1. 方法論と範囲

1.1. 調査方法

1.2. 調査目的と調査範囲

2. 定義と概要

3. エグゼクティブ・サマリー

3.1. タイプ別スニペット

3.2. アレルゲン供給源別スニペット

3.3. 治療タイプ別スニペット

3.4. エンドユーザー別スニペット

3.5. 地域別スニペット

4. ダイナミクス

4.1. 影響要因

4.1.1. 推進要因

4.1.1.1. アレルギーの増加

4.1.1.2. XX

4.1.2. 阻害要因

4.1.2.1. 高い治療費

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

6. タイプ別

6.1. はじめに

6.1.1. 市場タイプ別分析と前年比成長率分析(%), タイプ別

6.1.2. 市場魅力度指数(タイプ別

6.2. 季節性アレルギー性鼻炎*市場

6.2.1. 序論

6.2.2. 市場タイプ分析と前年比成長率分析(%)

6.3. 通年性アレルギー性鼻炎

7. アレルゲン源別

7.1. はじめに

7.1.1. アレルゲン供給源別市場タイプ分析および前年比成長率分析(%) 7.1.2.

7.1.2. 市場魅力度指数(アレルゲン源別

7.2. 花粉

7.2.1. はじめに

7.2.2. 市場タイプ分析と前年比成長率分析(%)

7.2.3. 樹木花粉

7.2.4. 草花粉

7.2.5. 雑草の花粉

7.3. カビの胞子

7.4. ダニ

8. 治療タイプ別

8.1. はじめに

8.1.1. 市場タイプ分析および前年比成長率分析(%)(治療タイプ別

8.1.2. 市場魅力度指数(治療タイプ別

8.2. 免疫療法

8.2.1. 序論

8.2.2. 市場タイプ分析と前年比成長率分析(%)

8.2.3. 皮下免疫療法(SCIT)

8.2.4. 舌下免疫療法(SLIT)

8.3. 薬剤クラス

8.3.1. 抗ヒスタミン薬

8.3.2. 副腎皮質ステロイド

8.3.3. うっ血除去薬

8.3.4. ロイコトリエン受容体拮抗薬

8.3.5. その他

8.4. ホメオパシー

8.5. その他

9. エンドユーザー別

9.1. はじめに

9.1.1. 市場タイプ分析および前年比成長率分析(%), エンドユーザー別

9.1.2. 市場魅力度指数(エンドユーザー別

9.2. 病院・専門クリニック*市場

9.2.1. はじめに

9.2.2. 市場タイプ分析と前年比成長率分析(%)

9.3. 在宅ケアの設定

9.4. ホメオパシー

9.5. その他

10. 地域別

10.1. はじめに

10.1.1. 地域別市場タイプ分析と前年比成長率分析(%).

10.1.2. 市場魅力度指数、地域別

10.2. 北米

10.2.1. 序論

10.2.2. 主な地域別ダイナミクス

10.2.3. 市場タイプ別分析と前年比成長率分析(%), タイプ別

10.2.4. 市場タイプ別分析と前年比成長率分析(%)、アレルゲン源別

10.2.5. 市場タイプ別分析と前年比成長率分析(%), 治療タイプ別

10.2.6. 市場タイプ別分析と前年比成長率分析(%), エンドユーザー別

10.2.7. 市場タイプ別分析と前年比成長率分析(%), 国別

10.2.7.1. 米国

10.2.7.2. カナダ

10.2.7.3. メキシコ

10.3. ヨーロッパ

10.3.1. はじめに

10.3.2. 主な地域別ダイナミクス

10.3.3. 市場タイプ別分析と前年比成長率分析(%), タイプ別

10.3.4. 市場タイプ別分析と前年比成長率分析(%)、アレルゲン源別

10.3.5. 市場タイプ別分析と前年比成長率分析(%), 治療タイプ別

10.3.6. 市場タイプ別分析と前年比成長率分析(%), エンドユーザー別

10.3.7. 市場タイプ別分析と前年比成長率分析(%), 国別

10.3.7.1. ドイツ

10.3.7.2. イギリス

10.3.7.3. フランス

10.3.7.4. スペイン

10.3.7.5. イタリア

10.3.7.6. その他のヨーロッパ

10.4. 南米

10.4.1. はじめに

10.4.2. 地域別主要市場

10.4.3. 市場タイプ別分析と前年比成長率分析(%), タイプ別

10.4.4. 市場タイプ別分析と前年比成長率分析(%)、アレルゲン源別

10.4.5. 市場タイプ別分析と前年比成長率分析(%), 治療タイプ別

10.4.6. 市場タイプ別分析と前年比成長率分析(%), エンドユーザー別

10.4.7. 市場タイプ別分析と前年比成長率分析(%), 国別

10.4.7.1. ブラジル

10.4.7.2. アルゼンチン

10.4.7.3. その他の南米諸国

10.5. アジア太平洋

10.5.1. 序論

10.5.2. 主な地域別ダイナミクス

10.5.3. 市場タイプ別分析と前年比成長率分析(%), タイプ別

10.5.4. 市場タイプ別分析と前年比成長率分析(%)、アレルゲン源別

10.5.5. 市場タイプ別分析と前年比成長率分析(%), 治療タイプ別

10.5.6. 市場タイプ別分析と前年比成長率分析(%), エンドユーザー別

10.5.7. 市場タイプ別分析と前年比成長率分析(%), 国別

10.5.7.1. 中国

10.5.7.2. インド

10.5.7.3. 日本

10.5.7.4. 韓国

10.5.7.5. その他のアジア太平洋地域

10.6. 中東・アフリカ

10.6.1. 序論

10.6.2. 主な地域別ダイナミクス

10.6.3. 市場タイプ別分析と前年比成長率分析(%), タイプ別

10.6.4. 市場タイプ別分析と前年比成長率分析(%)、アレルゲン源別

10.6.5. 市場タイプ別分析と前年比成長率分析(%), 治療タイプ別

10.6.6. 市場タイプ別分析と前年比成長率分析(%), エンドユーザー別

11. 競合情勢

11.1. 競争シナリオ

11.2. 市場ポジショニング/シェア分析

11.3. M&A分析

12. 企業プロフィール

12.1. ALK-Abelló A/S *

12.1.1. Company Overview

12.1.2. Product Portfolio and Description

12.1.3. Financial Overview

12.1.4. Key Developments

12.2. GSK plc

12.3. Sanofi

12.4. Merck & Co., Inc.

12.5. Johnson & Johnson Services, Inc.

12.6. Stallergenes Greer

12.7. Allergy Therapeutics

12.8. Teva Pharmaceutical Industries Ltd.

12.9. HAL Allergy B.V.

12.10. LETI Pharma

リストは網羅的ではありません

13. 付録

13.1. 会社概要とサービス

13.2. お問い合わせ

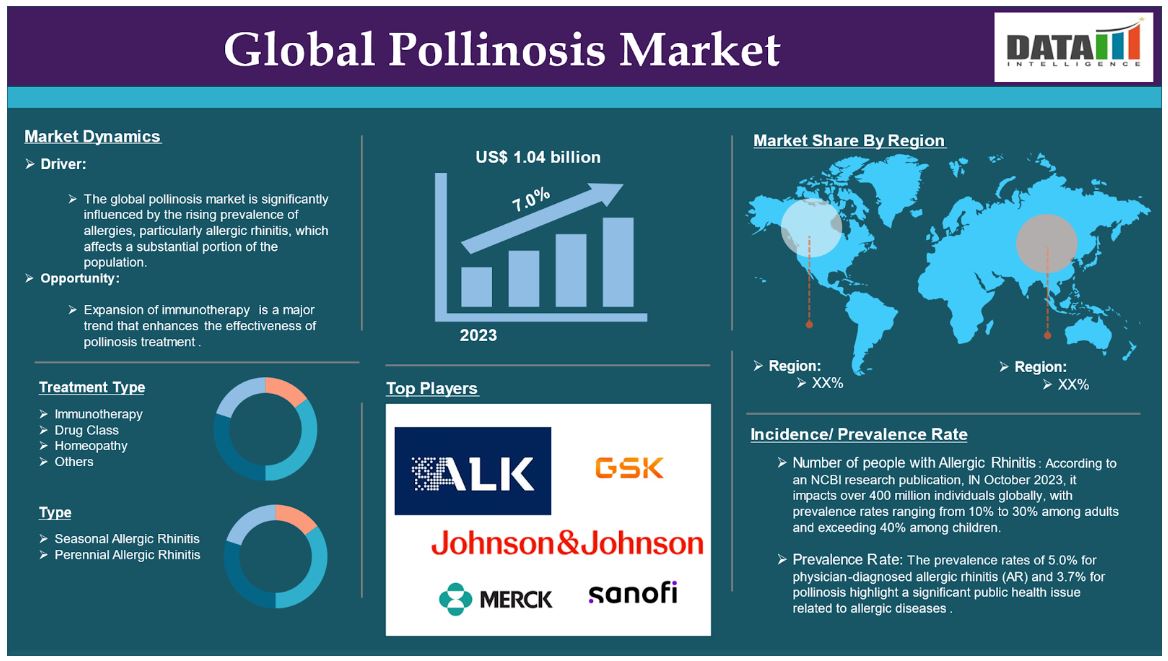

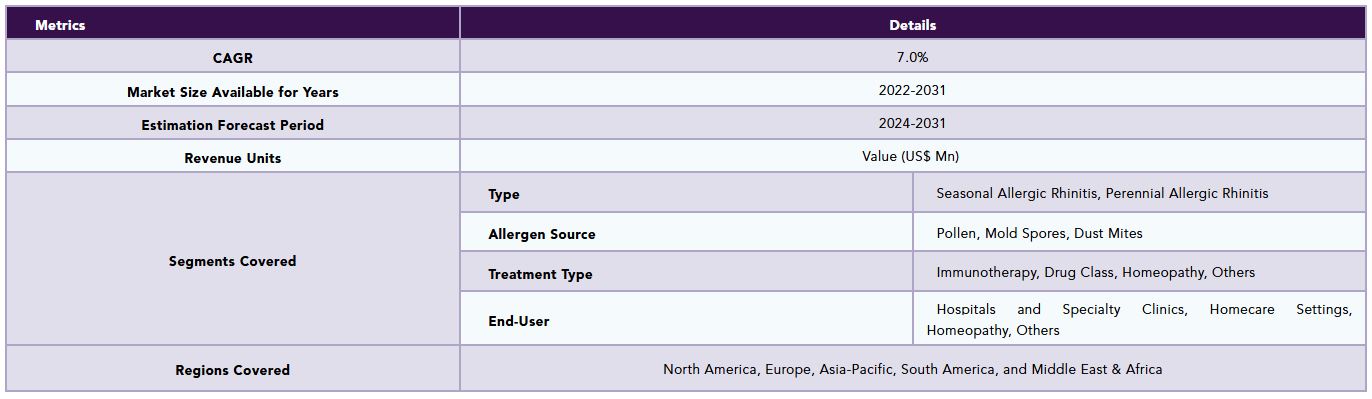

The global pollinosis market reached US$ 1.04 billion in 2023 and is expected to reach US$ 1.76 billion by 2031, growing at a CAGR of 7.0% during the forecast period 2024-2031.

Pollinosis, known as hay fever or allergic rhinitis, is an allergic reaction triggered by inhaling pollen grains from trees, grasses, and weeds. When a person with pollinosis breathes in pollen, their immune system mistakenly identifies it as harmful.

As per ScienceDirect research publication in July 2023, the reported prevalence rates of 5.0% for physician-diagnosed allergic rhinitis (AR) and 3.7% for pollinosis highlight a significant public health issue related to allergic diseases. These figures are expected to drive growth in the global pollinosis market, as there will be an increasing demand for effective treatments and management. The continuous advancements in allergy therapeutics will further facilitate this pollinosis market expansion in the years to come.

Market Dynamics: Drivers & Restraints

Increasing prevalence of allergies

The global pollinosis market is significantly influenced by the rising prevalence of allergies, particularly allergic rhinitis, which affects a substantial portion of the population.

Allergic rhinitis, commonly known as hay fever, is a significant public health issue that affects millions of people worldwide. According to an NCBI research publication, IN October 2023, it impacts over 400 million individuals globally, with prevalence rates ranging from 10% to 30% among adults and exceeding 40% among children. This widespread condition has notable implications for healthcare systems, quality of life, and economic burdens. Longer pollen seasons due to climate change and higher carbon dioxide levels contribute to increased pollen production, exacerbating allergic reactions.

Additionally, ongoing research and development in allergy therapeutics are significantly enhancing treatment options for allergic conditions, particularly through innovations like sublingual immunotherapy (SLIT) and biologics are improving patient outcomes and driving the pollinosis market growth. All these factors demand the pollinosis market.

Moreover, the rising demand for technological advancements contributes to the pollinosis market expansion.

High cost of treatment

The high cost of treatment is expected to hinder the pollinosis market growth. The high costs associated with advanced treatments for pollinosis create significant barriers to access for many patients. This financial burden often forces individuals to rely on less effective over-the-counter (OTC) medications instead of pursuing comprehensive treatment options like allergen-specific immunotherapy (ASIT).

According to Piniella Asthma + Allergy stated that the annual cost of pollinosis treatment can reach approximately $1,000 for standard therapies, which typically include over-the-counter medications and basic prescription treatments. More advanced options, such as oral therapies (e.g., sublingual immunotherapy), can escalate to around $4,000 per year.

These treatments are designed to provide longer-term relief by gradually desensitizing the patient to specific allergens. Sublingual immunotherapy (SLIT), in particular, may exceed $7,000 annually. This method allows patients to take allergen extracts under the tongue, offering a convenient alternative to traditional injections. Thus, the above factors could be limiting the pollinosis market's potential growth.

Segment Analysis

The global pollinosis market is segmented based on type, allergen source, treatment type, end-user, and region.

Treatment Type:

Immunotherapy segment is expected to dominate the pollinosis market share

The immunotherapy segment holds a major portion of the pollinosis market share and is expected to continue to hold a significant portion of the pollinosis market share during the forecast period.

Immunotherapy is designed to desensitize the immune system to specific allergens, thereby diminishing the severity of allergic reactions over time. This treatment involves the repeated administration of small doses of allergens, which helps the body develop tolerance. Types of immunotherapy for pollen allergies include SCIT and SLIT.

Subcutaneous Immunotherapy (SCIT) involves the injection of allergen extracts directly under the skin. This method has a long-standing history of effectiveness in treating various types of allergies. Sublingual Immunotherapy (SLIT), on the other hand, is administered through tablets or drops placed under the tongue. This approach is more convenient and less invasive, allowing patients to self-administer their treatment at home after an initial supervised dose.

Furthermore, advancements in immunotherapy options like SCIT and SLIT, greater awareness among patients, and supportive regulatory frameworks. LETIPharma’s specific vaccines for both subcutaneous and sublingual administration exemplify the innovation within this sector aimed at improving patient outcomes in allergy management.

For instance, one of the major key players in the industry ALK-Abelló A/S introduced allergy immunotherapy (AIT) treatments that are categorized as biologics because they are derived from living cells rather than being chemically synthesized. ALK’s AIT products are sourced from natural allergens, including grass pollen, tree pollen, and house dust mites.

Similarly, HAL Allergy has established itself as a prominent player in the allergen immunotherapy (AIT) market, offering a competitive portfolio that includes both subcutaneous immunotherapy (SCIT) and sublingual immunotherapy (SLIT) products. These products target common allergens such as pollen and house dust mites, addressing a significant need in the global pollinosis market. These factors have solidified the segment's position in the pollinosis market.

Drug class segment is the fastest-growing segment in the pollinosis market share

The drug class segment is the fastest-growing segment in the pollinosis market share and is expected to hold the market share over the forecast period.

In the global pollinosis market drug class includes antihistamines, corticosteroids, decongestants, leukotriene receptor antagonists, and others. Among these antihistamines, drug classes propel the segment in the market. Antihistamines are commonly utilized to alleviate allergic reactions by inhibiting the effects of histamines, which are chemicals released during an allergic response. Their effectiveness makes them a favored option for treating various allergic conditions, including pollinosis.

Antihistamines provide rapid relief from symptoms such as sneezing, itching, and a runny nose, contributing to their growing popularity. They are effective against multiple types of allergies, including food allergies, inhaled allergens like pollen, and indoor allergens such as dust mites. This versatility enhances their appeal in the market, allowing them to cater to a wide range of patients.

Furthermore, key players in the industry product launches and technological developments that would drive this market growth. For instance, one of the key players in the industry Allergy Therapeutics introduced the Pollinex Grasses + Rye and Pollinex Trees are the only registered subcutaneous treatments available for hay fever in the UK, specifically designed for individuals who continue to experience troublesome symptoms despite using traditional anti-allergy medications like antihistamines, nasal sprays, and eye drops. These factors have solidified the segment's position in the pollinosis market.

Type:

Perennial allergic rhinitis segment is expected to dominate the pollinosis market share

The perennial allergic rhinitis segment holds a major portion of the pollinosis market share and is expected to continue to hold a significant portion of the pollinosis market share during the forecast period.

Perennial allergic rhinitis (PAR) is caused by allergens that are present year-round, such as dust mites, pet dander, mold, and cockroach droppings. Unlike seasonal allergic rhinitis, which may improve during certain times of the year, PAR leads to continuous exposure to these allergens. This chronic exposure results in persistent symptoms such as nasal congestion, sneezing, itchy eyes, and postnasal drip.

According to a ScienceDirect research publication in July 2024, the reported prevalence rate of 38.5% indicates that a substantial portion of the teenage population in Japan is affected by PAR. This high rate suggests that allergic rhinitis is a widespread issue, which can have considerable implications for public health, education, and overall quality of life for affected individuals. These factors have solidified the segment's position in the pollinosis market.

The presence of effective treatment options and growing awareness of allergic conditions further strengthen the market position of perennial allergic rhinitis (PAR). As healthcare systems evolve and adapt to better address patient needs, the PAR segment is set for ongoing pollinosis growth in the upcoming years.

Seasonal allergic rhinitis segment is the fastest-growing segment in the pollinosis market share

The seasonal allergic rhinitis segment is the fastest-growing segment in the pollinosis market share and is expected to hold the market share over the forecast period. The increasing prevalence of seasonal allergies, particularly due to environmental factors such as climate change and rising pollution levels, is a significant driver for the SAR segment in the global pollinosis market.

Seasonal allergic rhinitis (SAR) is characterized by allergic symptoms that occur in response to inhaled allergens, primarily pollen from grasses and trees, during specific seasons. However, many patients with SAR are polysensitized, they may react to multiple allergens and experience symptoms year-round. This phenomenon highlights the complexity of allergic rhinitis and suggests that the distinction between seasonal and perennial allergic rhinitis (PAR) is not always clear-cut.

As per NPJ primary care respiratory medicine research articles in December 2022, the prevalence of recorded allergic rhinitis in general practice ranges from 0.4% to 4.1%. This indicates that while some individuals are diagnosed and treated for allergic rhinitis, a significant number may not be captured in official health records. These factors have solidified the segment's position in the pollinosis market.

Geographical Analysis

North America is expected to hold a significant position in the pollinosis market share

North America holds a substantial position in the pollinosis market and is expected to hold most of the market share.

The rising prevalence of pollen allergies is significantly influenced by environmental factors such as climate change, urbanization, and increased pollution levels. These factors contribute to longer pollen seasons and higher concentrations of allergens in the air, which in turn drives market growth.

The increasing awareness among the general public about allergies and their management options is significantly impacting the demand for allergy therapies. This is driven by several factors, including improved diagnostic capabilities, greater public education, and the rising prevalence of allergic conditions. Immunotherapy options including subcutaneous immunotherapy (SCIT) and sublingual immunotherapy (SLIT) are driving the market growth.

There is a strong presence of major pharmaceutical companies engaged in research activities focused on developing new therapies for allergies. Innovations in biotechnology and immunology are leading to the creation of more effective allergy treatments, including immunotherapy options.

Significant investments in healthcare facilities and infrastructure improvements are playing a crucial role in enhancing access to allergy diagnostics and treatments across North America. These developments, coupled with favorable reimbursement policies for immunotherapy procedures, are facilitating wider acceptance among patients and healthcare providers.

Furthermore, in this region, a major number of key players’ presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, technological advancements, & investments, and product launches & approvals would propel this market growth.

For instance, in April 2024, in Washington, DC, National Asthma and Allergy Awareness Month by the Asthma and Allergy Foundation of America (AAFA) plays a significant role in the U.S. pollinosis market. This initiative focuses on empowering individuals and communities through education, resources, and advocacy opportunities related to asthma and allergies, particularly pollen allergies. Thus, the above factors are consolidating the region's position as a dominant force in the pollinosis market.

Asia Pacific is growing at the fastest pace in the pollinosis market

Asia Pacific holds the fastest pace in the pollinosis market and is expected to hold most of the market share.

Rapid urbanization in the Asia-Pacific region significantly contributes to the growth of the pollinosis market. As populations shift from rural areas to urban centers, they face rising levels of air pollution and allergens, which can worsen allergic conditions. Urban settings typically experience increased emissions from vehicles and industrial sources, leading to a rise in respiratory allergies, including pollinosis.

Furthermore, the region is seeing improvements in healthcare infrastructure, which enhances access to allergy diagnostics and treatments. Government initiatives focused on improving healthcare services are essential for addressing the growing burden of allergic diseases in this context.

Additionally, risk factors and the impact of the changing environment on pollinosis in the Asia-Pacific would drive this pollinosis market growth. As per an NCBI research publication in 2021, the impact of environmental changes, particularly elevated ozone levels, on the allergenicity of pollen, such as that from birch trees, has significant implications for individuals with allergies. Research has established that higher levels of ozone (O3) in the atmosphere can enhance the allergenic properties of pollen. Thus, the above factors are consolidating the region's position as the fastest-growing force in the pollinosis market.

Competitive Landscape

The major global players in the pollinosis market include ALK-Abelló A/S, GSK plc, Sanofi, Merck & Co., Inc. Johnson & Johnson Services, Inc., Stallergenes Greer, Allergy Therapeutics, Teva Pharmaceutical Industries Ltd., HAL Allergy B.V., and LETI Pharma among others.

Emerging Players

The emerging players in the pollinosis market include Saphnix Life Sciences, Quantum Allergy Canada., Solace Biotech Ltd., and East-West Pharma India Pvt. Ltd. among others.

Key Developments

• In May 2024, Stallergenes Greer offers two specific sublingual immunotherapy (SLIT) tablets aimed at treating allergies AITGRYS, which targets grass pollen, and AITMYTE, which focuses on house dust mites (HDM). Both products are designed to help patients manage their allergic reactions by gradually desensitizing their immune systems to these common allergens.

• In April 2021, the FDA's approval of short ragweed pollen allergen extract (Ragwitek) for the treatment of pollen-induced allergic rhinitis in children and adolescents marks a significant advancement in allergy management. This treatment is specifically designed for individuals aged 5 to 65 years who suffer from allergic reactions to short ragweed pollen, a common allergen in North America.

Why Purchase the Report?

• To visualize the global pollinosis market segmentation based on type, allergen source, treatment type, end-user, and region and understand key commercial assets and players.

• Identify commercial opportunities by analyzing trends and co-development.

• Excel data sheet with numerous data points of the pollinosis market with all segments.

• PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

• Product mapping is available in excel consisting of key products of all the major players.

The global pollinosis market report would provide approximately 70 tables, 63 figures, and 184 pages.

Target Audience 2023

• Manufacturers/ Buyers

• Industry Investors/Investment Bankers

• Research Professionals

• Emerging Companies

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Type

3.2. Snippet by Allergen Source

3.3. Snippet by Treatment Type

3.4. Snippet by End-User

3.5. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Increasing Prevalence of Allergies

4.1.1.2. XX

4.1.2. Restraints

4.1.2.1. High Cost of Treatment

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

6. By Type

6.1. Introduction

6.1.1. Market Type Analysis and Y-o-Y Growth Analysis (%), By Type

6.1.2. Market Attractiveness Index, By Type

6.2. Seasonal Allergic Rhinitis *

6.2.1. Introduction

6.2.2. Market Type Analysis and Y-o-Y Growth Analysis (%)

6.3. Perennial Allergic Rhinitis

7. By Allergen Source

7.1. Introduction

7.1.1. Market Type Analysis and Y-o-Y Growth Analysis (%), By Allergen Source

7.1.2. Market Attractiveness Index, By Allergen Source

7.2. Pollen*

7.2.1. Introduction

7.2.2. Market Type Analysis and Y-o-Y Growth Analysis (%)

7.2.3. Tree pollen

7.2.4. Grass pollen

7.2.5. Weed pollen

7.3. Mold Spores

7.4. Dust Mites

8. By Treatment Type

8.1. Introduction

8.1.1. Market Type Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

8.1.2. Market Attractiveness Index, By Treatment Type

8.2. Immunotherapy*

8.2.1. Introduction

8.2.2. Market Type Analysis and Y-o-Y Growth Analysis (%)

8.2.3. Subcutaneous Immunotherapy (SCIT)

8.2.4. Sublingual Immunotherapy (SLIT)

8.3. Drug Class

8.3.1. Antihistamines

8.3.2. Corticosteroids

8.3.3. Decongestants

8.3.4. Leukotriene Receptor Antagonists

8.3.5. Others

8.4. Homeopathy

8.5. Others

9. By End-User

9.1. Introduction

9.1.1. Market Type Analysis and Y-o-Y Growth Analysis (%), By End-User

9.1.2. Market Attractiveness Index, By End-User

9.2. Hospitals & Specialty Clinics*

9.2.1. Introduction

9.2.2. Market Type Analysis and Y-o-Y Growth Analysis (%)

9.3. Homecare Settings

9.4. Homeopathy

9.5. Others

10. By Region

10.1. Introduction

10.1.1. Market Type Analysis and Y-o-Y Growth Analysis (%), By Region

10.1.2. Market Attractiveness Index, By Region

10.2. North America

10.2.1. Introduction

10.2.2. Key Region-Specific Dynamics

10.2.3. Market Type Analysis and Y-o-Y Growth Analysis (%), By Type

10.2.4. Market Type Analysis and Y-o-Y Growth Analysis (%), By Allergen Source

10.2.5. Market Type Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

10.2.6. Market Type Analysis and Y-o-Y Growth Analysis (%), By End-User

10.2.7. Market Type Analysis and Y-o-Y Growth Analysis (%), By Country

10.2.7.1. U.S.

10.2.7.2. Canada

10.2.7.3. Mexico

10.3. Europe

10.3.1. Introduction

10.3.2. Key Region-Specific Dynamics

10.3.3. Market Type Analysis and Y-o-Y Growth Analysis (%), By Type

10.3.4. Market Type Analysis and Y-o-Y Growth Analysis (%), By Allergen Source

10.3.5. Market Type Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

10.3.6. Market Type Analysis and Y-o-Y Growth Analysis (%), By End-User

10.3.7. Market Type Analysis and Y-o-Y Growth Analysis (%), By Country

10.3.7.1. Germany

10.3.7.2. U.K.

10.3.7.3. France

10.3.7.4. Spain

10.3.7.5. Italy

10.3.7.6. Rest of Europe

10.4. South America

10.4.1. Introduction

10.4.2. Key Region-Specific Dynamics

10.4.3. Market Type Analysis and Y-o-Y Growth Analysis (%), By Type

10.4.4. Market Type Analysis and Y-o-Y Growth Analysis (%), By Allergen Source

10.4.5. Market Type Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

10.4.6. Market Type Analysis and Y-o-Y Growth Analysis (%), By End-User

10.4.7. Market Type Analysis and Y-o-Y Growth Analysis (%), By Country

10.4.7.1. Brazil

10.4.7.2. Argentina

10.4.7.3. Rest of South America

10.5. Asia-Pacific

10.5.1. Introduction

10.5.2. Key Region-Specific Dynamics

10.5.3. Market Type Analysis and Y-o-Y Growth Analysis (%), By Type

10.5.4. Market Type Analysis and Y-o-Y Growth Analysis (%), By Allergen Source

10.5.5. Market Type Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

10.5.6. Market Type Analysis and Y-o-Y Growth Analysis (%), By End-User

10.5.7. Market Type Analysis and Y-o-Y Growth Analysis (%), By Country

10.5.7.1. China

10.5.7.2. India

10.5.7.3. Japan

10.5.7.4. South Korea

10.5.7.5. Rest of Asia-Pacific

10.6. Middle East and Africa

10.6.1. Introduction

10.6.2. Key Region-Specific Dynamics

10.6.3. Market Type Analysis and Y-o-Y Growth Analysis (%), By Type

10.6.4. Market Type Analysis and Y-o-Y Growth Analysis (%), By Allergen Source

10.6.5. Market Type Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

10.6.6. Market Type Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

11.1. Competitive Scenario

11.2. Market Positioning/Share Analysis

11.3. Mergers and Acquisitions Analysis

12. Company Profiles

12.1. ALK-Abelló A/S *

12.1.1. Company Overview

12.1.2. Product Portfolio and Description

12.1.3. Financial Overview

12.1.4. Key Developments

12.2. GSK plc

12.3. Sanofi

12.4. Merck & Co., Inc.

12.5. Johnson & Johnson Services, Inc.

12.6. Stallergenes Greer

12.7. Allergy Therapeutics

12.8. Teva Pharmaceutical Industries Ltd.

12.9. HAL Allergy B.V.

12.10. LETI Pharma

LIST NOT EXHAUSTIVE

13. Appendix

13.1. About Us and Services

13.2. Contact Us

❖ 世界の花粉症市場に関するよくある質問(FAQ) ❖

・花粉症の世界市場規模は?

→DataM Intelligence社は2023年の花粉症の世界市場規模を10億4,000万米ドルと推定しています。

・花粉症の世界市場予測は?

→DataM Intelligence社は2031年の花粉症の世界市場規模を17億6,000万米ドルと予測しています。

・花粉症市場の成長率は?

→DataM Intelligence社は花粉症の世界市場が2024年~2031年に年平均7.0%成長すると予測しています。

・世界の花粉症市場における主要企業は?

→DataM Intelligence社は「ALK-Abelló A/S, GSK plc, Sanofi, Merck & Co., Inc. Johnson & Johnson Services, Inc., Stallergenes Greer, Allergy Therapeutics, Teva Pharmaceutical Industries Ltd., HAL Allergy B.V., and LETI Pharmaなど ...」をグローバル花粉症市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。