1 はじめに 27

1.1 調査目的 27

1.2 市場の定義 28

1.2.1 包含と除外 28

1.3 調査範囲 29

1.3.1 対象市場 29

1.3.2 考慮した年数 30

1.4 考慮した通貨 30

1.5 単位の検討 30

1.6 利害関係者 30

1.7 変更点のまとめ 31

2 調査方法 32

2.1 調査データ 32

2.1.1 二次データ 33

2.1.1.1 二次資料からの主要データ 33

2.1.2 一次データ 34

2.1.2.1 一次調査参加者 34

2.1.2.2 一次資料からの主要データ 34

2.1.2.3 一次インタビューの内訳 35

2.1.2.4 業界専門家からの洞察 35

2.2 市場規模の推定 36

2.2.1 供給側分析のための計算 36

2.2.2 ボトムアップアプローチ 38

2.2.3 トップダウンアプローチ 38

2.3 データの三角測量 39

2.4 調査の前提 40

2.5 研究の限界 40

2.6 リスク評価 40

3 エグゼクティブ・サマリー 41

4 プレミアムインサイト

4.1 黒鉛市場におけるプレーヤーにとっての魅力的な機会 45

4.2 黒鉛市場、タイプ別 45

4.3 アジア太平洋地域の黒鉛市場:用途別、国別 46

4.4 黒鉛市場:国別 46

5 市場の概要 47

5.1 市場ダイナミクス 47

5.1.1 推進要因 48

5.1.1.1 電気自動車販売の成長 48

5.1.1.2 鉄鋼・アルミニウム産業の活況 49

5.1.1.3 経済の脱炭素化 50

5.1.2 抑制要因 50

5.1.2.1 サプライチェーンの不安定性と資源制約 50

5.1.2.2 黒鉛生産に関する環境問題 50

5.1.2.3 人造黒鉛の高い生産コスト 51

5.1.3 機会 51

5.1.3.1 再生可能エネルギー貯蔵技術の拡大 51

5.1.3.2 グラフェン系アプリケーションの出現 51

5.1.4 課題 52

5.1.4.1 電池技術におけるシリコンベースの負極の急速な採用 52

5.1.4.2 カーボンナノ材料による黒鉛代替の可能性 52

5.2 ポーターのファイブ・フォース分析 52

5.2.1 代替品の脅威 54

5.2.2 新規参入企業の脅威 54

5.2.3 買い手の交渉力 54

5.2.4 供給者の交渉力 55

5.2.5 競合の激しさ 55

5.3 バリューチェーン分析 56

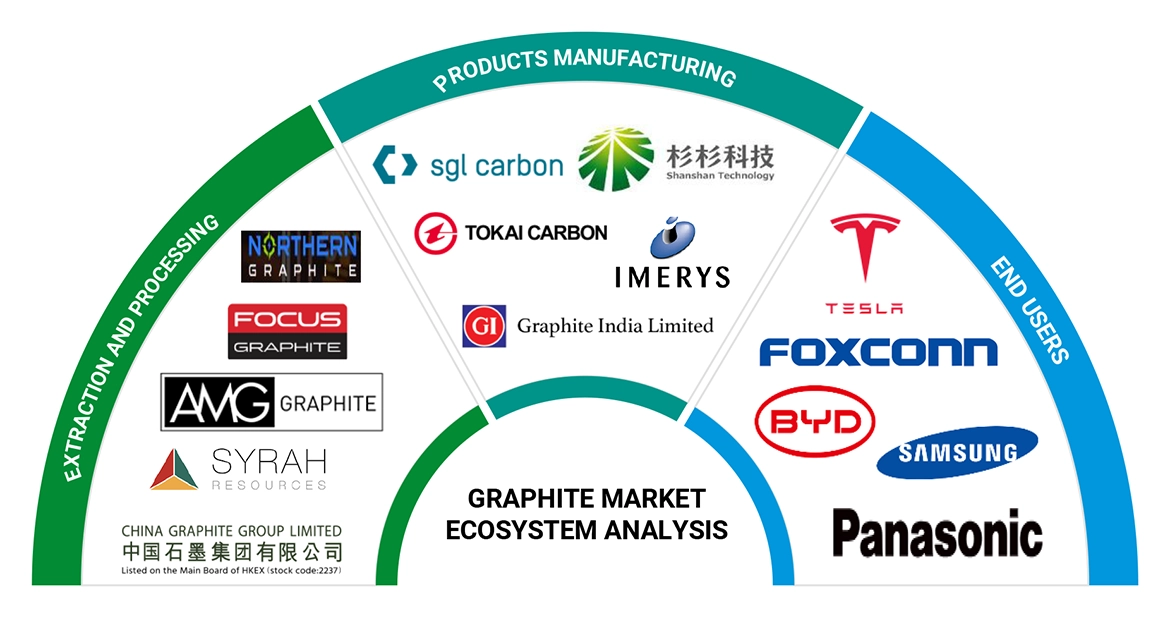

5.4 エコシステム分析 58

5.5 顧客ビジネスに影響を与えるトレンドと破壊 59

5.6 ケーススタディ分析 61

5.6.1 ティルパティ・黒鉛、事業全体の意思決定を改善するために薄片状黒鉛のバ リュー・チェーンをデジタル化 61

5.6.2 シラー・リソース、持続可能な取り組みによる成長達成のための洞察を鉱山会社に提供 61

5.6.3 自動車・航空宇宙産業での組立を簡素化するスピサー・グラフ・ライト・ドライブシャフトの展開 62

5.7 特許分析 63

5.8 規制情勢 64

5.8.1 規制機関、政府機関、その他の団体 65

5.8.2 電気自動車用電池に関する規制 66

5.8.3 欧州と米国のリチウムイオン電池生産に関する規制 67

5.8.4 電池とアキュムレータに関する規制 68

5.8.5 リチウムイオン電池の輸送に関する規制 68

5.9 技術分析 69

5.9.1 主要技術 69

5.9.1.1 電熱処理と精製 69

5.9.1.2 黒鉛化と熱処理 70

5.9.2 補足技術 71

5.9.2.1 黒鉛の球状化 71

5.9.2.2 空気分級 72

5.9.3 隣接技術 73

5.9.3.1 化学気相成長 73

5.9.3.2 バイオリーチング 74

5.10 貿易分析 76

5.10.1 輸入データ(HSコード2504) 76

5.10.2 輸出データ(HSコード2504) 77

5.11 主要会議・イベント(2024-2025年) 78

5.12 価格分析 79

5.13 世界のマクロ経済見通し 82

5.13.1 GDP 83

5.13.2 外国直接投資 84

5.14 投資と資金調達のシナリオ 85

5.15 主要ステークホルダーと購買基準 85

5.15.1 購入プロセスにおける主要ステークホルダー 85

5.15.2 購入基準 86

6 黒鉛市場:用途別 87

6.1 導入 88

6.2 電極 90

6.2.1 電気アーク炉製造における黒鉛電極の採用増加が市場を牽引 90

6.3 耐火物・鋳造 91

6.3.1 製鉄およびその他の高温工業プロセスが黒鉛の採用を促進 91

6.4 電池 93

6.4.1 電気自動車需要の急増とリサイクル技術の進歩が成長を促進 93

6.5 摩擦製品 95

6.5.1 安全性と性能を重視する自動車産業が成長を促進 95

6.6 潤滑油 96

6.6.1 高温・高圧環境における先進潤滑油のニーズが市場を牽引 96

6.7 その他の用途 98

7 黒鉛市場、純度別 100

7.1 導入 101

7.2 高純度 101

7.2.1 産業界全般にわたる精密性と性能への需要が成長を後押し 101

7.3 低純度 102

7.3.1 コスト効率の高い産業用ソリューションへのニーズが市場を牽引 102

8 黒鉛市場、タイプ別 103

8.1 導入 104

8.2 天然黒鉛 105

8.2.1 天然黒鉛の多様な用途が電池需要を牽引 105

8.2.2 薄片状

8.2.3 非晶質 110

8.2.4 ベイン 111

8.3 合成黒鉛 113

8.3.1 電気自動車におけるリチウム電池の普及が市場を牽引 113

8.3.2 黒鉛電極 115

8.3.3 炭素繊維 115

8.3.4 黒鉛ブロック 116

8.3.5 黒鉛粉末 116

8.3.6 その他 116

9 黒鉛市場(最終用途産業別) 117

9.1 はじめに 117

9.2 冶金 117

9.3 自動車 117

9.4 エレクトロニクス 118

9.5 その他の最終用途産業 118

10 黒鉛市場(地域別) 119

10.1 はじめに 120

10.2 アジア太平洋地域 122

10.2.1 中国 128

10.2.1.1 EV用電池生産の拡大が成長を後押し 128

10.2.2 インド 130

10.2.2.1 インフラ、エネルギー、製造セクターからの黒鉛需要の増加が市場を牽引 130

10.2.3 日本 133

10.2.3.1 グリーン技術を促進する政府政策が需要を促進 133

10.2.4 韓国 135

10.2.4.1 EV用電池の生産と技術革新への戦略的集中が成長を後押し 135

10.2.5 オーストラリア・ニュージーランド 138

10.2.5.1 持続可能な鉱業の重視が成長を促進 138

10.2.6 その他のアジア太平洋地域 140

10.3 北米 143

10.3.1 米国 148

10.3.1.1 活況を呈する自動車産業が市場を牽引 148

10.3.2 カナダ 150

10.3.2.1 政府の戦略的イニシアチブが市場を促進 150

10.3.3 メキシコ 153

10.3.3.1 エレクトロモビリティへのシフトが市場を牽引 153

10.4 欧州 155

10.4.1 ドイツ 161

10.4.1.1 主要電池メーカーとEVメーカーの存在が市場を牽引 161

10.4.2 イギリス 163

10.4.2.1 再生可能エネルギーとグリーン輸送への移行が市場を牽引 163

10.4.3 フランス 166

10.4.3.1 環境に優しい自動車の普及が市場を押し上げる 166

10.4.4 イタリア 168

10.4.4.1 エネルギー貯蔵プロジェクトによる送電網安定化への国内注力 が市場を牽引 168

10.4.5 スペイン 170

10.4.5.1 グリーンエネルギーに対する政府の強いコミットメントが成長を牽引 170

10.4.6 その他の欧州 173

10.5 南米 175

10.5.1 ブラジル 180

10.5.1.1 戦略的投資とEV需要の拡大が成長を後押し 180

10.5.2 チリ 183

10.5.2.1 リチウムイオン電池のサプライチェーンにおける同国の役割が市場を押し上げる 183

10.5.3 アルゼンチン 185

10.5.3.1 豊富な鉱物資源、政府の支援イニシアティブ、国際パートナーシップが成長を促進 185

10.5.4 その他の南米諸国 188

10.6 中東・アフリカ 190

10.6.1 GCC諸国 195

10.6.1.1 サウジアラビア 195

10.6.1.1.1 「ビジョン2030」構想が全産業で黒鉛需要を促進 195

10.6.1.2 ウアイ 198

10.6.1.2.1 再生可能エネルギーへの意欲と産業革新が市場を牽引 198

10.6.1.3 その他のGCC諸国 200

10.6.1.4 南アフリカ 202

10.6.1.4.1 急速な鉄鋼生産が黒鉛電極の採用を促進 202

10.6.2 その他の中東・アフリカ 205

11 競争環境 208

11.1 導入 208

11.2 主要企業の戦略/勝利への権利(2020~2024年) 208

11.3 収益分析(2019~2023年) 209

11.4 市場シェア分析(2023年) 210

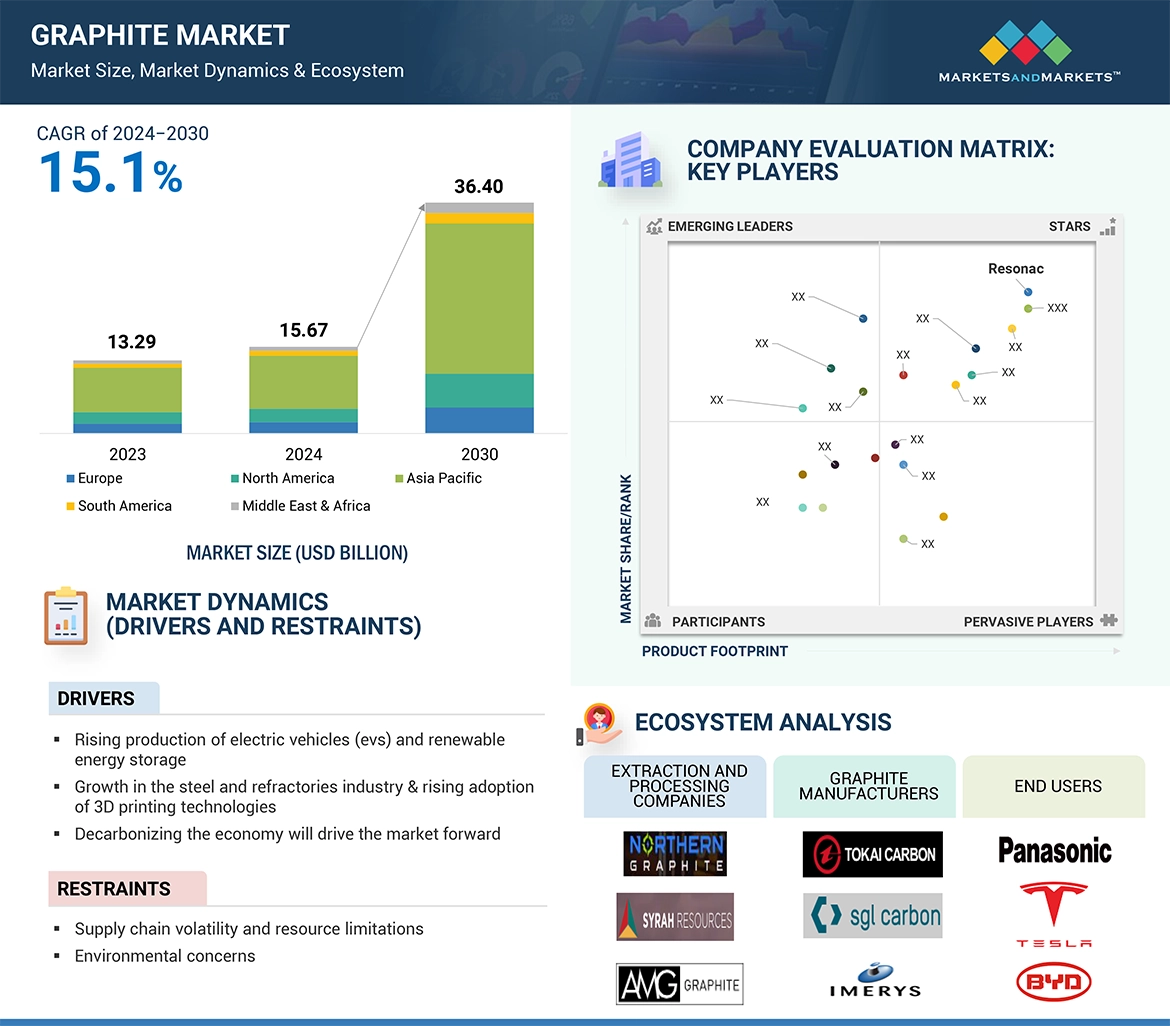

11.5 企業評価マトリックス:主要プレイヤー、2023年 212

11.5.1 スター企業 212

11.5.2 新興リーダー 212

11.5.3 浸透型プレーヤー 212

11.5.4 参加企業 212

11.5.5 企業フットプリント 214

11.5.5.1 企業フットプリント 214

11.5.5.2 タイプ別フットプリント 215

11.5.5.3 純度フットプリント 216

11.5.5.4 アプリケーションフットプリント 217

11.5.5.5 最終用途産業のフットプリント 218

11.5.5.6 地域別フットプリント 219

11.6 企業評価マトリックス:新興企業/SM(2023年) 219

11.6.1 進歩的企業 220

11.6.2 対応力のある企業 220

11.6.3 ダイナミックな企業 220

11.6.4 スタートアップ・ブロック 220

11.6.5 競争ベンチマーキング 222

11.6.5.1 新興企業/中小企業のリスト 222

11.6.5.2 新興企業/中小企業の競争ベンチマーキング 223

11.7 ブランド/製品の比較 224

11.8 企業評価と財務指標 225

11.9 競争シナリオ 226

11.9.1 取引 226

11.9.2 拡張 227

12 企業プロファイル 228

12.1 主要プレーヤー 228

AMG (Germany)

Asbury Carbons (US)

Grafitbergbau Kaisersberg GmbH (Austria)

BTR New Material Group Co.,Ltd.(China)

Imerys (France)

Nacional de Grafite (Brazil)

SGL Carbon (Germany)

Mineral Commodities Ltd. (Australia)

Resonac Holdings Corporation(Japan)

Toyo Tanso Co.,Ltd.(Japan)

Mersen Property (France)

Shanshan Co (China)

Syrah Resources Limited(Australia)

Graphite India Limited (India)

ECO GRAF (Australia)

GrafTech International (US)

Tokai Carbon Co.Ltd.(Japan)

13 隣接市場と関連市場 280

13.1 導入 280

13.2 制限 280

13.3 相互関連市場 280

13.4 リチウムイオン電池市場 280

13.4.1 市場の定義 280

13.4.2 市場概要 280

13.4.3 電圧別リチウムイオン電池市場 281

13.5 低電圧 281

13.5.1 電池性能向上のための継続的な研究開発が市場を牽引 281

13.6 中型 282

13.6.1 太陽エネルギーシステムの普及が市場を牽引 282

13.7 高 282

13.7.1 海洋・軍事分野からの需要増加が

市場を牽引 282

14 付録 283

14.1 ディスカッションガイド 283

14.2 Knowledgestore: Marketsandmarketsの購読ポータル 287

14.3 カスタマイズオプション 289

14.4 関連レポート 289

14.5 著者の詳細 290

One of the significant drivers of the graphite is a growing battery market. The battery graphite has become the ultimate and most used anode material in lithium-ion batteries, mainly for its unique characteristics, including high energy density, excellent chemical stability, and low lithium ion potential. It is the material taking up approximately 95% of the anode market and is a critical component in every lithium-ion battery, whether it be lithium iron phosphate (LFP) or nickel cobalt manganese (NCM) chemistry..

“By Graphite type, the synthetic graphite segment is estimated to be the largest segment of the graphite market from 2024 to 2030.”

Synthetic graphite mainly leads the graphite market due to preference in the anodes of lithium-ion batteries in electric vehicles. Synthesized from graphitizing petroleum coke in high-temperature furnaces, synthetic graphite's carbon purity ranges up to 99-99.9%. It carries more energy density per unit mass compared with natural flake graphite but is highly energy-intensive in terms of production, which indirectly contributes to a greater carbon footprint. China commands dominant global market share of synthetic graphite, with about 80% of its supply, justifying its dominance position in this critical battery component. Synthetic graphite is where demand for high-performance lithium-ion batteries, especially in the electric vehicle space, has been fueling..

“By Graphite purity, high purity graphite is estimated to be the largest segment of the graphite market from 2024 to 2030 by CAGR.”

High purity graphite has the greatest CAGR by graphite purity segment, with several key benefits, including a highly stable, electrically conductive, and thermally resilient material. High purity graphite has 99% or higher carbon content, this element is produced through rigorous refining and purification processes-these include thermal and chemical treatments. This process removes impurities such as silicon, aluminum, and iron. High-purity graphite has applications in a range of high-tech industries. For instance, it is used as the preferred anode material in lithium-ion batteries to improve energy storage capacity and cycle life, which are critical for the efficacy of EVs and grid energy storage systems. The high thermal and electrical conductivity makes it useful in aerospace and electronics applications.

“The Asia Pacific region's graphite market is projected to have the highest share in 2024.”

Asia Pacific is expected to lead the highest share of market in 2024| This is due to its leadership in EV battery production, industrial growth, and government-backed green initiatives. China is also a global supply chain that accounts for more than 70% of the global production of EV batteries. Subsidies, inclusive charging infrastructure, and supporting license policies followed by the APAC region's market, especially China, have electric vehicle government initiatives. Recycling is also on the rise with Chinese companies leading the graphite recovery from spent batteries. Moreover, the momentum in India's growing steel industry and infrastructure projects under the National Infrastructure Pipeline are also raising demand for synthetic graphite, and initiatives like PLI Scheme for battery manufacturing increase graphite use in the energy sector.

Profile break-up of primary participants for the report:

• By Company Type: Tier 1 – 40%, Tier 2 – 20%, and Tier 3 – 40%

• By Designation: C-level Executives – 10%, Directors – 70%, and Others – 20%

• By Region: North America – 20%, Europe –20%, Asia Pacific – 45%, South America -10%, and Middle East & Asia -5%

The Graphite report is dominated by players such as AMG (Germany), Asbury Carbons (US), Grafitbergbau Kaisersberg GmbH (Austria), BTR New Material Group Co.,Ltd.(China), Imerys (France), Nacional de Grafite (Brazil), SGL Carbon (Germany), Mineral Commodities Ltd. (Australia), Resonac Holdings Corporation(Japan), Toyo Tanso Co.,Ltd.(Japan), Mersen Property (France), Shanshan Co (China), Syrah Resources Limited(Australia), Graphite India Limited (India), ECO GRAF (Australia), GrafTech International (US), Tokai Carbon Co., Ltd.(Japan) and Others.

Research Coverage:

The report defines, segments, and projects the graphite market size based on Graphite Type, Graphite Purity, Application, End Use Industry and Region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as expansions, agreements, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the graphite market and its segments. This report is also expected to help stakeholder businesses and the market’s competitive landscape better, gain insights to improve the position of their companies, and make suitable go-to-market strategies. It also enables stakeholders to understand the market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (High production of EVs, and renewable energy storage and Rising demand for synthetic graphite and decarbonization), restraints (Supply chain volatility and resource limitations, Safety and environmental concerns, and high production costs), opportunities (Expansion in renewable energy storage and development of new graphene based applications), and challenges (expected utilization of silicon-based anodes in batteries, Carbon nanomaterials and other substitutes) influencing the growth of the graphite market.

• New Product and Innovation: The report includes detailed analysis of latest products of graphite (graphitic hard carbon, palm kernel shell-based graphite, and battery-grade graphite) and innovations (graphene-enhanced electrodes, silicon-graphite composite anodes, and additive manufacturing with graphite)

• Market Development: Comprehensive information about lucrative markets – the report analyses The graphite market is across varied regions.

• Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the graphite market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players AMG (Germany), Asbury Carbons (US), Grafitbergbau Kaisersberg GmbH (Austria), BTR New Material Group Co.,Ltd.(China), Imerys (France), Nacional de Grafite (Brazil), SGL Carbon (Germany), Mineral Commodities Ltd. (Australia), Resonac Holdings Corporation(Japan), Toyo Tanso Co.,Ltd.(Japan), Mersen Property (France), Shanshan Co (China), Syrah Resources Limited(Australia), Graphite India Limited (India), ECO GRAF (Australia), GrafTech International (US), and Tokai Carbon Co., Ltd.(Japan) are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 28

1.2.1 INCLUSIONS AND EXCLUSIONS 28

1.3 STUDY SCOPE 29

1.3.1 MARKETS COVERED 29

1.3.2 YEARS CONSIDERED 30

1.4 CURRENCY CONSIDERED 30

1.5 UNIT CONSIDERED 30

1.6 STAKEHOLDERS 30

1.7 SUMMARY OF CHANGES 31

2 RESEARCH METHODOLOGY 32

2.1 RESEARCH DATA 32

2.1.1 SECONDARY DATA 33

2.1.1.1 Key data from secondary sources 33

2.1.2 PRIMARY DATA 34

2.1.2.1 Primary participants 34

2.1.2.2 Key data from primary sources 34

2.1.2.3 Breakdown of primary interviews 35

2.1.2.4 Insights from industry experts 35

2.2 MARKET SIZE ESTIMATION 36

2.2.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS 36

2.2.2 BOTTOM-UP APPROACH 38

2.2.3 TOP-DOWN APPROACH 38

2.3 DATA TRIANGULATION 39

2.4 RESEARCH ASSUMPTIONS 40

2.5 RESEARCH LIMITATIONS 40

2.6 RISK ASSESSMENT 40

3 EXECUTIVE SUMMARY 41

4 PREMIUM INSIGHTS 45

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GRAPHITE MARKET 45

4.2 GRAPHITE MARKET, BY TYPE 45

4.3 ASIA PACIFIC GRAPHITE MARKET, BY APPLICATION AND COUNTRY 46

4.4 GRAPHITE MARKET, BY COUNTRY 46

5 MARKET OVERVIEW 47

5.1 MARKET DYNAMICS 47

5.1.1 DRIVERS 48

5.1.1.1 Growing electric vehicle sales 48

5.1.1.2 Booming steel and aluminum industries 49

5.1.1.3 Decarbonization of economy 50

5.1.2 RESTRAINTS 50

5.1.2.1 Supply chain volatility and resource constraints 50

5.1.2.2 Environmental concerns about graphite production 50

5.1.2.3 High production cost of synthetic graphite 51

5.1.3 OPPORTUNITIES 51

5.1.3.1 Expansion of renewable energy storage technologies 51

5.1.3.2 Emergence of graphene-based applications 51

5.1.4 CHALLENGES 52

5.1.4.1 Rapid adoption of silicon-based anodes in battery technology 52

5.1.4.2 Potential substitution of graphite by carbon nanomaterials 52

5.2 PORTER’S FIVE FORCES ANALYSIS 52

5.2.1 THREAT OF SUBSTITUTES 54

5.2.2 THREAT OF NEW ENTRANTS 54

5.2.3 BARGAINING POWER OF BUYERS 54

5.2.4 BARGAINING POWER OF SUPPLIERS 55

5.2.5 INTENSITY OF COMPETITIVE RIVALRY 55

5.3 VALUE CHAIN ANALYSIS 56

5.4 ECOSYSTEM ANALYSIS 58

5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 59

5.6 CASE STUDY ANALYSIS 61

5.6.1 TIRUPATI GRAPHITE DIGITIZES FLAKE GRAPHITE VALUE CHAIN FOR IMPROVED DECISION-MAKING ACROSS OPERATIONS 61

5.6.2 SYRAH RESOURCES PROVIDES MINING COMPANY WITH INSIGHTS ON ACHIEVING GROWTH THROUGH SUSTAINABLE INITIATIVES 61

5.6.3 DEPLOYMENT OF SPICER GRAPH LITE DRIVESHAFT TO SIMPLIFY ASSEMBLY IN AUTOMOTIVE AND AEROSPACE INDUSTRIES 62

5.7 PATENT ANALYSIS 63

5.8 REGULATORY LANDSCAPE 64

5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 65

5.8.2 REGULATIONS ON ELECTRIC VEHICLE BATTERIES 66

5.8.3 EUROPE AND US REGULATIONS ON LITHIUM-ION BATTERY PRODUCTION 67

5.8.4 REGULATIONS ON BATTERIES AND ACCUMULATORS 68

5.8.5 REGULATIONS ON TRANSPORT OF LITHIUM-ION BATTERIES 68

5.9 TECHNOLOGY ANALYSIS 69

5.9.1 KEY TECHNOLOGIES 69

5.9.1.1 Electrothermal treatment and purification 69

5.9.1.2 Graphitization and heat treatment 70

5.9.2 COMPLEMENTARY TECHNOLOGIES 71

5.9.2.1 Spheroidization of graphite 71

5.9.2.2 Air classification 72

5.9.3 ADJACENT TECHNOLOGIES 73

5.9.3.1 Chemical vapor deposition 73

5.9.3.2 Bioleaching 74

5.10 TRADE ANALYSIS 76

5.10.1 IMPORT DATA (HS CODE 2504) 76

5.10.2 EXPORT DATA (HS CODE 2504) 77

5.11 KEY CONFERENCES AND EVENTS, 2024–2025 78

5.12 PRICING ANALYSIS 79

5.13 GLOBAL MACROECONOMIC OUTLOOK 82

5.13.1 GDP 83

5.13.2 FOREIGN DIRECT INVESTMENT 84

5.14 INVESTMENT AND FUNDING SCENARIO 85

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA 85

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS 85

5.15.2 BUYING CRITERIA 86

6 GRAPHITE MARKET, BY APPLICATION 87

6.1 INTRODUCTION 88

6.2 ELECTRODE 90

6.2.1 INCREASED ADOPTION OF GRAPHITE ELECTRODES IN PRODUCTION OF ELECTRIC ARC FURNACES TO DRIVE MARKET 90

6.3 REFRACTORY & FOUNDRY 91

6.3.1 STEELMAKING AND OTHER HIGH-TEMPERATURE INDUSTRIAL PROCESSES TO DRIVE ADOPTION OF GRAPHITE 91

6.4 BATTERY 93

6.4.1 SURGE IN DEMAND FOR ELECTRIC VEHICLES AND ADVANCEMENTS IN RECYCLING TECHNOLOGY TO PROPEL GROWTH 93

6.5 FRICTION PRODUCT 95

6.5.1 FOCUS OF AUTOMOTIVE INDUSTRY ON SAFETY AND PERFORMANCE TO PROPEL GROWTH 95

6.6 LUBRICANT 96

6.6.1 NEED FOR ADVANCED LUBRICANTS IN HIGH-TEMPERATURE, HIGH-PRESSURE ENVIRONMENTS TO DRIVE MARKET 96

6.7 OTHER APPLICATIONS 98

7 GRAPHITE MARKET, BY PURITY 100

7.1 INTRODUCTION 101

7.2 HIGH PURITY 101

7.2.1 DEMAND FOR PRECISION AND PERFORMANCE ACROSS INDUSTRIES TO BOOST GROWTH 101

7.3 LOW PURITY 102

7.3.1 NEED TO POWER COST-EFFECTIVE INDUSTRIAL SOLUTIONS TO DRIVE MARKET 102

8 GRAPHITE MARKET, BY TYPE 103

8.1 INTRODUCTION 104

8.2 NATURAL GRAPHITE 105

8.2.1 VERSATILE APPLICATIONS OF NATURAL GRAPHITE TO DRIVE ITS DEMAND IN BATTERIES 105

8.2.2 FLAKE 108

8.2.3 AMORPHOUS 110

8.2.4 VEIN 111

8.3 SYNTHETIC GRAPHITE 113

8.3.1 EXTENSIVE USE OF LITHIUM BATTERIES IN ELECTRIC VEHICLES TO DRIVE MARKET 113

8.3.2 GRAPHITE ELECTRODE 115

8.3.3 CARBON FIBER 115

8.3.4 GRAPHITE BLOCK 116

8.3.5 GRAPHITE POWDER 116

8.3.6 OTHERS 116

9 GRAPHITE MARKET, BY END-USE INDUSTRY 117

9.1 INTRODUCTION 117

9.2 METALLURGY 117

9.3 AUTOMOTIVE 117

9.4 ELECTRONICS 118

9.5 OTHER END-USE INDUSTRIES 118

10 GRAPHITE MARKET, BY REGION 119

10.1 INTRODUCTION 120

10.2 ASIA PACIFIC 122

10.2.1 CHINA 128

10.2.1.1 Expansion of EV battery production to boost growth 128

10.2.2 INDIA 130

10.2.2.1 Rising demand for graphite from infrastructure, energy, and manufacturing sectors to drive market 130

10.2.3 JAPAN 133

10.2.3.1 Government policies promoting green technologies to propel demand 133

10.2.4 SOUTH KOREA 135

10.2.4.1 Strategic focus on EV battery production and technological innovation to boost growth 135

10.2.5 AUSTRALIA & NEW ZEALAND 138

10.2.5.1 Emphasis on sustainable mining to drive growth 138

10.2.6 REST OF ASIA PACIFIC 140

10.3 NORTH AMERICA 143

10.3.1 US 148

10.3.1.1 Booming automotive industry to drive market 148

10.3.2 CANADA 150

10.3.2.1 Strategic government initiatives to propel market 150

10.3.3 MEXICO 153

10.3.3.1 Shift toward electromobility to drive market 153

10.4 EUROPE 155

10.4.1 GERMANY 161

10.4.1.1 Presence of key battery and EV manufacturers to propel market 161

10.4.2 UK 163

10.4.2.1 Transition to renewable energy and green transportation to drive market 163

10.4.3 FRANCE 166

10.4.3.1 Adoption of environment-friendly vehicles to boost market 166

10.4.4 ITALY 168

10.4.4.1 Domestic focus on grid stabilization through energy storage projects to propel market 168

10.4.5 SPAIN 170

10.4.5.1 Government’s strong commitment to green energy to drive growth 170

10.4.6 REST OF EUROPE 173

10.5 SOUTH AMERICA 175

10.5.1 BRAZIL 180

10.5.1.1 Strategic investments and growing demand from EVs to boost growth 180

10.5.2 CHILE 183

10.5.2.1 Country’s role in lithium-ion battery supply chain to boost market 183

10.5.3 ARGENTINA 185

10.5.3.1 Abundant mineral resources, government-backed initiatives, and international partnerships to propel growth 185

10.5.4 REST OF SOUTH AMERICA 188

10.6 MIDDLE EAST & AFRICA 190

10.6.1 GCC COUNTRIES 195

10.6.1.1 SAUDI ARABIA 195

10.6.1.1.1 Vision 2030 initiative to fuel demand for graphite across industries 195

10.6.1.2 UAE 198

10.6.1.2.1 Renewable energy ambitions and industrial innovation to propel market 198

10.6.1.3 Rest of GCC Countries 200

10.6.1.4 SOUTH AFRICA 202

10.6.1.4.1 Rapid steel production to drive adoption of graphite electrodes 202

10.6.2 REST OF MIDDLE EAST & AFRICA 205

11 COMPETITIVE LANDSCAPE 208

11.1 INTRODUCTION 208

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 208

11.3 REVENUE ANALYSIS, 2019–2023 209

11.4 MARKET SHARE ANALYSIS, 2023 210

11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 212

11.5.1 STARS 212

11.5.2 EMERGING LEADERS 212

11.5.3 PERVASIVE PLAYERS 212

11.5.4 PARTICIPANTS 212

11.5.5 COMPANY FOOTPRINT 214

11.5.5.1 Company footprint 214

11.5.5.2 Type footprint 215

11.5.5.3 Purity footprint 216

11.5.5.4 Application footprint 217

11.5.5.5 End-use industry footprint 218

11.5.5.6 Region footprint 219

11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023 219

11.6.1 PROGRESSIVE COMPANIES 220

11.6.2 RESPONSIVE COMPANIES 220

11.6.3 DYNAMIC COMPANIES 220

11.6.4 STARTING BLOCKS 220

11.6.5 COMPETITIVE BENCHMARKING 222

11.6.5.1 List of start-ups/SMEs 222

11.6.5.2 Competitive benchmarking of start-ups/SMEs 223

11.7 BRAND/PRODUCT COMPARISON 224

11.8 COMPANY VALUATION AND FINANCIAL METRICS 225

11.9 COMPETITIVE SCENARIO 226

11.9.1 DEALS 226

11.9.2 EXPANSIONS 227

12 COMPANY PROFILES 228

12.1 KEY PLAYERS 228

12.1.1 SHANSHAN CO 228

12.1.1.1 Business overview 228

12.1.1.2 Products offered 229

12.1.1.3 MnM view 230

12.1.1.3.1 Right to win 230

12.1.1.3.2 Strategic choices 230

12.1.1.3.3 Weaknesses and competitive threats 230

12.1.2 SGL CARBON 231

12.1.2.1 Business overview 231

12.1.2.2 Products offered 232

12.1.2.3 Recent developments 233

12.1.2.3.1 Deals 233

12.1.2.3.2 Expansions 234

12.1.2.4 MnM view 234

12.1.2.4.1 Right to win 234

12.1.2.4.2 Strategic choices 234

12.1.2.4.3 Weaknesses and competitive threats 234

12.1.3 RESONAC HOLDINGS CORPORATION 235

12.1.3.1 Business overview 235

12.1.3.2 Products offered 236

12.1.3.3 Recent developments 237

12.1.3.3.1 Deals 237

12.1.3.4 MnM view 237

12.1.3.4.1 Right to win 237

12.1.3.4.2 Strategic choices 237

12.1.3.4.3 Weaknesses and competitive threats 237

12.1.4 GRAFTECH INTERNATIONAL 238

12.1.4.1 Business overview 238

12.1.4.2 Products offered 239

12.1.4.3 Recent developments 239

12.1.4.3.1 Expansions 239

12.1.4.4 MnM view 239

12.1.4.4.1 Right to win 239

12.1.4.4.2 Strategic choices 240

12.1.4.4.3 Weaknesses and competitive threats 240

12.1.5 IMERYS 241

12.1.5.1 Business overview 241

12.1.5.2 Products offered 243

12.1.5.3 MnM view 243

12.1.5.3.1 Right to win 243

12.1.5.3.2 Strategic choices 243

12.1.5.3.3 Weaknesses and competitive threats 243

12.1.6 AMG 244

12.1.6.1 Business overview 244

12.1.6.2 Products offered 246

12.1.6.3 Recent developments 247

12.1.6.3.1 Deals 247

12.1.7 ASBURY CARBONS 248

12.1.7.1 Business overview 248

12.1.7.2 Products offered 248

12.1.7.3 Recent developments 250

12.1.7.3.1 Deals 250

12.1.8 GRAFITBERGBAU KAISERSBERG GMBH 251

12.1.8.1 Business overview 251

12.1.8.2 Products offered 251

12.1.9 BTR NEW MATERIAL GROUP CO., LTD. 253

12.1.9.1 Business overview 253

12.1.9.2 Products offered 253

12.1.9.3 Recent developments 254

12.1.9.3.1 Deals 254

12.1.10 NACIONAL DE GRAFITE 255

12.1.10.1 Business overview 255

12.1.10.2 Products offered 255

12.1.11 MINERAL COMMODITIES LTD. 257

12.1.11.1 Business overview 257

12.1.11.2 Products offered 258

12.1.11.3 Recent developments 258

12.1.11.3.1 Deals 258

12.1.12 TOKAI CARBON CO., LTD 259

12.1.12.1 Business overview 259

12.1.12.2 Products offered 260

12.1.12.3 Recent developments 260

12.1.12.3.1 Deals 260

12.1.13 TOYO TANSO CO., LTD. 261

12.1.13.1 Business overview 261

12.1.13.2 Products offered 262

12.1.14 MERSEN PROPERTY 263

12.1.14.1 Business overview 263

12.1.14.2 Products offered 265

12.1.15 GRAPHITE INDIA LIMITED 266

12.1.15.1 Business overview 266

12.1.15.2 Products offered 267

12.1.16 SYRAH RESOURCES LIMITED 268

12.1.16.1 Business overview 268

12.1.16.2 Products offered 269

12.1.17 ECOGRAF 270

12.1.17.1 Business overview 270

12.1.17.2 Products offered 271

12.2 OTHER PLAYERS 272

12.2.1 TIRUPATI CARBONS & CHEMICALS PVT LTD 272

12.2.2 NORTHERN GRAPHITE 272

12.2.3 NOVONIX LIMITED 273

12.2.4 TALGA GROUP 273

12.2.5 HEBEI KUNTIAN NEW ENERGY CO. LTD. 274

12.2.6 ZENTEK LTD. 275

12.2.7 NIPPON CARBON CO., LTD. 276

12.2.8 POCO 277

12.2.9 HEG LIMITED 278

12.2.10 PINGDINGSHAN ORIENTAL CARBON CO., LTD. 279

13 ADJACENT AND RELATED MARKETS 280

13.1 INTRODUCTION 280

13.2 LIMITATIONS 280

13.3 INTERCONNECTED MARKETS 280

13.4 LITHIUM-ION BATTERY MARKET 280

13.4.1 MARKET DEFINITION 280

13.4.2 MARKET OVERVIEW 280

13.4.3 LITHIUM-ION BATTERY MARKET, BY VOLTAGE 281

13.5 LOW 281

13.5.1 ONGOING RESEARCH AND DEVELOPMENT TO IMPROVE BATTERY PERFORMANCE TO DRIVE MARKET 281

13.6 MEDIUM 282

13.6.1 RISING ADOPTION OF SOLAR ENERGY SYSTEMS TO DRIVE MARKET 282

13.7 HIGH 282

13.7.1 INCREASING DEMAND FROM MARINE AND MILITARY SECTORS TO

DRIVE MARKET 282

14 APPENDIX 283

14.1 DISCUSSION GUIDE 283

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 287

14.3 CUSTOMIZATION OPTIONS 289

14.4 RELATED REPORTS 289

14.5 AUTHOR DETAILS 290

❖ 世界の黒鉛市場に関するよくある質問(FAQ) ❖

・黒鉛の世界市場規模は?

→MarketsandMarkets社は2024年の黒鉛の世界市場規模を156.7億米ドルと推定しています。

・黒鉛の世界市場予測は?

→MarketsandMarkets社は2030年の黒鉛の世界市場規模を364.0億米ドルと予測しています。

・黒鉛市場の成長率は?

→MarketsandMarkets社は黒鉛の世界市場が2024年~2030年に年平均15.1%成長すると予測しています。

・世界の黒鉛市場における主要企業は?

→MarketsandMarkets社は「AMG (Germany), Asbury Carbons (US), Grafitbergbau Kaisersberg GmbH (Austria), BTR New Material Group Co.,Ltd.(China), Imerys (France), Nacional de Grafite (Brazil), SGL Carbon (Germany), Mineral Commodities Ltd. (Australia), Resonac Holdings Corporation(Japan), Toyo Tanso Co.,Ltd.(Japan), Mersen Property (France), Shanshan Co (China), Syrah Resources Limited(Australia), Graphite India Limited (India), ECO GRAF (Australia), GrafTech International (US), Tokai Carbon Co., Ltd.(Japan)など ...」をグローバル黒鉛市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。