1 はじめに

1.1 調査目的 25

1.2 市場の定義 25

1.3 調査範囲 26

1.3.1 対象市場 26

1.3.2 調査の対象および対象外 26

1.3.3 考慮した年数 27

1.3.4 通貨

1.3.5 単位

1.4 制限事項 28

1.5 利害関係者 28

2 調査方法 29

2.1 調査データ 29

2.1.1 二次データ 30

2.1.1.1 二次資料からの主要データ 30

2.1.2 一次データ 30

2.1.2.1 一次資料からの主なデータ 31

2.1.2.2 主要な一次情報源 31

2.1.2.3 一次インタビューの主な参加者 31

2.1.2.4 専門家へのインタビューの内訳 32

2.1.2.5 主要な業界インサイト 32

2.2 ベースナンバーの算出 33

2.2.1 供給側分析 33

2.2.2 需要サイド分析 33

2.3 成長予測 33

2.3.1 供給サイド 33

2.3.2 需要サイド 34

2.4 市場規模の推定 34

2.4.1 ボトムアップアプローチ 35

2.4.2 トップダウンアプローチ 35

2.5 データの三角測量 36

2.6 リサーチの前提 37

2.7 成長予測 37

2.8 リスク評価 38

2.9 要因分析 39

3 エグゼクティブ・サマリー 40

4 プレミアムインサイト 44

4.1 再生テレフタル酸(rTPA)市場におけるプレーヤーの魅力的な機会 44

4.2 再生テレフタル酸(rTPA)市場、プロセス別 44

4.3 再生テレフタル酸(rTPA)市場:最終用途産業別 45

4.4 再生テレフタル酸(rTPA)市場:主要国別 45

5 市場の概要 46

5.1 はじめに 46

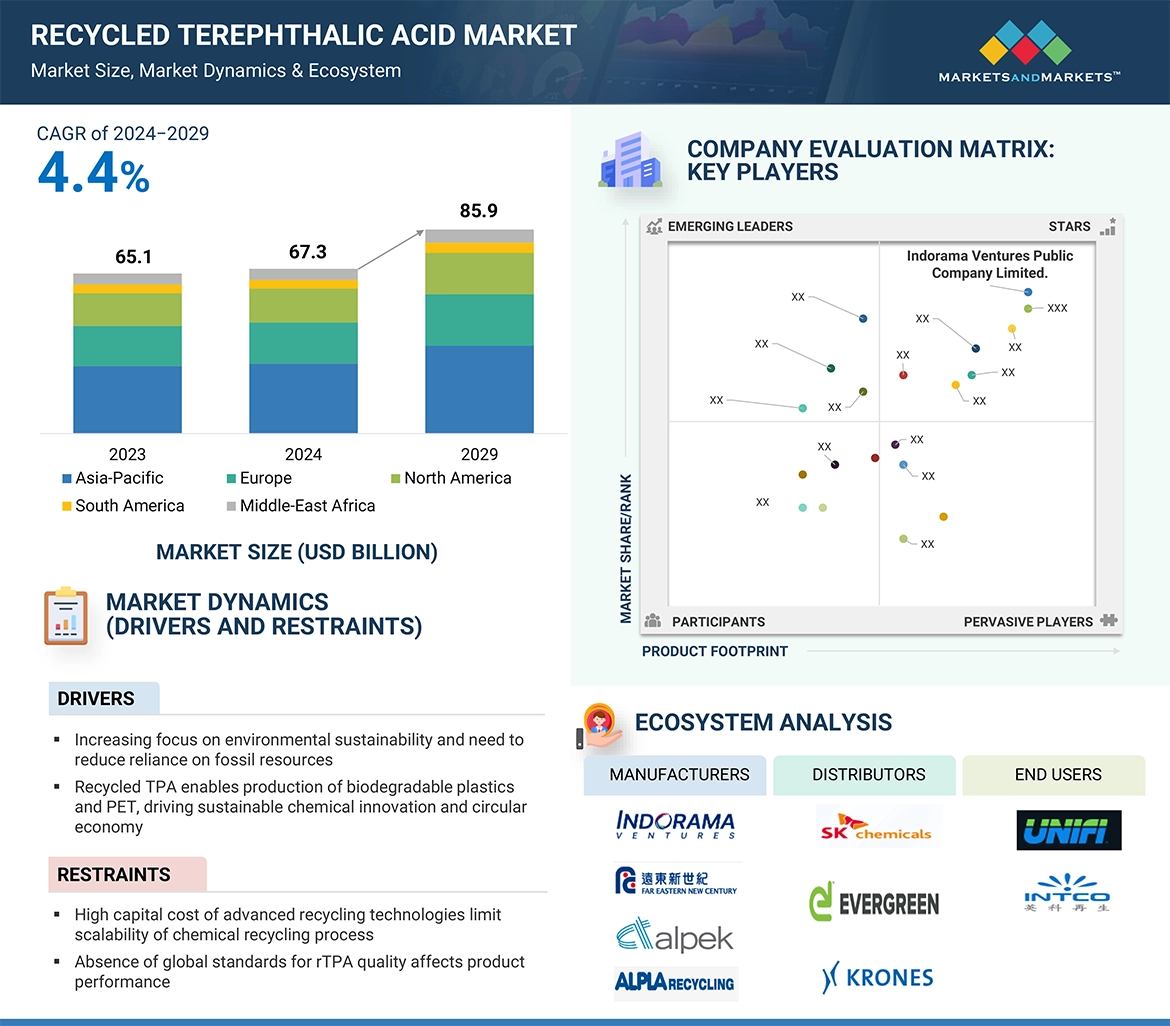

5.2 市場ダイナミクス 46

5.2.1 推進要因 47

5.2.1.1 環境の持続可能性への関心の高まりと化石資源への依存を減らす必要性 47

化石資源への依存を減らす必要性の高まり 47

5.2.1.2 リサイクルTPA は生分解性プラスチックやPET の製造を可能にし、持続可能な化学技術革新と環

PETの生産を可能にし、持続可能な化学革新と循環型経済を促進 47

5.2.2 阻害要因 48

5.2.2.1 先進的リサイクル技術の資本コストが高く、ケミカルリサイク ルプロセスの拡張性が制限される 48

ケミカル・リサイクル・プロセスの拡張性 48

5.2.2.2 rTPA 品質に関する世界標準の不在は製品性能に影響 48

5.2.3 機会 49

5.2.3.1 ファッションと繊維産業におけるrPET需要の増加は持続可能なrTPA生産の機会を提供 49

5.2.3.2 ケミカルリサイクル技術の進歩は、高純度のrTPA を生産する機会

に匹敵する高純度のrTPA を生産する機会。

5.2.4 課題 50

5.2.4.1 現在のリサイクル技術における課題は、着色プラスチックや混合プラスチックの効率的な処理を制限する 50

5.3 ジェネレーティブAI 50

5.3.1 導入 50

5.4 再生テレフタル酸(rTPA)市場における生成AIの影響 51

6 業界動向 52

6.1 はじめに 52

6.2 顧客ビジネスに影響を与えるトレンド/混乱 52

6.3 サプライチェーン分析 53

6.4 投資と資金調達のシナリオ 55

6.5 価格分析 56

6.5.1 平均販売価格動向(地域別) 56

6.5.2 平均販売価格動向:プロセス別 57

6.5.3 主要企業の平均販売価格動向(プロセス別) 57

6.6 エコシステム分析 58

6.7 技術分析 60

6.7.1 主要技術 60

6.7.2 補完的技術 61

6.7.3 隣接技術 61

6.8 特許分析 62

6.8.1 方法論 62

6.8.2 付与特許 62

6.8.2.1 特許公開動向 62

6.8.3 洞察 63

6.8.4 法的地位 63

6.8.5 管轄区域分析 63

6.8.6 上位出願者 64

6.9 貿易分析 67

6.9.1 輸入シナリオ(HSコード2917360) 67

6.9.2 輸出シナリオ(HSコード2917360) 68

6.10 主要会議・イベント(2024-2025年) 68

6.11 関税、規格、規制の状況 68

6.11.1 関税分析 69

6.11.2 規制機関、政府機関、その他の組織 69

6.11.3 標準規格 72

6.12 ポーターの5つの力分析 73

6.12.1 新規参入の脅威 74

6.12.2 代替品の脅威 75

6.12.3 供給者の交渉力 75

6.12.4 買い手の交渉力 75

6.12.5 競合の激しさ 76

6.13 主要ステークホルダーと購買基準 76

6.13.1 購入プロセスにおける主要ステークホルダー 76

6.13.2 購入基準 77

6.14 マクロ経済見通し 78

6.14.1 GDPの動向と予測(国別) 78

6.15 ケーススタディ分析 79

6.15.1 ケーススタディ1:使用後のペットポリマーボトルからリサイクルされたテレフタル酸モノマーの特性評価 79

6.15.2 ケーススタディ 2: テレフタル酸モノマー製造のための再生ポリエチレンテレフタレートプラスチックの酸加水分解 80

テレフタル酸 80

7 再生テレフタル酸(rTPA)市場、プロセス別 81

7.1 導入 82

7.2 加水分解 84

7.2.1 ペット廃棄物からの効率的かつ持続可能なテレフタル酸回収技術の進歩が市場を牽引 84

7.3 熱分解 84

7.3.1 混合ペットや汚染ペットの効果的なリサイクルが可能 84

7.4 その他のプロセス 85

7.4.1 解糖 85

7.4.2 酢酸分解 85

8 再生テレフタル酸(rTPA)市場、用途別 86

8.1 はじめに 87

8.2 繊維 88

8.2.1 繊維および工業用途の持続可能なポリエステル繊維製造への応用が市場を牽引 88

8.3 樹脂 89

8.3.1 多業種にわたる持続可能なポリエステル樹脂生産におけるRTPA の利用が市場を牽引 89

8.4 フィルム 89

8.4.1 高機能フィルム生産におけるRTpaの利用が市場成長を支える 89

市場の成長を支える 89

8.5 その他の用途 90

8.5.1 シート 90

8.5.2 ボトル 90

9 再生テレフタル酸(rTPA)市場:最終用途産業別 91

9.1 はじめに 92

9.2 繊維 94

9.2.1 ファッション産業における持続可能性へのニーズが市場を牽引 94

9.3 自動車 94

9.3.1 軽量素材の需要と自動車性能の向上が市場を牽引 94

9.4 建設 95

9.4.1 環境に優しい建設材料への需要の高まりが市場を牽引

が市場を牽引 95

9.5 包装 95

9.5.1 プラスチック廃棄物を最小限に抑える持続可能な包装への需要 95

9.6 その他の最終用途産業 96

9.6.1 消費財 96

9.6.2 エレクトロニクス 96

10 再生テレフタル酸(rTPA)市場:地域別 97

10.1 はじめに 98

10.2 アジア太平洋地域 100

10.2.1 中国 106

10.2.1.1 規制要件の増加と公害・廃棄物管理に対する社会的意識の高まりが市場を牽引 106

10.2.2 日本 107

10.2.2.1 高度な廃棄物管理とリサイクル技術がrTPAの利用を促進 107

10.2.3 インド 109

10.2.3.1 大規模なポリエステル生産がrTPAの必要性を増大 109

10.2.4 韓国 111

10.2.4.1 高品質素材の研究開発への多額の投資が市場成長を支える 111

10.2.5 その他のアジア太平洋地域 113

10.3 北米 114

10.3.1 米国 119

10.3.1.1 環境に優しいペットボトル需要の増加が市場を牽引 119

10.3.2 カナダ 121

10.3.2.1 政府によるプラスチックリサイクルの義務付けが食品・飲料包装へのrTPA の採用を促進 121

10.3.3 メキシコ 123

10.3.3.1 リサイクルと持続可能性の促進を目指す政府の取り組みが市場を後押し 123

10.4 欧州 124

10.4.1 ドイツ 130

10.4.1.1 強力なリサイクルインフラとrTPA の使用を強制するEU 規制が市場成長を支える 130

の利用が市場成長を支える 130

10.4.2 イタリア 131

10.4.2.1 大規模なファッション・繊維産業が市場を牽引 131

10.4.3 フランス 133

10.4.3.1 プラスチック廃棄物削減のための循環型経済への大規模投資 133

10.4.4 イギリス 135

10.4.4.1 プラスチック汚染抑制のための強力な規制枠組みがrTPAの使用を促進 135

の利用を促進するための強力な規制枠組み 135

10.4.5 スペイン 136

10.4.5.1 エネルギー効率の高い建物のためのrTPA を組み込んだ持続可能な建設製品の採用

を組み込んだ持続可能な建設製品の採用が市場を促進 136

10.4.6 ロシア 138

10.4.6.1 持続可能な高性能消費財素材市場の成長が市場を牽引 138

市場を牽引 138

10.4.7 その他のヨーロッパ 140

10.5 中東・アフリカ 141

10.5.1 GCC諸国 146

10.5.1.1 サウジアラビア 146

10.5.1.1.1 ビジョン2030構想に後押しされた持続可能な高性能消費財市場の拡大 146

10.5.1.2 ウアイ 148

10.5.1.2.1 戦略的立地と経済の多様化が市場成長を支える 148

10.5.1.3 その他のGCC諸国 150

10.5.2 南アフリカ 151

10.5.2.1 燃費規制による軽量自動車部品でのrTPA使用の増加 151

10.5.3 中東・アフリカのその他地域 153

10.6 南米 155

10.6.1 アルゼンチン 159

10.6.1.1 リサイクル素材の採用を促す環境負荷低減のための国家キャンペーン 159

10.6.2 ブラジル 161

10.6.2.1 グローバルブランドのサーキュラーファッションとアップサイクル繊維製造へのシフトが市場を促進 161

10.6.3 その他の南米地域 162

11 競争環境 165

11.1 はじめに 165

11.2 主要プレーヤーの戦略/勝利への権利 165

11.3 市場シェア分析 167

11.4 収益分析 170

11.5 企業評価マトリックス:主要プレイヤー(2023年) 170

11.5.1 スター企業 170

11.5.2 新興リーダー 171

11.5.3 浸透型プレーヤー 171

11.5.4 参加企業 171

11.5.5 企業フットプリント:主要プレイヤー(2023年) 172

11.5.5.1 企業フットプリント 172

11.5.5.2 プロセスフットプリント 173

11.5.5.3 アプリケーションフットプリント 173

11.5.5.4 最終用途産業のフットプリント 174

11.5.5.5 地域別フットプリント 174

11.6 企業評価マトリックス:新興企業/SM(2023年) 175

11.6.1 進歩的企業 175

11.6.2 対応力のある企業 175

11.6.3 ダイナミックな企業 175

175 11.6.4 スタートアップ・ブロック 175

11.6.5 競争ベンチマーキング:新興企業/SM(2023年) 177

11.6.5.1 主要新興企業/中小企業の詳細リスト 177

11.6.5.2 主要新興企業/SMEの競合ベンチマーキング 178

11.7 ブランド/製品の比較分析 179

11.8 企業評価と財務指標 181

11.8.1 企業評価 181

11.8.2 財務指標 181

11.9 競争シナリオ 182

11.9.1 取引 182

11.9.2 拡張 184

12 企業プロファイル 186

Indorama Ventures Public Company Limited. (Thailand)

Alpek S.A.B. de C.V. (Mexico)

SUEZ (France)

ALPLA (Austria)

Unifi Inc. (US)

SK chemicals (South Korea)

Krones AG (Germany)

Far Eastern New Century Corporation (Taiwan)

Biffa (England)

Plastipak Holdings Inc. (US)

13 付録 229

13.1 ディスカッション・ガイド 229

13.2 Knowledgestore: マーケットサ ンドマーケッツの購読ポータル 232

13.3 カスタマイズオプション 234

13.4 関連レポート 234

13.5 著者の詳細 235

The growth factors for the recycled terephthalic acid market is good, driven by growing environmental regulations, high sustainability trends, and the global shift toward a more circular economy. More severe regulation is being laid down by governments across the globe to minimize plastic waste and ensure recycling, whereas consumers are becoming keen on more environmentally friendly products in the areas of packaging, textiles, and the automotive industry that push demand for recycled terephthalic acid.

“Hydrolysis accounted for the fastest growing share in process segment of Recyceled terephthalic acid market in terms of value.”

Hydrolysis is also likely to be the process with the highest growth rate in the rTA market because it is an efficient and scalable process, capable of producing highly pure TPA. The chemical recycling method includes breaking down PET waste into its monomers, such as TPA and ethylene glycol (EG), by applying water and catalysts under controlled temperature and pressure. It produces high-grade TPA and is highly efficient. This gives it an edge over other methods when pure recycled material is required, like the packaging and textiles industries. Hydrolysis is favored by urgent conditions of sustainable requirements and therefore reliance on producing high-grade recycled materials. This trend in the packaging and textiles industries to use more recycled content-in addition to regulatory mandates-plays toward sustaining future demand.

“Resins accounted for the fastest growing in application segment of Recyceled terephthalic acid market in terms of value.”

Resins are likely to witness the highest growth rate in the recycled terephthalic acid market because of their widespread usage across various industries, along with growing demand for sustainable alternatives against virgin plastics. Recycled terephthalic acid is a critical raw material for rPET resins, which finds wide applicability in packaging, mainly in bottles and containers. Increasing stress on reduction of plastic waste along with regulatory frameworks encouraging recycling have been able to boost the adoption of rPET in manufacturers, which has led to the growth in resin applications in the recycled terephthalic acid market. Particularly, the packaging industry is a great input for this demand. Companies are looking for rPET resins as consumers and regulatory bodies are increasing their interest in sustainable packaging solutions.

“Packaging accounted for the fastest growing in end-use industry segment of Recyceled terephthalic acid market in terms of value.”

Packaging industry will be one of the fastest-growing end-use industries in the market for rTA as the demand for sustainable solutions for packaging will grow and more stringent regulations reduce plastic waste. Recycled terephthalic acid is one of the most important raw materials used to manufacture rPET, which has different applications related to packaging, including bottles, containers, and films. Around the world, governments are keen on enhancing the recycling rate and use of recycled material in packaging production. Therefore, manufacturers have embraced rPET, which has increased the demand for recycled terephthalic acid. Demand from the packaging industry for recycled terephthalic acid has also increased due to growing consumers' preference for environmental products.

“Asia pacific is the fastest growing market for Recyceled terephthalic acid.”

Asia-Pacific will grow fast, mainly due to rapid industrialization, tight environmental legislations, and high PET consumption in the region. Most countries, including China, India, Japan, and South Korea, have enormous demands for recycled products as part of their more comprehensive efforts to eradicate plastic wastes and encourage sustainable development. In addition, advancement of chemical recycling technologies within the region with recycling infrastructure investments drives the market further. This is coupled with large amounts of PET waste, supportive government policies, and corporate sustainability goals. Asia-Pacific will be key growth region in the rTA market, thus ensuring its position as the region with the highest growth.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Recyceled terephthalic acid market, and information was gathered from secondary research to determine and verify the market size of several segments.

• By Company Type: Tier 1 – 50%, Tier 2 – 30%, and Tier 3 – 20%

• By Designation: Managers– 15%, Directors – 20%, and Others – 65%

• By Region: North America – 25%, Europe – 30%, APAC – 35%, the Middle East & Africa –5%, and South America- 5%

The Recyceled terephthalic acid market comprises major players Indorama Ventures Public Company Limited. (Thailand), Alpek S.A.B. de C.V. (Mexico), SUEZ (France), ALPLA (Austria), Unifi, Inc. (US), SK chemicals (South Korea), Krones AG (Germany), Far Eastern New Century Corporation (Taiwan), Biffa (England), Plastipak Holdings, Inc. (US). The study includes in-depth competitive analysis of these key players in the Recyceled terephthalic acid market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for Recyceled terephthalic acid market on the basis of grade, function, application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for Recyceled terephthalic acid market.

Key benefits of buying this report

This research report is focused on various levels of analysis — industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Recyceled terephthalic acid market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

•Analysis of drivers: (Increasing focus on environmental sustainability and need to reduce reliance on fossil resources, Recycled TPA enables production of biodegradable plastics and PET, driving sustainable chemical innovation and circular economy), restraints (High capital cost of advanced recycling technologies limit scalability of chemical recycling process), opportunities (Rising demand for rPET in the fashion and textile industries presents opportunities for sustainable rTPA production), and challenges (Challenges in current recycling technologies limit efficient processing of colored and blended plastics) influencing the growth of Recyceled terephthalic acid market.

•Market Penetration: Comprehensive information on the Recyceled terephthalic acid market offered by top players in the global Recyceled terephthalic acid market.

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, in the Recyceled terephthalic acid market.

•Market Development: Comprehensive information about lucrative emerging markets the report analyzes the markets for Recyceled terephthalic acid market across regions.

•Market Capacity: Production capacities of companies producing Recyceled terephthalic acid are provided wherever available with upcoming capacities for the Recyceled terephthalic acid market.

•Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Recyceled terephthalic acid market.

1 INTRODUCTION 25

1.1 STUDY OBJECTIVES 25

1.2 MARKET DEFINITION 25

1.3 STUDY SCOPE 26

1.3.1 MARKETS COVERED 26

1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY 26

1.3.3 YEARS CONSIDERED 27

1.3.4 CURRENCY CONSIDERED 27

1.3.5 UNITS CONSIDERED 28

1.4 LIMITATIONS 28

1.5 STAKEHOLDERS 28

2 RESEARCH METHODOLOGY 29

2.1 RESEARCH DATA 29

2.1.1 SECONDARY DATA 30

2.1.1.1 Key data from secondary sources 30

2.1.2 PRIMARY DATA 30

2.1.2.1 Key data from primary sources 31

2.1.2.2 Key primary sources 31

2.1.2.3 Key participants for primary interviews 31

2.1.2.4 Breakdown of interviews with experts 32

2.1.2.5 Key industry insights 32

2.2 BASE NUMBER CALCULATION 33

2.2.1 SUPPLY-SIDE ANALYSIS 33

2.2.2 DEMAND-SIDE ANALYSIS 33

2.3 GROWTH FORECAST 33

2.3.1 SUPPLY SIDE 33

2.3.2 DEMAND SIDE 34

2.4 MARKET SIZE ESTIMATION 34

2.4.1 BOTTOM-UP APPROACH 35

2.4.2 TOP-DOWN APPROACH 35

2.5 DATA TRIANGULATION 36

2.6 RESEARCH ASSUMPTIONS 37

2.7 GROWTH FORECAST 37

2.8 RISK ASSESSMENT 38

2.9 FACTOR ANALYSIS 39

3 EXECUTIVE SUMMARY 40

4 PREMIUM INSIGHTS 44

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RECYCLED TEREPHTHALIC ACID MARKET 44

4.2 RECYCLED TEREPHTHALIC ACID MARKET, BY PROCESS 44

4.3 RECYCLED TEREPHTHALIC ACID MARKET, BY END-USE INDUSTRY 45

4.4 RECYCLED TEREPHTHALIC ACID MARKET, BY KEY COUNTRY 45

5 MARKET OVERVIEW 46

5.1 INTRODUCTION 46

5.2 MARKET DYNAMICS 46

5.2.1 DRIVERS 47

5.2.1.1 Increasing focus on environmental sustainability and need to

reduce reliance on fossil resources 47

5.2.1.2 Recycled TPA enables production of biodegradable plastics and

PET, driving sustainable chemical innovation and circular economy 47

5.2.2 RESTRAINTS 48

5.2.2.1 High capital cost of advanced recycling technologies limits

scalability of chemical recycling process 48

5.2.2.2 Absence of global standards for rTPA quality affects product performance 48

5.2.3 OPPORTUNITIES 49

5.2.3.1 Rising demand for rPET in fashion and textile industries presents opportunities for sustainable rTPA production 49

5.2.3.2 Advances in chemical recycling technologies present opportunity

for producing high-purity rTPA comparable to virgin TPA 49

5.2.4 CHALLENGES 50

5.2.4.1 Challenges in current recycling technologies limit efficient processing of colored and blended plastics 50

5.3 GENERATIVE AI 50

5.3.1 INTRODUCTION 50

5.4 IMPACT OF GENERATIVE AI ON RECYCLED TEREPHTHALIC ACID MARKET 51

6 INDUSTRY TRENDS 52

6.1 INTRODUCTION 52

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 52

6.3 SUPPLY CHAIN ANALYSIS 53

6.4 INVESTMENT AND FUNDING SCENARIO 55

6.5 PRICING ANALYSIS 56

6.5.1 AVERAGE SELLING PRICE TREND, BY REGION 56

6.5.2 AVERAGE SELLING PRICE TREND, BY PROCESS 57

6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PROCESS 57

6.6 ECOSYSTEM ANALYSIS 58

6.7 TECHNOLOGY ANALYSIS 60

6.7.1 KEY TECHNOLOGIES 60

6.7.2 COMPLEMENTARY TECHNOLOGIES 61

6.7.3 ADJACENT TECHNOLOGIES 61

6.8 PATENT ANALYSIS 62

6.8.1 METHODOLOGY 62

6.8.2 GRANTED PATENTS 62

6.8.2.1 Patent publication trends 62

6.8.3 INSIGHTS 63

6.8.4 LEGAL STATUS 63

6.8.5 JURISDICTION ANALYSIS 63

6.8.6 TOP APPLICANTS 64

6.9 TRADE ANALYSIS 67

6.9.1 IMPORT SCENARIO (HS CODES 2917360) 67

6.9.2 EXPORT SCENARIO (HS CODES 2917360) 68

6.10 KEY CONFERENCES AND EVENTS, 2024–2025 68

6.11 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPE 68

6.11.1 TARIFF ANALYSIS 69

6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 69

6.11.3 STANDARDS 72

6.12 PORTER’S FIVE FORCES ANALYSIS 73

6.12.1 THREAT OF NEW ENTRANTS 74

6.12.2 THREAT OF SUBSTITUTES 75

6.12.3 BARGAINING POWER OF SUPPLIERS 75

6.12.4 BARGAINING POWER OF BUYERS 75

6.12.5 INTENSITY OF COMPETITIVE RIVALRY 76

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA 76

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS 76

6.13.2 BUYING CRITERIA 77

6.14 MACROECONOMIC OUTLOOK 78

6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY 78

6.15 CASE STUDY ANALYSIS 79

6.15.1 CASE STUDY 1: CHARACTERIZATION OF TEREPHTHALIC ACID MONOMER RECYCLED FROM POST-CONSUMER PET POLYMER BOTTLES 79

6.15.2 CASE STUDY 2: ACIDIC HYDROLYSIS OF RECYCLED POLYETHYLENE TEREPHTHALATE PLASTIC FOR PRODUCTION OF MONOMER

TEREPHTHALIC ACID 80

7 RECYCLED TEREPHTHALIC ACID MARKET, BY PROCESS 81

7.1 INTRODUCTION 82

7.2 HYDROLYSIS 84

7.2.1 ADVANCEMENTS IN TECHNOLOGY FOR EFFICIENT AND SUSTAINABLE RECOVERY OF TEREPHTHALIC ACID FROM PET WASTE TO PROPEL MARKET 84

7.3 PYROLYSIS 84

7.3.1 ENABLES EFFECTIVE RECYCLING OF MIXED AND CONTAMINATED PET 84

7.4 OTHER PROCESSES 85

7.4.1 GLYCOLYSIS 85

7.4.2 ACETOLYSIS 85

8 RECYCLED TEREPHTHALIC ACID MARKET, BY APPLICATION 86

8.1 INTRODUCTION 87

8.2 FIBERS 88

8.2.1 APPLICATION IN SUSTAINABLE POLYESTER FIBER PRODUCTION FOR TEXTILES AND INDUSTRIAL USES TO DRIVE MARKET 88

8.3 RESINS 89

8.3.1 UTILIZATION OF RTPA IN SUSTAINABLE POLYESTER RESIN PRODUCTION ACROSS MULTIPLE INDUSTRIES TO PROPEL MARKET 89

8.4 FILMS 89

8.4.1 UTILIZATION OF RTPA IN HIGH-PERFORMANCE FILM PRODUCTION

TO SUPPORT MARKET GROWTH 89

8.5 OTHER APPLICATIONS 90

8.5.1 SHEETS 90

8.5.2 BOTTLES 90

9 RECYCLED TEREPHTHALIC ACID MARKET, BY END-USE INDUSTRY 91

9.1 INTRODUCTION 92

9.2 TEXTILE 94

9.2.1 NEED FOR SUSTAINABILITY IN FASHION INDUSTRY TO DRIVE MARKET 94

9.3 AUTOMOTIVE 94

9.3.1 DEMAND FOR LIGHTWEIGHT MATERIALS AND IMPROVED VEHICLE PERFORMANCE TO PROPEL MARKET 94

9.4 CONSTRUCTION 95

9.4.1 RISING DEMAND FOR ECO-FRIENDLY CONSTRUCTION MATERIALS

TO DRIVE MARKET 95

9.5 PACKAGING 95

9.5.1 DEMAND FOR SUSTAINABLE PACKAGING TO MINIMIZE PLASTIC WASTE 95

9.6 OTHER END-USE INDUSTRIES 96

9.6.1 CONSUMER GOODS 96

9.6.2 ELECTRONICS 96

10 RECYCLED TEREPHTHALIC ACID MARKET, BY REGION 97

10.1 INTRODUCTION 98

10.2 ASIA PACIFIC 100

10.2.1 CHINA 106

10.2.1.1 Increased regulatory requirements and public awareness of pollution and waste management to drive market 106

10.2.2 JAPAN 107

10.2.2.1 Advanced waste management and recycling technologies to encourage use of rTPA 107

10.2.3 INDIA 109

10.2.3.1 Large-scale polyester production amplifies need for rTPA 109

10.2.4 SOUTH KOREA 111

10.2.4.1 Significant investment in R&D for high-quality materials to support market growth 111

10.2.5 REST OF ASIA PACIFIC 113

10.3 NORTH AMERICA 114

10.3.1 US 119

10.3.1.1 Increasing demand for eco-friendly plastic bottles to propel market 119

10.3.2 CANADA 121

10.3.2.1 Government mandates for plastic recycling encourage adoption of rTPA in food & beverage packaging 121

10.3.3 MEXICO 123

10.3.3.1 Government initiatives aimed at promoting recycling and sustainability to propel market 123

10.4 EUROPE 124

10.4.1 GERMANY 130

10.4.1.1 Strong recycling infrastructure and EU regulations enforcing rTPA

use to support market growth 130

10.4.2 ITALY 131

10.4.2.1 Large fashion and textile industries to drive market 131

10.4.3 FRANCE 133

10.4.3.1 Large-scale investments in circular economy practices to reduce plastic waste 133

10.4.4 UK 135

10.4.4.1 Strong regulatory frameworks to curb plastic pollution to drive use

of rTPA 135

10.4.5 SPAIN 136

10.4.5.1 Adoption of sustainable construction products incorporating rTPA

for energy-efficient buildings to propel market 136

10.4.6 RUSSIA 138

10.4.6.1 Growing market for sustainable, high-performance consumer

goods materials to drive market 138

10.4.7 REST OF EUROPE 140

10.5 MIDDLE EAST & AFRICA 141

10.5.1 GCC COUNTRIES 146

10.5.1.1 Saudi Arabia 146

10.5.1.1.1 Growing market for sustainable, high-performance consumer goods fueled by Vision 2030 initiatives to propel market 146

10.5.1.2 UAE 148

10.5.1.2.1 Strategic location and economic diversification to support market growth 148

10.5.1.3 Rest of GCC countries 150

10.5.2 SOUTH AFRICA 151

10.5.2.1 Growing use of rTPA in lightweight automotive components to fuel efficiency regulations 151

10.5.3 REST OF MIDDLE EAST & AFRICA 153

10.6 SOUTH AMERICA 155

10.6.1 ARGENTINA 159

10.6.1.1 National campaigns to reduce environmental impact to encourage adoption of recycled materials 159

10.6.2 BRAZIL 161

10.6.2.1 Shift toward circular fashion and upcycled textile manufacturing for global brands to propel market 161

10.6.3 REST OF SOUTH AMERICA 162

11 COMPETITIVE LANDSCAPE 165

11.1 INTRODUCTION 165

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 165

11.3 MARKET SHARE ANALYSIS 167

11.4 REVENUE ANALYSIS 170

11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 170

11.5.1 STARS 170

11.5.2 EMERGING LEADERS 171

11.5.3 PERVASIVE PLAYERS 171

11.5.4 PARTICIPANTS 171

11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 172

11.5.5.1 Company footprint 172

11.5.5.2 Process footprint 173

11.5.5.3 Application footprint 173

11.5.5.4 End-use industry footprint 174

11.5.5.5 Region footprint 174

11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 175

11.6.1 PROGRESSIVE COMPANIES 175

11.6.2 RESPONSIVE COMPANIES 175

11.6.3 DYNAMIC COMPANIES 175

11.6.4 STARTING BLOCKS 175

11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 177

11.6.5.1 Detailed list of key startups/SMEs 177

11.6.5.2 Competitive benchmarking of key startups/SMEs 178

11.7 BRAND/PRODUCT COMPARATIVE ANALYSIS 179

11.8 COMPANY VALUATION AND FINANCIAL METRICS 181

11.8.1 COMPANY VALUATION 181

11.8.2 FINANCIAL METRICS 181

11.9 COMPETITIVE SCENARIO 182

11.9.1 DEALS 182

11.9.2 EXPANSIONS 184

12 COMPANY PROFILES 186

12.1 KEY PLAYERS 186

12.1.1 INDORAMA VENTURES PUBLIC COMPANY LIMITED 186

12.1.1.1 Business overview 186

12.1.1.2 Products offered 187

12.1.1.3 Recent developments 188

12.1.1.3.1 Deals 188

12.1.1.3.2 Expansions 188

12.1.1.3.3 Other developments 189

12.1.1.4 MnM view 189

12.1.1.4.1 Key strengths 189

12.1.1.4.2 Strategic choices 190

12.1.1.4.3 Weaknesses and competitive threats 190

12.1.2 ALPEK S.A.B. DE C.V. 191

12.1.2.1 Business overview 191

12.1.2.2 Products offered 192

12.1.2.3 Recent developments 193

12.1.2.3.1 Deals 193

12.1.2.3.2 Other developments 193

12.1.2.4 MnM view 194

12.1.2.4.1 Key strengths 194

12.1.2.4.2 Strategic choices 194

12.1.2.4.3 Weaknesses and competitive threats 194

12.1.3 SUEZ 195

12.1.3.1 Business overview 195

12.1.3.2 Products offered 196

12.1.3.3 Recent developments 197

12.1.3.3.1 Deals 197

12.1.3.3.2 Other developments 197

12.1.3.4 MnM view 197

12.1.3.4.1 Key strengths 197

12.1.3.4.2 Strategic choices 198

12.1.3.4.3 Weaknesses and competitive threats 198

12.1.4 ALPLA 199

12.1.4.1 Business overview 199

12.1.4.2 Products offered 199

12.1.4.3 Recent developments 200

12.1.4.3.1 Expansions 200

12.1.4.4 MnM view 200

12.1.4.4.1 Key strengths 200

12.1.4.4.2 Strategic choices 201

12.1.4.4.3 Weaknesses and competitive threats 201

12.1.5 UNIFI, INC. 202

12.1.5.1 Business overview 202

12.1.5.2 Products offered 203

12.1.5.3 MnM view 203

12.1.5.3.1 Key strengths 203

12.1.5.3.2 Strategic choices 203

12.1.5.3.3 Weaknesses and competitive threats 203

12.1.6 SK CHEMICALS 204

12.1.6.1 Business overview 204

12.1.6.2 Products offered 205

12.1.6.3 Recent developments 206

12.1.6.3.1 Deals 206

12.1.6.4 MnM view 206

12.1.6.4.1 Key strengths 206

12.1.6.4.2 Strategic choices 206

12.1.6.4.3 Weaknesses and competitive threats 206

12.1.7 FAR EASTERN NEW CENTURY CORPORATION 207

12.1.7.1 Business overview 207

12.1.7.2 Products offered 208

12.1.7.3 Recent developments 208

12.1.7.3.1 Expansions 208

12.1.7.3.2 Other developments 209

12.1.7.4 MnM view 209

12.1.7.4.1 Key strengths 209

12.1.7.4.2 Strategic choices 209

12.1.7.4.3 Weaknesses and competitive threats 209

12.1.8 BIFFA 210

12.1.8.1 Business overview 210

12.1.8.2 Products offered 210

12.1.8.3 Recent developments 211

12.1.8.3.1 Deals 211

12.1.8.4 MnM view 211

12.1.8.4.1 Key strengths 211

12.1.8.4.2 Strategic choices 212

12.1.8.4.3 Weaknesses and competitive threats 212

12.1.9 PLASTIPAK HOLDINGS, INC. 213

12.1.9.1 Business overview 213

12.1.9.2 Products offered 213

12.1.9.3 Recent developments 214

12.1.9.3.1 Deals 214

12.1.9.3.2 Expansions 214

12.1.9.4 MnM view 215

12.1.9.4.1 Key strengths 215

12.1.9.4.2 Strategic choices 215

12.1.9.4.3 Weaknesses and competitive threats 215

12.1.10 VISY 216

12.1.10.1 Business overview 216

12.1.10.2 Products offered 216

12.1.10.3 MnM view 217

12.1.10.3.1 Key strengths 217

12.1.10.3.2 Strategic choices 217

12.1.10.3.3 Weaknesses and competitive threats 217

12.2 OTHER PLAYERS 218

12.2.1 MARGLEN INDUSTRIES 218

12.2.2 CARBIOS 219

12.2.3 POLYQUEST, INC. 220

12.2.4 EVERGREEN 221

12.2.5 DEPOLY 222

12.2.6 REVALYU RESOURCES GMBH 223

12.2.7 EKOPET 224

12.2.8 LOOP INDUSTRIES, INC. 225

12.2.9 TERRACLE 226

12.2.10 INTCO 227

12.2.11 GOREWISE 228

13 APPENDIX 229

13.1 DISCUSSION GUIDE 229

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 232

13.3 CUSTOMIZATION OPTIONS 234

13.4 RELATED REPORTS 234

13.5 AUTHOR DETAILS 235

❖ 世界の再生テレフタル酸(rTPA)市場に関するよくある質問(FAQ) ❖

・再生テレフタル酸(rTPA)の世界市場規模は?

→MarketsandMarkets社は2024年の再生テレフタル酸(rTPA)の世界市場規模を23.4億米ドルと推定しています。

・再生テレフタル酸(rTPA)の世界市場予測は?

→MarketsandMarkets社は2029年の再生テレフタル酸(rTPA)の世界市場規模を29.0億米ドルと予測しています。

・再生テレフタル酸(rTPA)市場の成長率は?

→MarketsandMarkets社は再生テレフタル酸(rTPA)の世界市場が2024年~2029年に年平均4.4%成長すると予測しています。

・世界の再生テレフタル酸(rTPA)市場における主要企業は?

→MarketsandMarkets社は「Indorama Ventures Public Company Limited. (Thailand)、Alpek S.A.B. de C.V. (Mexico)、SUEZ (France)、ALPLA (Austria)、Unifi、Inc. (US)、SK chemicals (South Korea)、Krones AG (Germany)、Far Eastern New Century Corporation (Taiwan)、Biffa (England)、Plastipak Holdings、Inc. (US)など ...」をグローバル再生テレフタル酸(rTPA)市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。