1 はじめに 26

1.1 調査目的 26

1.2 市場の定義 26

1.3 調査範囲 27

1.3.1 対象市場と地域範囲 27

1.3.2 対象範囲と除外範囲 28

1.3.3 考慮した年数 28

1.4 考慮した通貨 29

1.5 制限事項 29

1.6 利害関係者 29

1.7 変更点のまとめ 30

2 調査方法 31

2.1 調査データ 31

2.2 調査アプローチ 31

2.2.1 二次データ 32

2.2.1.1 二次資料からの主要データ 32

2.2.2 一次データ 33

2.2.2.1 一次情報源 34

2.2.2.2 一次資料からの主要データ 34

2.2.2.3 主要な業界インサイト 35

2.2.2.4 一次インタビューの内訳 35

2.3 市場規模の推定 36

2.3.1 ボトムアップアプローチ 37

2.3.1.1 アプローチ1:企業の収益推定 37

2.3.1.2 アプローチ2:企業プレゼンテーションとプライマリーインタビュー 37

2.3.1.3 成長予測 38

2.3.1.4 CAGR予測 38

2.3.2 トップダウンアプローチ 38

2.4 市場の内訳とデータの三角測量 40

2.5 市場シェアの推定 40

2.6 調査の前提 41

2.7 成長率の前提 41

2.8 調査の限界 42

2.9 リスク評価 42

2.9.1 リスク評価 最小残存疾病検査市場 42

3 エグゼクティブサマリー 43

4 プレミアムインサイト 47

4.1 最小残存病変検査市場の概要 47

4.2 最小残存病変検査市場シェア:製品別、2024年対2029年 48

4.3 最小残存病変検査市場シェア、技術別、

2024年対2029年 48

4.4 最小残存病変検査市場シェア、用途別、

2024年対2029年 49

4.5 最小残存病変検査市場シェア:エンドユーザー別、2024年対2029年 49

4.6 残留軽症疾患検査市場:地理的成長機会 50

5 市場の概要 51

5.1 はじめに 51

5.2 市場ダイナミクス 51

5.2.1 推進要因 52

5.2.1.1 血液悪性腫瘍の発生率の増加 52

5.2.1.2 製薬会社と製品メーカー間の共同研究や提携の増加 52

5.2.1.3 世界的な医療機関によるがん啓発イニシアチブの増加 53

5.2.2 阻害要因 54

5.2.2.1 複雑な規制の枠組みが新しい分子診断検査の承認を遅らせている 54

5.2.2.2 最小残存病変検査キットの高コスト 54

5.2.3 機会 54

5.2.3.1 新興国における成長機会 54

5.2.4 課題 55

5.2.4.1 患者に対する不透明な償還シナリオと政策 55

5.3 価格分析 56

5.3.1 主要企業の製品・地域別価格動向 56

5.4 特許分析 58

5.4.1 主要特許のリスト 59

5.5 バリューチェーン分析 60

5.6 サプライチェーン分析 61

5.7 貿易分析 62

5.7.1 輸入データ 62

5.7.2 輸出データ 63

5.8 エコシステム分析 63

5.8.1 エコシステムにおける役割 64

5.9 ポーターの5つの力分析 64

5.9.1 新規参入の脅威 65

5.9.2 代替品の脅威 65

5.9.3 買い手の交渉力 66

5.9.4 供給者の交渉力 66

5.9.5 競合の激しさ 66

5.10 主要ステークホルダーと購買基準 67

5.10.1 購入プロセスにおける主要ステークホルダー 67

5.10.2 購入基準 68

5.11 規制分析 69

5.11.1 規制情勢 69

5.11.1.1 北米 69

5.11.1.1.1 米国 69

5.11.1.1.2 カナダ 69

5.11.1.2 欧州 69

5.11.1.3 アジア太平洋 70

5.11.1.3.1 中国 70

5.11.1.3.2 日本 71

5.11.1.4 ラテンアメリカ 72

5.11.1.4.1 ブラジル 72

5.11.1.4.2 メキシコ 72

5.11.1.5 中東 73

5.11.1.6 アフリカ 73

5.11.2 規制機関、政府機関、その他の組織 73

5.12 技術分析 75

5.12.1 主要技術 75

5.12.1.1 PCRとNGS 75

5.12.2 隣接技術 76

5.12.2.1 デジタルPCR 76

5.13 2023~2024年の主要会議・イベント 76

5.14 顧客のビジネスに影響を与えるトレンド/混乱 78

5.15 投資と資金調達のシナリオ 79

5.16 ケーススタディ分析 79

5.17 AI/遺伝子AIが最小残存病変検査市場に与える影響 80

6 残留病検査市場:製品別 82

6.1 導入 83

6.2 検査キット・試薬 83

6.2.1 疾患の早期発見と予防医療に対する意識の高まりが市場を促進 83

6.3 検査機器 85

6.3.1 より迅速で正確な検査結果に対するニーズの高まりが市場成長を促進 85

7 微小残存疾患検査市場:技術別 86

7.1 導入 87

7.2 ポリメラーゼ連鎖反応法 87

7.2.1 PCR技術のコストメリットが採用を促進 87

7.3 次世代シーケンサー 88

7.3.1 高感度と経済的メリットが採用を後押し 88

7.4 フローサイトメトリー 89

7.4.1 癌の発生率と有病率の増加が市場成長を促進 89

7.5 その他の技術 90

8 最小残存病変検査市場、用途別 92

8.1 導入 93

8.2 血液悪性腫瘍 93

8.2.1 白血病 95

8.2.1.1 骨髄性白血病 98

8.2.1.1.1 成人におけるAMLの高い有病率が成長を支える 98

8.2.1.2 リンパ球性白血病 100

8.2.1.2.1 小児のALL罹患率の高さが市場を牽引 100

8.2.1.3 その他の白血病 103

8.2.2 リンパ腫 105

8.2.2.1 非ホジキンリンパ腫 108

8.2.2.1.1 免疫系を抑制する薬剤の消費が成長を牽引 108

8.2.2.2 ホジキンリンパ腫 110

8.2.2.2.1 ホジキンリンパ腫の罹患率の増加がMRD検査の需要を促進 110

8.3 固形がん 112

8.3.1 治療効果を評価するMRDの能力が成長を促進 112

8.4 多発性骨髄腫 114

8.4.1 多発性骨髄腫の発生率の上昇が市場を牽引 114

8.5 その他の用途 116

9 微小残存病変検査市場:エンドユーザー別 119

9.1 導入 120

9.2 病院・専門クリニック 120

9.2.1 病院を訪れる患者数の増加が成長を促進 120

9.3 診断ラボ 121

9.3.1 堅牢なインフラと専門的な検査能力が成長を支える 121

9.4 学術・研究機関 122

9.4.1 研究活動の増加が市場を後押し 122

9.5 その他のエンドユーザー 123

10 最小残存病変検査市場:地域別 124

10.1 はじめに 125

10.2 北米 125

10.2.1 北米のマクロ経済見通し 129

10.2.2 米国 129

10.2.2.1 癌有病率の増加が市場を牽引 129

10.2.3 カナダ 132

10.2.3.1 様々ながん検診プログラムが市場の成長を支える 132

10.3 欧州 136

10.3.1 欧州のマクロ経済見通し 136

10.3.2 ドイツ 140

10.3.2.1 MRD検査市場を支える研究費に対する政府の支援 140

10.3.3 英国 143

10.3.3.1 診断ラボ数の増加が市場成長を促進 143

10.3.4 フランス 146

10.3.4.1 フランスにおける研究開発費の増加が市場を牽引 146

10.3.5 イタリア 149

10.3.5.1 有利な資金調達シナリオが市場を牽引 149

10.3.6 スペイン 152

10.3.6.1 スペインの研究所の統合が市場成長を支える 152

10.3.7 その他の欧州 155

10.4 アジア太平洋地域 158

10.4.1 アジア太平洋地域のマクロ経済見通し 158

10.4.2 中国 163

10.4.2.1 高度医療施設への一般市民のアクセスの増加が市場を牽引 163

10.4.3 日本 166

10.4.3.1 国民皆保険制度が市場成長を支える 166

10.4.4 インド 169

10.4.4.1 医療制度への民間・公共投資の増加が市場を牽引 169

10.4.5 その他のアジア太平洋地域 172

10.5 ラテンアメリカ 176

10.5.1 民間投資と公共投資の増加が市場を牽引 176

10.5.2 ラテンアメリカのマクロ経済見通し 176

10.6 中東・アフリカ 179

10.6.1 研究資金の増加が市場を牽引 179

10.6.2 中東・アフリカのマクロ経済展望 180

10.7 北アフリカ諸国 183

10.7.1 先進医療インフラへの注目の高まりと研究資金がGCC市場を牽引 183

10.7.2 北アフリカ諸国のマクロ経済見通し 183

11 競争環境 187

11.1 概要 187

11.2 主要プレーヤーの戦略/勝利への権利 187

11.2.1 最小残存病変検査市場における各社の戦略概要 187

11.3 収益分析、2019年~2023年 190

11.4 市場シェア分析、2023年 191

11.5 企業評価マトリックス:主要企業、2023年 193

11.5.1 評価ベンダーのリスト 193

11.5.2 星の数 193

11.5.3 新興リーダー 193

11.5.4 浸透型プレーヤー 193

11.5.5 参加企業 193

11.5.6 企業フットプリント:主要プレイヤー(2023年) 195

11.5.6.1 企業フットプリント 195

11.5.6.2 製品フットプリント 195

11.5.6.3 技術のフットプリント 196

11.5.6.4 アプリケーションフットプリント 196

11.5.6.5 地域別フットプリント 197

11.6 企業評価マトリクス:新興企業/SM(2023年) 197

11.6.1 進歩的企業 197

11.6.2 対応力のある企業 197

11.6.3 ダイナミックな企業 197

11.6.4 スタートアップ・ブロック 198

11.6.5 競争ベンチマーク:新興企業/SM(2023年) 199

11.7 企業評価と財務指標 201

11.8 ブランド/製品の比較 202

11.9 競争シナリオ 203

11.9.1 製品上市 203

11.9.2 取引 204

12 企業プロファイル 206

12.1 主要企業 206

F. Hoffmann-La Roche Ltd. (スイス)

Labcorp Inc. (スイス)

Labcorp Inc.(米国)

Guardant Health(米国)

シスメックス株式会社(日本)

NeoGenomics Laboratories Inc.(米国)

Adaptive Biotechnologies Corporation(米国)

ArcherDX Inc.(米国)

Asuragen Inc.(米国)

Arup Laboratories Inc. (米国)

Bio-Rad Laboratories Inc.(米国)

Cergentis B.V.(オランダ)

Molecular MD (ICON plc)(アイルランド)

Invivoscribe Inc.(米国)

Mission Bio Inc.(米国)

Natera Inc.(米国)

Opko Health Inc.(米国)

Quest Diagnostics(米国)

Genetron Health(中国)

13 付録 239

13.1 ディスカッションガイド 239

13.2 Knowledgestore: Marketsandmarketsの購読ポータル 242

13.3 カスタマイズオプション 244

13.4 関連レポート 244

13.5 著者の詳細 245

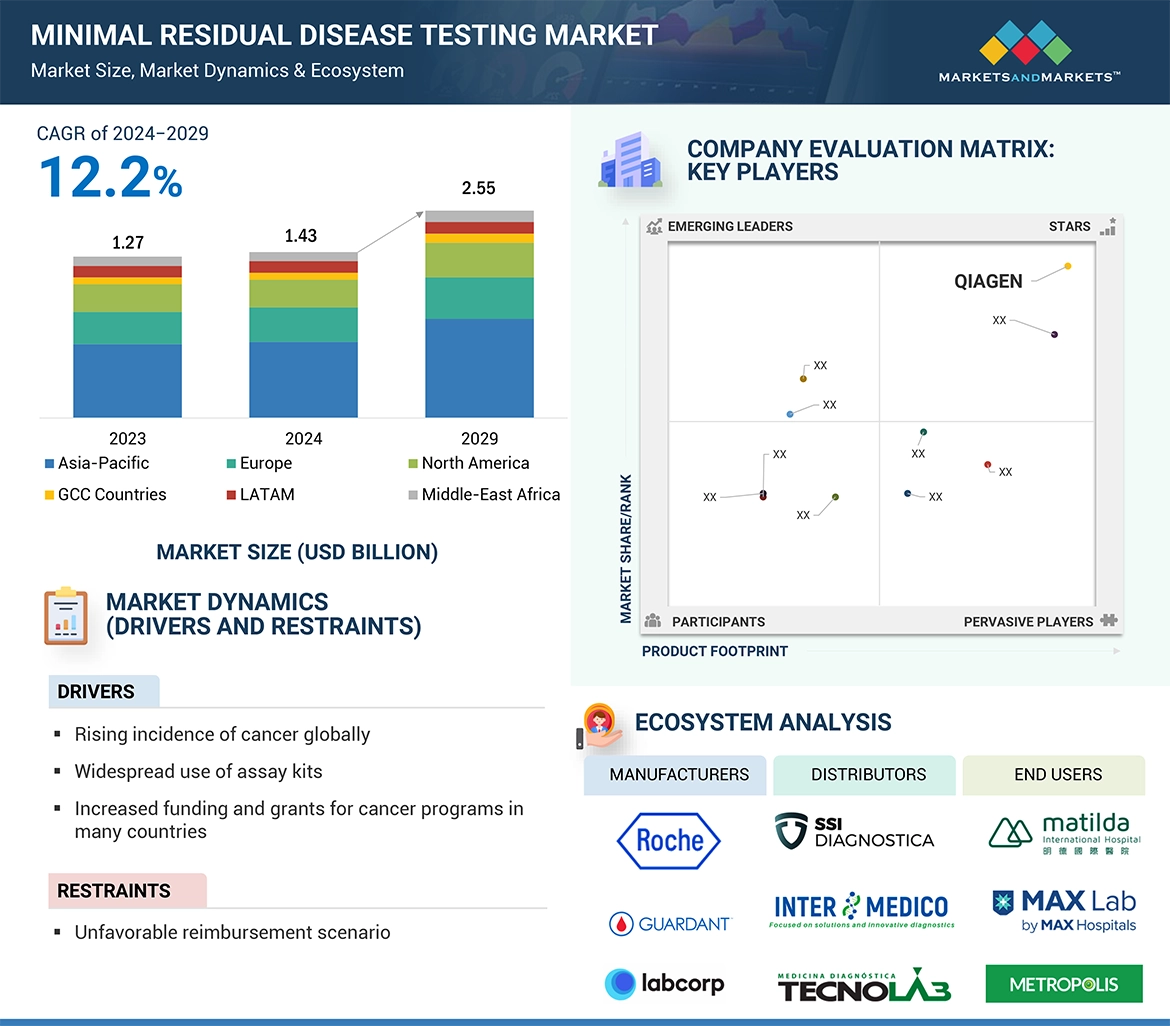

Increased funding and grants for cancer control programs across the globe have emerged as an important growth factor in the MRD testing market. Substantial funding is now being committed by governments and international bodies, including WHO and the Global Fund, to address the increasing burden of cancer, especially in terms of early detection and prevention. These funds are being channelled into increasing access to diagnostic facilities, especially in high-burden regions where the healthcare infrastructure is generally weak. The availability of funds also encourages the training of healthcare professionals who work with a patient to accurately diagnose and properly manage cases of cancer. Apart from that, research grants and international collaborations are also enabling cancer testing integration into routine health care services. Thus, this growing funding is rendering MRD tests available and enhancing the efforts to control cancer globally. This, in turn, is fuelling the growth of the global minimal residual disease testing market.

“MRD Assay Kits & Reagents segment is expected to have the fastest growth rate in the MRD testing market, by product, during the forecast period.”

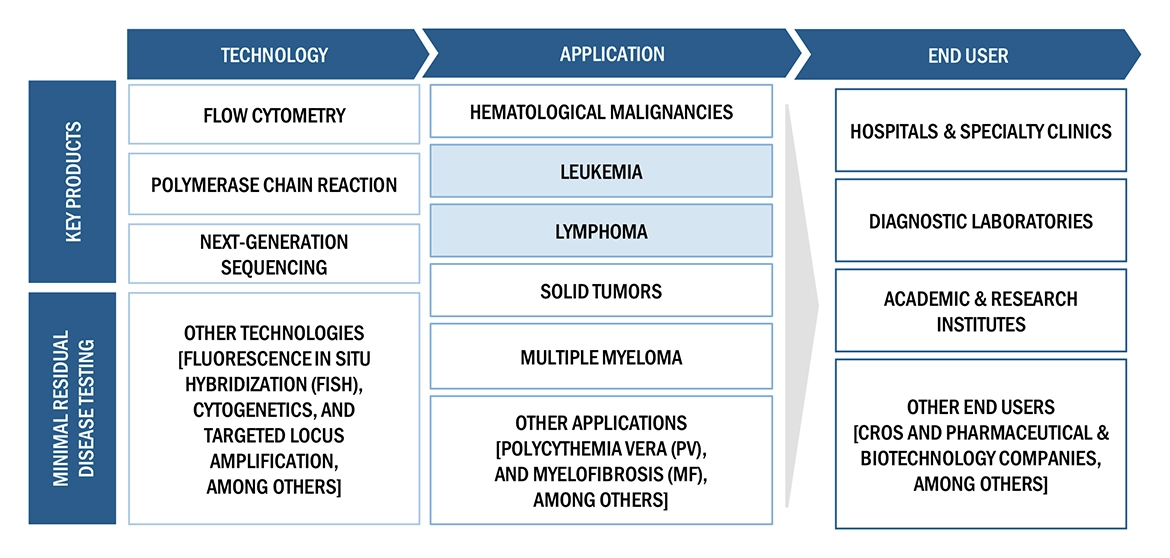

The MRD testing market is segmented into assay kits & reagents, and instruments based on product. Assay kits & reagents are projected to account for the highest CAGR during the forecast period. One major driving factor is its higher accuracy of tests. Growing penetration of these tests in high-risk populations, continue to support increased demand. Favourable regulatory approvals and recommendations by various international health bodies, including the WHO, have also helped increase their adoption. Along with such factors, rising funding for research in cancer and advancements in diagnostics are also driving the high growth of the test kits segment in the MRD testing market.

“Haematological malignancies segment accounted for the highest growth rate in the MRD testing market, by application, during the forecast period.”

Based on application, the minimal residual disease testing market is segmented into hematological malignancies, solid tumors, and other applications. In 2021, the hematological malignancies application segment accounted for the largest share. Factors contributing to the growth of this segment are increasing incidences of leukemia, lymphoma and their types and awareness about continuous monitoring of patients with these diseases.

“Asia Pacific: The fastest-growing region in MRD testing market.”

The worldwide market for MRD testing is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Notably, the Asia Pacific region is anticipated to experience the most substantial growth in the forecast period. The Asia Pacific region bears a high burden of tuberculosis, such as in India and China, which record a high incidence rate and thereby drives the need for essential cancer screening and management. Growth in government and international organization funding and campaigns against cancer has also led to better access to diagnostics and healthcare infrastructure in Asia Pacific. Awareness among the communities and among healthcare workers regarding the need for early detection of cancer has also been significantly increasing the demand for further testing. Another major growth driver of this segment in the MRD testing market is the increasing healthcare expenditure, along with supportive regulatory frameworks. All these factors propel increased growth of the MRD testing market in the Asia Pacific region.

The break-up of the profile of primary participants in the MRD testing market:

• By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 – 20%

• By Designation: Managers - 30%, D-level - 50%, and Others - 20%

• By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6%, and Others - 4%

The key players in this market are are F. Hoffmann-La Roche Ltd. (Switzerland), Labcorp Inc. (US), Guardant Health (US), Sysmex Corporation (Japan), NeoGenomics Laboratories, Inc. (US), Adaptive Biotechnologies Corporation (US), ArcherDX, Inc. (US), Asuragen Inc. (US), Arup Laboratories Inc. (US), Bio-Rad Laboratories, Inc. (US), Cergentis B.V. (Netherlands), Molecular MD (ICON plc) (Ireland), Invivoscribe, Inc. (US), Mission Bio, Inc. (US), Natera, Inc. (US), Opko Health, Inc. (US), Quest Diagnostics (US), and Genetron Health (China).

Research Coverage:

This research report categorizes the MRD testing market by product (assay kits & reagents, instruments), by technology (PCR, NGS, flow cytometry, and other applications), by application (hematological malignancies, solid tumors, multiple myeloma, and other applications), by end user (diagnostic laboratories, hospitals & clinics, academic & research institutes, and other end users), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa and GCC Countries). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the MRD testing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, key strategies, acquisitions, and agreements. New product & service launches, and recent developments associated with the MRD testing market. Competitive analysis of upcoming startups in the MRD testing market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall MRD testing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

• Analysis of key drivers (rising incidence of cancer, and increased funding and grants for cancer control programs), opportunities (Growth opportunities in emerging economies), restraints (Unfavorable reimbursement scenario), and challenges (changing regulatory landscape and operational barriers and labor shortage) influencing the growth of the MRD testing market.

• Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the MRD testing market.

• Market Development: Comprehensive information about lucrative markets – the report analyses the MRD testing market across varied regions.

• Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the MRD testing market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings of leading players like F. Hoffmann-La Roche Ltd. (Switzerland), Labcorp Inc. (US), Guardant Health (US), Sysmex Corporation (Japan), NeoGenomics Laboratories, Inc. (US), Adaptive Biotechnologies Corporation (US).

1 INTRODUCTION 26

1.1 STUDY OBJECTIVES 26

1.2 MARKET DEFINITION 26

1.3 STUDY SCOPE 27

1.3.1 MARKETS COVERED & REGIONAL SCOPE 27

1.3.2 INCLUSIONS & EXCLUSIONS 28

1.3.3 YEARS CONSIDERED 28

1.4 CURRENCY CONSIDERED 29

1.5 LIMITATIONS 29

1.6 STAKEHOLDERS 29

1.7 SUMMARY OF CHANGES 30

2 RESEARCH METHODOLOGY 31

2.1 RESEARCH DATA 31

2.2 RESEARCH APPROACH 31

2.2.1 SECONDARY DATA 32

2.2.1.1 Key data from secondary sources 32

2.2.2 PRIMARY DATA 33

2.2.2.1 Primary sources 34

2.2.2.2 Key data from primary sources 34

2.2.2.3 Key industry insights 35

2.2.2.4 Breakdown of primary interviews 35

2.3 MARKET SIZE ESTIMATION 36

2.3.1 BOTTOM-UP APPROACH 37

2.3.1.1 Approach 1: Company revenue estimation 37

2.3.1.2 Approach 2: Presentations of companies and primary interviews 37

2.3.1.3 Growth forecast 38

2.3.1.4 CAGR projections 38

2.3.2 TOP-DOWN APPROACH 38

2.4 MARKET BREAKDOWN & DATA TRIANGULATION 40

2.5 MARKET SHARE ESTIMATION 40

2.6 STUDY ASSUMPTIONS 41

2.7 GROWTH RATE ASSUMPTIONS 41

2.8 RESEARCH LIMITATIONS 42

2.9 RISK ASSESSMENT 42

2.9.1 RISK ASSESSMENT: MINIMAL RESIDUAL DISEASE TESTING MARKET 42

3 EXECUTIVE SUMMARY 43

4 PREMIUM INSIGHTS 47

4.1 MINIMAL RESIDUAL DISEASE TESTING MARKET OVERVIEW 47

4.2 MINIMAL RESIDUAL DISEASE TESTING MARKET SHARE, BY PRODUCT, 2024 VS. 2029 48

4.3 MINIMAL RESIDUAL DISEASE TESTING MARKET SHARE, BY TECHNOLOGY,

2024 VS. 2029 48

4.4 MINIMAL RESIDUAL DISEASE TESTING MARKET SHARE, BY APPLICATION,

2024 VS. 2029 49

4.5 MINIMAL RESIDUAL DISEASE TESTING MARKET SHARE, BY END USER, 2024 VS. 2029 49

4.6 MINIMAL RESIDUAL DISEASE TESTING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES 50

5 MARKET OVERVIEW 51

5.1 INTRODUCTION 51

5.2 MARKET DYNAMICS 51

5.2.1 DRIVERS 52

5.2.1.1 Rising incidence of hematological malignancies 52

5.2.1.2 Increasing collaborations and partnerships between pharmaceutical companies and product manufacturers 52

5.2.1.3 Increasing cancer awareness initiatives by global health organizations 53

5.2.2 RESTRAINTS 54

5.2.2.1 Complex regulatory frameworks delaying approvals of new molecular diagnostics tests 54

5.2.2.2 High cost of minimal residual disease testing kits 54

5.2.3 OPPORTUNITIES 54

5.2.3.1 Growth opportunities in emerging countries 54

5.2.4 CHALLENGES 55

5.2.4.1 Unclear reimbursement scenario and policies for patients 55

5.3 PRICING ANALYSIS 56

5.3.1 INDICATIVE PRICING TREND OF KEY PLAYERS, BY PRODUCT & REGION 56

5.4 PATENT ANALYSIS 58

5.4.1 LIST OF MAJOR PATENTS 59

5.5 VALUE CHAIN ANALYSIS 60

5.6 SUPPLY CHAIN ANALYSIS 61

5.7 TRADE ANALYSIS 62

5.7.1 IMPORT DATA 62

5.7.2 EXPORT DATA 63

5.8 ECOSYSTEM ANALYSIS 63

5.8.1 ROLE IN ECOSYSTEM 64

5.9 PORTER’S FIVE FORCES ANALYSIS 64

5.9.1 THREAT OF NEW ENTRANTS 65

5.9.2 THREAT OF SUBSTITUTES 65

5.9.3 BARGAINING POWER OF BUYERS 66

5.9.4 BARGAINING POWER OF SUPPLIERS 66

5.9.5 INTENSITY OF COMPETITIVE RIVALRY 66

5.10 KEY STAKEHOLDERS & BUYING CRITERIA 67

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS 67

5.10.2 BUYING CRITERIA 68

5.11 REGULATORY ANALYSIS 69

5.11.1 REGULATORY LANDSCAPE 69

5.11.1.1 North America 69

5.11.1.1.1 US 69

5.11.1.1.2 Canada 69

5.11.1.2 Europe 69

5.11.1.3 Asia Pacific 70

5.11.1.3.1 China 70

5.11.1.3.2 Japan 71

5.11.1.4 Latin America 72

5.11.1.4.1 Brazil 72

5.11.1.4.2 Mexico 72

5.11.1.5 Middle East 73

5.11.1.6 Africa 73

5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 73

5.12 TECHNOLOGY ANALYSIS 75

5.12.1 KEY TECHNOLOGIES 75

5.12.1.1 PCR and NGS 75

5.12.2 ADJACENT TECHNOLOGIES 76

5.12.2.1 Digital PCR 76

5.13 KEY CONFERENCES & EVENTS IN 2023–2024 76

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 78

5.15 INVESTMENT & FUNDING SCENARIO 79

5.16 CASE STUDY ANALYSIS 79

5.17 IMPACT OF AI/GEN AI ON MINIMAL RESIDUAL DISEASE TESTING MARKET 80

6 MINIMAL RESIDUAL DISEASE TESTING MARKET, BY PRODUCT 82

6.1 INTRODUCTION 83

6.2 ASSAY KITS & REAGENTS 83

6.2.1 INCREASING AWARENESS ABOUT EARLY DISEASE DETECTION AND PREVENTIVE HEALTHCARE TO PROPEL MARKET 83

6.3 INSTRUMENTS 85

6.3.1 RISING NEED FOR FASTER AND MORE ACCURATE TEST RESULTS TO DRIVE MARKET GROWTH 85

7 MINIMAL RESIDUAL DISEASE TESTING MARKET, BY TECHNOLOGY 86

7.1 INTRODUCTION 87

7.2 POLYMERASE CHAIN REACTION 87

7.2.1 COST BENEFITS OF PCR TECHNOLOGY TO DRIVE ADOPTION 87

7.3 NEXT-GENERATION SEQUENCING 88

7.3.1 HIGH SENSITIVITY AND ECONOMIC BENEFITS TO SUPPORT ADOPTION 88

7.4 FLOW CYTOMETRY 89

7.4.1 GROWING INCIDENCE AND PREVALENCE OF CANCER TO PROPEL MARKET GROWTH 89

7.5 OTHER TECHNOLOGIES 90

8 MINIMAL RESIDUAL DISEASE TESTING MARKET, BY APPLICATION 92

8.1 INTRODUCTION 93

8.2 HEMATOLOGICAL MALIGNANCIES 93

8.2.1 LEUKEMIA 95

8.2.1.1 Myeloid leukemia 98

8.2.1.1.1 High prevalence of AML in adults to support growth 98

8.2.1.2 Lymphocytic leukemia 100

8.2.1.2.1 High incidence of ALL in children to drive market 100

8.2.1.3 Other leukemias 103

8.2.2 LYMPHOMA 105

8.2.2.1 Non-Hodgkin lymphoma 108

8.2.2.1.1 Growing consumption of medications that suppress immune system to drive growth 108

8.2.2.2 Hodgkin lymphoma 110

8.2.2.2.1 Growing incidence of Hodgkin lymphoma to propel demand for MRD testing 110

8.3 SOLID TUMORS 112

8.3.1 ABILITY OF MRD TO ASSESS TREATMENT RESPONSE TO FUEL GROWTH 112

8.4 MULTIPLE MYELOMA 114

8.4.1 RISING INCIDENCE OF MULTIPLE MYELOMAS TO DRIVE MARKET 114

8.5 OTHER APPLICATIONS 116

9 MINIMAL RESIDUAL DISEASE TESTING MARKET, BY END USER 119

9.1 INTRODUCTION 120

9.2 HOSPITALS & SPECIALTY CLINICS 120

9.2.1 INCREASING NUMBER OF PATIENTS VISITING HOSPITALS TO DRIVE GROWTH 120

9.3 DIAGNOSTIC LABORATORIES 121

9.3.1 ROBUST INFRASTRUCTURE AND SPECIALIZED TESTING CAPABILITIES TO SUPPORT GROWTH 121

9.4 ACADEMIC & RESEARCH INSTITUTES 122

9.4.1 INCREASING RESEARCH ACTIVITIES TO BOOST MARKET 122

9.5 OTHER END USERS 123

10 MINIMAL RESIDUAL DISEASE TESTING MARKET, BY REGION 124

10.1 INTRODUCTION 125

10.2 NORTH AMERICA 125

10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 129

10.2.2 US 129

10.2.2.1 Increasing prevalence of cancer to drive market 129

10.2.3 CANADA 132

10.2.3.1 Availability of various cancer screening programs to support market growth 132

10.3 EUROPE 136

10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 136

10.3.2 GERMANY 140

10.3.2.1 Government support for research funding to support MRD testing market 140

10.3.3 UK 143

10.3.3.1 Increasing number of diagnostic laboratories to propel market growth 143

10.3.4 FRANCE 146

10.3.4.1 Rising R&D expenditure in France to drive market 146

10.3.5 ITALY 149

10.3.5.1 Favorable funding scenario to drive market 149

10.3.6 SPAIN 152

10.3.6.1 Consolidation of laboratories in Spain to support market growth 152

10.3.7 REST OF EUROPE 155

10.4 ASIA PACIFIC 158

10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 158

10.4.2 CHINA 163

10.4.2.1 Growing public access to advanced healthcare facilities to drive market 163

10.4.3 JAPAN 166

10.4.3.1 Universal healthcare reimbursement policy to support market growth 166

10.4.4 INDIA 169

10.4.4.1 Increasing private and public investments in healthcare system to drive market 169

10.4.5 REST OF ASIA PACIFIC 172

10.5 LATIN AMERICA 176

10.5.1 INCREASING PRIVATE AND PUBLIC INVESTMENTS TO DRIVE MARKET 176

10.5.2 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 176

10.6 MIDDLE EAST & AFRICA 179

10.6.1 INCREASING FUNDING IN RESEARCH TO DRIVE MARKET 179

10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 180

10.7 GCC COUNTRIES 183

10.7.1 RISING FOCUS ON ADVANCED HEALTH INFRASTRUCTURE AND FUNDING IN RESEARCH TO DRIVE GCC MARKET 183

10.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES 183

11 COMPETITIVE LANDSCAPE 187

11.1 OVERVIEW 187

11.2 KEY PLAYER STRATEGY/RIGHT TO WIN 187

11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN MINIMAL RESIDUAL DISEASE TESTING MARKET 187

11.3 REVENUE ANALYSIS, 2019–2023 190

11.4 MARKET SHARE ANALYSIS, 2023 191

11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 193

11.5.1 LIST OF EVALUATED VENDORS 193

11.5.2 STARS 193

11.5.3 EMERGING LEADERS 193

11.5.4 PERVASIVE PLAYERS 193

11.5.5 PARTICIPANTS 193

11.5.6 COMPANY FOOTPRINT: KEY PLAYERS, 2023 195

11.5.6.1 Company footprint 195

11.5.6.2 Product footprint 195

11.5.6.3 Technology footprint 196

11.5.6.4 Application footprint 196

11.5.6.5 Region footprint 197

11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 197

11.6.1 PROGRESSIVE COMPANIES 197

11.6.2 RESPONSIVE COMPANIES 197

11.6.3 DYNAMIC COMPANIES 197

11.6.4 STARTING BLOCKS 198

11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 199

11.7 COMPANY VALUATION & FINANCIAL METRICS 201

11.8 BRAND/PRODUCT COMPARISON 202

11.9 COMPETITIVE SCENARIO 203

11.9.1 PRODUCT LAUNCHES 203

11.9.2 DEALS 204

12 COMPANY PROFILES 206

12.1 KEY PLAYERS 206

12.1.1 F. HOFFMANN-LA ROCHE AG 206

12.1.1.1 Business overview 206

12.1.1.2 Products offered 207

12.1.1.3 Recent developments 208

12.1.1.3.1 Product launches 208

12.1.1.4 MnM view 208

12.1.1.4.1 Right to win 208

12.1.1.4.2 Strategic choices 208

12.1.1.4.3 Weaknesses & competitive threats 208

12.1.2 LABORATORY CORPORATION OF AMERICA HOLDINGS 209

12.1.2.1 Business overview 209

12.1.2.2 Products offered 210

12.1.2.3 Recent developments 211

12.1.2.3.1 Deals 211

12.1.2.4 MnM view 211

12.1.2.4.1 Right to win 211

12.1.2.4.2 Strategic choices 211

12.1.2.4.3 Weaknesses & competitive threats 211

12.1.3 GUARDANT HEALTH, INC. 212

12.1.3.1 Business overview 212

12.1.3.2 Products offered 213

12.1.3.3 Recent developments 214

12.1.3.3.1 Product launches & approvals 214

12.1.3.3.2 Deals 215

12.1.3.4 MnM view 215

12.1.3.4.1 Right to win 215

12.1.3.4.2 Strategic choices 215

12.1.3.4.3 Weaknesses & competitive threats 215

12.1.4 SYSMEX CORPORATION 216

12.1.4.1 Business overview 216

12.1.4.2 Products offered 217

12.1.4.3 Recent developments 217

12.1.4.3.1 Product launches 217

12.1.4.4 MnM view 218

12.1.4.4.1 Right to win 218

12.1.4.4.2 Strategic choices 218

12.1.4.4.3 Weaknesses & competitive threats 218

12.1.5 NEOGENOMICS LABORATORIES 219

12.1.5.1 Business overview 219

12.1.5.2 Products offered 219

12.1.5.3 Recent developments 220

12.1.5.3.1 Deals 220

12.1.5.4 MnM view 220

12.1.5.4.1 Right to win 220

12.1.5.4.2 Strategic choices 220

12.1.5.4.3 Weaknesses & competitive threats 220

12.1.6 MOLECULARMD (A SUBSIDIARY OF ICON PLC) 221

12.1.6.1 Business overview 221

12.1.6.2 Products offered 222

12.1.7 ADAPTIVE BIOTECHNOLOGIES 223

12.1.7.1 Business overview 223

12.1.7.2 Products offered 224

12.1.7.3 Recent developments 224

12.1.7.3.1 Deals 224

12.1.8 ARCHERDX (INVITAE CORPORATION) 225

12.1.8.1 Business overview 225

12.1.8.2 Products offered 226

12.1.8.3 Recent developments 227

12.1.8.3.1 Product launches 227

12.1.8.3.2 Deals 227

12.1.9 BIO-RAD LABORATORIES, INC. 228

12.1.9.1 Business overview 228

12.1.9.2 Products offered 229

12.1.10 NATERA, INC. 230

12.1.10.1 Business overview 230

12.1.10.2 Products offered 231

12.2 OTHER PLAYERS 232

12.2.1 OPKO HEALTH, INC. 232

12.2.2 GENETRON HEALTH 233

12.2.3 QUEST DIAGNOSTICS, INC. 234

12.2.4 ASURAGEN, INC. 235

12.2.5 INVIVOSCRIBE, INC. 236

12.2.6 ARUP LABORATORIES INC. 237

12.2.7 MISSION BIO, INC. 237

12.2.8 CERGENTIS B.V. 238

13 APPENDIX 239

13.1 DISCUSSION GUIDE 239

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 242

13.3 CUSTOMIZATION OPTIONS 244

13.4 RELATED REPORTS 244

13.5 AUTHOR DETAILS 245

❖ 世界のMRD検査市場に関するよくある質問(FAQ) ❖

・MRD検査の世界市場規模は?

→MarketsandMarkets社は2024年のMRD検査の世界市場規模を14.3億米ドルと推定しています。

・MRD検査の世界市場予測は?

→MarketsandMarkets社は2029年のMRD検査の世界市場規模を25.5億米ドルと予測しています。

・MRD検査市場の成長率は?

→MarketsandMarkets社はMRD検査の世界市場が2024年~2029年に年平均12.2%成長すると予測しています。

・世界のMRD検査市場における主要企業は?

→MarketsandMarkets社は「F. Hoffmann-La Roche Ltd. (スイス)、Labcorp Inc. (スイス)、Labcorp Inc.(米国)、Guardant Health(米国)、シスメックス株式会社(日本)、NeoGenomics Laboratories, Inc.(米国)、Adaptive Biotechnologies Corporation(米国)、ArcherDX, Inc.(米国)、Asuragen Inc.(米国)、Arup Laboratories Inc. (米国)、Bio-Rad Laboratories, Inc.(米国)、Cergentis B.V.(オランダ)、Molecular MD (ICON plc)(アイルランド)、Invivoscribe, Inc.(米国)、Mission Bio, Inc.(米国)、Natera, Inc.(米国)、Opko Health, Inc.(米国)、Quest Diagnostics(米国)、Genetron Health(中国)など ...」をグローバルMRD検査市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。