1. 方法論と範囲

1.1. 調査方法

1.2. 調査目的と調査範囲

2. 定義と概要

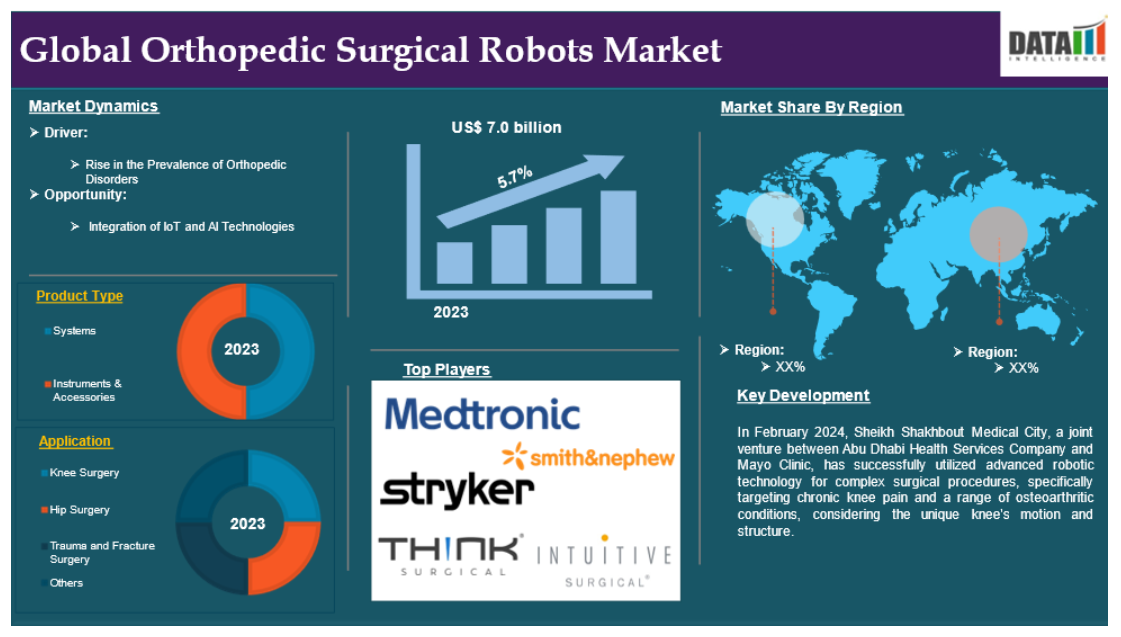

3. エグゼクティブ・サマリー

3.1. 製品タイプ別スニペット

3.2. 適応症別スニペット

3.3. エンドユーザー別スニペット

3.4. 地域別スニペット

4. ダイナミクス

4.1. 影響要因

4.1.1. 推進要因

4.1.1.1. 関節炎の有病率の上昇

4.1.1.2. XX

4.2. 阻害要因

4.2.1. 手術ロボットに関連する高コストとメンテナンスコスト

4.3. 機会

4.3.1. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

6. 製品タイプ別

6.1. 製品紹介

6.1.1. 製品タイプ別市場規模分析および前年比成長率分析(%)

6.1.2. 市場魅力度指数(製品タイプ別

6.2. ロボット手術システム

6.2.1. はじめに

6.2.2. 市場規模分析と前年比成長率分析(%)

6.3. 機器とアクセサリー

7. 適応症別

7.1. はじめに

7.1.1. 市場規模分析および前年比成長率分析(%)、適応症別

7.1.2. 市場魅力度指数、適応症別

7.2. 一般外科*市場

7.2.1. 序論

7.2.2. 市場規模分析と前年比成長率分析(%)

7.3. 整形外科

7.4. 脳神経外科

7.5. 心臓血管

7.6. 婦人科

7.7. 放射線科

7.8. その他

8. エンドユーザー別

8.1. 導入

8.1.1. 市場規模分析および前年比成長率分析(%), エンドユーザー別

8.1.2. 市場魅力度指数、エンドユーザー別

8.2. 病院*市場

8.2.1. はじめに

8.2.2. 市場規模分析と前年比成長率分析(%)

8.3. 外来手術センター

8.4. その他

9. 地域別

9.1. 導入

9.1.1. 地域別市場規模分析および前年比成長率分析(%)

9.1.2. 市場魅力度指数、地域別

9.2. 北米

9.2.1. 序論

9.2.2. 主な地域別ダイナミクス

9.2.3. 市場規模分析および前年比成長率分析(%), 製品タイプ別

9.2.4. 市場規模分析および前年比成長率分析(%)、適応症別

9.2.5. 市場規模分析および前年比成長率分析(%), エンドユーザー別

9.2.6. 市場規模分析および前年比成長率分析(%), 国別

9.2.6.1. 米国

9.2.6.2. カナダ

9.2.6.3. メキシコ

9.3. ヨーロッパ

9.3.1. はじめに

9.3.2. 主な地域別動向

9.3.3. 市場規模分析および前年比成長率分析(%), 製品タイプ別

9.3.4. 市場規模分析および前年比成長率分析(%)、適応症別

9.3.5. 市場規模分析および前年比成長率分析(%), エンドユーザー別

9.3.6. 市場規模分析および前年比成長率分析(%), 国別

9.3.6.1. ドイツ

9.3.6.2. イギリス

9.3.6.3. フランス

9.3.6.4. スペイン

9.3.6.5. イタリア

9.3.6.6. その他のヨーロッパ

9.4. 南米

9.4.1. はじめに

9.4.2. 地域別主要市場

9.4.3. 市場規模分析および前年比成長率分析(%), 製品タイプ別

9.4.4. 市場規模分析および前年比成長率分析(%)、適応症別

9.4.5. 市場規模分析および前年比成長率分析(%), エンドユーザー別

9.4.6. 市場規模分析および前年比成長率分析(%), 国別

9.4.6.1. ブラジル

9.4.6.2. アルゼンチン

9.4.6.3. その他の南米諸国

9.5. アジア太平洋

9.5.1. はじめに

9.5.2. 主な地域別ダイナミクス

9.5.3. 市場規模分析および前年比成長率分析(%), 製品タイプ別

9.5.4. 市場規模分析および前年比成長率分析(%)、適応症別

9.5.5. 市場規模分析および前年比成長率分析(%), エンドユーザー別

9.5.6. 市場規模分析および前年比成長率分析(%), 国別

9.5.6.1. 中国

9.5.6.2. インド

9.5.6.3. 日本

9.5.6.4. 韓国

9.5.6.5. その他のアジア太平洋地域

9.6. 中東・アフリカ

9.6.1. 序論

9.6.2. 主な地域別ダイナミクス

9.6.3. 市場規模分析および前年比成長率分析(%), 製品タイプ別

9.6.4. 市場規模分析および前年比成長率分析(%)、適応症別

9.6.5. 市場規模分析および前年比成長率分析(%), エンドユーザー別

10. 競合情勢

10.1. 競争シナリオ

10.2. 市場ポジショニング/シェア分析

10.3. M&A分析

11. 企業プロフィール

11.1. Intuitive Surgical *

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Stryker Corporation

11.3. Medtech Surgical

11.4. THINK Surgical

11.5. Asensus Surgical

11.6. CMR Surgical

11.7. Stereotaxis

11.8. Distalmotion

11.9. EndoQuest Robotics

11.10. Medicaroid Corporation

リストは網羅的ではありません

12. 付録

12.1. 会社概要とサービス

12.2. お問い合わせ

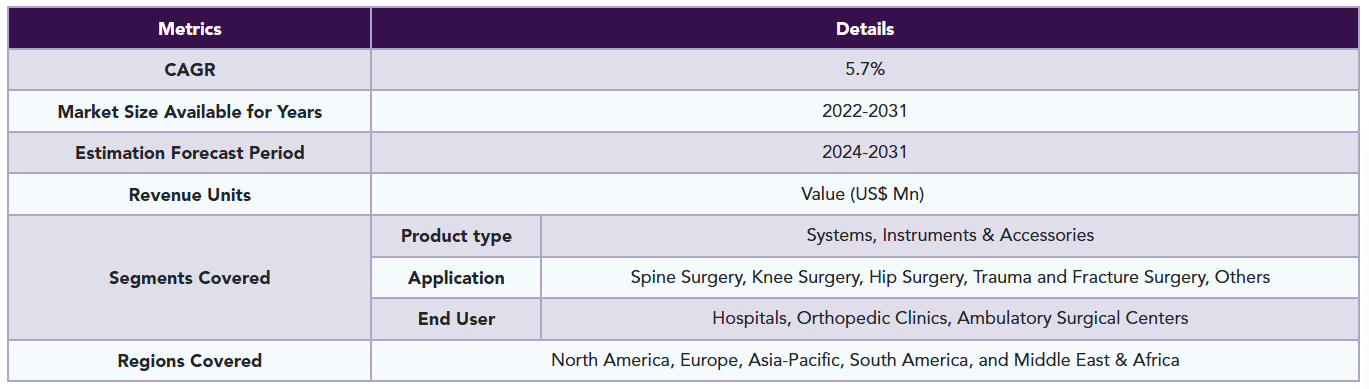

Global Surgical Robots market reached US$ 5.29 billion in 2023 and is expected to reach US$ 12.54 billion by 2031, growing at a CAGR of 11.3% during the forecast period 2024-2031.

Surgical robots are high-tech systems that are used in most surgical procedures in order to increase the degree of precision, flexibility and control. These robotic systems enable the surgeons to conduct more complex operations with more precision and less invasive methods. The application of robotic surgery technique has expanded over many other fields, such as urology, gynecology, cardiology and orthopedics because of its advantages including decrease in recovery time for patients, smaller cuts, less incidents of complications, and good results.

Robotic surgical systems mainly comprise a surgical console that the surgeon uses to maneuver the robot, a robotic arm equipped with surgical instruments, and a camera system that displays the operational field in three dimensions, offering high definition views. The main factor driving the demand for these systems is advanced technology, accompanied by awareness and the preference for operations that are less invasive.

Market Dynamics: Drivers & Restraints

Rise in the Prevalence of Arthiritis

The rise in arthritis prevalence is driving demand for surgical robots in orthopedic procedures, particularly knee and hip replacements. Robotic surgery systems, known for their precision and minimal invasiveness, are being used for these procedures due to their enhanced accuracy and reduced recovery times. As the global aging population grows and arthritis cases increase, the demand for robotic-assisted surgeries is expected to grow further.

For instance, according to National Institutes of Health (NIH), and the Arthritis Foundation, 2024, Around 70 million US citizens suffer from arthritis or chronic joint symptoms, with rheumatic diseases being the leading cause of disability among those aged 65 and older. Osteoarthritis, the most common form, affects 20.7 million adults, with most affected in at least one joint. Rheumatoid arthritis, the most severe form, affects 2.1 million Americans, with an average onset between 20 and 45 years old.

High Cost and Maintanance Cost Associated With the Surgical Robots

The surgical robot market is expensive due to advanced technology, high research and development expenses, and careful manufacturing. For instance, the da Vince Surgical System costs around $2 billion initially, not including staff and surgeon training as well as maintenance and surgical accessories.

These systems use advanced robotics and machine learning algorithms, requiring significant investments for maintenance and operation. High-quality sensors, cameras, and surgical instruments, along with stringent norm-based testing, further increase costs. Increased maintenance, training, and specialized requirements for operating rooms further heighten costs, hindering their widespread adoption despite their clinical benefits.

Segment Analysis

The global surgical robots market is segmented based on product type, indication, end user, and region.

Product Type:

Robotic surgery systems segment is expected to dominate the surgical robots market share

The robotic surgery systems segment holds a major portion of the surgical robots market share and is expected to continue to hold a significant portion of the surgical robots market share during the forecast period.

Robotic surgery systems, like the da Vinci Surgical System, revolutionize minimally invasive surgeries by improving precision, reducing recovery times, and minimizing complications. They are increasingly used in fields like urology, gynecology, orthopedics, and cardiovascular surgery due to their ability to perform complex procedures with smaller incisions and higher accuracy. The global demand for robotic surgery is driven by technological advancements, healthcare infrastructure investments, and the growing need for minimally invasive surgical solutions.

For instance, in July 2024, Medtronic has introduced its Live Stream function for the Touch Surgery digital technology ecosystem, featuring AI capabilities. The technology was used to assist in the removal of seeds from a red pepper by a Hugo surgical robot. The Live Stream feature was demonstrated at DeviceTalks Boston in May.

Instruments and Accessories segment is the fastest-growing segment in the surgical robots market share

The instruments and accessories segment is the fastest-growing segment in the surgical robots market share and is expected to hold the market share over the forecast period.

Surgical robots have instruments and accessories that enhance their functionality and effectiveness. These components are the different robotic arms and surgical instruments needed cameras, and other tools, which allow for specific articulation, internal imaging, and visualization during complicated procedures.

Moreover, with the rapid development and advancement of technology in surgical robotics, a corresponding increase comes in the urge for specialized instruments and accessories as evident in urology, gynecology, orthopedics, and surgical general practices. These factors are important for the belief that these robotic systems can be used for a variety of minimally invasive surgeries, which brings to the increasing trend of the surgical robots industry. The ongoing development and enhancement of instruments and accessories will influence the growth of the market, as these products are increasingly preferred by surgeons in the provision of services to patients in need of better treatment results and more targeted treatment.

Indication:

General surgery segment is expected to dominate the surgical robots market share

The general surgery segment holds a major portion of the surgical robots market share and is expected to continue to hold a significant portion of the surgical robots market share during the forecast period.

Robotic systems are of utmost importance in the field of general surgery as they allow the surgeons to undertake and accomplish difficult tasks with a high degree of accuracy and less invasion to the patient. Such systems improve the surgeon’s performance through high definition three-dimensional views, flexible motion, and better reach to distant places. Operations such as cholecystectomy, repair of hernias, and surgeries on the colon and rectum are already being done with the aid of robots. The primary advantages of robotics in general surgery consist of loss of blood, cost of treatment due to reduced days spent in hospital, faster recovery rates and reduced length of operative incisions.

Orthopedic segment is the fastest-growing segment in the surgical robots market share

The orthopedic segment is the fastest-growing segment in the surgical robots market share and is expected to hold the market share over the forecast period.

Over the last decade, the possibilities of arthroplasty, spinal and trauma surgeries have undergone a revolutionary change with the introduction of robotic systems in orthopedic surgery. These systems ensure a more accurate placement of implants, particularly most of the knee and hip replacement implants reducing the chances of misalignment and complications. Robotic Surgery incorporates the use of computer systems and robotics to assist orthopedic surgeons in maximizing their efforts to ensure the precision of the procedures being performed.

On the whole enhanced robotic system enabled users to plan and execute surgical procedures with anatomical accuracy resulting to minimal damage to the non target tissues and fast healing. The robotic systems are anticipated to witness a significant increase in demand within orthopedic surgical procedures because of the rising aging population and prevalence of musculoskeletal disorders, hence making it a substantial component of the overall surgical robots market.

Geographical Analysis

North America is expected to hold a significant position in the Surgical Robots market share

North America holds a substantial position in the surgical robots market and is expected to hold most of the market share due to novel product launches, FDA clearance, rise in use of automated surgical tools in the health care sector and the expansion of health care facilities in the United States. The fact that there are fewer healthcare professionals and surgeons in the United States as a result of the patient population will help boost the regional market for surgical robots.

For instance, in March 2024, Intuitive a global technology leader in minimally invasive care and the pioneer of robotic-assisted surgery, announced that the U.S. Food and Drug Administration (FDA) provided 510(k) clearance for da Vinci 5, the company’s next-generation multiport robotic system.

Moreover, in February 2023, Senhance is a robotic surgical system created by Asensus Surgical, a US-based medical devices company. The technology is used to aid surgeons and hospitals in doing performance-guided general laparoscopic surgical operations as well as laparoscopic gynaecology, urology, and thoracic surgeries.

Europe is growing at the fastest pace in the Surgical Robots market

Europe holds the fastest pace in the Surgical Robots market and is expected to hold most of the market share due to the improvement in healthcare facilities, a rise in the need for minimally invasive procedures, and the increasing cases of chronic diseases that warrant complicated surgical operations. Furthermore, the region is characterized by high government support for healthcare services, effective uptake of advanced technologies, and continued funding for robotics expansion. In Europe, the surgical robots industry is also buoyed by the presence of premier medical devices manufacturers and availability of a highly skilled labor force.

For instance, in August 2024, ECential, a French company specializing in surgical robotics, received 510(k) clearance from the Food and Drug Administration for a spine technology in June. The FDA clearance covered a spine navigation and robotic-assistance device that is compatible with specific Depuy Synthes instruments. ECential created the system to guide the instruments in one of two modes, freehand or robotic assisted guidance.

Competitive Landscape

The major global players in the surgical robots market include Intuitive Surgical, Stryker Corporation, Medtech Surgical, THINK Surgical, Asensus Surgical, CMR Surgical, Stereotaxis, Distalmotion, EndoQuest Robotics, Medicaroid Corporation among others.

Emerging Players

The emerging players in the surgical robots market include Quantum Surgical, MicroPort MedBot, Brain Lab and among others.

Key Developments

• In May 2023 Robocath designs, a company that develops and commercializes smart robotic solutions to treat cardiovascular diseases launched its R-One+, a revolutionary robotic platform for coronary angioplasties, will be unveiled at the EuroPCR 2023 conference in Paris. According to the robotics company located in Rouen, France, the device would not only prevent radiation-induced damage but also make treatments safer and easier.

• In Feb 2023 Asensus Surgical announced said it has engaged into a multi-year collabration with Google Cloud. Google Cloud's secure cloud data architecture and machine learning are being integrated into the Asensus surgical robot platform as part of the cooperation. Through its Intelligent Surgical Unit (ISU), it extends the possibilities of Asensus' performance-guided surgical platform.

Why Purchase the Report?

• To visualize the global surgical robots market segmentation based on product type, indication, end user, and region and understand key commercial assets and players.

• Identify commercial opportunities by analyzing trends and co-development.

• Excel data sheet with numerous data points of the surgical robots market with all segments.

• PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

• Product mapping is available in excel consisting of key products of all the major players.

The global surgical robots market report would provide approximately 70 tables, 65 figures, and 184 pages.

Target Audience 2023

• Manufacturers/ Buyers

• Industry Investors/Investment Bankers

• Research Professionals

• Emerging Companies

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Indication

3.3. Snippet by End User

3.4. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Rise in the Prevalence of Arthritis

4.1.1.2. XX

4.2. Restraints

4.2.1. High Cost and Maintenance Cost Associated with the Surgical Robots

4.3. Opportunity

4.3.1. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

6. By Product Type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

6.1.2. Market Attractiveness Index, By Product Type

6.2. Robotic Surgery Systems*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Instruments and Accessories

7. By Indication

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

7.1.2. Market Attractiveness Index, By Indication

7.2. General Surgery*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Orthopedic

7.4. Neurosurgery

7.5. Cardiovascular

7.6. Gynecology

7.7. Radiology

7.8. Others

8. By End User

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

8.1.2. Market Attractiveness Index, By End User

8.2. Hospitals*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Ambulatory Surgical Centers

8.4. Others

9. By Region

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

9.1.2. Market Attractiveness Index, By Region

9.2. North America

9.2.1. Introduction

9.2.2. Key Region-Specific Dynamics

9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

9.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.2.6.1. U.S.

9.2.6.2. Canada

9.2.6.3. Mexico

9.3. Europe

9.3.1. Introduction

9.3.2. Key Region-Specific Dynamics

9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

9.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.3.6.1. Germany

9.3.6.2. U.K.

9.3.6.3. France

9.3.6.4. Spain

9.3.6.5. Italy

9.3.6.6. Rest of Europe

9.4. South America

9.4.1. Introduction

9.4.2. Key Region-Specific Dynamics

9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

9.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.4.6.1. Brazil

9.4.6.2. Argentina

9.4.6.3. Rest of South America

9.5. Asia-Pacific

9.5.1. Introduction

9.5.2. Key Region-Specific Dynamics

9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

9.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.5.6.1. China

9.5.6.2. India

9.5.6.3. Japan

9.5.6.4. South Korea

9.5.6.5. Rest of Asia-Pacific

9.6. Middle East and Africa

9.6.1. Introduction

9.6.2. Key Region-Specific Dynamics

9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

9.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

10. Competitive Landscape

10.1. Competitive Scenario

10.2. Market Positioning/Share Analysis

10.3. Mergers and Acquisitions Analysis

11. Company Profiles

11.1. Intuitive Surgical *

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Stryker Corporation

11.3. Medtech Surgical

11.4. THINK Surgical

11.5. Asensus Surgical

11.6. CMR Surgical

11.7. Stereotaxis

11.8. Distalmotion

11.9. EndoQuest Robotics

11.10. Medicaroid Corporation

LIST NOT EXHAUSTIVE

12. Appendix

12.1. About Us and Services

12.2. Contact Us

❖ 世界の手術用ロボット市場に関するよくある質問(FAQ) ❖

・手術用ロボットの世界市場規模は?

→DataM Intelligence社は2023年の手術用ロボットの世界市場規模を52.9億米ドルと推定しています。

・手術用ロボットの世界市場予測は?

→DataM Intelligence社は2031年の手術用ロボットの世界市場規模を125.4億米ドルと予測しています。

・手術用ロボット市場の成長率は?

→DataM Intelligence社は手術用ロボットの世界市場が2024年~2031年に年平均11.3%成長すると予測しています。

・世界の手術用ロボット市場における主要企業は?

→DataM Intelligence社は「Intuitive Surgical, Stryker Corporation, Medtech Surgical, THINK Surgical, Asensus Surgical, CMR Surgical, Stereotaxis, Distalmotion, EndoQuest Robotics, Medicaroid Corporationなど ...」をグローバル手術用ロボット市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。