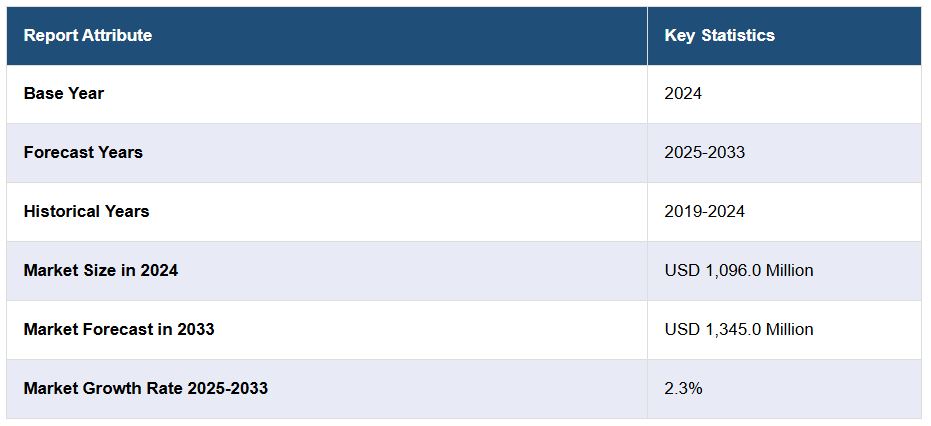

Japan Semiconductor Diode Market Overview (2025–2033)

The Japan semiconductor diode market was valued at USD 1,096.0 million in 2024 and is projected to reach USD 1,345.0 million by 2033, growing at a compound annual growth rate (CAGR) of 2.3% during the forecast period of 2025–2033. This steady growth trajectory is underpinned by the rising demand for high-speed communication systems, increasing consumer electronics penetration, and technological advancements in diode applications across sectors such as automotive, industrial automation, and smart devices.

Market Fundamentals

Semiconductor diodes play a vital role in the modern electronics ecosystem. As unidirectional current flow devices, they are key components in rectification, signal modulation, power conversion, and light emission. Japan, known for its electronics innovation, continues to be a significant contributor to diode technology development, producing high-quality components for both domestic consumption and global supply chains.

The versatility of semiconductor diodes—ranging from traditional rectifiers to specialized types like light-emitting diodes (LEDs), Zener diodes, and Schottky diodes—has cemented their indispensable role in modern applications. With the advent of Industry 4.0, electric mobility, and IoT-based solutions, demand for advanced diodes that offer energy efficiency, miniaturization, and high-speed switching continues to increase.

Key Market Trends

Japan’s commitment to energy efficiency and carbon neutrality has accelerated the adoption of LED lighting across residential, commercial, and industrial infrastructures. LEDs, a major product segment within the diode category, have largely replaced incandescent and fluorescent lighting due to their lower energy consumption and extended operational lifespan.

Moreover, the proliferation of high-performance consumer electronics such as 8K televisions, augmented reality (AR) devices, and wearables has necessitated the development of compact, high-speed, and thermally stable diodes. In the communication sector, optoelectronic diodes supporting 5G and fiber-optic networks are witnessing robust growth due to their ability to handle high-frequency data transmissions with minimal latency.

Another key trend is the integration of semiconductor diodes into automotive electronics, especially with the shift toward electric and autonomous vehicles. Applications include battery management systems, ADAS (Advanced Driver Assistance Systems), in-vehicle infotainment, and LED headlamps.

Segment Analysis

By Type:

-

Zener Diodes: Widely used in voltage regulation and surge protection.

-

Schottky Diodes: Preferred for low voltage and high-speed switching applications.

-

Laser Diodes: Increasingly used in optical storage, laser printers, and LiDAR.

-

Light Emitting Diodes (LEDs): Dominant in lighting, display technologies, and indicators.

-

Small Signal Diodes: Employed in high-frequency applications and digital circuits.

-

Others: Includes tunnel diodes and photodiodes, catering to niche uses.

By End Use Industry:

-

Communications: The backbone of Japan’s tech sector, requiring high-performance optoelectronics.

-

Consumer Electronics: Continual demand for lighter, thinner, and more efficient devices drives diode innovation.

-

Automotive: Rapid electrification and automation in vehicles are boosting diode applications.

-

Computers and Peripherals: From power regulation to data transfer, diodes play an essential role in computing.

-

Others: Includes industrial automation, healthcare electronics, and defense.

Regional Insights

Japan’s semiconductor diode market is regionally diverse, with innovation hubs spread across:

-

Kanto Region: Home to Tokyo and Yokohama, a leading area for R&D and high-tech manufacturing.

-

Kansai/Kinki Region: Osaka and Kyoto foster strong electronics and semiconductor industries.

-

Chubu Region: An industrial powerhouse with strong automotive and component production.

-

Kyushu-Okinawa: Known for its semiconductor fabrication facilities.

-

Tohoku, Chugoku, Hokkaido, and Shikoku Regions: Emerging areas focused on regional manufacturing and specialized applications.

Competitive Landscape

Japan’s semiconductor diode market is characterized by intense competition, a highly skilled workforce, and a focus on innovation. Key players operate with vertically integrated manufacturing and extensive R&D capabilities. The market structure includes large conglomerates, specialized component manufacturers, and strategic alliances across the supply chain.

Key elements analyzed in the competitive landscape include:

-

Market share analysis and positioning

-

Company profiles and SWOT assessments

-

Innovation pipelines and patent activity

-

Strategic initiatives such as mergers, acquisitions, and partnerships

Growth Drivers and Challenges

Drivers:

-

Increased investment in smart infrastructure and green energy

-

Expanding applications in automotive and consumer electronics

-

Government initiatives to boost domestic semiconductor production

-

Demand for miniaturized and high-efficiency components

Challenges:

-

Global semiconductor supply chain disruptions

-

High R&D costs and the need for continuous innovation

-

Competition from lower-cost manufacturing bases in Asia

Outlook

The Japan semiconductor diode market is poised for stable long-term growth, bolstered by strong end-user demand, technological advancements, and supportive policy frameworks. With continued innovation in materials, miniaturization, and integration, diodes will remain a critical enabler of Japan’s digital and energy-efficient transformation.

[Table of Contents]

1 Preface

2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Japan Semiconductor Diode Market – Introduction

4.1 Overview

4.2 Market Dynamics

4.3 Industry Trends

4.4 Competitive Intelligence

5 Japan Semiconductor Diode Market Landscape

5.1 Historical and Current Market Trends (2019-2024)

5.2 Market Forecast (2025-2033)

6 Japan Semiconductor Diode Market – Breakup by Type

6.1 Zener Diode

6.1.1 Overview

6.1.2 Historical and Current Market Trends (2019-2024)

6.1.3 Market Forecast (2025-2033)

6.2 Schottky Diode

6.2.1 Overview

6.2.2 Historical and Current Market Trends (2019-2024)

6.2.3 Market Forecast (2025-2033)

6.3 Laser Diode

6.3.1 Overview

6.3.2 Historical and Current Market Trends (2019-2024)

6.3.3 Market Forecast (2025-2033)

6.4 Light Emitting Diode

6.4.1 Overview

6.4.2 Historical and Current Market Trends (2019-2024)

6.4.3 Market Forecast (2025-2033)

6.5 Small Signal Diode

6.5.1 Overview

6.5.2 Historical and Current Market Trends (2019-2024)

6.5.3 Market Forecast (2025-2033)

6.6 Others

6.6.1 Historical and Current Market Trends (2019-2024)

6.6.2 Market Forecast (2025-2033)

7 Japan Semiconductor Diode Market – Breakup by End Use Industry

7.1 Communications

7.1.1 Overview

7.1.2 Historical and Current Market Trends (2019-2024)

7.1.3 Market Forecast (2025-2033)

7.2 Consumer Electronics

7.2.1 Overview

7.2.2 Historical and Current Market Trends (2019-2024)

7.2.3 Market Forecast (2025-2033)

7.3 Automotive

7.3.1 Overview

7.3.2 Historical and Current Market Trends (2019-2024)

7.3.3 Market Forecast (2025-2033)

7.4 Computer and Computer Peripherals

7.4.1 Overview

7.4.2 Historical and Current Market Trends (2019-2024)

7.4.3 Market Forecast (2025-2033)

7.5 Others

7.5.1 Historical and Current Market Trends (2019-2024)

7.5.2 Market Forecast (2025-2033)

8 Japan Semiconductor Diode Market – Breakup by Region

8.1 Kanto Region

8.1.1 Overview

8.1.2 Historical and Current Market Trends (2019-2024)

8.1.3 Market Breakup by Type

8.1.4 Market Breakup by End Use Industry

8.1.5 Key Players

8.1.6 Market Forecast (2025-2033)

8.2 Kansai/Kinki Region

8.2.1 Overview

8.2.2 Historical and Current Market Trends (2019-2024)

8.2.3 Market Breakup by Type

8.2.4 Market Breakup by End Use Industry

8.2.5 Key Players

8.2.6 Market Forecast (2025-2033)

8.3 Central/ Chubu Region

8.3.1 Overview

8.3.2 Historical and Current Market Trends (2019-2024)

8.3.3 Market Breakup by Type

8.3.4 Market Breakup by End Use Industry

8.3.5 Key Players

8.3.6 Market Forecast (2025-2033)

8.4 Kyushu-Okinawa Region

8.4.1 Overview

8.4.2 Historical and Current Market Trends (2019-2024)

8.4.3 Market Breakup by Type

8.4.4 Market Breakup by End Use Industry

8.4.5 Key Players

8.4.6 Market Forecast (2025-2033)

8.5 Tohoku Region

8.5.1 Overview

8.5.2 Historical and Current Market Trends (2019-2024)

8.5.3 Market Breakup by Type

8.5.4 Market Breakup by End Use Industry

8.5.5 Key Players

8.5.6 Market Forecast (2025-2033)

8.6 Chugoku Region

8.6.1 Overview

8.6.2 Historical and Current Market Trends (2019-2024)

8.6.3 Market Breakup by Type

8.6.4 Market Breakup by End Use Industry

8.6.5 Key Players

8.6.6 Market Forecast (2025-2033)

8.7 Hokkaido Region

8.7.1 Overview

8.7.2 Historical and Current Market Trends (2019-2024)

8.7.3 Market Breakup by Type

8.7.4 Market Breakup by End Use Industry

8.7.5 Key Players

8.7.6 Market Forecast (2025-2033)

8.8 Shikoku Region

8.8.1 Overview

8.8.2 Historical and Current Market Trends (2019-2024)

8.8.3 Market Breakup by Type

8.8.4 Market Breakup by End Use Industry

8.8.5 Key Players

8.8.6 Market Forecast (2025-2033)

9 Japan Semiconductor Diode Market – Competitive Landscape

9.1 Overview

9.2 Market Structure

9.3 Market Player Positioning

9.4 Top Winning Strategies

9.5 Competitive Dashboard

9.6 Company Evaluation Quadrant

10 Profiles of Key Players

10.1 Company A

10.1.1 Business Overview

10.1.2 Product Portfolio

10.1.3 Business Strategies

10.1.4 SWOT Analysis

10.1.5 Major News and Events

10.2 Company B

10.2.1 Business Overview

10.2.2 Product Portfolio

10.2.3 Business Strategies

10.2.4 SWOT Analysis

10.2.5 Major News and Events

10.3 Company C

10.3.1 Business Overview

10.3.2 Product Portfolio

10.3.3 Business Strategies

10.3.4 SWOT Analysis

10.3.5 Major News and Events

10.4 Company D

10.4.1 Business Overview

10.4.2 Product Portfolio

10.4.3 Business Strategies

10.4.4 SWOT Analysis

10.4.5 Major News and Events

10.5 Company E

10.5.1 Business Overview

10.5.2 Product Portfolio

10.5.3 Business Strategies

10.5.4 SWOT Analysis

10.5.5 Major News and Events

Company names have not been provided here as this is a sample TOC. Complete list to be provided in the final report.

11 Japan Semiconductor Diode Market – Industry Analysis

11.1 Drivers, Restraints, and Opportunities

11.1.1 Overview

11.1.2 Drivers

11.1.3 Restraints

11.1.4 Opportunities

11.2 Porters Five Forces Analysis

11.2.1 Overview

11.2.2 Bargaining Power of Buyers

11.2.3 Bargaining Power of Suppliers

11.2.4 Degree of Competition

11.2.5 Threat of New Entrants

11.2.6 Threat of Substitutes

11.3 Value Chain Analysis

12 Appendix

[Purchase Detail]

| Purchase Option | Discounted Price | Original Price |

|---|---|---|

| Single User License | $2,999 | $3,699 |

| Five User License | $3,999 | $4,699 |

| Corporate User License | $4,999 | $5,699 |

※Report Format: PDF+Excel

※Delivery Lead Time: 2 working days