1 はじめに 48

1.1 調査目的 48

1.2 市場の定義 48

1.3 調査範囲 49

1.3.1 対象市場と地域範囲 49

1.3.2 対象範囲と除外項目 50

1.3.3 考慮した年数 51

1.3.4 考慮した通貨 52

1.4 制限事項 52

1.4.1 範囲に関する限界 52

1.4.2 方法論に関連する限界 52

1.5 利害関係者

1.6 変更点のまとめ 53

2 調査方法 54

2.1 調査データ 54

2.1.1 二次データ 55

2.1.1.1 二次情報源のリスト 55

2.1.1.2 二次資料からの主要データ 55

2.1.2 一次データ 56

2.1.2.1 一次資料のリスト 57

2.1.2.2 一次資料からの主要データ 58

2.1.2.3 主要な業界インサイト 58

2.1.2.4 専門家へのインタビューの内訳 59

2.2 市場規模の推定 59

2.3 要因分析 61

2.4 成長予測 61

2.5 データ三角測量 65

2.6 リサーチの前提 66

2.7 リスク評価 66

3 エグゼクティブ・サマリー 67

4 プレミアムインサイト

4.1 医療診断用人工知能市場におけるプレーヤーにとっての魅力的な機会 71

4.2 北米:医療診断における人工知能市場、

用途別、国別 72

4.3 医療診断における人工知能市場:主要国別 73

4.4 医療診断における人工知能市場:地域別 74

4.5 医療診断における人工知能市場:先進国vs. 新興国

5 市場概要 75

5.1 はじめに 75

5.2 市場ダイナミクス 75

5.2.1 推進要因 76

5.2.1.1 デジタル化と情報システム導入の増加に伴うビッグデータの流入 76

5.2.1.2 業界を超えたパートナーシップとコラボレーションの急増 76

5.2.1.3 放射線科におけるAIベースのソリューション需要の増加 77

5.2.1.4 医療現場でAIベースの技術を導入する政府のイニシアティブの高まり 78

5.2.1.5 AIベースの新興企業に対する豊富な資金提供 78

5.2.2 阻害要因 79

5.2.2.1 医療従事者がAIベース技術の導入に消極的 79

5.2.2.2 不十分なAI労働力と医療ソフトウェアに関する曖昧な規制ガイドライン 79

5.2.3 機会 80

5.2.3.1 未開拓の新興市場 80

5.2.3.2 人間を意識したAIシステム開発への注目の高まり 81

5.2.4 課題 81

5.2.4.1 予算の制約 81

5.2.4.2 デジタルフットプリントの増加と技術トレンドによる非構造化医療データ 81

5.2.4.3 データ保護に関するプライバシーの問題 82

5.2.4.4 AIソリューションの相互運用性の制限 82

5.3 エコシステム分析 83

5.4 ケーススタディ分析 84

5.4.1 マヨ・クリニック、AI対応のデジタル診断を統合し、グーグル・クラウド・プラットフォームで医学研究を促進 84

5.4.2 人員不足とバックログの課題を解決するveye lung nodules 84

5.4.3 NVIDIA AIエンタープライズ・ソフトウェアとGPUが腫瘍ターゲティングの性能と精度を向上 85

5.4.4 浙江大学と浙江 de image solutions はインテルの AI ソリューションを使用して超音波を処理 85

5.4.5 ウェイテマタ地区保健委員会プロジェクトが高精度医療ソリューションを活用 86

5.5 バリューチェーン分析 86

5.5.1 上流 87

5.5.2 ミッドストリーム 87

5.5.3 ダウンストリーム 87

5.6 貿易分析 88

5.7 ポーターの5つの力分析 90

5.7.1 新規参入の脅威 91

5.7.2 代替品の脅威 91

5.7.3 供給者の交渉力 91

5.7.4 買い手の交渉力 91

5.7.5 競合の激しさ 92

5.8 主要ステークホルダーと購買基準 92

5.8.1 購入プロセスにおける主要ステークホルダー 92

5.8.2 購入基準 94

5.9 規制情勢 95

5.9.1 北米 95

5.9.1.1 1996年医療保険の相互運用性と説明責任に関する法律(HIPAA) 96

5.9.1.2 2009年経済的及び臨床的保健のための医療情報技術法(HITECH) 96

5.9.1.3 2017年消費者プライバシー保護法 96

5.9.1.4 2015年国家サイバーセキュリティ保護促進法 96

5.9.1.5 Future of Life InstituteのAsilomar AI原則 97

5.9.2 欧州 97

5.9.2.1 欧州医療機器規則(EU)2017/745と体外診断用医療機器規則(EU)2017/746、一般データ保護規則2016/679との組み合わせ 97

5.9.2.2 人工知能法(AI法) 97

5.9.3 アジア太平洋地域 98

5.9.3.1 中華人民共和国のサイバーセキュリティ法 98

5.9.4 その他の地域 98

5.9.4.1 個人情報保護法 98

5.9.5 規制機関、政府機関、その他の組織 99

5.10 特許分析 102

5.10.1 診断用AIの特許公開動向 102

5.10.2 出願管轄と上位出願人の分析 103

5.11 技術分析 106

5.11.1 主要技術 106

5.11.1.1 機械学習 106

5.11.1.2 ディープラーニング 106

5.11.2 補完技術 107

5.11.2.1 ラボラトリーオートメーション 107

5.11.2.2 ehr 107

5.11.3 隣接技術 107

5.11.3.1 自然言語処理 107

5.11.3.2 ビッグデータ分析 107

5.12 価格分析 108

5.12.1 指標価格分析(コンポーネント別) 108

5.12.2 主要プレイヤーの指標価格分析(コンポーネント別) 109

5.12.3 地域別の指標価格分析 110

5.13 主要会議・イベント(2024~2025年) 112

5.14 顧客ビジネスに影響を与えるトレンド/破壊 113

5.15 アンメットニーズ: 医療診断における人工知能市場 114

5.15.1 エンドユーザーの期待 115

5.16 保険償還シナリオ 116

5.16.1 放射線診断におけるAIソフトウェアの償還 118

5.17 投資と資金調達シナリオ 119

6 医療診断における人工知能市場、

コンポーネント別 120

6.1 導入 121

6.2 ソフトウェア 123

6.2.1 画像診断ソフトウェア 126

6.2.1.1 高度な機能の統合(3Dレンダリング、AI主導の画像解析、自動レポート)が需要を牽引 126

6.2.2 予測分析ソフトウェア 128

6.2.2.1 病気の早期発見、個別化治療、業務効率向上のための医療におけるAIを活用した予測分析の利用拡大が市場を牽引 128

6.2.3 診断ソフトウェア 130

6.2.3.1 正確性と効率性を高めるための診断プロセスへのAI統合の増加が市場成長を促進 130

6.3 サービス 132

6.3.1 AIシステムの導入・統合の増加が需要を促進 132

6.4 ハードウェア 134

6.4.1 プロセッサ 137

6.4.1.1 MPU 140

6.4.1.1.1 放射線科、腫瘍科、循環器科における正確な画像診断のためのAI搭載医療診断システムの需要増加が市場を牽引 140

6.4.1.2 GPU 142

6.4.1.2.1 医療画像診断の精度と有効性を高める能力が需要を牽引 142

6.4.1.3 FPGA 144

6.4.1.3.1 医用画像処理の速度と精度を最適化し、医用画像システムの堅牢性を向上させる能力が需要を牽引 144

6.4.1.4 asic 146

6.4.1.4.1 需要を支える高速動作機能 146

6.4.2 メモリ 148

6.4.2.1 AIアプリケーション向け広帯域メモリの開発が市場を牽引 148

6.4.3 ネットワーク 151

6.4.3.1 アダプター 153

6.4.3.1.1 シームレスなデータ統合の需要増と機械学習・画像技術の採用拡大が市場を牽引 153

6.4.3.2 スイッチ 155

6.4.3.2.1 効率的なデータルーティングと統合機能が需要を促進 155

6.4.3.3 インターコネクト 157

6.4.3.3.1 効率的なデータ伝送の必要性が需要を促進 157

7 医療診断における人工知能市場(エンドユーザー別) 160

7.1 導入 161

7.2 病院 164

7.2.1 先進的なAI画像診断ソリューションの導入増加が市場を牽引 164

7.3 画像診断センター 166

7.3.1 民間画像診断センターの増加が市場を牽引 166

7.4 診断ラボ 168

7.4.1 検体検査量の増加が市場を牽引 168

7.5 その他のエンドユーザー 170

8 医療診断における人工知能市場(モダリティ別) 173

8.1 はじめに 174

8.2 画像診断モダリティ 176

8.2.1 コンピュータ断層撮影 179

8.2.1.1 AIソリューションに対応した心臓CT装置の利用可能性の増加が市場を牽引 179

8.2.2 X線 181

8.2.2.1 主要企業によるX線画像診断の革新的AIソリューションが市場を牽引 181

8.2.3 磁気共鳴イメージング 183

8.2.3.1 技術進歩の高まりがMRIにおけるAIの採用を促進 183

8.2.4 超音波 185

8.2.4.1 卵巣がんの有病率の増加が市場を牽引 185

8.2.5 マンモグラフィ 187

8.2.5.1 乳がん有病率の増加が市場を牽引 187

8.2.6 その他の画像診断モダリティ 189

8.3 診断モダリティ 191

8.3.1 免疫測定法 194

8.3.1.1 個別化治療への関心の高まりが市場を牽引 194

8.3.2 臨床化学 196

8.3.2.1 精密医療と効率的な医療システムへの需要の増加が市場を牽引 196

8.3.3 血液学 198

8.3.3.1 効率的な血液疾患診断へのニーズの高まりとAI駆動技術の進歩が市場を牽引 198

8.3.4 微生物学 200

8.3.4.1 精密な診断と抗菌剤耐性に対する需要の高まりがAI導入を促進 200

8.3.5 その他の診断モダリティ 202

9 医療診断における人工知能市場、

アプリケーション別 205

9.1 はじめに 206

9.2 生体内診断アプリケーション 208

9.2.1 放射線医学 211

9.2.1.1 正確な画像判読と診断ミスの減少がAI需要を促進 211

9.2.2 がん領域 213

9.2.2.1 癌の早期発見と個別化治療が市場を牽引 213

9.2.3 循環器 216

9.2.3.1 CVDに関連する複雑性の増加が市場を牽引 216

9.2.4 神経分野 218

9.2.4.1 アルツハイマー病の診断への応用がAI技術の需要を高める 218

9.2.5 産科/婦人科 220

9.2.5.1 婦人科手術における低侵襲技術の使用増加が市場を牽引 220

9.2.6 眼科 222

9.2.6.1 眼疾患の早期発見・予防ニーズの高まりが市場を牽引 222

9.2.7 その他の生体内アプリケーション 224

9.3 体外診断アプリケーション 226

9.3.1 感染症 229

9.3.1.1 疾患発生管理の必要性と抗菌薬耐性が市場を牽引 229

9.3.2 内分泌 231

9.3.2.1 糖尿病や甲状腺疾患の診断におけるAI利用の増加が市場を牽引 231

9.3.3 自己免疫検査 233

9.3.3.1 自己免疫疾患の検出精度を高め、早期診断・治療を改善する機能が市場を牽引 233

9.3.4 血液スクリーニングと凝固検査 235

9.3.4.1 血液由来疾患や凝固障害のスクリーニング需要の増加が市場を牽引 235

9.3.5 その他の体外アプリケーション 237

10 医療診断における人工知能市場:地域別 240

10.1 はじめに 241

10.2 北米 242

10.2.1 北米のマクロ経済見通し 252

10.2.2 米国 252

10.2.2.1 画像診断件数の増加が市場を牽引 252

10.2.3 カナダ 262

10.2.3.1 放射線学における研究助成金と学術の向上が市場を牽引 262

10.3 欧州 273

10.3.1 欧州のマクロ経済見通し 274

10.3.2 ドイツ 283

10.3.2.1 医療診断における人工知能(AI)導入促進のための政府支援の増加が市場を牽引 283

10.3.3 フランス 293

10.3.3.1 医療画像診断におけるAI研究強化のための企業向け資金提供が市場成長を促進 293

10.3.4 イギリス 303

10.3.4.1 X線撮影手技の増加が市場を牽引 303

10.3.5 イタリア 313

10.3.5.1 老年人口の増加によるEHRとEMRの台数増加が需要を牽引 313

10.3.6 スペイン 323

10.3.6.1 AIに関する意識の高まりが市場成長を後押し 323

10.3.7 その他のヨーロッパ 333

10.4 アジア太平洋地域 342

10.4.1 アジア太平洋地域のマクロ経済見通し 352

10.4.2 中国 353

10.4.2.1 臨床意思決定におけるAI利用の増加が市場を牽引 353

10.4.3 日本 363

10.4.3.1 強固な医療インフラが先進的AIソリューションの導入を促進 363

10.4.4 インド 373

10.4.4.1 研究開発投資に対する政府の好意的な取り組みが市場を牽引 373

10.4.5 その他のアジア太平洋地域 382

10.5 ラテンアメリカ 392

10.5.1 ラテンアメリカのマクロ経済見通し 401

10.5.2 ブラジル 401

10.5.2.1 医療市場における高い技術進歩が市場を牽引 401

10.5.3 メキシコ 411

10.5.3.1 AI関連教育への投資流入とイニシアチブが市場を牽引 411

10.5.4 その他のラテンアメリカ 420

10.6 中東・アフリカ 430

10.6.1 GCC諸国 439

10.6.1.1 医療水準の向上、業務の合理化、質の高い医療の提供を目的とした診断におけるAI導入の増加が市場を牽引 439

10.6.2 その他の中東・アフリカ 449

11 競争環境 460

11.1 概要 460

11.2 主要プレーヤーの戦略/勝利への権利 460

11.3 収益分析 461

11.4 市場シェア分析 462

11.5 ランキング分析 465

11.6 企業評価マトリックス:主要プレーヤー2023 466

11.6.1 スター企業 466

11.6.2 新興リーダー 466

11.6.3 浸透型プレーヤー 466

11.6.4 参加企業 466

11.6.5 企業フットプリント:主要プレイヤー(2023年) 468

11.6.5.1 企業フットプリント 468

11.6.5.2 コンポーネントのフットプリント 469

11.6.5.3 アプリケーションフットプリント 470

11.6.5.4 エンドユーザーフットプリント 471

11.6.5.5 地域別フットプリント 472

11.7 企業評価マトリクス:新興企業/SM(2023年) 473

11.7.1 先進的企業 473

11.7.2 ダイナミックな企業 473

11.7.3 対応力のある企業 473

11.7.4 スタートアップ・ブロック 473

11.7.5 競争ベンチマーク:新興企業/中小企業(2023年) 475

11.7.5.1 主要新興企業/中小企業の詳細リスト 475

11.7.5.2 主要新興企業/SMEの競合ベンチマーキング 476

11.8 企業評価と財務指標 477

11.9 ブランド/製品の比較 478

11.10 競争シナリオ 479

11.10.1 製品の発売 479

11.10.2 取引 481

11.10.3 その他 483

12 企業プロファイル 484

12.1 主要企業 484

Microsoft (US)

Merative (US)

Intel Corporation (US)

NVIDIA Corporation (US)

Google (US)

GE HealthCare (US)

Digital Diagnostics Inc. (US)

Siemens Healthineers (Germany)

Koninklijke Philips N.V. (Netherlands)

Advanced Micro Devices Inc. (US)

HeartFlow Inc. (US)

Enlitic Inc. (US)

InformAI (US)

isometric (Belgium)

Butterfly Network Inc. (US)

Aidence (Netherlands)

Nano-X Imaging LTD. (Israel)

Quibim (Spain)

Qure.ai (India)

Viz.ai Inc (US)

Aidoc (US)

Lunit Inc. (South Korea)

Therapixel (France)

EchoNous Inc. (US)

and Brainomix (UK)

13 付録 541

13.1 ディスカッション・ガイド 541

13.2 Knowledgestore: Marketsandmarketsの購読ポータル 544

13.3 カスタマイズオプション 546

13.4 関連レポート 546

13.5 著者の詳細 547

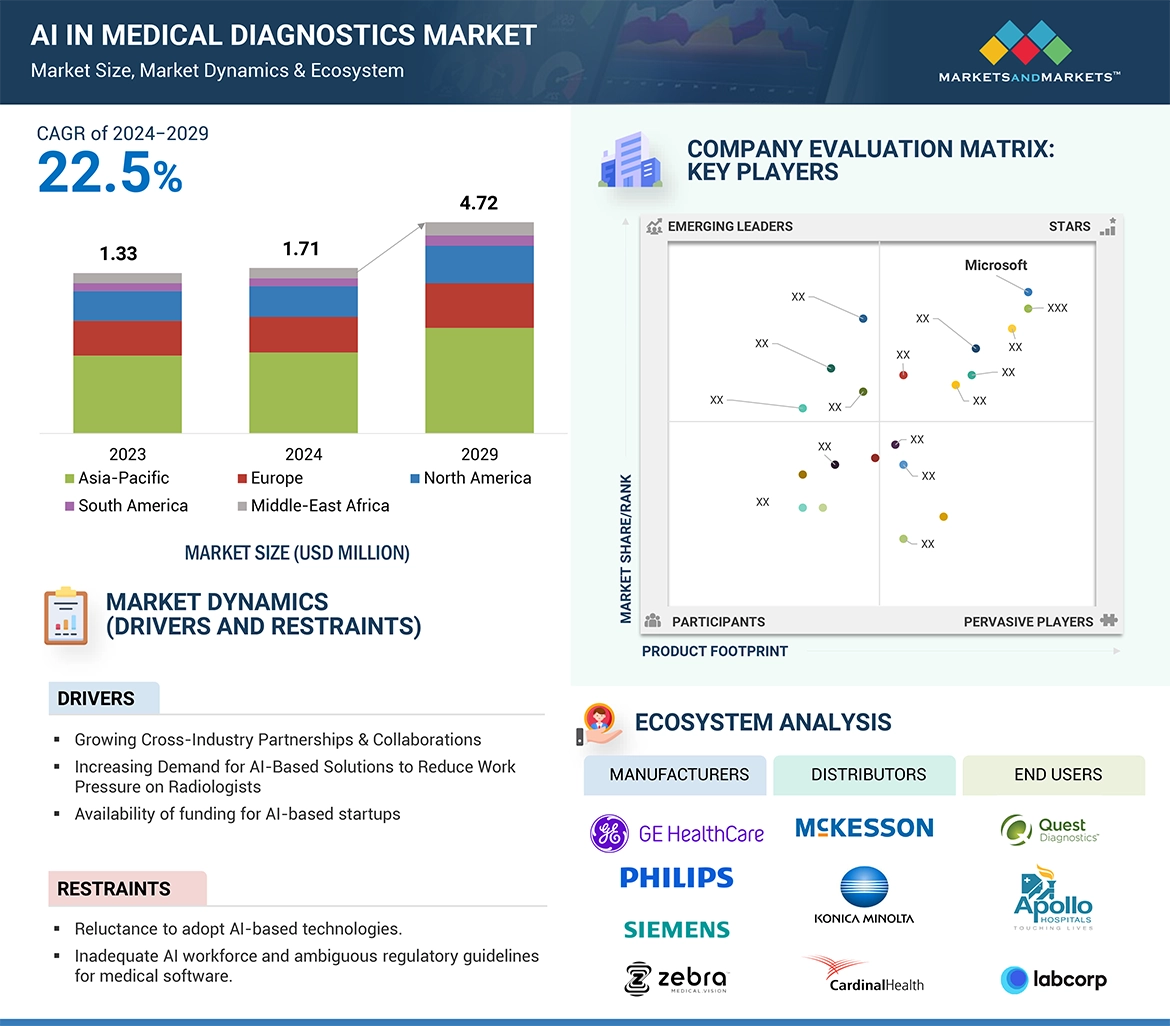

The adoption of AI in medical diagnostics is rising at a faster pace owing to factors such as growing government focus on increasing uptake of AI-based technologies, AI solutions being more used by radiologists to decrease workload, and the increasing number of cross-industry partnerships & collaborations.

However, the shortage of trained AI workforce and unstable regulations are factors expected to restrain the market growth.

“Services segment is expected to grow at the highest rate from 2024 to 2029 in global AI in medical diagnostics market”

The AI in medical diagnostics market is categorized by components into software, hardware, and services. In 2023, the software segment dominated the market due to its capability to streamline operations, automate workflows, and enhance diagnostic accuracy. However, from 2024 to 2029, the services segment is expected to witness the highest growth rate, driven by increasing demand for managed services, integration support, and training required to deploy and optimize AI solutions in healthcare settings. These services help address challenges such as limited healthcare staff and the growing volume of imaging scans, enabling healthcare providers to achieve operational efficiency and improved patient care.

“In Vivo Diagnostics Segment is estimated to account for the largest share of the global AI in medical diagnostics market in 2023”

The AI in the medical diagnostics market is also segmented by application into in vivo and in vitro diagnostics. In 2023, the in vivo diagnostics segment is anticipated to hold the largest market share due to the growing adoption of AI solutions by healthcare practitioners. These solutions assist in real-time imaging analysis, reducing human error, and improving treatment outcomes. In vivo diagnostics applications, such as AI-powered imaging for cancer detection and cardiovascular assessments, are widely used in clinical practice. While the in vivo segment leads currently, the in vitro segment, focusing on AI-based tools for laboratory testing and analysis, is expected to exhibit vigorous growth during the forecast period, driven by growing advancements in AI for precision diagnostics and laboratory automation.

“The Hospitals segment is estimated to account for the largest share of the global AI in medical diagnostics market in 2023”

By end users, the AI in the medical diagnostics market is divided into hospitals, diagnostic imaging centers, diagnostic laboratories, and other end users. In 2023, the hospital segment is projected to hold the largest market share of this market. Factors such as the increase in the adoption of MIS procedures in hospitals to enhance the quality of patient care, and the advancement in the application of imaging modalities to improve workflow.

“North America to dominate the AI in medical diagnostics market in 2023.”

Geographically, the AI in medical diagnostics market can be broadly categorized into five key regional segments: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The region of North America is likely to see the maximum share in 2023, due to advanced health care infrastructure, with widespread adoption of AI technologies and significant investment in R&D by companies and institutions. However, the Asia-Pacific region is forecasted to grow with the highest CAGR over the period from 2024-2029, due to a growing prevalence of cancer, increased use of AI in diagnostics and for the purpose of health system upgradation by the government.

Breakdown of supply-side primary interviews, by company type, designation, and region:

• By Company Type: Tier 1 (35%), Tier 2 (45%), and Tier 3 (20%)

• By Designation: C-level (35%), Director-level (25%), and Others (40%)

• By Region: North America (40%), Europe (30%), Asia Pacific (20%), and RoW (10%)

The prominent players in this market are Microsoft (US), Merative (US), Intel Corporation (US), NVIDIA Corporation (US), Google (US), GE HealthCare (US), Digital Diagnostics Inc. (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), Advanced Micro Devices, Inc. (US), HeartFlow, Inc. (US), Enlitic, Inc. (US), InformAI (US), isometric (Belgium), Butterfly Network, Inc. (US), Aidence (Netherlands), Nano-X Imaging LTD. (Israel), Quibim (Spain), Qure.ai (India), Viz.ai, Inc (US), Aidoc (US), Lunit, Inc. (South Korea), Therapixel (France), EchoNous, Inc. (US), and Brainomix (UK).

• Research Coverage

• The report studies the AI in medical diagnostics market based on component, application, end user, modality and region

• The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth

• The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders

• The report studies micro-markets with respect to their growth trends, prospects, and contributions to the total AI in medical diagnostics market

• The report forecasts the revenue of market segments with respect to five major regions

Rationale to Buy the Report

The research report will help smaller and newer businesses as well as established ones understand the state of the market, which will help them increase their market share. Businesses that purchase the study may choose to employ one or more of the tactics listed below to increase their market presence.

This report provides insightful data on the following pointers:

• Analysis of key drivers (Influx of big data, a growing number of cross-industry partnerships, increasing adoption of AI solutions to reduce work pressure on radiologists, rising government initiatives), restraints (Reluctance among medical practitioners to adopt AI-based technologies, Inadequate AI workforce and ambiguous regulatory guidelines for medical software), opportunities (Untapped emerging markets, Increasing focus on developing human-aware AI systems), and challenges (Budgetary constraints, Unstructured healthcare data) influencing the growth of the ai in medical diagnostics market

• Market Penetration: In-depth coverage of product portfolios offered by the top players in the AI in the medical diagnstics market.

• Product Development/Innovation: In-depth coverage of product portfolios offered by the top players in the AI in the medical diagnstics market.

• Market Development: Insightful data on profitable developing areas.

• Market Diversification: Details about recent developments and advancements in the AI in the medical diagnstics market.

• Competitive Assessment: Extensive assessment of the products, growth tactics, revenue projections, and market categories of the top competitors.

1 INTRODUCTION 48

1.1 STUDY OBJECTIVES 48

1.2 MARKET DEFINITION 48

1.3 STUDY SCOPE 49

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 49

1.3.2 INCLUSIONS AND EXCLUSIONS 50

1.3.3 YEARS CONSIDERED 51

1.3.4 CURRENCY CONSIDERED 52

1.4 LIMITATIONS 52

1.4.1 SCOPE-RELATED LIMITATIONS 52

1.4.2 METHODOLOGY-RELATED LIMITATIONS 52

1.5 STAKEHOLDERS 52

1.6 SUMMARY OF CHANGES 53

2 RESEARCH METHODOLOGY 54

2.1 RESEARCH DATA 54

2.1.1 SECONDARY DATA 55

2.1.1.1 List of secondary sources 55

2.1.1.2 Key data from secondary sources 55

2.1.2 PRIMARY DATA 56

2.1.2.1 List of primary sources 57

2.1.2.2 Key data from primary sources 58

2.1.2.3 Key industry insights 58

2.1.2.4 Breakdown of interviews with experts 59

2.2 MARKET SIZE ESTIMATION 59

2.3 FACTOR ANALYSIS 61

2.4 GROWTH FORECAST 61

2.5 DATA TRIANGULATION 65

2.6 RESEARCH ASSUMPTIONS 66

2.7 RISK ASSESSMENT 66

3 EXECUTIVE SUMMARY 67

4 PREMIUM INSIGHTS 71

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET 71

4.2 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET,

BY APPLICATION AND COUNTRY 72

4.3 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY KEY COUNTRY 73

4.4 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY REGION 74

4.5 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET: DEVELOPED VS. EMERGING ECONOMIES 74

5 MARKET OVERVIEW 75

5.1 INTRODUCTION 75

5.2 MARKET DYNAMICS 75

5.2.1 DRIVERS 76

5.2.1.1 Influx of big data with increasing digitization and adoption of information systems 76

5.2.1.2 Surge in cross-industry partnerships & collaborations 76

5.2.1.3 Increasing demand for AI-based solutions in radiology 77

5.2.1.4 Rising government initiatives to implement AI-based technologies in healthcare settings 78

5.2.1.5 Availability of extensive funding for AI-based startups 78

5.2.2 RESTRAINTS 79

5.2.2.1 Reluctance among medical practitioners to adopt AI-based technologies 79

5.2.2.2 Inadequate AI workforce and ambiguous regulatory guidelines for medical software 79

5.2.3 OPPORTUNITIES 80

5.2.3.1 Untapped emerging markets 80

5.2.3.2 Increasing focus on developing human-aware AI systems 81

5.2.4 CHALLENGES 81

5.2.4.1 Budgetary constraints 81

5.2.4.2 Unstructured healthcare data due to growing digital footprint and technology trends 81

5.2.4.3 Privacy concerns related to data protection 82

5.2.4.4 Limited interoperability for AI solutions 82

5.3 ECOSYSTEM ANALYSIS 83

5.4 CASE STUDY ANALYSIS 84

5.4.1 MAYO CLINIC INTEGRATES AI-ENABLED DIGITAL DIAGNOSTICS AND BOOSTS MEDICAL RESEARCH WITH GOOGLE CLOUD PLATFORM 84

5.4.2 RESOLVING CHALLENGES OF UNDERSTAFFED WORKFORCE AND BACKLOG WITH VEYE LUNG NODULES 84

5.4.3 NVIDIA AI ENTERPRISE SOFTWARE AND GPUS HELP IMPROVE PERFORMANCE AND PRECISION OF TUMOR TARGETING 85

5.4.4 ZHEJIANG UNIVERSITY AND ZHEJIANG DE IMAGE SOLUTIONS USE INTEL AI SOLUTIONS TO PROCESS ULTRASOUND 85

5.4.5 WAITEMATA DISTRICT HEALTH BOARD PROJECT UTILIZES PRECISION-DRIVEN HEALTH SOLUTIONS 86

5.5 VALUE CHAIN ANALYSIS 86

5.5.1 UPSTREAM 87

5.5.2 MID-STREAM 87

5.5.3 DOWNSTREAM 87

5.6 TRADE ANALYSIS 88

5.7 PORTER'S FIVE FORCES ANALYSIS 90

5.7.1 THREAT OF NEW ENTRANTS 91

5.7.2 THREAT OF SUBSTITUTES 91

5.7.3 BARGAINING POWER OF SUPPLIERS 91

5.7.4 BARGAINING POWER OF BUYERS 91

5.7.5 INTENSITY OF COMPETITIVE RIVALRY 92

5.8 KEY STAKEHOLDERS & BUYING CRITERIA 92

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS 92

5.8.2 BUYING CRITERIA 94

5.9 REGULATORY LANDSCAPE 95

5.9.1 NORTH AMERICA 95

5.9.1.1 Health Insurance Portability and Accountability Act of 1996 (HIPAA) 96

5.9.1.2 Health Information Technology for Economic and Clinical Health Act of 2009 (HITECH) 96

5.9.1.3 Consumer Privacy Protection Act of 2017 96

5.9.1.4 National Cybersecurity Protection Advancement Act of 2015 96

5.9.1.5 Future of Life Institute’s Asilomar AI Principles 97

5.9.2 EUROPE 97

5.9.2.1 European Medical Devices Regulation (EU) 2017/745 and In-vitro Diagnostic Medical Devices Regulation (EU) 2017/746, in Combination with General Data Protection Regulation 2016/679 97

5.9.2.2 Artificial Intelligence Act (AI Act) 97

5.9.3 ASIA PACIFIC 98

5.9.3.1 Cybersecurity Law of the People’s Republic of China 98

5.9.4 REST OF WORLD 98

5.9.4.1 Protection of Personal Information Act 98

5.9.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 99

5.10 PATENT ANALYSIS 102

5.10.1 PATENT PUBLICATION TRENDS FOR AI IN MEDICAL DIAGNOSTICS 102

5.10.2 JURISDICTION AND TOP APPLICANT ANALYSIS 103

5.11 TECHNOLOGY ANALYSIS 106

5.11.1 KEY TECHNOLOGIES 106

5.11.1.1 Machine learning 106

5.11.1.2 Deep learning 106

5.11.2 COMPLEMENTARY TECHNOLOGIES 107

5.11.2.1 Laboratory automation 107

5.11.2.2 EHR 107

5.11.3 ADJACENT TECHNOLOGIES 107

5.11.3.1 Natural language processing 107

5.11.3.2 Big data analytics 107

5.12 PRICING ANALYSIS 108

5.12.1 INDICATIVE PRICING ANALYSIS, BY COMPONENT 108

5.12.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY COMPONENT 109

5.12.3 INDICATIVE PRICING ANALYSIS, BY REGION 110

5.13 KEY CONFERENCES & EVENTS, 2024–2025 112

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 113

5.15 UNMET NEEDS: ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET 114

5.15.1 END USER EXPECTATIONS 115

5.16 REIMBURSEMENT SCENARIO 116

5.16.1 REIMBURSEMENT FOR AI SOFTWARE IN RADIOLOGY 118

5.17 INVESTMENT AND FUNDING SCENARIO 119

6 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET,

BY COMPONENT 120

6.1 INTRODUCTION 121

6.2 SOFTWARE 123

6.2.1 IMAGING SOFTWARE 126

6.2.1.1 Integration of advanced features (3D rendering, AI-driven image analysis, and automated reporting) to drive demand 126

6.2.2 PREDICTIVE ANALYSIS SOFTWARE 128

6.2.2.1 Growing use of AI-powered predictive analytics in healthcare for early disease detection, personalized treatment, and enhancing operational efficiency to drive market 128

6.2.3 DIAGNOSTIC SOFTWARE 130

6.2.3.1 Increased integration of AI into diagnostic processes for enhancing accuracy and efficiency to fuel market growth 130

6.3 SERVICES 132

6.3.1 RISING DEPLOYMENT AND INTEGRATION OF AI SYSTEMS TO DRIVE DEMAND 132

6.4 HARDWARE 134

6.4.1 PROCESSORS 137

6.4.1.1 MPU 140

6.4.1.1.1 Increasing demand for AI-powered medical diagnostic systems for accurate imaging in radiology, oncology, and cardiology to drive market 140

6.4.1.2 GPU 142

6.4.1.2.1 Ability to enhance accuracy and efficacy of medical imaging and diagnostics to drive demand 142

6.4.1.3 FPGA 144

6.4.1.3.1 Capability to optimize speed and accuracy of medical image processing and improve robustness of medical imaging systems to drive demand 144

6.4.1.4 ASIC 146

6.4.1.4.1 Rapid operation feature to support demand 146

6.4.2 MEMORY 148

6.4.2.1 Development of high-bandwidth memory for AI applications to drive market 148

6.4.3 NETWORKS 151

6.4.3.1 Adapter 153

6.4.3.1.1 Increasing demand for seamless data integration and growing adoption of machine learning and imaging technologies to drive market 153

6.4.3.2 Switch 155

6.4.3.2.1 Efficient data routing and integration features to fuel demand 155

6.4.3.3 Interconnect 157

6.4.3.3.1 Need for efficient data transmission to drive demand 157

7 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY END USER 160

7.1 INTRODUCTION 161

7.2 HOSPITALS 164

7.2.1 RISING INSTALLATION OF ADVANCED AI DIAGNOSTIC IMAGING SOLUTIONS TO DRIVE MARKET 164

7.3 DIAGNOSTIC IMAGING CENTERS 166

7.3.1 INCREASING NUMBER OF PRIVATE IMAGING CENTERS TO DRIVE MARKET 166

7.4 DIAGNOSTIC LABORATORIES 168

7.4.1 RISING SPECIMEN TEST VOLUMES TO DRIVE MARKET 168

7.5 OTHER END USERS 170

8 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY MODALITY 173

8.1 INTRODUCTION 174

8.2 IMAGING MODALITIES 176

8.2.1 COMPUTED TOMOGRAPHY 179

8.2.1.1 Rising availability of cardiac CT devices enabled with AI solutions to drive market 179

8.2.2 X-RAY 181

8.2.2.1 Innovative AI solutions for x-ray imaging by key players to drive market 181

8.2.3 MAGNETIC RESONANCE IMAGING 183

8.2.3.1 Rising technological advancements to drive adoption of AI in MRI 183

8.2.4 ULTRASOUND 185

8.2.4.1 Increasing prevalence of ovarian cancer to drive market 185

8.2.5 MAMMOGRAPHY 187

8.2.5.1 Increasing prevalence of breast cancer to drive market 187

8.2.6 OTHER IMAGING MODALITIES 189

8.3 DIAGNOSTICS MODALITIES 191

8.3.1 IMMUNOASSAY 194

8.3.1.1 Increasing focus on individualized therapies to drive market 194

8.3.2 CLINICAL CHEMISTRY 196

8.3.2.1 Increased demand for precision medicine and efficient healthcare systems to drive market 196

8.3.3 HEMATOLOGY 198

8.3.3.1 Rising need for efficient blood disorder diagnostics and advancements in AI-driven technologies to drive market 198

8.3.4 MICROBIOLOGY 200

8.3.4.1 Rising demand for precise diagnostics and antimicrobial resistance drives AI adoption 200

8.3.5 OTHER DIAGNOSTIC MODALITIES 202

9 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET,

BY APPLICATION 205

9.1 INTRODUCTION 206

9.2 IN VIVO DIAGNOSTICS APPLICATIONS 208

9.2.1 RADIOLOGY 211

9.2.1.1 Pressing need for accurate imaging interpretation and reduction of diagnostic errors to drive demand for AI 211

9.2.2 ONCOLOGY 213

9.2.2.1 Early cancer detection and personalized therapies to drive market 213

9.2.3 CARDIOLOGY 216

9.2.3.1 Rising complexities associated with CVD to drive market 216

9.2.4 NEUROLOGY 218

9.2.4.1 Application in diagnosing Alzheimer’s to boost demand for AI technologies 218

9.2.5 OBSTETRICS/GYNECOLOGY 220

9.2.5.1 Rising use of minimally invasive techniques in gynecology procedures to drive market 220

9.2.6 OPHTHALMOLOGY 222

9.2.6.1 Rising need for early detection & prevention of eye diseases to drive market 222

9.2.7 OTHER IN VIVO APPLICATIONS 224

9.3 IN VITRO DIAGNOSTICS APPLICATIONS 226

9.3.1 INFECTIOUS DISEASES 229

9.3.1.1 Need for disease outbreak management and antimicrobial resistance to drive market 229

9.3.2 ENDOCRINOLOGY 231

9.3.2.1 Rising use of AI for diagnosing diabetes and thyroid disorders to drive market 231

9.3.3 AUTOIMMUNE TESTING 233

9.3.3.1 Capability to enhance accuracy in detecting autoimmune diseases to improve early diagnosis and treatment to drive market 233

9.3.4 BLOOD SCREENING AND COAGULATION TESTING 235

9.3.4.1 Increasing demand for screening bloodborne diseases and coagulation disorders to drive market 235

9.3.5 OTHER IN VITRO APPLICATIONS 237

10 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY REGION 240

10.1 INTRODUCTION 241

10.2 NORTH AMERICA 242

10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 252

10.2.2 US 252

10.2.2.1 Increasing number of imaging procedures to drive market 252

10.2.3 CANADA 262

10.2.3.1 Research grants and improved academics in radiology to drive market 262

10.3 EUROPE 273

10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 274

10.3.2 GERMANY 283

10.3.2.1 Rising government support for promoting adoption of AI in medical diagnostics to drive market 283

10.3.3 FRANCE 293

10.3.3.1 Availability of funding for companies to enhance AI research in medical imaging to fuel market growth 293

10.3.4 UK 303

10.3.4.1 Increasing radiography procedures to drive market 303

10.3.5 ITALY 313

10.3.5.1 Increasing volume of EHRs and EMRs due to rising geriatric population to drive demand 313

10.3.6 SPAIN 323

10.3.6.1 Growing awareness regarding AI to favor market growth 323

10.3.7 REST OF EUROPE 333

10.4 ASIA PACIFIC 342

10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 352

10.4.2 CHINA 353

10.4.2.1 Rising use of AI in clinical decision-making to drive market 353

10.4.3 JAPAN 363

10.4.3.1 Strong healthcare infrastructure to drive uptake of advanced AI solutions 363

10.4.4 INDIA 373

10.4.4.1 Favorable government initiatives for R&D investments to drive market 373

10.4.5 REST OF ASIA PACIFIC 382

10.5 LATIN AMERICA 392

10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 401

10.5.2 BRAZIL 401

10.5.2.1 High technological advancements in healthcare market to drive market 401

10.5.3 MEXICO 411

10.5.3.1 Investment inflows and initiatives for AI-related education to drive market 411

10.5.4 REST OF LATIN AMERICA 420

10.6 MIDDLE EAST & AFRICA 430

10.6.1 GCC COUNTRIES 439

10.6.1.1 Rising adoption of AI in diagnostics to elevate healthcare standards, streamline operations, and make high-quality care more available to drive market 439

10.6.2 REST OF MIDDLE EAST & AFRICA 449

11 COMPETITIVE LANDSCAPE 460

11.1 OVERVIEW 460

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 460

11.3 REVENUE ANALYSIS 461

11.4 MARKET SHARE ANALYSIS 462

11.5 RANKING ANALYSIS 465

11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS 2023 466

11.6.1 STARS 466

11.6.2 EMERGING LEADERS 466

11.6.3 PERVASIVE PLAYERS 466

11.6.4 PARTICIPANTS 466

11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 468

11.6.5.1 Company footprint 468

11.6.5.2 Component footprint 469

11.6.5.3 Application footprint 470

11.6.5.4 End user footprint 471

11.6.5.5 Regional footprint 472

11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 473

11.7.1 PROGRESSIVE COMPANIES 473

11.7.2 DYNAMIC COMPANIES 473

11.7.3 RESPONSIVE COMPANIES 473

11.7.4 STARTING BLOCKS 473

11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 475

11.7.5.1 Detailed list of key startups/SMEs 475

11.7.5.2 Competitive benchmarking of key startups/SMEs 476

11.8 COMPANY VALUATION AND FINANCIAL METRICS 477

11.9 BRAND/PRODUCT COMPARISON 478

11.10 COMPETITIVE SCENARIO 479

11.10.1 PRODUCT LAUNCHES 479

11.10.2 DEALS 481

11.10.3 OTHERS 483

12 COMPANY PROFILES 484

12.1 KEY PLAYERS 484

12.1.1 MICROSOFT 484

12.1.1.1 Business overview 484

12.1.1.2 Products/Solutions/Services offered 485

12.1.1.3 Recent developments 487

12.1.1.3.1 Product launches 487

12.1.1.3.2 Deals 487

12.1.1.4 MnM view 489

12.1.1.4.1 Key strengths/Right to win 489

12.1.1.4.2 Strategic choices 489

12.1.1.4.3 Weaknesses/Competitive threats 489

12.1.2 NVIDIA CORPORATION 490

12.1.2.1 Business overview 490

12.1.2.2 Products/Solutions/Services offered 491

12.1.2.3 Recent developments 493

12.1.2.3.1 Product launches 493

12.1.2.4 MnM view 494

12.1.2.4.1 Key strengths/Right to win 494

12.1.2.4.2 Strategic choices 495

12.1.2.4.3 Weaknesses/Competitive threats 495

12.1.3 MERATIVE 496

12.1.3.1 Business overview 496

12.1.3.2 Products/Solutions/Services offered 497

12.1.3.3 Recent developments 497

12.1.3.3.1 Product launches 497

12.1.3.3.2 Deals 498

12.1.3.3.3 Others 498

12.1.3.3.4 Expansions 499

12.1.3.4 MnM view 499

12.1.3.4.1 Key strengths/Right to win 499

12.1.3.4.2 Strategic choices 499

12.1.3.4.3 Weaknesses/Competitive threats 499

12.1.4 GOOGLE (ALPHABET, INC.) 500

12.1.4.1 Business overview 500

12.1.4.2 Products/Solutions/Services offered 501

12.1.4.3 Recent developments 502

12.1.4.3.1 Product launches 502

12.1.4.3.2 Deals 502

12.1.4.3.3 Others 503

12.1.4.4 MnM view 503

12.1.4.4.1 Key strengths/Right to win 503

12.1.4.4.2 Strategic choices 503

12.1.4.4.3 Weaknesses/Competitive threats 503

12.1.5 INTEL CORPORATION 504

12.1.5.1 Business overview 504

12.1.5.2 Products/Solutions/Services offered 505

12.1.5.3 Recent developments 507

12.1.5.3.1 Product launches 507

12.1.5.3.2 Deals 508

12.1.5.4 MnM view 508

12.1.5.4.1 Key strengths/Right to win 508

12.1.5.4.2 Strategic choices 508

12.1.5.4.3 Weaknesses/Competitive threats 509

12.1.6 SIEMENS HEALTHINEERS AG 510

12.1.6.1 Business overview 510

12.1.6.2 Products/Solutions/Services offered 511

12.1.6.3 Recent developments 512

12.1.6.3.1 Product launches 512

12.1.6.3.2 Deals 512

12.1.7 GE HEALTHCARE 514

12.1.7.1 Business overview 514

12.1.7.2 Products/Solutions/Services offered 515

12.1.7.3 Recent developments 516

12.1.7.3.1 Product launches 516

12.1.7.3.2 Deals 516

12.1.7.3.3 Others 518

12.1.7.3.4 Expansions 518

12.1.8 ADVANCED MICRO DEVICES, INC. 519

12.1.8.1 Business overview 519

12.1.8.2 Products/Solutions/Services offered 520

12.1.8.3 Recent developments 520

12.1.8.3.1 Product launches 520

12.1.8.3.2 Deals 521

12.1.9 KONINKLIJKE PHILIPS N.V. 522

12.1.9.1 Business overview 522

12.1.9.2 Products/Solutions/Services offered 523

12.1.9.3 Recent developments 525

12.1.9.3.1 Product launches 525

12.1.9.3.2 Deals 525

12.1.9.3.3 Others 526

12.1.10 DIGITAL DIAGNOSTICS, INC. 527

12.1.10.1 Business overview 527

12.1.10.2 Products/Solutions/Services offered 527

12.1.10.3 Recent developments 528

12.1.10.3.1 Deals 528

12.1.10.3.2 Others 528

12.1.10.3.3 Expansions 529

12.1.11 INFORMAI 530

12.1.11.1 Business overview 530

12.1.11.2 Products/Solutions/Services offered 530

12.1.11.3 Recent developments 531

12.1.11.3.1 Deals 531

12.1.11.3.2 Others 531

12.2 OTHER PLAYERS 532

12.2.1 HEARTFLOW, INC. 532

12.2.2 ENLITIC, INC. 532

12.2.3 AIDENCE 533

12.2.4 BUTTERFLY NETWORK, INC. 533

12.2.5 NANO-X IMAGING LTD. 534

12.2.6 VIZ.AI, INC. 535

12.2.7 QUIBIM 535

12.2.8 QURE.AI 536

12.2.9 THERAPIXEL 536

12.2.10 AIDOC 537

12.2.11 LUNIT, INC. 538

12.2.12 ECHONOUS, INC. 539

12.2.13 ICOMETRIX 540

12.2.14 BRAINOMIX 540

13 APPENDIX 541

13.1 DISCUSSION GUIDE 541

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 544

13.3 CUSTOMIZATION OPTIONS 546

13.4 RELATED REPORTS 546

13.5 AUTHOR DETAILS 547

❖ 世界の医療診断における人工知能(AI)市場に関するよくある質問(FAQ) ❖

・医療診断における人工知能(AI)の世界市場規模は?

→MarketsandMarkets社は2024年の医療診断における人工知能(AI)の世界市場規模を17.1億米ドルと推定しています。

・医療診断における人工知能(AI)の世界市場予測は?

→MarketsandMarkets社は2029年の医療診断における人工知能(AI)の世界市場規模を47.2億米ドルと予測しています。

・医療診断における人工知能(AI)市場の成長率は?

→MarketsandMarkets社は医療診断における人工知能(AI)の世界市場が2024年~2029年に年平均22.5%成長すると予測しています。

・世界の医療診断における人工知能(AI)市場における主要企業は?

→MarketsandMarkets社は「Microsoft (US), Merative (US), Intel Corporation (US), NVIDIA Corporation (US), Google (US), GE HealthCare (US), Digital Diagnostics Inc. (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), Advanced Micro Devices, Inc. (US), HeartFlow, Inc. (US), Enlitic, Inc. (US), InformAI (US), isometric (Belgium), Butterfly Network, Inc. (US), Aidence (Netherlands), Nano-X Imaging LTD. (Israel), Quibim (Spain), Qure.ai (India), Viz.ai, Inc (US), Aidoc (US), Lunit, Inc. (South Korea), Therapixel (France), EchoNous, Inc. (US), and Brainomix (UK)など ...」をグローバル医療診断における人工知能(AI)市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。