1 はじめに 32

1.1 調査目的 32

1.2 市場の定義 32

1.3 調査範囲 33

1.3.1 市場セグメンテーションと地域範囲 33

1.3.2 含むものと含まないもの 34

1.3.3 考慮した年数 35

1.4 考慮した通貨 35

1.5 単位の考慮 35

1.6 利害関係者 35

1.7 変更点のまとめ 36

2 調査方法 37

2.1 調査データ 37

2.1.1 二次データ 38

2.1.1.1 主要な二次情報源のリスト 38

2.1.1.2 二次資料からの主要データ 38

2.1.2 一次データ 39

2.1.2.1 一次資料からの主要データ 39

2.1.2.2 主要な一次インタビュー参加者のリスト 40

2.1.2.3 主要な業界インサイト 40

2.1.2.4 専門家へのインタビューの内訳 40

2.2 市場規模の推定 41

2.2.1 ボトムアップアプローチ 41

2.2.2 トップダウンアプローチ 42

2.3 予測数の算出 42

2.4 データの三角測量 43

2.5 要因分析 44

2.6 前提条件 45

2.7 限界とリスク 45

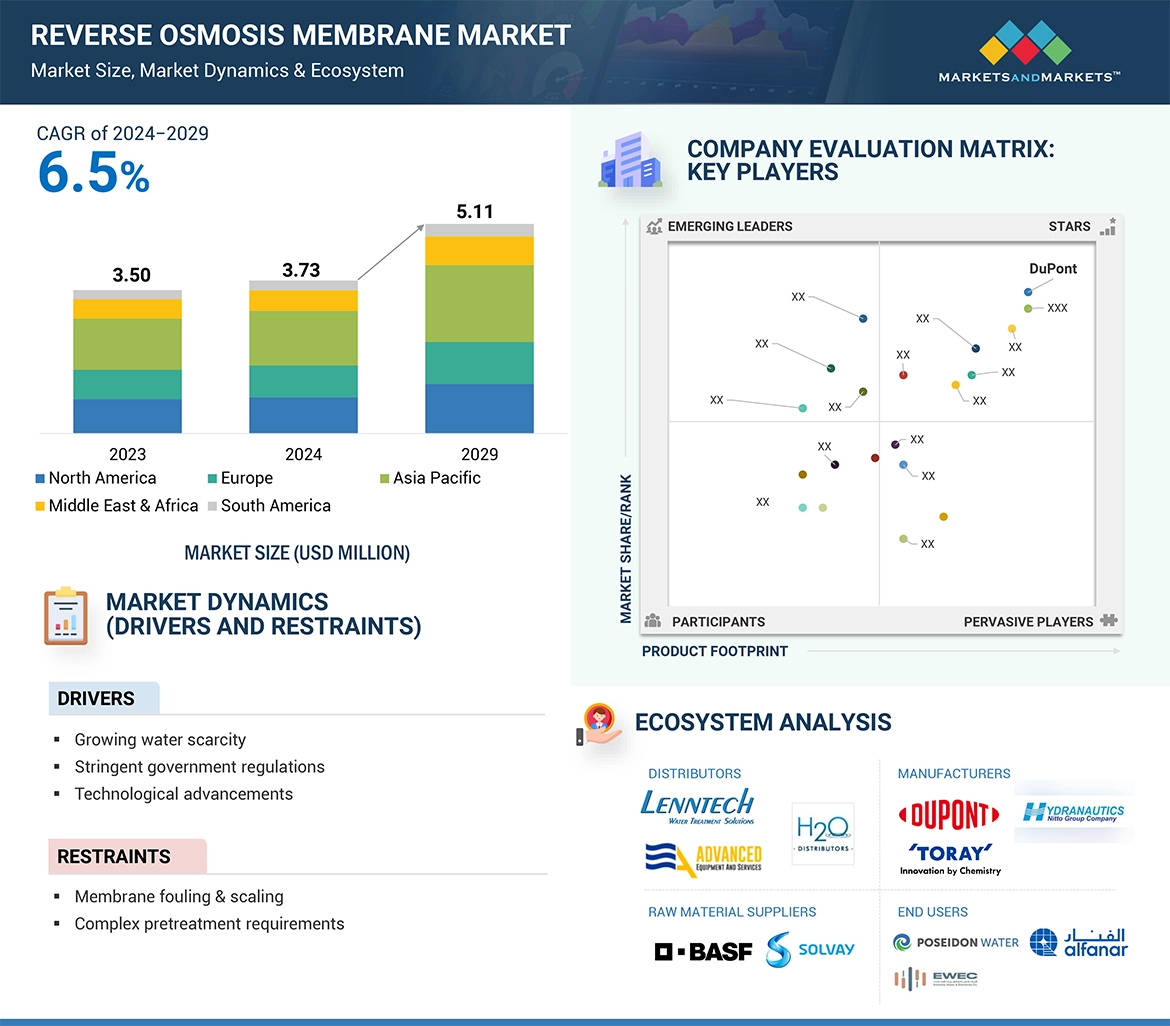

3 エグゼクティブ・サマリー 46

4 プレミアム・インサイト 51

4.1 逆浸透膜市場における

逆浸透膜市場 51

4.2 逆浸透膜市場、タイプ別 51

4.3 逆浸透膜市場:フィルターモジュール別 52

4.4 逆浸透膜市場:用途別 52

4.5 逆浸透膜市場:最終用途産業別 53

4.6 逆浸透膜市場:主要国別 53

5 市場の概要 54

5.1 導入 54

5.2 市場ダイナミクス 54

5.2.1 推進要因 55

5.2.1.1 淡水不足の増大 55

5.2.1.2 水質と廃水処理に関する厳しい基準の実施 57

5.2.1.3 逆浸透膜の技術進歩 58

5.2.2 阻害要因 58

5.2.2.1 膜のファウリングとスケーリング 58

5.2.2.2 ろ過に必要な複雑な前処理 58

5.2.3 機会 59

5.2.3.1 新興国による水処理需要の増加 59

5.2.3.2 工業用途における汚染物質除去の必要性 59

5.2.4 課題 59

5.2.4.1 ブラインの廃棄物としての排出 59

5.2.4.2 高いエネルギー消費と運転コスト 60

5.3 ポーターの5つの力分析 60

5.3.1 新規参入による脅威 61

5.3.2 代替品の脅威 61

5.3.3 供給業者の交渉力 61

5.3.4 買い手の交渉力 61

5.3.5 競合の激しさ 62

5.4 主要ステークホルダーと購買基準 63

5.4.1 購入プロセスにおける主要ステークホルダー 63

5.4.2 品質 63

5.4.3 サービス 64

5.5 マクロ経済見通し 65

5.5.1 GDPの動向と予測 65

5.5.2 都市廃水処理 67

5.6 AI/GENAIの影響 68

5.7 バリューチェーン分析 68

5.8 エコシステム分析 70

5.9 ケーススタディ分析 71

5.9.1 デュポンが海水淡水化ソリューションを利用してグジャラート州の工業拠点に水の安全保障を確保 71

5.9.2 東レの低ファウリング逆浸透(RO)膜技術がタイの廃水再利用プラントのコスト効率を向上 72

5.9.3 ジョホールバルのバイオディーゼル産業におけるハイドロノーティクスの逆浸透(RO)膜ソ リューションによる処理コストの削減とグリセリン回収の促進 73

5.10 関税と規制の状況 73

5.10.1 環境規制 73

5.10.2 北米 74

5.10.3 アジア太平洋地域 74

5.10.4 欧州 75

5.10.5 基準 75

5.10.6 規制機関、政府機関、その他の団体

その他の団体

5.11 技術分析 77

5.11.1 主要技術 77

5.11.1.1 酸化グラフェン膜 77

5.11.1.2 パルスフロー逆浸透膜 77

5.11.2 補完技術 78

5.11.2.1 ナノコンポジット逆浸透(RO)膜 78

5.11.3 隣接技術 78

5.11.3.1 予知保全 78

5.12 顧客ビジネスに影響を与えるトレンド/破壊 78

5.13 貿易分析 80

5.13.1 輸入シナリオ(HSコード842121) 80

5.13.2 輸出シナリオ(HS コード 842121) 81

5.14 主要会議・イベント(2024-2025年) 82

5.15 価格分析 84

5.15.1 平均販売価格動向(地域別) 84

5.15.2 平均販売価格動向:フィルターモジュール別 84

5.15.3 平均販売価格動向:最終用途産業別 85

5.16 投資と資金調達シナリオ 85

5.17 特許分析 86

5.17.1 導入 86

5.17.2 文書タイプ 86

5.17.3 過去10年間の公開動向 87

5.17.4 洞察 87

5.17.5 特許の法的地位 88

5.17.6 管轄区域分析 88

5.17.7 上位出願者 89

6 逆浸透膜市場:タイプ別 91

6.1 導入 92

6.2 セルロース系膜 94

6.2.1 イオン選択性と安定性を高めるナノセルロース技術の進歩 94

6.2.2 酢酸セルロース膜 94

6.2.3 その他 94

6.3 薄膜複合膜 95

6.3.1 溶解性汚染物質を含む供給流の浄化に最適 95

6.3.2 ポリアミド複合膜 95

6.3.3 その他

6.4 その他のタイプ 96

7 逆浸透膜市場:フィルターモジュール別 97

7.1 導入 98

7.2 プレート&フレーム 100

7.2.1 低コストと洗浄の容易さ 100

7.3 チューブラー 101

7.3.1 堅牢な設計と大容量給水への対応能力 101

7.4 スパイラル巻き 101

7.4.1 高効率と最適な空間利用 101

7.5 中空糸 101

7.5.1 高い濾過効率と低いエネルギー消費 101

8 逆浸透膜市場、用途別 103

8.1 導入 104

8.2 脱塩 107

8.2.1 急速な人口増加と枯渇する水資源が需要を押し上げる 107

需要を押し上げる 107

8.3 水処理 107

8.3.1 厳しい水質基準と変動する需要が市場を牽引 107

が市場を牽引 107

8.4 廃水処理と再利用 108

8.4.1 水の再利用イニシアティブと持続可能な実践が需要を押し上げる 108

8.5 プロセス水 108

8.5.1 持続可能な水管理への産業界の関心の高まりが市場を牽引 108

8.6 飲料水 109

8.6.1 安全で清潔な飲料水需要の増加が市場を牽引 109

8.7 その他の用途 109

9 逆浸透膜市場:最終用途産業別 110

9.1 導入 111

9.2 上水・廃水処理 114

9.2.1 住宅・商業 114

9.2.1.1 化学薬品を使用しないクリーンな水へのニーズの高まりが需要を後押し 114

9.2.2 自治体 115

9.2.2.1 自治体の地下水再生が市場を牽引 115

9.3 工業処理 115

9.3.1 エネルギー・電力 115

9.3.1.1 逆浸透(RO)膜による水処理がプラントの運転効率を高める 115

9.3.2 食品・飲料 116

9.3.2.1 環境負荷低減の効率化と水の再利用が市場を牽引 116

9.3.3 ヘルスケア 116

9.3.3.1 医薬品原料の製造工程規制が需要を押し上げる 116

9.3.4 化学・石油化学 116

9.3.4.1 逆浸透(RO)膜の選択的分離特性が需要を押し上げる 116

9.3.5 その他 117

10 逆浸透膜市場(地域別) 118

10.1 はじめに 119

10.2 アジア太平洋地域 121

10.2.1 中国 133

10.2.1.1 工業化と都市化の進展が市場を牽引 133

10.2.2 日本 135

10.2.2.1 先端技術と産業部門の発展が市場を牽引 135

10.2.3 インド 137

10.2.3.1 持続可能な開発に対する環境問題の高まりが廃水需要を押し上げる 137

10.2.4 韓国 139

10.2.4.1 食品・飲料産業の成長が市場を牽引 139

10.2.5 オーストラリア 141

10.2.5.1 海水淡水化とリサイクルプロジェクトの増加が市場を牽引 141

10.2.6 その他のアジア太平洋地域 143

10.3 欧州 145

10.3.1 ドイツ 157

10.3.1.1 排水処理に関するEUの最高基準が市場を牽引 157

10.3.2 スペイン 160

10.3.2.1 海水淡水化プラントの建設増加が市場を牽引 160

10.3.3 イタリア 162

10.3.3.1 食品・飲料、製薬産業の成長が市場を牽引 162

10.3.4 イギリス 164

10.3.4.1 海上・陸上プラットフォームにおける油ガス田の確立が市場を牽引 164

10.3.5 フランス 166

10.3.5.1 水処理インフラの進歩が市場を牽引 166

10.3.6 ロシア 168

10.3.6.1 水処理施設の近代化と建設に注力する政府が需要を後押し 168

10.3.7 トルコ 170

10.3.7.1 産業部門の成長が市場を牽引 170

10.3.8 その他のヨーロッパ 172

10.4 北米 174

10.4.1 米国 186

10.4.1.1 石油生産活動の増加と飲料水需要の増加が市場を牽引 186

10.4.2 カナダ 188

10.4.2.1 食品加工産業の拡大が市場を牽引 188

10.4.3 メキシコ 190

10.4.3.1 政府のイニシアティブと製造業の成長が市場を牽引 190

10.5 中東・アフリカ 192

10.5.1 GCC 203

10.5.1.1 サウジアラビア 203

10.5.1.1.1 利用可能な帯水層の存在と大規模海水淡水化プロジェクトのネットワークが市場を牽引 203

10.5.1.2 GCCのその他の地域 205

10.5.2 エジプト 207

10.5.2.1 水利用の最適化と支援環境の醸成が市場を牽引 207

10.5.3 南アフリカ 209

10.5.3.1 高度処理技術の需要が市場を押し上げる 209

10.5.4 その他の中東・アフリカ地域 211

10.6 南アメリカ 213

10.6.1 ブラジル 223

10.6.1.1 飲料水と工業用処理水の高い需要が市場を牽引 223

10.6.2 アルゼンチン 226

10.6.2.1 処理能力の増加と外国投資が市場を後押し 226

10.6.3 その他の南米 228

11 競争環境 230

11.1 概要 230

11.2 主要プレーヤーの戦略/勝利への権利 230

11.3 収益分析、2021~2023年 233

11.4 市場シェア分析 234

11.5 企業評価と財務指標 236

11.6 ブランド/製品の比較 237

11.6.1 フィルムテック 238

11.6.2 TM700D 238

11.6.3 nanoh2o 238

11.6.4 プロシリーズ 238

11.7 企業評価マトリックス:主要企業(2023年) 238

11.7.1 スター企業 238

11.7.2 新興リーダー 238

11.7.3 浸透型プレーヤー 239

11.7.4 参加企業 239

11.7.5 企業フットプリント:主要プレーヤー、2023年 240

11.8 企業評価マトリクス:新興企業/中小企業(2023年) 246

11.8.1 対応型企業 246

11.8.2 進歩的企業 246

11.8.3 ダイナミックな企業 246

11.8.4 スターティングブロック 246

11.8.5 競争ベンチマーク:新興企業/SM(2023年) 248

11.9 競争シナリオとトレンド 250

11.9.1 製品上市 250

11.9.2 取引 251

11.9.3 事業拡大 254

11.9.4 その他の開発 255

12 企業プロファイル 256

DuPont (US)

Toray Industries Inc (Japan)

LG Chem (South Korea)

Hydranautics (US)

Veolia (France)

Toyobo Co.Ltd (Japan)

Kovalus Separation Solutions (US) Alfa Laval (Sweden)

Mann+Hummel Water and Fluid Solutions (Germany)

Membranium (Russia)

Pentair (US)

Thermo Fisher Scientific (US)

Lanxess (Germany)

Merck KGaA (Germany)

Pall Corporation (US)

and Best Water Technology Group (Austria)

13 付録 320

13.1 ディスカッションガイド 320

13.2 Knowledgestore: マーケットサ ンドマーケッツの購読ポータル 323

13.3 関連レポート 325

13.4 著者の詳細 326

RO membrane Rapid industrialization, expanding population and increasing water scarcity is fueling the demand for RO membrane worldwide. Additionally, the expanding industries in emerging economies such as food & beverage, pharmaceuticals and chemicals is creating a demand for RO membranes to process industrial wastewater.

“Based on application, desalination accounts the largest market during the forecast period, in terms of value.”

Desalination accounts for the largest share of RO membrane market by application due to its vital role in addressing the water scarcity challenges globally. Regions with limited freshwater resources such as Middle Wast & Africa are highly dependent on desalination to meet the growing needs for safe and clean drinking water. Due to the cost effectiveness and energy efficient properties RO membranes are heavily used in desalination plants for removing salts and contaminants from sweater and brackish water for producing high quality water. Moreover, the rising demand from municipal and industrial sectors along with stringent environmental regulations, is increasing the adoption of RO membranes in desalination plants. The rising global water scarcity, the application of RO membranes for desalination applications is anticipated to grow.

“Based on end-use industry, industrial processing is the fastest growing market during the forecast period, in terms of value.”

The implementation of stringent government regulations and increasing water scarcity globally has created a need for water purification across various industries such as food & beverage, healthcare, petrochemicals & energy. These industries require higher quality water purification for manufacturing processes which increases the adoption of RO membranes for these applications due to their efficiency water purification. Moreover, the rising industrialization along with growing urbanization is leading to increased usage of water in industries such as oil refining and power generation, further fueling the demand for RO membranes. Collectively, these factors have been leading to industrial processing to be the fastest growing market for RO membranes.

“Based on region, Asia Pacific is the largest and fastest growing market for RO membrane, in terms of value.”

The rapidly expanding population, rising industrialization and growing water scarcity has created need for safe and clean drinking water. This has encouraged significant investments in water and wastewater treatments propelling a demand for RO membranes in these applications due to their effectiveness. The stringent government regulations for water treatment and water quality along with initiatives for improving accessibility of pure water is further fueling the demand for RO membranes in the region. The developing economies like China and India are implementing large scale desalination plants for meeting the pure water needs due to rising population resulting into adoption of RO membranes for these applications. These factors collectively have positioned Asia Pacific to emerge as largest and fastest growing market for RO membranes.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted.

A breakdown of the profiles of the primary interviewees are as follows:

• By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

• By Designation: C-Level - 35%, Director Level - 25%, and Others - 40%

• By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, Middle East & Africa-5%, and Latin America-6%

The key players in this market are DuPont (US), Toray Industries Inc (Japan), LG Chem (South Korea), Hydranautics (US), Veolia (France), Toyobo Co., Ltd (Japan), Kovalus Separation Solutions (US) Alfa Laval (Sweden), Mann+Hummel Water and Fluid Solutions (Germany), Membranium (Russia), Pentair (US), Thermo Fisher Scientific (US), Lanxess (Germany), Merck KGaA (Germany), Pall Corporation (US), and Best Water Technology Group (Austria)

Research Coverage

This report segments the RO membrane market based on filter module, application, type, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the RO membrane market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the RO membrane market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

•Analysis of key drivers (Growing water scarcity, Stringent government regulations, Industrialization and Technological advancements), restraints (Membrane fouling & scaling and Complex Pretreatment Requirements), opportunities (Increasing demand for water treatment in developing countries and growing industrial applications) and challenges (Discharge of brine as waste and high energy consumption).

•Market Penetration: Comprehensive information on the RO membrane market offered by top players in the global RO membrane market.

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the RO membrane market.

•Market Development: Comprehensive information about lucrative emerging markets — the report analyzes the markets for RO membrane market across regions.

•Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global RO membrane market

•Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the RO membrane market

1 INTRODUCTION 32

1.1 STUDY OBJECTIVES 32

1.2 MARKET DEFINITION 32

1.3 STUDY SCOPE 33

1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE 33

1.3.2 INCLUSIONS & EXCLUSIONS 34

1.3.3 YEARS CONSIDERED 35

1.4 CURRENCY CONSIDERED 35

1.5 UNITS CONSIDERED 35

1.6 STAKEHOLDERS 35

1.7 SUMMARY OF CHANGES 36

2 RESEARCH METHODOLOGY 37

2.1 RESEARCH DATA 37

2.1.1 SECONDARY DATA 38

2.1.1.1 List of key secondary sources 38

2.1.1.2 Key data from secondary sources 38

2.1.2 PRIMARY DATA 39

2.1.2.1 Key data from primary sources 39

2.1.2.2 List of key primary interview participants 40

2.1.2.3 Key industry insights 40

2.1.2.4 Breakdown of interviews with experts 40

2.2 MARKET SIZE ESTIMATION 41

2.2.1 BOTTOM-UP APPROACH 41

2.2.2 TOP-DOWN APPROACH 42

2.3 FORECAST NUMBER CALCULATION 42

2.4 DATA TRIANGULATION 43

2.5 FACTOR ANALYSIS 44

2.6 ASSUMPTIONS 45

2.7 LIMITATIONS AND RISKS 45

3 EXECUTIVE SUMMARY 46

4 PREMIUM INSIGHTS 51

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN

REVERSE OSMOSIS MEMBRANE MARKET 51

4.2 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE 51

4.3 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE 52

4.4 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION 52

4.5 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY 53

4.6 REVERSE OSMOSIS MEMBRANE MARKET, BY KEY COUNTRY 53

5 MARKET OVERVIEW 54

5.1 INTRODUCTION 54

5.2 MARKET DYNAMICS 54

5.2.1 DRIVERS 55

5.2.1.1 Growing scarcity of fresh water 55

5.2.1.2 Implementation of stringent standards for water quality and wastewater treatment 57

5.2.1.3 Technological advancements in reverse osmosis membranes 58

5.2.2 RESTRAINTS 58

5.2.2.1 Membrane fouling & scaling 58

5.2.2.2 Complex pretreatment requirements for filtration 58

5.2.3 OPPORTUNITIES 59

5.2.3.1 Increasing demand for water treatment from emerging economies 59

5.2.3.2 Need for eliminating contaminants in industrial applications 59

5.2.4 CHALLENGES 59

5.2.4.1 Discharge of brine as waste 59

5.2.4.2 High energy consumption and operational costs 60

5.3 PORTER’S FIVE FORCES ANALYSIS 60

5.3.1 THREAT FROM NEW ENTRANTS 61

5.3.2 THREAT OF SUBSTITUTES 61

5.3.3 BARGAINING POWER OF SUPPLIERS 61

5.3.4 BARGAINING POWER OF BUYERS 61

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 62

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA 63

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS 63

5.4.2 QUALITY 63

5.4.3 SERVICE 64

5.5 MACROECONOMIC OUTLOOK 65

5.5.1 GDP TRENDS AND FORECASTS 65

5.5.2 TREATED MUNICIPAL WASTEWATER 67

5.6 IMPACT OF AI/GENAI 68

5.7 VALUE CHAIN ANALYSIS 68

5.8 ECOSYSTEM ANALYSIS 70

5.9 CASE STUDY ANALYSIS 71

5.9.1 DUPONT ENSURED WATER SECURITY FOR GUJARAT’S INDUSTRIAL HUB USING DESALINATION SOLUTIONS 71

5.9.2 TORAY’S LOW-FOULING RO MEMBRANE TECHNOLOGY DRIVES COST-EFFICIENCY AT THAI WASTEWATER REUSE PLANTS 72

5.9.3 HYDRANAUTICS’ RO SOLUTION LOWERS TREATMENT COSTS AND ENHANCES GLYCERIN RECOVERY IN JOHOR BAHRU’S BIODIESEL INDUSTRY 73

5.10 TARIFF AND REGULATORY LANDSCAPE 73

5.10.1 ENVIRONMENTAL REGULATIONS 73

5.10.2 NORTH AMERICA 74

5.10.3 ASIA PACIFIC 74

5.10.4 EUROPE 75

5.10.5 STANDARDS 75

5.10.6 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 76

5.11 TECHNOLOGY ANALYSIS 77

5.11.1 KEY TECHNOLOGIES 77

5.11.1.1 Graphene oxide membranes 77

5.11.1.2 Pulse flow reverse osmosis 77

5.11.2 COMPLEMENTARY TECHNOLOGIES 78

5.11.2.1 Nanocomposite RO membranes 78

5.11.3 ADJACENT TECHNOLOGIES 78

5.11.3.1 Predictive maintenance 78

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 78

5.13 TRADE ANALYSIS 80

5.13.1 IMPORT SCENARIO (HS CODE 842121) 80

5.13.2 EXPORT SCENARIO (HS CODE 842121) 81

5.14 KEY CONFERENCES AND EVENTS, 2024–2025 82

5.15 PRICING ANALYSIS 84

5.15.1 AVERAGE SELLING PRICE TREND, BY REGION 84

5.15.2 AVERAGE SELLING PRICE TREND, BY FILTER MODULE 84

5.15.3 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY 85

5.16 INVESTMENT AND FUNDING SCENARIO 85

5.17 PATENT ANALYSIS 86

5.17.1 INTRODUCTION 86

5.17.2 DOCUMENT TYPES 86

5.17.3 PUBLICATION TRENDS IN LAST 10 YEARS 87

5.17.4 INSIGHTS 87

5.17.5 LEGAL STATUS OF PATENTS 88

5.17.6 JURISDICTION ANALYSIS 88

5.17.7 TOP APPLICANTS 89

6 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE 91

6.1 INTRODUCTION 92

6.2 CELLULOSE-BASED MEMBRANE 94

6.2.1 ADVANCEMENTS IN NANOCELLULOSE TECHNOLOGY TO ENHANCE ION SELECTIVITY AND STABILITY 94

6.2.2 CELLULOSE ACETATE MEMBRANES 94

6.2.3 OTHERS 94

6.3 THIN FILM COMPOSITE MEMBRANE 95

6.3.1 IDEAL FOR PURIFICATION OF FEED STREAMS CONTAINING DISSOLVED CONTAMINANTS 95

6.3.2 POLYAMIDE COMPOSITE MEMBRANES 95

6.3.3 OTHERS 96

6.4 OTHER TYPES 96

7 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE 97

7.1 INTRODUCTION 98

7.2 PLATE & FRAME 100

7.2.1 LOW COST AND EASE OF CLEANING 100

7.3 TUBULAR 101

7.3.1 ROBUST DESIGN AND ABILITY TO HANDLE LARGE WATER FEED STREAMS 101

7.4 SPIRAL WOUND 101

7.4.1 HIGH EFFICIENCY AND OPTIMAL SPACE UTILIZATION 101

7.5 HOLLOW FIBER 101

7.5.1 HIGH FILTRATION EFFICIENCY AND LOW ENERGY CONSUMPTION 101

8 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION 103

8.1 INTRODUCTION 104

8.2 DESALINATION 107

8.2.1 RAPID POPULATION GROWTH AND DEPLETING WATER RESOURCES

TO BOOST DEMAND 107

8.3 UTILITY WATER TREATMENT 107

8.3.1 STRINGENT WATER QUALITY STANDARDS AND FLUCTUATING DEMAND

TO DRIVE MARKET 107

8.4 WASTEWATER TREATMENT & REUSE 108

8.4.1 WATER REUSE INITIATIVES AND SUSTAINABLE PRACTICES TO BOOST DEMAND 108

8.5 PROCESS WATER 108

8.5.1 INCREASING FOCUS OF INDUSTRIES ON SUSTAINABLE WATER MANAGEMENT PRACTICES TO DRIVE MARKET 108

8.6 POTABLE WATER 109

8.6.1 RISING DEMAND FOR SAFE AND CLEAN DRINKING WATER TO DRIVE MARKET 109

8.7 OTHER APPLICATIONS 109

9 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY 110

9.1 INTRODUCTION 111

9.2 WATER & WASTEWATER TREATMENT 114

9.2.1 RESIDENTIAL & COMMERCIAL 114

9.2.1.1 Pressing need for chemical–free clean water to boost demand 114

9.2.2 MUNICIPAL 115

9.2.2.1 Reclaiming groundwater in municipal settings to drive market 115

9.3 INDUSTRIAL PROCESSING 115

9.3.1 ENERGY & POWER 115

9.3.1.1 Water treatment by RO membranes to boost plant operation efficiency 115

9.3.2 FOOD & BEVERAGE 116

9.3.2.1 Efficiency in reducing environmental impact and enabling water reuse to drive market 116

9.3.3 HEALTHCARE 116

9.3.3.1 Regulating manufacturing process of pharmaceutical ingredients to boost demand 116

9.3.4 CHEMICAL & PETROCHEMICAL 116

9.3.4.1 Selective separation properties of RO membranes to boost demand 116

9.3.5 OTHERS 117

10 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION 118

10.1 INTRODUCTION 119

10.2 ASIA PACIFIC 121

10.2.1 CHINA 133

10.2.1.1 Growing industrialization and urbanization to drive market 133

10.2.2 JAPAN 135

10.2.2.1 Development of advanced technologies and industrial sector to drive market 135

10.2.3 INDIA 137

10.2.3.1 Rising environmental concerns for sustainable development to boost demand for wastewater 137

10.2.4 SOUTH KOREA 139

10.2.4.1 Growth of food & beverage industry to drive market 139

10.2.5 AUSTRALIA 141

10.2.5.1 Rise in seawater desalination and recycling projects to drive market 141

10.2.6 REST OF ASIA PACIFIC 143

10.3 EUROPE 145

10.3.1 GERMANY 157

10.3.1.1 Highest EU standards for wastewater treatment to drive market 157

10.3.2 SPAIN 160

10.3.2.1 Rising construction of desalinated plants to drive market 160

10.3.3 ITALY 162

10.3.3.1 Growth of food & beverage and pharmaceutical industries to drive market 162

10.3.4 UK 164

10.3.4.1 Established presence of oil & gas production fields in offshore and onshore platforms to drive market 164

10.3.5 FRANCE 166

10.3.5.1 Advancements in water treatment infrastructure to drive market 166

10.3.6 RUSSIA 168

10.3.6.1 Government focus on modernization and construction of water facilities to boost demand 168

10.3.7 TURKEY 170

10.3.7.1 Growth of industrial sector to drive market 170

10.3.8 REST OF EUROPE 172

10.4 NORTH AMERICA 174

10.4.1 US 186

10.4.1.1 Increase in oil production activities and rising demand for potable drinking water to drive market 186

10.4.2 CANADA 188

10.4.2.1 Expansion of food processing industries to drive market 188

10.4.3 MEXICO 190

10.4.3.1 Government initiatives and growth of manufacturing sector to drive market 190

10.5 MIDDLE EAST & AFRICA 192

10.5.1 GCC 203

10.5.1.1 Saudi Arabia 203

10.5.1.1.1 Presence of tapped aquifers and network of large desalination projects to drive market 203

10.5.1.2 Rest of GCC 205

10.5.2 EGYPT 207

10.5.2.1 Optimizing water usage and fostering a supportive environment to drive market 207

10.5.3 SOUTH AFRICA 209

10.5.3.1 Demand for advanced treatment technologies to boost market 209

10.5.4 REST OF MIDDLE EAST & AFRICA 211

10.6 SOUTH AMERICA 213

10.6.1 BRAZIL 223

10.6.1.1 High demand for potable and industrial processing water to drive market 223

10.6.2 ARGENTINA 226

10.6.2.1 Increase in treatment capacities and foreign investments to boost market 226

10.6.3 REST OF SOUTH AMERICA 228

11 COMPETITIVE LANDSCAPE 230

11.1 OVERVIEW 230

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 230

11.3 REVENUE ANALYSIS, 2021–2023 233

11.4 MARKET SHARE ANALYSIS 234

11.5 COMPANY VALUATION AND FINANCIAL METRICS 236

11.6 BRAND/PRODUCT COMPARISON 237

11.6.1 FILMTEC 238

11.6.2 TM700D 238

11.6.3 NANOH2O 238

11.6.4 PRO SERIES 238

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 238

11.7.1 STARS 238

11.7.2 EMERGING LEADERS 238

11.7.3 PERVASIVE PLAYERS 239

11.7.4 PARTICIPANTS 239

11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 240

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 246

11.8.1 RESPONSIVE COMPANIES 246

11.8.2 PROGRESSIVE COMPANIES 246

11.8.3 DYNAMIC COMPANIES 246

11.8.4 STARTING BLOCKS 246

11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 248

11.9 COMPETITIVE SCENARIO AND TRENDS 250

11.9.1 PRODUCT LAUNCHES 250

11.9.2 DEALS 251

11.9.3 EXPANSIONS 254

11.9.4 OTHER DEVELOPMENTS 255

12 COMPANY PROFILES 256

12.1 KEY PLAYERS 256

12.1.1 DUPONT 256

12.1.1.1 Business overview 256

12.1.1.2 Products/Solutions/Services offered 257

12.1.1.3 Recent developments 261

12.1.1.3.1 Deals 261

12.1.1.4 MnM view 262

12.1.1.4.1 Key strengths 262

12.1.1.4.2 Strategic choices 262

12.1.1.4.3 Weaknesses and threats 263

12.1.2 TORAY INDUSTRIES, INC. 264

12.1.2.1 Business overview 264

12.1.2.2 Products/Solutions/Services offered 265

12.1.2.3 Recent developments 267

12.1.2.3.1 Product launches 267

12.1.2.3.2 Deals 268

12.1.2.4 MnM view 268

12.1.2.4.1 Key strengths 268

12.1.2.4.2 Strategic choices 268

12.1.2.4.3 Weaknesses and competitive threats 269

12.1.3 LG CHEM 270

12.1.3.1 Business overview 270

12.1.3.2 Products/Solutions/Services offered 271

12.1.3.3 Recent developments 276

12.1.3.3.1 Expansions 276

12.1.3.3.2 Other developments 277

12.1.3.4 MnM view 277

12.1.3.4.1 Key strengths 277

12.1.3.4.2 Strategic choices 277

12.1.3.4.3 Weaknesses and competitive threats 278

12.1.4 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY) 279

12.1.4.1 Business overview 279

12.1.4.2 Products/Solutions/Services offered 279

12.1.4.3 Recent developments 280

12.1.4.3.1 Product launches 280

12.1.4.4 MnM view 281

12.1.4.4.1 Key strengths 281

12.1.4.4.2 Strategic choices 281

12.1.4.4.3 Weaknesses and competitive threats 281

12.1.5 VEOLIA 282

12.1.5.1 Business overview 282

12.1.5.2 Products/Solutions/Services offered 283

12.1.5.3 Recent developments 284

12.1.5.3.1 Deals 284

12.1.5.4 MnM view 285

12.1.5.4.1 Key strengths 285

12.1.5.4.2 Strategic choices 285

12.1.5.4.3 Weaknesses and competitive threats 285

12.1.6 TOYOBO, CO. LTD. 286

12.1.6.1 Business overview 286

12.1.6.2 Products/Solutions/Services offered 287

12.1.6.3 MnM view 287

12.1.7 ALFA LAVAL 289

12.1.7.1 Business overview 289

12.1.7.2 Products/Solutions/Services offered 290

12.1.7.3 MnM view 291

12.1.8 MANN + HUMMEL 292

12.1.8.1 Business overview 292

12.1.8.2 Products/Services/Solutions offered 293

12.1.8.3 Recent developments 294

12.1.8.3.1 Deals 294

12.1.8.3.2 Expansions 294

12.1.8.4 MnM view 295

12.1.9 MERCK KGAA 296

12.1.9.1 Business overview 296

12.1.9.2 Products/Solutions/Services offered 297

12.1.10 KOVALUS SEPARATION SOLUTIONS 299

12.1.10.1 Business overview 299

12.1.10.2 Products/Solutions/Services offered 299

12.1.10.3 Recent developments 300

12.1.10.3.1 Product launches 300

12.1.10.3.2 Deals 301

12.1.10.4 MnM view 301

12.1.11 MEMBRANIUM 302

12.1.11.1 Business overview 302

12.1.11.2 Products/Services/Solutions offered 302

12.1.12 PENTAIR 303

12.1.12.1 Business overview 303

12.1.12.2 Products/Solutions/Services offered 304

12.1.13 THERMO FISHER SCIENTIFIC 305

12.1.13.1 Business overview 305

12.1.13.2 Products/Solutions/Services offered 306

12.1.14 PALL CORPORATION 307

12.1.14.1 Business overview 307

12.1.14.2 Products/Solutions/Services offered 307

12.1.15 BEST WATER TECHNOLOGY GROUP 308

12.1.15.1 Business overview 308

12.1.15.2 Products/Solutions/Services offered 308

12.2 OTHER PLAYERS 309

12.2.1 SYNDER FILTRATION, INC. 309

12.2.2 LENNTECH 310

12.2.3 AQUAPORIN A/S 311

12.2.4 KURITA WATER INDUSTRIES 312

12.2.5 APPLIED MEMBRANES, INC. 313

12.2.6 MEMBRACON 314

12.2.7 EUROWATER 315

12.2.8 AXEON WATER 316

12.2.9 PERMIONICS MEMBRANES PRIVATE LIMITED 317

12.2.10 VONTRON TECHNOLOGY 318

12.2.11 NEWATER 319

13 APPENDIX 320

13.1 DISCUSSION GUIDE 320

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 323

13.3 RELATED REPORTS 325

13.4 AUTHOR DETAILS 326

❖ 世界の逆浸透(RO)膜市場に関するよくある質問(FAQ) ❖

・逆浸透(RO)膜の世界市場規模は?

→MarketsandMarkets社は2024年の逆浸透(RO)膜の世界市場規模を37.3億米ドルと推定しています。

・逆浸透(RO)膜の世界市場予測は?

→MarketsandMarkets社は2029年の逆浸透(RO)膜の世界市場規模を51.1億米ドルと予測しています。

・逆浸透(RO)膜市場の成長率は?

→MarketsandMarkets社は逆浸透(RO)膜の世界市場が2024年~2029年に年平均6.5%成長すると予測しています。

・世界の逆浸透(RO)膜市場における主要企業は?

→MarketsandMarkets社は「DuPont (US)、Toray Industries Inc (Japan)、LG Chem (South Korea)、Hydranautics (US)、Veolia (France)、Toyobo Co.、Ltd (Japan)、Kovalus Separation Solutions (US) Alfa Laval (Sweden)、Mann+Hummel Water and Fluid Solutions (Germany)、Membranium (Russia)、Pentair (US)、Thermo Fisher Scientific (US)、Lanxess (Germany)、Merck KGaA (Germany)、Pall Corporation (US)、and Best Water Technology Group (Austria)など ...」をグローバル逆浸透(RO)膜市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。