1 はじめに 30

1.1 調査目的 30

1.2 市場の定義 30

1.3 調査範囲 31

1.3.1 対象市場と地域範囲 31

1.3.2 対象範囲と除外範囲 32

1.3.3 考慮した年数 33

1.4 考慮した通貨 33

1.5 単位の考慮 33

1.6 制限事項 33

1.7 利害関係者 34

1.8 変更点のまとめ 34

2 調査方法 35

2.1 調査データ 35

2.1.1 二次データ 36

2.1.1.1 二次資料からの主要データ 36

2.1.2 一次データ 36

2.1.2.1 一次ソースからの主要データ 37

2.1.2.2 主要な業界インサイト 37

2.2 市場規模の推定 38

2.3 データ三角測量 40

2.4 要因分析 41

2.5 リサーチの前提条件 42

2.6 調査の限界とリスク評価 42

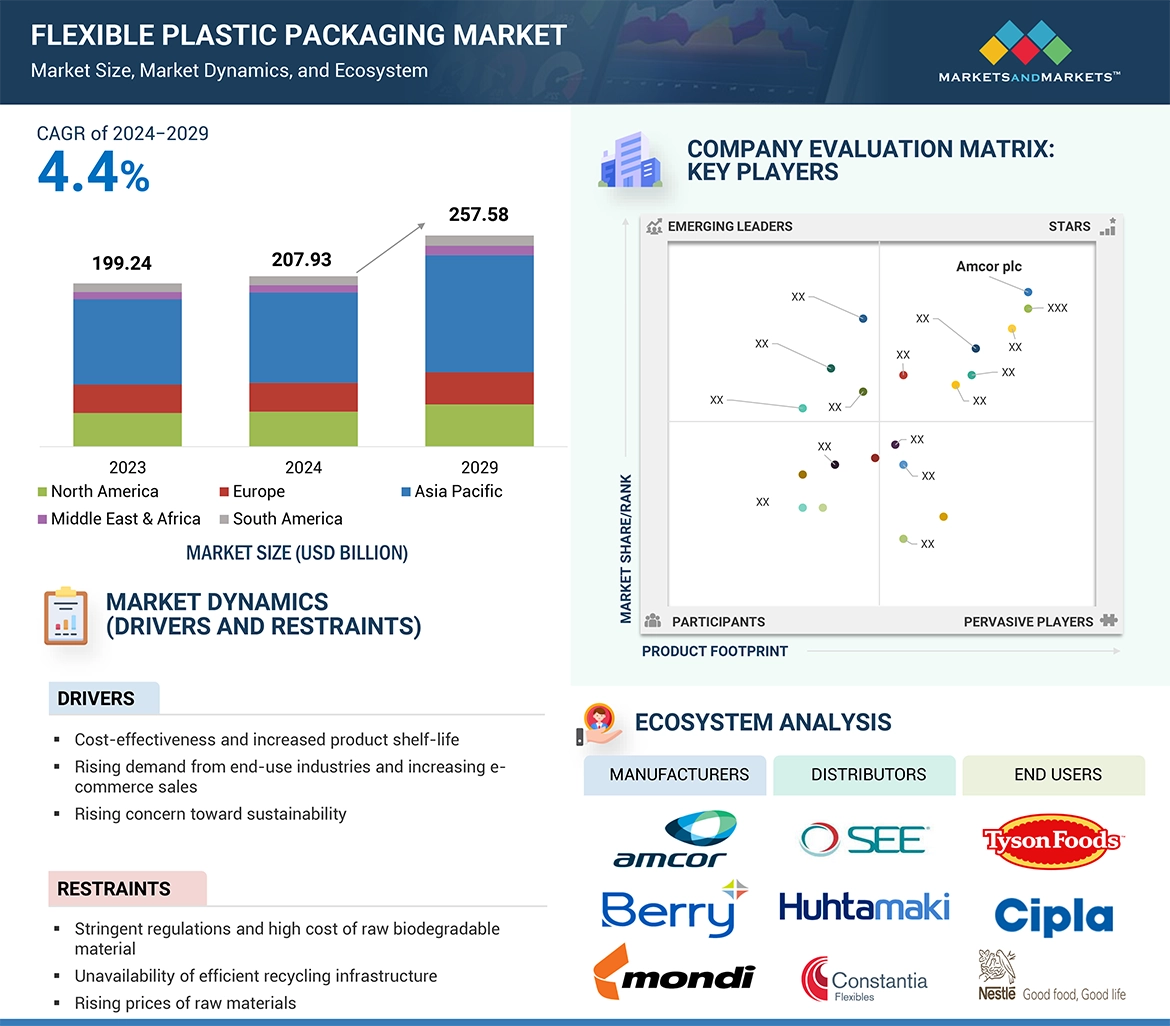

3 エグゼクティブサマリー 43

4 プレミアムインサイト 48

4.1 軟質プラスチック包装市場におけるプレーヤーの魅力的な機会 48

4.2 アジア太平洋地域の軟質プラスチック包装市場:用途別、国別 49

4.3 軟質プラスチック包装市場:包装タイプ別 49

4.4 軟質プラスチック包装市場:用途別 50

4.5 軟質プラスチック包装市場:印刷技術別 50

4.6 軟質プラスチック包装市場:材料別 51

4.7 軟質プラスチック包装市場:国別 51

5 市場の概要 52

5.1 はじめに 52

5.2 市場ダイナミクス 52

5.2.1 ドライバー 53

5.2.1.1 コスト効率と製品保存期間の延長 53

5.2.1.2 最終用途産業からの需要の高まりと電子商取引の増加 53

電子商取引の増加 53

5.2.1.3 持続可能性に関する懸念の高まり 54

5.2.2 足かせ 55

5.2.2.1 軟質プラスチック包装に関する厳しい規制と生分解性プラスチック原料の高

生分解性原料の高コスト 55

5.2.2.2 原材料価格の上昇 56

5.2.3 機会 57

5.2.3.1 消費者の需要と嗜好の高まりに対応した持続可能な包装ソリューションの導入 57

5.2.3.2 従来の包装材料のより良い代替 57

5.2.4 課題 58

5.2.4.1 絶え間なく変化する顧客の需要に対応するため、軟質プラスチック包装技術の革新と改善への絶え間ない圧力 58

5.2.4.2 プラスチックのリサイクル性 59

6 業界動向 60

6.1 顧客ビジネスに影響を与えるトレンド/混乱 60

6.2 価格分析 61

6.2.1 主要企業の平均販売価格動向(包装タイプ別) 62

6.2.2 平均販売価格動向(地域別) 62

6.3 バリューチェーン分析 63

6.4 エコシステム分析 64

6.5 技術分析 65

6.5.1 主要技術 65

6.5.1.1 バリアコーティング 65

6.5.1.2 デジタル印刷 65

6.5.2 補完技術 66

6.5.2.1 インテリジェント包装 66

6.5.2.2 高度な密封技術 66

6.6 AI/GENAIの軟質プラスチック包装市場への影響 66

6.7 特許分析 67

6.7.1 導入 67

6.7.2 アプローチ 68

6.7.3 上位出願者 68

6.8 貿易分析 72

6.8.1 輸出シナリオ(HSコード3920) 72

6.8.2 輸入シナリオ(HSコード3920) 73

6.9 主要会議とイベント(2024-2025年) 74

6.10 関税と規制の状況 74

6.10.1 関税分析 75

6.10.2 規制機関、政府機関、その他の組織 76

6.10.3 主な規制と基準 80

6.10.3.1 REACH規則(EU)10/2011および(EC)1935/2004 80

6.10.3.2 ISO規格 81

6.11 ポーターの5つの力分析 81

6.11.1 新規参入の脅威 82

6.11.2 代替品の脅威 82

6.11.3 供給者の交渉力 82

6.11.4 買い手の交渉力 83

6.11.5 競争の激しさ 83

6.12 主要ステークホルダーと購買基準 83

6.12.1 購入プロセスにおける主要ステークホルダー 83

6.12.2 購買基準 84

6.13 ケーススタディ分析 85

6.13.1 シールドエアのクライオバック・ブランドのダーフレッシュ・トレー/スキン真空包装は売上増に貢献 85

6.13.2 リサイクル率30%のアムコアの包装は

サステナビリティの需要に対応 85

6.13.3 モンディのポリプロピレン(PP)ベースのウォレットパック包装は持続可能性に貢献 86

6.14 マクロ経済の展望 86

6.14.1 導入 86

6.14.2 GDPの動向と予測 87

6.15 投資と資金調達のシナリオ 88

6.15.1 投資と資金調達のシナリオ 88

6.15.2 資金調達(製品別) 89

7 軟質プラスチック包装市場:素材別 90

7.1 はじめに 91

7.2 プラスチック 92

7.2.1 高い柔軟性、耐久性、劣化への耐性が需要を牽引 92

が需要を牽引 92

7.2.2 ポリプロピレン(pp) 94

7.2.2.1 二軸延伸ポリプロピレン(BOPP) 95

7.2.2.2 キャストポリプロピレン(CPP) 95

7.2.3 ポリエチレン 95

7.2.3.1 高密度ポリエチレン(HDPE) 95

7.2.3.2 低密度ポリエチレン(LDPE) 96

7.2.4 ポリ塩化ビニル 96

7.2.5 ポリエチレンテレフタレート(ペット) 96

7.2.6 エチレンビニルアセテート(EVA) 96

7.2.7 ポリアミド 97

7.2.8 ポリスチレン 97

7.2.9 バイオプラスチック 97

7.3 アルミニウム箔 98

7.3.1 優れたバリア特性と汎用性が需要を牽引 98

7.4 その他の素材 98

8 軟質プラスチック包装市場:包装タイプ別 99

8.1 はじめに 100

8.2 パウチ 102

8.2.1 柔軟性、費用対効果、利便性により食品・飲料、パーソナルケア製品、医薬品、家庭用製品での使用増加 が需要を牽引 102

8.2.2 スタンドアップパウチ 102

8.2.3 フラットパウチ 103

8.3 ロールストック 103

8.3.1 保存期間の延長と風味・香りの保持を目的とした利用の増加が市場を牽引 103

市場を牽引 103

8.4 袋 104

8.4.1 使いやすさ、携帯性、適応性が需要を後押し 104

8.5 フィルム&ラップ 105

8.5.1 パッケージングにおける耐久性、柔軟性、持続可能性

需要を促進する 105

8.6 その他の包装タイプ 105

9 軟質プラスチック包装市場:印刷技術別 106

9.1 はじめに 107

9.2 フレキソ印刷 109

9.2.1 軟質プラスチック包装用フレキソ印刷の革新とトレンドが市場を牽引 109

9.3 グラビア 109

9.3.1 軟質プラスチック包装向けの高速で高品質なソリューションが

が需要を牽引 109

9.4 デジタル印刷 110

9.4.1 迅速な納期、費用対効果の高いカスタマイズ、鮮やかなグラフィックによる高品質印刷が

鮮やかなグラフィックによる高品質印刷が需要を促進 110

9.5 その他の技術 110

10 軟質プラスチック包装市場:用途別 111

10.1 はじめに 112

10.2 食品 114

10.2.1 創造的デザインによる製品プレゼンテーションの向上と

と品質保持が需要を牽引 114

10.2.2 スナック菓子 114

10.2.3 冷凍食品 115

10.2.4 果物・野菜 115

10.2.5 乳製品 115

10.2.6 その他の食品 115

10.3 飲料 116

10.3.1 好況の飲料産業が需要を促進 116

10.4 医薬品・ヘルスケア 116

10.4.1 安全性、無菌性、持続可能性への需要に対応する能力

が市場を牽引 116

10.5 パーソナルケア&化粧品 117

10.5.1 製品の保存性、審美性の向上、

持続可能性が需要を牽引 117

10.6 その他の用途 118

11 軟質プラスチック包装市場:地域別 119

11.1 はじめに 120

11.2 北米 122

11.2.1 米国 127

11.2.1.1 ヘルスケア製品への支出の増加と技術革新が需要を牽引 127

が需要を牽引 127

11.2.2 カナダ 131

11.2.2.1 食品・飲料業界からの需要急増が市場を牽引 131

11.2.3 メキシコ 134

11.2.3.1 食品・飲料貿易の増加が市場成長にプラスの影響を与える 134

11.3 アジア太平洋地域 138

11.3.1 中国 143

11.3.1.1 食品貿易の増加と包装産業に関する政府主導のイニシアティブが

包装産業に関する政府主導の取り組みが市場を牽引

11.3.2 日本 147

11.3.2.1 都市化、高齢化の進展、進化する消費者需要が市場を牽引 147

11.3.3 インド 150

11.3.3.1 食品、医薬品、電子商取引産業における革新が市場を牽引 150

市場を牽引 150

11.3.4 韓国 154

11.3.4.1 ライフスタイルの変化と小売食品販売の増加が市場を牽引 154

11.3.5 その他のアジア太平洋地域 157

11.4 欧州 160

11.4.1 ドイツ 165

11.4.1.1 食品・飲料に対する消費者の嗜好の変化が需要を促進 165

11.4.2 イギリス 169

11.4.2.1 経済成長と食品・飲料・ヘルスケア産業の革新が市場を牽引 169

11.4.3 フランス 172

11.4.3.1 持続可能性の目標と技術の進歩が市場成長を促進 172

市場成長を促進 172

11.4.4 スペイン 175

11.4.4.1 化粧品・パーソナルケア産業の成長が市場を牽引 175

11.4.5 ロシア 178

11.4.5.1 環境に優しいソリューションに対する消費者需要の増加が市場を牽引 178

市場を牽引 178

11.4.6 イタリア 181

11.4.6.1 小売、食品、ヘルスケア産業の活況が需要を牽引 181

11.4.7 その他のヨーロッパ 184

11.5 中東・アフリカ 187

11.5.1 GCC諸国 192

11.5.1.1 サウジアラビア 195

11.5.1.1.1 医療・食品包装産業の高成長が市場を牽引

市場を牽引

11.5.1.2 アラブ首長国連邦 199

11.5.1.2.1 食品、潤滑油、基油の高い輸送量が需要を牽引 199

が需要を牽引 199

11.5.1.3 その他のGCC諸国 202

11.5.2 南アフリカ 205

11.5.2.1 成長する食品・飲料、製薬産業が市場を牽引 205

市場を牽引する 205

11.5.3 その他の中東・アフリカ地域 208

11.6 南米 211

11.6.1 ブラジル 216

11.6.1.1 経済成長が需要を促進 216

11.6.2 アルゼンチン 219

11.6.2.1 拡大する食品・飲料と牛肉輸出産業

市場を牽引 219

11.6.3 その他の南米地域 222

12 競争環境 226

12.1 概要 226

12.2 主要企業の戦略/勝利への権利 226

12.3 市場シェア分析 229

12.4 収益分析 232

12.5 企業評価と財務指標 232

12.6 製品/ブランド比較分析 234

12.7 企業評価マトリックス:主要企業、2023年 235

12.7.1 スター企業 235

12.7.2 新興リーダー 235

12.7.3 浸透型プレーヤー 235

12.7.4 参加企業 235

12.7.5 企業フットプリント:主要プレーヤー、2023年 237

12.7.5.1 企業フットプリント 237

12.7.5.2 パッケージングタイプのフットプリント 238

12.7.5.3 アプリケーションフットプリント 238

12.7.5.4 素材フットプリント 239

12.7.5.5 印刷技術のフットプリント 239

12.7.5.6 地域別フットプリント 240

12.8 企業評価マトリクス:新興企業/中小企業(2023年) 240

12.8.1 進歩的企業 240

12.8.2 対応力のある企業 240

12.8.3 ダイナミックな企業 241

12.8.4 スターティングブロック 241

12.8.5 競争ベンチマーキング:新興企業/SM(2023年) 242

12.8.5.1 主要新興企業・中小企業のリスト 242

12.8.5.2 主要新興企業/中小企業の競争ベンチマーク 243

12.9 競争シナリオ 245

12.9.1 製品上市 245

12.9.2 取引 249

12.9.3 事業拡大 258

13 企業プロファイル 263

13.1 主要企業 263

Amcor plc(オーストラリア)

Berry Global Inc.(米国)

Sonoco Products Company(米国)

Constantia Flexibles(オーストリア)

Huhtamaki Oyj(フィンランド)

Mondi(英国)

Sealed Air(米国)

Transcontinental Inc.(カナダ)

CCL Industries(カナダ)

Coveris(オーストリア)

Bischof+Klein SE & Co. KG(ドイツ)

14 隣接市場と関連市場 362

14.1 導入 362

14.2 制限 362

14.3 硬質プラスチック包装市場 363

14.3.1 市場の定義 363

14.3.2 市場概要 363

14.3.2.1 硬質プラスチック包装市場:原料別 363

14.3.2.2 硬質プラスチック包装市場:タイプ別 365

14.3.2.3 硬質プラスチック包装市場:用途別 366

14.3.2.4 硬質プラスチック包装市場:地域別 367

15 付録 368

15.1 ディスカッションガイド 368

15.2 Knowledgestore: Marketsandmarketsの購読ポータル 361

15.3 カスタマイズオプション 373

15.4 関連レポート

15.5 著者の詳細 374

The flexible plastic packaging market has continued to grow with drivers such as convenience, economy, and sustainability. It is lightweight and flexible, making the plastic packaging material suitable for a wide diversity of products, ranging from food to beverage to personal care. Innovative flexibility in plastic packaging resulted in more smart and active elements, such as embedded sensors and oxygen scavengers, which make the product stay fresher and safer for longer. High-barrier films improve moisture and oxygen resistance, and smart packaging allows for interactive consumer engagement with technologies such as QR codes, NFC tags, and sensors. These developments help consumers gain access to critical information, track freshness, and detect tampering, which all significantly add value to the experience of packaging. These factors are driving the growth of the flexible plastic packaging market.

“Flexography is the largest segment in the flexible plastic packaging market by printing technology”

Flexography holds a majority in the printing technology segment of the flexible plastic packaging market due to its versatility and efficiency for printing high-quality prints on various substrates. One of the main driving forces for flexographic printing growth is the expanding demand for sustainable packaging. Flexographic printing advantages include high-speed production, versatility across multiple substrates, cost-effective for large runs, quality prints, environmental benefits through eco-friendly inks, flexibility in customization, minimal generation of waste, and possible streamlining of productions by using in-line finishing processes. Flexography has adapted to demands for environmental considerations by using water-based inks and UV-LED curing systems, instead of energy-intensive dryers which save on energy and eliminate VOCs. This has ensured that flexographic printing remains at the forefront in the flexible plastic packaging market and continues growing.

“Food is the largest segment by applications in the flexible plastic packaging market”

The evolution of consumer lifestyle demanding convenience, ready-to-eat meals, and on-the-go snacks calls for flexible plastic packaging. It is a solution to meet the needs of this change, driving market growth in the food industry through extended shelf life and ensured food safety, preservation of quality, cost-efficient approaches, improved customer convenience, and innovations in design for better product presentation. The Food and Agriculture Organization of the United Nations asserts that global food production needs to surge by 70% to 2050. Hitting such high demand calls for perpetual innovation and growth in the food sector, especially in flexible plastic packaging solutions that can enhance product preservation, safety, and convenience. Recent advancements like Modified atmosphere packaging (MAP) can be defined as the enclosure of the food product in a package in which the percentage of the three principal gases (CO2, O2, and N2) is modified to provide an optimal atmosphere for retarding microbiological growth and deteriorative chemical processes. On the whole, the factors of convenience, sustainability, and improved preservation of product give rise to the food application segment dominating the market.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and the information gathered through secondary research.

The break-up of primary interviews is given below:

• By Department: Sales/Export/Marketing: 54%, Production: 23%, and CXOs: 23%

• By Designation: C Level: 54%, Director Level: 28%, and Others: 18%

• By Region: North America: 38%, Europe: 32%, Asia Pacific: 30%

Amcor plc (Australia), Berry Global Inc. (US), Sonoco Products Company (US), Constantia Flexibles (Austria), Huhtamaki Oyj (Finland), Mondi (UK), Sealed Air (US), Transcontinental Inc. (Canada), CCL Industries (Canada), Coveris (Austria), and Bischof+Klein SE & Co. KG (Germany) among others are some of the key players in the flexible plastic packaging market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the flexible plastic packaging market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on packaging type, material, printing technology, application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the flexible plastic packaging market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall flexible plastic packaging market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (Cost-effectiveness and increased product shelf life, Rising demand from end-use industries and increasing e-commerce sales, and Rising concerns toward sustainability), restraints (Stringent regulations and high cost of raw biodegradable material, Lack of efficient recycling infrastructure, and Rising prices of raw materials), opportunities (Implementing sustainable packaging solutions to meet growing consumer demand and preference, and Better substitute for traditional packaging materials), challenges (Constant pressure to innovate and improve to meet ever-changing customer demands and Recyclability of plastics).

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the flexible plastic packaging market

• Market Development: Comprehensive information about lucrative markets – the report analyses the flexible plastic packaging market across varied regions

• Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the flexible plastic packaging market

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Amcor plc (Australia), Berry Global Inc. (US), Sonoco Products Company (US), Constantia Flexibles (Austria), Huhtamaki Oyj (Finland), Mondi (UK), Sealed Air (US), Transcontinental Inc. (Canada), CCL Industries (Canada), Coveris (Austria), and Bischof+Klein SE & Co. KG (Germany) among others are the top manufacturers covered in the flexible plastic packaging market.

1 INTRODUCTION 30

1.1 STUDY OBJECTIVES 30

1.2 MARKET DEFINITION 30

1.3 STUDY SCOPE 31

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 31

1.3.2 INCLUSIONS AND EXCLUSIONS 32

1.3.3 YEARS CONSIDERED 33

1.4 CURRENCY CONSIDERED 33

1.5 UNIT CONSIDERED 33

1.6 LIMITATIONS 33

1.7 STAKEHOLDERS 34

1.8 SUMMARY OF CHANGES 34

2 RESEARCH METHODOLOGY 35

2.1 RESEARCH DATA 35

2.1.1 SECONDARY DATA 36

2.1.1.1 Key data from secondary sources 36

2.1.2 PRIMARY DATA 36

2.1.2.1 Key data from primary sources 37

2.1.2.2 Key industry insights 37

2.2 MARKET SIZE ESTIMATION 38

2.3 DATA TRIANGULATION 40

2.4 FACTOR ANALYSIS 41

2.5 RESEARCH ASSUMPTIONS 42

2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT 42

3 EXECUTIVE SUMMARY 43

4 PREMIUM INSIGHTS 48

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLEXIBLE PLASTIC PACKAGING MARKET 48

4.2 ASIA PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET, BY APPLICATION AND COUNTRY 49

4.3 FLEXIBLE PLASTIC PACKAGING MARKET, BY PACKAGING TYPE 49

4.4 FLEXIBLE PLASTIC PACKAGING MARKET, BY APPLICATION 50

4.5 FLEXIBLE PLASTIC PACKAGING MARKET, BY PRINTING TECHNOLOGY 50

4.6 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL 51

4.7 FLEXIBLE PLASTIC PACKAGING MARKET, BY COUNTRY 51

5 MARKET OVERVIEW 52

5.1 INTRODUCTION 52

5.2 MARKET DYNAMICS 52

5.2.1 DRIVERS 53

5.2.1.1 Cost-effectiveness and increased product shelf life 53

5.2.1.2 Rising demand from end-use industries and increasing

e-commerce sales 53

5.2.1.3 Growing concerns regarding sustainability 54

5.2.2 RESTRAINTS 55

5.2.2.1 Stringent regulations related to flexible plastic packaging and

high cost of raw biodegradable materials 55

5.2.2.2 Rising raw material prices 56

5.2.3 OPPORTUNITIES 57

5.2.3.1 Implementation of sustainable packaging solutions to meet growing consumer demand and preferences 57

5.2.3.2 Better substitute for traditional packaging materials 57

5.2.4 CHALLENGES 58

5.2.4.1 Constant pressure of innovation and improvement in flexible plastic packaging technology to meet ever-changing customer demands 58

5.2.4.2 Recyclability of plastics 59

6 INDUSTRY TRENDS 60

6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 60

6.2 PRICING ANALYSIS 61

6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PACKAGING TYPE 62

6.2.2 AVERAGE SELLING PRICE TREND, BY REGION 62

6.3 VALUE CHAIN ANALYSIS 63

6.4 ECOSYSTEM ANALYSIS 64

6.5 TECHNOLOGY ANALYSIS 65

6.5.1 KEY TECHNOLOGIES 65

6.5.1.1 Barrier coating 65

6.5.1.2 Digital printing 65

6.5.2 COMPLEMENTARY TECHNOLOGIES 66

6.5.2.1 Intelligent packaging 66

6.5.2.2 Advanced sealing techniques 66

6.6 IMPACT OF AI/GEN AI ON FLEXIBLE PLASTIC PACKAGING MARKET 66

6.7 PATENT ANALYSIS 67

6.7.1 INTRODUCTION 67

6.7.2 APPROACH 68

6.7.3 TOP APPLICANTS 68

6.8 TRADE ANALYSIS 72

6.8.1 EXPORT SCENARIO (HS CODE 3920) 72

6.8.2 IMPORT SCENARIO (HS CODE 3920) 73

6.9 KEY CONFERENCES AND EVENTS, 2024–2025 74

6.10 TARIFF AND REGULATORY LANDSCAPE 74

6.10.1 TARIFF ANALYSIS 75

6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 76

6.10.3 KEY REGULATIONS AND STANDARDS 80

6.10.3.1 REACH Regulation (EU) 10/2011 and (EC) 1935/2004 80

6.10.3.2 ISO Standards 81

6.11 PORTER’S FIVE FORCES ANALYSIS 81

6.11.1 THREAT OF NEW ENTRANTS 82

6.11.2 THREAT OF SUBSTITUTES 82

6.11.3 BARGAINING POWER OF SUPPLIERS 82

6.11.4 BARGAINING POWER OF BUYERS 83

6.11.5 INTENSITY OF COMPETITION RIVALRY 83

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA 83

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS 83

6.12.2 BUYING CRITERIA 84

6.13 CASE STUDY ANALYSIS 85

6.13.1 SEALED AIR’S CRYOVAC BRAND DARFRESH TRAY/SKIN VACUUM PACKAGING HELPS INCREASE SALES 85

6.13.2 AMCOR’S 30% RECYCLED CONTENT PACKAGING MEETS

SUSTAINABILITY DEMAND 85

6.13.3 MONDI’S WALLETPACK POLYPROPYLENE (PP)-BASED MONO-MATERIAL PACKAGING HELPS IN SUSTAINABILITY 86

6.14 MACRO-ECONOMIC OUTLOOK 86

6.14.1 INTRODUCTION 86

6.14.2 GDP TRENDS AND FORECASTS 87

6.15 INVESTMENT AND FUNDING SCENARIO 88

6.15.1 INVESTMENT AND FUNDING SCENARIO 88

6.15.2 FUNDING, BY PRODUCT 89

7 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL 90

7.1 INTRODUCTION 91

7.2 PLASTICS 92

7.2.1 HIGH FLEXIBILITY, DURABILITY, AND RESISTANCE TO DEGRADATION

TO DRIVE DEMAND 92

7.2.2 POLYPROPYLENE (PP) 94

7.2.2.1 Biaxially oriented polypropylene (BOPP) 95

7.2.2.2 Cast polypropylene (CPP) 95

7.2.3 POLYETHYLENE (PE) 95

7.2.3.1 High-density polyethylene (HDPE) 95

7.2.3.2 Low-density polyethylene (LDPE) 96

7.2.4 POLYVINYL CHLORIDE 96

7.2.5 POLYETHYLENE TEREPHTHALATE (PET) 96

7.2.6 ETHYLENE-VINYL ACETATE (EVA) 96

7.2.7 POLYAMIDES 97

7.2.8 POLYSTYRENE (PS) 97

7.2.9 BIOPLASTICS 97

7.3 ALUMINUM FOILS 98

7.3.1 EXCELLENT BARRIER PROPERTIES AND VERSATILITY TO DRIVE DEMAND 98

7.4 OTHER MATERIALS 98

8 FLEXIBLE PLASTIC PACKAGING MARKET, BY PACKAGING TYPE 99

8.1 INTRODUCTION 100

8.2 POUCHES 102

8.2.1 RISING USE IN FOOD & BEVERAGES, PERSONAL CARE PRODUCTS, PHARMACEUTICALS, AND HOUSEHOLD PRODUCTS DUE TO FLEXIBILITY, COST-EFFECTIVENESS, AND CONVENIENCE TO DRIVE DEMAND 102

8.2.2 STAND-UP POUCHES 102

8.2.3 FLAT POUCHES 103

8.3 ROLLSTOCK 103

8.3.1 INCREASING USE TO EXTEND SHELF LIFE AND PRESERVE FLAVOR

AND AROMA TO DRIVE MARKET 103

8.4 BAGS 104

8.4.1 EASE OF USE, PORTABILITY, AND ADAPTABILITY TO FUEL DEMAND 104

8.5 FILMS & WRAPS 105

8.5.1 DURABILITY, FLEXIBILITY, AND SUSTAINABILITY IN PACKAGING

TO PROPEL DEMAND 105

8.6 OTHER PACKAGING TYPES 105

9 FLEXIBLE PLASTIC PACKAGING MARKET, BY PRINTING TECHNOLOGY 106

9.1 INTRODUCTION 107

9.2 FLEXOGRAPHY 109

9.2.1 INNOVATIONS AND TRENDS IN FLEXOGRAPHIC PRINTING FOR FLEXIBLE PLASTIC PACKAGING TO DRIVE MARKET 109

9.3 ROTOGRAVURE 109

9.3.1 HIGH-SPEED AND QUALITY SOLUTION FOR FLEXIBLE PLASTIC PACKAGING

TO DRIVE DEMAND 109

9.4 DIGITAL PRINTING 110

9.4.1 QUICK TURNAROUND TIME, COST-EFFECTIVE CUSTOMIZATION, AND

HIGH-QUALITY PRINTS WITH VIBRANT GRAPHICS TO FUEL DEMAND 110

9.5 OTHER TECHNOLOGIES 110

10 FLEXIBLE PLASTIC PACKAGING MARKET, BY APPLICATION 111

10.1 INTRODUCTION 112

10.2 FOOD 114

10.2.1 IMPROVEMENT OF PRODUCT PRESENTATION WITH CREATIVE DESIGNS

AND PRESERVATION OF PRODUCT QUALITY TO DRIVE DEMAND 114

10.2.2 SNACKS 114

10.2.3 FROZEN FOOD 115

10.2.4 FRUITS & VEGETABLES 115

10.2.5 DAIRY 115

10.2.6 OTHER FOODS 115

10.3 BEVERAGES 116

10.3.1 BOOMING BEVERAGE INDUSTRY TO FUEL DEMAND 116

10.4 PHARMACEUTICALS & HEALTHCARE 116

10.4.1 ABILITY TO MEET DEMAND FOR SAFETY, STERILITY, AND SUSTAINABILITY

TO DRIVE MARKET 116

10.5 PERSONAL CARE & COSMETICS 117

10.5.1 ENHANCEMENT OF PRODUCT PRESERVATION, AESTHETIC APPEAL,

AND SUSTAINABILITY TO DRIVE DEMAND 117

10.6 OTHER APPLICATIONS 118

11 FLEXIBLE PLASTIC PACKAGING MARKET, BY REGION 119

11.1 INTRODUCTION 120

11.2 NORTH AMERICA 122

11.2.1 US 127

11.2.1.1 Increased spending on healthcare products and innovation

to drive demand 127

11.2.2 CANADA 131

11.2.2.1 Surging demand from food & beverage industry to drive market 131

11.2.3 MEXICO 134

11.2.3.1 Rising food & beverage trade to positively impact market growth 134

11.3 ASIA PACIFIC 138

11.3.1 CHINA 143

11.3.1.1 Rising food trade and government-led initiatives related to

packaging industry to drive market 143

11.3.2 JAPAN 147

11.3.2.1 Urbanization, growing aging population, and evolving consumer demand to drive market 147

11.3.3 INDIA 150

11.3.3.1 Innovations in food, pharmaceutical, and e-commerce industries

to drive market 150

11.3.4 SOUTH KOREA 154

11.3.4.1 Changing lifestyles and growing retail food sales to propel market 154

11.3.5 REST OF ASIA PACIFIC 157

11.4 EUROPE 160

11.4.1 GERMANY 165

11.4.1.1 Shifting consumer preferences for food & beverages to fuel demand 165

11.4.2 UK 169

11.4.2.1 Expanding economy and innovations in food, drink, and healthcare industries to drive market 169

11.4.3 FRANCE 172

11.4.3.1 Sustainability goals and technological advancements to

fuel market growth 172

11.4.4 SPAIN 175

11.4.4.1 Growing cosmetic & personal care industry to drive market 175

11.4.5 RUSSIA 178

11.4.5.1 Increasing consumer demand for eco-friendly solutions to

propel market 178

11.4.6 ITALY 181

11.4.6.1 Booming retail, food, and healthcare industries to drive demand 181

11.4.7 REST OF EUROPE 184

11.5 MIDDLE EAST & AFRICA 187

11.5.1 GCC COUNTRIES 192

11.5.1.1 Saudi Arabia 195

11.5.1.1.1 High growth of healthcare and food packaging

industries to drive market 195

11.5.1.2 UAE 199

11.5.1.2.1 High transportation of food, lubricants, and base oils

to drive demand 199

11.5.1.3 Rest of GCC Countries 202

11.5.2 SOUTH AFRICA 205

11.5.2.1 Growing food & beverage and pharmaceutical industries

to drive market 205

11.5.3 REST OF MIDDLE EAST & AFRICA 208

11.6 SOUTH AMERICA 211

11.6.1 BRAZIL 216

11.6.1.1 Economic growth to fuel demand 216

11.6.2 ARGENTINA 219

11.6.2.1 Expanding food & beverage and beef export industries

to drive market 219

11.6.3 REST OF SOUTH AMERICA 222

12 COMPETITIVE LANDSCAPE 226

12.1 OVERVIEW 226

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 226

12.3 MARKET SHARE ANALYSIS 229

12.4 REVENUE ANALYSIS 232

12.5 COMPANY VALUATION AND FINANCIAL METRICS 232

12.6 PRODUCT/BRAND COMPARISON ANALYSIS 234

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 235

12.7.1 STARS 235

12.7.2 EMERGING LEADERS 235

12.7.3 PERVASIVE PLAYERS 235

12.7.4 PARTICIPANTS 235

12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 237

12.7.5.1 Company footprint 237

12.7.5.2 Packaging type footprint 238

12.7.5.3 Application footprint 238

12.7.5.4 Material footprint 239

12.7.5.5 Printing technology footprint 239

12.7.5.6 Region footprint 240

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 240

12.8.1 PROGRESSIVE COMPANIES 240

12.8.2 RESPONSIVE COMPANIES 240

12.8.3 DYNAMIC COMPANIES 241

12.8.4 STARTING BLOCKS 241

12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 242

12.8.5.1 List of key startups and SMEs 242

12.8.5.2 Competitive benchmarking of key startups/SMEs 243

12.9 COMPETITIVE SCENARIO 245

12.9.1 PRODUCT LAUNCHES 245

12.9.2 DEALS 249

12.9.3 EXPANSIONS 258

13 COMPANY PROFILES 263

13.1 KEY PLAYERS 263

13.1.1 AMCOR PLC 263

13.1.1.1 Business overview 263

13.1.1.2 Products/Solutions/Services offered 264

13.1.1.3 Recent developments 267

13.1.1.3.1 Product launches 267

13.1.1.3.2 Deals 268

13.1.1.3.3 Expansions 270

13.1.1.3.4 Others 271

13.1.1.4 MnM view 272

13.1.1.4.1 Key strengths/Right to win 272

13.1.1.4.2 Strategic choices 272

13.1.1.4.3 Weaknesses/Competitive threats 272

13.1.2 BERRY GLOBAL INC. 273

13.1.2.1 Business overview 273

13.1.2.2 Products/Solutions/Services offered 274

13.1.2.3 Recent developments 276

13.1.2.3.1 Product launches 276

13.1.2.3.2 Deals 277

13.1.2.3.3 Expansions 280

13.1.2.4 MnM view 281

13.1.2.4.1 Key strengths/Right to win 281

13.1.2.4.2 Strategic choices 282

13.1.2.4.3 Weaknesses/Competitive threats 282

13.1.3 SONOCO PRODUCTS COMPANY 283

13.1.3.1 Business overview 283

13.1.3.2 Products/Solutions/Services offered 284

13.1.3.3 Recent developments 286

13.1.3.3.1 Product launches 286

13.1.3.3.2 Deals 286

13.1.3.3.3 Expansions 288

13.1.3.3.4 Others 288

13.1.3.4 MnM view 288

13.1.3.4.1 Key strengths/Right to win 288

13.1.3.4.2 Strategic choices 289

13.1.3.4.3 Weaknesses/Competitive threats 289

13.1.4 CONSTANTIA FLEXIBLES 290

13.1.4.1 Business overview 290

13.1.4.2 Products/Solutions/Services offered 291

13.1.4.3 Recent developments 293

13.1.4.3.1 Product launches 293

13.1.4.3.2 Deals 294

13.1.4.3.3 Expansions 296

13.1.4.4 MnM view 297

13.1.4.4.1 Key strengths/Right to win 297

13.1.4.4.2 Strategic choices 297

13.1.4.4.3 Weaknesses/Competitive threats 297

13.1.5 HUHTAMAKI OYJ 298

13.1.5.1 Business overview 298

13.1.5.2 Products/Solutions/Services offered 300

13.1.5.3 Recent developments 301

13.1.5.3.1 Product launches 301

13.1.5.3.2 Deals 302

13.1.5.3.3 Expansions 303

13.1.5.3.4 Others 304

13.1.5.4 MnM view 304

13.1.5.4.1 Key strengths/Right to win 304

13.1.5.4.2 Strategic choices 304

13.1.5.4.3 Weaknesses/Competitive threats 305

13.1.6 MONDI 306

13.1.6.1 Business overview 306

13.1.6.2 Products/Solutions/Services offered 307

13.1.6.3 Recent developments 309

13.1.6.3.1 Product launches 309

13.1.6.3.2 Deals 310

13.1.6.3.3 Expansions 312

13.1.6.4 MnM view 313

13.1.7 SEALED AIR 314

13.1.7.1 Business overview 314

13.1.7.2 Products/Solutions/Services offered 315

13.1.7.3 Recent developments 317

13.1.7.3.1 Product launches 317

13.1.7.3.2 Deals 317

13.1.7.3.3 Expansions 319

13.1.7.4 MnM view 319

13.1.8 TRANSCONTINENTAL INC. 320

13.1.8.1 Business overview 320

13.1.8.2 Products/Solutions/Services offered 321

13.1.8.3 Recent developments 323

13.1.8.3.1 Product launches 323

13.1.8.3.2 Deals 323

13.1.8.3.3 Expansions 324

13.1.8.4 MnM view 325

13.1.9 CCL INDUSTRIES 326

13.1.9.1 Business overview 326

13.1.9.2 Products/Solutions/Services offered 327

13.1.9.3 Recent developments 328

13.1.9.3.1 Deals 328

13.1.9.3.2 Expansions 330

13.1.9.4 MnM view 330

13.1.10 COVERIS 331

13.1.10.1 Business overview 331

13.1.10.2 Products/Solutions/Services offered 331

13.1.10.3 Recent developments 333

13.1.10.3.1 Product launches 333

13.1.10.3.2 Deals 334

13.1.10.3.3 Expansions 336

13.1.10.4 MnM view 338

13.1.11 BISCHOF + KLEIN SE & CO. KG 339

13.1.11.1 Business overview 339

13.1.11.2 Products/Solutions/Services offered 339

13.1.11.3 Recent developments 340

13.1.11.3.1 Product launches 340

13.1.11.3.2 Deals 341

13.1.11.3.3 Expansions 341

13.1.11.4 MnM view 341

13.2 OTHER PLAYERS 342

13.2.1 PROAMPAC 342

13.2.2 UFLEX LIMITED 343

13.2.3 NOVOLEX 344

13.2.4 ALUFLEXPACK AG 345

13.2.5 PPC FLEX COMPANY INC. 346

13.2.6 PRINTPACK 347

13.2.7 WIHURI GROUP 348

13.2.8 C-P FLEXIBLE PACKAGING 349

13.2.9 GUALA PACK S.P.A. 350

13.2.10 COSMO FILMS 351

13.2.11 CLONDALKIN GROUP 352

13.2.12 SWISS PAC PRIVATE LIMITED 353

13.2.13 GLENROY, INC. 354

13.2.14 AMERICAN PACKAGING CORPORATION 355

13.2.15 SIGMA PLASTIC GROUP 356

13.2.16 EPAC HOLDINGS, LLC. 357

13.2.17 TIPA LTD 358

13.2.18 TRACELESS MATERIALS GMBH 359

13.2.19 NORIWARE 360

13.2.20 POLYMATERIA LIMITED 361

14 ADJACENT AND RELATED MARKET 362

14.1 INTRODUCTION 362

14.2 LIMITATIONS 362

14.3 RIGID PLASTIC PACKAGING MARKET 363

14.3.1 MARKET DEFINITION 363

14.3.2 MARKET OVERVIEW 363

14.3.2.1 Rigid plastic packaging market, by raw material 363

14.3.2.2 Rigid plastic packaging market, by type 365

14.3.2.3 Rigid plastic packaging market, by application 366

14.3.2.4 Rigid plastic packaging market, by region 367

15 APPENDIX 368

15.1 DISCUSSION GUIDE 368

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 371

15.3 CUSTOMIZATION OPTIONS 373

15.4 RELATED REPORTS 373

15.5 AUTHOR DETAILS 374

❖ 世界の軟質プラスチック包装市場に関するよくある質問(FAQ) ❖

・軟質プラスチック包装の世界市場規模は?

→MarketsandMarkets社は2024年の軟質プラスチック包装の世界市場規模を2079億3000万米ドルと推定しています。

・軟質プラスチック包装の世界市場予測は?

→MarketsandMarkets社は2029年の軟質プラスチック包装の世界市場規模を2575億8000万米ドルと予測しています。

・軟質プラスチック包装市場の成長率は?

→MarketsandMarkets社は軟質プラスチック包装の世界市場が2024年~2029年に年平均4.4%成長すると予測しています。

・世界の軟質プラスチック包装市場における主要企業は?

→MarketsandMarkets社は「Amcor plc(オーストラリア)、Berry Global Inc.(米国)、Sonoco Products Company(米国)、Constantia Flexibles(オーストリア)、Huhtamaki Oyj(フィンランド)、Mondi(英国)、Sealed Air(米国)、Transcontinental Inc.(カナダ)、CCL Industries(カナダ)、Coveris(オーストリア)、Bischof+Klein SE & Co. KG(ドイツ)など ...」をグローバル軟質プラスチック包装市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。