1 はじめに 23

1.1 調査目的 23

1.2 市場の定義 23

1.3 調査範囲 24

1.3.1 対象市場 24

1.3.2 対象範囲と除外項目 25

1.3.3 定義と包含範囲:タイプ別 25

1.3.4 用途別の定義と含有量 26

1.3.5 考慮される年数 27

1.3.6 通貨

1.3.7 単位

1.4 利害関係者 28

1.5 変更点のまとめ 28

2 調査方法 29

2.1 調査データ 29

2.1.1 二次データ 30

2.1.1.1 二次資料からの主要データ 30

2.1.2 一次データ 30

2.1.2.1 需要側と供給側の専門家へのインタビュー 31

2.1.2.2 一次資料からの主要データ 31

2.1.2.3 主要な業界インサイト 32

2.1.2.4 専門家へのインタビューの内訳 32

2.2 市場規模の推定 33

2.2.1 トップダウンアプローチ 33

2.2.2 ボトムアップアプローチ 35

2.3 成長予測 36

2.3.1 供給サイドの予測 36

2.3.2 需要サイドの予測 36

2.4 要因分析 37

2.5 データの三角測量 38

2.6 調査の前提 40

2.7 研究の限界 40

2.8 リスク評価 41

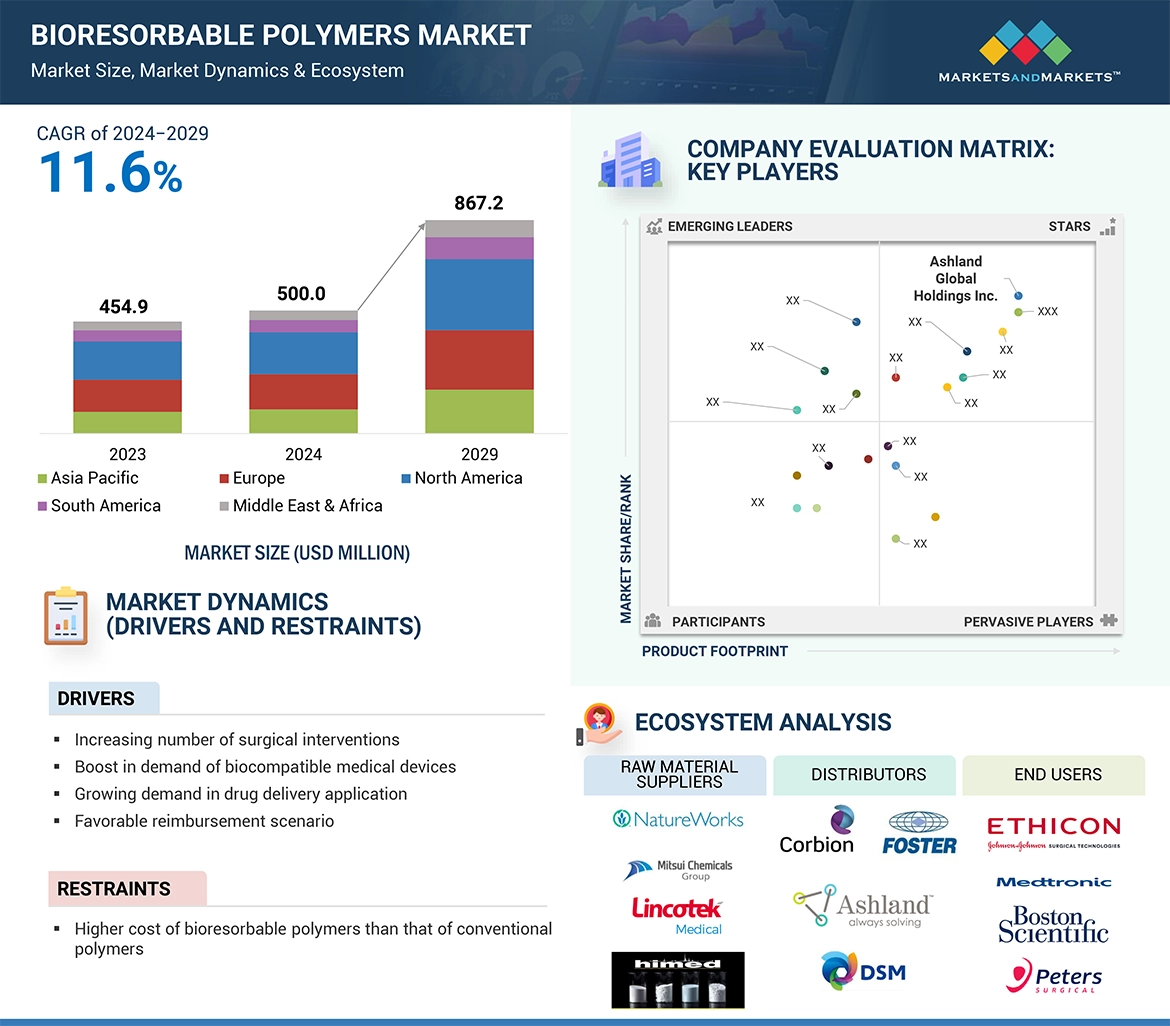

3 エグゼクティブ・サマリー

4 プレミアムインサイト 46

4.1 生体吸収性ポリマー市場におけるプレーヤーの大きな機会 46

4.2 生体吸収性ポリマー市場、地域別 46

4.3 北米:生体吸収性ポリマー市場:タイプ別・国別 47

4.4 生体吸収性ポリマー市場:用途・地域別 47

4.5 生体吸収性ポリマー市場の魅力 48

5 市場の概要 49

5.1 はじめに 49

5.2 市場ダイナミクス 49

5.2.1 推進要因 50

5.2.1.1 外科手術件数の増加 50

5.2.1.2 生体適合性医療機器に対する需要の高まり 50

5.2.1.3 薬物送達アプリケーションの需要増加 50

5.2.1.4 好ましい償還シナリオ 51

5.2.2 阻害要因 52

5.2.2.1 低侵襲手術への嗜好の高まり 52

5.2.2.2 従来のポリマーよりも生体吸収性ポリマーのコストが高い 52

5.2.2.3 新興国における品質管理対策の欠如 53

5.2.3 機会 53

5.2.3.1 エレクトロスピニング技術と3Dプリンティング技術 53

5.2.4 課題 54

5.2.4.1 医療機器に対する厳しい規制の枠組み 54

5.2.4.2 生体吸収性医療製品の効果的な使用には熟練した人材が必要 54

5.3 ポーターの5つの力分析 54

5.3.1 新規参入の脅威 56

5.3.2 代替品の脅威 56

5.3.3 供給者の交渉力 56

5.3.4 買い手の交渉力 56

5.3.5 競合の激しさ 57

5.4 主要ステークホルダーと購買基準 57

5.4.1 購入プロセスにおける主要ステークホルダー 57

5.4.2 購買基準 58

5.5 マクロ経済指標 59

5.5.1 主要国のGDP動向と予測 59

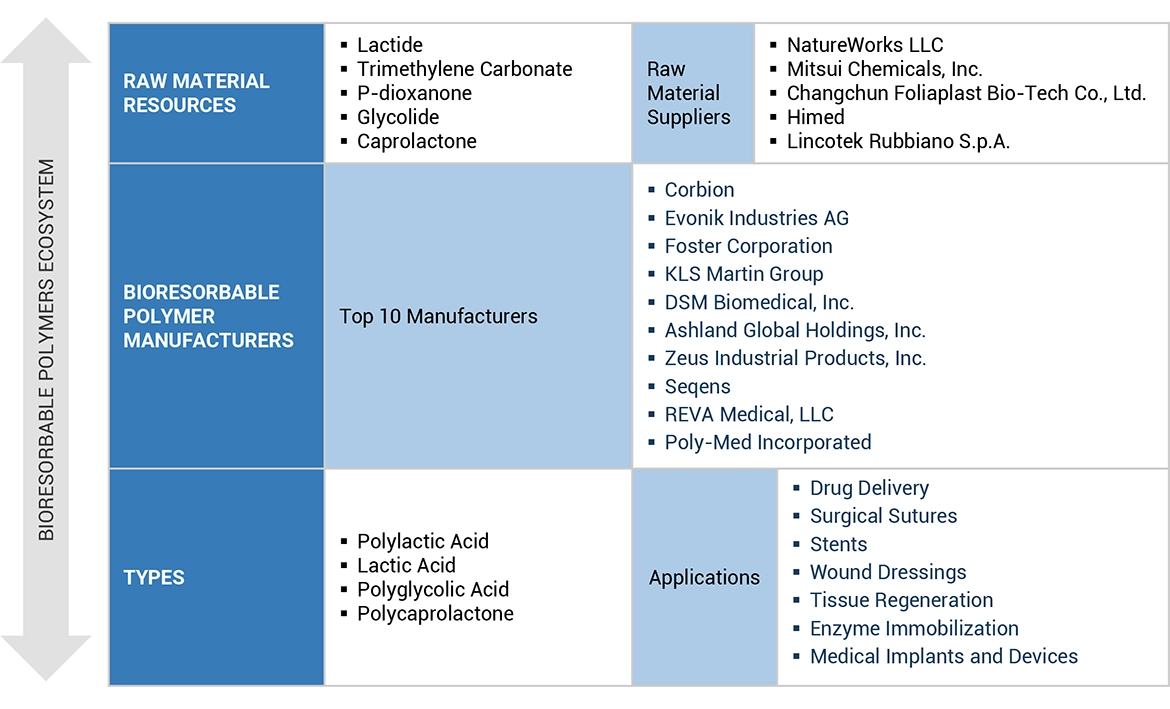

6 業界動向 60

6.1 サプライチェーン分析 60

6.1.1 原材料サプライヤー 60

6.1.2 製造業者 61

6.1.3 販売業者 61

6.1.4 最終用途産業 61

6.2 価格分析 61

6.2.1 主要企業の平均販売価格動向(用途別) 61

6.2.2 平均販売価格動向(地域別) 62

6.3 顧客ビジネスに影響を与えるトレンド/混乱 63

6.4 エコシステム分析 64

6.5 技術分析 66

6.5.1 主要技術 66

6.5.1.1 生体吸収性ポリマーにおけるエレクトロスピニング技術 66

6.5.2 補足技術 66

6.5.2.1 溶融押出技術 66

6.6 ケーススタディ分析 67

6.6.1 組織工学用生体吸収性ポリマー足場 67

6.6.2 心血管デバイス用生体吸収性材料 67

6.6.3 頭蓋顎顔面外科用の生体吸収性3dプリント患者特異的インプラント 68

6.7 貿易分析 68

6.7.1 輸入シナリオ(HSコード390770) 68

6.7.2 輸出シナリオ(HSコード390770) 69

6.8 規制の状況 70

6.8.1 規制機関、政府機関、その他の組織 71

6.8.2 規制の枠組み 74

6.8.2.1 生体吸収性ポリマー事業に影響を与える規制 74

6.8.2.2 医療機器における生体吸収性ポリマーに関するFDAガイドライン 74

6.8.2.3 REACH(化学物質の登録、評価、認可、制限) 74

6.8.2.4 ISO 10993(医療機器の生物学的評価) 75

6.8.2.5 生体吸収性ポリマーに関するEU医療機器規制(MDR) 75

6.8.2.6 吸収性ポリマーとインプラントに関するASTM規格 75

6.9 主要会議・イベント(2024~2025年) 75

6.10 投資と資金調達のシナリオ 76

6.11 特許分析 76

6.11.1 アプローチ 76

6.11.2 特許の種類 76

6.11.3 上位出願者 79

6.11.4 管轄地域分析 82

6.12 生体吸収性ポリマー市場におけるAI/GEN AIの影響 82

7 生体吸収性ポリマー市場:タイプ別 83

7.1 はじめに 84

7.2 ポリ乳酸(プラ) 86

7.2.1 整形外科用器具の需要増加が市場を牽引 86

7.3 ポリグリコール酸(PGA) 88

7.3.1 縫合糸やその他の医療用インプラントへの使用が市場を牽引 88

7.4 ポリ乳酸-グリコール酸(PRGA) 90

7.4.1 生体適合性と生分解性が市場を牽引 90

7.5 ポリカプロラクトン(PCL) 93

7.5.1 薬物送達、組織工学、整形外科用器具への応用が市場を牽引 93

7.6 その他のタイプ 95

8 生体吸収性ポリマー市場、用途別 97

8.1 はじめに 98

8.2 整形外科用器具 100

8.2.1 北米と欧州での高い消費が市場を牽引 100

8.3 ドラッグデリバリー 104

8.3.1 経口カプセルへの大きな需要が市場を牽引 104

8.4 その他の用途 107

9 生体吸収性ポリマー市場:地域別 110

9.1 はじめに 111

9.2 北米 113

9.2.1 米国 118

9.2.1.1 整形外科用器具とドラッグデリバリー用途の需要増加が市場を牽引 118

9.2.2 カナダ 120

9.2.2.1 老年人口の増加が需要を押し上げる 120

9.2.3 メキシコ 121

9.2.3.1 医療ツーリズムの増加が市場成長を促進 121

9.3 アジア太平洋地域 123

9.3.1 中国 128

9.3.1.1 経済成長が市場成長の主な促進要因 128

9.3.2 日本 130

9.3.2.1 急速な高齢化が市場を牽引 130

9.3.3 インド 131

9.3.3.1 製薬・医療産業の成長が市場を牽引 131

9.3.4 韓国 133

9.3.4.1 医療施設へのアクセスの増加が市場を牽引 133

9.4 ヨーロッパ 135

9.4.1 ドイツ 140

9.4.1.1 確立された医療産業と技術の進歩が市場成長の機会を提供 140

9.4.2 英国 142

9.4.2.1 医療費の増加が市場成長を促進 142

9.4.3 イタリア 143

9.4.3.1 整形外科用途と医薬品用途が市場を牽引 143

9.4.4 フランス 145

9.4.4.1 医療セクターを強化する取り組みが需要を牽引 145

9.4.5 ロシア 146

9.4.5.1 整形外科、ヘルスケア、医薬品分野が市場成長に大きく貢献 146

9.5 中東・アフリカ 148

9.5.1 中東 152

9.5.1.1 医療インフラの改善が市場を牽引 152

9.5.2 アフリカ 154

9.5.2.1 南アフリカが最大市場に 154

9.6 南米 155

9.6.1 ブラジル 159

9.6.1.1 手術におけるインプラント需要の増加が市場を牽引 159

9.6.2 アルゼンチン 161

9.6.2.1 大手企業による投資が市場を牽引 161

10 競争環境 163

10.1 はじめに 163

10.2 主要企業の戦略/勝利への権利 163

10.3 市場シェア分析 164

10.4 収益分析 166

10.5 企業評価マトリックス:主要プレイヤー(2023年) 167

10.5.1 スター企業 167

10.5.2 新興リーダー 167

10.5.3 浸透型プレーヤー 167

10.5.4 参加企業 167

10.5.5 企業フットプリント:主要プレーヤー(2023年) 169

10.5.5.1 企業フットプリント 169

10.5.5.2 タイプ別フットプリント 170

10.5.5.3 アプリケーション別フットプリント 171

10.5.5.4 地域別フットプリント 172

10.6 企業評価マトリクス:新興企業/SM(2023年) 173

10.6.1 進歩的企業 173

10.6.2 対応力のある企業 173

10.6.3 ダイナミックな企業 173

10.6.4 スタートアップ・ブロック 173

10.6.5 競争ベンチマーキング:新興企業/SM(2023年) 175

10.6.5.1 主要新興企業/中小企業の詳細リスト 175

10.6.5.2 主要新興企業/中小企業の競合ベンチマーキング 176

10.7 ブランド/製品の比較 177

10.8 企業評価と財務指標 178

10.9 競争シナリオ 179

10.9.1 製品上市 179

10.9.2 取引 180

10.9.3 拡張 180

11 企業プロファイル 182

11.1 主要企業 182

Corbion (Netherlands)

Evonik Industries AG (Germany)

Foster Corporation (US)

KLS Martin Group (Germany)

DSM Biomedical (US)

Ashland Global Holdings Inc. (US)

Zeus Company LLC (US)

Seqens (France)

Reva Medical LLC (US)

and Poly-Med Incorporated (US).

12 隣接市場と関連市場 210

12.1 はじめに 210

12.2 制限 210

12.3 ポリ乳酸市場 210

12.3.1 市場の定義 210

12.3.2 市場概要 211

12.4 ポリ乳酸市場:地域別 211

12.4.1 欧州 211

12.4.2 北米 212

12.4.3 アジア太平洋 213

12.4.4 南米 213

12.4.5 中東・アフリカ 214

13 付録 215

13.1 ディスカッション・ガイド 215

13.2 Knowledgestore:Marketsandmarketsの購読ポータル 218

13.3 カスタマイズオプション 220

13.4 関連レポート 220

13.5 著者の詳細 221

Favorable regulations and policies by the government towards healthcare industry are positively influencing the bioresorbable polymers market. Various countries have created regulations that encourage manufacturers to increase biocompatibility & biodegradability of medical devices like orthopedic devices. These changes promote the creation of bioresorbable polymers. New technologies for the surgical implants are driving the demand for bioresorbable polymers. This further encourages businesses to invest in the bioresorbable polymers market.

“PCL type segment is projected to be the third-fastest growing segment of bioresorbable polymers market, during the forecast period”

PCL type segment is estimated to be the third-fastest growing segment of bioresorbable polymers market, during the forecast period. This demand is primarily due to its demand in drug delivery systems. The properties of biocompatibility and flexibility make PCL flexible and capable for use in any drug delivery format, such as injectable microparticles, implantable devices, and capsules. Compatibility with other bioresorbable polymers brings it as the first choice for customized formulations in advanced therapeutic systems.

“Drug delivery was the second largest end-use industry of bioresorbable polymers market, in terms of value, in 2023.”

Drug delivery segment stands as the second-largest application in the bioresorbable polymers market. The demand is fueled by the need of controlled, targeted, and sustained-release drug systems, resulting in improved patient outcomes. Bioresorbable polymers are also widely employed in the preparation of implantable drug matrices and capsules to provide a slow and controlled release of therapeutic agents over time. This avoids the need for re-dose, thus significantly reducing discomfort to the patient. Their biocompatibility ensures that these polymers degrade safely within the body, well in line with the increasing trend by the medical industry towards innovative, patient-centered care solutions. With the desire for advanced drug delivery systems all over the world on the rise, bioresorbable polymers are among the most important choices when making efficient and effective therapeutic solutions.

“Europe was the second largest region in the bioresorbable polymers market, in terms of value.”

Europe was the second-largest region in the bioresorbable polymers market, in terms of value, in 2023. The bioresorbable polymers market in the region is comparatively mature, growing slower than the developing markets in the Asia-Pacific region and South America. The demand of bioresorbable polymers in the European region is primarily due to the increasing prevalence of chronic diseases such as cancers, cardiovascular diseases, orthopedic disorders, and neurological conditions. Bariatric, trauma, orthopedic, and cardiovascular surgical procedures are also on the rise in Europe. The region has developed a strong health care infrastructure and increased the level of advanced medical research further, which has clearly enhanced this market for bioresorbable polymers offered as sustainable and biocompatible solutions for implants and drug delivery systems. Additionally, the support by regulatory towards biodegradable material-based medical devices helps to spread across the European market.

• By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

• By Designation: Directors - 50%, Managers - 30%, and Others - 20%

• By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World – 5%

The key players profiled in the report include Corbion (Netherlands), Evonik Industries AG (Germany), Foster Corporation (US), KLS Martin Group (Germany), DSM Biomedical (US), Ashland Global Holdings Inc. (US), Zeus Company LLC (US), Seqens (France), Reva Medical, LLC (US), and Poly-Med Incorporated (US).

Research Coverage

This report segments the market for bioresorbable polymers based on type, application, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for bioresorbable polymers.

Reasons to Buy this Report

This research report is focused on various levels of analysis — industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the bioresorbable polymers market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

• Market Penetration: Comprehensive information on bioresorbable polymers offered by top players in the global market

• Analysis of key drivers: (Increasing number of surgical interventions, Boost in demand of biocompatible medical devices, Growing demand in drug delivery application, Favorable reimbursement scenario), opportunities (Electrospinning and 3D Printing Technologies), and challenges (Stringent regulatory framework for medical devices)

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the bioresorbable polymers market

• Market Development: Comprehensive information about lucrative emerging markets — the report analyzes the markets for bioresorbable polymers across regions.

• Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global bioresorbable polymers market

• Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the bioresorbable polymers market

1 INTRODUCTION 23

1.1 STUDY OBJECTIVES 23

1.2 MARKET DEFINITION 23

1.3 STUDY SCOPE 24

1.3.1 MARKETS COVERED 24

1.3.2 INCLUSIONS AND EXCLUSIONS 25

1.3.3 DEFINITION AND INCLUSIONS, BY TYPE 25

1.3.4 DEFINITION AND INCLUSIONS, BY APPLICATION 26

1.3.5 YEARS CONSIDERED 27

1.3.6 CURRENCY CONSIDERED 27

1.3.7 UNITS CONSIDERED 27

1.4 STAKEHOLDERS 28

1.5 SUMMARY OF CHANGES 28

2 RESEARCH METHODOLOGY 29

2.1 RESEARCH DATA 29

2.1.1 SECONDARY DATA 30

2.1.1.1 Key data from secondary sources 30

2.1.2 PRIMARY DATA 30

2.1.2.1 Interviews with experts – demand and supply sides 31

2.1.2.2 Key data from primary sources 31

2.1.2.3 Key industry insights 32

2.1.2.4 Breakdown of interviews with experts 32

2.2 MARKET SIZE ESTIMATION 33

2.2.1 TOP-DOWN APPROACH 33

2.2.2 BOTTOM-UP APPROACH 35

2.3 GROWTH FORECAST 36

2.3.1 SUPPLY-SIDE FORECAST 36

2.3.2 DEMAND-SIDE FORECAST 36

2.4 FACTOR ANALYSIS 37

2.5 DATA TRIANGULATION 38

2.6 RESEARCH ASSUMPTIONS 40

2.7 RESEARCH LIMITATIONS 40

2.8 RISK ASSESSMENT 41

3 EXECUTIVE SUMMARY 42

4 PREMIUM INSIGHTS 46

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN BIORESORBABLE POLYMERS MARKET 46

4.2 BIORESORBABLE POLYMERS MARKET, BY REGION 46

4.3 NORTH AMERICA: BIORESORBABLE POLYMERS MARKET, BY TYPE AND COUNTRY 47

4.4 BIORESORBABLE POLYMERS MARKET, BY APPLICATION AND REGION 47

4.5 BIORESORBABLE POLYMERS MARKET ATTRACTIVENESS 48

5 MARKET OVERVIEW 49

5.1 INTRODUCTION 49

5.2 MARKET DYNAMICS 49

5.2.1 DRIVERS 50

5.2.1.1 Increasing number of surgical interventions 50

5.2.1.2 Rising demand for biocompatible medical devices 50

5.2.1.3 Growing demand for drug delivery applications 50

5.2.1.4 Favorable reimbursement scenario 51

5.2.2 RESTRAINTS 52

5.2.2.1 Increasing preference for minimally invasive surgeries 52

5.2.2.2 Higher cost of bioresorbable polymers than conventional polymers 52

5.2.2.3 Lack of quality control measures in emerging countries 53

5.2.3 OPPORTUNITIES 53

5.2.3.1 Electrospinning and 3D printing technologies 53

5.2.4 CHALLENGES 54

5.2.4.1 Stringent regulatory framework for medical devices 54

5.2.4.2 Requirement of skilled personnel for effective use of bioresorbable medical products 54

5.3 PORTER’S FIVE FORCES ANALYSIS 54

5.3.1 THREAT OF NEW ENTRANTS 56

5.3.2 THREAT OF SUBSTITUTES 56

5.3.3 BARGAINING POWER OF SUPPLIERS 56

5.3.4 BARGAINING POWER OF BUYERS 56

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 57

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA 57

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS 57

5.4.2 BUYING CRITERIA 58

5.5 MACROECONOMIC INDICATORS 59

5.5.1 GDP TRENDS AND FORECAST OF MOST PROMINENT ECONOMIES 59

6 INDUSTRY TRENDS 60

6.1 SUPPLY CHAIN ANALYSIS 60

6.1.1 RAW MATERIAL SUPPLIERS 60

6.1.2 MANUFACTURERS 61

6.1.3 DISTRIBUTORS 61

6.1.4 END-USE INDUSTRIES 61

6.2 PRICING ANALYSIS 61

6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION 61

6.2.2 AVERAGE SELLING PRICE TREND, BY REGION 62

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 63

6.4 ECOSYSTEM ANALYSIS 64

6.5 TECHNOLOGY ANALYSIS 66

6.5.1 KEY TECHNOLOGIES 66

6.5.1.1 Electrospinning technology in bioresorbable polymers 66

6.5.2 COMPLEMENTARY TECHNOLOGIES 66

6.5.2.1 Melt extrusion technology 66

6.6 CASE STUDY ANALYSIS 67

6.6.1 BIORESORBABLE POLYMER SCAFFOLDS FOR TISSUE ENGINEERING 67

6.6.2 BIORESORBABLE MATERIALS FOR CARDIOVASCULAR DEVICES 67

6.6.3 BIORESORBABLE 3D-PRINTED PATIENT-SPECIFIC IMPLANTS FOR CRANIO-MAXILLOFACIAL SURGERY 68

6.7 TRADE ANALYSIS 68

6.7.1 IMPORT SCENARIO (HS CODE 390770) 68

6.7.2 EXPORT SCENARIO (HS CODE 390770) 69

6.8 REGULATORY LANDSCAPE 70

6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

6.8.2 REGULATORY FRAMEWORK 74

6.8.2.1 Regulations impacting bioresorbable polymers business 74

6.8.2.2 FDA guidelines for bioabsorbable polymers in medical devices 74

6.8.2.3 REACH (Registration, evaluation, authorization and restriction of chemicals) 74

6.8.2.4 ISO 10993 (Biological evaluation of medical devices) 75

6.8.2.5 EU medical device regulation (MDR) for bioresorbable polymers 75

6.8.2.6 ASTM standards for absorbable polymers and implants 75

6.9 KEY CONFERENCES AND EVENTS, 2024–2025 75

6.10 INVESTMENT AND FUNDING SCENARIO 76

6.11 PATENT ANALYSIS 76

6.11.1 APPROACH 76

6.11.2 PATENT TYPES 76

6.11.3 TOP APPLICANTS 79

6.11.4 JURISDICTION ANALYSIS 82

6.12 IMPACT OF AI/GEN AI ON BIORESORBABLE POLYMERS MARKET 82

7 BIORESORBABLE POLYMERS MARKET, BY TYPE 83

7.1 INTRODUCTION 84

7.2 POLYLACTIC ACID (PLA) 86

7.2.1 RISING DEMAND FOR ORTHOPEDIC DEVICES TO DRIVE MARKET 86

7.3 POLYGLYCOLIC ACID (PGA) 88

7.3.1 USE IN SUTURES AND OTHER MEDICAL IMPLANTS TO PROPEL MARKET 88

7.4 POLY (LACTIC-CO-GLYCOLIC ACID) (PLGA) 90

7.4.1 BIOCOMPATIBILITY AND BIODEGRADABILITY TO DRIVE MARKET 90

7.5 POLYCAPROLACTONE (PCL) 93

7.5.1 DRUG DELIVERY, TISSUE ENGINEERING, AND ORTHOPEDIC DEVICE APPLICATIONS TO DRIVE MARKET 93

7.6 OTHER TYPES 95

8 BIORESORBABLE POLYMERS MARKET, BY APPLICATION 97

8.1 INTRODUCTION 98

8.2 ORTHOPEDIC DEVICES 100

8.2.1 HIGH CONSUMPTION IN NORTH AMERICA AND EUROPE TO DRIVE MARKET 100

8.3 DRUG DELIVERY 104

8.3.1 SIGNIFICANT DEMAND FOR ORAL CAPSULES TO DRIVE MARKET 104

8.4 OTHER APPLICATIONS 107

9 BIORESORBABLE POLYMERS MARKET, BY REGION 110

9.1 INTRODUCTION 111

9.2 NORTH AMERICA 113

9.2.1 US 118

9.2.1.1 Growing demand for orthopedic devices and drug delivery applications to drive market 118

9.2.2 CANADA 120

9.2.2.1 Increasing geriatric population to boost demand 120

9.2.3 MEXICO 121

9.2.3.1 Rising medical tourism to propel market growth 121

9.3 ASIA PACIFIC 123

9.3.1 CHINA 128

9.3.1.1 Economic growth to be major driver for market growth 128

9.3.2 JAPAN 130

9.3.2.1 Rapidly aging population to drive market 130

9.3.3 INDIA 131

9.3.3.1 Growing pharmaceutical and medical industries to drive market 131

9.3.4 SOUTH KOREA 133

9.3.4.1 Increasing access to healthcare facilities to drive market 133

9.4 EUROPE 135

9.4.1 GERMANY 140

9.4.1.1 Established healthcare industry and technological advancements offer opportunities for market growth 140

9.4.2 UK 142

9.4.2.1 Increasing healthcare expenditure to drive market growth 142

9.4.3 ITALY 143

9.4.3.1 Orthopedic and pharmaceutical applications to propel market 143

9.4.4 FRANCE 145

9.4.4.1 Initiatives to boost healthcare sector to drive demand 145

9.4.5 RUSSIA 146

9.4.5.1 Orthopedics, healthcare, and pharmaceutical segments contribute significantly to market growth 146

9.5 MIDDLE EAST & AFRICA 148

9.5.1 MIDDLE EAST 152

9.5.1.1 Improving healthcare infrastructure to drive market 152

9.5.2 AFRICA 154

9.5.2.1 South Africa to be largest market 154

9.6 SOUTH AMERICA 155

9.6.1 BRAZIL 159

9.6.1.1 Rising demand for implants in surgeries to drive market 159

9.6.2 ARGENTINA 161

9.6.2.1 Investments by major players to drive market 161

10 COMPETITIVE LANDSCAPE 163

10.1 INTRODUCTION 163

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 163

10.3 MARKET SHARE ANALYSIS 164

10.4 REVENUE ANALYSIS 166

10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 167

10.5.1 STARS 167

10.5.2 EMERGING LEADERS 167

10.5.3 PERVASIVE PLAYERS 167

10.5.4 PARTICIPANTS 167

10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 169

10.5.5.1 Company footprint 169

10.5.5.2 Type footprint 170

10.5.5.3 Application footprint 171

10.5.5.4 Region footprint 172

10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 173

10.6.1 PROGRESSIVE COMPANIES 173

10.6.2 RESPONSIVE COMPANIES 173

10.6.3 DYNAMIC COMPANIES 173

10.6.4 STARTING BLOCKS 173

10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 175

10.6.5.1 Detailed list of key startups/SMEs 175

10.6.5.2 Competitive benchmarking of key startups/SMEs 176

10.7 BRAND/PRODUCT COMPARISON 177

10.8 COMPANY VALUATION AND FINANCIAL METRICS 178

10.9 COMPETITIVE SCENARIO 179

10.9.1 PRODUCT LAUNCHES 179

10.9.2 DEALS 180

10.9.3 EXPANSIONS 180

11 COMPANY PROFILES 182

11.1 KEY PLAYERS 182

11.1.1 CORBION 182

11.1.1.1 Business overview 182

11.1.1.2 Products/Solutions/Services offered 183

11.1.1.3 Recent developments 185

11.1.1.3.1 Deals 185

11.1.1.4 MnM view 185

11.1.1.4.1 Right to win 185

11.1.1.4.2 Strategic choices 185

11.1.1.4.3 Weaknesses and competitive threats 185

11.1.2 EVONIK INDUSTRIES AG 186

11.1.2.1 Business overview 186

11.1.2.2 Products/Solutions/Services offered 187

11.1.2.3 Recent developments 188

11.1.2.3.1 Expansions 188

11.1.2.3.2 Deals 188

11.1.2.4 MnM view 189

11.1.2.4.1 Right to win 189

11.1.2.4.2 Strategic choices 189

11.1.2.4.3 Weaknesses and competitive threats 189

11.1.3 FOSTER CORPORATION 190

11.1.3.1 Business overview 190

11.1.3.2 Products/Solutions/Services offered 190

11.1.3.3 MnM view 191

11.1.3.3.1 Right to win 191

11.1.3.3.2 Strategic choices 191

11.1.3.3.3 Weaknesses and competitive threats 191

11.1.4 KLS MARTIN GROUP 192

11.1.4.1 Business overview 192

11.1.4.2 Products/Solutions/Services offered 192

11.1.4.3 MnM view 193

11.1.4.3.1 Right to win 193

11.1.4.3.2 Strategic choices 193

11.1.4.3.3 Weaknesses and competitive threats 193

11.1.5 DSM BIOMEDICAL 194

11.1.5.1 Business overview 194

11.1.5.2 Products/Solutions/Services offered 194

11.1.5.3 MnM view 195

11.1.5.3.1 Right to win 195

11.1.5.3.2 Strategic choices 195

11.1.5.3.3 Weaknesses and competitive threats 195

11.1.6 ASHLAND GLOBAL HOLDINGS INC. 196

11.1.6.1 Business overview 196

11.1.6.2 Products/Solutions/Services offered 197

11.1.6.3 Recent developments 198

11.1.6.3.1 Product launches 198

11.1.6.3.2 Expansions 198

11.1.7 ZEUS COMPANY LLC 199

11.1.7.1 Business overview 199

11.1.7.2 Products/Solutions/Services offered 199

11.1.7.3 Recent developments 200

11.1.7.3.1 Product launches 200

11.1.8 SEQENS 201

11.1.8.1 Business overview 201

11.1.8.2 Products/Solutions/Services offered 201

11.1.9 REVA MEDICAL, LLC 202

11.1.9.1 Business overview 202

11.1.9.2 Products/Solutions/Services offered 202

11.1.10 POLY-MED INCORPORATED 203

11.1.10.1 Business overview 203

11.1.10.2 Products/Solutions/Services offered 203

11.2 OTHER PLAYERS 205

11.2.1 BEZWADA BIOMEDICAL, LLC 205

11.2.2 NOMISMA HEALTHCARE PVT. LTD. 206

11.2.3 BMG INC. 206

11.2.4 POLYSCIENCES, INC. 207

11.2.5 HUIZHOU FORYOU MEDICAL DEVICES CO., LTD. 207

11.2.6 MUSASHINO CHEMICAL LABORATORY, LTD. 208

11.2.7 HENAN XINGHAN BIOLOGICAL TECHNOLOGY CO., LTD. 209

12 ADJACENT AND RELATED MARKETS 210

12.1 INTRODUCTION 210

12.2 LIMITATIONS 210

12.3 POLY LACTIC ACID MARKET 210

12.3.1 MARKET DEFINITION 210

12.3.2 MARKET OVERVIEW 211

12.4 POLY LACTIC ACID MARKET, BY REGION 211

12.4.1 EUROPE 211

12.4.2 NORTH AMERICA 212

12.4.3 ASIA PACIFIC 213

12.4.4 SOUTH AMERICA 213

12.4.5 MIDDLE EAST & AFRICA 214

13 APPENDIX 215

13.1 DISCUSSION GUIDE 215

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 218

13.3 CUSTOMIZATION OPTIONS 220

13.4 RELATED REPORTS 220

13.5 AUTHOR DETAILS 221

❖ 世界の生体吸収性ポリマー市場に関するよくある質問(FAQ) ❖

・生体吸収性ポリマーの世界市場規模は?

→MarketsandMarkets社は2024年の生体吸収性ポリマーの世界市場規模を5億米ドルと推定しています。

・生体吸収性ポリマーの世界市場予測は?

→MarketsandMarkets社は2029年の生体吸収性ポリマーの世界市場規模を8億6,720万米ドルと予測しています。

・生体吸収性ポリマー市場の成長率は?

→MarketsandMarkets社は生体吸収性ポリマーの世界市場が2024年~2029年に年平均11.6%成長すると予測しています。

・世界の生体吸収性ポリマー市場における主要企業は?

→MarketsandMarkets社は「Corbion (Netherlands), Evonik Industries AG (Germany), Foster Corporation (US), KLS Martin Group (Germany), DSM Biomedical (US), Ashland Global Holdings Inc. (US), Zeus Company LLC (US), Seqens (France), Reva Medical, LLC (US), and Poly-Med Incorporated (US).など ...」をグローバル生体吸収性ポリマー市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。