1. 方法論と範囲

1.1. 調査方法

1.2. 調査目的と調査範囲

2. 定義と概要

3. エグゼクティブ・サマリー

3.1. タイプ別スニペット

3.2. 用途別スニペット

3.3. 流通チャネル別スニペット

3.4. 地域別スニペット

4. ダイナミクス

4.1. 影響要因

4.1.1. 推進要因

4.1.1.1. 高齢化人口と慢性疾患負担の増加

4.1.1.2. 生物製剤とバイオシミラーの需要拡大

4.1.2. 阻害要因

4.1.2.1. 規制上の課題

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 特許分析

5.5. 規制分析

5.6. SWOT分析

5.7. アンメット・ニーズ

6. タイプ別

6.1. はじめに

6.1.1. 市場規模分析および前年比成長率分析(%), タイプ別

6.1.2. 市場魅力度指数(タイプ別

6.2. 生物製剤

6.2.1. 序論

6.2.2. 市場規模分析と前年比成長率分析(%)

6.2.3. モノクローナル抗体

6.2.4. ワクチン

6.2.5. 組み換えタンパク質

6.2.6. 血液因子

6.2.7. その他

6.3. バイオシミラー

6.3.1. バイオシミラーモノクローナル抗体

6.3.2. バイオシミラーワクチン

6.3.3. バイオシミラー組換えタンパク質

6.3.4. バイオシミラー血液因子

6.3.5. その他

7. 用途別

7.1. 導入

7.1.1. 市場規模分析および前年比成長率分析(%), アプリケーション別

7.1.2. 市場魅力度指数:用途別

7.2. オンコロジー*市場

7.2.1. 序論

7.2.2. 市場規模分析と前年比成長率分析(%)

7.3. 自己免疫疾患

7.4. 慢性疾患

7.5. 感染症

7.6. 神経学

7.7. 眼科

7.8. その他

8. 流通チャネル別

8.1. はじめに

8.1.1. 市場規模分析および前年比成長率分析(%), 流通チャネル別

8.1.2. 市場魅力度指数(流通チャネル別

8.2. 病院薬局

8.2.1. 序論

8.2.2. 市場規模分析と前年比成長率分析(%)

8.3. 小売薬局

8.4. オンライン薬局

9. 地域別

9.1. はじめに

9.1.1. 地域別市場規模分析および前年比成長率分析(%)

9.1.2. 市場魅力度指数、地域別

9.2. 北米

9.2.1. 序論

9.2.2. 主な地域別ダイナミクス

9.2.3. 市場規模分析および前年比成長率分析(%), タイプ別

9.2.4. 市場規模分析とYoY成長率分析(%)、用途別

9.2.5. 市場規模分析および前年比成長率分析(%), 流通チャネル別

9.2.6. 市場規模分析および前年比成長率分析(%), 国別

9.2.6.1. 米国

9.2.6.2. カナダ

9.2.6.3. メキシコ

9.3. ヨーロッパ

9.3.1. はじめに

9.3.2. 主な地域別動向

9.3.3. 市場規模分析および前年比成長率分析(%), タイプ別

9.3.4. 市場規模分析とYoY成長率分析(%)、用途別

9.3.5. 市場規模分析および前年比成長率分析(%), 流通チャネル別

9.3.6. 市場規模分析および前年比成長率分析(%), 国別

9.3.6.1. ドイツ

9.3.6.2. イギリス

9.3.6.3. フランス

9.3.6.4. スペイン

9.3.6.5. イタリア

9.3.6.6. その他のヨーロッパ

9.4. 南米

9.4.1. はじめに

9.4.2. 地域別主要市場

9.4.3. 市場規模分析および前年比成長率分析(%), タイプ別

9.4.4. 市場規模分析とYoY成長率分析(%)、用途別

9.4.5. 市場規模分析および前年比成長率分析(%), 流通チャネル別

9.4.6. 市場規模分析および前年比成長率分析(%), 国別

9.4.6.1. ブラジル

9.4.6.2. アルゼンチン

9.4.6.3. その他の南米諸国

9.5. アジア太平洋

9.5.1. はじめに

9.5.2. 主な地域別ダイナミクス

9.5.3. 市場規模分析および前年比成長率分析(%), タイプ別

9.5.4. 市場規模分析および前年比成長率分析(%), アプリケーション別

9.5.5. 市場規模分析および前年比成長率分析(%), 流通チャネル別

9.5.6. 市場規模分析および前年比成長率分析(%), 国別

9.5.6.1. 中国

9.5.6.2. インド

9.5.6.3. 日本

9.5.6.4. 韓国

9.5.6.5. その他のアジア太平洋地域

9.6. 中東・アフリカ

9.6.1. 序論

9.6.2. 主な地域別ダイナミクス

9.6.3. 市場規模分析および前年比成長率分析(%), タイプ別

9.6.4. 市場規模分析とYoY成長率分析(%)、用途別

9.6.5. 市場規模分析および前年比成長率分析(%), 流通チャネル別

10. 競合情勢

10.1. 競争シナリオ

10.2. 市場ポジショニング/シェア分析

10.3. M&A分析

11. 企業プロフィール

11.1. Amgen Inc.*

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Johnson & Johnson

11.3. Biogen Inc.

11.4. Teva Pharmaceutical Industries Limited

11.5. Biocon Biologics Inc.

11.6. Pfizer Inc.

11.7. Celltrion, Inc.

11.8. Samsung Bioepis

11.9. AbbVie Inc.

11.10. Boehringer Ingelheim International GmbH

リストは網羅的ではありません

12. 付録

12.1. 会社概要とサービス

12.2. お問い合わせ

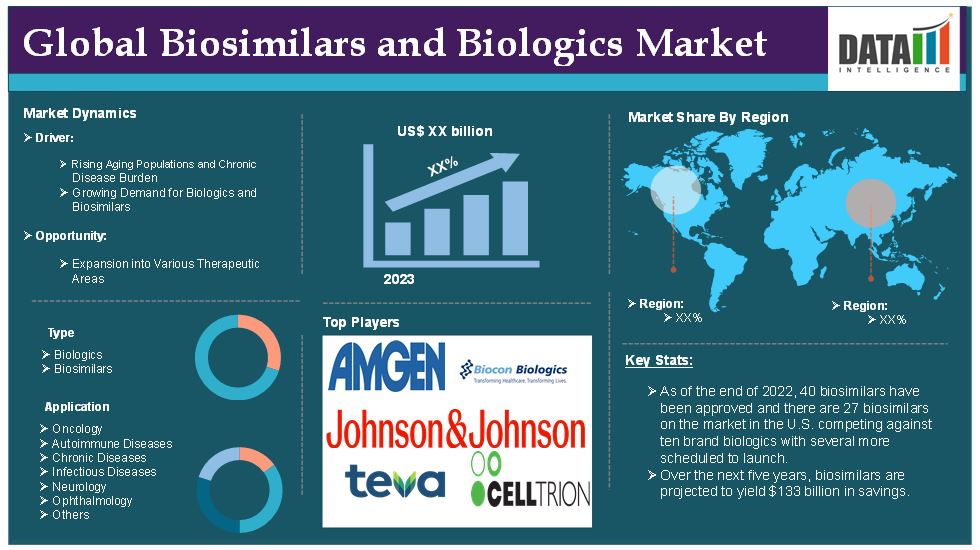

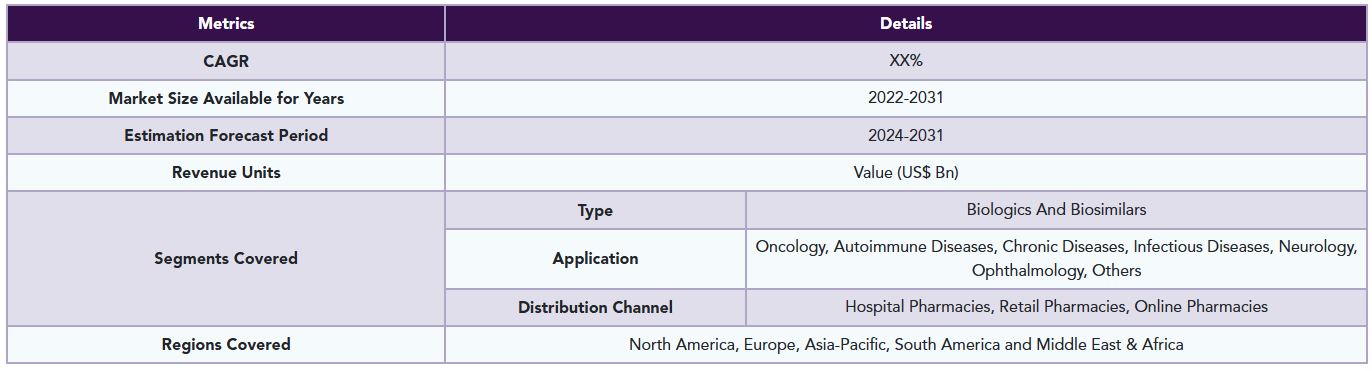

Global Biosimilars and Biologics market reached US$ 19.5 billion in 2023 and is expected to reach US$ 91.98 billion by 2031, growing at a CAGR of 21.4% during the forecast period 2024- 2031.

Biologics are a category of medical products derived from or containing components of living organisms. Unlike traditional pharmaceuticals, typically made through chemical synthesis, biologics are produced using biotechnology, involving complex processes such as recombinant DNA technology and cell culture. Biosimilars are a type of biologic that are highly similar, but not identical, to an already approved reference biologic. A biosimilar is developed and marketed once the patent and exclusivity period of the original biologic has expired, providing a more affordable treatment option while maintaining similar therapeutic efficacy.

The global demand for biosimilars and biologics is robust. It continues to grow, driven by the increasing prevalence of chronic diseases, aging populations, technological advancements and efforts to make healthcare more affordable. For instance, according to the Pharmaceutical Research and Manufacturers of America, as of the end of 2022, 40 biosimilars have been approved and there are 27 biosimilars on the market in the U.S. competing against ten brand biologics with several more scheduled to launch.

Market Dynamics: Drivers & Restraints

Rising aging populations and chronic disease burden

The rising aging populations and chronic disease burden are significantly driving the biosimilars and biologics market and are expected to drive the market over the forecast period. As populations age, the prevalence of chronic diseases such as cancer, diabetes and autoimmune disorders increases. These conditions often require long-term, specialized treatments, and biologics offer targeted and effective therapies for many of these diseases. The high efficacy of biologics in treating complex chronic conditions creates strong demand as the global elderly population grows.

For instance, the National Institute of Health estimates that the yearly increases in the overall worldwide incidence and prevalence of autoimmune diseases are 19.1% and 12.5%, respectively. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. By 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million. 38.4 million people of all ages had diabetes (11.6% of the population) in 2021. 38.1 million were adults ages 18 years or older.

According to the World Health Organization, between 2015 and 2050, the proportion of the world's population over 60 years will nearly double from 12% to 22%, this aging population drives up the demand for biologics as a primary treatment option, expanding the market size. At the same time, this demographic’s high treatment needs exert financial pressure on healthcare systems, leading to an increased emphasis on cost-saving alternatives, such as biosimilars, once the original biologics’ patents expire.

Regulatory challenges

Regulatory challenges pose significant barriers to the growth of the biosimilars and biologics markets. These challenges stem from complex approval processes, differing regulations across regions and stringent requirements that can delay market entry and increase costs. Unlike generics, biosimilars are required to undergo rigorous clinical testing to demonstrate safety, efficacy and biosimilarity to their reference biologics.

Regulatory bodies like the FDA and EMA demand comprehensive evidence, including analytical, animal and clinical data, to ensure biosimilars are comparable to original biologics. This approval process can be lengthy and costly, often requiring several years to complete.

In the United States, the FDA’s Biologics Price Competition and Innovation Act (BPCIA) provides a pathway for biosimilar approval, but the process remains time-consuming and expensive. For instance, Sandoz’s Zarxio (filgrastim-sndz) took about four years from initial development to FDA approval as the first U.S.-approved biosimilar. These extended timelines can delay market entry, limit the availability of biosimilars, and discourage investment in biosimilar development due to high upfront costs.

Segment Analysis

The global biosimilars and biologics market is segmented based on type, application, distribution channel and region.

Application:

The oncology segment is expected to dominate the global biosimilars and biologics market share

The oncology segment holds a major portion of the biosimilars and biologics market share and is expected to continue to hold a significant portion of the market share over the forecast period. Cancer remains one of the leading causes of morbidity and mortality worldwide, with about 20 million cases. This growing patient population fuels the demand for innovative therapies, including biologics and biosimilars, that can target cancer cells with high specificity. As a result, biologics and biosimilars have become essential in oncology treatment protocols.

Biosimilars in oncology have gained acceptance because they undergo rigorous clinical trials to demonstrate equivalence to their reference biologics. Over time, physicians and patients have become more comfortable with biosimilars in oncology due to clinical evidence and supportive real-world data. Their integration into oncology treatment regimens has helped build confidence in their use, which, in turn, supports further growth.

For instance, according to ScienceDirect, a total of 48 biosimilars have been approved by the FDA in the US. Of these, 21 (44%) are used for the treatment of cancer, ie, Oncology Biosimilars. In the US, the first biosimilar for cancer, Mvasi, a biosimilar for the drug Avastin (bevacizumab) was approved in September 2017.

Cancer biologics are often prohibitively expensive, posing a financial challenge for healthcare systems and patients. Biosimilars offer similar efficacy and safety at a fraction of the cost, allowing for more sustainable oncology care and expanding access to advanced cancer treatments. For instance, in July 2024, Zydus Lifesciences Ltd cleared that the Mexican regulatory authority has granted marketing approval for Mamitra, a Trastuzumab biosimilar used to treat various types of cancer.

North America is expected to hold a significant position in the global biosimilars and biologics market

North America region is expected to hold the largest share in biosimilars and biologics market over the forecast period. North America especially the United States and Canada has large and aging populations, leading to a higher prevalence of diseases such as cancer, cardiovascular conditions and autoimmune diseases, all of which require biologics. This drives both the demand for biologics and the need for affordable alternatives like biosimilars.

For instance, according to the Population Reference Bureau, the number of Americans ages 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050 (a 47% increase). Additionally, according to the CDC, an estimated 129 million people in the US have at least 1 major chronic disease. The National Health Council indicates that autoimmune diseases affect approximately 50 million Americans. The National Institutes for Health (NIH) estimates that they collectively affect between 5% and 8% percent of the U.S. population. The increasing availability of biosimilars for various chronic diseases expands patient access and improves treatment outcomes.

The U.S. Food and Drug Administration (FDA) has established a clear and streamlined regulatory pathway for the approval of biosimilars. This includes the Biologics Price Competition and Innovation Act (BPCIA), which facilitates the approval of biosimilars and helps shorten the timeline for market entry. For instance, according to the Association for Accessible Medicines, over the next five years, biosimilars are projected to yield $133 billion in savings. These savings are expected to grow as more biosimilars are introduced, benefiting both patients and the overall healthcare economy.

Asia Pacific is growing at the fastest pace in the Biosimilars and Biologics market

The Asia Pacific region is experiencing the fastest growth in the biosimilars and biologics market. The Asia-Pacific region has one of the largest and fastest-growing populations in the world, with countries like China, India, Japan and South Korea leading the way. For instance, according to the ESCAP, in Asia Pacific, the number of older persons is projected to more than double, from 630 million in 2020 to about 1.3 billion by 2050. This vast population is driving an increasing demand for healthcare services, including biologics, to treat chronic diseases such as cancer, diabetes, autoimmune disorders, and cardiovascular diseases.

Asia Pacific countries, especially India and China, have become global hubs for pharmaceutical manufacturing, including the production of biologics and biosimilars. India is known as the "pharmacy of the world," and companies in India have been instrumental in producing affordable biosimilars for global markets. These companies are leveraging advanced manufacturing technologies to produce high-quality biosimilars at a lower cost than their Western counterparts.

For instance, Biocon, one of India's largest pharmaceutical companies, has been a significant player in the biosimilar space, with products such as Ogivri (biosimilar to Herceptin) and Fulphila (biosimilar to Neulasta). These products have been exported to countries worldwide, with strong demand in Asia Pacific.

Competitive Landscape

The major global players in the biosimilars and biologics market include Amgen Inc., Johnson & Johnson, Biogen Inc., Teva Pharmaceutical Industries Limited, Biocon Biologics Inc. Pfizer Inc., Celltrion, Inc., Samsung Bioepis, AbbVie Inc., Boehringer Ingelheim International GmbH and among others.

Emerging Players

The emerging players in the biosimilars and biologics market include Eli Lilly and Company, Sanofi S.A., Fresenius Kabi AG, Coherus BioSciences Inc, Alvotech S.A, Polpharma Biologics S.A., Formycon AG, Hexal AG, and among others.

Key Developments

In October 2024, Fresenius Kabi officially launched Tyenne, the first and only approved biosimilar of tocilizumab in Canada. This new treatment option is aimed at improving access to care for patients suffering from various inflammatory and immune diseases, including rheumatoid arthritis, giant cell arteritis and systemic juvenile idiopathic arthritis, among others.

In July 2024, Sandoz announced the European launch of Pyzchiva, a ustekinumab biosimilar approved for the treatment of several autoimmune conditions including psoriasis and Crohn’s disease.

In July 2024, STADA and Alvotech launched Uzpruvo, the first approved biosimilar to Stelara in Europe, across a majority of European countries. This includes the largest markets in the region, where pricing and reimbursement approvals have been secured for market entry. The pioneering launch comes immediately upon the expiry of exclusivity rights linked to the European reference molecule patent, offering patients, physicians and payers expanded access at the earliest possible opportunity to a life-altering medicine used in certain indications within gastroenterology, dermatology and rheumatology.

Why Purchase the Report?

• To visualize the global biosimilars and biologics market segmentation based on type, application, distribution channel and region and understand key commercial assets and players.

• Identify commercial opportunities by analyzing trends and co-development.

• Excel data sheet with numerous data points of the biosimilars and biologics market with all segments.

• PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

• Product mapping is available in excel consisting of key products of all the major players.

The global biosimilars and biologics market report would provide approximately 62 tables, 55 figures and 192 pages.

Target Audience 2023

• Manufacturers/ Buyers

• Industry Investors/Investment Bankers

• Research Professionals

• Emerging Companies

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Type

3.2. Snippet by Application

3.3. Snippet by Distribution Channel

3.4. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Rising Aging Populations and Chronic Disease Burden

4.1.1.2. Growing Demand for Biologics and Biosimilars

4.1.2. Restraints

4.1.2.1. Regulatory Challenges

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Patent Analysis

5.5. Regulatory Analysis

5.6. SWOT Analysis

5.7. Unmet Needs

6. By Type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

6.1.2. Market Attractiveness Index, By Type

6.2. Biologics*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.2.3. Monoclonal Antibodies

6.2.4. Vaccines

6.2.5. Recombinant Proteins

6.2.6. Blood Factors

6.2.7. Others

6.3. Biosimilars

6.3.1. Biosimilar Monoclonal Antibodies

6.3.2. Biosimilar Vaccines

6.3.3. Biosimilar Recombinant Proteins

6.3.4. Biosimilar Blood Factors

6.3.5. Others

7. By Application

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

7.1.2. Market Attractiveness Index, By Application

7.2. Oncology*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Autoimmune Diseases

7.4. Chronic Diseases

7.5. Infectious Diseases

7.6. Neurology

7.7. Ophthalmology

7.8. Others

8. By Distribution Channel

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

8.1.2. Market Attractiveness Index, By Distribution Channel

8.2. Hospital Pharmacies*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Retail Pharmacies

8.4. Online Pharmacies

9. By Region

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

9.1.2. Market Attractiveness Index, By Region

9.2. North America

9.2.1. Introduction

9.2.2. Key Region-Specific Dynamics

9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.2.6.1. U.S.

9.2.6.2. Canada

9.2.6.3. Mexico

9.3. Europe

9.3.1. Introduction

9.3.2. Key Region-Specific Dynamics

9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.3.6.1. Germany

9.3.6.2. U.K.

9.3.6.3. France

9.3.6.4. Spain

9.3.6.5. Italy

9.3.6.6. Rest of Europe

9.4. South America

9.4.1. Introduction

9.4.2. Key Region-Specific Dynamics

9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.4.6.1. Brazil

9.4.6.2. Argentina

9.4.6.3. Rest of South America

9.5. Asia-Pacific

9.5.1. Introduction

9.5.2. Key Region-Specific Dynamics

9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.5.6.1. China

9.5.6.2. India

9.5.6.3. Japan

9.5.6.4. South Korea

9.5.6.5. Rest of Asia-Pacific

9.6. Middle East and Africa

9.6.1. Introduction

9.6.2. Key Region-Specific Dynamics

9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

10. Competitive Landscape

10.1. Competitive Scenario

10.2. Market Positioning/Share Analysis

10.3. Mergers and Acquisitions Analysis

11. Company Profiles

11.1. Amgen Inc.*

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Johnson & Johnson

11.3. Biogen Inc.

11.4. Teva Pharmaceutical Industries Limited

11.5. Biocon Biologics Inc.

11.6. Pfizer Inc.

11.7. Celltrion, Inc.

11.8. Samsung Bioepis

11.9. AbbVie Inc.

11.10. Boehringer Ingelheim International GmbH

LIST NOT EXHAUSTIVE

12. Appendix

12.1. About Us and Services

12.2. Contact Us

❖ 世界のバイオシミラー&生物製剤市場に関するよくある質問(FAQ) ❖

・バイオシミラー&生物製剤の世界市場規模は?

→DataM Intelligence社は2023年のバイオシミラー&生物製剤の世界市場規模を95億米ドルと推定しています。

・バイオシミラー&生物製剤の世界市場予測は?

→DataM Intelligence社は2031年のバイオシミラー&生物製剤の世界市場規模を919.8億米ドルと予測しています。

・バイオシミラー&生物製剤市場の成長率は?

→DataM Intelligence社はバイオシミラー&生物製剤の世界市場が2024年~2031年に年平均21.4%成長すると予測しています。

・世界のバイオシミラー&生物製剤市場における主要企業は?

→DataM Intelligence社は「Amgen Inc., Johnson & Johnson, Biogen Inc., Teva Pharmaceutical Industries Limited, Biocon Biologics Inc. Pfizer Inc., Celltrion, Inc., Samsung Bioepis, AbbVie Inc., Boehringer Ingelheim International GmbHなど ...」をグローバルバイオシミラー&生物製剤市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。