1 はじめに 32

1.1 調査目的 32

1.2 市場の定義 32

1.3 調査範囲 33

1.3.1 フレグランス原料市場の細分化 33

1.3.2 考慮した年数 34

1.3.3 含むものと含まないもの 34

1.3.4 フレグランス成分市場:定義と包含、

ソース別 36

1.3.5 フレグランス成分市場:定義と包含、

サブソース別 36

1.3.6 フレグランス成分市場:定義と包含、

成分タイプ別 36

1.4 考慮される単位 37

1.4.1 通貨/価値単位 37

1.4.2 考慮される数量単位 37

1.5 利害関係者 38

1.6 変更点のまとめ 38

2 調査方法 39

2.1 調査データ 39

2.1.1 二次データ 40

2.1.1.1 二次資料からの主要データ 40

2.1.2 一次データ 41

2.1.2.1 一次情報源からの主要データ 41

2.1.2.2 主要な業界インサイト 42

2.1.2.3 一次インタビューの内訳 42

2.1.3 ボトムアップアプローチ 43

2.1.4 トップダウンアプローチ 44

2.2 データの三角測量 45

2.3 リサーチの前提 46

2.4 調査の限界 47

2.5 リスク評価 47

3 エグゼクティブ・サマリー 48

4 プレミアムインサイト 54

4.1 フレグランス原料市場におけるプレーヤーにとっての魅力的な機会 54

4.2 欧州: フレグランス原料市場:供給源別、国別 55

4.3 香料原料市場:地域別スナップショット 56

4.4 フレグランス原料市場:供給源別、地域別 57

4.5 フレグランス成分市場:成分タイプ別・地域別 58

4.6 香料成分市場:用途・地域別 59

5 市場の概要 60

5.1 はじめに 60

5.2 マクロ経済的展望 60

5.2.1 成長するパーソナルケアと化粧品産業 60

5.3 市場ダイナミクス 62

5.3.1 ドライバー 62

5.3.1.1 クリーンラベル傾向の増加 62

5.3.1.2 持続可能性とグリーンケミストリーの重視の高まり 63

5.3.1.3 機能性製品とフレグランスの統合の拡大 63

5.3.2 足かせ 63

5.3.2.1 品質・規制基準の遵守 63

5.3.2.2 原料価格の変動 64

5.3.3 機会 64

5.3.3.1 小売業界のデジタル化 64

5.3.3.2 最終用途産業における革新 64

5.3.4 課題 65

5.3.4.1 新興国におけるバリューチェーンの限定的な進展 65

5.3.4.2 消費者の嗜好の変化 65

5.4 次世代AIがフレグランス原料市場に与える影響 65

5.4.1 導入 65

5.4.2 フレグランス成分における遺伝子AIの使用 65

5.4.2.1 AI主導の処方 65

5.4.2.2 市場動向の予測分析 66

5.4.2.3 原料調達の最適化 66

5.4.2.4 フレグランス開発における持続可能性 66

5.4.2.5 消費者体験の向上 66

5.4.3 ケーススタディ分析 66

5.4.3.1 シムライズとIBMのフレグランス開発におけるAI連携 66

5.4.3.2 次世代製品開発のためのジボダンによる画期的なAIツールの発表 66

5.4.4 フレグランス原料市場への影響 67

5.4.4.1 パーソナライゼーションと消費者エンゲージメント 67

5.4.5 Gen AIに取り組む隣接エコシステム 67

5.4.5.1 香料と食品原料 67

5.4.5.2 デジタル香水プラットフォーム 67

5.4.5.3 美容・パーソナルケア産業 67

6 業界動向 68

6.1 はじめに 68

6.2 サプライチェーン分析 68

6.2.1 原材料の調達 68

6.2.2 加工と抽出 69

6.2.3 製造と混合 69

6.2.4 流通及びサプライチェーン管理 69

6.2.5 規制遵守 69

6.3 バリューチェーン分析 70

6.4 技術分析 70

6.4.1 主要技術 70

6.4.2 補完的技術 71

6.4.3 隣接技術 71

6.5 価格分析 71

6.5.1 地域別フレグランス原料の平均販売価格動向 72

6.6 顧客ビジネスに影響を与えるトレンド/混乱 75

6.7 エコシステム分析 76

6.8 ケーススタディ分析 78

6.8.1 ジボダンの戦略的動き:ナテックス買収による天然成分トレンドの取り込み 78

6.8.2 ジボダンによる天然成分の持続可能な調達 78

6.8.3 シンライズのシンデオPMDグリーン 79

6.8.4 再:再生可能原料でコンシャスな香水を推進するDSM-Firmenichの新コレクション 80

6.9 貿易分析 81

6.9.1 輸入シナリオ(HSコード3303) 81

6.9.2 輸出シナリオ(HSコード3303) 82

6.10 規制の状況 83

6.10.1 規制機関、政府機関、その他の団体 83

6.11 主要会議・イベント(2024~2025年) 86

6.12 投資と資金調達シナリオ 86

6.13 特許分析 87

6.13.1 アプローチ 87

6.13.2 文書タイプ 87

6.13.3 出願者のトップ 89

6.14 ポーターの5つの力分析 90

6.14.1 新規参入の脅威 90

6.14.2 代替品の脅威 91

6.14.3 供給者の交渉力 91

6.14.4 買い手の交渉力 91

6.14.5 競合の激しさ 91

6.15 主要ステークホルダーと購買基準 92

6.15.1 購入プロセスにおける主要ステークホルダー 92

6.15.2 購入基準 93

7 香料原料市場:供給源別 94

7.1 はじめに

7.2 天然 96

7.2.1 柑橘類 99

7.2.1.1 環境に優しい柑橘類が市場の嗜好をリード 99

7.2.2 フローラル 99

7.2.2.1 産業における高い商品価値が需要を押し上げる 99

7.2.3 フルーティー 100

7.2.3.1 パーソナルケアと飲料産業での高い利用が市場成長を促進 100

市場成長 100

7.2.4 ウッディ 100

7.2.4.1 抽出方法の革新が市場発展を促進 100

7.2.5 オリエンタル 100

7.2.5.1 高級香水での使用の増加が市場拡大を促進 100

7.2.6 その他の天然資源 101

7.3 合成 101

7.3.1 柑橘類 103

7.3.1.1 季節的制約を克服する能力が需要を牽引 103

7.3.2 フローラル 104

7.3.2.1 バイオテクノロジーの進歩が市場成長を可能にする 104

7.3.3 フルーティー 104

7.3.3.1 合成フルーティフレグランスを精製するための高度なデジタル技術と官能技術の利用が市場を牽引 104

7.3.4 ウッディ 105

7.3.4.1 環境負荷の大幅な低減が需要を牽引 105

7.3.5 オリエンタル 105

7.3.5.1 希少でユニークな素材を使ったエキゾチックな香りの需要が市場を牽引 105

7.3.6 その他の合成原料 105

8 フレグランス原料市場(原料タイプ別) 106

8.1 はじめに 107

8.2 汎用原料 109

8.2.1 拡張性と手頃な価格が需要を牽引 109

8.3 特殊原料 110

8.3.1 独特で高級感のあるフレグランス・プロファイルへの嗜好の高まりが市場を牽引 110

8.4 独自成分 112

8.4.1 特徴的な香りの需要の高まりが市場を牽引 112

9 フレグランス原料市場(用途別) 114

9.1 はじめに 115

9.2 パーソナルケア製品 117

9.2.1 フレグランスの使用は官能的な豊かさを高め、製品の魅力を高める 117

9.3 家庭用製品 119

9.3.1 家庭用品における香料の使用は消費者の満足度を高める 119

9.4 化粧品 121

9.4.1 香りは美容製品の魅力と使いやすさを高める 121

9.5 食品と飲料 123

9.5.1 フレグランス成分は官能的魅力を高め、ブランド認知に影響を与える 123

9.6 工業用 125

9.6.1 不要な化学臭をマスキングするニーズが市場を牽引 125

9.7 その他の用途 127

10 香料成分市場:形態別 129

10.1 導入 130

10.2 液体 131

10.2.1 取り扱いが容易で製剤との適合性が需要を促進 131

10.3 粉末 131

10.3.1 長い保存期間と輸送の容易さが市場を牽引 131

11 香料成分市場:技術別 132

11.1 導入 133

11.2 抽出技術 133

11.2.1 天然香料の消費拡大が需要を加速 133

11.3 バイオテクノロジー 133

11.3.1 環境に優しく一貫性のある香料への需要の高まりが市場を牽引 133

11.4 カプセル化及び放出制御 134

11.4.1 顧客の嗜好に合わせてカスタマイズできる能力

が需要を牽引 134

11.5 その他の技術 134

12 香料原料市場(地域別) 135

12.1 はじめに 136

12.2 北米 138

12.2.1 北米のマクロ経済見通し 138

12.2.2 米国 146

12.2.2.1 FDA規制が市場を牽引 146

12.2.3 カナダ 147

12.2.3.1 環境意識の高まりと天然製品に対する需要が市場を牽引 147

が市場を牽引 147

12.2.4 メキシコ 148

12.2.4.1 化粧品とパーソナルケア分野の繁栄が市場を活性化 148

12.3 欧州 150

12.3.1 欧州のマクロ経済見通し 150

12.3.2 ドイツ 157

12.3.2.1 手頃な高級品とセルフケアの回復力が市場を牽引 157

12.3.3 イギリス 158

12.3.3.1 パーソナルケア分野の成長が香料原料の需要を牽引 158

12.3.4 フランス 159

12.3.4.1 フランス製香水の人気の高まりが市場を牽引 159

12.3.5 イタリア 160

12.3.5.1 米国の美容ブランドによるイタリアへのアウトソーシングが市場を牽引 160

12.3.6 スペイン 162

12.3.6.1 健康と美容製品に対する需要の高まりが市場を押し上げる 162

12.3.7 その他の欧州 163

12.4 アジア太平洋地域 165

12.4.1 アジア太平洋地域のマクロ経済見通し 165

12.4.2 中国 173

12.4.2.1 中国伝統香料の活性化と国内ブランドの台頭が市場を活性化 173

12.4.3 インド 174

12.4.3.1 アロマセラピーとホリスティックヘルスソリューションの需要増加が市場を牽引 174

12.4.4 日本 175

12.4.4.1 低アレルギー性の天然成分を好む消費者の増加と規制の変更が市場を牽引 175

12.4.5 オーストラリア、ニュージーランド 176

12.4.5.1 天然・有機パーソナルケア製品に対する需要の高まりが市場を活性化 176

12.4.6 その他のアジア太平洋地域 178

12.5 南米 179

12.5.1 南米のマクロ経済見通し 179

12.5.2 ブラジル 186

12.5.2.1 身だしなみに対する文化的親和性と多様な消費者の嗜好が市場を牽引 186

12.5.3 アルゼンチン 187

12.5.3.1 プレミアム・パーソナルケア製品に対する需要の高まりが

が市場を牽引 187

12.5.4 その他の南米地域 189

12.6 その他の地域 190

12.6.1 その他の地域のマクロ経済見通し 190

12.6.2 中東 197

12.6.2.1 文化的親和性と経済力が市場を牽引 197

12.6.3 アフリカ 198

12.6.3.1 文化遺産と豊富な天然資源が市場を牽引 198

13 競争環境 200

13.1 はじめに 200

13.2 主要企業が採用した戦略/勝つための権利(2020~2024年) 200

13.3 市場シェア分析、202年

13.4 収益分析、2021-2023 203

13.5 主要市場参入企業のグローバル・スナップショット 204

13.6 企業評価マトリックス:主要企業、2023年 204

13.6.1 スター企業 204

13.6.2 新興リーダー 204

13.6.3 浸透型プレーヤー 205

13.6.4 参加企業 205

13.6.5 企業フットプリント:主要プレーヤー(2023年) 206

13.6.5.1 企業フットプリント 206

13.6.5.2 地域別フットプリント 207

13.6.5.3 発生源のフットプリント 208

13.6.5.4 アプリケーションフットプリント 209

13.7 企業評価マトリクス:新興企業/SM(2023年) 210

13.7.1 進歩的企業 210

13.7.2 対応力のある企業 210

13.7.3 ダイナミックな企業 210

13.7.4 スタートアップ・ブロック 210

13.7.5 競争ベンチマーキング:新興企業/SM、2023年 212

13.7.5.1 主要新興企業/中小企業の詳細リスト 212

13.7.5.2 主要新興企業/中小企業の競合ベンチマーキング 213

13.8 ブランド/製品の比較 214

13.9 企業評価と財務指標 215

13.10 競争シナリオ 216

13.10.1 製品上市 216

13.10.2 取引 222

13.10.3 事業拡大 227

13.10.4 その他の開発 236

14 会社プロファイル 237

14.1 紹介 237

14.2 主要プレーヤー 237

BASF (Germany)

MANE SA (France)

dsm-firmenich (Switzerland)

Givaduan (Switzerland)

International Flavors and Fragrances (US)

Sensient Technologies (US)

Takasago International Corporation (Japan)

Robertet Fragrances Inc (France)

Kao Chemicals (Japan)

and Symrise (Germany)

15 隣接・関連市場 350

15.1 導入 350

15.2 制限 350

15.3 アロマ原料市場 350

15.3.1 市場の定義 350

15.3.2 市場概要 350

15.4 アロマ原料市場:地域別 351

15.4.1 欧州 351

15.4.2 アジア太平洋 352

15.4.3 北米 352

15.4.4 中東・アフリカ 353

15.4.5 南米 353

16 付録 354

16.1 ディスカッション・ガイド 354

16.2 Knowledgestore: マーケットサ ンドマーケッツの購読ポータル 357

16.3 カスタマイズオプション 359

16.4 関連レポート 359

16.5 著者の詳細 360

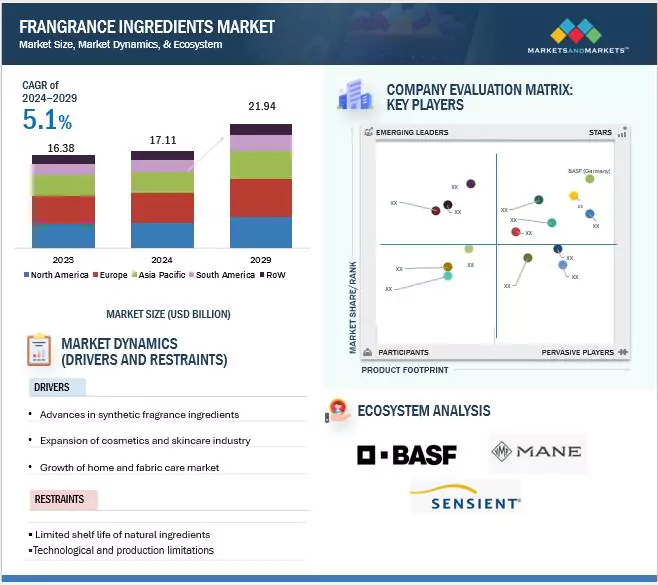

Fragrance Ingredients are crucial for providing desirable qualities to products. Widely used across the industry, these fragrances are employed for customer attraction, more sale due to desirable qualities of products.

End-users encompass large-scale cosmetics brands, well-established personal care brands, emerging food and beverage companies, household products producers, and consumers who prioritize convenience and desirable qualities of product. The market's growth is driven by factors such as Innovation in Scent Profiles, Increase in Disposable Income, and the Advances in Technology and Extraction Processes.

“Extraction Process is popular in the fragrance ingredients market across the globe due to wide usage across manufacturers.”

The extraction process is a straightforward and widely used method in the fragrance industry for deriving scents from essential oils. Fragrance compounds, including flowers, oils, and leaves, are often processed to extract these essential oils, which serve as the foundation for many perfumes and scented products.

On November 5, 2024, Robertett, a leading supplier of natural raw materials for fragrances and flavors recently announced its acquisition of Phasex, a Massachusetts-based pioneer in supercritical CO₂ extraction technology. Supercritical CO₂ extraction enables the extraction of aromatic and functional components from solid biomass or liquid raw materials using carbon dioxide in a supercritical state, ensuring high purity and quality of the resulting extracts.

Acquisitions like this underscore the increasing prominence and adoption of advanced extraction technologies in the fragrance ingredients market. These technologies not only enhance the efficiency and sustainability of production processes but also support the growing demand for natural, high-quality fragrance ingredients. Such strategic investments reflect the market's commitment to innovation and its response to consumer preferences for eco-friendly and ethically sourced products.

“Synthetic ingredients is popular in the fragrance ingredients market across the globe due to its cost-effectiveness and it is easy to maintain quality across production.”

Perfumes crafted from synthetic ingredients offer remarkable consistency, as controlled manufacturing conditions ensure that each batch smells identical, maintaining quality across production. These lab-made ingredients are also cost-effective, typically less expensive than natural extracts, making synthetic perfumes accessible to a broader audience. Furthermore, synthetic scents unlock creative possibilities for perfumers, allowing them to design unique, innovative fragrances that are unattainable with natural ingredients alone, thanks to custom molecular engineering for specific scent profiles. Synthetic ingredients also excel in longevity and performance, with many designed for lasting scent retention and strong sillage, making them highly sought-after in commercial perfumery. Additionally, synthetic fragrances contribute to sustainability by reducing dependence on natural resources and enabling consistent supply chains, unaffected by seasonal or environmental factors that impact natural raw materials. This stability supports large-scale production and facilitates meeting the growing global demand for diverse and affordable fragrances.

“By ingredient type, commodity fragrance in the fragrance ingredients market are popular due to its mass-production”

Commodity fragrance ingredients refer to standard, widely used aromatic compounds that are typically mass-produced and readily available in the market. They include common synthetic molecules like vanillin or linalool. Vanilla, derived from the pods of the Vanilla planifolia orchid, is the world’s most popular flavor and fragrance. Although it contains around 200 different compounds, its distinctive aroma and taste are primarily attributed to vanillin. This versatile ingredient is highly valued across various industries, including ice creams, confectionery, dairy products, perfumes, pharmaceuticals, and liqueurs, making it a cornerstone of a substantial multimillion-dollar market.

“Europe and its fragrance ingredient market to be affected by EU Green Deal.”

Europe’s regulatory landscape is undergoing significant changes, largely driven by the forthcoming EU Chemicals Strategy for Sustainability (CSS), part of the EU Green Deal. Over 80 regulatory updates have been proposed, including revisions to REACH and CLP (Classification, Labelling, and Packaging), with new hazard classifications such as endocrine disruption recently introduced. The CSS introduces stricter frameworks, such as the general risk approach, which aims to impose faster and more stringent restrictions on chemicals in both professional and consumer products. Additionally, the "essential use" concept provides limited exceptions to these general restrictions, while mixture toxicity assessments and the “safe and sustainable by design” initiative set standards for safer chemical innovation. These changes will bring a range of new safety and sustainability requirements, impacting the fragrance ingredients market by demanding increased compliance, reformulations, and more sustainable practices across product lifecycles.

The break-up of the profile of primary participants in the fragrance ingredients market:

By Company: Tier 1- 40.0%, Tier 2- 20.0% and Tier 3- 40.0%.

By Designation: CXO’s: 26.0%, Managers: 30.0% and Executives: 44.0%

By Region: North America – 20.0%, Europe – 20.0%, Asia Pacific – 40.0%, South America – 10.0% and RoW – 10.0%

Key Market Players

Key players operating in the fragrance ingredients market include BASF (Germany), MANE SA (France), dsm-firmenich (Switzerland), Givaduan (Switzerland), International Flavors and Fragrances (US), Sensient Technologies (US), Takasago International Corporation (Japan), Robertet Fragrances, Inc (France), Kao Chemicals (Japan), and Symrise (Germany).

Research Coverage:

This research report categorizes the fragrance ingredients market by technology (Extraction Technologies, Biotechnology, Encapsulation and Controlled Release, Other Technology) by source (Natural (Citrus, Floral, Fruity, Woody, oriental, others) Synthetic (Citrus, Floral, Fruity, Woody, oriental, others), by Ingredient Type (commodity ingredients, specialty ingredients, proprietary ingredients) by application (personal care products, household products, cosmetics, food and beverage, industrial applications), by form (Liquid, Powder) and by region (North America, Europe, Asia Pacific, South America and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the fragrance ingredients market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products and services; key strategies; contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the fragrance ingredients market. Competitive analysis of upcoming startups in the fragrance ingredients market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall fragrance ingredients market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (Advances in synthetic fragrance ingredients , Expansion of the Cosmetics and Skincare Industry, Innovation in Scent Profiles, and Increase in Disposable Income), restraints (Limited Shelf life of natural ingredients, Stringent Regulations), opportunities (Innovation in Sustainable Fragrance Ingredients, Expanding Applications in Household and Industrial Products, Technological Advances in fragrance industry), and challenges (Managing Environmental Impact of Production, High development and testing cost) influencing the growth of the fragrance ingredients market.

• Product Development/Innovation: Detailed insights on research & development activities, and new product & service launches in the fragrance ingredients market.

• Market Development: Comprehensive information about lucrative markets – the report analyses the fragrance ingredients market across varied regions.

• Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the fragrance ingredients market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including Key players operating in the fragrance ingredients market include BASF (Germany), MANE SA (France), dsm-firmenich (Switzerland), Givaduan (Switzerland), International Flavors and Fragrances (US), Sensient Technologies (US), Takasago International Corporation (Japan), Robertet Fragrances, Inc (France), Kao Chemicals (Japan), and Symrise (Germany) among others in the fragrance ingredients market strategies.

1 INTRODUCTION 32

1.1 STUDY OBJECTIVES 32

1.2 MARKET DEFINITION 32

1.3 STUDY SCOPE 33

1.3.1 FRAGRANCE INGREDIENTS MARKET SEGMENTATION 33

1.3.2 YEARS CONSIDERED 34

1.3.3 INCLUSIONS AND EXCLUSIONS 34

1.3.4 FRAGRANCE INGREDIENTS MARKET: DEFINITION AND INCLUSIONS,

BY SOURCE 36

1.3.5 FRAGRANCE INGREDIENTS MARKET: DEFINITION AND INCLUSIONS,

BY SUB-SOURCE 36

1.3.6 FRAGRANCE INGREDIENTS MARKET: DEFINITION AND INCLUSIONS,

BY INGREDIENT TYPE 36

1.4 UNIT CONSIDERED 37

1.4.1 CURRENCY/VALUE UNIT 37

1.4.2 VOLUME UNITS CONSIDERED 37

1.5 STAKEHOLDERS 38

1.6 SUMMARY OF CHANGES 38

2 RESEARCH METHODOLOGY 39

2.1 RESEARCH DATA 39

2.1.1 SECONDARY DATA 40

2.1.1.1 Key data from secondary sources 40

2.1.2 PRIMARY DATA 41

2.1.2.1 Key data from primary sources 41

2.1.2.2 Key industry insights 42

2.1.2.3 Breakdown of primary interviews 42

2.1.3 BOTTOM-UP APPROACH 43

2.1.4 TOP-DOWN APPROACH 44

2.2 DATA TRIANGULATION 45

2.3 RESEARCH ASSUMPTIONS 46

2.4 RESEARCH LIMITATIONS 47

2.5 RISK ASSESSMENT 47

3 EXECUTIVE SUMMARY 48

4 PREMIUM INSIGHTS 54

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FRAGRANCE INGREDIENTS MARKET 54

4.2 EUROPE: FRAGRANCE INGREDIENTS MARKET, BY SOURCE AND COUNTRY 55

4.3 FRAGRANCE INGREDIENTS MARKET: REGIONAL SNAPSHOT 56

4.4 FRAGRANCE INGREDIENTS MARKET, BY SOURCE AND REGION 57

4.5 FRAGRANCE INGREDIENTS MARKET, BY INGREDIENT TYPE AND REGION 58

4.6 FRAGRANCE INGREDIENTS MARKET, BY APPLICATION AND REGION 59

5 MARKET OVERVIEW 60

5.1 INTRODUCTION 60

5.2 MACROECONOMIC OUTLOOK 60

5.2.1 GROWING PERSONAL CARE AND COSMETICS INDUSTRY 60

5.3 MARKET DYNAMICS 62

5.3.1 DRIVERS 62

5.3.1.1 Increase in clean label trends 62

5.3.1.2 Growing emphasis on sustainability and green chemistry 63

5.3.1.3 Expansion of functional products and fragrance integration 63

5.3.2 RESTRAINTS 63

5.3.2.1 Compliance with quality and regulatory standards 63

5.3.2.2 Fluctuating raw material prices 64

5.3.3 OPPORTUNITIES 64

5.3.3.1 Digitalization of retail industry 64

5.3.3.2 Innovation in end-use industries 64

5.3.4 CHALLENGES 65

5.3.4.1 Limited progression in value chain among emerging economies 65

5.3.4.2 Changing consumer preferences 65

5.4 IMPACT OF GEN AI ON FRAGRANCE INGREDIENTS MARKET 65

5.4.1 INTRODUCTION 65

5.4.2 USE OF GEN AI IN FRAGRANCE INGREDIENTS 65

5.4.2.1 AI-driven formulation 65

5.4.2.2 Predictive analytics for market trends 66

5.4.2.3 Optimizing ingredient sourcing 66

5.4.2.4 Sustainability in fragrance development 66

5.4.2.5 Enhanced consumer experiences 66

5.4.3 CASE STUDY ANALYSIS 66

5.4.3.1 AI collaboration between Symrise and IBM in fragrance creation 66

5.4.3.2 Launch of ground-breaking AI tools by Givaudan for next-generation product development 66

5.4.4 IMPACT ON FRAGRANCE INGREDIENTS MARKET 67

5.4.4.1 Personalization and consumer engagement 67

5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI 67

5.4.5.1 Flavors and food ingredients 67

5.4.5.2 Digital perfumery platforms 67

5.4.5.3 Beauty and personal care industry 67

6 INDUSTRY TRENDS 68

6.1 INTRODUCTION 68

6.2 SUPPLY CHAIN ANALYSIS 68

6.2.1 RAW MATERIAL SOURCING 68

6.2.2 PROCESSING AND EXTRACTION 69

6.2.3 MANUFACTURING AND BLENDING 69

6.2.4 DISTRIBUTION AND SUPPLY CHAIN MANAGEMENT 69

6.2.5 REGULATORY COMPLIANCE 69

6.3 VALUE CHAIN ANALYSIS 70

6.4 TECHNOLOGY ANALYSIS 70

6.4.1 KEY TECHNOLOGIES 70

6.4.2 COMPLEMENTARY TECHNOLOGIES 71

6.4.3 ADJACENT TECHNOLOGIES 71

6.5 PRICING ANALYSIS 71

6.5.1 AVERAGE SELLING PRICE TREND OF FRAGRANCE INGREDIENTS, BY REGION 72

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 75

6.7 ECOSYSTEM ANALYSIS 76

6.8 CASE STUDY ANALYSIS 78

6.8.1 STRATEGIC MOVE BY GIVAUDAN: CAPTURING NATURAL INGREDIENT TREND THROUGH NATUREX ACQUISITION 78

6.8.2 SUSTAINABLE SOURCING OF NATURALS BY GIVAUDAN 78

6.8.3 SYMRISE’S SYMDEO PMD GREEN 79

6.8.4 RE: NEW COLLECTION FROM DSM-FIRMENICH DRIVE CONSCIOUS PERFUMERY WITH RENEWABLE INGREDIENTS 80

6.9 TRADE ANALYSIS 81

6.9.1 IMPORT SCENARIO (HS CODE 3303) 81

6.9.2 EXPORT SCENARIO (HS CODE 3303) 82

6.10 REGULATORY LANDSCAPE 83

6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 83

6.11 KEY CONFERENCES AND EVENTS, 2024–2025 86

6.12 INVESTMENT AND FUNDING SCENARIO 86

6.13 PATENT ANALYSIS 87

6.13.1 APPROACH 87

6.13.2 DOCUMENT TYPES 87

6.13.3 TOP APPLICANTS 89

6.14 PORTER’S FIVE FORCES ANALYSIS 90

6.14.1 THREAT OF NEW ENTRANTS 90

6.14.2 THREAT OF SUBSTITUTES 91

6.14.3 BARGAINING POWER OF SUPPLIERS 91

6.14.4 BARGAINING POWER OF BUYERS 91

6.14.5 INTENSITY OF COMPETITIVE RIVALRY 91

6.15 KEY STAKEHOLDERS AND BUYING CRITERIA 92

6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS 92

6.15.2 BUYING CRITERIA 93

7 FRAGRANCE INGREDIENTS MARKET, BY SOURCE 94

7.1 INTRODUCTION 95

7.2 NATURAL 96

7.2.1 CITRUS 99

7.2.1.1 Eco-friendly citrus leads in market preference 99

7.2.2 FLORAL 99

7.2.2.1 High commercial value in industries to boost demand 99

7.2.3 FRUITY 100

7.2.3.1 High usage in personal care and beverage industries to foster

market growth 100

7.2.4 WOODY 100

7.2.4.1 Innovation in extraction methods to encourage market development 100

7.2.5 ORIENTAL 100

7.2.5.1 Increasing use in luxury perfumes to facilitate market expansion 100

7.2.6 OTHER NATURAL SOURCES 101

7.3 SYNTHETIC 101

7.3.1 CITRUS 103

7.3.1.1 Ability to overcome seasonal limitations to drive demand 103

7.3.2 FLORAL 104

7.3.2.1 Advancements in biotechnology to enable market growth 104

7.3.3 FRUITY 104

7.3.3.1 Use of advanced digital and sensory techniques to refine synthetic fruity fragrances to drive market 104

7.3.4 WOODY 105

7.3.4.1 Significant reduction in environmental impact to drive demand 105

7.3.5 ORIENTAL 105

7.3.5.1 Demand for exotic fragrances using rare and unique materials to drive market 105

7.3.6 OTHER SYNTHETIC SOURCES 105

8 FRAGRANCE INGREDIENTS MARKET, BY INGREDIENT TYPE 106

8.1 INTRODUCTION 107

8.2 COMMODITY INGREDIENTS 109

8.2.1 SCALABILITY AND AFFORDABILITY TO DRIVE DEMAND 109

8.3 SPECIALTY INGREDIENTS 110

8.3.1 GROWING PREFERENCE FOR UNIQUE AND LUXURIOUS FRAGRANCE PROFILES TO DRIVE MARKET 110

8.4 PROPRIETARY INGREDIENTS 112

8.4.1 GROWING DEMAND FOR DISTINCTIVE SIGNATURE SCENTS TO DRIVE MARKET 112

9 FRAGRANCE INGREDIENTS MARKET, BY APPLICATION 114

9.1 INTRODUCTION 115

9.2 PERSONAL CARE PRODUCTS 117

9.2.1 FRAGRANCE USE BOOSTS SENSORY RICHNESS AND ENHANCES PRODUCT APPEAL 117

9.3 HOUSEHOLD PRODUCTS 119

9.3.1 USE OF FRAGRANCE IN HOUSEHOLD PRODUCTS ENHANCES CONSUMER SATISFACTION 119

9.4 COSMETICS 121

9.4.1 FRAGRANCE ENHANCES APPEAL AND USABILITY OF BEAUTY PRODUCTS 121

9.5 FOOD AND BEVERAGES 123

9.5.1 FRAGRANCE INGREDIENTS ENHANCE SENSORY APPEAL AND IMPACT BRAND PERCEPTION 123

9.6 INDUSTRIAL 125

9.6.1 NEED TO MASK UNWANTED CHEMICAL ODORS TO DRIVE MARKET 125

9.7 OTHER APPLICATIONS 127

10 FRAGRANCE INGREDIENTS MARKET, BY FORM 129

10.1 INTRODUCTION 130

10.2 LIQUID 131

10.2.1 EASY HANDLING AND COMPATIBILITY WITH FORMULATIONS TO PROMOTE DEMAND 131

10.3 POWDER 131

10.3.1 LONGER SHELF LIFE AND EASE OF TRANSPORT TO DRIVE MARKET 131

11 FRAGRANCE INGREDIENTS MARKET, BY TECHNOLOGY 132

11.1 INTRODUCTION 133

11.2 EXTRACTION TECHNOLOGY 133

11.2.1 INCREASING CONSUMPTION OF NATURAL FRAGRANCES TO ACCELERATE DEMAND 133

11.3 BIOTECHNOLOGY 133

11.3.1 GROWING DEMAND FOR ECO-FRIENDLY AND CONSISTENT FRAGRANCES TO DRIVE MARKET 133

11.4 ENCAPSULATION & CONTROLLED RELEASE 134

11.4.1 CAPACITY TO BE CUSTOMIZED TO MEET CUSTOMER PREFERENCES

TO DRIVE DEMAND 134

11.5 OTHER TECHNOLOGIES 134

12 FRAGRANCE INGREDIENTS MARKET, BY REGION 135

12.1 INTRODUCTION 136

12.2 NORTH AMERICA 138

12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 138

12.2.2 US 146

12.2.2.1 FDA regulations to drive market 146

12.2.3 CANADA 147

12.2.3.1 Rising eco-consciousness and demand for natural products

to drive market 147

12.2.4 MEXICO 148

12.2.4.1 Thriving cosmetics and personal care sectors to fuel market 148

12.3 EUROPE 150

12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 150

12.3.2 GERMANY 157

12.3.2.1 Resilience of affordable luxury and self-care to drive market 157

12.3.3 UK 158

12.3.3.1 Growth in personal care sector to drive demand for fragrance ingredients 158

12.3.4 FRANCE 159

12.3.4.1 Growing popularity of French perfumes to drive market 159

12.3.5 ITALY 160

12.3.5.1 Outsourcing by US beauty brands to Italy to drive market 160

12.3.6 SPAIN 162

12.3.6.1 Growing demand for health and beauty products to boost market 162

12.3.7 REST OF EUROPE 163

12.4 ASIA PACIFIC 165

12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 165

12.4.2 CHINA 173

12.4.2.1 Revitalization of traditional Chinese fragrances and rise of domestic brands to fuel market 173

12.4.3 INDIA 174

12.4.3.1 Rising demand for aromatherapy and holistic health solutions to drive market 174

12.4.4 JAPAN 175

12.4.4.1 Increasing consumer preference for natural, hypoallergenic ingredients and regulatory changes to drive market 175

12.4.5 AUSTRALIA AND NEW ZEALAND 176

12.4.5.1 Growing demand for natural and organic personal care products to fuel market 176

12.4.6 REST OF ASIA PACIFIC 178

12.5 SOUTH AMERICA 179

12.5.1 MACROECONOMIC OUTLOOK FOR SOUTH AMERICA 179

12.5.2 BRAZIL 186

12.5.2.1 Cultural affinity for personal grooming and diverse consumer preferences to drive market 186

12.5.3 ARGENTINA 187

12.5.3.1 Increasing demand for premium personal care products

to drive market 187

12.5.4 REST OF SOUTH AMERICA 189

12.6 REST OF THE WORLD 190

12.6.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD 190

12.6.2 MIDDLE EAST 197

12.6.2.1 Cultural affinity and economic power drive market 197

12.6.3 AFRICA 198

12.6.3.1 Cultural heritage and abundant natural resources drive market 198

13 COMPETITIVE LANDSCAPE 200

13.1 INTRODUCTION 200

13.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN, 2020–2024 200

13.3 MARKET SHARE ANALYSIS, 2023 202

13.4 REVENUE ANALYSIS, 2021–2023 203

13.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS 204

13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 204

13.6.1 STARS 204

13.6.2 EMERGING LEADERS 204

13.6.3 PERVASIVE PLAYERS 205

13.6.4 PARTICIPANTS 205

13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 206

13.6.5.1 Company footprint 206

13.6.5.2 Region footprint 207

13.6.5.3 Source footprint 208

13.6.5.4 Application footprint 209

13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 210

13.7.1 PROGRESSIVE COMPANIES 210

13.7.2 RESPONSIVE COMPANIES 210

13.7.3 DYNAMIC COMPANIES 210

13.7.4 STARTING BLOCKS 210

13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 212

13.7.5.1 Detailed list of key startups/SMEs 212

13.7.5.2 Competitive benchmarking of key startups/SMEs 213

13.8 BRAND/PRODUCT COMPARISON 214

13.9 COMPANY VALUATION AND FINANCIAL METRICS 215

13.10 COMPETITIVE SCENARIO 216

13.10.1 PRODUCT LAUNCHES 216

13.10.2 DEALS 222

13.10.3 EXPANSIONS 227

13.10.4 OTHER DEVELOPMENTS 236

14 COMPANY PROFILES 237

14.1 INTRODUCTION 237

14.2 MAJOR PLAYERS 237

14.2.1 BASF 237

14.2.1.1 Business overview 237

14.2.1.2 Products/Solutions/Services offered 238

14.2.1.3 Recent developments 241

14.2.1.3.1 Product launches 241

14.2.1.3.2 Deals 241

14.2.1.3.3 Expansions 242

14.2.1.4 SWOT analysis 242

14.2.1.5 MnM view 243

14.2.1.5.1 Right to win 243

14.2.1.5.2 Strategic choices 243

14.2.1.5.3 Weaknesses and competitive threats 243

14.2.2 INTERNATIONAL FLAVORS & FRAGRANCES, INC. 244

14.2.2.1 Business overview 244

14.2.2.2 Products/Solutions/Services offered 245

14.2.2.3 Recent developments 248

14.2.2.3.1 Deals 248

14.2.2.3.2 Expansions 249

14.2.2.4 SWOT analysis 250

14.2.2.5 MnM view 251

14.2.2.5.1 Right to win 251

14.2.2.5.2 Strategic choices 251

14.2.2.5.3 Weaknesses and competitive threats 251

14.2.3 GIVAUDAN 252

14.2.3.1 Business overview 252

14.2.3.2 Products/Solutions/Services offered 253

14.2.3.3 Recent developments 255

14.2.3.3.1 Product launches 255

14.2.3.3.2 Deals 256

14.2.3.3.3 Expansions 258

14.2.3.4 SWOT analysis 259

14.2.3.5 MnM view 259

14.2.3.5.1 Right to win 259

14.2.3.5.2 Strategic choices 260

14.2.3.5.3 Weaknesses and competitive threats 260

14.2.4 SYMRISE 261

14.2.4.1 Business overview 261

14.2.4.2 Products/Solutions/Services offered 262

14.2.4.3 Recent developments 265

14.2.4.3.1 Product launches 265

14.2.4.3.2 Deals 266

14.2.4.3.3 Expansions 267

14.2.4.3.4 Other developments 268

14.2.4.4 SWOT analysis 268

14.2.4.5 MnM view 269

14.2.4.5.1 Right to win 269

14.2.4.5.2 Strategic choices 269

14.2.4.5.3 Weaknesses and competitive threats 269

14.2.5 DSM-FIRMENICH 270

14.2.5.1 Business overview 270

14.2.5.2 Products/Solutions/Services offered 271

14.2.5.3 Recent developments 274

14.2.5.3.1 Product launches 274

14.2.5.3.2 Deals 275

14.2.5.3.3 Expansions 276

14.2.5.4 SWOT analysis 277

14.2.5.5 MnM view 277

14.2.5.5.1 Right to win 277

14.2.5.5.2 Strategic choices 278

14.2.5.5.3 Weaknesses and competitive threats 278

14.2.6 ROBERTET GROUP 279

14.2.6.1 Business overview 279

14.2.6.2 Products/Solutions/Services offered 280

14.2.6.3 Recent developments 284

14.2.6.3.1 Deals 284

14.2.6.3.2 Other developments 285

14.2.6.4 SWOT analysis 286

14.2.6.5 MnM view 286

14.2.7 TAKASAGO INTERNATIONAL CORPORATION 287

14.2.7.1 Business overview 287

14.2.7.2 Products/Solutions/Services offered 288

14.2.7.3 SWOT analysis 289

14.2.7.4 MnM view 290

14.2.8 MANE 291

14.2.8.1 Business overview 291

14.2.8.2 Products/Solutions/Services offered 292

14.2.8.3 Recent developments 292

14.2.8.3.1 Product launches 292

14.2.8.3.2 Deals 293

14.2.8.3.3 Expansions 293

14.2.8.4 SWOT analysis 296

14.2.8.5 MnM view 296

14.2.9 KAO CORPORATION 297

14.2.9.1 Business overview 297

14.2.9.2 Products/Solutions/Services offered 299

14.2.9.3 Recent developments 300

14.2.9.3.1 Product launches 300

14.2.9.3.2 Deals 300

14.2.9.3.3 Expansions 301

14.2.9.4 SWOT analysis 301

14.2.9.5 MnM view 302

14.2.10 T. HASEGAWA CO., LTD. 303

14.2.10.1 Business overview 303

14.2.10.2 Products/Solutions/Services offered 304

14.2.10.3 SWOT analysis 305

14.2.10.4 MnM view 305

14.2.11 CPL AROMAS 306

14.2.11.1 Business overview 306

14.2.11.2 Products/Solutions/Services offered 307

14.2.11.3 Recent developments 308

14.2.11.3.1 Product launches 308

14.2.11.3.2 Deals 309

14.2.11.3.3 Expansions 310

14.2.11.4 SWOT analysis 311

14.2.11.5 MnM view 311

14.2.12 AROMATECH 312

14.2.12.1 Business overview 312

14.2.12.2 Products/Solutions/Services offered 312

14.2.12.3 Recent developments 314

14.2.12.3.1 Product launches 314

14.2.12.4 SWOT analysis 315

14.2.12.5 MnM view 315

14.2.13 TREATT PLC 316

14.2.13.1 Business overview 316

14.2.13.2 Products/Solutions/Services offered 317

14.2.13.3 Recent developments 318

14.2.13.3.1 Deals 318

14.2.13.3.2 Expansions 318

14.2.13.4 SWOT analysis 319

14.2.13.5 MnM view 319

14.2.14 HUABAO 320

14.2.14.1 Business overview 320

14.2.14.2 Products/Solutions/Services offered 321

14.2.14.3 SWOT analysis 322

14.2.14.4 MnM view 322

14.2.15 KEVA 323

14.2.15.1 Business overview 323

14.2.15.2 Products/Solutions/Services offered 325

14.2.15.3 Recent developments 325

14.2.15.3.1 Deals 325

14.2.15.4 SWOT analysis 326

14.2.15.5 MnM view 326

14.3 OTHER PLAYERS 327

14.3.1 KALPSUTRA CHEMICALS PVT. LTD. 327

14.3.1.1 Business overview 327

14.3.1.2 Products/Solutions/Services offered 327

14.3.1.3 Recent developments 329

14.3.1.4 SWOT analysis 329

14.3.1.5 MnM view 329

14.3.2 ETERNIS FINE CHEMICALS 330

14.3.2.1 Business overview 330

14.3.2.2 Products/Solutions/Services offered 330

14.3.2.3 Recent developments 332

14.3.2.3.1 Deals 332

14.3.2.4 SWOT analysis 332

14.3.2.5 MnM view 333

14.3.3 AXXENCE AROMATIC GMBH 334

14.3.3.1 Business overview 334

14.3.3.2 Products/Solutions/Services offered 334

14.3.3.3 Recent developments 336

14.3.3.3.1 Deals 336

14.3.3.4 SWOT analysis 336

14.3.3.5 MnM view 337

14.3.4 FINE FRAGRANCES 338

14.3.4.1 Business overview 338

14.3.4.2 Products/Solutions/Services offered 338

14.3.4.3 Recent developments 339

14.3.4.4 SWOT analysis 340

14.3.4.5 MnM view 340

14.3.5 HARMONY ORGANICS PVT. LTD. 341

14.3.5.1 Business overview 341

14.3.5.2 Products/Solutions/Services offered 341

14.3.5.3 Recent developments 343

14.3.5.3.1 Product launches 343

14.3.5.4 SWOT analysis 344

14.3.5.5 MnM view 344

14.3.6 YIN YANG AROMA CHEMICAL GROUP 345

14.3.7 CRESCENT FRAGRANCES PVT. LTD. 346

14.3.8 VEERA FRAGRANCES 347

14.3.9 GEM AROMATICS LIMITED 348

14.3.10 BERJÉ INC. 349

15 ADJACENT & RELATED MARKETS 350

15.1 INTRODUCTION 350

15.2 LIMITATIONS 350

15.3 AROMA INGREDIENTS MARKET 350

15.3.1 MARKET DEFINITION 350

15.3.2 MARKET OVERVIEW 350

15.4 AROMA INGREDIENTS MARKET, BY REGION 351

15.4.1 EUROPE 351

15.4.2 ASIA PACIFIC 352

15.4.3 NORTH AMERICA 352

15.4.4 MIDDLE EAST & AFRICA 353

15.4.5 SOUTH AMERICA 353

16 APPENDIX 354

16.1 DISCUSSION GUIDE 354

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 357

16.3 CUSTOMIZATION OPTIONS 359

16.4 RELATED REPORTS 359

16.5 AUTHOR DETAILS 360

❖ 世界のフレグランス成分市場に関するよくある質問(FAQ) ❖

・フレグランス成分の世界市場規模は?

→MarketsandMarkets社は2024年のフレグランス成分の世界市場規模を171.1億米ドルと推定しています。

・フレグランス成分の世界市場予測は?

→MarketsandMarkets社は2029年のフレグランス成分の世界市場規模を219.4億米ドルと予測しています。

・フレグランス成分市場の成長率は?

→MarketsandMarkets社はフレグランス成分の世界市場が2024年~2029年に年平均5.1%成長すると予測しています。

・世界のフレグランス成分市場における主要企業は?

→MarketsandMarkets社は「BASF (Germany), MANE SA (France), dsm-firmenich (Switzerland), Givaduan (Switzerland), International Flavors and Fragrances (US), Sensient Technologies (US), Takasago International Corporation (Japan), Robertet Fragrances, Inc (France), Kao Chemicals (Japan), and Symrise (Germany)など ...」をグローバルフレグランス成分市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。