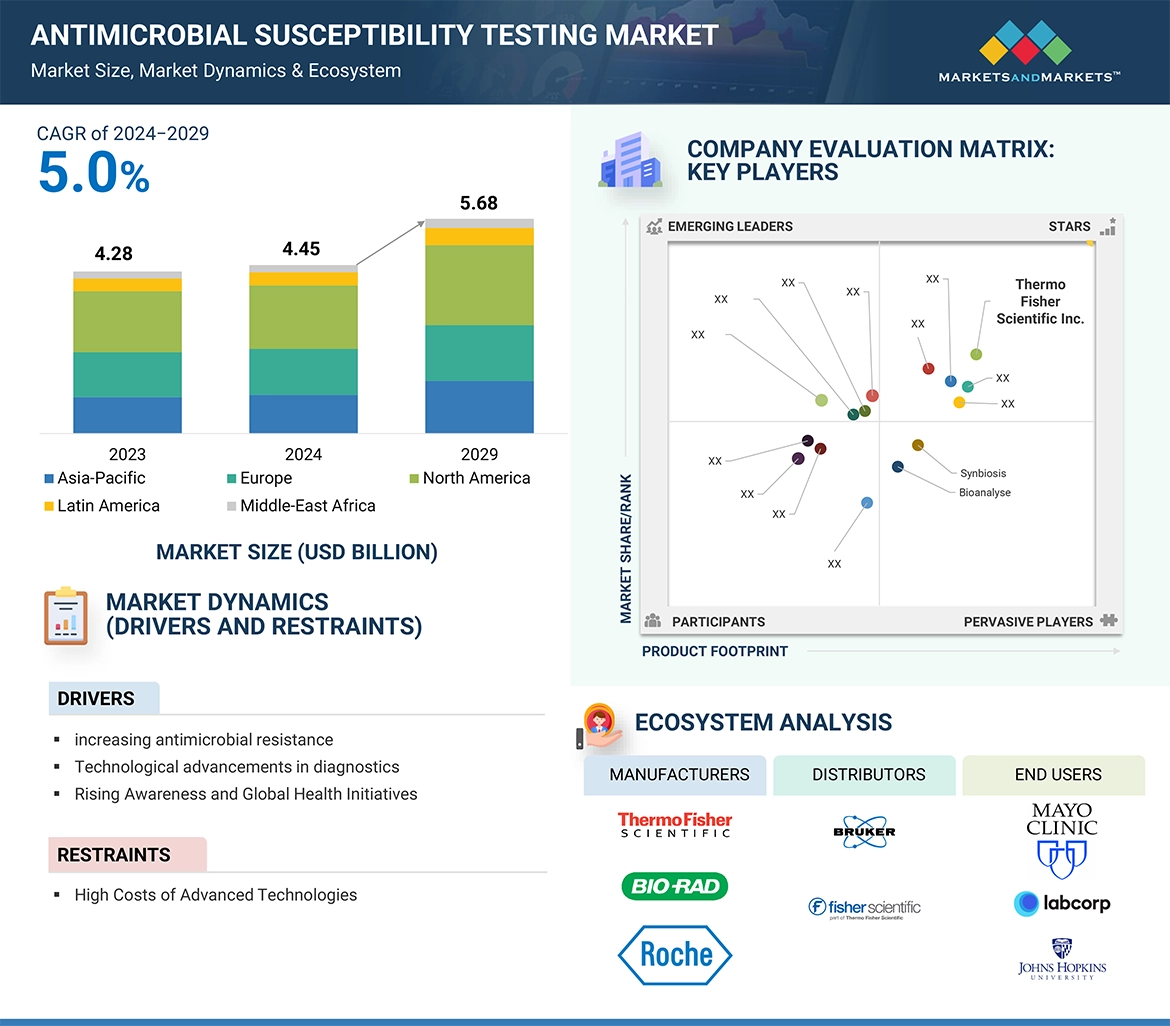

4.1 抗菌薬感受性試験市場の概要 49

4.2 抗菌薬感受性試験市場、

地域別、2024年対2029年(百万米ドル) 50

4.3 抗菌薬感受性試験市場、

地域・エンドユーザー別、2023年(百万米ドル) 51

4.4 抗菌薬感受性試験市場における地理的成長機会

市場成長機会

5 市場の概要

5.1 はじめに

5.2 市場ダイナミクス

5.2.1 推進要因 54

5.2.1.1 抗菌薬耐性の増加 54

5.2.1.2 診断技術の進歩 56

5.2.1.3 臨床研究アプリケーションの拡大 57

5.2.1.4 政府のイニシアチブの高まり 58

5.2.2 阻害要因 58

5.2.2.1 自動化機器の高コスト 58

5.2.3 機会 59

5.2.3.1 迅速検査ソリューションの出現 59

5.2.3.2 デジタルヘルス技術との統合 60

5.2.4 課題 61

5.2.4.1 複雑な規制環境 61

5.3 業界動向 62

5.3.1 等温マイクロカロリメトリー 62

5.3.2 蛍光活性化セルソーティング 63

5.3.3 スマートフォンベースの光学分光法 63

5.3.4 マイクロフルイディクスとマイクロドロップレット 63

5.4 エコシステム分析 64

5.5 サプライチェーン分析 65

5.5.1 著名企業 65

5.5.2 中小企業 65

5.5.3 エンドユーザー 65

5.6 バリューチェーン分析 66

5.7 ポーターの5つの力分析 68

5.7.1 新規参入企業の脅威 69

5.7.2 供給者の交渉力 69

5.7.3 買い手の交渉力 69

5.7.4 代替品の脅威 69

5.7.5 競合の激しさ 69

5.8 主要ステークホルダーと購買基準 70

5.8.1 購入プロセスにおける主要ステークホルダー 70

5.8.2 購入基準

5.9 特許分析 72

5.10 貿易分析 75

5.10.1 輸入データ 75

5.10.2 輸出データ 76

5.11 主要な会議とイベント(2024-2025年) 77

5.12 顧客のビジネスに影響を与えるトレンド/混乱 78

5.13 技術分析 78

5.13.1 主要技術 79

5.13.1.1 PCR 79

5.13.1.2 マイクロ流体工学とラボオンチップ 79

5.13.1.3 合成抗菌ペプチド 79

5.13.2 補完技術 79

5.13.2.1 マルディトフ 79

5.13.3 隣接技術 80

5.13.3.1 ナノテクノロジー 80

5.13.3.2 ナノモーション技術 80

5.13.3.3 バイオチップ技術 80

5.14 規制の状況 81

5.14.1 北米 81

5.14.1.1 米国 81

5.14.1.2 カナダ 82

5.14.2 欧州 82

5.14.3 アジア太平洋地域 83

5.14.3.1 日本 83

5.14.3.2 中国 84

5.14.3.3 インド 84

5.14.4 規制機関、政府機関、

その他の組織 85

5.15 投資と資金調達のシナリオ 87

5.16 価格分析 88

5.16.1 平均販売価格(地域別) 88

5.16.2 平均販売価格、主要プレーヤー別 92

5.17償還シナリオ 92

5.18 アンメットニーズと主要ペインポイント 94

5.19 抗菌薬感受性試験市場におけるAI/GEN AIの影響 94

6 抗菌薬感受性試験市場:製品別 96

6.1 導入 97

6.2 消耗品 97

6.2.1 培地および増殖培地 98

6.2.1.1 ディスク拡散法とブロス希釈法の高い利用率が市場を牽引 98

市場を牽引 98

6.2.2 感受性試験ディスク 99

6.2.2.1 低コスト、使いやすさが普及を後押し 99

6.2.3 マイクストリップ 99

6.2.3.1 正確性、簡便性、詳細な結果が利用を促進 99

6.2.4 感受性試験用プレート 100

6.2.4.1 専用プレートの入手可能性が市場を牽引 100

6.3 検査機器 101

6.3.1 自動化された検査機器 102

6.3.1.1 検査室の自動化傾向の継続がセグメント成長を促進 102

6.3.2 分子診断システム 103

6.3.2.1 分子診断の技術的進歩が市場を促進 103

が市場を牽引 103

6.4 研究用消耗品 104

6.4.1 病院で実施される感受性検査の増加が需要を牽引 104

7 抗菌薬感受性試験市場:タイプ別 105

7.1 導入 106

7.2 抗菌薬感受性試験 106

7.2.1 多剤耐性の出現が抗菌薬感受性検査製品の採用を増加させる 106

7.3 抗真菌剤感受性試験 107

7.3.1 感染症の流行増加が検査需要を促進 107

7.4 抗寄生虫感受性試験 109

7.4.1 市場成長を支える意識の高まり 109

7.5 抗ウイルス剤感受性試験 110

7.5.1 患者の転帰を向上させる抗ウイルス剤感受性検査の進歩 110

8 抗菌薬感受性試験市場:方法別 111

8.1 導入 112

8.2 定性試験法 112

8.2.1 自動化されたast 113

8.2.1.1 自動化機器の使用を促進する進歩と耐性パターン 113

8.2.2 ディスク拡散法 115

8.2.2.1 簡便性、正確性、柔軟性が採用を後押し 115

8.2.3 寒天希釈法 116

8.2.3.1 採用に影響する時間と労力のかかる性質 116

8.2.4 遺伝子型分析法 117

8.2.4.1 ゴールドスタンダードの地位が採用拡大に寄与 117

8.3 定量的方法 118

8.3.1 エテスト法 119

8.3.1.1 定量法市場ではEtest法が大きなシェアを占める 119

8.3.2 ブロスマクロダイリューション 120

8.3.2.1 高精度、同時検査機能が市場を牽引 120

9 抗菌薬感受性試験市場:用途別 121

9.1 はじめに 122

9.2 臨床診断 123

9.2.1 技術的進歩が市場を牽引 123

9.3 創薬・医薬品開発 124

9.3.1 需要拡大を支える研究開発とイノベーションの重視 124

9.4 疫学 125

9.4.1 より良い理解と意思決定の必要性が採用を促進 125

9.5 その他のアプリケーション 126

10 抗菌薬感受性試験市場:エンドユーザー別 127

10.1 導入 128

10.2 病院・診断センター 128

10.2.1 病院・診断センターが最大市場シェアを占める 128

10.3 製薬・バイオテクノロジー企業 129

10.3.1 製品開発の重視が市場を牽引 129

10.4 学術・研究機関 130

10.4.1 研究開発活動の活発化と研究支援が市場を牽引 130

10.5 臨床研究機関 132

10.5.1 世界的な臨床試験の拡大が市場成長を促進 132

11 抗菌薬感受性試験市場(地域別) 133

11.1 はじめに 134

11.2 北米 135

11.2.1 北米:マクロ経済見通し 135

11.2.2 米国 140

11.2.2.1 北米市場で最大のシェアを占める米国 140

11.2.3 カナダ 142

11.2.3.1 政府の好意的な取り組みが市場成長を促進 142

11.3 欧州 144

11.3.1 欧州: マクロ経済見通し 144

11.3.2 ドイツ 149

11.3.2.1 AMRに対する政府の取り組みが市場を牽引 149

11.3.3 フランス 150

11.3.3.1 AMRサーベイランスの強化が市場を牽引 150

11.3.4 英国 152

11.3.4.1 AMRに関する新たな行動計画が普及を促進 152

11.3.5 イタリア 153

11.3.5.1 AMR患者の増加と抗生物質の大量使用が検査需要を促進 153

11.3.6 スペイン 155

11.3.6.1 グラム陰性桿菌におけるAMRの増加が市場を牽引 155

11.3.7 その他の欧州 157

11.4 アジア太平洋地域 158

11.4.1 アジア太平洋地域:マクロ経済見通し 159

11.4.2 日本 164

11.4.2.1 感染症管理のための産官学連携が市場成長を支える 164

11.4.3 中国 166

11.4.3.1 AMR管理重視の高まりが市場を牽引 166

11.4.4 インド 168

11.4.4.1 臨床診断における政府と業界の取り組みが市場成長を促進 168

11.4.5 オーストラリア 170

11.4.5.1 抗菌薬治療ガイドラインの確立と実施が市場成長を促進 170

11.4.6 韓国 172

11.4.6.1 迅速なAMR検出の必要性が自動ASTシステムの需要を促進 172

11.4.7 その他のアジア太平洋地域 173

11.5 ラテンアメリカ 175

11.5.1 ラテンアメリカ:マクロ経済見通し 175

11.5.2 ブラジル 179

11.5.2.1 AMR検出の実施重視の高まりが市場を牽引 179

11.5.3 メキシコ 181

11.5.3.1 ASTシステムの拡大を支える経済成長 181

11.5.4 その他のラテンアメリカ 182

11.6 中東・アフリカ 183

11.6.1 中東・アフリカ:マクロ経済見通し 184

11.6.2 北アフリカ諸国 188

11.6.2.1 成長を支える医療インフラ開発イニシアティブ 188

11.6.3 その他の中東・アフリカ 189

12 競争環境 191

12.1 概要 191

12.2 主要プレーヤーの戦略/勝利への権利 191

12.2.1 抗菌薬感受性試験市場で各社が採用した戦略の概要 192

12.3 収益分析 193

12.4 市場シェア分析、2023年 194

12.5 企業評価マトリックス:主要企業(2023年) 196

12.5.1 スター企業 196

12.5.2 新興リーダー 196

12.5.3 浸透型プレーヤー 196

12.5.4 参加企業 196

12.5.5 企業フットプリント:主要プレーヤー(2023年) 198

12.5.5.1 企業フットプリント 198

12.5.5.2 地域別フットプリント 199

12.5.5.3 製品フットプリント 200

12.5.5.4 タイプ別フットプリント 201

12.5.5.5 メソッドフットプリント 202

12.5.5.6 アプリケーションフットプリント 203

12.5.5.7 エンドユーザーフットプリント 204

12.6 企業評価マトリクス:新興企業/SM(2023年) 205

12.6.1 進歩的企業 205

12.6.2 対応力のある企業 205

12.6.3 ダイナミックな企業 205

12.6.4 スタートアップ企業 205

12.6.5 競争ベンチマーク:新興企業/SM(2023年) 207

12.7 評価と財務指標 209

12.7.1 財務指標 209

12.7.2 企業評価 209

12.8 ブランド/製品の比較 210

12.9 競争シナリオ 211

12.9.1 製品の上市と承認 211

12.9.2 取引 212

13 会社プロファイル 213

BioMérieux (France)

Becton

Dickinson and company (US)

Thermo Fisher Scientific Inc. (US)

Danaher Corporation (US)

Bio-Rad laboratories (US)

14 付録 274

14.1 ディスカッションガイド 274

14.2 Knowledgestore: Marketsandmarketsの購読ポータル 279

14.3 カスタマイズオプション 281

14.4 関連レポート 281

14.5 著者の詳細 282

Key advantages of the AST market include the fact that it is very crucial in improving patient care through proper identification and timely selection of effective antimicrobial therapy. AST therefore has an added advantage in combating the rise of the antimicrobial resistance problem in providing correct susceptibility profiles that assist appropriate antibiotic usage.

“Consumables to register largest market share in 2022-2029.”

The largest share in antimicrobial susceptibility testing (AST) is held by the consumables segment. A significant and ever-increasing amount of critical material is consumed. It comprises culture media, reagents, antibiotic discs, and other materials and can be considered basically necessary for AST procedures. The market share of the consumable is thus added to owing to the growing incidence of infectious diseases and the emergence of antibiotic-resistant pathogens and increasing demand for AST services.

Second, the production of more sophisticated AST technologies will need more technical consumables. Obviously, molecular-based AST methods will require specific nucleic acid extraction kits, PCR reagents, and detection probes. Persistent demand for accurate and effective AST testing creates a sustainable demand for consumables, which further solidifies them as the core of the overall AST market.

“Hospitals & diagnostic centers segment held the largest share of antimicrobial susceptibility testingmarket in 2023, by End-user.”

Based on the end-user, the antimicrobial susceptibility testing market is segmented into hospitals & diagnostic laboratories, pharmaceutical and biotechnology companies, research & academic Institutes and clinical research organizations. In the year 2023, the global antimicrobial susceptibility testing market was dominated by hospitals and diagnostic centers. Growth within the number of hospitals and diagnostic centers in the AST market is also derived from increases in the timely and accurate diagnostics needs for managing infectious diseases and fighting against antimicrobial resistance.

"Asia Pacific to register highest growth rate in the market during the forecast period."

The Asia Pacific region, and China in particular, is witnessing a very rapid growth in the AST market due to various reasons. The increasing population in this region, allied with increasing incomes and access to better health care, has resulted in more stringent demands for diagnostics services. It is not overstressed in the sense that the ever-growing occurrence of infectious diseases and antimicrobial-resistant pathogens demands utmost importance in attaching real value to accurate AST as the primary basis for guiding proper treatment.

Advances in AST technology, particularly through the development of molecular rapid diagnostics and automated systems, is driving the market.. These speed up the process of AST, give results quicker in turn-around time, have increased efficiency with precise results, which put AST within the reach of healthcare providers. Additionally, the investments done by governments in upgrading the health care infrastructure along with such initiatives have paved a favorable path toward the growth of the market in the country, particularly in China.

A number of drivers were responsible for the upswing, including:

A breakdown of the primary participants referred to for this report is provided below:

• By Company Type: Tier 1–30%, Tier 2–42%, and Tier 3– 28%

• By Designation: C-level-- 10%, Director-level–14%, and Others–76%

• By Region: North America–40%, Europe-30%, Asia Pacific–20%, Latin America- 5%, Middle east and africa- 5%

Prominent players in this market are BioMérieux (France), Becton, Dickinson and company (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Bio-Rad laboratories (US), Bruker (US), Roche diagnostics (Switzerland, Accelerate diagnostics (US), Himedia laboratories (India), Liofilchem s.r.l.(Italy), Alifax s.r.l.(Italy), Creative Diagnostics (US), among others.

Research Coverage

The market is segmented into product, type, method, application, end user, and region. In the report, factors affecting the antimicrobial susceptibility testing market- drivers, restraints, opportunities, and challenges-are described. Opportunities and challenges for stakeholders and the details of leading players' competitive landscape are also highlighted. The report further segments the micro-markets into growth trends, prospects, and contribution to the antimicrobial susceptibility testing market. It forecasts revenue growth from different market segments, focusing on five major geographical regions.

Key Benefits of Buying the Report:

The report is designed to aid new entrants by providing them with detailed data on the antimicrobial susceptibility testing market, thereby allowing them to understand investment opportunities. It provides comprehensive insight into key players as well as smaller ones, thus favoring strong risk assessment and informed investment decisions. Due to precise segmentation-such as by end-users and regions-the report offers focused insights in specific segments of the market. It further outlines the critical trends, challenges, growth drivers, and opportunities that complete the strategic decision-making process with well-rounded analysis.

The report provides the insights on the following pointers:

Analysis of the key drivers, restraints, opportunities, and challenges influencing the rise of the antimicrobial susceptibility testing market. The key drivers of antimicrobial susceptibility testing are an upsurge in infectious diseases and, correspondingly, higher numbers of antibiotic resistance around the world. Growing demand for timely and accurate diagnostic tools that guide effective treatment strategies fuels demand for AST. Technologically, the development of rapid and automated testing systems supports market growth by increasing efficiency and accuracy in tests.

Product Development/Innovation: Insights into emerging technologies, current R&D activities, and recent launches of products and services in the antimicrobial susceptibility testing market.

Market Development: The report further provides in detail the profitable markets by segmenting the antimicrobial susceptibility testing market into various regions

Market Diversification: Detailed insight into new product launches, unexplored markets, recent developments, and investments made in the antimicrobial susceptibility testing market.

Competitive Assessment: Detailed assessment of market share, service offerings leading strategies of key players such as BioMérieux (France), Becton, Dickinson and company (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Bio-Rad laboratories (US), among others.

1 INTRODUCTION 25

1.1 STUDY OBJECTIVES 25

1.2 MARKET DEFINITION 25

1.3 MARKET SCOPE 26

1.3.1 MARKETS COVERED 26

1.3.2 INCLUSIONS AND EXCLUSIONS 27

1.3.3 YEARS CONSIDERED 27

1.3.4 CURRENCY CONSIDERED 27

1.4 STAKEHOLDERS 28

1.5 SUMMARY OF CHANGES 28

2 RESEARCH METHODOLOGY 29

2.1 RESEARCH DATA 29

2.2 RESEARCH DESIGN 30

2.2.1 SECONDARY RESEARCH 30

2.2.2 PRIMARY RESEARCH 32

2.2.2.1 Primary sources 33

2.2.2.2 Key industry insights 34

2.2.2.3 Breakdown of primaries 34

2.3 MARKET SIZE ESTIMATION 35

2.3.1 BOTTOM-UP APPROACH 36

2.3.1.1 Approach 1: Company revenue estimation approach 37

2.3.1.2 Approach 2: Customer-based market estimation 38

2.3.1.3 Approach 3: Top-down approach 39

2.3.1.4 Approach 4: Primary interviews 40

2.3.1.5 CAGR projections 41

2.4 DATA TRIANGULATION & MARKET BREAKDOWN 42

2.5 MARKET SHARE ASSESSMENT 43

2.6 STUDY ASSUMPTIONS 43

2.7 ASSUMPTIONS/MARKET FORECASTING METHODOLOGY 43

2.8 LIMITATIONS AND RISK ASSESSMENT 44

3 EXECUTIVE SUMMARY 45

4 PREMIUM INSIGHTS 49

4.1 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET OVERVIEW 49

4.2 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET,

BY REGION, 2024 VS. 2029 (USD MILLION) 50

4.3 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET,

BY REGION AND END USER, 2023 (USD MILLION) 51

4.4 GEOGRAPHIC GROWTH OPPORTUNITIES IN ANTIMICROBIAL SUSCEPTIBILITY

TESTING MARKET 52

5 MARKET OVERVIEW 53

5.1 INTRODUCTION 53

5.2 MARKET DYNAMICS 54

5.2.1 DRIVERS 54

5.2.1.1 Rising antimicrobial resistance 54

5.2.1.2 Advancements in diagnostic technologies 56

5.2.1.3 Expansion of clinical research applications 57

5.2.1.4 Rise in government initiatives 58

5.2.2 RESTRAINTS 58

5.2.2.1 High cost of automated instruments 58

5.2.3 OPPORTUNITIES 59

5.2.3.1 Emergence of rapid testing solutions 59

5.2.3.2 Integration with digital health technologies 60

5.2.4 CHALLENGES 61

5.2.4.1 Intricate regulatory landscape 61

5.3 INDUSTRY TRENDS 62

5.3.1 ISOTHERMAL MICROCALORIMETRY 62

5.3.2 FLUORESCENCE-ACTIVATED CELL SORTING 63

5.3.3 SMARTPHONE-BASED OPTICAL SPECTROSCOPY 63

5.3.4 MICROFLUIDICS AND MICRODROPLETS 63

5.4 ECOSYSTEM ANALYSIS 64

5.5 SUPPLY CHAIN ANALYSIS 65

5.5.1 PROMINENT COMPANIES 65

5.5.2 SMALL AND MEDIUM-SIZED ENTERPRISES 65

5.5.3 END USERS 65

5.6 VALUE CHAIN ANALYSIS 66

5.7 PORTER’S FIVE FORCES ANALYSIS 68

5.7.1 THREAT OF NEW ENTRANTS 69

5.7.2 BARGAINING POWER OF SUPPLIERS 69

5.7.3 BARGAINING POWER OF BUYERS 69

5.7.4 THREAT OF SUBSTITUTES 69

5.7.5 INTENSITY OF COMPETITIVE RIVALRY 69

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA 70

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS 70

5.8.2 BUYING CRITERIA 71

5.9 PATENT ANALYSIS 72

5.10 TRADE ANALYSIS 75

5.10.1 IMPORT DATA 75

5.10.2 EXPORT DATA 76

5.11 KEY CONFERENCES AND EVENTS, 2024–2025 77

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 78

5.13 TECHNOLOGY ANALYSIS 78

5.13.1 KEY TECHNOLOGIES 79

5.13.1.1 PCR 79

5.13.1.2 Microfluidics and lab-on-a-chip 79

5.13.1.3 Synthetic antimicrobial peptides 79

5.13.2 COMPLIMENTARY TECHNOLOGIES 79

5.13.2.1 MALDI-TOF 79

5.13.3 ADJACENT TECHNOLOGIES 80

5.13.3.1 Nanotechnology 80

5.13.3.2 Nanomotion technology 80

5.13.3.3 Biochip technology 80

5.14 REGULATORY LANDSCAPE 81

5.14.1 NORTH AMERICA 81

5.14.1.1 US 81

5.14.1.2 Canada 82

5.14.2 EUROPE 82

5.14.3 ASIA PACIFIC 83

5.14.3.1 Japan 83

5.14.3.2 China 84

5.14.3.3 India 84

5.14.4 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

5.15 INVESTMENT AND FUNDING SCENARIO 87

5.16 PRICING ANALYSIS 88

5.16.1 AVERAGE SELLING PRICE, BY REGION 88

5.16.2 AVERAGE SELLING PRICE, BY KEY PLAYER 92

5.17 REIMBURSEMENT SCENARIO 92

5.18 UNMET NEEDS AND KEY PAIN POINTS 94

5.19 IMPACT OF AI/GEN AI ON ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET 94

6 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT 96

6.1 INTRODUCTION 97

6.2 CONSUMABLES 97

6.2.1 CULTURE & GROWTH MEDIA 98

6.2.1.1 High utilization of disk diffusion and broth dilution methods

to drive market 98

6.2.2 SUSCEPTIBILITY TESTING DISKS 99

6.2.2.1 Low costs, ease of use to support adoption 99

6.2.3 MIC STRIPS 99

6.2.3.1 Accuracy, simplicity, and thorough results to drive usage 99

6.2.4 SUSCEPTIBILITY TESTING PLATES 100

6.2.4.1 Availability of specialized plates to drive market 100

6.3 LAB INSTRUMENTS 101

6.3.1 AUTOMATED LABORATORY INSTRUMENTS 102

6.3.1.1 Ongoing trend of laboratory automation to fuel segment growth 102

6.3.2 MOLECULAR DIAGNOSTICS SYSTEMS 103

6.3.2.1 Technological advancements in molecular diagnostics

to propel market 103

6.4 LAB DISPOSABLES 104

6.4.1 INCREASING NUMBER OF SUSCEPTIBILITY TESTS PERFORMED IN HOSPITALS TO DRIVE DEMAND 104

7 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY TYPE 105

7.1 INTRODUCTION 106

7.2 ANTIBACTERIAL SUSCEPTIBILITY TESTING 106

7.2.1 EMERGENCE OF MULTIDRUG-RESISTANCE TO INCREASE ADOPTION OF ANTIBACTERIAL SUSCEPTIBILITY TESTING PRODUCTS 106

7.3 ANTIFUNGAL SUSCEPTIBILITY TESTING 107

7.3.1 INCREASING PREVALENCE OF INFECTIOUS DISEASES TO PROPEL DEMAND FOR TESTING 107

7.4 ANTIPARASITIC SUSCEPTIBILITY TESTING 109

7.4.1 RISING AWARENESS TO SUPPORT MARKET GROWTH 109

7.5 ANTIVIRAL SUSCEPTIBILITY TESTING 110

7.5.1 ADVANCEMENTS IN ANTIVIRAL SUSCEPTIBILITY TESTING TO ENHANCE PATIENT OUTCOMES 110

8 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD 111

8.1 INTRODUCTION 112

8.2 QUALITATIVE METHODS 112

8.2.1 AUTOMATED AST 113

8.2.1.1 Advancements and resistance patterns to drive use of automated instruments 113

8.2.2 DISK DIFFUSION 115

8.2.2.1 Simplicity, accuracy, and flexibility to support adoption 115

8.2.3 AGAR DILUTION 116

8.2.3.1 Time-consuming and labor-intensive nature to affect adoption 116

8.2.4 GENOTYPIC METHOD 117

8.2.4.1 Gold standard status to support greater adoption 117

8.3 QUANTITATIVE METHODS 118

8.3.1 ETEST METHOD 119

8.3.1.1 Etest to hold larger share of quantitative methods market 119

8.3.2 BROTH MACRODILUTION 120

8.3.2.1 Precision, simultaneous testing capability to drive market 120

9 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION 121

9.1 INTRODUCTION 122

9.2 CLINICAL DIAGNOSTICS 123

9.2.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET 123

9.3 DRUG DISCOVERY & DEVELOPMENT 124

9.3.1 EMPHASIS ON R&D AND INNOVATION TO SUPPORT DEMAND GROWTH 124

9.4 EPIDEMIOLOGY 125

9.4.1 NEED FOR BETTER UNDERSTANDING AND DECISION MAKING TO PROPEL ADOPTION 125

9.5 OTHER APPLICATIONS 126

10 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER 127

10.1 INTRODUCTION 128

10.2 HOSPITALS & DIAGNOSTIC CENTERS 128

10.2.1 HOSPITALS & DIAGNOSTIC CENTERS TO HOLD LARGEST MARKET SHARE 128

10.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES 129

10.3.1 EMPHASIS ON PRODUCT DEVELOPMENT TO DRIVE MARKET 129

10.4 ACADEMIC & RESEARCH INSTITUTES 130

10.4.1 RISING R&D ACTIVITY AND SUPPORT FOR RESEARCH TO DRIVE MARKET 130

10.5 CLINICAL RESEARCH ORGANIZATIONS 132

10.5.1 EXPANSION OF CLINICAL TRIALS WORLDWIDE TO PROPEL MARKET GROWTH 132

11 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION 133

11.1 INTRODUCTION 134

11.2 NORTH AMERICA 135

11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK 135

11.2.2 US 140

11.2.2.1 US to hold largest share of North American market 140

11.2.3 CANADA 142

11.2.3.1 Favorable government initiatives to drive market growth 142

11.3 EUROPE 144

11.3.1 EUROPE: MACROECONOMIC OUTLOOK 144

11.3.2 GERMANY 149

11.3.2.1 Government initiatives for AMR to drive market 149

11.3.3 FRANCE 150

11.3.3.1 Focus on enhancing AMR surveillance to propel market 150

11.3.4 UK 152

11.3.4.1 New action plans for AMR to propel adoption 152

11.3.5 ITALY 153

11.3.5.1 Rising instances of AMR and high use of antibiotics to propel demand for testing 153

11.3.6 SPAIN 155

11.3.6.1 Rising AMR in gram-negative bacilli to drive market 155

11.3.7 REST OF EUROPE 157

11.4 ASIA PACIFIC 158

11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK 159

11.4.2 JAPAN 164

11.4.2.1 Industry-government collaborations for infectious disease management to support market growth 164

11.4.3 CHINA 166

11.4.3.1 Rising emphasis on AMR management to drive market 166

11.4.4 INDIA 168

11.4.4.1 Expanding government and industry efforts in clinical diagnostics to propel market growth 168

11.4.5 AUSTRALIA 170

11.4.5.1 Establishment and implementation of antimicrobial treatment guidelines to favor market growth 170

11.4.6 SOUTH KOREA 172

11.4.6.1 Need for rapid AMR detection to drive demand for automated AST systems 172

11.4.7 REST OF ASIA PACIFIC 173

11.5 LATIN AMERICA 175

11.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK 175

11.5.2 BRAZIL 179

11.5.2.1 Rising emphasis on implementing AMR detection to drive market 179

11.5.3 MEXICO 181

11.5.3.1 Economic growth to support expansion of AST systems 181

11.5.4 REST OF LATIN AMERICA 182

11.6 MIDDLE EAST & AFRICA 183

11.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK 184

11.6.2 GCC COUNTRIES 188

11.6.2.1 Healthcare infrastructural development initiatives to support growth 188

11.6.3 REST OF MIDDLE EAST & AFRICA 189

12 COMPETITIVE LANDSCAPE 191

12.1 OVERVIEW 191

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 191

12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET 192

12.3 REVENUE ANALYSIS 193

12.4 MARKET SHARE ANALYSIS, 2023 194

12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 196

12.5.1 STARS 196

12.5.2 EMERGING LEADERS 196

12.5.3 PERVASIVE PLAYERS 196

12.5.4 PARTICIPANTS 196

12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 198

12.5.5.1 Company footprint 198

12.5.5.2 Region footprint 199

12.5.5.3 Product footprint 200

12.5.5.4 Type footprint 201

12.5.5.5 Method footprint 202

12.5.5.6 Application footprint 203

12.5.5.7 End-user footprint 204

12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 205

12.6.1 PROGRESSIVE COMPANIES 205

12.6.2 RESPONSIVE COMPANIES 205

12.6.3 DYNAMIC COMPANIES 205

12.6.4 STARTING BLOCKS 205

12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 207

12.7 VALUATION & FINANCIAL METRICS 209

12.7.1 FINANCIAL METRICS 209

12.7.2 COMPANY VALUATION 209

12.8 BRAND/PRODUCT COMPARISON 210

12.9 COMPETITIVE SCENARIO 211

12.9.1 PRODUCT LAUNCHES & APPROVALS 211

12.9.2 DEALS 212

13 COMPANY PROFILES 213

13.1 KEY PLAYERS 213

13.1.1 BIOMÉRIEUX SA 213

13.1.1.1 Business overview 213

13.1.1.2 Products offered 214

13.1.1.3 Recent developments 216

13.1.1.3.1 Product launches & approvals 216

13.1.1.3.2 Deals 217

13.1.1.4 MnM view 217

13.1.1.4.1 Right to win 217

13.1.1.4.2 Strategic choices 217

13.1.1.4.3 Weaknesses & competitive threats 217

13.1.2 BECTON, DICKINSON AND COMPANY 218

13.1.2.1 Business overview 218

13.1.2.2 Products offered 220

13.1.2.3 Recent developments 221

13.1.2.3.1 Deals 221

13.1.2.3.2 Other developments 221

13.1.2.4 MnM view 221

13.1.2.4.1 Right to win 221

13.1.2.4.2 Strategic choices 222

13.1.2.4.3 Weaknesses and competitive threats 222

13.1.3 THERMO FISHER SCIENTIFIC INC. 223

13.1.3.1 Business overview 223

13.1.3.2 Products offered 224

13.1.3.3 Recent developments 226

13.1.3.3.1 Product launches & approvals 226

13.1.3.3.2 Deals 226

13.1.3.4 MnM view 227

13.1.3.4.1 Right to win 227

13.1.3.4.2 Strategic choices 227

13.1.3.4.3 Weaknesses and competitive threats 227

13.1.4 DANAHER CORPORATION 228

13.1.4.1 Business overview 228

13.1.4.2 Products offered 230

13.1.4.3 Recent developments 231

13.1.4.3.1 Product launches & approvals 231

13.1.4.3.2 Deals 232

13.1.4.4 MnM view 233

13.1.4.4.1 Right to win 233

13.1.4.4.2 Strategic choices 233

13.1.4.4.3 Weaknesses and competitive threats 233

13.1.5 BIO-RAD LABORATORIES, INC. 234

13.1.5.1 Business overview 234

13.1.5.2 Products offered 235

13.1.5.2.1 Deals 236

13.1.5.3 MnM view 236

13.1.5.3.1 Right to win 236

13.1.5.3.2 Strategic choices 236

13.1.5.3.3 Weaknesses and competitive threats 236

13.1.6 BRUKER 237

13.1.6.1 Business overview 237

13.1.6.2 Products offered 239

13.1.6.3 Recent developments 241

13.1.6.3.1 Product launches & approvals 241

13.1.6.3.2 Deals 241

13.1.7 ROCHE DIAGNOSTICS 242

13.1.7.1 Business overview 242

13.1.7.2 Products offered 243

13.1.7.3 Recent developments 245

13.1.7.3.1 Product launches & approvals 245

13.1.7.3.2 Deals 246

13.1.8 MERCK KGAA 247

13.1.8.1 Business overview 247

13.1.8.2 Products offered 248

13.1.8.3 Recent developments 249

13.1.8.3.1 Deals 249

13.1.9 ACCELERATE DIAGNOSTICS, INC. 250

13.1.9.1 Business overview 250

13.1.9.2 Products offered 251

13.1.9.3 Recent developments 252

13.1.9.3.1 Product launches & approvals 252

13.1.9.3.2 Deals 252

13.1.9.3.3 Other developments 252

13.1.10 HIMEDIA LABORATORIES 253

13.1.10.1 Business overview 253

13.1.10.2 Products offered 254

13.1.11 LIOFILCHEM S.R.L. 255

13.1.11.1 Business overview 255

13.1.11.2 Products offered 255

13.1.12 ALIFAX S.R.L. 258

13.1.12.1 Business overview 258

13.1.12.2 Products offered 258

13.1.13 CREATIVE DIAGNOSTICS 259

13.1.13.1 Business overview 259

13.1.13.2 Products offered 260

13.1.14 SYNBIOSIS 261

13.1.14.1 Business overview 261

13.1.14.2 Products offered 262

13.1.15 BIOANALYSE 263

13.1.15.1 Business overview 263

13.1.15.2 Products offered 263

13.2 OTHER KEY PLAYERS 264

13.2.1 ZHUHAI DL BIOTECH CO., LTD. 264

13.2.2 ELITECHGROUP 265

13.2.3 MAST GROUP LTD. 267

13.2.4 CONDALAB 268

13.2.5 GENEFLUIDICS, INC. 269

13.2.6 BIOTRON HEALTHCARE 269

13.2.7 INVIVOGEN 270

13.2.8 MP BIOMEDICALS 271

13.2.9 QUANTAMATRIX INC. 271

13.2.10 SYSMEX EUROPE SE 272

13.2.11 COPAN DIAGNOSTICS INC. 272

13.2.12 ERBA DIAGNOSTICS MANNHEIM GMBH 273

14 APPENDIX 274

14.1 DISCUSSION GUIDE 274

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 279

14.3 CUSTOMIZATION OPTIONS 281

14.4 RELATED REPORTS 281

14.5 AUTHOR DETAILS 282

❖ 世界の抗菌薬感受性試験市場に関するよくある質問(FAQ) ❖

・抗菌薬感受性試験の世界市場規模は?

→MarketsandMarkets社は2024年の抗菌薬感受性試験の世界市場規模を44.5億米ドルと推定しています。

・抗菌薬感受性試験の世界市場予測は?

→MarketsandMarkets社は2029年の抗菌薬感受性試験の世界市場規模を56.8億米ドルと予測しています。

・抗菌薬感受性試験市場の成長率は?

→MarketsandMarkets社は抗菌薬感受性試験の世界市場が2024年~2029年に年平均5.0%成長すると予測しています。

・世界の抗菌薬感受性試験市場における主要企業は?

→MarketsandMarkets社は「BioMérieux (France)、Becton、Dickinson and company (US)、Thermo Fisher Scientific Inc. (US)、Danaher Corporation (US)、Bio-Rad laboratories (US)など ...」をグローバル抗菌薬感受性試験市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。