1 はじめに 26

1.1 調査目的 26

1.2 市場の定義 26

1.3 調査範囲 27

1.3.1 対象市場と地域範囲 27

1.3.2 対象範囲と除外項目 28

1.3.3 考慮した年数 28

1.4 考慮した通貨 28

1.5 単位の考慮 28

1.6 利害関係者 29

1.7 変更点のまとめ 29

2 調査方法 30

2.1 調査データ 30

2.1.1 二次データ 31

2.1.1.1 主要な二次情報源のリスト 31

2.1.1.2 二次資料からの主要データ 31

2.1.2 一次データ 32

2.1.2.1 一次資料からの主要データ 32

2.1.2.2 主要な一次インタビュー参加者のリスト 33

2.1.2.3 主要な業界インサイト 33

2.1.2.4 専門家へのインタビューの内訳 33

2.2 市場規模の推定 34

2.2.1 ボトムアップアプローチ 34

2.2.2 トップダウンアプローチ 35

2.3 成長予測 36

2.4 データの三角測量 37

2.5 要因分析 38

2.6 リサーチの前提 38

2.7 調査の限界とリスク分析 39

3 エグゼクティブサマリー 40

4 プレミアムインサイト 44

4.1 医療用エラストマー市場におけるプレーヤーにとっての魅力的な機会 44

4.2 医療用エラストマー市場:タイプ別、2024年対2029年(キロトン) 44

4.3 医療用エラストマー市場:用途別(2024年対2029年)(キロトン) 45

4.4 医療用エラストマー市場:最終用途産業別、2024年対2029年(キロトン) 45

4.5 医療用エラストマー市場:主要国別 46

5 市場概要 47

5.1 はじめに 47

5.2 市場ダイナミクス 47

5.2.1 推進要因 48

5.2.1.1 医療機器の需要拡大 48

5.2.1.2 医療における技術の進歩 48

5.2.1.3 慢性疾患の蔓延 49

5.2.2 阻害要因 49

5.2.2.1 高い製造コスト 49

5.2.3 機会 50

5.2.3.1 新興国における医療投資の増加 50

5.2.3.2 低侵襲デバイスでの使用の増加 50

5.2.4 課題 50

5.2.4.1 厳しい規制要件 50

5.3 ポーターの5つの力分析 51

5.3.1 新規参入による脅威 52

5.3.2 代替品の脅威 52

5.3.3 供給者の交渉力 52

5.3.4 買い手の交渉力 53

5.3.5 競合の激しさ 53

5.4 主要ステークホルダーと購買基準 54

5.4.1 購買プロセスにおける主要ステークホルダー 54

5.4.2 購買基準 55

5.5 マクロ経済の見通し 56

5.5.1 GDPの動向と予測 56

5.6 AI/ジェナイの影響 59

5.7 バリューチェーン分析 60

5.8 エコシステム分析 61

5.9 ケーススタディ分析 62

5.9.1 非ラテックス医療部品への移行を支援したケント・エラストマー 62

5.9.2 クーパー大学病院がデンテック・セーフティコンフォート・エアンクス MD でポリフェニレンエーテルの回復力を強化 63

5.9.3 整形外科用途でシリコーンに代わる高性能材料としてのテクノフロン FK 63

5.10 規制の状況 64

5.10.1 環境規制 64

5.10.2 北米 64

5.10.3 アジア太平洋地域 65

5.10.4 欧州 66

5.10.5 規制機関、政府機関、その他の組織 67

5.11 技術分析 68

5.11.1 主要技術 68

5.11.1.1 押出技術 68

5.11.1.2 圧縮成形 68

5.11.2 補足技術 68

5.11.2.1 共押出技術 68

5.11.3 隣接技術 69

5.11.3.1 積層造形技術 69

5.12 顧客ビジネスに影響を与えるトレンド/破壊 69

5.13 貿易分析 70

5.13.1 輸入シナリオ(HSコード 391000) 70

5.13.2 輸出シナリオ(HS コード 391000) 71

5.13.3 輸入シナリオ(HSコード400270) 72

5.13.4 輸出シナリオ(HSコード400270) 73

5.14 主要会議・イベント(2024-2025年) 74

5.15 価格分析 75

5.15.1 医療用エラストマーの地域別平均販売価格動向 75

5.15.2 医療用エラストマーの平均販売価格動向(用途別) 76

用途別 76

5.15.3 医療用エラストマーの平均販売価格動向(用途別) 76

最終用途産業別 76

5.16 投資と資金調達のシナリオ 77

5.17 特許分析 77

5.17.1 導入 77

5.17.2 特許の法的地位 79

5.17.3 管轄区域分析 80

5.18 潜在顧客のリスト 80

6 医療用エラストマー市場:技術別 83

6.1 導入 84

6.2 押出成形 84

6.3 射出成形 84

6.4 圧縮成形 84

6.5 その他の技術 85

7 医療用エラストマー市場:最終用途産業別 86

7.1 はじめに 87

7.2 病院・診療所 89

7.2.1 慢性疾患の蔓延が市場を牽引 89

7.3 医薬品 89

7.3.1 包装と薬物送達システムにおけるエラストマーの重要な役割が普及を促進 89

7.4 医療機器製造 90

7.4.1 先端医療機器への需要の高まりが市場成長を後押し 90

7.5 その他の最終用途産業 90

8 医療用エラストマー市場:用途別 91

8.1 はじめに 92

8.2 医療用チューブ 96

8.2.1 先進的医療用チュービング・ソリューションにおける高い消費が市場を牽引 96

8.3 カテーテル 97

8.3.1 カテーテル製造における重要な役割が成長を促進 97

8.4 グローブ 97

8.4.1 個人用保護具のニーズの高まりが需要を押し上げる 97

8.5 注射器 97

8.5.1 プレフィルドシリンジ 98

8.5.1.1 投与ミスのリスク低減:採用の主要因 98

8.5.2 非充填シリンジ 98

8.5.2.1 慢性疾患の罹患率の増加が採用を促進 98

8.5.3 バイアル 98

8.5.3.1 安全で効果的な薬物送達システムに対するニーズの増加が市場を牽引 98

8.6 医療・輸液バッグ 99

8.6.1 院内感染の増加が市場成長を支える 99

8.7 インプラント 99

8.7.1 加齢に伴う健康状態の蔓延が市場を牽引 99

8.8 その他の用途 100

9 医療用エラストマー市場:タイプ別 101

9.1 はじめに 102

9.2 熱硬化性エラストマー 104

9.2.1 シリコーン 104

9.2.1.1 医療・医薬用途におけるラテックス製品の効率的代替材料 104

9.2.1.2 高温加硫 105

9.2.1.3 液状シリコーンゴム 105

9.2.1.4 常温加硫 105

9.2.2 エチレンプロピレンジエンモノマー 106

9.2.2.1 様々な医療用途に適し、市場成長を支える主な要因 106

9.2.3 その他の熱硬化性エラストマー 106

9.3 熱可塑性エラストマー 106

9.3.1 熱可塑性ポリウレタン 107

9.3.1.1 押出成形技術による複雑な設計の製造の効率化 107

9.3.2 スチレンブロック共重合体 107

9.3.2.1 SBCの生体安定性が医療用途での有用性を高める-市場成長 の主要因 107

9.3.3 その他の熱可塑性エラストマー 107

10 医療用エラストマー市場:地域別 108

10.1 はじめに 109

10.2 北米 111

10.2.1 米国 121

10.2.1.1 医療支出の増加が市場を牽引 121

10.2.2 カナダ 124

10.2.2.1 拡大する医療制度が市場成長を支える 124

10.2.3 メキシコ 128

10.2.3.1 政府のイニシアティブと医療セクターの成長が市場を牽引 128

10.3 アジア太平洋地域 132

10.3.1 中国 142

10.3.1.1 高齢化の進展が市場を牽引 142

10.3.2 日本 145

10.3.2.1 感染対策と患者の安全性への関心の高まりが市場を促進 145

10.3.3 インド 149

10.3.3.1 医療分野への投資の増加が市場を牽引 149

10.3.4 韓国 153

10.3.4.1 高品質医療機器への需要増加が市場を牽引 153

10.3.5 インドネシア 157

10.3.5.1 慢性疾患の増加が市場を牽引 157

10.3.6 その他のアジア太平洋地域 161

10.4 欧州 165

10.4.1 ドイツ 175

10.4.1.1 研究開発投資の増加が市場を牽引 175

10.4.2 イギリス 178

10.4.2.1 高齢者人口の増加が市場成長を支える 178

10.4.3 フランス 182

10.4.3.1 大手医療機器メーカーの存在が市場を促進 182

10.4.4 イタリア 186

10.4.4.1 公立病院からの医療機器需要が増加 186

10.4.5 スペイン 190

10.4.5.1 医療インフラへの投資の増加が市場を牽引 190

10.4.6 その他のヨーロッパ 194

10.5 中東・アフリカ 198

10.5.1 GCC諸国 207

10.5.1.1 サウジアラビア 207

10.5.1.1.1 先端医療技術のニーズが市場を牽引 207

10.5.1.2 その他のGCC諸国 211

10.5.2 南アフリカ 215

10.5.2.1 伝染病の発生が市場を牽引 215

10.5.3 その他の中東・アフリカ 219

10.6 南米 223

10.6.1 ブラジル 232

10.6.1.1 南米最大の医療用エラストマー市場 232

10.6.2 アルゼンチン 235

10.6.2.1 医療機器需要の増加が市場を牽引 235

10.6.3 南米のその他地域 239

11 競争環境 244

11.1 概要 244

11.2 主要プレーヤーの戦略/勝利への権利(2019~2024年) 245

11.3 収益分析、2021-2023年 246

11.4 市場シェア分析、2023年 247

11.4.1 北米:用途別市場シェア分析(2023年) 248

11.4.2 欧州: 市場シェア分析、用途別、2023年 249

11.4.3 アジア太平洋地域:用途別市場シェア分析、2023年 250

11.4.4 DOW 250

11.4.5 エクソンモービル・コーポレーション 251

11.4.6 セラニーズコーポレーション 251

11.4.7 BASF 251

11.4.8 ワッカー・ケミー 251

11.5 企業評価と財務指標 252

11.6 ブランド/製品の比較 253

11.6.1 医療用エラストマー市場:ブランド/製品比較分析 253

11.6.2 エラストラン 253

11.6.3 エンゲージ 8480K ヘルスプラス 253

11.6.4 ハイトレル 254

11.6.5 エクデル 254

11.7 企業評価マトリックス:主要企業(2023年) 254

11.7.1 スター企業 254

11.7.2 新興リーダー 254

11.7.3 浸透型プレーヤー 254

11.7.4 参加企業 254

11.7.5 企業フットプリント:主要プレーヤー、2023年 256

11.7.5.1 全体的な企業フットプリント 256

11.7.5.2 地域別フットプリント 257

11.7.5.3 技術のフットプリント 258

11.7.5.4 タイプ別フットプリント 259

11.7.5.5 アプリケーションフットプリント 260

11.7.5.6 産業フットプリント 261

11.8 企業評価マトリクス:新興企業/SM(2023年) 262

11.8.1 進歩的企業 262

11.8.2 対応力のある企業 262

11.8.3 ダイナミックな企業 262

11.8.4 スタートアップ・ブロック 262

11.8.5 競争ベンチマーキング:新興企業/SM(2023年) 264

11.8.5.1 新興企業/中小企業の詳細リスト 264

11.8.5.2 新興企業/中小企業の競合ベンチマーキング 265

11.9 競争シナリオ 267

11.9.1 製品上市 267

11.9.2 取引 268

11.9.3 拡張 269

11.9.4 その他の開発 270

12 企業プロフィール 271

12.1 主要企業 271

BASF (Germany)

Dow (US)

Celanese Corporation (US)

Eastman Chemical Company (US)

Syensqo (Belgium)

Mitsubishi Chemical Group Corporation (Japan)

Kuraray Co.Ltd. (Japan)

ExxonMobil (US)

Momentive Performance Materials (US)

Envalior (Germany) and Zeon Corporation (Japan)

13 付録 326

13.1 ディスカッションガイド 326

13.2 Knowledgestore: Marketsandmarketsの購読ポータル 329

13.3 カスタマイズオプション 331

13.4 関連レポート 331

13.5 著者の詳細 332

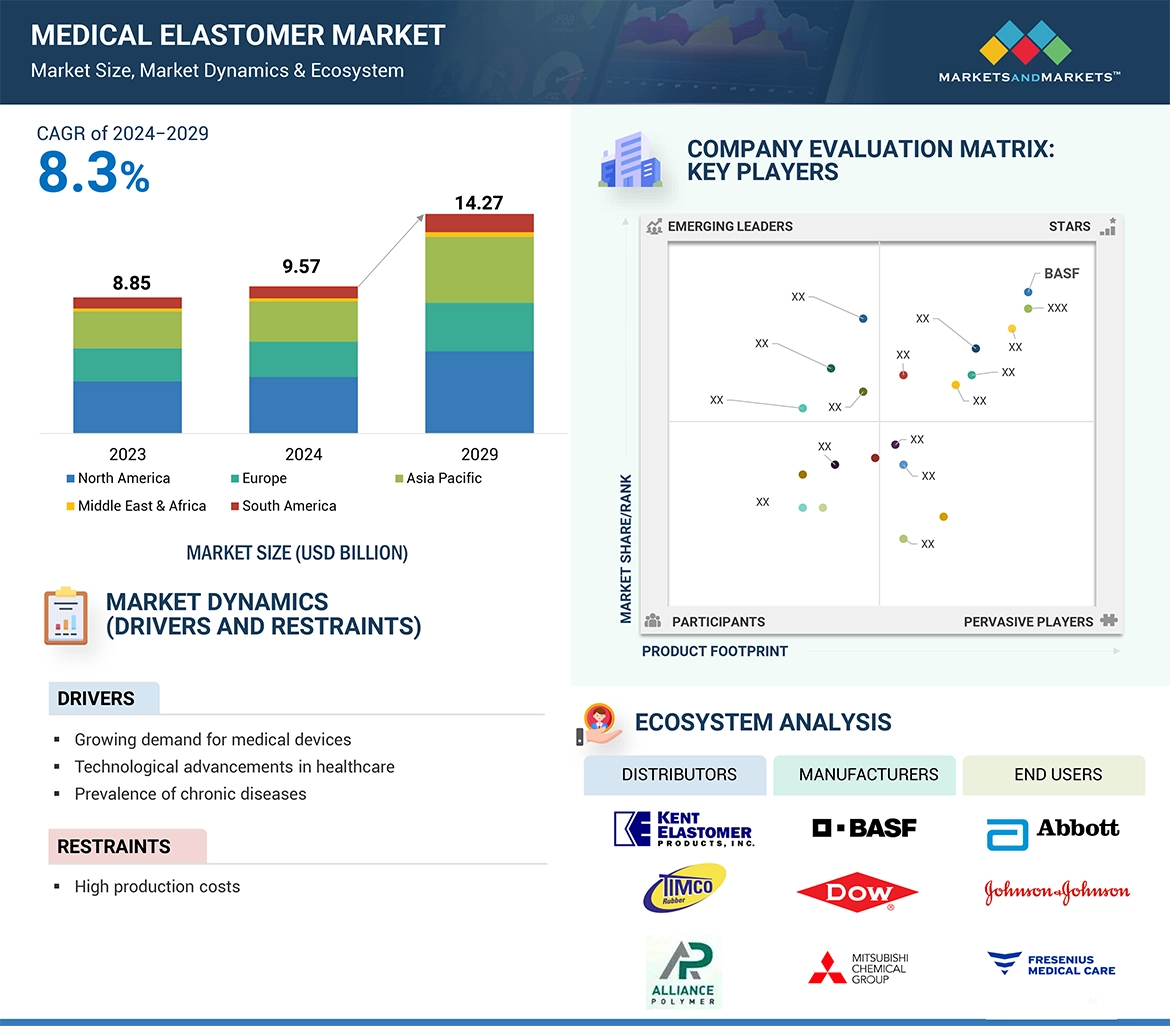

Growing demand for medical devices is fueling the demand for medical elastomers worldwide. This is a result of the increased use in disposable medical equipment, such as syringes, valves, tubing, and critical implants; artificial heart valves and artificial joints. These materials are versatile, offering durability, biocompatibility, and flexibility, making them suitable in a wide range of medical applications, such as medical tubes, bags, and gloves. The growing healthcare costs in developing economies coupled with technology advancements will further fuel the increasing demand for these critical commodities, rendering them even more indispensable to meet growing healthcare needs across the world. Additionally, the expanding population in emerging economies along with the rising prevalence of chronic diseases is creating a demand for medical elastomers.

“Based on application, implants are the fastest growing application in medical elastomer market during the forecast period, in terms of value.”

Implants are the fastest growing application of medical elastomers due to increasing demand for biocompatible, durable and flexible materials in medical procedures. The rising prevalence of chronic diseases and aging populations are driving the need of durable implants in medical elastomers, as it provides superior orthopedic, dental, and soft tissue implant performance. Flexibility and comfort with least complications further make them appealing. Moreover, the ability of elastomers to be molded into complex shapes and the excellent biocompatibility enhances the future applications of customized implants, thereby further fueling the demand for medical elastomers.

“Based on end-use industry, hospitals & clinics account the largest share in medical elastomer market during the forecast period, in terms of value.”

Hospitals and clinics account for the largest share in the medical elastomer market due to their heavy dependence on medical devices and equipment that utilize elastomer materials. These institutions need a wide range of products based on medical elastomers such as catheters, medical tubing, seals, gaskets, surgical gloves, and implants, in order to ensure appropriate patient care and treatment. However, the growing need for healthcare services due to growing ageing population and rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders further boosts the demand for these medical devices. The properties of medical elastomers such as biocompatibility and excellent flexibility & durability along with chemical resistance makes them highly functional for various applications in hospital and clinic applications. These factors, along with the stringent regulatory requirements from healthcare authorities like FDA, ensure that hospitals and clinics are adopting high-quality elastomer-based products. All these factors combined strong healthcare needs, adherence to regulatory requirements, and the drive for advanced, reliable medical devices ensure make hospitals & clinics account largest market share by industry in the medical elastomer market.

“Based on region, Asia Pacific accounts the second largest market for medical elastomer, in terms of value.”

Asia Pacific accounts the second largest market for medical elastomers because of various factors such as economic development, rapid population growth, a good healthcare sector, and increasing demand for medical devices. The rise in investments for healthcare infrastructure in emerging economies like China and India is driving the demand for adoption high-quality medical elastomers into healthcare equipments such as medical tubing, implants, and diagnostic equipment. Large and aging population in the region have added up to this demand as prevalence of chronic diseases is rising among this population. Asia Pacific is, therefore, a growth product concerning medical facility organizations dedicated to better healthcare access, positioning it as a major player in the global medical elastomer market.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

• By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

• By Designation: Directors- 35%, Managers - 25%, and Others - 40%

• By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW – 11%

The key players in this market are BASF (Germany), Dow (US), Celanese Corporation (US), Eastman Chemical Company (US), Syensqo (Belgium), Mitsubishi Chemical Group Corporation (Japan), Kuraray Co., Ltd. (Japan), ExxonMobil (US), Momentive Performance Materials (US), Envalior (Germany) and Zeon Corporation (Japan).

Research Coverage

This report segments the medical elastomer market based on type, technology, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the medical elastomer market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the medical elastomer market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

• Analysis of key drivers (Growing demand for medical devices, Technological advancements in healthcare and Prevalence of chronic diseases), restraints (High production costs), opportunities (Growing healthcare investment in emerging economies) and challenges (Stringent regulatory requirements).

• Market Penetration: Comprehensive information on the medical elastomer market offered by top players in the global medical elastomer market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the medical elastomer market.

• Market Development: Comprehensive information about lucrative emerging markets — the report analyzes the markets for medical elastomer market across regions.

• Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global medical elastomer market

• Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the medical elastomer market

1 INTRODUCTION 26

1.1 STUDY OBJECTIVES 26

1.2 MARKET DEFINITION 26

1.3 STUDY SCOPE 27

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 27

1.3.2 INCLUSIONS AND EXCLUSIONS 28

1.3.3 YEARS CONSIDERED 28

1.4 CURRENCY CONSIDERED 28

1.5 UNITS CONSIDERED 28

1.6 STAKEHOLDERS 29

1.7 SUMMARY OF CHANGES 29

2 RESEARCH METHODOLOGY 30

2.1 RESEARCH DATA 30

2.1.1 SECONDARY DATA 31

2.1.1.1 List of key secondary sources 31

2.1.1.2 Key data from secondary sources 31

2.1.2 PRIMARY DATA 32

2.1.2.1 Key data from primary sources 32

2.1.2.2 List of key primary interview participants 33

2.1.2.3 Key industry insights 33

2.1.2.4 Breakdown of interviews with experts 33

2.2 MARKET SIZE ESTIMATION 34

2.2.1 BOTTOM-UP APPROACH 34

2.2.2 TOP-DOWN APPROACH 35

2.3 GROWTH FORECAST 36

2.4 DATA TRIANGULATION 37

2.5 FACTOR ANALYSIS 38

2.6 RESEARCH ASSUMPTIONS 38

2.7 RESEARCH LIMITATIONS AND RISK ANALYSIS 39

3 EXECUTIVE SUMMARY 40

4 PREMIUM INSIGHTS 44

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL ELASTOMERS MARKET 44

4.2 MEDICAL ELASTOMERS MARKET, BY TYPE, 2024 VS. 2029 (KILOTON) 44

4.3 MEDICAL ELASTOMERS MARKET, BY APPLICATION, 2024 VS. 2029 (KILOTON) 45

4.4 MEDICAL ELASTOMERS MARKET, BY END-USE INDUSTRY, 2024 VS. 2029 (KILOTON) 45

4.5 MEDICAL ELASTOMERS MARKET, BY KEY COUNTRY 46

5 MARKET OVERVIEW 47

5.1 INTRODUCTION 47

5.2 MARKET DYNAMICS 47

5.2.1 DRIVERS 48

5.2.1.1 Growing demand for medical devices 48

5.2.1.2 Technological advancements in healthcare 48

5.2.1.3 Prevalence of chronic diseases 49

5.2.2 RESTRAINTS 49

5.2.2.1 High production costs 49

5.2.3 OPPORTUNITIES 50

5.2.3.1 Growing healthcare investments in emerging economies 50

5.2.3.2 Increasing use in minimally invasive devices 50

5.2.4 CHALLENGES 50

5.2.4.1 Stringent regulatory requirements 50

5.3 PORTER’S FIVE FORCES ANALYSIS 51

5.3.1 THREAT FROM NEW ENTRANTS 52

5.3.2 THREAT OF SUBSTITUTES 52

5.3.3 BARGAINING POWER OF SUPPLIERS 52

5.3.4 BARGAINING POWER OF BUYERS 53

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 53

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA 54

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS 54

5.4.2 BUYING CRITERIA 55

5.5 MACROECONOMIC OUTLOOK 56

5.5.1 GDP TRENDS AND FORECASTS 56

5.6 IMPACT OF AI/GENAI 59

5.7 VALUE CHAIN ANALYSIS 60

5.8 ECOSYSTEM ANALYSIS 61

5.9 CASE STUDY ANALYSIS 62

5.9.1 KENT ELASTOMERS HELPED IN TRANSITIONING TO NON-LATEX MEDICAL COMPONENTS 62

5.9.2 COOPER UNIVERSITY HOSPITAL BOOSTS POLYPHENYLENE ETHER RESILIENCE WITH DENTEC SAFETY COMFORT-AIRNXMD 63

5.9.3 TECNOFLON FKM AS HIGH-PERFORMANCE ALTERNATIVE TO SILICONE IN ORTHOPEDIC APPLICATIONS 63

5.10 REGULATORY LANDSCAPE 64

5.10.1 ENVIRONMENTAL REGULATIONS 64

5.10.2 NORTH AMERICA 64

5.10.3 ASIA PACIFIC 65

5.10.4 EUROPE 66

5.10.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 67

5.11 TECHNOLOGY ANALYSIS 68

5.11.1 KEY TECHNOLOGIES 68

5.11.1.1 Extrusion technology 68

5.11.1.2 Compression molding 68

5.11.2 COMPLEMENTARY TECHNOLOGIES 68

5.11.2.1 Co-extrusion technology 68

5.11.3 ADJACENT TECHNOLOGIES 69

5.11.3.1 Additive manufacturing technology 69

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 69

5.13 TRADE ANALYSIS 70

5.13.1 IMPORT SCENARIO (HS CODE 391000) 70

5.13.2 EXPORT SCENARIO (HS CODE 391000) 71

5.13.3 IMPORT SCENARIO (HS CODE 400270) 72

5.13.4 EXPORT SCENARIO (HS CODE 400270) 73

5.14 KEY CONFERENCES AND EVENTS, 2024–2025 74

5.15 PRICING ANALYSIS 75

5.15.1 AVERAGE SELLING PRICE TREND OF MEDICAL ELASTOMERS, BY REGION 75

5.15.2 AVERAGE SELLING PRICE TREND OF MEDICAL ELASTOMERS,

BY APPLICATION 76

5.15.3 AVERAGE SELLING PRICE TREND OF MEDICAL ELASTOMERS,

BY END-USE INDUSTRY 76

5.16 INVESTMENT AND FUNDING SCENARIO 77

5.17 PATENT ANALYSIS 77

5.17.1 INTRODUCTION 77

5.17.2 LEGAL STATUS OF PATENTS 79

5.17.3 JURISDICTION ANALYSIS 80

5.18 LIST OF POTENTIAL CUSTOMERS 80

6 MEDICAL ELASTOMERS MARKET, BY TECHNOLOGY 83

6.1 INTRODUCTION 84

6.2 EXTRUSION 84

6.3 INJECTION MOLDING 84

6.4 COMPRESSION MOLDING 84

6.5 OTHER TECHNOLOGIES 85

7 MEDICAL ELASTOMERS MARKET, BY END-USE INDUSTRY 86

7.1 INTRODUCTION 87

7.2 HOSPITALS & CLINICS 89

7.2.1 RISING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET 89

7.3 PHARMACEUTICAL 89

7.3.1 CRUCIAL ROLE OF ELASTOMERS IN PACKAGING AND DRUG DELIVERY SYSTEMS TO PROPEL ADOPTION 89

7.4 MEDICAL DEVICE MANUFACTURING 90

7.4.1 RISING DEMAND FOR ADVANCED MEDICAL DEVICES TO SUPPORT MARKET GROWTH 90

7.5 OTHER END-USE INDUSTRIES 90

8 MEDICAL ELASTOMERS MARKET, BY APPLICATION 91

8.1 INTRODUCTION 92

8.2 MEDICAL TUBING 96

8.2.1 HIGH CONSUMPTION IN ADVANCING MEDICAL TUBING SOLUTIONS TO DRIVE MARKET 96

8.3 CATHETERS 97

8.3.1 VITAL ROLE IN PRODUCTION OF CATHETERS TO PROPEL GROWTH 97

8.4 GLOVES 97

8.4.1 INCREASING NEED FOR PERSONAL PROTECTIVE EQUIPMENT TO INCREASE DEMAND 97

8.5 SYRINGES 97

8.5.1 PRE-FILLED SYRINGES 98

8.5.1.1 Reduce risk of dosing errors—key factor driving adoption 98

8.5.2 NON-PRE-FILLED SYRINGES 98

8.5.2.1 Increasing incidence of chronic diseases to propel adoption 98

8.5.3 VIALS 98

8.5.3.1 Increasing need for safe and effective drug delivery systems to drive market 98

8.6 MEDICAL & INFUSION BAGS 99

8.6.1 RISE IN HOSPITAL-ACQUIRED INFECTIONS TO SUPPORT MARKET GROWTH 99

8.7 IMPLANTS 99

8.7.1 INCREASING PREVALENCE OF AGE-RELATED HEALTH CONDITIONS TO DRIVE MARKET 99

8.8 OTHER APPLICATIONS 100

9 MEDICAL ELASTOMERS MARKET, BY TYPE 101

9.1 INTRODUCTION 102

9.2 THERMOSET ELASTOMERS 104

9.2.1 SILICONE 104

9.2.1.1 Efficient alternative to latex products in medical and pharmaceutical applications 104

9.2.1.2 High temperature vulcanized 105

9.2.1.3 Liquid silicone rubber 105

9.2.1.4 Room temperature vulcanized 105

9.2.2 ETHYLENE PROPYLENE DIENE MONOMER 106

9.2.2.1 Suitable for various medical applications—key factor supporting market growth 106

9.2.3 OTHER THERMOSET ELASTOMERS 106

9.3 THERMOPLASTIC ELASTOMERS 106

9.3.1 THERMOPLASTIC POLYURETHANE 107

9.3.1.1 Provide efficiency in manufacturing complex designs using extrusion and molding techniques 107

9.3.2 STYRENE BLOCK COPOLYMERS 107

9.3.2.1 Biostability of SBC increases utility in medical applications—key factor driving market growth 107

9.3.3 OTHER THERMOPLASTIC ELASTOMERS 107

10 MEDICAL ELASTOMERS MARKET, BY REGION 108

10.1 INTRODUCTION 109

10.2 NORTH AMERICA 111

10.2.1 US 121

10.2.1.1 Rising healthcare spending to drive market 121

10.2.2 CANADA 124

10.2.2.1 Expanding healthcare system to support market growth 124

10.2.3 MEXICO 128

10.2.3.1 Government initiatives and growth of healthcare sector to drive market 128

10.3 ASIA PACIFIC 132

10.3.1 CHINA 142

10.3.1.1 Growing aging population to drive market 142

10.3.2 JAPAN 145

10.3.2.1 Increased focus on infection control and patient safety to propel market 145

10.3.3 INDIA 149

10.3.3.1 Increasing investments in healthcare sector to drive market 149

10.3.4 SOUTH KOREA 153

10.3.4.1 Rising demand for high quality medical devices to drive market 153

10.3.5 INDONESIA 157

10.3.5.1 Rising incidence of chronic diseases to drive market 157

10.3.6 REST OF ASIA PACIFIC 161

10.4 EUROPE 165

10.4.1 GERMANY 175

10.4.1.1 Increased investments in R&D to drive market 175

10.4.2 UK 178

10.4.2.1 Rising geriatric population to support market growth 178

10.4.3 FRANCE 182

10.4.3.1 Presence of significant medical device manufacturers to propel market 182

10.4.4 ITALY 186

10.4.4.1 Rising demand for medical devices from public hospitals to increase demand 186

10.4.5 SPAIN 190

10.4.5.1 Increasing investments in healthcare infrastructure to propel market 190

10.4.6 REST OF EUROPE 194

10.5 MIDDLE EAST & AFRICA 198

10.5.1 GCC COUNTRIES 207

10.5.1.1 Saudi Arabia 207

10.5.1.1.1 Need for advanced medical technologies to drive market 207

10.5.1.2 Rest of GCC countries 211

10.5.2 SOUTH AFRICA 215

10.5.2.1 Outbreak of contagious diseases to drive market 215

10.5.3 REST OF MIDDLE EAST & AFRICA 219

10.6 SOUTH AMERICA 223

10.6.1 BRAZIL 232

10.6.1.1 Largest market for medical elastomers in South America 232

10.6.2 ARGENTINA 235

10.6.2.1 Growing demand for medical devices to drive market 235

10.6.3 REST OF SOUTH AMERICA 239

11 COMPETITIVE LANDSCAPE 244

11.1 OVERVIEW 244

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024 245

11.3 REVENUE ANALYSIS, 2021–2023 246

11.4 MARKET SHARE ANALYSIS, 2023 247

11.4.1 NORTH AMERICA: MARKET SHARE ANALYSIS, BY APPLICATION, 2023 248

11.4.2 EUROPE: MARKET SHARE ANALYSIS, BY APPLICATION, 2023 249

11.4.3 ASIA PACIFIC: MARKET SHARE ANALYSIS, BY APPLICATION, 2023 250

11.4.4 DOW 250

11.4.5 EXXON MOBIL CORPORATION 251

11.4.6 CELANESE CORPORATION 251

11.4.7 BASF 251

11.4.8 WACKER CHEMIE AG 251

11.5 COMPANY VALUATION AND FINANCIAL METRICS 252

11.6 BRAND/PRODUCT COMPARISON 253

11.6.1 MEDICAL ELASTOMERS MARKET: BRAND/PRODUCT COMPARISON ANALYSIS 253

11.6.2 ELASTOLLAN 253

11.6.3 ENGAGE 8480K HEALTH+ 253

11.6.4 HYTREL 254

11.6.5 ECDEL 254

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 254

11.7.1 STARS 254

11.7.2 EMERGING LEADERS 254

11.7.3 PERVASIVE PLAYERS 254

11.7.4 PARTICIPANTS 254

11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 256

11.7.5.1 Overall company footprint 256

11.7.5.2 Region footprint 257

11.7.5.3 Technology footprint 258

11.7.5.4 Type Footprint 259

11.7.5.5 Application footprint 260

11.7.5.6 Industry footprint 261

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 262

11.8.1 PROGRESSIVE COMPANIES 262

11.8.2 RESPONSIVE COMPANIES 262

11.8.3 DYNAMIC COMPANIES 262

11.8.4 STARTING BLOCKS 262

11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 264

11.8.5.1 Detailed list of startups/SMEs 264

11.8.5.2 Competitive benchmarking of startups/SMEs 265

11.9 COMPETITIVE SCENARIO 267

11.9.1 PRODUCT LAUNCHES 267

11.9.2 DEALS 268

11.9.3 EXPANSIONS 269

11.9.4 OTHER DEVELOPMENTS 270

12 COMPANY PROFILES 271

12.1 KEY PLAYERS 271

12.1.1 DOW 271

12.1.1.1 Business overview 271

12.1.1.2 Products offered 272

12.1.1.3 Recent developments 273

12.1.1.3.1 Other developments 273

12.1.1.4 MnM view 273

12.1.1.4.1 Key strengths 273

12.1.1.4.2 Strategic choices 273

12.1.1.4.3 Weaknesses and competitive threats 274

12.1.2 EXXON MOBIL CORPORATION 274

12.1.2.1 Business overview 274

12.1.2.2 Products offered 276

12.1.2.3 MnM view 276

12.1.2.3.1 Key strengths 276

12.1.2.3.2 Strategic choices 276

12.1.2.3.3 Weaknesses and competitive threats 276

12.1.3 CELANESE CORPORATION 277

12.1.3.1 Business overview 277

12.1.3.2 Products offered 278

12.1.3.3 Recent developments 279

12.1.3.3.1 Deals 279

12.1.3.4 MnM view 280

12.1.3.4.1 Key strengths 280

12.1.3.4.2 Strategic choices 280

12.1.3.4.3 Weaknesses and competitive threats 280

12.1.4 BASF 281

12.1.4.1 Business overview 281

12.1.4.2 Products offered 282

12.1.4.3 Recent developments 283

12.1.4.3.1 Expansions 283

12.1.4.4 MnM view 283

12.1.4.4.1 Key strengths 283

12.1.4.4.2 Strategic choices 284

12.1.4.4.3 Weaknesses and competitive threats 284

12.1.5 WACKER CHEMIE AG 285

12.1.5.1 Business overview 285

12.1.5.2 Products offered 286

12.1.5.3 Recent developments 287

12.1.5.3.1 Product launches 287

12.1.5.3.2 Expansions 288

12.1.5.4 MnM view 289

12.1.5.4.1 Key strengths 289

12.1.5.4.2 Strategic choices 289

12.1.5.4.3 Weaknesses and competitive threats 289

12.1.6 EASTMAN CHEMICAL COMPANY 290

12.1.6.1 Business overview 290

12.1.6.2 Products offered 291

12.1.6.3 MnM view 291

12.1.6.3.1 Key strengths 291

12.1.6.3.2 Strategic choices 292

12.1.6.3.3 Weaknesses and competitive threats 292

12.1.7 SYENSQO 293

12.1.7.1 Business overview 293

12.1.7.2 Products offered 294

12.1.7.3 Recent developments 295

12.1.7.3.1 Other developments 295

12.1.7.4 MnM view 295

12.1.7.4.1 Key strengths 295

12.1.7.4.2 Strategic choices 295

12.1.7.4.3 Weaknesses and competitive threats 296

12.1.8 KURARAY CO., LTD 297

12.1.8.1 Business overview 297

12.1.8.2 Products offered 298

12.1.8.3 MnM view 299

12.1.8.3.1 Key strengths 299

12.1.8.3.2 Strategic choices 299

12.1.8.3.3 Weaknesses and competitive threats 299

12.1.9 MITSUBISHI CHEMICAL GROUP CORPORATION 300

12.1.9.1 Business overview 300

12.1.9.2 Products offered 301

12.1.9.3 Recent developments 302

12.1.9.3.1 Other developments 302

12.1.9.3.2 Deals 303

12.1.9.4 MnM view 303

12.1.10 MOMENTIVE PERFORMANCE MATERIALS 304

12.1.10.1 Business overview 304

12.1.10.2 Products offered 304

12.1.10.3 MnM view 305

12.1.11 ENVALIOR 306

12.1.11.1 Business overview 306

12.1.11.2 Products offered 306

12.1.12 ZEON CORPORATION 308

12.1.12.1 Business overview 308

12.1.12.2 Products offered 309

12.1.13 THE LUBRIZOL CORPORATION 310

12.1.13.1 Business overview 310

12.1.13.2 Products offered 310

12.1.13.3 MnM view 311

12.2 OTHER PLAYERS 312

12.2.1 KRATON CORPORATION 312

12.2.2 FOSTER CORPORATION 313

12.2.3 BIOMERICS 314

12.2.4 RTP COMPANY 315

12.2.5 ROMAR ENGINEERING 316

12.2.6 THE RUBBER GROUP 317

12.2.7 KENT ELASTOMER PRODUCTS 318

12.2.8 RAUMEDIC AG 319

12.2.9 THE HYGENIC COMPANY, LLC 320

12.2.10 HEXAPOL AB 321

12.2.11 TEKNI-PLEX, INC 322

12.2.12 TRINSEO 323

12.2.13 TRELLEBORG AB 324

12.2.14 SAINT-GOBAIN 325

13 APPENDIX 326

13.1 DISCUSSION GUIDE 326

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 329

13.3 CUSTOMIZATION OPTIONS 331

13.4 RELATED REPORTS 331

13.5 AUTHOR DETAILS 332

❖ 世界の医療用エラストマー市場に関するよくある質問(FAQ) ❖

・医療用エラストマーの世界市場規模は?

→MarketsandMarkets社は2024年の医療用エラストマーの世界市場規模を95.7億米ドルと推定しています。

・医療用エラストマーの世界市場予測は?

→MarketsandMarkets社は2029年の医療用エラストマーの世界市場規模を142.7億米ドルと予測しています。

・医療用エラストマー市場の成長率は?

→MarketsandMarkets社は医療用エラストマーの世界市場が2024年~2029年に年平均8.3%成長すると予測しています。

・世界の医療用エラストマー市場における主要企業は?

→MarketsandMarkets社は「BASF (Germany), Dow (US), Celanese Corporation (US), Eastman Chemical Company (US), Syensqo (Belgium), Mitsubishi Chemical Group Corporation (Japan), Kuraray Co., Ltd. (Japan), ExxonMobil (US), Momentive Performance Materials (US), Envalior (Germany) and Zeon Corporation (Japan)など ...」をグローバル医療用エラストマー市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。