1 はじめに 32

1.1 調査目的 32

1.2 市場の定義 32

1.3 調査範囲 33

1.3.1 対象市場と地域範囲 33

1.3.2 対象範囲と除外範囲 34

1.3.3 考慮した年数 36

1.4 考慮した単位 36

1.5 通貨の考慮 36

1.6 制限事項 36

1.7 利害関係者 37

1.8 変更点のまとめ 37

2 調査方法 38

2.1 調査データ 38

2.2 市場の内訳とデータの三角測量 39

2.2.1 二次調査と一次調査 40

2.2.2 二次データ 40

2.2.2.1 二次ソースからの主要データ 41

2.2.2.2 主な二次情報源のリスト 41

2.2.3 一次データ 41

2.2.3.1 一次資料からの主要データ 42

2.2.3.2 主要な業界インサイト 42

2.2.3.3 一次インタビュー参加者リスト 43

2.2.3.4 一次データの内訳 43

2.3 市場スコープ 44

2.4 市場規模の推定方法 44

2.4.1 ボトムアップアプローチ 44

2.4.1.1 需要サイド分析 45

2.4.1.2 地域分析 46

2.4.1.3 国レベル分析 46

2.4.1.4 需要サイドの仮定 46

2.4.1.5 需要サイドの計算 46

2.4.2 トップダウン・アプローチ 47

2.4.3 サプライサイド分析 48

2.4.3.1 供給側の仮定 49

2.4.3.2 供給側の計算 49

2.5 予測の前提 49

2.6 リスク分析 49

2.7 調査の前提 50

2.8 調査の限界 50

3 エグゼクティブ・サマリー 51

4 プレミアムインサイト 56

4.1 発電機市場におけるプレーヤーにとっての魅力的な機会 56

4.2 アジア太平洋地域の発電機市場:エンドユーザー別、国別 56

4.3 発電機市場:燃料タイプ別 57

4.4 発電機市場:用途別 57

4.5 発電機市場:エンドユーザー別 57

4.6 発電機市場:販売チャネル別 58

4.7 発電機市場:設計別 58

4.8 発電機市場:定格電力別 58

5 市場の概要 59

5.1 導入 59

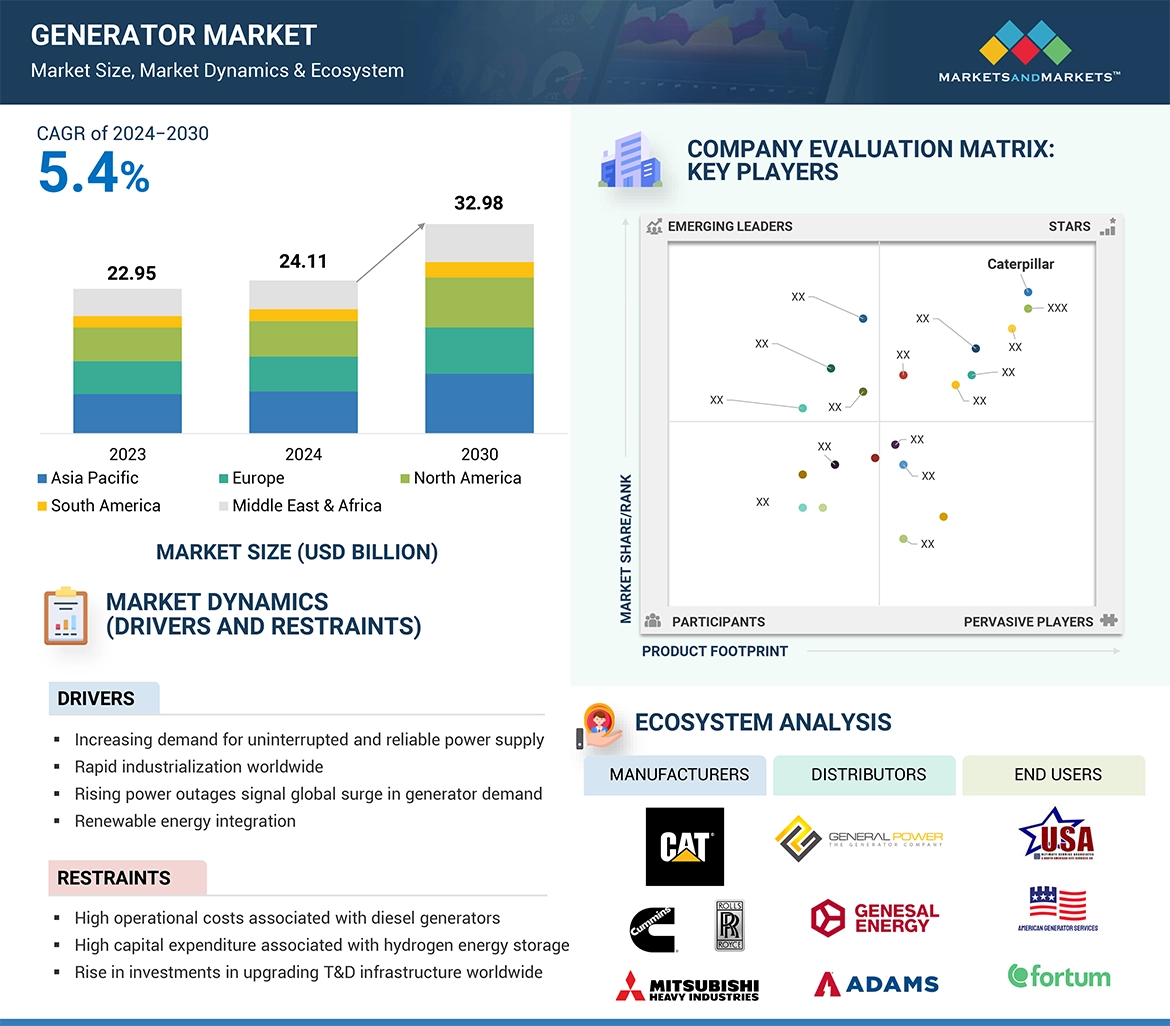

5.2 市場ダイナミクス 60

5.2.1 推進要因 60

5.2.1.1 停電のない信頼できる電力供給に対する需要の増加 60

5.2.1.2 急速な工業化 61

5.2.1.3 DERMS 採用の増加 62

5.2.1.4 停電の増加 62

5.2.1.5 再生可能エネルギーの統合 63

5.2.2 阻害要因 63

5.2.2.1 ディーゼル発電機に伴う高い運転コスト 63

5.2.2.2 水素エネルギー貯蔵に関連する高い資本支出 64

5.2.2.3 世界的な T&D インフラ整備投資の増加 65

5.2.3 機会 66

5.2.3.1 燃料電池発電機の採用増加 66

5.2.3.2 ハイブリッド発電機、バイフューエル発電機、インバーターへの需要の高まり 67

5.2.3.3 政府主導による水素の普及、流通、利用への取り組み 68

5.2.3.4 クリーン電力ソリューションの重視 69

5.2.4 課題 70

5.2.4.1 厳しい排出規制の賦課 70

5.2.4.2 固体酸化物燃料電池の長い起動時間 70

5.3 顧客ビジネスに影響を与えるトレンド/混乱 70

5.4 価格分析 71

5.4.1 主要メーカーの平均販売価格動向(定格出力別) 71

5.4.2 発電機の平均販売価格動向(地域別) 72

5.5 バリューチェーン分析 72

5.6 エコシステム分析 74

5.7 投資と資金調達のシナリオ 75

5.8 技術分析 76

5.8.1 主要技術 76

5.8.1.1 IoT 76

5.8.2 隣接技術 76

5.8.2.1 ハイブリッド発電機システム 76

5.8.2.2 熱エネルギー貯蔵 76

5.9 特許分析 76

5.10 貿易分析 79

5.10.1 HSコード 850161 79

5.10.1.1 輸出データ 79

5.10.1.2 輸入データ 80

5.10.2 HSコード850162 82

5.10.2.1 輸出データ 82

5.10.2.2 輸入データ 83

5.10.3 HSコード850163 84

5.10.3.1 輸出データ 84

5.10.3.2 輸入データ 86

5.10.4 HSコード850164 87

5.10.4.1 輸出データ 87

5.10.4.2 輸入データ 88

5.11 主要会議・イベント(2024~2025年) 90

5.12 ケーススタディ分析 90

5.12.1 発電事業者は、停電時のシームレスな電力移行を保証するテーラースタンバイ発電機パッケージを設計 90

5.12.2 TGC は、一貫した信頼性の高い非常用電力を確保する高度な発電機技術を使用した電源バッ クアップシステムを設計、設置 91

5.12.3 DTGEN 社、クイーン・エリザベス大学病院の電力インフラを強化する特 殊機器を活用 91

5.12.4 Perennial Brite Global は大容量ディーゼル発電機のレンタルサービスを提供し、緊急 の電力ニーズに迅速に対応 91

5.13 関税と規制の状況 92

5.13.1 発電機に関連する製造業者の関税 92

5.13.2 規制機関、政府機関、その他の組織 95

5.13.3 発電機市場:標準 98

5.14 ポーターの5つの力分析 101

5.14.1 供給業者の交渉力 102

5.14.2 買い手の交渉力 102

5.14.3 新規参入者の脅威 102

5.14.4 代替品の脅威 103

5.14.5 競合の激しさ 103

5.15 主要ステークホルダーと購買基準 103

5.15.1 購入プロセスにおける主要ステークホルダー 103

5.15.2 購入基準 104

5.16 AI/ジェネレーティブAIのジェネレーター市場への影響 104

5.16.1 発電機市場におけるAI/ジェネレーティブAIのアプリケーション 104

5.16.2 AI/ジェネレーティブAIのエンドユーザー別、地域別の影響 105

5.16.3 発電機市場におけるAI/ジェネレーティブAIの影響(地域別) 106

5.17 世界のマクロ経済見通し 106

5.17.1 導入 106

5.17.2 GDPの動向と予測 106

5.17.3 インフレ率 107

5.17.4 製造付加価値 108

6 発電機市場、燃料タイプ別 109

6.1 はじめに 110

6.2 ディーゼル 111

6.2.1 建設・採掘作業への適合性が市場を牽引 111

6.3 ガス 113

6.3.1 低コストと環境負荷の低減が市場成長を促進 113

6.4 LPG 114

6.4.1 クリーンエネルギー需要の増加が市場成長を促進 114

6.5 バイオ燃料 115

6.5.1 低炭素排出が需要を押し上げる 115

6.6 石炭ガス 117

6.6.1 産業部門の拡大が需要を加速 117

6.7 ガソリン 118

6.7.1 ポータブル電源の需要増加が有利な成長機会を提供 118

6.8 生産者ガス 119

6.8.1 温室効果ガスの排出削減が市場を牽引 119

6.9 燃料電池 120

6.9.1 持続可能な発電重視の高まりが市場成長を促進 120

7 発電機市場、定格出力別 122

7.1 導入 123

7.2 50kwまで 124

7.2.1 10 kw まで 126

7.2.1.1 軽量で低燃費の発電機への需要の高まりが需要を加速 126

7.2.2 11~20 kw 126

7.2.2.1 小型機械や産業用工具を操作するための無停電電源装置への需要増が市場を牽引 126

7.2.3 21~30kw 127

7.2.3.1 戦闘地域での機動性向上が需要を押し上げる 127

7.2.4 31-40 kw 127

7.2.4.1 業種を超えたシームレスな事業継続と重要インフラ支援が市場を牽引 127

7.2.5 41~50 kw 128

7.2.5.1 ヘルスケアと建設分野での需要拡大が市場成長を促進 128

7.3 51-280 kw 128

7.3.1 遠隔地の建設現場やインフラ開発プロジェクトでの用途拡大が需要を加速 128

7.4 281~500 kw 129

7.4.1 石油・ガス、鉱業での用途拡大が需要を押し上げる 129

7.5 501~2,000 kw 130

7.5.1 化学プロジェクトへの投資の増加が需要を押し上げる 130

7.6 2,001~3,500 kw 131

7.6.1 データセンター、医療、重要インフラへの導入増加が市場を牽引 131

7.7 3,500 kW 以上 132

7.7.1 海洋分野での無停電電源装置に対する需要の高まりが市場成長を促進 132

8 発電機市場:販売チャネル別 134

8.1 導入 135

8.2 直接販売 135

8.2.1 コスト削減への関心の高まりが市場成長を促進 135

8.3 間接的 136

8.3.1 顧客基盤の拡大が需要を押し上げる 136

9 発電機市場:設計別 138

9.1 導入 139

9.2 定置型 140

9.2.1 無停電運転への需要の高まりがセグメント成長を促進 140

9.3 ポータブル 141

9.3.1 非常用バックアップ電源の需要増加が市場成長を促進 141

10 発電機市場(用途別) 142

10.1 導入 143

10.2 スタンバイ 144

10.2.1 停電時や停電時の非常用電源へのニーズの高まりが需要を押し上げる 144

10.3 プライム&連続 145

10.3.1 遠隔地の建築現場や非電化地域での導入が増加し、需要を加速 145

10.4 ピークカット 146

10.4.1 電気料金の削減が市場を牽引 146

11 発電機市場(エンドユーザー別) 148

11.1 導入 149

11.2 産業用 150

11.3 ユーティリティ/発電 152

11.3.1 急増する無停電電源へのニーズが市場成長を促進 152

11.3.2 石油・ガス 153

11.3.2.1 発電インフラへの投資増が需要を加速 153

11.3.3 化学・石油化学 155

11.3.3.1 石油・ガスおよび石油化学の川下産業への投資の増加が市場成長を促進 155

11.3.4 鉱業・金属 156

11.3.4.1 過酷な条件の遠隔採掘地への適応性が需要を押し上げる 156

11.3.5 製造業 157

11.3.5.1 送電網が不安定な時の信頼できる電力需要の増加が市場を牽引 157

11.3.6 海洋 158

11.3.6.1 船内のスペースを最適化する能力がセグメントの成長を促進 158

11.3.7 建設 159

11.3.7.1 遠隔地の建設現場での電力供給重視の高まりが市場を牽引 159

11.3.8 その他の産業用エンドユーザー 160

11.4 住宅 162

11.4.1 異常気象時の電力バックアップニーズの高まりが需要を加速 162

11.5 商業 163

11.5.1 医療 165

11.5.1.1 建築基準や安全基準に準拠する必要性の高まりが有利な成長機会を提供 165

11.5.2 IT・通信 167

11.5.2.1 スマートフォンの普及が市場成長を促進 167

11.5.3 データセンター 168

11.5.3.1 データセンターにおけるクリーンエネルギーソリューションの採用拡大が需要を押し上げる 168

11.5.4 その他の商業エンドユーザー 169

12 発電機市場(地域別) 171

12.1 はじめに 172

12.2 北米 174

12.2.1 米国 181

12.2.1.1 天候関連の事故発生の増加が需要を押し上げる 181

12.2.2 カナダ 183

12.2.2.1 燃料電池と再生可能発電分野の進歩が市場成長を促進 183

12.2.3 メキシコ 186

12.2.3.1 都市人口の増加が市場を牽引 186

12.3 欧州 187

12.3.1 ドイツ 194

12.3.1.1 水素を動力源とするバックアップシステムへの移行が市場成長を促進 194

12.3.2 ロシア 196

12.3.2.1 原油輸出の増加が市場成長を促進 196

12.3.3 フランス 198

12.3.3.1 グリーン産業への投資増加が需要を加速 198

12.3.4 イギリス 200

12.3.4.1 インダストリー4.0の到来が有利な成長機会を提供 200

12.3.5 その他の欧州 202

12.4 アジア太平洋地域 205

12.4.1 中国 212

12.4.1.1 農村部から都市部への急速なシフトが需要を押し上げる 212

12.4.2 インド 215

12.4.2.1 クリーンエネルギー分野の開発重視の高まりが市場を牽引 215

12.4.3 日本 217

12.4.3.1 ガスインフラの拡大が市場成長を促進 217

12.4.4 オーストラリア 219

12.4.4.1 政府主導のソーラー製造促進策が需要を加速 219

12.4.5 韓国 222

12.4.5.1 エネルギー効率の高いLNG船の需要拡大が市場を牽引 222

12.4.6 ニュージーランド 224

12.4.6.1 ネットゼロ目標の達成に向けた重点化が市場成長を促進 224

12.4.7 インドネシア 226

12.4.7.1 クリーンで排出ガスのない発電への注目の高まりが有利な成長機会を提供 226

12.4.8 その他のアジア太平洋地域 228

12.5 中東・アフリカ 231

12.5.1 GCC 238

12.5.1.1 サウジアラビア 238

12.5.1.1.1 インフラプロジェクトの増加が市場成長を促進 238

12.5.1.2 アラブ首長国連邦 241

12.5.1.2.1 再生可能エネルギー分野への海外投資の増加が需要を後押し 241

12.5.1.3 GCCの他の地域 243

12.5.2 南アフリカ 246

12.5.2.1 停電への対応ニーズの高まりが市場成長を促進 246

12.5.3 ナイジェリア 248

12.5.3.1 無停電電力供給への需要の高まりが市場成長を促進 248

12.5.4 アルジェリア 250

12.5.4.1 石油・ガス分野への投資の増加が市場を牽引 250

12.5.5 その他の中東・アフリカ 252

12.6 南米 255

12.6.1 ブラジル 261

12.6.1.1 ネットゼロエミッション重視が需要を押し上げる 261

12.6.2 アルゼンチン 263

12.6.2.1 停電件数の増加が市場を牽引 263

12.6.3 その他の南米地域 265

13 競争環境 269

13.1 はじめに 269

13.2 主要プレーヤーの戦略/勝利への権利(2020~2024年) 269

13.3 収益分析、2019年~2023年 270

13.4 市場シェア分析、2023年 271

13.5 企業評価と財務指標 273

13.6 ブランド/製品の比較 274

13.7 企業評価マトリックス:主要企業、2023年 275

13.7.1 スター企業 275

13.7.2 新興リーダー 275

13.7.3 浸透型プレーヤー 275

13.7.4 参加企業 275

13.7.5 企業フットプリント:主要プレーヤー、2023年 277

13.7.5.1 企業フットプリント 277

13.7.5.2 地域別フットプリント 278

13.7.5.3 アプリケーションのフットプリント 279

13.7.5.4 燃料タイプのフットプリント 280

13.7.5.5 エンドユーザーのフットプリント 281

13.8 企業評価マトリクス:新興企業/SM(2023年) 282

13.8.1 進歩的企業 282

13.8.2 対応力のある企業 282

13.8.3 ダイナミックな企業 282

13.8.4 スタートアップ・ブロック 282

13.8.5 競争ベンチマーキング:新興企業/SM(2023年) 283

13.8.5.1 主要新興企業/中小企業の詳細リスト 283

13.8.5.2 主要新興企業/中小企業の競争ベンチマーク 284

13.9 競争シナリオ 284

13.9.1 製品上市 284

13.9.2 取引 290

13.9.3 拡張 291

13.9.4 その他の開発 292

14 企業プロフィール 296

Caterpillar (US)

Cummins Inc. (US)

Rolls-Royce Plc (UK)

Mitsubishi Heavy Industries Ltd. (Japan)

Generac (US)

and Wacker Neuson SE (Germany)

Man Energy Solutions (Germany)

Briggs & Stratton (US)

Atlas Copco (Sweden)

Kirloskar (India)

15 付録 362

15.1 業界の専門家による洞察 362

15.2 ディスカッションガイド 363

15.3 Knowledgestore: Marketsandmarketsの購読ポータル 367

15.4 カスタマイズオプション 369

15.5 関連レポート 369

15.6 著者の詳細 370

Increasing demand for uninterrupted and reliable power supply, rapid industrialization owing to the demand for generators, and the rapidly expanding manufacturing sector are expected to drive the demand for generators.

“Fuel cells segment is expected to grow at the highest CAGR during the forecast period.”

The fuel cells segment is growing at the highest CAGR in the generator market by fuel type. Fuel cells have emerged as a promising market by fuel type for generators globally. With their efficient and clean energy conversion process, fuel cell generators play a significant role in meeting the growing demand for sustainable power generation. With ongoing advancements in fuel cell technology, coupled with the growing availability of renewable hydrogen sources, the sales of fuel cell (hydrogen) fuel type generators are expected to continue their upward trend. These generators will play a pivotal role in the global transition to a cleaner and more sustainable energy landscape.

“Commercial segment is expected to emerge as the second largest segment by end-user.”

Commercial segment is expected to become the second largest end user in the Generator market due to the need of uninterrupted operation. Diverse commercial sectors drive the demand for generators, as they are essential for ensuring business continuity and risk mitigation. Industries such as IT & telecom, healthcare, data centers, hospitality, retail, and public infrastructure all recognize the critical need for a reliable power supply. Power outages can lead to substantial financial losses and pose safety risks, making it crucial for these establishments to maintain smooth operations, especially during peak hours or in remote locations where power grids may be less reliable. Generators play a key role in protecting business interests by providing uninterrupted power, thus minimizing potential disruptions and losses.

“China to grow at the highest CAGR for Asia Pacific Generator market.”

China is experiencing the highest growth rate in the generator market due to several factors. The presence of established players in China such as Weichai Holding Group Co., Ltd., along with a large customer base, is among the major factors driving the generator market in China. China is rapidly urbanizing and moving the majority of its population from rural to urban areas, rapid and furious urban growth accelerates demands for infrastructure to support this growth, which necessarily requires more stable and reliable power sources, thereby increasing demand for generators to serve construction sites, industrial areas, and cities using lots of energy.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects.

The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 10%, Europe- 15%, Asia Pacific- 60%, the Middle East & Africa- 10%, and South America- 5%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

Caterpillar (US), Cummins Inc. (US), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries Ltd. (Japan), Generac (US), and Wacker Neuson SE (Germany), Man Energy Solutions (Germany), Briggs & Stratton (US), Atlas Copco (Sweden), Kirloskar (India) are some of the key players in the Generator market.

The study includes an in-depth competitive analysis of these key players in the Generator market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the Generator market by • fuel type (Diesel, Gas, LPG, Biofuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells), application (Standby, Peak Shaving, Prime & Continuous), sales channel (Direct, Indirect), design (Stationary, Portable), power rating (Upto 50 KW, 51–280 KW, 281–500 KW, 501–2,000 KW, 2,001–3,500 KW, Above 3,500 KW), by end user (Industrial, Commercial, and Residential) and by region (North America, South America, Europe, Asia Pacific, and Middle east & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Generator market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the Generator market. Competitive analysis of upcoming startups in the Generator market ecosystem is covered in this report.

Key Benefits of Buying the Report

•Analysis of key drivers (Increasing demand for uninterrupted and reliable power supply, Rapid industrialization worldwide, Rising power outages signal global surge in generator demand, Renewable energy integration and Distributed Energy Resource Management Systems optimize grids and boost demand for reliable backup generators), restraints (High operational costs associated with diesel generators, High capital expenditure associated with hydrogen energy storage, and Rise in investments in upgrading T&D infrastructure worldwide), opportunities (Rising adoption of fuel cell generators across several industries for backup power, Increasing deployment of hybrid, bi-fuel, and inverter generators, Government initiatives supporting development of hydrogen economy, and Growing popularity of fuel cell generators), and challenges (Longer start-up times of solid oxide fuel cells, Stringent government regulations pertaining to conventional fuel generators) influences the growth of the generator market.

•Product Development/ Innovation: The developments such as Hybrid generator systems are an emerging technology in the generator market due to their ability to combine traditional generators with renewable energy sources like solar or wind power. This integration helps reduce fuel consumption and emissions by using renewable energy as a primary power source, with the generator providing backup power as needed, leading to cost savings and more efficient operation.

•Market Development: Fuel cells is gaining traction as a clean, versatile energy carrier, offering promising solutions for decarbonizing multiple sectors. Recognizing its potential, governments around the world are introducing policies to encourage the production, distribution, and use of fuels cells. These initiatives are fostering a supportive environment for the development and adoption of clean energy technologies, including fuel cell generators. Clean hydrogen production plays a crucial role in advancing fuel cell generators as sustainable energy alternatives. With the increasing emphasis on hydrogen technologies, the demand for fuel cell generators is expected to grow, driving a shift from traditional fossil fuel-based power generation to cleaner, more sustainable solutions.

• Market Diversification: Cummins is focused on driving revenue growth and improving gross margins by strategically repositioning its product portfolio to maximize long-term shareholder value. In 2024, the company introduced the Centum Series genset, responding to strong market demand. The new models, C2750D6E and C3000D6EB, deliver power outputs of 2750kW and 3000kW, respectively, and are specifically engineered for critical applications, including data centers, healthcare facilities, and wastewater treatment plants. These models offer outstanding performance and consistent reliability, ensuring they meet the stringent requirements of their customers.

•Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Caterpillar (US), Cummins Inc. (US), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries Ltd. (Japan), Generac (US), and Wacker Neuson SE (Germany), Man Energy Solutions (Germany), Briggs & Stratton (US), Atlas Copco (Sweden), Kirloskar (India) among others in the Generator market.

1 INTRODUCTION 32

1.1 STUDY OBJECTIVES 32

1.2 MARKET DEFINITION 32

1.3 STUDY SCOPE 33

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 33

1.3.2 INCLUSIONS AND EXCLUSIONS 34

1.3.3 YEARS CONSIDERED 36

1.4 UNIT CONSIDERED 36

1.5 CURRENCY CONSIDERED 36

1.6 LIMITATIONS 36

1.7 STAKEHOLDERS 37

1.8 SUMMARY OF CHANGES 37

2 RESEARCH METHODOLOGY 38

2.1 RESEARCH DATA 38

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION 39

2.2.1 SECONDARY AND PRIMARY RESEARCH 40

2.2.2 SECONDARY DATA 40

2.2.2.1 Key data from secondary sources 41

2.2.2.2 List of major secondary sources 41

2.2.3 PRIMARY DATA 41

2.2.3.1 Key data from primary sources 42

2.2.3.2 Key industry insights 42

2.2.3.3 List of primary interview participants 43

2.2.3.4 Breakdown of primaries 43

2.3 MARKET SCOPE 44

2.4 MARKET SIZE ESTIMATION METHODOLOGY 44

2.4.1 BOTTOM-UP APPROACH 44

2.4.1.1 Demand-side analysis 45

2.4.1.2 Regional analysis 46

2.4.1.3 Country-level analysis 46

2.4.1.4 Demand-side assumptions 46

2.4.1.5 Demand-side calculations 46

2.4.2 TOP-DOWN APPROACH 47

2.4.3 SUPPLY-SIDE ANALYSIS 48

2.4.3.1 Supply-side assumptions 49

2.4.3.2 Supply-side calculations 49

2.5 FORECAST ASSUMPTIONS 49

2.6 RISK ANALYSIS 49

2.7 RESEARCH ASSUMPTIONS 50

2.8 RESEARCH LIMITATIONS 50

3 EXECUTIVE SUMMARY 51

4 PREMIUM INSIGHTS 56

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GENERATOR MARKET 56

4.2 GENERATOR MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY 56

4.3 GENERATOR MARKET, BY FUEL TYPE 57

4.4 GENERATOR MARKET, BY APPLICATION 57

4.5 GENERATOR MARKET, BY END USER 57

4.6 GENERATOR MARKET, BY SALES CHANNEL 58

4.7 GENERATOR MARKET, BY DESIGN 58

4.8 GENERATOR MARKET, BY POWER RATING 58

5 MARKET OVERVIEW 59

5.1 INTRODUCTION 59

5.2 MARKET DYNAMICS 60

5.2.1 DRIVERS 60

5.2.1.1 Increasing demand for uninterrupted and reliable power supply 60

5.2.1.2 Rapid industrialization 61

5.2.1.3 Rising adoption of DERMS 62

5.2.1.4 Increasing power outages 62

5.2.1.5 Integration of renewable energy sources 63

5.2.2 RESTRAINTS 63

5.2.2.1 High operational costs associated with diesel generators 63

5.2.2.2 High capital expenditure related to hydrogen energy storage 64

5.2.2.3 Rise in investments in upgrading T&D infrastructure worldwide 65

5.2.3 OPPORTUNITIES 66

5.2.3.1 Rising adoption of fuel cell generators 66

5.2.3.2 Growing demand for hybrid generators, bi-fuel generators, and inverters 67

5.2.3.3 Government-led initiatives to promote, distribute, and utilize hydrogen 68

5.2.3.4 Emphasis on generating clean power solutions 69

5.2.4 CHALLENGES 70

5.2.4.1 Imposition of strict emission standards 70

5.2.4.2 Long start-up times of solid oxide fuel cells 70

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 70

5.4 PRICING ANALYSIS 71

5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY POWER RATING 71

5.4.2 AVERAGE SELLING PRICE TREND OF GENERATORS, BY REGION 72

5.5 VALUE CHAIN ANALYSIS 72

5.6 ECOSYSTEM ANALYSIS 74

5.7 INVESTMENT AND FUNDING SCENARIO 75

5.8 TECHNOLOGY ANALYSIS 76

5.8.1 KEY TECHNOLOGIES 76

5.8.1.1 IoT 76

5.8.2 ADJACENT TECHNOLOGIES 76

5.8.2.1 Hybrid generator systems 76

5.8.2.2 Thermal energy storage 76

5.9 PATENT ANALYSIS 76

5.10 TRADE ANALYSIS 79

5.10.1 HS CODE 850161 79

5.10.1.1 Export data 79

5.10.1.2 Import data 80

5.10.2 HS CODE 850162 82

5.10.2.1 Export data 82

5.10.2.2 Import data 83

5.10.3 HS CODE 850163 84

5.10.3.1 Export data 84

5.10.3.2 Import data 86

5.10.4 HS CODE 850164 87

5.10.4.1 Export data 87

5.10.4.2 Import data 88

5.11 KEY CONFERENCES AND EVENTS, 2024–2025 90

5.12 CASE STUDY ANALYSIS 90

5.12.1 GENERATOR COMPANY DESIGNED TAILOR STANDBY GENERATOR PACKAGE THAT ENSURED SEAMLESS POWER TRANSITION DURING OUTAGES 90

5.12.2 TGC DESIGNED AND INSTALLED POWER BACKUP SYSTEM USING ADVANCED GENERATOR TECHNOLOGY THAT ENSURED CONSISTENT AND RELIABLE EMERGENCY POWER 91

5.12.3 DTGEN UTILIZED SPECIALIZED EQUIPMENT THAT BOOSTED POWER INFRASTRUCTURE IN QUEEN ELIZABETH UNIVERSITY HOSPITAL 91

5.12.4 PERENNIAL BRITE GLOBAL PROVIDED HIGH-CAPACITY DIESEL GENERATOR RENTAL SERVICE THAT ENABLED RAPID DEPLOYMENT TO ADDRESS URGENT POWER NEEDS 91

5.13 TARIFF AND REGULATORY LANDSCAPE 92

5.13.1 MFN TARIFFS RELATED TO GENERATORS 92

5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 95

5.13.3 GENERATOR MARKET: STANDARDS 98

5.14 PORTER’S FIVE FORCES ANALYSIS 101

5.14.1 BARGAINING POWER OF SUPPLIERS 102

5.14.2 BARGAINING POWER OF BUYERS 102

5.14.3 THREAT OF NEW ENTRANTS 102

5.14.4 THREAT OF SUBSTITUTES 103

5.14.5 INTENSITY OF COMPETITIVE RIVALRY 103

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA 103

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS 103

5.15.2 BUYING CRITERIA 104

5.16 IMPACT OF AI/GENERATIVE AI ON GENERATOR MARKET 104

5.16.1 AI/GENERATIVE AI APPLICATIONS IN GENERATOR MARKET 104

5.16.2 IMPACT OF AI/GENERATIVE AI, BY END USER AND REGION 105

5.16.3 IMPACT OF AI/GENERATIVE AI IN GENERATOR MARKET, BY REGION 106

5.17 GLOBAL MACROECONOMIC OUTLOOK 106

5.17.1 INTRODUCTION 106

5.17.2 GDP TRENDS AND FORECAST 106

5.17.3 INFLATION 107

5.17.4 MANUFACTURING VALUE ADDED 108

6 GENERATOR MARKET, BY FUEL TYPE 109

6.1 INTRODUCTION 110

6.2 DIESEL 111

6.2.1 SUITABILITY FOR CONSTRUCTION AND MINING OPERATIONS TO DRIVE MARKET 111

6.3 GAS 113

6.3.1 LOW COST AND REDUCED ENVIRONMENTAL IMPACT TO FOSTER MARKET GROWTH 113

6.4 LPG 114

6.4.1 INCREASING DEMAND FOR CLEAN ENERGY TO FOSTER MARKET GROWTH 114

6.5 BIOFUELS 115

6.5.1 LOW CARBON EMISSION TO BOOST DEMAND 115

6.6 COAL GAS 117

6.6.1 EXPANDING INDUSTRIAL SECTOR TO ACCELERATE DEMAND 117

6.7 GASOLINE 118

6.7.1 RISING DEMAND FOR PORTABLE POWER SOURCES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES 118

6.8 PRODUCER GAS 119

6.8.1 REDUCED GREENHOUSE GAS EMISSIONS TO DRIVE MARKET 119

6.9 FUEL CELLS 120

6.9.1 RISING EMPHASIS ON SUSTAINABLE POWER GENERATION TO FOSTER MARKET GROWTH 120

7 GENERATOR MARKET, BY POWER RATING 122

7.1 INTRODUCTION 123

7.2 UP TO 50 KW 124

7.2.1 UP TO 10 KW 126

7.2.1.1 Increasing demand for lightweight and fuel-efficient generators to accelerate demand 126

7.2.2 11–20 KW 126

7.2.2.1 Growing demand for uninterrupted power supply to operate small machines and industrial tools to drive market 126

7.2.3 21–30 KW 127

7.2.3.1 Enhanced mobility in combat zones to boost demand 127

7.2.4 31–40 KW 127

7.2.4.1 Requirement for seamless business continuity and critical infrastructure support across industries to drive market 127

7.2.5 41–50 KW 128

7.2.5.1 Growing demand among healthcare and construction sectors to foster market growth 128

7.3 51–280 KW 128

7.3.1 INCREASING APPLICATION IN REMOTE CONSTRUCTION SITES AND INFRASTRUCTURE DEVELOPMENT PROJECTS TO ACCELERATE DEMAND 128

7.4 281–500 KW 129

7.4.1 RISING APPLICATION IN OIL & GAS AND MINING INDUSTRIES TO BOOST DEMAND 129

7.5 501–2,000 KW 130

7.5.1 GROWING INVESTMENTS IN CHEMICAL PROJECTS TO BOOST DEMAND 130

7.6 2,001–3,500 KW 131

7.6.1 INCREASING IMPLEMENTATION IN DATA CENTERS, HEALTHCARE, AND CRITICAL INFRASTRUCTURE TO DRIVE MARKET 131

7.7 ABOVE 3,500 KW 132

7.7.1 GROWING DEMAND FOR UNINTERRUPTED POWER SUPPLY IN MARINE SECTOR TO FOSTER MARKET GROWTH 132

8 GENERATOR MARKET, BY SALES CHANNEL 134

8.1 INTRODUCTION 135

8.2 DIRECT 135

8.2.1 RISING FOCUS ON COST SAVING TO FUEL MARKET GROWTH 135

8.3 INDIRECT 136

8.3.1 ABILITY TO EXPAND CUSTOMER BASE TO BOOST DEMAND 136

9 GENERATOR MARKET, BY DESIGN 138

9.1 INTRODUCTION 139

9.2 STATIONARY 140

9.2.1 GROWING DEMAND FOR UNINTERRUPTED OPERATIONS TO FOSTER SEGMENTAL GROWTH 140

9.3 PORTABLE 141

9.3.1 INCREASING DEMAND FOR EMERGENCY BACKUP POWER SOURCES TO FUEL MARKET GROWTH 141

10 GENERATOR MARKET, BY APPLICATION 142

10.1 INTRODUCTION 143

10.2 STANDBY 144

10.2.1 INCREASING NEED FOR EMERGENCY POWER DURING BLACKOUTS AND BROWNOUTS TO BOOST DEMAND 144

10.3 PRIME & CONTINUOUS 145

10.3.1 GROWING IMPLEMENTATION IN REMOTE BUILDING SITES AND OFF-GRID LOCATIONS TO ACCELERATE DEMAND 145

10.4 PEAK SHAVING 146

10.4.1 REDUCED ELECTRICITY EXPENSES TO DRIVE MARKET 146

11 GENERATOR MARKET, BY END USER 148

11.1 INTRODUCTION 149

11.2 INDUSTRIAL 150

11.3 UTILITIES/POWER GENERATION 152

11.3.1 SURGING NEED FOR UNINTERRUPTED POWER SUPPLY TO FUEL MARKET GROWTH 152

11.3.2 OIL & GAS 153

11.3.2.1 Rising investments in power generation infrastructure to accelerate demand 153

11.3.3 CHEMICALS & PETROCHEMICALS 155

11.3.3.1 Increasing investments in downstream oil & gas and petrochemical industries to foster market growth 155

11.3.4 MINING & METALS 156

11.3.4.1 Adaptability to remote mining areas in harsh conditions to boost demand 156

11.3.5 MANUFACTURING 157

11.3.5.1 Increasing demand for reliable power during grid instability to drive market 157

11.3.6 MARINE 158

11.3.6.1 Ability to optimize space within vessels to foster segmental growth 158

11.3.7 CONSTRUCTION 159

11.3.7.1 Rising emphasis on providing power at remote construction sites to drive market 159

11.3.8 OTHER INDUSTRIAL END USERS 160

11.4 RESIDENTIAL 162

11.4.1 GROWING NEED FOR POWER BACKUPS IN EXTREME WEATHER CONDITIONS TO ACCELERATE DEMAND 162

11.5 COMMERCIAL 163

11.5.1 HEALTHCARE 165

11.5.1.1 Increasing need to comply with building codes and safety standards to offer lucrative growth opportunities 165

11.5.2 IT & TELECOMMUNICATIONS 167

11.5.2.1 Widespread adoption of smartphones to foster market growth 167

11.5.3 DATA CENTERS 168

11.5.3.1 Growing adoption of clean energy solutions in data centers to boost demand 168

11.5.4 OTHER COMMERCIAL END USERS 169

12 GENERATOR MARKET, BY REGION 171

12.1 INTRODUCTION 172

12.2 NORTH AMERICA 174

12.2.1 US 181

12.2.1.1 Increasing occurrence of weather-related incidents to boost demand 181

12.2.2 CANADA 183

12.2.2.1 Advancements in fuel cell and renewable power generation sectors to foster market growth 183

12.2.3 MEXICO 186

12.2.3.1 Rising urban population to drive market 186

12.3 EUROPE 187

12.3.1 GERMANY 194

12.3.1.1 Transition to hydrogen-powered backup systems to fuel market growth 194

12.3.2 RUSSIA 196

12.3.2.1 Increase in crude oil exports to foster market growth 196

12.3.3 FRANCE 198

12.3.3.1 Increased investments in green industry to accelerate demand 198

12.3.4 UK 200

12.3.4.1 Advent of Industry 4.0 to offer lucrative growth opportunities 200

12.3.5 REST OF EUROPE 202

12.4 ASIA PACIFIC 205

12.4.1 CHINA 212

12.4.1.1 Rapid shift from rural to urban areas to boost demand 212

12.4.2 INDIA 215

12.4.2.1 Rising emphasis on developing clean energy sectors to drive market 215

12.4.3 JAPAN 217

12.4.3.1 Expansion of gas infrastructure to foster market growth 217

12.4.4 AUSTRALIA 219

12.4.4.1 Government-led initiatives to boost solar manufacturing to accelerate demand 219

12.4.5 SOUTH KOREA 222

12.4.5.1 Growing demand for energy-efficient and LNG-powered vessels to drive market 222

12.4.6 NEW ZEALAND 224

12.4.6.1 Increasing emphasis on achieving net-zero goals to foster market growth 224

12.4.7 INDONESIA 226

12.4.7.1 Rising emphasis on generating clean and emission-free electricity to offer lucrative growth opportunities 226

12.4.8 REST OF ASIA PACIFIC 228

12.5 MIDDLE EAST & AFRICA 231

12.5.1 GCC 238

12.5.1.1 Saudi Arabia 238

12.5.1.1.1 Growing number of infrastructure projects to fuel market growth 238

12.5.1.2 UAE 241

12.5.1.2.1 Increasing foreign investments in renewable energy sector to boost demand 241

12.5.1.3 Rest of GCC 243

12.5.2 SOUTH AFRICA 246

12.5.2.1 Rising need to address power outages to fuel market growth 246

12.5.3 NIGERIA 248

12.5.3.1 Increasing demand for uninterrupted power supply to foster market growth 248

12.5.4 ALGERIA 250

12.5.4.1 Growing investments in oil & gas sector to drive market 250

12.5.5 REST OF MIDDLE EAST & AFRICA 252

12.6 SOUTH AMERICA 255

12.6.1 BRAZIL 261

12.6.1.1 Emphasis on net-zero emissions to boost demand 261

12.6.2 ARGENTINA 263

12.6.2.1 Rising number of power outages to drive market 263

12.6.3 REST OF SOUTH AMERICA 265

13 COMPETITIVE LANDSCAPE 269

13.1 INTRODUCTION 269

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 269

13.3 REVENUE ANALYSIS, 2019–2023 270

13.4 MARKET SHARE ANALYSIS, 2023 271

13.5 COMPANY VALUATION AND FINANCIAL METRICS 273

13.6 BRAND/PRODUCT COMPARISON 274

13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 275

13.7.1 STARS 275

13.7.2 EMERGING LEADERS 275

13.7.3 PERVASIVE PLAYERS 275

13.7.4 PARTICIPANTS 275

13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 277

13.7.5.1 Company footprint 277

13.7.5.2 Region footprint 278

13.7.5.3 Application footprint 279

13.7.5.4 Fuel type footprint 280

13.7.5.5 End user footprint 281

13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 282

13.8.1 PROGRESSIVE COMPANIES 282

13.8.2 RESPONSIVE COMPANIES 282

13.8.3 DYNAMIC COMPANIES 282

13.8.4 STARTING BLOCKS 282

13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 283

13.8.5.1 Detailed list of key startups/SMEs 283

13.8.5.2 Competitive benchmarking of key startups/SMEs 284

13.9 COMPETITIVE SCENARIO 284

13.9.1 PRODUCT LAUNCHES 284

13.9.2 DEALS 290

13.9.3 EXPANSIONS 291

13.9.4 OTHER DEVELOPMENTS 292

14 COMPANY PROFILES 296

14.1 KEY PLAYERS 296

14.1.1 CATERPILLAR 296

14.1.1.1 Business overview 296

14.1.1.2 Products/Solutions/Services offered 297

14.1.1.3 Recent developments 300

14.1.1.3.1 Product launches 300

14.1.1.3.2 Deals 301

14.1.1.3.3 Other developments 302

14.1.1.4 MnM view 302

14.1.1.4.1 Key strengths/Right to win 302

14.1.1.4.2 Strategic choices 302

14.1.1.4.3 Weaknesses/Competitive threats 302

14.1.2 CUMMINS INC. 303

14.1.2.1 Business overview 303

14.1.2.2 Products/Solutions/Services offered 304

14.1.2.3 Recent developments 307

14.1.2.3.1 Product launches 307

14.1.2.3.2 Deals 308

14.1.2.3.3 Other developments 310

14.1.2.4 MnM view 310

14.1.2.4.1 Key strengths/Right to win 310

14.1.2.4.2 Strategic choices 310

14.1.2.4.3 Weaknesses/Competitive threats 310

14.1.3 MITSUBISHI HEAVY INDUSTRIES, LTD. 311

14.1.3.1 Business overview 311

14.1.3.2 Products/Solutions/Services offered 312

14.1.3.3 Recent developments 313

14.1.3.3.1 Product launches 313

14.1.3.3.2 Deals 314

14.1.3.4 MnM view 314

14.1.3.4.1 Key strengths/Right to win 314

14.1.3.4.2 Strategic choices 314

14.1.3.4.3 Weaknesses/Competitive threats 314

14.1.4 ROLLS-ROYCE PLC 315

14.1.4.1 Business overview 315

14.1.4.2 Products/Solutions/Services offered 316

14.1.4.3 Recent developments 318

14.1.4.3.1 Product launches 318

14.1.4.3.2 Deals 318

14.1.4.3.3 Other developments 320

14.1.4.4 MnM view 320

14.1.4.4.1 Key strengths/Right to win 320

14.1.4.4.2 Strategic choices 320

14.1.4.4.3 Weaknesses/Competitive threats 320

14.1.5 GENERAC POWER SYSTEMS, INC. 321

14.1.5.1 Business overview 321

14.1.5.2 Products/Solutions/Services offered 322

14.1.5.3 Recent developments 324

14.1.5.3.1 Product launches 324

14.1.5.3.2 Deals 325

14.1.5.3.3 Expansions 325

14.1.5.3.4 Other developments 325

14.1.5.4 MnM view 326

14.1.5.4.1 Key strengths/Right to win 326

14.1.5.4.2 Strategic choices 326

14.1.5.4.3 Weaknesses/Competitive threats 326

14.1.6 WÄRTSILÄ 327

14.1.6.1 Business overview 327

14.1.6.2 Products/Solutions/Services offered 328

14.1.6.3 Recent developments 329

14.1.6.3.1 Deals 329

14.1.6.3.2 Other developments 329

14.1.7 WACKER NEUSON SE 330

14.1.7.1 Business overview 330

14.1.7.2 Products/Solutions/Services offered 331

14.1.7.3 Recent developments 332

14.1.7.3.1 Product launches 332

14.1.8 SIEMENS ENERGY 333

14.1.8.1 Business overview 333

14.1.8.2 Products/Solutions/Services offered 334

14.1.8.3 Recent developments 335

14.1.8.3.1 Deals 335

14.1.9 MAN ENERGY SOLUTIONS 336

14.1.9.1 Business overview 336

14.1.9.2 Products/Solutions/Services offered 336

14.1.10 BRIGGS & STRATTON 338

14.1.10.1 Business overview 338

14.1.10.2 Products/Solutions/Services offered 338

14.1.10.3 Recent developments 339

14.1.10.3.1 Product launches 339

14.1.11 ATLAS COPCO AB 340

14.1.11.1 Business overview 340

14.1.11.2 Products/Solutions/Services offered 341

14.1.11.3 Recent developments 342

14.1.11.3.1 Product launches 342

14.1.12 ABB 343

14.1.12.1 Business overview 343

14.1.12.2 Products/Solutions/Services offered 344

14.1.13 KIRLOSKAR 345

14.1.13.1 Business overview 345

14.1.13.2 Products/Solutions/Services offered 346

14.1.13.3 Recent developments 348

14.1.13.3.1 Product launches 348

14.1.14 YANMAR HOLDINGS CO., LTD. 349

14.1.14.1 Business overview 349

14.1.14.2 Products/Solutions/Services offered 349

14.1.14.3 Recent developments 351

14.1.14.3.1 Product launches 351

14.1.14.3.2 Other developments 351

14.1.15 WEICHAI HOLDING GROUP CO., LTD. 352

14.1.15.1 Business overview 352

14.1.15.2 Products/Solutions/Services offered 353

14.2 OTHER PLAYERS 355

14.2.1 GREAVES COTTON LIMITED 355

14.2.2 AKSA POWER GENERATION 356

14.2.3 HONDA INDIA POWER PRODUCTS LTD. 357

14.2.4 DOOSAN BOBCAT 357

14.2.5 MULTIQUIP INC. 358

14.2.6 TAYLOR POWER SYSTEMS, INC 358

14.2.7 AB VOLVO PENTA 359

14.2.8 SHANGHAI DIESEL ENGINE CO., LTD. 359

14.2.9 DEERE & COMPANY 360

14.2.10 DENYO CO., LTD. 361

15 APPENDIX 362

15.1 INSIGHTS FROM INDUSTRY EXPERTS 362

15.2 DISCUSSION GUIDE 363

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 367

15.4 CUSTOMIZATION OPTIONS 369

15.5 RELATED REPORTS 369

15.6 AUTHOR DETAILS 370

❖ 世界の発電機市場に関するよくある質問(FAQ) ❖

・発電機の世界市場規模は?

→MarketsandMarkets社は2024年の発電機の世界市場規模を241.1億米ドルと推定しています。

・発電機の世界市場予測は?

→MarketsandMarkets社は2030年の発電機の世界市場規模を329.8億米ドルと予測しています。

・発電機市場の成長率は?

→MarketsandMarkets社は発電機の世界市場が2024年~2030年に年平均5.4%成長すると予測しています。

・世界の発電機市場における主要企業は?

→MarketsandMarkets社は「Caterpillar (US)、Cummins Inc. (US)、Rolls-Royce Plc (UK)、Mitsubishi Heavy Industries Ltd. (Japan)、Generac (US)、and Wacker Neuson SE (Germany)、Man Energy Solutions (Germany)、Briggs & Stratton (US)、Atlas Copco (Sweden)、Kirloskar (India)など ...」をグローバル発電機市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。