1 はじめに 30

1.1 調査目的 30

1.2 市場の定義 30

1.3 調査範囲 31

1.3.1 市場セグメンテーション 31

1.3.2 考慮した年数 32

1.3.3 含むものと含まないもの 32

1.4 考慮した通貨 33

1.5 利害関係者 33

1.6 変更点のまとめ 34

2 調査方法 35

2.1 調査データ 35

2.1.1 二次データ 36

2.1.1.1 二次資料からの主要データ 37

2.1.2 一次データ 37

2.1.2.1 業界の専門家からの洞察 37

2.2 要因分析 38

2.2.1 導入 38

2.2.2 需要側指標 39

2.2.2.1 電動化技術への嗜好の高まり 39

2.2.2.2 新型民間航空機需要の増加 39

2.2.2.3 よりクリーンで静かな航空機に対する需要の急増 40

2.2.3 供給側指標 40

2.2.3.1 航空機における電気システムの採用増加 40

2.2.3.2 発電用燃料電池の使用増加 40

2.3 市場規模の推定 41

2.3.1 ボトムアップアプローチ 41

2.3.1.1 市場規模の推定 41

2.3.1.2 調査方法 42

2.3.2 トップダウンアプローチ 42

2.4 市場の内訳とデータの三角測量 43

2.5 リサーチの前提 45

2.6 リスク分析 45

2.7 調査の限界 45

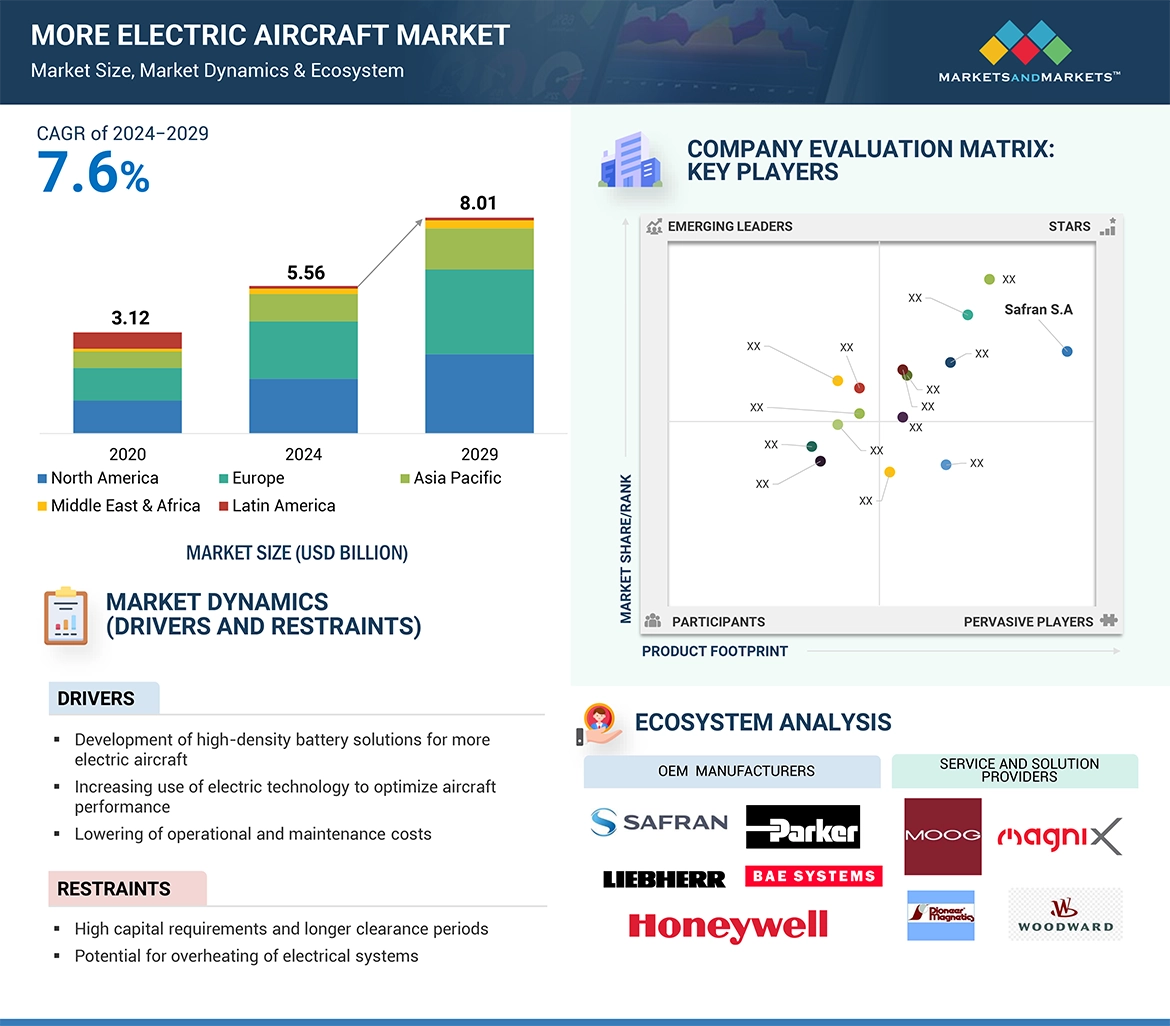

3 エグゼクティブサマリー 46

4 プレミアムインサイト 50

4.1 電動航空機市場におけるプレーヤーの魅力的な機会 50

4.2 電動航空機市場:用途別 51

4.3 電動航空機市場:主要国別 52

5 市場の概要

5.1 はじめに

5.2 市場ダイナミクス

5.2.1 ドライバー 54

5.2.1.1 電動航空機向けの高密度バッテリーソリューションの開発 54

5.2.1.2 航空機の性能を最適化するための電気技術の使用の増加 55

5.2.1.3 運用・保守コストの低減 55

5.2.1.4 排出ガスと航空機騒音の低減 55

5.2.1.5 電気システムの技術的進歩 56

5.2.2 抑制要因 56

5.2.2.1 高い資本要件と長いクリアランス期間 56

5.2.2.2 電気システムの過熱の可能性 56

5.2.3 機会 57

5.2.3.1 発電用代替電源の導入 57

5.2.3.2 パワーエレクトロニクス部品の進歩 57

5.2.3.3 アーバンエアモビリティ(UAM)技術の採用 58

5.2.4 課題 58

5.2.4.1 信頼性の高いケーブルシステムへの要求 58

5.2.4.2 最大離陸重量の大幅増加 58

5.3 顧客ビジネスに影響を与えるトレンド/混乱 59

5.3.1 より多くの電動航空機市場における収益シフトと新たな収益ポケット 59

5.4 バリューチェーン分析 60

5.5 エコシステム分析 61

5.5.1 著名企業 61

5.5.2 民間企業および中小企業 61

5.5.3 エンドユーザー 61

5.6 技術分析 63

5.6.1 主要技術 63

5.6.1.1 電気モーターとバッテリーに電力を供給するターボジェネレーター 63

5.6.1.2 電動アクチュエータ 63

5.6.2 隣接技術 63

5.6.2.1 フライ・バイ・ワイヤ 63

5.7 ケーススタディ分析 64

5.7.1 ハネウェル、より多くの電動アーキテクチャを最適化 64

5.7.2 ハネウェルがボーイング社の補助動力装置の設計に成功 64

5.7.3 電気タクシーシステム 64

5.8 価格分析 65

5.8.1 平均販売価格帯(コンポーネント別) 65

5.8.2 指標価格分析(コンポーネント別) 66

5.8.3 平均販売価格帯、プラットフォーム別、2023年 67

5.9 電動航空機の増加、航空機タイプ別 67

5.10 主要ステークホルダーと購買基準 68

5.10.1 購入プロセスにおける主要ステークホルダー 68

5.10.2 購入基準 69

5.11 規制の状況 70

5.11.1 規制機関、政府機関、その他の組織 70

5.12 貿易分析 72

5.13 主要な会議とイベント(2024-2025年) 73

5.14 ビジネスモデル 74

5.15 総所有コスト 75

5.16 投資と資金調達のシナリオ 76

5.17 部品表 77

5.18 技術ロードマップ 79

5.19 ジェネレーティブAIのインパクト 80

5.19.1 導入 80

5.19.2 上位国による航空分野でのAIの採用 81

5.19.3 航空業界におけるAIのインパクト:ユースケース 82

5.19.4 AIの電動航空機市場への影響 83

5.20 マクロ経済的展望 85

5.20.1 北米 85

5.20.2 欧州 85

5.20.3 アジア太平洋 86

5.20.4 中東 86

5.20.5 ラテンアメリカ 86

5.20.6 アフリカ 87

6 業界動向 88

6.1 はじめに 88

6.2 技術動向 88

6.2.1 油圧式着陸装置から電動式着陸装置への移行 88

6.2.2 電動航空機の増加における電気・電子技術の利用 89

6.2.2.1 機械技術 89

6.2.2.2 パワーエレクトロニクス 89

6.2.2.3 エネルギー管理 90

6.2.3 先進的バッテリー

6.2.3.1 リチウム硫黄(Li-S) 90

6.2.4 電動モーター駆動スマートポンプ 90

6.2.5 高電圧配電 91

6.2.6 電気作動システム(フライ・バイ・ワイヤ) 91

6.2.7 3Dプリンティング 91

6.3 サプライチェーン分析 92

6.4 メガトレンドの影響 93

6.4.1 持続可能な航空燃料 93

6.5 特許分析 93

7 電動航空機市場の拡大、エンドユーザー別 96

7.1 導入 97

7.2 民間 98

7.2.1 排出量削減への取り組みが市場を牽引 98

7.3 軍事 98

7.3.1 防衛費の増加が市場を牽引 98

8 航空機電動化(MEA)市場、用途別 99

8.1 導入 100

8.2 発電 101

8.2.1 電動化アーキテクチャーへの需要の高まりが市場を活性化

市場の活性化 101

8.3 配電 101

8.3.1 電圧を検出し、迅速な負荷遮断を提供する能力

需要促進へ 101

8.4 電力変換 102

8.4.1 需要を生み出すための運転効率向上の必要性 102

8.5 エネルギー貯蔵 102

8.5.1 先進的なバッテリーと燃料電池システムの使用の増加

市場を押し上げる 102

9 電動航空機の増加、プラットフォーム別市場 103

9.1 導入 104

9.2 固定翼機 105

9.2.1 燃費と信頼性の向上が需要を牽引 105

9.2.2 ナローボディ航空機(NBA) 106

9.2.2.1 軽量化が市場を牽引 106

9.2.3 ワイドボディ航空機(WBA) 106

106 9.2.3.1 カーボンフットプリントの低減が市場を牽引 106

9.2.4 リージョナル航空機 107

9.2.4.1 旅客輸送量の増加が需要を喚起 107

9.2.5 戦闘機 107

9.2.5.1 軍事予算の増加が市場を押し上げる 107

9.3 回転翼 107

9.3.1 運用効率向上のニーズが市場を牽引 107

10 航空機電動化(MEA)市場、システム別 109

10.1 導入 110

10.2 推進システム 111

10.2.1 燃料管理システム 111

10.2.1.1 燃料使用量の削減に寄与 111

10.2.2 推力反転システム 112

10.2.2.1 ブレーキの磨耗を低減させる 112

10.3 機体システム 112

10.3.1 環境制御システム 113

10.3.1.1 快適なキャビン環境の確保 113

10.3.2 アクセサリ駆動システム 113

10.3.2.1 動力伝達能力の向上に貢献 113

10.3.3 パワー・マネージメント・システム 113

10.3.3.1 航空機のエネルギー効率の向上 113

10.3.4 客室内装システム 114

10.3.4.1 顧客体験の向上に利用 114

10.3.5 飛行制御システム 114

10.3.5.1 航空機の方向制御 114

10.3.6 着陸装置システム 114

10.3.6.1 離着陸の促進 114

11 電動航空機の増加、コンポーネント別 115

11.1 導入 116

11.2 動力源 117

11.2.1 バッテリー 117

11.2.1.1 ニッケルベースのバッテリー 117

11.2.1.1.1 大容量と急速充電機能 117

11.2.1.2 鉛蓄電池 118

11.2.1.2.1 低コストとメンテナンスの制限による使用の増加 118

11.2.1.3 リチウム電池 118

11.2.1.3.1 高エネルギー密度と軽量化を必要とする未来型アプリケーションでの幅広い採用 118

11.2.2 燃料電池 118

11.2.2.1 効率の向上と燃料負荷の低減 118

11.2.3 太陽電池 118

11.2.3.1 液体燃料の必要性がなくなる 118

11.3 アクチュエーター 119

11.3.1 電気式 119

11.3.2 より高い信頼性 119

11.3.3 ハイブリッド電気 119

11.3.4 省エネルギーへの貢献 119

11.3.4.1 静電アクチュエータ(EHA) 120

11.3.4.2 電気機械式アクチュエータ(EMA) 120

11.3.4.3 電気バックアップ油圧アクチュエータ 120

11.4 電動ポンプ 120

11.4.1 次世代航空機への適合 120

11.5 パワーエレクトロニクス 121

11.5.1 整流器 121

11.5.1.1 交流から直流への変換に使用 121

11.5.2 インバータ 121

11.5.2.1 直流から交流への変換の促進 121

11.5.3 コンバータ 122

11.5.3.1 航空宇宙ネットワークに高品質の直流電力を供給 122

11.6 配電装置 122

11.6.1 ワイヤー&ケーブル 123

11.6.1.1 航空機の電動化による需要の増加 123

11.6.2 コネクター&コネクターアクセサリー 123

11.6.2.1 接続性の高い配線システムへのニーズの高まりが需要を押し上げる 123

11.6.3 バスバー 123

11.6.3.1 簡単な設置で普及が進む 123

11.7 発電機 123

11.7.1 スターター発電機 124

11.7.1.1 並列電力供給ユニットとしての機能 124

11.7.2 補助電源装置(APU) 124

11.7.2.1 航空機へのバックアップ電源供給 124

11.7.3 可変速定周波(VSCF)発電機 125

11.7.3.1 より柔軟な電気システムアーキテクチャの提供 125

11.8 バルブ 125

11.8.1 MEAエンジンのガスレベル調整 125

12 航空機電動化(MEA)市場、地域別 126

12.1 はじめに 127

12.2 北米 128

12.2.1 北米:乳棒分析 128

12.2.2 米国 133

12.2.2.1 大手OEMの存在が市場を牽引 133

12.2.3 カナダ 135

12.2.3.1 研究開発活動の活発化が市場を後押し 135

12.3 欧州 137

12.3.1 欧州: ペストル分析 138

12.3.2 英国 142

12.3.2.1 著名な航空機OEMの存在が市場を活性化 142

12.3.3 フランス 145

12.3.3.1 航空宇宙産業への高い投資が市場を牽引 145

12.3.4 ドイツ 147

12.3.4.1 電気推進技術の開発が需要を牽引 147

12.3.5 ロシア 149

12.3.5.1 成長する航空分野が市場を押し上げる 149

12.3.6 イタリア 152

12.3.6.1 航空機需要の増加が市場を活性化 152

12.3.7 その他のヨーロッパ 154

12.4 アジア太平洋地域 156

12.4.1 アジア太平洋地域:ペストル分析 157

12.4.2 中国 161

12.4.2.1 航空宇宙製品の需要拡大が市場を活性化 161

12.4.3 インド 164

12.4.3.1 急速に拡大する航空セクターが市場成長を促進 164

12.4.4 日本 166

12.4.4.1 航空機の自社開発の増加が需要を牽引 166

12.4.5 韓国 168

12.4.5.1 電気部品メーカーの存在が市場を支える 168

12.4.6 オーストラリア 171

12.4.6.1 航空交通量の増加が需要を押し上げる 171

12.4.7 その他のアジア太平洋地域 173

12.5 中東・アフリカ 176

12.5.1 中東・アフリカ:ペストル分析 176

12.5.2 UAE 180

12.5.2.1 世界の大手航空会社の存在が市場を牽引 180

12.5.3 サウジアラビア 183

12.5.3.1 先進パワーエレクトロニクスの著しい成長が市場を牽引 183

12.5.4 イスラエル 185

12.5.4.1 航空機増備ニーズの高まりが市場を加速 185

12.5.5 南アフリカ 187

12.5.5.1 観光セクターの拡大が市場を活性化 187

12.5.6 その他の中東・アフリカ 189

12.6 ラテンアメリカ 192

12.6.1 ラテンアメリカ:ペストル分析 192

12.6.2 ブラジル 196

12.6.2.1 大手航空会社の存在が市場を後押し 196

12.6.3 メキシコ 198

12.6.3.1 政府の取り組みが市場を牽引 198

12.6.4 その他のラテンアメリカ地域 201

13 競争環境 204

13.1 はじめに 204

13.2 主要プレーヤーの戦略/勝利への権利(2020~2024年) 204

13.3 ランキング分析 207

13.4 上位5社の収益分析(2020~2023年) 208

13.5 市場シェア分析(2023年) 209

13.6 企業評価マトリックス:主要プレーヤー、2023年 210

13.6.1 スター企業 210

13.6.2 新興リーダー 210

13.6.3 浸透型プレーヤー 210

13.6.4 参加企業 210

13.6.5 企業フットプリント 212

13.7 企業評価マトリクス:新興企業/SM(2023年) 216

13.7.1 先進的企業 216

13.7.2 対応力のある企業 216

13.7.3 ダイナミックな企業 216

13.7.4 スタートアップ・ブロック 216

13.7.5 競争ベンチマーク:新興企業/SM(2023年) 218

13.8 企業評価と財務指標 219

13.9 ブランドと製品の比較 220

13.10 競争シナリオ 221

13.10.1 製品上市 221

13.10.2 取引 222

14 会社プロファイル 228

14.3.1 PBS AEROSPACE 274

14.3.2 AVIONIC INSTRUMENTS, LLC 275

14.3.3 EAGLEPICHER TECHNOLOGIES LLC 276

14.3.4 PIONEER MAGNETICS 277

14.3.5 WRIGHT ELECTRIC 278

14.3.6 MAGNIX 278

14.3.7 RADIANT POWER CORPORATION 279

14.3.8 AMPAIRE 280

14.3.9 WOODWARD 280

15 付録 281

15.1 ディスカッション・ガイド 281

15.2 Knowledgestore: Marketsandmarketsの購読ポータル 285

15.3 カスタマイズオプション 287

15.4 関連レポート 287

15.5 著者の詳細 288

In recent years, innovations in battery technology has been a critical factor driving the development of More Electric Aircraft (MEA), as these systems enable more sustainable and efficient power solutions. Among such innovation parts of solid-state batteries and higher energy densities, such batteries are safer and better at a long-lasting lifetime than conventional lithium-ion. The solid-state battery makes use of the solid material instead of the liquid electrolyte while trying to achieve lower energy levels. This actually reduces the risks associated with the thermal runaway and encourages their use in safety for high energy applications of aviation.

Based on application, Power conversion is expected to grow at the highest rate during the forecast period. Highly demanding aircraft systems including, flight control, landing gears, environmental controls have huge demands and require a system of conversion of electrical powers in airplanes that move on from hydraulics to pneumatics to the alternative electric version. Power conversion technology allows these systems to function on various levels of voltage, stepping the power up or down, ensuring stable and efficient operation across multiple functions.

Based on End User, Civil segment is expected to lead the market. The civil aviation sector is expected to lead the More Electric Aircraft (MEA) market due to the high demand for sustainable, fuel-efficient technologies among commercial airlines and operators. Environmental regulations and pressure from the industry to reduce greenhouse gas emissions have expedited the implementation of electric systems in civil aviation, making the sector lead the More Electric Aircraft (MEA) market. ICAO and other governments around the world are implementing more stringent emission requirements, and this forces airlines to pursue MEA technology in order to meet the new standards and reduce their carbon footprint. Many commercial aircraft manufacturers, therefore, highlight electric-driven systems for parts such as flight controls, landing gear, environmental controls, and power distribution.

"Europe is expected to account for the largest share in 2024"

Europe is expected to take the lead in the MEA market due to strategic focus on developing sustainable aviation and substantial government support for green technologies. The Green Deal and Clean Aviation program initiatives of the European Union have allocated huge funding and regulatory support for the development and deployment of MEA technologies. These programs intend to position Europe as a leader in green aviation solutions by incentivizing aerospace manufacturers to migrate from traditional systems to electric-driven alternatives. Another contributing factor is the region's strong emphasis on research cooperation between companies, universities, and government agencies that is accelerating MEA technology. National strategies for sustainable aviation have been established by the countries of France, Germany, and the United Kingdom as well, which have, in turn, created an environment of healthy competition between them for MEA innovations. This commitment places Europe in a natural leadership role regarding MEA adoption; the region will, therefore be well-positioned to help define industry standards for newer, greener, more electric-based aircraft technology for global markets.

The break-up of the profile of primary participants in the more electric aircraft market:

• By Company Type: Tier 1 – 49%, Tier 2 – 37%, and Tier 3 – 14%

• By Designation: C Level – 55%, Director Level – 27%, and Others – 18%

• By Region: North America – 32%, Europe – 32%, Asia Pacific – 16%, Middle East & Africa – 10%, Latin America – 10%

Research Coverage:

The report segments the more electric aircraft market based on component, application, system, platform, end-user, and Region. The more electric aircraft market is segmented into power sources, generators, actuators, electric pumps, power electronics, distribution devices, valves, based on components. Based on the application, the market is segmented into power generation, distribution, conversion, and energy storage. Based on the solution, the market is segmented into propulsion and airframe systems. Based on the platform, the market is segmented into fixed-wing and rotary-wing. Based on the end user, the market is segmented into civil and military. The more electric aircraft market has been studied in North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, as well as key strategies such as contracts, partnerships, agreements, new product and service launches, mergers and acquisitions, and recent developments in the more electric aircraft market. This research includes a competitive analysis of upcoming startups in the more electric aircraft market ecosystem.

Reasons to buy this report:

The research will provide industry leaders and potential entrants with information on the closest estimations of revenue figures for the more electric aircraft market. This study will assist stakeholders in better understanding the competitive environment and gaining new insights to position their businesses better and develop appropriate go-to-market strategies. The study also assists stakeholders in understanding the pulse of the industry and offers data on major market drivers, restraints, challenges, and opportunities.

Advancements in key power sources drive the more electric aircraft market.

The report provides insights on the following pointers:

•The report also helps stakeholders understand the market pulse and provides information on key market Drivers (Development of high-density battery solutions for more electric aircraft, Increasing use of electric technology to optimize aircraft performance, Lowering of operational and maintenance costs, Reduction in emissions and aircraft noise, Technological advancements in electric systems), Restraints ( High capital requirements and longer clearance periods, Potential for overheating of electrical systems), Opportunities (Introduction of alternative power sources for electric power generation, Development of advanced power electronics component, Adoption of Urban Air Mobility (UAM) technologies), and Challenges (Requirement for reliable cable systems, Significant increase in maximum take-off weight).

•Market Penetration: The market's leading companies provide comprehensive information about more electric aircraft.

•Product Development/Innovation: In-depth information on future technologies, R&D efforts, and new product and service launches in the more electric aircraft market.

•Market Development: In-depth information on profitable markets - the study examines the more electric aircraft market in several areas.

•Market Diversification: Comprehensive data on new goods and services, new geographies, current advancements, and investments in the more electric aircraft market.

•Competitive Assessment: An in-depth examination of the more electric aircraft industry's major companies' market shares, growth strategies, and service offerings is provided.

1 INTRODUCTION 30

1.1 STUDY OBJECTIVES 30

1.2 MARKET DEFINITION 30

1.3 STUDY SCOPE 31

1.3.1 MARKET SEGMENTATION 31

1.3.2 YEARS CONSIDERED 32

1.3.3 INCLUSIONS AND EXCLUSIONS 32

1.4 CURRENCY CONSIDERED 33

1.5 STAKEHOLDERS 33

1.6 SUMMARY OF CHANGES 34

2 RESEARCH METHODOLOGY 35

2.1 RESEARCH DATA 35

2.1.1 SECONDARY DATA 36

2.1.1.1 Key data from secondary sources 37

2.1.2 PRIMARY DATA 37

2.1.2.1 Insights from industry experts 37

2.2 FACTOR ANALYSIS 38

2.2.1 INTRODUCTION 38

2.2.2 DEMAND-SIDE INDICATORS 39

2.2.2.1 Growing preference for more electric technology 39

2.2.2.2 Increasing demand for new commercial aircraft 39

2.2.2.3 Surging demand for cleaner and quieter aircraft 40

2.2.3 SUPPLY-SIDE INDICATORS 40

2.2.3.1 Increasing adoption of electrical systems in aircraft 40

2.2.3.2 Rising use of fuel cells for electric power generation 40

2.3 MARKET SIZE ESTIMATION 41

2.3.1 BOTTOM-UP APPROACH 41

2.3.1.1 Market size estimation 41

2.3.1.2 Research methodology 42

2.3.2 TOP-DOWN APPROACH 42

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION 43

2.5 RESEARCH ASSUMPTIONS 45

2.6 RISK ANALYSIS 45

2.7 RESEARCH LIMITATIONS 45

3 EXECUTIVE SUMMARY 46

4 PREMIUM INSIGHTS 50

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MORE ELECTRIC AIRCRAFT MARKET 50

4.2 MORE ELECTRIC AIRCRAFT MARKET, BY APPLICATION 51

4.3 MORE ELECTRIC AIRCRAFT MARKET, BY KEY COUNTRIES 52

5 MARKET OVERVIEW 53

5.1 INTRODUCTION 53

5.2 MARKET DYNAMICS 54

5.2.1 DRIVERS 54

5.2.1.1 Development of high-density battery solutions for more electric aircraft 54

5.2.1.2 Increasing use of electric technology to optimize aircraft performance 55

5.2.1.3 Lowering of operational and maintenance costs 55

5.2.1.4 Reduction in emissions and aircraft noise 55

5.2.1.5 Technological advancements in electric systems 56

5.2.2 RESTRAINTS 56

5.2.2.1 High capital requirements and longer clearance periods 56

5.2.2.2 Potential for overheating of electrical systems 56

5.2.3 OPPORTUNITIES 57

5.2.3.1 Introduction of alternative power sources for electric power generation 57

5.2.3.2 Advancements in power electronic components 57

5.2.3.3 Adoption of urban air mobility (UAM) technologies 58

5.2.4 CHALLENGES 58

5.2.4.1 Requirement for reliable cable systems 58

5.2.4.2 Significant increase in maximum take-off weight 58

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 59

5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MORE ELECTRIC AIRCRAFT MARKET 59

5.4 VALUE CHAIN ANALYSIS 60

5.5 ECOSYSTEM ANALYSIS 61

5.5.1 PROMINENT COMPANIES 61

5.5.2 PRIVATE AND SMALL ENTERPRISES 61

5.5.3 END USERS 61

5.6 TECHNOLOGY ANALYSIS 63

5.6.1 KEY TECHNOLOGIES 63

5.6.1.1 Turbogenerators for powering electric motors and batteries 63

5.6.1.2 Electric actuators 63

5.6.2 ADJACENT TECHNOLOGIES 63

5.6.2.1 Fly-by-wire 63

5.7 CASE STUDY ANALYSIS 64

5.7.1 HONEYWELL OPTIMIZES MORE ELECTRIC ARCHITECTURE 64

5.7.2 HONEYWELL SUCCESSFULLY DESIGNS AUXILIARY POWER UNIT FOR BOEING 64

5.7.3 ELECTRIC TAXI SYSTEMS 64

5.8 PRICING ANALYSIS 65

5.8.1 AVERAGE SELLING PRICE RANGE, BY COMPONENT 65

5.8.2 INDICATIVE PRICING ANALYSIS, BY COMPONENT 66

5.8.3 AVERAGE SELLING PRICE RANGE, BY PLATFORM, 2023 67

5.9 MORE ELECTRIC AIRCRAFT, BY AIRCRAFT TYPE 67

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA 68

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS 68

5.10.2 BUYING CRITERIA 69

5.11 REGULATORY LANDSCAPE 70

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 70

5.12 TRADE ANALYSIS 72

5.13 KEY CONFERENCES AND EVENTS, 2024–2025 73

5.14 BUSINESS MODEL 74

5.15 TOTAL COST OF OWNERSHIP 75

5.16 INVESTMENT AND FUNDING SCENARIO 76

5.17 BILL OF MATERIALS 77

5.18 TECHNOLOGY ROADMAP 79

5.19 IMPACT OF GENERATIVE AI 80

5.19.1 INTRODUCTION 80

5.19.2 ADOPTION OF AI IN AVIATION BY TOP COUNTRIES 81

5.19.3 IMPACT OF AI ON AVIATION: USE CASES 82

5.19.4 IMPACT OF AI ON MORE ELECTRIC AIRCRAFT MARKET 83

5.20 MACROECONOMIC OUTLOOK 85

5.20.1 NORTH AMERICA 85

5.20.2 EUROPE 85

5.20.3 ASIA PACIFIC 86

5.20.4 MIDDLE EAST 86

5.20.5 LATIN AMERICA 86

5.20.6 AFRICA 87

6 INDUSTRY TRENDS 88

6.1 INTRODUCTION 88

6.2 TECHNOLOGY TRENDS 88

6.2.1 SHIFT FROM HYDRAULIC TO ELECTRIC LANDING GEAR 88

6.2.2 USE OF ELECTRICAL AND ELECTRONICS TECHNOLOGIES IN MORE ELECTRIC AIRCRAFT 89

6.2.2.1 Machine technologies 89

6.2.2.2 Power electronics 89

6.2.2.3 Energy management 90

6.2.3 ADVANCED BATTERIES 90

6.2.3.1 Lithium-sulfur (Li-S) 90

6.2.4 ELECTRIC MOTOR-DRIVEN SMART PUMPS 90

6.2.5 HIGH-VOLTAGE POWER DISTRIBUTION 91

6.2.6 ELECTRIC ACTUATION SYSTEMS (FLY-BY-WIRE) 91

6.2.7 3D PRINTING 91

6.3 SUPPLY CHAIN ANALYSIS 92

6.4 IMPACT OF MEGATRENDS 93

6.4.1 SUSTAINABLE AVIATION FUEL 93

6.5 PATENT ANALYSIS 93

7 MORE ELECTRIC AIRCRAFT MARKET, BY END USER 96

7.1 INTRODUCTION 97

7.2 CIVIL 98

7.2.1 FOCUS ON REDUCING EMISSIONS TO PROPEL MARKET 98

7.3 MILITARY 98

7.3.1 INCREASED DEFENSE SPENDING TO DRIVE MARKET 98

8 MORE ELECTRIC AIRCRAFT MARKET, BY APPLICATION 99

8.1 INTRODUCTION 100

8.2 POWER GENERATION 101

8.2.1 INCREASING DEMAND FOR MORE ELECTRIC ARCHITECTURE

TO FUEL MARKET 101

8.3 POWER DISTRIBUTION 101

8.3.1 ABILITY TO DETECT VOLTAGE AND PROVIDE PROMPT LOAD SHUT-OFF

TO DRIVE DEMAND 101

8.4 POWER CONVERSION 102

8.4.1 NEED TO INCREASE OPERATIONAL EFFICIENCY TO GENERATE DEMAND 102

8.5 ENERGY STORAGE 102

8.5.1 INCREASED USE OF ADVANCED BATTERY AND FUEL CELL SYSTEMS

TO BOOST MARKET 102

9 MORE ELECTRIC AIRCRAFT MARKET, BY PLATFORM 103

9.1 INTRODUCTION 104

9.2 FIXED-WING 105

9.2.1 IMPROVED FUEL CONSUMPTION AND RELIABILITY TO DRIVE DEMAND 105

9.2.2 NARROW-BODY AIRCRAFT (NBA) 106

9.2.2.1 Reduction in weight factor to drive market 106

9.2.3 WIDE-BODY AIRCRAFT (WBA) 106

9.2.3.1 Need to lower carbon footprint to fuel market 106

9.2.4 REGIONAL AIRCRAFT 107

9.2.4.1 Increase in air passenger traffic to fuel demand 107

9.2.5 FIGHTER JETS 107

9.2.5.1 Increasing military budgets to boost market 107

9.3 ROTARY-WING 107

9.3.1 NEED FOR INCREASED OPERATIONAL EFFICIENCY TO DRIVE MARKET 107

10 MORE ELECTRIC AIRCRAFT MARKET, BY SYSTEM 109

10.1 INTRODUCTION 110

10.2 PROPULSION SYSTEMS 111

10.2.1 FUEL MANAGEMENT SYSTEMS 111

10.2.1.1 Help reduce fuel usage 111

10.2.2 THRUST REVERSER SYSTEMS 112

10.2.2.1 Facilitate reduced brake wear 112

10.3 AIRFRAME SYSTEMS 112

10.3.1 ENVIRONMENTAL CONTROL SYSTEMS 113

10.3.1.1 Ensure comfortable cabin environment 113

10.3.2 ACCESSORY DRIVE SYSTEMS 113

10.3.2.1 Help increase power transmission capabilities 113

10.3.3 POWER MANAGEMENT SYSTEMS 113

10.3.3.1 Increase energy efficiency in aircraft 113

10.3.4 CABIN INTERIOR SYSTEMS 114

10.3.4.1 Used to enhance customer experience 114

10.3.5 FLIGHT CONTROL SYSTEMS 114

10.3.5.1 Employed to control aircraft direction 114

10.3.6 LANDING GEAR SYSTEMS 114

10.3.6.1 Facilitate take-off and landing 114

11 MORE ELECTRIC AIRCRAFT MARKET, BY COMPONENT 115

11.1 INTRODUCTION 116

11.2 POWER SOURCES 117

11.2.1 BATTERIES 117

11.2.1.1 Nickel-based batteries 117

11.2.1.1.1 High capacity and quick-charging capabilities 117

11.2.1.2 Lead-acid batteries 118

11.2.1.2.1 Increasing use due to low cost and limited maintenance 118

11.2.1.3 Lithium-based batteries 118

11.2.1.3.1 Wide adoption in futuristic applications requiring high energy density and low weight 118

11.2.2 FUEL CELLS 118

11.2.2.1 Increase efficiency and help to reduce fuel load 118

11.2.3 SOLAR CELLS 118

11.2.3.1 Eliminate requirement for liquid fuel 118

11.3 ACTUATORS 119

11.3.1 ELECTRIC 119

11.3.2 OFFER GREATER RELIABILITY 119

11.3.3 HYBRID ELECTRIC 119

11.3.4 HELP SAVE ENERGY 119

11.3.4.1 Electro-hydrostatic actuators (EHA) 120

11.3.4.2 Electro-mechanical actuators (EMA) 120

11.3.4.3 Electrical-backup hydraulic actuators 120

11.4 ELECTRIC PUMPS 120

11.4.1 SUITED TO NEXT-GENERATION AIRCRAFT 120

11.5 POWER ELECTRONICS 121

11.5.1 RECTIFIERS 121

11.5.1.1 Used for AC to DC conversion 121

11.5.2 INVERTERS 121

11.5.2.1 Facilitate DC to AC conversion 121

11.5.3 CONVERTERS 122

11.5.3.1 Provide high-quality DC electrical power for aerospace networks 122

11.6 DISTRIBUTION DEVICES 122

11.6.1 WIRES & CABLES 123

11.6.1.1 Increasing demand due to shift toward more electric aircraft 123

11.6.2 CONNECTORS & CONNECTOR ACCESSORIES 123

11.6.2.1 Rising need for well-connected wiring systems to boost demand 123

11.6.3 BUSBARS 123

11.6.3.1 Easy installation to increase adoption 123

11.7 GENERATORS 123

11.7.1 STARTER GENERATORS 124

11.7.1.1 Acts as parallel electrical power supply units 124

11.7.2 AUXILIARY POWER UNITS (APU) 124

11.7.2.1 Provide back-up electrical supply for aircraft 124

11.7.3 VARIABLE SPEED CONSTANT FREQUENCY (VSCF) GENERATORS 125

11.7.3.1 Offer more flexible electrical system architecture 125

11.8 VALVES 125

11.8.1 REGULATE GAS LEVELS IN MEA ENGINES 125

12 MORE ELECTRIC AIRCRAFT MARKET, BY REGION 126

12.1 INTRODUCTION 127

12.2 NORTH AMERICA 128

12.2.1 NORTH AMERICA: PESTLE ANALYSIS 128

12.2.2 US 133

12.2.2.1 Presence of leading OEMs to drive market 133

12.2.3 CANADA 135

12.2.3.1 Increasing R&D activities to boost market 135

12.3 EUROPE 137

12.3.1 EUROPE: PESTLE ANALYSIS 138

12.3.2 UK 142

12.3.2.1 Presence of prominent aircraft OEMs to fuel market 142

12.3.3 FRANCE 145

12.3.3.1 High investments in aerospace industry to drive market 145

12.3.4 GERMANY 147

12.3.4.1 Developments in electric propulsion technologies to drive demand 147

12.3.5 RUSSIA 149

12.3.5.1 Growing aviation sector to boost market 149

12.3.6 ITALY 152

12.3.6.1 Increasing demand for aircraft to fuel market 152

12.3.7 REST OF EUROPE 154

12.4 ASIA PACIFIC 156

12.4.1 ASIA PACIFIC: PESTLE ANALYSIS 157

12.4.2 CHINA 161

12.4.2.1 Growing demand for aerospace products to fuel market 161

12.4.3 INDIA 164

12.4.3.1 Rapidly expanding aviation sector to spur market growth 164

12.4.4 JAPAN 166

12.4.4.1 Increasing in-house development of aircraft to drive demand 166

12.4.5 SOUTH KOREA 168

12.4.5.1 Presence of electric component manufacturers to support market 168

12.4.6 AUSTRALIA 171

12.4.6.1 Increasing air traffic to boost demand 171

12.4.7 REST OF ASIA PACIFIC 173

12.5 MIDDLE EAST & AFRICA 176

12.5.1 MIDDLE EAST & AFRICA: PESTLE ANALYSIS 176

12.5.2 UAE 180

12.5.2.1 Presence of leading global airlines to drive market 180

12.5.3 SAUDI ARABIA 183

12.5.3.1 Significant growth in advanced power electronics to drive market 183

12.5.4 ISRAEL 185

12.5.4.1 Growing need to ramp up aircraft fleet to accelerate market 185

12.5.5 SOUTH AFRICA 187

12.5.5.1 Expanding tourism sector to fuel market 187

12.5.6 REST OF MIDDLE EAST & AFRICA 189

12.6 LATIN AMERICA 192

12.6.1 LATIN AMERICA: PESTLE ANALYSIS 192

12.6.2 BRAZIL 196

12.6.2.1 Presence of leading airlines to boost market 196

12.6.3 MEXICO 198

12.6.3.1 Government initiatives to drive market 198

12.6.4 REST OF LATIN AMERICA 201

13 COMPETITIVE LANDSCAPE 204

13.1 INTRODUCTION 204

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 204

13.3 RANKING ANALYSIS 207

13.4 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020–2023 208

13.5 MARKET SHARE ANALYSIS, 2023 209

13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 210

13.6.1 STARS 210

13.6.2 EMERGING LEADERS 210

13.6.3 PERVASIVE PLAYERS 210

13.6.4 PARTICIPANTS 210

13.6.5 COMPANY FOOTPRINT 212

13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 216

13.7.1 PROGRESSIVE COMPANIES 216

13.7.2 RESPONSIVE COMPANIES 216

13.7.3 DYNAMIC COMPANIES 216

13.7.4 STARTING BLOCKS 216

13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 218

13.8 COMPANY VALUATION AND FINANCIAL METRICS 219

13.9 BRAND/PRODUCT COMPARISON 220

13.10 COMPETITIVE SCENARIO 221

13.10.1 PRODUCT LAUNCHES 221

13.10.2 DEALS 222

14 COMPANY PROFILES 228

14.1 INTRODUCTION 228

14.2 KEY PLAYERS 228

14.2.1 SAFRAN S.A. 228

14.2.1.1 Business overview 228

14.2.1.2 Products/Solutions/Services offered 230

14.2.1.3 Recent developments 230

14.2.1.3.1 Deals 230

14.2.1.4 MnM view 231

14.2.1.4.1 Key strengths 231

14.2.1.4.2 Strategic choices 231

14.2.1.4.3 Weaknesses and competitive threats 232

14.2.2 HONEYWELL INTERNATIONAL, INC. 233

14.2.2.1 Business overview 233

14.2.2.2 Products/Solutions/Services offered 234

14.2.2.3 Recent developments 235

14.2.2.3.1 Product launches 235

14.2.2.3.2 Deals 236

14.2.2.4 MnM view 237

14.2.2.4.1 Key strengths 237

14.2.2.4.2 Strategic choices 237

14.2.2.4.3 Weaknesses and competitive threats 238

14.2.3 RTX 239

14.2.3.1 Business overview 239

14.2.3.2 Products/Solutions/Services offered 240

14.2.3.3 Recent developments 241

14.2.3.3.1 Deals 241

14.2.3.4 MnM view 242

14.2.3.4.1 Key strengths 242

14.2.3.4.2 Strategic choices 242

14.2.3.4.3 Weaknesses and competitive threats 242

14.2.4 GENERAL ELECTRIC 243

14.2.4.1 Business overview 243

14.2.4.2 Products/Solutions/Services offered 244

14.2.4.3 Recent developments 245

14.2.4.3.1 Deals 245

14.2.4.4 MnM view 245

14.2.4.4.1 Key strengths 245

14.2.4.4.2 Strategic choices 246

14.2.4.4.3 Weaknesses and competitive threats 246

14.2.5 PARKER HANNIFIN CORPORATION 247

14.2.5.1 Business overview 247

14.2.5.2 Products/Solutions/Services offered 248

14.2.5.3 Recent developments 249

14.2.5.3.1 Deals 249

14.2.6 BAE SYSTEMS PLC 250

14.2.6.1 Business overview 250

14.2.6.2 Products/Solutions/Services offered 251

14.2.7 BOMBARDIER INC. 253

14.2.7.1 Business overview 253

14.2.7.2 Products/Solutions/Services offered 254

14.2.8 EMBRAER S.A. 255

14.2.8.1 Business overview 255

14.2.8.2 Products/Solutions/Services offered 256

14.2.9 LIEBHERR 257

14.2.9.1 Business overview 257

14.2.9.2 Products/Solutions/Services offered 258

14.2.10 AMETEK, INC. 259

14.2.10.1 Business overview 259

14.2.10.2 Products/Solutions/Services offered 260

14.2.10.3 Recent developments 261

14.2.10.3.1 Deals 261

14.2.11 NABTESCO CORPORATION 262

14.2.11.1 Business overview 262

14.2.11.2 Products/Solutions/Services offered 262

14.2.12 MOOG INC. 263

14.2.12.1 Business overview 263

14.2.12.2 Products/Solutions/Services offered 264

14.2.12.3 Recent developments 264

14.2.12.3.1 Deals 264

14.2.13 ASTRONICS CORPORATION 265

14.2.13.1 Business overview 265

14.2.13.2 Products/Solutions/Services offered 266

14.2.14 ROLLS-ROYCE PLC 268

14.2.14.1 Business overview 268

14.2.14.2 Products/Solutions/Services offered 269

14.2.14.3 Recent developments 270

14.2.15 EATON 271

14.2.15.1 Business overview 271

14.2.15.2 Products/Solutions/Services offered 272

14.2.16 AMPHENOL CORPORATION 273

14.2.16.1 Business overview 273

14.2.16.2 Products/Solutions/Services offered 274

14.3 OTHER PLAYERS 274

14.3.1 PBS AEROSPACE 274

14.3.2 AVIONIC INSTRUMENTS, LLC 275

14.3.3 EAGLEPICHER TECHNOLOGIES LLC 276

14.3.4 PIONEER MAGNETICS 277

14.3.5 WRIGHT ELECTRIC 278

14.3.6 MAGNIX 278

14.3.7 RADIANT POWER CORPORATION 279

14.3.8 AMPAIRE 280

14.3.9 WOODWARD 280

15 APPENDIX 281

15.1 DISCUSSION GUIDE 281

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 285

15.3 CUSTOMIZATION OPTIONS 287

15.4 RELATED REPORTS 287

15.5 AUTHOR DETAILS 288