1 はじめに

1.1 調査目的 34

1.2 市場の定義 35

1.3 調査範囲 35

1.3.1 対象市場 35

1.3.2 考慮した年数 36

1.4 対象範囲と除外 36

1.5 考慮した通貨 37

1.6 利害関係者 38

1.7 変更点のまとめ 38

2 調査方法 39

2.1 調査データ 39

2.1.1 二次データ 41

2.1.1.1 二次資料からの主要データ 41

2.1.2 一次データ 42

2.1.2.1 一次資料からの主なデータ 42

2.1.2.2 主要な一次資料 42

2.2 要因分析 43

2.2.1 導入 43

2.2.2 需要側指標 43

2.2.2.1 世界の航空旅客・貨物輸送量の増加 43

2.2.3 供給側指標 43

2.3 市場範囲 44

2.3.1 超軽量・小型航空機市場、タイプ別 44

2.3.2 超軽量・小型航空機市場:最終用途別 44

2.3.3 超軽量・小型航空機市場:推進機別 44

2.4 調査アプローチと方法論 44

2.4.1 ボトムアップアプローチ 45

2.4.1.1 超軽量・小型航空機の地域別市場 45

2.4.1.2 超軽量・小型航空機市場のセグメント規模 45

2.4.1.3 超軽量・小型航空機市場、最終用途別 45

2.4.1.4 超軽量・小型航空機市場:ハイブリッド電動機別 45

2.4.2 価格分析 46

2.4.3 トップダウン・アプローチ 46

2.4.4 従来の超軽量・小型航空機市場、

地域・国別 47

2.4.5 ハイブリッド電動式超軽量・軽量航空機市場:地域別、国別 47

地域別、国別 47

2.4.6 超軽量・小型航空機全体市場:地域別、国別 47

2.5 市場の内訳とデータ三角測量 48

2.6 調査の前提 50

2.6.1 従来型の超軽量・小型航空機 50

2.6.2 ハイブリッド電気式超軽量・軽量航空機 50

2.6.3 超軽量・小型航空機アフターマーケット 50

2.6.4 その他の前提 50

2.7 研究の限界 52

2.8 リスク分析

3 エグゼクティブ・サマリー

4 プレミアムインサイト 56

4.1 超軽量・小型航空機市場におけるプレーヤーの魅力的な機会 56

4.2 超軽量・小型航空機市場:OEM別 56

4.3 超軽量・小型航空機市場:飛行操作別 57

4.4 超軽量・軽量航空機市場:素材別 57

4.5 超軽量・小型航空機市場:最終用途別 58

5 市場の概要

5.1 はじめに

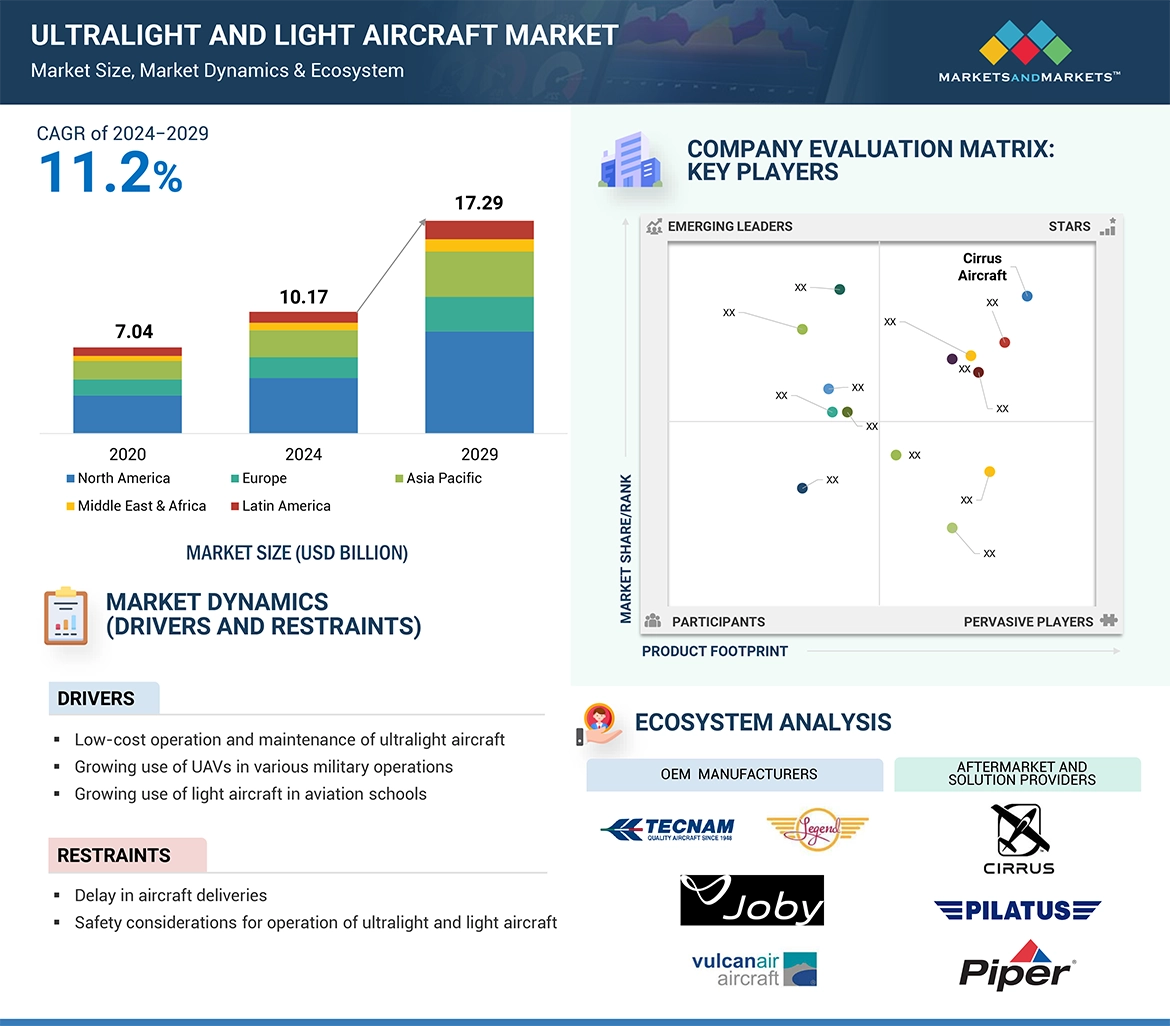

5.2 市場ダイナミクス 59

5.2.1 推進要因 60

5.2.1.1 超軽量航空機の低コスト運用・保守 60

5.2.1.2 様々な軍事作戦におけるUAVの使用の増加 61

5.2.1.3 航空学校における軽飛行機の利用の増加 61

5.2.1.4 個人飛行やレクリエーション飛行の需要の高まり 62

5.2.2 抑制要因 62

5.2.2.1 航空機納入の遅れ 62

5.2.2.2 超軽量・小型航空機の運航における安全性への配慮 62

5.2.3 機会 63

5.2.3.1 従来の航空機推進力の進歩 63

5.2.3.2 乗用ドローンとUAVペイロードの進歩 64

5.2.4 課題 64

5.2.4.1 開発コストが超軽量・軽量航空機の利点を上回る 64

5.2.4.2 超軽量航空機の航続距離とペイロードの制限 64

5.3 バリューチェーン分析 65

5.4 顧客ビジネスに影響を与えるトレンド/混乱 66

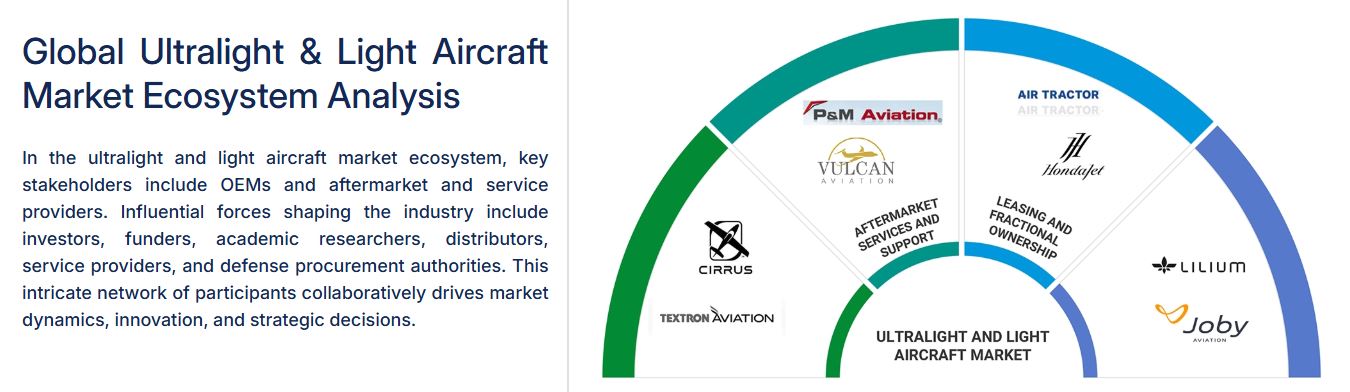

5.5 エコシステム分析 66

5.5.1 著名企業 66

5.5.2 民間企業及び中小企業 67

5.5.3 エンドユーザー 67

5.6 ハイブリッド推進力と電気推進力の技術動向 68

5.6.1 燃料電池 68

5.6.2 リチウム硫黄(Li-S) 68

5.6.3 分散型電気推進(DEP) 69

5.6.4 高エネルギー軽量耐荷重貯蔵用多機能構造(M シェル) 69

5.6.5 電気航空機用リチウム空気電池の統合計算実験開発 69

5.7 価格分析 69

5.7.1 軽飛行機の平均販売価格 69

5.7.2 主要企業の超軽量・小型航空機の平均販売価格 70

5.7.3 超軽量・軽量航空機の地域別平均販売価格 71

5.8 ケーススタディ分析 72

5.8.1 ケーススタディ1:VTOLビジネスジェット 72

5.8.2 ケーススタディ2 エフトール初の有人試験 72

5.8.3 ケーススタディ3:農業用途のエフトール 73

5.9 貿易分析(2019-2023年) 73

5.10 主要会議とイベント(2025年) 74

5.11 規制情勢 75

5.11.1 北米 75

5.11.2 欧州 76

5.11.3 規制機関、政府機関、その他の組織 76

5.12 購入プロセスにおける主要ステークホルダー 78

5.13 技術分析 79

5.13.1 主要技術 79

5.13.1.1 電池とエネルギー貯蔵ソリューション 79

5.13.1.2 ハイブリッド・パワートレイン 79

5.13.2 補完技術 80

5.13.2.1 先進的コーティング技術と防錆技術 80

5.13.2.2 軽量ソーラーパネル 80

5.14 ビジネスモデル 80

5.15 投資と資金調達のシナリオ 83

5.16 ジェネレーティブAI/AIのインパクト 83

5.16.1 導入 83

5.16.2 上位国による民間航空機へのジェネレーティブAIの採用 84

5.17 部品表 86

5.18 技術ロードマップ 88

5.19 マクロ経済的展望 89

5.19.1 北米 89

5.19.2 欧州 89

5.19.3 アジア太平洋 89

5.19.4 中東 90

5.19.5 ラテンアメリカ 90

5.19.6 アフリカ 90

6 業界動向 91

6.1 はじめに 91

6.2 技術分析 91

6.2.1 旅客用ドローン 91

6.2.2 戦闘用ドローン 91

6.2.3 エフトール航空機 92

6.2.4 アーバンエアモビリティ 92

6.2.5 先進アビオニクス 93

6.3 メガトレンドの影響 93

6.3.1 電気推進 93

6.3.1.1 ハイブリッド電気推進システムの設計 93

6.3.1.2 全電気推進システム設計 94

6.3.2 自律型航空機 94

6.3.3 先端材料と製造 94

6.4 技術革新と特許登録 95

7 超軽量・軽量航空機市場、販売地点別 98

7.1 導入 99

7.2 OEM 100

7.2.1 超軽量航空機 101

7.2.1.1 持続可能な航空技術の進歩が市場を牽引 101

7.2.1.2 400kg未満の重量機 101

7.2.1.3 総重量400~600kg 102

7.2.2 軽飛行機 102

7.2.2.1 自家用およびビジネス航空需要の増加が市場を牽引 102

7.2.3 600~2,500kgの総トン数 102

7.2.4 2,500~5,700kgの大型貨物船 103

7.3 アフターマーケット 104

7.3.1 MRO 105

7.3.1.1 規制要件の増加が市場を牽引 105

7.3.2 部品交換 105

7.3.2.1 最新化と規制遵守の重視が市場を牽引 105

8 超軽量・小型航空機市場(システム別) 106

8.1 導入 107

8.2 航空機構造 108

8.2.1 軽量素材の需要が市場を牽引 108

8.3 アビオニクス 108

8.3.1 乗客の安全を確保するためのリアルタイムデータと状況認識の必要性が市場を牽引 108

8.4 航空機システム 108

8.4.1 電気推進における技術進歩が市場を牽引 108

8.5 キャビン・インテリア 108

8.5.1 ビジネス航空機向け機内エンターテインメント・システムの需要増加が市場を牽引 108

9 超軽量・小型航空機市場(運航方法別) 109

9.1 導入 110

9.2 コンベンショナル離着陸(CTOL) 111

9.2.1 プライベートジェット、飛行訓練、近距離移動に最適 111

9.3 垂直離着陸(VTOL) 111

9.3.1 滑走路インフラのない環境に最適 111

10 超軽量・小型航空機市場、技術別 112

10.1 導入 113

10.2 有人 114

10.2.1 商業・農業用途での需要増加が市場を牽引 114

10.3 無人 114

10.3.1 あらかじめ決められた自動化されたコマンドで動作 114

11 超軽量・小型航空機市場:推進力別 115

11.1 導入 116

11.2 電気・ハイブリッド 117

11.2.1 ハイブリッド 118

11.2.1.1 ソーラー 118

11.2.1.1.1 ゼロエミッション航空機の需要増加が市場を牽引 118

11.2.1.2 バッテリー 118

11.2.1.2.1 ハイブリッド電気航空機モデルの人気の高まりが市場を牽引 118

11.2.1.3 燃料電池 118

11.2.1.3.1 燃料消費量と排出量の削減ニーズが市場を牽引 118

11.2.2 完全電動 119

11.2.2.1 研究開発への多額の投資が市場を牽引 119

11.3 従来型燃料 119

11.3.1 ターボプロップ 120

11.3.1.1 従来のジェットエンジンよりも優れた燃料効率が市場を牽引 120

11.3.2 ピストンエンジン 120

11.3.2.1 低コストと高性能が市場を牽引 120

12 超軽量・小型航空機市場(最終用途別) 121

12.1 はじめに 122

12.2 民間・商業 123

12.2.1 旅客機 124

12.2.1.1 軽ビジネス機の運航・保守コストの低減が市場を牽引 124

12.2.1.2 使用例: 旅客チャーターサービスにおけるピラタス PC-12 124

12.2.2 個人向け 124

12.2.2.1 出張用小型航空機の調達増加が市場を牽引 124

12.2.2.2 使用例: エグゼクティブの出張用Piper Navajo Chieftain 124

12.2.3 商業貨物 125

12.2.3.1 遠隔地への貨物輸送に役立つ 125

12.2.3.2 使用例: 貨物輸送におけるセスナ208キャラバン 125

12.2.4 訓練 125

12.2.4.1 市場の原動力となる一定のパイロット訓練需要 125

12.2.4.2 ユースケース: ウェスタンミシガン大学のパイロット訓練用TRAC20 G7 125

12.2.5 農業 126

12.2.5.1 様々な農作業における需要が市場を牽引 126

12.2.5.2 使用例: 農業散布用エアトラクターAT-802 126

12.2.6 調査研究 126

12.2.6.1 市場牽引のための重要データ収集の必要性 126

12.2.6.2 使用例: 環境調査におけるDornier 228 126

12.2.7 医療 127

12.2.7.1 救急サービスでの使用 127

12.2.7.2 使用例: Med-Trans CorporationとBeechcraft King Air 350 127

12.3 軍事 127

12.3.1 諜報・監視・偵察(ISR) 128

12.3.1.1 偵察による戦闘情報の収集 128

12.3.1.2 ユースケース: 対テロ作戦におけるISR支援 128

12.3.2 捜索・救難 128

12.3.2.1 遭難時の援助提供 128

12.3.2.2 ユースケース 山岳地帯での捜索・救助活動 128

12.3.3 軍用貨物 129

12.3.3.1 機密性の高い軍事拠点への貨物輸送 129

12.3.3.2 使用例: 遠隔地の戦闘前哨地での迅速な補給 129

12.3.4 訓練 129

12.3.4.1 軍事飛行のためのパイロット訓練の実施 129

12.3.4.2 使用例: 米空軍パイロット訓練プログラム 129

13 超軽量・小型航空機市場、素材別 130

13.1 導入 131

13.2 アルミニウム 132

132.2.1 軽量・高強度材料 132

13.3 複合材料 132

133.3.1 アルミニウムより軽いという利点 132

13.4 その他の素材 132

14 超軽量・軽量航空機市場:地域別 133

14.1 はじめに 134

14.2 北米 135

14.2.1 乳棒分析 136

14.2.2 米国 142

14.2.2.1 個人向け航空需要の増加が市場を牽引 142

14.2.3 カナダ 145

14.2.3.1 レクリエーション航空への関心の高まりが市場を牽引 145

14.3 欧州 147

14.3.1 ペッスル分析 147

14.3.2 イギリス 155

14.3.2.1 技術の進歩と持続可能な航空への関心の高まりが市場を牽引 155

14.3.3 フランス 157

14.3.3.1 グリーン航空の研究開発が市場を牽引 157

14.3.4 ドイツ 160

14.3.4.1 政府の環境政策が市場を牽引 160

14.3.5 ロシア 162

14.3.5.1 農村部での軽飛行機導入の増加が市場を牽引 162

14.3.6 イタリア 164

14.3.6.1 グリーン航空技術の研究開発に対する政府のインセンティブが市場を牽引 164

14.3.7 スペイン 166

14.3.7.1 航空研究開発への投資が市場を牽引 166

14.3.8 その他のヨーロッパ 169

14.4 アジア太平洋地域 171

14.4.1 乳棒分析 171

14.4.2 中国 179

14.4.2.1 規制改革と国内航空宇宙技術への投資増加が市場を牽引 179

14.4.3 インド 181

14.4.3.1 地域航空旅行のためのUDANスキームが市場を牽引 181

14.4.4 日本 183

14.4.4.1 航空宇宙イノベーションが市場を牽引 183

14.4.5 オーストラリア 185

14.4.5.1 有利な航空規制が市場を牽引 185

14.4.6 韓国 188

14.4.6.1 民間航空への関心の高まりが市場を牽引 188

14.4.7 その他のアジア太平洋地域 190

14.5 中東 192

14.5.1 ペッスル分析 198

14.5.2 GCC 199

14.5.2.1 UAE 199

14.5.2.1.1 砂漠観光の人気の高まりが市場を牽引 199

14.5.2.2 サウジアラビア 201

14.5.2.2.1 航空アクセスの拡大が市場を牽引 201

14.5.3 その他の中東地域 203

14.6 アフリカ 206

14.6.1 ペストル分析 212

14.6.2 南アフリカ 213

14.6.2.1 整備された航空エコシステムが市場を牽引 213

14.6.3 その他のアフリカ 215

14.7 ラテンアメリカ 217

14.7.1 乳棒分析 218

14.7.2 ブラジル 225

14.7.2.1 遠隔地の接続性を向上させる政府の航空プログラムが市場を牽引 225

14.7.3 メキシコ 227

14.7.3.1 活況を呈する観光産業が市場を牽引 227

14.7.4 その他のラテンアメリカ 229

15 競争環境 232

15.1 はじめに 232

15.2 主要プレーヤーの戦略/勝利への権利(2020~2024年) 232

15.3 収益分析、2020~2023年 234

15.4 市場シェア分析、2023年 235

15.5 企業評価マトリックス:主要プレーヤー、2023年 237

15.5.1 スター企業 237

15.5.2 新興リーダー 237

15.5.3 浸透型プレーヤー 237

15.5.4 参加企業 237

15.5.5 企業フットプリント 239

15.6 企業評価マトリックス:新興企業/SM(2023年) 243

15.6.1 先進的企業 243

15.6.2 対応力のある企業 243

15.6.3 ダイナミックな企業 243

15.6.4 スターティング・ブロック 243

15.6.5 競争ベンチマーキング 245

15.7 企業評価と財務指標 247

15.8 ブランド/製品の比較 248

15.9 競争シナリオ 248

15.9.1 製品上市 248

15.9.2 取引 249

15.9.3 その他の進展 251

16 企業プロフィール 255

Cirrus Aircraft (US)

Costruzioni Aeronautiche TECNAM SpA (Italy)

Textron Inc. (US)

Pilatus Aircraft (US)

Piper Aircraft Inc. (US)

Evektor Aerotechnik (Czech Republic)

American Legend Aircraft Co. (US)

Thrust Aircraft Private Limited (India)

Air Tractor (US)

P&M Aviation (India)

Quicksilver Aircraft (US)

Flight Design General Aviation GmbH (Germany)

Aeropro (Canada)

Autogyro GmbH (Germany)

Vulcanair (Italy)

Honda Aircraft Company (Japan)

17 付録 292

17.1 ディスカッション・ガイド 292

17.2 Knowledgestore: Marketsandmarketsの購読ポータル 295

17.3 カスタマイズオプション 297

17.4 関連レポート 297

17.5 著者の詳細 298

The aircraft is increasingly being used for recreational flying, such as sightseeing, camping, and fishing. They are also used for transportation, such as personal commuting. Ultralight and light aircraft also affordable to maintain and operate.

“Low-cost operation and maintenance of ultralight aircraft are driving the ultralight and light aircraft market.”

Low-cost operations and maintenance are the two main growth drivers in the ultralight and light aircraft market. These have simpler designs, consume lesser fuel, and have less mechanical complexity compared to their larger counterparts, which significantly cuts down on the operating cost. This has attracted wide users, ranging from private owners and recreational pilots to flight schools and small commercial operators. Light aircraft present an economical alternative for training and short-haul missions, thereby allowing wider access to aviation. Being more lightweight plus fuel-efficient engines reduce the frequency of maintenance and thus appeal to more people in both personal and professional sectors.

“Based on flight operation, the CTOL segment accounts for the largest market size during the forecast period.”

Based on flight operation, the ultralight and light aircraft market is segmented into Conventional Take-off and Landing (CTOL) and Vertical Take-off and Landing (VTOL). CTOLs are also expected to capture the bulk of the market for ultralight and light aircraft because they provide an infrastructure that is most well-developed, yet relatively cheaper, and used in different applications. A CTOL aircraft needs to land or take off with a runway, making the current distribution of small regional airports friendly to them to integrate without requiring specific and unique infrastructures. This is one benefit over VTOL aircraft, since those normally require new or modified facilities for safe operation, particularly in urban environments.

The cost is relatively low on development, production, and operations for the CTOL aircraft compared to the newest emerging VTOL models. This is because the operating procedures of the CTOLs are not very complex and involve a known technology base that guarantees the dependability of the aircraft, which is less costly to maintain. Such factors make the aircraft appealing to personal and recreational pilots, flight schools, and small businesses.

“Based on the system, the aircraft systems segment is projected to grow at the highest CAGR during the forecast period.”

Based on system, the ultralight and light aircraft market is segmented into aerostructure, avionics, aircraft systems, and cabin interiors. Aircraft systems will dominate the ultralight and light aircraft market because of their critical role in enhancement of performance, safety, and user experience as this sector attracts a wider range of pilots and applications. The, autopilot, stability controls, and safety features are becoming more complex and reachable with the advancement of digital technology and miniaturization. For example, those formerly only available on higher-up, commercial aircraft—now, digital avionics and glass cockpits are available on many small light and ultralight planes. This capability includes real-time feeds that navigate, weather, or information on engine performance right out to the pilot through direct vision, providing infinitely higher situational awareness than there could be before and ease a pilot's flying for this reason.

“Based on technology , the unmanned segment to grow at the highest CAGR during the forecast period.”

The ultralight and light aircraft market has been segmented on the basis of technology into the manned and unmanned segments. Unmanned segment is projected to grow at the highest CAGR as UAV has more prominent benefits than manned counterparts with respect to all applications pertaining to safety, cost, and convenience. These aircraft can do tasks and operate in conditions that would be too dangerous or impractical for a human pilot, including surveillance, agricultural monitoring, search and rescue, and environmental research. Therefore, agricultural operations, infrastructure inspection, and public safety are all finding a use for unmanned aircraft in order to provide very accurate and efficient operation.

“Asia Pacific is projected to account for the second largest market share during the forecast period.”

The Asia-Pacific region is expected to account for the second largest market share due to several strong factors, such as high economic growth, rising disposable incomes, and a growing interest in aviation. The more these countries continue to expand their economies, more people and businesses are looking at having affordable air travel options, which boost demand for light aircraft to be used for personal, recreational, and commercial purposes.

In addition, the region's vast geography, comprising many islands and remote areas, presents unique opportunities for light aircraft to provide essential connectivity where traditional transportation options may be limited. Another emerging trend is urban air mobility solutions, including air taxis and cargo drones, gaining traction in densely populated cities, stimulating demand further.

The break-up of profile of primary participants in the ultralight and light aircraft market:

• By Company Type: Tier 1 – 49%, Tier 2 – 37%, and Tier 3 – 14%

• By Designation: C Level – 55%, Director Level – 27%, and Others – 18%

• By Region: North America – 32%, Europe – 32%, Asia Pacific – 16%, Middle East & Africa – 10%, Latin America – 10%

Major players operating in the ultralight and light aircraft market are Cirrus Aircraft (US), Costruzioni Aeronautiche TECNAM SpA (Italy) , Textron Inc. (US) , Pilatus Aircraft (US) , Piper Aircraft, Inc. (US) , Evektor Aerotechnik (Czech Republic) , American Legend Aircraft Co. (US) , Thrust Aircraft Private Limited (India) , Air Tractor (US) , P&M Aviation (India) , Quicksilver Aircraft (US) , Flight Design General Aviation GmbH (Germany) , Aeropro (Canada), Autogyro GmbH (Germany) , Vulcanair (Italy), Honda Aircraft Company (Japan).

Research Coverage:

This research report categorizes the ultralight and light aircraft market basis of By Pointt of sale (OEM and Aftermarket) , End Use (Civil and Commercial and Military),Flight Operation (CTOL and VTOL), Technology (Manned and Unmanned), Propulsion (Conventional Fuel and Electric-Hybrid), Material (Aluminium, Composites and Other Materials), System (Aerostructures, Avionics, Cabin Interiors and Aircraft Systems), in these segments have been mapped across major Regions (North America, Europe, Asia Pacific, Middle East and Africa, Latin America).

A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; agreements, collaborations, new product launches, contracts, expansion, acquisitions, and partnerships associated with the aircraft health monitoring market. Competitive analysis of upcoming startups in the ultralight and light aircraft market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall ultralight and light aircraft market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

•The scope of the report covers detailed information regarding the major factors, such as drivers ( Low-cost operation and maintenance of ultralight aircraft, Growing use of UAVs in various military operations , Growing use of light aircraft in aviation schools, Growing demand for personal and recreational flying), restraints ( Delay in aircraft deliveries, Safety considerations for operation of ultralight and light aircraft), challenges ( Development costs outweigh benefits of ultralight and light aircraft, Limited range and payload of ultralight aircraft), and opportunities (Advancements in traditional aircraft propulsion, advancements in passenger drones and UAV payload), influencing the growth of the ultralight and light aircraft market.

•Market Penetration: Comprehensive information on ultralight and light aircraft offered by the top players in the market.

•Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the ultralight and light aircraft market

•Market Development: Comprehensive information about lucrative markets – the report analyzes the aircraft health monitoring market across varied regions

•Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Ultralight and light aircraft market

•Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the ultralight and light aircraft market

1 INTRODUCTION 34

1.1 STUDY OBJECTIVES 34

1.2 MARKET DEFINITION 35

1.3 STUDY SCOPE 35

1.3.1 MARKETS COVERED 35

1.3.2 YEARS CONSIDERED 36

1.4 INCLUSIONS AND EXCLUSIONS 36

1.5 CURRENCY CONSIDERED 37

1.6 STAKEHOLDERS 38

1.7 SUMMARY OF CHANGES 38

2 RESEARCH METHODOLOGY 39

2.1 RESEARCH DATA 39

2.1.1 SECONDARY DATA 41

2.1.1.1 Key data from secondary sources 41

2.1.2 PRIMARY DATA 42

2.1.2.1 Key data from primary sources 42

2.1.2.2 Key primary sources 42

2.2 FACTOR ANALYSIS 43

2.2.1 INTRODUCTION 43

2.2.2 DEMAND-SIDE INDICATORS 43

2.2.2.1 Rise in global air passenger and cargo traffic 43

2.2.3 SUPPLY-SIDE INDICATORS 43

2.3 MARKET SCOPE 44

2.3.1 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TYPE 44

2.3.2 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE 44

2.3.3 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION 44

2.4 RESEARCH APPROACH AND METHODOLOGY 44

2.4.1 BOTTOM-UP APPROACH 45

2.4.1.1 Regional ultralight and light aircraft market 45

2.4.1.2 Segment size of ultralight and light aircraft market 45

2.4.1.3 Ultralight and light aircraft market, by end use 45

2.4.1.4 Ultralight and light aircraft market, by hybrid-electric 45

2.4.2 PRICING ANALYSIS 46

2.4.3 TOP-DOWN APPROACH 46

2.4.4 CONVENTIONAL ULTRALIGHT AND LIGHT AIRCRAFT MARKET,

BY REGION AND COUNTRY 47

2.4.5 HYBRID-ELECTRIC ULTRALIGHT AND LIGHT AIRCRAFT MARKET,

BY REGION AND COUNTRY 47

2.4.6 OVERALL ULTRALIGHT AND LIGHT MARKET, BY REGION AND COUNTRY 47

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION 48

2.6 RESEARCH ASSUMPTIONS 50

2.6.1 CONVENTIONAL ULTRALIGHT AND LIGHT AIRCRAFT 50

2.6.2 HYBRID-ELECTRIC ULTRALIGHT AND LIGHT AIRCRAFT 50

2.6.3 ULTRALIGHT AND LIGHT AIRCRAFT AFTERMARKET 50

2.6.4 OTHER ASSUMPTIONS 50

2.7 RESEARCH LIMITATIONS 52

2.8 RISK ANALYSIS 52

3 EXECUTIVE SUMMARY 53

4 PREMIUM INSIGHTS 56

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ULTRALIGHT AND LIGHT AIRCRAFT MARKET 56

4.2 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY OEM 56

4.3 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION 57

4.4 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL 57

4.5 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE 58

5 MARKET OVERVIEW 59

5.1 INTRODUCTION 59

5.2 MARKET DYNAMICS 59

5.2.1 DRIVERS 60

5.2.1.1 Low-cost operation and maintenance of ultralight aircraft 60

5.2.1.2 Increasing use of UAVs in various military operations 61

5.2.1.3 Growing use of light aircraft in aviation schools 61

5.2.1.4 Rising demand for personal and recreational flying 62

5.2.2 RESTRAINTS 62

5.2.2.1 Delay in aircraft deliveries 62

5.2.2.2 Safety considerations for operation of ultralight and light aircraft 62

5.2.3 OPPORTUNITIES 63

5.2.3.1 Advancements in traditional aircraft propulsion 63

5.2.3.2 Advancements in passenger drones and UAV payload 64

5.2.4 CHALLENGES 64

5.2.4.1 Development costs outweigh benefits of ultralight and light aircraft 64

5.2.4.2 Limited range and payload of ultralight aircraft 64

5.3 VALUE CHAIN ANALYSIS 65

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 66

5.5 ECOSYSTEM ANALYSIS 66

5.5.1 PROMINENT COMPANIES 66

5.5.2 PRIVATE AND SMALL ENTERPRISES 67

5.5.3 END USERS 67

5.6 TECHNOLOGY TRENDS IN HYBRID AND ELECTRIC PROPULSION 68

5.6.1 FUEL CELLS 68

5.6.2 LITHIUM-SULFUR (LI-S) 68

5.6.3 DISTRIBUTED ELECTRIC PROPULSION (DEP) 69

5.6.4 MULTIFUNCTIONAL STRUCTURES FOR HIGH-ENERGY LIGHTWEIGHT LOADBEARING STORAGE (M-SHELLS) 69

5.6.5 INTEGRATED COMPUTATIONAL-EXPERIMENTAL DEVELOPMENT OF LI-AIR BATTERIES FOR ELECTRIC AIRCRAFT 69

5.7 PRICING ANALYSIS 69

5.7.1 AVERAGE SELLING PRICE OF LIGHT AIRCRAFT 69

5.7.2 AVERAGE SELLING PRICE OF KEY PLAYERS FOR ULTRALIGHT AND LIGHT AIRCRAFT 70

5.7.3 AVERAGE SELLING PRICE OF ULTRALIGHT AND LIGHT AIRCRAFT, BY REGION 71

5.8 CASE STUDY ANALYSIS 72

5.8.1 CASE STUDY 1: VTOL BUSINESS JET 72

5.8.2 CASE STUDY 2: FIRST MANNED TEST OF EVTOL 72

5.8.3 CASE STUDY 3: EVTOL FOR AGRICULTURAL APPLICATIONS 73

5.9 TRADE ANALYSIS, 2019–2023 73

5.10 KEY CONFERENCES AND EVENTS, 2025 74

5.11 REGULATORY LANDSCAPE 75

5.11.1 NORTH AMERICA 75

5.11.2 EUROPE 76

5.11.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 76

5.12 KEY STAKEHOLDERS IN BUYING PROCESS 78

5.13 TECHNOLOGY ANALYSIS 79

5.13.1 KEY TECHNOLOGIES 79

5.13.1.1 Battery and energy storage solutions 79

5.13.1.2 Hybrid powertrains 79

5.13.2 COMPLEMENTARY TECHNOLOGIES 80

5.13.2.1 Advanced coating and anti-corrosion technologies 80

5.13.2.2 Lightweight solar panels 80

5.14 BUSINESS MODELS 80

5.15 INVESTMENT AND FUNDING SCENARIO 83

5.16 IMPACT OF GENERATIVE AI/AI 83

5.16.1 INTRODUCTION 83

5.16.2 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION BY TOP COUNTRIES 84

5.17 BILL OF MATERIALS 86

5.18 TECHNOLOGY ROADMAP 88

5.19 MACROECONOMIC OUTLOOK 89

5.19.1 NORTH AMERICA 89

5.19.2 EUROPE 89

5.19.3 ASIA PACIFIC 89

5.19.4 MIDDLE EAST 90

5.19.5 LATIN AMERICA 90

5.19.6 AFRICA 90

6 INDUSTRY TRENDS 91

6.1 INTRODUCTION 91

6.2 TECHNOLOGY ANALYSIS 91

6.2.1 PASSENGER DRONES 91

6.2.2 COMBAT DRONES 91

6.2.3 EVTOL AIRCRAFT 92

6.2.4 URBAN AIR MOBILITY 92

6.2.5 ADVANCED AVIONICS 93

6.3 IMPACT OF MEGATRENDS 93

6.3.1 ELECTRIC PROPULSION 93

6.3.1.1 Hybrid electric propulsion system design 93

6.3.1.2 All-electric propulsion system design 94

6.3.2 AUTONOMOUS AIRCRAFT 94

6.3.3 ADVANCED MATERIALS AND MANUFACTURING 94

6.4 INNOVATIONS AND PATENT REGISTRATIONS 95

7 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY POINT OF SALE 98

7.1 INTRODUCTION 99

7.2 OEM 100

7.2.1 ULTRALIGHT AIRCRAFT 101

7.2.1.1 Advancement in sustainable aviation technologies to drive market. 101

7.2.1.2 <400 KG MTOW 101

7.2.1.3 400-600 KG MTOW 102

7.2.2 LIGHT AIRCRAFT 102

7.2.2.1 Growing demand for private and business aviation to drive market 102

7.2.3 600–2,500 KG MTOW 102

7.2.4 2,500–5,700 KG MTOW 103

7.3 AFTERMARKET 104

7.3.1 MRO 105

7.3.1.1 increasing regulatory requirements to drive market 105

7.3.2 PARTS REPLACEMENTS 105

7.3.2.1 Emphasis on modernization and regulatory compliance to drive market 105

8 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY SYSTEM 106

8.1 INTRODUCTION 107

8.2 AEROSTRUCTURES 108

8.2.1 DEMAND FOR LIGHTWEIGHT MATERIALS TO DRIVE MARKET 108

8.3 AVIONICS 108

8.3.1 NEED FOR REAL-TIME DATA AND SITUATIONAL AWARENESS TO ENSURE PASSENGER SAFETY TO DRIVE MARKET 108

8.4 AIRCRAFT SYSTEMS 108

8.4.1 TECHNOLOGICAL ADVANCEMENTS IN ELECTRIC PROPULSION TO DRIVE MARKET 108

8.5 CABIN INTERIORS 108

8.5.1 INCREASING DEMAND FOR IN-FLIGHT ENTERTAINMENT SYSTEMS FOR BUSINESS AIRCRAFT TO DRIVE MARKET 108

9 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY FLIGHT OPERATION 109

9.1 INTRODUCTION 110

9.2 CONVENTIONAL TAKE-OFF AND LANDING (CTOL) 111

9.2.1 SUITABLE FOR PRIVATE JETS, FLIGHT TRAINING, AND SHORT-DISTANCE TRAVEL 111

9.3 VERTICAL TAKE-OFF AND LANDING (VTOL) 111

9.3.1 IDEAL FOR ENVIRONMENTS WITHOUT RUNWAY INFRASTRUCTURE 111

10 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY TECHNOLOGY 112

10.1 INTRODUCTION 113

10.2 MANNED 114

10.2.1 INCREASING DEMAND IN COMMERCIAL AND AGRICULTURAL APPLICATIONS TO DRIVE MARKET 114

10.3 UNMANNED 114

10.3.1 OPERATES ON PRE-DETERMINED SET OF AUTOMATED COMMANDS 114

11 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY PROPULSION 115

11.1 INTRODUCTION 116

11.2 ELECTRIC-HYBRID 117

11.2.1 HYBRID 118

11.2.1.1 Solar 118

11.2.1.1.1 Rising demand for zero-emission aircraft to drive market 118

11.2.1.2 Battery 118

11.2.1.2.1 Growing popularity of hybrid electric aircraft models to drive market 118

11.2.1.3 Fuel Cell 118

11.2.1.3.1 Need to reduce fuel consumption and emissions to drive market 118

11.2.2 FULLY ELECTRIC 119

11.2.2.1 Heavy investment in R&D to drive market 119

11.3 CONVENTIONAL FUEL 119

11.3.1 TURBOPROP 120

11.3.1.1 Superior fuel efficiency over traditional jet engines to drive market 120

11.3.2 PISTON ENGINE 120

11.3.2.1 Low cost and high performance to drive market 120

12 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY END USE 121

12.1 INTRODUCTION 122

12.2 CIVIL & COMMERCIAL 123

12.2.1 PASSENGER 124

12.2.1.1 Lower operating and maintenance costs of light business aircraft to drive market 124

12.2.1.2 Use case: Pilatus PC-12 in passenger charter services 124

12.2.2 PERSONAL 124

12.2.2.1 Increasing procurement of light aircraft for business travel to drive market 124

12.2.2.2 Use case: Piper Navajo Chieftain for executive business travel 124

12.2.3 COMMERCIAL CARGO 125

12.2.3.1 Helps in transfer of cargo to remote areas 125

12.2.3.2 Use case: Cessna 208 Caravan in cargo transport 125

12.2.4 TRAINING 125

12.2.4.1 Constant demand for pilot training to drive market 125

12.2.4.2 Use case: TRAC20 G7 at Western Michigan University for pilot training 125

12.2.5 AGRICULTURE 126

12.2.5.1 Demand in various farming tasks to drive market 126

12.2.5.2 Use case: Air Tractor AT-802 for agricultural spraying 126

12.2.6 SURVEY & RESEARCH 126

12.2.6.1 Need to collect important data to drive market 126

12.2.6.2 Use case: Dornier 228 in environmental surveying 126

12.2.7 MEDICAL 127

12.2.7.1 Usage in emergency services 127

12.2.7.2 Use case: Med-Trans Corporation and Beechcraft King Air 350 127

12.3 MILITARY 127

12.3.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR) 128

12.3.1.1 Gathers battle intelligence through surveillance 128

12.3.1.2 Use case: ISR support in anti-terrorism operations 128

12.3.2 SEARCH & RESCUE 128

12.3.2.1 Provides aid during distress situations 128

12.3.2.2 Use case: Mountainous search & rescue operation 128

12.3.3 MILITARY CARGO 129

12.3.3.1 Transfers cargo to sensitive military locations 129

12.3.3.2 Use case: Rapid resupply in remote combat outpost 129

12.3.4 TRAINING 129

12.3.4.1 Conducts training of pilots for military flying 129

12.3.4.2 Use case: US Air Force Pilot Training Program 129

13 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY MATERIAL 130

13.1 INTRODUCTION 131

13.2 ALUMINUM 132

13.2.1 LIGHTWEIGHT AND HIGH-STRENGTH MATERIAL 132

13.3 COMPOSITES 132

13.3.1 ADVANTAGE OF BEING LIGHTER THAN ALUMINUM 132

13.4 OTHER MATERIALS 132

14 ULTRALIGHT AND LIGHT AIRCRAFT MARKET, BY REGION 133

14.1 INTRODUCTION 134

14.2 NORTH AMERICA 135

14.2.1 PESTLE ANALYSIS 136

14.2.2 US 142

14.2.2.1 Rising demand for personal aviation to drive market 142

14.2.3 CANADA 145

14.2.3.1 Rising interest in recreational aviation to drive market 145

14.3 EUROPE 147

14.3.1 PESTLE ANALYSIS 147

14.3.2 UK 155

14.3.2.1 Technological advancements and increasing interest in sustainable aviation to drive market 155

14.3.3 FRANCE 157

14.3.3.1 R&D of green aviation to drive market 157

14.3.4 GERMANY 160

14.3.4.1 Government environmental policies to drive market 160

14.3.5 RUSSIA 162

14.3.5.1 Increasing adoption of light aircraft in rural areas to drive market 162

14.3.6 ITALY 164

14.3.6.1 Government incentives for R&D in green aviation technologies to drive market 164

14.3.7 SPAIN 166

14.3.7.1 Investment in aviation R&D to drive market 166

14.3.8 REST OF EUROPE 169

14.4 ASIA PACIFIC 171

14.4.1 PESTLE ANALYSIS 171

14.4.2 CHINA 179

14.4.2.1 Regulatory reforms and increasing investments in domestic aerospace technology to drive market 179

14.4.3 INDIA 181

14.4.3.1 UDAN scheme for regional air travel to drive market 181

14.4.4 JAPAN 183

14.4.4.1 Focus on aerospace innovation to drive market 183

14.4.5 AUSTRALIA 185

14.4.5.1 Favorable aviation regulations to drive market 185

14.4.6 SOUTH KOREA 188

14.4.6.1 Increasing interest in private aviation to drive market 188

14.4.7 REST OF ASIA PACIFIC 190

14.5 MIDDLE EAST 192

14.5.1 PESTLE ANALYSIS 198

14.5.2 GCC 199

14.5.2.1 UAE 199

14.5.2.1.1 Growing popularity of desert tourism to drive market 199

14.5.2.2 Saudi Arabia 201

14.5.2.2.1 Expanding aviation accessibility to drive market 201

14.5.3 REST OF MIDDLE EAST 203

14.6 AFRICA 206

14.6.1 PESTLE ANALYSIS 212

14.6.2 SOUTH AFRICA 213

14.6.2.1 Well-established aviation ecosystem to drive market 213

14.6.3 REST OF AFRICA 215

14.7 LATIN AMERICA 217

14.7.1 PESTLE ANALYSIS 218

14.7.2 BRAZIL 225

14.7.2.1 Government’s aviation programs to improve connectivity in remote areas to drive market 225

14.7.3 MEXICO 227

14.7.3.1 Booming tourism sector to drive market 227

14.7.4 REST OF LATIN AMERICA 229

15 COMPETITIVE LANDSCAPE 232

15.1 INTRODUCTION 232

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024 232

15.3 REVENUE ANALYSIS, 2020–2023 234

15.4 MARKET SHARE ANALYSIS, 2023 235

15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 237

15.5.1 STARS 237

15.5.2 EMERGING LEADERS 237

15.5.3 PERVASIVE PLAYERS 237

15.5.4 PARTICIPANTS 237

15.5.5 COMPANY FOOTPRINT 239

15.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023 243

15.6.1 PROGRESSIVE COMPANIES 243

15.6.2 RESPONSIVE COMPANIES 243

15.6.3 DYNAMIC COMPANIES 243

15.6.4 STARTING BLOCKS 243

15.6.5 COMPETITIVE BENCHMARKING 245

15.7 COMPANY VALUATION AND FINANCIAL METRICS 247

15.8 BRAND/PRODUCT COMPARISON 248

15.9 COMPETITIVE SCENARIO 248

15.9.1 PRODUCT LAUNCHES 248

15.9.2 DEALS 249

15.9.3 OTHER DEVELOPMENTS 251

16 COMPANY PROFILES 255

16.1 KEY PLAYERS 255

16.1.1 CIRRUS AIRCRAFT 255

16.1.1.1 Business overview 255

16.1.1.2 Products/Solutions/Services offered 255

16.1.1.3 Recent developments 256

16.1.1.4 MnM view 256

16.1.1.4.1 Key strengths 256

16.1.1.4.2 Strategic choices 256

16.1.1.4.3 Weaknesses and competitive threats 256

16.1.2 COSTRUZIONI AERONAUTICHE TECNAM SPA 257

16.1.2.1 Business overview 257

16.1.2.2 Products/Solutions/Services offered 257

16.1.2.3 Recent developments 258

16.1.2.4 MnM view 259

16.1.2.4.1 Key strengths 259

16.1.2.4.2 Strategic choices 259

16.1.2.4.3 Weaknesses and competitive threats 259

16.1.3 TEXTRON INC. 260

16.1.3.1 Business overview 260

16.1.3.2 Products/Solutions/Services offered 261

16.1.3.3 Recent developments 262

16.1.3.4 MnM view 265

16.1.3.4.1 Key strengths 265

16.1.3.4.2 Strategic choices 265

16.1.3.4.3 Weaknesses and competitive threats 266

16.1.4 PILATUS AIRCRAFT 267

16.1.4.1 Business overview 267

16.1.4.2 Products/Solutions/Services offered 268

16.1.4.3 Recent developments 268

16.1.4.4 MnM view 269

16.1.4.4.1 Key strengths 269

16.1.4.4.2 Strategic choices 270

16.1.4.4.3 Weaknesses and competitive threats 270

16.1.5 PIPER AIRCRAFT, INC. 271

16.1.5.1 Business overview 271

16.1.5.2 Products/Solutions/Services offered 271

16.1.5.3 Recent developments 272

16.1.5.4 MnM view 273

16.1.5.4.1 Key strengths 273

16.1.5.4.2 Strategic choices 273

16.1.5.4.3 Weaknesses and competitive threats 273

16.1.6 EVEKTOR AEROTECHNIK 274

16.1.6.1 Business overview 274

16.1.6.2 Products/Solutions/Services offered 274

16.1.6.3 Recent developments 274

16.1.7 AMERICAN LEGEND AIRCRAFT CO. 276

16.1.7.1 Business overview 276

16.1.7.2 Products/Solutions/Services offered 276

16.1.8 THRUST AIRCRAFT PRIVATE LIMITED 277

16.1.8.1 Business overview 277

16.1.8.2 Products/Solutions/Services offered 277

16.1.9 AIR TRACTOR 278

16.1.9.1 Business overview 278

16.1.9.2 Products/Solutions/Services offered 278

16.1.9.3 Recent developments 279

16.1.10 P&M AVIATION 280

16.1.10.1 Business overview 280

16.1.10.2 Products/Solutions/Services offered 280

16.1.11 QUICKSILVER AIRCRAFT 281

16.1.11.1 Business overview 281

16.1.11.2 Products/Solutions/Services offered 281

16.1.12 FLIGHT DESIGN GENERAL AVIATION GMBH 282

16.1.12.1 Business overview 282

16.1.12.2 Products/Solutions/Services offered 282

16.1.12.3 Recent developments 282

16.1.13 AEROPRO 283

16.1.13.1 Business overview 283

16.1.13.2 Products/Solutions/Services offered 283

16.1.14 AUTOGYRO GMBH 284

16.1.14.1 Business overview 284

16.1.14.2 Products/Solutions/Services offered 284

16.1.15 VULCANAIR 285

16.1.15.1 Business overview 285

16.1.15.2 Products/Solutions/Services offered 285

16.1.16 HONDA AIRCRAFT COMPANY 286

16.1.16.1 Business overview 286

16.1.16.2 Products/Solutions/Services offered 286

16.2 OTHER PLAYERS 287

16.2.1 VOLOCOPTER GMBH 287

16.2.2 LILIUM GMBH 287

16.2.3 NEVA AEROSPACE 288

16.2.4 OPENER AERO 288

16.2.5 WISK AERO 289

16.2.6 JOBY AVIATION 289

16.2.7 WING AVIATION LLC 290

16.2.8 KAREM AIRCRAFT INC. 290

16.2.9 LIFT AIRCRAFT INC. 291

16.2.10 XTI AIRCRAFT 291

17 APPENDIX 292

17.1 DISCUSSION GUIDE 292

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 295

17.3 CUSTOMIZATION OPTIONS 297

17.4 RELATED REPORTS 297

17.5 AUTHOR DETAILS 298

❖ 世界の超軽量・小型航空機市場に関するよくある質問(FAQ) ❖

・超軽量・小型航空機の世界市場規模は?

→MarketsandMarkets社は2024年の超軽量・小型航空機の世界市場規模を101億7000万米ドルと推定しています。

・超軽量・小型航空機の世界市場予測は?

→MarketsandMarkets社は2029年の超軽量・小型航空機の世界市場規模を172億9000万米ドルと予測しています。

・超軽量・小型航空機市場の成長率は?

→MarketsandMarkets社は超軽量・小型航空機の世界市場が2024年~2029年に年平均11.2%成長すると予測しています。

・世界の超軽量・小型航空機市場における主要企業は?

→MarketsandMarkets社は「Cirrus Aircraft (US)、Costruzioni Aeronautiche TECNAM SpA (Italy) 、Textron Inc. (US) 、Pilatus Aircraft (US) 、Piper Aircraft、Inc. (US) 、Evektor Aerotechnik (Czech Republic) 、American Legend Aircraft Co. (US) 、Thrust Aircraft Private Limited (India) 、Air Tractor (US) 、P&M Aviation (India) 、Quicksilver Aircraft (US) 、Flight Design General Aviation GmbH (Germany) 、Aeropro (Canada)、Autogyro GmbH (Germany) 、Vulcanair (Italy)、Honda Aircraft Company (Japan)など ...」をグローバル超軽量・小型航空機市場の主要企業として認識しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、納品レポートの情報と少し異なる場合があります。