1 はじめに

1.1 調査目的 37

1.2 市場の定義 37

1.3 調査範囲 38

1.3.1 市場セグメンテーション 38

1.3.2 対象と除外 39

1.4 考慮した年数 40

1.5 考慮した通貨 40

1.6 利害関係者 41

1.7 変更点のまとめ 41

2 調査方法 42

2.1 調査データ 42

2.1.1 二次データ 43

2.1.1.1 二次資料からの主要データ 43

2.1.2 一次データ

2.1.2.1 一次資料からの主要データ 44

2.1.2.2 一次インタビューからの主な洞察 45

2.1.2.3 一次プロファイルの内訳 45

2.2 市場規模の推定 46

2.2.1 ボトムアップアプローチ(需要側) 47

2.2.2 トップダウンアプローチ(供給側) 48

2.3 データの三角測量 49

2.4 リサーチの前提 49

2.5 限界とリスク評価 50

3 エグゼクティブ・サマリー 51

4 プレミアム・インサイト 57

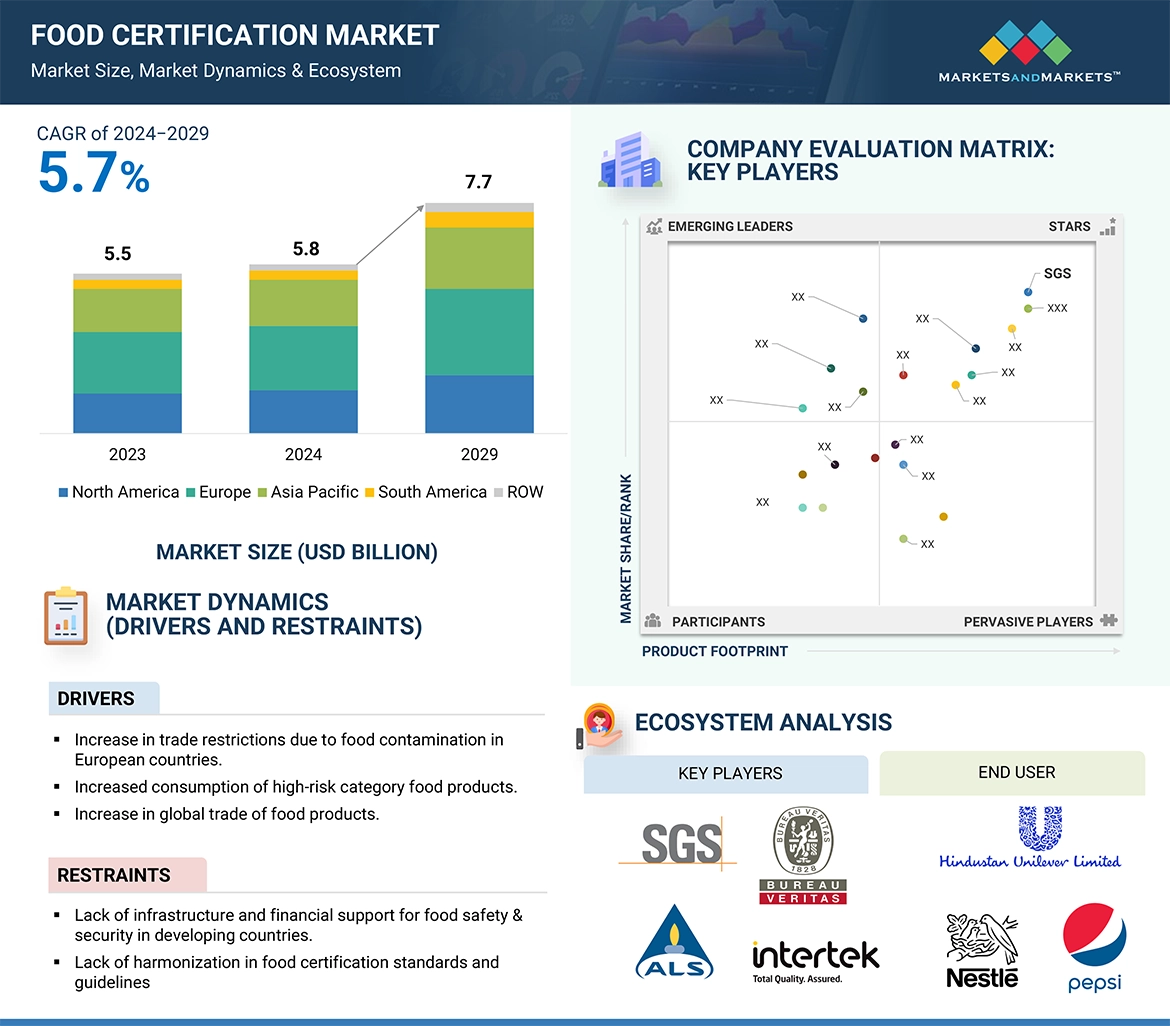

4.1 食品認証市場における主要企業の魅力的な機会 57

4.2 食品認証市場:地域別スナップショット 57

4.3 欧州の食品認証市場:主要タイプ別、国別 58

4.4 食品認証市場:認証タイプ別、地域別 59

4.5 食品認証市場:用途別、地域別 60

4.6 食品認証市場:エンドユーザー別、地域別 61

4.7 食品認証市場:認証範囲別、地域別 62

4.8 食品認証市場:価格感応度別・地域別 63

5 市場の概要 64

5.1 はじめに 64

5.2 マクロ経済指標 64

5.2.1 食中毒事例の増加 64

5.2.2 食品回収事例の増加 66

5.3 市場ダイナミクス 67

5.3.1 推進要因 67

5.3.1.1 欧州諸国における食品汚染による貿易制限の増加 67

5.3.1.2 高リスクカテゴリー食品の消費拡大による食品安全保証の需要増加 68

5.3.1.3 世界的な食品貿易の増加 68

5.3.1.4 厳しい食品産業基準及び認証要件 68

5.3.1.5 食品の透明性と信頼性に対する消費者の要求 69

5.3.1.5.1 消費者の信頼構築のための認証プログラムの採用の増加 69

5.3.1.5.2 製品範囲の拡大とブランド価値の強化の重視 69

5.3.1.6 食品品質認証スキーム 70

5.3.1.6.1 欧州 70

5.3.1.6.2 世界的な食品安全イニシアチブ 70

70 5.3.1.7 認証と監査の容易さが外部委託認証の市場成長を促進する 70

5.3.2 阻害要因 71

5.3.2.1 発展途上国における食品安全・安心のためのインフラ及び財政支援の欠如 71

5.3.2.2 食品認証基準及びガイドラインの調和の欠如 71

5.3.3 機会 71

5.3.3.1 様々な国内フードサービス及び小売チェーンの人気の高まり 71

5.3.3.2 食品安全性強化のための予算配分と支出の増加 72

5.3.3.3 ハラル、オーガニック、「フリーフロム」食品認証の採用 72

5.3.3.3.1 有機製品に対する認証 73

5.3.3.4 第三者プロバイダーによる認証のアウトソーシングの増加傾向 73

5.3.3.5 食品加工業界による食品安全管理慣行の義務化 73

5.3.3.6 発展途上国における食品貿易の増加 74

5.3.3.6.1 中小企業の数の増加 74

5.3.4 課題 74

5.3.4.1 企業による虚偽の表示や認証の事例 74

5.3.4.1.1 虚偽のハラル認証 75

5.3.4.2 小規模製造業者のリソース不足、限られた認識、財政的支援不足 76

5.3.4.2.1 小規模製造業者の限られた財源と投資能力 76

5.4 遺伝子AIの食品認証市場への影響 77

5.4.1 食品認証市場における遺伝子AIの利用 77

5.4.2 ケーススタディ分析 78

5.4.2.1 早期警告検知のためにAIを活用したSGS 78

5.4.2.2 DEKRAは安全基準を維持するためにAIによる遠隔監査を実施 78

5.4.3 AI が隣接するエコシステムに与える影響 78

6 業界動向 79

6.1 導入 79

6.2 顧客ビジネスに影響を与えるトレンド/混乱 80

6.3 価格分析 80

6.3.1 指標価格分析 81

6.4 バリューチェーン分析 81

6.4.1 原材料サプライヤー 82

6.4.2 食品加工業者及び製造業者 82

6.4.3 パッケージング&ラベリング 82

6.4.4 流通・物流 82

6.4.5 小売業者及び外食業者 82

6.4.6 最終消費者

6.5 サプライチェーン分析 83

6.6 エコシステム/市場マップ 84

6.7 技術分析 86

6.7.1 デジタル認証 86

6.7.2 第三者認証 87

6.7.3 認証検証のためのブロックチェーン 88

6.7.4 遺伝子組み換えラベルに対する規制の賦課 89

6.7.5 グローバル食品安全イニシアチブ(GFSI)の導入 89

6.7.6 食品安全問題を報告するための食品と飼料のための迅速な警告システム(rasff) 89

6.8 2024~2025年の主要会議とイベント 90

6.9 関税と規制の状況 91

6.9.1 規制機関、政府機関、その他の組織 91

6.10 ポーターのファイブフォース分析 93

6.10.1 競争相手の強さ 93

6.10.2 供給業者の交渉力 93

6.10.3 買い手の交渉力 94

6.10.4 代替品の脅威 94

6.10.5 新規参入の脅威 94

6.11 主要ステークホルダーと購買基準 95

6.11.1 購入プロセスにおける主要ステークホルダー 95

6.11.2 購入基準 96

6.12 投資と資金調達のシナリオ 97

6.13 ケーススタディ分析 98

6.13.1 欧州の試験・検査・認証企業が食品認証で約8,000万~1億米ドルの新たな収益ポケットに参入 98

6.13.1.1 名称 98

6.13.1.2 問題提起 98

6.13.1.3 MnMアプローチ 98

6.13.1.4 収益への影響(RI) 98

6.13.2 環境試験所は食品認証によって潜在的な収益生成を強化した 98

6.13.2.1 名称 98

6.13.2.2 問題提起 98

6.13.2.3 MnMアプローチ 98

6.13.2.4 収益への影響(RI) 99

6.13.3 オーストラリアと東南アジア市場で拡大する食品安全検査サービスプロバイダー 99

6.13.3.1 名称 99

6.13.3.2 問題提起 99

6.13.3.3 MnMアプローチ 99

6.13.3.4 収益への影響(RI) 99

7 食品認証市場、タイプ別 100

7.1 導入 101

7.2 安全性と品質の認証 102

7.2.1 消費者の信頼と食品安全基準の維持の必要性が安全性と品質の認証の成長を促進する 102

7.2.2 ISO 22000 103

7.2.2.1 国際的な安全・品質基準を満たすためのISO 22000認証の採用拡大 103

7.2.3 ブリティッシュ・リテール・コンソーシアム(BRC)のグローバル基準 104

7.2.3.1 最良の食品安全慣行のベンチマークとみなされるBRC認証 104

7.2.4 国際食品規格(IFS) 105

7.2.4.1 市場を推進するためには、サプライヤーが厳格な食品安全・品質要件に準拠しているかどうかを評価する必要性 105

7.2.5 安全品質食品(SQF)認証 106

7.2.5.1 規制の商業用食品品質基準を満たすための SQF 認証プログラムに対する需要の高まり 106

7.3 ダイエット&ライフスタイル認証 107

7.3.1 ハラル、コーシャ、「フリーフロム」食品に対する世界の消費者の嗜好を満たすための食生活・ライフスタイル認証 への需要の高まり 107

7.3.2 ハラル 108

7.3.2.1 ハラル製品の安全性と衛生に関する懸念が食品認証需要を促進 108

7.3.3 コーシャー 109

7.3.3.1 グローバル化と多国籍企業の拡大が食品認証市場の成長を促進する 109

7.3.4 「フリーフロム」認証 110

7.3.4.1 オーガニック製品や天然製品に対する消費者の嗜好の高まりがフリーフロム認証の需要を押し上げる 110

7.4 その他の認証タイプ 112

8 食品認証市場、用途別 113

8.1 はじめに 114

8.2 食肉、鶏肉、魚介類製品 115

8.2.1 食肉加工品の消費増加が成長を牽引 115

8.2.2 生鮮食品 117

8.2.2.1 生鮮食肉、鶏肉、水産物製品の安全性確保に対する需要の高まりが市場成長を促進 117

8.2.3 冷凍 117

8.2.3.1 微生物汚染の事例が増加し、製品の安全性、品質、国際規格への適合を確保する需要が高まる 117

8.2.4 加工食品 118

8.2.4.1 消費者の信頼を高め、汚染リスクを最小限に抑える必要性が市場成長を促進 118

8.3 乳製品 118

8.3.1 市場成長を促進する乳製品輸出の厳しい認証要件 118

8.4 乳幼児用食品 119

8.4.1 幼児を保護し健康的な栄養を促進する必要性が市場成長を刺激 119

8.5 ベーカリー&菓子製品 120

8.5.1 市場成長を加速する消費者の信頼向上のための自主的認証取得の必要性 120

8.6 飲料 121

8.6.1 成長する飲料認証が消費者の信頼を高め、市場拡大を促進 121

8.6.2 アルコール飲料 122

8.6.2.1 不純物混入や一貫性のない品質を避ける必要性がアルコール飲料の認証需要を促進 122

8.6.3 ノンアルコール飲料 123

8.6.3.1 トレーサビリティを提供し、真正性を検証する認証 123

8.7 「フリーフロム」食品 123

8.7.1 特定の原材料や添加物を避けることによる健康効果に対する意識の高まりが市場拡大を促進 123

8.7.2 果物・野菜 124

8.7.2.1 果物・野菜の安全性と品質確保の必要性が市場成長を拡大 124

8.7.3 生鮮食品 125

8.7.3.1 厳格な農法の遵守を保証する認証が重要な役割を果たす 125

8.7.4 ドライフルーツ・ナッツ 126

8.7.4.1 ドライフルーツ製造業者が厳格な品質基準を遵守し、安全な取り扱い方法を確保することを保証する認証 126

8.8 冷凍果物・野菜 126

8.8.1 安全な加工・保存を確認し、栄養品質と安全性を保持するための冷凍果物・野菜認証の必要性 126

8.9 栄養補助食品とサプリメント 126

8.9.1 健康とウェルネスに対する意識の高まりが市場成長を後押し 126

8.10 その他の用途 127

9 食品認証市場:エンドユーザー別 129

9.1 はじめに 130

9.2 食品・飲料メーカー 131

9.2.1 自社製品が認知された特定の規格に準拠していることを明確かつ信頼できる形で証明することによ り消費者の信頼を構築する必要性が市場を牽引 131

9.3 小売・スーパーマーケット 132

9.3.1 安全でない行為を防止し、適切なラベリングを確保するためのフェアトレードやノン・グモなどの認証が市場を牽引 132

9.4 レストラン・外食チェーン 133

9.4.1 アレルゲンフリーやオーガニックラベルなどの認証が健康基準や信用を守る 133

9.5 生産者 134

9.5.1 製品が特定の農業、環境、品質基準を満たしていることを示す認証 134

9.6 その他のエンドユーザー 135

10 食品認証市場(認証範囲別) 137

10.1 導入 138

10.2 単一製品認証 139

10.2.1 安全性、品質、規制遵守に関する業界標準を満たすことを保証する単一製品認証 139

10.3 複数製品認証 140

10.3.1 さまざまなカテゴリーにわたる多様な製品を提供するための複数製品認証 140

10.4 全社的認証 141

10.4.1 組織内の全体的な業務とプロセスを強化する全社的認証 141

11 食品認証市場:価格感応度別 142

11.1 導入 143

11.2 プレミアム認証 144

11.2.1 品質または倫理的ニーズが厳しい市場に対応するプレミアム認証 144

11.3 費用対効果の高い認証 145

11.3.1 業界の安全性と品質基準への適合を確保するための費用対効果の高い認証 145

12 食品認証市場(地域別) 146

12.1 はじめに 147

12.2 北米 148

12.2.1 米国 154

12.2.1.1 食品認証のための強固な枠組みと厳格な規制基準が市場を牽引 154

12.2.2 カナダ 157

12.2.2.1 カナダの輸出業者に米国の食品安全基準の更新への適合を義務付ける米国の指令と、健康的な有機食品への需要の高まりが市場を促進 157

12.2.3 メキシコ 161

12.2.3.1 食中毒事例の増加と適正農業規範(GAP)枠組みの確立が市場成長を促進 161

12.3 欧州 164

12.3.1 英国 169

12.3.1.1 消費者のプレミアム製品へのシフトが食品認証の需要を押し上げる 169

12.3.2 ドイツ 172

172 12.3.2.1 高品質食品を選ぶことができる消費者の高い購買力 172

12.3.3 フランス 175

12.3.3.1 市場成長を促進する品質基準の重視と食品安全性の重視 175

12.3.4 イタリア 178

12.3.4.1 ベーカリー製品と乳製品の高い消費量が食品安全対策の採用を促進 178

12.3.5 スペイン 181

12.3.5.1 食品に対する厳格な品質管理手順と食品の品質と安全性に関する消費者の意識の高まりが市場を促進 181

12.3.6 ポーランド 184

12.3.6.1 加工食品消費の増加と食品・農産物輸入に関するEU規制の遵守が市場を牽引 184

12.3.7 その他のヨーロッパ 187

12.4 アジア太平洋地域 190

12.4.1 中国 196

12.4.1.1 非ベジタリアン製品における食品偽装と詐欺事件の増加が成長を促進 196

12.4.2 インド 199

12.4.2.1 強固な食品安全対策を実施するために食品の国際規格に準拠する必要性の高まり 199

12.4.3 日本 202

12.4.3.1 健康上の利点から食品安全対策を採用する需要の高まりが市場成長を後押し 202

12.4.4 韓国 205

12.4.4.1 輸入食品安全ハザードの管理強化が市場成長を促進 205

12.4.5 オーストラリアとニュージーランド 208

12.4.5.1 規制強化により食品安全対策を導入する企業 208

12.4.6 その他のアジア太平洋地域 211

12.5 その他の地域(列記) 213

12.5.1 中東 219

12.5.1.1 宗教的信条によるハラル食品需要の大幅増加が市場成長を促進 219

12.5.2 南アフリカ 222

12.5.2.1 有機製品に対する需要の高まりが市場拡大を促進 222

12.5.3 その他のアフリカ 225

12.6 南米 227

12.6.1 ブラジル 233

12.6.1.1 動植物検疫局(APHIS)による厳しい規制が市場成長を促進 233

12.6.2 アルゼンチン 236

12.6.2.1 食品および農産物の貿易増加による食品認証需要の促進 236

12.6.3 その他の南米地域 239

13 競争環境 243

13.1 概要 243

13.2 主要企業の戦略/勝利への権利 243

13.3 収益分析 246

13.4 主要プレーヤーの年間売上高対成長率 247 成長 247

13.5 市場シェア分析、2023年 247

13.6 企業評価と財務指標 248

13.6.1 企業評価 248

13.6.2 Ev/Ebidtaを用いた主要企業のEbitda財務指標 249

13.7 主要市場参入企業のグローバルスナップショット 249

13.8 企業評価マトリックス:主要プレーヤー、2023年 250

13.8.1 スター企業 250

13.8.2 新興リーダー 250

13.8.3 浸透型プレーヤー 250

13.8.4 参入企業 250

13.8.5 企業フットプリント:主要プレーヤー 252

13.8.5.1 企業フットプリント 252

13.8.5.2 タイプ別フットプリント 252

13.8.5.3 アプリケーション別フットプリント 253

13.8.5.4 地域別フットプリント 254

13.9 企業評価マトリクス:新興企業/SM(2023年) 254

13.9.1 進歩的企業 254

13.9.2 対応力のある企業 254

13.9.3 ダイナミックな企業 255

13.9.4 スターティングブロック 255

13.9.5 競争ベンチマーキング:新興企業/SM(2023年) 256

13.9.5.1 主要新興企業/SMEの詳細リスト 256

13.9.5.2 主要新興企業/SMEの競合ベンチマーキング 257

13.10 ブランド/製品の比較 258

13.11 競争シナリオとトレンド 258

13.11.1 製品の上市/開発/承認 258

13.11.2 取引 259

13.11.3 拡張 261

14 会社プロファイル 262

DEKRA (Germany)

SGS (France)

Intertek Group plc (UK)

AsureQuality (New Zealand)

Bureau Veritas (France)

LQRA (UK)

DNV (Norway)

TÜV SÜD (Germany)

Kiwa (Netherlands)

ALS (US)

Eurofins Scientific

UL LLC (US)

EAGLE Certification Group (US)

INTL Certification Limited (UK)

Assurecloud (Africa)

15 隣接市場および関連市場 307

15.1 導入 307

15.2 制限 307

15.3 認証機関市場 307

15.3.1 市場の定義 307

15.3.2 市場概要 308

15.4 食品認証市場 309

15.4.1 市場の定義 309

15.4.2 市場概要 309

16 付録 311

16.1 ディスカッションガイド 311

16.2 Knowledgestore: Marketsandmarketsのサブスクリプション・ポータル 315

16.3 カスタマイズオプション 317

16.4 関連レポート 317

16.5 著者の詳細 318

"North America is projected to witness the fastest growth during the forecast period."

Health consciousness is a significant driver in North America, with consumers becoming more aware of the importance of food safety and quality. The rising incidence of food allergies and intolerances has led to heightened demand for certifications that assure consumers of the safety and suitability of products for their specific dietary needs. As a result, food manufacturers are increasingly pursuing certifications to enhance transparency and build consumer trust. Moreover, stringent food safety regulations and standards in the United States and Canada necessitate compliance from food businesses, further propelling the market for certifications. Organizations like the FDA and USDA enforce rigorous guidelines that compel companies to ensure their products meet established safety and quality standards.

“Meat, poultry, and seafood application segments dominate the food certification market.”

Due to their critical importance in ensuring food safety and quality within these highly regulated industries. As primary sources of protein, these products are subject to stringent safety standards to prevent contamination and ensure consumer trust. The growing global demand for meat, poultry, and seafood products, driven by rising populations and changing dietary preferences, has heightened the focus on certifications that guarantee the safety, traceability, and quality of these foods. Certifications such as Hazard Analysis Critical Control Point (HACCP), ISO 22000, and specific certifications for organic, humane, and sustainable practices are increasingly sought after by producers and consumers alike.

“Safety and quality certifications dominate the food certification market.”

Due to their crucial role in ensuring that food products meet stringent health and safety standards. As consumers become increasingly aware of food safety issues and the risks of foodborne illnesses, the demand for certifications that validate the safety and quality of food products has grown significantly. These certifications not only help businesses comply with local and international regulations but also provide assurance to consumers regarding the safety and integrity of the products they purchase. In an era where consumers are more discerning about their food choices, the presence of safety and quality certifications serves as a critical differentiator, enhancing brand reputation and fostering consumer trust.

Break-up of Primaries:

By Company Type: Tier 1 – 55.0%, Tier 2 – 25.0%, Tier 3 – 20.0%,

By Designation: Managers – 25.0%, Directors – 15.0%, and Others- 60.0%

By Region: North America – 40.0%, Europe – 35.0%, Asia Pacific -20.0%, RoW – 5.0%

Leading players profiled in this report:

DEKRA (Germany)

SGS (France)

Intertek Group plc (UK)

AsureQuality (New Zealand)

Bureau Veritas (France)

LQRA (UK)

DNV (Norway)

TÜV SÜD (Germany)

Kiwa (Netherlands)

ALS (US)

Eurofins Scientific

UL LLC (US)

EAGLE Certification Group (US)

INTL Certification Limited (UK)

Assurecloud (Africa)

The study includes an in-depth competitive analysis of these key players in the authentication and brand protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the food certification market, by certification type (safety & quality certifications, dietary & lifestyle certification, other certification types), application (meat, poultry, & seafood products, dairy products, infant food products, bakery & confectionery, beverages, free-from foods, fruits & vegetables, nutraceuticals & supplements, other applications), end-user, certification scope, price sensitivity and region (North America, Europe, Asia Pacific, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the food certification market. A detailed analysis of the key industry players has been done to provide insights into their business overview, and services; key strategies; Contracts, partnerships, and agreements. new service launches, mergers and acquisitions, and recent developments associated with the food certification market.

Reasons to buy this report:

•Analysis of key drivers (increased consumption of high-risk category food products, increase in global food trade, consumer demand for food transparency and credibility), restraints (lack of infrastructure and financial support for food safety and security in developing countries), opportunities (popularity of multiple domestic foodservice and retail chains), and challenges (instances of false labeling and certification among companies) influencing the growth of the food certification market.

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new service launches in the food certification market.

•Market Development: Comprehensive information about lucrative markets – the report analyses the food certification market across varied regions.

•Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the food certification market.

•Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like DEKRA (Germany), SGS (France), Intertek Group plc (UK), AsureQuality (New Zealand), Bureau Veritas (France), LQRA (UK), DNV (Norway), TÜV SÜD (Germany), Kiwa (Netherlands), ALS (US), Eurofins Scientific, UL LLC (US), EAGLE Certification Group (US), INTL Certification Limited (UK), Assurecloud (Africa) among others in food certification market.

1 INTRODUCTION 37

1.1 STUDY OBJECTIVES 37

1.2 MARKET DEFINITION 37

1.3 STUDY SCOPE 38

1.3.1 MARKET SEGMENTATION 38

1.3.2 INCLUSIONS & EXCLUSIONS 39

1.4 YEARS CONSIDERED 40

1.5 CURRENCY CONSIDERED 40

1.6 STAKEHOLDERS 41

1.7 SUMMARY OF CHANGES 41

2 RESEARCH METHODOLOGY 42

2.1 RESEARCH DATA 42

2.1.1 SECONDARY DATA 43

2.1.1.1 Key data from secondary sources 43

2.1.2 PRIMARY DATA 43

2.1.2.1 Key data from primary sources 44

2.1.2.2 Key insights from primary interviews 45

2.1.2.3 Breakdown of primary profiles 45

2.2 MARKET SIZE ESTIMATION 46

2.2.1 BOTTOM-UP APPROACH (DEMAND SIDE) 47

2.2.2 TOP-DOWN APPROACH (SUPPLY SIDE) 48

2.3 DATA TRIANGULATION 49

2.4 RESEARCH ASSUMPTIONS 49

2.5 LIMITATIONS AND RISK ASSESSMENT 50

3 EXECUTIVE SUMMARY 51

4 PREMIUM INSIGHTS 57

4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN FOOD CERTIFICATION MARKET 57

4.2 FOOD CERTIFICATION MARKET: REGIONAL SNAPSHOT 57

4.3 EUROPEAN FOOD CERTIFICATION MARKET: BY KEY TYPE AND COUNTRY 58

4.4 FOOD CERTIFICATION MARKET: BY CERTIFICATION TYPE AND REGION 59

4.5 FOOD CERTIFICATION MARKET: BY APPLICATION AND REGION 60

4.6 FOOD CERTIFICATION MARKET: BY END USER AND REGION 61

4.7 FOOD CERTIFICATION MARKET: BY CERTIFICATION SCOPE AND REGION 62

4.8 FOOD CERTIFICATION MARKET: BY PRICE SENSITIVITY AND REGION 63

5 MARKET OVERVIEW 64

5.1 INTRODUCTION 64

5.2 MACROECONOMIC INDICATORS 64

5.2.1 INCREASE IN INSTANCES OF FOODBORNE ILLNESS 64

5.2.2 INCREASE IN FOOD RECALL CASES 66

5.3 MARKET DYNAMICS 67

5.3.1 DRIVERS 67

5.3.1.1 Increase in trade restriction due to food contamination in European countries 67

5.3.1.2 Rising demand for food safety assurances due to growing consumption of high-risk category food products 68

5.3.1.3 Increase in global trade of food products 68

5.3.1.4 Strict food industry standards and certification requirements 68

5.3.1.5 Consumer demand for food transparency and credibility 69

5.3.1.5.1 Rising adoption of certification programs to build consumer trust 69

5.3.1.5.2 Emphasis on expanding product range and enhancing brand value 69

5.3.1.6 Food quality certification scheme 70

5.3.1.6.1 Europe 70

5.3.1.6.2 Global food safety initiative 70

5.3.1.7 Ease of certification and auditing to drive market growth for outsourced certifications 70

5.3.2 RESTRAINTS 71

5.3.2.1 Lack of infrastructure and financial support for food safety and security in developing countries 71

5.3.2.2 Lack of harmonization in food certification standards and guidelines 71

5.3.3 OPPORTUNITIES 71

5.3.3.1 Growing popularity of various domestic foodservice and retail chains 71

5.3.3.2 Increase in budget allocation and spending to enhance food safety 72

5.3.3.3 Adoption of halal, organic, and "free-from" food certifications 72

5.3.3.3.1 Certification for organic products 73

5.3.3.4 Increasing trend of outsourcing certifications from third-party providers 73

5.3.3.5 Food processing industry focusing on mandating food safety management practices 73

5.3.3.6 Rise in food trade among developing countries 74

5.3.3.6.1 Rise in number of SMEs 74

5.3.4 CHALLENGES 74

5.3.4.1 Instances of false labeling and certifications among companies 74

5.3.4.1.1 False halal certification 75

5.3.4.2 Insufficient resources, limited awareness, and lack of financial support among small-scale manufacturers 76

5.3.4.2.1 Limited financial resources and investment capabilities among small-scale manufacturers 76

5.4 IMPACT OF GEN AI ON FOOD CERTIFICATION MARKET 77

5.4.1 USE OF GEN AI IN FOOD CERTIFICATION MARKET 77

5.4.2 CASE STUDY ANALYSIS 78

5.4.2.1 SGS harnessed AI for early warning detection 78

5.4.2.2 DEKRA conducted remote audits with AI to maintain safety standards 78

5.4.3 IMPACT OF GEN AI ON ADJACENT ECOSYSTEM 78

6 INDUSTRY TRENDS 79

6.1 INTRODUCTION 79

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 80

6.3 PRICING ANALYSIS 80

6.3.1 INDICATIVE PRICING ANALYSIS 81

6.4 VALUE CHAIN ANALYSIS 81

6.4.1 RAW MATERIAL SUPPLIERS 82

6.4.2 FOOD PROCESSORS & MANUFACTURERS 82

6.4.3 PACKAGING & LABELING 82

6.4.4 DISTRIBUTION & LOGISTICS 82

6.4.5 RETAILERS & FOODSERVICE PROVIDERS 82

6.4.6 END CONSUMERS 82

6.5 SUPPLY CHAIN ANALYSIS 83

6.6 ECOSYSTEM/MARKET MAP 84

6.7 TECHNOLOGY ANALYSIS 86

6.7.1 DIGITAL CERTIFICATIONS 86

6.7.2 THIRD-PARTY CERTIFICATIONS 87

6.7.3 BLOCKCHAIN FOR CERTIFICATION VERIFICATION 88

6.7.4 REGULATORY IMPOSITIONS ON GENETICALLY MODIFIED LABELS 89

6.7.5 INTRODUCTION OF GLOBAL FOOD SAFETY INITIATIVES (GFSI) 89

6.7.6 RAPID ALERT SYSTEMS FOR FOOD AND FEED (RASFF) TO REPORT FOOD SAFETY ISSUES 89

6.8 KEY CONFERENCES AND EVENTS IN 2024–2025 90

6.9 TARIFF AND REGULATORY LANDSCAPE 91

6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 91

6.10 PORTER’S FIVE FORCES ANALYSIS 93

6.10.1 INTENSITY OF COMPETITIVE RIVALRY 93

6.10.2 BARGAINING POWER OF SUPPLIERS 93

6.10.3 BARGAINING POWER OF BUYERS 94

6.10.4 THREAT OF SUBSTITUTES 94

6.10.5 THREAT OF NEW ENTRANTS 94

6.11 KEY STAKEHOLDERS AND BUYING CRITERIA 95

6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS 95

6.11.2 BUYING CRITERIA 96

6.12 INVESTMENT AND FUNDING SCENARIO 97

6.13 CASE STUDY ANALYSIS 98

6.13.1 EUROPEAN TESTING, INSPECTION, AND CERTIFICATION COMPANY PENETRATED NEW REVENUE POCKETS WORTH NEARLY USD 80–100 MILLION WITH FOOD CERTIFICATION 98

6.13.1.1 Title 98

6.13.1.2 Problem statement 98

6.13.1.3 MnM approach 98

6.13.1.4 Revenue Impact (RI) 98

6.13.2 ENVIRONMENTAL TESTING LABORATORY ENHANCED ITS POTENTIAL REVENUE GENERATION WITH FOOD CERTIFICATION 98

6.13.2.1 Title 98

6.13.2.2 Problem statement 98

6.13.2.3 MnM approach 98

6.13.2.4 Revenue Impact (RI) 99

6.13.3 FOOD SAFETY TESTING SERVICE PROVIDER EXPANDED IN AUSTRALIAN AND SOUTHEAST ASIAN MARKETS 99

6.13.3.1 Title 99

6.13.3.2 Problem statement 99

6.13.3.3 MnM approach 99

6.13.3.4 Revenue Impact (RI) 99

7 FOOD CERTIFICATION MARKET, BY TYPE 100

7.1 INTRODUCTION 101

7.2 SAFETY & QUALITY CERTIFICATIONS 102

7.2.1 NEED FOR CONSUMER TRUST AND MAINTAINING FOOD SAFETY STANDARDS TO DRIVE GROWTH FOR SAFETY AND QUALITY CERTIFICATIONS 102

7.2.2 ISO 22000 103

7.2.2.1 Growing adoption of ISO 22000 certifications to meet international safety and quality standards 103

7.2.3 BRITISH RETAIL CONSORTIUM (BRC) GLOBAL STANDARDS 104

7.2.3.1 BRC certification to be considered as benchmark for best food safety practices 104

7.2.4 INTERNATIONAL FEATURED STANDARDS (IFS) 105

7.2.4.1 Need for evaluation of supplier compliance with stringent food safety and quality requirements to propel market 105

7.2.5 SAFE QUALITY FOOD (SQF) CERTIFICATIONS 106

7.2.5.1 Rising demand for SQF certification program to meet regulatory commercial food quality criteria 106

7.3 DIETARY & LIFESTYLE CERTIFICATIONS 107

7.3.1 RISING DEMAND FOR DIETARY AND LIFESTYLE CERTIFICATIONS TO MEET GLOBAL CONSUMER PREFERENCES FOR HALAL, KOSHER, AND 'FREE-FROM' FOODS 107

7.3.2 HALAL 108

7.3.2.1 Concerns regarding safety and hygiene of halal products to fuel demand for food certification 108

7.3.3 KOSHER 109

7.3.3.1 Globalization and expansion of multinational companies to promote growth of food certification market 109

7.3.4 ‘‘FREE-FROM’ CERTIFICATIONS 110

7.3.4.1 Growing consumer preference for organic and natural products to boost demand for free-from certifications 110

7.4 OTHER CERTIFICATION TYPES 112

8 FOOD CERTIFICATION MARKET, BY APPLICATION 113

8.1 INTRODUCTION 114

8.2 MEAT, POULTRY, AND SEAFOOD PRODUCTS 115

8.2.1 RISING CONSUMPTION OF PROCESSED MEAT PRODUCTS TO DRIVE GROWTH 115

8.2.2 FRESH 117

8.2.2.1 Rising demand for ensuring safety of fresh meat, poultry, and seafood products to fuel market growth 117

8.2.3 FROZEN 117

8.2.3.1 Growing instances of microbial contamination to drive demand for ensuring product safety, quality, and compliance with international standards 117

8.2.4 PROCESSED 118

8.2.4.1 Need to enhance consumer trust and minimize risk of contamination to foster market growth 118

8.3 DAIRY PRODUCTS 118

8.3.1 STRINGENT CERTIFICATION REQUIREMENTS FOR DAIRY PRODUCT EXPORTS TO PROPEL MARKET GROWTH 118

8.4 INFANT FOOD PRODUCTS 119

8.4.1 NEED TO SAFEGUARD YOUNG CHILDREN AND PROMOTE HEALTHY NUTRITION TO STIMULATE MARKET GROWTH 119

8.5 BAKERY & CONFECTIONERY PRODUCTS 120

8.5.1 NEED TO OBTAIN VOLUNTARY CERTIFICATIONS TO ENHANCE CONSUMER CONFIDENCE TO ACCELERATE MARKET GROWTH 120

8.6 BEVERAGES 121

8.6.1 GROWING BEVERAGE CERTIFICATIONS TO BOOST CONSUMER TRUST AND DRIVE MARKET EXPANSION 121

8.6.2 ALCOHOLIC BEVERAGES 122

8.6.2.1 Need to avoid adulteration and inconsistent quality to drive demand for certifications in alcoholic beverages 122

8.6.3 NON-ALCOHOLIC BEVERAGES 123

8.6.3.1 Certifications to provide traceability and validate authenticity of non-alcoholic beverages 123

8.7 ‘FREE-FROM’ FOODS 123

8.7.1 GROWING AWARENESS OF HEALTH BENEFITS ASSOCIATED WITH AVOIDING CERTAIN INGREDIENTS OR ADDITIVES TO PROPEL MARKET EXPANSION 123

8.7.2 FRUITS & VEGETABLES 124

8.7.2.1 Need to ensure safety and quality of fruits and vegetables to expand market growth 124

8.7.3 FRESH PRODUCE 125

8.7.3.1 Certification to play crucial role for ensuring compliance with strict farming practices 125

8.7.4 DRIED FRUITS & NUTS 126

8.7.4.1 Certification to guarantee dried fruit manufacturers adhere to strict quality standards and ensure safe handling practices 126

8.8 FROZEN FRUITS & VEGETABLES 126

8.8.1 NEED FOR FROZEN FRUITS AND VEGETABLES CERTIFICATION TO VERIFY SAFE PROCESS AND STORE AND PRESERVE NUTRITIONAL QUALITY AND SAFETY 126

8.9 NUTRACEUTICALS & SUPPLEMENTS 126

8.9.1 INCREASING AWARENESS OF HEALTH AND WELLNESS TO BOOST MARKET GROWTH 126

8.10 OTHER APPLICATIONS 127

9 FOOD CERTIFICATION MARKET, BY END USER 129

9.1 INTRODUCTION 130

9.2 FOOD & BEVERAGE MANUFACTURERS 131

9.2.1 NEED TO BUILD CONSUMER TRUST BY PROVIDING CLEAR AND CREDIBLE PROOF THAT THEIR PRODUCTS ADHERE TO SPECIFIC, RECOGNIZED STANDARDS TO DRIVE MARKET 131

9.3 RETAIL & SUPERMARKETS 132

9.3.1 CERTIFICATIONS LIKE FAIR TRADE AND NON-GMO TO HELP PREVENT UNSAFE PRACTICES AND ENSURE PROPER LABELING TO PROPEL MARKET 132

9.4 RESTAURANTS & FOODSERVICE CHAINS 133

9.4.1 CERTIFICATIONS LIKE ALLERGEN-FREE AND ORGANIC LABELS TO UPHOLD HEALTH STANDARDS AND TRUST 133

9.5 GROWERS 134

9.5.1 CERTIFICATIONS TO DEMONSTRATE THAT PRODUCTS MEET SPECIFIC AGRICULTURAL, ENVIRONMENTAL, AND QUALITY STANDARDS 134

9.6 OTHER END USERS 135

10 FOOD CERTIFICATION MARKET, BY CERTIFICATION SCOPE 137

10.1 INTRODUCTION 138

10.2 SINGLE PRODUCT CERTIFICATION 139

10.2.1 SINGLE PRODUCT CERTIFICATION TO ENSURE IT MEETS INDUSTRY STANDARDS FOR SAFETY, QUALITY, AND REGULATORY COMPLIANCE 139

10.3 MULTIPLE PRODUCT CERTIFICATION 140

10.3.1 MULTIPLE PRODUCT CERTIFICATION TO PROVIDE DIVERSE ARRAY OF PRODUCTS ACROSS DIFFERENT CATEGORIES 140

10.4 COMPANY-WIDE CERTIFICATION 141

10.4.1 COMPANY-WIDE CERTIFICATION TO ENHANCE OVERALL OPERATIONS AND PROCESSES WITHIN ORGANIZATION 141

11 FOOD CERTIFICATION MARKET, BY PRICE SENSITIVITY 142

11.1 INTRODUCTION 143

11.2 PREMIUM CERTIFICATIONS 144

11.2.1 PREMIUM CERTIFICATIONS TO ADDRESS MARKETS WITH STRICT QUALITY OR ETHICAL NEEDS 144

11.3 COST-EFFECTIVE CERTIFICATIONS 145

11.3.1 COST-EFFECTIVE CERTIFICATIONS TO ENSURE COMPLIANCE WITH INDUSTRY SAFETY AND QUALITY STANDARDS 145

12 FOOD CERTIFICATION MARKET, BY REGION 146

12.1 INTRODUCTION 147

12.2 NORTH AMERICA 148

12.2.1 US 154

12.2.1.1 Robust framework for food certification and strict regulatory standards to drive market 154

12.2.2 CANADA 157

12.2.2.1 US mandate requiring Canadian exporters to meet updated US food safety standards and growing demand for healthy, organic foods compliance to propel market 157

12.2.3 MEXICO 161

12.2.3.1 Rising instances of foodborne illness and establishment of Good Agricultural Practices (GAP) framework to fuel market growth 161

12.3 EUROPE 164

12.3.1 UK 169

12.3.1.1 Consumer shift toward premium products to boost demand for food certification 169

12.3.2 GERMANY 172

12.3.2.1 High purchasing power among consumers to enable them to opt high-quality food products 172

12.3.3 FRANCE 175

12.3.3.1 High emphasis on quality standards and focus on food safety to foster market growth 175

12.3.4 ITALY 178

12.3.4.1 High consumption of bakery and dairy products to bolster adoption of food safety measures 178

12.3.5 SPAIN 181

12.3.5.1 Stringent quality control procedures for food products and rising consumer awareness regarding food quality and safety to propel market 181

12.3.6 POLAND 184

12.3.6.1 Rise in processed food consumption and adherence to EU regulations for food and agricultural imports to drive market 184

12.3.7 REST OF EUROPE 187

12.4 ASIA PACIFIC 190

12.4.1 CHINA 196

12.4.1.1 Increased food adulteration and fraud incidents in non-vegetarian products to drive growth 196

12.4.2 INDIA 199

12.4.2.1 Growing need to comply with international standards for food products to implement strong food safety practices 199

12.4.3 JAPAN 202

12.4.3.1 Growing demand to adopt food safety measures due to health benefits to boost market growth 202

12.4.4 SOUTH KOREA 205

12.4.4.1 Increase in control over imported food safety hazards to foster market growth 205

12.4.5 AUSTRALIA & NEW ZEALAND 208

12.4.5.1 Companies to adopt food safety measures due to enforced regulations 208

12.4.6 REST OF ASIA PACIFIC 211

12.5 REST OF THE WORLD (ROW) 213

12.5.1 MIDDLE EAST 219

12.5.1.1 Significant increase in demand for halal food products driven by religious beliefs to fuel market growth 219

12.5.2 SOUTH AFRICA 222

12.5.2.1 Growing demand for organic products to fuel market expansion 222

12.5.3 REST OF AFRICA 225

12.6 SOUTH AMERICA 227

12.6.1 BRAZIL 233

12.6.1.1 Stringent regulations imposed by Animal and Plant Health Inspection Service (APHIS) to augment market growth 233

12.6.2 ARGENTINA 236

12.6.2.1 Increased trade of food and agricultural products to fuel demand for food certifications 236

12.6.3 REST OF SOUTH AMERICA 239

13 COMPETITIVE LANDSCAPE 243

13.1 OVERVIEW 243

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 243

13.3 REVENUE ANALYSIS 246

13.4 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH 247

13.5 MARKET SHARE ANALYSIS, 2023 247

13.6 COMPANY VALUATION AND FINANCIAL METRICS 248

13.6.1 COMPANY VALUATION 248

13.6.2 KEY PLAYERS’ EBITDA FINANCIAL METRICS USING EV/EBIDTA 249

13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS 249

13.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 250

13.8.1 STARS 250

13.8.2 EMERGING LEADERS 250

13.8.3 PERVASIVE PLAYERS 250

13.8.4 PARTICIPANTS 250

13.8.5 COMPANY FOOTPRINT: KEY PLAYERS 252

13.8.5.1 Company footprint 252

13.8.5.2 Type footprint 252

13.8.5.3 Application footprint 253

13.8.5.4 Regional footprint 254

13.9 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023 254

13.9.1 PROGRESSIVE COMPANIES 254

13.9.2 RESPONSIVE COMPANIES 254

13.9.3 DYNAMIC COMPANIES 255

13.9.4 STARTING BLOCKS 255

13.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 256

13.9.5.1 Detailed List of Key Startups/SME 256

13.9.5.2 Competitive benchmarking of key startups/SMEs 257

13.10 BRAND/PRODUCT COMPARISON 258

13.11 COMPETITIVE SCENARIO AND TRENDS 258

13.11.1 PRODUCT LAUNCHES/DEVELOPMENTS/APPROVALS 258

13.11.2 DEALS 259

13.11.3 EXPANSIONS 261

14 COMPANY PROFILES 262

14.1 KEY PLAYERS 262

14.1.1 SGS 262

14.1.1.1 Business overview 262

14.1.1.2 Products/Solutions/Services offered 263

14.1.1.3 Recent developments 263

14.1.1.3.1 Product launches 263

14.1.1.3.2 Deals 264

14.1.1.3.3 Other deals/developments 265

14.1.1.4 MnM view 265

14.1.1.4.1 Key strengths 265

14.1.1.4.2 Strategic choices 265

14.1.1.4.3 Weaknesses and competitive threats 265

14.1.2 EUROFINS SCIENTIFIC 266

14.1.2.1 Business overview 266

14.1.2.2 Products/Solutions/Services offered 267

14.1.2.3 Recent developments 267

14.1.2.4 MnM view 267

14.1.2.4.1 Key strengths 267

14.1.2.4.2 Strategic choices 268

14.1.2.4.3 Weaknesses and competitive threats 268

14.1.3 BUREAU VERITAS 269

14.1.3.1 Business overview 269

14.1.3.2 Products/Solutions/Services offered 270

14.1.3.3 Recent developments 271

14.1.3.3.1 Deals 271

14.1.3.4 MnM view 271

14.1.3.4.1 Key strengths 271

14.1.3.4.2 Strategic choices 271

14.1.3.4.3 Weaknesses and competitive threats 271

14.1.4 DEKRA 272

14.1.4.1 Business overview 272

14.1.4.2 Products/Solutions/Services offered 273

14.1.4.3 Recent developments 274

14.1.4.3.1 Deals 274

14.1.4.4 MnM view 274

14.1.4.4.1 Key strengths 274

14.1.4.4.2 Strategic choices 274

14.1.4.4.3 Weaknesses and competitive threats 274

14.1.5 INTERTEK GROUP PLC 275

14.1.5.1 Business overview 275

14.1.5.2 Products/Solutions/Services offered 276

14.1.5.3 Recent developments 277

14.1.5.3.1 Product launches 277

14.1.5.3.2 Deals 277

14.1.5.4 MnM view 278

14.1.5.4.1 Key strengths 278

14.1.5.4.2 Strategic choices 278

14.1.5.4.3 Weaknesses and competitive threats 278

14.1.6 DNV 279

14.1.6.1 Business overview 279

14.1.6.2 Products/Solutions/Services offered 280

14.1.6.3 Recent developments 280

14.1.6.3.1 Deals 280

14.1.6.4 MnM view 280

14.1.7 ASUREQUALITY 281

14.1.7.1 Business overview 281

14.1.7.2 Products/Solutions/Services offered 282

14.1.7.3 Recent developments 282

14.1.7.4 MnM view 282

14.1.7.4.1 Key strengths 282

14.1.8 TÜV SÜD 283

14.1.8.1 Business overview 283

14.1.8.2 Products/Solutions/Services offered 284

14.1.8.3 Recent developments 285

14.1.8.4 MnM view 285

14.1.9 ALS 286

14.1.9.1 Business overview 286

14.1.9.2 Products/Solutions/Services offered 287

14.1.9.3 Recent developments 287

14.1.9.3.1 Deals 287

14.1.9.3.2 Expansions 287

14.1.9.4 MnM view 287

14.1.10 UL LLC 288

14.1.10.1 Business overview 288

14.1.10.2 Products/Solutions/Services offered 288

14.1.10.3 Recent developments 288

14.1.10.4 MnM view 288

14.1.11 KIWA 289

14.1.11.1 Business overview 289

14.1.11.2 Products/Solutions/Services offered 289

14.1.11.3 Recent developments 290

14.1.11.3.1 Deals 290

14.1.11.4 MnM view 290

14.1.12 CONTROL UNION CERTIFICATIONS 291

14.1.12.1 Business overview 291

14.1.12.2 Products/Solutions/Services offered 291

14.1.12.3 Recent developments 292

14.1.12.3.1 Deals 292

14.1.12.4 MnM view 292

14.1.13 AIB INTERNATIONAL, INC. 293

14.1.13.1 Business overview 293

14.1.13.2 Products/Solutions/Services offered 293

14.1.13.3 Recent developments 294

14.1.13.3.1 Deals 294

14.1.13.4 MnM view 294

14.1.14 NSF 295

14.1.14.1 Business overview 295

14.1.14.2 Products/Solutions/Services offered 295

14.1.14.3 Recent developments 296

14.1.14.4 MnM view 296

14.1.15 SCS GLOBAL SERVICES 297

14.1.15.1 Business overview 297

14.1.15.2 Products/Solutions/Services offered 297

14.1.15.3 Recent developments 298

14.1.15.3.1 Deals 298

14.1.15.4 MnM view 298

14.2 OTHER PLAYERS 299

14.2.1 INTL CERTIFICATION LIMITED 299

14.2.1.1 Business overview 299

14.2.1.2 Products/Solutions/Services offered 299

14.2.1.3 Recent developments 299

14.2.1.4 MnM view 299

14.2.2 INDOCERT 300

14.2.2.1 Business overview 300

14.2.2.2 Products/Solutions/Services offered 300

14.2.2.3 Recent developments 300

14.2.2.4 MnM view 300

14.2.3 TQ CERT 301

14.2.3.1 Business overview 301

14.2.3.2 Products/Solutions/Services offered 301

14.2.3.3 Recent developments 301

14.2.3.4 MnM view 301

14.2.4 MS CERTIFICATION SERVICES PVT. LTD. 302

14.2.4.1 Business overview 302

14.2.4.2 Products/Solutions/Services offered 302

14.2.4.3 Recent developments 302

14.2.4.4 MnM view 302

14.2.5 SOCOTEC 303

14.2.5.1 Business overview 303

14.2.5.2 Products/Solutions/Services offered 303

14.2.5.3 Recent developments 303

14.2.5.4 MnM view 303

14.2.6 SAFE FOOD ALLIANCE – FOOD CERTIFICATION MARKET 304

14.2.7 CDG CERTIFICATION LIMITED – FOOD CERTIFICATION MARKET 304

14.2.8 EAGLE CERTIFICATION GROUP – FOOD CERTIFICATION MARKET 305

14.2.9 EQUALITAS CERTIFICATIONS LIMITED – FOOD CERTIFICATION MARKET 305

14.2.10 OCEAN – FOOD CERTIFICATION MARKET 306

15 ADJACENT AND RELATED MARKETS 307

15.1 INTRODUCTION 307

15.2 LIMITATIONS 307

15.3 CERTIFICATE AUTHORITY MARKET 307

15.3.1 MARKET DEFINITION 307

15.3.2 MARKET OVERVIEW 308

15.4 FOOD CERTIFICATION MARKET 309

15.4.1 MARKET DEFINITION 309

15.4.2 MARKET OVERVIEW 309

16 APPENDIX 311

16.1 DISCUSSION GUIDE 311

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 315

16.3 CUSTOMIZATION OPTIONS 317

16.4 RELATED REPORTS 317

16.5 AUTHOR DETAILS 318