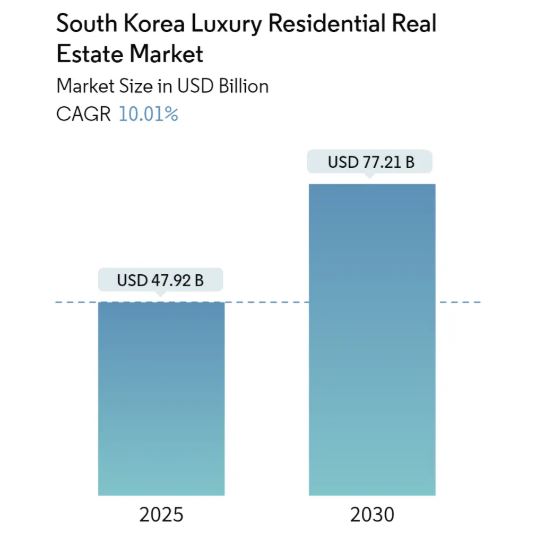

The South Korea luxury residential real estate market is poised for significant transformation and growth despite facing recent challenges, including monetary tightening and declining property prices. The market is projected to grow from USD 47.92 billion in 2025 to USD 77.21 billion by 2030, registering a steady CAGR of 10.01% during the forecast period. This growth is driven by both long-term structural factors and short-term market adjustments.

Over the past decade, luxury real estate has been one of the most resilient and attractive investment options in South Korea, particularly concentrated in prime districts such as Gangnam, Seocho, and Songpa, collectively known as the “Gangnam 3 Districts.” However, since 2022, the market has been under pressure due to interest rate hikes by the Bank of Korea and regulatory tightening on housing loans. These measures, aimed at cooling down overheated property prices, have led to a sharp contraction in transaction volume and a decline in luxury apartment prices, including in the traditionally robust Gangnam area.

Nevertheless, the medium-to-long-term outlook for the luxury residential market remains favorable. First, despite recent price corrections, the underlying demand for high-end housing remains intact due to South Korea’s wealthy class, expatriate executives, and the increasing trend of tech entrepreneurs and K-content industry leaders seeking prime residences. Moreover, developers are increasingly shifting focus toward sustainable and technology-integrated luxury properties, which are highly attractive to modern buyers.

The integration of smart home features, energy-efficient designs, and eco-friendly materials is expected to become a key selling point in the upcoming years. In addition, the development of large-scale projects such as the Songdo K-Content City and ongoing urban redevelopment projects in Seoul and Busan are likely to unlock new opportunities for the luxury housing market.

External macroeconomic factors, including inflation and high borrowing costs, will continue to moderate market momentum in the short term. However, the absence of panic selling and the stability of the luxury segment suggest that the market correction is more of a soft landing than a crash. Regulatory changes like restrictions on jeonse (lump-sum deposit lease) loans and limits on mortgage lending have reduced speculative buying, but the structural demand for luxury housing is supported by Korea’s status as a business hub, strong household wealth, and the social value associated with luxury property ownership.

In conclusion, the South Korean luxury residential real estate market is undergoing a necessary adjustment phase, yet its core growth drivers — affluent domestic demand, expatriate interest, technological innovation, and urban development — remain strong. The market is expected to stabilize and resume its growth trajectory as the macroeconomic environment improves and developers adapt to new buyer expectations.

[Table of Contents]

1. Introduction

1.1 Study Assumptions

1.2 Scope of the Study

2. Research Methodology

2.1 Analytical Approach

2.2 Research Phases

3. Executive Summary

4. Market Insights and Dynamics

4.1 Current Market Scenario

4.2 Market Drivers

4.2.1 Influx of Expatriates and Demand for High-End Accommodation

4.2.2 Adoption of Smart Homes and Advanced Technologies

4.3 Market Restraints

4.3.1 Decline in Foreign Investment

4.3.2 Impact of Government Regulations

4.4 Market Opportunities

4.4.1 Development of Sustainable and Eco-Friendly Luxury Properties

4.4.2 Growing Adoption of Smart Technology in Residences

4.5 Value Chain & Supply Chain Analysis

4.6 Industry Attractiveness – Porter’s Five Forces Analysis

4.6.1 Bargaining Power of Suppliers

4.6.2 Bargaining Power of Buyers

4.6.3 Threat of New Entrants

4.6.4 Threat of Substitutes

4.6.5 Competitive Rivalry

4.7 Industry Policies and Regulations

4.8 Technological Developments

4.9 Impact of COVID-19 on the Market

5. Market Segmentation

5.1 By Property Type

5.1.1 Apartments & Condominiums

5.1.2 Villas & Landed Houses

5.2 By City

5.2.1 Seoul

5.2.2 Busan

5.2.3 Other Major Cities

6. Competitive Landscape

6.1 Market Concentration Overview

6.2 Company Profiles

6.2.1 Samsung C&T Corporation

6.2.2 Daewoo Engineering & Construction

6.2.3 KyeRyong Construction Industrial

6.2.4 Hoban Construction

6.2.5 DL Construction

6.2.6 Daebang Construction

6.2.7 Ssangyong Engineering & Construction

6.2.8 Dongbu Corporation

6.2.9 Bando Engineering & Construction

6.2.10 Hyosung Heavy Industries

(List Not Exhaustive)