1 はじめに 27

1.1 調査目的 27

1.2 市場の定義 28

1.3 調査範囲 28

1.3.1 対象市場と地域範囲 28

1.3.2 考慮した年数 29

1.3.3 含むものと含まないもの 29

1.4 考慮した通貨 30

1.5 考慮した単位 30

1.6 制限事項 30

1.7 利害関係者 30

1.8 変更点のまとめ 31

2 調査方法 32

2.1 調査データ 32

2.1.1 二次データ 33

2.1.1.1 主要な二次情報源のリスト 33

2.1.1.2 二次資料からの主要データ 33

2.1.2 一次データ 34

2.1.2.1 専門家への一次インタビュー 34

2.1.2.2 一次インタビューの内訳 34

2.1.2.3 一次資料からの主要データ 35

2.1.3 二次調査および一次調査 36

2.1.3.1 主要な業界インサイト 37

2.2 市場規模の推定 37

2.2.1 ボトムアップアプローチ 38

2.2.1.1 ボトムアップ分析による市場規模算出アプローチ 38

2.2.2 トップダウンアプローチ 39

2.2.2.1 トップダウン分析による市場規模算出アプローチ 39

2.3 市場の内訳とデータの三角測量 40

2.4 リサーチの前提 42

2.5 調査の限界 42

2.6 リスク分析 43

3 エグゼクティブサマリー 44

4 プレミアムインサイト 48

4.1 自動搬送車市場におけるプレーヤーにとっての魅力的な機会 48

4.2 自動搬送車市場、タイプ別 49

4.3 無人搬送車(AGV)市場:ナビゲーション技術別 49

4.4 無人搬送車(AGV)市場:産業別 50

4.5 北米の無人搬送車(AGV)市場:産業別、国別

国別 50

4.6 無人搬送車(AGV)市場:国別 51

5 市場の概要 52

5.1 はじめに 52

5.2 市場ダイナミクス

5.2.1 推進要因

5.2.1.1 様々な産業における自動化ソリューションへの需要の高まり 53

5.2.1.2 職場の安全性向上への注目の高まり 53

5.2.1.3 大量生産からマスカスタマイゼーションへの顕著なシフト 53

5.2.1.4 マテリアルハンドリング技術への需要の高まり 54

5.2.1.5 電子商取引の急速な拡大 54

5.2.2 阻害要因 55

5.2.2.1 高い設置、メンテナンス、切り替えコスト 55

5.2.2.2 AGVよりも移動ロボットへの嗜好の高まり 56

5.2.2.3 発展途上国におけるインフラ互換性の問題 56

5.2.3 機会 57

5.2.3.1 倉庫業におけるインダストリー4.0 テクノロジーの導入の増加 57

技術の導入の高まり 57

5.2.3.2 中小企業による産業オートメーションへの注目の高まり 58

5.2.3.3 新興国における産業部門の大幅な成長 58

5.2.3.4 東南アジアにおけるイントラロジスティクス部門の急成長 58

5.2.3.5 AGV機能を強化するための絶え間ない技術革新 58

5.2.4 課題 59

5.2.4.1 低い人件費が新興国での採用を制限 59

5.2.4.2 技術的課題と操業停止時間 60

5.3 バリューチェーン分析 60

5.4 エコシステム分析 63

5.5 価格分析 65

5.5.1 主要企業が提供するフォークリフトトラックの指標価格(2023年) 65

5.5.2 AGVのタイプ別平均販売価格動向(2020~2023年) 66

5.5.3 農業機械の地域別平均販売価格動向(2020~2023年) 67

5.6 顧客ビジネスに影響を与えるトレンド/混乱 68

5.7 投資と資金調達のシナリオ 68

5.8 技術分析 69

5.8.1 主要技術 69

5.8.1.1 人工知能 69

5.8.1.2 機械学習 69

5.8.2 隣接技術 69

5.8.2.1 モノのインターネット 69

5.8.2.2 5G 69

5.8.3 補完技術 70

5.8.3.1 協調ロボット 70

5.8.3.2 デジタル・ツイン技術 70

5.9 ポーターの5つの力分析 70

5.10 主要ステークホルダーと購買基準 72

5.10.1 購入プロセスにおける主要ステークホルダー 72

5.10.2 購入基準 72

5.11 ケーススタディ分析 73

5.11.1 マスタームーバーのAGVがトヨタ自動車製造の効率性を加速

の効率を加速

5.11.2 キルコイパストラル社へのAGVとパレタイジングシステムの導入 74

パストラル社 74

5.11.3 スコットオートメーションの先進AGVとパレタイジングシステムが

キルコイ・パストラル社の効率向上 74

5.11.4 ジャガー・ランドローラー社におけるAGV ベースのインストルメント・パネル組立ライン

ジャガー・ランドローバー・スロバキアの効率向上 75

5.11.5 E80グループがメッツァティッシュの倉庫にLGVを導入し

をメッツァティッシュの倉庫に導入

5.12 主要な会議とイベント(2024-2025 年) 76

5.13 貿易分析 78

5.13.1 輸入シナリオ(HSコード842710) 78

5.13.2 輸出シナリオ(HSコード842710) 79

5.14 特許分析 80

5.15 規制の状況 83

5.15.1 規制機関、政府機関、その他の団体 83

5.15.2 規格 85

5.15.3 規制 87

5.16 AIが自動搬送車市場に与える影響 88

5.16.1 導入 88

5.16.2 自動搬送車市場への影響 89

5.16.3 主要ユースケースと市場の可能性 89

6 新たな技術と自動搬送車の応用

自動搬送車 92

6.1 はじめに 92

6.2 自動搬送車に使われる新技術 92

6.2.1 ライダーセンサー

6.2.2 カメラビジョン 93

6.2.3 デュアルモード無人搬送車(AGV) 93

6.3 自動搬送車の最新用途 94

6.3.1 病院 94

6.3.2 テーマパーク 94

6.3.3 農業 95

7 無人搬送車(AGV)用バッテリーの種類と充電方法

無人搬送車(AGV) 96

7.1 はじめに

7.2 無人搬送車(AGV)に使用されるバッテリーの種類 96

7.2.1 鉛蓄電池 96

7.2.2 リチウムイオン電池 97

7.2.3 ニッケル系電池 97

7.2.4 その他

7.3 バッテリー充電の代替手段 97

7.3.1 自動充電と機会充電 97

7.3.1.1 ワイヤレス充電 97

7.3.2 電池交換 98

7.3.2.1 自動バッテリー交換 98

7.3.3 プラグイン充電 98

7.3.3.1 手動プラグイン充電 98

7.3.3.2 自動プラグイン充電 98

8 自動搬送車市場における提供品 99

8.1 導入 99

8.2 ハードウェア 99

8.3 ソフトウェアとサービス 100

9 自動搬送車の最新動向 101

9.1 導入 101

9.2 モノのインターネット接続 101

9.3 協働型無人搬送車(AGV)の採用 101

9.4 拡張性とモジュール設計 101

9.5 高度なナビゲーション技術 101

9.6 エネルギー効率と持続可能性 102

9.7 人工知能と機械学習の統合 102

9.8 リアルタイムデータ処理のためのエッジコンピューティング 102

10 自動搬送車の応用 103

10.1 導入 103

10.2 ピック&プレース 103

10.3 パッケージング&パレタイジング 104

10.4 組み立てと保管 104

11 自動搬送車市場:積載量別 105

11.1 導入 106

11.2 小型無人搬送車(AGV) 107

11.2.1 小荷重を扱う際の柔軟性と費用対効果

市場の成長を支える 107

11.3 中型AGV 108

11.3.1 多様な産業で中程度の負荷を処理する能力

需要を押し上げる 108

11.4 大型農業機械 109

11.4.1 極めて重い荷重を処理する能力が市場の成長を牽引 109

セグメント別の成長

12 自動搬送車市場:タイプ別 110

12.1 導入 111

12.2 牽引車 114

12.2.1 生産性の向上とコスト削減が市場成長を支える

市場成長 114

12.3 ユニットロードキャリア 116

12.3.1 人件費削減と業務効率化が需要を後押し 116

12.4 パレットトラック 119

12.4.1 自動車、動きの速い消費財、食品・飲料での使用増加が市場成長を促進 119

12.5 組み立てライン用車両 121

12.5.1 チェーンベースの搬送システムよりも経済性が高い

が採用を促進 121

12.6 フォークリフトトラック 124

12.6.1 床から床、床からラックへの作業における需要の増加がセグメント成長を促進 124

12.7 その他のタイプ 126

13 自動搬送車市場:ナビゲーション技術別 129

13.1 導入 130

13.2 レーザー誘導 132

13.2.1 精度と柔軟性が市場の成長を促進 132

13.3 磁気誘導 133

133.3.1 設置の容易さ、耐久性、信頼性が採用を促進 133

13.4 誘導ガイダンス 135

13.4.1 最も過酷な産業用セットアップへの適合性が需要を高める 135

13.5 光学式テープ・ガイダンス 136

13.5.1 簡単で便利なAGV向けソリューションが市場成長を促進 136

13.6 ビジョンガイダンス 138

13.6.1 ダイナミックな環境での信頼性と複雑な空間での操作性が

が市場成長を加速 138

13.7 その他のナビゲーション技術 139

14 自動搬送車市場、産業別 141

14.1 はじめに 142

14.2 自動車 144

14.2.1 アフターセールス・スペアパーツ需要の増加が市場を牽引 144

14.3 金属・重機 146

14.3.1 ワークフローを容易にするAGVの展開が需要を促進 146

14.4 食品・飲料 148

14.4.1 世界的な食品需要の増加に対応するためにAGVの導入が増加。

市場成長を加速 148

14.5 化学 150

14.5.1 自動化とインダストリー4.0 の拡大が市場を牽引 150

14.6 ヘルスケア 152

14.6.1 患者ケアにおけるAGVsの使用増加と革新的な利用が

市場成長を促進する 152

14.7 3PL 154

14.7.1 日常業務におけるAGVへの依存が市場成長を促進 154

市場成長を促進 154

14.8 半導体・エレクトロニクス 156

14.8.1 廉価で携帯可能な機能的電子機器の需要急増が需要を促進 156

14.9 航空 158

14.9.1 航空宇宙産業の製造合理化ニーズの高まりが市場を牽引 158

が市場を牽引 158

14.10 電子商取引 160

14.10.1 マテリアルハンドリング作業へのAGVの採用が市場成長を促進 160

市場の成長を促進 160

14.11 その他の産業 162

15 自動搬送車市場:地域別 164

15.1 はじめに 165

15.2 北米 167

15.2.1 北米のマクロ経済見通し 167

15.2.2 米国 171

15.2.2.1 倉庫施設を持つ既存自動車メーカーの存在が市場成長を促進 171

市場成長を促進 171

15.2.3 カナダ 172

15.2.3.1 様々な産業における持続的な自動化が市場を牽引 172

15.2.4 メキシコ 174

15.2.4.1 確立された製造業が市場成長を促進 174

15.3 欧州 175

15.3.1 欧州のマクロ経済見通し 175

15.3.2 ドイツ 178

15.3.2.1 熟練した労働力と研究開発への投資で需要急増 178

15.3.3 イギリス 180

15.3.3.1 自動車セクターの需要増加が市場成長を刺激 180

15.3.4 フランス 182

15.3.4.1 成長する電子商取引産業が市場成長を加速 182

15.3.5 イタリア 183

15.3.5.1 高度なロジスティクスと自動化ソリューションに対する需要の急増が市場

が市場を牽引 183

15.3.6 スペイン 185

15.3.6.1 活況を呈する物流産業と再生可能エネルギーが市場成長を促進 185

15.3.7 オランダ 186

15.3.7.1 効率的なサプライチェーンネットワークと最先端の倉庫インフラが需要を後押し 186

15.3.8 その他のヨーロッパ地域 188

15.4 アジア太平洋 189

15.4.1 アジア太平洋地域のマクロ経済見通し 190

15.4.2 中国 194

15.4.2.1 輸送、倉庫、ロジスティクスサービスに対する需要の高まり

ロジスティクス・サービスに対する需要の高まり 194

15.4.3 日本 196

15.4.3.1 高騰する人件費と幅広い産業基盤が市場成長を支える 196

市場成長を支える 196

15.4.4 オーストラリア 197

15.4.4.1 成長する製造業と鉱業が需要を急増 197

15.4.5 韓国 199

15.4.5.1 AGV世界企業のプレゼンス向上が市場を牽引 199

15.4.6 インド 200

15.4.6.1 人口増加、旺盛な内需、持続可能な経済成長が機会を創出 200

15.4.7 マレーシア 202

15.4.7.1 革新的な物流ソリューションへの需要の高まりが市場成長を支える 202

市場成長を支える 202

15.4.8 インドネシア 203

15.4.8.1 急速な産業発展が市場成長を促進 203

15.4.9 シンガポール 205

15.4.9.1 先進技術とインフラが市場成長を促進 205

15.4.10 タイ 206

15.4.10.1 製造業の拡大とインフラ整備が市場を牽引 206

15.4.11 その他のアジア太平洋地域 208

15.5 ROW 209

15.5.1 ROWのマクロ経済見通し 209

15.5.2 中東 212

15.5.2.1 GCC 214

15.5.2.1.1 サウジアラビア 214

15.5.2.1.1 ビジョン2030の下での経済多様化への注目の高まりが市場成長を促進 214

15.5.2.1.2 ウアイ 214

15.5.2.1.2.1 輸送、倉庫、物流サービスに対する需要の高まりが市場成長を促進 214

15.5.2.1.3 GCCのその他の地域 214

15.5.2.2 その他の中東地域 215

15.5.2.3 南米 215

15.5.2.3.1 食品・飲料産業における自動化への政府支援が市場成長を支える 215

15.5.2.4 アフリカ 217

15.5.2.4.1 様々な産業で倉庫自動化ソリューションの採用が増加し、AGVの採用が増加 217

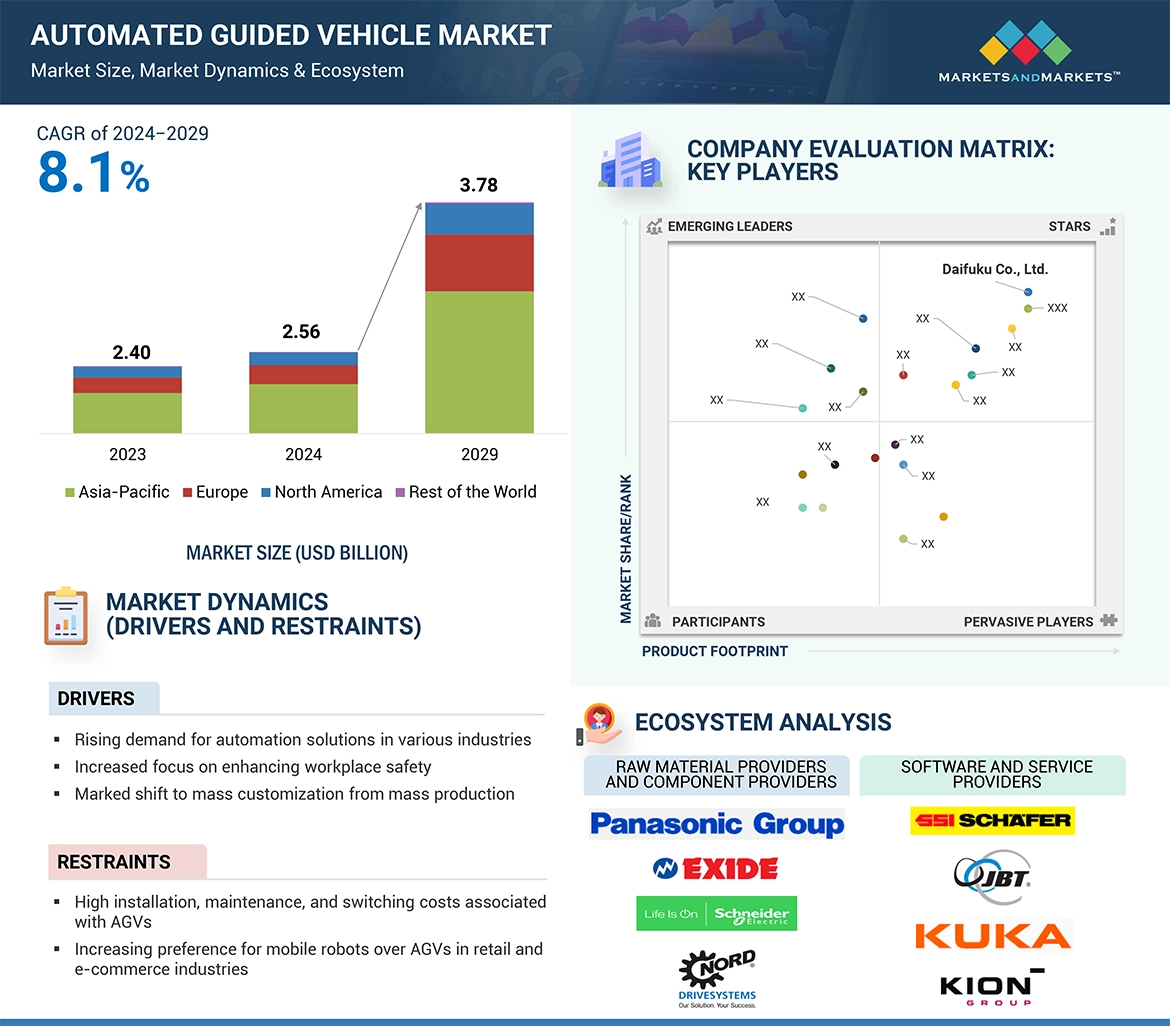

16 競争環境 219

16.1 導入 219

16.2 主要企業の戦略/勝利への権利(2021~2024年) 219

16.3 収益分析、2019年~2023年 221

16.4 市場シェア分析、2023年 222

16.5 企業評価と財務指標、2024年 224

16.6 ブランド/製品の比較 225

16.7 企業評価マトリックス:主要企業、2023年 226

16.7.1 スター企業 226

16.7.2 新興リーダー 226

16.7.3 浸透型プレーヤー 226

16.7.4 参加企業 226

16.7.5 企業フットプリント:主要プレーヤー、2023年 228

16.7.5.1 企業フットプリント 228

16.7.5.2 地域別フットプリント 229

16.7.5.3 ナビゲーション技術のフットプリント 230

16.7.5.4 タイプ別フットプリント 231

16.7.5.5 産業別フットプリント 232

16.8 企業評価マトリクス:新興企業/中小企業(2023年) 234

16.8.1 進歩的企業 234

16.8.2 対応力のある企業 234

16.8.3 ダイナミックな企業 234

16.8.4 スターティングブロック 234

16.8.5 競争ベンチマーキング:新興企業/SM(2023年) 236

16.8.5.1 主要新興企業/中小企業の詳細リスト 236

16.8.5.2 主要新興企業/中小企業の競争ベンチマーク 236

16.9 競争シナリオ 237

16.9.1 製品上市 237

16.9.2 取引 238

16.9.3 拡張 239

16.9.4 その他の開発 240

17 企業プロフィール 241

17.1 主要プレーヤー 241

Daifuku Co. (日本)

JBT(米国)

KION Group AG(ドイツ)

豊田自動織機(日本)

KUKA AG(ドイツ)

18 付録 298

18.1 ディスカッションガイド 298

18.2 Knowledgestore: Marketsandmarketsの購読ポータル 302

18.3 カスタマイズオプション 304

18.4 関連レポート 304

18.5 著者の詳細 305

This growth is driven by the increasing demand for efficient intralogistics systems as well as the rapidly proliferating e-commerce activities that need streamlined warehouse management. The improvements in battery technology in addition to the introduction of modular AGV designs have greatly improved the versatility and reliability of these systems. The growing trend toward sustainability has also led to increasing investment in electric and autonomous vehicles, which are essential in modernizing material handling processes.

"Tow vehicles to maintain largest market share during the forecast period.”

Tow vehicles are expected to emerge as the leader in the automated guided vehicle market in terms of market share during the forecast period due to their versatile applications across various industries. These tow vehicles, being utilized mainly to transport heavy loads with ease, possess a higher advantage in material handling operations in terms of increased productivity, low labor cost, and minimal error rates. These AGVs are increasingly used in manufacturing, warehouses, and distribution centers due to the bulk goods movement over a distance. Advances in the navigation technologies along with integration with automation systems have made tow vehicles more reliable and adaptable. As industries increasingly adopt automation to achieve better efficiency in operations and increase demand, tow vehicles are expected to remain the leader in the automated guided vehicle market.

“Laser guidance technology to hold largest market share due to ability to support flexible and scalable operations in dynamic industrial settings.”

Laser guidance technology is likely to hold the largest market share during the forecast period. Unlike other conventional guidance systems, laser-guided AGVs do not demand physical infrastructures like magnetic strips or tracks, making them cost-effective for those facilities planning to expand or reconfigure layouts. Furthermore, laser guidance enhances route optimization and operational efficiency, allowing real-time path adjustments that are helpful in those industrial sectors characterized by high throughput requirements, such as e-commerce and retail logistics. The growing emphasis focus on smart factories and initiatives around Industry 4.0 also fuel the adoption of laser-guided AGVs, given that their advanced sensors and mapping capabilities fit well with the growing need for digitized and autonomous workflows. sensors and mapping capabilities fit well with the growing need for digitized and autonomous workflows.

"3PL Segment is Projected to Witness a Substantially High CAGR in the market during the forecast period."

The 3PL segment is expected to be the dominant automated guided vehicle market, because of the increasing demand for efficient and cost-effective material handling solutions. An increase in e-commerce and international trade activities driving the adoption of advanced AGVs, streamlining the warehouse operations, enhancing inventory management and optimization of supply chain processes for leading 3PL providers. Features such as real-time tracking, route optimization, and predictive maintenance offered by the integration of smart technologies, lot, and Al in AGVs have further increased their adoption. Therefore, as businesses are gradually focusing on increasing their speed, accuracy, and scalability in the offerings of their logistics, the demand for advanced AGV solutions in the 3PL industry is set to rise significantly. Accordingly, this is expected to be a contributing factor in innovation and market growth in the AGV market.

"Europe is set to hold a significant share in automated guided vehicle market"

Europe is expected to be the pivotal in the AGV market since driven by the region's intense focus on innovation; strong logistics networks, and demand for highly advanced material handling solutions. Emphasis on making the manufacturing sector digital and automated by the European Union has also contributed to fostering AGV adoption. Its programs related to smart manufacturing and transition toward connected factories are further boosting demand. The UK, Spain, and the Netherlands are significant traction due to their growing retail and logistics industries.

Breakdown of primaries

A variety of executives from key organizations operating in the automated guided vehicle market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

• By Company Type: Tier 1 –30%, Tier 2 – 40%, and Tier 3 – 30%

• By Designation: C-level Executives – 35%, Directors – 40%, and Others – 20%

• By Region: North America – 30%, Europe – 25%, Asia Pacific – 30%, and RoW – 15%

Major players profiled in this report are as follows: Major Players:Daifuku Co., Ltd. (Japan), JBT (US), KION Group AG (Germany), Toyota Industries Corporation (Japan), and KUKA AG (Germany) and Others. These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the automated guided vehicle market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the automated guided vehicle market has been segmented based on type, navigation technology, industry and region. The type segment consists of Tow Vehicles, Unit Load Carriers, Pallet Trucks, Assembly Line Vehicle, Forklift Vehicles and Other Types (AGCs, Hybrid AGVs, Customized AGVs). The navigation technology segment consists of Laser Guidance, Magnetic Guidance, Inductive Guidance, Optical Tape Guidance, Vision Guidance, and Other Guidance Technologies (Inertial, Beacon, Dead Reckoning Guidance). The industry segment consists of Automotive, Chemicals, Aviation, Semiconductor & Electronics, E-commerce, Food & Beverage, Healthcare, Metals & Heavy Machinery, 3PL, and Others (Printing & Paper, Textile). The market has been segmented into four regions-North America, Asia Pacific, Europe, and RoW.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the automated guided vehicle market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

Analysis of key drivers (Rising demand for automation solutions in various industries, Increased focus on enhancing workplace safety, Marked shift to mass customization from mass production, Growing demand for material handling technology fuels automated guided vehicle sales, and Rising demand in E-commerce drives automated guided vehicle (AGV) adoption for efficient order fulfillment), restraints (High installation, maintenance, and switching costs associated with AGVs, Increasing preference for mobile robots over AGVs in retail and e-commerce industries, Lack of flexibility and obstacle resistance in AGVs, and Challenges with infrastructure compatibility in developing countries) opportunities (Growing implementation of Industry 4.0 technologies in warehousing sector, Increasing focus on industrial automation by SMEs, Substantial growth of industrial sector in emerging economies, Presence of huge intralogistics sector in Southeast Asia, and Enhanced AGV Capabilities through technological integration), and challenges (Low labor costs restricting adoption of AGVs in emerging economies , Technical challenges related to sensing elements, and Maintenance challenges and downtime in AGV Operations) influencing the growth of the automated guided vehicle market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the automated guided vehicle market.

• Market Development: Comprehensive information about lucrative markets – the report analyses the automated guided vehicle market across varied regions.

• Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the automated guided vehicle market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Daifuku Co., Ltd. (Japan), JBT (US), KION Group AG (Germany), Toyota Industries Corporation (Japan), KUKA AG (Germany) and Others.

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 28

1.3 STUDY SCOPE 28

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 28

1.3.2 YEARS CONSIDERED 29

1.3.3 INCLUSIONS AND EXCLUSIONS 29

1.4 CURRENCY CONSIDERED 30

1.5 UNITS CONSIDERED 30

1.6 LIMITATIONS 30

1.7 STAKEHOLDERS 30

1.8 SUMMARY OF CHANGES 31

2 RESEARCH METHODOLOGY 32

2.1 RESEARCH DATA 32

2.1.1 SECONDARY DATA 33

2.1.1.1 List of key secondary sources 33

2.1.1.2 Key data from secondary sources 33

2.1.2 PRIMARY DATA 34

2.1.2.1 Primary interviews with experts 34

2.1.2.2 Breakdown of primary interviews 34

2.1.2.3 Key data from primary sources 35

2.1.3 SECONDARY AND PRIMARY RESEARCH 36

2.1.3.1 Key industry insights 37

2.2 MARKET SIZE ESTIMATION 37

2.2.1 BOTTOM-UP APPROACH 38

2.2.1.1 Approach to arrive at market size using bottom-up analysis 38

2.2.2 TOP-DOWN APPROACH 39

2.2.2.1 Approach to arrive at market size using top-down analysis 39

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 40

2.4 RESEARCH ASSUMPTIONS 42

2.5 RESEARCH LIMITATIONS 42

2.6 RISK ANALYSIS 43

3 EXECUTIVE SUMMARY 44

4 PREMIUM INSIGHTS 48

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET 48

4.2 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE 49

4.3 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY 49

4.4 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY 50

4.5 AUTOMATED GUIDED VEHICLE MARKET IN NORTH AMERICA, BY INDUSTRY

AND COUNTRY 50

4.6 AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY 51

5 MARKET OVERVIEW 52

5.1 INTRODUCTION 52

5.2 MARKET DYNAMICS 52

5.2.1 DRIVERS 53

5.2.1.1 Rising demand for automation solutions in various industries 53

5.2.1.2 Increasing focus on enhancing workplace safety 53

5.2.1.3 Marked shift to mass customization from mass production 53

5.2.1.4 Growing demand for material handling technology 54

5.2.1.5 Rapid expansion of e-commerce industry 54

5.2.2 RESTRAINTS 55

5.2.2.1 High installation, maintenance, and switching costs 55

5.2.2.2 Growing preference for mobile robots over AGVs 56

5.2.2.3 Issues with infrastructure compatibility in developing countries 56

5.2.3 OPPORTUNITIES 57

5.2.3.1 Growing implementation of Industry 4.0 technologies

in warehousing sector 57

5.2.3.2 Increasing focus on industrial automation by SMEs 58

5.2.3.3 Substantial growth of industrial sector in emerging economies 58

5.2.3.4 Rapidly growing intralogistics sector in Southeast Asia 58

5.2.3.5 Constant technological innovations to enhance AGV capabilities 58

5.2.4 CHALLENGES 59

5.2.4.1 Low labor costs restricting adoption in emerging economies 59

5.2.4.2 Technical challenges and downtime in operations 60

5.3 VALUE CHAIN ANALYSIS 60

5.4 ECOSYSTEM ANALYSIS 63

5.5 PRICING ANALYSIS 65

5.5.1 INDICATIVE PRICING OF FORKLIFT TRUCKS OFFERED BY KEY PLAYERS, 2023 65

5.5.2 AVERAGE SELLING PRICE TREND FOR AGVS, BY TYPE, 2020–2023 66

5.5.3 AVERAGE SELLING PRICE TREND FOR AGVS, BY REGION, 2020–2023 67

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 68

5.7 INVESTMENT AND FUNDING SCENARIO 68

5.8 TECHNOLOGY ANALYSIS 69

5.8.1 KEY TECHNOLOGIES 69

5.8.1.1 Artificial intelligence 69

5.8.1.2 Machine learning 69

5.8.2 ADJACENT TECHNOLOGIES 69

5.8.2.1 Internet of Things 69

5.8.2.2 5G 69

5.8.3 COMPLEMENTARY TECHNOLOGIES 70

5.8.3.1 Collaborative robots 70

5.8.3.2 Digital twin technology 70

5.9 PORTER'S FIVE FORCES ANALYSIS 70

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA 72

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS 72

5.10.2 BUYING CRITERIA 72

5.11 CASE STUDY ANALYSIS 73

5.11.1 MASTERMOVER'S AGV ACCELERATES EFFICIENCY AT TOYOTA

MOTOR MANUFACTURING 73

5.11.2 IMPLEMENTATION OF AGV & PALLETISING SYSTEM FOR KILCOY

PASTORAL COMPANY 74

5.11.3 SCOTT AUTOMATION’S ADVANCED AGV AND PALLETISING SYSTEM

ENHANCE EFFICIENCY OF KILCOY PASTORAL COMPANY 74

5.11.4 AGV-BASED INSTRUMENTAL PANEL ASSEMBLY LINE ENHANCES

EFFICIENCY AT JAGUAR LAND ROVER SLOVAKIA 75

5.11.5 E80 GROUP IMPLEMENTS LGVS AT METSÄ TISSUE’S WAREHOUSES

TO IMPROVE OPERATIONAL PERFORMANCE 76

5.12 KEY CONFERENCES AND EVENTS, 2024–2025 76

5.13 TRADE ANALYSIS 78

5.13.1 IMPORT SCENARIO (HS CODE 842710) 78

5.13.2 EXPORT SCENARIO (HS CODE 842710) 79

5.14 PATENT ANALYSIS 80

5.15 REGULATORY LANDSCAPE 83

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 83

5.15.2 STANDARDS 85

5.15.3 REGULATIONS 87

5.16 IMPACT OF AI ON AUTOMATED GUIDED VEHICLE MARKET 88

5.16.1 INTRODUCTION 88

5.16.2 IMPACT ON AUTOMATED GUIDED VEHICLE MARKET 89

5.16.3 TOP USE CASES AND MARKET POTENTIAL 89

6 EMERGING TECHNOLOGIES AND APPLICATIONS OF

AUTOMATED GUIDED VEHICLES 92

6.1 INTRODUCTION 92

6.2 EMERGING TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES 92

6.2.1 LIDAR SENSORS 92

6.2.2 CAMERA VISION 93

6.2.3 DUAL-MODE AUTOMATED GUIDED VEHICLES 93

6.3 LATEST APPLICATIONS OF AUTOMATED GUIDED VEHICLES 94

6.3.1 HOSPITALS 94

6.3.2 THEME PARKS 94

6.3.3 AGRICULTURE 95

7 BATTERY TYPES AND CHARGING ALTERNATIVES FOR

AUTOMATED GUIDED VEHICLES 96

7.1 INTRODUCTION 96

7.2 TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES 96

7.2.1 LEAD–ACID BATTERIES 96

7.2.2 LITHIUM–ION BATTERIES 97

7.2.3 NICKEL-BASED BATTERIES 97

7.2.4 OTHERS 97

7.3 BATTERY CHARGING ALTERNATIVES 97

7.3.1 AUTOMATIC AND OPPORTUNITY CHARGING 97

7.3.1.1 Wireless charging 97

7.3.2 BATTERY SWAP 98

7.3.2.1 Automatic battery swap 98

7.3.3 PLUG-IN CHARGING 98

7.3.3.1 Manual plug-in charging 98

7.3.3.2 Automatic plug-in charging 98

8 OFFERINGS IN AUTOMATED GUIDED VEHICLE MARKET 99

8.1 INTRODUCTION 99

8.2 HARDWARE 99

8.3 SOFTWARE AND SERVICES 100

9 RECENT TRENDS IN AUTOMATED GUIDED VEHICLES 101

9.1 INTRODUCTION 101

9.2 INTERNET OF THINGS CONNECTIVITY 101

9.3 ADOPTION OF COLLABORATIVE AGVS 101

9.4 SCALABILITY AND MODULAR DESIGN 101

9.5 ADVANCED NAVIGATION TECHNOLOGIES 101

9.6 ENERGY EFFICIENCY AND SUSTAINABILITY 102

9.7 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING 102

9.8 EDGE COMPUTING FOR REAL-TIME DATA PROCESSING 102

10 APPLICATIONS OF AUTOMATED GUIDED VEHICLES 103

10.1 INTRODUCTION 103

10.2 PICK & PLACE 103

10.3 PACKAGING & PALLETIZING 104

10.4 ASSEMBLY & STORAGE 104

11 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY 105

11.1 INTRODUCTION 106

11.2 LIGHT-DUTY AGVS 107

11.2.1 FLEXIBILITY AND COST-EFFECTIVENESS IN HANDLING SMALL LOADS

TO SUPPORT MARKET GROWTH 107

11.3 MEDIUM-DUTY AGVS 108

11.3.1 ABILITY TO HANDLE MODERATE LOADS ACROSS DIVERSE INDUSTRIES

TO BOOST DEMAND 108

11.4 HEAVY-DUTY AGVS 109

11.4.1 CAPACITY TO HANDLE EXTREMELY HEAVY LOADS TO DRIVE

SEGMENTAL GROWTH 109

12 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE 110

12.1 INTRODUCTION 111

12.2 TOW VEHICLES 114

12.2.1 HEIGHTENED PRODUCTIVITY AND COST SAVINGS TO SUPPORT

MARKET GROWTH 114

12.3 UNIT LOAD CARRIERS 116

12.3.1 REDUCED LABOR COST AND OPERATIONAL EFFICIENCY TO BOOST DEMAND 116

12.4 PALLET TRUCKS 119

12.4.1 INCREASING USAGE IN AUTOMOTIVE, FAST-MOVING CONSUMER GOODS, AND FOOD & BEVERAGESS TO FUEL MARKET GROWTH 119

12.5 ASSEMBLY LINE VEHICLES 121

12.5.1 ECONOMIC VIABILITY THAN CHAIN-BASED CONVEYANCE SYSTEMS

TO DRIVE ADOPTION 121

12.6 FORKLIFT TRUCKS 124

12.6.1 RISING DEMAND IN FLOOR-TO-FLOOR AND FLOOR-TO-RACKING OPERATIONS TO FUEL SEGMENTAL GROWTH 124

12.7 OTHER TYPES 126

13 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY 129

13.1 INTRODUCTION 130

13.2 LASER GUIDANCE 132

13.2.1 ACCURACY AND FLEXIBILITY TO AUGMENT MARKET GROWTH 132

13.3 MAGNETIC GUIDANCE 133

13.3.1 EASY TO INSTALL, DURABILITY, AND RELIABILITY TO DRIVE ADOPTION 133

13.4 INDUCTIVE GUIDANCE 135

13.4.1 SUITABILITY FOR TOUGHEST INDUSTRIAL SETUPS TO INCREASE DEMAND 135

13.5 OPTICAL TAPE GUIDANCE 136

13.5.1 EASY AND CONVENIENT SOLUTION FOR AGVS TO FOSTER MARKET GROWTH 136

13.6 VISION GUIDANCE 138

13.6.1 RELIABILITY IN DYNAMIC ENVIRONMENTS AND MANEUVERABILITY

IN COMPLEX SPACES TO ACCELERATE MARKET GROWTH 138

13.7 OTHER NAVIGATION TECHNOLOGIES 139

14 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY 141

14.1 INTRODUCTION 142

14.2 AUTOMOTIVE 144

14.2.1 GROWING DEMAND FOR AFTER-SALES SPARE PARTS TO DRIVE MARKET 144

14.3 METALS & HEAVY MACHINERY 146

14.3.1 DEPLOYMENT OF AGVS TO EASE WORKFLOW TO SPUR DEMAND 146

14.4 FOOD & BEVERAGES 148

14.4.1 RISING ADOPTION OF AGVS TO MEET INCREASING GLOBAL FOOD

DEMAND TO ACCELERATE MARKET GROWTH 148

14.5 CHEMICAL 150

14.5.1 WIDER TREND TOWARD AUTOMATION AND INDUSTRY 4.0 TO DRIVE MARKET 150

14.6 HEALTHCARE 152

14.6.1 INCREASING AND INNOVATIVE USE OF AGVS IN PATIENT CARE

TO FUEL MARKET GROWTH 152

14.7 3PL 154

14.7.1 RELIANCE ON AGVS FOR DAY-TO-DAY OPERATIONS TO FOSTER

MARKET GROWTH 154

14.8 SEMICONDUCTOR & ELECTRONICS 156

14.8.1 SURGING DEMAND FOR INEXPENSIVE, PORTABLE, AND FUNCTIONAL ELECTRONIC DEVICES TO PROPEL DEMAND 156

14.9 AVIATION 158

14.9.1 ESCALATING NEED TO STREAMLINE AEROSPACE MANUFACTURING

TO DRIVE MARKET 158

14.10 E-COMMERCE 160

14.10.1 ADOPTION OF AGVS FOR MATERIAL HANDLING OPERATIONS

TO FUEL MARKET GROWTH 160

14.11 OTHER INDUSTRIES 162

15 AUTOMATED GUIDED VEHICLE MARKET, BY REGION 164

15.1 INTRODUCTION 165

15.2 NORTH AMERICA 167

15.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 167

15.2.2 US 171

15.2.2.1 Presence of established automobile manufacturers with

warehousing facilities to fuel market growth 171

15.2.3 CANADA 172

15.2.3.1 Sustained automation in various industries to drive market 172

15.2.4 MEXICO 174

15.2.4.1 Well-established manufacturing sector to foster market growth 174

15.3 EUROPE 175

15.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 175

15.3.2 GERMANY 178

15.3.2.1 Skilled workforce and investments in R&D to spike demand 178

15.3.3 UK 180

15.3.3.1 Rising demand from automotive sector to stimulate market growth 180

15.3.4 FRANCE 182

15.3.4.1 Growing e-commerce industry to accelerate market growth 182

15.3.5 ITALY 183

15.3.5.1 Surging demand for advanced logistics and automation solutions

to propel market 183

15.3.6 SPAIN 185

15.3.6.1 Booming logistics industry and renewable energy to fuel market growth 185

15.3.7 NETHERLANDS 186

15.3.7.1 Efficient supply chain networks and state-of-the-art warehousing infrastructure to boost demand 186

15.3.8 REST OF EUROPE 188

15.4 ASIA PACIFIC 189

15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 190

15.4.2 CHINA 194

15.4.2.1 Heightened demand for transportation, warehousing, and

logistics services to augment market growth 194

15.4.3 JAPAN 196

15.4.3.1 Escalating labor costs and broad industrial base to

support market growth 196

15.4.4 AUSTRALIA 197

15.4.4.1 Growing manufacturing and mining industries to spike demand 197

15.4.5 SOUTH KOREA 199

15.4.5.1 Increasing presence of global AGV companies to drive market 199

15.4.6 INDIA 200

15.4.6.1 Growing population, strong domestic demand, and sustainable economic growth to create opportunities 200

15.4.7 MALAYSIA 202

15.4.7.1 Growing demand for innovative logistics solutions to

support market growth 202

15.4.8 INDONESIA 203

15.4.8.1 Rapid industrial development to fuel market growth 203

15.4.9 SINGAPORE 205

15.4.9.1 Advanced technology and infrastructure to propel market growth 205

15.4.10 THAILAND 206

15.4.10.1 Manufacturing expansion and infrastructure growth to drive market 206

15.4.11 REST OF ASIA PACIFIC 208

15.5 ROW 209

15.5.1 MACROECONOMIC OUTLOOK FOR ROW 209

15.5.2 MIDDLE EAST 212

15.5.2.1 GCC 214

15.5.2.1.1 Saudi Arabia 214

15.5.2.1.1.1 Rising focus on economic diversification under Vision 2030 to foster market growth 214

15.5.2.1.2 UAE 214

15.5.2.1.2.1 Heightened demand for transportation, warehousing, and logistics services to augment market growth 214

15.5.2.1.3 Rest of GCC 214

15.5.2.2 Rest of Middle East 215

15.5.2.3 South America 215

15.5.2.3.1 Government support for automation in Food & beveragess industry to support market growth 215

15.5.2.4 Africa 217

15.5.2.4.1 Rising adoption of warehouse automation solutions in various industries to increase AGV adoption 217

16 COMPETITIVE LANDSCAPE 219

16.1 INTRODUCTION 219

16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024 219

16.3 REVENUE ANALYSIS, 2019–2023 221

16.4 MARKET SHARE ANALYSIS, 2023 222

16.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024 224

16.6 BRAND/PRODUCT COMPARISON 225

16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 226

16.7.1 STARS 226

16.7.2 EMERGING LEADERS 226

16.7.3 PERVASIVE PLAYERS 226

16.7.4 PARTICIPANTS 226

16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 228

16.7.5.1 Company footprint 228

16.7.5.2 Region footprint 229

16.7.5.3 Navigation technology footprint 230

16.7.5.4 Type footprint 231

16.7.5.5 Industry footprint 232

16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 234

16.8.1 PROGRESSIVE COMPANIES 234

16.8.2 RESPONSIVE COMPANIES 234

16.8.3 DYNAMIC COMPANIES 234

16.8.4 STARTING BLOCKS 234

16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 236

16.8.5.1 Detailed list of key startups/SMEs 236

16.8.5.2 Competitive benchmarking of key startups/SMEs 236

16.9 COMPETITIVE SCENARIO 237

16.9.1 PRODUCT LAUNCHES 237

16.9.2 DEALS 238

16.9.3 EXPANSIONS 239

16.9.4 OTHER DEVELOPMENTS 240

17 COMPANY PROFILES 241

17.1 KEY PLAYERS 241

17.1.1 DAIFUKU CO., LTD. 241

17.1.1.1 Business overview 241

17.1.1.2 Products/Solutions/Services offered 242

17.1.1.3 Recent developments 243

17.1.1.3.1 Deals 243

17.1.1.3.2 Expansions 243

17.1.1.4 MnM view 244

17.1.1.4.1 Key strengths 244

17.1.1.4.2 Strategic choices 244

17.1.1.4.3 Weaknesses and competitive threats 244

17.1.2 JBT 245

17.1.2.1 Business overview 245

17.1.2.2 Products/Solutions/Services offered 246

17.1.2.3 Recent developments 247

17.1.2.3.1 Product launches 247

17.1.2.4 MnM view 247

17.1.2.4.1 Key strengths 247

17.1.2.4.2 Strategic choices 247

17.1.2.4.3 Weaknesses and competitive threats 247

17.1.3 KION GROUP AG 248

17.1.3.1 Business overview 248

17.1.3.2 Products/Solutions/Services offered 249

17.1.3.3 Recent developments 250

17.1.3.3.1 Expansions 250

17.1.3.4 MnM view 251

17.1.3.4.1 Key strengths 251

17.1.3.4.2 Strategic choices 251

17.1.3.4.3 Weaknesses and competitive threats 251

17.1.4 TOYOTA INDUSTRIES CORPORATION 252

17.1.4.1 Business overview 252

17.1.4.2 Products/Solutions/Services offered 253

17.1.4.3 Recent developments 255

17.1.4.3.1 Product launches 255

17.1.4.3.2 Deals 256

17.1.4.4 MnM view 257

17.1.4.4.1 Key strengths 257

17.1.4.4.2 Strategic choices 257

17.1.4.4.3 Weaknesses and competitive threats 257

17.1.5 KUKA AG 258

17.1.5.1 Business overview 258

17.1.5.2 Products/Solutions/Services offered 259

17.1.5.3 Recent developments 260

17.1.5.3.1 Product launches 260

17.1.5.3.2 Deals 260

17.1.5.3.3 Other developments 261

17.1.5.4 MnM view 261

17.1.5.4.1 Key strengths 261

17.1.5.4.2 Strategic choices 261

17.1.5.4.3 Weaknesses and competitive threats 261

17.1.6 SCOTT 262

17.1.6.1 Business overview 262

17.1.6.2 Products/Solutions/Services offered 263

17.1.6.3 Recent developments 264

17.1.6.3.1 Deals 264

17.1.7 SSI SCHAEFER 265

17.1.7.1 Business overview 265

17.1.7.2 Products/Solutions/Services offered 265

17.1.7.3 Recent developments 266

17.1.7.3.1 Deals 266

17.1.7.3.2 Other developments 267

17.1.8 HYSTER-YALE MATERIALS HANDLING, INC. 268

17.1.8.1 Business overview 268

17.1.8.2 Products/Solutions/Services offered 269

17.1.8.3 Recent developments 270

17.1.8.3.1 Developments 270

17.1.9 EK ROBOTICS GMBH 271

17.1.9.1 Business overview 271

17.1.9.2 Products/Solutions/Services offered 271

17.1.9.3 Recent developments 273

17.1.9.3.1 Product launches 273

17.1.9.3.2 Deals 274

17.1.9.3.3 Expansions 274

17.1.10 MEIDENSHA CORPORATION 275

17.1.10.1 Business overview 275

17.1.10.2 Products/Solutions/Services offered 277

17.1.10.3 Recent developments 277

17.1.10.3.1 Product launches 277

17.1.11 MITSUBISHI LOGISNEXT CO., LTD 278

17.1.11.1 Business overview 278

17.1.11.2 Products/Solutions/Services offered 279

17.1.11.3 Recent developments 281

17.1.11.3.1 Expansions 281

17.1.12 OCEANEERING INTERNATIONAL, INC. 282

17.1.12.1 Business overview 282

17.1.12.2 Products/Solutions/Services offered 283

17.1.12.3 Recent developments 284

17.1.12.3.1 Product launches 284

17.1.12.3.2 Deals 284

17.1.12.3.3 Expansions 284

17.1.12.3.4 Other developments 285

17.2 OTHER PLAYERS 286

17.2.1 AIM 286

17.2.2 ASSECO CEIT, A.S. 287

17.2.3 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD. 287

17.2.4 JIANGXI DANBAHE ROBOT CO., LTD. 288

17.2.5 E80 GROUP S.P.A. 289

17.2.6 GLOBAL AGV 290

17.2.7 GRENZEBACH GROUP 291

17.2.8 IDC CORPORATION 291

17.2.9 NANCHANG IKWELL ROBOTICS CO., LTD. 292

17.2.10 SAFELOG GMBH 293

17.2.11 SIMPLEX ROBOTICS PVT. LTD. 294

17.2.12 SYSTEM LOGISTICS S.P.A. 295

17.2.13 BALYO SA 296

17.2.14 SHENZHEN MIRCOLOMAY TECHNOLOGY CO., LTD. 297

18 APPENDIX 298

18.1 DISCUSSION GUIDE 298

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 302

18.3 CUSTOMIZATION OPTIONS 304

18.4 RELATED REPORTS 304

18.5 AUTHOR DETAILS 305

❖ 世界の無人搬送車(AGV)市場に関するよくある質問(FAQ) ❖

・無人搬送車(AGV)の世界市場規模は?

→MarketsandMarkets社は2024年の無人搬送車(AGV)の世界市場規模を25億6000万米ドルと推定しています。

・無人搬送車(AGV)の世界市場予測は?

→MarketsandMarkets社は2029年の無人搬送車(AGV)の世界市場規模を37億8000万米ドルと予測しています。

・無人搬送車(AGV)市場の成長率は?

→MarketsandMarkets社は無人搬送車(AGV)の世界市場が2024年~2029年に年平均8.1%成長すると予測しています。

・世界の無人搬送車(AGV)市場における主要企業は?

→MarketsandMarkets社は「Daifuku Co. (日本)、JBT(米国)、KION Group AG(ドイツ)、豊田自動織機(日本)、KUKA AG(ドイツ)など ...」をグローバル無人搬送車(AGV)市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。