1 はじめに

1.1 調査目的 34

1.2 市場の定義 34

1.3 市場範囲 34

1.3.1 対象と除外 34

1.3.2 対象市場 35

1.3.3 考慮した年数 36

1.4 考慮した通貨 36

1.5 利害関係者 37

1.6 変更点のまとめ 37

2 調査方法 39

2.1 調査アプローチ 39

2.1.1 二次データ 40

2.1.1.1 二次資料からの主要データ 41

2.1.2 一次データ 41

2.1.2.1 一次情報源からの主要データ 42

2.1.2.2 主要な業界インサイト 43

2.2 市場規模の推定 45

2.3 市場の内訳とデータの三角測量 50

2.4 リサーチの前提 51

2.5 調査の限界 51

2.5.1 方法論に関する限界 51

2.5.2 範囲に関する限界 51

2.6 リスク分析 52

3 エグゼクティブ・サマリー

4 プレミアムインサイト 56

4.1 理学療法機器市場におけるプレーヤーにとっての魅力的な機会 56

4.2 アジア太平洋地域:理学療法機器市場:エンドユーザー別、国別 57

4.3 理学療法機器市場:主要国別 58

4.4 理学療法機器市場:地域別 58

4.5 理学療法機器市場:先進国vs. 新興市場 59

5 市場の概要 60

5.1 はじめに 60

5.2 市場ダイナミクス

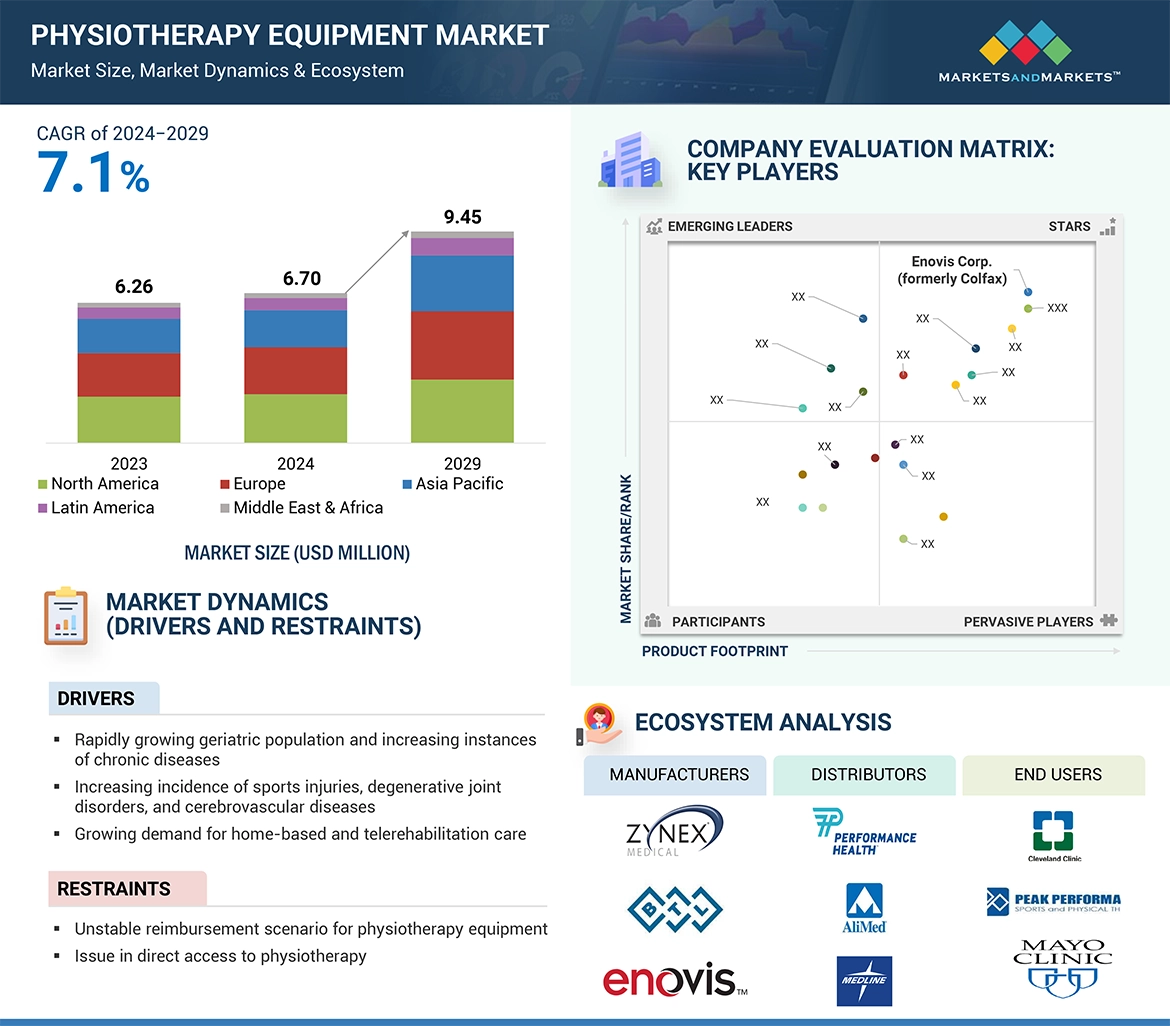

5.2.1 推進要因

5.2.1.1 老年人口の急増と慢性疾患の増加 61

5.2.1.2 スポーツ外傷、退行性関節障害、脳血管疾患の罹患率の増加 62

5.2.1.3 リハビリテーション医療に対する需要の高まり 63

5.2.1.4 在宅および遠隔リハビリテーションケアの需要の高まり 63

5.2.2 抑制要因 64

5.2.2.1 理学療法に対する不安定な償還シナリオ 64

5.2.2.2 理学療法への直接アクセスの問題 64

5.2.3 機会 65

5.2.3.1 新興国における人口の多さ 65

5.2.3.2 技術の進歩 66

5.2.4 課題 66

5.2.4.1 熟練した人材の不足 66

5.2.4.2 鍼治療とその他の代替療法 66

5.3 ポーターの5つの力分析 67

5.3.1 新規参入の脅威 68

5.3.2 代替品の脅威 68

5.3.3 供給者の交渉力 68

5.3.4 買い手の交渉力 68

5.3.5 競合の激しさ 69

5.4 業界動向 69

5.4.1 理学療法機器におけるモノのインターネットの統合 69

5.4.2 理学療法機器の技術的進歩 70

5.5 バリューチェーン分析 70

5.6 技術分析 71

5.6.1 主要技術 71

5.6.1.1 ロボット器具 71

5.6.1.2 人工知能と機械学習 72

5.6.1.3 バーチャル理学療法 72

5.6.2 補足技術 72

5.6.2.1 拡張現実 72

5.6.3 隣接技術 73

5.6.3.1 ウェアラブルセンサー 73

5.7 規制の状況 73

5.7.1 規制機関、政府機関、その他の組織 73

5.7.2 規制の枠組み 74

5.7.2.1 北米 74

5.7.2.1.1 米国 74

5.7.2.1.2 カナダ 75

5.7.2.2 欧州

5.7.2.3 アジア太平洋地域 75

5.7.2.3.1 日本 75

5.7.2.3.2 中国 76

5.7.2.3.3 インド 77

5.8 特許分析 77

5.8.1 理学療法機器の特許公開動向 77

5.8.2 洞察: 管轄と上位出願人の分析 78

5.9 貿易分析 80

5.10 価格分析 82

5.11 2024-2025年の主要会議とイベント 84

5.12 主要ステークホルダーと購買基準 84

5.12.1 購入プロセスにおける主要ステークホルダー 84

5.12.2 購入基準 85

5.13 理学療法機器市場におけるエンドユーザーの期待 86

5.14 隣接市場分析 86

5.15 エコシステム分析 87

5.16 ケーススタディ分析 88

5.16.1 ケーススタディ1:スタートゥーン・ラボがPheezee理学療法機器のUSDA承認を取得 88

5.16.2 ケーススタディ 2: UKNHSがAIを活用した理学療法クリニックを開設 89

5.16.3 ケーススタディ3:BurjeelとLeejamがリヤドでフィジオセラビアを発売 90

5.17 サプライチェーン分析 90

5.18 顧客ビジネスに影響を与えるトレンド/混乱 91

5.19 投資と資金調達のシナリオ 92

5.20 保険償還シナリオ 92

5.21 理学療法機器市場に対する生成愛の影響 93

6 理学療法機器市場:製品別 94

6.1 導入 95

6.2 機器 95

6.2.1 電気療法機器 98

6.2.1.1 リハビリテーション現場で使用される神経筋電気刺激と治療用電気刺激 98

6.2.2 超音波装置 102

6.2.2.1 結合組織治療において主要な用途となる超音波装置 102

6.2.3 運動療法機器 105

6.2.3.1 療法的エクササイズの利点が認知され、セグメント成長を牽引 105

6.2.4 温熱療法機器 107

6.2.4.1 温熱療法は関節炎の主要な治療法として認識されている 107

6.2.5 凍結療法機器 110

6.2.5.1 健康増進とフィットネス人気の高まりがセグメント成長を牽引 110

6.2.6 コンビネーションセラピー機器 112

6.2.6.1 様々な患者層への幅広い応用がセグメント成長を牽引 112

6.2.7 持続的受動運動療法機器 115

6.2.7.1 関節再建手術の増加がセグメント成長を牽引 115

6.2.8 衝撃波治療装置 117

6.2.8.1 急性や慢性の痛みを引き起こす様々な適応症の治療に使われる非外科的療法 117

6.2.9 レーザー治療機器 121

6.2.9.1 理学療法に使用される多目的ツール 121

6.2.10 牽引療法機器 123

6.2.10.1 非外傷性脊髄損傷患者の増加が需要を牽引 123

6.2.11 磁気圧迫療法機器 125

6.2.11.1 磁気治療の治療効果は他の理学療法より低い 125

6.2.12 その他の理学療法機器 127

6.3 アクセサリー 129

6.3.1 理学療法用家具 131

6.3.1.1 理学療法、リハビリ、作業療法、スポーツ医学、カイロプラクティック医学に使用 131

6.3.2 その他のアクセサリー 133

7 理学療法機器市場(用途別) 136

7.1 はじめに 137

7.2 筋骨格系 138

7.2.1 筋骨格系疾患の罹患率の増加が成長を牽引 138

7.3 神経 140

7.3.1 神経疾患の罹患率の増加が成長を牽引 140

7.4 心血管・肺疾患 142

7.4.1 心血管疾患の有病率の増加が成長を促進 142

7.5 小児科 144

7.5.1 活動と日常生活への参加を促進する小児理学療法 144

7.6 婦人科 146

7.6.1 予測期間中、婦人科分野が最も急成長するアプリケーション 146

7.7 その他の用途 149

8 理学療法機器市場:エンドユーザー別 151

8.1 はじめに 152

8.2 理学療法&リハビリセンター 153

8.2.1 スポーツ傷害や障害の発生率の増加がセグメント成長を牽引 153

8.3 病院 155

8.3.1 病院における患者数の増加がセグメント成長を牽引 155

8.4 在宅介護環境 157

8.4.1 在宅ケア需要の増加がセグメント成長の原動力 157

8.5 医院 159

8.5.1 健康問題の管理における最初の接点 159

8.6 その他のエンドユーザー 161

9 理学療法機器市場(地域別) 164

9.1 はじめに 165

9.2 北米 166

9.2.1 マクロ経済見通し 167

9.2.2 米国 172

9.2.2.1 予測期間中は北米市場を支配 172

9.2.3 カナダ 177

9.2.3.1 予防医療サービスの浸透が市場を押し上げる 177

9.3 欧州 182

9.3.1 マクロ経済見通し 183

9.3.2 ドイツ 188

9.3.2.1 高齢者人口の増加と慢性疾患の増加が需要を牽引 188

9.3.3 イギリス 193

9.3.3.1 理学療法が広く受け入れられ、理学療法機器の導入が増加 193

9.3.4 フランス 198

9.3.4.1 医療費の増加と有利な償還シナリオが市場を牽引 198

9.3.5 イタリア 202

9.3.5.1 転倒による怪我と整形外科疾患の増加が市場を牽引 202

9.3.6 スペイン 207

9.3.6.1 老年人口の増加が理学療法機器の普及を促進 207

9.3.7 その他のヨーロッパ 211

9.4 アジア太平洋地域 216

9.4.1 マクロ経済見通し 222

9.4.2 日本 223

9.4.2.1 高齢者人口の増加が理学療法機器の普及を促進 223

9.4.3 中国 227

9.4.3.1 政府によるフィットネス計画が市場を牽引 227

9.4.4 インド 232

9.4.4.1 新たな急性期医療環境の拡大が需要を牽引 232

9.4.5 オーストラリア 237

9.4.5.1 人口増加と慢性筋骨格系疾患の増加が市場を牽引 237

9.4.6 韓国 241

9.4.6.1 急速な高齢化と医療ツーリズムの増加が市場を牽引 241

9.4.7 その他のアジア太平洋地域 245

9.5 ラテンアメリカ 249

9.5.1 マクロ経済見通し 254

9.5.2 ブラジル 255

9.5.2.1 急速な高齢化と医療インフラの拡大が市場成長を促進 255

9.5.3 メキシコ 259

9.5.3.1 慢性疾患の高い有病率が市場を牽引 259

9.5.4 アルゼンチン 263

9.5.4.1 医療インフラの進歩が市場を牽引 263

9.5.5 その他のラテンアメリカ地域 267

9.6 中東・アフリカ 271

9.6.1 マクロ経済見通し 272

9.6.2 GCC諸国 277

9.6.2.1 堅調なヘルスケア産業が市場を牽引 277

9.6.3 その他の中東・アフリカ地域 282

10 競争環境 287

10.1 概要 287

10.2 主要企業が採用した戦略 287

10.3 市場上位企業の売上シェア分析 290

10.4 市場シェア分析 291

10.5 企業評価マトリックス:主要プレーヤー 293

10.5.1 スター企業 293

10.5.2 新興リーダー 293

10.5.3 浸透型プレーヤー 294

10.5.4 参加企業 294

10.5.5 企業フットプリント:主要企業(2023年) 295

10.5.5.1 企業フットプリント 295

10.5.5.2 地域別フットプリント 296

10.5.5.3 製品フットプリント 297

10.5.5.4 アプリケーションフットプリント 298

10.5.5.5 エンドユーザーのフットプリント 299

10.6 企業評価マトリクス:新興企業/SM(2023年) 300

10.6.1 進歩的企業 300

10.6.2 対応力のある企業 300

10.6.3 ダイナミック企業 300

10.6.4 スターティング・ブロック 300

10.6.5 競争ベンチマーキング:新興企業/SM、2023年 302

10.7 競争シナリオ 303

10.7.1 製品の上市と承認 303

10.7.2 取引 304

10.7.3 事業拡大 306

10.7.4 その他の開発 307

10.8 ブランド/製品の比較 308

10.9 主要企業の研究開発評価 309

10.10 企業評価と財務指標 309

10.10.1 財務指標 309

10.10.2 企業評価 310

11 会社プロファイル 311

11.1 主要企業 311

11.1.1 エノビス(旧コルファックス) 311

11.1.1.1 事業概要 311

11.1.1.2 提供製品 312

11.1.1.3 最近の動向 317

11.1.1.3.1 製品の発売 317

11.1.1.3.2 取引 318

11.1.1.3.3 事業拡大 318

11.1.1.3.4 その他の展開 319

11.1.1.4 MnMの見解 319

11.1.1.4.1 勝利への権利 319

11.1.1.4.2 戦略的選択 320

11.1.1.4.3 弱点と競争上の脅威 320

11.1.2 ZIMMER MEDIZINSYSTEME GMBH 321

11.1.2.1 事業概要 321

11.1.2.2 提供製品 321

11.1.2.3 最近の動向 323

11.1.2.3.1 製品の発売 323

11.1.2.3.2 取引 323

11.1.2.3.3 その他の動向 324

11.1.2.4 MnMの見解 324

11.1.2.4.1 勝利への権利 324

11.1.2.4.2 戦略的選択 324

11.1.2.4.3 弱点と競争上の脅威 324

11.1.3 ザイネックス 325

11.1.3.1 事業概要 325

11.1.3.2 提供製品 326

11.1.3.3 最近の動向 327

11.1.3.3.1 製品の上市と承認 327

11.1.3.3.2 取引 328

11.1.3.3.3 事業拡大 328

11.1.3.3.4 その他の展開 329

11.1.3.4 MnMの見解 329

11.1.3.4.1 勝利への権利 329

11.1.3.4.2 戦略的選択 329

11.1.3.4.3 弱点と競争上の脅威 329

11.1.4 パフォーマンス・ヘルス(マディソン・ディアボーン・パートナーズの子会社) 330

11.1.4.1 事業概要 330

11.1.4.2 提供製品 330

11.1.4.3 最近の動向 337

11.1.4.3.1 製品の発売 337

11.1.4.3.2 取引 337

11.1.4.3.3 その他の動向 338

11.1.4.4 MnMの見解 339

11.1.4.4.1 勝利への権利 339

11.1.4.4.2 戦略的選択 339

11.1.4.4.3 弱点と競争上の脅威 339

11.1.5 伊藤忠商事 340

11.1.5.1 事業概要 340

11.1.5.2 提供製品 340

11.1.5.3 MnMの見解 342

11.1.5.3.1 勝利への権利 342

11.1.5.3.2 戦略的選択 342

11.1.5.3.3 弱点と競争上の脅威 342

11.1.6 ダイナトロニクス 343

11.1.6.1 事業概要 343

11.1.6.2 提供製品 344

11.1.6.3 最近の動向 346

11.1.6.3.1 製品の発売 346

11.1.6.3.2 取引 347

11.1.7 BTLインダストリーズ 348

11.1.7.1 事業概要 348

11.1.7.2 提供製品 348

11.1.7.3 最近の動向 349

11.1.7.3.1 取引 349

11.1.7.3.2 事業拡大 350

11.1.7.3.3 その他の展開 350

11.1.8 エンラフ・ノニウス・ビー・ヴィ 351

11.1.8.1 事業概要 351

11.1.8.2 提供製品 351

11.1.8.3 最近の動向 353

11.1.8.3.1 取引 353

11.1.9 エムズフィジオ(株 354

11.1.9.1 事業概要 354

11.1.9.2 提供製品 354

11.1.10 メクトロニック・メディカル 356

11.1.10.1 事業概要 356

11.1.10.2 提供製品 356

11.1.11 ホワイトホール製造 358

11.1.11.1 事業概要 358

11.1.11.2 製品 358

11.1.12 リッチマー(コンパス・ヘルス・ブランドの子会社) 360

11.1.12.1 事業概要 360

11.1.12.2 提供製品 360

11.1.12.3 最近の動向 362

11.1.12.3.1 製品の発売 362

11.1.12.3.2 取引 362

11.1.13 ライフケアシステムズ 363

11.1.13.1 事業概要 363

11.1.13.2 提供製品 363

11.1.14 ストルツメディカル 367

11.1.14.1 事業概要 367

11.1.14.2 提供製品 367

11.1.14.3 最近の展開 368

11.1.14.3.1 製品の発売 368

11.1.14.3.2 取引 368

11.1.14.3.3 事業拡大 369

11.1.15 メトラーエレクトロニクス 370

11.1.15.1 事業概要 370

11.1.15.2 提供製品 370

11.1.16 アルジオス 372

11.1.16.1 事業概要 372

11.1.16.2 提供製品 372

11.1.16.3 最近の開発 373

11.1.16.3.1 取引 373

11.1.17 ジムナ・インターナショナル 374

11.1.17.1 事業概要 374

11.1.17.2 提供製品 374

11.1.17.3 最近の動向 375

11.1.17.3.1 製品の発売 375

11.1.18 HMSメディカルシステムズ 376

11.1.18.1 事業概要 376

11.1.18.2 提供製品 376

11.1.18.3 最近の開発 378

11.1.18.3.1 製品の発売 378

11.1.19 アスター 380

11.1.19.1 事業概要 380

11.1.19.2 提供製品 380

11.1.20 エンビトロンS.R.O.(サーティコングループ会社) 382

11.1.20.1 事業概要 382

11.1.20.2 提供製品 382

11.1.20.3 最近の動向 382

11.1.20.3.1 その他の開発 382

11.2 その他のプレーヤー 383

11.2.1 Physiomed Elektromedizin ag (旧Proxomed) 383

11.2.2 テクノボディ 384

384 11.2.3 クールシステムズ・インク 385

11.2.4 ジョハリ・デジタル 385

11.2.5 パウエルメディック 386

12 付録 387

12.1 ディスカッションガイド 387

12.2 Knowledgestore: Marketsandmarketsの購読ポータル 391

12.3 カスタマイズオプション 393

12.4 関連レポート 393

12.5 著者の詳細 394

Lifestyle factors, such as lack of exercise and poor dieting, compounded by an ageing population, explain the growth of chronic illnesses like arthritis and cardiovascular diseases. The rehabilitation requirements increase correspondingly. Concomitantly, the increased number of rehabilitation requirements leads to an upsurge in demands for physiotherapy equipment in the management of older people in terms of mobility and pain relief. The market is also driven by several other factors such as rise in technological advancements, rising R&D spending, increased awareness, the need for personalised physiotherapy equipments and expansion in economy of emerging countries.

“The electrotherapy segment from the physiotherapy equipment segment accounted for the largest share during the forecast period.”

Types of electrotherapy used in physiotherapy include TENS (Transcutaneous Electrical Nerve Stimulation), IFT (Interferential Therapy), EMS (Electrical Muscle Stimulation), PENS (Percutaneous Electrical Nerve Stimulation), and Therapeutic Ultrasound. Electrotherapy offers a range of non-invasive treatments that may generate significant relief from body pain and nerve pain, acceleration of healing in musculoskeletal injuries, improvement of blood circulation, wound healing, and muscle spasm relaxation-all with a minimum to no side effect. Moreover, the ease with which patients can now receive treatments has been greatly increased by the introduction of compact and portable electrotherapy devices. Additionally, the treatment outcomes of patients have improved due to enabling of patients to receive personalised care.

“The Musculoskeletal applications segment accounted for the largest share, by application during the forecast period."

Musculoskeletal physiotherapy can treat injuries such as ligament sprains, muscle strains, arthritis, cartilage tears, and support pre/post-surgery and fracture rehabilitation, as well as back pain. Factors that might explain the increase in musculoskeletal injuries include ageing and greater participation in physical activity and sports, sedentary lifestyles that contribute to poor posture and weak muscles, obesity, as well as repetitive strain from particular jobs or activities and an increasingly common incidence of chronic conditions like arthritis. The incidence of these injuries has also been exacerbated by an increase in road accidents and industrial injuries, particularly in industries that require physical labour.

“North America accounted for the largest share, by region and APAC is estimated to register the highest CAGR during the forecast period.”

The physiotherapy equipment market is segmented into five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa, and the GCC Countries. North America had largest share in the physiotherapy equipment market for a number of key considerations. Its advanced healthcare system, compounded by a robust reimbursement system such as Medicare, supports the deployment of advanced physiotherapy equipment for the population. Robust regulatory systems in the US facilitate the development and introduction of high-quality physiotherapy equipment, ensuring that these devices meet stringent safety and efficacy standards for optimal patient care.

The Asia Pacific is witnessed to have the highest CAGR during the forecast period. Many APAC countries, including Japan, South Korea, and China, are witnessing rapid aging in their population. Also, there is increased healthcare expenditure in rising economies such as India, Thailand and Malaysia. Therefore, high population with rising chronic illnesses and increased spending on health are the reasons for its high growth.

A breakdown of the primary participants (supply-side) for the Physiotherapy equipment market referred to for this report is provided below:

• By Company Type: Tier 1–35%, Tier 2–40%, and Tier 3–25%

• By Designation: C-level–20%, Director Level–35%, and Others–45%

• By Region: North America–27%, Europe–25%, Asia Pacific–30%, ROW- 8% .

The prominent players in the Physiotherapy Equipment market are Enovis Corp. (US), BTL Industries (UK), Performance Health (US), ITO Co., Ltd. (Japan), Enraf-Nonius B.V. (Netherlands), Dynatronics Corporation (US), Mectronic Medicale (Italy), EMS Physio Ltd. (UK), Whitehall Manufacturing (US), Zimmer MedizinSysteme GmbH (Germany), Zynex Inc, (US), Richmar (US), Life Care Systems (India), Storz Medical AG (Germany), Mettler Electronics Corp (US), Algeos (UK), Gymna (Belgium), Astar (Poland), HMS Medical Systems (India), Embitron s.r.o (Czech Republic), Physiomed Elektromedizin AG (Germany), Tecnobody (Italy), Johari Digitals (India), PowerMedic (Denmark), and CoolSystems Inc. (US).

Research Coverage

This report studies the Physiotherapy Equipment Market based on products, applications, end-users and region. The report also analyses factors (such as drivers, restraints, opportunities and challenges) affecting market growth. It evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micro markets concerning their growth trends, prospects, and contributions to the total Physiotherapy Equipment Market. The report forecasts the revenue of the market segments to five major regions.

Reasons to Buy the Report

This report also includes.

• Analysis of key drivers (rapid aging, technological advancements), restraints (unstable reimbursement scenario), challenges (alternate therapies), and opportunities (rise in home healthcare services) contributing to the growth of the Physiotherapy Equipment Market.

• Product Development/Innovation: Detailed insights on upcoming trends, research & development activities, in the Physiotherapy Equipment Market.

• Market Development: Comprehensive information on the lucrative emerging markets by products, applications, end-users and region.

• Market Diversification: Exhaustive information about the growing geographies, recent developments, and investments in the Physiotherapy Equipment Market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, company evaluation quadrant, and capabilities of leading players in the global Physiotherapy Equipment Market.

1 INTRODUCTION 34

1.1 STUDY OBJECTIVES 34

1.2 MARKET DEFINITION 34

1.3 MARKET SCOPE 34

1.3.1 INCLUSIONS AND EXCLUSIONS 34

1.3.2 MARKETS COVERED 35

1.3.3 YEARS CONSIDERED 36

1.4 CURRENCY CONSIDERED 36

1.5 STAKEHOLDERS 37

1.6 SUMMARY OF CHANGES 37

2 RESEARCH METHODOLOGY 39

2.1 RESEARCH APPROACH 39

2.1.1 SECONDARY DATA 40

2.1.1.1 Key data from secondary sources 41

2.1.2 PRIMARY DATA 41

2.1.2.1 Key data from primary sources 42

2.1.2.2 Key industry insights 43

2.2 MARKET SIZE ESTIMATION 45

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 50

2.4 RESEARCH ASSUMPTIONS 51

2.5 RESEARCH LIMITATIONS 51

2.5.1 METHODOLOGY-RELATED LIMITATIONS 51

2.5.2 SCOPE-RELATED LIMITATIONS 51

2.6 RISK ANALYSIS 52

3 EXECUTIVE SUMMARY 53

4 PREMIUM INSIGHTS 56

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHYSIOTHERAPY EQUIPMENT MARKET 56

4.2 ASIA PACIFIC: PHYSIOTHERAPY EQUIPMENT MARKET, BY END USER AND COUNTRY 57

4.3 PHYSIOTHERAPY EQUIPMENT MARKET, BY KEY COUNTRIES 58

4.4 PHYSIOTHERAPY EQUIPMENT MARKET, BY REGION 58

4.5 PHYSIOTHERAPY EQUIPMENT MARKET: DEVELOPED VS. EMERGING MARKETS 59

5 MARKET OVERVIEW 60

5.1 INTRODUCTION 60

5.2 MARKET DYNAMICS 61

5.2.1 DRIVERS 61

5.2.1.1 Rapidly growing geriatric population and increasing instances of chronic diseases 61

5.2.1.2 Growing incidence of sports injuries, degenerative joint disorders, and cerebrovascular diseases 62

5.2.1.3 Rising demand for rehabilitation care 63

5.2.1.4 Growing demand for home-based and telerehabilitation care 63

5.2.2 RESTRAINTS 64

5.2.2.1 Unstable reimbursement scenario for physiotherapy 64

5.2.2.2 Issue in direct access to physiotherapy 64

5.2.3 OPPORTUNITIES 65

5.2.3.1 Large population in emerging economies 65

5.2.3.2 Technological advancements 66

5.2.4 CHALLENGES 66

5.2.4.1 Shortage of skilled personnel 66

5.2.4.2 Acupuncture and other alternative therapies 66

5.3 PORTER'S FIVE FORCES ANALYSIS 67

5.3.1 THREAT OF NEW ENTRANTS 68

5.3.2 THREAT OF SUBSTITUTES 68

5.3.3 BARGAINING POWER OF SUPPLIERS 68

5.3.4 BARGAINING POWER OF BUYERS 68

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 69

5.4 INDUSTRY TRENDS 69

5.4.1 INTEGRATION OF INTERNET OF THINGS IN PHYSIOTHERAPY EQUIPMENT 69

5.4.2 TECHNOLOGICAL ADVANCEMENTS IN PHYSIOTHERAPY EQUIPMENT 70

5.5 VALUE CHAIN ANALYSIS 70

5.6 TECHNOLOGY ANALYSIS 71

5.6.1 KEY TECHNOLOGIES 71

5.6.1.1 Robotic instruments 71

5.6.1.2 Artificial intelligence and machine learning 72

5.6.1.3 Virtual physiotherapy 72

5.6.2 COMPLEMENTARY TECHNOLOGIES 72

5.6.2.1 Augmented reality 72

5.6.3 ADJACENT TECHNOLOGIES 73

5.6.3.1 Wearable sensors 73

5.7 REGULATORY LANDSCAPE 73

5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 73

5.7.2 REGULATORY FRAMEWORK 74

5.7.2.1 North America 74

5.7.2.1.1 US 74

5.7.2.1.2 Canada 75

5.7.2.2 Europe 75

5.7.2.3 Asia Pacific 75

5.7.2.3.1 Japan 75

5.7.2.3.2 China 76

5.7.2.3.3 India 77

5.8 PATENT ANALYSIS 77

5.8.1 PATENT PUBLICATION TRENDS FOR PHYSIOTHERAPY EQUIPMENT 77

5.8.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS 78

5.9 TRADE ANALYSIS 80

5.10 PRICING ANALYSIS 82

5.11 KEY CONFERENCES AND EVENTS DURING 2024-2025 84

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA 84

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS 84

5.12.2 BUYING CRITERIA 85

5.13 END USER EXPECTATIONS IN PHYSIOTHERAPY EQUIPMENT MARKET 86

5.14 ADJACENT MARKET ANALYSIS 86

5.15 ECOSYSTEM ANALYSIS 87

5.16 CASE STUDY ANALYSIS 88

5.16.1 CASE STUDY 1: STARTOON LABS RECEIVED USFDA APPROVAL FOR PHEEZEE PHYSIOTHERAPY DEVICE 88

5.16.2 CASE STUDY 2: UKNHS TO LAUNCH AI-DRIVEN PHYSIOTHERAPY CLINIC 89

5.16.3 CASE STUDY 3: BURJEEL AND LEEJAM LAUNCHED PHYSIOTHERABIA IN RIYADH 90

5.17 SUPPLY CHAIN ANALYSIS 90

5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 91

5.19 INVESTMENT AND FUNDING SCENARIO 92

5.20 REIMBURSEMENT SCENARIO 92

5.21 IMPACT OF GENERATIVE AI ON PHYSIOTHERAPY EQUIPMENT MARKET 93

6 PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT 94

6.1 INTRODUCTION 95

6.2 EQUIPMENT 95

6.2.1 ELECTROTHERAPY EQUIPMENT 98

6.2.1.1 Neuromuscular electrical stimulation and therapeutic electrical stimulation to be used in rehabilitation settings 98

6.2.2 ULTRASOUND EQUIPMENT 102

6.2.2.1 Ultrasound equipment to have major applications in connective tissue therapies 102

6.2.3 EXERCISE THERAPY EQUIPMENT 105

6.2.3.1 Awareness of advantages of therapeutic exercises to drive segmental growth 105

6.2.4 HEAT THERAPY EQUIPMENT 107

6.2.4.1 Heat therapy recognized as leading treatment for arthritis 107

6.2.5 CRYOTHERAPY EQUIPMENT 110

6.2.5.1 Rising popularity of wellness and fitness to drive segmental growth 110

6.2.6 COMBINATION THERAPY EQUIPMENT 112

6.2.6.1 Wide application across different patient population to drive segmental growth 112

6.2.7 CONTINUOUS PASSIVE MOTION THERAPY EQUIPMENT 115

6.2.7.1 Increasing number of reconstructive joint surgeries to drive segmental growth 115

6.2.8 SHOCKWAVE THERAPY EQUIPMENT 117

6.2.8.1 Non-surgical therapy used to treat various indications causing acute or chronic pain 117

6.2.9 LASER THERAPY EQUIPMENT 121

6.2.9.1 Versatile tool used for physical therapy 121

6.2.10 TRACTION THERAPY EQUIPMENT 123

6.2.10.1 Growing cases of non-traumatic spinal cord injuries to drive demand 123

6.2.11 MAGNETIC PRESSURE THERAPY EQUIPMENT 125

6.2.11.1 Therapeutic effectiveness of magnetotherapy to be lower than other physical therapies 125

6.2.12 OTHER PHYSIOTHERAPY EQUIPMENT 127

6.3 ACCESSORIES 129

6.3.1 PHYSIOTHERAPY FURNITURE 131

6.3.1.1 Used for physical therapy, rehab, occupational therapy, sports medicine, and chiropractic medicine 131

6.3.2 OTHER ACCESSORIES 133

7 PHYSIOTHERAPY EQUIPMENT MARKET, BY APPLICATION 136

7.1 INTRODUCTION 137

7.2 MUSCULOSKELETAL 138

7.2.1 RISING INCIDENCE OF MUSCULOSKELETAL DISORDERS TO DRIVE GROWTH 138

7.3 NEUROLOGICAL 140

7.3.1 INCREASING INCIDENCE OF NEUROLOGICAL DISORDERS TO DRIVE GROWTH 140

7.4 CARDIOVASCULAR & PULMONARY 142

7.4.1 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES TO DRIVE GROWTH 142

7.5 PEDIATRIC 144

7.5.1 PEDIATRIC PHYSIOTHERAPY TO PROMOTE ACTIVITY AND PARTICIPATION IN EVERYDAY ROUTINES 144

7.6 GYNECOLOGICAL 146

7.6.1 GYNECOLOGICAL SEGMENT TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD 146

7.7 OTHER APPLICATIONS 149

8 PHYSIOTHERAPY EQUIPMENT MARKET, BY END USER 151

8.1 INTRODUCTION 152

8.2 PHYSIOTHERAPY & REHABILITATION CENTERS 153

8.2.1 RISING INCIDENCE OF SPORTS INJURIES AND DISABILITIES TO DRIVE SEGMENTAL GROWTH 153

8.3 HOSPITALS 155

8.3.1 GROWING PATIENT VOLUMES AT HOSPITALS TO DRIVE SEGMENTAL GROWTH 155

8.4 HOME CARE SETTINGS 157

8.4.1 RISING DEMAND FOR HOME CARE TO DRIVE SEGMENTAL GROWTH 157

8.5 PHYSICIANS’ OFFICES 159

8.5.1 FIRST POINT OF CONTACT FOR MANAGEMENT OF HEALTH PROBLEMS 159

8.6 OTHER END USERS 161

9 PHYSIOTHERAPY EQUIPMENT MARKET, BY REGION 164

9.1 INTRODUCTION 165

9.2 NORTH AMERICA 166

9.2.1 MACROECONOMIC OUTLOOK 167

9.2.2 US 172

9.2.2.1 To dominate North American market during forecast period 172

9.2.3 CANADA 177

9.2.3.1 Growing penetration of preventive care services to boost market 177

9.3 EUROPE 182

9.3.1 MACROECONOMIC OUTLOOK 183

9.3.2 GERMANY 188

9.3.2.1 Rising geriatric population and increase in chronic conditions to drive demand 188

9.3.3 UK 193

9.3.3.1 Wide acceptance of physical therapy to increase adoption of physiotherapy equipment 193

9.3.4 FRANCE 198

9.3.4.1 Rising healthcare expenditure and favorable reimbursement scenario to drive market 198

9.3.5 ITALY 202

9.3.5.1 Increasing incidence of fall injuries and orthopedic disorders to drive market 202

9.3.6 SPAIN 207

9.3.6.1 Rising geriatric population to drive adoption of physiotherapy equipment 207

9.3.7 REST OF EUROPE 211

9.4 ASIA PACIFIC 216

9.4.1 MACROECONOMIC OUTLOOK 222

9.4.2 JAPAN 223

9.4.2.1 Large geriatric population to drive adoption of physiotherapy equipment 223

9.4.3 CHINA 227

9.4.3.1 Fitness plans by government to drive market 227

9.4.4 INDIA 232

9.4.4.1 Expansion of new acute care settings to drive demand 232

9.4.5 AUSTRALIA 237

9.4.5.1 Growing population and rising cases of chronic musculoskeletal conditions to drive market 237

9.4.6 SOUTH KOREA 241

9.4.6.1 Fast-growing aging population and rising medical tourism to drive market 241

9.4.7 REST OF ASIA PACIFIC 245

9.5 LATIN AMERICA 249

9.5.1 MACROECONOMIC OUTLOOK 254

9.5.2 BRAZIL 255

9.5.2.1 Rapidly aging population and expanding healthcare infrastructure to augment market growth 255

9.5.3 MEXICO 259

9.5.3.1 High prevalence rates of chronic conditions to drive market 259

9.5.4 ARGENTINA 263

9.5.4.1 Advancements in healthcare infrastructure to drive market 263

9.5.5 REST OF LATIN AMERICA 267

9.6 MIDDLE EAST & AFRICA 271

9.6.1 MACROECONOMIC OUTLOOK 272

9.6.2 GCC COUNTRIES 277

9.6.2.1 ROBUST HEALTHCARE INDUSTRY TO DRIVE MARKET 277

9.6.3 REST OF MIDDLE EAST & AFRICA 282

10 COMPETITIVE LANDSCAPE 287

10.1 OVERVIEW 287

10.2 STRATEGIES ADOPTED BY KEY PLAYERS 287

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS 290

10.4 MARKET SHARE ANALYSIS 291

10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS 293

10.5.1 STARS 293

10.5.2 EMERGING LEADERS 293

10.5.3 PERVASIVE PLAYERS 294

10.5.4 PARTICIPANTS 294

10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 295

10.5.5.1 Company footprint 295

10.5.5.2 Region footprint 296

10.5.5.3 Product footprint 297

10.5.5.4 Application footprint 298

10.5.5.5 End user footprint 299

10.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023 300

10.6.1 PROGRESSIVE COMPANIES 300

10.6.2 RESPONSIVE COMPANIES 300

10.6.3 DYNAMIC COMPANIES 300

10.6.4 STARTING BLOCKS 300

10.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023 302

10.7 COMPETITIVE SCENARIO 303

10.7.1 PRODUCT LAUNCHES AND APPROVALS 303

10.7.2 DEALS 304

10.7.3 EXPANSIONS 306

10.7.4 OTHER DEVELOPMENTS 307

10.8 BRAND/PRODUCT COMPARISON 308

10.9 R&D ASSESSMENT OF KEY PLAYERS 309

10.10 COMPANY VALUATION AND FINANCIAL METRICS 309

10.10.1 FINANCIAL METRICS 309

10.10.2 COMPANY VALUATION 310

11 COMPANY PROFILES 311

11.1 KEY PLAYERS 311

11.1.1 ENOVIS (FORMERLY COLFAX) 311

11.1.1.1 Business overview 311

11.1.1.2 Products offered 312

11.1.1.3 Recent developments 317

11.1.1.3.1 Product launches 317

11.1.1.3.2 Deals 318

11.1.1.3.3 Expansions 318

11.1.1.3.4 Other developments 319

11.1.1.4 MnM view 319

11.1.1.4.1 Right to win 319

11.1.1.4.2 Strategic choices 320

11.1.1.4.3 Weaknesses & competitive threats 320

11.1.2 ZIMMER MEDIZINSYSTEME GMBH 321

11.1.2.1 Business overview 321

11.1.2.2 Products offered 321

11.1.2.3 Recent developments 323

11.1.2.3.1 Product launches 323

11.1.2.3.2 Deals 323

11.1.2.3.3 Other developments 324

11.1.2.4 MnM view 324

11.1.2.4.1 Right to win 324

11.1.2.4.2 Strategic choices 324

11.1.2.4.3 Weaknesses & competitive threats 324

11.1.3 ZYNEX, INC. 325

11.1.3.1 Business overview 325

11.1.3.2 Products offered 326

11.1.3.3 Recent developments 327

11.1.3.3.1 Product launches and approvals 327

11.1.3.3.2 Deals 328

11.1.3.3.3 Expansions 328

11.1.3.3.4 Other developments 329

11.1.3.4 MnM view 329

11.1.3.4.1 Right to win 329

11.1.3.4.2 Strategic choices 329

11.1.3.4.3 Weaknesses & competitive threats 329

11.1.4 PERFORMANCE HEALTH (SUBSIDIARY OF MADISON DEARBORN PARTNERS) 330

11.1.4.1 Business overview 330

11.1.4.2 Products offered 330

11.1.4.3 Recent developments 337

11.1.4.3.1 Product launches 337

11.1.4.3.2 Deals 337

11.1.4.3.3 Other developments 338

11.1.4.4 MnM view 339

11.1.4.4.1 Right to win 339

11.1.4.4.2 Strategic choices 339

11.1.4.4.3 Weaknesses & competitive threats 339

11.1.5 ITO CO., LTD. 340

11.1.5.1 Business overview 340

11.1.5.2 Products offered 340

11.1.5.3 MnM view 342

11.1.5.3.1 Right to win 342

11.1.5.3.2 Strategic choices 342

11.1.5.3.3 Weaknesses & competitive threats 342

11.1.6 DYNATRONICS CORPORATION 343

11.1.6.1 Business overview 343

11.1.6.2 Products offered 344

11.1.6.3 Recent developments 346

11.1.6.3.1 Product launches 346

11.1.6.3.2 Deals 347

11.1.7 BTL INDUSTRIES 348

11.1.7.1 Business overview 348

11.1.7.2 Products offered 348

11.1.7.3 Recent developments 349

11.1.7.3.1 Deals 349

11.1.7.3.2 Expansions 350

11.1.7.3.3 Other developments 350

11.1.8 ENRAF-NONIUS B.V. 351

11.1.8.1 Business overview 351

11.1.8.2 Products offered 351

11.1.8.3 Recent developments 353

11.1.8.3.1 Deals 353

11.1.9 EMS PHYSIO LTD. 354

11.1.9.1 Business overview 354

11.1.9.2 Products offered 354

11.1.10 MECTRONIC MEDICALE 356

11.1.10.1 Business overview 356

11.1.10.2 Products offered 356

11.1.11 WHITEHALL MANUFACTURING 358

11.1.11.1 Business overview 358

11.1.11.2 Products offered 358

11.1.12 RICHMAR (SUBSIDIARY OF COMPASS HEALTH BRANDS) 360

11.1.12.1 Business overview 360

11.1.12.2 Products offered 360

11.1.12.3 Recent developments 362

11.1.12.3.1 Product launches 362

11.1.12.3.2 Deals 362

11.1.13 LIFE CARE SYSTEMS 363

11.1.13.1 Business overview 363

11.1.13.2 Products offered 363

11.1.14 STORZ MEDICAL AG 367

11.1.14.1 Business overview 367

11.1.14.2 Products offered 367

11.1.14.3 Recent developments 368

11.1.14.3.1 Product launches 368

11.1.14.3.2 Deals 368

11.1.14.3.3 Expansions 369

11.1.15 METTLER ELECTRONICS CORP. 370

11.1.15.1 Business overview 370

11.1.15.2 Products offered 370

11.1.16 ALGEOS 372

11.1.16.1 Business overview 372

11.1.16.2 Products offered 372

11.1.16.3 Recent developments 373

11.1.16.3.1 Deals 373

11.1.17 GYMNA INTERNATIONAL 374

11.1.17.1 Business overview 374

11.1.17.2 Products offered 374

11.1.17.3 Recent developments 375

11.1.17.3.1 Product launches 375

11.1.18 HMS MEDICAL SYSTEMS 376

11.1.18.1 Business overview 376

11.1.18.2 Products offered 376

11.1.18.3 Recent developments 378

11.1.18.3.1 Product launches 378

11.1.19 ASTAR 380

11.1.19.1 Business overview 380

11.1.19.2 Products offered 380

11.1.20 EMBITRON S.R.O. (A CERTICON GROUP COMPANY) 382

11.1.20.1 Business overview 382

11.1.20.2 Products offered 382

11.1.20.3 Recent developments 382

11.1.20.3.1 Other developments 382

11.2 OTHER PLAYERS 383

11.2.1 PHYSIOMED ELEKTROMEDIZIN AG (FORMERLY PROXOMED) 383

11.2.2 TECNOBODY 384

11.2.3 COOLSYSTEMS, INC. 385

11.2.4 JOHARI DIGITAL 385

11.2.5 POWERMEDIC 386

12 APPENDIX 387

12.1 DISCUSSION GUIDE 387

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 391

12.3 CUSTOMIZATION OPTIONS 393

12.4 RELATED REPORTS 393

12.5 AUTHOR DETAILS 394

❖ 世界の理学療法機器市場に関するよくある質問(FAQ) ❖

・理学療法機器の世界市場規模は?

→MarketsandMarkets社は2024年の理学療法機器の世界市場規模を201.3億米ドルと推定しています。

・理学療法機器の世界市場予測は?

→MarketsandMarkets社は2029年の理学療法機器の世界市場規模を270.3億米ドルと予測しています。

・理学療法機器市場の成長率は?

→MarketsandMarkets社は理学療法機器の世界市場が2024年~2029年に年平均6.1%成長すると予測しています。

・世界の理学療法機器市場における主要企業は?

→MarketsandMarkets社は「Enovis Corp. (US), BTL Industries (UK), Performance Health (US), ITO Co., Ltd. (Japan), Enraf-Nonius B.V. (Netherlands), Dynatronics Corporation (US), Mectronic Medicale (Italy), EMS Physio Ltd. (UK), Whitehall Manufacturing (US), Zimmer MedizinSysteme GmbH (Germany), Zynex Inc, (US), Richmar (US), Life Care Systems (India), Storz Medical AG (Germany), Mettler Electronics Corp (US), Algeos (UK), Gymna (Belgium), Astar (Poland), HMS Medical Systems (India), Embitron s.r.o (Czech Republic), Physiomed Elektromedizin AG (Germany), Tecnobody (Italy), Johari Digitals (India), PowerMedic (Denmark), and CoolSystems Inc. (US)など ...」をグローバル理学療法機器市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。