1 はじめに 24

1.1 調査目的 24

1.2 市場の定義 25

1.3 調査範囲 25

1.3.1 対象市場と地域範囲 25

1.3.2 対象範囲と除外範囲 26

1.3.3 考慮した年数 26

1.3.4 通貨

1.3.5 単位の考慮 27

1.4 制限事項 27

1.5 利害関係者 27

1.6 変更点のまとめ 28

2 調査方法 29

2.1 調査データ 29

2.1.1 二次データ 30

2.1.1.1 二次情報源のリスト 30

2.1.1.2 二次資料からの主要データ 31

2.1.2 一次データ 32

2.1.2.1 一次資料からの主要データ 32

2.1.2.2 一次調査参加者のリスト 32

2.1.2.3 主要な業界インサイト 33

2.1.2.4 専門家へのインタビューの内訳 33

2.2 市場規模の推定 34

2.2.1 ボトムアップアプローチ 35

2.2.2 トップダウンアプローチ 35

2.3 ベース数の算出 36

2.3.1 需要サイドアプローチ 36

2.3.2 マーケットエンジニアリングプロセス 36

2.4 市場の内訳とデータの三角測量 37

2.5 調査の前提 38

2.6 リスク評価 38

2.7 調査の限界 38

3 エグゼクティブサマリー 39

4 プレミアムインサイト 44

4.1 バッテリーコーティング市場におけるプレーヤーにとっての魅力的な機会 44

4.2 バッテリーコーティング市場:地域別 45

4.3 アジア太平洋地域のバッテリーコーティング市場:材料タイプ別・国別 45

4.4 バッテリーコーティング市場:主要国別 46

5 市場の概要 47

5.1 バッテリーコーティング市場におけるAI/GEN AIの影響 47

5.1.1 ケーススタディと具体的な影響 47

5.1.1.1 フォルクスワーゲン・グループのAI搭載バッテリー研究センター 47

5.1.1.2 バッテリーコーティング最適化のためのテスラのAI活用 48

5.1.1.3 ソリッドパワー社の固体電池コーティングへのAI駆動アプローチ 48

5.1.1.4 電池の安全性と耐久性を高めるトヨタのAI活用 48

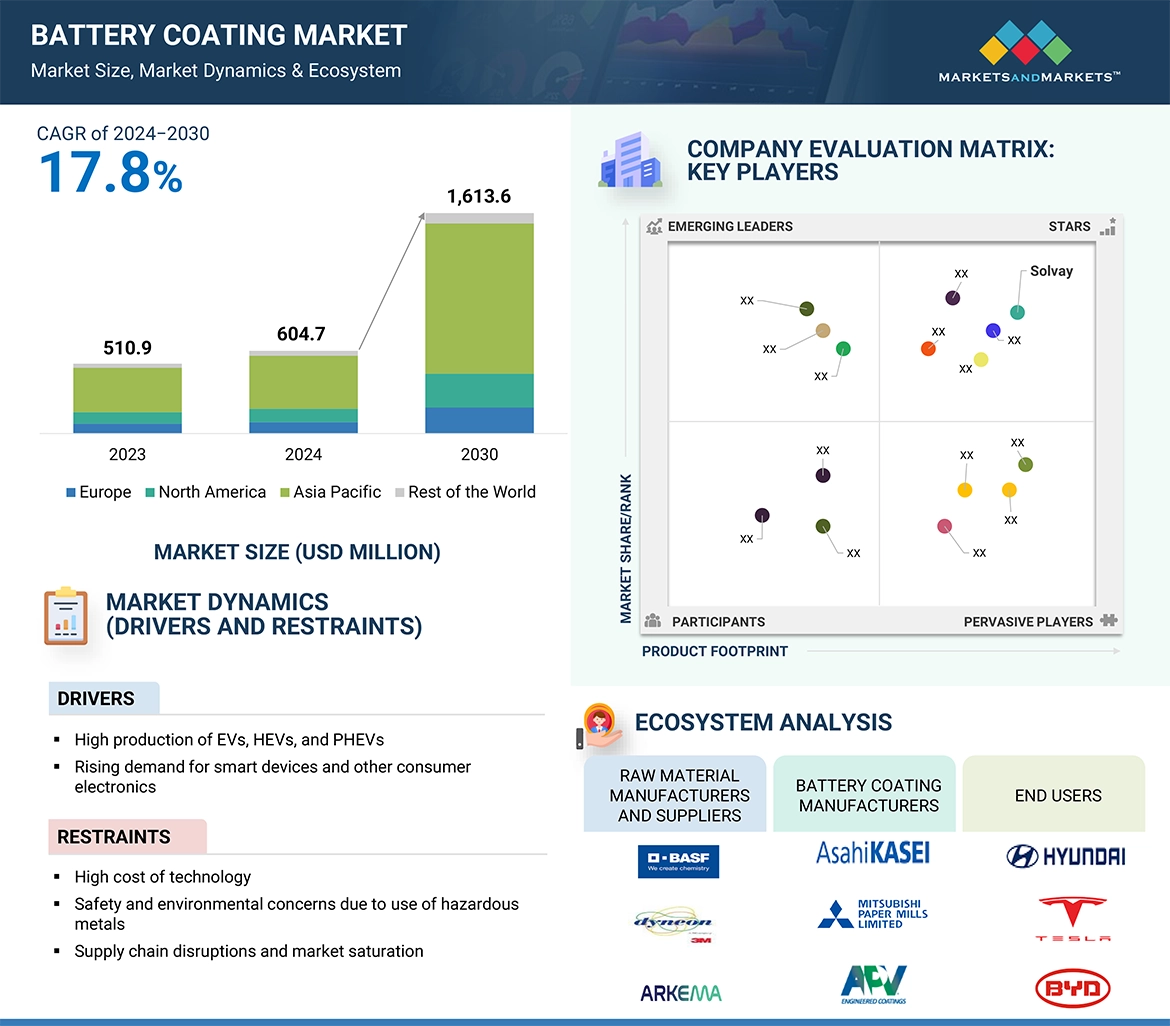

5.2 市場ダイナミクス 49

5.2.1 ドライバー 50

5.2.1.1 EV、HEV、PHEVの生産台数の多さ 50

5.2.1.2 スマートデバイスやその他の家電製品の需要増加 52

5.2.2 阻害要因 53

5.2.2.1 コーティング技術のコスト高 53

5.2.2.2 有害金属の使用による安全性と環境への懸念 53

5.2.2.3 サプライチェーンの混乱と市場の飽和 54

5.2.3 機会 54

5.2.3.1 電池材料の革新と技術進歩 54

5.2.3.2 エネルギー貯蔵装置におけるリチウムイオン電池の使用 54

5.2.4 課題 56

5.2.4.1 有機溶剤の引火性と揮発性に関する懸念 56

5.2.4.2 研究開発コストの高さ 56

5.3 ポーターの5つの力分析 57

5.3.1 新規参入の脅威 58

5.3.2 代替品の脅威 58

5.3.3 買い手の交渉力 58

5.3.4 供給者の交渉力 59

5.3.5 競合の激しさ 59

5.4 主要ステークホルダーと購買基準 60

5.4.1 購入プロセスにおける主要ステークホルダー 60

5.4.2 購買基準 60

5.5 バリューチェーン分析 61

5.6 エコシステム分析 64

5.7 顧客ビジネスに影響を与えるトレンドと破壊的要因 66

5.8 ケーススタディ分析 67

5.8.1 ケーススタディ1:電気自動車用バッテリー向けアルケマのKynar Pvdf 67

5.8.2 ケーススタディ 2: ソルベイのリチウムイオン電池コーティング用ソレフ® PVDF 68

5.8.3 ケーススタディ3:エネルギー貯蔵システム用PPGの電極コーティング・ソリューション 68

5.9 特許分析 69

5.9.1 方法論 69

5.9.2 主要特許のリスト 70

5.10 規制の状況 71

5.10.1 規制機関、政府機関、その他の団体 71

5.10.2 電気自動車用電池に関する規制 73

5.10.3 欧州と米国のリチウムイオン電池生産に関する規制 74

5.10.4 電池とアキュムレータに関する規制 75

5.10.5 リチウムイオン電池の輸送に関する規制 75

5.11 技術分析 75

5.11.1 主要技術 75

5.11.1.1 原子層堆積法 75

5.11.1.2 化学気相成長法 76

5.11.1.3 乾式電極コーティング 76

5.11.2 補完技術 77

5.11.2.1 高度な特性評価技術 77

5.11.2.2 ナノテクノロジー 77

5.11.3 隣接技術 78

5.11.3.1 電池セル組立における接着剤 78

5.11.3.2 リサイクル技術 78

5.12 貿易分析 79

5.12.1 輸入シナリオ(HSコード8545) 79

5.12.2 輸出シナリオ(HSコード8545) 80

5.13 主要会議・イベント(2024-2025年) 81

5.14 価格分析 82

5.14.1 バッテリーコーティング市場の平均販売価格動向(素材タイプ別) 82

5.14.2 PVDF材料の地域別平均販売価格動向 83

5.15 世界のマクロ経済見通し 86

5.15.1 GDP 86

5.15.2 電気自動車の普及拡大 88

5.16 投資と資金調達のシナリオ 88

6 バッテリーコーティング市場:技術タイプ別 89

6.1 導入 89

6.2 原子層堆積法 89

6.3 プラズマエンハンスト化学気相成長法 90

6.4 化学気相成長法 90

90 6.5 乾燥粉末コーティング

6.6 物理蒸着 91

7 バッテリーコーティング市場:バッテリータイプ別 92

7.1 はじめに 93

7.2 リチウムイオン電池 94

7.2.1 電気自動車と携帯電子機器の需要増加が市場を牽引 94

7.3 鉛蓄電池 96

7.3.1 エネルギー貯蔵と非常用照明システムへの幅広い応用が市場を牽引 96

7.4 ニッケル・カドミウム電池 97

7.4.1 産業用途での需要増加が市場を牽引 97

7.5 グラフェン電池 97

7.5.1 次世代エネルギー貯蔵システムの需要急増が市場を牽引 97

システムが市場を牽引 97

8 バッテリーコーティング市場(バッテリー成分別) 99

8.1 はじめに 100

8.2 電極コーティング 101

8.2.1 家電・エネルギー分野における持続可能性への需要の高まりが市場を牽引 101

8.2.2 正極コーティング 102

8.2.3 負極コーティング 102

8.3 セパレータコーティング 103

8.3.1 リチウム電池の需要増加が市場を牽引 103

8.4 バッテリーパックコーティング 104

8.4.1 耐久性と熱管理を強化する電池パック保護コーティング 104

9 バッテリーコーティング市場:材料タイプ別 106

9.1 はじめに 107

9.2 ポリフッ化ビニリデン 109

9.2.1 ポリフッ化ビニリデン被覆セパレータの高い気孔率と電気化学的安定性が需要を押し上げる 109

9.3 セラミック 111

9.3.1 高い放熱性と低い引張強度が市場を牽引 111

9.4 アルミナ 113

9.4.1 機械的強度の高い電池用セパレータの需要急増が市場を牽引 113

9.5 オキシド 115

9.5.1 高電圧でのサイクル性能の向上が需要を牽引 115

9.6 カーボン 117

9.6.1 サイクル性能と電気化学性能が向上する黒鉛負極材 117

9.7 ポリウレタン 119

9.7.1 引き抜き技術への需要増加が市場を牽引 119

9.8 エポキシ 121

9.8.1 優れた誘電特性と機械特性が需要を押し上げる 121

9.9 その他の材料 122

10 バッテリーコーティング市場:地域別 124

10.1 はじめに 125

10.2 北米 126

10.2.1 米国 130

10.2.1.1 自動車産業の拡大が市場を牽引 130

10.2.2 北米以外の地域 133

10.3 欧州 136

10.3.1 ドイツ 140

10.3.1.1 主要電池メーカーとEVメーカーの存在が市場成長を促進 140

10.3.2 イギリス 142

10.3.2.1 再生可能エネルギーへの移行と環境に優しい輸送が市場を牽引 142

10.3.3 フランス 146

10.3.3.1 環境に優しい自動車の普及が市場を後押し 146

10.3.4 その他の欧州 148

10.4 アジア太平洋地域 152

10.4.1 中国 157

10.4.1.1 電気自動車販売の増加が市場を押し上げる 157

10.4.2 日本 159

10.4.2.1 自動車・エレクトロニクス分野の成長が市場を牽引 159

10.4.3 韓国 162

10.4.3.1 EV需要の増加と環境に優しいエネルギーへの政府の取り組みが市場を押し上げる 162

10.4.4 インド 165

10.4.4.1 通信セクターの拡大が高性能電池の需要を押し上げる 165

10.4.5 その他のアジア太平洋地域 167

10.5 その他の地域 171

11 競争環境 175

11.1 はじめに 175

11.2 主要プレーヤーの戦略/勝利への権利 175

11.3 収益分析(2019-2023年) 177

11.4 市場シェア分析(2023年) 177

11.4.1 主要市場プレーヤーのランキング(2023年) 178

11.5 ブランド/製品比較分析 180

11.6 企業評価マトリックス:主要プレイヤー、2023年 182

11.6.1 スター企業 182

11.6.2 新興リーダー 182

11.6.3 浸透型プレーヤー 182

11.6.4 参加企業 182

11.6.5 企業フットプリント:主要プレイヤー(2023年) 184

11.6.5.1 企業フットプリント 184

11.6.5.2 地域別フットプリント 185

11.6.5.3 電池タイプのフットプリント 186

11.6.5.4 素材別フットプリント 187

11.7 企業評価マトリクス:新興企業/SM(2023年) 188

11.7.1 進歩的企業 188

11.7.2 対応力のある企業 188

11.7.3 ダイナミックな企業 188

11.7.4 スタートアップ・ブロック 188

11.7.5 競争ベンチマーキング:新興企業/SM(2023年) 189

11.7.5.1 主要新興企業/中小企業の詳細リスト 189

11.7.5.2 主要新興企業/SMEの競合ベンチマーキング 190

11.8 企業評価と財務指標 191

11.8.1 企業評価 191

11.8.2 財務指標 191

11.9 競争シナリオと動向 192

11.9.1 製品上市 192

11.9.2 取引 193

11.9.3 拡張 194

12 会社プロファイル 195

Arkema (France)

Solvay (Belgium)

Asahi Kasei Corporation (Japan)

Ube Corporation (Japan)

PPG Industries Inc. (US) Mitsubishi Paper Mills Ltd. (Japan)

Tanaka Chemical Corporation (Japan)

SK Innovation Co. Ltd. (South Korea)

Ashland (US)

Axalta Coating Systems

LLC (US)

Targray (Canada)

Samco Inc. (Japan) Durr Group (Germany)

APV Engineered Coatings (US)

and Alkegen (US)

14 付録 250

14.1 ディスカッションガイド 250

14.2 Knowledgestore: マーケットサ ンドマーケッツの購読ポータル 254

14.3 カスタマイズオプション 256

14.4 関連レポート 256

14.5 著者の詳細 257

The growing electric vehicle market is a major driver of the battery coating market. Battery coating is commonly employed in electrodes (cathode and anode), separators, housing packs, and other areas of the battery to improve performance and reduce heat gain and losses caused by instability of operating temperatures.

“By battery component, the electrode coating segment is estimated to be the largest segment of the battery coating market from 2024 to 2030.”

Electrode coatings dominate the battery component market due to their direct impact on lifespan, performance, and efficiency. Coatings on both cathodes and anodes improve critical properties such as electrical conductivity, thermal stability, and resistance to degradation during charging and discharging cycles.

In the case of a cathode, it enhances electrochemical cathode performance by improving conductivity and protection against oxidation. Coating of the anode, typically made of graphite or silicon, helps reduce lithium-ion loss, increases the anode's mechanical strength, and enhances charge/discharge efficiency. Such coatings cause these lower-side reactions and prevent the degradation of the anode material, increasing battery life and the speed that the charge time should be.

“By battery type, graphene battery is estimated to be the largest segment of the battery coating market from 2024 to 2030 by CAGR.”

Graphene-type batteries have the greatest CAGR by battery type segment due to several key benefits, including high energy density, where graphene's enormous surface area and conductivity allow for compact energy storage, resulting in greater ranges and quicker charging times. Additionally, its ability to conduct electrons quickly facilitates ultra-fast charging which is essential for electric vehicles and portable devices. Graphene-based materials endure more charge-discharge cycles with minimal degradation, extending battery lifespan. Moreover, graphene’s thermal stability and resistance to electrolyte leakage enhance battery safety, reducing the risks of fires or explosions. These benefits make graphene batteries particularly attractive for various applications, including electric vehicles and consumer electronics. While mass production and cost challenges remain, ongoing advancements in graphene technology suggest a promising future for this innovative energy storage solution.

“From 2024 to 2030, by material, PVDF is expected to be the largest by material segment in the battery coating market.”

Based on the material segment, Polyvinylidene fluoride (PVDF) is expected to hold the highest CAGR in the battery coating market. PVDF has excellent chemical resistance, high thermal stability, and mechanical strength, enhancing battery performance and lifespan. It is compatible with different electrolytes and improves the transport of ions; hence, it is vital in high-performance batteries, especially in electric vehicles and energy storage systems. Arkema SA (France) and Solvay SA (Belgium) are the primary polyvinylidene fluoride battery coating materials providers.

“The Asia Pacific region's battery coating market is projected to have the highest share in 2024.”

Asia Pacific will contribute the highest share of the market in 2023. The reason is the presence of various giants in electric automotive across the region. China is also considered a global supply chain hub for the battery storage industry. Government initiatives in electric vehicles with subsidies, comprehensive charging infrastructure, and supporting license policies follow the APAC region's market, particularly China. The increasing necessity for bettering the efficiencies of batteries for manufacturers to keep pace with regulatory matters and consumer calls is actually what gives this market's growth an opportunity for many further advancements in this region's technology of battery coatings.

Profile break-up of primary participants for the report:

• By Company Type: Tier 1 – 20%, Tier 2 – 40%, and Tier 3 – 40%

• By Designation: C-level Executives – 10%, Directors – 70%, and Others – 20%

• By Region: North America – 20%, Europe –45%, Asia Pacific – 25%, and Rest of the World-10%,

The Battery coating report is dominated by players such as

Arkema (France), Solvay (Belgium), Asahi Kasei Corporation (Japan), Ube Corporation (Japan), PPG Industries, Inc. (US) Mitsubishi Paper Mills, Ltd. (Japan), Tanaka Chemical Corporation (Japan), SK Innovation Co. Ltd. (South Korea), Ashland (US), Axalta Coating Systems, LLC (US), Targray (Canada), Samco Inc. (Japan) Durr Group (Germany), APV Engineered Coatings (US), and Alkegen (US) and others.

Research Coverage:

The report defines, segments, and projects the battery coating market size based on components, materials, technology, battery type, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as expansions, agreements, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the battery coating market and its segments. This report is also expected to help stakeholder businesses and the market’s competitive landscape better, gain insights to improve the position of their companies, and make suitable go-to-market strategies. It also enables stakeholders to understand the market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (High production of EVs, HEVs, and PHEVs and Rising demand for smart devices and other consumer electronics), restraints (High cost of technology, Safety and environmental concerns due to the use of hazardous metals), opportunities (Innovations and technological advances in battery materials Lithium-ion batteries in energy storage devices), and challenges (Expected utilization of solid electrolytes) influencing the growth of the battery coating market.

• Market Development: Comprehensive information about lucrative markets – the report analyses The battery coating market is across varied regions.

• Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the battery coating market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Arkema (France), Solvay (Belgium), Asahi Kasei Corporation (Japan), Ube Corporation (Japan), PPG Industries, Inc. (US) Mitsubishi Paper Mills, Ltd. (Japan), Tanaka Chemical Corporation (Japan), SK Innovation Co. Ltd. (South Korea), Ashland (US), Axalta Coating Systems, LLC (US), Targray (Canada), Samco Inc. (Japan) Durr Group (Germany), APV Engineered Coatings (US), and Alkegen (US) are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

1 INTRODUCTION 24

1.1 STUDY OBJECTIVES 24

1.2 MARKET DEFINITION 25

1.3 STUDY SCOPE 25

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 25

1.3.2 INCLUSIONS AND EXCLUSIONS 26

1.3.3 YEARS CONSIDERED 26

1.3.4 CURRENCY CONSIDERED 27

1.3.5 UNIT CONSIDERED 27

1.4 LIMITATIONS 27

1.5 STAKEHOLDERS 27

1.6 SUMMARY OF CHANGES 28

2 RESEARCH METHODOLOGY 29

2.1 RESEARCH DATA 29

2.1.1 SECONDARY DATA 30

2.1.1.1 List of secondary sources 30

2.1.1.2 Key data from secondary sources 31

2.1.2 PRIMARY DATA 32

2.1.2.1 Key data from primary sources 32

2.1.2.2 List of primary participants 32

2.1.2.3 Key industry insights 33

2.1.2.4 Breakdown of interviews with experts 33

2.2 MARKET SIZE ESTIMATION 34

2.2.1 BOTTOM-UP APPROACH 35

2.2.2 TOP-DOWN APPROACH 35

2.3 BASE NUMBER CALCULATION 36

2.3.1 DEMAND SIDE APPROACH 36

2.3.2 MARKET ENGINEERING PROCESS 36

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION 37

2.5 STUDY ASSUMPTIONS 38

2.6 RISK ASSESSMENT 38

2.7 RESEARCH LIMITATIONS 38

3 EXECUTIVE SUMMARY 39

4 PREMIUM INSIGHTS 44

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BATTERY COATING MARKET 44

4.2 BATTERY COATING MARKET, BY REGION 45

4.3 ASIA PACIFIC BATTERY COATING MARKET, BY MATERIAL TYPE & COUNTRY 45

4.4 BATTERY COATING MARKET, BY KEY COUNTRY 46

5 MARKET OVERVIEW 47

5.1 IMPACT OF AI/GEN AI ON BATTERY COATING MARKET 47

5.1.1 CASE STUDIES AND SPECIFIC IMPACT 47

5.1.1.1 Volkswagen Group's AI-powered battery research center 47

5.1.1.2 Tesla's use of ai for battery coating optimization 48

5.1.1.3 Solid Power's AI-driven approach to solid-state battery coating 48

5.1.1.4 Toyota's use of AI for battery safety and durability 48

5.2 MARKET DYNAMICS 49

5.2.1 DRIVERS 50

5.2.1.1 High production of EVs, HEVs, and PHEVs 50

5.2.1.2 Rising demand for smart devices and other consumer electronics 52

5.2.2 RESTRAINTS 53

5.2.2.1 High cost of coating technology 53

5.2.2.2 Safety and environmental concerns due to use of hazardous metals 53

5.2.2.3 Supply chain disruptions and market saturation 54

5.2.3 OPPORTUNITIES 54

5.2.3.1 Innovations and technological advances in battery materials 54

5.2.3.2 Use of lithium-ion batteries in energy storage devices 54

5.2.4 CHALLENGES 56

5.2.4.1 Concerns regarding flammability and volatility of organic solvents 56

5.2.4.2 High R&D costs 56

5.3 PORTER’S FIVE FORCES ANALYSIS 57

5.3.1 THREAT OF NEW ENTRANTS 58

5.3.2 THREAT OF SUBSTITUTES 58

5.3.3 BARGAINING POWER OF BUYERS 58

5.3.4 BARGAINING POWER OF SUPPLIERS 59

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 59

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA 60

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS 60

5.4.2 BUYING CRITERIA 60

5.5 VALUE CHAIN ANALYSIS 61

5.6 ECOSYSTEM ANALYSIS 64

5.7 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS 66

5.8 CASE STUDY ANALYSIS 67

5.8.1 CASE STUDY 1: ARKEMA’S KYNAR PVDF FOR ELECTRIC VEHICLE BATTERIES 67

5.8.2 CASE STUDY 2: SOLVAY’S SOLEF® PVDF FOR LITHIUM-ION BATTERY COATINGS 68

5.8.3 CASE STUDY 3: PPG’S ELECTRODE COATING SOLUTIONS FOR ENERGY STORAGE SYSTEMS 68

5.9 PATENT ANALYSIS 69

5.9.1 METHODOLOGY 69

5.9.2 LIST OF MAJOR PATENTS 70

5.10 REGULATORY LANDSCAPE 71

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

5.10.2 REGULATIONS ON ELECTRIC VEHICLE BATTERIES 73

5.10.3 EUROPE AND US REGULATIONS ON LITHIUM-ION BATTERY PRODUCTION 74

5.10.4 REGULATIONS ON BATTERIES AND ACCUMULATORS 75

5.10.5 REGULATIONS ON TRANSPORT OF LITHIUM-ION BATTERIES 75

5.11 TECHNOLOGY ANALYSIS 75

5.11.1 KEY TECHNOLOGIES 75

5.11.1.1 Atomic layer deposition 75

5.11.1.2 Chemical vapor deposition 76

5.11.1.3 Dry electrode coating 76

5.11.2 COMPLEMENTARY TECHNOLOGIES 77

5.11.2.1 Advanced characterization techniques 77

5.11.2.2 Nanotechnology 77

5.11.3 ADJACENT TECHNOLOGIES 78

5.11.3.1 Adhesives in battery cell assembly 78

5.11.3.2 Recycling technologies 78

5.12 TRADE ANALYSIS 79

5.12.1 IMPORT SCENARIO (HS CODE 8545) 79

5.12.2 EXPORT SCENARIO (HS CODE 8545) 80

5.13 KEY CONFERENCES AND EVENTS, 2024‒2025 81

5.14 PRICING ANALYSIS 82

5.14.1 AVERAGE SELLING PRICE TREND OF BATTERY COATING MARKET, BY MATERIAL TYPE 82

5.14.2 AVERAGE SELLING PRICE TREND OF PVDF MATERIAL, BY REGION 83

5.15 GLOBAL MACROECONOMIC OUTLOOK 86

5.15.1 GDP 86

5.15.2 RISING ADOPTION OF ELECTRIC VEHICLES 88

5.16 INVESTMENT AND FUNDING SCENARIO 88

6 BATTERY COATING MARKET, BY TECHNOLOGY TYPE 89

6.1 INTRODUCTION 89

6.2 ATOMIC LAYER DEPOSITION 89

6.3 PLASMA–ENHANCED CHEMICAL VAPOR DEPOSITION 90

6.4 CHEMICAL VAPOR DEPOSITION 90

6.5 DRY POWDER COATING 90

6.6 PHYSICAL VAPOR DEPOSITION 91

7 BATTERY COATING MARKET, BY BATTERY TYPE 92

7.1 INTRODUCTION 93

7.2 LITHIUM-ION BATTERY 94

7.2.1 RISING DEMAND FOR ELECTRIC VEHICLES AND PORTABLE ELECTRONIC DEVICES TO DRIVE MARKET 94

7.3 LEAD ACID BATTERY 96

7.3.1 WIDE APPLICATION IN ENERGY STORAGE AND EMERGENCY LIGHTING SYSTEMS TO DRIVE MARKET 96

7.4 NICKEL CADMIUM BATTERY 97

7.4.1 INCREASING DEMAND IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET 97

7.5 GRAPHENE BATTERY 97

7.5.1 SURGE IN DEMAND FOR NEXT-GENERATION ENERGY STORAGE

SYSTEMS TO DRIVE MARKET 97

8 BATTERY COATING MARKET, BY BATTERY COMPONENT 99

8.1 INTRODUCTION 100

8.2 ELECTRODE COATING 101

8.2.1 RISING DEMAND FOR SUSTAINABILITY ACROSS CONSUMER ELECTRONICS AND ENERGY SECTORS TO DRIVE MARKET 101

8.2.2 CATHODE COATING 102

8.2.3 ANODE COATING 102

8.3 SEPARATOR COATING 103

8.3.1 RISING DEMAND FOR LITHIUM BATTERIES TO DRIVE MARKET 103

8.4 BATTERY PACK COATING 104

8.4.1 PROTECTIVE BATTERY PACK COATINGS TO ENHANCE DURABILITY AND THERMAL MANAGEMENT 104

9 BATTERY COATING MARKET, BY MATERIAL TYPE 106

9.1 INTRODUCTION 107

9.2 POLYVINYLIDENE FLUORIDE 109

9.2.1 HIGHER POROSITY AND ELECTROCHEMICAL STABILITY OF POLYVINYLIDENE FLUORIDE COATED SEPARATORS TO BOOST DEMAND 109

9.3 CERAMIC 111

9.3.1 HIGH DISSIPATION AND LOW TENSILE STRENGTH TO DRIVE MARKET 111

9.4 ALUMINA 113

9.4.1 SURGE IN DEMAND FOR HIGH MECHANICAL STRENGTH BATTERY SEPARATORS TO DRIVE MARKET 113

9.5 OXIDE 115

9.5.1 IMPROVED CYCLING PERFORMANCE AT HIGH OPERATING VOLTAGES TO DRIVE DEMAND 115

9.6 CARBON 117

9.6.1 GRAPHITE ANODE MATERIALS TO OFFER IMPROVED CYCLING AND ELECTROCHEMICAL PERFORMANCE 117

9.7 POLYURETHANE 119

9.7.1 INCREASING DEMAND FOR PULTRUSION TECHNOLOGY TO DRIVE MARKET 119

9.8 EPOXY 121

9.8.1 EXCELLENT DIELECTRIC AND MECHANICAL PROPERTIES TO BOOST DEMAND 121

9.9 OTHER MATERIALS 122

10 BATTERY COATING MARKET, BY REGION 124

10.1 INTRODUCTION 125

10.2 NORTH AMERICA 126

10.2.1 US 130

10.2.1.1 Expansion of automotive sector to drive market 130

10.2.2 REST OF NORTH AMERICA 133

10.3 EUROPE 136

10.3.1 GERMANY 140

10.3.1.1 Presence of key battery and EV manufacturers to spur market growth 140

10.3.2 UK 142

10.3.2.1 Transition to renewable energy and greener transportation to drive market 142

10.3.3 FRANCE 146

10.3.3.1 Adoption of environment-friendly vehicles to boost market 146

10.3.4 REST OF EUROPE 148

10.4 ASIA PACIFIC 152

10.4.1 CHINA 157

10.4.1.1 Rise in sales of electric vehicles to boost market 157

10.4.2 JAPAN 159

10.4.2.1 Growth of automotive and electronics sectors to drive market 159

10.4.3 SOUTH KOREA 162

10.4.3.1 Growing demand for EVs and government initiatives toward greener energy to boost market 162

10.4.4 INDIA 165

10.4.4.1 Expansion of telecommunication sector to boost demand for high–performance batteries 165

10.4.5 REST OF ASIA PACIFIC 167

10.5 REST OF WORLD 171

11 COMPETITIVE LANDSCAPE 175

11.1 INTRODUCTION 175

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 175

11.3 REVENUE ANALYSIS, 2019–2023 177

11.4 MARKET SHARE ANALYSIS, 2023 177

11.4.1 RANKING OF KEY MARKET PLAYERS, 2023 178

11.5 BRAND/PRODUCT COMPARISON ANALYSIS 180

11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 182

11.6.1 STARS 182

11.6.2 EMERGING LEADERS 182

11.6.3 PERVASIVE PLAYERS 182

11.6.4 PARTICIPANTS 182

11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 184

11.6.5.1 Company footprint 184

11.6.5.2 Region footprint 185

11.6.5.3 Battery type footprint 186

11.6.5.4 Material footprint 187

11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 188

11.7.1 PROGRESSIVE COMPANIES 188

11.7.2 RESPONSIVE COMPANIES 188

11.7.3 DYNAMIC COMPANIES 188

11.7.4 STARTING BLOCKS 188

11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 189

11.7.5.1 Detailed list of key startups/SMEs 189

11.7.5.2 Competitive benchmarking of key startups/SMEs 190

11.8 COMPANY VALUATION AND FINANCIAL METRICS 191

11.8.1 COMPANY VALUATION 191

11.8.2 FINANCIAL METRICS 191

11.9 COMPETITIVE SCENARIO AND TRENDS 192

11.9.1 PRODUCT LAUNCHES 192

11.9.2 DEALS 193

11.9.3 EXPANSIONS 194

12 COMPANY PROFIELS 195

12.1 KEY PLAYERS 195

12.1.1 ARKEMA 195

12.1.1.1 Business overview 195

12.1.1.2 Products/Solutions/Services offered 196

12.1.1.3 Recent developments 197

12.1.1.3.1 Product launches 197

12.1.1.3.2 Deals 197

12.1.1.3.3 Expansions 197

12.1.1.4 MnM view 198

12.1.1.4.1 Right to win 198

12.1.1.4.2 Strategic choices 198

12.1.1.4.3 Weaknesses and competitive threats 198

12.1.2 SOLVAY 199

12.1.2.1 Business overview 199

12.1.2.2 Products/Solutions/Services offered 200

12.1.2.3 Recent developments 201

12.1.2.3.1 Expansions 201

12.1.2.4 MnM view 202

12.1.2.4.1 Right to win 202

12.1.2.4.2 Strategic choices 202

12.1.2.4.3 Weaknesses and competitive threats 202

12.1.3 ASAHI KASEI CORPORATION 203

12.1.3.1 Business overview 203

12.1.3.2 Products/Solutions/Services offered 204

12.1.3.3 Recent developments 205

12.1.3.3.1 Expansions 205

12.1.3.4 MnM view 205

12.1.3.4.1 Right to win 205

12.1.3.4.2 Strategic choices 205

12.1.3.4.3 Weaknesses and competitive threats 206

12.1.4 PPG INDUSTRIES, INC. 207

12.1.4.1 Business overview 207

12.1.4.2 Products/Solutions/Services offered 208

12.1.4.3 Recent developments 209

12.1.4.3.1 Expansions 209

12.1.4.4 MNM view 210

12.1.4.4.1 Right to win 210

12.1.4.4.2 Strategic choices 211

12.1.4.4.3 Weaknesses and competitive threats 211

12.1.5 UBE CORPORATION 212

12.1.5.1 Business overview 212

12.1.5.2 Products/Solutions/Services offered 213

12.1.5.3 Recent developments 214

12.1.5.3.1 Deals 214

12.1.5.4 MnM view 215

12.1.5.4.1 Right to win 215

12.1.5.4.2 Strategic choices 215

12.1.5.4.3 Weaknesses and competitive threats 215

12.1.6 TANAKA CHEMICAL CORPORATION 216

12.1.6.1 Business overview 216

12.1.6.2 Products/Solutions/Services offered 217

12.1.7 MITSUBISHI PAPER MILLS, LTD. 218

12.1.7.1 Business overview 218

12.1.7.2 Products/Solutions/Services offered 219

12.1.8 DURR GROUP 220

12.1.8.1 Business overview 220

12.1.8.2 Products/Solutions/Services offered 221

12.1.8.3 Recent developments 222

12.1.8.3.1 Deals 222

12.1.9 TARGRAY 223

12.1.9.1 Business overview 223

12.1.9.2 Products/Solutions/Services offered 223

12.1.10 ALKEGEN 224

12.1.10.1 Business overview 224

12.1.10.2 Products/Solutions/Services offered 224

12.1.10.3 Recent developments 225

12.1.11 APV ENGINEERED COATINGS 226

12.1.11.1 Business overview 226

12.1.11.2 Products/Solutions/Services offered 226

12.1.12 SK INNOVATION CO., LTD. 227

12.1.12.1 Business overview 227

12.1.12.2 Products/Solutions/Services offered 228

12.1.12.3 Recent developments 228

12.1.12.3.1 Expansions 228

12.1.13 AXALTA COATING SYSTEMS LTD. 229

12.1.13.1 Business overview 229

12.1.13.2 Products/Solutions/Services offered 230

12.1.14 ASHLAND INC. 232

12.1.14.1 Business overview 232

12.1.14.2 Products/Solutions/Services offered 233

12.1.15 SAMCO INC. 234

12.1.15.1 Business overview 234

12.1.15.2 Products/Solutions/Services offered 235

12.1.15.3 Recent developments 237

12.1.15.3.1 Expansions 237

12.2 OTHER PLAYERS 238

12.2.1 BENEQ 238

12.2.1.1 Recent developments 238

12.2.1.1.1 Deals 238

12.2.1.1.2 Expansions 239

12.2.2 FORGE NANO INC. 239

12.2.2.1 Recent developments 240

12.2.2.1.1 Deals 240

12.2.3 PULRON 241

12.2.4 NEI CORPORATION 241

12.2.5 ALTEO 242

12.2.5.1 Recent developments 242

12.2.5.1.1 Product launches 242

12.2.5.1.2 Deals 243

12.2.5.1.3 Expansions 243

12.2.6 WRIGHT COATING TECHNOLOGIES 244

12.2.7 PARKER HANNIFIN CORP. 245

12.2.8 AKZO NOBEL N.V. 245

12.2.9 XIAMEN ACEY NEW ENERGY TECHNOLOGY CO. 246

12.2.10 SHANDONG HENGYI NEW MATERIAL TECHNOLOGY CO., LTD. 246

13 ADJACENT AND RELATED MARKETS 247

13.1 INTRODUCTION 247

13.2 LIMITATIONS 247

13.3 INTERCONNECTED MARKETS 247

13.3.1 LITHIUM-ION BATTERY MARKET 247

13.3.1.1 Market definition 247

13.3.1.2 Market overview 247

13.3.2 LITHIUM-ION BATTERY MARKET, BY VOLTAGE 248

13.4 LOW 248

13.4.1 BUILT-IN BATTERY MANAGEMENT TO DRIVE DEMAND AMONG

CONSUMER ELECTRONICS 248

13.5 MEDIUM 249

13.5.1 RISING ADOPTION IN SOLAR ENERGY SYSTEMS TO DRIVE MARKET 249

13.6 HIGH 249

13.6.1 ENHANCED SAFETY FEATURES TO BOOST DEMAND FROM

MARINE AND MILITARY SECTORS 249

14 APPENDIX 250

14.1 DISCUSSION GUIDE 250

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 254

14.3 CUSTOMIZATION OPTIONS 256

14.4 RELATED REPORTS 256

14.5 AUTHOR DETAILS 257

❖ 世界のバッテリーコーティング市場に関するよくある質問(FAQ) ❖

・バッテリーコーティングの世界市場規模は?

→MarketsandMarkets社は2024年のバッテリーコーティングの世界市場規模を6億470万ドルと推定しています。

・バッテリーコーティングの世界市場予測は?

→MarketsandMarkets社は2030年のバッテリーコーティングの世界市場規模を16億1360万ドルと予測しています。

・バッテリーコーティング市場の成長率は?

→MarketsandMarkets社はバッテリーコーティングの世界市場が2024年~2030年に年平均17.8%成長すると予測しています。

・世界のバッテリーコーティング市場における主要企業は?

→MarketsandMarkets社は「Arkema (France)、Solvay (Belgium)、Asahi Kasei Corporation (Japan)、Ube Corporation (Japan)、PPG Industries、Inc. (US) Mitsubishi Paper Mills、Ltd. (Japan)、Tanaka Chemical Corporation (Japan)、SK Innovation Co. Ltd. (South Korea)、Ashland (US)、Axalta Coating Systems、LLC (US)、Targray (Canada)、Samco Inc. (Japan) Durr Group (Germany)、APV Engineered Coatings (US)、and Alkegen (US)など ...」をグローバルバッテリーコーティング市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。