Market Overview

Functional drinks are non-alcoholic beverages that are specially formulated to provide health benefits beyond basic nutrition. These drinks are typically enriched with bioactive ingredients such as vitamins, minerals, amino acids, antioxidants, dietary fibers, or probiotics. They are designed to support specific physiological functions, such as boosting energy, improving digestion, enhancing mental focus, strengthening the immune system, or promoting overall well-being. Common types of functional drinks include sports drinks, energy drinks, fortified waters, probiotic beverages, and herbal teas. As consumer health awareness continues to grow, functional drinks are gaining popularity as convenient solutions for maintaining a healthy lifestyle.

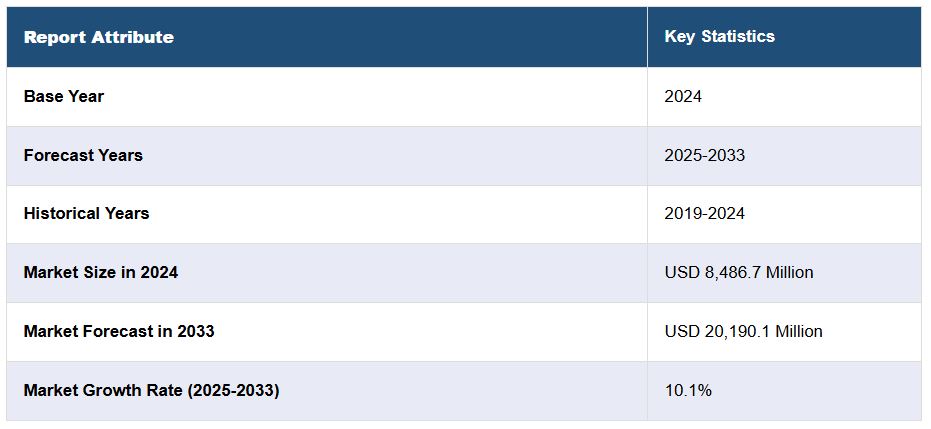

The Japan functional drinks market reached a value of USD 8,486.7 million in 2024 and is projected to grow substantially over the coming years, with a forecasted market size of USD 20,190.1 million by 2033. This represents a compound annual growth rate (CAGR) of 10.1% during the forecast period of 2025 to 2033. Functional drinks refer to non-alcoholic beverages enriched with nutrients such as vitamins, minerals, amino acids, probiotics, and dietary fibers. These beverages are designed to deliver specific health benefits, including energy enhancement, improved gut health, inflammation reduction, and metabolic support. As health consciousness rises among Japanese consumers, the demand for functional drinks continues to accelerate.

Drivers of Market Growth

The increasing pace of modern life in Japan, marked by hectic work routines and a growing preference for convenience, has led to a surge in demand for ready-to-drink (RTD) beverages. Functional drinks are especially benefiting from this trend due to their perceived health benefits and convenience. Additionally, a rise in digestive health issues such as gastroenteritis, ulcers, and GERD has prompted consumers to seek beverages with probiotics and other gut-friendly ingredients.

Moreover, the growing application of functional drinks in both preventive health and recovery from illnesses has widened their appeal. Consumers are moving away from traditional carbonated drinks and instead gravitating toward healthier alternatives like fruit and vegetable juices, specialty drinks, and natural beverages. This shift is supported by broader wellness trends and an emphasis on nutritional intake, further stimulating market growth.

Influence of Social Trends and Innovation

The role of social media in shaping consumer preferences cannot be overlooked. Functional drink brands are leveraging social platforms and celebrity endorsements to promote their products, thus expanding their visibility and market reach. Leading regional and global players are also innovating with new flavors and formulations that incorporate traditional Japanese ingredients, such as kombucha, Aojiru (green vegetable juice), Sakura tea, and Mugicha (barley tea). These local adaptations resonate well with domestic consumers and contribute to brand differentiation in a competitive market.

Another significant trend is the emergence of organic and clean-label functional drinks. With increasing concerns around artificial additives and synthetic ingredients, consumers are seeking more transparent and natural product options. This has driven manufacturers to reformulate products and invest in organic certification, further enhancing their market appeal and contributing to sustained growth.

Market Segmentation

The functional drinks market in Japan can be segmented based on product type, distribution channel, and region. This segmentation enables a more granular analysis of market trends and consumer behavior patterns.

By Type:

-

Sports Drinks – Designed to replenish electrolytes and support hydration during physical activity.

-

Energy Drinks – Popular among young adults and professionals for their immediate energy-boosting properties.

-

Carbonated Drinks – Enriched with functional ingredients but less popular due to growing health concerns.

-

Fruit/Vegetable Drinks – Witnessing strong demand due to their natural and nutritional image.

-

Bottled Water – Functional waters with added minerals or vitamins are gaining popularity.

-

Specialty Drinks – Includes drinks tailored for specific health functions such as immune support or skin health.

-

Functional Tea & Coffee – Infused with antioxidants, adaptogens, or other bioactive compounds.

-

Others – Encompasses emerging drink categories with innovative health claims.

By Distribution Channel:

-

Supermarkets and Hypermarkets – Remain the dominant retail format due to wide product availability and strong consumer trust.

-

Convenience Stores – Benefit from high foot traffic and are essential for on-the-go purchases.

-

Specialist Retailers – Focused on health and wellness products, offering curated selections of functional beverages.

-

Online Retailers – Growing rapidly, driven by the convenience of home delivery and availability of niche products.

-

Others – Includes vending machines, fitness centers, and direct-to-consumer models.

By Region:

-

Kanto Region – The most populous and economically active region, with Tokyo as a major consumption hub.

-

Kinki Region – Includes Osaka and Kyoto, showing increasing interest in premium and organic products.

-

Central/Chubu Region – A mix of urban and rural demographics, with growing exposure to wellness trends.

-

Kyushu-Okinawa Region – Displays strong adoption of traditional Japanese ingredients in functional drinks.

-

Tohoku Region – Emerging market with increasing health awareness.

-

Chugoku Region – Gradual expansion in functional drink offerings in retail stores.

-

Hokkaido Region – Unique regional flavors and growing influence of winter sports nutrition.

-

Shikoku Region – Smaller market but poised for growth through digital retail channels.

Competitive Landscape

The Japan functional drinks market is highly competitive, with a mix of global giants and domestic players vying for market share. Key players include Archer Daniels Midland Co., Ashahi Soft Drinks Co Ltd., Danone, ITO EN, Monster Beverage Corporation, Nestlé, PepsiCo Inc., Red Bull, Rockstar Inc. (PepsiCo Inc.), Coca-Cola Bottlers Japan Inc. (The Coca-Cola Company), Suntory Beverage & Food Ltd. (Suntory Group), and Taisho Pharmaceutical Co. Ltd. These companies are actively investing in product innovation, marketing campaigns, and distribution expansion to strengthen their positions. The competition also extends to new entrants offering organic and plant-based functional beverages, which are rapidly gaining traction among health-conscious consumers.

Outlook

The functional drinks market in Japan is set for dynamic growth over the next decade, driven by evolving consumer preferences, heightened health awareness, and continuous innovation in beverage formulation. The combination of demographic shifts, lifestyle changes, and technological advancements in food science will further reinforce the expansion of this sector. Companies that prioritize clean labeling, cater to specific health needs, and leverage digital engagement strategies are likely to lead the next wave of growth in the Japanese functional drinks landscape.

Table of Contents

1 Preface

2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Japan Functional Drinks Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Sports Drinks

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Energy Drinks

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Carbonated Drinks

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Fruit/Vegetable Drinks

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Bottled Water

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Specialty Drinks

6.6.1 Market Trends

6.6.2 Market Forecast

6.7 Functional Tea/ Coffee

6.7.1 Market Trends

6.7.2 Market Forecast

6.8 Others

6.8.1 Market Trends

6.8.2 Market Forecast

7 Market Breakup by Distribution Channel

7.1 Supermarkets and Hypermarkets

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Convenience Stores

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Specialist Retailers

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Online Retailers

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by Region

8.1 Kanto Region

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Kinki Region

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Central/ Chubu Region

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Kyushu-Okinawa Region

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Tohoku Region

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Chugoku Region

8.6.1 Market Trends

8.6.2 Market Forecast

8.7 Hokkaido Region

8.7.1 Market Trends

8.7.2 Market Forecast

8.8 Shikoku Region

8.8.1 Market Trends

8.8.2 Market Forecast

9 SWOT Analysis

9.1 Overview

9.2 Strengths

9.3 Weakness

9.4 Opportunities

9.5 Threats

10 Value Chain Analysis

11 Porter’s Five Forces Analysis

11.1 Overview

11.2 Bargaining Power of Buyers

11.3 Bargaining Power of Suppliers

11.4 Degree of Competition

11.5 Threat of New Entrants

11.6 Threat of Substitutes

12 Competitive Landscape

12.1 Market Structure

12.2 Key Players

12.3 Profiles of Key Players

12.3.1 Archer Daniels Midland Co.

12.3.1.1 Company Overview

12.3.1.2 Product Portfolio

12.3.1.3 Financials

12.3.1.4 SWOT Analysis

12.3.2 Ashahi Soft Drinks Co Ltd.

12.3.2.1 Company Overview

12.3.2.2 Product Portfolio

12.3.3 Danone

12.3.3.1 Company Overview

12.3.3.2 Product Portfolio

12.3.3.3 Financials

12.3.3.4 SWOT Analysis

12.3.4 ITO EN

12.3.4.1 Company Overview

12.3.4.2 Product Portfolio

12.3.4.3 Financials

12.3.5 Monster Beverage Corporation

12.3.5.1 Company Overview

12.3.5.2 Product Portfolio

12.3.5.3 Financials

12.3.5.4 SWOT Analysis

12.3.6 Nestlé

12.3.6.1 Company Overview

12.3.6.2 Product Portfolio

12.3.6.3 Financials

12.3.6.4 SWOT Analysis

12.3.7 PepsiCo Inc.

12.3.7.1 Company Overview

12.3.7.2 Product Portfolio

12.3.7.3 Financials

12.3.7.4 SWOT Analysis

12.3.8 Red Bull

12.3.8.1 Company Overview

12.3.8.2 Product Portfolio

12.3.8.3 Swot Analysis

12.3.9 Rockstar Inc. (PepsiCo Inc.)

12.3.9.1 Company Overview

12.3.9.2 Product Portfolio

12.3.9.3 Financials

12.3.9.4 SWOT Analysis

12.3.10 Coca-Cola Bottlers Japan Inc. (The Coca-Cola Company)

12.3.10.1 Company Overview

12.3.10.2 Product Portfolio

12.3.10.3 Financials

12.3.10.4 SWOT Analysis

12.3.11 Suntory Beverage & Food Ltd. (Suntory Group)

12.3.11.1 Company Overview

12.3.11.2 Product Portfolio

12.3.12 Taisho Pharmaceutical Co. Ltd.

12.3.12.1 Company Overview

12.3.12.2 Product Portfolio

12.3.12.3 Financials

List of Figures

Figure 1: Japan: Functional Drinks Market: Major Drivers and Challenges

Figure 2: Japan: Functional Drinks Market: Sales Value (in Million USD), 2019-2024

Figure 3: Japan: Functional Drinks Market: Breakup by Type (in %), 2024

Figure 4: Japan: Functional Drinks Market: Breakup by Distribution Channel (in %), 2024

Figure 5: Japan: Functional Drinks Market: Breakup by Region (in %), 2024

Figure 6: Japan: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 7: Japan: Functional Drinks (Sports Drinks) Market: Sales Value (in Million USD), 2019 & 2024

Figure 8: Japan: Functional Drinks (Sports Drinks) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 9: Japan: Functional Drinks (Energy Drinks) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Japan: Functional Drinks (Energy Drinks) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Japan: Functional Drinks (Carbonated Drinks) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Japan: Functional Drinks (Carbonated Drinks) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Japan: Functional Drinks (Fruit/Vegetable Drinks) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Japan: Functional Drinks (Fruit/Vegetable Drinks) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Japan: Functional Drinks (Bottled Water) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Japan: Functional Drinks (Bottled Water) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Japan: Functional Drinks (Specialty Drinks) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Japan: Functional Drinks (Specialty Drinks) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Japan: Functional Drinks (Functional Tea & Coffee) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Japan: Functional Drinks (Functional Tea & Coffee) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Japan: Functional Drinks (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Japan: Functional Drinks (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Japan: Functional Drinks (Supermarkets & Hypermarkets) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Japan: Functional Drinks (Supermarkets & Hypermarkets) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Japan: Functional Drinks (Convenience Stores) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Japan: Functional Drinks (Convenience Stores) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Japan: Functional Drinks (Specialist Retailers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Japan: Functional Drinks (Specialist Retailers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Japan: Functional Drinks (Online Retailers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Japan: Functional Drinks (Online Retailers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Japan: Functional Drinks (Other Distribution Channels) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Japan: Functional Drinks (Other Distribution Channels) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Kanto Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Kanto Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Kinki Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Kinki Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Central/ Chubu Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Central/ Chubu Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Kyushu-Okinawa Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Kyushu-Okinawa Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Tohoku Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Tohoku Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Chugoku Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Chugoku Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Hokkaido Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Hokkaido Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Shikoku Region: Functional Drinks Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Shikoku Region: Functional Drinks Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Japan: Functional Drinks Industry: SWOT Analysis

Figure 50: Japan: Functional Drinks Industry: Value Chain Analysis

Figure 51: Japan: Functional Drinks Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Japan: Functional Drinks Market: Key Industry Highlights, 2024 and 2033

Table 2: Japan: Functional Drinks Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Japan: Functional Drinks Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 4: Japan: Functional Drinks Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 5: Japan: Functional Drinks Market: Competitive Structure

Table 6: Japan: Functional Drinks Market: Key Players

| Purchase Option | Discounted Price | Original Price |

|---|---|---|

| Single User License | $2,999 | $3,699 |

| Five User License | $3,999 | $4,699 |

| Corporate User License | $4,999 | $5,699 |

※Report Format: PDF+Excel

※Delivery Lead Time: 2 working days