Japan Implantable Medical Devices Market Overview (2025–2033)

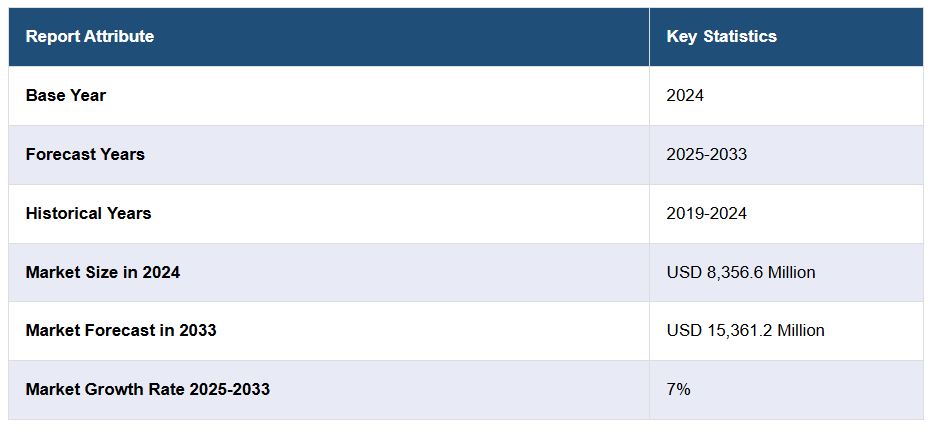

The Japan implantable medical devices market has emerged as a vital component of the country’s healthcare infrastructure, with the market size reaching USD 8,356.6 million in 2024. Looking ahead, it is projected to attain USD 15,361.2 million by 2033, growing at a compound annual growth rate (CAGR) of 7% during the forecast period of 2025 to 2033. This robust growth trajectory is driven by an aging population, the increasing prevalence of chronic diseases, and advancements in medical technology, all of which are contributing to the rising demand for innovative and effective implantable medical devices across Japan.

Implantable medical devices are sophisticated instruments designed to be placed inside or on the surface of the human body for therapeutic or diagnostic purposes. These devices are instrumental in replacing missing biological structures, enhancing bodily functions, or delivering medications in a controlled manner. Examples of widely used implantable devices include cardiac pacemakers, defibrillators, orthopedic implants, cochlear implants, dental prosthetics, and insulin pumps. Their ability to significantly improve the quality of life, enable quicker recovery, and provide long-term solutions for chronic conditions has positioned them as indispensable tools in modern healthcare.

Market Drivers

One of the primary drivers of the Japanese implantable medical devices market is the growing burden of chronic diseases, including cardiovascular disorders, orthopedic conditions, and diabetes. These health issues are particularly prevalent among the elderly—a demographic segment that continues to expand in Japan, which now has one of the highest proportions of elderly individuals in the world. As a result, the demand for medical implants such as pacemakers, joint replacement devices, and insulin pumps has increased significantly.

Moreover, continuous innovation in biomaterials and device engineering has enhanced the performance, safety, and biocompatibility of implantable devices. Developments in miniaturization, wireless communication, battery longevity, and the integration of artificial intelligence are making these devices more reliable and accessible. These technological advancements not only improve patient outcomes but also reduce the frequency of surgical revisions and lower long-term healthcare costs.

In addition, greater awareness among patients and healthcare providers regarding the benefits of early intervention and the effectiveness of implantable solutions is contributing to higher adoption rates. The Japanese government has also implemented favorable regulatory policies and streamlined approval pathways for high-performance medical devices, further accelerating market expansion.

Market Segmentation

Product Type:

The market is segmented by product type into orthopedic implants, dental implants, facial implants, breast implants, cardiovascular implants, and others. Among these, orthopedic and cardiovascular implants constitute a substantial share, primarily driven by the increasing incidence of arthritis, osteoporosis, heart disease, and other degenerative conditions. Dental implants are also witnessing strong growth due to rising demand for cosmetic and restorative dentistry among aging populations.

Material:

Based on material, the market is classified into polymers, metals, ceramics, and biologics. Metallic implants dominate due to their mechanical strength and durability, particularly in orthopedic and cardiovascular applications. However, the demand for polymer-based and biologic implants is increasing due to their flexibility, lighter weight, and better integration with biological tissues. Ceramics are primarily used in dental and orthopedic applications where high wear resistance is essential.

End User:

In terms of end users, the market is segmented into hospitals, ambulatory surgery centers (ASCs), and clinics. Hospitals represent the largest segment due to the availability of comprehensive surgical facilities and specialized professionals. However, ASCs are gaining traction owing to their cost-effectiveness, shorter patient stay, and growing preference for minimally invasive procedures.

Region:

Geographically, the report provides a detailed analysis of the implantable medical devices market across all major regions in Japan: Kanto, Kansai/Kinki, Central/Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku. The Kanto region, home to Tokyo and other major metropolitan areas, represents the most significant market share due to its dense population, advanced healthcare infrastructure, and high healthcare expenditure.

Competitive Landscape

The competitive landscape of the Japan implantable medical devices market is characterized by a mix of global medical device giants and domestic players, each striving to gain market share through innovation, strategic partnerships, and expansion into untapped regional markets. The report includes comprehensive company profiles, highlighting business overviews, product portfolios, recent developments, financial performance, and competitive strategies. Market structure, top-performing companies, strategic initiatives, and technological advancements are thoroughly examined, providing stakeholders with a clear understanding of the industry’s dynamics.

Strategic Insights

The Japan implantable medical devices market is poised for continuous transformation, supported by technological innovation, a growing patient base, and evolving healthcare delivery models. The convergence of digital health, artificial intelligence, and personalized medicine is anticipated to open new opportunities in the implantable devices segment. For instance, next-generation implants embedded with biosensors or real-time monitoring capabilities could offer predictive diagnostics and proactive interventions, paving the way for precision healthcare.

Furthermore, the market is likely to benefit from rising investment in medical research and public-private partnerships aimed at enhancing healthcare access, particularly in rural and underserved regions of Japan. As surgical techniques become less invasive and patient recovery times improve, the scope for outpatient procedures using implantable devices is expected to broaden.

Conclusion

The implantable medical devices market in Japan is set to grow steadily in the coming decade, fueled by favorable demographic trends, a supportive regulatory environment, and a continuous wave of technological innovation. Stakeholders across the healthcare value chain—including device manufacturers, healthcare providers, regulatory authorities, and investors—must collaborate to ensure equitable access, affordability, and sustained innovation in this vital sector. With a clear focus on quality, safety, and clinical efficacy, Japan remains a key market in the global implantable medical devices landscape.

[Table of Contents]

1 Preface

2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Japan Implantable Medical Devices Market – Introduction

4.1 Overview

4.2 Market Dynamics

4.3 Industry Trends

4.4 Competitive Intelligence

5 Japan Implantable Medical Devices Market Landscape

5.1 Historical and Current Market Trends (2019-2024)

5.2 Market Forecast (2025-2033)

6 Japan Implantable Medical Devices Market – Breakup by Product Type

6.1 Orthopedic Implants

6.1.1 Overview

6.1.2 Historical and Current Market Trends (2019-2024)

6.1.3 Market Forecast (2025-2033)

6.2 Dental Implants

6.2.1 Overview

6.2.2 Historical and Current Market Trends (2019-2024)

6.2.3 Market Forecast (2025-2033)

6.3 Facial Implants

6.3.1 Overview

6.3.2 Historical and Current Market Trends (2019-2024)

6.3.3 Market Forecast (2025-2033)

6.4 Breast Implants

6.4.1 Overview

6.4.2 Historical and Current Market Trends (2019-2024)

6.4.3 Market Forecast (2025-2033)

6.5 Cardiovascular Implants

6.5.1 Overview

6.5.2 Historical and Current Market Trends (2019-2024)

6.5.3 Market Forecast (2025-2033)

6.6 Others

6.6.1 Historical and Current Market Trends (2019-2024)

6.6.2 Market Forecast (2025-2033)

7 Japan Implantable Medical Devices Market – Breakup by Material

7.1 Polymers

7.1.1 Overview

7.1.2 Historical and Current Market Trends (2019-2024)

7.1.3 Market Forecast (2025-2033)

7.2 Metals

7.2.1 Overview

7.2.2 Historical and Current Market Trends (2019-2024)

7.2.3 Market Forecast (2025-2033)

7.3 Ceramics

7.3.1 Overview

7.3.2 Historical and Current Market Trends (2019-2024)

7.3.3 Market Forecast (2025-2033)

7.4 Biologics

7.4.1 Overview

7.4.2 Historical and Current Market Trends (2019-2024)

7.4.3 Market Forecast (2025-2033)

8 Japan Implantable Medical Devices Market – Breakup by End User

8.1 Hospitals

8.1.1 Overview

8.1.2 Historical and Current Market Trends (2019-2024)

8.1.3 Market Forecast (2025-2033)

8.2 Ambulatory Surgery Centers (ASCs)

8.2.1 Overview

8.2.2 Historical and Current Market Trends (2019-2024)

8.2.3 Market Forecast (2025-2033)

8.3 Clinics

8.3.1 Overview

8.3.2 Historical and Current Market Trends (2019-2024)

8.3.3 Market Forecast (2025-2033)

9 Japan Implantable Medical Devices Market – Breakup by Region

9.1 Kanto Region

9.1.1 Overview

9.1.2 Historical and Current Market Trends (2019-2024)

9.1.3 Market Breakup by Product Type

9.1.4 Market Breakup by Material

9.1.5 Market Breakup by End User

9.1.6 Key Players

9.1.7 Market Forecast (2025-2033)

9.2 Kansai/Kinki Region

9.2.1 Overview

9.2.2 Historical and Current Market Trends (2019-2024)

9.2.3 Market Breakup by Product Type

9.2.4 Market Breakup by Material

9.2.5 Market Breakup by End User

9.2.6 Key Players

9.2.7 Market Forecast (2025-2033)

9.3 Central/ Chubu Region

9.3.1 Overview

9.3.2 Historical and Current Market Trends (2019-2024)

9.3.3 Market Breakup by Product Type

9.3.4 Market Breakup by Material

9.3.5 Market Breakup by End User

9.3.6 Key Players

9.3.7 Market Forecast (2025-2033)

9.4 Kyushu-Okinawa Region

9.4.1 Overview

9.4.2 Historical and Current Market Trends (2019-2024)

9.4.3 Market Breakup by Product Type

9.4.4 Market Breakup by Material

9.4.5 Market Breakup by End User

9.4.6 Key Players

9.4.7 Market Forecast (2025-2033)

9.5 Tohoku Region

9.5.1 Overview

9.5.2 Historical and Current Market Trends (2019-2024)

9.5.3 Market Breakup by Product Type

9.5.4 Market Breakup by Material

9.5.5 Market Breakup by End User

9.5.6 Key Players

9.5.7 Market Forecast (2025-2033)

9.6 Chugoku Region

9.6.1 Overview

9.6.2 Historical and Current Market Trends (2019-2024)

9.6.3 Market Breakup by Product Type

9.6.4 Market Breakup by Material

9.6.5 Market Breakup by End User

9.6.6 Key Players

9.6.7 Market Forecast (2025-2033)

9.7 Hokkaido Region

9.7.1 Overview

9.7.2 Historical and Current Market Trends (2019-2024)

9.7.3 Market Breakup by Product Type

9.7.4 Market Breakup by Material

9.7.5 Market Breakup by End User

9.7.6 Key Players

9.7.7 Market Forecast (2025-2033)

9.8 Shikoku Region

9.8.1 Overview

9.8.2 Historical and Current Market Trends (2019-2024)

9.8.3 Market Breakup by Product Type

9.8.4 Market Breakup by Material

9.8.5 Market Breakup by End User

9.8.6 Key Players

9.8.7 Market Forecast (2025-2033)

10 Japan Implantable Medical Devices Market – Competitive Landscape

10.1 Overview

10.2 Market Structure

10.3 Market Player Positioning

10.4 Top Winning Strategies

10.5 Competitive Dashboard

10.6 Company Evaluation Quadrant

11 Profiles of Key Players

11.1 Company A

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Business Strategies

11.1.4 SWOT Analysis

11.1.5 Major News and Events

11.2 Company B

11.2.1 Business Overview

11.2.2 Product Portfolio

11.2.3 Business Strategies

11.2.4 SWOT Analysis

11.2.5 Major News and Events

11.3 Company C

11.3.1 Business Overview

11.3.2 Product Portfolio

11.3.3 Business Strategies

11.3.4 SWOT Analysis

11.3.5 Major News and Events

11.4 Company D

11.4.1 Business Overview

11.4.2 Product Portfolio

11.4.3 Business Strategies

11.4.4 SWOT Analysis

11.4.5 Major News and Events

11.5 Company E

11.5.1 Business Overview

11.5.2 Product Portfolio

11.5.3 Business Strategies

11.5.4 SWOT Analysis

11.5.5 Major News and Events

Company names have not been provided here as this is a sample TOC. Complete list to be provided in the final report.

12 Japan Implantable Medical Devices Market – Industry Analysis

12.1 Drivers, Restraints, and Opportunities

12.1.1 Overview

12.1.2 Drivers

12.1.3 Restraints

12.1.4 Opportunities

12.2 Porters Five Forces Analysis

12.2.1 Overview

12.2.2 Bargaining Power of Buyers

12.2.3 Bargaining Power of Suppliers

12.2.4 Degree of Competition

12.2.5 Threat of New Entrants

12.2.6 Threat of Substitutes

12.3 Value Chain Analysis

13 Appendix

| Purchase Option | Discounted Price | Original Price |

|---|---|---|

| Single User License | $2,999 | $3,699 |

| Five User License | $3,999 | $4,699 |

| Corporate User License | $4,999 | $5,699 |

※Report Format: PDF+Excel

※Delivery Lead Time: 2 working days

Definition of Implantable Medical Devices

Implantable medical devices are medical instruments that are surgically inserted into the human body either permanently or temporarily to support, monitor, or replace biological functions. These devices are used in a wide range of medical fields, including cardiology, orthopedics, neurology, and dentistry. Unlike external devices, implantable devices operate inside the body and often function autonomously or with minimal external intervention. They are typically designed to stay in the body for extended periods and must be biocompatible, mechanically stable, and functionally reliable.

Key Characteristics

One of the most critical characteristics of implantable medical devices is biocompatibility. Since these devices come into direct contact with tissues and bodily fluids, the materials used—such as titanium, stainless steel, ceramics, silicone, and polymers—must not cause adverse immune responses or inflammation. Another essential feature is durability. Many devices, such as joint implants or pacemakers, are expected to function reliably for several years without degradation. Additionally, implantable devices must be mechanically robust to withstand the physical stresses within the body, especially in load-bearing applications such as orthopedic implants.

Advancements in medical engineering have also led to the miniaturization of devices, allowing for easier implantation and less invasive procedures. Moreover, many modern implants incorporate advanced technologies such as sensors, wireless communication, and AI-driven feedback systems. These smart implants can provide real-time monitoring and data transmission, enhancing patient care and enabling more precise medical interventions.

Types of Implantable Medical Devices

Implantable medical devices cover a broad spectrum of categories based on their functionality and area of application. One major category is cardiovascular implants, which include pacemakers, defibrillators, and stents. These devices help regulate heart rhythms, prevent cardiac arrest, or keep blood vessels open. Orthopedic implants such as hip, knee, and spinal implants are used to restore mobility and support damaged bones or joints. Dental implants serve as artificial tooth roots and are anchored into the jawbone to support crowns or bridges, offering long-term solutions for tooth loss.

Neurological implants, including deep brain stimulators and spinal cord stimulators, are used to manage chronic pain, epilepsy, Parkinson’s disease, and other neurological conditions. Cochlear implants, designed for patients with severe hearing loss, convert sound into electrical signals that directly stimulate the auditory nerve. Breast implants, typically used in reconstructive or cosmetic procedures, restore the shape and size of the breast. Contraceptive implants, a form of long-term birth control, are inserted under the skin and release hormones to prevent pregnancy. Finally, insulin pumps and drug delivery systems can also be classified as implantable devices when they are placed subcutaneously to provide continuous or controlled medication administration.

Applications in Healthcare

Implantable medical devices are indispensable in managing a wide array of chronic and acute medical conditions. In cardiovascular medicine, pacemakers and implantable cardioverter defibrillators (ICDs) significantly reduce the risk of sudden cardiac death and manage arrhythmias. Orthopedic implants help restore mobility and relieve pain in patients with joint degeneration or trauma, contributing to improved quality of life and functional independence. In the field of neurology, implantable stimulators can mitigate the effects of tremors, seizures, or chronic pain, offering an alternative to pharmaceutical therapy.

These devices are also crucial in personalized medicine, where implantable biosensors can monitor glucose levels, intracranial pressure, or cardiac output in real time. Such continuous monitoring enables physicians to tailor treatment plans more accurately and make data-driven decisions. In surgical and post-operative care, implants may be used temporarily to stabilize bones, deliver medication, or aid in wound healing.

In recent years, technological integration has allowed for remote monitoring and telemedicine applications. Patients with implantable devices can now transmit physiological data to healthcare providers via Bluetooth or other wireless technologies, allowing for early detection of complications and reducing the need for hospital visits.

Emerging Trends

With the integration of digital health technologies, the landscape of implantable medical devices is evolving rapidly. Smart implants that combine biosensors, real-time analytics, and even machine learning algorithms are beginning to emerge. These devices can adapt to physiological changes, predict complications, and initiate automated responses, such as adjusting insulin dosage or stimulating nerves based on biometric feedback.

Another major trend is the use of 3D printing to manufacture customized implants tailored to individual patient anatomy. This technology enhances fit, function, and compatibility, particularly in complex orthopedic and dental applications. In addition, advances in battery technology and energy harvesting are addressing power supply challenges, extending the operational life of implantable devices.

As the global population continues to age and the prevalence of chronic diseases rises, the demand for implantable medical devices will likely continue to grow. Regulatory bodies and manufacturers are also working to improve the safety, effectiveness, and accessibility of these devices, ensuring better outcomes for a broader patient base.