1 はじめに

1.1 調査目的

1.2 市場の定義 33

1.3 調査範囲 33

1.3.1 市場セグメンテーション 34

1.3.2 含むものと含まないもの 35

1.3.3 考慮した年数 36

1.4 考慮した単位 36

1.4.1 通貨を考慮 36

1.4.2 数量の考慮 37

1.5 利害関係者 37

1.6 変更点のまとめ 38

2 調査方法 39

2.1 調査データ 39

2.1.1 二次データ 39

2.1.1.1 二次資料からの主要データ 40

2.1.2 一次データ 40

2.1.2.1 一次資料からの主要データ 40

2.1.2.2 一次プロファイルの内訳 41

2.1.2.3 業界専門家による主な洞察 42

2.2 市場規模の推定 42

2.2.1 トップダウンアプローチ 43

2.2.2 サプライサイド分析 43

2.2.3 ボトムアップアプローチ(需要サイド) 44

2.3 データの三角測量 46

2.4 リサーチの前提 47

2.5 研究の限界とリスク評価 48

3 エグゼクティブサマリー 49

4 プレミアムインサイト 54

4.1 代用糖市場の概要 54

4.2 北米:砂糖代替品市場:タイプ別、国別 55

4.3 高強度代用糖市場、供給源別 55

4.4 代用糖市場、形態別 56

4.5 代用糖市場:用途別 56

4.6 代用糖市場:タイプ別、地域別 57

4.7 代用糖市場:地域別スナップショット 58

5 市場の概要 59

5.1 はじめに 59

5.2 マクロ経済指標 60

5.2.1 従来型砂糖の価格と供給の変動 60

5.2.2 世界の人口とGDPの増加 60

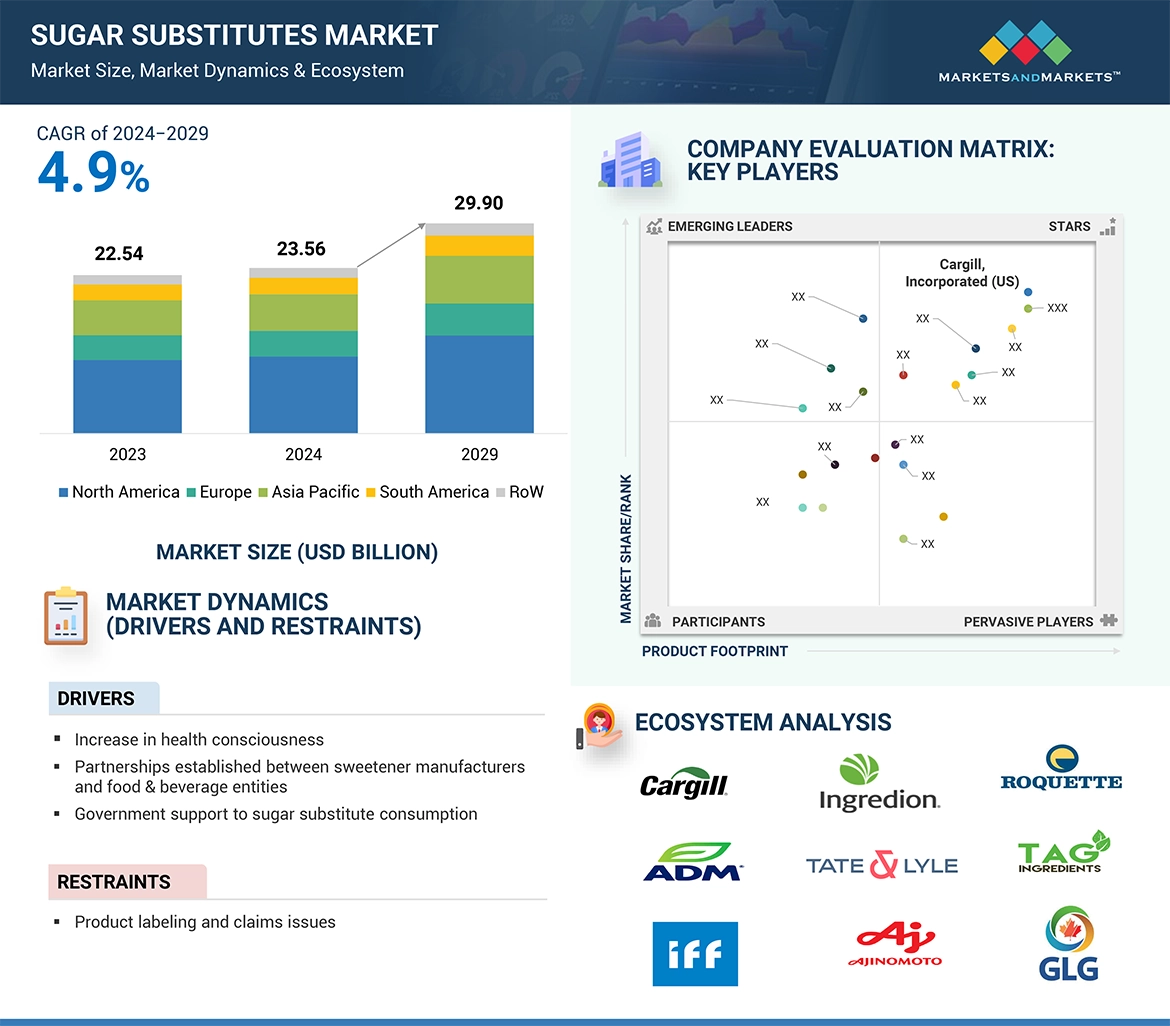

5.3 市場ダイナミクス

5.3.1 推進要因 62

5.3.1.1 健康志向の高まり 62

5.3.1.2 甘味料メーカーと食品・飲料企業とのパートナーシップの確立 63

5.3.1.3 新しく改良された甘味料の開発につながる技術の進歩 63

5.3.1.4 代用糖消費に対する政府の支援 63

5.3.2 抑制要因 64

5.3.2.1 代替甘味料および甘味料ベースの製品に対する国際的な品質基準および規制の遵守 64

5.3.2.2 代用甘味料の消費に伴う副作用 64

5.3.3 機会 65

5.3.3.1 糖尿病の健康のための甘味料技術の研究開発の進展 65

5.3.3.2 代用糖生産への投資の増加 65

5.3.3.3 他の応用分野への多様化の可能性 65

5.3.4 課題 66

5.3.4.1 製品のラベリングとクレームの問題 66

5.3.4.2 生産コスト上昇に起因する天然甘味料のプレミアム価格設定 67

5.4 食品・飲料原料/添加物に対する遺伝子AIの影響 67

5.4.1 導入 67

5.4.2 食品・飲料原料/添加物における遺伝子AIの使用 68

5.4.3 ケーススタディ分析 69

5.4.3.1 Kerry Trendspotter はリアルタイムのソーシャルメディアデータを分析することで、新たな素材とフレーバーのトレンドの正確な特定と予測を可能に 69

5.4.3.2 ジボダン(スイス)は、膨大な消費者データを実用的な洞察に変換する高度なデジタルツールを開発 69

5.4.3.3 International Flavors & Fragrances Inc.(米国)はSalus Optima(英国)と提携し、パーソナライズされた栄養プラットフォームを構築 70

5.4.3.4 食品・飲料業界の課題を解決するAIとクラウド技術 71

5.4.4 代用糖市場への影響 71

5.4.5 Gen AIに取り組む隣接エコシステム 71

6 業界動向 72

6.1 導入 72

6.2 サプライチェーン分析 72

6.3 バリューチェーン分析 73

6.3.1 研究・製品開発 74

6.3.2 原料調達 74

6.3.3 加工及び抽出 75

6.3.4 品質管理とコンプライアンス 75

6.3.5 流通・販売 75

6.3.6 エンドユーザー

6.4 貿易分析 75

6.4.1 スクラロースの輸入シナリオ 75

6.4.2 主要国別スクラロースの輸出シナリオ 77

6.5 技術分析 78

6.5.1 主要技術 78

6.5.1.1 超音波アシスト発酵 78

6.5.2 補足技術 78

6.5.2.1 液体-液体抽出 78

6.5.3 隣接技術 79

6.5.3.1 HPLC-DAD 79

6.6 価格分析 79

6.6.1 主要企業の砂糖代替品の平均販売価格動向(低強度甘味料別) 79

6.6.2 平均販売価格動向(地域別) 80

6.6.3 平均販売価格動向(タイプ別) 81

6.7 エコシステム分析 82

6.7.1 需要サイド 82

6.7.2 供給サイド 82

6.8 顧客ビジネスに影響を与えるトレンド/混乱 85

6.8.1 顧客ビジネスに影響を与えるトレンド/混乱 85

6.9 特許分析 86

6.10 2024~2025年の主要会議・イベント 88

6.11 規制情勢 89

6.11.1 規制機関、政府機関、その他の組織 89

6.11.2 規制の枠組み 92

6.11.2.1 はじめに 92

6.11.2.2 北米 92

6.11.2.2.1 米国 92

6.11.2.2 カナダ 94

6.11.2.3 欧州 95

6.11.2.4 アジア太平洋地域 103

6.11.2.4.1 中国 103

6.11.2.4.2 インド 104

6.11.2.4.3 日本 105

6.11.2.4.4 オーストラリア・ニュージーランド 105

6.11.2.5 ラテンアメリカ 106

6.11.2.5.1 ブラジル 106

6.11.2.5.2 アルゼンチン 107

6.11.2.5.3 メキシコ 107

6.11.2.6 中東・アフリカ 107

6.12 ポーターの5つの力分析 107

6.12.1 新規参入の脅威 109

6.12.2 代替品の脅威 109

6.12.3 買い手の交渉力 109

6.12.4 供給者の交渉力 109

6.12.5 競合の激しさ 110

6.13 主要ステークホルダーと購買基準 110

6.13.1 購入プロセスにおける主要ステークホルダー 110

6.13.2 購買基準 111

6.14 ケーススタディ分析 112

6.14.1 カーギル社 砂糖摂取量を減らす製品の発売 112

6.14.2 砂糖の消費削減を奨励する取り組みの増加 112

6.15 投資と資金調達のシナリオ 113

7 砂糖代替品市場:製造技術別 114

7.1 導入 114

7.2 精密発酵 114

7.3 酵素変換 115

7.4 化学合成 115

7.5 その他の製造技術 115

8 代用糖市場、タイプ別 116

8.1 導入 117

8.2 高フルクトース・コーンシロップ 118

8.2.1 食品・飲料業界のいくつかの有名ブランドで使用 118

8.3 高強度甘味料 120

8.3.1 代謝上の課題があるにもかかわらず、カロリーゼロおよび砂糖不使用の食品および飲料に使用 120

8.3.2 天然高強度甘味料 122

8.3.2.1 ステビア 123

8.3.2.1.1 ステビアの進化 123

8.3.2.2 モンクフルーツ 126

8.3.2.3 その他の天然高強度甘味料 127

8.3.3 人工高強度甘味料 128

8.3.3.1 アスパルテーム 131

8.3.3.2 シクラメート 132

8.3.3.3 スクラロース 133

8.3.3.4 サッカリン 134

8.3.3.5 エースK 135

8.3.3.6 その他の人工高強度甘味料 136

8.4 低強度甘味料 137

8.4.1 砂糖に匹敵する甘味で副作用のリスクがないものが望ましい 137

8.4.2 d-タガトース 140

8.4.3 ソルビトール 141

8.4.4 マルチトール 142

8.4.5 キシリトール 143

8.4.6 マンニトール 144

8.4.7 エリスリトール 145

8.4.8 アルロース 146

8.4.9 その他の低強度甘味料 147

9 代用糖市場、用途別 149

9.1 はじめに 150

9.2 食品 151

9.2.1 食品用途における低カロリー代替甘味料の幅広い需要 151

9.2.2 製菓製品 153

9.2.2.1 チョコレート菓子 154

9.2.2.2 甘味菓子 155

9.2.2.3 ガム 155

9.2.2.4 ハードキャンディ 155

9.2.2.5 その他の菓子類 155

9.2.3 ベーカリー製品 155

9.2.4 乳製品 157

9.2.5 卓上甘味料 158

9.2.6 スイートスプレッド 158

9.2.7 その他の食品用途 159

9.3 飲料 160

9.3.1 無糖飲料の消費者層の拡大 160

9.3.2 炭酸飲料 162

9.3.3 果実飲料・ジュース 163

9.3.4 粉末飲料 164

9.3.5 アルコール飲料 165

9.3.6 香料入りアルコール飲料 166

9.3.7 植物由来飲料 167

9.3.8 その他の飲料 168

9.4 ヘルス&パーソナルケア製品 169

9.4.1 スキンケアの革新と自然な解決策への欲求の融合が天然甘味料を牽引 169

9.5 医薬品 171

9.5.1 医薬品における甘味料の革新的処方への投資 171

9.5.2 コーティング 172

9.5.3 充填剤 172

9.5.4 結合剤 172

9.5.5 保湿剤 173

9.5.6 甘味料 173

9.6 その他の用途 173

10 代用糖市場:形態別 175

10.1 導入 176

10.2 ドライ 177

10.2.1 製パン・飲料ミックスによく使用される 177

10.2.2 粉末 178

10.2.3 顆粒 178

10.2.4 その他の乾燥形態 178

10.3 液体 179

10.3.1 容易な溶解性と長期保存性に対する需要の高まり 179

10.3.2 シロップ

10.3.3 ジェル 181

11 高強度糖代替物市場(供給源別) 182

11.1 導入 183

11.2 人工的なもの 184

11.2.1 厳格な規制の下での使用の拡大 184

11.3 天然物 186

11.3.1 植物由来の食品・飲料に対する需要の急増 186

12 代用糖市場、地域別 189

12.1 はじめに 190

12.2 北米 193

12.2.1 米国 201

12.2.1.1 主要企業の存在と糖尿病予備軍および糖尿病人口の増加 201

12.2.2 カナダ 203

12.2.2.1 複数の代替糖に対する政府の承認 203

12.2.3 メキシコ 205

12.2.3.1 健康意識を高めるための国家キャンペーンの急増 205

12.3 欧州 206

12.3.1 ドイツ 214

12.3.1.1 低糖質オプションの需要に対応するステビア入り製品メーカー の存在 214

12.3.2 イギリス 216

12.3.2.1 クリーンラベル甘味料を製品に統合する政府の後押しに支えられた卓越した食品産業 216

12.3.3 フランス 218

12.3.3.1 高齢化と投資家に優しい政策の増加 218

12.3.4 イタリア 219

12.3.4.1 消費者のライフスタイルの変化と高齢化による機能性食品の需要 219

12.3.5 スペイン 221

221 12.3.5.1 政府政策による砂糖の大量消費対策 221

12.3.6 その他の欧州地域 222

12.4 アジア太平洋地域 224

12.4.1 中国 233

12.4.1.1 中国におけるメーカー投資、Tier1およびTier2都市におけるダイナミックなコンビニエンスストア・チャネル 233

12.4.2 インド 235

12.4.2.1 糖尿病およびその他の関連疾患の患者数の増加 235

12.4.3 日本 237

12.4.3.1 健康的な生活を促進するための政府イニシアチブの成長 237

12.4.4 オーストラリア・ニュージーランド 239

12.4.4.1 糖尿病人口の増加がより健康的な代替食品への需要を促進 239

12.4.5 その他のアジア太平洋地域 241

12.5 南米 242

12.5.1 ブラジル 250

12.5.1.1 低糖質オプションの管理を必要とする様々な健康状態の発生率の上昇 250

12.5.2 アルゼンチン 252

12.5.2.1 都市化の進展と健康食品の需要 252

12.5.3 その他の南米地域 254

12.6 その他の地域(列記) 255

12.6.1 中東 263

12.6.1.1 支出能力の拡大とRTDティーの消費の増加 263

12.6.2 アフリカ 265

12.6.2.1 低カロリー消耗品の採用増加 265

13 競争環境 267

13.1 概要 267

13.2 主要プレーヤーの戦略/勝利への権利 267

13.3 収益分析、2021~2023年 270

13.4 市場シェア分析、2023年 271

13.4.1 市場ランキング分析 272

13.5 企業評価マトリックス:主要プレーヤー、2023年 274

13.5.1 スター企業 274

13.5.2 新興リーダー 274

13.5.3 浸透型プレーヤー 274

13.5.4 参加企業 275

13.5.5 企業フットプリント:主要プレーヤー(2023年) 276

13.5.5.1 企業フットプリント 276

13.5.5.2 地域別フットプリント 277

13.5.5.3 タイプ別フットプリント 278

13.5.5.4 高強度甘味料の供給源のフットプリント 279

13.5.5.5 アプリケーション・フットプリント 280

13.6 企業評価マトリクス:新興企業/中小企業(2023年) 281

13.6.1 進歩的企業 281

13.6.2 対応力のある企業 281

13.6.3 ダイナミックな企業 281

13.6.4 スターティング・ブロック 281

13.6.5 競争ベンチマーキング(新興企業/SM)(2023年) 283

13.6.5.1 主要新興企業/中小企業の詳細リスト 283

13.6.5.2 新興企業/SMEの競合ベンチマーキング 284

13.7 企業評価と財務指標 285

13.7.1 企業評価 285

13.7.2 財務指標 285

13.8 ブランド/製品の比較 286

13.9 競争シナリオとトレンド 287

13.9.1 製品上市 287

13.9.2 取引 288

13.9.3 拡張 292

14 企業プロフィール 294

Cargill

Incorporated (US)

ADM (US)

Ingredion (US)

International Flavors & Fragrances Inc (US)

Tate & Lyle (UK)

Ajinomoto Co. Inc (Japan)

GLG Life Tech Corp (Canada)

Celanese Corporation (US)

Roquette Frères (France)

PCIPL (India)

Mane SA. (France)

Döhler GmbH (Germany)

Morita Kagaku Kogyo Co.Ltd (Japan)

zuChem (US)

and Van Wankum Ingredients (Netherlands).

Tag Ingredients India Pvt Ltd (India)

Sweetly SteviaUSA (UK)

Foodchem International Corporation (China)

JK Sucralose Inc. (China)

The Real Stevia Company AB (Sweden)

Stevia Hub India (India)

Pyure Brands (US)

XiliNat (Mexico)

Savanna Ingredients (Germany) and Bonumose Inc (US)

15 隣接・関連市場 354

15.1 はじめに 354

15.2 調査の限界 354

15.3 甘味料市場 354

15.3.1 市場の定義 354

15.3.2 市場概要 355

15.4 低強度甘味料市場 356

15.4.1 市場の定義 356

15.4.2 市場概要 356

16 付録 357

16.1 ディスカッションガイド 357

16.2 Knowledgestore: Marketsandmarketsの購読ポータル 364

16.3 カスタマイズオプション 366

16.4 関連レポート 366

16.5 著者の詳細 367

The demand for sugar substitutes is gaining significant importance in food & beverages, health & personal care products, and pharmaceutical industries. Some of the factors, such as changing consumer preferences regarding healthy lifestyle habits, increasing obesity and diabetes prevalence, and enhanced awareness of the risks of excessive sugar consumption to health, are encouraging the manufacturers to provide low-calorie and zero-calorie sweeteners in the production of food & beverages, health & personal care products, and pharmaceutical products as consumers are more inclined towards the demand for sweetness without adding calories to the diet.

Additionally, regulatory support, government initiatives, and implementation of taxes on sugary products are positively influencing reducing sugar intake further and promoting healthy food consumption. This is expected to generate a significant opportunity for sugar substitute manufacturers to enter the market with the introduction of natural & novel sweeteners and new generations of sweeteners with improved flavor profiles and blends of various sweeteners for optimal taste to use in a wide range of applications. For instance, according to the Global Report on the use of sugar-sweetened beverage taxes published by WHO in 2023, national level excise taxes applied to sugar-sweetened beverages, as these beverages include significant sources of free sugars, and it is associated with several non-communicable diseases (NCDs). This would also help in maintaining public health concerns.

Furthermore, the inclusion of sugar substitutes in various functional food & beverage products is enabling manufacturers to develop new lines of products that are aligned with current trends, such as keto-friendly products, low-calorie or no-sugar-added products, natural & clean-label products, among others. These consumer trends and innovations in product labeling are expected to generate a significant opportunity for the functional food & beverage and health supplement product manufacturers.

Disruption in the sugar substitutes market: the disruption in the sugar substitutes market is expected to create both challenges and opportunities for the key players in the market. For instance, changes in product labeling laws for transparency in product packaging will create opportunities for natural sweetener products. However, this may pose a challenge for the manufacturers producing artificial sweeteners as consumers are focusing on ingredients that are naturally sourced and clean labelled. Furthermore, blending sugar substitutes with other functional ingredients in the final products could provide superior taste and flavors. Thus, technological innovation for ingredient management to optimize the sweetener profile could create better substitutes.

“The high-intensity sweeteners is growing at a significant CAGR among the type of sugar substitutes market.”

The high-intensity sweeteners such as stevia, monk fruits, aspartame, sucralose, ace-K, and other sweeteners are significantly sweetener than sucrose, and they are used in very small quantities to meet the desired sweetness. Consumer shift towards their dietary habits, such as the keto diet, low-carb regimes, among others, are minimizing sugar consumption, hence driving the usage of various high-intensity sweeteners in products such as snacks & cereals, beverages, and processed foods. Furthermore, the opportunity for reformulation of existing products with the usage of various high-intensity sweeteners with reduced-sugar options without compromising the taste of the products is also expected to generate significant demand for high-intensity sweeteners.

“The artificial high-intensity sweeteners segment is projected to hold a significant market share in the source segment during the forecast period.”

The FDA is actively monitoring and regulating sweeteners in food, reaffirming its commitment to public health, particularly after the International Agency for Research on Cancer (IARC) classified aspartame as “possibly carcinogenic to humans” in July 2023. The FDA disagrees with this conclusion, emphasizing that aspartame is one of the most extensively studied food additives, with over 100 studies confirming its safety and can be consumed under the approved conditions. Furthermore, the FDA still maintains its acceptable daily intake for aspartame and thus allows the additive in low-calorie or sugar-free products. It is largely used as a tabletop sweetener and in chewing gum, cold breakfast cereals, and dry bases for certain foods (for example, beverages, instant coffee & tea, gelatins, puddings & fillings, and dairy products & toppings). Furthermore, artificial sweeteners such as acesulfame potassium, sucralose, neotame, and saccharin can be used as a food ingredient, ensuring the regulatory status and safety of the ingredients in the product before marketing. Thus, acceptance of numerous sweeteners in food & beverage applications is expected to drive demand for artificial sweeteners, given increased requirements for lower-calorie and sugar-free options by the consuming public.

"North America is expected to have a significant share in the sugar substitutes market."

North America is the largest market for bakery items, candies, and confectioneries. An upsurge in snacking culture and gourmet/artisanal products is further pushing this market in a positive direction. As health-consciousness increases among consumers, they are looking for alternatives to traditional sugary food, which is thereby promoting a tremendous shift towards healthy food.

Concurrently with this demand, the North American market for sugar substitutes is increasing. According to the article published by the US CENTERS FOR DISEASE CONTROL AND PREVENTION (CDC), over one in three Americans is at increased risk for type 2 diabetes in November 2023. An increased prevalence of prediabetes and a growing awareness toward healthier lifestyles have acted as an impetus for consumers to seek reduced amounts of sugar in the food products they consume, thereby increasing the use of sugar substitutes. ADM (US), Ingredion (US), and Cargill, Incorporated (US) are some of the major players in the North American sugar substitutes market. They specialize in new and innovative sweeteners with novel functions that support consumers in developing healthy eating habits, helping them in a better way to capture this new trend.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the sugar substitutes market:

• By Company Type: Tier 1 – 25%, Tier 2 – 45%, and Tier 3 – 30%

• By Designation: CXO’s – 20%, Managers – 50%, Executives- 30%

• By Region: North America – 25%, Europe – 30%, Asia Pacific – 20%, South America – 15% and Rest of the World –10%

Prominent companies in the market Cargill, Incorporated (US), ADM (US), Ingredion (US), International Flavors & Fragrances Inc (US), Tate & Lyle (UK), Ajinomoto Co. Inc (Japan), GLG Life Tech Corp (Canada), Celanese Corporation (US), Roquette Frères (France), PCIPL (India), Mane SA. (France), Döhler GmbH (Germany), Morita Kagaku Kogyo Co., Ltd (Japan), zuChem (US), and Van Wankum Ingredients (Netherlands).

Other players include Tag Ingredients India Pvt Ltd (India), Sweetly SteviaUSA (UK), Foodchem International Corporation (China), JK Sucralose Inc. (China), The Real Stevia Company AB (Sweden), Stevia Hub India (India), Pyure Brands (US), XiliNat (Mexico), Savanna Ingredients (Germany) and Bonumose, Inc (US).

Research Coverage:

This research report categorizes the Sugar Substitutes Market by Type (HFCS, High-intensity Sweeteners, Low-Intensity Sweeteners), Manufacturing Technology (Precision Fermentation, Enzymatic Conversion, Chemical Synthesis), Application, Form, Source, and Region - Global Forecast to 2029. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of sugar substitutes. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the sugar substitutes market. Competitive analysis of upcoming startups in the sugar substitutes market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, patent, regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall sugar substitutes and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

• Analysis of key drivers (Increase in health consciousness), restraints (Health concerns associated with consumption of sugar substitutes), opportunities (Rising investments in sugar substitute production), and challenges (Product labeling and claims issues) influencing the growth of the sugar substitutes market.

• New product launch/Innovation: Detailed insights on research & development activities and new product launches in the sugar substitutes market.

• Market Development: Comprehensive information about lucrative markets – the report analyzes the sugar substitutes across varied regions.

• Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the sugar substitutes market.

• Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as Cargill, Incorporated (US), ADM (US), Ingredion (US), International Flavors & Fragrances Inc (US), Tate & Lyle (UK) and other players in the sugar substitutes market.

1 INTRODUCTION 33

1.1 STUDY OBJECTIVES 33

1.2 MARKET DEFINITION 33

1.3 STUDY SCOPE 33

1.3.1 MARKET SEGMENTATION 34

1.3.2 INCLUSIONS AND EXCLUSIONS 35

1.3.3 YEARS CONSIDERED 36

1.4 UNIT CONSIDERED 36

1.4.1 CURRENCY CONSIDERED 36

1.4.2 VOLUME CONSIDERED 37

1.5 STAKEHOLDERS 37

1.6 SUMMARY OF CHANGES 38

2 RESEARCH METHODOLOGY 39

2.1 RESEARCH DATA 39

2.1.1 SECONDARY DATA 39

2.1.1.1 Key data from secondary sources 40

2.1.2 PRIMARY DATA 40

2.1.2.1 Key data from primary sources 40

2.1.2.2 Breakdown of primary profiles 41

2.1.2.3 Key insights from industry experts 42

2.2 MARKET SIZE ESTIMATION 42

2.2.1 TOP-DOWN APPROACH 43

2.2.2 SUPPLY-SIDE ANALYSIS 43

2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE) 44

2.3 DATA TRIANGULATION 46

2.4 RESEARCH ASSUMPTIONS 47

2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT 48

3 EXECUTIVE SUMMARY 49

4 PREMIUM INSIGHTS 54

4.1 SUGAR SUBSTITUTES MARKET OVERVIEW 54

4.2 NORTH AMERICA: SUGAR SUBSTITUTES MARKET, BY TYPE AND COUNTRY 55

4.3 HIGH-INTENSITY SUGAR SUBSTITUTES MARKET, BY SOURCE 55

4.4 SUGAR SUBSTITUTES MARKET, BY FORM 56

4.5 SUGAR SUBSTITUTES MARKET, BY APPLICATION 56

4.6 SUGAR SUBSTITUTES MARKET, BY TYPE AND REGION 57

4.7 SUGAR SUBSTITUTES MARKET: REGIONAL SNAPSHOT 58

5 MARKET OVERVIEW 59

5.1 INTRODUCTION 59

5.2 MACROECONOMIC INDICATORS 60

5.2.1 FLUCTUATIONS IN PRICES AND SUPPLY OF CONVENTIONAL SUGAR 60

5.2.2 GLOBAL INCREASE IN POPULATION AND GDP 60

5.3 MARKET DYNAMICS 61

5.3.1 DRIVERS 62

5.3.1.1 Increase in health consciousness 62

5.3.1.2 Partnerships established between sweetener manufacturers and food & beverage entities 63

5.3.1.3 Advances in technology leading to development of new and improved sweeteners 63

5.3.1.4 Government support for sugar substitute consumption 63

5.3.2 RESTRAINTS 64

5.3.2.1 Adherence to international quality standards and regulations for alternative sweeteners and sweetener-based products 64

5.3.2.2 Side effects associated with consumption of sugar substitutes 64

5.3.3 OPPORTUNITIES 65

5.3.3.1 Advancement in research & development in sweetener technology for diabetic wellness 65

5.3.3.2 Rising investments in sugar substitute production 65

5.3.3.3 Potential for diversification into other application sectors 65

5.3.4 CHALLENGES 66

5.3.4.1 Product labeling and claims issues 66

5.3.4.2 Premium pricing of natural sweeteners owing to higher costs of production 67

5.4 IMPACT OF GEN AI ON FOOD & BEVERAGE INGREDIENTS/ADDITIVES 67

5.4.1 INTRODUCTION 67

5.4.2 USE OF GEN AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES 68

5.4.3 CASE STUDY ANALYSIS 69

5.4.3.1 Kerry Trendspotter enabled precise identification and prediction of emerging ingredients and flavor trends by analyzing real-time social media data 69

5.4.3.2 Givaudan (Switzerland) developed advanced digital tools to translate vast amounts of consumer data into actionable insights 69

5.4.3.3 International Flavors & Fragrances Inc. (US) partnered with Salus Optima (UK) to create a personalized nutrition platform 70

5.4.3.4 AI and cloud technology to address challenges in the food and beverage industry 71

5.4.4 IMPACT ON SUGAR SUBSTITUTE MARKET 71

5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI 71

6 INDUSTRY TRENDS 72

6.1 INTRODUCTION 72

6.2 SUPPLY CHAIN ANALYSIS 72

6.3 VALUE CHAIN ANALYSIS 73

6.3.1 RESEARCH & PRODUCT DEVELOPMENT 74

6.3.2 RAW MATERIAL SOURCING 74

6.3.3 PROCESSING & EXTRACTION 75

6.3.4 QUALITY CONTROL AND COMPLIANCE 75

6.3.5 DISTRIBUTION AND SALES 75

6.3.6 END USERS 75

6.4 TRADE ANALYSIS 75

6.4.1 IMPORT SCENARIO OF SUCRALOSE 75

6.4.2 EXPORT SCENARIO OF SUCRALOSE, BY KEY COUNTRY 77

6.5 TECHNOLOGY ANALYSIS 78

6.5.1 KEY TECHNOLOGIES 78

6.5.1.1 Ultrasound-assisted fermentation 78

6.5.2 COMPLEMENTARY TECHNOLOGIES 78

6.5.2.1 Liquid-liquid extraction 78

6.5.3 ADJACENT TECHNOLOGIES 79

6.5.3.1 HPLC-DAD 79

6.6 PRICING ANALYSIS 79

6.6.1 AVERAGE SELLING PRICE TREND OF SUGAR SUBSTITUTES AMONG KEY PLAYERS, BY LOW-INTENSITY SWEETENERS 79

6.6.2 AVERAGE SELLING PRICE TREND, BY REGION 80

6.6.3 AVERAGE SELLING PRICE TREND, BY TYPE 81

6.7 ECOSYSTEM ANALYSIS 82

6.7.1 DEMAND SIDE 82

6.7.2 SUPPLY SIDE 82

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 85

6.8.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 85

6.9 PATENT ANALYSIS 86

6.10 KEY CONFERENCES & EVENTS DURING 2024–2025 88

6.11 REGULATORY LANDSCAPE 89

6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 89

6.11.2 REGULATORY FRAMEWORK 92

6.11.2.1 Introduction 92

6.11.2.2 North America 92

6.11.2.2.1 US 92

6.11.2.2.2 Canada 94

6.11.2.3 Europe 95

6.11.2.4 Asia Pacific 103

6.11.2.4.1 China 103

6.11.2.4.2 India 104

6.11.2.4.3 Japan 105

6.11.2.4.4 Australia & New Zealand 105

6.11.2.5 Latin America 106

6.11.2.5.1 Brazil 106

6.11.2.5.2 Argentina 107

6.11.2.5.3 Mexico 107

6.11.2.6 Middle East & Africa 107

6.12 PORTER’S FIVE FORCES ANALYSIS 107

6.12.1 THREAT OF NEW ENTRANTS 109

6.12.2 THREAT OF SUBSTITUTES 109

6.12.3 BARGAINING POWER OF BUYERS 109

6.12.4 BARGAINING POWER OF SUPPLIERS 109

6.12.5 INTENSITY OF COMPETITIVE RIVALRY 110

6.13 KEY STAKEHOLDERS & BUYING CRITERIA 110

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS 110

6.13.2 BUYING CRITERIA 111

6.14 CASE STUDY ANALYSIS 112

6.14.1 CARGILL, INCORPORATED: LAUNCH OF PRODUCTS TO LOWER SUGAR INTAKE 112

6.14.2 INCREASE IN INITIATIVES TO ENCOURAGE REDUCED CONSUMPTION OF SUGAR 112

6.15 INVESTMENT AND FUNDING SCENARIO 113

7 SUGAR SUBSTITUTES MARKET, BY MANUFACTURING TECHNOLOGY 114

7.1 INTRODUCTION 114

7.2 PRECISION FERMENTATION 114

7.3 ENZYMATIC CONVERSION 115

7.4 CHEMICAL SYNTHESIS 115

7.5 OTHER MANUFACTURING TECHNOLOGIES 115

8 SUGAR SUBSTITUTES MARKET, BY TYPE 116

8.1 INTRODUCTION 117

8.2 HIGH-FRUCTOSE CORN SYRUP 118

8.2.1 USED IN SEVERAL WELL-KNOWN BRANDS IN FOOD & BEVERAGE INDUSTRY 118

8.3 HIGH-INTENSITY SWEETENERS 120

8.3.1 USE IN ZERO-CALORIE AND SUGAR-FREE FOOD AND BEVERAGES DESPITE SOME METABOLIC CHALLENGES 120

8.3.2 NATURAL HIGH-INTENSITY SWEETENERS 122

8.3.2.1 Stevia 123

8.3.2.1.1 Evolution of Stevia 123

8.3.2.2 Monk Fruit 126

8.3.2.3 Other natural high intensity sweeteners 127

8.3.3 ARTIFICIAL HIGH-INTENSITY SWEETENERS 128

8.3.3.1 Aspartame 131

8.3.3.2 Cyclamate 132

8.3.3.3 Sucralose 133

8.3.3.4 Saccharin 134

8.3.3.5 Ace-K 135

8.3.3.6 Other artificial high-intensity sweeteners 136

8.4 LOW-INTENSITY SWEETENERS 137

8.4.1 PREFERRED FOR SWEETNESS COMPARABLE WITH THAT OF SUGAR WITHOUT RISK OF SIDE-EFFECTS 137

8.4.2 D-TAGATOSE 140

8.4.3 SORBITOL 141

8.4.4 MALTITOL 142

8.4.5 XYLITOL 143

8.4.6 MANNITOL 144

8.4.7 ERYTHRITOL 145

8.4.8 ALLULOSE 146

8.4.9 OTHER LOW-INTENSITY SWEETENERS 147

9 SUGAR SUBSTITUTES MARKET, BY APPLICATION 149

9.1 INTRODUCTION 150

9.2 FOOD PRODUCTS 151

9.2.1 WIDE DEMAND FOR LOW-CALORIE SUBSTITUTES IN FOOD APPLICATIONS 151

9.2.2 CONFECTIONERY PRODUCTS 153

9.2.2.1 Chocolate confectionery 154

9.2.2.2 Sweet confectionery 155

9.2.2.3 Gums 155

9.2.2.4 Hard candies 155

9.2.2.5 Other confectionery products 155

9.2.3 BAKERY PRODUCTS 155

9.2.4 DAIRY PRODUCTS 157

9.2.5 TABLETOP SWEETENERS 158

9.2.6 SWEET SPREADS 158

9.2.7 OTHER FOOD APPLICATIONS 159

9.3 BEVERAGES 160

9.3.1 EXPANSION OF CONSUMER BASE FOR SUGAR-FREE BEVERAGES 160

9.3.2 CARBONATED DRINKS 162

9.3.3 FRUIT DRINKS & JUICES 163

9.3.4 POWDERED DRINKS 164

9.3.5 ALCOHOLIC BEVERAGES 165

9.3.6 FLAVORED ALCOHOLIC BEVERAGES 166

9.3.7 PLANT-BASED BEVERAGES 167

9.3.8 OTHER BEVERAGES 168

9.4 HEALTH & PERSONAL CARE PRODUCTS 169

9.4.1 NATURAL SWEETENERS DRIVEN BY CONVERGENCE OF SKINCARE INNOVATION AND DESIRE FOR NATURAL SOLUTIONS 169

9.5 PHARMACEUTICALS 171

9.5.1 INVESTMENTS IN INNOVATIVE FORMULATIONS FOR SWEETENERS IN PHARMACEUTICALS 171

9.5.2 COATING 172

9.5.3 FILLERS 172

9.5.4 BINDERS 172

9.5.5 HUMECTANTS 173

9.5.6 SWEETENERS 173

9.6 OTHER APPLICATIONS 173

10 SUGAR SUBSTITUTES MARKET, BY FORM 175

10.1 INTRODUCTION 176

10.2 DRY 177

10.2.1 OFTEN USED FOR BAKING AND BEVERAGE MIXES 177

10.2.2 POWDER 178

10.2.3 GRANULES 178

10.2.4 OTHER DRY FORMS 178

10.3 LIQUID 179

10.3.1 RISE IN DEMAND FOR EASY SOLUBILITY AND LONG SHELF LIFE 179

10.3.2 SYRUP 180

10.3.3 GEL 181

11 HIGH-INTENSITY SUGAR SUBSTITUTES MARKET, BY SOURCE 182

11.1 INTRODUCTION 183

11.2 ARTIFICIAL 184

11.2.1 GROWING USE UNDER RIGOROUS REGULATORY PURVIEW 184

11.3 NATURAL 186

11.3.1 SURGE IN DEMAND FOR PLANT-BASED FOOD AND BEVERAGES 186

12 SUGAR SUBSTITUTES MARKET, BY REGION 189

12.1 INTRODUCTION 190

12.2 NORTH AMERICA 193

12.2.1 US 201

12.2.1.1 Presence of key players and rise in prediabetic and diabetic population 201

12.2.2 CANADA 203

12.2.2.1 Government approval for several sugar alternatives 203

12.2.3 MEXICO 205

12.2.3.1 Surge in national campaigns to create health awareness 205

12.3 EUROPE 206

12.3.1 GERMANY 214

12.3.1.1 Presence of several manufacturers of products with stevia to capitalize on demand for low-sugar options 214

12.3.2 UK 216

12.3.2.1 Prominent food industry supported by government push to integrate clean-label sweeteners into products 216

12.3.3 FRANCE 218

12.3.3.1 Aging population and increase in investor-friendly policies 218

12.3.4 ITALY 219

12.3.4.1 Demand for functional food due to changing consumer lifestyles and aging population 219

12.3.5 SPAIN 221

12.3.5.1 High sugar consumption to be combated with government policies 221

12.3.6 REST OF EUROPE 222

12.4 ASIA PACIFIC 224

12.4.1 CHINA 233

12.4.1.1 Manufacturer investments in China, along with dynamic convenience store channels in tier-1 and -2 cities 233

12.4.2 INDIA 235

12.4.2.1 Rise in cases of diabetes and other associated ailments 235

12.4.3 JAPAN 237

12.4.3.1 Growth in government initiatives to promote healthy living 237

12.4.4 AUSTRALIA & NEW ZEALAND 239

12.4.4.1 Rise in diabetic population to drive demand for healthier alternatives 239

12.4.5 REST OF ASIA PACIFIC 241

12.5 SOUTH AMERICA 242

12.5.1 BRAZIL 250

12.5.1.1 Rise in incidences of various health conditions that require low-sugar options to be managed 250

12.5.2 ARGENTINA 252

12.5.2.1 Increase in urbanization and demand for healthy food products 252

12.5.3 REST OF SOUTH AMERICA 254

12.6 REST OF THE WORLD (ROW) 255

12.6.1 MIDDLE EAST 263

12.6.1.1 Greater spending capacity and higher consumption of RTD teas 263

12.6.2 AFRICA 265

12.6.2.1 Rise in adoption of low-calorie consumable products 265

13 COMPETITIVE LANDSCAPE 267

13.1 OVERVIEW 267

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 267

13.3 REVENUE ANALYSIS, 2021–2023 270

13.4 MARKET SHARE ANALYSIS, 2023 271

13.4.1 MARKET RANKING ANALYSIS 272

13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 274

13.5.1 STARS 274

13.5.2 EMERGING LEADERS 274

13.5.3 PERVASIVE PLAYERS 274

13.5.4 PARTICIPANTS 275

13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023 276

13.5.5.1 Company footprint 276

13.5.5.2 Region footprint 277

13.5.5.3 Type footprint 278

13.5.5.4 High-intensity sweetener source footprint 279

13.5.5.5 Application footprint 280

13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023 281

13.6.1 PROGRESSIVE COMPANIES 281

13.6.2 RESPONSIVE COMPANIES 281

13.6.3 DYNAMIC COMPANIES 281

13.6.4 STARTING BLOCKS 281

13.6.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023 283

13.6.5.1 Detailed list of key startups/SMEs 283

13.6.5.2 Competitive benchmarking of startups/SMEs 284

13.7 COMPANY VALUATION AND FINANCIAL METRICS 285

13.7.1 COMPANY VALUATION 285

13.7.2 FINANCIAL METRICS 285

13.8 BRAND/PRODUCT COMPARISON 286

13.9 COMPETITIVE SCENARIO AND TRENDS 287

13.9.1 PRODUCT LAUNCHES 287

13.9.2 DEALS 288

13.9.3 EXPANSIONS 292

14 COMPANY PROFILES 294

14.1 KEY PLAYERS 294

14.1.1 CARGILL, INCORPORATED 294

14.1.1.1 Business overview 294

14.1.1.2 Products/Solutions/Services offered 295

14.1.1.3 Recent developments 297

14.1.1.3.1 Deals 297

14.1.1.3.2 Expansions 298

14.1.1.4 MnM view 299

14.1.1.4.1 Key strengths 299

14.1.1.4.2 Strategic choices 299

14.1.1.4.3 Weaknesses and competitive threats 299

14.1.2 ADM 300

14.1.2.1 Business overview 300

14.1.2.2 Products/Solutions/Services offered 301

14.1.2.3 Recent developments 303

14.1.2.3.1 Deals 303

14.1.2.4 MnM view 303

14.1.2.4.1 Key strengths 303

14.1.2.4.2 Strategic choices 303

14.1.2.4.3 Weaknesses and competitive threats 303

14.1.3 INTERNATIONAL FLAVORS & FRAGRANCES INC 304

14.1.3.1 Business overview 304

14.1.3.2 Products/Solutions/Services offered 305

14.1.3.3 Recent developments 306

14.1.3.3.1 Deals 306

14.1.3.4 MnM view 306

14.1.3.4.1 Key strengths 306

14.1.3.4.2 Strategic choices 306

14.1.3.4.3 Weaknesses and competitive threats 306

14.1.4 TATE & LYLE 307

14.1.4.1 Business overview 307

14.1.4.2 Products/Solutions/Services offered 308

14.1.4.3 Recent developments 309

14.1.4.3.1 Product launches 309

14.1.4.4 MnM view 310

14.1.4.4.1 Key strengths 310

14.1.4.4.2 Strategic choices 310

14.1.4.4.3 Weaknesses and competitive threats 310

14.1.5 INGREDION 311

14.1.5.1 Business overview 311

14.1.5.2 Products/Solutions/Services offered 312

14.1.5.3 Recent developments 313

14.1.5.3.1 Product launches 313

14.1.5.3.2 Deals 314

14.1.5.3.3 Expansions 316

14.1.5.4 MNM view 316

14.1.5.4.1 Key strengths 316

14.1.5.4.2 Strategic choices 316

14.1.5.4.3 Weaknesses and competitive threats 316

14.1.6 AJINOMOTO CO., INC. 317

14.1.6.1 Business overview 317

14.1.6.2 Products/Solutions/Services offered 318

14.1.6.3 Recent developments 319

14.1.6.4 MnM view 319

14.1.7 GLG LIFE TECH CORP 320

14.1.7.1 Business overview 320

14.1.7.2 Products/Solutions/Services offered 321

14.1.7.3 Recent developments 322

14.1.7.4 MnM view 322

14.1.8 CELANESE CORPORATION 323

14.1.8.1 Business overview 323

14.1.8.2 Products/Solutions/Services offered 324

14.1.8.3 Recent developments 325

14.1.8.3.1 Deals 325

14.1.8.4 MnM view 325

14.1.9 ROQUETTE FRÈRES 326

14.1.9.1 Business overview 326

14.1.9.2 Products/Solutions/Services offered 326

14.1.9.3 Recent developments 328

14.1.9.3.1 Deals 328

14.1.9.3.1 Expansions 329

14.1.9.4 MnM view 329

14.1.10 PCIPL 330

14.1.10.1 Business overview 330

14.1.10.2 Products/Solutions/Services offered 330

14.1.10.3 Recent developments 331

14.1.10.4 MnM view 331

14.1.11 MANE SA 332

14.1.11.1 Business overview 332

14.1.11.2 Products/Services/Solutions offered 332

14.1.11.3 Recent developments 333

14.1.11.4 MnM view 333

14.1.12 DÖHLER GMBH 334

14.1.12.1 Business overview 334

14.1.12.2 Products/Services/Solutions offered 334

14.1.12.3 Recent developments 335

14.1.12.3.1 Deals 335

14.1.12.4 MnM view 335

14.1.13 MORITA KAGAKU KOGYO CO., LTD 336

14.1.13.1 Business overview 336

14.1.13.2 Products/Solutions/Services offered 336

14.1.13.3 Recent developments 336

14.1.13.4 MnM view 336

14.1.14 ZUCHEM 337

14.1.14.1 Business overview 337

14.1.14.2 Products/Services/Solutions offered 337

14.1.14.3 Recent developments 337

14.1.14.4 MnM view 338

14.1.15 VAN WANKUM INGREDIENTS 339

14.1.15.1 Business overview 339

14.1.15.2 Products offered 339

14.1.15.3 Recent developments 340

14.1.15.4 MnM view 340

14.2 OTHER PLAYERS/STARTUPS/SMES 341

14.2.1 TAG INGREDIENTS INDIA PVT. LTD. 341

14.2.1.1 Business overview 341

14.2.1.2 Products/Services/Solutions offered 341

14.2.1.3 Recent developments 342

14.2.1.4 MnM view 342

14.2.2 SWEETLY STEVIAUSA 343

14.2.2.1 Business overview 343

14.2.2.2 Products/Services/Solutions offered 343

14.2.2.3 Recent developments 343

14.2.2.4 MnM view 344

14.2.3 FOODCHEM INTERNATIONAL CORPORATION 345

14.2.3.1 Business overview 345

14.2.3.2 Products/Services/Solutions offered 345

14.2.3.3 Recent developments 346

14.2.3.4 MnM view 346

14.2.4 JK SUCRALOSE INC. 347

14.2.4.1 Business overview 347

14.2.4.2 Products/Services/Solutions offered 347

14.2.4.3 Recent developments 347

14.2.4.4 MnM view 347

14.2.5 THE REAL STEVIA COMPANY AB 348

14.2.5.1 Business overview 348

14.2.5.2 Products/Services/Solutions offered 348

14.2.5.3 Recent developments 349

14.2.5.4 MnM view 349

14.2.6 STEVIA HUB INDIA 350

14.2.7 PYURE BRANDS 351

14.2.8 XILINAT 352

14.2.9 SAVANNA INGREDIENTS 352

14.2.10 BONUMOSE, INC 353

15 ADJACENT & RELATED MARKETS 354

15.1 INTRODUCTION 354

15.2 STUDY LIMITATIONS 354

15.3 SWEETENERS MARKET 354

15.3.1 MARKET DEFINITION 354

15.3.2 MARKET OVERVIEW 355

15.4 LOW-INTENSITY SWEETENERS MARKET 356

15.4.1 MARKET DEFINITION 356

15.4.2 MARKET OVERVIEW 356

16 APPENDIX 357

16.1 DISCUSSION GUIDE 357

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 364

16.3 CUSTOMIZATION OPTIONS 366

16.4 RELATED REPORTS 366

16.5 AUTHOR DETAILS 367

❖ 世界の砂糖代替品市場に関するよくある質問(FAQ) ❖

・砂糖代替品の世界市場規模は?

→MarketsandMarkets社は2024年の砂糖代替品の世界市場規模を235.6億米ドルと推定しています。

・砂糖代替品の世界市場予測は?

→MarketsandMarkets社は2029年の砂糖代替品の世界市場規模を299.0億米ドルと予測しています。

・砂糖代替品市場の成長率は?

→MarketsandMarkets社は砂糖代替品の世界市場が2024年~2029年に年平均4.9%成長すると予測しています。

・世界の砂糖代替品市場における主要企業は?

→MarketsandMarkets社は「Cargill、Incorporated (US)、ADM (US)、Ingredion (US)、International Flavors & Fragrances Inc (US)、Tate & Lyle (UK)、Ajinomoto Co. Inc (Japan)、GLG Life Tech Corp (Canada)、Celanese Corporation (US)、Roquette Frères (France)、PCIPL (India)、Mane SA. (France)、Döhler GmbH (Germany)、Morita Kagaku Kogyo Co.、Ltd (Japan)、zuChem (US)、and Van Wankum Ingredients (Netherlands).、Tag Ingredients India Pvt Ltd (India)、Sweetly SteviaUSA (UK)、Foodchem International Corporation (China)、JK Sucralose Inc. (China)、The Real Stevia Company AB (Sweden)、Stevia Hub India (India)、Pyure Brands (US)、XiliNat (Mexico)、Savanna Ingredients (Germany) and Bonumose、Inc (US)など ...」をグローバル砂糖代替品市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。