1 はじめに 27

1.1 調査目的 27

1.2 市場の定義 28

1.3 包含と除外 30

1.4 調査範囲 31

1.4.1 考慮した年数 31

1.5 考慮した単位 32

1.5.1 通貨(金額単位) 32

1.5.2 数量単位 32

1.6 利害関係者 33

2 調査方法 34

2.1 調査データ 34

2.1.1 二次データ 35

2.1.1.1 参照した二次資料 36

2.1.1.1 自律走行型建設機械市場規模の推定に参照した二次資料 36

2.1.1.2 二次資料からの主要データ 37

2.1.2 一次データ 37

2.1.2.1 一次参加者 38

2.1.2.2 一次インタビューの内訳 38

2.1.2.3 サンプリング手法とデータ収集方法 39

2.2 市場規模の推定 39

2.2.1 ボトムアップアプローチ 41

2.2.2 トップダウンアプローチ 42

2.3 データの三角測量 43

2.4 リサーチの前提条件と関連リスク 44

2.5 調査の限界 45

3 エグゼクティブサマリー 46

4 プレミアムインサイト 50

4.1 自律型建設機械市場におけるプレーヤーにとっての魅力的な機会 50

4.2 自律型建設機械市場:機器タイプ別 51

4.3 自律型建設機械市場:用途別 51

4.4 自律型建設機械市場:自動化レベル別 52

4.5 自律型建設機械市場:推進タイプ別 52

4.6 自律型建設機械市場:出力別 53

4.7 自律型建設機械市場:地域別 53

5 市場の概要

5.1 導入 54

5.2 市場ダイナミクス

5.2.1 推進要因

5.2.1.1 インフラ開発と鉱業活動の成長 55

5.2.1.2 ブドウ園における高価な労働力と自動化の進展 57

5.2.2 阻害要因 58

5.2.2.1 高い初期投資 58

5.2.3 機会 58

5.2.3.1 AlとMLの進歩 58

5.2.4 課題 60

5.2.4.1 サイバーセキュリティリスク 60

5.2.4.2 技術統合の複雑さ 60

5.3 エコシステム分析 62

5.4 サプライチェーン分析 64

5.4.1 OEMS 64

5.4.2 技術プロバイダー 65

5.4.3 センサーメーカー 65

5.4.4 エンドユーザー 65

5.5 主要ステークホルダーと購買基準 65

5.5.1 購入プロセスにおける主要ステークホルダー 65

5.5.2 購入基準 66

5.6 AI/ジェネレーティブAIが自律型建設機械市場に与える影響 67

5.6.1 AI/ジェネレーティブAIの影響 67

5.7 主要な会議とイベント(2024~2025年) 68

5.8 技術分析 68

5.8.1 主要技術 69

5.8.1.1 センサーフュージョン技術 69

5.8.2 隣接技術 69

5.8.2.1 拡張現実(AR) 69

5.8.3 補完技術 69

5.8.3.1 予知保全技術 69

5.9 投資と資金調達のシナリオ 70

5.10 特許分析 71

5.11 貿易分析 74

5.11.1 自律型建設機械の輸入シナリオ 74

5.11.2 自律型建設機械の輸出シナリオ 76

5.12 ケーススタディ分析 78

5.12.1 自律走行トラック開発におけるセーフアイとデータスピードの提携 78

5.12.2 知覚とローカライゼーション・ソリューションによる自律型建設機械の実現(タタ・エルクシ ーからの引用) 79

5.12.3 tata elxsi 社は自律走行運搬で採掘作業の最適化を支援 80

5.13 規制の状況 81

5.13.1 アジア太平洋地域 81

5.13.2 欧州 82

5.13.3 アメリカ 83

5.14 顧客ビジネスに影響を与えるトレンドと混乱 84

5.15 価格分析 84

5.15.1 自律走行型建設機械の機種別平均販売価格帯 85

5.15.2 自律走行型建設機械の地域別平均販売価格範囲 85

5.16 OEM出力の分析 86

5.17 自律型建設機械の構成要素 87

5.17.1 ライダー 88

5.17.2 レーダー

5.17.3 GPS 89

5.17.4 カメラ/ビジョン・システム 89

5.17.5 超音波システム 89

6 自律型建設機械市場、機器タイプ別 90

6.1 導入 91

6.2 ドーザー 94

6.2.1 建設・採掘プロジェクトにおける生産性と作業効率の大幅改善の必要性 94

6.3 ダンプトラック 95

6.3.1 強力なエンジンと過酷な運転条件に耐える堅牢な構造 95

6.4 ローダー 97

6.4.1 洗練された自動化技術と組み合わされた機能的多様性 97

6.5 掘削機 98

6.5.1 様々な地形における安定性と牽引力の最適化 98

6.6 運搬トラック 100

6.6.1 自動化が進む鉱業に不可欠 100

6.7 コンパクター 101

6.7.1 品質向上と人手による見落としを最小化する建設業に不可欠 101

6.8 農業用トラクター 103

6.8.1 農業、特にブドウ園での需要 103

6.9 主要な洞察 104

7 自律走行型オフハイウェイ車市場(用途別) 105

7.1 導入 106

7.2 自律走行型建設 108

7.2.1 アジア太平洋地域の急速な都市化と技術導入はこの分野に有利 108

7.3 自律型鉱業 109

7.3.1 過程を自動化し、危険な環境における人間の存在を最小化する著名鉱業企業の取り組み 109

7.4 自律型農業 111

7.4.1 労働力不足と運営コストの上昇が農家に自律走行車の選択を促す 111

7.5 主要な洞察 112

8 自律型建設機械市場、

自動化レベル別 113

8.1 導入 114

8.2 完全自律型 116

8.2.1 人間作業員の事故や負傷のリスクを低減する必要性 116

8.3 半自律型 117

8.3.1 建設・農業産業における効率性と生産性向上の需要 117

8.4 主要な洞察 119

9 自律型建設機械市場、推進力別 120

9.1 導入 121

9.2 ディーゼル 123

9.2.1 ディーゼルエンジン車の高い積載能力とパワー 123

9.3 電気・ハイブリッド 124

9.3.1 バッテリー技術の進歩とコンパクトな構造 124

9.4 主要な洞察 126

10 自律型建設機械市場:出力別 127

10.1 導入 128

10.2 100馬力未満 130

10.2.1 都市環境におけるコンパクトで汎用性の高い機械に対する需要の増加 130

10.3 100~250馬力 131

10.3.1 効率と持続可能性を優先する需要 131

10.4 251馬力以上 133

10.4.1 運転ワークフローの改善への注目度が高まり、強力な自律走行車の需要が高まる 133

10.5 主要な洞察 134

11 自律型建設機械市場(地域別) 135

11.1 はじめに 136

11.2 アジア太平洋地域 138

11.2.1 アジア太平洋地域:マクロ経済指標 138

11.2.2 中国 143

11.2.2.1 建設・農業分野向け新型自律走行機器開発のための政府技術投資 143

11.2.3 日本 145

11.2.3.1 労働人口の減少がOEMの自動化製品の研究開発投資を促進 145

11.2.4 インド 147

11.2.4.1 半自律型建設機械の需要が徐々に拡大、受け入れ率は厳しい 147

11.2.5 インドネシア 148

11.2.5.1 政府の支援とともに鉱業部門が主要な牽引役に 148

11.3 欧州 150

11.3.1 欧州: マクロ経済指標 150

11.3.2 ドイツ 157

11.3.2.1 新しい自律走行トラックやコンパクターのテストを含む大規模な取り組み 157

11.3.3 フランス 159

11.3.3.1 有力企業による投資と新しい自律走行機器の導入 159

11.3.4 スペイン 161

11.3.4.1 自律走行農用トラクターの試験と早期導入 161

11.3.5 イギリス 162

11.3.5.1 自律走行技術に対する政府の積極的支援と業界リーダーからの投資 162

11.3.6 イタリア 165

11.3.6.1 初期投資の課題を相殺する自律走行型建設機械の優位性に対する認識の高まり 165

11.4 アメリカ 167

11.4.1 アメリカ:マクロ経済指標 167

11.4.2 米国 172

11.4.2.1 整備されたインフラと確立された産業運営 172

11.4.3 カナダ 175

11.4.3.1 複雑な規制の枠組みとともに持続可能性を重視 175

11.4.4 メキシコ 177

177 11.4.4.1 インフラと建設産業への近代化と投資の推進 177

11.4.5 ブラジル 179

179 11.4.5.1 安全性と効率向上のための自律走行技術への投資 179

12 競争環境 181

12.1 概要 181

12.2 主要プレーヤーの戦略/勝利への権利(2021~2024年) 181

12.3 市場シェア分析、2023年 184

12.4 収益分析、2019-2023 186

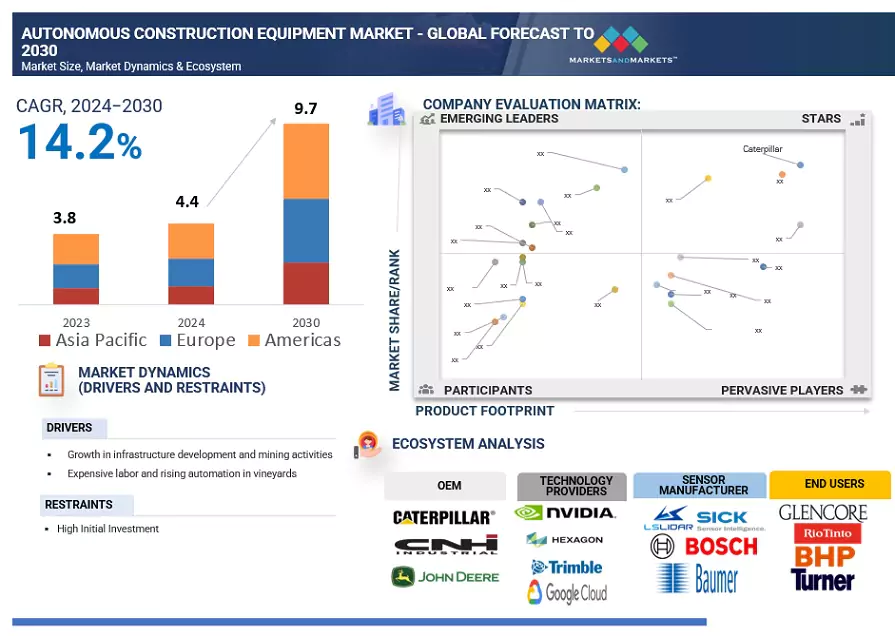

12.5 企業評価マトリックス:主要プレイヤー(2023年) 187

12.5.1 スター企業 187

12.5.2 新興リーダー 187

12.5.3 浸透型プレーヤー 188

12.5.4 参加企業 188

12.5.5 自律型建設機械市場:企業の足跡 189

12.5.5.1 企業フットプリント 189

12.5.5.2 アプリケーションフットプリント 190

12.5.5.3 自動化レベルのフットプリント 191

12.5.5.4 地域別フットプリント 192

12.6 企業評価と財務指標 193

12.6.1 企業評価 193

12.6.2 財務指標 193

12.7 ブランド/製品の比較 194

12.8 競合のシナリオと動向 194

12.8.1 製品上市 194

12.8.2 取引 198

12.8.3 拡張 204

12.8.4 その他の開発 206

13 会社プロファイル 207

Deere & Company (US)

CNH Industrial (UK)

Caterpillar (US

Komatsu Ltd (Japan)

Libherr Group (Switzerland)

Hitachi Construction Machinery Co.Ltd (Japan)

Volvo Construction Equipment (Sweden)

Doosan Bobcat (South Korea)

Built Robotics (Us)

HD Hyundai (South Korea) and Sandvik (Sweden)

14 Marketsandmarketsの提言 285

14.1 自律型建設機械市場はアメリカが支配する 285

14.2 主要注目分野: 半自律走行車の普及拡大

AIやフリート管理ソリューションなどの先進技術の統合 285

14.3 結論 286

15 付録 287

15.1 業界専門家の洞察 287

15.2 ディスカッションガイド 288

15.3 Knowledgestore: Marketsandmarketsの購読ポータル 291

15.4 カスタマイズオプション 293

15.4.1 自律型建設機械市場、地域別、タイプ別 293

15.4.1.1 アジア太平洋地域 293

15.4.1.2 欧州 293

15.4.1.3 北米 293

15.4.1.4 その他の地域 293

15.4.2 自律走行型農業用トラクター市場、用途別 293

15.4.2.1 耕うん(一次耕うんおよび二次耕うん) 293

15.4.2.2 種まき 293

15.4.2.3 収穫作業 293

15.4.2.4 その他の農業用途 293

15.4.3 自律走行型農業用トラクター市場(出力別) 293

15.4.3.1 100馬力未満 293

15.4.3.2 100~250馬力 293

15.4.3.3 251馬力以上 293

15.4.4 製品分析 293

15.5 関連レポート 294

15.6 著者の詳細 295

OEMs from agricultural industries like John Deere (US) have introduced See & Spray Ultimate technology. This technology uses 36 cameras mounted on the boom to scan over 2,100 square feet per second.

"Semi-Autonomous Construction Equipment segment is expected to be the largest market by Level of Automation."

Automation in construction equipment is revolutionizing industries like mining, construction, and agriculture through advanced technologies such as sensors, AI, and high-resolution cameras. Semi-autonomous construction equipment hold the largest market share due to the balance between automation and human control, letting operators manage complicated tasks while providing improved safety, efficiency, and lower labor requirements, all without the limited incremental expenses, skipping the regulatory hurdles that come with full autonomy. Semi-autonomous construction equipment are increasingly transforming construction and mining operations with advanced technology, which enhances safety and operational efficiency. Technologies such as Grade Assist in excavators automate boom and bucket control by Caterpillar, allowing operators to focus on critical tasks and significantly reducing the need for frequent grade checks. Similarly, John Deere's AutoTrac tractor system utilizes GPS and RTK technology for precise guidance along predetermined paths. Loaders benefit from payload management systems that ensure safe handling. Leading OEMs are advancing these technologies to further boost productivity and safety. Hence, the increasing use of several automated features for reducing human control and helping in operation efficiency with cost-competitive pricing will drive the demand for the semi-autonomous construction equipment segment.

"Mining equipment are expected to be the promising application of all autonomous construction equipment."

The mining industry has increasingly adopted automation across various equipment to enhance operational efficiency and safety, including dump trucks, loaders, excavators, etc. These autonomous systems are utilized for extracting minerals such as coal, gold, copper, and iron ore, focusing on underground mining applications. Countries like Australia have been leaders in adopting autonomous solutions, while Latin American countries such as Colombia and Chile are also integrating these technologies to optimize their mining activities. Major mining companies, including BHP, Rio Tinto, and Vale, have been at the forefront of implementing autonomous solutions driven by the need to improve productivity, ensure worker safety, and address the challenges of operating in remote and hazardous environments. Leading OEMs like Liebherr, AB Volvo, and Sandvik have led this transformation. Sandvik plans to launch the AutoMine Interoperable Access Control System (ACS) in 2024, enhancing productivity by enabling third-party autonomous equipment to operate within its safety zones.

"Asia Pacific is Estimated to Fastest Growing Autonomous Construction Equipment Market."

The growth of autonomous construction equipment in Asia Pacific is mainly driven by factors such as government initiatives supporting autonomous vehicle deployment and advancements in safety technologies.

The Autonomous construction equipment market is witnessing rapid year-on-year growth in the Asia Pacific region, which comprises some of the fastest-developing economies globally, such as China, Japan, Australia, Indonesia, and India, driven by the increasing need for efficiency, safety, and environmental sustainability across key sectors such as mining, construction, and agriculture.The demand for autonomous construction equipment is growing significantly in Asia Pacific is mainly due to several projects undertaken, such as dams, airports, and hydroelectricity, in the past. This provided an opportunity for the penetration of autonomous construction equipment market.Further, The continuously increasing demand for automation in mining equipment in countries such as China, Indonesia, and Australia is also expected to drive the demand for electric autonomous mining equipment in Asia Pacific. Battery electric mining equipment is ideal for incorporating autonomous technology as it is easier for autonomous computing systems to operate battery-electric equipment.

Major players, including Komatsu, HD Hyundai, Sany, and Caterpillar, are launching innovative semi & fully autonomous equipment in the Asia Pacific. For instance, products like Komatsu's HD605-7 AC autonomous mining truck and John Deere's autonomous farm tractor are designed to optimize operations and reduce labor costs. Further, recent partnerships, such as the one between Hexagon and BUMA in Indonesia and the development of advanced technologies like Hitachi's Real-Time Digital Twin Platform, are accelerating market growth in this region. As the region's infrastructure development and mining operations expand, the demand for autonomous solutions is expected to rise.

The breakup of primary respondents

By Company: OEMs – 70%, Component Manufacturers -30%

By Designation: C-Level Executives - 30%, Director Levels- 60%, Others – 10%

By Region: Europe - 20%, Asia Pacific - 55%, Americas- 25%

The autonomous construction equipment market will be dominated by global players, including Deere & Company (US), CNH Industrial (UK), Caterpillar (US, Komatsu Ltd (Japan), Libherr Group (Switzerland), Hitachi Construction Machinery Co., Ltd (Japan), Volvo Construction Equipment (Sweden), Doosan Bobcat (South Korea), Built Robotics (Us), HD Hyundai (South Korea), and Sandvik (Sweden). The study includes an in-depth competitive analysis of these key players in the autonomous construction equipment market with their company profiles, recent developments, and key market strategies.

Research Coverage

The study's primary objective is to define, describe, and forecast the autonomous construction equipment market by volume and value. The study segments of the Autonomous Construction Equipment Market are by equipment type (Dozers, Dump Trucks, Loaders, Excavators, Haul Trucks, compactors (road roller), and Farm Tractors), power output (<100 HP, 101-250 HP, and >251 HP), propulsion (Diesel and Electric & Hybrid), level of automation (Autonomous and Semi-Autonomous), Application (Construction, Mining, and Agriculture), and region (Americas, Europe, and Asia Pacific). It analyzes the opportunities offered by various market segments to the stakeholders. It tracks and analyzes competitive developments such as market ranking analysis, joint ventures, acquisitions, and other activities by key industry participants.

The report provides insights on the following pointers:

•Analysis of key drivers (Growth in infrastructure development and mining activities, and rising automation in vineyards), restraints ( high initial investment), opportunities (Advancements in AI and Machine learning), and challenges (Cybersecurity Risks).

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the autonomous construction equipment market.

•Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the autonomous construction equipment market

•Competitive Assessment: In-depth assessment of market share analysis, growth strategies, and product offerings of leading players in the autonomous construction equipment market, such as Deere & Company (US), CNH Industrial (UK), Caterpillar (US, Komatsu Ltd (Japan), Libherr Group (Switzerland), Hitachi Construction Machinery Co., Ltd (Japan), Volvo Construction Equipment (Sweden), Doosan Bobcat (South Korea), Built Robotics (Us), HD Hyundai (South Korea), and Sandvik (Sweden).

The report showcases Qualitative insights on the component (LIDAR, RADAR, GPS, camera/vision system, and ultrasonic sensors) chapter.

The report analyze the pricing analysis, OEM analysis, and key buying criteria of the autonomous construction equipment market.

The report showcases technological developments impacting the market

Analysis of markets concerning individual growth trends, prospects, and contributions to the total market

Detailed OEM analysis for Power Output Vs. Number of Equipment.

Analysis of the supply chain analysis, ecosystem analysis, patent analysis, trade analysis, and case study analysis.

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 28

1.3 INCLUSIONS AND EXCLUSIONS 30

1.4 STUDY SCOPE 31

1.4.1 YEARS CONSIDERED 31

1.5 UNITS CONSIDERED 32

1.5.1 CURRENCY (VALUE UNIT) 32

1.5.2 VOLUME UNIT 32

1.6 STAKEHOLDERS 33

2 RESEARCH METHODOLOGY 34

2.1 RESEARCH DATA 34

2.1.1 SECONDARY DATA 35

2.1.1.1 Secondary sources referred 36

2.1.1.1.1 Secondary sources referred to for estimating autonomous construction equipment market size 36

2.1.1.2 Key data from secondary sources 37

2.1.2 PRIMARY DATA 37

2.1.2.1 Primary participants 38

2.1.2.2 Breakdown of primary interviews 38

2.1.2.3 Sampling techniques and data collection methods 39

2.2 MARKET SIZE ESTIMATION 39

2.2.1 BOTTOM-UP APPROACH 41

2.2.2 TOP-DOWN APPROACH 42

2.3 DATA TRIANGULATION 43

2.4 RESEARCH ASSUMPTIONS AND ASSOCIATED RISKS 44

2.5 RESEARCH LIMITATIONS 45

3 EXECUTIVE SUMMARY 46

4 PREMIUM INSIGHTS 50

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET 50

4.2 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY EQUIPMENT TYPE 51

4.3 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY APPLICATION 51

4.4 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY LEVEL OF AUTOMATION 52

4.5 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION TYPE 52

4.6 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT 53

4.7 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY REGION 53

5 MARKET OVERVIEW 54

5.1 INTRODUCTION 54

5.2 MARKET DYNAMICS 55

5.2.1 DRIVERS 55

5.2.1.1 Growth in infrastructure development and mining activities 55

5.2.1.2 Expensive labor and rising automation in vineyards 57

5.2.2 RESTRAINTS 58

5.2.2.1 High initial investment 58

5.2.3 OPPORTUNITIES 58

5.2.3.1 Advancements in Al and ML 58

5.2.4 CHALLENGES 60

5.2.4.1 Cybersecurity risks 60

5.2.4.2 Complexity of technological integration 60

5.3 ECOSYSTEM ANALYSIS 62

5.4 SUPPLY CHAIN ANALYSIS 64

5.4.1 OEMS 64

5.4.2 TECHNOLOGY PROVIDERS 65

5.4.3 SENSOR MANUFACTURERS 65

5.4.4 END USERS 65

5.5 KEY STAKEHOLDERS AND BUYING CRITERIA 65

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS 65

5.5.2 BUYING CRITERIA 66

5.6 IMPACT OF AI/GENERATIVE AI ON AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET 67

5.6.1 IMPACT OF AI/GENERATIVE AI 67

5.7 KEY CONFERENCES AND EVENTS, 2024–2025 68

5.8 TECHNOLOGY ANALYSIS 68

5.8.1 KEY TECHNOLOGIES 69

5.8.1.1 Sensor fusion technology 69

5.8.2 ADJACENT TECHNOLOGIES 69

5.8.2.1 Augmented Reality (AR) 69

5.8.3 COMPLEMENTARY TECHNOLOGIES 69

5.8.3.1 Predictive maintenance technology 69

5.9 INVESTMENT AND FUNDING SCENARIO 70

5.10 PATENT ANALYSIS 71

5.11 TRADE ANALYSIS 74

5.11.1 IMPORT SCENARIO OF AUTONOMOUS CONSTRUCTION EQUIPMENT 74

5.11.2 EXPORT SCENARIO OF AUTONOMOUS CONSTRUCTION EQUIPMENT 76

5.12 CASE STUDY ANALYSIS 78

5.12.1 SAFEAI AND DATASPEED PARTNER ON AUTONOMOUS HAUL TRUCK DEVELOPMENT 78

5.12.2 ENABLING AUTONOMOUS CONSTRUCTION EQUIPMENT WITH PERCEPTION AND LOCALIZATION SOLUTIONS (ADAPTED FROM TATA ELXSI) 79

5.12.3 TATA ELXSI HELPED OPTIMIZE MINING OPERATION WITH AUTONOMOUS HAULING 80

5.13 REGULATORY LANDSCAPE 81

5.13.1 ASIA PACIFIC 81

5.13.2 EUROPE 82

5.13.3 AMERICAS 83

5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 84

5.15 PRICING ANALYSIS 84

5.15.1 INDICATIVE AVERAGE SELLING PRICE RANGE OF AUTONOMOUS CONSTRUCTION EQUIPMENT, BY EQUIPMENT TYPE 85

5.15.2 INDICATIVE AVERAGE SELLING PRICE RANGE OF AUTONOMOUS CONSTRUCTION EQUIPMENT, BY REGION 85

5.16 OEM POWER OUTPUT ANALYSIS 86

5.17 COMPONENTS OF AUTONOMOUS CONSTRUCTION EQUIPMENT 87

5.17.1 LIDAR 88

5.17.2 RADAR 88

5.17.3 GPS 89

5.17.4 CAMERA/VISION SYSTEMS 89

5.17.5 ULTRASONIC SYSTEMS 89

6 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY EQUIPMENT TYPE 90

6.1 INTRODUCTION 91

6.2 DOZERS 94

6.2.1 NEED TO SIGNIFICANTLY IMPROVE PRODUCTIVITY AND OPERATIONAL EFFICIENCY IN CONSTRUCTION AND MINING PROJECTS 94

6.3 DUMP TRUCKS 95

6.3.1 POWERFUL ENGINES COMBINED WITH ROBUST STRUCTURE TO WITHSTAND HARSH OPERATING CONDITIONS 95

6.4 LOADERS 97

6.4.1 FUNCTIONAL VERSATILITY COMBINED WITH SOPHISTICATED AUTOMATION TECHNOLOGIES 97

6.5 EXCAVATORS 98

6.5.1 OPTIMIZED FOR STABILITY AND TRACTION ON VARIOUS TERRAINS 98

6.6 HAUL TRUCKS 100

6.6.1 ESSENTIAL IN INCREASINGLY AUTOMATED MINING INDUSTRY 100

6.7 COMPACTORS 101

6.7.1 ESSENTIAL IN CONSTRUCTION INDUSTRY TO ENHANCE QUALITY AND MINIMIZE HUMAN OVERSIGHT 101

6.8 FARM TRACTORS 103

6.8.1 PARTICULAR DEMAND IN AGRICULTURE, ESPECIALLY VINEYARDS 103

6.9 PRIMARY INSIGHTS 104

7 AUTONOMOUS OFF-HIGHWAY VEHICLES MARKET, BY APPLICATION 105

7.1 INTRODUCTION 106

7.2 AUTONOMOUS CONSTRUCTION 108

7.2.1 ASIA PACIFIC’S RAPID URBANIZATION AND TECHNOLOGICAL ADOPTION TO BE FAVORABLE FOR THIS SEGMENT 108

7.3 AUTONOMOUS MINING 109

7.3.1 INITIATIVES BY PROMINENT MINING COMPANIES TO AUTOMATE PROCESSES AND MINIMIZE HUMAN PRESENCE IN HAZARDOUS ENVIRONMENTS 109

7.4 AUTONOMOUS AGRICULTURE 111

7.4.1 LABOR SHORTAGES AND RISE IN OPERATIONAL COSTS TO ENCOURAGE FARMERS TO CHOOSE AUTONOMOUS VEHICLES 111

7.5 PRIMARY INSIGHTS 112

8 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET,

BY LEVEL OF AUTOMATION 113

8.1 INTRODUCTION 114

8.2 FULLY AUTONOMOUS 116

8.2.1 NEED TO REDUCE RISK OF ACCIDENTS AND INJURIES TO HUMAN WORKERS 116

8.3 SEMI-AUTONOMOUS 117

8.3.1 DEMAND FOR INCREASED EFFICIENCY AND PRODUCTIVITY IN CONSTRUCTION AND AGRICULTURE INDUSTRIES 117

8.4 PRIMARY INSIGHTS 119

9 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY PROPULSION 120

9.1 INTRODUCTION 121

9.2 DIESEL 123

9.2.1 HIGH LOAD-CARRYING CAPACITY AND POWER OF DIESEL-POWERED VEHICLES 123

9.3 ELECTRIC & HYBRID 124

9.3.1 ADVANCEMENTS IN BATTERY TECHNOLOGY AND COMPACT CONSTRUCTION 124

9.4 PRIMARY INSIGHTS 126

10 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY POWER OUTPUT 127

10.1 INTRODUCTION 128

10.2 LESS THAN 100 HP 130

10.2.1 INCREASE IN DEMAND FOR COMPACT AND VERSATILE MACHINERY IN URBAN ENVIRONMENTS 130

10.3 100–250 HP 131

10.3.1 DEMAND TO PRIORITIZE EFFICIENCY AND SUSTAINABILITY 131

10.4 251 HP AND ABOVE 133

10.4.1 HIGHER FOCUS ON IMPROVING OPERATIONAL WORKFLOWS TO DRIVE DEMAND FOR POWERFUL AUTONOMOUS VEHICLES 133

10.5 PRIMARY INSIGHTS 134

11 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY REGION 135

11.1 INTRODUCTION 136

11.2 ASIA PACIFIC 138

11.2.1 ASIA PACIFIC: MACROECONOMIC INDICATORS 138

11.2.2 CHINA 143

11.2.2.1 Government investment in technologies for development of new autonomous equipment for construction & agriculture sectors 143

11.2.3 JAPAN 145

11.2.3.1 Declining workforce encourages OEMs to substantially invest in R&D for automation products 145

11.2.4 INDIA 147

11.2.4.1 Gradual growth in demand for semi-autonomous construction equipment with challenging acceptance rates 147

11.2.5 INDONESIA 148

11.2.5.1 Mining sector to be key driver along with government support 148

11.3 EUROPE 150

11.3.1 EUROPE: MACROECONOMIC INDICATORS 150

11.3.2 GERMANY 157

11.3.2.1 Large-scale initiatives including testing of new autonomous trucks and compactors 157

11.3.3 FRANCE 159

11.3.3.1 Investment by prominent players and introduction of new autonomous equipment 159

11.3.4 SPAIN 161

11.3.4.1 Testing and early adoption of autonomous farm tractors 161

11.3.5 UK 162

11.3.5.1 Proactive government support for autonomous technologies and investments from industry leaders 162

11.3.6 ITALY 165

11.3.6.1 Increase in awareness of autonomous construction equipment advantages to offset initial investment challenges 165

11.4 AMERICAS 167

11.4.1 AMERICAS: MACROECONOMIC INDICATORS 167

11.4.2 US 172

11.4.2.1 Well-developed infrastructure with established industry operations 172

11.4.3 CANADA 175

11.4.3.1 Focus on sustainability, along with complex regulatory framework 175

11.4.4 MEXICO 177

11.4.4.1 Push for modernization and investment in infrastructure and construction industry 177

11.4.5 BRAZIL 179

11.4.5.1 Investment in autonomous technologies for better safety and efficiency 179

12 COMPETITIVE LANDSCAPE 181

12.1 OVERVIEW 181

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024 181

12.3 MARKET SHARE ANALYSIS, 2023 184

12.4 REVENUE ANALYSIS, 2019–2023 186

12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 187

12.5.1 STARS 187

12.5.2 EMERGING LEADERS 187

12.5.3 PERVASIVE PLAYERS 188

12.5.4 PARTICIPANTS 188

12.5.5 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET: COMPANY FOOTPRINT 189

12.5.5.1 Company footprint 189

12.5.5.2 Application footprint 190

12.5.5.3 Level of automation footprint 191

12.5.5.4 Regional footprint 192

12.6 COMPANY VALUATION AND FINANCIAL METRICS 193

12.6.1 COMPANY VALUATION 193

12.6.2 FINANCIAL METRICS 193

12.7 BRAND/PRODUCT COMPARISON 194

12.8 COMPETITIVE SCENARIO AND TRENDS 194

12.8.1 PRODUCT LAUNCHES 194

12.8.2 DEALS 198

12.8.3 EXPANSIONS 204

12.8.4 OTHER DEVELOPMENTS 206

13 COMPANY PROFILES 207

13.1 KEY PLAYERS 207

13.1.1 DEERE & COMPANY 207

13.1.1.1 Business overview 207

13.1.1.2 Products offered 209

13.1.1.3 Recent developments 210

13.1.1.3.1 Product launches 210

13.1.1.3.2 Deals 211

13.1.1.4 MnM view 213

13.1.1.4.1 Key strengths/Right to win 213

13.1.1.4.2 Strategic choices 213

13.1.1.4.3 Weaknesses and competitive threats 213

13.1.2 CNH INDUSTRIAL 214

13.1.2.1 Business overview 214

13.1.2.2 Products offered 215

13.1.2.3 Recent developments 216

13.1.2.3.1 Product launches 216

13.1.2.3.2 Deals 218

13.1.2.3.3 Other developments 220

13.1.2.4 MnM view 220

13.1.2.4.1 Key strengths/Right to win 220

13.1.2.4.2 Strategic choices 220

13.1.2.4.3 Weaknesses and competitive threats 220

13.1.3 CATERPILLAR 221

13.1.3.1 Business overview 221

13.1.3.2 Products offered 222

13.1.3.3 Recent developments 223

13.1.3.3.1 Product launches 223

13.1.3.3.2 Deals 224

13.1.3.4 MnM view 225

13.1.3.4.1 Key strengths/Right to win 225

13.1.3.4.2 Strategic choices 225

13.1.3.4.3 Weaknesses and competitive threats 225

13.1.4 KOMATSU LTD. 226

13.1.4.1 Business overview 226

13.1.4.2 Products offered 227

13.1.4.3 Recent developments 228

13.1.4.3.1 Product launches 228

13.1.4.3.2 Deals 228

13.1.4.3.3 Other developments 229

13.1.4.4 MnM view 230

13.1.4.4.1 Key strengths/Right to win 230

13.1.4.4.2 Strategic choices 230

13.1.4.4.3 Weaknesses and Competitive Threats 230

13.1.5 LIEBHERR 231

13.1.5.1 Business overview 231

13.1.5.2 Products offered 232

13.1.5.3 Recent developments 233

13.1.5.3.1 Product launches 233

13.1.5.3.2 Deals 234

13.1.5.3.3 Other developments 235

13.1.5.4 MnM view 235

13.1.5.4.1 Key strengths/Right to win 235

13.1.5.4.2 Strategic choices 235

13.1.5.4.3 Weaknesses and competitive threats 235

13.1.6 HITACHI CONSTRUCTION MACHINERY CO., LTD. 236

13.1.6.1 Business overview 236

13.1.6.2 Products offered 238

13.1.6.3 Recent developments 238

13.1.6.3.1 Product launches 238

13.1.6.3.2 Deals 239

13.1.6.3.3 Expansions 240

13.1.7 AB VOLVO 241

13.1.7.1 Business overview 241

13.1.7.2 Products offered 242

13.1.7.3 Recent developments 243

13.1.7.3.1 Product launches 243

13.1.7.3.2 Deals 244

13.1.7.3.3 Other developments 244

13.1.8 DOOSAN BOBCAT 245

13.1.8.1 Business overview 245

13.1.8.2 Products offered 246

13.1.8.3 Recent developments 247

13.1.8.3.1 Product launches 247

13.1.8.3.2 Deals 248

13.1.9 BUILT ROBOTICS 249

13.1.9.1 Business overview 249

13.1.9.2 Products offered 249

13.1.9.3 Recent developments 250

13.1.9.3.1 Product launches 250

13.1.9.3.2 Deals 250

13.1.10 HD HYUNDAI 251

13.1.10.1 Business overview 251

13.1.10.2 Products offered 252

13.1.10.3 Recent developments 253

13.1.10.3.1 Product launches 253

13.1.10.3.2 Deals 253

13.1.11 SANDVIK 254

13.1.11.1 Business overview 254

13.1.11.2 Products offered 255

13.1.11.3 Recent developments 256

13.1.11.3.1 Product launches 256

13.1.11.3.2 Deals 257

13.1.11.3.3 Expansions 258

13.1.12 HEXAGON AB 259

13.1.12.1 Business overview 259

13.1.12.2 Products offered 261

13.1.12.3 Recent developments 262

13.1.12.3.1 Product launches 262

13.1.12.3.2 Deals 263

13.1.12.3.3 Expansions 264

13.1.13 RAVEN INDUSTRIES INC. 265

13.1.13.1 Business overview 265

13.1.13.2 Products offered 266

13.1.13.3 Recent developments 267

13.1.13.3.1 Product launches 267

13.1.14 OUSTER INC. 268

13.1.14.1 Business overview 268

13.1.14.2 Products offered 269

13.1.14.3 Recent developments 270

13.1.14.3.1 Product launches 270

13.1.14.3.2 Deals 270

13.1.14.3.3 Expansions 271

13.1.15 TRIMBLE INC. 272

13.1.15.1 Business overview 272

13.1.15.2 Products offered 273

13.1.15.2.1 Deals 274

13.2 OTHER PLAYERS 275

13.2.1 TELEO, INC. 275

13.2.2 MONARCH TRACTOR 276

13.2.3 SAFEAI, INC. 277

13.2.4 YANMAR HOLDINGS CO., LTD. 278

13.2.5 KUBOTA CORPORATION 279

13.2.6 SANY GROUP 280

13.2.7 EPIROC HONG KONG LIMITED 281

13.2.8 CLAAS KGAA MBH 282

13.2.9 WIRTGEN AMERICA, INC. 283

13.2.10 LEDDARTECH HOLDINGS INC. 284

14 RECOMMENDATIONS BY MARKETSANDMARKETS 285

14.1 AMERICAS TO DOMINATE AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET 285

14.2 KEY FOCUS AREAS: GROWING PENETRATION OF SEMI-AUTONOMOUS VEHICLES

AND INTEGRATION OF ADVANCED TECHNOLOGIES LIKE AI & FLEET MANAGEMENT SOLUTIONS 285

14.3 CONCLUSION 286

15 APPENDIX 287

15.1 INSIGHTS OF INDUSTRY EXPERTS 287

15.2 DISCUSSION GUIDE 288

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 291

15.4 CUSTOMIZATION OPTIONS 293

15.4.1 AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY REGION, BY TYPE 293

15.4.1.1 Asia Pacific 293

15.4.1.2 Europe 293

15.4.1.3 North America 293

15.4.1.4 Rest of the World 293

15.4.2 AUTONOMOUS FARM TRACTORS MARKET, BY APPLICATION 293

15.4.2.1 Tillage (primary & secondary tillage) 293

15.4.2.2 Seed sowing 293

15.4.2.3 Harvesting 293

15.4.2.4 Other farm applications 293

15.4.3 AUTONOMOUS FARM TRACTORS MARKET, BY POWER OUTPUT 293

15.4.3.1 Less than 100 HP 293

15.4.3.2 100–250 HP 293

15.4.3.3 251 HP and above 293

15.4.4 PRODUCT ANALYSIS 293

15.5 RELATED REPORTS 294

15.6 AUTHOR DETAILS 295

❖ 世界の自律型建設機械市場に関するよくある質問(FAQ) ❖

・自律型建設機械の世界市場規模は?

→MarketsandMarkets社は2024年の自律型建設機械の世界市場規模を44.3億米ドルと推定しています。

・自律型建設機械の世界市場予測は?

→MarketsandMarkets社は2030年の自律型建設機械の世界市場規模を98.6億米ドルと予測しています。

・自律型建設機械市場の成長率は?

→MarketsandMarkets社は自律型建設機械の世界市場が2024年~2030年に年平均14.3%成長すると予測しています。

・世界の自律型建設機械市場における主要企業は?

→MarketsandMarkets社は「Deere & Company (US)、CNH Industrial (UK)、Caterpillar (US、Komatsu Ltd (Japan)、Libherr Group (Switzerland)、Hitachi Construction Machinery Co.、Ltd (Japan)、Volvo Construction Equipment (Sweden)、Doosan Bobcat (South Korea)、Built Robotics (Us)、HD Hyundai (South Korea)、and Sandvik (Sweden)など ...」をグローバル自律型建設機械市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。