1 はじめに 36

1.1 調査目的 36

1.2 市場の定義 36

1.3 調査範囲 37

1.3.1 対象市場と地域範囲 37

1.3.2 対象範囲と除外項目 38

1.3.3 考慮した年数 38

1.4 考慮した通貨 39

1.5 単位の考慮 39

1.6 利害関係者 39

1.7 変更点のまとめ 39

2 調査方法 40

2.1 調査データ 40

2.1.1 二次データ 41

2.1.1.1 主要な二次情報源のリスト 41

2.1.1.2 二次資料からの主要データ 42

2.1.2 一次データ 42

2.1.2.1 一次資料からの主要データ 42

2.1.2.2 主要な業界インサイト 43

2.1.2.3 専門家へのインタビューの内訳 43

2.2 市場規模の推定 44

2.2.1 ボトムアップアプローチ 44

2.2.2 トップダウンアプローチ 45

2.3 データの三角測量 46

2.4 要因分析 47

2.5 調査の前提 47

2.6 研究の限界 48

2.7 リスク評価 48

3 エグゼクティブ・サマリー 49

4 プレミアムインサイト 53

4.1 軟包装市場におけるプレーヤーの魅力的な機会 53

4.2 軟包装市場、素材別 53

4.3 軟包装市場:包装タイプ別 54

4.4 軟包装市場:印刷技術別 54

4.5 軟包装市場:用途別 55

4.6 アジア太平洋地域の軟包装市場:地域・用途別 55

4.7 軟包装市場:主要国別 56

5 市場の概要 57

5.1 はじめに 57

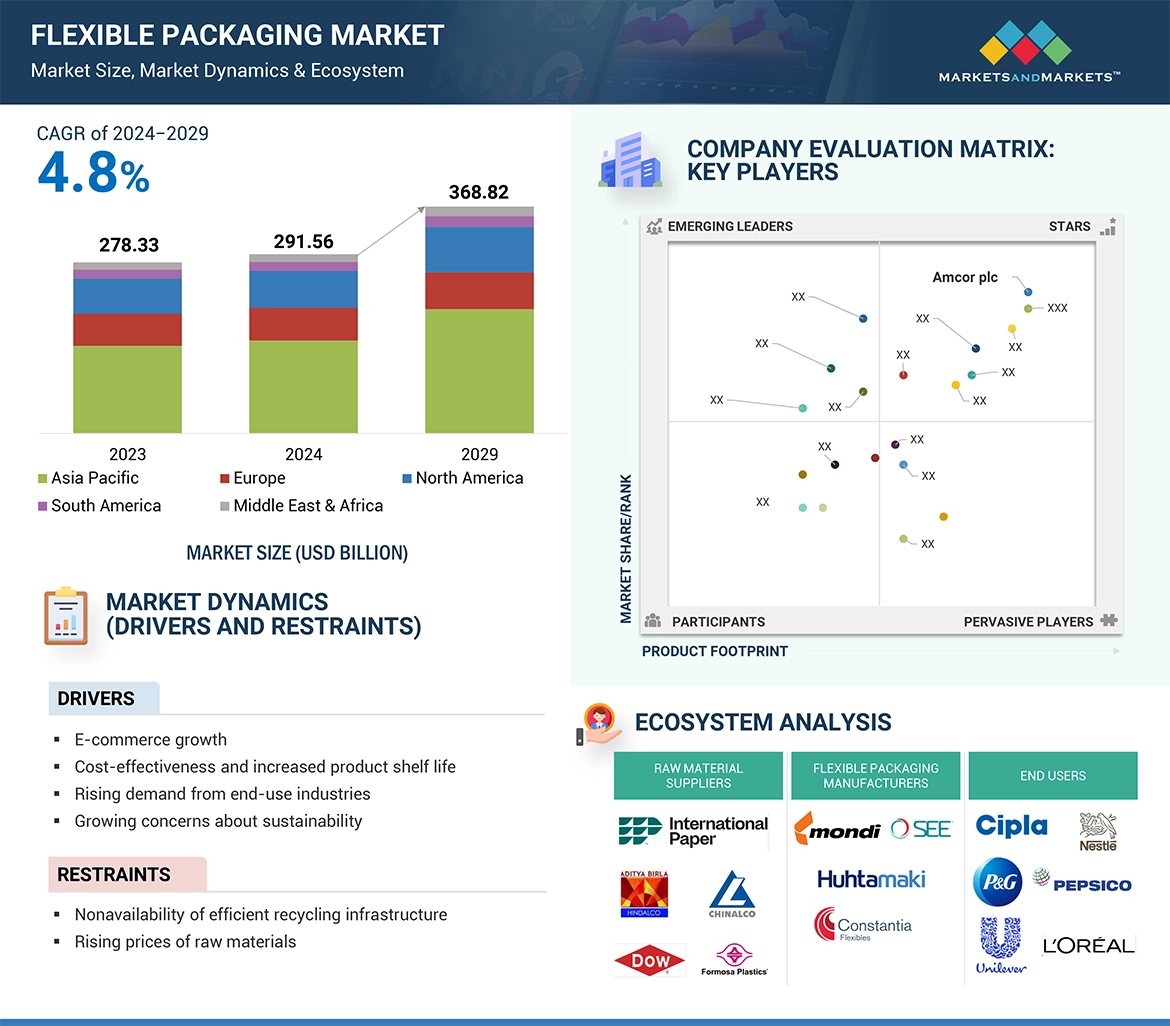

5.2 市場ダイナミクス 57

5.2.1 ドライバー 58

5.2.1.1 電子商取引プラットフォームの成長 58

5.2.1.2 コスト効率と製品保存期間の向上 58

5.2.1.3 最終用途産業からの使い捨て包装に対する需要の高まり 59

5.2.1.4 持続可能性への関心の高まり 59

5.2.2 阻害要因 60

5.2.2.1 効率的なリサイクルインフラが利用できない 60

5.2.2.2 原材料価格の高騰 60

5.2.3 機会 61

5.2.3.1 持続可能な包装に対する需要の高まり 61

5.2.3.2 従来の包装よりも軟包装が好まれる 61

5.2.4 課題 61

5.2.4.1 急速な技術進歩が従来型包装の販売を妨げている 61

を妨げている 61

5.2.4.2 サプライチェーンの混乱 61

5.3 顧客ビジネスに影響を与えるトレンドと混乱 62

5.4 価格分析 64

5.4.1 主要企業の平均販売価格動向(素材別) 64

5.4.2 平均販売価格動向(地域別) 64

5.5 バリューチェーン分析 65

5.6 エコシステム分析 67

5.7 技術分析 69

5.7.1 主要技術 69

5.7.1.1 フレキシブル製品の様々な印刷方法 69

5.7.1.2 軟包装用フォームフィルシール機 69

5.7.2 補足技術 70

5.7.2.1 新規紙用途の伸縮紙 70

5.7.2.2 食用及び生分解性包装 70

5.7.3 隣接技術 70

5.7.3.1 包装の自動化 70

5.8 Gen AI/AIが軟包装市場に与える影響 71

5.9 特許分析 72

5.9.1 導入 72

5.9.2 方法論 72

5.9.3 軟包装市場、特許分析 72

5.10 貿易分析 77

5.10.1 輸出シナリオ(HSコード3920) 77

5.10.2 輸入シナリオ(HSコード3920) 78

5.10.3 輸出シナリオ(HSコード48) 78

5.10.4 輸入シナリオ(HSコード48) 79

5.11 2024-2025年の主要会議とイベント 79

5.12 関税と規制の状況 80

5.12.1 規制機関、政府機関、その他の組織 80

その他の組織 80

5.12.2 軟包装市場における規制 86

5.12.2.1 公正包装表示法(FPLA)(米国) 86

5.12.2.2 包装および包装廃棄物指令(94/62/EC)(EU) 86

5.12.2.3 包装に関する必須要件(EN 13427、EN 13428) 86

5.12.2.4 新しい EU 包装規則(PPWR) 86

5.12.3 平均関税率 87

5.13 ポーターの5つの力分析 88

5.13.1 新規参入の脅威 89

5.13.2 代替品の脅威 89

5.13.3 買い手の交渉力 89

5.13.4 供給者の交渉力 90

5.13.5 競合の激しさ 90

5.14 主要ステークホルダーと購買基準 91

5.14.1 購入プロセスにおける主要ステークホルダー 91

5.14.2 購入基準 92

5.15 ケーススタディ分析 93

5.15.1 ペーパーパックは生分解性と堆肥化可能なソリューションでカトマンズと提携 93

5.15.2 ペーパーパックのハーパー社向けリファインバッグ 93 持続可能性への

サステナビリティ需要に対応 93

5.15.3 アムコーの30% リサイクルコンテントパッケージングが

バージンプラスチック使用量の削減 94

5.16 マクロ経済指標 94

5.16.1 はじめに 94

5.16.2 GDPの動向と予測 94

5.17 投資と資金調達のシナリオ 95

6 軟包装市場:素材別 97

6.1 はじめに 98

6.2 プラスチック 99

6.2.1 軟包装で最も広く使われている素材 99

6.3 紙 101

6.3.1 便利な保管と機能的包装を提供 101

6.4 金属 102

6.4.1 湿気に対する効果的なバリア、製品の保存性を高める 102

102

7 軟包装市場:包装タイプ別 105

7.1 導入 106

7.2 パウチ 107

7.2.1 経済的でヒートシール可能な効率的包装 107

7.3 袋 109

7.3.1 加工食品包装に広く利用されている 109

7.4 ロールストック 111

7.4.1 賞味期限と透明性を高めるためのデザイン 111

7.5 フィルム&ラップ 113

7.5.1 オンライン販売とeコマースの増加による需要の増加 113

7.6 その他の包装タイプ 114

8 軟包装市場:印刷技術別 117

8.1 はじめに 118

8.2 フレキソ印刷 119

8.2.1 画像印刷と製版に広く利用 119

8.3 グラビア 120

8.3.1 高画質で高品質な印刷を提供 120

8.4 デジタル印刷 120

8.4.1 環境負荷の低減と廃棄物の最小化 120

8.5 その他の印刷技術 120

9 軟包装市場、用途別 122

9.1 はじめに 123

9.2 食品 125

9.2.1 コンビニエンス食品の利用増加が市場を押し上げる 125

9.3 飲料 126

9.3.1 消費者の嗜好の変化が市場を牽引 126

9.4 医薬品・ヘルスケア 128

9.4.1 医薬品需要の増加が市場を牽引 128

9.5 パーソナルケア&化粧品 130

9.5.1 リーズナブルな小型包装が需要を押し上げる 130

9.6 その他の用途 131

10 軟包装市場(地域別) 133

10.1 はじめに 134

10.2 アジア太平洋地域 141

10.2.1 中国 148

10.2.1.1 eコマース産業の成長が市場を牽引 148

10.2.2 インド 152

10.2.2.1 組織小売業とeコマース部門からの高い需要が市場を牽引

市場を牽引 152

10.2.3 日本 156

10.2.3.1 急速な都市化と進化する消費者ニーズが市場を牽引 156

10.2.4 韓国 160

10.2.4.1 ライフスタイルの進化と小売食品販売の増加が市場を牽引 160

10.2.5 その他のアジア太平洋地域 164

10.3 北米 168

10.3.1 米国 175

10.3.1.1 確立されたeコマース・プラットフォームが成長を促進 175

10.3.2 カナダ 179

10.3.2.1 食品・飲料業界からの需要増加が市場を牽引 179

10.3.3 メキシコ 183

10.3.3.1 大手電子商取引プラットフォームの優位性が市場を牽引 183

10.4 欧州 187

10.4.1 ドイツ 194

10.4.1.1 盛んな食品・飲料セクターが携帯用包装製品の需要を押し上げる 194

10.4.2 イギリス 198

10.4.2.1 持続可能な包装イニシアチブの採用が市場を牽引 198

10.4.3 フランス 202

10.4.3.1 食品・医薬品産業の拡大が市場を牽引 202

10.4.4 イタリア 206

10.4.4.1 農業食品・化粧品産業の成長がパウチ・真空袋の需要を押し上げる 206

10.4.5 スペイン 210

10.4.5.1 利便性とすぐに食べられる食事に対する消費者の嗜好の高まりが持続可能な包装需要を牽引 210

10.4.6 ロシア 214

10.4.6.1 冷凍食品・飲料需要の急増が市場を牽引 214

10.4.7 その他のヨーロッパ 218

10.5 中東・アフリカ 222

10.5.1 GCC諸国 229

10.5.1.1 サウジアラビア 233

10.5.1.1.1 eコマース事業者の増加が市場を牽引 233

10.5.1.2 アラブ首長国連邦 237

10.5.1.2.1 漏れのない生分解性基油へのニーズの高まりが市場を牽引 237

10.5.1.3 その他のGCC諸国 241

10.5.2 南アフリカ 245

10.5.2.1 食品・飲料、製薬産業の拡大が市場を押し上げる 245

10.5.3 その他の中東・アフリカ 249

10.6 南米 253

10.6.1 ブラジル 260

10.6.1.1 急速な経済成長が革新的な包装オプションの需要を押し上げる 260

包装オプションの需要が高まる 260

10.6.2 アルゼンチン 264

10.6.2.1 食品包装需要の増加が市場を牽引 264

10.6.3 その他の南米地域 268

11 競争環境 273

11.1 概要 273

11.2 主要企業の戦略 273

11.3 市場シェア分析 276

11.3.1 市場ランキング分析 277

11.4 収益分析 279

11.5 企業評価と財務指標 280

11.6 製品・ブランド比較分析 281

11.7 企業評価マトリックス:主要企業、2023年 282

11.7.1 スター企業 282

11.7.2 新興リーダー 282

11.7.3 浸透型プレーヤー 282

11.7.4 参加企業 282

11.7.5 企業フットプリント:主要プレーヤー(2023年) 284

11.7.5.1 企業フットプリント 284

11.7.5.2 地域別フットプリント 285

11.7.5.3 パッケージングタイプのフットプリント 286

11.7.5.4 用途別フットプリント 287

11.7.5.5 素材フットプリント 288

11.7.5.6 印刷技術のフットプリント 289

11.8 企業評価マトリクス:新興企業/中小企業(2023年) 289

11.8.1 先進的企業 289

11.8.2 対応力のある企業 289

11.8.3 ダイナミックな企業 290

11.8.4 スタートアップ・ブロック 290

11.8.5 競争ベンチマーキング:新興企業/SM(2023年) 291

11.8.5.1 主要新興企業/中小企業の詳細リスト 291

11.8.5.2 主要新興企業/中小企業の競合ベンチマーキング 292

11.9 競争シナリオと動向 294

11.9.1 製品上市 294

11.9.2 取引 303

11.9.3 事業拡大 319

12 企業プロファイル 328

12.1 主要企業 328

Amcor Plc(オーストラリア)

Berry Global Group Inc.(米国)

Sonoco Products Company(米国)

MONDI(英国)

Sealed Air(米国)

Huhtamaki Oyj(フィンランド)

Constantia Flexibles(オーストリア)

Transcontinental Inc.(カナダ)

13 隣接・関連市場 424

13.1 はじめに 424

13.2 軟質プラスチック包装市場 424

13.2.1 市場の定義 424

13.2.2 市場概要 424

13.2.3 軟質プラスチック包装市場:用途別 424

13.2.4 軟質プラスチック包装市場:材料別 426

13.2.5 軟質プラスチック包装市場:包装タイプ別 428

13.2.6 軟質プラスチック包装市場:印刷技術別 430

13.2.7 軟質プラスチック包装市場:地域別 431

14 付録 433

14.1 ディスカッションガイド 433

14.2 Knowledgestore: Marketsandmarketsの購読ポータル 437

14.3 カスタマイズオプション 439

14.4 関連レポート 439

14.5 著者の詳細 440

The five types of packaging include pouches, bags, roll stocks, films and wraps, and others. Pouches are the most leading type in flexible packaging, representing the largest market share. Key advantages of pouches are low weight, reusability, vacuum sealing, and a low package-to-product ratio. In the food and beverage industry, the demand for pouches is at the highest because it finds applications to pack items like tea, coffee, milk, ketchup, and many others.

"By Packaging Type, Pouches accounted for the highest CAGR during the forecast period"

Flexible pouch-based packaging is widely used in the food and beverage sector for packaging milk, tea, coffee, ketchup, etc. Pouches are also a favorite for bulk coffee or for foods such as dried/smoked meats. They are easy to use, can be heat sealed, and they are available in handy sizes and formats. The reasons for their popularity in the food and beverage sector are excellent properties, such as low weight, reusability, vacuum sealing, and a low package-to-product ratio.

"By Material, Plastic accounted for the highest CAGR during the forecast period"

Flexible packaging products are produced from raw materials such as paper, plastic, and metal. Plastic flexible packaged items like pouches and films are used to pack all kinds of products, from soaps, detergents, snacks, namkeen, ketchup, chocolates, candies to other food items. Flexible plastic packaging grows much faster than rigid plastic packaging, which not only serves multiple purposes, extending shelf life, ensuring food safety, and providing sufficient barrier protection against heat, pathogens, and other external factors.

"By End Use Industry, Personal care and cosmetics accounted for the highest CAGR during the forecast period"

Flexible packaging offers solutions to the beauty industry that are appealing for educated, eco-conscious consumers. Also, its airtight design provides a sturdy protective barrier that helps in maintaining the freshness of powders, gels and oils sold by personal care and cosmetics companies. Flexible packaging products are used in a various of items, such as soaps, cosmetics and perfumes, in addition to facial tissues and napkins.

"By Printing Technology, Flexography accounted for the highest CAGR during the forecast period"

Flexography is commonly use in flexible packaging printing. The process in flexography includes image preparation, plate making, printing, and finishing. What sets flexography apart from all other printing processes is the use of plates that are made from flexible materials including plastic, rubber, and UV-sensitive polymer. Flexography inks are low in viscosity which dries fast, hence the whole process is hastened, speeding up the production process and saving costs in production.

"APAC is projected to account for the highest CAGR in the flexible packaging market during the forecast period"

The Asia Pacific region, including India, China, Japan, Australia, South Korea, and the rest of Asia Pacific, is the fastest growing region in the flexible packaging market. In India, China, and Japan, this market has been expected to grow drastically because of the increased development activities and fast economic expansion happening in these countries. Additionally, the upward trend for rising urbanization in these countries leads to a large customer base for food, beverages, and FMCG products, which contributes to market growth during the forecast period.

• By Company Type: Tier 1: 40%, Tier 2: 25%, Tier 3: 35%

• By Designation: C Level: 35%, Director Level: 30%, Others: 35%

• By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, Middle East & Africa: 5%, and South America: 5%.

Companies Covered:

Companies Covered: Amcor Plc (Australia), Berry Global Group Inc. (US), Sonoco Products Company (US), MONDI (UK), Sealed Air (US), Huhtamaki Oyj (Finland), Constantia Flexibles (Austria), Transcontinental Inc. (Canada) are some key players in Flexible Packaging Market.

Research Coverage

The market study covers the flexible packaging market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, application, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the flexible packaging market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall flexible packaging market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (growing demand from E-commerce growth), restraints (Non-availability of efficient recycling infrastructure), opportunities (Growing demand for sustainable packaging), and challenges (Rapid changes in technologies) influencing the growth of the flexible packaging market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the flexible packaging market

• Market Development: Comprehensive information about profitable markets – the report analyses the flexible packaging market across varied regions

• Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the flexible packaging market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as Amcor Plc (Australia), Berry Global Group Inc. (US), Smurfit WestRock (Ireland), Sonoco Products Company (US), MONDI (UK), Sealed Air (US), Huhtamaki Oyj (Finland), Constantia Flexibles (Austria), Transcontinental Inc. (Canada) and among others in the flexible packaging market. The report also helps stakeholders understand the pulse of the flexible packaging market and provides them with information on key market drivers, restraints, challenges, and opportunities.

1 INTRODUCTION 36

1.1 STUDY OBJECTIVES 36

1.2 MARKET DEFINITION 36

1.3 STUDY SCOPE 37

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 37

1.3.2 INCLUSIONS AND EXCLUSIONS 38

1.3.3 YEARS CONSIDERED 38

1.4 CURRENCY CONSIDERED 39

1.5 UNIT CONSIDERED 39

1.6 STAKEHOLDERS 39

1.7 SUMMARY OF CHANGES 39

2 RESEARCH METHODOLOGY 40

2.1 RESEARCH DATA 40

2.1.1 SECONDARY DATA 41

2.1.1.1 List of key secondary sources 41

2.1.1.2 Key data from secondary sources 42

2.1.2 PRIMARY DATA 42

2.1.2.1 Key data from primary sources 42

2.1.2.2 Key industry insights 43

2.1.2.3 Breakdown of interviews with experts 43

2.2 MARKET SIZE ESTIMATION 44

2.2.1 BOTTOM-UP APPROACH 44

2.2.2 TOP-DOWN APPROACH 45

2.3 DATA TRIANGULATION 46

2.4 FACTOR ANALYSIS 47

2.5 RESEARCH ASSUMPTIONS 47

2.6 RESEARCH LIMITATIONS 48

2.7 RISK ASSESSMENT 48

3 EXECUTIVE SUMMARY 49

4 PREMIUM INSIGHTS 53

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLEXIBLE PACKAGING MARKET 53

4.2 FLEXIBLE PACKAGING MARKET, BY MATERIAL 53

4.3 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE 54

4.4 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY 54

4.5 FLEXIBLE PACKAGING MARKET, BY APPLICATION 55

4.6 ASIA PACIFIC FLEXIBLE PACKAGING MARKET, BY REGION AND APPLICATION 55

4.7 FLEXIBLE PACKAGING MARKET, BY KEY COUNTRY 56

5 MARKET OVERVIEW 57

5.1 INTRODUCTION 57

5.2 MARKET DYNAMICS 57

5.2.1 DRIVERS 58

5.2.1.1 Growth of E-commerce platform 58

5.2.1.2 Cost-effectiveness and enhanced product shelf life 58

5.2.1.3 Rising demand for disposable packaging from end-use industries 59

5.2.1.4 Growing concerns toward sustainability 59

5.2.2 RESTRAINTS 60

5.2.2.1 Non-availability of efficient recycling infrastructure 60

5.2.2.2 Surge in raw material price 60

5.2.3 OPPORTUNITIES 61

5.2.3.1 Growing demand for sustainable packaging 61

5.2.3.2 Preference for flexible packaging over traditional packaging 61

5.2.4 CHALLENGES 61

5.2.4.1 Rapid technological advancements hampering sale of

traditional packaging 61

5.2.4.2 Supply chain disruptions 61

5.3 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS 62

5.4 PRICING ANALYSIS 64

5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL 64

5.4.2 AVERAGE SELLING PRICE TREND, BY REGION 64

5.5 VALUE CHAIN ANALYSIS 65

5.6 ECOSYSTEM ANALYSIS 67

5.7 TECHNOLOGY ANALYSIS 69

5.7.1 KEY TECHNOLOGIES 69

5.7.1.1 Various printing methods for flexible products 69

5.7.1.2 Form Fill Seal machine for flexible packaging 69

5.7.2 COMPLEMENTARY TECHNOLOGIES 70

5.7.2.1 Stretchable paper for novel paper applications 70

5.7.2.2 Edible and biodegradable packaging 70

5.7.3 ADJACENT TECHNOLOGIES 70

5.7.3.1 Packaging automation 70

5.8 IMPACT OF GEN AI/AI ON FLEXIBLE PACKAGING MARKET 71

5.9 PATENT ANALYSIS 72

5.9.1 INTRODUCTION 72

5.9.2 METHODOLOGY 72

5.9.3 FLEXIBLE PACKAGING MARKET, PATENT ANALYSIS 72

5.10 TRADE ANALYSIS 77

5.10.1 EXPORT SCENARIO (HS CODE 3920) 77

5.10.2 IMPORT SCENARIO (HS CODE 3920) 78

5.10.3 EXPORT SCENARIO (HS CODE 48) 78

5.10.4 IMPORT SCENARIO (HS CODE 48) 79

5.11 KEY CONFERENCES AND EVENTS IN 2024–2025 79

5.12 TARIFF AND REGULATORY LANDSCAPE 80

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 80

5.12.2 REGULATIONS IN FLEXIBLE PACKAGING MARKET 86

5.12.2.1 The Fair Packaging and Labeling Act (FPLA) (US) 86

5.12.2.2 Packaging and Packaging Waste Directive (94/62/EC) (EU) 86

5.12.2.3 Essential Requirements for Packaging (EN 13427, EN 13428) 86

5.12.2.4 New EU Packaging Regulation (PPWR) 86

5.12.3 AVERAGE TARIFF RATES 87

5.13 PORTER’S FIVE FORCES ANALYSIS 88

5.13.1 THREAT OF NEW ENTRANTS 89

5.13.2 THREAT OF SUBSTITUTES 89

5.13.3 BARGAINING POWER OF BUYERS 89

5.13.4 BARGAINING POWER OF SUPPLIERS 90

5.13.5 INTENSITY OF COMPETITIVE RIVALRY 90

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA 91

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS 91

5.14.2 BUYING CRITERIA 92

5.15 CASE STUDY ANALYSIS 93

5.15.1 PAPERPAK PARTNERS WITH KATHMANDU FOR BIODEGRADABLE AND COMPOSTABLE SOLUTIONS 93

5.15.2 PAPERPAK’S REFINED BAG FOR HARPER, INC. TO MEET

SUSTAINABILITY DEMAND 93

5.15.3 AMCOR’S 30% RECYCLED CONTENT PACKAGING REDUCES

VIRGIN PLASTIC USAGE 94

5.16 MACROECONOMIC INDICATORS 94

5.16.1 INTRODUCTION 94

5.16.2 GDP TRENDS AND FORECASTS 94

5.17 INVESTMENT AND FUNDING SCENARIO 95

6 FLEXIBLE PACKAGING MARKET, BY MATERIAL 97

6.1 INTRODUCTION 98

6.2 PLASTIC 99

6.2.1 MOST WIDELY USED MATERIAL IN FLEXIBLE PACKAGING 99

6.3 PAPER 101

6.3.1 PROVIDES CONVENIENT STORAGE AND FUNCTIONAL PACKAGING 101

6.4 METAL 102

6.4.1 EFFECTIVE BARRIER AGAINST MOISTURE, ENHANCING

SHELF LIFE OF PRODUCTS 102

7 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE 105

7.1 INTRODUCTION 106

7.2 POUCHES 107

7.2.1 ECONOMICAL AND HEAT-SEALABLE WITH EFFICIENT PACKAGING 107

7.3 BAGS 109

7.3.1 WIDELY USED IN PROCESSED FOOD PACKAGING 109

7.4 ROLLSTOCK 111

7.4.1 DESIGNED TO INCREASE SHELF LIFE AND TRANSPARENCY 111

7.5 FILMS & WRAPS 113

7.5.1 RISING DEMAND DUE TO INCREASING ONLINE SALES AND E-COMMERCE 113

7.6 OTHER PACKAGING TYPES 114

8 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY 117

8.1 INTRODUCTION 118

8.2 FLEXOGRAPHY 119

8.2.1 WIDELY USED IN IMAGE PRINTING AND PLATE MAKING 119

8.3 ROTOGRAVURE 120

8.3.1 PROVIDES HIGH-QUALITY PRINT WITH FINE IMAGES 120

8.4 DIGITAL PRINTING 120

8.4.1 REDUCES ENVIRONMENTAL IMPACT AND MINIMIZES WASTE 120

8.5 OTHER PRINTING TECHNOLOGIES 120

9 FLEXIBLE PACKAGING MARKET, BY APPLICATION 122

9.1 INTRODUCTION 123

9.2 FOOD 125

9.2.1 RISING UTILIZATION OF CONVENIENCE FOODS TO BOOST MARKET 125

9.3 BEVERAGES 126

9.3.1 SHIFT IN CONSUMER PREFERENCE TO DRIVE MARKET 126

9.4 PHARMACEUTICAL & HEALTHCARE 128

9.4.1 RISE IN DEMAND FOR PHARMACEUTICAL PRODUCTS TO DRIVE MARKET 128

9.5 PERSONAL CARE & COSMETICS 130

9.5.1 AFFORDABLE SMALL-SIZE PACKAGING TO BOOST DEMAND 130

9.6 OTHER APPLICATIONS 131

10 FLEXIBLE PACKAGING MARKET, BY REGION 133

10.1 INTRODUCTION 134

10.2 ASIA PACIFIC 141

10.2.1 CHINA 148

10.2.1.1 Growth of e-commerce industry to drive market 148

10.2.2 INDIA 152

10.2.2.1 High demand from organized retail and e-commerce sectors

to drive market 152

10.2.3 JAPAN 156

10.2.3.1 Rapid urbanization and evolving consumer demands to drive market 156

10.2.4 SOUTH KOREA 160

10.2.4.1 Evolving lifestyles and increasing retail food sales to drive market 160

10.2.5 REST OF ASIA PACIFIC 164

10.3 NORTH AMERICA 168

10.3.1 US 175

10.3.1.1 Established e-commerce platforms to propel growth 175

10.3.2 CANADA 179

10.3.2.1 Rising demand from food & beverage industries to drive market 179

10.3.3 MEXICO 183

10.3.3.1 Dominance of major e-commerce platforms to drive market 183

10.4 EUROPE 187

10.4.1 GERMANY 194

10.4.1.1 Thriving food & beverage sector to boost demand for portable packaging products 194

10.4.2 UK 198

10.4.2.1 Adoption of sustainable packaging initiatives to drive market 198

10.4.3 FRANCE 202

10.4.3.1 Expansion of food and pharmaceutical industries to drive market 202

10.4.4 ITALY 206

10.4.4.1 Growth of agri-food and cosmetics industries to boost demand for pouches and vacuum-sealed bags 206

10.4.5 SPAIN 210

10.4.5.1 Evolving consumer preferences for convenience and ready–to–eat meals to drive demand for sustainable packaging 210

10.4.6 RUSSIA 214

10.4.6.1 Surge in demand for frozen foods and beverages to drive market 214

10.4.7 REST OF EUROPE 218

10.5 MIDDLE EAST & AFRICA 222

10.5.1 GCC COUNTRIES 229

10.5.1.1 Saudi Arabia 233

10.5.1.1.1 Growing number of e-commerce businesses to drive market 233

10.5.1.2 UAE 237

10.5.1.2.1 Pressing need for leakproof and biodegradable base oils to drive market 237

10.5.1.3 Rest of GCC countries 241

10.5.2 SOUTH AFRICA 245

10.5.2.1 Expansion of food & beverage and pharmaceutical industries to boost market 245

10.5.3 REST OF MIDDLE EAST & AFRICA 249

10.6 SOUTH AMERICA 253

10.6.1 BRAZIL 260

10.6.1.1 Rapid economic growth to boost demand for innovative

packaging options 260

10.6.2 ARGENTINA 264

10.6.2.1 Rising demand for food packaging to drive market 264

10.6.3 REST OF SOUTH AMERICA 268

11 COMPETITIVE LANDSCAPE 273

11.1 OVERVIEW 273

11.2 KEY PLAYER STRATEGIES 273

11.3 MARKET SHARE ANALYSIS 276

11.3.1 MARKET RANKING ANALYSIS 277

11.4 REVENUE ANALYSIS 279

11.5 COMPANY VALUATION AND FINANCIAL METRICS 280

11.6 PRODUCT/BRAND COMPARISON ANALYSIS 281

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 282

11.7.1 STARS 282

11.7.2 EMERGING LEADERS 282

11.7.3 PERVASIVE PLAYERS 282

11.7.4 PARTICIPANTS 282

11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 284

11.7.5.1 Company footprint 284

11.7.5.2 Region footprint 285

11.7.5.3 Packaging type footprint 286

11.7.5.4 Application footprint 287

11.7.5.5 Material footprint 288

11.7.5.6 Printing technology footprint 289

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 289

11.8.1 PROGRESSIVE COMPANIES 289

11.8.2 RESPONSIVE COMPANIES 289

11.8.3 DYNAMIC COMPANIES 290

11.8.4 STARTING BLOCKS 290

11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 291

11.8.5.1 Detailed list of key startups/SMEs 291

11.8.5.2 Competitive benchmarking of key startups/SMEs 292

11.9 COMPETITIVE SCENARIO AND TRENDS 294

11.9.1 PRODUCT LAUNCHES 294

11.9.2 DEALS 303

11.9.3 EXPANSIONS 319

12 COMPANY PROFILES 328

12.1 KEY PLAYERS 328

12.1.1 AMCOR PLC 328

12.1.1.1 Business overview 328

12.1.1.2 Products/Solutions/Services offered 329

12.1.1.3 Recent developments 331

12.1.1.3.1 Product launches 331

12.1.1.3.2 Deals 333

12.1.1.3.3 Expansions 335

12.1.1.4 MnM view 336

12.1.1.4.1 Right to win 336

12.1.1.4.2 Strategic choices 336

12.1.1.4.3 Weaknesses & competitive threats 336

12.1.2 BERRY GLOBAL INC. 337

12.1.2.1 Business overview 337

12.1.2.2 Products/Solutions/Services offered 338

12.1.2.3 Recent developments 340

12.1.2.3.1 Product launches 340

12.1.2.3.2 Deals 341

12.1.2.3.3 Expansions 344

12.1.2.4 MnM view 346

12.1.2.4.1 Right to win 346

12.1.2.4.2 Strategic choices 346

12.1.2.4.3 Weaknesses & competitive threats 347

12.1.3 WESTROCK COMPANY 348

12.1.3.1 Business overview 348

12.1.3.2 Products/Solutions/Services offered 350

12.1.3.3 Recent developments 351

12.1.3.3.1 Product launches 351

12.1.3.3.2 Deals 351

12.1.3.3.3 Expansions 353

12.1.3.4 MnM view 353

12.1.3.4.1 Right to win 353

12.1.3.4.2 Strategic choices 353

12.1.3.4.3 Weaknesses and competitive threats 353

12.1.4 SMURFIT KAPPA GROUP 354

12.1.4.1 Business overview 354

12.1.4.2 Products/Solutions/Services offered 356

12.1.4.3 Recent developments 357

12.1.4.3.1 Product launches 357

12.1.4.3.2 Deals 357

12.1.4.3.3 Expansions 358

12.1.4.4 MnM view 359

12.1.4.4.1 Right to win 359

12.1.4.4.2 Strategic choices 359

12.1.4.4.3 Weaknesses and competitive threats 359

12.1.5 SONOCO PRODUCTS COMPANY 360

12.1.5.1 Business overview 360

12.1.5.2 Products/Solutions/Services offered 361

12.1.5.3 Recent developments 362

12.1.5.3.1 Product launches 362

12.1.5.3.2 Deals 363

12.1.5.3.3 Expansions 364

12.1.5.4 MnM view 364

12.1.5.4.1 Right to win 364

12.1.5.4.2 Strategic choices 365

12.1.5.4.3 Weaknesses and competitive threats 365

12.1.6 MONDI 366

12.1.6.1 Business overview 366

12.1.6.2 Products/Solutions/Services offered 367

12.1.6.3 Recent developments 368

12.1.6.3.1 Product launches 368

12.1.6.3.2 Deals 371

12.1.6.3.3 Expansions 375

12.1.6.4 MnM view 377

12.1.6.4.1 Right to win 377

12.1.6.4.2 Strategic choices 377

12.1.6.4.3 Weakness and competitive threats 378

12.1.7 SEALED AIR 379

12.1.7.1 Business overview 379

12.1.7.2 Products/Solutions/Services offered 380

12.1.7.3 Recent developments 381

12.1.7.3.1 Product launches 381

12.1.7.3.2 Deals 382

12.1.7.3.3 Expansions 383

12.1.7.4 MnM view 383

12.1.8 HUHTAMAKI OYJ 385

12.1.8.1 Business overview 385

12.1.8.2 Products/Solutions/Services offered 386

12.1.8.3 Recent developments 388

12.1.8.3.1 Product launches 388

12.1.8.3.2 Deals 389

12.1.8.3.3 Expansions 391

12.1.8.4 MnM view 391

12.1.8.4.1 Right to win 391

12.1.8.4.2 Strategic choices 392

12.1.8.4.3 Weaknesses and competitive threats 392

12.1.9 CONSTANTIA FLEXIBLES 393

12.1.9.1 Business overview 393

12.1.9.2 Products/Solutions/Services offered 394

12.1.9.3 Recent developments 395

12.1.9.3.1 Product launches 395

12.1.9.3.2 Deals 397

12.1.9.3.3 Expansions 399

12.1.9.4 MnM view 400

12.1.10 TRANSCONTINENTAL INC. 401

12.1.10.1 Business overview 401

12.1.10.2 Products/Solutions/Services offered 402

12.1.10.3 Recent developments 403

12.1.10.3.1 Product launches 403

12.1.10.3.2 Deals 404

12.1.10.3.3 Expansions 405

12.1.10.4 MnM view 405

12.1.11 BISCHOF+KLEIN SE & CO. KG 406

12.1.11.1 Business overview 406

12.1.11.2 Products/Solutions/Services offered 406

12.1.11.3 Recent developments 407

12.1.11.3.1 Deals 408

12.1.11.3.2 Expansions 409

12.1.11.4 MnM view 409

12.2 OTHER PLAYERS 410

12.2.1 DS SMITH 410

12.2.2 PROAMPAC 411

12.2.3 UFLEX LIMITED 412

12.2.4 NOVOLEX 413

12.2.5 SILAFRICA 414

12.2.6 ALUFLEXPACK AG 415

12.2.7 PPC FLEX COMPANY, INC. 416

12.2.8 PRINTPACK, INC. 417

12.2.9 NOVUS HOLDINGS LTD. 418

12.2.10 AHLSTROM 419

12.2.11 WIHURI GROUP 420

12.2.12 C-P FLEXIBLE PACKAGING 421

12.2.13 COSMO FILMS 422

12.2.14 GUALA PACK S.P.A. 423

13 ADJACENT & RELATED MARKET 424

13.1 INTRODUCTION 424

13.2 FLEXIBLE PLASTIC PACKAGING MARKET 424

13.2.1 MARKET DEFINITION 424

13.2.2 MARKET OVERVIEW 424

13.2.3 FLEXIBLE PLASTIC PACKAGING MARKET, BY APPLICATION 424

13.2.4 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL 426

13.2.5 FLEXIBLE PLASTIC PACKAGING MARKET, BY PACKAGING TYPE 428

13.2.6 FLEXIBLE PLASTIC PACKAGING MARKET, BY PRINTING TECHNOLOGY 430

13.2.7 FLEXIBLE PLASTIC PACKAGING MARKET, BY REGION 431

14 APPENDIX 433

14.1 DISCUSSION GUIDE 433

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 437

14.3 CUSTOMIZATION OPTIONS 439

14.4 RELATED REPORTS 439

14.5 AUTHOR DETAILS 440

❖ 世界の軟包装市場に関するよくある質問(FAQ) ❖

・軟包装の世界市場規模は?

→MarketsandMarkets社は2024年の軟包装の世界市場規模を2915億6000万米ドルと推定しています。

・軟包装の世界市場予測は?

→MarketsandMarkets社は2029年の軟包装の世界市場規模を3688億2000万米ドルと予測しています。

・軟包装市場の成長率は?

→MarketsandMarkets社は軟包装の世界市場が2024年~2029年に年平均4.8%成長すると予測しています。

・世界の軟包装市場における主要企業は?

→MarketsandMarkets社は「Amcor Plc(オーストラリア)、Berry Global Group Inc.(米国)、Sonoco Products Company(米国)、MONDI(英国)、Sealed Air(米国)、Huhtamaki Oyj(フィンランド)、Constantia Flexibles(オーストリア)、Transcontinental Inc.(カナダ)など ...」をグローバル軟包装市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。